Exhibit 99.2 3rd Quarter Fiscal 2019 November 20, 2018 Results Conference Call

Forward Looking Statements, Non-GAAP Financial Measures and Other Information This presentation contains “forward-looking statements”. Other than statements of historical facts, all statements contained in this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and objectives of management, are forward-looking statements. Words such as “outlook,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “should,” “could,” “project,” and similar expressions, as well as statements in future tense, identify forward-looking statements. You should not consider forward-looking statements as a guarantee of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences are discussed in the Company’s Transition Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 2, 2018 and other filings with the SEC. The forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. The Company undertakes no obligation to update these forward-looking statements to reflect new information, or events or circumstances arising after such date. This presentation includes certain “Non-GAAP” financial measures as defined by Regulation G of the SEC. As required by the SEC, a reconciliation of those measures to the most directly comparable GAAP measures is provided on the Regulation G slides included as slides 13 through 21 of this presentation. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. 2

Participants Steven E. Nielsen President & Chief Executive Officer Timothy R. Estes Chief Operating Officer H. Andrew DeFerrari Chief Financial Officer Richard B. Vilsoet Chief Legal Officer Agenda Introduction and Q3-19 Overview Industry Update Financial & Operational Highlights Outlook Conclusion Q&A 33

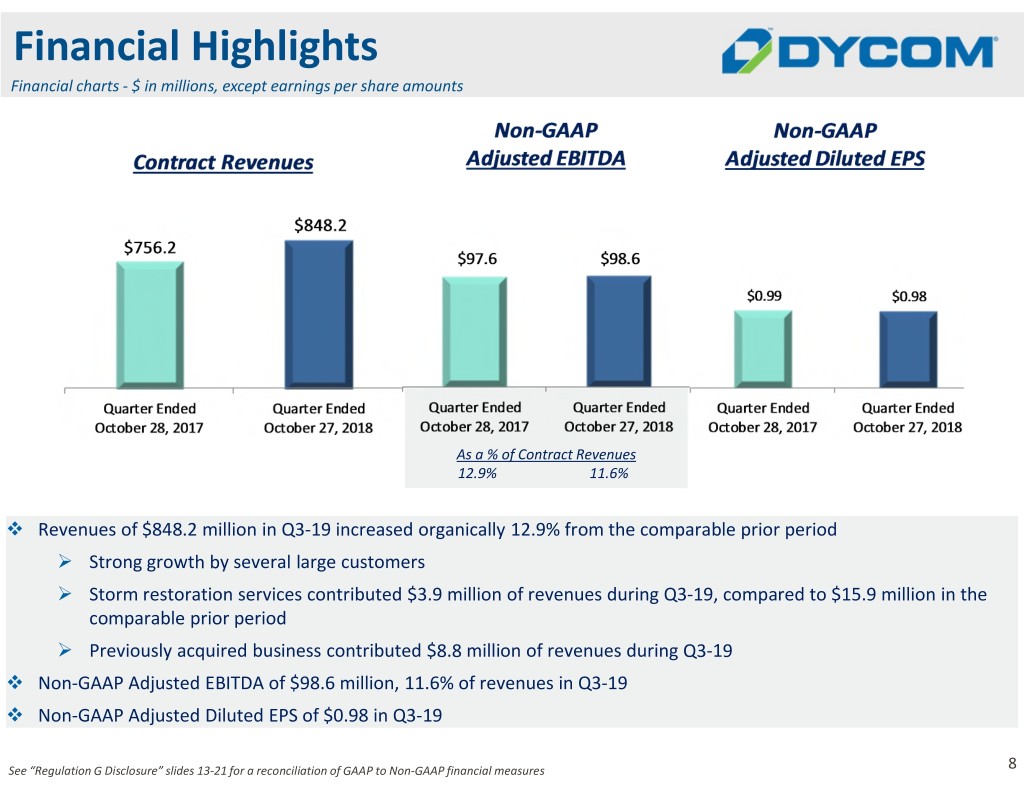

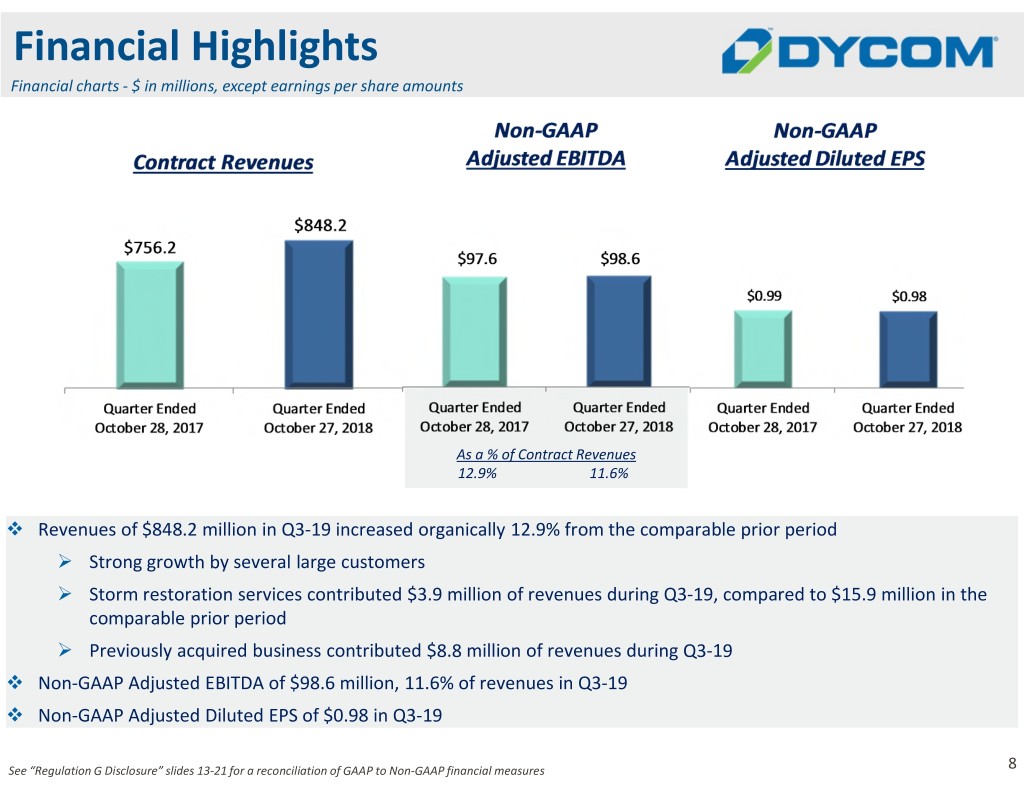

Q3-19 Overview and Highlights Strong organic revenue growth of 12.9% Contract revenues of $848.2 million for the quarter ended October 27, 2018, compared to $756.2 million for the quarter ended October 28, 2017 Contract revenues of $8.8 million from a previously acquired business and $3.9 million from storm restoration services Solid operating performance Non-GAAP Adjusted EBITDA of $98.6 million, or 11.6% of contract revenues, for the quarter ended October 27, 2018, compared to $97.6 million, or 12.9% of contract revenues, for the quarter ended October 28, 2017 Non-GAAP Adjusted Diluted EPS of $0.98 per share for the quarter ended October 27, 2018, compared to $0.99 per share for the quarter ended October 28, 2017 Ample liquidity Liquidity of $350.1 million at Q3-19 consisting of $328.5 million of availability under Senior Credit Facility and cash of $21.5 million Senior Credit Facility amended and restated during October 2018, increasing revolver capacity to $750.0 million and the term loan to $450.0 million and extending maturity to October 2023 No outstanding revolver borrowings at the end of Q3-19 See “Regulation G Disclosure” slides 13-21 for a reconciliation of GAAP to Non-GAAP financial measures. 4

Industry Update Industry increasing network bandwidth dramatically Major industry participants deploying significant 1 gigabit wireline networks Emerging wireless technologies are driving significant wireline deployments Wireline deployments necessary to facilitate expected decades long deployment of fully converged wireless/wireline networks that will enable high bandwidth low latency applications Industry effort required to deploy these converged networks continues to meaningfully broaden our set of opportunities. Total industry opportunities in aggregate, are robust. Delivering valuable service to customers Currently providing services for 1 gigabit full deployments across the country in dozens of metropolitan areas to a number of customers Have secured and are actively working on a number of converged wireless/wireline multi-use networks Customers are revealing with more specificity multi-year initiatives that are being implemented and managed on a market by market basis Our ability to provide integrated planning, engineering and design, procurement and construction and maintenance services provides value to several industry participants As with prior large scale network deployments, normal timing and customer spending modulations expected as network deployment strategies and technologies evolve. Tactical considerations may also impact timing. Dycom’s scale, market position and financial strength position it well as opportunities continue to expand 5

Revenue Highlights Organic % adjusted for revenues from acquired businesses and storm restoration services, when applicable. Non-GAAP Organic Growth (Decline) % Q3-19 organic growth of 12.9% 30% 22.9% 25% Top 5 customers increased 18.3% 20% 14.9% 12.9% organically 15% 10% 4.6% All other customers decreased 2.9% 5% 0.8% 0% organically (8.4)% -5% (10.6)% (10.0)% -10% -15% (a) (a) Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q1-19 Q2-19 Q3-19 (a) Due to the change in the Company’s fiscal year end, the Company’s fiscal 2018 six month transition period consisted of Q1-18 and Q2-18. Top 5 customers represented 78.4% and 75.3% of revenues in quarters ended October 27, 2018 and October 28, 2017, respectively Organic growth with Comcast at 8.7%, Verizon at 115.9%, and AT&T at 14.9% See “Regulation G Disclosure” slides 13-21 for a reconciliation of GAAP to Non-GAAP financial measures. 6

