Dycom Q2 2020 Results August 28, 2019

Participants Agenda Steven E. Nielsen • Q2 2020 Overview President & Chief Executive Officer • Industry Update Timothy R. Estes Chief Operating Officer • Financial & Operational Highlights H. Andrew DeFerrari Chief Financial Officer • Outlook Ryan F. Urness • Conclusion General Counsel • Q&A 2

Important Information Caution Concerning Forward-Looking Statements This presentation contains “forward-looking statements”. Other than statements of historical facts, all statements contained in this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and objectives of management, are forward-looking statements. Words such as “outlook,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “should,” “could,” “project,” and similar expressions, as well as statements in future tense, identify forward-looking statements. You should not consider forward- looking statements as a guarantee of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences are discussed in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 4, 2019 and other filings with the SEC. The forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. The Company undertakes no obligation to update these forward-looking statements to reflect new information, or events or circumstances arising after such date. Non-GAAP Financial Measures This presentation includes certain “Non-GAAP” financial measures as defined by Regulation G of the SEC. As required by the SEC, an explanation of the Non-GAAP financial measures and a reconciliation of those measures to the most directly comparable GAAP financial measures are provided in the Company’s Form 8-K filed with the SEC on August 28, 2019 and on the Company’s Investor Center website at https://ir.dycomind.com. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. 3

Contract Revenues Q2 2020 Overview Contract revenues Strong organic revenue growth of 11.1% Entered into contract modification that increases revenue produced by a large customer program. As a result, recognized $11.8 million of contract revenues for services performed in prior periods and $1.8 million of related performance-based compensation expense. On an after-tax basis, these items contributed $0.23 per common share diluted for Q2 2020. Operating performance Non-GAAP Adjusted Non-GAAP Adjusted EBITDA for Q2 2020 of $100.2 million, or 11.3% of contract revenues, compared Diluted EPS to $97.8 million, or 12.2% of contract revenues, for Q2 2019 Non-GAAP Adjusted Diluted EPS of $1.09 per share for Q2 2020 compared to $1.05 per share for Q2 2019 Liquidity Ample liquidity of $289.1 million at the end of Q2 2020 consisting of availability under Senior Credit Facility and cash on hand $65.0 million in outstanding revolver borrowings at the end of Q2 2020 4

Industry Update Industry increasing network bandwidth dramatically Major industry participants constructing or upgrading significant wireline networks generally designed to provision 1 gigabit network speeds directly to consumers or wirelessly using 5G technologies Emerging wireless technologies are driving significant wireline deployments Wireline deployments necessary to facilitate expected decades long deployment of fully converged wireless/wireline networks that will enable high bandwidth, low latency 5G applications Industry effort required to deploy these converged networks continues to meaningfully broaden our set of opportunities Dycom’s competitively unparalleled scale and financial strength position it well to deliver valuable services to its customers Currently providing services for 1 gigabit full deployments and converged wireless/wireline multi-use network deployments across the country in more than a dozen metropolitan areas to several customers Customers are pursuing multi-year initiatives that are being planned and managed on a market by market basis Dycom’s ability to provide integrated planning, engineering and design, procurement and construction and maintenance services is of particular value to several industry participants 5

