Investor Presentation March 2020

Important Information Caution Concerning Forward-Looking Statements This presentation contains “forward-looking statements”. Other than statements of historical facts, all statements contained in this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and objectives of management, are forward-looking statements. Words such as “outlook,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “should,” “could,” “project,” and similar expressions, as well as statements in future tense, identify forward-looking statements. You should not consider forward- looking statements as a guarantee of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences are discussed in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 2, 2020 and other filings with the SEC. The forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. The Company undertakes no obligation to update these forward-looking statements to reflect new information, or events or circumstances arising after such date. Non-GAAP Financial Measures This presentation includes certain “Non-GAAP” financial measures as defined by Regulation G of the SEC. As required by the SEC, an explanation of the Non-GAAP financial measures and a reconciliation of those measures to the most directly comparable GAAP financial measures are provided in the Company’s Form 8-K filed with the SEC on March 12, 2020 and on the Company’s Investor Center website at https://ir.dycomind.com. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. 2

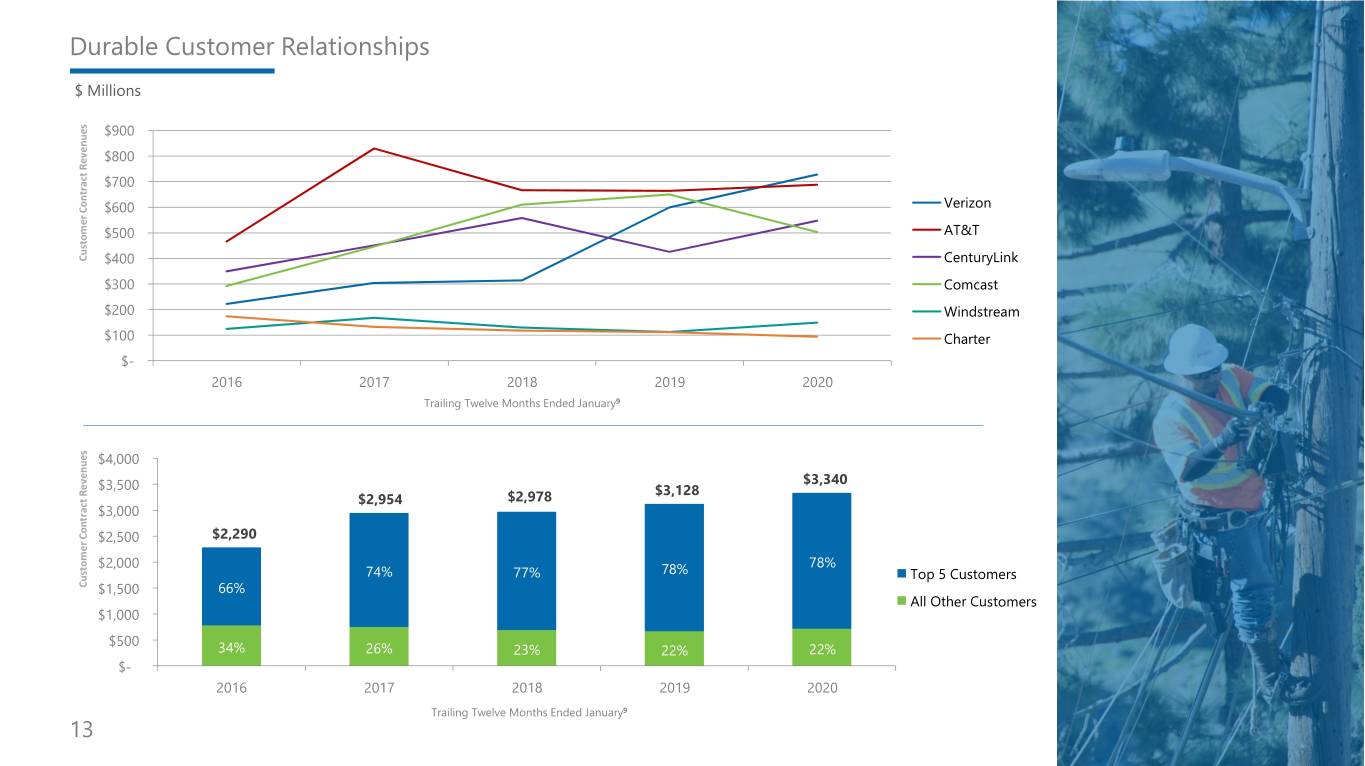

Dycom Overview Leading supplier of specialty contracting services to telecommunication providers Operates throughout the continental United States Nationwide footprint with 44 operating subsidiaries and over 15,000 employees Strong revenue base and customer relationships Contract revenues of $3.340 billion for fiscal 2020, compared to $3.128 billion for fiscal 2019 Non-GAAP Adjusted EBITDA for fiscal 2020 of $310.0 million, or 9.3% of contract revenues, compared to $330.0 million, or 10.5% of contract revenues, for fiscal 2019 Non-GAAP Adjusted Diluted Earnings per Common Share of $2.27 for fiscal 2020, compared to $2.78 for fiscal 2019 Solid financial profile Ample liquidity of $337.3 million at the end of Q4 2020 consisting of availability under Senior Credit Facility and cash balances No outstanding revolver borrowings at the end of Q4 2020 3