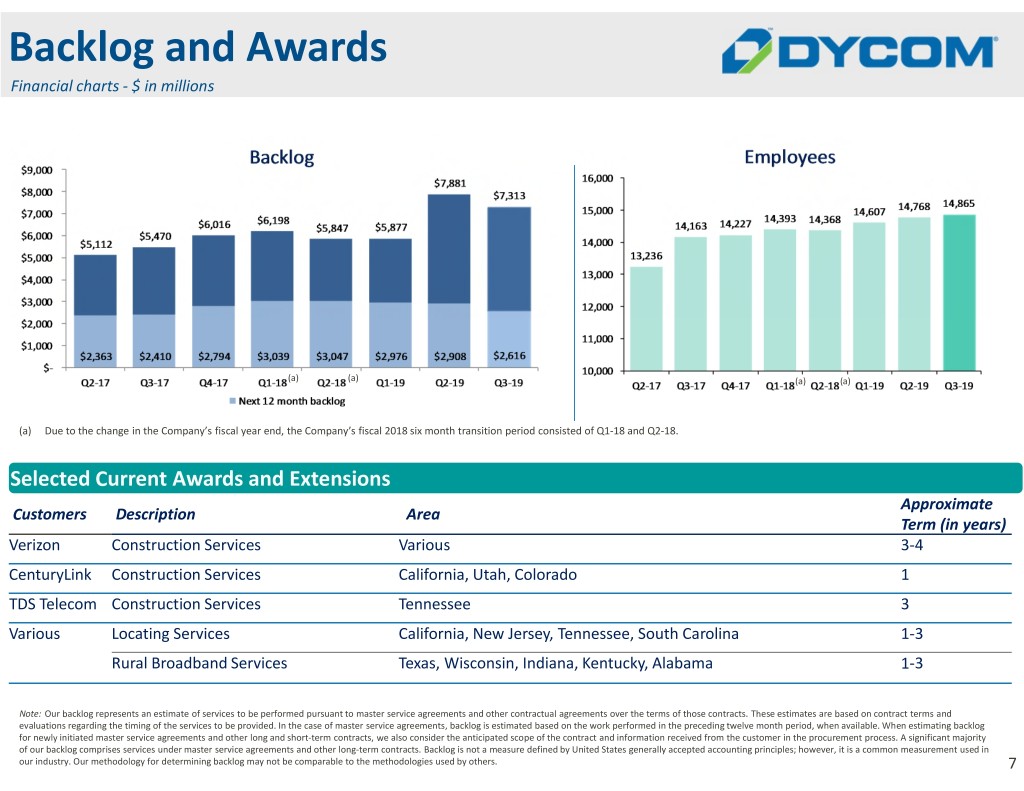

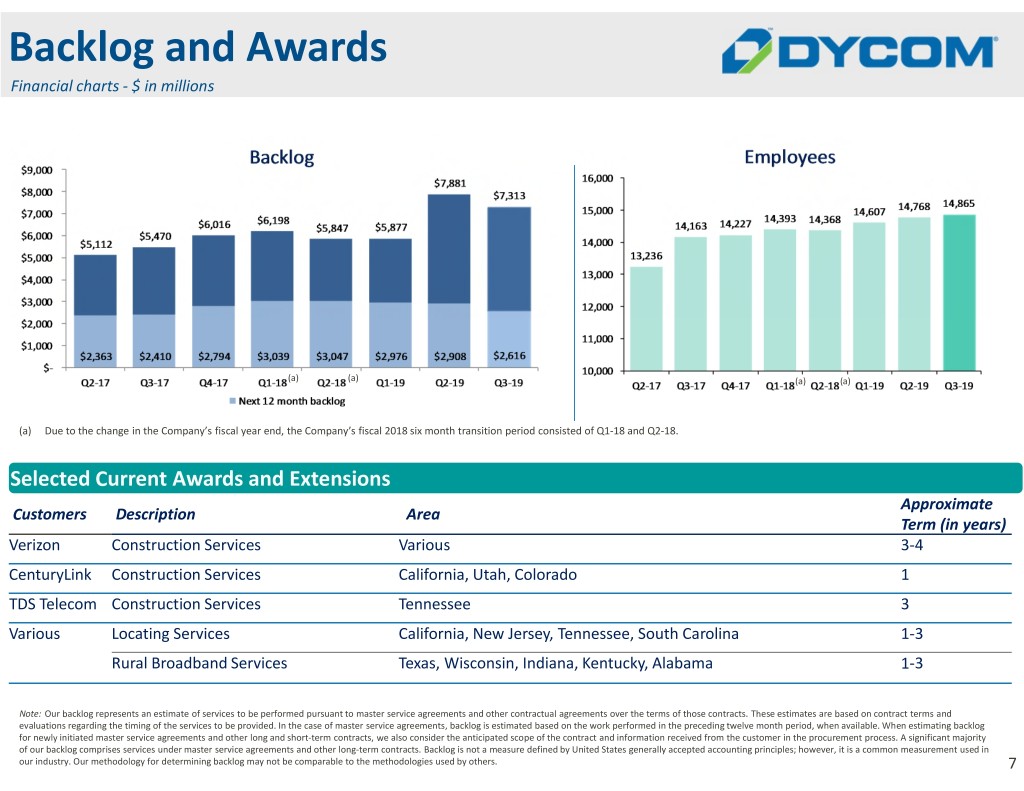

Backlog and Awards Financial charts - $ in millions (a) (a) (a) (a) (a) Due to the change in the Company’s fiscal year end, the Company’s fiscal 2018 six month transition period consisted of Q1-18 and Q2-18. Selected Current Awards and Extensions Approximate Customers Description Area Term (in years) Verizon Construction Services Various 3-4 CenturyLink Construction Services California, Utah, Colorado 1 TDS Telecom Construction Services Tennessee 3 Various Locating Services California, New Jersey, Tennessee, South Carolina 1-3 Rural Broadband Services Texas, Wisconsin, Indiana, Kentucky, Alabama 1-3 Note: Our backlog represents an estimate of services to be performed pursuant to master service agreements and other contractual agreements over the terms of those contracts. These estimates are based on contract terms and evaluations regarding the timing of the services to be provided. In the case of master service agreements, backlog is estimated based on the work performed in the preceding twelve month period, when available. When estimating backlog for newly initiated master service agreements and other long and short-term contracts, we also consider the anticipated scope of the contract and information received from the customer in the procurement process. A significant majority of our backlog comprises services under master service agreements and other long-term contracts. Backlog is not a measure defined by United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others. 7

Financial Highlights Financial charts - $ in millions, except earnings per share amounts As a % of Contract Revenues 12.9% 11.6% Revenues of $848.2 million in Q3-19 increased organically 12.9% from the comparable prior period Strong growth by several large customers Storm restoration services contributed $3.9 million of revenues during Q3-19, compared to $15.9 million in the comparable prior period Previously acquired business contributed $8.8 million of revenues during Q3-19 Non-GAAP Adjusted EBITDA of $98.6 million, 11.6% of revenues in Q3-19 Non-GAAP Adjusted Diluted EPS of $0.98 in Q3-19 See “Regulation G Disclosure” slides 13-21 for a reconciliation of GAAP to Non-GAAP financial measures 8

Liquidity Overview Financial tables - $ in millions Financial profile remains strong Cash flows support scale of operations Liquidity Summary As of Cash Flow Summary Quarter Ended July 28, 2018 October 27, 2018 October 28, 2017 October 27, 2018 Cash and equivalents $ 23.9 $ 21.5 Cash provided by (used in) operating activities $ 56.8 $ (55.5) Capital expenditures, net of disposals $ (47.2) $ (42.6) Senior Credit Facility, matures October 2023: (a) Proceeds from (payments on) Senior Credit Facility $ (4.8) $ 104.0 Revolving Facility $ - $ - Share repurchases $ (16.9) $ - Term Loan Facilities 346.0 450.0 Other financing & investing activities, net $ (2.0) $ (8.2) 0.75% Convertible Senior Notes, mature September 2021: Notional Value 485.0 485.0 Total Notional Amount of Debt $ 831.0 $ 935.0 Total Days Sales Outstanding ("DSO") (b) Net Debt (Notional Debt less Cash) $ 807.1 $ 913.5 October 27, 2018 106 July 28, 2018 96 Total Notional Amount of Debt (see above) $ 831.0 $ 935.0 October 28, 2017 90 Unamortized debt discount and debt fees on 0.75% Convertible Senior Notes (72.4) (67.2) The Company adopted Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers Debt, net of debt discount and fees $ 758.6 $ 867.8 (Topic 606) (“ASU 2014-09”) effective January 28, 2018, the first day of fiscal 2019. The adoption of ASU 2014-09 resulted in certain balance sheet classification changes between unbilled accounts receivable and Availability on revolver $ 401.4 $ 328.5 contract assets (formerly referred to as costs and estimated earnings in excess of billings). For comparability Cash and availability on revolver $ 425.3 $ 350.1 with historical periods, the Company has presented total DSO, net of contract liabilities. Senior Credit Facility amended and restated during Capital expenditures, net of disposals at $42.6 million for the October 2018, increasing revolver capacity to $750.0 million quarter ended October 27, 2018 and the term loan to $450.0 million and extending maturity to October 2023 Cap-ex, net of disposals for Fiscal 2019 anticipated at $150 - $160 million Liquidity of $350.1 million at the end of Q3-19 consisting of availability under Senior Credit Facility and cash on hand (a) The Company had $48.6 million of standby letters of credit outstanding under the Senior Credit Facility at both July 28, 2018 and October 27, 2018 (b) DSO is calculated as the summation of current accounts receivable (including unbilled receivables), plus current contract assets, less contract liabilities (formerly referred to as billings in excess of costs and estimated earnings) divided by average revenue per day during the respective quarter. Long-term contract assets are excluded from the calculation of DSO, as these amounts represent payments made to customers pursuant to long-term agreements and are recognized as a reduction of contract revenues over the period for which the related services are provided to the customers. 9

