- MOD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Modine Manufacturing (MOD) DEF 14ADefinitive proxy

Filed: 23 Jun 20, 5:09pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-2 |

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Date: | Thursday, July 23, 2020 |

Time: | 8:00 a.m. |

| 1. | Election of the Company-nominated slate of three directors for terms expiring in 2023; |

| 2. | Approval of the Modine Manufacturing Company 2020 Incentive Compensation Plan; |

| 3. | Advisory approval of the Company’s named executive officer compensation; |

| 4. | Ratification of the appointment of the Company’s independent registered public accounting firm; and |

| 5. | Consideration of any other matters properly brought before the shareholders at the meeting. |

| By order of the Board of Directors, | |

| |

| Sylvia A. Stein | |

| Vice President, General Counsel and Corporate Secretary |

| 1 | |

| 8 | |

| 13 | |

| 15 | |

| 17 | |

| 31 | |

TABLES | |

| 32 | |

| 34 | |

| 35 | |

| 37 | |

| 38 | |

| 39 | |

| 40 | |

| 43 | |

| 46 | |

| 46 | |

| 52 | |

| 52 | |

| 53 | |

| 54 | |

| 56 | |

| 56 | |

| 57 | |

| A-1 | |

| B-1 |

| • | Business operations leadership; |

| • | Relevant industry experience; |

| • | Global business experience; |

| • | Financial expertise; |

| • | Technological expertise; |

| • | Corporate governance expertise; |

| • | Financial markets experience; and |

| • | Strategic planning and execution expertise, including mergers and acquisitions experience. |

Board of Directors | Business Operations Leadership | Relevant Industry Experience | Global Business Experience | Financial Expertise | Technological Expertise | Corporate Governance Expertise | Financial Markets Experience | Strategic Planning and Execution Expertise | |||||||

Mr. Burke | X | X | X | X | X | X | X | ||||||||

Mr. Anderson | X | X | X | X | X | X | |||||||||

Mr. Ashleman | X | X | X | X | X | X | |||||||||

Mr. Bills | X | X | X | X | X | ||||||||||

Mr. Cooley | X | X | X | X | X | ||||||||||

Dr. Garimella | X | X | |||||||||||||

Mr. Moore | X | X | X | X | X | ||||||||||

Mr. Patterson | X | X | X | X | X | ||||||||||

Ms. Williams | X | X | X | X | X | ||||||||||

Ms. Yan | X | X | X | X | X | X |

Eric D. Ashleman Age 53 Director since 2019  | Current Position: Experience: | President & Chief Operating Officer, IDEX Corporation. Mr. Ashleman joined IDEX Corporation, a developer, designer and manufacturer of fluidics systems and specialty engineered products, in 2008 as President of Gast Manufacturing and has served in a variety of capacities since then, including: President, Gast Manufacturing and Global Dispensing; Vice President and Group Executive, Fire, Safety and Diversified Segment; Senior Vice President and Group Executive, Health and Science Technology, and Fire, Safety and Diversified Segments; and Senior Vice President and Chief Operating Officer. Prior to joining IDEX, Mr. Ashleman served as President of Schutt Sports from 2006 to 2008. |

| Specific Attributes and Skills for Mr. Ashleman: | ||

Expertise | Discussion of Skills and Attributes | |

Business Operations Leadership | Mr. Ashleman has acquired business operations leadership through his many roles at IDEX Corporation, and particularly in his current role as President and Chief Operating Officer, where he is responsible for the global operations of a diversified industrial company. | |

Relevant Industry Experience | Mr. Ashleman serves as President and Chief Operating Officer of IDEX Corporation, a global, diversified industrial company that manufactures for and sells into numerous markets also served by the Company, including the automotive, energy and industrial sectors. | |

Global Business Experience | Mr. Ashleman has acquired substantial global business experience through his roles with IDEX Corporation, and particularly in his current role as President and Chief Operating Officer, as he leads the operations of a global, diversified industrial company. | |

Financial Expertise | Mr. Ashleman has acquired significant financial expertise through his roles at IDEX Corporation and through his previous role as President of Schutt Sports. | |

Corporate Governance Expertise | Through his roles at IDEX Corporation and through his previous role as President of Schutt Sports, Mr. Ashleman has obtained considerable corporate governance expertise. | |

Strategic Planning and Execution Expertise | Mr. Ashleman has developed short- and long-term strategic planning and execution expertise through his numerous roles at IDEX Corporation, and through his previous role as President of Schutt Sports. | |

Larry O. Moore Age 70 Director since 2010  | Current Position: Experience: | Retired. Mr. Moore retired as Senior Vice President, Module Centers & Operations of Pratt & Whitney, a division of United Technologies and a manufacturer of aircraft engines. Mr. Moore served in this capacity from 2002 until his retirement in 2009. Immediately prior to joining Pratt & Whitney, Mr. Moore served in various management positions with Cummins and Ford Motor Company. |

| Specific Attributes and Skills for Mr. Moore: | ||

Expertise | Discussion of Skills and Attributes | |

Business Operations Leadership | Mr. Moore gained his business operations leadership experience, including experience in low-cost country sourcing and operational excellence, at United Technologies where he served as Senior Vice President, Module Centers & Operations of Pratt & Whitney, and at Cummins where he served in various operations management positions. | |

Relevant Industry Experience | Mr. Moore has a deep understanding of the diesel engine markets for off-highway and commercial truck markets gained over his 23-year career in various positions with Volkswagen of America, Inc., General Motors Corporation and Ford Motor Company, as well as Cummins and Pratt & Whitney. | |

Expertise | Discussion of Skills and Attributes | |

Global Business Experience | Mr. Moore has extensive experience working with global industrial companies. | |

Technological Expertise | Mr. Moore has acquired significant technological expertise through his roles in multiple technology-driven business enterprises. | |

Strategic Planning and Execution Expertise | Through his affiliations with Pratt & Whitney, Cummins, Ford Motor Company and other global industrial companies, Mr. Moore has obtained significant experience in a variety of strategic planning and execution strategies. | |

Marsha C. Williams Age 69 Director since 1999  | Current Position: Experience | Retired. Ms. Williams retired as Senior Vice President and Chief Financial Officer of Orbitz Worldwide, Inc., an online travel company (July 2007 - December 2010). Prior to joining Orbitz Worldwide, Inc., Ms. Williams was Executive Vice President and Chief Financial Officer (2002 – February 2007) of Equity Office Properties Trust, a real estate investment trust. Prior to that time, Ms. Williams was Chief Administrative Officer of Crate and Barrel and served as Vice President and Treasurer of Amoco Corporation; Vice President and Treasurer of Carson Pirie Scott & Company; and Vice President of The First National Bank of Chicago. |

| Public Company Directorships: | McDermott International, Inc.; Fifth Third Bancorp (Lead Director of the Board of Directors); and Davis Funds | |

| Specific Attributes and Skills for Ms. Williams: | ||

Expertise | Discussion of Skills and Attributes | |

Global Business Experience | Ms. Williams was an executive officer of Orbitz Worldwide, Inc. and is currently a director of several public companies with global operations. In these roles, Ms. Williams has accumulated extensive knowledge of global finance, capital management, internal controls and human resources. | |

Financial Expertise | As Vice President and Chief Financial Officer of Orbitz Worldwide, Inc., and Executive Vice President and Chief Financial Officer of Equity Office Properties Trust, Ms. Williams gained significant financial acumen relating to complex, global companies. | |

Corporate Governance Expertise | Ms. Williams serves on the board of several public companies, and is the Lead Director of the Fifth Third Bancorp Board of Directors. | |

Financial Markets Experience | As the former Vice President and Chief Financial Officer of Orbitz Worldwide, Inc., Executive Vice President and Chief Financial Officer of Equity Office Properties Trust, and Lead Director of Fifth Third Bancorp, Ms. Williams has significant experience in the financial markets in which the Company competes for financing. | |

Strategic Planning and Execution Expertise | Ms. Williams has engaged in all facets of strategic planning and execution, particularly through her roles with Orbitz Worldwide, Inc. and Equity Office Properties Trust. | |

Dr. Suresh V. Garimella Age 56 Director since 2011  | Current Position: Experience: | President, University of Vermont Prior to Dr. Suresh Garimella’s selection as President of the University of Vermont, he served as Executive Vice President for Research and Partnerships at Purdue University (2014-2019), where he was Goodson Distinguished Professor in the School of Mechanical Engineering and Founding Director of the Cooling Technologies Research Center. He previously held the Cray-Research Professorship at the University of Wisconsin-Milwaukee. In 2018, Dr. Garimella was appointed by President Trump to the National Science Board, which oversees the National Science Foundation and also serves as an independent body of advisers to both the president and Congress on policy matters related to science, engineering and educating the next generation of scientists. In 2019, he was appointed to the External Advisory Board for the Chief Research Office at Sandia National Laboratories. Dr. Garimella also served as a Jefferson Science Fellow at the U.S. Department of State (2010-2011) and as a Senior Fellow for Energy and Climate Partnership of the Americas (ECPA) for five years. Dr. Garimella received his Bachelor of Technology from Indian Institute of Technology, Madras, India, his Master of Science from The Ohio State University, and his Ph.D. from the University of California at Berkeley, all in Mechanical Engineering. |

| Specific Attributes and Skills for Dr. Garimella: | ||

Expertise | Discussion of Skills and Attributes | |

Technological Expertise | Dr. Garimella is a renowned expert in thermal management and heat transfer technology, which is central to the success of the Company. | |