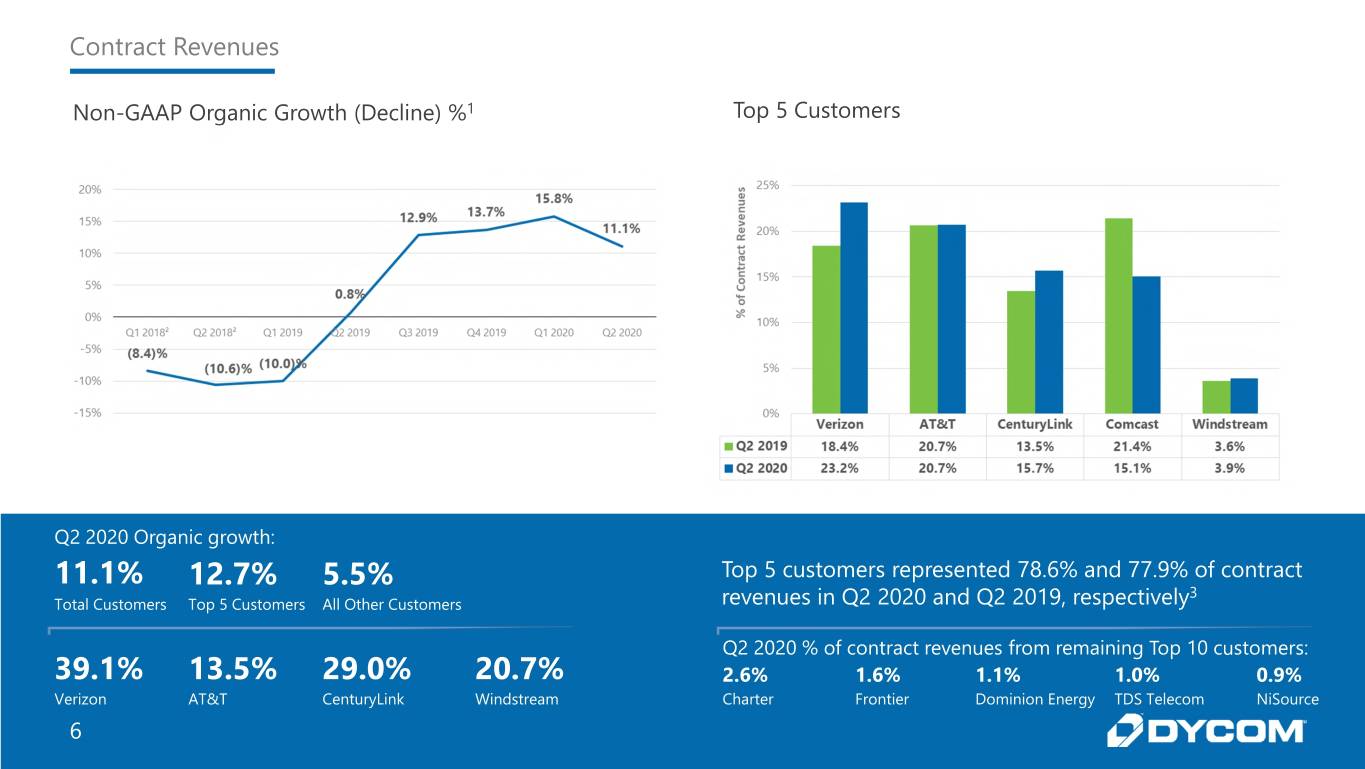

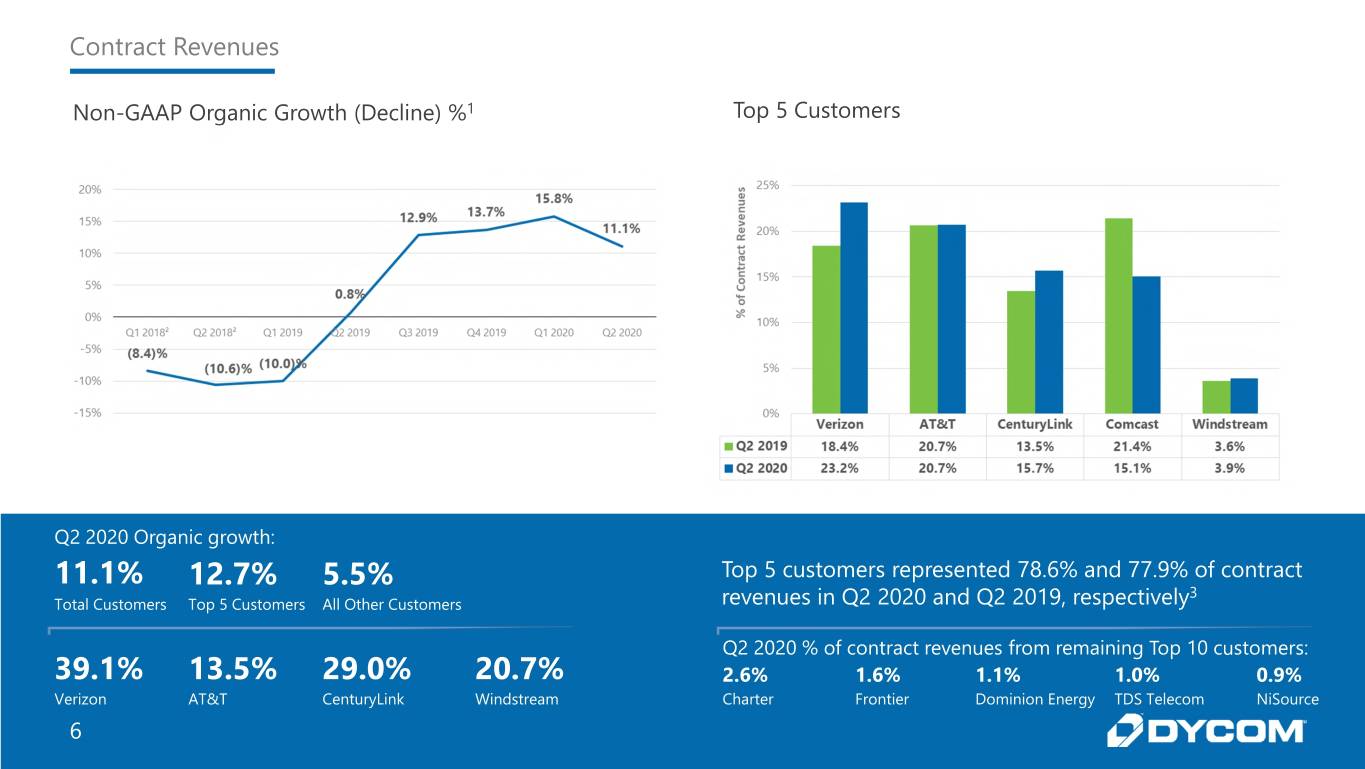

Contract Revenues Non-GAAP Organic Growth (Decline) %1 Top 5 Customers Q2 2020 Organic growth: 11.1% 12.7% 5.5% Top 5 customers represented 78.6% and 77.9% of contract 3 Total Customers Top 5 Customers All Other Customers revenues in Q2 2020 and Q2 2019, respectively Q2 2020 % of contract revenues from remaining Top 10 customers: 39.1% 13.5% 29.0% 20.7% 2.6% 1.6% 1.1% 1.0% 0.9% Verizon AT&T CenturyLink Windstream Charter Frontier Dominion Energy TDS Telecom NiSource 6

