Exhibit 99

Table of Contents

The statement of operations and supplemental statement of operations provided in this supplemental information package present funds from operations (FFO), adjusted funds from operations (AFFO), net operating income (NOI) and adjusted EBITDA, which are REIT industry financial measures that are not calculated in accordance with accounting principles generally accepted in the United States. Please see page 21 for a definition of these supplemental performance measures. Please see the supplemental statement of operations reconciliation for a reconciliation of certain captions in the supplemental statement of operations reported in this supplemental information package to the statement of operations as reported in the Company’s filings with the SEC on Form 10-Q.

Consolidated Balance Sheets

(in thousands except for per share amounts)

| | | As of | | | As of | |

| | | June 30, | | | September 30, | |

| | | 2021 | | | 2020 | |

| | (unaudited) | | | | |

| ASSETS | | | | | | |

| | | | | | | |

| Real Estate Investments: | | | | | | | | |

| Land | | $ | 266,791 | | | $ | 250,497 | |

| Buildings and Improvements | | | 1,942,840 | | | | 1,793,367 | |

| Total Real Estate Investments | | | 2,209,631 | | | | 2,043,864 | |

| Accumulated Depreciation | | | (332,725 | ) | | | (296,020 | ) |

| Real Estate Investments | | | 1,876,906 | | | | 1,747,844 | |

| | | | | | | | | |

| Cash and Cash Equivalents | | | 90,896 | | | | 23,517 | |

| Securities Available for Sale at Fair Value | | | 148,382 | | | | 108,832 | |

| Tenant and Other Receivables | | | 3,201 | | | | 5,431 | |

| Deferred Rent Receivable | | | 15,066 | | | | 12,856 | |

| Prepaid Expenses | | | 9,191 | | | | 7,554 | |

| Intangible Assets, net of Accumulated Amortization of $19,061 and $17,330, respectively | | | 19,939 | | | | 16,832 | |

| Capitalized Lease Costs, net of Accumulated Amortization of $4,614 and $4,286, respectively | | | 5,817 | | | | 5,631 | |

| Financing Costs, net of Accumulated Amortization of $648 and $356, respectively | | | 1,088 | | | | 1,380 | |

| Other Assets | | | 7,592 | | | | 9,906 | |

| TOTAL ASSETS | | $ | 2,178,078 | | | $ | 1,939,783 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Fixed Rate Mortgage Notes Payable, net of Unamortized Debt | | | | | | | | |

| Issuance Costs | | $ | 848,994 | | | $ | 799,507 | |

| Loans Payable | | | 165,000 | | | | 75,000 | |

| Accounts Payable and Accrued Expenses | | | 5,532 | | | | 3,998 | |

| Other Liabilities | | | 22,705 | | | | 23,673 | |

| Total Liabilities | | | 1,042,231 | | | | 902,178 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | | | | | | | | |

| Shareholders’ Equity: | | | | | | | | |

| 6.125% Series C Cumulative Redeemable Preferred Stock, $0.01 Par Value Per Share: 26,600 and 21,900 Shares Authorized as of June 30, 2021 and September 30, 2020, respectively; 21,986 and 18,880 Shares Issued and Outstanding as of June 30, 2021 and September 30, 2020, respectively | | | 549,640 | | | | 471,994 | |

| Common Stock, $0.01 Par Value Per Share: 300,000 and 200,000 Shares Authorized as of June 30, 2021 and September 30, 2020, respectively; 98,302 and 98,054 Shares Issued and Outstanding as of June 30, 2021 and September 30, 2020, respectively | | | 983 | | | | 981 | |

| Excess Stock, $0.01 Par Value Per Share: 200,000 Shares Authorized as of June 30, 2021 and September 30, 2020; No Shares Issued or Outstanding as of June 30, 2021 and September 30, 2020 | | | -0- | | | | -0- | |

| Additional Paid-In Capital | | | 587,730 | | | | 568,998 | |

| Accumulated Other Comprehensive Loss | | | (2,506 | ) | | | (4,368 | ) |

| Undistributed Income | | | -0- | | | | -0- | |

| Total Shareholders’ Equity | | | 1,135,847 | | | | 1,037,605 | |

| TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY | | $ | 2,178,078 | | | $ | 1,939,783 | |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 3 |

Consolidated Statements of Income (Loss)

(unaudited) (in thousands)

| | | For The | | | For The | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | 6/30/2021 | | | 6/30/2020 | | | 6/30/2021 | | | 6/30/2020 | |

| INCOME: | | | | | | | | | | | | | | | | |

| Rental Revenue | | $ | 39,032 | | | $ | 35,427 | | | $ | 115,123 | | | $ | 105,410 | |

| Reimbursement Revenue | | | 6,962 | | | | 6,348 | | | | 20,818 | | | | 19,772 | |

| Lease Termination Income | | | -0- | | | | -0- | | | | 377 | | | | -0- | |

| TOTAL INCOME | | | 45,994 | | | | 41,775 | | | | 136,318 | | | | 125,182 | |

| | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | |

| Real Estate Taxes | | | 5,402 | | | | 5,140 | | | | 16,324 | | | | 15,205 | |

| Operating Expenses | | | 1,688 | | | | 1,590 | | | | 5,361 | | | | 5,344 | |

| General & Administrative Expenses | | | 2,246 | | | | 2,198 | | | | 6,363 | | | | 6,858 | |

| Non-recurring Strategic Alternatives & Proxy Costs | | | 8,657 | | | | -0- | | | | 10,896 | | | | -0- | |

| Non-recurring Severance Expense | | | -0- | | | | -0- | | | | -0- | | | | 786 | |

| Depreciation | | | 13,016 | | | | 11,743 | | | | 38,158 | | | | 34,650 | |

| Amortization of Capitalized Lease Costs and Intangible Assets | | | 1,031 | | | | 788 | | | | 2,718 | | | | 2,308 | |

| TOTAL EXPENSES | | | 32,040 | | | | 21,459 | | | | 79,820 | | | | 65,151 | |

| | | | | | | | | | | | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | | | | | | | | | |

| Dividend Income | | | 1,486 | | | | 2,344 | | | | 4,681 | | | | 8,987 | |

| Realized Gain On Sale of Real Estate Investment | | | 6,376 | | | | -0- | | | | 6,376 | | | | -0- | |

| Realized Gain On Sale of Securities Transactions | | | -0- | | | | -0- | | | | 2,248 | | | | -0- | |

| Unrealized Holding Gains (Losses) Arising During the Periods | | | 16,471 | | | | 19,610 | | | | 55,377 | | | | (67,100 | ) |

| Interest Expense, including Amortization of Financing Costs | | | (9,685 | ) | | | (8,975 | ) | | | (28,231 | ) | | | (27,235 | ) |

| TOTAL OTHER INCOME (EXPENSE) | | | 14,648 | | | | 12,979 | | | | 40,451 | | | | (85,348 | ) |

| | | | | | | | | | | | | | | | | |

| NET INCOME (LOSS) | | | 28,602 | | | | 33,295 | | | | 96,949 | | | | (25,317 | ) |

| Less: Net Income (Loss) Attributable to Non-Controlling Interest | | | 2,894 | | | | (163 | ) | | | 2,996 | | | | (86 | ) |

| | | | | | | | | | | | | | | | | |

| NET INCOME (LOSS) ATTRIBUTABLE TO SHAREHOLDERS | | | 25,708 | | | | 33,458 | | | | 93,953 | | | | (25,231 | ) |

| Less: Preferred Dividends | | | 8,416 | | | | 6,607 | | | | 25,003 | | | | 19,469 | |

| | | | | | | | | | | | | | | | | |

| NET INCOME (LOSS) ATTRIBUTABLE TO COMMON SHAREHOLDERS | | $ | 17,292 | | | $ | 26,851 | | | $ | 68,950 | | | $ | (44,700 | ) |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 4 |

FFO, AFFO and Adjusted EBITDA Reconciliations

(unaudited) (in thousands)

| | | For The | | | For The | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | 6/30/2021 | | | 6/30/2020 | | | 6/30/2021 | | | 6/30/2020 | |

| FFO, AFFO | | | | | | | | | | | | | | | | |

| Net Income (Loss) Attributable to Common Shareholders | | $ | 17,292 | | | $ | 26,851 | | | $ | 68,950 | | | $ | (44,700 | ) |

| Less/Plus: Unrealized Holding (Gains) Losses Arising During the Periods | | | (16,471 | ) | | | (19,610 | ) | | | (55,377 | ) | | | 67,100 | |

| Plus: Depreciation Expense (excluding Corporate Office Capitalized Costs) | | | 12,960 | | | | 11,672 | | | | 37,959 | | | | 34,436 | |

| Plus: Amortization of Intangible Assets | | | 599 | | | | 524 | | | | 1,731 | | | | 1,539 | |

| Plus: Amortization of Capitalized Lease Costs | | | 374 | | | | 284 | | | | 971 | | | | 830 | |

| Less: Realized Gain on Sale of Real Estate Investment (A) | | | (3,252 | ) | | | -0- | | | | (3,252 | ) | | | -0- | |

| FFO Attributable to Common Shareholders (B) | | | 11,502 | | | | 19,721 | | | | 50,982 | | | | 59,205 | |

| Plus: Depreciation of Corporate Office Capitalized Costs | | | 57 | | | | 57 | | | | 172 | | | | 176 | |

| Plus: Stock Compensation Expense | | | 77 | | | | 98 | | | | 210 | | | | 368 | |

| Plus: Amortization of Financing Costs | | | 350 | | | | 326 | | | | 1,026 | | | | 1,082 | |

| Plus: Non-recurring Strategic Alternatives & Proxy Costs | | | 8,657 | | | | -0- | | | | 10,896 | | | | -0- | |

| Plus: Non-recurring Severance Expense | | | -0- | | | | -0- | | | | -0- | | | | 786 | |

| Less: Realized Gain on Sale of Securities Transactions | | | -0- | | | | -0- | | | | (2,248 | ) | | | -0- | |

| Less: Lease Termination Income | | | -0- | | | | -0- | | | | (377 | ) | | | -0- | |

| Less: Recurring Capital Expenditures | | | (229 | ) | | | (508 | ) | | | (791 | ) | | | (1,443 | ) |

| Less: Effect of Non-cash U.S. GAAP Straight-line Rent Adjustment | | | (713 | ) | | | (231 | ) | | | (2,363 | ) | | | (1,469 | ) |

| AFFO Attributable to Common Shareholders | | $ | 19,701 | | | $ | 19,463 | | | $ | 57,507 | | | $ | 58,705 | |

| | | For The | | | For The | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | 6/30/2021 | | | 6/30/2020 | | | 6/30/2021 | | | 6/30/2020 | |

| Adjusted EBITDA | | | | | | | | | | | | | | | | |

| Net Income (Loss) Attributable to Common Shareholders | | $ | 17,292 | | | $ | 26,851 | | | $ | 68,950 | | | $ | (44,700 | ) |

| Plus: Preferred Dividends | | | 8,416 | | | | 6,607 | | | | 25,003 | | | | 19,469 | |

| Plus: Interest Expense, including Amortization of Financing Costs | | | 9,685 | | | | 8,975 | | | | 28,231 | | | | 27,235 | |

| Plus: Depreciation and Amortization | | | 14,047 | | | | 12,531 | | | | 40,876 | | | | 36,958 | |

| Plus: Net Amortization of Acquired Above and Below Market Lease Revenue | | | 26 | | | | 26 | | | | 77 | | | | 77 | |

| Plus: Non-recurring Strategic Alternatives & Proxy Costs | | | 8,657 | | | | -0- | | | | 10,896 | | | | -0- | |

| Less/Plus: Unrealized Holding (Gains) Losses Arising During the Periods | | | (16,471 | ) | | | (19,610 | ) | | | (55,377 | ) | | | 67,100 | |

| Less: Realized Gain on Sale of Real Estate Investment (A) | | | (3,252 | ) | | | -0- | | | | (3,252 | ) | | | -0- | |

| Less: Gain on Sale of Securities Transactions | | | -0- | | | | -0- | | | | (2,248 | ) | | | -0- | |

| Adjusted EBITDA | | $ | 38,400 | | | $ | 35,380 | | | $ | 113,156 | | | $ | 106,139 | |

| (A) | Represents our portion of the net realized gain from the sale of our property that we owned a 51% interest in. |

| (B) | FFO Attributable to Common Shareholders for the three and nine months ended June 30, 2021 includes Non-recurring Strategic Alternatives & Proxy Costs of $8.7 million and $10.9 million, respectively. FFO Attributable to Common Shareholders for the three and nine months ended June 30, 2021 excluding these Non-recurring Strategic Alternatives & Proxy Costs is $20.2 million and $61.9 million, respectively. |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 5 |