Strategic Planning and Execution Expertise | In his current position, Dr. Garimella is responsible for setting the strategy for the University of Vermont to achieve its mission and vision, all in collaboration with the University’s Board of Trustees. Previously, he was deeply engaged with the development and execution of Purdue University’s strategic plans and, in particular, the plans relating to the University’s strategic research initiatives and partnerships, both within and outside the United States. In addition, Dr. Garimella is a Member of the National Science Board, and serves on its Committee on Strategy, which is responsible for setting short- and long-term strategy and objectives for the National Science Foundation. | |

Christopher W. Patterson Age 66 Director since 2010  | Current Position: Experience: Public Company Directorships: | Retired. Mr. Patterson retired as President and Chief Executive Officer of Daimler Trucks North America LLC, a leading producer of heavy-duty and medium-duty trucks and specialized commercial vehicles in North America. Mr. Patterson served in this capacity from 2005 until his retirement in 2009. Prior to this, he held senior positions, including as Senior Vice President, Service & Parts, with Freightliner LLC (predecessor to Daimler Trucks North America), and other international, commercial truck producers. Finning International Inc., Vancouver, B.C. (Canada) |

| Specific Attributes and Skills for Mr. Patterson: | ||

Expertise | Discussion of Skills and Attributes | |

Business Operations Leadership | Mr. Patterson gained his business operations leadership experience as President and Chief Executive Officer of Daimler Trucks North America LLC and brings extensive strategic sales and marketing experience to the Company’s Board. | |

Relevant Industry Experience | Mr. Patterson has a significant understanding of commercial truck markets and the operations of global commercial vehicle OEMs. | |

Global Business Experience | Mr. Patterson’s extensive executive and leadership experience, as described above, gives him valuable insight into the complexities, challenges and issues facing global manufacturing businesses. | |

Corporate Governance Expertise | Mr. Patterson has significant corporate governance experience from his role as President and Chief Executive Officer of Daimler Trucks North America LLC. In addition, Mr. Patterson serves on the board of another public company. | |

Strategic Planning and Execution Expertise | Through his many roles at Daimler Trucks North America LLC, and particularly in his position as President and Chief Executive Officer, Mr. Patterson obtained significant experience in establishing and executing on that entity’s short- and long-term strategic plans. | |

Christine Y. Yan Age 54 Director since 2014  | Current Position: Experience: Public Company Directorships: | Retired. Ms. Yan retired as Vice President of Integration, Stanley Black & Decker, Inc., a diversified global provider of power and hand tools, Engineered Fastening Systems for Automotive and other industries, and Electronic Security and Monitoring Systems. Ms. Yan served in this capacity from January 2018 until her retirement in November 2018. Prior to this, she held a variety of positions with Stanley Black & Decker, including President of Asia, Stanley Black & Decker, Inc.; President of Storage and Workspace Systems; integration leader of Stanley Engineered Fastening Group; President of the Americas business of Stanley Engineered Fastening; and President of Stanley Engineered Fastening’s Global Automotive business. ON Semiconductor; Ansell Limited; and Cabot Corporation |

| Specific Attributes and Skills for Ms. Yan: | ||

Expertise | Discussion of Skills and Attributes | |

Business Operations Leadership | Ms. Yan gained her business operations experience as the leader of various business units within Stanley Black & Decker, Inc. | |

Relevant Industry Experience | Ms. Yan has gained a significant understanding of the vehicular industry through her experience in various positions, including as President, with Stanley Engineered Fastening’s Global Automotive business. | |

Global Business Experience | Ms. Yan’s experience as President of Asia, Stanley Black & Decker, Inc. and President of Stanley Engineered Fastening’s Global Automotive business and as General Manager of China Operations for Emhart Teknologies (Black & Decker's Fastening and Assembly Systems Group) has provided Ms. Yan with significant insight into international business and, in particular, business in China. | |

Corporate Governance Expertise | In addition to her tenure as a director of Modine, Ms. Yan serves on the board of three other public companies. | |

Technological Expertise | Ms. Yan’s engineering background and past and current positions at Stanley Black & Decker, Inc. have provided her with significant exposure to and experience with technologically sophisticated business operations. | |

Strategic Planning and Execution Expertise | Ms. Yan has acquired substantial expertise in strategic planning as the leader of numerous significant business units within Stanley Black & Decker, Inc. | |

David G. Bills Age 59 Director since 2015  | Current Position: Experience: Public Company Directorships: | Senior Advisor at Incentrum Group Merchant Banking. Mr. Bills served as Senior Vice President – Corporate Strategy of DuPont, a science-based products and services company, from 2009 until his retirement in 2017. Mr. Bills joined DuPont in 2001 as Vice-President – Corporate Planning, and during his time at DuPont he also served as Vice President and General Manager—Displays; President – Fluoroproducts; and Chief Marketing and Sales Officer. Before joining DuPont, Mr. Bills was a partner with McKinsey & Company, Inc., a corporate advisory firm, where he worked with senior executives of Fortune 500 companies on corporate and business unit strategy, growth programs, business development, and marketing and sales strategies. Lydall, Inc. |

| Specific Attributes and Skills for Mr. Bills: | ||

Expertise | Discussion of Skills and Attributes | |

Business Operations Leadership | Mr. Bills gained his business operations experience leading and managing business units during his tenure at DuPont. | |

Global Business Experience | Mr. Bills’ experience at DuPont included leading business units, managing marketing and sales activities, and leading corporate strategy and mergers and acquisitions (“M&A”) activity, all on a global basis. In addition, his responsibilities at McKinsey & Company, Inc. included assisting its clients in developing global strategies, including in the areas of growth, business development, and marketing and sales. | |

Technological Expertise | Through his engineering background and his roles with DuPont, Mr. Bills has acquired significant experience in application-based technology. | |

Financial Markets Experience | Through his experience with DuPont and McKinsey & Company, Inc., Mr. Bills has gained expertise in growth and M&A financing opportunities in the financial markets in which the Company competes for financing. | |

Strategic Planning and Execution Expertise | Mr. Bills’ primary function in his roles at both DuPont and McKinsey & Company, Inc. has been strategic planning. Mr. Bills brings a unique focus on strategy to the Board, as exhibited by the combination of his experience assisting numerous clients with their planning needs, leading multiple DuPont business units, and developing growth strategies at DuPont through both organic and M&A opportunities. Mr. Bills led DuPont’s M&A team and all related activities from 2011 until his retirement. | |

Thomas A. Burke Age 63 Director since 2008  | Current Position: Experience: | President and Chief Executive Officer of Modine since 2008. Mr. Burke joined Modine in May 2005 as Executive Vice President and subsequently served as Executive Vice President and Chief Operating Officer (July 2006 – March 2008). Prior to joining Modine, Mr. Burke worked for five years in various management positions with Visteon Corporation, a leading supplier of parts and systems to automotive manufacturers, including as Vice President of North American Operations (2002 – May 2005) and Vice President, European and South American Operations (2001 – 2002). Prior to working at Visteon Corporation, Mr. Burke worked in positions of increasing responsibility at Ford Motor Company. |

| Public Company Directorships: | USG Corporation (2013 – 2019) | |

| Specific Attributes and Skills for Mr. Burke: | ||

Expertise | Discussion of Skills and Attributes | |

Business Operations Leadership | Mr. Burke serves as President and Chief Executive Officer of the Company. | |

Relevant Industry Experience | Mr. Burke has unique knowledge of the challenges, risks and opportunities facing a global supplier of thermal management products to global customers gained through his experience with the Company as well as at Visteon Corporation and Ford Motor Company. Mr. Burke’s membership on the Board and leadership of the Company’s Executive Council help to ensure that the Board is linked to the Company’s management and operations. | |

Global Business Experience | Mr. Burke’s extensive operational and technical managerial experience at Ford Motor Company, Visteon Corporation and the Company provide him with significant insight and experience in the operations, challenges and complex issues facing global manufacturing businesses. | |

Financial Expertise | Mr. Burke has gained significant financial expertise through his role as President and Chief Executive Officer of the Company, and as a director and member of the Audit Committee of another public company. | |

Technological Expertise | Mr. Burke has a strong background in and knowledge of thermal management technology. | |

Corporate Governance Expertise | Mr. Burke has gained significant corporate governance experience in his role as President and Chief Executive Officer of the Company and previously as a director of another public company. | |

Strategic Planning and Execution Expertise | As President and Chief Executive Officer of the Company, Mr. Burke has played an integral role in the Company’s short- and long-term strategic planning processes. | |

Charles P. Cooley Age 64 Director since 2006  | Current Position: Experience: Public Company Directorships: | Retired. Mr. Cooley retired as Senior Vice President and Chief Financial Officer of The Lubrizol Corporation, a specialty chemical company (April 2009 – September 2011). Mr. Cooley joined The Lubrizol Corporation as Vice President, Treasurer and Chief Financial Officer (April 1998 – July 2005) and subsequently served as its Senior Vice President, Treasurer and Chief Financial Officer (July 2005 – April 2009). Prior to joining The Lubrizol Corporation, Mr. Cooley was Assistant Treasurer of Corporate Finance, Atlantic Richfield Company (ARCO), and Vice President, Finance, ARCO Products Company. KeyCorp (2012 – 2020) |

| Specific Attributes and Skills for Mr. Cooley: | ||

Expertise | Discussion of Skills and Attributes | |

Global Business Experience | Mr. Cooley served as Chief Financial Officer of The Lubrizol Corporation, a company with extensive operations throughout the world. | |

Financial Expertise | Mr. Cooley has substantial experience as Chief Financial Officer of The Lubrizol Corporation including extensive knowledge of complex accounting issues, capital management and internal controls. | |

