UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-2619

MoneyMart Assets, Inc.

(Exact name of registrant as specified in charter)

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

(Address of principal executive offices)

Jonathan D. Shain

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

(Name and address of agent for service)

Registrant’s telephone number, including area code: 973-802-6469

Date of fiscal year end: 12/31/03

Date of reporting period: 12/31/03

| Item 1 | – Reports to Stockholders – [ INSERT REPORT ] |

ANNUAL REPORT

DECEMBER 31, 2003

MONEYMART ASSETS, INC.

FUND TYPE

Money market

OBJECTIVE

Maximum current income consistent with stability of capital and the maintenance of liquidity

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Dear Shareholder,

February 23, 2004

As you may know, the mutual fund industry recently has been the subject of much media attention. As president of MoneyMart Assets, Inc., I’d like to provide you with an update on the issues as they pertain to your fund.

Regulators and government authorities have requested information regarding trading practices from many mutual fund companies across the nation. Our fund family has been cooperating with inquiries it has received, and at the same time, Prudential Financial, Inc. has been conducting its own internal review. This review encompasses the policies, systems, and procedures of our fund family, Prudential Financial’s investment units and its proprietary distribution channels. The review also includes mutual fund trading activity by investment professionals who manage our funds.

Market timing

The frequent trading of shares in response to short-term fluctuations in the market is known as “market timing”. When market timing occurs in violation of a fund’s prospectus, in certain circumstances, a fund may have to sell portfolio securities to have the cash necessary to redeem the market timer’s shares. The redemption may happen when it is not advantageous to sell securities and result in harming the fund’s performance and/or subject the fund to additional transaction costs.

Prudential Investments LLC, the Fund’s investment manager, has actively discouraged market timing and for years our mutual fund prospectuses have identified and addressed this issue. Prudential Investments has established operating policies and procedures that are designed to detect and deter frequent trading activities that would be disruptive to the management of our mutual fund portfolios, and has rejected numerous orders placed by market timers in the past.

Late trading

The Securities and Exchange Commission requires that orders to purchase or redeem mutual fund shares be received either by the fund or by an intermediary (such as a broker, financial adviser, or 401(k) record keeper) before the time at which the fund calculates its net asset value (normally 4:00 p.m., Eastern time) if they are to receive that day’s price. The policies of our mutual funds do not make and have not made allowances for the practice known as “late trading”.

For more than 40 years we have offered investors quality investment products, financial guidance, and responsive customer service. Today we remain committed to this heritage and to the highest ethical principles in our investment practices.

Sincerely,

Judy A. Rice, President

MoneyMart Assets, Inc.

Your Fund’s Performance

Fund Objective

The investment objective of MoneyMart Assets, Inc. (the Fund) is to seek maximum current income consistent with stability of capital and the maintenance of liquidity. There can be no assurance that the Fund will achieve its investment objective.

The Fund is a diversified portfolio of high-quality, U.S. dollar-denominated money market securities issued by the U.S. government and its agencies, and major corporations and commercial banks of the United States and foreign countries. Maturities can range from one day to 13 months. We only purchase securities rated in one of the two highest rating categories by at least two major rating agencies, or if not rated, deemed to be of equivalent quality by our credit research staff.

| | | | | | | | | | | |

| | | | |

| Fund Facts as of 12/31/03 | | | | | | | | | |

| | | 7-Day

Current Yield | | | Net Asset

Value (NAV) | | Weighted Avg.

Maturity (WAM) | | Net Assets

(Millions) |

Class A | | 0.49 | % | | $ | 1.00 | | 48 Days | | $ | 5,089.4 |

|

Class Z* | | 0.62 | % | | $ | 1.00 | | 48 Days | | $ | 187.7 |

|

iMoneyNet, Inc. Taxable Prime Retail Avg.** | | 0.39 | % | | | N/A | | 58 Days | | | N/A |

|

Note: Yields will fluctuate from time to time, and past performance is not indicative of future results. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| *Class | Z shares are not subject to distribution and service (12b-1) fees. |

| ** | iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. For purposes of this report, iMoneyNet, Inc. reported the 7-day current yield and WAM on the last Monday of the reporting period. This is the data of all funds in the iMoneyNet, Inc. Taxable Prime Retail Average category as of December 29, 2003, the closest date to the end of our reporting period. |

| | |

| 2 | | Visit our website at www.jennisondryden.com |

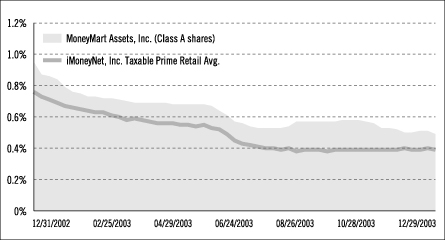

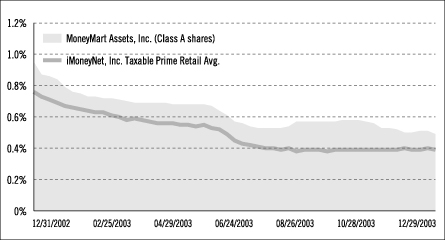

Money Market Fund Yield Comparison

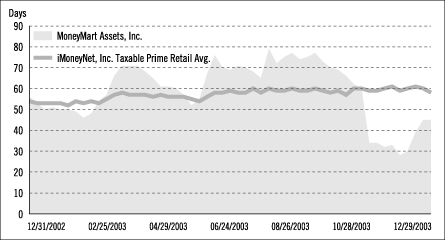

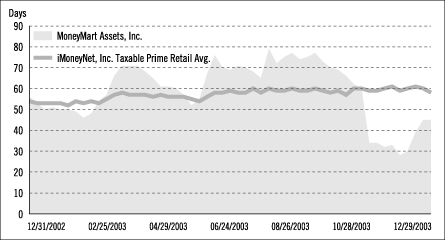

Weighted Average Maturity Comparison

Past performance is not indicative of future results. The graphs portray weekly 7-day current yields and weekly WAMs for MoneyMart Assets, Inc. (Class A shares – yields only) and the iMoneyNet, Inc. Taxable Prime Retail Average every Tuesday from December 31, 2002 to December 29, 2003, the closest dates to the beginning and end of our reporting period. Note: iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. For purposes of this report, iMoneyNet, Inc. reported the final 7-day current yield and WAM on the last Monday of the reporting period. The data portrayed at the end of the reporting period in the graph may not match the data portrayed in the Fund Facts table as of December 31, 2003.

Investment Adviser’s Report

Prudential Investment Management, Inc.

Meeting the challenge posed by low interest rates in 2003

Money market yields were volatile at low levels in 2003. This investment environment reflected changing economic conditions in the United States, an uncertain outlook for monetary policy, and geopolitical risks. Our approach to security selection and interest-rate risk aimed to enhance the Fund’s yields and allow its shareholders easy access to their money. Throughout 2003, the Fund provided competitive yields, and its NAV remained at $1.00 per share.

As an essential component of our investment strategy, we maintained a diversified portfolio of high-quality, short-term debt securities of federal agencies, banks, and corporations that spanned the range of money market maturities. By altering this mix of securities, we adjusted the Fund’s weighted average maturity (WAM), which is expressed in days and takes into account the maturity and quantity of each security held in the portfolio. WAM indicates the portfolio’s sensitivity to changes in interest rates.

For much of the first two months of 2003, the Fund’s WAM was shorter than that of its competitors as measured by the iMoneyNet, Inc. Taxable Prime Retail Average. During this time, money market yields declined as financial markets speculated that the Federal Reserve (the Fed) might cut short-term interest rates later in the year in an effort to promote growth in the sluggish U.S. economy.

