The statement of operations and supplemental statement of operations provided in this supplemental information package present funds from operations, core funds from operations, adjusted funds from operations, net operating income, EBITDAre and Adjusted EBITDA, which are REIT industry financial measures that are not calculated in accordance with accounting principles generally accepted in the United States. Please see page 20 for a definition of these supplemental performance measures. Please see the supplemental statement of operations reconciliation for a reconciliation of certain captions in the supplemental statement of operations reported in this supplemental information package to the statement of operations as reported in the Company’s filings with the SEC on Form 10-Q.

Consolidated Balance Sheets

| | | As of | | | As of | |

| ASSETS | | June 30, 2018 | | | September 30, 2017 | |

| | | (unaudited) | | | | |

| Real Estate Investments: | | | | | | | | |

| Land | | $ | 203,651,326 | | | $ | 187,224,819 | |

| Buildings and Improvements | | | 1,402,366,135 | | | | 1,244,691,715 | |

| Total Real Estate Investments | | | 1,606,017,461 | | | | 1,431,916,534 | |

| Accumulated Depreciation | | | (197,433,826 | ) | | | (171,060,478 | ) |

| Real Estate Investments | | | 1,408,583,635 | | | | 1,260,856,056 | |

| | | | | | | | | |

| Real Estate Held for Sale | | | -0- | | | | 14,606,028 | |

| Cash and Cash Equivalents | | | 6,892,242 | | | | 10,226,046 | |

| Securities Available for Sale at Fair Value | | | 167,594,279 | | | | 123,764,770 | |

| Tenant and Other Receivables | | | 845,043 | | | | 1,753,054 | |

| Deferred Rent Receivable | | | 9,203,719 | | | | 8,049,275 | |

| Prepaid Expenses | | | 7,071,943 | | | | 5,434,874 | |

| Intangible Assets, net of Accumulated Amortization of $13,244,102 and $13,404,318, respectively | | | 13,364,966 | | | | 10,010,165 | |

| Capitalized Lease Costs, net of Accumulated Amortization of $3,050,738 and $3,393,187, respectively | | | 4,434,124 | | | | 4,180,907 | |

| Financing Costs, net of Accumulated Amortization of $901,240 and $619,555, respectively | | | 594,024 | | | | 875,709 | |

| Other Assets | | | 5,896,592 | | | | 3,280,871 | |

| TOTAL ASSETS | | $ | 1,624,480,567 | | | $ | 1,443,037,755 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Fixed Rate Mortgage Notes Payable, net of Unamortized Debt | | | | | | | | |

| Issuance Costs | | $ | 657,083,249 | | | $ | 591,364,371 | |

| Loans Payable | | | 157,792,824 | | | | 120,091,417 | |

| Accounts Payable and Accrued Expenses | | | 3,025,832 | | | | 4,450,753 | |

| Other Liabilities | | | 17,665,160 | | | | 14,265,518 | |

| Total Liabilities | | | 835,567,065 | | | | 730,172,059 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | | | | | | | | |

| Shareholders’ Equity: | | | | | | | | |

| 6.125% Series C Cumulative Redeemable Preferred Stock, $0.01 Par Value Per Share: 12,400,000 Shares Authorized as of June 30, 2018 and September 30, 2017; 11,099,461 and 9,839,445 Shares Issued and Outstanding as of June 30, 2018 and September 30, 2017, respectively | | | 277,486,525 | | | | 245,986,125 | |

| Common Stock, $0.01 Par Value Per Share: 192,039,750 Shares Authorized as of June 30, 2018 and September 30, 2017; 80,137,070 and 75,630,521 Shares Issued and Outstanding as of June 30, 2018 and September 30, 2017, respectively | | | 801,371 | | | | 756,305 | |

| Excess Stock, $0.01 Par Value Per Share: 200,000,000 Shares Authorized as of June 30, 2018 and September 30, 2017; No Shares Issued or Outstanding as of June 30, 2018 and September 30, 2017 | | | -0- | | | | -0- | |

| Additional Paid-In Capital | | | 518,994,574 | | | | 459,552,701 | |

| Accumulated Other Comprehensive Income (Loss) | | | (8,368,968 | ) | | | 6,570,565 | |

| Undistributed Income | | | -0- | | | | -0- | |

| Total Shareholders’ Equity | | | 788,913,502 | | | | 712,865,696 | |

| TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY | | $ | 1,624,480,567 | | | $ | 1,443,037,755 | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 3 of 24 |

Consolidated Statements of Income

(unaudited)

| | For The | | | For The | |

| | Three Months Ended | | | Nine Months Ended | |

| | | 6/30/2018 | | | 6/30/2017 | | | 6/30/2018 | | | 6/30/2017 | |

| INCOME: | | | | | | | | | | | | | | | | |

| Rental Revenue | | $ | 29,256,147 | | | $ | 24,400,237 | | | $ | 85,558,614 | | | $ | 71,291,923 | |

| Reimbursement Revenue | | | 6,941,678 | | | | 4,208,859 | | | | 17,002,541 | | | | 11,806,975 | |

| Lease Termination Income | | | -0- | | | | -0- | | | | 210,261 | | | | -0- | |

| TOTAL INCOME | | | 36,197,825 | | | | 28,609,096 | | | | 102,771,416 | | | | 83,098,898 | |

| | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | |

| Real Estate Taxes | | | 5,950,262 | | | | 3,520,322 | | | | 13,592,573 | | | | 9,279,165 | |

| Operating Expenses | | | 1,458,618 | | | | 1,053,253 | | | | 4,371,154 | | | | 3,635,986 | |

| General & Administrative Expenses | | | 1,887,722 | | | | 1,786,852 | | | | 6,052,791 | | | | 5,307,853 | |

| Acquisition Costs | | | -0- | | | | -0- | | | | -0- | | | | 178,526 | |

| Depreciation | | | 9,162,563 | | | | 7,318,258 | | | | 26,504,609 | | | | 21,449,830 | |

| Amortization of Capitalized Lease Costs and Intangible Assets | | | 613,927 | | | | 451,823 | | | | 1,740,620 | | | | 1,327,376 | |

| TOTAL EXPENSES | | | 19,073,092 | | | | 14,130,508 | | | | 52,261,747 | | | | 41,178,736 | |

| | | | | | | | | | | | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | | | | | | | | | |

| Dividend and Interest Income | | | 3,627,984 | | | | 1,899,320 | | | | 9,380,411 | | | | 4,630,653 | |

| Gain on Sale of Securities Transactions | | | -0- | | | | 1,487,836 | | | | 111,387 | | | | 2,293,944 | |

| Interest Expense, including Amortization of Financing Costs | | | (8,279,324 | ) | | | (6,135,381 | ) | | | (23,640,556 | ) | | | (18,835,864 | ) |

| TOTAL OTHER INCOME (EXPENSE) | | | (4,651,340 | ) | | | (2,748,225 | ) | | | (14,148,758 | ) | | | (11,911,267 | ) |

| | | | | | | | | | | | | | | | | |

| INCOME FROM CONTINUING OPERATIONS | | | 12,473,393 | | | | 11,730,363 | | | | 36,360,911 | | | | 30,008,895 | |

| | | | | | | | | | | | | | | | | |

| Gain on Sale of Real Estate Investments | | | 2,097,380 | | | | -0- | | | | 7,485,266 | | | | -0- | |

| | | | | | | | | | | | | | | | | |

| NET INCOME | | | 14,570,773 | | | | 11,730,363 | | | | 43,846,177 | | | | 30,008,895 | |

| | | | | | | | | | | | | | | | | |

| Less: Preferred Dividends | | | 4,248,029 | | | | 4,045,787 | | | | 12,813,194 | | | | 11,325,583 | |

| Less: Redemption of Preferred Stock | | | -0- | | | | 2,467,165 | | | | -0- | | | | 2,467,165 | |

| NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS | | $ | 10,322,744 | | | $ | 5,217,411 | | | $ | 31,032,983 | | | $ | 16,216,147 | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 4 of 24 |

Net Income, FFO, Core FFO, AFFO, EBITDAre, Adjusted EBITDA and NOI Reconciliations

(unaudited)

| | | For The | | | For The | |

| | | Three Months Ended | | | Nine Months Ended | |

| FFO, Core FFO, AFFO | | 6/30/2018 | | | 6/30/2017 | | | 6/30/2018 | | | 6/30/2017 | |

| Net Income Attributable to Common Shareholders | | $ | 10,322,744 | | | $ | 5,217,411 | | | $ | 31,032,983 | | | $ | 16,216,147 | |

| Plus: Depreciation Expense (excluding Corporate Office Capitalized Costs) | | | 9,123,069 | | | | 7,278,976 | | | | 26,386,150 | | | | 21,332,662 | |

| Plus: Amortization of Intangible Assets | | | 417,088 | | | | 262,325 | | | | 1,157,950 | | | | 771,145 | |

| Plus: Amortization of Capitalized Lease Costs | | | 222,516 | | | | 214,990 | | | | 659,701 | | | | 632,707 | |

| Less: (Gain) / Plus: Loss on Sale of Real Estate Investments | | | (2,097,380 | ) | | | -0- | | | | (7,485,266 | ) | | | 95,336 | |

| FFO Attributable to Common Shareholders | | | 17,988,037 | | | | 12,973,702 | | | | 51,751,518 | | | | 39,047,997 | |

| Plus: Acquisition Costs | | | -0- | | | | -0- | | | | -0- | | | | 178,526 | |

| Plus: Redemption of Preferred Stock | | | -0- | | | | 2,467,165 | | | | -0- | | | | 2,467,165 | |

| Core FFO Attributable to Common Shareholders | | | 17,988,037 | | | | 15,440,867 | | | | 51,751,518 | | | | 41,693,688 | |

| Plus: Depreciation of Corporate Office Capitalized Costs | | | 39,494 | | | | 39,282 | | | | 118,459 | | | | 117,167 | |

| Plus: Stock Compensation Expense | | | 96,970 | | | | 174,709 | | | | 339,139 | | | | 441,054 | |

| Plus: Amortization of Financing Costs | | | 314,527 | | | | 283,573 | | | | 910,977 | | | | 949,470 | |

| Less: Gain on Sale of Securities Transactions | | | -0- | | | | (1,487,836 | ) | | | (111,387 | ) | | | (2,293,944 | ) |

| Less: Lease Termination Income | | | -0- | | | | -0- | | | | (210,261 | ) | | | -0- | |

| Less: Recurring Capital Expenditures | | | (490,371 | ) | | | (195,186 | ) | | | (774,091 | ) | | | (571,988 | ) |

| Less: Effect of Non-cash U.S. GAAP Straight-line Rent Adjustment | | | (600,659 | ) | | | (294,936 | ) | | | (1,357,145 | ) | | | (924,792 | ) |

| AFFO Attributable to Common Shareholders | | $ | 17,347,998 | | | $ | 13,960,473 | | | $ | 50,667,209 | | | $ | 39,410,655 | |

| | | | Three Months Ended | | | | Nine Months Ended | |

| EBITDAre, Adjusted EBITDA | | | 6/30/2018 | | | | 6/30/2017 | | | | 6/30/2018 | | | | 6/30/2017 | |

| Net Income Attributable to Common Shareholders | | $ | 10,322,744 | | | $ | 5,217,411 | | | $ | 31,032,983 | | | $ | 16,216,147 | |

| Plus: Preferred Dividends | | | 4,248,029 | | | | 4,045,787 | | | | 12,813,194 | | | | 11,325,583 | |

| Plus: Redemption of Preferred Stock | | | -0- | | | | 2,467,165 | | | | -0- | | | | 2,467,165 | |

| Plus: Interest Expense, including Amortization of Financing Costs | | | 8,279,324 | | | | 6,135,381 | | | | 23,640,556 | | | | 18,835,864 | |

| Plus: Depreciation and Amortization | | | 9,776,490 | | | | 7,770,081 | | | | 28,245,229 | | | | 22,777,206 | |

| Less: (Gain) / Plus: Loss on Sale of Real Estate Investments | | | (2,097,380 | ) | | | -0- | | | | (7,485,266 | ) | | | 95,336 | |

| EBITDAre | | | 30,529,207 | | | | 25,635,825 | | | | 88,246,696 | | | | 71,717,301 | |

| Plus: Acquisition Costs | | | -0- | | | | -0- | | | | -0- | | | | 178,526 | |

| Plus: Net Amortization of Acquired Above and Below Market Lease Revenue | | | 25,677 | | | | 25,492 | | | | 77,031 | | | | 76,476 | |

| Less: Gain on Sale of Securities Transactions | | | -0- | | | | (1,487,836 | ) | | | (111,387 | ) | | | (2,293,944 | ) |

| Adjusted EBITDA | | $ | 30,554,884 | | | $ | 24,173,481 | | | $ | 88,212,340 | | | $ | 69,678,359 | |

| | | | Three Months Ended | | | | Nine Months Ended | |

| Net Operating Income | | | 6/30/2018 | | | | 6/30/2017 | | | | 6/30/2018 | | | | 6/30/2017 | |