Expertise | Discussion of Skills and Attributes | |

Corporate Governance Expertise | In his role as Chief Financial Officer of The Lubrizol Corporation, Mr. Cooley gained significant experience implementing effective corporate governance practices. In addition, Mr. Cooley served on the board of KeyCorp until 2020. | |

Financial Markets Experience | As Chief Financial Officer of The Lubrizol Corporation, Mr. Cooley had significant experience in the financial markets in which the Company competes for financing. | |

Strategic Planning and Execution Expertise | Mr. Cooley has been heavily engaged in strategic planning activities throughout his career, particularly through his numerous roles with The Lubrizol Corporation. | |

Name | Audit | ONC | Governance | Technology |

David J. Anderson | X | X | X | |

Eric D. Ashleman | X | X | ||

David G. Bills | X | X | X | |

Thomas A. Burke | ||||

Charles P. Cooley | Chair | X | X | |

Suresh V. Garimella | X | X | Chair | |

Larry O. Moore | X | X | X | |

Christopher W. Patterson | X | Chair | X | |

Marsha C. Williams | Chair | |||

Christine Y. Yan | X | X | X | |

Total Number of Meetings | 8 | 4 | 4 | 1 |

Name and Address of Owner (1) | Number of Shares Owned and Nature of Interest | Percent of Class | ||

Dimensional Fund Advisors LP (2) | 4,259,505 | 8.38 | ||

Building One | ||||

6300 Bee Cave Road | ||||

Austin, Texas, 78746 | ||||

Frontier Capital Management Co., LLC (3) | 4,102,067 | 8.07 | ||

99 Summer Street | ||||

Boston, MA 02110 | ||||

BlackRock, Inc. (4) | 3,716,781 | 7.31 | ||

55 East 52nd St. | ||||

New York, NY 10055 | ||||

The Vanguard Group (5) | 3,264,487 | 6.42 | ||

100 Vanguard Blvd. | ||||

Malvern, PA 19355 |

| (1) | The number of shares is as of the date the shareholder reported the holdings in filings under the Exchange Act, unless more recent information was provided. The above beneficial ownership information is based on information furnished by the specified persons and is determined in accordance with Exchange Act Rule 13d-3, and other facts known to the Company. |

| (2) | Based on Amendment No. 4 to Schedule 13G filed under the Exchange Act on February 12, 2020, Dimensional Fund Advisors LP (“DFA”) has the sole power to vote or direct the vote of 4,102,440 shares and the sole power to dispose or direct the disposition of 4,259,505 shares. DFA is a registered investment adviser to four mutual funds and serves as investment manager or sub-adviser to various other clients (the “Funds”). In these roles, DFA or its subsidiaries (together, “Dimensional”) may possess voting and/or investment power over securities of the Company that are owned by the Funds, and it may be deemed to be the beneficial owner over such shares. Dimensional disclaims beneficial ownership of such securities. |

| (3) | Based on Amendment No. 6 to Schedule 13G filed under the Exchange Act on February 14, 2020, Frontier Capital Management Co., LLC has the sole power to vote or direct the vote of 1,638,601 shares and the sole power to dispose or direct the disposition of 4,102,067 shares. |

| (4) | Based on Amendment No. 7 to Schedule 13G filed under the Exchange Act on February 5, 2020, BlackRock, Inc. and certain subsidiaries of BlackRock, Inc. have the sole power to vote or direct the vote of 3,580,587 shares and the sole power to dispose or direct the disposition of 3,716,781 shares. |

| (5) | Based on Amendment No. 6 to Schedule 13G filed under the Exchange Act on February 12, 2020, The Vanguard Group (“Vanguard”) has the sole power to vote or direct the vote of 50,162 shares, shared power to vote or direct the vote of 13,300 shares, the sole power to dispose or direct the disposition of 3,209,161 shares, and shared power to dispose or direct the disposition of 55,326 shares. Vanguard Fiduciary Trust Company and Vanguard Investments Australia, Ltd., each a wholly owned subsidiary of Vanguard, are beneficial owners of 42,026 shares and 21,436 shares, respectively, as a result of serving as investment managers to their respective clients. |

| • | Each director, director-nominee and “named executive officer” (as described below under Compensation Discussion and Analysis); and |

| • | all directors and executive officers of the Company as a group. |

Name | Direct Ownership | Options Exercisable within 60 days of May 29, 2020 | Held in 401(k) Retirement Plan | Restricted Shares / Units (Not Vested) | Total (1) | Percent of Class | ||||||

David J. Anderson | 65,481 | - | NA | - | 65,481 | * | ||||||

Eric D. Ashleman | 8,620 | - | NA | - | 8,620 | * | ||||||

David G. Bills | 41,540 | - | NA | - | 41,540 | * | ||||||

Charles P. Cooley | 79,941 | - | NA | - | 79,941 | * | ||||||

Suresh V. Garimella | 48,755 | - | NA | - | 48,755 | * | ||||||

Larry O. Moore | 49,381 | - | NA | - | 49,381 | * | ||||||

Christopher W. Patterson | 71,481 | - | NA | - | 71,481 | * | ||||||

Marsha C. Williams | 112,840 | - | NA | - | 112,840 | * | ||||||

Christine Y. Yan | 47,271 | - | NA | - | 47,271 | * | ||||||

Thomas A. Burke | 476,790 | 594,061 | 8,165 | 181,909 | 1,260,925 | 2.48 | ||||||

Michael B. Lucareli | 132,293 | 109,405 | 971 | 52,532 | 295,201 | * | ||||||

Scott L. Bowser | 131,207 | 70,171 | 4,765 | 39,498 | 245,641 | * | ||||||

Dennis P. Appel | 10,081 | 7,802 | - | - | 17,883 | * | ||||||

Scott D. Wollenberg | 48,953 | 29,887 | 915 | 24,759 | 104,514 | * | ||||||

Sylvia A. Stein | 1,301 | 7,703 | - | 16,816 | 25,820 | * | ||||||

Joel T. Casterton | 6,735 | 10,475 | 1,345 | 16,657 | 35,212 | * | ||||||

All directors and executive officers as a group (19 persons) | 1,429,554 | 918,815 | 17,955 | 384,784 | 2,751,108 | 5.40 |

| * | Represents less than one percent of the class. |

| (1) | Includes shares of common stock that are issuable upon the exercise of stock options exercisable within 60 days of May 29, 2020, and restricted stock units. Such information is not necessarily to be construed as an admission of beneficial ownership. |

Name | Fees Paid in Cash ($)(1) | Stock Awards ($)(2)(3) | Change in Pension Value ($)(4) | Total ($) | ||||

David J. Anderson | 85,000 | 124,990 | NA | 209,990 | ||||

Eric D. Ashleman | 85,000 | 124,990 | NA | 209,990 | ||||

David G. Bills | 85,000 | 124,990 | NA | 209,990 | ||||

Charles P. Cooley | 100,000 | 124,990 | NA | 224,990 | ||||

Suresh V. Garimella | 92,500 | 124,990 | NA | 217,490 | ||||

Larry O. Moore | 85,000 | 124,990 | NA | 209,990 | ||||

Christopher W. Patterson | 96,875 | 124,990 | NA | 221,865 | ||||

Marsha C. Williams | 95,000 | 224,982 | 176 | 320,158 | ||||

Christine Y. Yan | 85,000 | 124,990 | NA | 209,990 |

| (1) | These amounts include amounts deferred at the director’s election into the Modine Manufacturing Company Directors Deferred Compensation Plan. |

| (2) | In July 2019, all of the independent directors at that time, other than Ms. Williams, were granted 8,620 shares of unrestricted stock or restricted stock units. As explained above, the Company granted 15,516 shares of unrestricted stock to Ms. Williams at the same time. None of the directors included in the table above held any unvested stock awards as of the end of fiscal 2020. |

| (3) | Represents the aggregate grant date fair value of stock grants computed in accordance with Financial Accounting Standards Board (“FASB”) ASC Topic 718. The assumptions used to determine the value of the awards are discussed in Note 4 of the Notes to Consolidated Financial Statements contained in the Company’s Form 10-K for the fiscal year ended March 31, 2020. |

| (4) | Represents the change in pension value between the end of fiscal 2019 and the end of fiscal 2020 under the Modine Manufacturing Company Director Emeritus Retirement Plan. The change in pension value is solely a result of the change in the interest rate used to calculate the present value of the pension benefit under the Director Emeritus Retirement Plan because no benefits otherwise continue to accrue under that plan. The Company used discount rates of 3.4 percent and 4.0 percent, respectively, to calculate the present value of the pension benefit obligation at March 31, 2020 and March 31, 2019. |

| • | Thomas A. Burke, President and Chief Executive Officer; |

| • | Michael B. Lucareli, Vice President, Finance and Chief Financial Officer; |

| • | Scott L. Bowser, Vice President, Commercial and Industrial Solutions and Chief Operating Officer; |

| • | Dennis P. Appel, Former Vice President, Commercial and Industrial Solutions; |

| • | Scott D. Wollenberg, Former Vice President and Chief Technology Officer; |

| • | Sylvia A. Stein, Vice President, General Counsel and Corporate Secretary; and |

| • | Joel T. Casterton, Vice President, Vehicular Thermal Solutions. |

| • | The Company leveraged the Office of Strategic Planning and Development to complete a comprehensive evaluation of its Vehicular Thermal Solutions (“VTS”) business segment. In connection with this evaluation and effective April 1, 2020, the Company began managing its global automotive business separately from the other businesses within the VTS segment as it targets the sale or eventual exit of the automotive business; |