NOI Reconciliations

(unaudited) (in thousands)

| | | For The | | | For The | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | 6/30/2021 | | | 6/30/2020 | | | 6/30/2021 | | | 6/30/2020 | |

| Net Operating Income | | | | | | | | | | | | | | | | |

| Net Income (Loss) Attributable to Common Shareholders | | $ | 17,292 | | | $ | 26,851 | | | $ | 68,950 | | | $ | (44,700 | ) |

| Plus: Net Income (Loss) Attributable to Non-Controlling Interest | | | 2,894 | | | | (163 | ) | | | 2,996 | | | | (86 | ) |

| Plus: Preferred Dividend Expense | | | 8,416 | | | | 6,607 | | | | 25,003 | | | | 19,469 | |

| Plus: General & Administrative Expenses | | | 2,246 | | | | 2,198 | | | | 6,363 | | | | 6,858 | |

| Plus: Non-recurring Strategic Alternative & Proxy Costs | | | 8,657 | | | | -0- | | | | 10,896 | | | | -0- | |

| Plus: Non-recurring Severance Expense | | | -0- | | | | -0- | | | | -0- | | | | 786 | |

| Plus: Depreciation | | | 13,016 | | | | 11,743 | | | | 38,158 | | | | 34,650 | |

| Plus: Amortization of Capitalized Lease Costs and Intangible Assets | | | 1,031 | | | | 788 | | | | 2,718 | | | | 2,308 | |

| Plus: Interest Expense, including Amortization of Financing Costs | | | 9,685 | | | | 8,975 | | | | 28,231 | | | | 27,235 | |

| Less/Plus: Unrealized Holding (Gains) Losses Arising During the Periods | | | (16,471 | ) | | | (19,610 | ) | | | (55,377 | ) | | | 67,100 | |

| Less: Dividend Income | | | (1,486 | ) | | | (2,344 | ) | | | (4,681 | ) | | | (8,987 | ) |

| Less: Realized Gain on Sale of Securities Transactions | | | -0- | | | | -0- | | | | (2,248 | ) | | | -0- | |

| Less: Realized Gain on Sale of Real Estate Investment | | | (6,376 | ) | | | -0- | | | | (6,376 | ) | | | -0- | |

| Less: Lease Termination Income | | | -0- | | | | -0- | | | | (377 | ) | | | -0- | |

| Net Operating Income – NOI | | $ | 38,904 | | | $ | 35,045 | | | $ | 114,256 | | | $ | 104,633 | |

| | | For The | | | For The | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | 6/30/2021 | | | 6/30/2020 | | | 6/30/2021 | | | 6/30/2020 | |

| Components of Net Operating Income Consists of: | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | |

| Rental Revenue | | $ | 39,032 | | | | 35,427 | | | $ | 115,123 | | | $ | 105,410 | |

| Reimbursement Revenue | | | 6,962 | | | | 6,348 | | | | 20,818 | | | | 19,772 | |

| Total Rental and Reimbursement Revenue | | | 45,994 | | | | 41,775 | | | | 135,941 | | | | 125,182 | |

| | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | |

| Real Estate Taxes | | | 5,402 | | | | 5,140 | | | | 16,324 | | | | 15,205 | |

| Operating Expenses | | | 1,688 | | | | 1,590 | | | | 5,361 | | | | 5,344 | |

| Total Real Estate Taxes and Operating Expenses | | | 7,090 | | | | 6,730 | | | | 21,685 | | | | 20,549 | |

| Net Operating Income – NOI | | $ | 38,904 | | | $ | 35,045 | | | $ | 114,256 | | | $ | 104,633 | |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 6 |

Financial Highlights

(unaudited) (in thousands except for per share amounts)

| | | For The | | | For The | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | 6/30/2021 | | | 6/30/2020 | | | Change (%) | | | 6/30/2021 | | | 6/30/2020 | | | Change (%) | |

| | | | | | | | | | | | | | | | | | | |

| Weighted Average Common Shares Outstanding | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 98,302 | | | | 97,906 | | | | 0.4 | % | | | 98,234 | | | | 97,548 | | | | 0.7 | % |

| Diluted | | | 98,539 | | | | 97,962 | | | | 0.6 | % | | | 98,415 | | | | 97,626 | | | | 0.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income (Loss) Attributable to Common Shareholders | | $ | 17,292 | | | $ | 26,851 | | | | (35.6 | )% | | $ | 68,950 | | | $ | (44,700 | ) | | | 254.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.17 | | | $ | 0.27 | | | | (37.0 | )% | | $ | 0.71 | | | $ | (0.46 | ) | | | 254.3 | % |

| Diluted | | | 0.17 | | | | 0.27 | | | | (37.0 | )% | | | 0.71 | | | | (0.46 | ) | | | 254.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Operating Income – NOI | | $ | 38,904 | | | $ | 35,045 | | | | 11.0 | % | | $ | 114,256 | | | $ | 104,633 | | | | 9.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.40 | | | $ | 0.36 | | | | 11.1 | % | | $ | 1.16 | | | $ | 1.07 | | | | 8.4 | % |

| Diluted | | | 0.39 | | | | 0.36 | | | | 8.3 | % | | | 1.16 | | | | 1.07 | | | | 8.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Funds From Operations – FFO | | $ | 11,502 | | | $ | 19,721 | | | | (41.7 | )% | | $ | 50,982 | | | $ | 59,205 | | | | (13.9 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.12 | | | $ | 0.20 | | | | (40.0 | )% | | $ | 0.52 | | | $ | 0.61 | | | | (14.8 | )% |

| Diluted | | | 0.12 | | | | 0.20 | | | | (40.0 | )% | | | 0.52 | | | | 0.61 | | | | (14.8 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| FFO Excluding Non-recurring Strategic Alternatives & Proxy Costs | | $ | 20,159 | | | $ | 19,721 | | | | 2.2 | % | | $ | 61,878 | | | $ | 59,205 | | | | 4.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.21 | | | $ | 0.20 | | | | 0.5 | % | | $ | 0.63 | | | $ | 0.61 | | | | 3.2 | % |

| Diluted | | | 0.20 | | | | 0.20 | | | | 0.0 | % | | | 0.63 | | | | 0.61 | | | | 3.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Funds From Operations – AFFO | | $ | 19,701 | | | $ | 19,463 | | | | 1.2 | % | | $ | 57,507 | | | $ | 58,705 | | | | (2.0 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.20 | | | $ | 0.20 | | | | 0.0 | % | | $ | 0.59 | | | $ | 0.60 | | | | (1.7 | )% |

| Diluted | | | 0.20 | | | | 0.20 | | | | 0.0 | % | | | 0.58 | | | | 0.60 | | | | (3.3 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends Declared per Common Share | | $ | 0.18 | | | $ | 0.17 | | | | | | | $ | 0.53 | | | $ | 0.51 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividend/FFO Excluding Non-recurring Strategic Alternatives & Proxy Costs | | | 90.0 | % | | | 85.0 | % | | | | | | | 84.1 | % | | | 83.6 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividend/AFFO Payout Ratio | | | 90.0 | % | | | 85.0 | % | | | | | | | 91.4 | % | | | 85.0 | % | | | | |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 7 |

Same Property Statistics

(unaudited) (in thousands except for square feet)

| | | For The Three Months Ended | | | | | | | |

| | | 6/30/2021 | | | | | | 6/30/2020 | | | Change | | | Change % | |

| | | | | | | | | | | | | | | | |

| Total Square Feet / Total Properties | | | 24,521,727 / 120 | | | | | | | | 23,375,642 / 118 | | | | 1,146,085 | | | | 4.9 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Occupancy Percentage at End of Period | | | 99.7 | % | | | | | | | 99.4 | % | | | 30 bps | | | | 0.3 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Square Feet / Number of Same Properties | | | | | | | 22,498,383 / 113 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Occupancy Percentage at End of Period | | | 99.6 | % | | | | | | | 99.4 | % | | | 20 bps | | | | 0.2 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Net Operating Income (NOI) (GAAP) | | $ | 34,550 | | | | | | | $ | 34,207 | | | $ | 343 | | | | 1.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Reversal of Effect of Non-cash U.S. GAAP Straight-line Rent Adjustment | | | (556 | ) | | | | | | | (586 | ) | | | 30 | | | | | |

| Same Property Cash NOI | | $ | 33,994 | | | | | | | $ | 33,621 | | | $ | 373 | | | | 1.1 | % |

Same Property Statistics include all properties owned during the entire periods presented with the exclusion of properties expanded during the periods presented.

Reconciliation of Same Property NOI to Total NOI

(unaudited) (in thousands)

| | | For The Three Months Ended | | | | | | | |

| | | 6/30/2021 | | | 6/30/2020 | | | Change | | | Change % | |

| | | | | | | | | | | | | |

| Same Property NOI (GAAP) | | $ | 34,550 | | | $ | 34,207 | | | $ | 343 | | | | 1.0 | % |

| | | | | | | | | | | | | | | | | |

| NOI of properties purchased subsequent to March 31, 2020 (two properties purchased during fiscal 2021 and three properties purchased during fiscal 2020) | | | 3,680 | | | | 426 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| NOI of property expanded subsequent to March 31, 2020 (two properties expanded during fiscal 2021) | | | 804 | | | | 688 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| NOI of property sold subsequent to March 31, 2020 (one property sold during fiscal 2021) | | | (130 | ) | | | (276 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total NOI | | $ | 38,904 | | | $ | 35,045 | | | $ | 3,859 | | | | 11.0 | % |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 8 |

Same Property Statistics

(unaudited) (in thousands except for square feet)

| | | For The Nine Months Ended | | | | | | | |

| | | 6/30/2021 | | | | | | 6/30/2020 | | | Change | | | Change % | |

| | | | | | | | | | | | | | | | |

| Total Square Feet / Total Properties | | | 24,521,727 / 120 | | | | | | | | 23,375,642 / 118 | | | | 1,146,085 | | | | 4.9 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Occupancy Percentage at End of Period | | | 99.7 | % | | | | | | | 99.4 | % | | | 30 bps | | | | 0.3 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Square Feet / Number of Same Properties | | | | | | | 21,729,641 / 111 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Occupancy Percentage at End of Period | | | 99.6 | % | | | | | | | 99.4 | % | | | 20 bps | | | | 0.2 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Same Property Net Operating Income (NOI) (GAAP) | | $ | 98,280 | | | | | | | $ | 98,179 | | | $ | 101 | | | | 0.1 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Reversal of Effect of Non-cash U.S. GAAP Straight-line Rent Adjustment | | | (1,195 | ) | | | | | | | (1,499 | ) | | | 304 | | | | | |

| Same Property Cash NOI | | $ | 97,085 | | | | | | | $ | 96,680 | | | $ | 405 | | | | 0.4 | % |

Same Property Statistics include all properties owned during the entire periods presented with the exclusion of properties expanded during the periods presented.