In retrospect, at the beginning of the year, a longer-than-average WAM would have better insulated the Fund’s interest income from the impact of declining yields. We repositioned the Fund’s WAM significantly longer than average in March and early April by investing in longer-term money market securities when we believed it advantageous to do so. Our purchases were made as yields rose temporarily due to the hope that a recently begun war in Iraq would end quickly. This strategy benefited the Fund when the decline in money market yields resumed in earnest during the spring amid renewed speculation that the Fed would lower rates.

While some market participants expected rates to be reduced by half a percentage point, we did not anticipate such an aggressive move. Therefore we avoided significantly purchasing longer-term money market securities in May and early June as yields continued to fall. Instead, our patience was rewarded when yields rose amid disappointment that the Fed cut the interbank overnight lending rate by only a quarter of a percentage point to 1% in late June. Yields also turned higher in the summer of 2003 as signs of brisk economic growth led financial markets to conclude that the Fed had finished its 2½-year rate-cutting campaign.

| | |

| 4 | | Visit our website at www.jennisondryden.com |

Finding attractive value in federal agency securities

In late summer, we took advantage of what we believed to be an attractive investment opportunity. The Federal Home Loan Mortgage Corporation (Freddie Mac), a U.S. government-sponsored enterprise that buys mortgages and packages them into mortgage-backed securities sold to investors, restated its earnings higher because of accounting irregularities. As a result of this news, yield spreads on Freddie Mac notes became generally tighter relative to corporate debt issues with comparable maturities. This partly reflected uncertainty about how Freddie Mac and the Federal National Mortgage Association (Fannie Mae) would be regulated in the future to prevent such problems from recurring. We capitalized on this window of opportunity by purchasing unsecured Freddie Mac and Fannie Mae notes, which provided incremental yield that benefited the Fund.

In the autumn of 2003, we adjusted our strategy by selling longer-term money market securities and focusing our purchases on securities with shorter maturity dates. This reduced the Fund’s interest-rate sensitivity and prepared the Fund to accommodate an outflow of assets in late 2003 associated with a joint venture between Prudential Securities Inc. and Wachovia Securities LLC. As the year drew to a close, we took advantage of attractive investment opportunities that typically emerge at year-end.

This Page Intentionally Left Blank

Financial Statements

| | |

|

| DECEMBER 31, 2003 | | ANNUAL REPORT |

MoneyMart Assets

This Page Intentionally Left Blank

Portfolio Of Investments

as of December 31, 2003

| | | | | | |

Principal Amount (000) | | Description | | Value (Note 1) |

| | | | | | | |

| |

| | Bank Note 0.8% | | | |

|

| | | | American Express Centurion Bank | | | |

| $ | 40,000 | | 1.09%, 1/26/04 | | $ | 40,000,000 |

| |

| | Certificates of Deposit—Canadian 3.5% | | | |

|

| | | | Canadian Imperial Bank of Commerce | | | |

| | 184,000 | | 1.09%, 1/8/04 | | | 184,000,000 |

| |

| | Certificates of Deposit—Domestic 7.7% | | | |

|

| | | | First Tennessee Bank NA | | | |

| | 50,000 | | 1.08%, 2/10/04 | | | 49,999,440 |

| | | | KBC Bank NV | | | |

| | 110,000 | | 1.09%, 2/23/04 | | | 109,999,192 |

| | | | Wells Fargo Bank NA | | | |

| | 78,000 | | 1.08%, 1/12/04 | | | 77,999,881 |

| | 170,000 | | 1.05%, 1/30/04 | | | 169,999,316 |

| | | | | |

|

|

| | | | | | | 407,997,829 |

| |

| | Certificates of Deposit—Eurodollar 1.9% | | | |

|

| | | | HBOS Treasury Services PLC | | | |

| | 100,000 | | 1.105%, 3/23/04 | | | 100,001,136 |

| |

| | Certificates of Deposit—Yankee 5.7% | | | |

|

| | | | Landesbank Hessen-Thuringren | | | |

| | 67,000 | | 1.075%, 1/5/04 | | | 66,999,798 |

| | | | Natexis Banque Populaires | | | |

| | 85,000 | | 1.10%, 3/17/04 | | | 85,001,789 |

| | | | Societe Generale NY | | | |

| | 100,000 | | 1.33%, 3/31/04 | | | 100,000,000 |

| | 25,000 | | 1.16%, 4/12/04 | | | 24,999,650 |

| | | | UBS AG | | | |

| | 25,000 | | 1.245%, 3/17/04 | | | 24,999,740 |

| | | | | |

|

|

| | | | | | | 302,000,977 |

| |

| | Commercial Paper 57.0% | | | |

|

| | | | Aegon Funding Corp. | | | |

| | 13,000 | | 1.10%, 1/7/04 | | | 12,997,617 |

| | 21,153 | | 1.095%, 1/8/04 | | | 21,148,496 |

| | 79,547 | | 1.095%, 1/13/04 | | | 79,517,965 |

| | | | | | | |

| | | | Alianz Finance Corp. | | | |

| | 40,000 | | 1.06%, 3/9/04 | | | 39,919,911 |

| | 100,000 | | 1.09%, 3/17/04 | | | 99,769,889 |

See Notes to Financial Statements.

Portfolio Of Investments

as of December 31, 2003 Cont’d.

| | | | | | |

Principal Amount (000) | | Description | | Value (Note 1) |

| | | | Alliance & Leicester PLC | | | |

| $ | 20,000 | | 1.09%, 3/5/04 | | $ | 19,961,244 |

| | | | Amsterdam Funding Corp. | | | |

| | 34,879 | | 1.09%, 1/15/04 | | | 34,864,215 |

| | 50,000 | | 1.10%, 1/20/04 | | | 49,970,972 |

| | 40,000 | | 1.09%, 1/21/04 | | | 39,975,778 |

| | 17,843 | | 1.09%, 1/22/04 | | | 17,831,655 |

| | 20,499 | | 1.09%, 1/26/04 | | | 20,483,483 |

| | | | Bear Stearns Co., Inc. | | | |

| | 100,000 | | 1.09%, 1/30/04 | | | 99,912,194 |

| | | | Bradford & Bingley Building PLC | | | |

| | 45,000 | | 1.10%, 1/8/04 | | | 44,990,375 |

| | | | Caisse Nationale Des Caisses | | | |

| | 25,000 | | 1.09%, 3/12/04 | | | 24,946,257 |

| | | | Citigroup Global Markets Holdings, Inc. | | | |

| | 158,000 | | 1.09%, 1/7/04 | | | 157,971,297 |

| | 85,000 | | 1.085%, 3/25/04 | | | 84,784,808 |

| | | | Den Norske Bank ASA | | | |

| | 45,000 | | 1.09%, 2/13/04 | | | 44,941,413 |

| | 70,000 | | 1.09%, 3/15/04 | | | 69,843,161 |

| | | | Edison Asset Securitization LLC | | | |

| | 100,000 | | 1.09%, 2/13/04 | | | 99,869,805 |

| | 150,000 | | 1.09%, 2/23/04 | | | 149,759,292 |

| | | | Falcon Asset Securitization Corp. | | | |

| | 89,000 | | 1.09%, 1/28/04 | | | 88,927,243 |

| | | | GE Capital International Funding | | | |

| | 50,000 | | 1.09%, 1/26/04 | | | 49,962,153 |

| | 50,000 | | 1.10%, 1/28/04 | | | 49,958,750 |

| | 35,000 | | 1.10%, 2/9/04 | | | 34,958,291 |

| | | | HBOS Treasury Services PLC | | | |

| | 51,000 | | 1.09%, 3/16/04 | | | 50,884,188 |

| | 90,000 | | 1.09%, 3/22/04 | | | 89,779,275 |

| | | | Independence Funding LLC | | | |

| | 50,000 | | 1.095%, 1/15/04 | | | 49,978,708 |

| | 73,386 | | 1.095%, 1/20/04 | | | 73,343,589 |

| | | | Long Lane Master Trust IV | | | |

| | 25,049 | | 1.10%, 1/30/04 | | | 25,026,804 |

| | 3,315 | | 1.12%, 2/17/04 | | | 3,310,153 |

| | | | | | | |

| | | | Market Street Funding Corp. | | | |

| | 58,000 | | 1.10%, 1/29/04 | | | 57,950,378 |

| | | | Morgan Stanley Dean Witter Co. | | | |

| | 150,000 | | 1.09%, 1/26/04 | | | 149,886,458 |

See Notes to Financial Statements.