| Net Income Attributable to Common Shareholders | | $ | 10,322,744 | | | $ | 5,217,411 | | | $ | 31,032,983 | | | $ | 16,216,147 | |

| Plus: Redemption of Preferred Stock | | | -0- | | | | 2,467,165 | | | | -0- | | | | 2,467,165 | |

| Plus: Preferred Dividends | | | 4,248,029 | | | | 4,045,787 | | | | 12,813,194 | | | | 11,325,583 | |

| Plus: General & Administrative Expenses | | | 1,887,722 | | | | 1,786,852 | | | | 6,052,791 | | | | 5,307,853 | |

| Plus: Acquisition Costs | | | -0- | | | | -0- | | | | -0- | | | | 178,526 | |

| Plus: Depreciation | | | 9,162,563 | | | | 7,318,258 | | | | 26,504,609 | | | | 21,449,830 | |

| Plus: Amortization of Capitalized Lease Costs and Intangible Assets | | | 613,927 | | | | 451,823 | | | | 1,740,620 | | | | 1,327,376 | |

| Plus: Interest Expense, including Amortization of Financing Costs | | | 8,279,324 | | | | 6,135,381 | | | | 23,640,556 | | | | 18,835,864 | |

| Less: Dividend and Interest Income | | | (3,627,984 | ) | | | (1,899,320 | ) | | | (9,380,411 | ) | | | (4,630,653 | ) |

| Less: Gain on Sale of Securities Transactions | | | -0- | | | | (1,487,836 | ) | | | (111,387 | ) | | | (2,293,944 | ) |

| Less: Gain on Sale of Real Estate Investments | | | (2,097,380 | ) | | | -0- | | | | (7,485,266 | ) | | | -0- | |

| Less: Lease Termination Income | | | -0- | | | | -0- | | | | (210,261 | ) | | | -0- | |

| Net Operating Income – NOI | | $ | 28,788,945 | | | $ | 24,035,521 | | | $ | 84,597,428 | | | $ | 70,183,747 | |

| | | | Three Months Ended | | | | Nine Months Ended | |

| Components of Net Operating Income Consists of: | | | 6/30/2018 | | | | 6/30/2017 | | | | 6/30/2018 | | | | 6/30/2017 | |

| Revenues: | | | | | | | | | | | | | | | | |

| Rental Revenue | | $ | 29,256,147 | | | $ | 24,400,237 | | | $ | 85,558,614 | | | $ | 71,291,923 | |

| Reimbursement Revenue | | | 6,941,678 | | | | 4,208,859 | | | | 17,002,541 | | | | 11,806,975 | |

| Total Rental and Reimbursement Revenue | | | 36,197,825 | | | | 28,609,096 | | | | 102,561,155 | | | | 83,098,898 | |

| | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | |

| Real Estate Taxes | | | 5,950,262 | | | | 3,520,322 | | | | 13,592,573 | | | | 9,279,165 | |

| Operating Expenses | | | 1,458,618 | | | | 1,053,253 | | | | 4,371,154 | | | | 3,635,986 | |

| Total Real Estate Taxes and Operating Expenses | | | 7,408,880 | | | | 4,573,575 | | | | 17,963,727 | | | | 12,915,151 | |

| Net Operating Income – NOI | | $ | 28,788,945 | | | $ | 24,035,521 | | | $ | 84,597,428 | | | $ | 70,183,747 | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 5 of 24 |

Financial Highlights

(unaudited)

| | | For The | | | For The | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | 6/30/2018 | | | 6/30/2017 | | | 6/30/2018 | | | 6/30/2017 | |

| | | | | | | | | | | | | |

| Weighted Average Common Shares Outstanding | | | | | | | | | | | | | | | | |

| Basic | | | 79,413,556 | | | | 72,881,974 | | | | 77,921,066 | | | | 71,264,806 | |

| Diluted | | | 79,571,767 | | | | 73,053,693 | | | | 78,098,849 | | | | 71,422,664 | |

| | | | | | | | | | | | | | | | | |

| Net Income Attributable to Common Shareholders | | $ | 10,322,744 | | | $ | 5,217,411 | | | $ | 31,032,983 | | | $ | 16,216,147 | |

| | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.13 | | | $ | 0.07 | | | $ | 0.40 | | | $ | 0.23 | |

| Diluted | | | 0.13 | | | | 0.07 | | | | 0.40 | | | | 0.23 | |

| | | | | | | | | | | | | | | | | |

| Net Operating Income – NOI | | $ | 28,788,945 | | | $ | 24,035,521 | | | $ | 84,597,428 | | | $ | 70,183,747 | |

| | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.36 | | | $ | 0.33 | | | $ | 1.09 | | | $ | 0.98 | |

| Diluted | | | 0.36 | | | | 0.33 | | | | 1.08 | | | | 0.98 | |

| | | | | | | | | | | | | | | | | |

| Funds From Operations – FFO | | $ | 17,988,037 | | | $ | 12,973,702 | | | $ | 51,751,518 | | | $ | 39,047,997 | |

| | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.23 | | | $ | 0.18 | | | $ | 0.66 | | | $ | 0.55 | |

| Diluted | | | 0.23 | | | | 0.18 | | | | 0.66 | | | | 0.55 | |

| | | | | | | | | | | | | | | | | |

| Core Funds From Operations - Core FFO | | $ | 17,988,037 | | | $ | 15,440,867 | | | $ | 51,751,518 | | | $ | 41,693,688 | |

| | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.23 | | | $ | 0.21 | | | $ | 0.66 | | | $ | 0.59 | |

| Diluted | | | 0.23 | | | | 0.21 | | | | 0.66 | | | | 0.58 | |

| | | | | | | | | | | | | | | | | |

| Core FFO Excluding Gain on Sale of Securities Transactions and Excluding Lease Termination Income | | $ | 17,988,037 | | | $ | 13,953,031 | | | $ | 51,429,870 | | | $ | 39,399,744 | |

| | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.23 | | | $ | 0.19 | | | $ | 0.66 | | | $ | 0.55 | |

| Diluted | | | 0.23 | | | | 0.19 | | | | 0.66 | | | $ | 0.55 | |

| | | | | | | | | | | | | | | | | |

| Adjusted Funds From Operations – AFFO | | $ | 17,347,998 | | | $ | 13,960,473 | | | $ | 50,667,209 | | | $ | 39,410,655 | |

| | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.22 | | | $ | 0.19 | | | $ | 0.65 | | | $ | 0.55 | |

| Diluted | | | 0.22 | | | | 0.19 | | | | 0.65 | | | $ | 0.55 | |

| | | | | | | | | | | | | | | | | |

| Dividends Declared per Common Share | | $ | 0.17 | | | $ | 0.16 | | | $ | 0.51 | | | $ | 0.48 | |

| | | | | | | | | | | | | | | | | |

| Dividend/AFFO Payout Ratio | | | 77.3 | % | | | | | | | | | | | | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 6 of 24 |

Same Property Statistics

(unaudited)

| | | For The

Three Months Ended | | | | | | | |

| | | 6/30/2018 | | | | | | 6/30/2017 | | | Change | | | Change % | |

| Total Square Feet / Total Properties | | | 20,534,513 / 109 | | | | | | | | 17,917,302 / 105 | | | | 2,617,211 | | | | 14.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Occupancy Percentage at End of Period | | | 99.6 | % | | | | | | | 99.8 | % | | | (20) bps | | | | (0.2 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Square Feet / Number of Same Properties | | | | | | | 15,745,437 / 94 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Occupancy Percentage at End of Period | | | 99.5 | % | | | | | | | 99.8 | % | | | (30) bps | | | | (0.3 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Net Operating Income (NOI) (GAAP) | | $ | 21,923,776 | | | | | | | $ | 22,120,270 | | | $ | (196,494 | ) | | | (0.9 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Reversal of Effect of Non-cash U.S. GAAP Straight-line Rent Adjustment | | | (273,227 | ) | | | | | | | (291,416 | ) | | | 18,189 | | | | | |

| Same Property Cash NOI | | $ | 21,650,549 | | | | | | | $ | 21,828,854 | | | $ | (178,305 | ) | | | (0.8 | )% |

Same Property Statistics include all properties owned during the entire periods presented with the exclusion of properties expanded during the periods presented.

The 0.9% decrease, amounting to $196,494 in Same Property NOI, consists of $143,366 attributable to decreased Same Property NOI from occupied properties and by a decrease in Same Property NOI from vacant properties of $53,128 attributable to a 30 bps decline in Same Property Occupancy Percentage.

The 0.8% decrease, amounting to $178,305 in Same Property Cash NOI, consists of $122,105 attributable to decreased Same Property Cash NOI from occupied properties and by a decrease in Same Property Cash NOI from vacant properties of $56,200 attributable to a 30 bps decline in Same Property Occupancy Percentage.

Reconciliation of Same Property NOI to Total NOI

| | For The | | | | | | | |

| | | Three Months Ended | | | | | | | |

| | | 6/30/2018 | | | 6/30/2017 | | | Change | | | Change % | |

| | | | | | | | | | | | | |

| Same Property NOI (GAAP) | | $ | 21,923,776 | | | $ | 22,120,270 | | | $ | (196,494 | ) | | | (0.9 | )% |

| | | | | | | | | | | | | | | | | |

| NOI of properties purchased subsequent to March 31, 2017 (five properties for fiscal 2018 and eight properties for fiscal 2017) | | | 6,052,542 | | | | 779,073 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| NOI of properties expanded subsequent to March 31, 2017 (two properties for fiscal 2018 and 2017) | | | 751,365 | | | | 714,174 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| NOI of property sold subsequent to March 31, 2017 (four properties for fiscal 2018) | | | 61,262 | | | | 422,004 | | | | | | | | | |

| Total NOI | | $ | 28,788,945 | | | $ | 24,035,521 | | | $ | 4,753,424 | | | | 19.8 | % |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 7 of 24 |

Same Property Statistics

(unaudited)

| | | | | | For The | | | | | | | |

| | | | | | Nine Months Ended | | | | | | | |

| | | 6/30/2018 | | | | | | 6/30/2017 | | | Change | | | Change % | |

| | | | | | | | | | | | | | | | |

| Total Square Feet / Total Properties | | | 20,534,513 / 109 | | | | | | | | 17,917,302 / 105 | | | | 2,617,211 | | | | 14.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Occupancy Percentage at End of Period | | | 99.6 | % | | | | | | | 99.8 | % | | | (20) bps | | | | (0.2 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Square Feet / Number of Same Properties | | | | | | | 15,406,853 / 93 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Occupancy Percentage at End of Period | | | 99.5 | % | | | | | | | 99.8 | % | | | (30) bps | | | | (0.3 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Net Operating Income (NOI) (GAAP) | | $ | 64,430,143 | | | | | | | $ | 64,683,081 | | | $ | (252,938 | ) | | | (0.4 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Reversal of Effect of Non-cash U.S. GAAP Straight-line Rent Adjustment | | | (748,741 | ) | | | | | | | (852,401 | ) | | | 103,660 | | | | | |

| Same Property Cash NOI | | $ | 63,681,402 | | | | | | | $ | 63,830,680 | | | $ | (149,278 | ) | | | (0.2 | )% |

Same Property Statistics include all properties owned during the entire periods presented with the exclusion of properties expanded during the periods presented.

The 0.4% decrease, amounting to $252,938 in Same Property NOI, consists of $115,936 attributable to decreased Same Property NOI from occupied properties and by a decrease in Same Property NOI from vacant properties of $137,002 attributable to a 30 bps decline in Same Property Occupancy Percentage.

The 0.2% decrease, amounting to $149,278 in Same Property Cash NOI, consists of $28,411 attributable to increased Same Property Cash NOI from occupied properties offset by a decrease in Same Property Cash NOI from vacant properties of $177,689 attributable to a 30 bps decline in Same Property Occupancy Percentage.