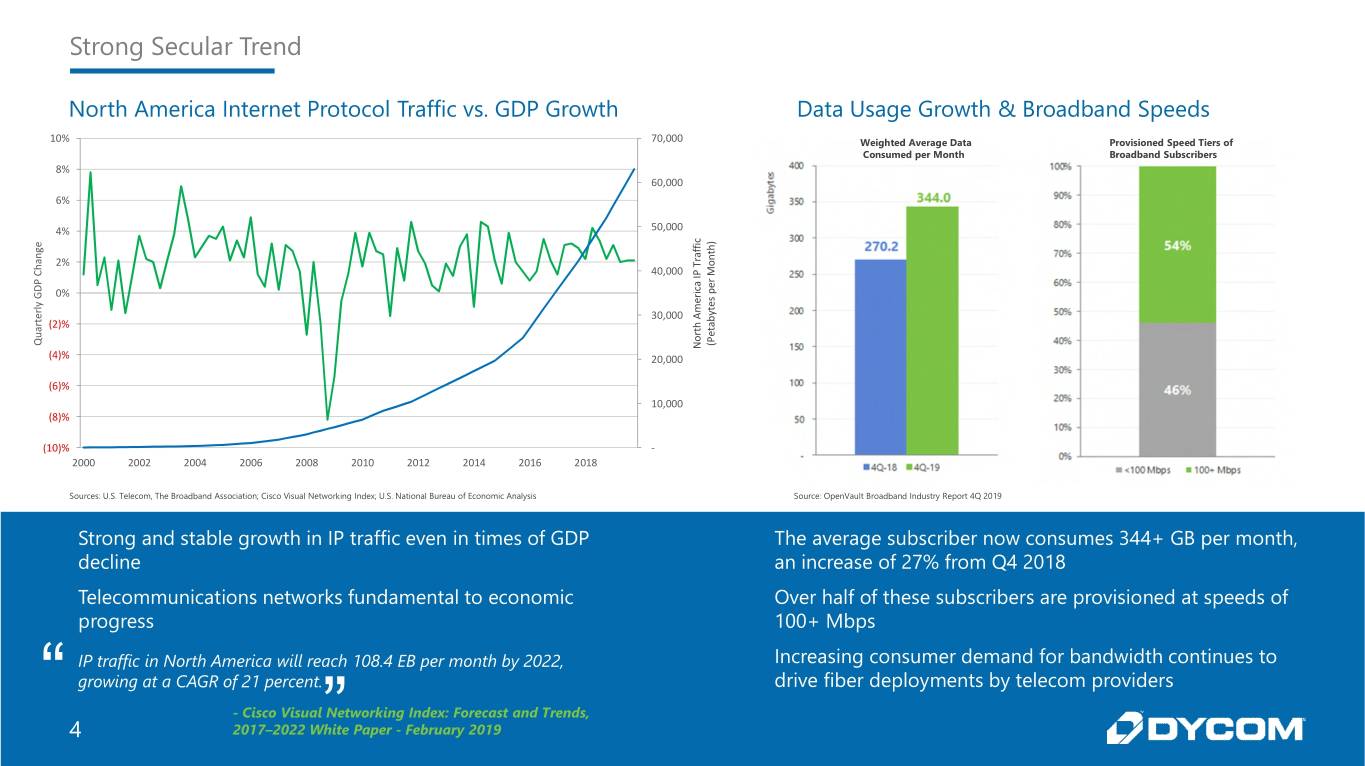

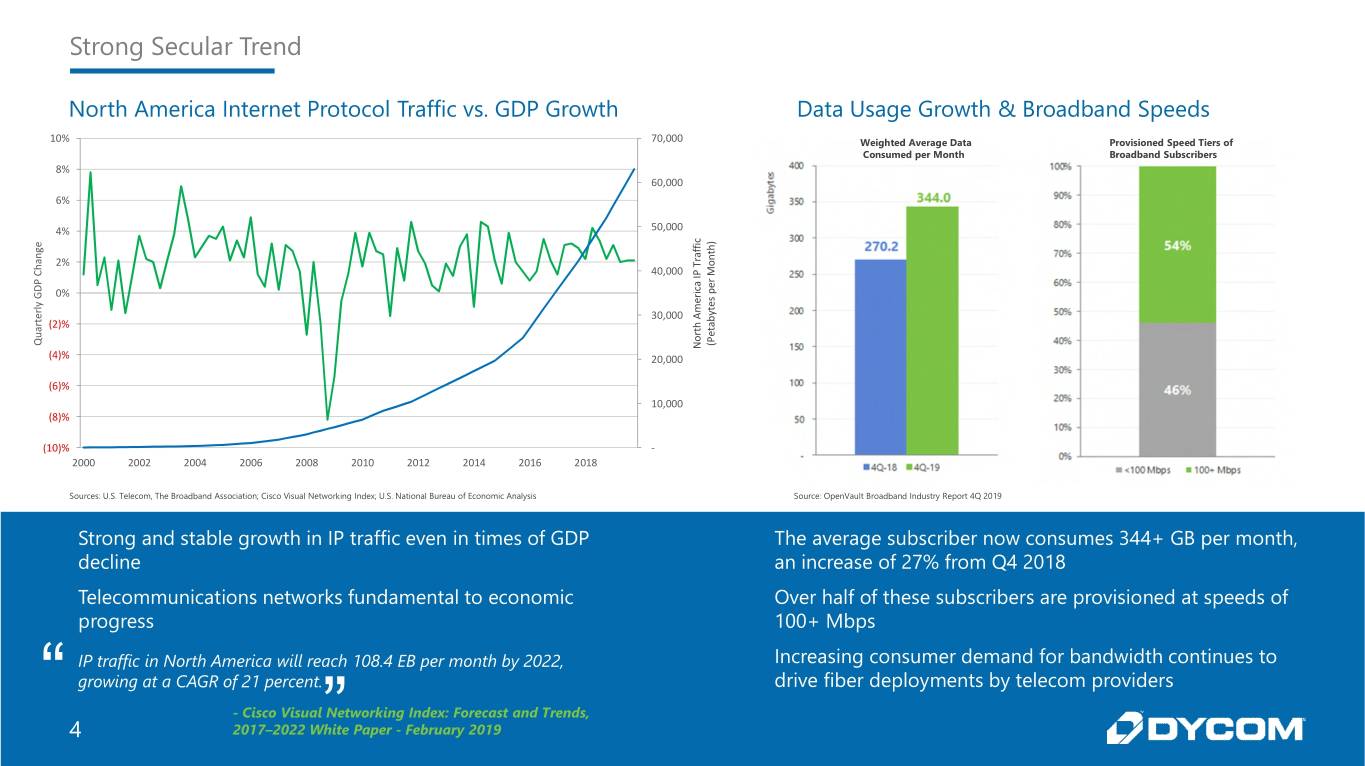

Strong Secular Trend North America Internet Protocol Traffic vs. GDP Growth Data Usage Growth & Broadband Speeds 10% 70,000 Weighted Average Data Provisioned Speed Tiers of Consumed per Month Broadband Subscribers 8% 60,000 6% 4% 50,000 c ) i e f h f g t a n n r a o 2% T h P M C 40,000 I r P a e c D i p r G 0% s e y e l t m r y e A 30,000 b t r a (2)% h t t a r e u o P Q ( N (4)% 20,000 (6)% 10,000 (8)% (10)% - 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 Sources: U.S. Telecom, The Broadband Association; Cisco Visual Networking Index; U.S. National Bureau of Economic Analysis Source: OpenVault Broadband Industry Report 4Q 2019 Strong and stable growth in IP traffic even in times of GDP The average subscriber now consumes 344+ GB per month, decline an increase of 27% from Q4 2018 Telecommunications networks fundamental to economic Over half of these subscribers are provisioned at speeds of progress 100+ Mbps IP traffic in North America will reach 108.4 EB per month by 2022, Increasing consumer demand for bandwidth continues to “ growing at a CAGR of 21 percent. drive fiber deployments by telecom providers - Cisco Visual Networking Index: Forecast and Trends, 4 2017–2022 White” Paper - February 2019

Industry Update Industry increasing network bandwidth dramatically Major industry participants constructing or upgrading significant wireline networks across broad sections of the country generally designed to provision 1 gigabit network speeds directly to consumers or wirelessly using 5G technologies Wireline deployments are the foundational element of what is expected to be a decades long deployment of fully converged wireless/wireline networks that will enable high bandwidth, low latency 5G applications Industry effort required to deploy these converged networks continues to meaningfully broaden Dycom’s set of opportunities