| | |

| 10 | | Visit our website at www.jennisondryden.com |

| | | | | | |

Principal Amount (000) | | Description | | Value (Note 1) |

| | | | Natexis Banques Populaires | | | |

| $ | 50,000 | | 1.09%, 3/11/04 | | $ | 49,894,028 |

| | | | New Center Asset Trust | | | |

| | 26,000 | | 1.10%, 2/25/04 | | | 25,956,306 |

| | | | Nordeutsche Landesbank Luxembourg | | | |

| | 21,000 | | 1.09%, 1/16/04 | | | 20,990,462 |

| | 54,196 | | 1.10%, 1/21/04 | | | 54,162,880 |

| | 28,000 | | 1.095%, 2/5/04 | | | 27,970,192 |

| | | | Preferred Receivables Funding Corp. | | | |

| | 27,000 | | 1.09%, 1/26/04 | | | 26,979,563 |

| | | | Prudential PLC | | | |

| | 142,000 | | 1.09%, 2/3/04 | | | 141,858,119 |

| | 29,000 | | 1.10%, 2/23/04 | | | 28,953,036 |

| | | | Schlumberger Technology Corp. | | | |

| | 9,288 | | 1.10%, 3/1/04 | | | 9,270,972 |

| | 42,000 | | 1.09%, 3/8/04 | | | 41,914,798 |

| | | | Sheffield Receivables Corp. | | | |

| | 100,000 | | 1.11%, 1/6/04 | | | 99,984,583 |

| | 95,000 | | 1.10%, 1/8/04 | | | 94,979,681 |

| | 23,980 | | 1.11%, 1/9/04 | | | 23,974,085 |

| | | | Stadshypotek Delaware, Inc. | | | |

| | 100,000 | | 1.09%, 3/23/04 | | | 99,751,722 |

| | 50,000 | | 1.10%, 3/23/04 | | | 49,874,722 |

| | | | Svenska Handelsbank, Inc. | | | |

| | 53,000 | | 1.09%, 2/10/04 | | | 52,935,811 |

| | | | Swiss RE Financial Products Corp. | | | |

| | 61,000 | | 1.10%, 1/29/04 | | | 60,947,811 |

| | | | Tulip Funding Corp. | | | |

| | 35,009 | | 1.09%, 1/12/04 | | | 34,997,340 |

| | 8,573 | | 1.10%, 1/20/04 | | | 8,568,023 |

| | | | Westpac Capital Corp. | | | |

| | 55,000 | | 1.115%, 5/27/04 | | | 54,749,590 |

| | | | Westpac Trust Securities New Zealand | | | |

| | 60,175 | | 1.14%, 6/4/04 | | | 59,879,641 |

| | | | | |

|

|

| | | | | | | 3,006,019,182 |

| | | | | | | |

| |

| | Loan Participation 0.8% | | | |

|

| | | | Countrywide Home Loan, Inc. | | | |

| | 42,000 | | 1.15%, 1/23/04 | | | 42,000,000 |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 11 |

Portfolio Of Investments

as of December 31, 2003 Cont’d.

| | | | | | |

Principal Amount (000) | | Description | | Value (Note 1) |

| |

| | Municipal Bonds 4.5% | | | |

|

| | | | Gulf Coast Wste. Disp. Auth. Texas Environ. Facs. Rev.,

ExxonMobil Proj. | | | |

| $ | 24,100 | | 1.27%, 1/2/04(b) | | $ | 24,100,000 |

| | | | Harris Cnty. Texas Hlth. Facs. Dev. Corp. Rev., St. Lukes Episcopal Hosp., Ser. B | | | |

| | 20,000 | | 1.39%, 1/2/04(b) | | | 20,000,000 |

| | | | New York City Transitional Fin. Auth., NYC Recov.,

Ser. 3-Subser. 3B | | | |

| | 65,950 | | 1.34%, 1/2/04(b) | | | 65,950,000 |

| | | | NYC Recov., Ser. 3-Subser. 3H | | | |

| | 10,900 | | 1.28%, 1/2/04(b) | | | 10,900,000 |

| | | | Port Auth. NY & NJ Spec. Oblig. Rev., Versatile Structure Oblig.,

Ser. 2 | | | |

| | 25,095 | | 1.27%, 1/2/04(b) | | | 25,095,000 |

| | | | Rhode Island St. Hlth. & Edl. Bldg. Corp. Rev., Hosp. Fin. Care New England, Ser. A | | | |

| | 16,400 | | 1.33%, 1/4/04(b) | | | 16,400,000 |

| | | | Sevier Cnty. Tennessee Pub. Bldg. Auth., Adj.-Loc. Govt. Pub. Impvt., Ser. IV-1 | | | |

| | 14,115 | | 1.34%, 1/2/04(b) | | | 14,115,000 |

| | | | South Dakota St. Hlth. & Edl. Facs. Auth. Rev., Rapid City Reg. Hosp. | | | |

| | 14,900 | | 1.32%, 1/2/04(b) | | | 14,900,000 |

| | | | Valdez Alaska Marine Term. Rev., | | | |

| | 15,350 | | Exxon Pipeline Co., Proj. A 1.20%, 1/2/04(b) | | | 15,350,000 |

| | | | Exxon Pipeline Co., Proj. B | | | |

| | 33,250 | | 1.20%, 1/2/04(b) | | | 33,250,000 |

| | | | | |

|

|

| | | | | | | 240,060,000 |

| |

| | Other Corporate Obligations 7.1% | | | |

|

| | | | American Express Credit Corp. | | | |

| | 45,000 | | 1.20%, 1/5/04(d) | | | 45,000,000 |

| | | | General Electric Capital Assurance Co.

1.22875%, 7/22/04(c)(d) | | | |

| | 49,000 | | (cost of $49,000,000, date purchased 7/17/03) | | | 49,000,000 |

| | | | Goldman Sachs Group, Inc. | | | |

| | 40,000 | | 1.31%, 3/15/04(d) | | | 40,000,000 |

| | | | | | | |

| | | | Merrill Lynch & Co., Inc. | | | |

| | 50,000 | | 1.294%, 1/12/04(d) | | | 50,000,000 |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

| | | | | | | |

Principal Amount (000) | | Description | | Value (Note 1) | |

| | | | Metropolitan Life Insurance Co.

1.2425%, 2/9/04(c)(d) | | | | |

| $ | 23,000 | | (cost of $23,000,000, date purchased 2/5/03) | | $ | 23,000,000 | |

| | 53,000 | | 1.27%, 10/4/04(b)

(cost of $53,000,000, date purchased 9/26/02) | | | 53,000,000 | |

| | | | Morgan Stanley Dean Witter Co. | | | | |

| | 43,000 | | 1.2825%, 1/15/04(b) | | | 43,000,000 | |

| | | | Pacific Life Insurance

1.29%, 10/15/04(c)(d) | | | | |

| | 38,000 | | (cost of $38,000,000, date purchased 7/1/03) | | | 38,000,000 | |

| | | | Travelers Insurance Co.