Reconciliation of Same Property NOI to Total NOI

(unaudited) (in thousands)

| | | For The Nine Months Ended | | | | | | | |

| | | 6/30/2021 | | | 6/30/2020 | | | Change | | | Change % | |

| | | | | | | | | | | | | |

| Same Property NOI (GAAP) | | $ | 98,280 | | | $ | 98,179 | | | $ | 101 | | | | 0.1 | % |

| | | | | | | | | | | | | | | | | |

NOI of properties purchased subsequent to September 30, 2019 (two properties purchased during fiscal 2021 and five properties purchased during fiscal 2020)

| | | 13,551 | | | | 4,393 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| NOI of properties expanded subsequent to September 30, 2019 (two properties expanded during fiscal 2021) | | | 2,238 | | | | 2,066 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| NOI of property sold subsequent to September 30, 2019 (one property sold during fiscal 2021) | | | 187 | | | | (5 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total NOI | | $ | 114,256 | | | $ | 104,633 | | | $ | 9,623 | | | | 9.2 | % |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 9 |

Consolidated Statements of Cash Flows

(unaudited)(in thousands)

| | | For The | |

| | | Nine Months Ended | |

| | | 6/30/2021 | | | 6/30/2020 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

| Net Income (Loss) | | $ | 96,949 | | | $ | (25,317 | ) |

| Noncash Items Included in Net Income (Loss): | | | | | | | | |

| Depreciation & Amortization | | | 41,919 | | | | 38,043 | |

| Deferred Straight Line Rent | | | (2,378 | ) | | | (1,459 | ) |

| Stock Compensation Expense | | | 210 | | | | 368 | |

| Securities Available for Sale Received as Dividend Income | | | (752 | ) | | | (977 | ) |

| Realized Gain on Sale of Real Estate Investment | | | (6,376 | ) | | | -0- | |

| Realized Gain on Sale of Securities Transactions | | | (2,248 | ) | | | -0- | |

| Unrealized Holding (Gains) Losses Arising During the Periods | | | (55,377 | ) | | | 67,100 | |

| Changes in: | | | | | | | | |

| Tenant & Other Receivables | | | 2,307 | | | | (1,153 | ) |

| Prepaid Expenses | | | (1,637 | ) | | | (2,242 | ) |

| Other Assets & Capitalized Lease Costs | | | 803 | | | | (1,999 | ) |

| Accounts Payable, Accrued Expenses & Other Liabilities | | | 3,348 | | | | 2,600 | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | | | 76,768 | | | | 74,964 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Purchase of Real Estate & Intangible Assets | | | (171,082 | ) | | | (160,023 | ) |

| Capital Improvements | | | (5,384 | ) | | | (4,726 | ) |

| Net Proceeds from Sale of Real Estate Investments | | | 12,303 | | | | -0- | |

| Return of Deposits on Real Estate | | | 5,060 | | | | 2,000 | |

| Deposits Paid on Acquisitions of Real Estate | | | (4,970 | ) | | | (550 | ) |

| Proceeds from the Sale of Securities Available for Sale | | | 16,327 | | | | -0- | |

| Proceeds from Securities Available for Sale Called for Redemption | | | 2,500 | | | | 250 | |

| NET CASH USED IN INVESTING ACTIVITIES | | | (145,246 | ) | | | (163,049 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Net Draws (Repayments) on Loans Payable | | | 90,000 | | | | (15,000 | ) |

| Proceeds from Fixed Rate Mortgage Notes Payable | | | 104,000 | | | | 100,560 | |

| Principal Payments on Fixed Rate Mortgage Notes Payable | | | (54,696 | ) | | | (41,166 | ) |

| Financing Costs Paid on Debt | | | (569 | ) | | | (2,397 | ) |

| Proceeds from the Exercise of Stock Options | | | 1,966 | | | | 1,016 | |

| Net Distributions to Non-controlling Interest | | | (5,491 | ) | | | (32 | ) |

Proceeds from At-The-Market 6.125% Series C Preferred Stock,

net of offering costs | | | 75,958 | | | | 84,815 | |

| Proceeds from Issuance of Common Stock in the DRIP, net of Dividend Reinvestments | | | 320 | | | | 18,641 | |

| Shares repurchased through the Common Stock Repurchase Plan | | | -0- | | | | (4,276 | ) |

| Preferred Dividends Paid | | | (24,607 | ) | | | (19,029 | ) |

| Common Dividends Paid, net of Reinvestments | | | (51,024 | ) | | | (43,122 | ) |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 135,857 | | | | 80,010 | |

| | | | | | | | | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | 67,379 | | | | (8,075 | ) |

| CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD | | | 23,517 | | | | 20,179 | |

| CASH AND CASH EQUIVALENTS - END OF PERIOD | | $ | 90,896 | | | $ | 12,104 | |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 10 |

Capital Structure and Leverage Ratios

(unaudited) (in thousands except for per share amounts)

| | | As of | | | As of | | | As of | |

| | | 6/30/2021 | | | 6/30/2020 | | | 9/30/2020 | |

| | | | | | | | | | |

| Fixed Rate Mortgage Notes Payable, net of Unamortized Debt Issuance Costs | | $ | 848,994 | | | $ | 804,342 | | | $ | 799,507 | |

| Loans Payable | | | 165,000 | | | | 80,000 | | | | 75,000 | |

| Total Debt | | | 1,013,994 | | | | 884,342 | | | | 874,507 | |

| | | | | | | | | | | | | |

| 6.125% Series C Cumulative Redeemable Preferred Stock | | | 549,640 | | | | 433,850 | | | | 471,994 | |

| Common Stock, Additional Paid-In-Capital & Other | | | 586,207 | | | | 589,935 | | | | 565,611 | |

| Total Shareholders’ Equity | | | 1,135,847 | | | | 1,023,785 | | | | 1,037,605 | |

| | | | | | | | | | | | | |

| Total Book Capitalization | | | 2,149,841 | | | | 1,908,127 | | | | 1,912,112 | |

| | | | | | | | | | | | | |

| Accumulated Depreciation | | | 332,725 | | | | 284,058 | | | | 296,020 | |

| Total Undepreciated Book Capitalization | | $ | 2,482,566 | | | $ | 2,192,185 | | | $ | 2,208,132 | |

| | | | | | | | | | | | | |

| Shares Outstanding | | | 98,302 | | | | 97,972 | | | | 98,054 | |

| Market Price Per Share | | $ | 18.72 | | | $ | 14.49 | | | $ | 13.85 | |

| | | | | | | | | | | | | |

| Equity Market Capitalization | | $ | 1,840,217 | | | $ | 1,419,609 | | | $ | 1,358,049 | |

| Total Debt | | | 1,013,994 | | | | 884,342 | | | | 874,507 | |

| Total Preferred Stock | | | 549,640 | | | | 433,850 | | | | 471,994 | |

| Total Market Capitalization | | $ | 3,403,851 | | | $ | 2,737,801 | | | $ | 2,704,550 | |

| | | | | | | | | | | | | |

| Total Debt | | $ | 1,013,994 | | | $ | 884,342 | | | $ | 874,507 | |

| less: Cash and Cash Equivalents | | | 90,896 | | | | 12,104 | | | | 23,517 | |

| Net Debt | | $ | 923,098 | | | $ | 872,238 | | | $ | 850,990 | |

| less: Securities Available for Sale at Fair Value (Securities) | | | 148,382 | | | | 118,877 | | | | 108,832 | |

| Net Debt Less Securities | | $ | 774,716 | | | $ | 753,361 | | | $ | 742,158 | |

| | | | | | | | | | | | | |

| Net Debt / Total Undepreciated Book Capitalization | | | 37.2 | % | | | 39.8 | % | | | 38.5 | % |

| Net Debt / Total Market Capitalization | | | 27.1 | % | | | 31.9 | % | | | 31.5 | % |

| Net Debt Plus Preferred Stock / Total Market Capitalization | | | 43.3 | % | | | 47.7 | % | | | 48.9 | % |

| Net Debt Less Securities / Total Undepreciated Book Capitalization | | | 31.2 | % | | | 34.4 | % | | | 33.6 | % |

| Net Debt Less Securities / Total Market Capitalization | | | 22.8 | % | | | 27.5 | % | | | 27.4 | % |

| Net Debt Less Securities Plus Preferred Stock / Total Market Capitalization | | | 38.9 | % | | | 43.4 | % | | | 44.9 | % |

| | | | | | | | | | | | | |

| Weighted Average Interest Rate on Fixed Rate Mortgage Debt | | | 3.86 | % | | | 4.00 | % | | | 3.98 | % |

| Weighted Average Term on Fixed Rate Mortgage Debt | | | 11.1 yrs. | | | | 11.2 yrs. | | | | 11.1 yrs. | |

| Weighted Average Lease Term | | | 7.2 yrs. | | | | 7.2 yrs. | | | | 7.1 yrs. | |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 11 |

Capital Structure and Leverage Ratios

(unaudited) (in thousands)

| | | For the Three Months Ended | | | For the Nine Months Ended | | | Fiscal Year Ended | |

| | | 6/30/2021 | | | 6/30/2020 | | | 6/30/2021 | | | 6/30/2020 | | | 9/30/2020 | |

| Net Income (Loss) Attributable to Common Shareholders | | $ | 17,292 | | | $ | 26,851 | | | $ | 68,950 | | | $ | (44,700 | ) | | $ | (48,617 | ) |

| Plus: Preferred Dividends | | | 8,416 | | | | 6,607 | | | | 25,003 | | | | 19,469 | | | | 26,474 | |

| Plus: Interest Expense, including Amortization of Financing Costs | | | 9,685 | | | | 8,975 | | | | 28,231 | | | | 27,235 | | | | 36,376 | |

| Plus: Depreciation and Amortization | | | 14,047 | | | | 12,531 | | | | 40,876 | | | | 36,958 | | | | 49,850 | |

| Plus: Net Amortization of Acquired Above and Below Market Lease Revenue | | | 26 | | | | 26 | | | | 77 | | | | 77 | | | | 103 | |

| Plus: Non-recurring Strategic Alternative & Proxy Costs | | | 8,657 | | | | -0- | | | | 10,896 | | | | -0- | | | | -0- | |

| Less/Plus: Unrealized Holding (Gains) Losses Arising During the Periods | | | (16,471 | ) | | | (19,610 | ) | | | (55,377 | ) | | | 67,100 | | | | 77,380 | |

| Less: Realized Gain on Sale of Real Estate Investment (A) | | | (3,252 | ) | | | -0- | | | | (3,252 | ) | | | -0- | | | | -0- | |

| Less: Realized Gain on Sale of Securities Transactions | | | -0- | | | | -0- | | | | (2,248 | ) | | | -0- | | | | -0- | |

| Adjusted EBITDA | | $ | 38,400 | | | $ | 35,380 | | | $ | 113,156 | | | $ | 106,139 | | | $ | 141,566 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest Expense, including Amortization of Financing Costs | | $ | 9,685 | | | $ | 8,975 | | | $ | 28,231 | | | $ | 27,235 | | | $ | 36,376 | |

| Preferred Dividends | | | 8,416 | | | | 6,607 | | | | 25,003 | | | | 19,469 | | | | 26,474 | |

| Total Fixed Charges | | $ | 18,101 | | | $ | 15,582 | | | $ | 53,234 | | | $ | 46,704 | | | $ | 62,850 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest Coverage | | | 4.0 x | | | | 3.9 x | | | | 4.0 x | | | | 3.9 x | | | | 3.9 x | |

| Fixed Charge Coverage | | | 2.1 x | | | | 2.3 x | | | | 2.1 x | | | | 2.3 x | | | | 2.3 x | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Debt | | $ | 923,098 | | | $ | 872,238 | | | $ | 923,098 | | | $ | 872,238 | | | $ | 850,990 | |

| Net Debt Less Securities | | | 774,716 | | | | 753,361 | | | | 774,716 | | | | 753,361 | | | | 742,158 | |

| Total Preferred Stock | | | 549,640 | | | | 433,850 | | | | 549,640 | | | | 433,850 | | | | 471,994 | |

| Annualized Adjusted EBITDA | | | 153,600 | | | | 141,520 | | | | 150,875 | | | | 141,519 | | | | 141,566 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Debt / Adjusted EBITDA | | | 6.0 x | | | | 6.2 x | | | | 6.1 x | | | | 6.2 x | | | | 6.0 x | |

| Net Debt Less Securities / Adjusted EBITDA | | | 5.0 x | | | | 5.3 x | | | | 5.1 x | | | | 5.3 x | | | | 5.2 x | |

| Net Debt + Preferred Stock / Adjusted EBITDA | | | 9.6 x | | | | 9.2 x | | | | 9.8 x | | | | 9.2 x | | | | 9.3 x | |

| Net Debt Less Securities + Preferred Stock / Adjusted EBITDA | | | 8.6 x | | | | 8.4 x | | | | 8.8 x | | | | 8.4 x | | | | 8.6 x | |

| | (A) | Represents our portion of the net realized gain from the sale of our property that we owned a 51% interest in. |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 12 |