Outlook for Quarter Ending January 26, 2019 (Q4-2019) Financial tables - $ in millions, except earnings per share amounts (% as a percent of contract revenues, except as noted for Effective income tax rate) Q4-19 Outlook Other Expectations Outlook – Outlook – Quarter Ended Quarter Ending Quarter Ended Quarter Ending January 27, 2018 January 26, 2019 January 27, 2018 January 26, 2019 (Q4-19) (Q4-19) Contract revenues $ 655.1 $ 695 - $ 745 Depreciation $ 36.6 $ 39.9 - $ 40.9 Amortization $ 5.8 $ 5.4 Share-based compensation $ 5.9 $ 5.3 (Included in General & Administrative Expense) GAAP Diluted Earnings (Loss) per Common $ 1.24 $ (0.09) - $ 0.13 Non-GAAP Adjusted Interest expense $ 5.2 $ 7.6 Share (a) (Excludes non-cash amortization of debt discount of $4.6 million for the quarter ended January 27, 2018 and expectation of $4.9 million for Q4-19) Non-GAAP Adjusted Diluted Earnings per $ 0.12 $ 0.02 - $ 0.24 Other income, net $ 0.3 $ 0.0 - $ 0.6 Common Share (Includes Gain on sales of fixed assets of $0.7 million for the quarter ended January 27, 2018 and expectation of $0.8 - $1.4 million for Q4-19) Non-GAAP Adjusted Effective income tax rate 44.6% 27.6% Non-GAAP Adjusted EBITDA % 9.1% 8.4% - 9.2% (as a % of Non-GAAP Adjusted Income before Taxes) Non-GAAP Adjusted Diluted Shares (a) 31.8 million 31.8 million (a) GAAP Loss per common share at the low end of the outlook range for the quarter ending January 26, 2019 is calculated using 31.3 million shares, which excludes common stock equivalents related to share- based awards as their effect would be anti-dilutive. See “Regulation G Disclosure” slides 13-21 for a reconciliation of GAAP to Non-GAAP financial measures. 10

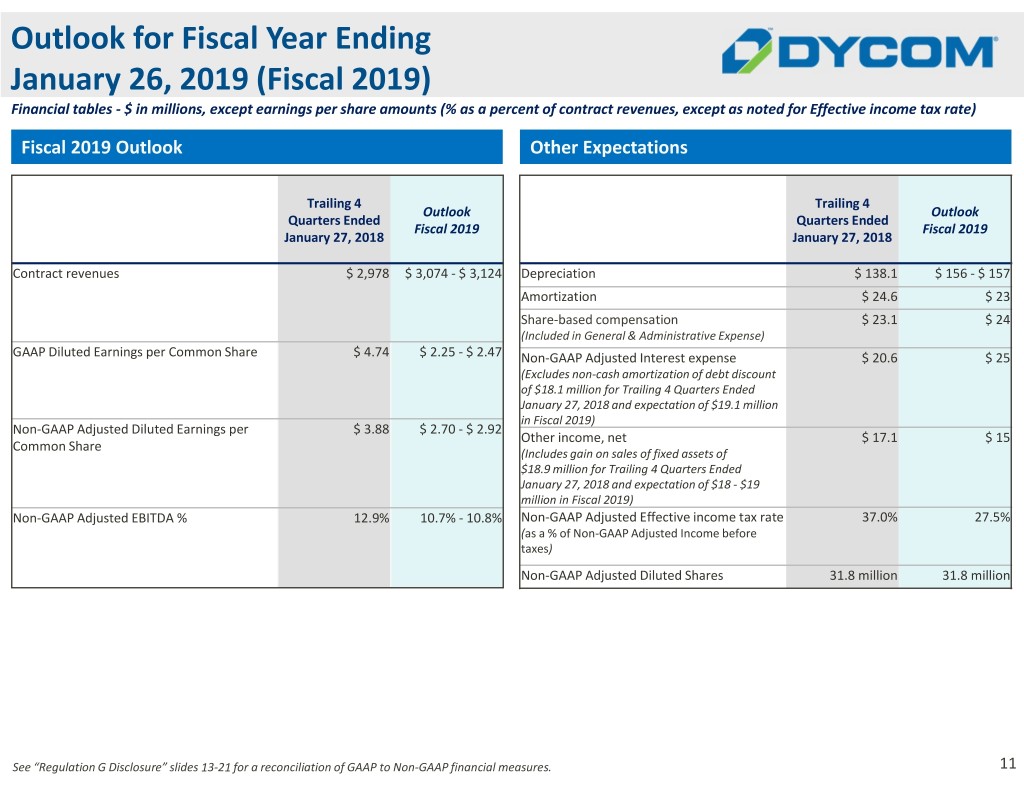

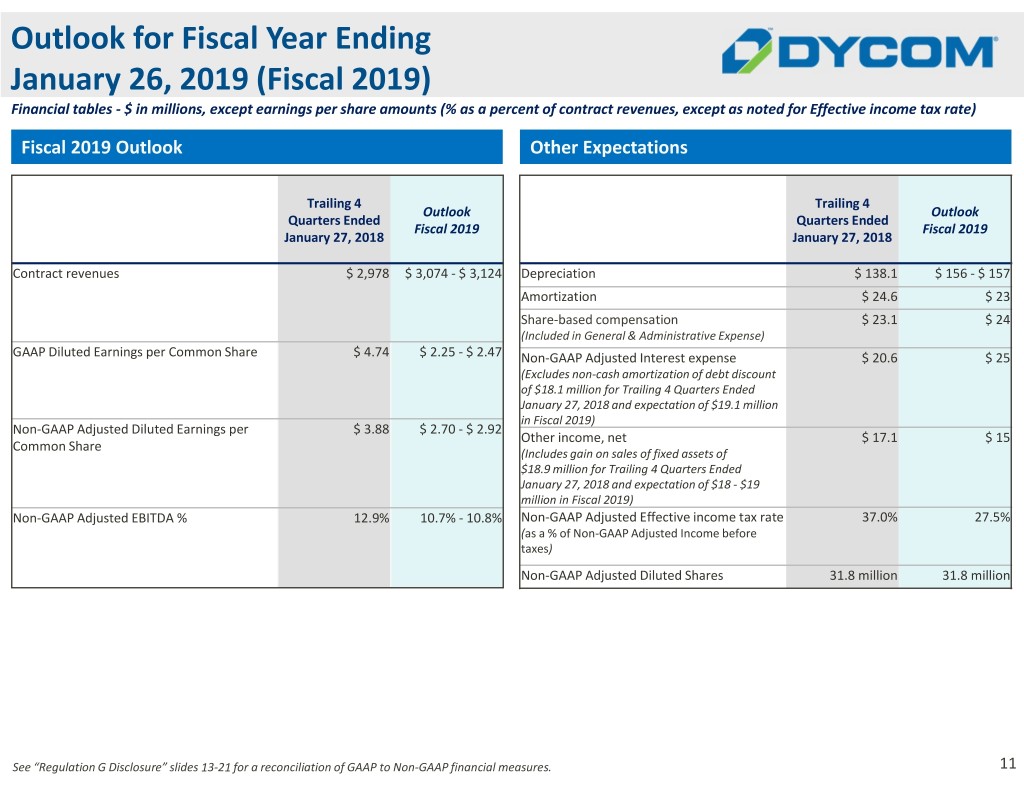

Outlook for Fiscal Year Ending January 26, 2019 (Fiscal 2019) Financial tables - $ in millions, except earnings per share amounts (% as a percent of contract revenues, except as noted for Effective income tax rate) Fiscal 2019 Outlook Other Expectations Trailing 4 Trailing 4 Outlook Outlook Quarters Ended Quarters Ended Fiscal 2019 Fiscal 2019 January 27, 2018 January 27, 2018 Contract revenues $ 2,978 $ 3,074 - $ 3,124 Depreciation $ 138.1 $ 156 - $ 157 Amortization $ 24.6 $ 23 Share-based compensation $ 23.1 $ 24 (Included in General & Administrative Expense) GAAP Diluted Earnings per Common Share $ 4.74 $ 2.25 - $ 2.47 Non-GAAP Adjusted Interest expense $ 20.6 $ 25 (Excludes non-cash amortization of debt discount of $18.1 million for Trailing 4 Quarters Ended January 27, 2018 and expectation of $19.1 million in Fiscal 2019) Non-GAAP Adjusted Diluted Earnings per $ 3.88 $ 2.70 - $ 2.92 Other income, net $ 17.1 $ 15 Common Share (Includes gain on sales of fixed assets of $18.9 million for Trailing 4 Quarters Ended January 27, 2018 and expectation of $18 - $19 million in Fiscal 2019) Non-GAAP Adjusted EBITDA % 12.9% 10.7% - 10.8% Non-GAAP Adjusted Effective income tax rate 37.0% 27.5% (as a % of Non-GAAP Adjusted Income before taxes) Non-GAAP Adjusted Diluted Shares 31.8 million 31.8 million See “Regulation G Disclosure” slides 13-21 for a reconciliation of GAAP to Non-GAAP financial measures. 11