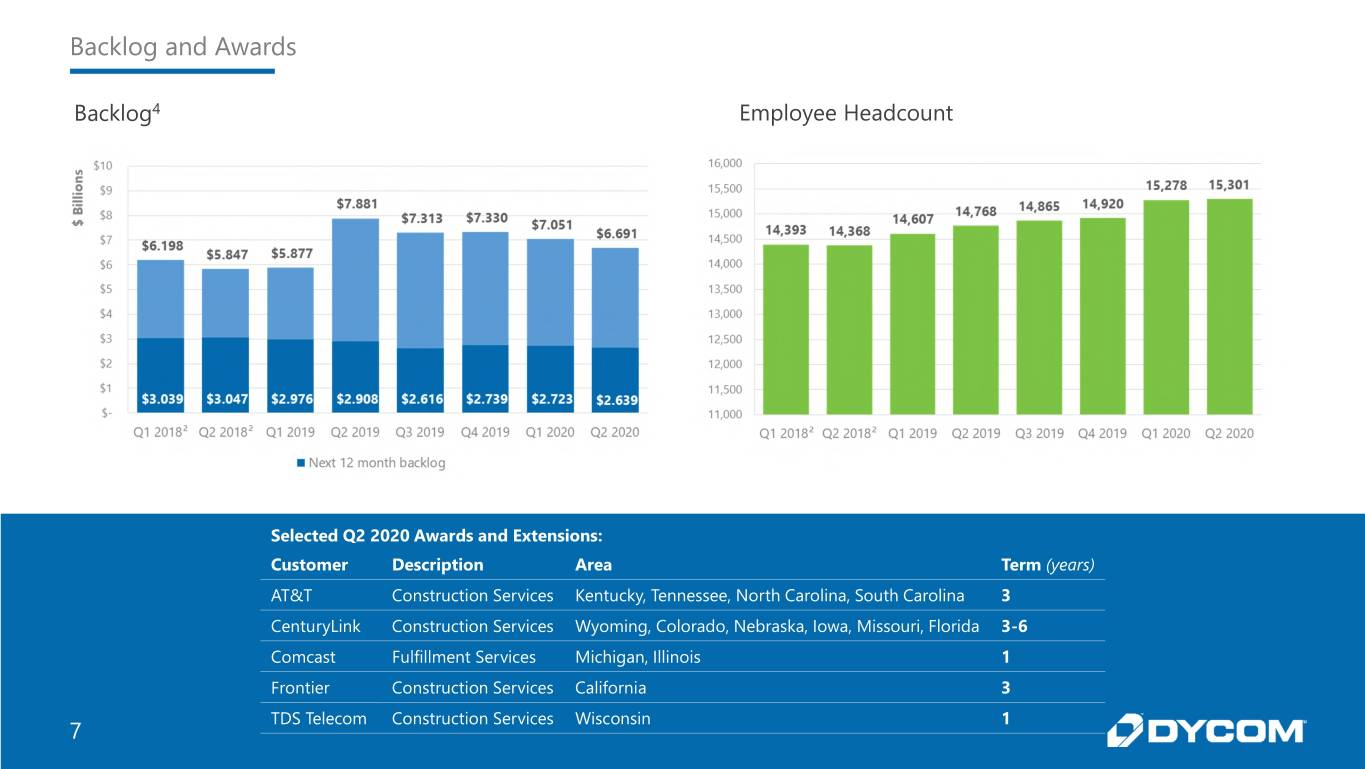

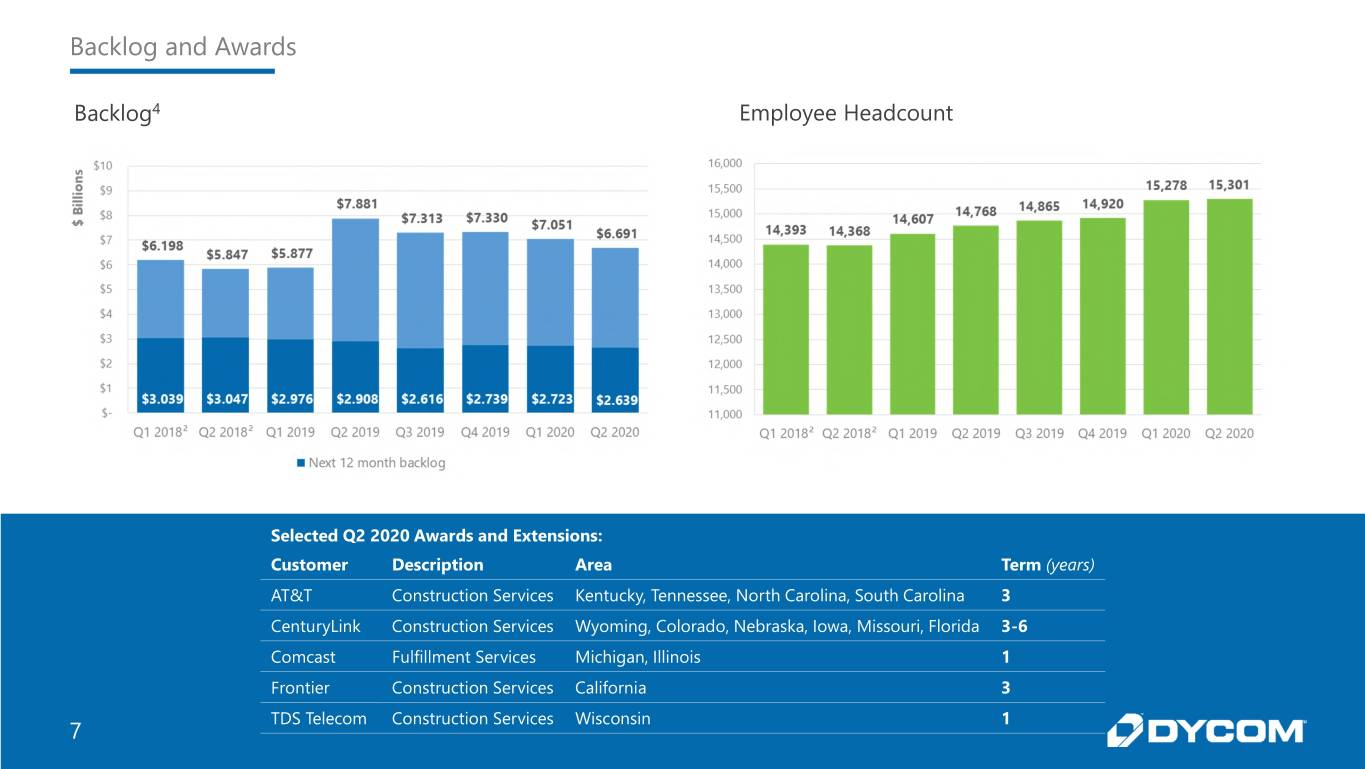

Backlog and Awards Backlog4 Employee Headcount Selected Q2 2020 Awards and Extensions: Customer Description Area Term (years) AT&T Construction Services Kentucky, Tennessee, North Carolina, South Carolina 3 CenturyLink Construction Services Wyoming, Colorado, Nebraska, Iowa, Missouri, Florida 3-6 Comcast Fulfillment Services Michigan, Illinois 1 Frontier Construction Services California 3 TDS Telecom Construction Services Wisconsin 1 7