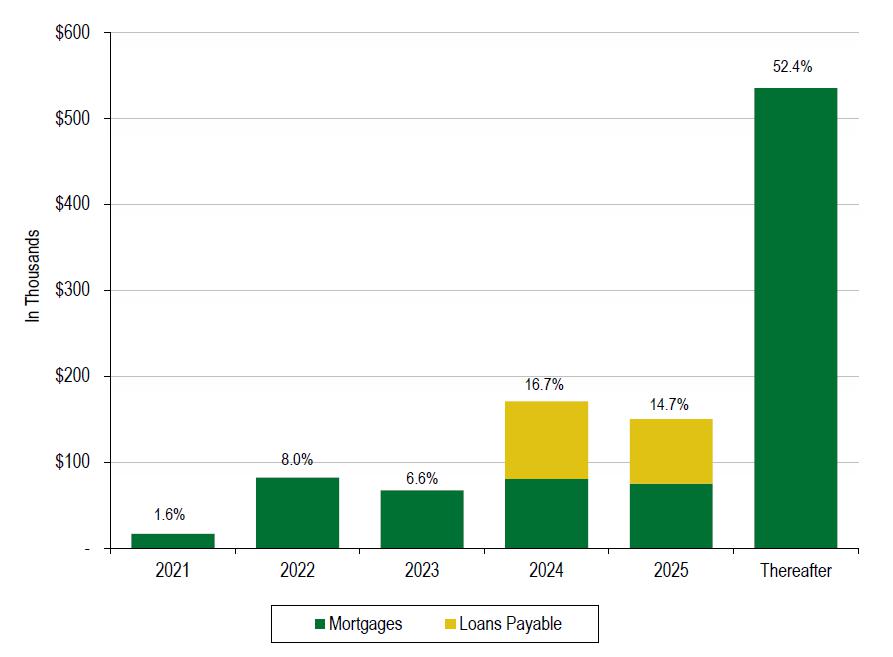

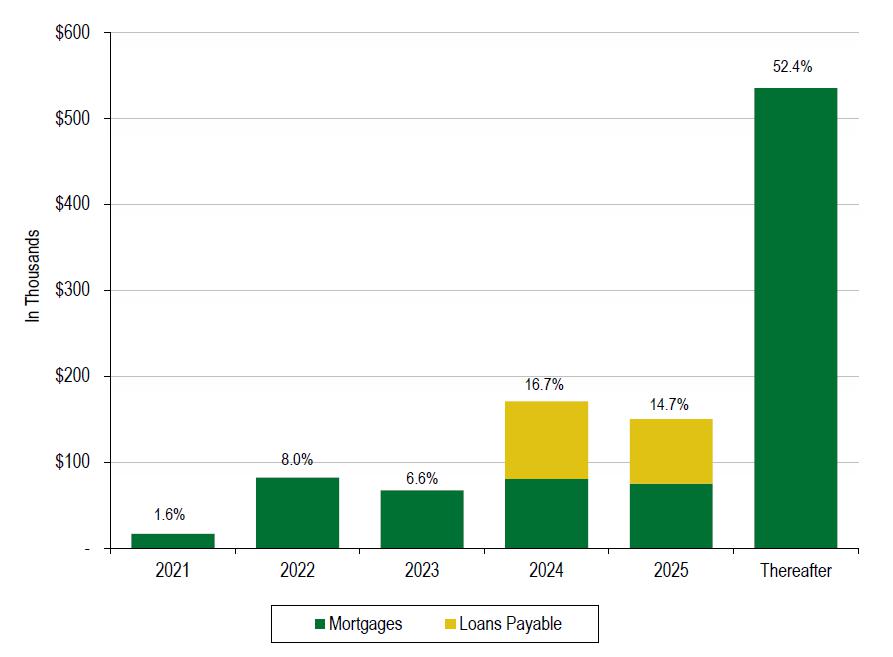

Debt Maturity

(unaudited) (In thousands)

| | | | | | Loans | | | | | | % of | |

| Fiscal Year Ended | | Mortgages | | | Payable | | | Total | | | Total | |

| | | | | | | | | | | | | |

| 2021 | | $ | 16,530 | | | | -0- | | | | 16,530 | | | | 1.6 | % |

| 2022 | | | 82,060 | | | | -0- | | | | 82,060 | | | | 8.0 | % |

| 2023 | | | 67,234 | | | | -0- | | | | 67,234 | | | | 6.6 | % |

| 2024 | | | 80,674 | | | | 90,000 | (B) | | | 170,674 | | | | 16.7 | % |

| 2025 | | | 75,069 | | | | 75,000 | (C) | | | 150,069 | | | | 14.7 | % |

| Thereafter | | | 535,108 | | | | -0- | | | | 535,108 | | | | 52.4 | % |

| Total as of 6/30/2021 | | $ | 856,675 | (A) | | $ | 165,000 | | | $ | 1,021,675 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | |

| Weighted Average Interest Rate | | | 3.86 | % | | | 2.16 | % | | | 3.59 | % | | | | |

| Weighted Average Term | | | 11.1 yrs. | | | | 3.0 yrs. | | | | 10.3 yrs. | | | | | |

| | (A) | Mortgages does not include unamortized debt issuance costs of $7.7 million. |

| | (B) | Represents a Line of Credit maturing January 2024. |

| | (C) | Represents a Term Loan maturing January 2025. |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 13 |

Property Table by Tenant

(unaudited)

| | | | Property | | | Square | | | Occupied Square | | | % of Occupied | | | Annual | | | % of Total | | | Rent Per | | | Undepreciated | | | Mortgage | |

| Tenant | | | Count | | | Footage | | | Footage | | | sf | | | Rent | | | Ann. Rent | | | sf Occup. | | | Cost | | | Balance | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FedEx Ground Package System, Inc. | | | | 47 | | | | 10,072,613 | | | | 10,072,613 | | | | 41.0 | % | | $ | 80,425,000 | | | | 50.6 | % | | $ | 7.98 | | | $ | 1,147,240,676 | | | | $ | 472,570,290 | |

| FedEx Corporation | | | | 16 | | | | 1,164,813 | | | | 1,164,813 | | | | 4.8 | % | | | 7,543,000 | | | | 4.7 | % | | | 6.48 | | | | 109,308,345 | | | | | 19,559,469 | |

| Total FedEx | | | | 63 | | | | 11,237,426 | | | | 11,237,426 | | | | 45.8 | % | | | 87,968,000 | | | | 55.3 | % | | | 7.83 | | | | 1,256,549,021 | | | | | 492,129,759 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Subsidiaries of Amazon.com, Inc. | | | | 5 | | | | 1,491,245 | | | | 1,491,245 | | | | 6.1 | % | | | 10,742,000 | | | | 6.8 | % | | | 7.20 | | | | 166,563,789 | | | | | 91,341,377 | |

| Milwaukee Electric Tool Corporation | | | | 1 | | | | 861,889 | | | | 861,889 | | | | 3.5 | % | | | 3,098,000 | | | | 2.0 | % | | | 3.59 | | | | 36,914,917 | | | | | 16,588,500 | |

| Shaw Industries, Inc. | | | | 1 | | | | 831,764 | | | | 831,764 | | | | 3.4 | % | | | 3,563,000 | | | | 2.2 | % | | | 4.28 | | | | 56,025,945 | | | | | 26,792,654 | |

| Home Depot U.S.A., Inc. | | | | 2 | | | | 828,748 | | | | 828,748 | | | | 3.4 | % | | | 6,537,000 | | | | 4.1 | % | | | 7.89 | | | | 104,539,007 | | | | | 55,945,982 | |

| ULTA, Inc. | | | | 1 | | | | 671,354 | | | | 671,354 | | | | 2.7 | % | | | 2,782,000 | | | | 1.8 | % | | | 4.14 | | | | 37,773,835 | | | | | 16,233,638 | |

| Jim Beam Brands Company (Beam Suntory) | | | | 1 | | | | 599,840 | | | | 599,840 | | | | 2.4 | % | | | 2,112,000 | | | | 1.3 | % | | | 3.52 | | | | 28,000,000 | | | | | 13,769,810 | |

| International Paper Company | | | | 2 | | | | 578,491 | | | | 578,491 | | | | 2.4 | % | | | 2,663,000 | | | | 1.7 | % | | | 4.60 | | | | 37,024,608 | | | | | 16,770,698 | |

| TreeHouse Private Brands, Inc. | | | | 1 | | | | 558,509 | | | | 558,509 | | | | 2.3 | % | | | 2,267,000 | | | | 1.4 | % | | | 4.06 | | | | 26,807,852 | | | | | 13,196,520 | |

| B. Braun Medical Inc. | | | | 1 | | | | 399,440 | | | | 399,440 | | | | 1.6 | % | | | 2,330,000 | | | | 1.5 | % | | | 5.83 | | | | 30,871,732 | | | | | 16,436,710 | |

| UGN, Inc. | | | | 1 | | | | 387,000 | | | | 387,000 | | | | 1.6 | % | | | 2,107,000 | | | | 1.3 | % | | | 5.44 | | | | 21,576,756 | | | | | 11,734,063 | |

| CBOCS Distribution, Inc. (Cracker Barrel) | | | | 1 | | | | 381,240 | | | | 381,240 | | | | 1.6 | % | | | 1,490,000 | | | | 0.9 | % | | | 3.91 | | | | 14,215,126 | | | | | -0- | |

| Best Buy Warehousing Logistics, Inc. | | | | 1 | | | | 368,060 | | | | 368,060 | | | | 1.5 | % | | | 1,725,000 | | | | 1.1 | % | | | 4.69 | | | | 19,600,000 | | | | | 7,508,796 | |

| Toyota Tsusho America, Inc. | | | | 1 | | | | 350,418 | | | | 350,418 | | | | 1.4 | % | | | 1,722,000 | | | | 1.1 | % | | | 4.91 | | | | 25,078,587 | | | | | 15,454,363 | |

| Coca-Cola | | | | 2 | | | | 328,045 | | | | 328,045 | | | | 1.3 | % | | | 1,701,000 | | | | 1.1 | % | | | 5.19 | | | | 20,504,069 | | | | | 1,333,843 | |

| Autoneum North America, Inc. | | | | 1 | | | | 315,560 | | | | 315,560 | | | | 1.3 | % | | | 1,746,000 | | | | 1.1 | % | | | 5.53 | | | | 21,040,396 | | | | | 12,221,167 | |

| Science Applications International Corporation | | | | 1 | | | | 302,400 | | | | 302,400 | | | | 1.2 | % | | | 1,708,000 | | | | 1.1 | % | | | 5.65 | | | | 14,463,148 | | | | | -0- | |

| Bunzl USA Holdings, Inc. | | | | 2 | | | | 268,778 | | | | 268,778 | | | | 1.1 | % | | | 1,457,000 | | | | 0.9 | % | | | 5.42 | | | | 18,731,674 | | | | | 4,356,890 | |

| Woodstream Corporation | (A) | | | 1 | | | | 256,000 | | | | 256,000 | | | | 1.0 | % | | | 987,000 | | | | 0.6 | % | | | 3.86 | | | | 9,029,539 | | | | | -0- | |

| Anda Pharmaceuticals, Inc. | | | | 1 | | | | 234,660 | | | | 234,660 | | | | 1.0 | % | | | 1,220,000 | | | | 0.8 | % | | | 5.20 | | | | 14,550,000 | | | | | 5,736,033 | |

| Mickey Thompson Performance Tires and Wheels (Goodyear Tire & Rubber Co.) | | | | 1 | | | | 219,765 | | | | 219,765 | | | | 0.9 | % | | | 1,537,000 | | | | 1.0 | % | | | 6.99 | | | | 18,934,065 | | | | | 10,284,946 | |