Conclusion Firm and strengthening end market opportunities Fiber deployments in contemplation of emerging wireless technologies have begun in many regions of the country Wireless construction activity in support of expanded coverage and capacity is poised to accelerate Telephone companies are deploying FTTH to enable 1 gigabit high speed connections Cable operators continuing to deploy fiber to small and medium businesses and enterprises. Fiber deep deployments and new build opportunities are increasing. Customers are consolidating supply chains creating opportunities for market share growth and increasing the long-term value of our maintenance and operations business. We are increasingly providing integrated planning, engineering and design, procurement and construction and maintenance. Encouraged that our major customers are committed to multi-year capital spending initiatives 12

Appendix: Regulation G Disclosure Explanation of Non-GAAP Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In the Company’s quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, it may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. The Company believes that the presentation of certain Non-GAAP financial measures in these materials provides information that is useful to investors because it allows for a more direct comparison of the Company’s performance for the period reported with the Company’s performance in prior periods. The Company cautions that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Management defines the Non-GAAP financial measures used in this presentation as follows: • Non-GAAP Organic Contract Revenues - contract revenues from businesses that are included for the entire period in both the current and comparable prior periods, excluding contract revenues from storm restoration services. Non-GAAP Organic Contract Revenue growth (decline) is calculated as the percentage change in Non-GAAP Organic Contract Revenues over those of the comparable prior year periods. Management believes organic growth (decline) is a helpful measure for comparing the Company’s revenue performance with prior periods. • Non-GAAP Adjusted EBITDA - net income before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items. Management believes Non-GAAP Adjusted EBITDA is a helpful measure for comparing the Company’s operating performance with prior periods as well as with the performance of other companies with different capital structures or tax rates. • Non-GAAP Adjusted Net Income - GAAP net income before the non-cash amortization of the debt discount and the related tax impact and certain non-recurring items. • Non-GAAP Adjusted Diluted Earnings per Common Share and Non-GAAP Adjusted Diluted Shares - Non-GAAP Adjusted Net Income divided by Non-GAAP Adjusted Diluted Shares outstanding. The Company has a note hedge in effect to offset the economic dilution of additional shares from the Company's 0.75% convertible senior notes due September 2021 (the "Notes") up to an average quarterly share price of $130.43. The measure of Non-GAAP Adjusted Diluted shares used in computing Non-GAAP Adjusted Diluted Earnings per Common Share excludes dilution from the Notes. Management believes that the calculation of Non-GAAP Adjusted Diluted shares to reflect the note hedge will be useful to investors because it provides insight into the offsetting economic effect of the hedge against potential conversion of the Notes. Management excludes or adjusts each of the items identified below from Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Diluted Earnings per Common Share: • Non-cash amortization of the debt discount - The Company’s Notes were allocated between debt and equity components. The difference between the principal amount and the carrying amount of the liability component of the Notes represents a debt discount. The debt discount is being amortized over the term of the Notes but does not result in periodic cash interest payments. The Company has excluded the non-cash amortization of the debt discount from its Non-GAAP financial measures because it believes it is useful to analyze the component of interest expense for the Notes that will be paid in cash. The exclusion of the non-cash amortization from the Company’s Non-GAAP financial measures provides management with a consistent measure for assessing financial results. • Tax impact from Tax Reform - During the quarter ended January 27, 2018, the Company recognized an income tax benefit of approximately $32.2 million resulting from tax reform, primarily due to a reduction of net deferred tax liabilities. The Company has excluded this impact because it is a significant change in the U.S. federal corporate tax rate and because the Company believes it is not indicative of the Company’s underlying results or ongoing operations. • Tax impact of excess tax benefits or deficiencies - The Company excludes certain tax impacts resulting from the vesting and exercise of share-based awards as these amounts may vary significantly from period to period. Excluding these amounts from the Company’s Non-GAAP financial measures provides management with a more consistent measure for assessing financial results. • Tax impact of adjusted results - The tax impact of adjusted results reflects the Company’s effective tax rate used for financial planning for the applicable period. 13

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Organic Contract Revenues Unaudited ($ in millions) NON-GAAP ADJUSTMENTS Revenue Growth (Decline)% Revenues from Additional week Non-GAAP - Contract Revenues from storm as a result of our Organic Quarters Ended: Revenues acquired restoration 52/53 week Contract Non-GAAP - Q3-19 Organic Growth: - GAAP businesses (a) services fiscal year (b) Revenues GAAP % Organic % October 27, 2018 $ 848.2 $ (8.8) $ (3.9) $ - $ 835.6 12.2% 12.9% October 28, 2017 $ 756.2 $ - $ (15.9) $ - $ 740.3 Prior Quarters Organic Growth (Decline): July 28, 2018 $ 799.5 $ (9.1) $ (3.8) $ - $ 786.6 2.5% 0.8% July 29, 2017 $ 780.2 $ - $ - $ - $ 780.2 April 28, 2018 $ 731.4 $ (15.4) $ (14.8) $ - $ 701.1 (7.0)% (10.0)% April 29, 2017 $ 786.3 $ (7.1) $ - $ - $ 779.2 January 27, 2018 $ 655.1 $ (8.4) $ (19.6) $ - $ 627.1 (6.6)% (10.6)% January 28, 2017 $ 701.1 $ - $ - $ - $ 701.1 October 28, 2017 $ 756.2 $ (8.6) $ (15.5) $ - $ 732.2 (5.4)% (8.4)% October 29, 2016 $ 799.2 $ - $ - $ - $ 799.2 July 29, 2017 $ 780.2 $ (19.3) $ - $ - $ 760.9 (1.1)% 4.6% July 30, 2016 $ 789.2 $ (5.6) $ - $ (56.0) $ 727.6 April 29, 2017 $ 786.3 $ (23.0) $ - $ - $ 763.4 18.3% 14.9% April 23, 2016 $ 664.6 $ - $ - $ - $ 664.6 January 28, 2017 $ 701.1 $ (13.4) $ - $ - $ 687.7 25.3% 22.9% January 23, 2016 $ 559.5 $ - $ - $ - $ 559.5 (a) Amounts represent contract revenues from acquired businesses that were not owned for the full period in both the current and comparable prior periods, including any contract revenues from storm restoration services for these acquired businesses. (b) The quarter ended July 30, 2016 contained 14 weeks as a result of our 52/53 week fiscal year as compared to 13 weeks in all other quarterly periods presented. The Non- GAAP adjustment is calculated independently for each comparative period as (i) contract revenues less, (ii) contract revenues from acquired businesses in each applicable period, (iii) divided by 14 weeks. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 13. 14

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Organic Contract Revenues – Certain Customers Unaudited ($ in millions) All customers Top 5 (excluding Total Contract Customers Top 5 Revenues combined (a) Customers) Comcast Verizon AT&T Windstream Contract Revenues - GAAP Quarter Ended October 27, 2018 (Q3-19) $ 848.2 $ 664.9 $ 183.4 $ 176.3 $ 174.1 $ 164.6 $ 31.1 Quarter Ended October 28, 2017 (Q1-18) $ 756.2 $ 566.3 $ 189.9 $ 165.0 $ 80.6 $ 143.5 $ 31.1 Contract Revenues - GAAP - % Changes 12.2% 17.4% (3.4)% 6.9% 116.0% 14.7% 0.2% Non-GAAP Adjustments Revenues from business acquired (Q3-19) $ (8.8) $ (7.6) $ (1.2) $ (7.1) $ - $ (0.5) $ - Revenues from storm restoration services (Q3-19) $ (3.9) $ (3.8) $ (0.0) $ (1.5) $ (0.0) $ (0.7) $ (1.3) Revenues from storm restoration services (Q1-18) $ (15.9) $ (13.7) $ (2.2) $ (10.7) $ - $ (1.3) $ (1.5) Non-GAAP - Organic Contract Revenues Quarter Ended October 27, 2018 (Q3-19) $ 835.6 $ 653.4 $ 182.2 $ 167.7 $ 174.0 $ 163.4 $ 29.8 Quarter Ended October 28, 2017 (Q1-18) $ 740.3 $ 552.6 $ 187.7 $ 154.3 $ 80.6 $ 142.2 $ 29.6 Non-GAAP - Organic Contract Revenues % Changes Organic Contract Revenues % Change 12.9% 18.3% (2.9)% 8.7% 115.9% 14.9% 1.0% (a) Includes Comcast, Verizon, AT&T, CenturyLink, and Windstream Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 13. 15