Reconciliation of Same Property NOI to Total NOI

| | For The | | | | | | | |

| | | Nine Months Ended | | | | | | | |

| | | 6/30/2018 | | | 6/30/2017 | | | Change | | | Change % | |

| | | | | | | | | | | | | |

| Same Property NOI (GAAP) | | $ | 64,430,143 | | | $ | 64,683,081 | | | $ | (252,938 | ) | | | (0.4 | )% |

| | | | | | | | | | | | | | | | | |

| NOI of properties purchased subsequent to September 30, 2016 (five properties for fiscal 2018 and ten properties for fiscal 2017) | | | 18,294,191 | | | | 3,212,077 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| NOI of properties expanded subsequent to September 30, 2016 (one property for fiscal 2018 and 2017) | | | 1,266,776 | | | | 1,138,270 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| NOI of property sold subsequent to September 30, 2016 (four properties for fiscal 2018 and one property for fiscal 2017) | | | 606,318 | | | | 1,150,319 | | | | | | | | | |

| Total NOI | | $ | 84,597,428 | | | $ | 70,183,747 | | | $ | 14,413,681 | | | | 20.5 | % |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 8 of 24 |

Consolidated Statements of Cash Flows

(unaudited)

| | | For The | |

| | | Nine Months Ended | |

| | | 6/30/2018 | | | 6/30/2017 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

| Net Income | | $ | 43,846,177 | | | $ | 30,008,895 | |

| Noncash Items Included in Net Income: | | | | | | | | |

| Depreciation & Amortization | | | 29,156,206 | | | | 23,726,676 | |

| Deferred Straight Line Rent | | | (1,357,145 | ) | | | (924,792 | ) |

| Stock Compensation Expense | | | 339,139 | | | | 441,054 | |

| Gain on Sale of Securities Transactions | | | (111,387 | ) | | | (2,293,944 | ) |

| (Gain) / Loss on Sale of Real Estate Investments | | | (7,485,266 | ) | | | 95,336 | |

| Changes in: | | | | | | | | |

| Tenant & Other Receivables | | | 1,775,444 | | | | 937,271 | |

| Prepaid Expenses | | | (1,637,069 | ) | | | (2,527,747 | ) |

| Other Assets & Capitalized Lease Costs | | | (2,173,910 | ) | | | 71,446 | |

| Accounts Payable, Accrued Expenses & Other Liabilities | | | 741,801 | | | | 656,824 | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | | | 63,093,990 | | | | 50,191,019 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Purchase of Real Estate & Intangible Assets | | | (174,919,132 | ) | | | (208,390,539 | ) |

| Capital Improvements | | | (4,541,705 | ) | | | (1,208,390 | ) |

| Proceeds from Sale of Real Estate Investments | | | 22,083,340 | | | | 4,125,819 | |

| Return of Deposits on Real Estate | | | 450,000 | | | | 2,700,000 | |

| Deposits Paid on Acquisitions of Real Estate | | | (700,000 | ) | | | (1,280,000 | ) |

| Proceeds from Sale of Securities Available for Sale | | | 2,619,949 | | | | 10,693,212 | |

| Purchase of Securities Available for Sale | | | (61,277,604 | ) | | | (39,467,317 | ) |

| NET CASH USED IN INVESTING ACTIVITIES | | | (216,285,152 | ) | | | (232,827,215 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Net Draws on Loans Payable | | | 37,701,407 | | | | 41,304,256 | |

| Proceeds from Fixed Rate Mortgage Notes Payable | | | 105,600,000 | | | | 137,925,000 | |

| Principal Payments on Fixed Rate Mortgage Notes Payable | | | (39,444,104 | ) | | | (59,936,689 | ) |

| Financing Costs Paid on Debt | | | (1,066,310 | ) | | | (1,650,516 | ) |

| Proceeds from the Exercise of Stock Options | | | 569,600 | | | | -0- | |

| Redemption of 7.625% Series A Preferred Stock | | | -0- | | | | (53,493,750 | ) |

| Redemption of 7.875% Series B Preferred Stock | | | -0- | | | | (57,500,000 | ) |

Proceeds from Underwritten Public Offering of Preferred Stock,

net of offering costs | | | -0- | | | | 71,003,093 | |

Proceeds from At-The-Market Preferred Equity Program,

net of offering costs | | | 30,991,952 | | | | -0- | |

| Proceeds from Issuance of Common Stock in the DRIP, net of Dividend Reinvestments | | | 58,428,746 | | | | 59,111,167 | |

| Preferred Dividends Paid | | | (12,548,850 | ) | | | (11,044,489 | ) |

| Common Dividends Paid, net of Reinvestments | | | (30,375,083 | ) | | | (27,081,387 | ) |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 149,857,358 | | | | 98,636,685 | |

| | | | | | | | | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | | | (3,333,804 | ) | | | (83,999,511 | ) |

| CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD | | | 10,226,046 | | | | 95,749,508 | |

| CASH AND CASH EQUIVALENTS - END OF PERIOD | | $ | 6,892,242 | | | $ | 11,749,997 | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 9 of 24 |

Capital Structure and Leverage Ratios

(unaudited)

| | As of | | | As of | | | As of | |

| | 6/30/2018 | | | 6/30/2017 | | | 9/30/2017 | |

| | | | | | | | | | |

| Fixed Rate Mortgage Notes Payable, net of Unamortized Debt Issuance Costs | | $ | 657,083,249 | | | $ | 554,486,956 | | | $ | 591,364,371 | |

| Loans Payable | | | 157,792,824 | | | | 122,094,940 | | | | 120,091,417 | |

| Total Debt | | | 814,876,073 | | | | 676,581,896 | | | | 711,455,788 | |

| | | | | | | | | | | | | |

| 6.125% Series C Cumulative Redeemable Preferred Stock | | | 277,486,525 | | | | 210,000,000 | | | | 245,986,125 | |

| Common Stock, Paid-In-Capital & Other | | | 511,426,977 | | | | 448,246,175 | | | | 466,879,571 | |

| Total Shareholders’ Equity | | | 788,913,502 | | | | 658,246,175 | | | | 712,865,696 | |

| | | | | | | | | | | | | |

| Total Book Capitalization | | | 1,603,789,575 | | | | 1,334,828,071 | | | | 1,424,321,484 | |

| | | | | | | | | | | | | |

| Accumulated Depreciation | | | 197,433,826 | | | | 169,226,861 | | | | 177,372,518 | |

| Total Undepreciated Book Capitalization | | $ | 1,801,223,401 | | | $ | 1,504,054,932 | | | $ | 1,601,694,002 | |

| | | | | | | | | | | | | |

| Shares Outstanding | | | 80,137,070 | | | | 73,824,161 | | | | 75,630,521 | |

| Market Price Per Share | | $ | 16.53 | | | $ | 15.05 | | | $ | 16.19 | |

| | | | | | | | | | | | | |

| Equity Market Capitalization | | $ | 1,324,665,767 | | | $ | 1,111,053,623 | | | $ | 1,224,458,135 | |

| Total Debt | | | 814,876,073 | | | | 676,581,896 | | | | 711,455,788 | |

| Total Preferred Stock | | | 277,486,525 | | | | 210,000,000 | | | | 245,986,125 | |

| Total Market Capitalization | | $ | 2,417,028,365 | | | $ | 1,997,635,519 | | | $ | 2,181,900,048 | |

| | | | | | | | | | | | | |

| Total Debt | | $ | 814,876,073 | | | $ | 676,581,896 | | | $ | 711,455,788 | |

| less: Cash and Cash Equivalents | | | 6,892,242 | | | | 11,749,997 | | | | 10,226,046 | |

| Net Debt | | $ | 807,983,831 | | | $ | 664,831,899 | | | $ | 701,229,742 | |

| less: Securities Available for Sale at Fair Value (Securities) | | | 167,594,279 | | | | 100,495,810 | | | | 123,764,770 | |

| Net Debt Less Securities | | $ | 640,389,552 | | | $ | 564,336,089 | | | $ | 577,464,972 | |

| | | | | | | | | | | | | |

| Net Debt / Total Undepreciated Book Capitalization | | | 44.9 | % | | | 44.2 | % | | | 43.8 | % |

| Net Debt / Total Market Capitalization | | | 33.4 | % | | | 33.3 | % | | | 32.1 | % |

| Net Debt Plus Preferred Stock / Total Market Capitalization | | | 44.9 | % | | | 43.8 | % | | | 43.4 | % |

| Net Debt Less Securities / Total Undepreciated Book Capitalization | | | 35.6 | % | | | 37.5 | % | | | 36.1 | % |

| Net Debt Less Securities / Total Market Capitalization | | | 26.5 | % | | | 28.3 | % | | | 26.5 | % |

| Net Debt Less Securities Plus Preferred Stock / Total Market Capitalization | | | 38.0 | % | | | 38.8 | % | | | 37.7 | % |

| | | | | | | | | | | | | |

| Weighted Average Interest Rate on Fixed Rate Debt | | | 4.11 | % | | | 4.21 | % | | | 4.18 | % |

| Weighted Average Term on Fixed Rate Debt | | | 11.5 yrs. | | | | 11.5 yrs. | | | | 11.6 yrs. | |

| Weighted Average Lease Term | | | 7.8 yrs. | | | | 7.8 yrs. | | | | 7.9 yrs. | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 10 of 24 |

Capital Structure and Leverage Ratios continued

(unaudited)

| | | | | | | | | | | | | | | Fiscal Year | |

| | | Three Months Ended | | | Nine Months Ended | | | Ended | |

| | | 6/30/2018 | | | 6/30/2017 | | | 6/30/2018 | | | 6/30/2017 | | | 9/30/2017 | |

| Net Income | | $14,570,773 | | | $11,730,363 | | | $43,846,177 | | | $30,008,895 | | | $40,271,085 | |

| Plus: Interest Expense, including Amortization of Financing Costs | | 8,279,324 | | | 6,135,381 | | | 23,640,556 | | | 18,835,864 | | | 25,754,121 | |

| Plus: Depreciation and Amortization | | 9,776,490 | | | 7,770,081 | | | 28,245,229 | | | 22,777,206 | | | 31,459,749 | |

| Less: (Gain) / Plus: Loss on Sale of Real Estate Investments | | (2,097,380) | | | -0- | | | (7,485,266) | | | 95,336 | | | 95,336 | |

| EBITDAre | | | 30,529,207 | | | | 25,635,825 | | | | 88,246,696 | | | | 71,717,301 | | | | 97,580,291 | |

| Plus: Acquisition Costs | | | -0- | | | | -0- | | | | -0- | | | | 178,526 | | | | 178,526 | |

| Plus: Net Amortization of Acquired Above and Below Market Lease Revenue | | | 25,677 | | | | 25,492 | | | | 77,031 | | | | 76,476 | | | | 101,968 | |

| Less: Gain on Sale of Securities Transactions | | | -0- | | | | (1,487,836 | ) | | | (111,387 | ) | | | (2,293,944 | ) | | | (2,311,714 | ) |

| Adjusted EBITDA | | $ | 30,554,884 | | | $ | 24,173,481 | | | $ | 88,212,340 | | | $ | 69,678,359 | | | $ | 95,549,071 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest Expense, including Amortization of Financing Costs | | $ | 8,279,324 | | | $ | 6,135,381 | | | $ | 23,640,556 | | | $ | 18,835,864 | | | $ | 25,754,121 | |

| Preferred Dividends | | | 4,248,029 | | | | 4,045,787 | | | | 12,813,194 | | | | 11,325,583 | | | | 14,861,686 | |

| Total Fixed Charges | | $ | 12,527,353 | | | $ | 10,181,168 | | | $ | 36,453,750 | | | $ | 30,161,447 | | | $ | 40,615,807 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest Coverage | | | 3.7 x | | | | 3.9 x | | | | 3.7 x | | | | 3.7 x | | | | 3.7 x | |

| Fixed Charge Coverage | | | 2.4 x | | | | 2.4 x | | | | 2.4 x | | | | 2.3 x | | | | 2.4 x | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Debt | | $ | 807,983,831 | | | $ | 664,831,899 | | | $ | 807,983,831 | | | $ | 664,831,899 | | | $ | 701,229,742 | |

| Net Debt Less Securities | | | 640,389,552 | | | | 564,336,089 | | | | 640,389,552 | | | | 564,336,089 | | | | 577,464,972 | |

| Total Preferred Stock | | | 277,486,525 | | | | 210,000,000 | | | | 277,486,525 | | | | 210,000,000 | | | | 245,986,125 | |

| Annualized Adjusted EBITDA | | | 122,219,536 | | | | 96,693,924 | | | | 117,616,453 | | | | 92,904,479 | | | | 95,549,071 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Debt / Adjusted EBITDA | | | 6.6 x | | | | 6.9 x | | | | 6.9 x | | | | 7.2 x | | | | 7.3 x | |

| Net Debt Less Securities / Adjusted EBITDA | | | 5.2 x | | | | 5.8 x | | | | 5.4 x | | | | 6.1 x | | | | 6.0 x | |

| Net Debt + Preferred Stock / Adjusted EBITDA | | | 8.9 x | | | | 9.0 x | | | | 9.2 x | | | | 9.4 x | | | | 9.9 x | |

| Net Debt Less Securities + Preferred Stock / Adjusted EBITDA | | | 7.5 x | | | | 8.0 x | | | | 7.8 x | | | | 8.3 x | | | | 8.6 x | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 11 of 24 |