| • | The Company instituted a series of cost-saving actions in response to a mid-year downturn in its end markets, and took further actions in response to the COVID-19 pandemic, including enhancing employee safety through additional cleaning and social distancing, delaying capital expenditures, and implementing employee salary reductions, furloughs and shortened work weeks; |

| • | The Company amended and extended the maturity of its senior secured credit facilities and issued a $100 million private placement note, the proceeds of which were used in part to prepay a note maturing in fiscal 2021; |

| • | The Company achieved operating income of $37.9 million and adjusted operating income of $97.3 million under challenging economic conditions. The Company reported a loss per share of $0.04 and adjusted earnings per share of $1.05; |

| • | The Company issued its inaugural sustainability report, which discusses Modine’s approach to managing environmental, social and governance issues and how the Company combines its commitment to constant improvement and innovation, while driving shareholder value, to develop non-financial metrics to ensure that Modine conducts its business the right way; |

| • | The Company recorded the lowest global Recordable Incident Rate (“RIR”) in Modine’s history, with a year-over-year reduction in RIR of 12 percent driven by Modine’s behavior-based safety program, which seeks to correct at-risk behaviors and positively reinforces safe behaviors; and |

| • | The Company continued to leverage the accountable mentoring principles of the Modine Operating System to measurably increase the improvement capability of Modine employees around the world. |

| • | Set CEO and CFO compensation at or near the median of Modine’s peer group of companies and the median of a broad survey of manufacturing companies, weighted equally, and compensation for the other NEOs at or near the median of a broad survey of manufacturing companies in order to meet its objective of offering competitive compensation. |

| • | Approved Free Cash Flow Margin (“FCF%”) and Adjusted Operating Income Growth as the equally-weighted performance metrics in the Management Incentive Plan (“MIP”) (the short-term cash bonus plan) for fiscal 2020. These performance goals drive alignment of management and shareholders’ interests both as a measure of capital efficiency and in achieving our earnings growth targets. |

| • | Approved Average Cash Flow Return on Invested Capital (“CFROIC”) and Average Annual Revenue Growth as the performance metrics for the Long-Term Incentive Plan (the “LTIP”) for fiscal 2020 to incentivize meeting and exceeding the Company’s operating performance goals over the three-year performance cycle. The two metrics are designed to focus management on key metrics and provide a compelling equity-based incentive plan with carefully selected standards, mitigating risk by avoiding short-term gains at the expense of the long-term health of the Company. The long-term pay orientation of the Company’s compensation system (compensation mix and time horizon of the LTIP) appropriately reflects the capital intensive nature, the investment time horizon and customer planning time horizon (i.e., long-term orders and partnering for end-product production) of the business. |

| • | Reviewed the composition of the Company’s Peer Group used for CEO and CFO compensation and company performance comparisons. |

| • | Conducted a risk assessment of the Company’s compensation practices and found no evidence of unreasonable risk taking in the Company’s compensation plans and arrangements. |

| • | Reviewed the Company’s succession plan for each executive officer and other key employees of the Company. |

| • | Established compensation for the Board of Directors, utilizing analysis provided by Farient. |

| • | Reviewed the Company’s guidelines regarding stock ownership requirements for Company officers and members of the Board of Directors and confirmed compliance therewith. |

| • | Reviewed regulatory, shareholder and market changes, including governance best practices as applicable to the Company. |

| • | Reviewed status of equity spend under the 2017 Incentive Plan and Amended and Restated 2008 Incentive Compensation Plan (collectively, the “Incentive Plans”). |

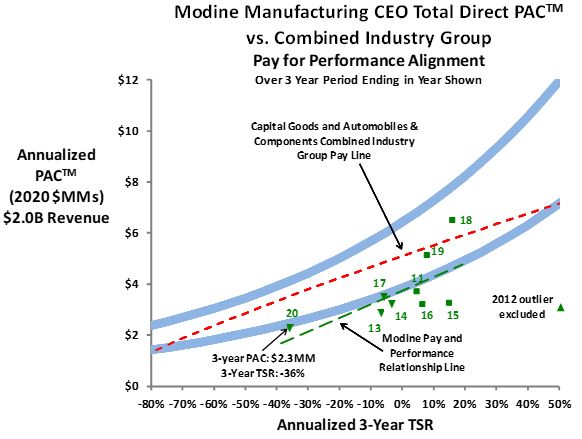

| • | Reviewed CEO pay-for-performance alignment, utilizing analysis provided by Farient. |

| • | A median compensation positioning strategy that targets total pay as well as each element of compensation at the median of the market, and allows actual compensation to vary from the median based on higher or lower performance, i.e., above median for above-market performance and below median for below-market performance; |

| • | A significant portion of compensation tied to performance, including short-term and long-term incentives tied to strong financial/operational performance; |

| • | Use of measures of performance for incentives that balance strong growth and returns and provide a direct link to shareholder value over time; |

| • | A significant weighting on equity-based long-term incentives, particularly performance stock; and |

| • | Share ownership guidelines (described on page 30), requiring that executives be meaningfully invested in the Company’s stock, and therefore be personally invested in the Company’s performance. |

| CEO in 3-year period ended 2012 has been excluded as an outlier Single CEO in 3-year periods ending: 2011-2020 Top/Middle/Bottom quartile relative TSR performance ranking |

| • | U.S. headquartered companies traded on major U.S. exchanges involved in these industries: industrial machinery; construction machinery and heavy trucks; agriculture and farm machinery; auto parts and equipment; electrical components and equipment; and building products (HVAC-related); |

| • | Companies with revenue between $700 million and $4.5 billion (approximately 0.3 to 2.0 times Modine’s budgeted revenue of $2.2 billion at the time of the peer group review), with proxy pay data size adjusted to approximate pay for a company of $2.0 billion as estimated at the time of the executive pay benchmarking; and |

| • | Technology-intensive companies with a strong focus on OEM suppliers, distributed product expertise and global industrial customers in the vehicular and industrial/commercial (e.g., HVAC&R) arena. |

Allison Transmission Holdings, Inc. | Hubbell Incorporated | Stoneridge, Inc. |

Briggs & Stratton Corporation Commercial Vehicle Group, Inc. | Lennox International Inc. Meritor, Inc. | Titan International, Inc. WABCO Holdings Inc. |

Donaldson Company, Inc. Enerpac Tool Group Corp.a EnerSys Inc. | Mueller Industries, Inc. Regal-Beloit Corporation SPX Corporation | Welbilt, Inc. Westinghouse Air Brake Technologies Corporation |

Harsco Corporation | Standex International Corporation | Woodward Inc. |

a This company is formerly known as Actuant Corporation, which has been included in our prior peer groups. | ||

| • | Compensation levels of the Company’s CEO and CFO; |

| • | Company’s compensation practices; and |

| • | Company’s relative performance and relative pay for performance for specified periods of time. |

| • | Compensation is a primary factor in attracting and retaining employees, and the Company can only achieve its goals if it attracts and retains qualified and highly skilled people; |

| • | All elements of executive compensation, including base salary, targeted annual incentives (cash-based), and targeted long-term incentives (equity-based), are set to levels that the ONC Committee believes ensure that executives are fairly, but not excessively, compensated; |

| • | Strong financial and operational performance is expected, and shareholder value must be preserved and enhanced over time; |

| • | Compensation must be linked to the interests of shareholders and the most effective means of ensuring this linkage is by granting equity incentives such as stock awards, stock options and performance stock awards; |

| • | Operating units of the Company are interdependent, and the Company, as a whole, benefits from cooperation and close collaboration among individual units, so it is important in the Company’s incentive plans to reward overall corporate results and focus on priorities that impact the total Company; and |

| • | The executive compensation program should reflect the economic condition of the Company, as well as Company performance relative to peers, so that in a year in which the Company underperforms, the compensation of the executive officers should be lower than in years when the Company is achieving or exceeding its objectives. |

| Pay Element | Competitive Positioning | Program Objectives | Time Horizon | Performance Measures for Fiscal 2020 |

| Base Salary | Compares to 50th percentile, but use of judgment to determine actual pay | Attract and retain key personnel; reward for individual performance | Annual | Individual performance Length of time in the position and overall experience Consistency of performance Changes in job responsibility |

Management Incentive Plan | Motivate and reward for achieving objectives | Annual | FCF% (50%) Adjusted Operating Income Growth (50%) | |

Long-Term Incentive Plan (% of total Long-Term Incentive Plan Value) Performance Stock Awards (40%) | Compares to 50th percentile, but use of judgment to determine actual pay | Align executive’s returns with those of shareholders Encourage long-term retention Reward for superior long-term performance | 3-year performance period with payout upon results certification | Three-year average CFROIC (50%) Three-year average Annual Revenue Growth (50%) |

Retention Restricted Stock Unit Awards (40%) | Reward employees for their continued commitment to the Company | 4-year ratable vesting starting on 1st anniversary of grant | Retention | |

| Stock Options (20%) | Focus executives on driving long-term performance | 4-year ratable vesting starting on 1st anniversary of grant (10 year term) | Stock price appreciation | |