| Rinnai America Corporation | | | | 1 | | | | 218,120 | | | | 218,120 | | | | 0.9 | % | | | 913,000 | | | | 0.6 | % | | | 4.19 | | | | 15,082,217 | | | | | -0- | |

| Anheuser-Busch, Inc. | | | | 1 | | | | 184,800 | | | | 184,800 | | | | 0.8 | % | | | 854,000 | | | | 0.5 | % | | | 4.62 | | | | 12,757,540 | | | | | -0- | |

| Carrier Enterprise, LLC (Carrier Global Corporation) | | | | 1 | | | | 184,317 | | | | 184,317 | | | | 0.8 | % | | | 1,160,000 | | | | 0.7 | % | | | 6.29 | | | | 18,494,917 | | | | | 4,025,447 | |

| Carlstar Group, LLC | | | | 1 | | | | 179,280 | | | | 179,280 | | | | 0.7 | % | | | 771,000 | | | | 0.5 | % | | | 4.30 | | | | 7,282,986 | | | | | -0- | |

| NF&M International, Inc. | (B) | | | 1 | | | | 174,802 | | | | 174,802 | | | | 0.7 | % | | | 795,000 | | | | 0.5 | % | | | 4.55 | | | | 5,445,065 | | | | | -0- | |

| Magna Seating of America, Inc. | | | | 1 | | | | 152,995 | | | | 152,995 | | | | 0.6 | % | | | 1,201,000 | | | | 0.8 | % | | | 7.85 | | | | 17,557,830 | | | | | 8,511,498 | |

| Victory Packaging, L.P. | | | | 1 | | | | 148,000 | | | | 148,000 | | | | 0.6 | % | | | 504,000 | | | | 0.3 | % | | | 3.41 | | | | 5,458,279 | | | | | -0- | |

| Challenger Lifts, Inc. (Snap-On Inc.) | | | | 1 | | | | 137,500 | | | | 137,500 | | | | 0.6 | % | | | 858,000 | | | | 0.5 | % | | | 6.24 | | | | 11,304,000 | | | | | 5,377,343 | |

| Altec Industries, Inc. | (A) | | | 1 | | | | 126,880 | | | | 126,880 | | | | 0.5 | % | | | 378,000 | | | | 0.2 | % | | | 2.98 | | | | 4,475,266 | | | | | -0- | |

| General Electric Company | | | | 1 | | | | 125,860 | | | | 125,860 | | | | 0.5 | % | | | 1,329,000 | | | | 0.8 | % | | | 10.56 | | | | 19,972,983 | | | | | 8,949,697 | |

| Keurig Dr Pepper | | | | 2 | | | | 110,080 | | | | 110,080 | | | | 0.4 | % | | | 757,000 | | | | 0.5 | % | | | 6.88 | | | | 10,498,031 | | | | | 1,303,703 | |

| Style Crest, Inc. | | | | 1 | | | | 106,507 | | | | 106,507 | | | | 0.4 | % | | | 433,000 | | | | 0.3 | % | | | 4.07 | | | | 7,421,032 | | | | | -0- | |

| Sonwil Distribution Center, Inc. | | | | 1 | | | | 104,981 | | | | 104,981 | | | | 0.4 | % | | | 630,000 | | | | 0.4 | % | | | 6.00 | | | | 10,960,823 | | | | | -0- | |

| Pittsburgh Glass Works, LLC, a Division of VITRO | | | | 1 | | | | 102,135 | | | | 102,135 | | | | 0.4 | % | | | 508,000 | | | | 0.3 | % | | | 4.97 | | | | 4,249,615 | | | | | -0- | |

| Dakota Bodies, LLC | | | | 1 | | | | 96,687 | | | | 96,687 | | | | 0.4 | % | | | 416,000 | | | | 0.3 | % | | | 4.30 | | | | 7,797,827 | | | | | -0- | |

| National Oilwell Varco, Inc. | | | | 1 | | | | 91,295 | | | | 91,295 | | | | 0.4 | % | | | 801,000 | | | | 0.5 | % | | | 8.77 | | | | 8,190,901 | | | | | 671,412 | |

| Joseph T. Ryerson and Son, Inc. | | | | 1 | | | | 89,123 | | | | 89,123 | | | | 0.4 | % | | | 519,000 | | | | 0.3 | % | | | 5.82 | | | | 7,184,598 | | | | | -0- | |

| CHEP USA, Inc. | | | | 1 | | | | 83,000 | | | | 83,000 | | | | 0.3 | % | | | 509,000 | | | | 0.3 | % | | | 6.13 | | | | 7,463,672 | | | | | -0- | |

| Sherwin-Williams Company | | | | 2 | | | | 78,887 | | | | 78,887 | | | | 0.3 | % | | | 648,000 | | | | 0.4 | % | | | 8.21 | | | | 7,427,594 | | | | | -0- | |

| United Parcel Service, Inc. | | | | 1 | | | | 75,000 | | | | 75,000 | | | | 0.3 | % | | | 595,000 | | | | 0.4 | % | | | 7.93 | | | | 6,741,021 | | | | | -0- | |

| Tampa Bay Grand Prix | | | | 1 | | | | 68,385 | | | | 68,385 | | | | 0.3 | % | | | 369,000 | | | | 0.2 | % | | | 5.40 | | | | 5,677,982 | | | | | -0- | |

| Various Tenants at Retail Shopping Center | | | | 1 | | | | 64,220 | | | | 61,190 | | | | 0.3 | % | | | 616,000 | | | | 0.4 | % | | | 10.07 | | | | 3,139,564 | | | | | -0- | |

| Locke Supply Co. | | | | 1 | | | | 60,000 | | | | 60,000 | | | | 0.2 | % | | | 340,000 | | | | 0.2 | % | | | 5.67 | | | | 5,097,101 | | | | | -0- | |

| Hartford Healthcare Corporation | | | | 1 | | | | 54,812 | | | | 54,812 | | | | 0.2 | % | | | 307,000 | | | | 0.2 | % | | | 5.60 | | | | 3,525,917 | | | | | -0- | |

| Siemens Real Estate | | | | 1 | | | | 51,130 | | | | 51,130 | | | | 0.2 | % | | | 464,000 | | | | 0.3 | % | | | 9.07 | | | | 4,554,684 | | | | | -0- | |

| Collins Aerospace (Raytheon Technologies Corporation) | | | | 1 | | | | 38,833 | | | | 38,833 | | | | 0.2 | % | | | 368,000 | | | | 0.2 | % | | | 9.48 | | | | 5,100,000 | | | | | -0- | |

| Foundation Building Materials, LLC | | | | 1 | | | | 36,270 | | | | 36,270 | | | | 0.2 | % | | | 179,000 | | | | 0.2 | % | | | 4.94 | | | | 2,543,770 | | | | | -0- | |

| Graybar Electric Company | | | | 1 | | | | 26,340 | | | | 26,340 | | | | 0.2 | % | | | 122,000 | | | | 0.1 | % | | | 4.63 | | | | 2,901,362 | | | | | -0- | |

| Vacant | (B) | | | 1 | | | | 80,856 | | | | -0- | | | | 0.0 | % | | | -0- | | | | 0.0 | % | | | -0- | | | | 2,518,657 | | | | | -0- | |

| Total as of 6/30/21 | | | | 120 | | | | 24,521,727 | | | | 24,437,841 | | | | 99.7 | % | | $ | 158,806,000 | | | | 100.0 | % | | $ | 6.50 | | | $ | 2,209,619,300 | | (C) | | $ | 856,674,849 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisitions Subsequent to 6/30/21 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FedEx Ground Package System, Inc. | | | | 1 | | | | 143,794 | | | | 143,794 | | | | 0.6 | % | | | 3,233,000 | | | | 1.9 | % | | | 22.48 | | | | | | | | | | |

| Pro Forma Total with Acquisitions Subsequent to 6/30/21 | | | | 121 | | | | 24,665,521 | | | | 24,581,635 | | | | 99.7 | % | | $ | 162,039,000 | | | | 100.0 | % | | $ | 6.59 | | | | | | | | | | |

| | (A) | Woodstream Corporation and Altec Industries, Inc. are located at one property and, therefore, are counted as one property in the Property Count Total. |

| | (B) | NF&M International is located in a 255,658 square foot industrial park in Monaca (Pittsburgh), PA, of which 80,856 square feet are vacant. This industrial park is counted as one property in the Property Count Total. |

| | | Other than two properties indicated in footnotes (A) and (B) and one retail property, all properties are single-tenant. |

| | (C) | Does not include unamortized debt issuance costs of $7,681,337. |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 14 |

Property Table by State

(unaudited)

| | | Property | | | Square | | | Occupied Square | | | % of Total | | | Annual | | | % of Total | | | Rent Per | | | Undepreciated | | | Mortgage | |

| State | | Count | | | Footage | | | Footage | | | sf | | | Rent | | | Ann. Rent | | | sf Occup. | | | Cost | | | Balance | |

| Ohio | | | 11 | | | | 2,358,769 | | | | 2,358,769 | | | | 9.6 | % | | $ | 15,863,000 | | | | 10.0 | % | | $ | 6.73 | | | $ | 209,060,892 | | | $ | 93,753,230 | |

| Georgia | | | 7 | | | | 2,297,214 | | | | 2,297,214 | | | | 9.4 | % | | | 16,134,000 | | | | 10.2 | % | | | 7.02 | | | | 259,469,156 | | | | 132,329,894 | |

| Florida | | | 13 | | | | 2,223,042 | | | | 2,223,042 | | | | 9.1 | % | | | 16,002,000 | | | | 10.1 | % | | | 7.20 | | | | 228,907,551 | | | | 79,618,189 | |

| Indiana | | | 4 | | | | 1,965,341 | | | | 1,965,341 | | | | 8.0 | % | | | 11,212,000 | | | | 7.1 | % | | | 5.70 | | | | 167,720,415 | | | | 88,647,033 | |

| Texas | | | 10 | | | | 1,790,337 | | | | 1,790,337 | | | | 7.3 | % | | | 13,844,000 | | | | 8.7 | % | | | 7.73 | | | | 183,394,825 | | | | 61,359,821 | |

| Kentucky | | | 3 | | | | 1,295,849 | | | | 1,295,849 | | | | 5.3 | % | | | 5,237,000 | | | | 3.3 | % | | | 4.04 | | | | 66,111,852 | | | | 32,343,673 | |

| South Carolina | | | 6 | | | | 1,273,676 | | | | 1,273,676 | | | | 5.2 | % | | | 9,882,000 | | | | 6.2 | % | | | 7.76 | | | | 129,988,641 | | | | 49,445,388 | |

| North Carolina | | | 5 | | | | 1,225,987 | | | | 1,225,987 | | | | 5.0 | % | | | 8,713,000 | | | | 5.5 | % | | | 7.11 | | | | 132,687,021 | | | | 64,164,667 | |

| Mississippi | | | 4 | | | | 1,158,889 | | | | 1,158,889 | | | | 4.7 | % | | | 4,560,000 | | | | 2.9 | % | | | 3.93 | | | | 56,266,970 | | | | 22,324,533 | |

| Illinois | | | 9 | | | | 958,102 | | | | 958,102 | | | | 3.9 | % | | | 6,254,000 | | | | 3.9 | % | | | 6.53 | | | | 83,672,112 | | | | 6,827,092 | |

| Tennessee | | | 3 | | | | 891,777 | | | | 891,777 | | | | 3.6 | % | | | 3,203,000 | | | | 2.0 | % | | | 3.59 | | | | 35,677,250 | | | | 2,603,021 | |

| Michigan | | | 4 | | | | 833,717 | | | | 833,717 | | | | 3.4 | % | | | 5,629,000 | | | | 3.5 | % | | | 6.75 | | | | 73,561,442 | | | | 20,775,968 | |

| Kansas | | | 4 | | | | 813,062 | | | | 813,062 | | | | 3.3 | % | | | 4,998,000 | | | | 3.1 | % | | | 6.15 | | | | 63,645,556 | | | | 23,557,610 | |