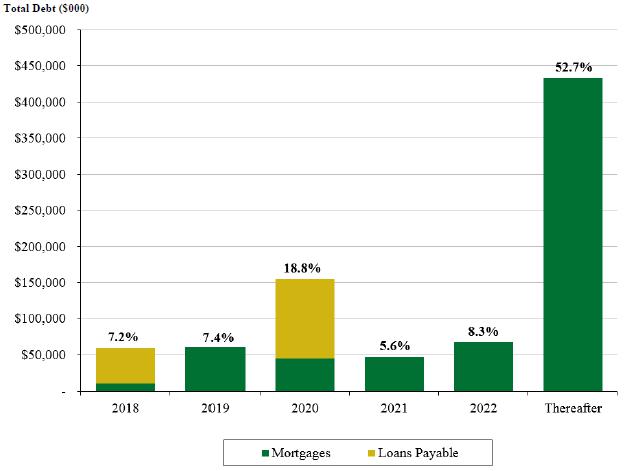

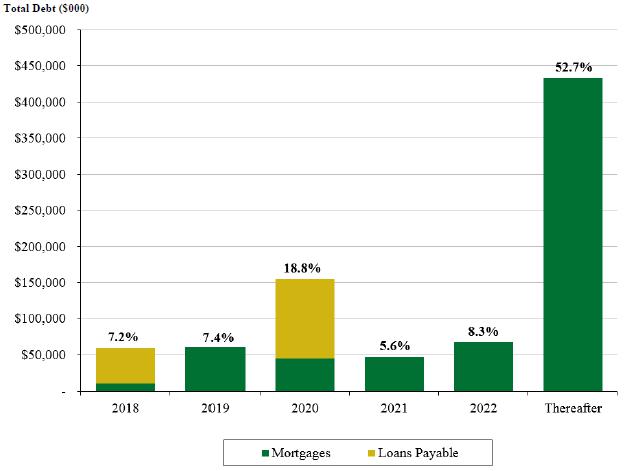

Debt Maturity

(unaudited)

Total Debt ($000)

| | | | | | | | Loans | | | | | | % of | |

| Fiscal Year Ended | | | | Mortgages | | | Payable | | | Total | | | Total | |

| | | | | | | | | | | | | | | |

| 2018 | | | | $ | 11,078,170 | | | $ | 47,792,824 | (B) | | $ | 58,870,994 | | | | 7.2 | % |

| 2019 | | | | | 60,710,638 | | | | -0- | | | | 60,710,638 | | | | 7.4 | % |

| 2020 | | | | | 45,027,671 | | | | 110,000,000 | (C) | | | 155,027,671 | | | | 18.8 | % |

| 2021 | | | | | 46,376,527 | | | | -0- | | | | 46,376,527 | | | | 5.6 | % |

| 2022 | | | | | 68,045,369 | | | | -0- | | | | 68,045,369 | | | | 8.3 | % |

| Thereafter | | | | | 433,880,088 | | | | -0- | | | | 433,880,088 | | | | 52.7 | % |

| | | | | | | | | | | | | | | | | | | |

| Total as of 6/30/2018 | | (A) | | $ | 665,118,463 | | | $ | 157,792,824 | | | $ | 822,911,287 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | |

| Weighted Average Interest Rate | | | | | 4.11 | % | | | 3.25 | % | | | 3.94 | % | | | | |

| Weighted Average Term | | | | | 11.5 yrs. | | | | 1.6 yrs. | | | | 9.6 yrs. | | | | | |

| (A) | Mortgages does not include unamortized debt issuance costs of $8,035,214. |

| (B) | Represents margin debt which is due upon demand and bears and interest rate of 2.00%. |

| (C) | Represents the amount drawn down on a line of credit that has a one year extension option, which is not reflected above. |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 12 of 24 |

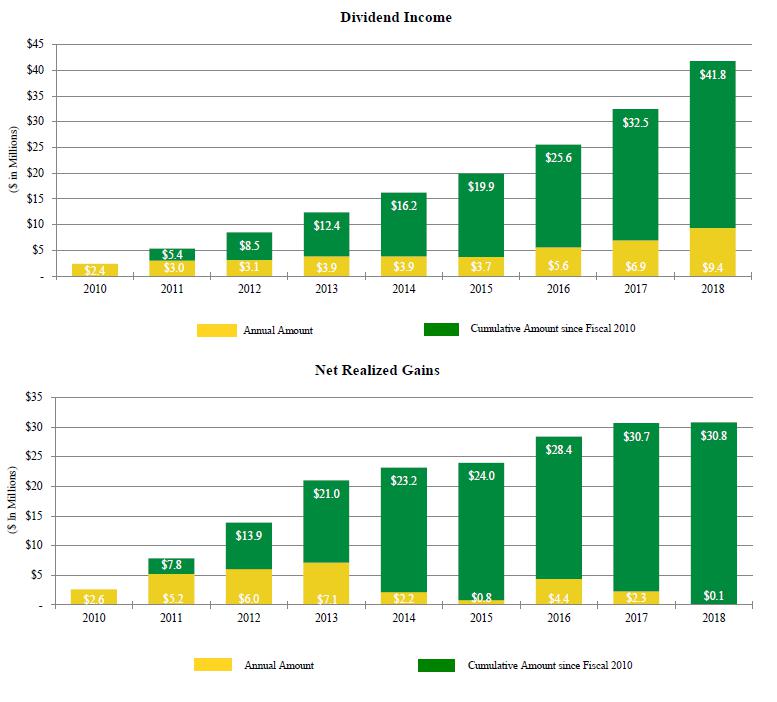

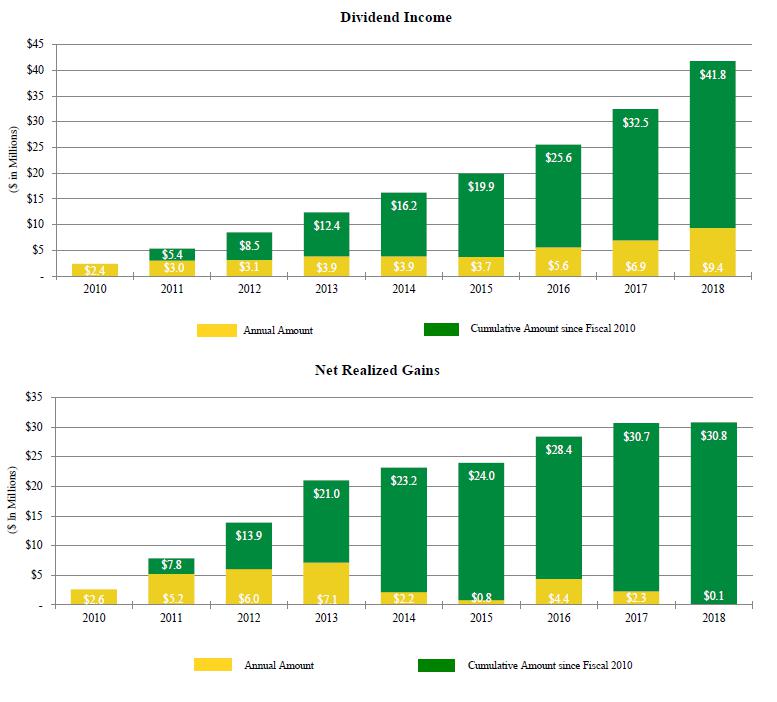

Securities Portfolio Performance

(unaudited)

All periods represent the full fiscal year with the exception of the current fiscal year which represents fiscal year to date.

| Fiscal Year Ended | | Securities Available for Sale | | | Dividend Income | | | Net Realized Gain on Sale of Securities | | | Net Realized Gain on Sale of Securities & Dividend Income | |

| | | | | | | | | | | | | |

| 2010 | | $ | 42,517,725 | | | $ | 2,387,757 | | | $ | 2,609,149 | | | $ | 4,996,906 | |

| 2011 | | | 44,265,059 | | | | 2,981,534 | | | | 5,238,203 | | | | 8,219,737 | |

| 2012 | | | 61,685,173 | | | | 3,144,837 | | | | 6,044,065 | | | | 9,188,902 | |

| 2013 | | | 45,451,740 | | | | 3,861,374 | | | | 7,133,252 | | | | 10,994,626 | |

| 2014 | | | 59,311,403 | | | | 3,863,136 | | | | 2,166,766 | | | | 6,029,902 | |

| 2015 | | | 54,541,237 | | | | 3,707,498 | | | | 805,513 | | | | 4,513,011 | |

| 2016 | | | 73,604,894 | | | | 5,607,403 | | | | 4,398,599 | | | | 10,006,002 | |

| 2017 | | | 123,764,770 | | | | 6,919,973 | | | | 2,311,714 | | | | 9,231,687 | |

| As of 6/30/2018 | | | 167,594,279 | | | | 9,373,467 | | | | 111,387 | | | | 9,484,854 | |

| | | | | | | | | | | | | | | | | |

| Total | | | | | | $ | 41,846,979 | | | $ | 30,818,648 | | | $ | 72,665,627 | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 13 of 24 |

Property Table by Tenant

(unaudited)

| | | | | Property | | | Square | | | Occupied Square | | | % of Occupied | | | Annual | | | % of Total | | | Rent Per | | | Undepreciated | | | Mortgage | |

| Tenant | | | | Count | | | Footage | | | Footage | | | sf | | | Rent | | | Ann. Rent | | | sf Occup. | | | Cost | | | Balance | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FedEx Ground Package System, Inc. | | | | | 42 | | | | 7,899,336 | | | | 7,899,336 | | | | 38.5 | % | | $ | 58,819,000 | | | | 48.8 | % | | $ | 7.45 | | | $ | 805,798,445 | | | $ | 349,664,510 | |

| FedEx Corporation | | | | | 16 | | | | 1,544,996 | | | | 1,544,996 | | | | 7.5 | % | | | 8,015,000 | | | | 6.7 | % | | | 5.19 | | | | 108,891,040 | | | | 23,032,703 | |

| Total FedEx | | | | | 58 | | | | 9,444,332 | | | | 9,444,332 | | | | 46.0 | % | | | 66,834,000 | | | | 55.5 | % | | | 7.08 | | | | 914,689,485 | | | | 372,697,213 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Milwaukee Electric Tool Corporation | | | | | 1 | | | | 861,889 | | | | 861,889 | | | | 4.2 | % | | | 3,032,000 | | | | 2.5 | % | | | 3.52 | | | | 36,914,917 | | | | 22,163,550 | |

| Shaw Industries, Inc. | | | | | 1 | | | | 831,764 | | | | 831,764 | | | | 4.1 | % | | | 3,551,000 | | | | 3.0 | % | | | 4.27 | | | | 56,025,945 | | | | 32,683,129 | |

| ULTA, Inc. | | | | | 1 | | | | 671,354 | | | | 671,354 | | | | 3.3 | % | | | 2,702,000 | | | | 2.2 | % | | | 4.02 | | | | 37,512,071 | | | | 20,495,423 | |

| Amazon.com Services, Inc. (Amazon.com, Inc.) | | | | | 2 | | | | 662,942 | | | | 662,942 | | | | 3.2 | % | | | 3,904,000 | | | | 3.2 | % | | | 5.89 | | | | 62,931,258 | | | | 38,210,841 | |

| Jim Beam Brands Company (Beam Suntory) | | | | | 1 | | | | 599,840 | | | | 599,840 | | | | 2.9 | % | | | 2,051,000 | | | | 1.7 | % | | | 3.42 | | | | 28,000,000 | | | | 16,873,754 | |

| International Paper Company | | | | | 2 | | | | 578,472 | | | | 578,472 | | | | 2.8 | % | | | 2,592,000 | | | | 2.2 | % | | | 4.48 | | | | 36,175,718 | | | | 20,996,375 | |

| TreeHouse Private Brands, Inc. | | | | | 1 | | | | 558,600 | | | | 558,600 | | | | 2.7 | % | | | 2,206,000 | | | | 1.8 | % | | | 3.95 | | | | 26,807,852 | | | | 15,485,705 | |

| B. Braun Medical Inc. | | | | | 1 | | | | 399,440 | | | | 399,440 | | | | 1.9 | % | | | 2,130,000 | | | | 1.8 | % | | | 5.33 | | | | 29,973,199 | | | | 19,422,368 | |

| CBOCS Distribution, Inc. (Cracker Barrel) | | | | | 1 | | | | 381,240 | | | | 381,240 | | | | 1.9 | % | | | 1,447,000 | | | | 1.2 | % | | | 3.80 | | | | 14,215,126 | | | | 7,276,403 | |

| Best Buy Warehousing Logistics, Inc. | | | | | 1 | | | | 368,060 | | | | 368,060 | | | | 1.8 | % | | | 1,676,000 | | | | 1.4 | % | | | 4.55 | | | | 19,600,000 | | | | 9,450,350 | |

| Coca-Cola | | | | | 2 | | | | 323,358 | | | | 323,358 | | | | 1.6 | % | | | 1,693,000 | | | | 1.4 | % | | | 5.24 | | | | 20,504,069 | | | | 4,850,865 | |

| Autoneum North America, Inc. | | | | | 1 | | | | 315,560 | | | | 315,560 | | | | 1.5 | % | | | 1,703,000 | | | | 1.4 | % | | | 5.40 | | | | 21,040,395 | | | | 14,663,085 | |

| Science Applications International Corporation | | | | | 1 | | | | 302,400 | | | | 302,400 | | | | 1.5 | % | | | 1,491,000 | | | | 1.2 | % | | | 4.93 | | | | 13,390,441 | | | | -0- | |

| United Technologies Corporation | | | | | 3 | | | | 283,150 | | | | 283,150 | | | | 1.4 | % | | | 2,264,000 | | | | 1.9 | % | | | 8.00 | | | | 27,687,512 | | | | 6,654,972 | |

| Bunzl USA Holdings, Inc. | | | | | 2 | | | | 268,778 | | | | 268,778 | | | | 1.3 | % | | | 1,474,000 | | | | 1.2 | % | | | 5.48 | | | | 18,696,890 | | | | 12,313,656 | |