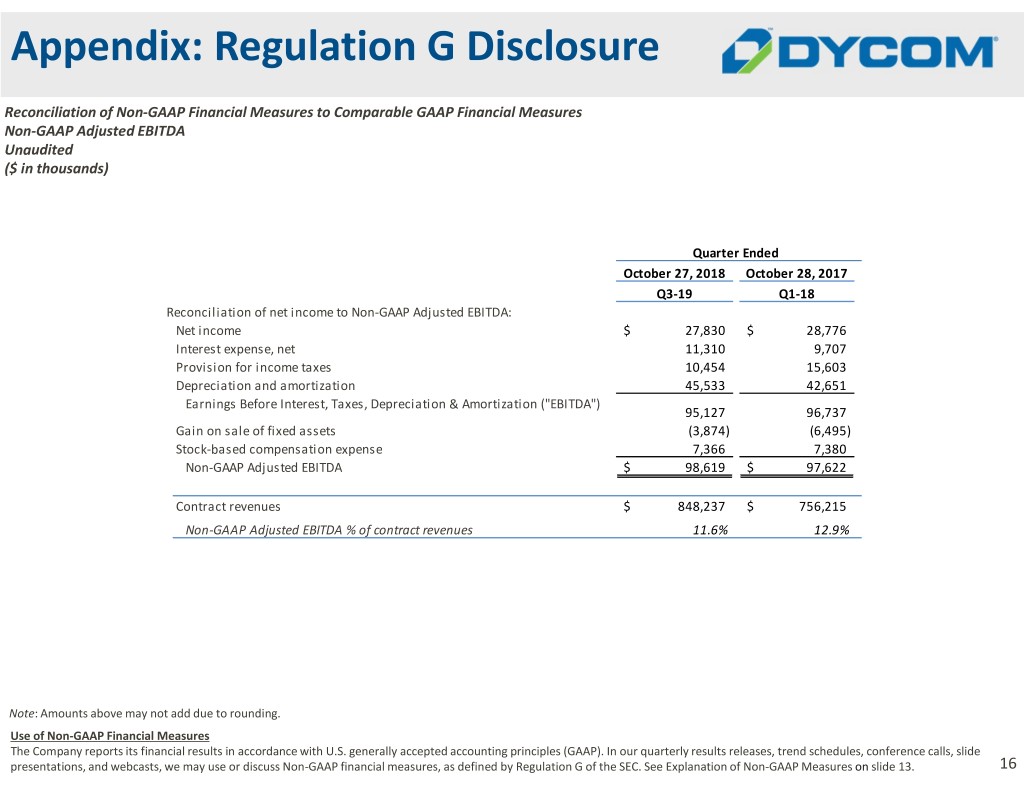

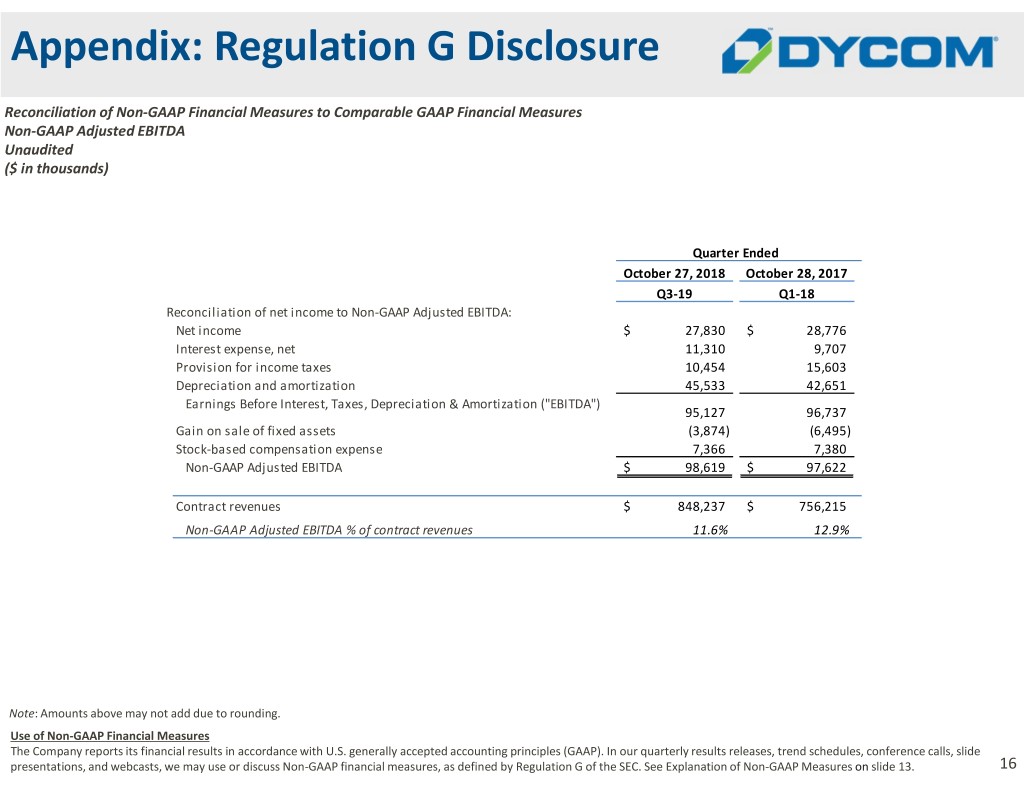

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Adjusted EBITDA Unaudited ($ in thousands) Quarter Ended October 27, 2018 October 28, 2017 Q3-19 Q1-18 Reconciliation of net income to Non-GAAP Adjusted EBITDA: Net income $ 27,830 $ 28,776 Interest expense, net 11,310 9,707 Provision for income taxes 10,454 15,603 Depreciation and amortization 45,533 42,651 Earnings Before Interest, Taxes, Depreciation & Amortization ("EBITDA") 95,127 96,737 Gain on sale of fixed assets (3,874) (6,495) Stock-based compensation expense 7,366 7,380 Non-GAAP Adjusted EBITDA $ 98,619 $ 97,622 Contract revenues $ 848,237 $ 756,215 Non-GAAP Adjusted EBITDA % of contract revenues 11.6% 12.9% Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 13. 16