| Missouri | | | 4 | | | | 740,119 | | | | 740,119 | | | | 3.0 | % | | | 3,003,000 | | | | 1.9 | % | | | 4.06 | | | | 35,555,482 | | | | -0- | |

| Oklahoma | | | 5 | | | | 735,721 | | | | 735,721 | | | | 3.0 | % | | | 4,943,000 | | | | 3.1 | % | | | 6.72 | | | | 69,942,758 | | | | 33,698,320 | |

| New York | | | 3 | | | | 518,565 | | | | 518,565 | | | | 2.1 | % | | | 3,554,000 | | | | 2.2 | % | | | 6.85 | | | | 52,841,861 | | | | 17,756,206 | |

| Pennsylvania | | | 3 | | | | 504,040 | | | | 423,184 | | | | 2.1 | % | | | 2,775,000 | | | | 1.7 | % | | | 6.56 | | | | 36,959,671 | | | | 11,047,899 | |

| Alabama | | | 2 | | | | 451,832 | | | | 451,832 | | | | 1.8 | % | | | 2,670,000 | | | | 1.7 | % | | | 5.91 | | | | 39,714,135 | | | | 15,893,528 | |

| New Jersey | | | 2 | | | | 411,365 | | | | 408,335 | | | | 1.7 | % | | | 5,944,000 | | | | 3.7 | % | | | 14.56 | | | | 87,127,186 | | | | 47,779,049 | |

| Virginia | | | 5 | | | | 407,443 | | | | 407,443 | | | | 1.7 | % | | | 2,474,000 | | | | 1.6 | % | | | 6.07 | | | | 35,059,207 | | | | 3,000,099 | |

| Colorado | | | 2 | | | | 295,227 | | | | 295,227 | | | | 1.2 | % | | | 2,441,000 | | | | 1.5 | % | | | 8.27 | | | | 35,694,134 | | | | 13,748,383 | |

| Arizona | | | 1 | | | | 288,045 | | | | 288,045 | | | | 1.2 | % | | | 1,409,000 | | | | 0.9 | % | | | 4.89 | | | | 16,824,226 | | | | 1,333,843 | |

| Wisconsin | | | 2 | | | | 238,666 | | | | 238,666 | | | | 1.0 | % | | | 1,295,000 | | | | 0.8 | % | | | 5.43 | | | | 16,377,221 | | | | 1,702,945 | |

| Washington | | | 1 | | | | 210,445 | | | | 210,445 | | | | 0.9 | % | | | 1,962,000 | | | | 1.2 | % | | | 9.32 | | | | 30,369,301 | | | | 14,569,993 | |

| Louisiana | | | 1 | | | | 175,315 | | | | 175,315 | | | | 0.7 | % | | | 1,274,000 | | | | 0.8 | % | | | 7.27 | | | | 18,425,875 | | | | 9,111,843 | |

| Maryland | | | 1 | | | | 148,881 | | | | 148,881 | | | | 0.6 | % | | | 1,455,000 | | | | 0.9 | % | | | 9.77 | | | | 14,632,389 | | | | -0- | |

| Nebraska | | | 1 | | | | 89,115 | | | | 89,115 | | | | 0.4 | % | | | 446,000 | | | | 0.3 | % | | | 5.00 | | | | 5,963,626 | | | | -0- | |

| Utah | | | 1 | | | | 69,734 | | | | 69,734 | | | | 0.3 | % | | | 772,000 | | | | 0.5 | % | | | 11.07 | | | | 12,666,994 | | | | 7,917,933 | |

| Minnesota | | | 1 | | | | 60,370 | | | | 60,370 | | | | 0.2 | % | | | 372,000 | | | | 0.4 | % | | | 6.16 | | | | 5,231,864 | | | | 1,364,689 | |

| Connecticut | | | 1 | | | | 54,812 | | | | 54,812 | | | | 0.2 | % | | | 307,000 | | | | 0.2 | % | | | 5.60 | | | | 3,525,917 | | | | -0- | |

| Iowa | | | 1 | | | | 36,270 | | | | 36,270 | | | | 0.1 | % | | | 179,000 | | | | 0.1 | % | | | 4.94 | | | | 2,543,770 | | | | -0- | |

| Total as of 6/30/21 | | | 120 | | | | 24,521,727 | | | | 24,437,841 | | | | 100.0 | % | | $ | 158,806,000 | | | | 100.0 | % | | $ | 6.50 | | | $ | 2,209,619,300 | | (A) | | $856,674,849 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisitions Subsequent to 6/30/21 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Vermont | | | 1 | | | | 143,794 | | | | 143,794 | | | | 0.6 | % | | | 3,233,000 | | | | 1.9 | % | | | 22.48 | | | | | | | | | |

| Pro Forma Total with Acquisitions Subsequent to 6/30/21 | | | 121 | | | | 24,665,521 | | | | 24,581,635 | | | | 100.0 | % | | $ | 162,039,000 | | | | 100.0 | % | | $ | 6.59 | | | | | | | | | |

| | (A) | Does not include unamortized debt issuance costs of $7,681,337. |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 15 |

Lease Expirations

(unaudited)

| | | | | Property | | | Square | | | % of Total | | | Annual | | | % of Total | | | Rent Per sf | | | Lease Exp. Term in | | | Undepreciated | | | Mortgage | |

| Fiscal Year | | | | Count | | | Footage | | | Sf | | | Rent | | | Ann. Rent | | | Occup. | | | Years | | | Cost | | | Balance | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2022 | | | | | 5 | | | | 1,065,169 | | | | 4.3 | % | | $ | 5,623,000 | | | | 3.5 | % | | $ | 5.28 | | | | 0.7 | | | $ | 71,756,260 | | | $ | 17,691,620 | |

| 2023(A) | | | | | 16 | | | | 2,117,731 | | | | 8.6 | % | | | 12,076,000 | | | | 7.6 | % | | | 5.70 | | | | 1.9 | | | | 149,258,939 | | | | 15,178,067 | |

| 2024 | | | | | 13 | | | | 1,887,039 | | | | 7.7 | % | | | 11,797,000 | | | | 7.4 | % | | | 6.25 | | | | 2.9 | | | | 137,674,811 | | | | 20,296,714 | |

| 2025(A) | | | | | 11 | | | | 2,607,541 | | | | 10.6 | % | | | 12,980,000 | | | | 8.2 | % | | | 4.98 | | | | 3.9 | | | | 170,882,575 | | | | 58,907,497 | |

| 2026(A) | | | | | 14 | | | | 1,738,731 | | | | 7.1 | % | | | 10,850,000 | | | | 6.8 | % | | | 6.24 | | | | 5.0 | | | | 137,382,883 | | | | 19,125,726 | |

| 2027 | | | | | 13 | | | | 2,390,188 | | | | 9.7 | % | | | 13,297,000 | | | | 8.4 | % | | | 5.56 | | | | 6.1 | | | | 187,747,728 | | | | 59,254,441 | |

| 2028 | | | | | 10 | | | | 2,172,458 | | | | 8.9 | % | | | 11,857,000 | | | | 7.5 | % | | | 5.46 | | | | 6.8 | | | | 153,000,879 | | | | 40,945,705 | |

| 2029 | | | | | 9 | | | | 1,831,303 | | | | 7.5 | % | | | 10,610,000 | | | | 6.7 | % | | | 5.79 | | | | 7.8 | | | | 147,994,178 | | | | 56,771,370 | |

| 2030 | | | | | 5 | | | | 1,102,002 | | | | 4.5 | % | | | 8,490,000 | | | | 5.3 | % | | | 7.70 | | | | 8.8 | | | | 129,463,623 | | | | 62,140,891 | |

| 2031 | | | | | 6 | | | | 1,218,941 | | | | 5.0 | % | | | 9,738,000 | | | | 6.1 | % | | | 7.99 | | | | 9.4 | | | | 137,855,742 | | | | 62,886,564 | |

| 2032 | | | | | 8 | | | | 2,131,983 | | | | 8.7 | % | | | 18,862,000 | | | | 11.9 | % | | | 8.85 | | | | 10.8 | | | | 291,154,266 | | | | 154,426,474 | |

| 2033 | | | | | 3 | | | | 1,038,508 | | | | 4.2 | % | | | 8,844,000 | | | | 5.6 | % | | | 8.52 | | | | 11.8 | | | | 137,685,523 | | | | 76,288,699 | |

| 2034 | | | | | 3 | | | | 1,561,256 | | | | 6.4 | % | | | 9,365,000 | | | | 5.9 | % | | | 6.00 | | | | 12.8 | | | | 127,748,518 | | | | 74,253,759 | |

| 2035 | | | | | 3 | | | | 856,283 | | | | 3.5 | % | | | 8,343,000 | | | | 5.3 | % | | | 9.74 | | | | 14.1 | | | | 131,119,464 | | | | 82,561,340 | |

| 2041 | | | | | 1 | | | | 657,518 | | | | 2.7 | % | | | 5,458,000 | | | | 3.4 | % | | | 8.30 | | | | 19.4 | | | | 93,235,690 | | | | 55,945,982 | |

| Various tenants at retail shopping center | | | | | 1 | | | | 64,220 | | | | 0.3 | % | | | 616,000 | | | | 0.4 | % | | | 10.07 | | | | -0- | | | | 3,139,564 | | | | -0- | |

| Vacant | | (A) | | | 1 | | | | 80,856 | | | | 0.3 | % | | | -0- | | | | 0.0 | % | | | -0- | | | | -0- | | | | 2,518,657 | | | | -0- | |

| Total as of 6/30/21 | | | | | 120 | | | | 24,521,727 | | | | 100.0 | % | | $ | 158,806,000 | | | | 100.0 | % | | $ | 6.50 | | | | 7.2 | | | $ | 2,209,619,300 | | (B) | | $856,674,849 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisitions Subsequent to 6/30/21 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2036 | | | | | 1 | | | | 143,794 | | | | 0.6 | % | | | 3,233,000 | | | | 1.9 | % | | | 22.48 | | | | 14.9 | | | | | | | | | |

| Pro Forma Total with Acquisitions Subsequent to 6/30/21 | | | | | 121 | | | | 24,665,521 | | | | 100.0 | % | | $ | 162,039,000 | | | | 100.0 | % | | $ | 6.59 | | | | 7.2 | | | | | | | | | |

| | (A) | Included in 2023 is Altec Industries and included in 2026 is Woodstream Corporation, which both occupy one property. Included in 2025 is NF&M International, which occupies 174,802 square feet of a 255,658 square foot Industrial Park. The remaining 80,856 square feet are included in Vacant. Each of these properties are counted as one property in the Property Count Total. Other than these properties and one retail property, all properties are single-tenant. |

| | (B) | Does not include unamortized debt issuance costs of $7,681,337. |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 16 |

Recent Acquisitions During Fiscal 2021

(unaudited)

| | | | | | | | | Date of | | Square | | | Annual | | | Rent Per | | | Lease | | Purchase | | | Initial Mortgage | |

| No | | Tenant | | City (MSA) | | State | | Acquisition | | Footage | | | Rent | | | sf Occup. | | | Expiration | | Price | | | Balance | |

| 1 | | FedEx Ground Package System, Inc. | | Plain City (Columbus) | | OH | | 12/17/2020 | | | 500,268 | | | $ | 4,569,000 | | | $ | 9.13 | | | 9/30/2035 | | $ | 73,304,000 | | | $ | 47,000,000 | |

| 2 | | Home Depot U.S.A., Inc. | | Locust Grove (Atlanta) | | GA | | 12/24/2020 | | | 657,518 | | | | 5,458,000 | | | | 8.30 | | | 11/30/2040 | | | 95,935,000 | | | | 57,000,000 | |

| | | As of 6/30/21 | | | | | | | | | 1,157,786 | | | $ | 10,027,000 | | | $ | 8.66 | | | | | $ | 169,239,000 | | | $ | 104,000,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Acquisitions Subsequent to 6/30/21 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 | | FedEx Ground Package System, Inc. | | Burlington | | VT | | 07/29/2021 | | | 143,794 | | | $ | 3,233,000 | | | | 22.48 | | | 8/31/2034 | | $ | 54,789,000 | | | | -0- | |

| | | Pro Forma Total with Acquisitions Subsequent to 6/30/21 | | | | | | | | | 1,301,580 | | | $ | 13,260,000 | | | $ | 10.19 | | | | | $ | 224,028,000 | | | $ | 104,000,000 | |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 17 |