| Woodstream Corporation | | (A) | | | 1 | | | | 256,000 | | | | 256,000 | | | | 1.2 | % | | | 914,000 | | | | 0.8 | % | | | 3.57 | | | | 8,935,160 | | | | -0- | |

| Anda Pharmaceuticals, Inc. | | | | | 1 | | | | 234,660 | | | | 234,660 | | | | 1.1 | % | | | 1,205,000 | | | | 1.0 | % | | | 5.14 | | | | 14,550,000 | | | | 7,718,748 | |

| UGN, Inc. | | | | | 1 | | | | 232,200 | | | | 232,200 | | | | 1.1 | % | | | 1,070,000 | | | | 0.9 | % | | | 4.61 | | | | 13,424,564 | | | | 7,248,514 | |

| Mickey Thompson Performance Tires and Wheels (Cooper Tire) | | | | | 1 | | | | 219,765 | | | | 219,765 | | | | 1.1 | % | | | 1,501,000 | | | | 1.2 | % | | | 6.83 | | | | 18,934,065 | | | | 12,287,866 | |

| Rinnai America Corporation | | | | | 1 | | | | 218,120 | | | | 218,120 | | | | 1.1 | % | | | 831,000 | | | | 0.7 | % | | | 3.81 | | | | 14,933,683 | | | | -0- | |

| Anheuser-Busch, Inc. | | | | | 1 | | | | 184,800 | | | | 184,800 | | | | 0.9 | % | | | 821,000 | | | | 0.7 | % | | | 4.44 | | | | 12,697,848 | | | | -0- | |

| Carlisle Tire & Wheel Company | | | | | 1 | | | | 179,280 | | | | 179,280 | | | | 0.9 | % | | | 739,000 | | | | 0.6 | % | | | 4.12 | | | | 7,232,986 | | | | -0- | |

| NF&M International, Inc. | | (B) | | | 1 | | | | 174,802 | | | | 174,802 | | | | 0.9 | % | | | 835,000 | | | | 0.7 | % | | | 4.78 | | | | 5,408,790 | | | | -0- | |

| Home Depot USA, Inc. | | | | | 1 | | | | 171,200 | | | | 171,200 | | | | 0.8 | % | | | 997,000 | | | | 0.8 | % | | | 5.82 | | | | 11,298,367 | | | | -0- | |

| Victory Packaging, L.P. | | | | | 1 | | | | 148,000 | | | | 148,000 | | | | 0.7 | % | | | 502,000 | | | | 0.4 | % | | | 3.39 | | | | 5,451,629 | | | | -0- | |

| Challenger Lifts, Inc. (Snap-On Inc.) | | | | | 1 | | | | 137,500 | | | | 137,500 | | | | 0.7 | % | | | 838,000 | | | | 0.7 | % | | | 6.09 | | | | 11,304,000 | | | | 6,623,753 | |

| Altec Industries, Inc. | | (A) | | | 1 | | | | 126,880 | | | | 126,880 | | | | 0.6 | % | | | 371,000 | | | | 0.3 | % | | | 2.92 | | | | 4,428,488 | | | | -0- | |

| General Electric Company | | | | | 1 | | | | 125,860 | | | | 125,860 | | | | 0.6 | % | | | 1,321,000 | | | | 1.1 | % | | | 10.50 | | | | 19,950,000 | | | | 11,393,300 | |

| The American Bottling Company (Dr Pepper Snapple) | | | | | 2 | | | | 110,080 | | | | 110,080 | | | | 0.5 | % | | | 743,000 | | | | 0.6 | % | | | 6.75 | | | | 10,498,031 | | | | 1,717,657 | |

| Style Crest, Inc. | | | | | 1 | | | | 106,507 | | | | 106,507 | | | | 0.5 | % | | | 387,000 | | | | 0.3 | % | | | 3.63 | | | | 7,238,613 | | | | -0- | |

| Pittsburgh Glass Works, LLC | | | | | 1 | | | | 102,135 | | | | 102,135 | | | | 0.5 | % | | | 442,000 | | | | 0.4 | % | | | 4.33 | | | | 4,245,913 | | | | -0- | |

| Holland 1916 Inc. | | | | | 1 | | | | 95,898 | | | | 95,898 | | | | 0.5 | % | | | 349,000 | | | | 0.3 | % | | | 3.64 | | | | 7,397,881 | | | | -0- | |

| National Oilwell Varco, Inc. | | | | | 1 | | | | 91,295 | | | | 91,295 | | | | 0.4 | % | | | 754,000 | | | | 0.6 | % | | | 8.26 | | | | 8,163,278 | | | | 2,269,158 | |

| Joseph T. Ryerson and Son, Inc. | | | | | 1 | | | | 89,052 | | | | 89,052 | | | | 0.4 | % | | | 506,000 | | | | 0.4 | % | | | 5.68 | | | | 6,977,442 | | | | -0- | |

| CHEP USA, Inc. | | | | | 1 | | | | 83,000 | | | | 83,000 | | | | 0.4 | % | | | 500,000 | | | | 0.4 | % | | | 6.02 | | | | 7,463,672 | | | | -0- | |

| Sherwin-Williams Company | | | | | 2 | | | | 78,887 | | | | 78,887 | | | | 0.4 | % | | | 643,000 | | | | 0.5 | % | | | 8.15 | | | | 7,244,128 | | | | -0- | |

| RGH Enterprises, Inc. (Cardinal Health) | | | | | 1 | | | | 75,000 | | | | 75,000 | | | | 0.4 | % | | | 607,000 | | | | 0.5 | % | | | 8.09 | | | | 5,525,600 | | | | -0- | |

| Tampa Bay Grand Prix | | | | | 1 | | | | 68,385 | | | | 68,385 | | | | 0.3 | % | | | 297,000 | | | | 0.2 | % | | | 4.34 | | | | 5,677,982 | | | | -0- | |

| Various Tenants at Retail Shopping Center | | | | | 1 | | | | 64,220 | | | | 64,220 | | | | 0.3 | % | | | 807,000 | | | | 0.7 | % | | | 12.57 | | | | 3,072,882 | | | | -0- | |

| SOFIVE, Inc. | | | | | 1 | | | | 60,400 | | | | 60,400 | | | | 0.3 | % | | | 558,000 | | | | 0.5 | % | | | 9.24 | | | | 4,929,208 | | | | 1,621,778 | |

| Kellogg Sales Company | | | | | 1 | | | | 54,812 | | | | 54,812 | | | | 0.3 | % | | | 329,000 | | | | 0.3 | % | | | 6.00 | | | | 3,494,108 | | | | -0- | |

| Siemens Real Estate | | | | | 1 | | | | 51,130 | | | | 51,130 | | | | 0.2 | % | | | 485,000 | | | | 0.4 | % | | | 9.49 | | | | 4,452,425 | | | | -0- | |

| Foundation Building Materials, LLC | | | | | 1 | | | | 36,270 | | | | 36,270 | | | | 0.2 | % | | | 172,000 | | | | 0.2 | % | | | 4.74 | | | | 2,523,644 | | | | -0- | |

| Graybar Electric Company | | | | | 1 | | | | 26,340 | | | | 26,340 | | | | 0.2 | % | | | 109,000 | | | | 0.2 | % | | | 4.14 | | | | 1,885,254 | | | | -0- | |

| Tenant Total as of 6/30/18 | | | | | 109 | | | | 20,453,657 | | | | 20,453,657 | | | | 99.6 | % | | $ | 120,383,000 | | | | 100.0 | % | | $ | 5.89 | | | $ | 1,603,504,519 | | (C) | $ | 665,118,463 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Vacant | | (B) | | | 1 | | | | 80,856 | | | | -0- | | | | 0.0 | % | | | -0- | | | | 0.0 | % | | | -0- | | | | 2,501,877 | | | | -0- | |

| Total as of 6/30/18 | | | | | 109 | | | | 20,534,513 | | | | 20,453,657 | | | | 99.6 | % | | $ | 120,383,000 | | | | 100.0 | % | | $ | 5.89 | | | $ | 1,606,006,396 | | | $ | 665,118,463 | |

| | (A) | Woodstream Corporation and Altec Industries, Inc. are located at one property and therefore are counted as one property in the Property Count total. |

| | | |

| | (B) | NF&M International is located in a 255,658 square foot Industrial Park in Monaca (Pittsburgh), PA, of which 80,856 square feet is vacant. This Industrial Park is counted as one property in the Property Count Total. Other than the two properties indicated in footnotes (A) and (B) and the one retail property, all other properties are single-tenant. |

| | | |

| | (C) | Does not include unamortized debt issuance costs of $8,035,214. |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 14 of 24 |

Property Table by State

(unaudited)

| | | Property | | | Square | | | Occupied Square | | | % of Total | | | Annual | | | % of Total | | | Rent Per | | | Undepreciated | | | Mortgage | |

| State | | Count | | | Footage | | | Footage | | | sf | | | Rent | | | Ann. Rent | | | sf Occup. | | | Cost | | | Balance | |

| Florida | | | 13 | | | | 2,211,583 | | | | 2,211,583 | | | | 10.8 | % | | $ | 15,711,000 | | | | 13.1 | % | | $ | 7.10 | | | $ | 226,437,810 | | | $ | 106,355,377 | |

| Texas | | | 10 | | | | 1,781,967 | | | | 1,781,967 | | | | 8.7 | % | | | 14,160,000 | | | | 11.8 | % | | | 7.95 | | | | 182,253,655 | | | | 79,504,203 | |

| Ohio | | | 9 | | | | 1,550,706 | | | | 1,550,706 | | | | 7.6 | % | | | 8,901,000 | | | | 7.4 | % | | | 5.74 | | | | 110,131,661 | | | | 40,605,871 | |

| Kentucky | | | 3 | | | | 1,295,940 | | | | 1,295,940 | | | | 6.3 | % | | | 5,095,000 | | | | 4.2 | % | | | 3.93 | | | | 66,111,852 | | | | 38,983,212 | |

| Mississippi | | | 4 | | | | 1,158,889 | | | | 1,158,889 | | | | 5.6 | % | | | 4,466,000 | | | | 3.7 | % | | | 3.85 | | | | 55,250,862 | | | | 29,882,298 | |

| Georgia | | | 4 | | | | 1,139,426 | | | | 1,139,426 | | | | 5.5 | % | | | 5,004,000 | | | | 4.2 | % | | | 4.39 | | | | 78,300,712 | | | | 33,078,998 | |

| South Carolina | | | 5 | | | | 1,008,358 | | | | 1,008,358 | | | | 4.9 | % | | | 6,599,000 | | | | 5.5 | % | | | 6.54 | | | | 79,435,118 | | | | 29,948,928 | |

| Indiana | | | 2 | | | | 999,176 | | | | 999,176 | | | | 4.9 | % | | | 4,417,000 | | | | 3.7 | % | | | 4.42 | | | | 63,016,153 | | | | 31,172,312 | |

| Illinois | | | 9 | | | | 958,045 | | | | 958,045 | | | | 4.7 | % | | | 6,117,000 | | | | 5.1 | % | | | 6.38 | | | | 82,238,327 | | | | 8,711,524 | |

| North Carolina | | | 4 | | | | 939,706 | | | | 939,706 | | | | 4.6 | % | | | 5,663,000 | | | | 4.7 | % | | | 6.03 | | | | 85,778,185 | | | | 43,294,579 | |

| Tennessee | | | 3 | | | | 891,777 | | | | 891,777 | | | | 4.3 | % | | | 3,093,000 | | | | 2.6 | % | | | 3.47 | | | | 33,846,631 | | | | 12,546,573 | |

| Michigan | | | 4 | | | | 833,054 | | | | 833,054 | | | | 4.1 | % | | | 5,574,000 | | | | 4.6 | % | | | 6.69 | | | | 72,976,507 | | | | 26,189,350 | |

| Kansas | | | 4 | | | | 813,043 | | | | 813,043 | | | | 4.0 | % | | | 4,619,000 | | | | 3.8 | % | | | 5.68 | | | | 60,943,937 | | | | 30,553,044 | |

| Missouri | | | 4 | | | | 739,330 | | | | 739,330 | | | | 3.6 | % | | | 2,828,000 | | | | 2.3 | % | | | 3.83 | | | | 34,975,893 | | | | 6,674,809 | |

| Oklahoma | | | 4 | | | | 614,941 | | | | 614,941 | | | | 3.0 | % | | | 3,916,000 | | | | 3.3 | % | | | 6.37 | | | | 54,939,875 | | | | 30,111,391 | |

| New York | | | 3 | | | | 518,565 | | | | 518,565 | | | | 2.5 | % | | | 3,886,000 | | | | 3.2 | % | | | 7.49 | | | | 51,336,422 | | | | 21,634,312 | |

| Pennsylvania | | | 3 | | | | 504,040 | | | | 423,184 | | | | 2.5 | % | | | 2,807,000 | | | | 2.3 | % | | | 6.63 | | | | 36,869,316 | | | | 14,745,434 | |