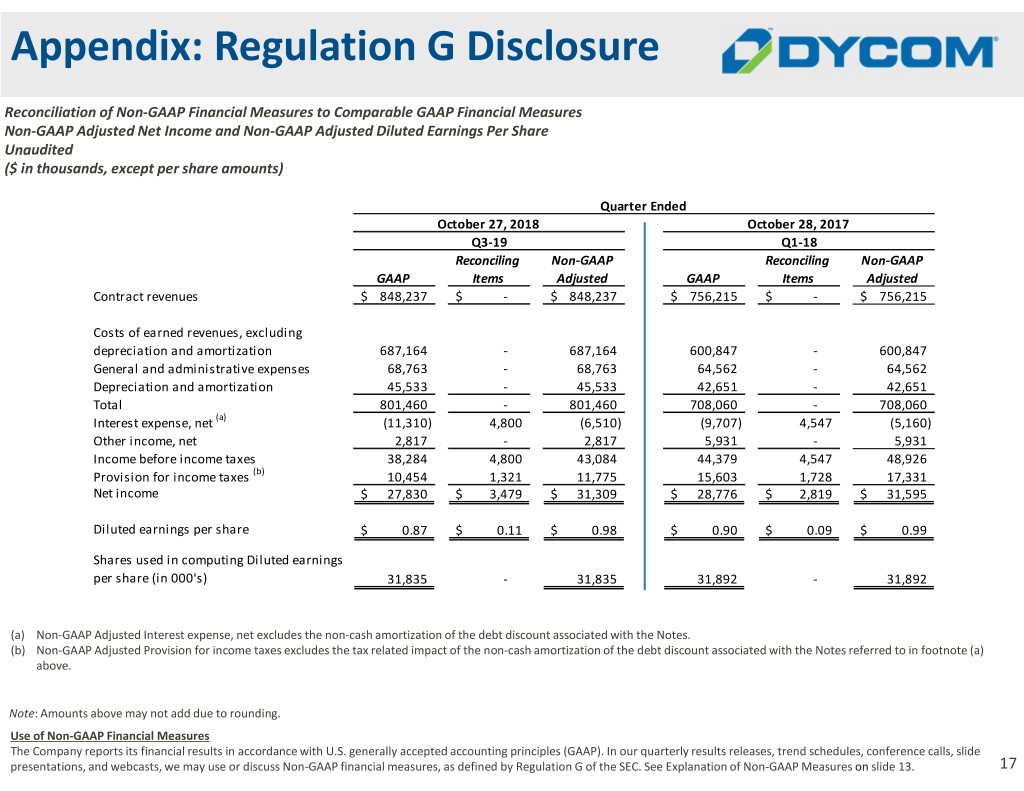

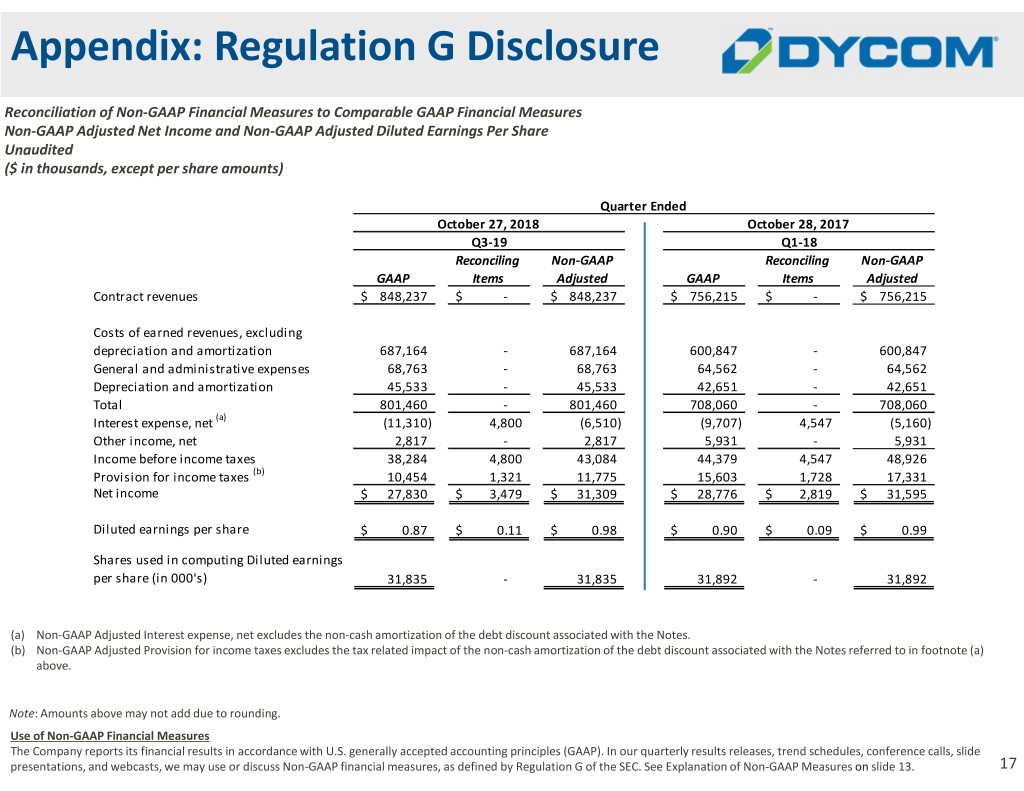

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Diluted Earnings Per Share Unaudited ($ in thousands, except per share amounts) Quarter Ended October 27, 2018 October 28, 2017 Q3-19 Q1-18 Reconciling Non-GAAP Reconciling Non-GAAP GAAP Items Adjusted GAAP Items Adjusted Contract revenues $ 848,237 $ - $ 848,237 $ 756,215 $ - $ 756,215 Costs of earned revenues, excluding depreciation and amortization 687,164 - 687,164 600,847 - 600,847 General and administrative expenses 68,763 - 68,763 64,562 - 64,562 Depreciation and amortization 45,533 - 45,533 42,651 - 42,651 Total 801,460 - 801,460 708,060 - 708,060 Interest expense, net (a) (11,310) 4,800 (6,510) (9,707) 4,547 (5,160) Other income, net 2,817 - 2,817 5,931 - 5,931 Income before income taxes 38,284 4,800 43,084 44,379 4,547 48,926 Provision for income taxes (b) 10,454 1,321 11,775 15,603 1,728 17,331 Net income $ 27,830 $ 3,479 $ 31,309 $ 28,776 $ 2,819 $ 31,595 Diluted earnings per share $ 0.87 $ 0.11 $ 0.98 $ 0.90 $ 0.09 $ 0.99 Shares used in computing Diluted earnings per share (in 000's) 31,835 - 31,835 31,892 - 31,892 (a) Non-GAAP Adjusted Interest expense, net excludes the non-cash amortization of the debt discount associated with the Notes. (b) Non-GAAP Adjusted Provision for income taxes excludes the tax related impact of the non-cash amortization of the debt discount associated with the Notes referred to in footnote (a) above. Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 13. 17

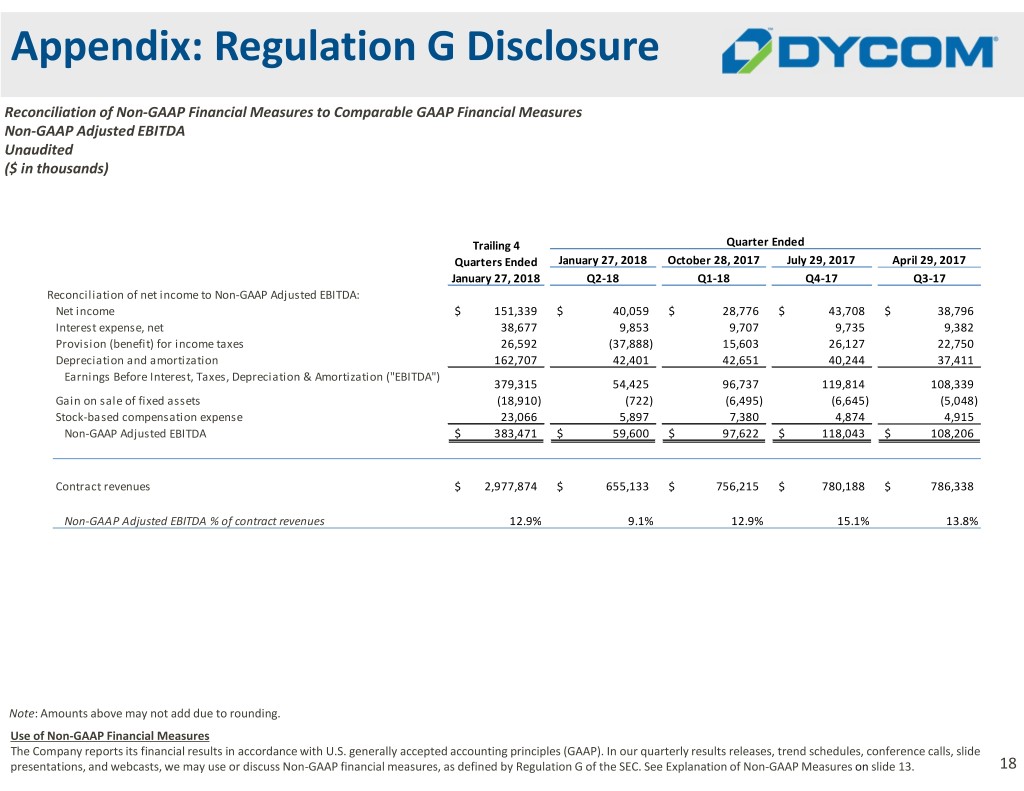

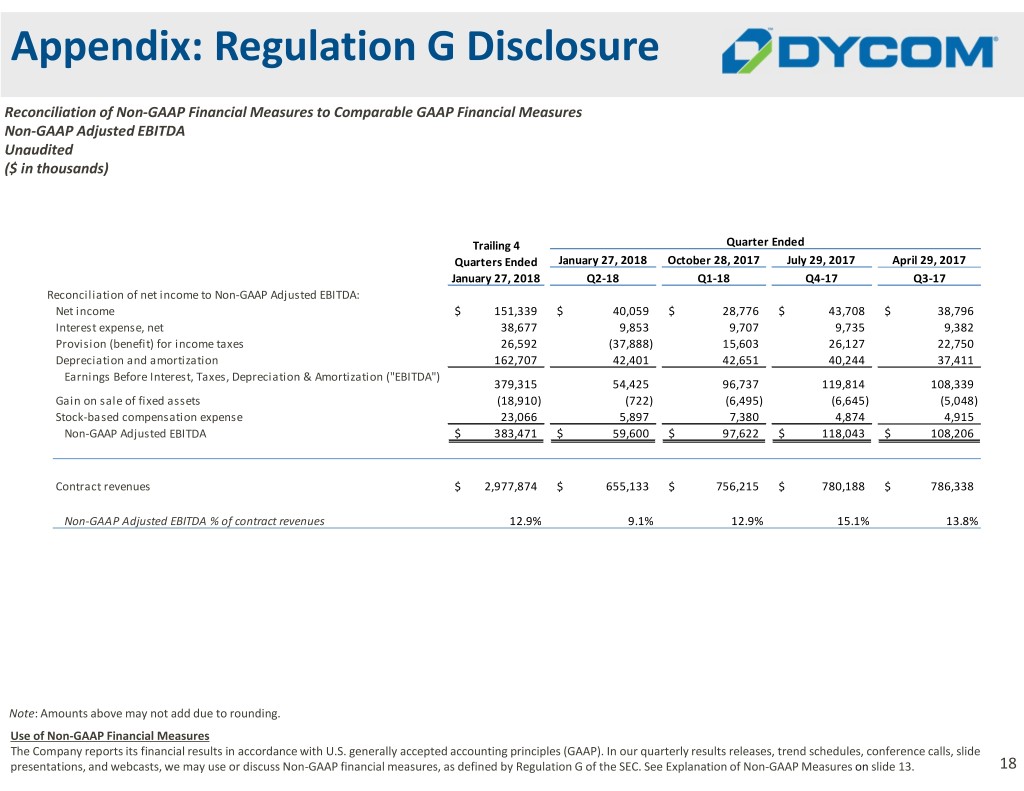

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Adjusted EBITDA Unaudited ($ in thousands) Trailing 4 Quarter Ended Quarters Ended January 27, 2018 October 28, 2017 July 29, 2017 April 29, 2017 January 27, 2018 Q2-18 Q1-18 Q4-17 Q3-17 Reconciliation of net income to Non-GAAP Adjusted EBITDA: Net income $ 151,339 $ 40,059 $ 28,776 $ 43,708 $ 38,796 Interest expense, net 38,677 9,853 9,707 9,735 9,382 Provision (benefit) for income taxes 26,592 (37,888) 15,603 26,127 22,750 Depreciation and amortization 162,707 42,401 42,651 40,244 37,411 Earnings Before Interest, Taxes, Depreciation & Amortization ("EBITDA") 379,315 54,425 96,737 119,814 108,339 Gain on sale of fixed assets (18,910) (722) (6,495) (6,645) (5,048) Stock-based compensation expense 23,066 5,897 7,380 4,874 4,915 Non-GAAP Adjusted EBITDA $ 383,471 $ 59,600 $ 97,622 $ 118,043 $ 108,206 Contract revenues $ 2,977,874 $ 655,133 $ 756,215 $ 780,188 $ 786,338 Non-GAAP Adjusted EBITDA % of contract revenues 12.9% 9.1% 12.9% 15.1% 13.8% Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 13. 18