1.23%, 7/8/04(c)(d) | | | | |

| | 34,000 | | (cost of $34,000,000, date purchased 6/30/03) | | | 34,000,000 | |

| | | | | |

|

|

|

| | | | | | | 375,000,000 | |

| |

| | U.S. Government Agency Obligation 12.1% | | | | |

| |

| | | | Federal Home Loan Bank | | | | |

| | 66,145 | | 3.75%, 4/15/04 | | | 66,614,419 | |

| | 125,000 | | 1.23%, 7/6/04 | | | 125,000,000 | |

| | | | Federal National Mortgage Assoc. | | | | |

| | 82,000 | | 1.13%, 2/11/04 | | | 81,894,471 | |

| | 150,000 | | 1.12%, 2/18/04 | | | 149,776,000 | |

| | 43,185 | | 3.625%, 4/15/04 | | | 43,476,158 | |

| | 15,000 | | 3.00%, 6/15/04 | | | 15,120,330 | |

| | 64,710 | | 0.00%, 6/23/04 | | | 64,362,831 | |

| | 90,779 | | 1.11%, 6/23/04 | | | 90,291,971 | |

| | | | | |

|

|

|

| | | | | | | 636,536,180 | |

| |

| | Joint Repurchase Agreement 0.1% | | | | |

| |

| | 4,209 | | Joint Repurchase Agreement Account,

1.00%, dated 12/31/03 due 1/2/04 in the amount of $4,209,234 value of collateral including accrued interest was $4,292,957

(cost $4,209,000; Note 5) | | | 4,209,000 | |

| | | | | |

|

|

|

| | | | Total Investments 101.2%

(amortized cost $5,337,824,304(a)) | | | 5,337,824,304 | |

| | | | Liabilities in excess of other assets (1.2%) | | | (60,701,441 | ) |

| | | | | |

|

|

|

| | | | Net Assets 100% | | $ | 5,277,122,863 | |

| | | | | |

|

|

|

| (a) | The cost of securities for federal income tax purposes is substantially the same as for financial reporting purposes. |

| (b) | Variable rate instrument. The maturity date presented for these instruments is the later of the next date on which the security can be redeemed at par or the next date on which the rate of interest is adjusted. |

| (c) | Private placement restricted as to resale and does not have a readily available market; the aggregate cost and value of such securities is $197,000,000 and is approximately 3.7% of net assets. |

| (d) | Floating Rate Security. The interest rate shown reflects the rate in effect at December 31, 2003. |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 13 |

The industry classification of portfolio holdings and liabilites in excess of other assets shown as a percentage of net assets as of December 31, 2003 was as follows:

| | | |

Commercial Banks | | 37.4 | % |

Asset Backed Securities | | 17.1 | |

Federal Credit Agencies | | 12.1 | |

Life Insurance | | 11.8 | |

Security Brokers & Dealers | | 7.2 | |

Fire, Marine, Casualty Insurance | | 5.8 | |

Municipality | | 4.5 | |

Short-Term Business Credit | | 2.5 | |

Oil & Gas Field Service | | 1.0 | |

Finance Services | | 0.9 | |

Mortgage Bankers | | 0.8 | |

Joint Repurchase Agreement Participant | | 0.1 | |

Liabilities in excess of other assets | | (1.2 | ) |

| | |

|

|

| | | 100.0 | % |

| | |

|

|

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

Statement of Assets and Liabilities

as of December 31, 2003

| | | |

Assets | | | |

|

Investments, at amortized cost which approximates market value | | $ | 5,337,824,304 |

Cash | | | 129,446 |

Receivable for Fund shares sold | | | 29,605,663 |

Interest receivable | | | 3,695,936 |

Prepaid expenses | | | 168,056 |

| | |

|

|

Total assets | | | 5,371,423,405 |

| | |

|

|

| |

Liabilities | | | |

|

Payable for Fund shares reacquired | | | 89,658,678 |

Accrued expenses | | | 2,531,799 |

Management fee payable | | | 1,455,273 |

Distribution fee payable | | | 583,034 |

Dividends payable | | | 71,758 |

| | |

|

|

Total liabilities | | | 94,300,542 |

| | |

|

|

| |

Net Assets | | $ | 5,277,122,863 |

| | |

|

|

Net assets were comprised of: | | | |

Common stock, at par ($.001 par value; 15 billion shares authorized for issuance) | | $ | 5,277,123 |

Paid-in capital in excess of par | | | 5,271,845,740 |

| | |

|

|

Net assets December 31, 2003 | | $ | 5,277,122,863 |

| | |

|

|

| | | |

Class A: | | | |

|

Net asset value, offering price and redemption price per share

($5,089,405,268 ÷ 5,089,405,268 shares of common stock issued and outstanding) | | $ | 1.00 |

| | |

|

|

| |

Class Z: | | | |

|

Net asset value, offering price and redemption price per share

($187,717,595 ÷ 187,717,595 shares of common stock issued and outstanding) | | $ | 1.00 |

| | |

|

|

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 15 |

Statement of Operations

Year Ended December 31, 2003

| | | |

Net Investment Income | | | |

|

Income | | | |

Interest | | $ | 83,997,990 |

| | |

|

|

| |

Expenses | | | |

Management fee | | | 20,301,632 |

Distribution fee—Class A | | | 8,169,668 |

Transfer agent’s fees and expenses | | | 11,582,000 |

Custodian’s fees and expenses | | | 414,000 |

Registration fees | | | 221,000 |

Reports to shareholders | | | 180,000 |

Insurance | | | 150,000 |

Legal fees and expenses | | | 72,000 |

Director’s fees and expenses | | | 53,000 |

Audit fees | | | 38,000 |

Miscellaneous | | | 24,561 |

| | |

|

|

Total expenses | | | 41,205,861 |

| | |

|

|

Net investment income | | | 42,792,129 |

| | |

|

|

| |

Net realized gain on investments | | | |

|

Net realized gain on investment transactions | | | 1,064,877 |

| | |

|

|

Net Increase In Net Assets Resulting From Operations | | $ | 43,857,006 |

| | |

|

|

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

| | | | | | | | |

| |

| | | Year Ended December 31,

| |

| | | 2003 | | | 2002 | |

Increase (Decrease) In Net Assets | | | | | | | | |

| |

Operations | | | | | | | | |

Net investment income | | $ | 42,792,129 | | | $ | 97,338,104 | |

Net realized gain on investment transactions | | | 1,064,877 | | | | 6,719 | |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 43,857,006 | | | | 97,344,823 | |

| | |

|

|

| |

|

|

|

Dividends and distributions to shareholders (Note 1) | | | | | | | | |

Class A | | | (42,332,082 | ) | | | (93,026,987 | ) |

Class Z | | | (1,524,924 | ) | | | (4,317,836 | ) |

| | |

|

|

| |

|

|

|

| | | | (43,857,006 | ) | | | (97,344,823 | ) |

| | |

|

|

| |

|

|

|

Fund share transactions (Note 4) (at $1.00 per share) | | | | | | | | |

Proceeds from shares sold | | | 22,027,286,713 | | | | 24,452,898,431 | |

Net asset value of shares issued to shareholders in reinvestment of dividends and distributions | | | 40,036,556 | | | | 94,275,800 | |