Dycom’s competitively unparalleled scale and financial strength position it well to deliver valuable services to its customers Currently providing services for 1 gigabit full deployments and converged wireless/wireline multi-use network deployments across the country in dozens of metropolitan areas to several customers Potential wired network construction opportunities exist outside of traditional customer franchise boundaries Customers are pursuing multi-year initiatives that are being planned and managed on a market by market basis Dycom’s ability to provide integrated planning, engineering and design, procurement and construction and maintenance services is of particular value to several industry participants 5

Industry Drivers Firm and strengthening end market opportunities Fiber deployments enabling new wireless technologies are underway in many regions of the country Wireless construction activity in support of expanded coverage and capacity continued to grow through the deployment of enhanced macro cells and new small cells Recently completed or have begun work associated with several thousand 5G small cell sites across 11 states Telephone companies are deploying FTTH to enable 1 gigabit high speed connections Cable operators are deploying fiber to small and medium businesses and enterprises; Fiber deep deployments to expand capacity are increasing Dramatically increased speeds to consumers are being provisioned and consumer data usage is growing dramatically Customers are consolidating supply chains creating opportunities for market share growth and increasing the long-term value of Dycom’s maintenance and operations business Dycom is increasingly providing integrated planning, engineering and design, procurement and construction and maintenance services for wired and converged wireless/wireline networks Encouraged that Dycom’s major customers are committed to multi-year capital spending initiatives 6