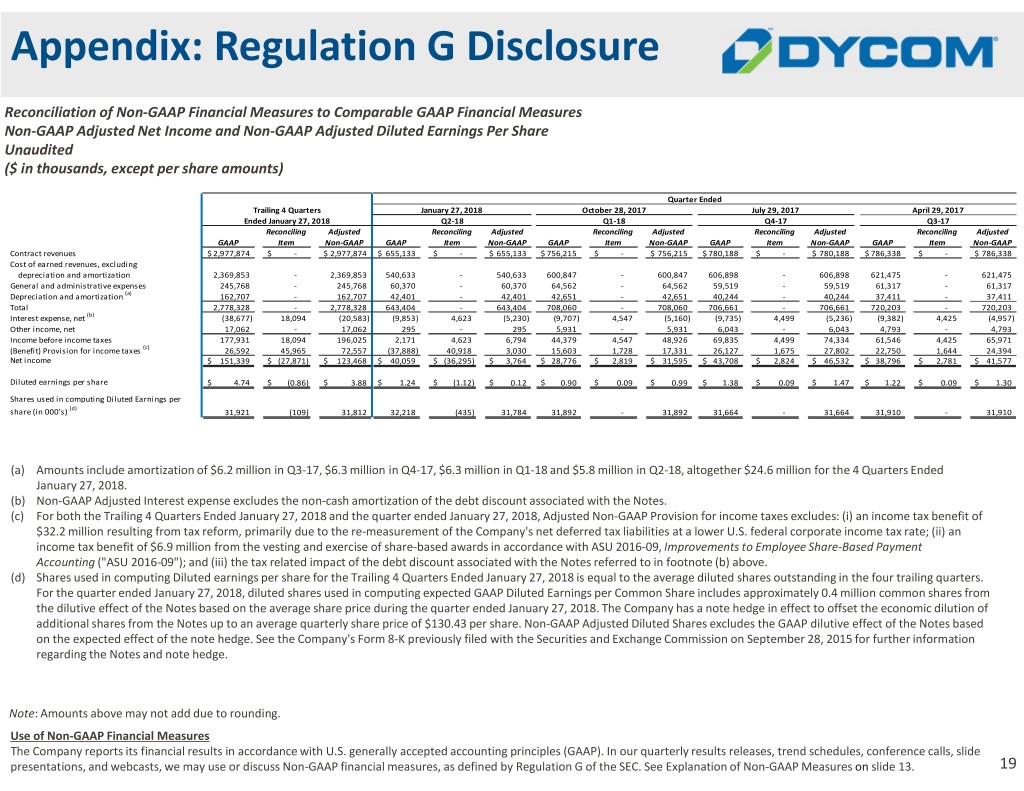

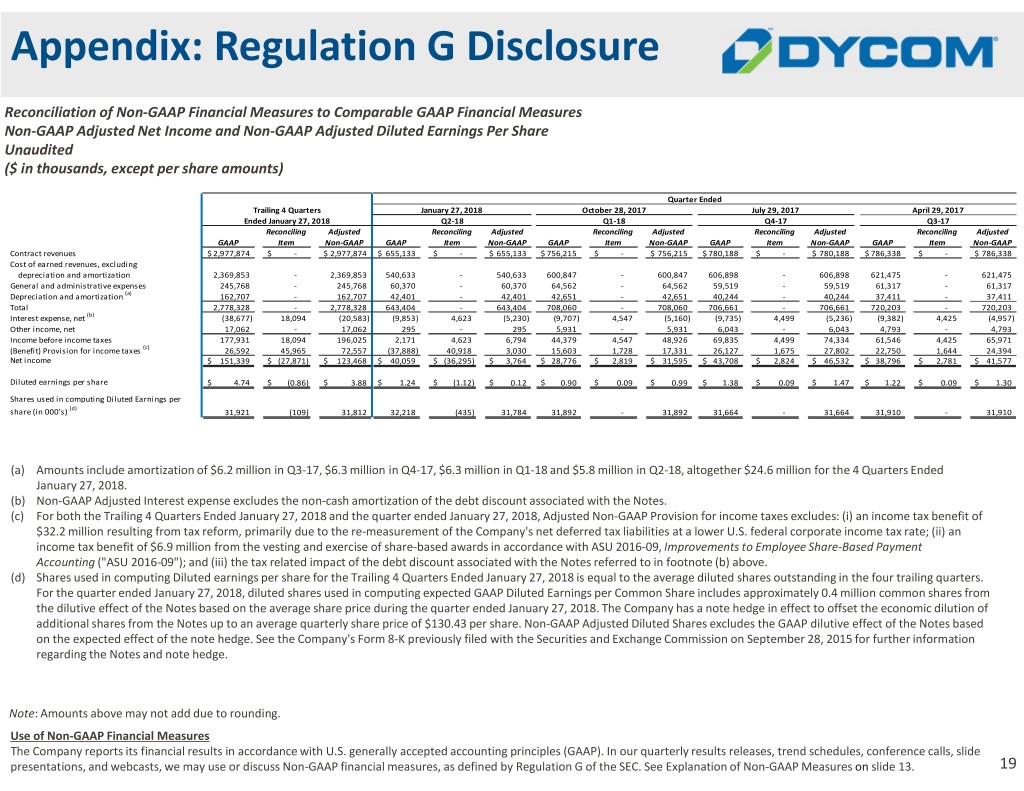

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Diluted Earnings Per Share Unaudited ($ in thousands, except per share amounts) Quarter Ended Trailing 4 Quarters January 27, 2018 October 28, 2017 July 29, 2017 April 29, 2017 Ended January 27, 2018 Q2-18 Q1-18 Q4-17 Q3-17 Reconciling Adjusted Reconciling Adjusted Reconciling Adjusted Reconciling Adjusted Reconciling Adjusted GAAP Item Non-GAAP GAAP Item Non-GAAP GAAP Item Non-GAAP GAAP Item Non-GAAP GAAP Item Non-GAAP Contract revenues $ 2,977,874 $ - $ 2,977,874 $ 655,133 $ - $ 655,133 $ 756,215 $ - $ 756,215 $ 780,188 $ - $ 780,188 $ 786,338 $ - $ 786,338 Cost of earned revenues, excluding depreciation and amortization 2,369,853 - 2,369,853 540,633 - 540,633 600,847 - 600,847 606,898 - 606,898 621,475 - 621,475 General and administrative expenses 245,768 - 245,768 60,370 - 60,370 64,562 - 64,562 59,519 - 59,519 61,317 - 61,317 Depreciation and amortization (a) 162,707 - 162,707 42,401 - 42,401 42,651 - 42,651 40,244 - 40,244 37,411 - 37,411 Total 2,778,328 - 2,778,328 643,404 - 643,404 708,060 - 708,060 706,661 - 706,661 720,203 - 720,203 Interest expense, net (b) (38,677) 18,094 (20,583) (9,853) 4,623 (5,230) (9,707) 4,547 (5,160) (9,735) 4,499 (5,236) (9,382) 4,425 (4,957) Other income, net 17,062 - 17,062 295 - 295 5,931 - 5,931 6,043 - 6,043 4,793 - 4,793 Income before income taxes 177,931 18,094 196,025 2,171 4,623 6,794 44,379 4,547 48,926 69,835 4,499 74,334 61,546 4,425 65,971 (Benefit) Provision for income taxes (c) 26,592 45,965 72,557 (37,888) 40,918 3,030 15,603 1,728 17,331 26,127 1,675 27,802 22,750 1,644 24,394 Net income $ 151,339 $ (27,871) $ 123,468 $ 40,059 $ (36,295) $ 3,764 $ 28,776 $ 2,819 $ 31,595 $ 43,708 $ 2,824 $ 46,532 $ 38,796 $ 2,781 $ 41,577 Diluted earnings per share $ 4.74 $ (0.86) $ 3.88 $ 1.24 $ (1.12) $ 0.12 $ 0.90 $ 0.09 $ 0.99 $ 1.38 $ 0.09 $ 1.47 $ 1.22 $ 0.09 $ 1.30 Shares used in computing Diluted Earnings per (d) share (in 000's) 31,921 (109) 31,812 32,218 (435) 31,784 31,892 - 31,892 31,664 - 31,664 31,910 - 31,910 (a) Amounts include amortization of $6.2 million in Q3-17, $6.3 million in Q4-17, $6.3 million in Q1-18 and $5.8 million in Q2-18, altogether $24.6 million for the 4 Quarters Ended January 27, 2018. (b) Non-GAAP Adjusted Interest expense excludes the non-cash amortization of the debt discount associated with the Notes. (c) For both the Trailing 4 Quarters Ended January 27, 2018 and the quarter ended January 27, 2018, Adjusted Non-GAAP Provision for income taxes excludes: (i) an income tax benefit of $32.2 million resulting from tax reform, primarily due to the re-measurement of the Company's net deferred tax liabilities at a lower U.S. federal corporate income tax rate; (ii) an income tax benefit of $6.9 million from the vesting and exercise of share-based awards in accordance with ASU 2016-09, Improvements to Employee Share-Based Payment Accounting ("ASU 2016-09"); and (iii) the tax related impact of the debt discount associated with the Notes referred to in footnote (b) above. (d) Shares used in computing Diluted earnings per share for the Trailing 4 Quarters Ended January 27, 2018 is equal to the average diluted shares outstanding in the four trailing quarters. For the quarter ended January 27, 2018, diluted shares used in computing expected GAAP Diluted Earnings per Common Share includes approximately 0.4 million common shares from the dilutive effect of the Notes based on the average share price during the quarter ended January 27, 2018. The Company has a note hedge in effect to offset the economic dilution of additional shares from the Notes up to an average quarterly share price of $130.43 per share. Non-GAAP Adjusted Diluted Shares excludes the GAAP dilutive effect of the Notes based on the expected effect of the note hedge. See the Company's Form 8-K previously filed with the Securities and Exchange Commission on September 28, 2015 for further information regarding the Notes and note hedge. Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 13. 19