Cost of shares reacquired | | | (23,921,012,672 | ) | | | (24,129,854,631 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets from Fund share transactions | | | (1,853,689,403 | ) | | | 417,319,600 | |

| | |

|

|

| |

|

|

|

Total increase (decrease) | | | (1,853,689,403 | ) | | | 417,319,600 | |

| | |

Net Assets | | | | | | | | |

| |

Beginning of year | | | 7,130,812,266 | | | | 6,713,492,666 | |

| | |

|

|

| |

|

|

|

End of year | | $ | 5,277,122,863 | | | $ | 7,130,812,266 | |

| | |

|

|

| |

|

|

|

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 17 |

Notes to Financial Statements

MoneyMart Assets, Inc. (the “Fund”), formerly Prudential MoneyMart Assets, Inc. is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The Fund invests primarily in a portfolio of money market instruments maturing in thirteen months or less whose ratings are within the two highest rating categories by a nationally recognized statistical rating organization or, if not rated, are of comparable quality. The ability of the issuers of the securities held by the Fund to meet their obligations may be affected by economic developments in a specific industry or region.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuations: Portfolio securities are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of any discount or premium. If the amortized cost method is determined not to represent fair value, the fair value shall be determined by or under the direction of the Board of Directors.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains (losses) on sales of securities are calculated on the identified cost basis. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis.

Net investment income (loss) (other than distribution fees, which are charged directly to the respective class) and realized gains (losses) are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Repurchase Agreements: In connection with transactions in repurchase agreements with United States financial institutions, it is the Fund’s policy that its custodian or designated subcustodians under triparty repurchase agreements, as the case may be, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transactions, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked to market on a daily basis to ensure the adequacy of the collateral. If the seller defaults and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

| | |

| 18 | | Visit our website at www.jennisondryden.com |

Loan Participations: The Fund may invest in loan participations. When the Fund purchases a loan participation, the Fund typically enters into a contractual relationship with the lender or third party selling such participations (“Selling Participant”), but not the borrower. As a result, the Fund assumes the credit risk of the borrower, the selling participant and any other persons interpositioned between the Fund and the borrower (“intermediate participants”). The Fund may not directly benefit from the collateral supporting the senior loan in which it has purchased the loan participation.

Federal Income Taxes: For federal income tax purposes, it is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal income tax provision is required.

Dividends and Distributions: The Fund declares daily dividends from net investment income and net realized short-term capital gains. Payment of dividends is made monthly. Income distributions and capital gain distributions are determined in accordance with federal income tax regulations which differ from generally accepted accounting principles.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement with Prudential Investments LLC (“PI”). Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadvisor’s performance of such services. PI has entered into a subadvisory agreement with Prudential Investment Management, Inc. (“PIM”). The subadvisory agreement provides that PIM will furnish investment advisory services in connection with the management of the Fund. In connection therewith, PIM is obligated to keep certain books and records of the Fund. PI pays for the services of PIM, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly, at an annual rate of .50 of 1% of the Fund’s average daily net assets up to $50 million and .30 of 1% of the Fund’s average daily net assets in excess of $50 million.

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A and Z shares of the

| | |

| MoneyMart Assets, Inc. | | 19 |

Notes to Financial Statements

Cont’d

Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A shares pursuant to the plan of distribution at an annual rate of .125 of 1% of the average daily net assets of the Class A shares. The Class A distribution fee is accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of the Class Z shares of the Fund.

PI, PIM and PIMS are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. During the year ended December 31, 2003 the Fund incurred fees of approximately $11,514,340 for the services of PMFS. As of December 31, 2003, approximately $847,900 of such fees were due to PFMS. Transfer agent fees and expenses in the Statement of Operations include certain out-of-pocket and sub-transfer agent expenses paid to non-affiliates, where applicable.

Note 4. Capital

The Fund offers Class A and Class Z shares. Class Z shares are not subject to any distribution and/or service fees and are offered exclusively for sale to a limited group of investors.

There are 15 billion authorized shares of $.001 par value common stock divided into two classes, which consist of 13 billion Class A and 2 billion Class Z shares.

Transactions in shares of common stock (at $1 net asset value per share) were as follows:

| | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2003

| | | 2002

| |

Class A

| | | | | | |

| Shares sold | | $ | 21,933,775,126 | | | $ | 23,911,022,067 | |

| Shares issued in reinvestment of dividends and distributions | | | 38,512,438 | | | | 89,950,769 | |

| Shared reacquired | | | (23,813,111,496 | ) | | | (23,511,503,799 | ) |

| | |

|

|

| |

|

|

|

| Net increase (decrease) in shares outstanding | | $ | (1,840,823,932 | ) | | $ | 489,469,037 | |

| | |

|

|

| |

|

|

|

Class Z

| | | | | | |

| Shares sold | | $ | 93,511,587 | | | $ | 541,876,364 | |

| Shares issued in reinvestment of dividends and distributions | | | 1,524,118 | | | | 4,325,031 | |

| Shared reacquired | | | (107,901,176 | ) | | | (618,350,832 | ) |

| | |

|

|

| |

|

|

|

| Net increase (decrease) in shares outstanding | | $ | (12,865,471 | ) | | $ | (72,149,437 | ) |

| | |

|

|

| |

|

|

|

| | |

| 20 | | Visit our website at www.jennisondryden.com |

Note 5. Joint Repurchase Agreement Account

The Fund, along with other affiliated registered investment companies, transfers uninvested cash balances into a single joint account, the daily aggregate balance of which is invested in one or more repurchase agreements collateralized by U.S. Treasury or federal agency obligations. As of December 31, 2003, the Fund had a 1.75% undivided interest in the joint account. The undivided interest for the Fund represents $4,209,000 in principal amount. As of such date, each repurchase agreement in the joint account and the collateral therefore were as follows:

Bank of America Securities LLC, 0.98%, in the principal amount of $25,634,000, repurchase price $25,635,396, dated 12/31/03 due 1/2/04. The value of the collateral including accrued interest was $26,146,680.

Greenwich Capital Market, 1.01%, in the principal amount of $75,000,000, repurchase price $75,004,208, dated 12/31/03 due 1/2/04. The value of the collateral including accrued interest was $76,501,470.

JP Morgan Chase Securities, Inc., 1.00%, in the principal amount of $65,000,000, repurchase price $65,003,611, dated 12/31/03 due 1/2/04. The value of the collateral including accrued interest was $66,300,359.

UBS Securities, 1.00%, in the principal amount of $75,000,000, repurchase price $75,004,167, dated 12/31/03 due 1/2/04. The value of the collateral including accrued interest was $76,503,568.

Note 6. Distributions and Tax Information

Distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. In order to present undistributed net investment income, accumulated net realized capital gains (losses) and paid-in capital on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to paid-in capital, undistributed net investment income and accumulated net realized gains on investments. For the year ended December 31, 2003, the adjustment was to decrease accumulated net realized gains and increase undistributed net investment income by $1,064,877 for distribution of realized gains.

For the years ended December 31, 2003 and December 31, 2002, the tax character of dividends paid, $43,857,006 and $97,344,823, respectively, as reflected in the Statement of Changes in Net Assets, was ordinary income.

| | |

| MoneyMart Assets, Inc. | | 21 |

Notes to Financial Statements

Cont’d

Note 7. Reorganization

The Fund has historically served as a mechanism for investing excess cash balances from Prudential Securities, Inc. customer accounts. During fiscal 2003, the Fund was notified that it would no longer be utilized in such a manner. As a result, it is expected that net assets will decline significantly. Even after the reorganization described below, it is expected that the Fund’s combined net assets will be significantly lower than the current level.