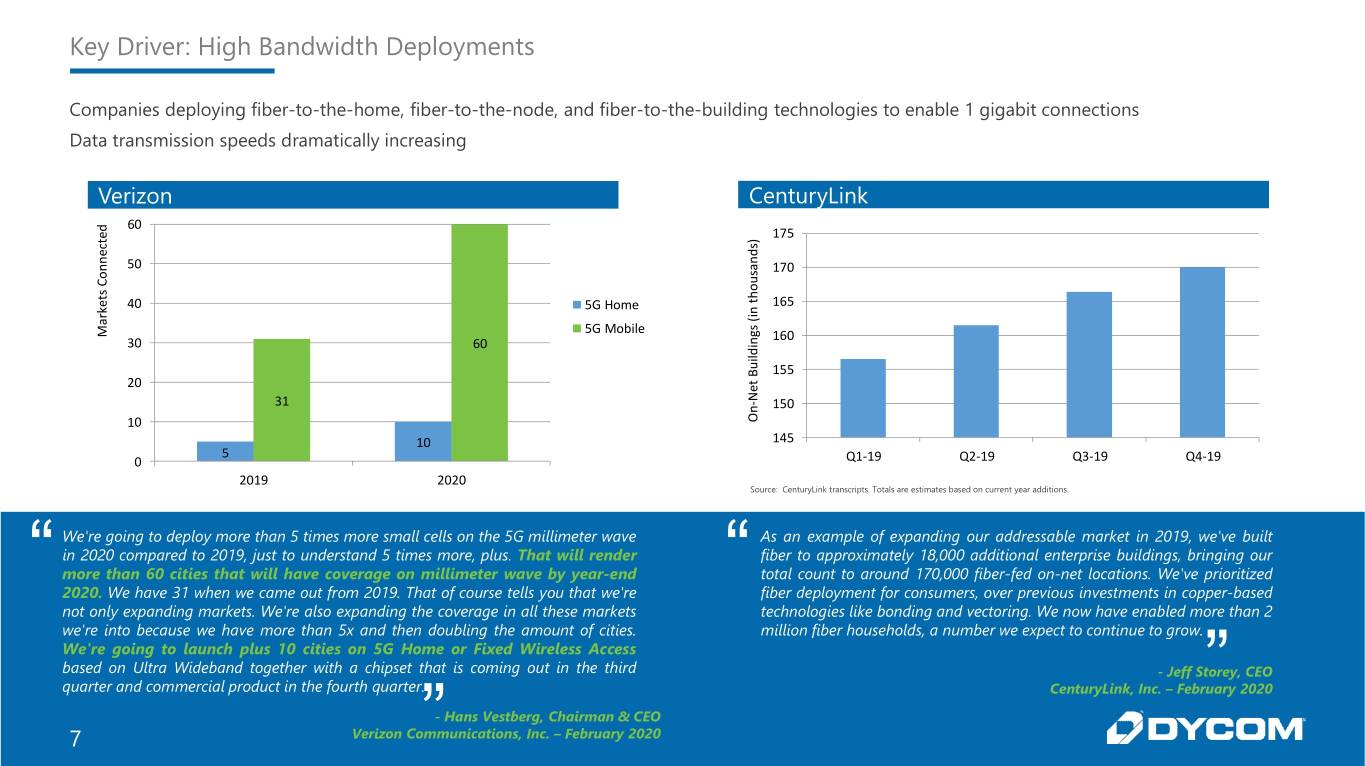

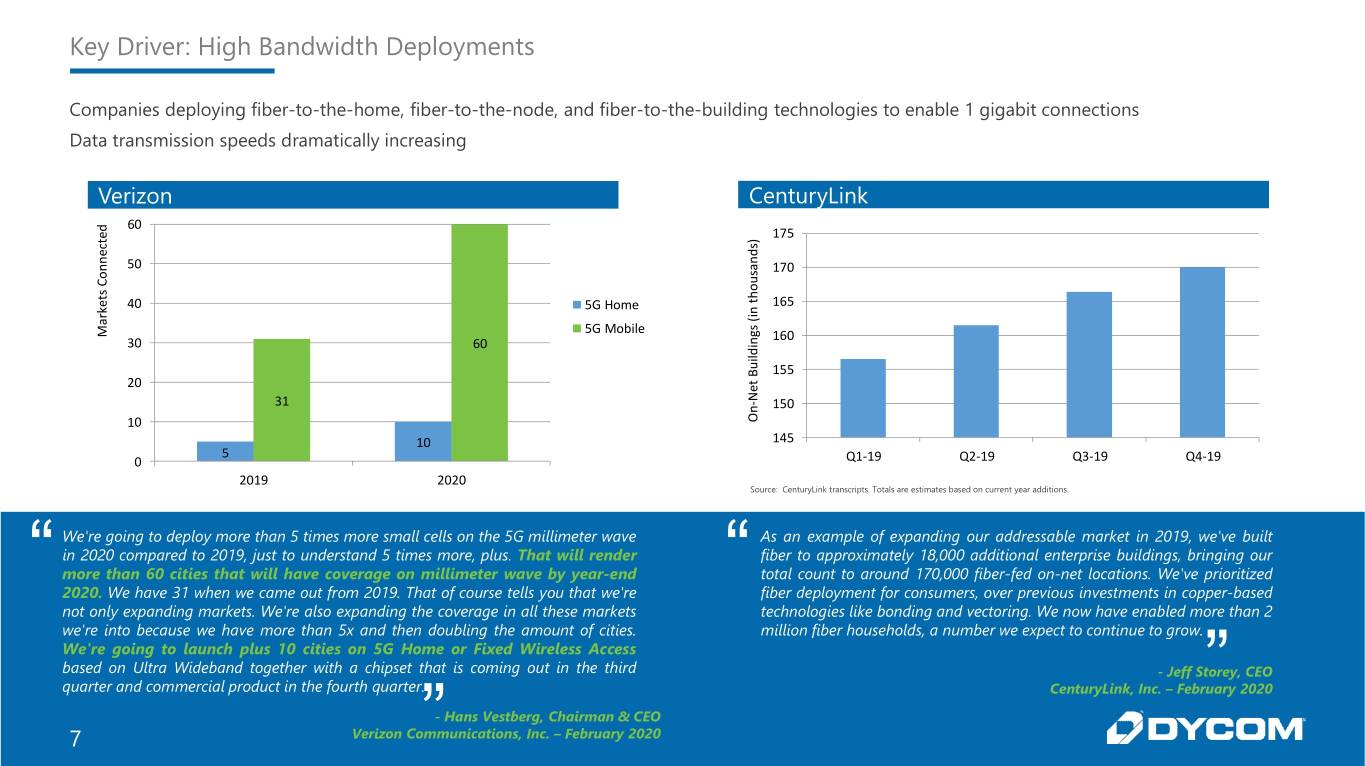

Key Driver: High Bandwidth Deployments Companies deploying fiber-to-the-home, fiber-to-the-node, and fiber-to-the-building technologies to enable 1 gigabit connections Data transmission speeds dramatically increasing Verizon CenturyLink d 60 e 175 ) t s c d e n n a n 50 170 s o u C o s h t t e 40 5G Home 165 k in r ( a 5G Mobile s g M 160 n 30 60 i d l i u B 155 20 t e N 31 - 150 n 10 O 10 145 5 0 Q1-19 Q2-19 Q3-19 Q4-19 2019 2020 Source: CenturyLink transcripts. Totals are estimates based on current year additions. We're going to deploy more than 5 times more small cells on the 5G millimeter wave As an example of expanding our addressable market in 2019, we've built in 2020 compared to 2019, just to understand 5 times more, plus. That will render fiber to approximately 18,000 additional enterprise buildings, bringing our “ more than 60 cities that will have coverage on millimeter wave by year-end “ total count to around 170,000 fiber-fed on-net locations. We've prioritized 2020. We have 31 when we came out from 2019. That of course tells you that we're fiber deployment for consumers, over previous investments in copper-based not only expanding markets. We're also expanding the coverage in all these markets technologies like bonding and vectoring. We now have enabled more than 2 we're into because we have more than 5x and then doubling the amount of cities. million fiber households, a number we expect to continue to grow. We're going to launch plus 10 cities on 5G Home or Fixed Wireless Access based on Ultra Wideband together with a chipset that is coming out in the third - Jeff Storey, CEO quarter and commercial product in the fourth quarter. CenturyLink, Inc. – February” 2020 - Hans Vestberg, Chairman & CEO 7 Verizon Communications,” Inc. – February 2020

Key Driver: 5G Deployment Growth in Number of Small Cells Wireless carriers are increasing 4G capacity and augmenting 4G with new 5G technologies creating growth opportunities in the near to intermediate term Number of small cells are predicted to hit 1,000,000 by 2027; hundreds of thousands of small cells will need to be deployed in the next few years to meet growing demands Emerging wireless technologies driving significant wireline deployments Wireline deployments are the foundational element