Name | Prior Salary | Fiscal 2020 Approved Base Salary | Percent Increase | |||

Mr. Burke | $975,000 | $975,000 | 0.0% | |||

Mr. Lucareli | $453,000 | $470,000 | 3.8% | |||

Mr. Bowser | $450,000 | $464,000 | 3.1% | |||

Mr. Appel | $398,000 | $410,000 | 3.0% | |||

Mr. Wollenberg | $356,000 | $367,000 | 3.1% | |||

Ms. Stein | $350,000 | $363,000 | 3.7% | |||

Mr. Casterton | $328,000 | $341,000 | 4.0% |

| Weight | Threshold | Target | Maximum | Actual | ||||||||||||||||

| FCF% | 50 | % | 1.5 | % | 4.5 | % | ≥7.5 | % | 2.6 | % | ||||||||||

Adjusted Operating Income Growth | 50 | % | 2 | % | 6 | % | ≥12 | % | -26 | % | ||||||||||

| Payout as a % of Target | N/A | 10 | % | 100 | % | 200 | % | 22 | % | |||||||||||

| MIP Target Payout for NEOs (Percentage of Base Salary) | ||||

| Mr. Burke | 100 | % | ||

| Mr. Lucareli | 70 | % | ||

| Mr. Bowser | 70 | % | ||

| Mr. Appel | 50 | % | ||

| Mr. Wollenberg | 50 | % | ||

| Ms. Stein | 50 | % | ||

| Mr. Casterton | 50 | % | ||

| Weight | Threshold | Target | Maximum | Actual | |||||||||||||

| ROACE | 50 | % | 5 | % | 9 | % | ≥14% | 8.2 | % | ||||||||

| Annual Revenue Growth | 50 | % | 3 | % | 8 | % | ≥13% | 11.5 | % | ||||||||

| Threshold | Target | Maximum | |||||||

| CFROIC | 7 | % | 10.5 | % | ≥14% | ||||

| Average Annual Revenue Growth | 3 | % | 8 | % | ≥13% | ||||

| Performance | CFROIC (50%) | Annual Revenue Growth (50%) |

| Threshold | 10% of Target Awards | 10% of Target Awards |

| Target | 100% of Target Awards | 100% of Target Awards |

| Maximum | 200% of Target Awards | 200% of Target Awards |

| LTIP Target Payout for NEOs (Percentage of Base Salary) | ||||

| Mr. Burke | 290 | % | ||

| Mr. Lucareli | 175 | % | ||

| Mr. Bowser | 175 | % | ||

| Mr. Appel | 100 | % | ||

| Mr. Wollenberg | 100 | % | ||

| Ms. Stein | 100 | % | ||

| Mr. Casterton | 100 | % | ||

| Performance Stock Awards | ||||||||||

Shares Subject to Stock Options (#) | Shares of Restricted Stock Units (#) | Threshold | Target | Maximum | ||||||

Mr. Burke | 101,541 | 85,294 | 8,529 | 85,294 | 170,588 | |||||

Mr. Lucareli | 29,537 | 24,811 | 2,481 | 24,811 | 49,622 | |||||

Mr. Bowser | 29,160 | 24,495 | 2,450 | 24,495 | 48,990 | |||||

Mr. Appel (1) | 14,724 | 12,368 | 1,237 | 12,368 | 24,736 | |||||

Mr. Wollenberg | 13,180 | 11,071 | 1,107 | 11,071 | 22,142 | |||||

Ms. Stein | 13,036 | 10,950 | 1,095 | 10,950 | 21,900 | |||||

Mr. Casterton | 12,246 | 10,287 | 1,029 | 10,287 | 20,574 | |||||

| (1) | Upon his departure from the Company effective September 26, 2019, Mr. Appel forfeited all unvested stock options, restricted stock units and performance stock awards. |

| Name and Principal Position | Fiscal Year | Salary ($)(1) | Bonus ($) | Stock Awards ($)(2) | Option Awards ($)(3) | Non-Equity Incentive Plan Compensation ($)(4) | Change in Pension Value ($)(5) | All Other Compensation ($)(6) | Total ($) | |||||||||

Thomas A. Burke | 2020 | 975,000 | - | 2,261,997 | 564,568 | - | NA | 47,286 | 3,848,850 | |||||||||

President and CEO | ||||||||||||||||||

| 2019 | 965,000 | - | 2,144,993 | 531,759 | 936,050 | NA | 46,105 | 4,623,907 | ||||||||||

| 2018 | 924,000 | - | 1,870,000 | 466,609 | 1,339,800 | NA | 65,429 | 4,665,838 | ||||||||||

Michael B. Lucareli | 2020 | 465,750 | - | 657,988 | 164,226 | - | 46,846 | 22,922 | 1,357,731 | |||||||||

VP, Finance and | ||||||||||||||||||

CFO | 2019 | 448,500 | - | 634,197 | 157,223 | 304,532 | 0 | 22,006 | 1,566,458 | |||||||||

| 2018 | 430,000 | - | 521,998 | 130,247 | 436,450 | 11,890 | 23,876 | 1,554,461 | ||||||||||

Scott L. Bowser | 2020 | 460,500 | - | 649,607 | 162,130 | - | 55,517 | 22,606 | 1,350,360 | |||||||||

VP, CIS and COO | ||||||||||||||||||

| 2019 | 406,292 | - | 316,794 | 78,537 | 218,978 | 0 | 19,894 | 1,040,495 | ||||||||||

| 2018 | 376,400 | - | 307,188 | 76,650 | 272,890 | 15,380 | 10,998 | 1,059,506 | ||||||||||

Dennis P. Appel | 2020 | 200,423 | - | 327,999 | 81,865 | - | NA | 190,087 | 800,375 | |||||||||

Former VP, CIS | ||||||||||||||||||

| 2019 | 395,000 | - | 318,405 | 78,936 | 191,575 | NA | 17,569 | 1,001,485 | ||||||||||

| 2018 | 383,250 | 100,313 (7) | 308,810 | 77,052 | 277,856 | NA | 21,412 | 1,068,380 | ||||||||||

Scott D. Wollenberg | 2020 | 364,250 | - | 293,603 | 73,281 | - | 38,879 | 17,634 | 787,647 | |||||||||

Former VP, CTO | ||||||||||||||||||

| 2019 | 353,250 | - | 284,789 | 70,602 | 171,326 | 0 | 16,903 | 896,870 | ||||||||||

Sylvia A. Stein | 2020 | 359,750 | - | 290,394 | 72,480 | - | NA | 18,322 | 740,946 | |||||||||

VP, GC and Corp. Sec. | ||||||||||||||||||

Joel T. Casterton | 2020 | 337,750 | - | 272,811 | 68,088 | - | NA | 16,791 | 695,440 | |||||||||

VP, VTS |

| (1) | The salary amounts include amounts deferred at the NEO’s option through contributions to the Modine 401(k) Retirement Plan and the Modine Deferred Compensation Plan. |

| (2) | Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for retention restricted stock unit awards and performance stock awards. For fiscal 2020, the Maximum grant date fair value for the performance stock awards are as follows for the NEOs – Mr. Burke $2,261,997; Mr. Lucareli $657,988; Mr. Bowser $649,607; Mr. Appel $327,999; Mr. Wollenberg $293,603; Ms. Stein $290,394; and Mr. Casterton $272,811. See Grants of Plan-Based Awards for Fiscal 2020, Compensation Discussion and Analysis – Equity Incentives – Long-Term Incentive Compensation and the Outstanding Equity Awards at Fiscal Year End table for further discussion regarding the retention restricted stock unit awards and the performance stock awards. The assumptions used to determine the fair value of the awards are discussed in Note 4 of the Notes to Consolidated Financial Statements contained in the Company’s Form 10-K for the fiscal year ended March 31, 2020. |

| (3) | Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for grants of stock options. The assumptions used to determine the value of the options are discussed in Note 4 of the Notes to Consolidated Financial Statements contained in the Company’s Form 10-K for the fiscal year ended March 31, 2020. The actual value, if any, that an optionee will realize upon the exercise of an option will depend on the excess of the market value of the Company’s common stock over the exercise price on the date the option is exercised, which cannot be determined until the option is exercised. |

| (4) | The amounts in the “Non-Equity Incentive Plan Compensation” column include payments under the MIP. For fiscal 2020, though the Committee made a preliminary approval of payments under the MIP, the final amounts (including potentially reduced amounts) will not be determined until October 2020. As a result, no payments are disclosed here for fiscal 2020. |

| (5) | Represents the change in pension value between the end of fiscal 2019 and the end of fiscal 2020 for the NEOs who participate in the Modine Manufacturing Company Pension Plan and the Executive Supplemental Retirement Plan. For purposes of calculating the change in benefit values from year to year, the discount rates used to determine the present value of the benefit were 3.4 percent as of March 31, 2020 and 4.0 percent as of March 31, 2019. |

| (6) | The amounts set forth in this column for fiscal 2020 include: |

| • | Company matching contributions to participant accounts in the 401(k) Retirement Plan (“401(k) Company Match”) equal to 100 percent of the amount contributed to the plan by the employee for up to 3 percent of annual income, and 50 percent of the amount contributed to the plan by the employee for up to an additional 3 percent of annual income, subject to the maximum contribution limit to the plan ($19,000 in calendar year 2019 and $19,500 in calendar year 2020); |

| • | Company contributions to the Deferred Compensation Plan equal to the amount of the Company match on salary that could not be contributed to the 401(k) Retirement Plan, because of statutory limits (“Company Excess Match/Contribution Overflow to Deferred Compensation Plan”); |

| • | Company payment of long-term disability insurance premiums (“Long-Term Disability Insurance Premiums”); |

| • | Company payment of life insurance premiums (“Life Insurance Premiums”); |

| • | Severance payments; and |

| • | Perquisites and other personal benefits. |

Name | 401(k) Company Match ($) | Company Excess Match / Contribution Overflow to Deferred Compensation Plan ($) | Long-Term Disability & Life Insurance Premiums ($) | Severance ($) | Perquisites ($) | Total ($) | ||||||