| Alabama | | | 2 | | | | 451,595 | | | | 451,595 | | | | 2.2 | % | | | 2,625,000 | | | | 2.2 | % | | | 5.81 | | | | 39,714,135 | | | | 19,426,573 | |

| Virginia | | | 5 | | | | 407,265 | | | | 407,265 | | | | 2.0 | % | | | 2,449,000 | | | | 2.0 | % | | | 6.01 | | | | 34,663,204 | | | | 4,514,935 | |

| Colorado | | | 2 | | | | 295,227 | | | | 295,227 | | | | 1.4 | % | | | 2,437,000 | | | | 2.0 | % | | | 8.25 | | | | 35,674,117 | | | | 17,399,645 | |

| Arizona | | | 1 | | | | 283,358 | | | | 283,358 | | | | 1.4 | % | | | 1,361,000 | | | | 1.1 | % | | | 4.80 | | | | 16,824,226 | | | | 3,924,048 | |

| Wisconsin | | | 2 | | | | 238,666 | | | | 238,666 | | | | 1.2 | % | | | 1,295,000 | | | | 1.1 | % | | | 5.43 | | | | 15,952,361 | | | | 2,720,662 | |

| Washington | | | 1 | | | | 210,445 | | | | 210,445 | | | | 1.0 | % | | | 1,962,000 | | | | 1.6 | % | | | 9.32 | | | | 30,228,547 | | | | 18,031,513 | |

| Louisiana | | | 1 | | | | 175,315 | | | | 175,315 | | | | 0.9 | % | | | 1,262,000 | | | | 1.0 | % | | | 7.20 | | | | 18,410,000 | | | | 11,306,837 | |

| Maryland | | | 1 | | | | 148,881 | | | | 148,881 | | | | 0.7 | % | | | 1,452,000 | | | | 1.2 | % | | | 9.75 | | | | 14,512,355 | | | | -0- | |

| New Jersey | | | 2 | | | | 124,620 | | | | 124,620 | | | | 0.6 | % | | | 1,365,000 | | | | 1.1 | % | | | 10.95 | | | | 8,002,092 | | | | 1,621,778 | |

| Nebraska | | | 1 | | | | 89,115 | | | | 89,115 | | | | 0.4 | % | | | 446,000 | | | | 0.4 | % | | | 5.00 | | | | 5,944,691 | | | | -0- | |

| Minnesota | | | 1 | | | | 60,398 | | | | 60,398 | | | | 0.3 | % | | | 372,000 | | | | 0.3 | % | | | 6.16 | | | | 5,220,000 | | | | 2,180,257 | |

| Connecticut | | | 1 | | | | 54,812 | | | | 54,812 | | | | 0.2 | % | | | 329,000 | | | | 0.3 | % | | | 6.00 | | | | 3,494,108 | | | | -0- | |

| Iowa | | | 1 | | | | 36,270 | | | | 36,270 | | | | 0.1 | % | | | 172,000 | | | | 0.1 | % | | | 4.74 | | | | 2,523,644 | | | | -0- | |

| Total as of 6/30/18 | | | 109 | | | | 20,534,513 | | | | 20,453,657 | | | | 100.0 | % | | $ | 120,383,000 | | | | 100.0 | % | | $ | 5.89 | | | $ | 1,606,006,396 | | (A) | $ | 665,118,463 | |

| | (A) | Does not include unamortized debt issuance costs of $8,035,214. |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 15 of 24 |

Lease Expirations

(unaudited)

| | | | | Property | | | Square | | | % of Total | | | Annual | | | % of Total | | | Rent Per sf | | | Lease Exp. | | | Undepreciated | | | Mortgage | |

| Fiscal Year | | | | Count | | | Footage | | | sf | | | Rent | | | Ann. Rent | | | Occup. | | | Term in Years | | | Cost | | | Balance | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2018 | | | | | 1 | | | | 82,269 | | | | 0.4 | % | | $ | 408,000 | | | | 0.3 | % | | $ | 4.96 | | | | 0.2 | | | $ | 6,919,836 | | | $ | -0- | |

| 2019 | | | | | 9 | | | | 1,366,742 | | | | 6.7 | % | | | 7,302,000 | | | | 6.1 | % | | | 5.34 | | | | 0.8 | | | | 82,903,975 | | | | 12,469,363 | |

| 2020 | | | | | 4 | | | | 383,449 | | | | 1.9 | % | | | 2,129,000 | | | | 1.8 | % | | | 5.55 | | | | 1.9 | | | | 27,447,899 | | | | -0- | |

| 2021 | | (A) | | | 10 | | | | 1,206,723 | | | | 5.9 | % | | | 5,467,000 | | | | 4.5 | % | | | 4.53 | | | | 2.9 | | | | 69,298,783 | | | | 7,997,496 | |

| 2022 | | | | | 7 | | | | 1,138,320 | | | | 5.5 | % | | | 6,419,000 | | | | 5.3 | % | | | 5.64 | | | | 3.7 | | | | 75,991,657 | | | | 25,889,809 | |

| 2023 | | (A) | | | 13 | | | | 1,668,804 | | | | 8.1 | % | | | 9,481,000 | | | | 7.9 | % | | | 5.68 | | | | 5.0 | | | | 116,791,437 | | | | 22,145,221 | |

| 2024 | | | | | 11 | | | | 1,526,126 | | | | 7.4 | % | | | 9,804,000 | | | | 8.1 | % | | | 6.42 | | | | 5.9 | | | | 115,781,294 | | | | 29,332,221 | |

| 2025 | | (A) | | | 9 | | | | 2,404,478 | | | | 11.7 | % | | | 12,271,000 | | | | 10.2 | % | | | 5.10 | | | | 6.9 | | | | 159,904,370 | | | | 76,246,573 | |

| 2026 | | | | | 7 | | | | 982,226 | | | | 4.8 | % | | | 7,922,000 | | | | 6.6 | % | | | 8.07 | | | | 7.9 | | | | 105,325,177 | | | | 41,183,573 | |

| 2027 | | | | | 11 | | | | 2,304,616 | | | | 11.2 | % | | | 12,629,000 | | | | 10.5 | % | | | 5.48 | | | | 9.1 | | | | 178,099,769 | | | | 73,983,041 | |

| 2028 | | | | | 9 | | | | 2,312,707 | | | | 11.3 | % | | | 11,809,000 | | | | 9.8 | % | | | 5.11 | | | | 9.8 | | | | 157,704,409 | | | | 75,378,937 | |

| 2029 | | | | | 4 | | | | 721,438 | | | | 3.5 | % | | | 4,070,000 | | | | 3.4 | % | | | 5.64 | | | | 10.7 | | | | 61,390,594 | | | | 27,711,524 | |

| 2030 | | | | | 4 | | | | 1,044,832 | | | | 5.1 | % | | | 7,403,000 | | | | 6.2 | % | | | 7.09 | | | | 11.8 | | | | 109,686,033 | | | | 62,908,543 | |

| 2031 | | | | | 3 | | | | 963,269 | | | | 4.7 | % | | | 7,122,000 | | | | 5.9 | % | | | 7.39 | | | | 12.8 | | | | 104,367,000 | | | | 65,934,926 | |

| 2032 | | | | | 6 | | | | 1,724,838 | | | | 8.4 | % | | | 13,134,000 | | | | 10.9 | % | | | 7.61 | | | | 13.8 | | | | 202,011,552 | | | | 128,451,531 | |

| 2034 | | | | | 1 | | | | 558,600 | | | | 2.7 | % | | | 2,206,000 | | | | 1.8 | % | | | 3.95 | | | | 15.3 | | | | 26,807,852 | | | | 15,485,705 | |

| Various tenants at retail shopping center | | | | | 1 | | | | 64,220 | | | | 0.3 | % | | | 807,000 | | | | 0.7 | % | | | 12.57 | | | | -0- | | | | 3,072,882 | | | | -0- | |

| Vacant | | (A) | | | 1 | | | | 80,856 | | | | 0.4 | % | | | -0- | | | | -0- | | | | -0- | | | | -0- | | | | 2,501,877 | | | | -0- | |

| Total as of 6/30/18 | | | | | 109 | | | | 20,534,513 | | | | 100.0 | % | | $ | 120,383,000 | | | | 100.0 | % | | $ | 5.89 | | | | 7.8 | | | $ | 1,606,006,396 | | (B) | $ | 665,118,463 | |

| | (A) | Included in 2021 is Woodstream Corporation and included in 2023 is Altec Industries which both occupy one property. Included in 2025 is NF&M International, which occupies 174,802 square feet of a 255,658 square foot Industrial Park. The remaining 80,856 square feet is included in Vacant. Each of these properties are counted as one property in the Property Count Total. Other than these properties and the one retail property, all other properties are single-tenant. |

| | | |

| | (B) | Does not include unamortized debt issuance costs of $8,035,214. |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 16 of 24 |

Recent Acquisitions During Fiscal 2018

(unaudited)

| | | | | | | | | Date of | | Square | | | Annual | | | Rent Per | | | Lease | | Purchase | | | Initial Mortgage | |

| No | | Tenant | | City (MSA) | | State | | Acquisition | | Footage | | | Rent | | | sf Occup. | | | Expiration | | Price | | | Balance | |

| 1 | | FedEx Corporation | | Charleston | | SC | | 11/2/2017 | | | 121,683 | | | $ | 1,315,000 | | | | 10.81 | | | 8/31/2032 | | $ | 21,872,170 | | | $ | 14,200,000 | |

| 2 | | Amazon.com Services, Inc. (Amazon.com, Inc.) | | Oklahoma City | | OK | | 11/30/2017 | | | 300,000 | | | | 1,884,000 | | | | 6.28 | | | 10/31/2027 | | | 30,250,000 | | | | 19,600,000 | |

| 3 | | Shaw Industries, Inc. | | Savannah | | GA | | 1/22/2018 | | | 831,764 | | | | 3,551,000 | | | | 4.27 | | | 9/30/2027 | | | 57,483,636 | | | | 33,300,000 | |

| 4 | | B. Braun Medical Inc. | | Daytona Beach | | FL | | 4/6/2018 | | | 399,440 | | | | 2,130,000 | | | | 5.33 | | | 4/1/2028 | | | 30,750,540 | | | | 19,500,000 | |

| 5 | | Amazon.com Services, Inc. (Amazon.com, Inc.) | | Mobile | | AL | | 6/28/2018 | | | 362,942 | | | | 2,020,000 | | | | 5.57 | | | 11/30/2028 | | | 33,688,276 | | | | 19,000,000 | |

| | | Total as of 6/30/18 | | | | | | | | | 2,015,829 | | | $ | 10,900,000 | | | $ | 5.41 | | | | | $ | 174,044,622 | | | $ | 105,600,000 | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 17 of 24 |

Property Table

(unaudited)

| | | | | | | | | | | | | | | | | | | Rent | | | Lease Exp. | | | | | | | |

| | | | | | | | | Fiscal Year | | | | | | Square | | | Annual | | | Per sf | | | Term in | | | Undepreciated | | | Mortgage | |

| No | | Tenant | | City (MSA) | | State | | Acquisition | | | Occup. | | | Footage | | | Rent | | | Occup. | | | Years | | | Cost | | | Balance | |

| 1 | | Milwaukee Electric Tool Corporation | | Olive Branch (Memphis, TN) | | MS | | | 2013 | | | | 100.0 | % | | | 861,889 | | | $ | 3,032,000 | | | $ | 3.52 | | | | 10.1 | | | $ | 36,914,917 | | | $ | 22,163,550 | |

| 2 | | Shaw Industries, Inc. | | Savannah | | GA | | | 2018 | | | | 100.0 | % | | | 831,764 | | | | 3,551,000 | | | | 4.27 | | | | 9.3 | | | | 56,025,945 | | | | 32,683,129 | |

| 3 | | ULTA, Inc. | | Greenwood (Indianapolis) | | IN | | | 2015 | | | | 100.0 | % | | | 671,354 | | | | 2,702,000 | | | | 4.02 | | | | 7.1 | | | | 37,512,071 | | | | 20,495,423 | |

| 4 | | Jim Beam Brands Company (Beam Suntory) | | Frankfort (Lexington) | | KY | | | 2015 | | | | 100.0 | % | | | 599,840 | | | | 2,051,000 | | | | 3.42 | | | | 6.6 | | | | 28,000,000 | | | | 16,873,754 | |

| 5 | | TreeHouse Private Brands, Inc. | | Buckner (Louisville) | | KY | | | 2014 | | | | 100.0 | % | | | 558,600 | | | | 2,206,000 | | | | 3.95 | | | | 15.3 | | | | 26,807,852 | | | | 15,485,705 | |

| 6 | | FedEx Corporation | | Memphis | | TN | | | 2010 | | | | 100.0 | % | | | 449,900 | | | | 1,327,000 | | | | 2.95 | | | | 0.9 | | | | 14,614,986 | | | | 5,270,170 | |

| 7 | | B. Braun Medical Inc. | | Daytona Beach | | FL | | | 2018 | | | | 100.0 | % | | | 399,440 | | | | 2,130,000 | | | | 5.33 | | | | 9.8 | | | | 29,973,199 | | | | 19,422,368 | |