Financial Highlights As % of Contract Revenues Revenues of $884.2 million in Q2 2020 increased organically 11.1% from the comparable prior period Entered into contract modification that increases revenue produced by a large customer program. As a result, recognized $11.8 million of contract revenues for services performed in prior periods and $1.8 million of related performance-based compensation expense. On an after-tax basis, these items contributed $0.23 per common share diluted for Q2 2020. Recognized $1.1 million of income tax expense in Q2 2020 related to a previous tax year filing. This expense is excluded from Non-GAAP Adjusted Diluted EPS. 8

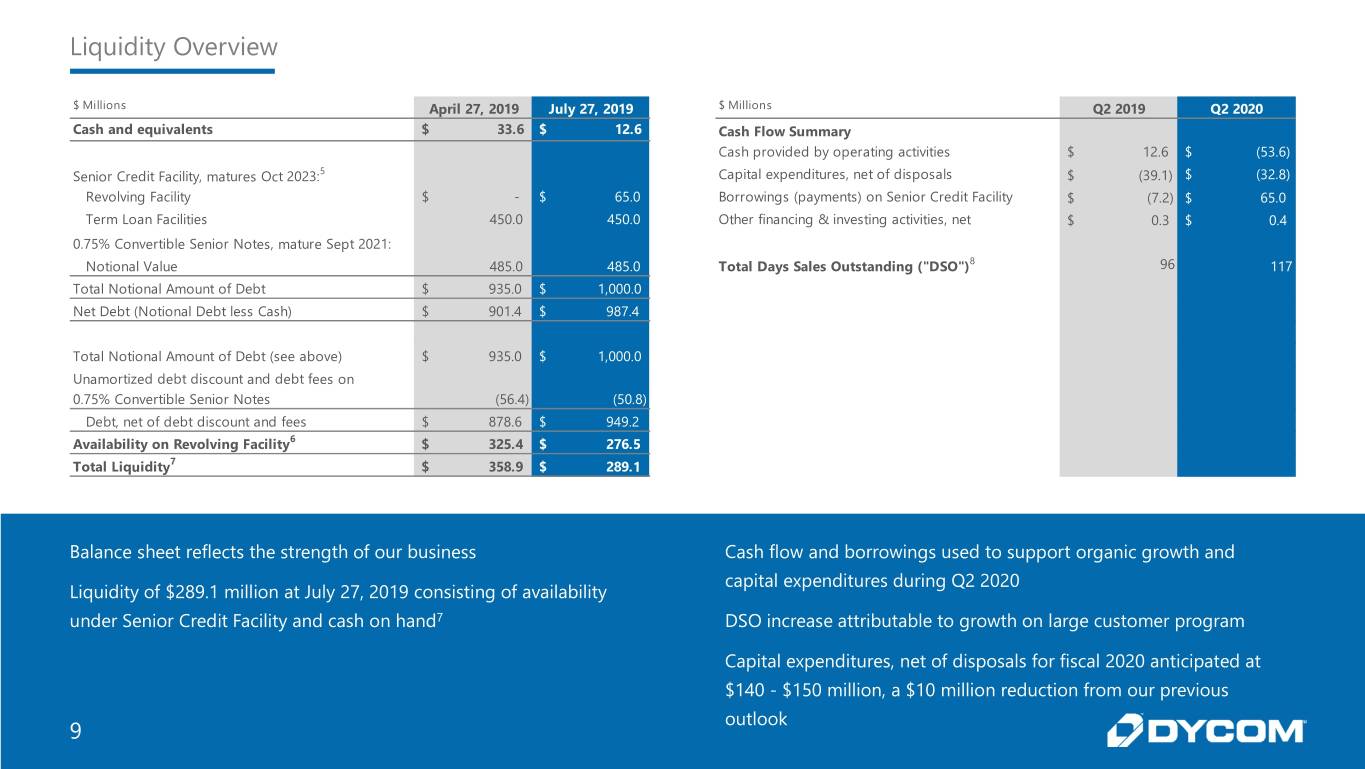

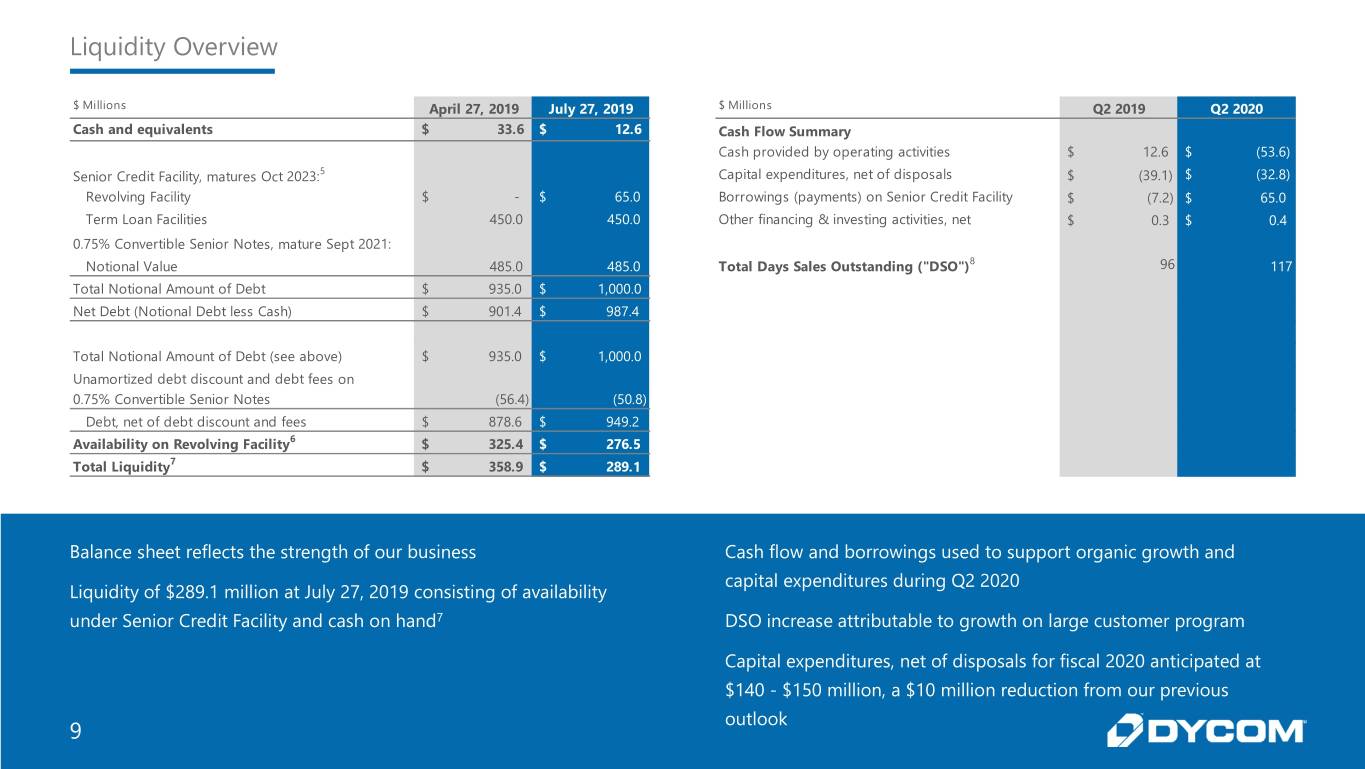

Liquidity Overview $ Millions April 27, 2019 July 27, 2019 $ Millions Q2 2019 Q2 2020 Cash and equivalents $ 33.6 $ 12.6 Cash Flow Summary Cash provided by operating activities $ 12.6 $ (53.6) Senior Credit Facility, matures Oct 2023:5 Capital expenditures, net of disposals $ (39.1) $ (32.8) Revolving Facility $ - $ 65.0 Borrowings (payments) on Senior Credit Facility $ (7.2) $ 65.0 Term Loan Facilities 450.0 450.0 Other financing & investing activities, net $ 0.3 $ 0.4 0.75% Convertible Senior Notes, mature Sept 2021: Notional Value 485.0 485.0 Total Days Sales Outstanding ("DSO")8 96 117 Total Notional Amount of Debt $ 935.0 $ 1,000.0 Net Debt (Notional Debt less Cash) $ 901.4 $ 987.4 Total Notional Amount of Debt (see above) $ 935.0 $ 1,000.0 Unamortized debt discount and debt fees on 0.75% Convertible Senior Notes (56.4) (50.8) Debt, net of debt discount and fees $ 878.6 $ 949.2 Availability on Revolving Facility6 $ 325.4 $ 276.5 Total Liquidity7 $ 358.9 $ 289.1 Balance sheet reflects the strength of our business Cash flow and borrowings used to support organic growth and capital expenditures during Q2 2020 Liquidity of $289.1 million at July 27, 2019 consisting of availability under Senior Credit Facility and cash on hand7 DSO increase attributable to growth on large customer program Capital expenditures, net of disposals for fiscal 2020 anticipated at $140 - $150 million, a $10 million reduction from our previous outlook 9