Property Table

(unaudited)

| | | | | | | | | | | | | | | | | | | Rent | | | Lease Exp. | | | | | | | |

| | | | | | | | | Fiscal Year | | | | | | Square | | | Annual | | | Per sf | | | Term in | | | Undepreciated | | | Mortgage | |

| No | | Tenant | | City (MSA) | | State | | Acquisition | | | Occup. | | | Footage | | | Rent | | | Occup. | | | Years | | | Cost | | | Balance | |

| 1 | | Milwaukee Electric Tool Corporation | | Olive Branch (Memphis, TN) | | MS | | | 2013 | | | | 100.0 | % | | | 861,889 | | | $ | 3,098,000 | | | $ | 3.59 | | | | 7.1 | | | $ | 36,914,917 | | | $ | 16,588,500 | |

| .2 | | Shaw Industries, Inc. | | Savannah | | GA | | | 2018 | | | | 100.0 | % | | | 831,764 | | | | 3,563,000 | | | | 4.28 | | | | 6.3 | | | | 56,025,945 | | | | 26,792,654 | |

| 3 | | ULTA, Inc. | | Greenwood (Indianapolis) | | IN | | | 2015 | | | | 100.0 | % | | | 671,354 | | | | 2,782,000 | | | | 4.14 | | | | 4.1 | | | | 37,773,835 | | | | 16,233,638 | |

| 4 | | Home Depot U.S.A., Inc. | | Locust Grove (Atlanta) | | GA | | | 2021 | | | | 100.0 | % | | | 657,518 | | | | 5,458,000 | | | | 8.30 | | | | 19.4 | | | | 93,235,690 | | | | 55,945,982 | |

| 5 | | Amazon.com.indc, LLC | | Greenwood (Indianapolis) | | IN | | | 2020 | | | | 100.0 | % | | | 615,747 | | | | 4,991,000 | | | | 8.11 | | | | 13.2 | | | | 79,363,910 | | | | 49,323,176 | |

| 6 | | Jim Beam Brands Company (Beam Suntory) | | Frankfort (Lexington) | | KY | | | 2015 | | | | 100.0 | % | | | 599,840 | | | | 2,112,000 | | | | 3.52 | | | | 3.6 | | | | 28,000,000 | | | | 13,769,810 | |

| 7 | | TreeHouse Private Brands, Inc. | | Buckner (Louisville) | | KY | | | 2014 | | | | 100.0 | % | | | 558,509 | | | | 2,267,000 | | | | 4.06 | | | | 12.3 | | | | 26,807,852 | | | | 13,196,520 | |

| 8 | | FedEx Ground Package System, Inc. | | Plain City (Columbus) | | OH | | | 2021 | | | | 100.0 | % | | | 500,268 | | | | 4,569,000 | | | | 9.13 | | | | 14.3 | | | | 71,741,593 | | | | 45,955,361 | |

| 9 | | FedEx Forward Depots, Inc. | | Memphis | | TN | | | 2010 | | | | 100.0 | % | | | 449,900 | | | | 1,394,000 | | | | 3.10 | | | | 7.9 | | | | 16,092,852 | | | | 2,603,021 | |

| 10 | | B. Braun Medical Inc. | | Daytona Beach | | FL | | | 2018 | | | | 100.0 | % | | | 399,440 | | | | 2,330,000 | | | | 5.83 | | | | 11.7 | | | | 30,871,732 | | | | 16,436,710 | |

| 11 | | UGN, Inc. | | Monroe (Cincinnati) | | OH | | | 2015 | | | | 100.0 | % | | | 387,000 | | | | 2,107,000 | | | | 5.44 | | | | 12.7 | | | | 21,576,756 | | | | 11,734,063 | |

| 12 | | Woodstream Corporation | | St. Joseph | | MO | | | 2001 | | | | 100.0 | % | | | 256,000 | | | | 987,000 | | | | 3.86 | | | | 5.3 | | | | 9,029,539 | | | | -0- | |

| | | Altec Industries, Inc. | | St. Joseph | | MO | | | 2001 | | | | 100.0 | % | | | 126,880 | | | | 378,000 | | | | 2.98 | | | | 1.7 | | | | 4,475,266 | | | | -0- | |

| 13 | | CBOCS Distribution, Inc. (Cracker Barrel) | | Lebanon (Nashville) | | TN | | | 2011 | | | | 100.0 | % | | | 381,240 | | | | 1,490,000 | | | | 3.91 | | | | 3.0 | | | | 14,215,126 | | | | -0- | |

| 14 | | FedEx Ground Package System, Inc. | | Braselton (Atlanta) | | GA | | | 2018 | | | | 100.0 | % | | | 373,750 | | | | 3,801,000 | | | | 10.17 | | | | 11.7 | | | | 60,237,411 | | | | 34,269,304 | |

| 15 | | Best Buy Warehousing Logistics, Inc. | | Streetsboro (Cleveland) | | OH | | | 2012 | | | | 100.0 | % | | | 368,060 | | | | 1,725,000 | | | | 4.69 | | | | 0.6 | | | | 19,600,000 | | | | 7,508,796 | |

| 16 | | Amazon.com Services, Inc. (Amazon.com, Inc.) | | Mobile | | AL | | | 2018 | | | | 100.0 | % | | | 362,942 | | | | 2,065,000 | | | | 5.69 | | | | 7.4 | | | | 33,052,316 | | | | 15,893,528 | |

| 17 | | FedEx Ground Package System, Inc. | | Concord (Charlotte) | | NC | | | 2017 | | | | 100.0 | % | | | 354,482 | | | | 2,537,000 | | | | 7.16 | | | | 10.9 | | | | 40,043,145 | | | | 20,962,281 | |

| 18 | | FedEx Ground Package System, Inc. | | Mesquite (Dallas) | | TX | | | 2017 | | | | 100.0 | % | | | 351,874 | | | | 3,209,000 | | | | 9.12 | | | | 10.8 | | | | 49,880,493 | | | | 25,939,833 | |

| 19 | | Toyota Tsusho America, Inc. | | Lafayette | | IN | | | 2019 | | | | 100.0 | % | | | 350,418 | | | | 1,722,000 | | | | 4.91 | | | | 8.0 | | | | 25,078,587 | | | | 15,454,363 | |

| 20 | | FedEx Ground Package System, Inc. | | Trenton | | NJ | | | 2019 | | | | 100.0 | % | | | 347,145 | | | | 5,328,000 | | | | 15.35 | | | | 11.0 | | | | 83,987,622 | | | | 47,779,049 | |

| 21 | | FedEx Ground Package System, Inc. | | Walker (Grand Rapids) | | MI | | | 2017 | | | | 100.0 | % | | | 343,483 | | | | 2,106,000 | | | | 6.13 | | | | 10.6 | | | | 31,654,987 | | | | 16,329,177 | |

| 22 | | FedEx Ground Package System, Inc. | | Hamburg (Buffalo) | | NY | | | 2017 | | | | 100.0 | % | | | 338,584 | | | | 2,329,000 | | | | 6.88 | | | | 9.8 | | | | 35,140,017 | | | | 17,756,206 | |

| 23 | | FedEx Ground Package System, Inc. | | Concord (Charlotte) | | NC | | | 2016 | | | | 100.0 | % | | | 330,717 | | | | 2,237,000 | | | | 6.76 | | | | 4.1 | | | | 33,053,688 | | | | 14,514,340 | |

| 24 | | FedEx Ground Package System, Inc. | | Indianapolis | | IN | | | 2014 | | | | 100.0 | % | | | 327,822 | | | | 1,717,000 | | | | 5.24 | | | | 6.3 | | | | 25,504,083 | | | | 7,635,856 | |

| 25 | | Autoneum North America, Inc. | | Aiken (Augusta, GA) | | SC | | | 2017 | | | | 100.0 | % | | | 315,560 | | | | 1,746,000 | | | | 5.53 | | | | 10.8 | | | | 21,040,396 | | | | 12,221,167 | |

| 26 | | FedEx Ground Package System, Inc. | | Olathe (Kansas City) | | KS | | | 2016 | | | | 100.0 | % | | | 313,763 | | | | 2,553,000 | | | | 8.14 | | | | 9.9 | | | | 34,388,619 | | | | 16,545,478 | |

| 27 | | FedEx Ground Package System, Inc. | | Ft. Worth (Dallas) | | TX | | | 2015 | | | | 100.0 | % | | | 312,923 | | | | 2,394,000 | | | | 7.65 | | | | 8.8 | | | | 35,648,449 | | | | 16,747,643 | |

| 28 | | FedEx Ground Package System, Inc. | | Davenport (Orlando) | | FL | | | 2016 | | | | 100.0 | % | | | 310,922 | | | | 2,625,000 | | | | 8.44 | | | | 9.8 | | | | 38,087,185 | | | | 19,635,183 | |

| 29 | | FedEx Ground Package System, Inc. | | Jacksonville | | FL | | | 2015 | | | | 100.0 | % | | | 304,859 | | | | 1,998,000 | | | | 6.55 | | | | 8.5 | | | | 30,925,530 | | | | 12,908,433 | |

| 30 | | Science Applications International Corporation | | Hanahan (Charleston) | | SC | | | 2005 | | | | 100.0 | % | | | 302,400 | | | | 1,708,000 | | | | 5.65 | | | | 2.3 | | | | 14,463,148 | | | | -0- | |

| 31 | | Amazon.com Services, Inc. (Amazon.com, Inc.) | | Oklahoma City | | OK | | | 2018 | | | | 100.0 | % | | | 300,000 | | | | 1,948,000 | | | | 6.49 | | | | 6.3 | | | | 29,878,942 | | | | 16,721,349 | |

| 32 | | International Paper Company | | Kenton | | OH | | | 2017 | | | | 100.0 | % | | | 298,472 | | | | 1,281,000 | | | | 4.29 | | | | 6.2 | | | | 18,730,500 | | | | 9,758,566 | |

| 33 | | Western Container Corp. (Coca-Cola) | | Tolleson (Phoenix) | | AZ | | | 2003 | | | | 100.0 | % | | | 288,045 | | | | 1,409,000 | | | | 4.89 | | | | 5.8 | | | | 16,824,226 | | | | 1,333,843 | |

| 34 | | FedEx Ground Package System, Inc. | | Greensboro | | NC | | | 2020 | | | | 100.0 | % | | | 286,281 | | | | 3,002,000 | | | | 10.49 | | | | 13.8 | | | | 46,710,877 | | | | 28,688,046 | |

| 35 | | International Paper Company | | Edwardsville (Kansas City) | | KS | | | 2014 | | | | 100.0 | % | | | 280,019 | | | | 1,382,000 | | | | 4.94 | | | | 2.2 | | | | 18,294,108 | | | | 7,012,132 | |

| 36 | | FedEx Ground Package System, Inc. | | Charleston | | SC | | | 2018 | | | | 100.0 | % | | | 265,318 | | | | 2,713,000 | | | | 10.23 | | | | 12.0 | | | | 46,576,380 | | | | 25,582,685 | |

| 37 | | NF&M International, Inc. | | Monaca (Pittsburgh) | | PA | | | 1977 | | | | 68.4 | % | | | 255,658 | | | | 795,000 | | | | 4.55 | | | | 3.8 | | | | 7,963,722 | | | | -0- | |

| 38 | | FedEx Ground Package System, Inc. | | Orion | | MI | | | 2007 | | | | 100.0 | % | | | 245,633 | | | | 1,908,000 | | | | 7.77 | | | | 2.0 | | | | 23,069,307 | | | | -0- | |

| 39 | | FedEx Ground Package System, Inc. | | Homestead (Miami) | | FL | | | 2017 | | | | 100.0 | % | | | 237,756 | | | | 2,282,000 | | | | 9.60 | | | | 10.8 | | | | 37,911,556 | | | | 19,553,431 | |