| 8 | | Woodstream Corporation | | St. Joseph | | MO | | | 2001 | | | | 100.0 | % | | | 256,000 | | | | 914,000 | | | | 3.57 | | | | 3.3 | | | | 8,935,160 | | | | -0- | |

| | | Altec Industries, Inc. | | St. Joseph | | MO | | | 2001 | | | | 100.0 | % | | | 126,880 | | | | 371,000 | | | | 2.92 | | | | 4.7 | | | | 4,428,488 | | | | -0- | |

| 9 | | CBOCS Distribution, Inc. (Cracker Barrel) | | Lebanon (Nashville) | | TN | | | 2011 | | | | 100.0 | % | | | 381,240 | | | | 1,447,000 | | | | 3.80 | | | | 6.0 | | | | 14,215,126 | | | | 7,276,403 | |

| 10 | | Best Buy Warehousing Logistics, Inc. | | Streetsboro (Cleveland) | | OH | | | 2012 | | | | 100.0 | % | | | 368,060 | | | | 1,676,000 | | | | 4.55 | | | | 3.6 | | | | 19,600,000 | | | | 9,450,350 | |

| 11 | | Amazon.com Services, Inc. (Amazon.com, Inc.) | | Mobile | | AL | | | 2018 | | | | 100.0 | % | | | 362,942 | | | | 2,020,000 | | | | 5.57 | | | | 10.4 | | | | 33,052,316 | | | | 19,000,000 | |

| 12 | | FedEx Ground Package System, Inc. | | Concord (Charlotte) | | NC | | | 2017 | | | | 100.0 | % | | | 354,482 | | | | 2,537,000 | | | | 7.16 | | | | 13.9 | | | | 40,043,145 | | | | 25,198,229 | |

| 13 | | FedEx Ground Package System, Inc. | | Mesquite (Dallas) | | TX | | | 2017 | | | | 100.0 | % | | | 351,874 | | | | 3,195,000 | | | | 9.08 | | | | 13.8 | | | | 49,880,493 | | | | 31,357,736 | |

| 14 | | FedEx Ground Package System, Inc. | | Walker (Grand Rapids) | | MI | | | 2017 | | | | 100.0 | % | | | 343,483 | | | | 2,102,000 | | | | 6.12 | | | | 13.6 | | | | 31,654,987 | | | | 19,737,797 | |

| 15 | | FedEx Ground Package System, Inc. | | Hamburg (Buffalo) | | NY | | | 2017 | | | | 100.0 | % | | | 338,584 | | | | 2,313,000 | | | | 6.83 | | | | 12.8 | | | | 34,850,000 | | | | 21,634,312 | |

| 16 | | FedEx Ground Package System, Inc. | | Concord (Charlotte) | | NC | | | 2016 | | | | 100.0 | % | | | 330,717 | | | | 2,237,000 | | | | 6.76 | | | | 7.1 | | | | 33,044,797 | | | | 18,096,350 | |

| 17 | | FedEx Ground Package System, Inc. | | Indianapolis | | IN | | | 2014 | | | | 100.0 | % | | | 327,822 | | | | 1,715,000 | | | | 5.23 | | | | 9.3 | | | | 25,504,083 | | | | 10,676,889 | |

| 18 | | Autoneum North America, Inc. | | Aiken (Augusta, GA) | | SC | | | 2017 | | | | 100.0 | % | | | 315,560 | | | | 1,703,000 | | | | 5.40 | | | | 13.8 | | | | 21,040,395 | | | | 14,663,085 | |

| 19 | | FedEx Ground Package System, Inc. | | Olathe (Kansas City) | | KS | | | 2016 | | | | 100.0 | % | | | 313,763 | | | | 2,200,000 | | | | 7.01 | | | | 12.9 | | | | 31,737,000 | | | | 20,248,994 | |

| 20 | | FedEx Ground Package System, Inc. | | Davenport (Orlando) | | FL | | | 2016 | | | | 100.0 | % | | | 310,922 | | | | 2,609,000 | | | | 8.39 | | | | 12.8 | | | | 37,780,000 | | | | 24,051,619 | |

| 21 | | FedEx Ground Package System, Inc. | | Ft. Worth (Dallas) | | TX | | | 2015 | | | | 100.0 | % | | | 304,608 | | | | 2,373,000 | | | | 7.79 | | | | 11.8 | | | | 35,300,832 | | | | 21,099,018 | |

| 22 | | Science Applications International Corporation | | Hanahan (Charleston) | | SC | | | 2005 | | | | 100.0 | % | | | 302,400 | | | | 1,491,000 | | | | 4.93 | | | | 0.8 | | | | 13,390,441 | | | | -0- | |

| 23 | | Amazon.com Services, Inc. (Amazon.com, Inc.) | | Oklahoma City | | OK | | | 2018 | | | | 100.0 | % | | | 300,000 | | | | 1,884,000 | | | | 6.28 | | | | 9.3 | | | | 29,878,942 | | | | 19,210,841 | |

| 24 | | International Paper Company | | Kenton | | OH | | | 2017 | | | | 100.0 | % | | | 298,472 | | | | 1,244,000 | | | | 4.17 | | | | 9.2 | | | | 17,881,607 | | | | 11,619,141 | |

| 25 | | FedEx Ground Package System, Inc. | | Jacksonville | | FL | | | 2015 | | | | 100.0 | % | | | 297,579 | | | | 1,998,000 | | | | 6.71 | | | | 11.5 | | | | 30,732,090 | | | | 16,529,498 | |

| 26 | | Western Container Corp. (Coca-Cola) | | Tolleson (Phoenix) | | AZ | | | 2003 | | | | 100.0 | % | | | 283,358 | | | | 1,361,000 | | | | 4.80 | | | | 8.8 | | | | 16,824,226 | | | | 3,924,048 | |

| 27 | | International Paper Company | | Edwardsville (Kansas City) | | KS | | | 2014 | | | | 100.0 | % | | | 280,000 | | | | 1,348,000 | | | | 4.81 | | | | 5.2 | | | | 18,294,108 | | | | 9,377,234 | |

| 28 | | NF&M International, Inc. | | Monaca (Pittsburgh) | | PA | | | 1988 | | | | 68.4 | % | | | 255,658 | | | | 835,000 | | | | 4.78 | | | | 6.5 | | | | 7,910,666 | | | | -0- | |

| 29 | | FedEx Ground Package System, Inc. | | Orion | | MI | | | 2007 | | | | 100.0 | % | | | 245,633 | | | | 1,908,000 | | | | 7.77 | | | | 5.0 | | | | 22,885,635 | | | | -0- | |

| 30 | | FedEx Ground Package System, Inc. | | Homestead (Miami) | | FL | | | 2017 | | | | 100.0 | % | | | 237,756 | | | | 2,282,000 | | | | 9.60 | | | | 13.8 | | | | 37,873,120 | | | | 23,637,442 | |

| 31 | | Anda Pharmaceuticals, Inc. | | Olive Branch (Memphis, TN) | | MS | | | 2012 | | | | 100.0 | % | | | 234,660 | | | | 1,205,000 | | | | 5.14 | | | | 4.1 | | | | 14,550,000 | | | | 7,718,748 | |

| 32 | | UGN, Inc. | | Monroe (Cincinnati) | | OH | | | 2015 | | | | 100.0 | % | | | 232,200 | | | | 1,070,000 | | | | 4.61 | | | | 11.7 | | | | 13,424,564 | | | | 7,248,514 | |

| 33 | | FedEx Ground Package System, Inc. | | Colorado Springs | | CO | | | 2016 | | | | 100.0 | % | | | 225,362 | | | | 1,832,000 | | | | 8.13 | | | | 7.6 | | | | 29,320,066 | | | | 16,900,557 | |

| 34 | | Mickey Thompson Performance Tires and Wheels (Cooper Tire) | | Stow | | OH | | | 2017 | | | | 100.0 | % | | | 219,765 | | | | 1,501,000 | | | | 6.83 | | | | 9.2 | | | | 18,934,065 | | | | 12,287,866 | |

| 35 | | Rinnai America Corporation | | Griffin (Atlanta) | | GA | | | 2006 | | | | 100.0 | % | | | 218,120 | | | | 831,000 | | | | 3.81 | | | | 2.5 | | | | 14,933,683 | | | | -0- | |

| 36 | | FedEx Ground Package System, Inc. | | Ft. Myers | | FL | | | 2017 | | | | 100.0 | % | | | 213,672 | | | | 1,418,000 | | | | 6.64 | | | | 9.2 | | | | 21,663,635 | | | | 13,468,857 | |

| 37 | | FedEx Ground Package System, Inc. | | Burlington (Seattle/Everett) | | WA | | | 2016 | | | | 100.0 | % | | | 210,445 | | | | 1,962,000 | | | | 9.32 | | | | 12.2 | | | | 30,228,547 | | | | 18,031,513 | |

| 38 | | FedEx Ground Package System, Inc. | | Sauget (St. Louis, MO) | | IL | | | 2015 | | | | 100.0 | % | | | 198,773 | | | | 1,036,000 | | | | 5.21 | | | | 10.9 | | | | 15,204,950 | | | | 8,711,524 | |

| 39 | | Anheuser-Busch, Inc. | | Granite City (St. Louis, MO) | | IL | | | 2001 | | | | 100.0 | % | | | 184,800 | | | | 821,000 | | | | 4.44 | | | | 3.4 | | | | 12,697,848 | | | | -0- | |

| 40 | | Carrier Corporation (United Technologies) | | Carrollton (Dallas) | | TX | | | 2010 | | | | 100.0 | % | | | 184,317 | | | | 1,576,000 | | | | 8.55 | | | | 0.5 | | | | 17,819,203 | | | | 6,654,972 | |

| 41 | | FedEx Ground Package System, Inc. | | Spring (Houston) | | TX | | | 2014 | | | | 100.0 | % | | | 181,176 | | | | 1,581,000 | | | | 8.73 | | | | 6.3 | | | | 19,294,396 | | | | 8,080,427 | |

| 42 | | Carlisle Tire & Wheel Company | | Edwardsville (Kansas City) | | KS | | | 2003 | | | | 100.0 | % | | | 179,280 | | | | 739,000 | | | | 4.12 | | | | 5.1 | | | | 7,232,986 | | | | -0- | |

| 43 | | FedEx Ground Package System, Inc. | | Ft. Mill (Charlotte, NC) | | SC | | | 2010 | | | | 100.0 | % | | | 176,939 | | | | 1,415,000 | | | | 8.00 | | | | 5.3 | | | | 15,870,217 | | | | 884,380 | |

| 44 | | FedEx Ground Package System, Inc. | | Covington (New Orleans) | | LA | | | 2016 | | | | 100.0 | % | | | 175,315 | | | | 1,262,000 | | | | 7.20 | | | | 7.0 | | | | 18,410,000 | | | | 11,306,837 | |

| 45 | | FedEx Ground Package System, Inc. | | Livonia (Detroit) | | MI | | | 2013 | | | | 100.0 | % | | | 172,005 | | | | 1,194,000 | | | | 6.94 | | | | 3.8 | | | | 13,762,030 | | | | 6,451,553 | |

| 46 | | Home Depot USA, Inc. | | Montgomery (Chicago) | | IL | | | 2004 | | | | 100.0 | % | | | 171,200 | | | | 997,000 | | | | 5.82 | | | | 2.0 | | | | 11,298,367 | | | | -0- | |

| 47 | | FedEx Ground Package System, Inc. | | Tampa | | FL | | | 2004 | | | | 100.0 | % | | | 170,779 | | | | 1,624,000 | | | | 9.51 | | | | 8.1 | | | | 19,696,227 | | | | 5,340,301 | |

| 48 | | FedEx Ground Package System, Inc. | | Edinburg | | TX | | | 2011 | | | | 100.0 | % | | | 164,207 | | | | 1,097,000 | | | | 6.68 | | | | 8.3 | | | | 12,039,014 | | | | -0- | |

| 49 | | FedEx Ground Package System, Inc. | | Lindale (Tyler) | | TX | | | 2015 | | | | 100.0 | % | | | 163,378 | | | | 725,000 | | | | 4.44 | | | | 6.0 | | | | 9,965,550 | | | | 5,734,508 | |

| 50 | | Bunzl Distribution Midcentral, Inc. | | Kansas City | | MO | | | 2015 | | | | 100.0 | % | | | 158,417 | | | | 752,000 | | | | 4.75 | | | | 3.3 | | | | 9,968,451 | | | | 6,674,809 | |

| 51 | | FedEx Ground Package System, Inc. | | Oklahoma City | | OK | | | 2012 | | | | 100.0 | % | | | 158,340 | | | | 1,048,000 | | | | 6.62 | | | | 7.0 | | | | 12,584,462 | | | | 3,544,046 | |

| 52 | | FedEx Ground Package System, Inc. | | Waco | | TX | | | 2012 | | | | 100.0 | % | | | 150,710 | | | | 1,078,000 | | | | 7.15 | | | | 7.2 | | | | 12,551,368 | | | | 4,308,385 | |

| 53 | | FedEx Ground Package System, Inc. | | Beltsville (Washington, DC) | | MD | | | 2001 | | | | 100.0 | % | | | 148,881 | | | | 1,452,000 | | | | 9.75 | | | | 10.1 | | | | 14,512,355 | | | | -0- | |

| 54 | | Victory Packaging, L.P. | | Fayetteville | | NC | | | 1997 | | | | 100.0 | % | | | 148,000 | | | | 502,000 | | | | 3.39 | | | | 2.7 | | | | 5,451,629 | | | | -0- | |

| 55 | | FedEx Ground Package System, Inc. | | El Paso | | TX | | | 2006 | | | | 100.0 | % | | | 144,149 | | | | 1,345,000 | | | | 9.33 | | | | 5.3 | | | | 12,431,192 | | | | -0- | |

| 56 | | FedEx Ground Package System, Inc. | | Cocoa | | FL | | | 2008 | | | | 100.0 | % | | | 144,138 | | | | 1,112,000 | | | | 7.71 | | | | 6.3 | | | | 14,127,449 | | | | -0- | |

| 57 | | FedEx Ground Package System, Inc. | | Cudahy (Milwaukee) | | WI | | | 2001 | | | | 100.0 | % | | | 139,564 | | | | 827,000 | | | | 5.93 | | | | 9.0 | | | | 9,382,361 | | | | -0- | |

| 58 | | Challenger Lifts, Inc. (Snap-On Inc.) | | Louisville | | KY | | | 2016 | | | | 100.0 | % | | | 137,500 | | | | 838,000 | | | | 6.09 | | | | 7.9 | | | | 11,304,000 | | | | 6,623,752 | |