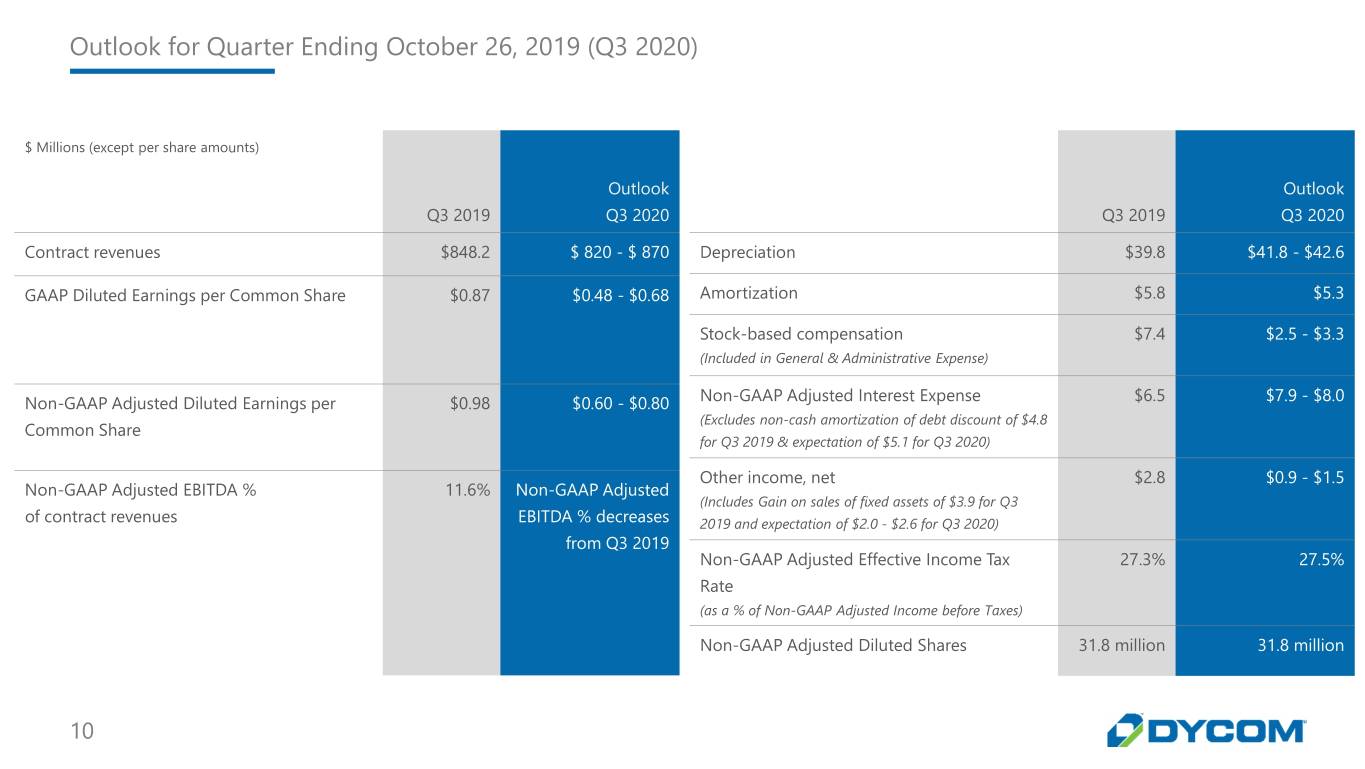

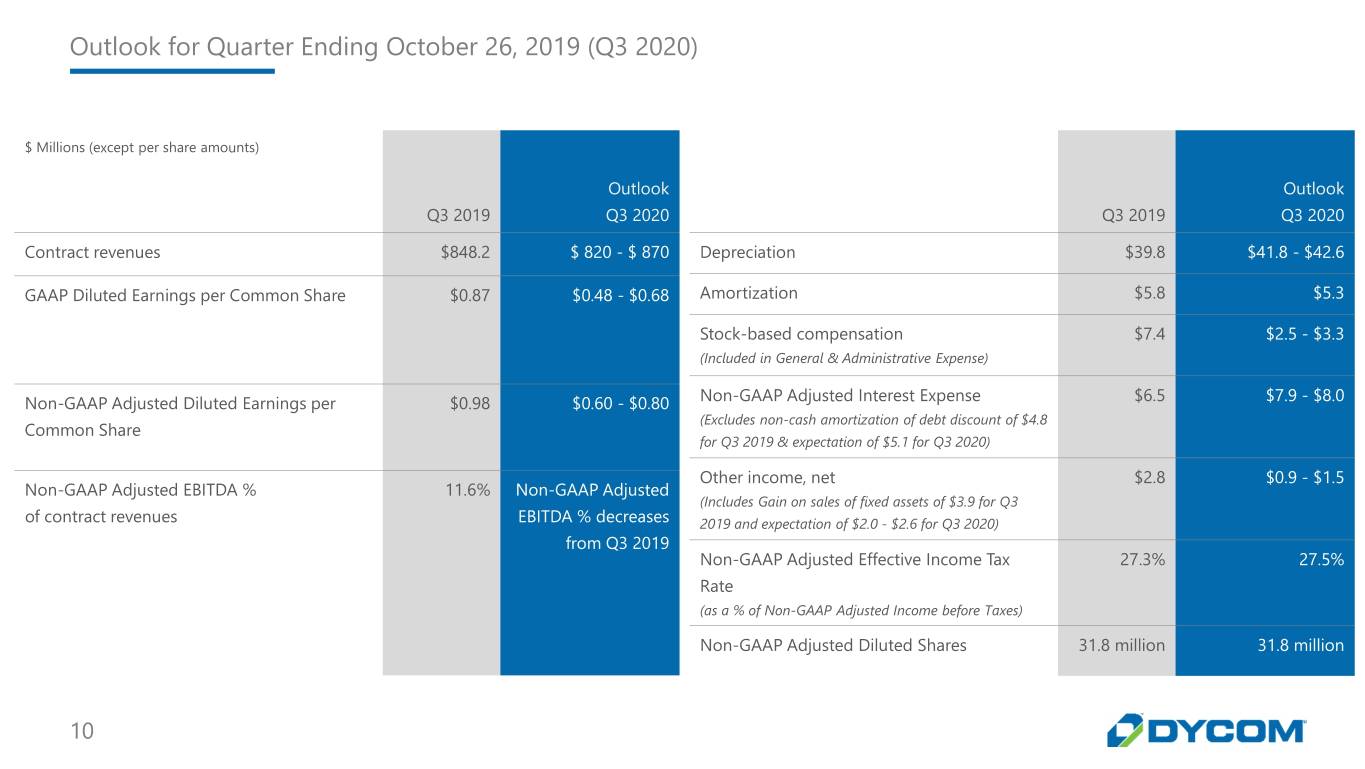

Outlook for Quarter Ending October 26, 2019 (Q3 2020) $ MillionsQ1 (except 2020 per Outlookshare amounts) Outlook Outlook Q3 2019 Q3 2020 Q3 2019 Q3 2020 Contract revenues $848.2 $ 820 - $ 870 Depreciation $39.8 $41.8 - $42.6 GAAP Diluted Earnings per Common Share $0.87 $0.48 - $0.68 Amortization $5.8 $5.3 Stock-based compensation $7.4 $2.5 - $3.3 (Included in General & Administrative Expense) Non-GAAP Adjusted Diluted Earnings per $0.98 $0.60 - $0.80 Non-GAAP Adjusted Interest Expense $6.5 $7.9 - $8.0 (Excludes non-cash amortization of debt discount of $4.8 Common Share for Q3 2019 & expectation of $5.1 for Q3 2020) Other income, net $2.8 $0.9 - $1.5 Non-GAAP Adjusted EBITDA % 11.6% Non-GAAP Adjusted (Includes Gain on sales of fixed assets of $3.9 for Q3 of contract revenues EBITDA % decreases 2019 and expectation of $2.0 - $2.6 for Q3 2020) from Q3 2019 Non-GAAP Adjusted Effective Income Tax 27.3% 27.5% Rate (as a % of Non-GAAP Adjusted Income before Taxes) Non-GAAP Adjusted Diluted Shares 31.8 million 31.8 million 10