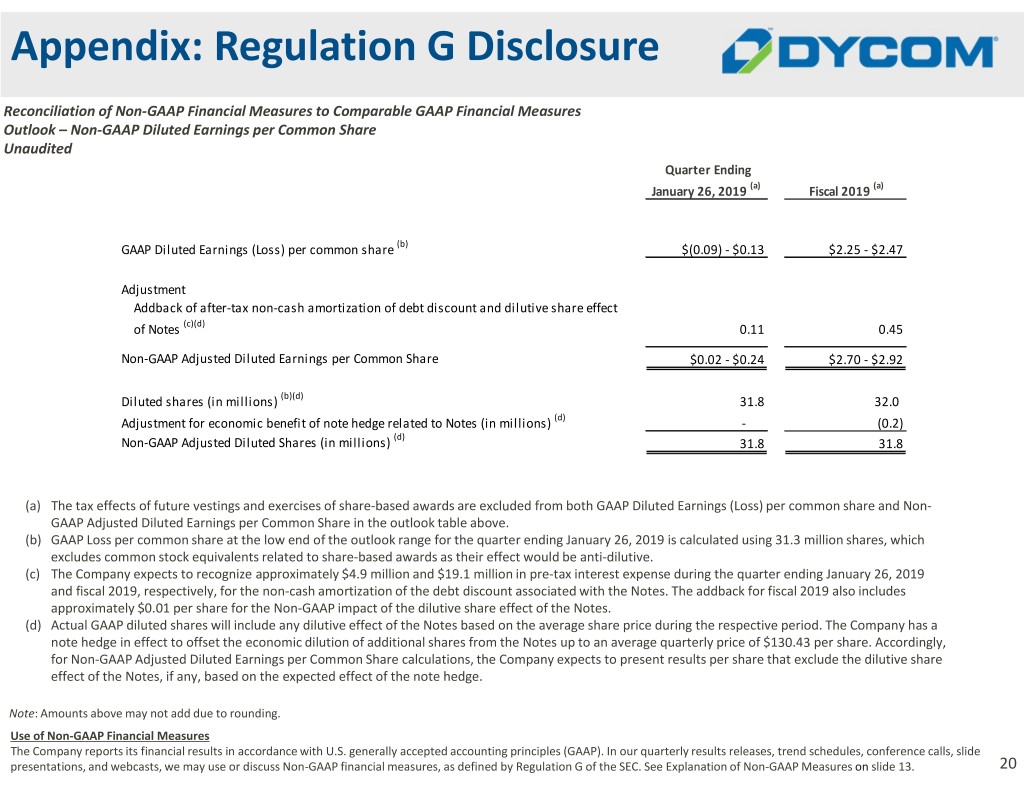

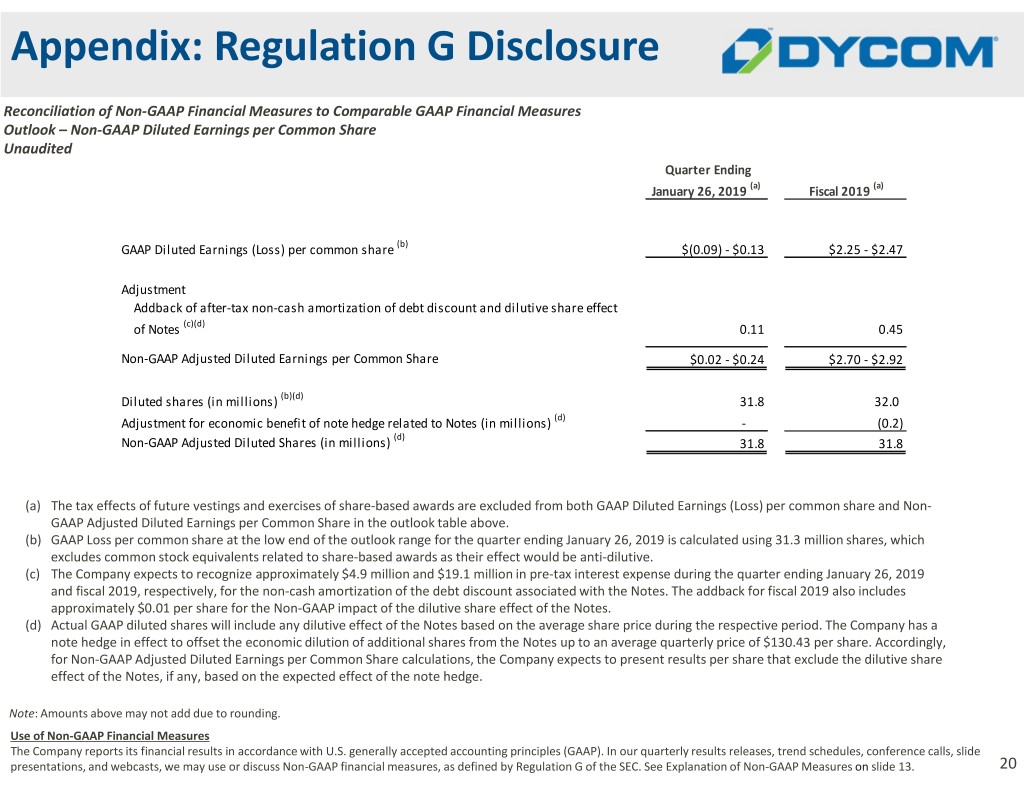

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Outlook – Non-GAAP Diluted Earnings per Common Share Unaudited Quarter Ending January 26, 2019 (a) Fiscal 2019 (a) GAAP Diluted Earnings (Loss) per common share (b) $(0.09) - $0.13 $2.25 - $2.47 Adjustment Addback of after-tax non-cash amortization of debt discount and dilutive share effect of Notes (c)(d) 0.11 0.45 Non-GAAP Adjusted Diluted Earnings per Common Share $0.02 - $0.24 $2.70 - $2.92 Diluted shares (in millions) (b)(d) 31.8 32.0 Adjustment for economic benefit of note hedge related to Notes (in millions) (d) - (0.2) (d) Non-GAAP Adjusted Diluted Shares (in millions) 31.8 31.8 (a) The tax effects of future vestings and exercises of share-based awards are excluded from both GAAP Diluted Earnings (Loss) per common share and Non- GAAP Adjusted Diluted Earnings per Common Share in the outlook table above. (b) GAAP Loss per common share at the low end of the outlook range for the quarter ending January 26, 2019 is calculated using 31.3 million shares, which excludes common stock equivalents related to share-based awards as their effect would be anti-dilutive. (c) The Company expects to recognize approximately $4.9 million and $19.1 million in pre-tax interest expense during the quarter ending January 26, 2019 and fiscal 2019, respectively, for the non-cash amortization of the debt discount associated with the Notes. The addback for fiscal 2019 also includes approximately $0.01 per share for the Non-GAAP impact of the dilutive share effect of the Notes. (d) Actual GAAP diluted shares will include any dilutive effect of the Notes based on the average share price during the respective period. The Company has a note hedge in effect to offset the economic dilution of additional shares from the Notes up to an average quarterly price of $130.43 per share. Accordingly, for Non-GAAP Adjusted Diluted Earnings per Common Share calculations, the Company expects to present results per share that exclude the dilutive share effect of the Notes, if any, based on the expected effect of the note hedge. Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 13. 20

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Reconciliation of Net Income to Non-GAAP Adjusted EBITDA based on the Midpoint of Earnings per Common Share ("EPS") Guidance Unaudited ($ in millions) Quarter Ending January 26, 2019 (Q4-19) Fiscal 2019 (at midpoint of EPS guidance) Net income $ 1 $ 76 Interest expense, net 13 44 Provision for income taxes 0.2 29 Depreciation and amortization 46 180 Earnings Before Interest, Taxes, Depreciation & Amortization ("EBITDA") 59 328 Gain on sale of fixed assets (1) (18) Stock-based compensation expense 5 24 Non-GAAP Adjusted EBITDA $ 63 $ 334 Contract revenues (at midpoint of guidance) $ 720 $ 3,099 Non-GAAP Adjusted EBITDA % of contract revenues (at midpoint of guidance) 8.8% 10.8% Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 13. 21

3rd Quarter Fiscal 2019 November 20, 2018 Results Conference Call