On November 18, 2003, the Board of Directors of the Fund approved an Agreement and Plan of Reorganization which provided for the transfer of all assets and assumption of all liabilities of Class A, B, C, and Z shares of the Special Money Market Fund, Inc. for Class A, B, C and Z shares of the Fund, respectively. As part of the reorganization, the Fund will commence offering Class B and C shares.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

Financial Statements

| | |

|

| DECEMBER 31, 2003 | | ANNUAL REPORT |

MoneyMart Assets

Financial Highlights

| | | | |

| |

| | | Class A

| |

| |

| | | Year Ended

December 31, 2003 | |

| |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Year | | $ | 1.000 | |

Income from investment operations: | | | | |

Net investment income and net realized gains | | | 0.006 | |

Dividends and distributions to shareholders | | | (0.006 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 1.000 | |

| | |

|

|

|

Total Return(a): | | | .65 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 5,089,405 | |

Average net assets (000) | | $ | 6,535,734 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | .62 | % |

Expenses, excluding distribution and service (12b-1) fees | | | .49 | % |

Net investment income | | | .63 | % |

| (a) | Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions. |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | |

|

| Class A | |

|

| Year Ended December 31, | |

|

| 2002 | | | 2001 | | | 2000 | | | 1999 | |

| |

| | | | | | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | | | | | |

| | 0.013 | | | | 0.037 | | | | 0.058 | | | | 0.046 | |

| | (0.013 | ) | | | (0.037 | ) | | | (0.058 | ) | | | (0.046 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 1.35 | % | | | 3.85 | % | | | 5.94 | % | | | 4.69 | % |

| | | | | | | | | | | | | | | |

| $ | 6,930,229 | | | $ | 6,440,760 | | | $ | 6,529,282 | | | $ | 6,393,586 | |

| $ | 6,947,463 | | | $ | 6,846,656 | | | $ | 6,538,256 | | | $ | 6,292,031 | |

| | | | | | | | | | | | | | | |

| | .61 | % | | | .65 | % | | | .67 | % | | | .68 | % |

| | .48 | % | | | .52 | % | | | .54 | % | | | .55 | % |

| | 1.34 | % | | | 3.76 | % | | | 5.81 | % | | | 4.60 | % |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 25 |

Financial Highlights

Cont’d

| | | | |

| |

| | | Class Z

| |

| |

| | | Year Ended

December 31, 2003 | |

| |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Year | | $ | 1.000 | |

Income from investment operations: | | | | |

Net investment income and net realized gains | | | 0.008 | |

Dividends and distributions to shareholders | | | (0.008 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 1.000 | |

| | |

|

|

|

Total Return(a): | | | .77 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 187,718 | |

Average net assets (000) | | $ | 198,143 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | .49 | % |

Expenses, excluding distribution and service (12b-1) fees | | | .49 | % |

Net investment income | | | .75 | % |

| (a) | Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions. |

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | |

|

| Class Z | |

|

| Year Ended December 31, | |

|

| 2002 | | | 2001 | | | 2000 | | | 1999 | |

| |

| | | | | | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | | | | | |

| | 0.015 | | | | 0.039 | | | | 0.059 | | | | 0.047 | |

| | (0.015 | ) | | | (0.039 | ) | | | (0.059 | ) | | | (0.047 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 1.48 | % | | | 3.98 | % | | | 6.07 | % | | | 4.82 | % |

| | | | | | | | | | | | | | | |

| $ | 200,583 | | | $ | 272,733 | | | $ | 253,173 | | | $ | 259,529 | |

| $ | 291,473 | | | $ | 283,850 | | | $ | 267,611 | | | $ | 227,112 | |

| | | | | | | | | | | | | | | |

| | .48 | % | | | .52 | % | | | .54 | % | | | .55 | % |

| | .48 | % | | | .52 | % | | | .54 | % | | | .55 | % |

| | 1.48 | % | | | 3.84 | % | | | 5.95 | % | | | 4.74 | % |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 27 |

Report of Independent Auditors

To the Board of Directors and Shareholders of MoneyMart Assets, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of MoneyMart Assets, Inc., formerly Prudential MoneyMart Assets, Inc., (the “Fund”) at December 31, 2003, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with auditing standards generally accepted in the United States of America, which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2003 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP New York, New York February 20, 2004

| | |

| 28 | | Visit our website at www.jennisondryden.com |

Federal Income Tax Information

(Unaudited)

We are required by Massachusetts, Missouri and Oregon to inform you that dividends which have been derived from interest on federal obligations are not taxable to shareholders. Please be advised that 2.79% of the dividends paid from ordinary income in the fiscal year ended December 31, 2003 qualify for each of these states’ tax exclusion.

In addition, the fund utilized redemptions as distributions in the amount of $0.000016 per share of ordinary income and $0.000106 per share of long-term capital gains.

In January 2004, you will be advised on IRS Form 1099 DIV or substitute 1099 DIV as to the federal tax status of the distributions received by you in calendar year 2003.

| | |

| MoneyMart Assets, Inc. | | 29 |

Management of the Fund

(Unaudited)

Information pertaining to the Trustees of the Fund is set forth below. Trustees who are not deemed to be “interested persons” of the Fund as defined in the Investment Company Act of 1940, as amended (the 1940 Act) are referred to as “Independent Trustees.” Trustees who are deemed to be “interested persons” of the Fund are referred to as “Interested Trustees.” “Fund Complex” consists of the Fund and any other investment companies managed by Prudential Investments LLC (PI).

Independent Directors**

Delayne Dedrick Gold (65), Director since 1983*** Oversees 88 portfolios in Fund complex

Principal occupations (last 5 years): Marketing Consultant (1982-present); formerly Senior Vice President and member of the Board of Directors, Prudential Bache Securities, Inc.

Robert E. La Blanc (69), Director since 1996*** Oversees 77 portfolios in Fund complex

Principal occupations (last 5 years): President (since 1981) of Robert E. La Blanc Associates, Inc. (telecommunications); formerly General Partner at Salomon Brothers and Vice-Chairman of Continental Telecom; Trustee of Manhattan College.

Other Directorships held:**** Director of Storage Technology Corporation (technology) (since 1979); Chartered Semiconductor Ltd. (Singapore) (since 1998); Titan Corporation (electronics) (since 1995); Computer Associates International, Inc. (since 2002) (Software Company); FiberNet Telecom Group, Inc. (since 2003) (telecom company); Director (since 1999) of First Financial Fund, Inc. and Director (since April 1999) of The High Yield Plus Fund, Inc.

Robin B. Smith (64), Director since 1996*** Oversees 69 portfolios in Fund complex

Principal occupations (last 5 years): Chairman of the Board (since January 2003) of Publishers Clearing House (Direct Marketing), formerly Chairman and Chief Executive Officer (August 1996-January 2003) of Publishers Clearing House.

Other Directorships held:**** Director of BellSouth Corporation (since 1992).

Stephen Stoneburn (60), Director since 1996*** Oversees 75 portfolios in Fund complex

Principal occupations (last 5 years): President and Chief Executive Officer (since June 1996) of Quadrant Media Corp. (a publishing company); formerly President (June 1995-June 1996) of Argus Integrated Media, Inc.; Senior Vice President and Managing Director (January 1993-1995) of Cowles Business Media and Senior Vice President of Fairchild Publications, Inc. (1975-1989).

Clay T. Whitehead (65), Director since 1999*** Oversees 94 Portfolios in Fund complex

Principal Occupations (last 5 years): President (since 1983) of National Exchange Inc. (new business development firm).