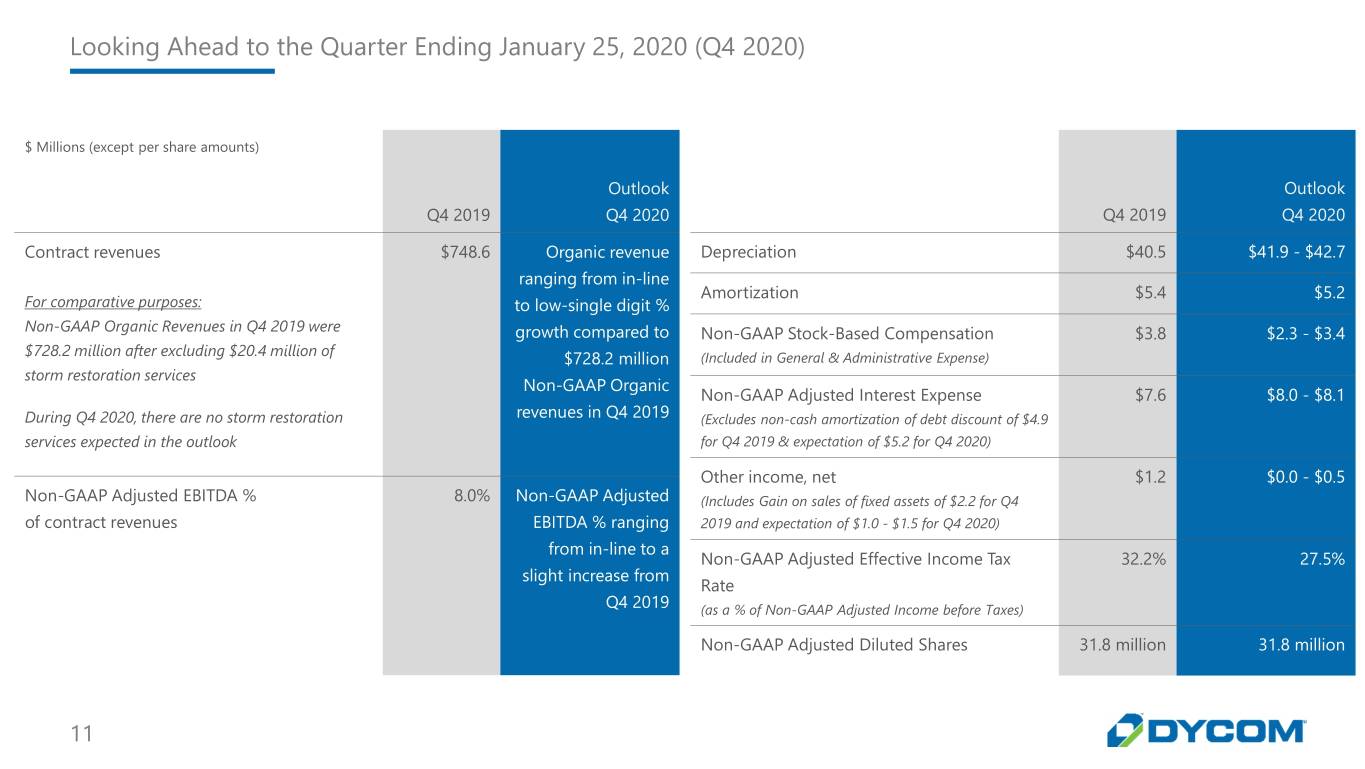

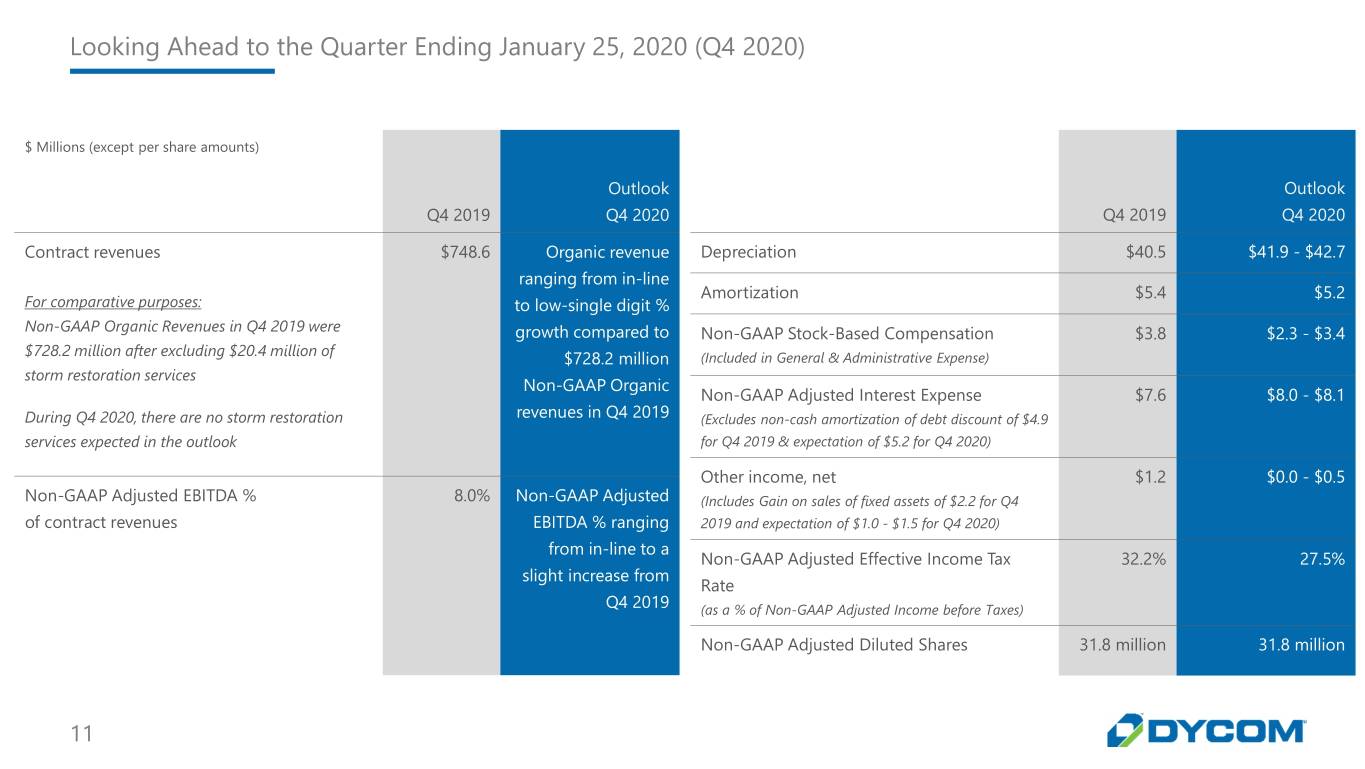

Looking Ahead to the Quarter Ending January 25, 2020 (Q4 2020) $ MillionsQ1 (except 2020 per Outlookshare amounts) Outlook Outlook Q4 2019 Q4 2020 Q4 2019 Q4 2020 Contract revenues $748.6 Organic revenue Depreciation $40.5 $41.9 - $42.7 ranging from in-line Amortization $5.4 $5.2 For comparative purposes: to low-single digit % Non-GAAP Organic Revenues in Q4 2019 were growth compared to Non-GAAP Stock-Based Compensation $3.8 $2.3 - $3.4 $728.2 million after excluding $20.4 million of $728.2 million (Included in General & Administrative Expense) storm restoration services Non-GAAP Organic Non-GAAP Adjusted Interest Expense $7.6 $8.0 - $8.1 During Q4 2020, there are no storm restoration revenues in Q4 2019 (Excludes non-cash amortization of debt discount of $4.9 services expected in the outlook for Q4 2019 & expectation of $5.2 for Q4 2020) Other income, net $1.2 $0.0 - $0.5 Non-GAAP Adjusted EBITDA % 8.0% Non-GAAP Adjusted (Includes Gain on sales of fixed assets of $2.2 for Q4 of contract revenues EBITDA % ranging 2019 and expectation of $1.0 - $1.5 for Q4 2020) from in-line to a Non-GAAP Adjusted Effective Income Tax 32.2% 27.5% slight increase from Rate Q4 2019 (as a % of Non-GAAP Adjusted Income before Taxes) Non-GAAP Adjusted Diluted Shares 31.8 million 31.8 million 11

Conclusion Firm and strengthening end market opportunities Fiber deployments enabling new wireless technologies are underway in many regions of the country Wireless construction activity in support of expanded coverage and capacity has begun to accelerate through the deployment of enhanced macro cells and new small cells Telephone companies are deploying FTTH to enable 1 gigabit high speed connections Cable operators are deploying fiber to small and medium businesses and enterprises. Fiber deep deployments and new build opportunities are underway. Dramatically increased speeds to consumers are being provisioned and consumer data usage is growing Customers are consolidating supply chains creating opportunities for market share growth and increasing the long-term value of Dycom’s maintenance and operations business Dycom is increasingly providing integrated planning, engineering and design, procurement and construction and maintenance services for wired and converged wireless/wireline networks Encouraged that Dycom’s major customers are committed to multi-year capital spending initiatives 12