of what is expected to be a decades long deployment of fully converged wireless/wireline networks that will enable high bandwidth, low latency 5G applications Source: Rysavy Research LLC and Wells Fargo Securities, LLC. It's the fiber itself. So every small cell node is connected to two strands of fiber, one coming from a network hub to the small cell and one coming from the small cell back to the network hub. That fiber is where the vast majority of the capital is in building out a small cell deployment. About 80% of our capital is in small – is in the fiber “ portion. And what that is, is digging up streets to bury the fiber and put it back together. It's not the actual strands of fiber itself that's expensive. It's the labor that goes into tearing up the streets and putting them back together. - Daniel K Schlanger, CFO & SVP ” Crown Castle International Corp. – November 2019 8

Key Driver: Fiber to Businesses Revenue earned by Comcast and Charter from Business Services totaled over $14 Billion8 of an Addressable Market of $80 billion s $60 n o i l l i B $50 $ $50 $40 Q4-19 TTM Revenue $30 From Business Services $30 Addressable Market $20 $10 $7.8 $6.4 $- Source: Comcast and Charter press releases and transcripts We ended the year at nearly $8 billion in business services revenue, with an I think there's a tremendous opportunity in our SMB business and our enterprise addressable market just in our footprint of approximately $50 billion. There was businesses are less penetrated from a market share perspective. So, you continue “ no shortage of new customers or additional revenue for us to capture in this “ to have people find broadband as a category and we continue to take market margin accretive growth business. share of the whole category. So, I think there's lots of growth in front of us. ” - Michael J. Cavanagh, SEVP & CFO - Tom Rutledge, Chairman and” CEO Comcast – January 2020 Charter Communications, Inc. – December 2019 9

Intensely Focused on Telecommunications Market Complete Lifecycle Services Crucial to Customers’ Success INSTALLATION MAINTENANCE Wireline Wireless PROCUREMENT PROGRAM CONSTRUCTION MANAGEMENT ENGINEERING & DESIGN Fiscal 2020 Revenue by Customer Type: 90.8% 6.1% 3.1% Telecommunications Underground Electric/Gas Locating Utilities & Other Dycom is well-positioned to benefit from future growth opportunities 10

