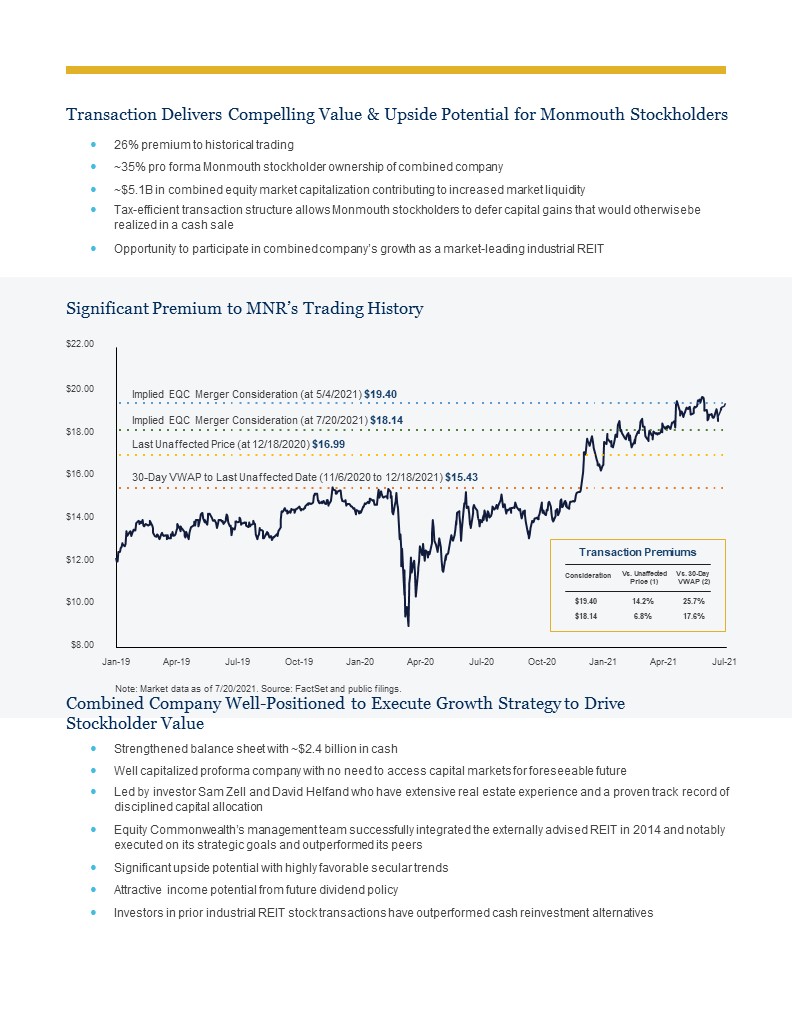

Forward-Looking StatementsSome of the statements contained in this communication constitute forward-looking statements within the meaning of the federal securities laws, including, but not limited to, statements regarding the merger with EQC. Any forward-looking statements contained in this communication are intended to be made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward looking statements by discussions of strategy, plans or intentions. Any forward-looking statements contained in this communication reflect Monmouth’s current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ significantly from those expressed in any forward-looking statement. For a further discussion of other factorsthat could cause Monmouth’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in Monmouth’s most recent Annual Report on Form 10-K and in its Quarterly Reports on Form 10-Q. While forward-looking statements reflect Monmouth’s good faith beliefs, they are not guarantees of future performance. Monmouth disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.Participants in the SolicitationMonmouth and certain of its directors and executive officers and other employees may be deemed to be participants in the solicitation of proxies from Monmouth’s stockholders in connection with the proposed merger with EQC under the rules of the SEC. Investors may obtain information regarding the names, affiliations and interests of directors and executive officers of Monmouth in Monmouth’s Annual Report on Form 10-K for Monmouth’s fiscal year ended September 30, 2020, which was filed with the SEC on November 23, 2020, as well as in Monmouth’s other filings with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the proxy statement/prospectus and other relevant proxy materials filed with the SEC in respect of the proposed merger.No Offer or SolicitationThis communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.Additional Information and Where to Find ItIn connection with the proposed merger between Monmouth and EQC, EQC has filed a registration statement on Form S-4 with the SEC, which became effective on July 23, 2021, to register the common shares of beneficial interest of EQC to be issued pursuant to the merger. The registration statement includes a joint proxy statement/prospectus which has been filed by EQC and Monmouth with the SEC and has been sent to the common shareholders of EQC seeking their approval of the share issuance and to the common shareholders of Monmouth seeking their approval of the merger (the “joint proxy statement/prospectus”). EQC and Monmouth may alsofile other documents regarding the proposed merger and share issuance with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAINIMPORTANT INFORMATION ABOUT THE PROPOSED MERGER AND SHARE ISSUANCE. Investors and security holders may obtain free copies of the registration statement and joint proxy statement/prospectus and other documents filed with the SEC by EQC or Monmouth through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders may obtain free copies of the registration statement and the joint proxy statement/prospectus and other documents filed with the SEC by EQC on EQC’s website at www. eqcre.com and may obtain free copies of the joint proxy statement/prospectus and other documents filed with the SEC by Monmouth on Monmouth’s website at www.mreic.reit. Reflects closing price as of December 18, 2020.Reflects VWAP for 30 trading days up to and including December 18, 2020.Permission to use quotations was neither sought nor obtained.