59 | | FedEx Ground Package System, Inc. | | Richfield (Cleveland) | | OH | | | 2006 | | | | 100.0 | % | | | 131,152 | | | | 1,493,000 | | | | 11.38 | | | | 6.3 | | | | 16,435,478 | | | | -0- | |

| | Third Quarter FY 2018 Supplemental of Monmouth Real Estate Investment Corp. Page 18 of 24 |

Property Table

(unaudited)

| | | | | | | | | | | | | | | | | | | Rent | | | Lease Exp. | | | | | | | |

| | | | | | | | | Fiscal Year | | | | | | Square | | | Annual | | | Per sf | | | Term in | | | Undepreciated | | | Mortgage | |

| No | | Tenant | | City (MSA) | | State | | Acquisition | | | Occup. | | | Footage | | | Rent | | | Occup. | | | Years | | | Cost | | | Balance | |

| 60 | | General Electric Company | | Imperial (Pittsburgh) | | PA | | | 2016 | | | | 100.0 | % | | | 125,860 | | | $ | 1,321,000 | | | $ | 10.50 | | | | 7.5 | | | $ | 19,950,000 | | | $ | 11,393,300 | |

| 61 | | FedEx Ground Package System, Inc. | | Wheeling (Chicago) | | IL | | | 2003 | | | | 100.0 | % | | | 123,000 | | | | 1,272,000 | | | | 10.34 | | | | 8.9 | | | | 18,537,652 | | | | -0- | |

| 62 | | FedEx Ground Package System, Inc. | | Altoona | | PA | | | 2014 | | | | 100.0 | % | | | 122,522 | | | | 651,000 | | | | 5.31 | | | | 5.2 | | | | 9,008,650 | | | | 3,352,134 | |

| 63 | | FedEx Corporation | | Charleston | | SC | | | 2018 | | | | 100.0 | % | | | 121,683 | | | | 1,315,000 | | | | 10.81 | | | | 14.2 | | | | 21,519,412 | | | | 13,857,243 | |

| 64 | | FedEx Corporation | | Mechanicsville (Richmond) | | VA | | | 2001 | | | | 100.0 | % | | | 112,799 | | | | 541,000 | | | | 4.80 | | | | 4.8 | | | | 7,792,395 | | | | -0- | |

| 65 | | FedEx Corporation | | Orlando | | FL | | | 2008 | | | | 100.0 | % | | | 110,638 | | | | 666,000 | | | | 6.02 | | | | 9.4 | | | | 8,714,362 | | | | 3,905,290 | |

| 66 | | Bunzl Distribution Oklahoma, Inc. | | Oklahoma City | | OK | | | 2017 | | | | 100.0 | % | | | 110,361 | | | | 722,000 | | | | 6.54 | | | | 6.2 | | | | 8,728,439 | | | | 5,638,847 | |

| 67 | | Style Crest, Inc. | | Winston-Salem | | NC | | | 2002 | | | | 100.0 | % | | | 106,507 | | | | 387,000 | | | | 3.63 | | | | 2.8 | | | | 7,238,613 | | | | -0- | |

| 68 | | FedEx Ground Package System, Inc. | | Cheektowaga (Buffalo) | | NY | | | 2000 | | | | 100.0 | % | | | 104,981 | | | | 966,000 | | | | 9.20 | | | | 1.2 | | | | 10,960,823 | | | | -0- | |

| 69 | | FedEx Ground Package System, Inc. | | West Chester Twp. (Cincinnati) | | OH | | | 1999 | | | | 100.0 | % | | | 103,818 | | | | 543,000 | | | | 5.23 | | | | 5.2 | | | | 5,733,686 | | | | -0- | |

| 70 | | FedEx Ground Package System, Inc. | | Roanoke | | VA | | | 2013 | | | | 100.0 | % | | | 103,402 | | | | 755,000 | | | | 7.30 | | | | 4.8 | | | | 10,200,000 | | | | 4,514,935 | |

| 71 | | Pittsburgh Glass Works, LLC | | O’ Fallon (St. Louis) | | MO | | | 1994 | | | | 100.0 | % | | | 102,135 | | | | 442,000 | | | | 4.33 | | | | 3.0 | | | | 4,245,913 | | | | -0- | |

| 72 | | FedEx Ground Package System, Inc. | | Green Bay | | WI | | | 2013 | | | | 100.0 | % | | | 99,102 | | | | 468,000 | | | | 4.72 | | | | 4.9 | | | | 6,570,000 | | | | 2,720,662 | |

| 73 | | Holland 1916 Inc. | | Liberty (Kansas City) | | MO | | | 1998 | | | | 100.0 | % | | | 95,898 | | | | 349,000 | | | | 3.64 | | | | 1.0 | | | | 7,397,881 | | | | -0- | |

| 74 | | FedEx Corporation | | Jacksonville | | FL | | | 1999 | | | | 100.0 | % | | | 95,883 | | | | 533,000 | | | | 5.56 | | | | 10.9 | | | | 6,383,328 | | | | -0- | |

| 75 | | FedEx Corporation | | Tampa | | FL | | | 2006 | | | | 100.0 | % | | | 95,662 | | | | 603,000 | | | | 6.30 | | | | 9.4 | | | | 7,682,572 | | | | -0- | |

| 76 | | FedEx Ground Package System, Inc. | | Hanahan (Charleston) | | SC | | | 2005 | | | | 100.0 | % | | | 91,776 | | | | 675,000 | | | | 7.35 | | | | 0.4 | | | | 7,614,653 | | | | 544,221 | |

| 77 | | National Oilwell Varco, Inc. | | Houston | | TX | | | 2010 | | | | 100.0 | % | | | 91,295 | | | | 754,000 | | | | 8.26 | | | | 4.3 | | | | 8,163,278 | | | | 2,269,158 | |

| 78 | | FedEx Corporation | | Omaha | | NE | | | 1999 | | | | 100.0 | % | | | 89,115 | | | | 446,000 | | | | 5.00 | | | | 5.3 | | | | 5,944,691 | | | | -0- | |

| 79 | | Joseph T. Ryerson and Son, Inc. | | Elgin (Chicago) | | IL | | | 2002 | | | | 100.0 | % | | | 89,052 | | | | 506,000 | | | | 5.68 | | | | 1.6 | | | | 6,977,442 | | | | -0- | |

| 80 | | FedEx Ground Package System, Inc. | | Huntsville | | AL | | | 2005 | | | | 100.0 | % | | | 88,653 | | | | 605,000 | | | | 6.82 | | | | 8.1 | | | | 6,661,819 | | | | 426,573 | |

| 81 | | CHEP USA, Inc. | | Roanoke | | VA | | | 2007 | | | | 100.0 | % | | | 83,000 | | | | 500,000 | | | | 6.02 | | | | 6.7 | | | | 7,463,672 | | | | -0- | |

| 82 | | FedEx Corporation | | Bedford Heights (Cleveland) | | OH | | | 2007 | | | | 100.0 | % | | | 82,269 | | | | 408,000 | | | | 4.96 | | | | 0.2 | | | | 6,919,836 | | | | -0- | |

| 83 | | RGH Enterprises, Inc. (Cardinal Health) | | Halfmoon (Albany) | | NY | | | 2012 | | | | 100.0 | % | | | 75,000 | | | | 607,000 | | | | 8.09 | | | | 3.4 | | | | 5,525,600 | | | | -0- | |

| 84 | | FedEx Corporation | | Schaumburg (Chicago) | | IL | | | 1997 | | | | 100.0 | % | | | 73,500 | | | | 478,000 | | | | 6.50 | | | | 8.8 | | | | 5,177,940 | | | | -0- | |

| 85 | | FedEx Corporation | | Romulus (Detroit) | | MI | | | 1998 | | | | 100.0 | % | | | 71,933 | | | | 370,000 | | | | 5.14 | | | | 2.9 | | | | 4,673,856 | | | | -0- | |

| 86 | | FedEx Ground Package System, Inc. | | Denver | | CO | | | 2005 | | | | 100.0 | % | | | 69,865 | | | | 605,000 | | | | 8.66 | | | | 7.3 | | | | 6,354,051 | | | | 499,088 | |

| 87 | | Tampa Bay Grand Prix | | Tampa | | FL | | | 2005 | | | | 100.0 | % | | | 68,385 | | | | 297,000 | | | | 4.34 | | | | 2.3 | | | | 5,677,982 | | | | -0- | |

| 88 | | Sherwin-Williams Company | | Rockford | | IL | | | 2011 | | | | 100.0 | % | | | 66,387 | | | | 481,000 | | | | 7.25 | | | | 5.5 | | | | 5,551,227 | | | | -0- | |

| 89 | | Various Tenants at Retail Shopping Center | | Somerset | | NJ | | | 1970 | | | | 100.0 | % | | | 64,220 | | | | 807,000 | | | | 12.57 | | | | na | | | | 3,072,882 | | | | -0- | |

| 90 | | The American Bottling Company (Dr Pepper Snapple) | | Cincinnati | | OH | | | 2015 | | | | 100.0 | % | | | 63,840 | | | | 481,000 | | | | 7.53 | | | | 11.3 | | | | 6,750,000 | | | | -0- | |

| 91 | | FedEx Corporation | | Chattanooga | | TN | | | 2007 | | | | 100.0 | % | | | 60,637 | | | | 319,000 | | | | 5.26 | | | | 4.3 | | | | 5,016,518 | | | | -0- | |

| 92 | | SOFIVE, Inc. | | Carlstadt (New York, NY) | | NJ | | | 2001 | | | | 100.0 | % | | | 60,400 | | | | 558,000 | | | | 9.24 | | | | 6.6 | | | | 4,929,210 | | | | 1,621,778 | |

| 93 | | FedEx Ground Package System, Inc. | | Stewartville (Rochester) | | MN | | | 2013 | | | | 100.0 | % | | | 60,398 | | | | 372,000 | | | | 6.16 | | | | 4.9 | | | | 5,220,000 | | | | 2,180,257 | |

| 94 | | Carrier Enterprise, LLC (United Technologies) | | Richmond | | VA | | | 2004 | | | | 100.0 | % | | | 60,000 | | | | 324,000 | | | | 5.40 | | | | 0.4 | | | | 4,768,309 | | | | -0- | |

| 95 | | FedEx Ground Package System, Inc. | | Augusta | | GA | | | 2005 | | | | 100.0 | % | | | 59,358 | | | | 501,000 | | | | 8.44 | | | | 3.0 | | | | 5,363,305 | | | | 395,869 | |

| 96 | | Kellogg Sales Company | | Newington (Hartford) | | CT | | | 2001 | | | | 100.0 | % | | | 54,812 | | | | 329,000 | | | | 6.00 | | | | 1.7 | | | | 3,494,108 | | | | -0- | |

| 97 | | Siemens Real Estate | | Lebanon (Cincinnati) | | OH | | | 2012 | | | | 100.0 | % | | | 51,130 | | | | 485,000 | | | | 9.49 | | | | 0.8 | | | | 4,452,425 | | | | -0- | |

| 98 | | FedEx Corporation | | Charlottesville | | VA | | | 1999 | | | | 100.0 | % | | | 48,064 | | | | 329,000 | | | | 6.85 | | | | 9.2 | | | | 4,438,828 | | | | -0- | |

| 99 | | FedEx Ground Package System, Inc. | | Corpus Christi | | TX | | | 2012 | | | | 100.0 | % | | | 46,253 | | | | 436,000 | | | | 9.43 | | | | 3.2 | | | | 4,808,329 | | | | -0- | |