Local Credibility, National Capability Operating Subsidiaries

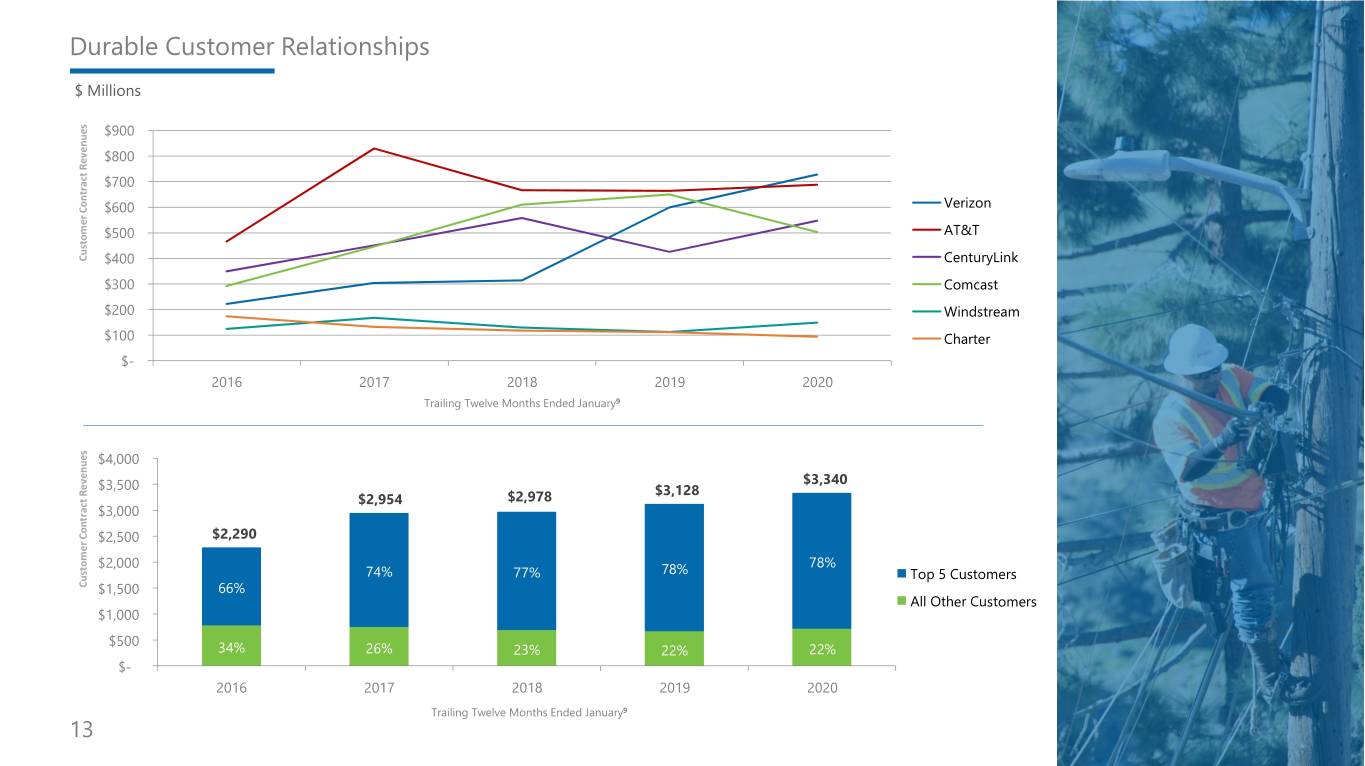

Well Established Customers Top 5 Customers Fiscal 2020 Organic growth: 8.3% 8.5% 7.4% Top 5 customers represented 78.4% of contract revenues in Total Customers Top 5 Customers All Other Customers both fiscal 2020 and fiscal 2019 Fiscal 2020 % of contract revenues from remaining Top 10 customers: 21.4% 7.1% 29.8% 36.8% 2.8% 1.7% 1.1% 0.9% 0.9% Verizon AT&T CenturyLink Windstream Charter Frontier Dominion Energy TDS Crown Castle 12

Durable Customer Relationships $ Millions s e $900 u n e v e $800 R t c a $700 r t on Verizon C $600 r e AT&T om $500 t s u C $400 CenturyLink $300 Comcast $200 Windstream $100 Charter $- 2016 2017 2018 2019 2020 Trailing Twelve Months Ended January9 s e u $4,000 n e v $3,340 e $3,500 R $3,128 t $2,978 c $2,954 a r $3,000 t on C $2,500 $2,290 r e om t $2,000 78% s 74% 77% 78% u Top 5 Customers C $1,500 66% All Other Customers $1,000 $500 34% 26% 23% 22% 22% $- 2016 2017 2018 2019 2020 Trailing Twelve Months Ended January9 13

Anchored by Long-Term Agreements Revenue by Contract Type for Fiscal 2020 Backlog6 Master Service Agreements 65.4% 23.2% 11.4% Short-term contracts Long-term contracts Dycom is party to hundreds of MSA’s and other agreements with customers that extend for periods of one or more years Generally multiple agreements maintained with each customer Master Service Agreements (MSA’s) are multi-year, multi-million dollar arrangements covering thousands of individual work orders generally with exclusive requirements; majority of contracts are based on units of delivery Backlog at $7.314 billion as of Q4 2020 14