Other Directorships held:**** Director (since 2000) of The High Yield Plus Fund, Inc.

| | |

| 30 | | Visit our website at www.jennisondryden.com |

Interested Directors**

Robert F. Gunia* (57), Vice President and Director since 1996*** Oversees 179 Portfolios in Fund complex

Principal Occupations (last 5 years): Executive Vice President and Chief Administrative Officer (since June 1999) of PI; Executive Vice President and Treasurer (since January 1996) of PI; President (since April 1999) of Prudential Investment Management Services LLC (PIMS); Corporate Vice President (since September 1997) of the Prudential Insurance Company of America (Prudential); Executive Vice President and Chief Administrative Officer (since May 2003) of American Skandia Investment Services, Inc. and American Skandia Advisory Services, Inc.; Executive Vice President (since March 1999) and Treasurer (since May 2000) of Prudential Mutual Fund Services LLC; formally Senior Vice President (March 1987-May 1999) of Prudential Securities Incorporated (Prudential Securities).

Other Directorships held:**** Vice President and Director (since May 1989) and Treasurer (since 1989) of The Asia Pacific Fund, Inc.

Information pertaining to the officers of the Company who are not Directors is set forth below.

Officers**

Judy A. Rice (56), President since 2003*** Oversees 95 Portfolios in Fund complex.

Principal Occupations (During Past 5 Years): President, Chief Executive Officer, Chief Operating Officer and Officer-In-Charge (since 2003) of PI; Director, Officer-In-Charge, President, Chief Executive Officer and Chief Operating Officer (since May 2003) of American Skandia Advisory Services, Inc. and American Skandia Investment Services, Inc.; Director, Officer-In-Charge, President, Chief Executive Officer (since May 2003) of American Skandia Fund Services, Inc.; Vice President (since February 1999) of Prudential Investment Management Services LLC; President, Chief Executive Officer and Officer-In-Charge (since April 2003) of Prudential Mutual Fund Services LLC; formerly various positions to Senior Vice President (1992-1999) of Prudential Securities; and various positions to Managing Director (1975-1992) of Solomon Smith Barney; Member of Board of Governors of the Money Management Institute.

Grace C. Torres (44), Treasurer and Principal Financial and Accounting Officer since 1996***

Principal Occupations (During Past 5 Years): Senior Vice President (since January 2000) of PI; Senior Vice President and Assistant Treasurer (since May 2003) of American Skandia Investment Services, Inc. and American Skandia Advisory Services, Inc. formerly First Vice President (December 1996-January 2000) of PI; and First Vice President (March 1993-1999) of Prudential Securities.

Jonathan D. Shain (45), Secretary since 2001***

Vice President and Corporate Counsel (since August 1996) of Prudential; Vice President and Assistant Secretary (since May 2003) of American Skandia Investment Services, Inc. and American Skandia Fund Services, Inc. formerly Attorney with Fleet Bank, N.A. (January 1997-July 1998).

See Notes to Financial Statements

| | |

| MoneyMart Assets, Inc. | | 31 |

Marguerite E.H. Morrison (47), Chief Legal Officer since 2003 and Assistant Secretary since 2002.***

Principal occupations (last 5 years): Vice President and Chief Legal Officer—Mutual Funds and Unit Investment Trusts (since August 2000) of Prudential; Senior Vice President, and Assistant Secretary (since February 2001) of PI; Senior Vice President and Secretary (since May 2003) of American Skandia Investment Services, Inc., American Skandia Advisory Services, Inc., and American Skandia Fund Services, Inc.; Vice President and Assistant Secretary of PIMS (since October 2001), previously Vice President and Associate General Counsel (December 1996-February 2001) of PI and Vice President and Associate General Counsel (September 1987-September 1996) of Prudential Securities.

Maryanne Ryan (39), Anti-Money Laundering Compliance Officer since 2002.***

Principal occupations (last 5 years): Vice President, Prudential (since November 1998), First Vice President, Prudential Securities (March 1997-May 1998); Anti-Money Laundering Compliance Officer (since 2003) of American Skandia Investment Services, Inc., American Skandia Advisory Services, Inc. and American Skandia Marketing, Inc.

| * | “Interested” Director, as defined in the 1940 Act, by reason of employment with the Manager (Prudential Investments LLC), the Subadviser (Prudential Investment Management, Inc.) or the Distributor (Prudential Investment Management Services LLC). |

| ** | Unless otherwise noted, the address of the Directors and officers is c/o: Prudential Investments LLC, Gateway Center Three, 100 Mulberry Street, Newark, NJ 07102. |

| *** | There is no set term of office for Directors and officers. The Independent Directors have adopted a retirement policy, which calls for the retirement of Directors on December 31 of the year in which they reach the age of 75. The table shows the number of years for which they have served as Director and/or officer. |

| **** | This row includes only directorships of companies required to register, or file reports with the SEC under the Securities and Exchange Act of 1934 (that is, ”public companies”) or other investment companies registered under the 1940 Act. |

Additional information about the Fund’s Directors is included in the Fund’s Statement of Additional Information which is available without charge, upon request, by calling (800) 225-1852 or (732) 482-7555 (Calling from outside the U.S.)

| | |

| 32 | | Visit our website at www.jennisondryden.com |

| | | | |

| | |

| n MAIL | | n TELEPHONE | | n WEBSITE |

Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 | | (800) 225-1852 | | www.jennisondryden.com |

|

| DIRECTORS |

Delayne Dedrick Gold•Robert F. Gunia•Robert E. La Blanc•Robin B. Smith•Stephen D. Stoneburn•

Clay T. Whitehead |

|

| OFFICERS |

Judy A. Rice, President•Robert F. Gunia, Vice President•Grace C. Torres, Treasurer and Principal

Financial and Accounting Officer•Marguerite E.H. Morrison, Chief Legal Officer and Assistant Secretary

Jonathan D. Shain, Secretary•Maryanne Ryan, Anti-Money Laundering Compliance Officer |

| | | | |

| MANAGER | | Prudential Investments LLC | | Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 |

|

| INVESTMENT ADVISER | | Prudential Investment

Management, Inc. | | Gateway Center Two

100 Mulberry Street

Newark, NJ 07102 |

|

| DISTRIBUTOR | | Prudential Investment

Management Services LLC | | Gateway Center Three

14th Floor

100 Mulberry Street

Newark, NJ 07102 |

|

| CUSTODIAN | | State Street Bank

and Trust Company | | One Heritage Drive

North Quincy, MA 02171 |

|

| TRANSFER AGENT | | Prudential Mutual Fund

Services LLC | | PO Box 8098

Philadelphia, PA 19101 |

|

| INDEPENDENT AUDITORS | | PricewaterhouseCoopers LLP | | 1177 Avenue of the

Americas

New York, NY 10036 |

|

| FUND COUNSEL | | Sullivan & Cromwell LLP | | 125 Broad Street

New York, NY 10004 |

| | | | | | | | |

|

| MoneyMart Assets, Inc. |

| Share Class | | | | A | | Z | | |

| | | | |

Nasdaq | | | | PBMXX | | PMZXX | | |

CUSIP | | | | 60936A308 | | 60936A407 | | |

| | | | | | | | | |

Mutual Funds:

| | | | |

| ARE NOT INSURED BY THE FDIC OR ANY FEDERAL GOVERNMENT AGENCY | | MAY LOSE VALUE | | ARE NOT A DEPOSIT OF OR GUARANTEED

BY ANY BANK OR ANY BANK AFFILIATE |

| | | | | | | | |

|

| MoneyMart Assets, Inc. |

| | | Share Class | | A | | Z | | |

| | | | |

| | | Nasdaq | | PBMXX | | PMZXX | | |

| | | CUSIP | | 60936A308 | | 60936A407 | | |

| | | | | | | | | |

MF108E IFS-A087701

| Item 2 | – Code of Ethics—See Exhibit (a) |

As of the end of the period covered by this report, the registrant has adopted a code of ethics (the “Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers”) that applies to the registrant’s Principal Executive Officer and Principal Financial Officer; the registrant’s Principal Financial Officer also serves as the Principal Accounting Officer.