Notes 1) Organic growth (decline) % adjusted for revenues from acquired businesses and storm restoration services, when applicable. 2) Due to the change in the Company’s fiscal year end, the Company’s fiscal 2018 six month transition period consisted of Q1 2018 and Q2 2018. 3) Top 5 customers included Verizon, AT&T, CenturyLink, Comcast and Windstream for Q2 2020, compared to Comcast, AT&T, Verizon, CenturyLink and Charter for Q2 2019. 4) Our backlog represents an estimate of services to be performed pursuant to master service agreements and other contractual agreements over the terms of those contracts. These estimates are based on contract terms and evaluations regarding the timing of the services to be provided. In the case of master service agreements, backlog is estimated based on the work performed in the preceding twelve-month period, when available. When estimating backlog for newly initiated master service agreements and other long and short-term contracts, we also consider the anticipated scope of the contract and information received from the customer during the procurement process. A significant majority of our backlog comprises services under master service agreements and other long-term contracts. Backlog is not a measure defined by United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others. 5) The Company had $52.3 million of standby letters of credit outstanding under the Senior Credit Facility at both July 27, 2019 and April 27, 2019. 6) Availability provided by the Company’s Senior Credit Facility includes incremental amounts of eligible cash and equivalents above $50 million. As of both July 27, 2019 and April 27, 2019, there were no incremental amounts included as Cash and equivalents were less than $50 million. 7) As of both July 27, 2019 and April 27, 2019, Total Liquidity represents the sum of the Availability on Revolving Facility and cash and equivalents. 8) DSO is calculated as the summation of current and non-current accounts receivable (including unbilled receivables), net of allowance for doubtful accounts, plus current contract assets, less contract liabilities (formerly referred to as billings in excess of costs and estimated earnings) divided by average revenue per day during the respective quarter. Long-term contract assets are excluded from the calculation of DSO, as these amounts represent payments made to customers pursuant to long-term agreements and are recognized as a reduction of contract revenues over the period for which the related services are provided to the customers. 13