10+ Years of Robust Cash Flow Generation $2,117 $2,117 Share Strong operating cash flow of Repurchases Other Cash Flow $444 $709 $1.357 billion over 10+ years Business Prudent approach to capital allocation: Acquisitions $618 $444 million invested in share repurchases $618 million invested in business acquisitions Cash Flow from Operations $1,055 million in cap-ex, net of disposals, or $1,357 Cap-Ex, net approximately 50% of allocation $1,055 Net Decrease in Cash , $50 Sources of Cash Uses of Cash Fiscal 2010 – Fiscal 2020 Robust cash flow generation and prudent capital allocation provide strong foundation for returns 15

Financial Update

Financial Overview Strong market opportunities Contract revenues of $3.340 billion for fiscal 2020, compared to $3.128 billion for fiscal 2019 Non-GAAP Adjusted EBITDA for fiscal 2020 of $310.0 million, or 9.3% of contract revenues, compared to $330.0 million, or 10.5% of contract revenues, for fiscal 2019 Non-GAAP Adjusted Diluted Earnings per Common Share of $2.27 for fiscal 2020, compared to $2.78 for fiscal 2019 Solid financial profile Ample liquidity of $337.3 million at the end of fiscal 2020 consisting of availability under Senior Credit Facility and cash balances No outstanding revolver borrowings at the end of Q4 2020 Outlook Significant majority of the markets under a large customer program will complete their initial phase during 2H FY2021 This initial phase will be substantially complete by the end of January 2021 in 90% of the markets Dycom serves 17

Annual Trends Growth in Contract Revenues Non-GAAP Adjusted EBITDA $3,340 $442 s $3,067 $3,128 s n $2,978 n $390 o o $384 i i l l l $2,673 l i i $330 M M $310 $ $ 14.6% 14.4% 12.9% 10.5% 9.3% FY2016 FY2017 4 Quarters Ended FY2019 FY2020 FY2016 FY2017 4 Quarters Ended FY2019 FY2020 Jan. 2018² Jan. 2018² Non-GAAP Adjusted EBITDA Non-GAAP Adjusted EBITDA as a % of Revenue Organic Revenue Trend1 Non-GAAP Adjusted Diluted EPS 22.7% $5.26 $4.48 14.1% $3.88 8.3% 3.6% $2.78 (0.2)% $2.27 FY2016 FY2017 4 Quarters Ended FY2019 FY2020 Jan. 2018² FY2016 FY2017 4 Quarters Ended FY2019 FY2020 Jan. 2018² 18

Quarterly Trends Growth in Contract Revenues Non-GAAP Adjusted EBITDA $98 $99 $100 s n $92 o i l l i M $74 $74 $ $60 $45 12.2% 11.6% 11.3% 10.4% 10.1% 8.8% 8.0% 6.0% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Non-GAAP Adjusted EBITDA Non-GAAP Adjusted EBITDA as a % of Revenue Organic Revenue Trend1 Non-GAAP Adjusted Diluted EPS $1.09 $1.05 15.8% $0.98 13.7% $0.88 12.9% 11.1% $0.65 4.7% $0.53 1.3% 0.8% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 $0.10 (10.0)% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 $(0.23) 19

Liquidity Overview Reduced net debt by $176.3 million during Q4 2020 . Repaid $103.0 million of revolving borrowings . Repaid $5.6 million of term loan borrowings . Purchased $25.0 million of principal amount of Notes . Increased cash by $42.7 million Liquidity of $337.3 million at January 25, 2020 20

Capital Allocated to Maximize Returns Dycom is committed to maximizing long term returns through prudent capital allocation Invest in Reduce Leverage to Pursue Complementary Organic Growth Historical Levels Acquisitions Focus on organic growth opportunities Generate free cash flow to reduce net Selectively acquire businesses that through strategic capital investments in debt complement our existing footprint and the business enhance our customer relationships Acquisitions have further strengthened Dycom’s customer base, geographic scope, and technical service offerings 21

Questions and Answers 22

Selected Information from Q4 2020 Dycom Results Conference Call Materials The following slides 24 & 25 were used on February 26, 2020 in connection with the Company’s conference call for its fiscal 2020 fourth quarter results and are included for your convenience. Reference is made to slide 2 titled “Important Information” with respect to these slides. The information and statements contained in slides 24 & 25 that are forward-looking are based on information that was available at the time the slides were initially prepared and/or management’s good faith belief at that time with respect to future events. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. For a full copy of the conference call materials, including the conference call transcript, see the Company’s Form 8-Ks filed with the Securities and Exchange Commission on February 26, 2020.