Thomas A. Burke | 12,600 | 31,275 | 3,411 | - | - | 47,286 | ||||||

Michael B. Lucareli | 12,796 | 8,153 | 1,974 | - | - | 22,922 | ||||||

Scott L. Bowser | 12,750 | 7,897 | 1,959 | 22,606 | ||||||||

Dennis P. Appel | 8,091 | 1,241 | 894 | 173,462 | 6,400 | 190,087 | ||||||

Scott D. Wollenberg | 12,289 | 3,658 | 1,687 | - | - | 17,634 | ||||||

Sylvia A. Stein | 13,216 | 3,431 | 1,675 | - | - | 18,322 | ||||||

Joel T. Casterton | 12,755 | 2,427 | 1,610 | - | - | 16,791 |

| (7) | Incentive payment made in accordance with original offer of employment. |

Name | Grant Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards (1) | Estimated Future Payouts of Performance-based Awards Under Equity Incentive Plan Awards (2) | All Other Stock Awards; Number of Shares of Stock or Units (#) (2) | All Other Option Awards; Number of Securities Under-lying Options (#) (2) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($) | |||||||||||||||

| Threshold ($) | Target ($) | Max ($) | Threshold (#) | Target (#) | Max (#) | |||||||||||||||||

Thomas A. | NA | 97,500 | 975,000 | 1,950,000 | NA | |||||||||||||||||

Burke | 5/29/19 | 8,529 | 85,294 | 170,588 | 1,130,998 | |||||||||||||||||

| 5/29/19 | 85,294 | 1,130,998 | ||||||||||||||||||||

| 5/29/19 | 101,541 | 13.26 | 564,568 | |||||||||||||||||||

Michael B. | NA | 32,603 | 326,025 | 652,050 | NA | |||||||||||||||||

Lucareli | 5/29/19 | 2,481 | 24,811 | 49,622 | 328,994 | |||||||||||||||||

| 5/29/19 | 24,811 | 328,994 | ||||||||||||||||||||

| 5/29/19 | 29,537 | 13.26 | 164,226 | |||||||||||||||||||

Scott L. | NA | 32,235 | 322,350 | 644,700 | NA | |||||||||||||||||

Bowser | 5/29/19 | 2,450 | 24,495 | 48,990 | 324,804 | |||||||||||||||||

| 5/29/19 | 24,495 | 324,804 | ||||||||||||||||||||

| 5/29/19 | 29,160 | 13.26 | 162,130 | |||||||||||||||||||

Dennis P. | NA | 20,350 | 203,500 | 407,000 | ||||||||||||||||||

Appel (3) | 5/29/19 | 1,237 | 12,368 | 24,736 | 164,000 | |||||||||||||||||

| 5/29/19 | 12,368 | 164,000 | ||||||||||||||||||||

| 5/29/19 | 14,724 | 13.26 | 81,865 | |||||||||||||||||||

Scott D. | NA | 18,213 | 182,125 | 364,250 | NA | |||||||||||||||||

Wollenberg | 5/29/19 | 1,107 | 11,071 | 22,142 | 146,801 | |||||||||||||||||

| 5/29/19 | 11,071 | 146,801 | ||||||||||||||||||||

| 5/29/19 | 13,180 | 13.26 | 73,281 | |||||||||||||||||||

Sylvia A. | NA | 17,988 | 179,875 | 359,750 | NA | |||||||||||||||||

Stein | 5/29/19 | 1,095 | 10,950 | 21,900 | 145,197 | |||||||||||||||||

| 5/29/19 | 10,950 | 145,197 | ||||||||||||||||||||

| 5/29/19 | 13,036 | 13.26 | 72,480 | |||||||||||||||||||

Joel T. | NA | 16,888 | 168,875 | 337,750 | NA | |||||||||||||||||

Casterton | 5/29/19 | 1,029 | 10,287 | 20,574 | 136,406 | |||||||||||||||||

| 5/29/19 | 10,287 | 136,406 | ||||||||||||||||||||

| 5/29/19 | 12,246 | 13.26 | 68,088 | |||||||||||||||||||

| (1) | Cash incentive plan awards are the MIP awards. No payments have been made under the fiscal 2020 MIP yet, and final determination of any payments will not be made until October 2020. |

| (2) | Stock options, retention restricted stock units and performance stock awards are made under the Incentive Plans. |

| (3) | Mr. Appel’s departure on September 26, 2019 resulted in his forfeiture of all awards granted to him in 2020. |

| Option Awards | Stock Awards | |||||||||||||||

Name | Number of Securities Underlying Unexercised Options Exercisable (#)(1) | Number of Securities Underlying Unexercised Options Unexercisable (#)(1) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock that Have Not Vested (#)(2) | Market Value of Shares or Units of Stock that Have Not Vested ($)(2) | Equity Incentive Plan Awards; Number of Unearned Shares, Units or Other Rights that Have Not Vested (#)(3) | Equity Incentive Plan Awards; Market or Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested ($)(3) | ||||||||

Thomas A. | 39,586 | - | 9.26 | 6/11/20 | 181,909 | 591,204 | 262,820 | 854,165 | ||||||||

Burke | 112,016 | - | 7.43 | 7/1/20 | ||||||||||||

| 27,622 | - | 14.93 | 7/21/21 | |||||||||||||

| 69,565 | - | 5.75 | 6/5/22 | |||||||||||||

| 47,690 | - | 10.40 | 6/3/23 | |||||||||||||

| 37,832 | - | 14.94 | 6/2/24 | |||||||||||||

| 55,538 | - | 11.39 | 6/2/25 | |||||||||||||

| 72,636 | 24,212 | 10.00 | 5/31/26 | |||||||||||||

| 31,958 | 31,961 | 15.90 | 6/1/27 | |||||||||||||

| 17,021 | 51,066 | 17.90 | 5/30/28 | |||||||||||||

| - | 101,541 | 13.26 | 5/29/29 | |||||||||||||

Michael B. | 3,594 | - | 9.26 | 6/11/20 | 52,532 | 170,729 | 75,356 | 244,907 | ||||||||

Lucareli | 4,820 | - | 14.93 | 7/21/21 | ||||||||||||

| 3,783 | - | 5.75 | 6/5/22 | |||||||||||||

| 13,379 | - | 10.40 | 6/3/23 | |||||||||||||

| 10,651 | - | 14.94 | 6/2/24 | |||||||||||||

| 15,285 | - | 11.39 | 6/2/25 | |||||||||||||

| 20,298 | 6,767 | 10.00 | 5/31/26 | |||||||||||||

| 8,920 | 8,922 | 15.90 | 6/1/27 | |||||||||||||

| 5,032 | 15,099 | 17.90 | 5/30/28 | |||||||||||||

| - | 29,537 | 13.26 | 5/29/29 | |||||||||||||

Scott L. | 7,094 | - | 9.26 | 6/11/20 | 39,498 | 128,369 | 52,664 | 171,158 | ||||||||

Bowser | 4,907 | - | 14.93 | 7/21/21 | ||||||||||||

| 7,785 | - | 10.40 | 6/3/23 | |||||||||||||

| 6,092 | - | 14.94 | 6/2/24 | |||||||||||||

| 8,726 | - | 11.39 | 6/2/25 | |||||||||||||

| 11,529 | 3,845 | 10.00 | 5/31/26 | |||||||||||||

| 5,250 | 5,250 | 15.90 | 6/1/27 | |||||||||||||

| 2,514 | 7,542 | 17.90 | 5/30/28 | |||||||||||||

| - | 29,160 | 13.26 | 5/29/29 | |||||||||||||

Dennis P. | 5,276 | - | 15.90 | 9/26/20 | - | - | - | - | ||||||||

Appel | 2,526 | - | 17.90 | 9/26/20 | ||||||||||||

Scott D. | 5,588 | - | 14.94 | 6/2/24 | 24,759 | 80,467 | 36,384 | 118,248 | ||||||||

Wollenberg | 2,062 | - | 11.39 | 6/2/25 | ||||||||||||

| 3,674 | 3,674 | 10.00 | 5/31/26 | |||||||||||||

| 4,716 | 4,718 | 15.90 | 6/1/27 | |||||||||||||

| 2,260 | 6,780 | 17.90 | 5/30/28 | |||||||||||||

| - | 13,180 | 13.26 | 5/29/29 | |||||||||||||

Sylvia A. | 2,222 | 6,666 | 17.90 | 5/30/28 | 16,816 | 54,652 | 18,771 | 61,006 | ||||||||