The registrant hereby undertakes to provide any person, without charge, upon request, a copy of the code of ethics. To request a copy of the code of ethics, contact the registrant 973-802-6469, and ask for a copy of the Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers.

| Item 3 | – Audit Committee Financial Expert – |

The registrant’s Board has determined that Mr. David Carson, member of the Board’s Audit Committee is an “audit committee financial expert,” and that he is “independent,” for purposes of this Item.

| Item 4 | – Principal Accountant Fees and Services – |

Form N-CSR, Item 4. Principal Accountant Fees and Services

For the fiscal years ended December 31, 2003 and December 31, 2002 PricewaterhouseCoopers LLP (“PwC”), the Registrant’s principal accountant, billed the Registrant $38,000 for professional services rendered for the audit of the Registrant’s annual financial statements or services that are normally provided in connection with statutory and regulatory filings.

None.

None.

None.

| (e) | (1) Audit Committee Pre-Approval Policies and Procedures |

THE PRUDENTIAL MUTUAL FUNDS

AUDIT COMMITTEE POLICY

on

Pre-Approval of Services Provided by the Independent Accountants

The Audit Committee of each Prudential Mutual Fund is charged with the responsibility to monitor the independence of the Fund’s independent accountants. As part of this responsibility, the Audit Committee must pre-approve any independent accounting firm’s engagement to render audit and/or permissible non-audit services, as required by law. In evaluating a proposed engagement of the independent accountants, the Audit Committee will assess the effect that the engagement might reasonably be expected to have on the accountant’s independence. The Committee’s evaluation will be based on:

| | • | a review of the nature of the professional services expected to be provided, |

| | • | a review of the safeguards put into place by the accounting firm to safeguard independence, and |

| | • | periodic meetings with the accounting firm. |

Policy for Audit and Non-Audit Services Provided to the Funds

On an annual basis, the scope of audits for each Fund, audit fees and expenses, and audit-related and non-audit services (and fees proposed in respect thereof) proposed to be performed by the Fund’s independent accountants will be presented by the Treasurer and the independent accountants to the Audit Committee for review and, as appropriate, approval prior to the initiation of such services. Such presentation shall be accompanied by confirmation by both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants. Proposed services shall be described in sufficient detail to enable the Audit Committee to assess the appropriateness of such services and fees, and the compatibility of the provision of such services with the auditor’s independence. The Committee shall receive periodic reports on the progress of the audit and other services which are approved by the Committee or by the Committee Chair pursuant to authority delegated in this Policy.

The categories of services enumerated under “Audit Services”, “Audit-related Services”, and “Tax Services” are intended to provide guidance to the Treasurer and the independent accountants as to those categories of services which the Committee believes are generally consistent with the independence of the independent accountants and which the Committee (or the Committee Chair) would expect upon the presentation of specific proposals to pre-approve. The enumerated categories are not intended as an exclusive list of audit, audit-related or tax services which the Committee (or the Committee Chair) would consider for pre-approval.

Audit Services

The following categories of audit services are considered to be consistent with the role of the Fund’s independent accountants

| | • | Annual Fund financial statement audits |

| | • | Seed audits (related to new product filings, as required) |

| | • | SEC and regulatory filings and consents |

Audit-related Services

The following categories of audit-related services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | Accounting consultations |

| | • | Fund merger support services |

| | • | Agreed Upon Procedure Reports |

| | • | Other Internal Control Reports |

Individual audit-related services that fall within one of these categories and are not presented to the Audit Committee as part of the annual pre-approval process will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $50,000.

Tax Services

The following categories of tax services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | Tax compliance services related to the filing or amendment of the following: |

| | n | Federal, state and local income tax compliance; and, |

| | n | Sales and use tax compliance |

| | • | Timely RIC qualification reviews |

| | • | Tax distribution analysis and planning |

| | • | Tax authority examination services |

| | • | Tax appeals support services |

| | • | Accounting methods studies |

| | • | Fund merger support services |

| | • | Tax consulting services and related projects |

Individual tax services that fall within one of these categories and are not presented to the Audit Committee as part of the annual pre-approval process will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $50,000.

Other Non-audit Services

Certain non-audit services that the independent accountants are legally permitted to render will be subject to pre-approval by the Committee or by one or more Committee members to whom the Committee has delegated this authority and who will report to the full Committee any pre-approval decisions made pursuant to this Policy. Non-audit services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Proscribed Services

The Fund’s independent accountants will not render services in the following categories of non-audit services:

| | • | Bookkeeping or other services related to the accounting records or financial statements of the Fund |

| | • | Financial information systems design and implementation |

| | • | Appraisal or valuation services, fairness opinions, or contribution-in-kind reports |

| | • | Internal audit outsourcing services |

| | • | Management functions or human resources |

| | • | Broker or dealer, investment adviser, or investment banking services |

| | • | Legal services and expert services unrelated to the audit |

| | • | Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible. |

Pre-approval of Non-Audit Services Provided to Other Entities Within the Prudential Fund Complex

Certain non-audit services provided to Prudential Investments LLC or any of its affiliates that also provide ongoing services to the Prudential Mutual Funds will be subject to pre-approval by the Audit Committee. The only non-audit services provided to these entities that will require pre-approval are those related directly to the operations and financial reporting of the Funds. Individual projects that are not presented to the Audit Committee as part of the annual pre-approval process, will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $50,000. Services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Although the Audit Committee will not pre-approve all services provided to Prudential Investments LLC and its affiliates, the Committee will receive an annual report from the Fund’s independent accounting firm showing the aggregate fees for all services provided to Prudential Investments and its affiliates.

(e)-(2) Percentage of services referred to in 4(b)- (4)(d) that were approved by the audit committee – Not applicable.

| (f) | Percentage of hours expended attributable to work performed by other than full time employees of principal accountant if greater than 50%. |

Not applicable.

N/A to Registrant. The aggregate non-audit fees billed by PwC for services rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant for each of the last two fiscal years 2003 and 2002 were $1,715,979 and $1,601,295 respectively.

(h) Principal Accountants Independence

The Registrant’s Audit Committee has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X is compatible with maintaining PwC’s independence.

| Item 7 | – Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies – Not required in this filing |

| Item 9 | – Controls and Procedures |

| | (a) | It is the conclusion of the registrant’s principal executive officer and principal financial officer that the effectiveness of the registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the registrant has been recorded, processed, summarized and reported within the time period specified in the Commission’s rules and forms and that the information required to be disclosed by the registrant has been accumulated and communicated to the registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure. |

| | (b) | There have been no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. |

| | (a) | Code of Ethics – attached hereto |

| | (b) | Certifications pursuant to Section 302 and 906 of the Sarbanes-Oxley Act – Attached hereto |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) MoneyMart Assets, Inc.

| | | | |

| | |

| By: | | (Signature and Title)* | | /s/ Jonathan D. Shain |

| | | | |

|

| | | | | Jonathan D. Shain Secretary |

Date February 9, 2004

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | | | |

| | |

| By: | | (Signature and Title)* | | /s/ Judy A. Rice |

| | | | |

|

| | | | | Judy A. Rice President and Principal Executive Officer |

Date February 9, 2004

| | | | |

| | |

| By: | | (Signature and Title)* | | /s/ Grace C. Torres |

| | | | |

|

| | | | | Grace C. Torres Treasurer and Principal Financial Officer |

Date February 9, 2004

| * | Print the name and title of each signing officer under his or her signature. |