Outlook for Quarter Ending April 25, 2020 (Q1 2021) The projections on this slide were provided on February 26, 2020 in connection with the Company’s conference call regarding its fiscal 2020 fourth quarter results. This information is provided for your reference only and should not be interpreted as a reiteration of these projections by the Company at any time after the date originally provided. The Company undertakes no obligation to revise these projections to reflect any future events or circumstances. Q1 2020 Outlook $ Millions (except per share amounts) Outlook Outlook Q1 2020 Q1 2021 Q1 2020 Q1 2021 Contract revenues $833.7 $730 - $780 Depreciation $41.0 $41.1 - $41.9 GAAP Diluted Earnings (Loss) per Common $0.45 $(0.20) - $(0.03) Amortization $5.3 $5.2 Share Non-GAAP Stock-Based Compensation $3.5 $1.8 - $2.6 (Included in General & Administrative Expense) Non-GAAP Adjusted Diluted Earnings (Loss) $0.53 $(0.09) - $0.08 Non-GAAP Adjusted Interest Expense $7.3 $6.9 - $7.0 per Common Share (Excludes non-cash amortization of debt discount of $4.9 for Q1 2020 & expectation of $4.9 for Q1 2021) Non-GAAP Adjusted EBITDA % 8.8% Non-GAAP Other income, net $5.7 $2.8 - $3.3 of contract revenues Adjusted EBITDA % (Includes Gain on sales of fixed assets of $6.7 for decreases from Q1 Q1 2020 and expectation of $3.7 - $4.2 for Q1 2021) 2020 Non-GAAP Adjusted Effective Income Tax Rate 27.2% 27.5% (as a % of Non-GAAP Adjusted Income before Taxes) Non-GAAP Adjusted Diluted Shares 31.8 million 31.6 - 31.8 million7 24

Looking Ahead to the Quarter Ending July 25, 2020 (Q2 2021) The projections on this slide were provided on February 26, 2020 in connection with the Company’s conference call regarding its fiscal 2020 fourth quarter results. This information is provided for your reference only and should not be interpreted as a reiteration of these projections by the Company at any time after the date originally provided. The Company undertakes no obligation to revise these projections to reflect any future events or circumstances. $ Millions (except per share amounts) Outlook Outlook Q2 2020 Q2 2021 Q2 2020 Q2 2021 Contract revenues $884.2 Range from Depreciation $41.9 $41.2 - $42.0 low-single digit Amortization $5.3 $5.2 decrease to low- single digit Stock-based compensation $2.3 $2.0 - $3.2 increase as a % of (Included in General & Administrative Expense) revenue compared Non-GAAP Adjusted Interest Expense $7.9 $7.2 - $7.4 to Q2 2020 (Excludes non-cash amortization of debt discount of Non-GAAP Adjusted EBITDA % 10.2% Non-GAAP $5.0 for Q2 2020 & expectation of $5.0 for Q2 2021) of contract revenues (excluding Adjusted EBITDA % Other income, net $4.0 $0.3 - $0.8 amounts in line (Includes Gain on sales of fixed assets of $4.8 for described Q2 2020 and expectation of $1.3 - $1.8 for Q2 2021) below) Non-GAAP Adjusted Effective Income Tax Rate 27.3% 27.5% (as a % of Non-GAAP Adjusted Income before Taxes) Non-GAAP Adjusted Diluted Shares 31.8 million 31.8 million For comparative purposes: In addition to other adjustments discussed on our website, Non-GAAP Adjusted EBITDA % in Q2 2020 of 10.2% excludes $11.8 million of earnings for a contract modification on a large customer program for services performed in periods prior to Q2 2020 and also excludes the related impact of performance-based compensation 25

Notes 1) Organic growth (decline) % adjusted for revenues from acquired businesses and storm restoration services, when applicable. 2) Due to the change in the Company’s fiscal year end, the Company’s fiscal 2018 six month transition period consisted of Q1 2018 and Q2 2018. Amounts provided for the 4 Quarters Ended Jan. 2018 represent the aggregate of Q3 2017, Q4 2017, Q1 2018 and Q2 2018 for comparative purposes to other twelve month periods presented. 3) The Company had $52.3 million of standby letters of credit outstanding under the Senior Credit Facility at both January 25, 2020 and October 26, 2019. 4) As of January 25, 2020, Availability on Revolving Facility includes $4.3 million representing the incremental amount of eligible cash and equivalents above $50 million as permitted by the Company’s Senior Credit Facility. As of October 26, 2019, there was no incremental amount included as Cash and equivalents were less than $50 million. 5) As of January 25, 2020, Liquidity represents the sum of the Availability on Revolving Facility, the $50 million threshold amount of cash and equivalents referred to in footnote five above and other available cash and equivalents. As of October 26, 2019, Liquidity represents the sum of the Availability on Revolving Facility and cash and equivalents. 6) Our backlog represents an estimate of services to be performed pursuant to master service agreements and other contractual agreements over the terms of those contracts. These estimates are based on contract terms and evaluations regarding the timing of the services to be provided. In the case of master service agreements, backlog is estimated based on the work performed in the preceding twelve-month period, when available. When estimating backlog for newly initiated master service agreements and other long and short-term contracts, we also consider the anticipated scope of the contract and information received from the customer in the procurement process. A significant majority of our backlog comprises services under master service agreements and other long-term contracts. Backlog is not a measure defined by United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others. 7) GAAP loss per common share and Non-GAAP Adjusted Loss per Common Share for the quarter ending April 25, 2020 is calculated using 31.6 million shares, which excludes common stock equivalents related to share- based awards as their effect would be anti-dilutive. Non-GAAP Adjusted Diluted Earnings per Common Share for the quarter ending April 25, 2020 is calculated using 31.8 million shares. 8) For the trailing twelve months (“TTM”) ended Dec 31, 2019. 9) Due to the change in the Company’s fiscal year end, the Company’s fiscal 2018 six month transition period consisted of Q1 2018 and Q2 2018. For comparative purposes all amounts provided are for 4 Quarters Ended January. 26