Stein | - | 13,036 | 13.26 | 5/29/29 | ||||||||||||

Joel T. | 9 | - | 14.93 | 7/21/21 | 16,657 | 54,135 | 19,798 | 64,344 | ||||||||

Casterton | 204 | - | 14.94 | 6/2/24 | ||||||||||||

| 632 | - | 11.39 | 6/2/25 | |||||||||||||

| 1,046 | 523 | 10.00 | 5/31/26 | |||||||||||||

| 676 | 679 | 15.90 | 6/1/27 | |||||||||||||

| 1,993 | 5,981 | 17.90 | 5/30/28 | |||||||||||||

| - | 12,246 | 13.26 | 5/29/29 | |||||||||||||

| (1) | The options vest in four equal annual installments commencing on the first anniversary of the date of grant. |

| (2) | All of these shares are retention restricted stock awards or retention restricted stock unit awards (collectively, “Retention Restricted Awards”). All Retention Restricted Awards vest in four equal annual installments commencing one year after the date of grant. The market value of the awards was determined by multiplying the number of unvested shares and restricted stock units by $3.25, the closing price of the Company’s common stock on the NYSE on March 31, 2020 (the last trading day of fiscal 2020). See Compensation Discussion and Analysis – Equity Incentives – Long-Term Incentive Compensation for a description of retention restricted stock unit awards. The description of retention restricted stock unit awards generally applies to retention restricted stock awards, except that the recipient is granted restricted stock under such an award rather than restricted stock units. |

| Shares vesting for | ||||||||||||||||||||||||||||

Thomas Burke (#) | Michael Lucareli (#) | Scott Bowser (#) | Dennis Appel (#) | Scott Wollenberg (#) | Sylvia Stein (#) | Joel Casterton (#) | ||||||||||||||||||||||

| May 29, 2020 | 21,323 | 6,202 | 6,123 | - | 2,767 | 2,737 | 2,571 | |||||||||||||||||||||

| May 30, 2020 | 14,979 | 4,428 | 2,212 | - | 1,988 | 1,955 | 1,754 | |||||||||||||||||||||

| May 31, 2020 | 22,275 | 6,225 | 3,536 | - | 3,380 | - | 482 | |||||||||||||||||||||

| June 1, 2020 | 14,701 | 4,103 | 2,415 | - | 2,169 | - | 311 | |||||||||||||||||||||

| May 29, 2021 | 21,323 | 6,202 | 6,123 | - | 2,767 | 2,737 | 2,571 | |||||||||||||||||||||

| May 30, 2021 | 14,979 | 4,428 | 2,212 | - | 1,988 | 1,955 | 1,754 | |||||||||||||||||||||

| June 1, 2021 | 14,702 | 4,106 | 2,415 | - | 2,172 | - | 314 | |||||||||||||||||||||

| May 29, 2022 | 21,323 | 6,202 | 6,123 | - | 2,767 | 2,737 | 2,571 | |||||||||||||||||||||

| May 30, 2022 | 14,979 | 4,431 | 2,213 | - | 1,991 | 1,956 | 1,755 | |||||||||||||||||||||

| May 29, 2023 | 21,325 | 6,205 | 6,126 | - | 2,770 | 2,739 | 2,574 | |||||||||||||||||||||

| (3) | The performance stock awards are reflected at the Target level for the fiscal 2020 and fiscal 2019 awards and at the Maximum level for the 2018 award. The actual payout of performance stock awards granted in fiscal 2018 was 126% percent of Target. See Compensation Discussion and Analysis – Equity Incentives – Long-Term Incentive Compensation for a description of performance stock awards. The market value of the performance stock awards was determined by multiplying the number of unvested shares by $3.25, the closing price of the Company’s common stock on the NYSE on March 31, 2020 (the last trading day of fiscal 2020). Mr. Appel’s departure on September 26, 2019 resulted in his forfeiture of all outstanding performance stock awards. |

| Option Awards | Stock Awards | ||||||||||||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) | |||||||||

Thomas A. Burke | 14,979 | 198,921 | (1 | ) | |||||||||

147,906 | 1,900,592 | (2 | ) | ||||||||||

14,701 | 188,908 | (3 | ) | ||||||||||

18,329 | 235,528 | (4 | ) | ||||||||||

Michael B. Lucareli | 4,428 | 58,804 | (1 | ) | |||||||||

41,334 | 531,142 | (2 | ) | ||||||||||

4,103 | 52,724 | (3 | ) | ||||||||||

5,044 | 64,815 | (4 | ) | ||||||||||

Scott L. Bowser | 2,212 | 29,375 | (1 | ) | |||||||||

23,479 | 301,705 | (2 | ) | ||||||||||

2,415 | 31,033 | (3 | ) | ||||||||||

2,882 | 37,034 | (4 | ) | ||||||||||

Dennis P. Appel | 2,223 | 29,521 | (1 | ) | |||||||||

2,427 | 31,187 | (3 | ) | ||||||||||

Scott D. Wollenberg | 1,988 | 26,401 | (1 | ) | |||||||||

22,443 | 288,393 | (2 | ) | ||||||||||

2,169 | 27,872 | (3 | ) | ||||||||||

2,724 | 35,003 | (4 | ) | ||||||||||

Sylvia A. Stein | 1,955 | 25,962 | (1 | ) | |||||||||

Joel T. Casterton | 1,754 | 23,293 | (1 | ) | |||||||||

3,195 | 41,056 | (2 | ) | ||||||||||

311 | 3,996 | (3 | ) | ||||||||||

417 | 5,358 | (4 | ) | ||||||||||

| (1) | Shares vested on May 30, 2019 at $13.28 per share, the closing price on such date. |

| (2) | Shares vested on May 31, 2019 at $12.85 per share, the closing price on such date. |

| (3) | Shares vested on June 1, 2019 at $12.85 per share, the closing price on May 31, 2019. |

| (4) | Shares vested on June 2, 2019 at $12.85 per share, the closing price on May 31, 2019. |

| Plan Name | Number of Years Credited Service (#) | Present Value of Accumulated Benefit ($) (1) | Payments During Last Fiscal Year ($) | |||||||||||

| Thomas A. Burke | NA | NA | NA | NA | ||||||||||

| Michael B. Lucareli | Salaried Pension Plan | 6.6 | 208,470 | - | ||||||||||

| SERP | NA | NA | NA | |||||||||||

| Total | 208,470 | - | ||||||||||||

| Scott L. Bowser | Salaried Pension Plan | 8.3 | 272,890 | - | ||||||||||

| SERP | NA | NA | NA | |||||||||||

| Total | 272,890 | - | ||||||||||||

| Dennis P. Appel | NA | NA | NA | NA | ||||||||||

| Scott D. Wollenberg | Salaried Pension Plan | 13.9 | 173,603 | - | ||||||||||

| SERP | NA | NA | NA | |||||||||||

| Total | 173,603 | - | ||||||||||||

| Sylvia A. Stein | NA | NA | NA | NA | ||||||||||

| Joel T. Casterton | NA | NA | NA | NA | ||||||||||

| (1) | The Company used the following assumptions to determine the present value of accumulated benefit as set forth in the table above: discount rate of 3.39%; Mortality: use of Pri-2012 (70% Blue Collar/30% White Collar Blend) table projected generationally using scale MP-2019 converging to an ultimate improvement factor of 0.75% over 10 years for age and 15 year for cohort (post - retirement decrement only); service up to March 31, 2006 and pay up to December 31, 2007 (the plans froze service accumulation on March 31, 2006 and pay changes on December 31, 2007); employees elect to begin payments as soon as they are eligible to receive unreduced benefits; 80% of employees elect lump sums from the qualified plan and 20% elect annuities; and all payments from the SERP are in the form of a lump sum with lump sums valued using a 3-tier yield curve of 1.73% for years 0-5, 2.72% for years 5-20 and 3.35% for years 20+ and the specified 417(e) mortality table. |

| Name | Executive Contributions in Last FY ($)(1) | Registrant Contributions in Last FY ($)(2) | Aggregate Earnings in Last FY ($) | Aggregate Withdrawals / Distributions ($) | Aggregate Balance at Last FYE ($)(3) | |||||||||||||||

| Thomas A. Burke | 39,000 | 31,275 | 48,924 | - | 1,165,252 | |||||||||||||||

| Michael B. Lucareli | 23,288 | 8,153 | (37,025 | ) | - | 288,945 | ||||||||||||||

| Scott L. Bowser | - | 7,897 | (14,040 | ) | - | 69,265 | ||||||||||||||

| Dennis P. Appel | 10,100 | 1,241 | 330 | 8,192 | 43,057 | |||||||||||||||

| Scott D. Wollenberg | 9,881 | 3,658 | (6,032 | ) | - | 51,740 | ||||||||||||||

| Sylvia A. Stein | 7,195 | 3,431 | (2,014 | ) | - | 10,494 | ||||||||||||||

| Joel T. Casterton | 33,775 | 2,427 | (13,584 | ) | - | 55,198 | ||||||||||||||

| (1) | Amounts include any deferrals of base salary and such amounts are included in the “Base Salary” column of the Summary Compensation Table. |

| (2) | Amounts are reported in the Summary Compensation Table. Company matching contributions that could not otherwise be made to the 401(k) Retirement Plan because of statutory limits are made to the Deferred Compensation Plan. |

| (3) | All executive contributions and contributions by the Company for fiscal 2020 have been reported in the Summary Compensation Table for the current year (i.e., fiscal 2020). In addition to the current year, executive contributions and contributions by the Company with respect to Mr. Burke for prior years in which Mr. Burke was an NEO have been reported in the Summary Compensation Table in prior years. In total, $732,804 in contributions have been reported for Mr. Burke as an NEO in the Summary Compensation Table in prior years. The remainder of the aggregate balance for Mr. Burke in the above column reflects earnings (and losses) on those contributions. In addition to the current year, since Mr. Lucareli became an NEO in fiscal 2011, the Company has reported $92,053 in contributions in the Summary Compensation Table for him prior to fiscal 2020. The remainder of the aggregate balance for Mr. Lucareli in the above column reflects contributions prior to fiscal 2011 and earnings (and losses) on all contributions. In addition to the current year, since Mr. Bowser became a participant in the Deferred Compensation plan in fiscal 2012, the Company has reported $43,044 in contributions in the Summary Compensation Table for him prior to fiscal 2020. The remainder of the aggregate balance for Mr. Bowser in the above column reflects the earnings (and losses) on all contributions. In addition to the current year, since Mr. Appel became an NEO in fiscal 2018 and became a participant in the Deferred Compensation plan in such year, the Company has reported $38,370 in contributions in the Summary Compensation Table for him prior to fiscal 2020. The remainder of Mr. Appel’s aggregate balance in the above column reflects the earnings (and losses) on all contributions. Mr. Wollenberg became an NEO in fiscal 2019, and the Company reported $3,388 in contributions in the Summary Compensation Table for him prior to fiscal 2020. The remainder of the aggregate balance for Mr. Wollenberg in the above column reflects contributions prior to fiscal 2019 and earnings (and losses) on all contributions. Ms. Stein and Mr. Casterton both became an NEO in fiscal 2020. Beyond the contributions reported in the Summary Compensation Table for Ms. Stein and Mr. Casterton for the current year, the remainder of their aggregate balances in the above column reflects contributions prior to fiscal 2020 and/or earnings (and losses) on all contributions. |

Name of Fund | Return for 12 Months Ended March 31, 2020 | |||

| Baird Aggregate Bond Inst | 7.55 | % | ||

| DFA US Large Cap Equity Institutional | -9.43 | % | ||

| DFA US Small Cap I | -27.15 | % | ||

| Fidelity 500 Index Fund | -6.99 | % | ||

| Fidelity Diversified International | -5.95 | % | ||

| Fidelity Mid Cap Index Fund | -18.29 | % | ||

| Fidelity Small Cap Index Fund | -23.87 | % | ||

| Fidelity Total Intl Index Fund | -16.38 | % | ||

| Fidelity US Bond Index Fund | 9.23 | % | ||

| Hartford MidCap R6 | -16.18 | % | ||

| T. Rowe Price Retirement Balanced I | -3.55 | % | ||

| T. Rowe Price Retirement I 2005 I | -3.13 | % | ||

| T. Rowe Price Retirement I 2010 I | -3.72 | % | ||

| T. Rowe Price Retirement I 2015 I | -4.58 | % | ||

| T. Rowe Price Retirement I 2020 I | -5.85 | % | ||

| T. Rowe Price Retirement I 2025 I | -7.14 | % | ||

| T. Rowe Price Retirement I 2030 I | -8.34 | % | ||

| T. Rowe Price Retirement I 2035 I | -9.35 | % | ||

| T. Rowe Price Retirement I 2040 I | -10.21 | % | ||

| T. Rowe Price Retirement I 2045 I | -10.90 | % | ||

| T. Rowe Price Retirement I 2050 I | -10.89 | % | ||

| T. Rowe Price Retirement I 2055 I | -10.90 | % | ||

| T. Rowe Price Retirement I 2060 I | -10.88 | % | ||

| Vanguard Short-Term Bond Index Admiral | 5.47 | % | ||

| Wells Fargo Govt MMkt I | 1.80 | % | ||

| • | we would not pay severance; |

| • | the executive would forfeit all unvested stock options, Retention Restricted Awards and performance stock awards; |

| • | all benefits and perquisites would cease; and |

| • | the NEO, if a participant in the Salaried Pension Plan, would be entitled to a distribution of his/her vested benefits under that plan, the SERP (see the Pension Benefits Table for Fiscal 2020 on page 38) and the Nonqualified Deferred Compensation Plan (see the Nonqualified Deferred Compensation Table for Fiscal 2020 on page 39). |

| • | we would not pay severance; |

| • | the ONC Committee may, in whole or in part, waive any or all remaining restrictions on unvested stock options and Retention Restricted Awards (for NEOs other than Mr. Wollenberg); |

| • | all benefits and perquisites would cease; and |

| • | the NEO, if a participant in the Salaried Pension Plan, the SERP or the Nonqualified Deferred Compensation Plan, would be entitled to a distribution of his/her vested benefits under those plans. |

| • | the executive’s estate would receive his/her base salary through the month in which the executive dies, plus any unused vacation pay (except for Mr. Wollenberg); |

| • | all unvested stock options and Retention Restricted Awards would vest (except for Mr. Wollenberg); |

| • | all benefits and perquisites would cease; |

| • | a prorated portion (based on the period worked during the performance period) of performance shares shall vest based on the Company’s actual achievement of the performance goals at the end of the performance period (except for Mr. Wollenberg); and |

| • | the NEO’s estate, if he or she was a participant in the Salaried Pension Plan, the SERP or the Nonqualified Deferred Compensation Plan, would be entitled to a distribution of his/her vested benefits under those plans. |

| • | he would receive base salary and bonus continuation at a level of 100 percent of the rate paid at the time of disability for the first 12 months and 60 percent for up to an additional 24 months, but in no event beyond the remainder of the term of his employment agreement (Mr. Burke may also receive disability benefits under the Company’s group long-term disability plan, except that such benefits would offset the previously described amounts); |

| • | all unvested stock options and Retention Restricted Awards would vest; |

| • | a prorated portion (based on the period worked during the performance period) of performance shares shall vest based on the Company’s actual achievement of the performance goals at the end of the performance period; and |

| • | all benefits and perquisites would cease. |

| • | we would not pay severance; |

| • | all unvested stock options and Retention Restricted Awards would vest (except for Mr. Wollenberg); |

| • | a prorated portion (based on the period worked during the performance period) of performance shares shall vest based on the Company’s actual achievement of the performance goals at the end of the performance period (except for Mr. Wollenberg); |

| • | all benefits and perquisites would cease; and |

| • | the NEO, if a participant in the Salaried Pension Plan, the SERP or the Nonqualified Deferred Compensation Plan, would be entitled to a distribution of his/her vested benefits under those plans. |

| • | pay to Mr. Burke an amount equal to three times his “Average Annual Earnings” (“Average Annual Earnings” means the average base salary and actual cash incentive or bonus he earned in the five taxable years preceding the year of termination) over the remainder of the employment agreement term; and |

| • | continue, for a period of 36 months from the date of termination, to allow the executive to participate in certain employee health, welfare and retirement benefits, including plans designed to provide the executive with benefits that he would have received under qualified plans but for the statutory limitations on qualified benefits. In the event that such plans preclude such participation, the Company would pay an equivalent amount in cash. |

| • | pay to Mr. Wollenberg an amount equal to fifty-two (52) weeks of Mr. Wollenberg’s salary, payable in a lump sum; |

| • | provided Mr. Wollenberg elects COBRA continuation coverage, partially subsidize group health plan coverage for a period of up to 12 months from the date of termination; |

| • | pay a prorated MIP payout with respect to fiscal 2020 based on financial projections as of Mr. Wollenberg’s termination date and prorated based on Mr. Wollenberg’s complete months of service in fiscal 2020, which is payable in a lump sum; |

| • | pay the cost for twelve (12) months of outplacement services; |

| • | fully vest all of Mr. Wollenberg’s restricted stock and restricted stock units granted in fiscal 2017, fiscal 2018 and fiscal 2019 upon Mr. Wollenberg’s termination of employment; and |

| • | fully vest all performance shares earned in accordance with the fiscal 2018-fiscal 2020 performance cycle at the earned payout percentage, and vest all performance shares earned in accordance with the fiscal 2019-fiscal 2021 at the earned payout percentage, but prorated for full months of active service provided by Mr. Wollenberg to Modine during this performance cycle. |

| • | pay to Mr. Burke an amount equal to three times the greater of (i) the sum of his base salary and Target bonus for the current fiscal year, or (ii) his five year average base salary and actual bonus for the five year period ending on the last day of the fiscal year immediately preceding the fiscal year of termination, payable in a lump sum; |

| • | pay to Mr. Burke an amount equal to the pro rata portion of the Target bonus for the calendar year in which his employment terminated; |

| • | accelerate the vesting of Mr. Burke’s unvested stock options and Retention Restricted Awards, so that all such awards would immediately vest or the restrictions would lapse, as the case may be, on the date of termination; |

| • | pay to Mr. Burke an additional lump sum payment sufficient to cover the full cost of excise taxes due to the application of Section 4999 of the Code, if applicable, and his federal, state and local income and employment taxes on the payments; |

| • | continue to provide coverage for a period of three years to Mr. Burke, his spouse and other dependents under all welfare benefit plans maintained by the Company in which such persons were participating immediately prior to the termination unless precluded by such plan, in which case the Company would pay an equivalent amount in cash; and |

| • | for each of the three calendar years ending during the three-year period beginning with Mr. Burke’s termination of employment, pay to Mr. Burke an amount (a “Supplemental Defined Contribution Benefit”) for each such calendar year approximately equal to the sum of the Company’s matching and discretionary contributions, if any, that would have be made to the 401(k) Retirement Plan and Deferred Compensation Plan for each applicable year had Mr. Burke continued employment for such three-year period, using certain assumptions set forth in Mr. Burke’s employment agreement. |

| • | Severance equal to 52 weeks’ Base Salary (i.e., $410,000), payable bi-weekly in accordance with standard Company practices; and |

| • |

Name | Cash Payment ($) | Accelerated Vesting of Equity ($)(1) | Retirement Plan Benefits: Pension Plan (Qualified & SERP) ($) | Perquisites and Continued Benefits ($) | Total ($) |

| Thomas A. Burke | |||||

| Death | 0 | $1,054,231 | NA | NA | $1,054,231 |

| Disability | $4,024,310 | $1,054,231 | NA | (2) | $5,078,541 |

| Involuntary Termination | $5,259,249 | 0 | NA | $5,433,883 | |

| Termination if Change in Control | $1,004,540 | NA | $174,634 (3) | $8,004,175 | |

| Change in Control (no termination) | NA | NA | NA | NA | NA |