| 40 | | Anda Pharmaceuticals, Inc. | | Olive Branch (Memphis, TN) | | MS | | | 2012 | | | | 100.0 | % | | | 234,660 | | | | 1,220,000 | | | | 5.20 | | | | 1.1 | | | | 14,550,000 | | | | 5,736,033 | |

| 41 | | FedEx Ground Package System, Inc. | | Colorado Springs | | CO | | | 2016 | | | | 100.0 | % | | | 225,362 | | | | 1,832,000 | | | | 8.13 | | | | 4.6 | | | | 29,320,066 | | | | 13,748,383 | |

| 42 | | Mickey Thompson Performance Tires and Wheels (Goodyear Tire & Rubber Company) | | Stow | | OH | | | 2017 | | | | 100.0 | % | | | 219,765 | | | | 1,537,000 | | | | 6.99 | | | | 6.2 | | | | 18,934,065 | | | | 10,284,946 | |

| 43 | | Rinnai America Corporation | | Griffin (Atlanta) | | GA | | | 2006 | | | | 100.0 | % | | | 218,120 | | | | 913,000 | | | | 4.19 | | | | 1.5 | | | | 15,082,217 | | | | -0- | |

| 44 | | FedEx Ground Package System, Inc. | | Ft. Myers | | FL | | | 2017 | | | | 100.0 | % | | | 213,672 | | | | 1,418,000 | | | | 6.64 | | | | 6.2 | | | | 21,684,310 | | | | 11,084,432 | |

| 45 | | FedEx Ground Package System, Inc. | | Burlington (Seattle/Everett) | | WA | | | 2016 | | | | 100.0 | % | | | 210,445 | | | | 1,962,000 | | | | 9.32 | | | | 9.2 | | | | 30,369,301 | | | | 14,569,993 | |

| 46 | | FedEx Ground Package System, Inc. | | Sauget (St. Louis, MO) | | IL | | | 2015 | | | | 100.0 | % | | | 198,729 | | | | 1,036,000 | | | | 5.21 | | | | 7.9 | | | | 15,407,470 | | | | 6,827,092 | |

| 47 | | Anheuser-Busch, Inc. | | Granite City (St. Louis, MO) | | IL | | | 2001 | | | | 100.0 | % | | | 184,800 | | | | 854,000 | | | | 4.62 | | | | 0.4 | | | | 12,757,540 | | | | -0- | |

| 48 | | Carrier Enterprise, LLC (Carrier Global Corporation) | | Carrollton (Dallas) | | TX | | | 2010 | | | | 100.0 | % | | | 184,317 | | | | 1,160,000 | | | | 6.29 | | | | 2.6 | | | | 18,494,917 | | | | 4,025,447 | |

| 49 | | FedEx Ground Package System, Inc. | | Spring (Houston) | | TX | | | 2014 | | | | 100.0 | % | | | 181,176 | | | | 1,581,000 | | | | 8.73 | | | | 3.3 | | | | 19,328,922 | | | | 6,106,876 | |

| 50 | | Carlstar Group, LLC | | Edwardsville (Kansas City) | | KS | | | 2003 | | | | 100.0 | % | | | 179,280 | | | | 771,000 | | | | 4.30 | | | | 2.1 | | | | 7,282,986 | | | | -0- | |

| 51 | | FedEx Ground Package System, Inc. | | Ft. Mill (Charlotte, NC) | | SC | | | 2010 | | | | 100.0 | % | | | 176,939 | | | | 1,598,000 | | | | 9.03 | | | | 7.2 | | | | 17,063,643 | | | | -0- | |

| 52 | | FedEx Ground Package System, Inc. | | Covington (New Orleans) | | LA | | | 2016 | | | | 100.0 | % | | | 175,315 | | | | 1,274,000 | | | | 7.27 | | | | 4.0 | | | | 18,425,875 | | | | 9,111,843 | |

| 53 | | FedEx Ground Package System, Inc. | | Tampa | | FL | | | 2004 | | | | 100.0 | % | | | 174,975 | | | | 1,624,000 | | | | 9.28 | | | | 5.1 | | | | 19,745,245 | | | | -0- | |

| 54 | | FedEx Ground Package System, Inc. | | Livonia (Detroit) | | MI | | | 2013 | | | | 100.0 | % | | | 172,668 | | | | 1,194,000 | | | | 6.92 | | | | 0.8 | | | | 13,887,897 | | | | 4,446,791 | |

| 55 | | Home Depot U.S.A., Inc. | | Montgomery (Chicago) | | IL | | | 2004 | | | | 100.0 | % | | | 171,230 | | | | 1,079,000 | | | | 6.30 | | | | 1.5 | | | | 11,303,317 | | | | -0- | |

| 56 | | FedEx Ground Package System, Inc. | | Edinburg | | TX | | | 2011 | | | | 100.0 | % | | | 164,207 | | | | 1,097,000 | | | | 6.68 | | | | 5.3 | | | | 12,039,014 | | | | -0- | |

| 57 | | FedEx Ground Package System, Inc. | | Lindale (Tyler) | | TX | | | 2015 | | | | 100.0 | % | | | 163,383 | | | | 725,000 | | | | 4.44 | | | | 3.0 | | | | 10,021,240 | | | | 4,503,798 | |

| 58 | | Bunzl Distribution Midcentral, Inc. | | Kansas City | | MO | | | 2015 | | | | 100.0 | % | | | 158,417 | | | | 714,000 | | | | 4.51 | | | | 5.3 | | | | 10,003,235 | | | | -0- | |

| 59 | | FedEx Ground Package System, Inc. | | Oklahoma City | | OK | | | 2012 | | | | 100.0 | % | | | 158,340 | | | | 1,048,000 | | | | 6.62 | | | | 4.1 | | | | 12,624,833 | | | | 1,913,054 | |

| 60 | | Magna Seating of America, Inc. | | Lancaster (Columbus) | | OH | | | 2020 | | | | 100.0 | % | | | 152,995 | | | | 1,201,000 | | | | 7.85 | | | | 8.6 | | | | 17,557,830 | | | | 8,511,498 | |

THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information THIRD QUARTER FISCAL YEAR 2021 SUPPLEMENTAL information | 18 |

Property Table

(unaudited)

| | | | | | | | | | | | | | | | | | | Rent | | | Lease Exp. | | | | | | | |

| | | | | | | | | Fiscal Year | | | | | | Square | | | Annual | | | Per sf | | | Term in | | | Undepreciated | | | Mortgage | |

| No | | Tenant | | City (MSA) | | State | | Acquisition | | | Occup. | | | Footage | | | Rent | | | Occup. | | | Years | | | Cost | | | Balance | |

| 61 | | FedEx Ground Package System, Inc. | | Waco | | TX | | | 2012 | | | | 100.0 | % | | | 150,710 | | | $ | 1,078,000 | | | $ | 7.15 | | | | 4.2 | | | $ | 12,551,368 | | | $ | 3,364,812 | |

| 62 | | FedEx Ground Package System, Inc. | | Beltsville (Washington, DC) | | MD | | | 2001 | | | | 100.0 | % | | | 148,881 | | | | 1,455,000 | | | | 9.77 | | | | 7.1 | | | | 14,632,389 | | | | -0- | |

| 63 | | Victory Packaging, L.P. | | Fayetteville | | NC | | | 1997 | | | | 100.0 | % | | | 148,000 | | | | 504,000 | | | | 3.41 | | | | 3.7 | | | | 5,458,279 | | | | -0- | |

| 64 | | FedEx Ground Package System, Inc. | | El Paso | | TX | | | 2006 | | | | 100.0 | % | | | 144,199 | | | | 1,345,000 | | | | 9.33 | | | | 2.3 | | | | 12,431,192 | | | | -0- | |

| 65 | | FedEx Ground Package System, Inc. | | Cocoa | | FL | | | 2008 | | | | 100.0 | % | | | 144,138 | | | | 1,112,000 | | | | 7.71 | | | | 3.3 | | | | 14,127,449 | | | | -0- | |

| 66 | | FedEx Ground Package System, Inc. | | Cudahy (Milwaukee) | | WI | | | 2001 | | | | 100.0 | % | | | 139,564 | | | | 827,000 | | | | 5.93 | | | | 6.0 | | | | 9,807,221 | | | | -0- | |

| 67 | | Challenger Lifts, Inc. (Snap-On Inc.) | | Louisville | | KY | | | 2016 | | | | 100.0 | % | | | 137,500 | | | | 858,000 | | | | 6.24 | | | | 4.9 | | | | 11,304,000 | | | | 5,377,343 | |

| 68 | | FedEx Ground Package System, Inc. | | Richfield (Cleveland) | | OH | | | 2006 | | | | 100.0 | % | | | 131,152 | | | | 1,493,000 | | | | 11.38 | | | | 3.3 | | | | 16,577,311 | | | | -0- | |

| 69 | | FedEx Ground Package System, Inc. | | Savannah | | GA | | | 2019 | | | | 100.0 | % | | | 126,520 | | | | 1,765,000 | | | | 13.95 | | | | 7.3 | | | | 27,531,560 | | | | 15,321,954 | |

| 70 | | General Electric Company | | Imperial (Pittsburgh) | | PA | | | 2016 | | | | 100.0 | % | | | 125,860 | | | | 1,329,000 | | | | 10.56 | | | | 9.5 | | | | 19,972,983 | | | | 8,949,697 | |

| 71 | | FedEx Ground Package System, Inc. | | Wheeling (Chicago) | | IL | | | 2003 | | | | 100.0 | % | | | 123,000 | | | | 1,272,000 | | | | 10.34 | | | | 5.9 | | | | 19,044,540 | | | | -0- | |

| 72 | | FedEx Ground Package System, Inc. | | Altoona | | PA | | | 2014 | | | | 100.0 | % | | | 122,522 | | | | 651,000 | | | | 5.31 | | | | 2.2 | | | | 9,022,966 | | | | 2,098,202 | |

| 73 | | FedEx Corporation | | Charleston | | SC | | | 2018 | | | | 100.0 | % | | | 121,683 | | | | 1,314,000 | | | | 10.80 | | | | 11.2 | | | | 21,538,966 | | | | 11,641,536 | |

| 74 | | Amazon.com Services, LLC | | Oklahoma City | | OK | | | 2020 | | | | 100.0 | % | | | 120,780 | | | | 935,000 | | | | 7.74 | | | | 9.2 | | | | 14,962,513 | | | | 9,403,324 | |

| 75 | | FedEx Corporation | | Mechanicsville (Richmond) | | VA | | | 2001 | | | | 100.0 | % | | | 112,799 | | | | 541,000 | | | | 4.80 | | | | 1.8 | | | | 7,836,425 | | | | -0- | |

| 76 | | FedEx Corporation | | Orlando | | FL | | | 2008 | | | | 100.0 | % | | | 110,621 | | | | 666,000 | | | | 6.02 | | | | 6.4 | | | | 8,810,059 | | | | -0- | |

| 77 | | Bunzl Distribution Oklahoma, Inc. | | Oklahoma City | | OK | | | 2017 | | | | 100.0 | % | | | 110,361 | | | | 743,000 | | | | 6.73 | | | | 3.2 | | | | 8,728,439 | | | | 4,356,890 | |

| 78 | | Style Crest, Inc. | | Winston-Salem | | NC | | | 2002 | | | | 100.0 | % | | | 106,507 | | | | 433,000 | | | | 4.07 | | | | 4.8 | | | | 7,421,032 | | | | -0- | |

| 79 | | Sonwil Distribution Center, Inc. | | Cheektowaga (Buffalo) | | NY | | | 2002 | | | | 100.0 | % | | | 104,981 | | | | 630,000 | | | | 6.00 | | | | 0.6 | | | | 10,960,823 | | | | -0- | |

| 80 | | FedEx Ground Package System, Inc. | | West Chester Twp. (Cincinnati) | | OH | | | 2000 | | | | 100.0 | % | | | 103,818 | | | | 560,000 | | | | 5.39 | | | | 2.2 | | | | 5,733,686 | | | | -0- | |

| 81 | | FedEx Ground Package System, Inc. | | Roanoke | | VA | | | 2013 | | | | 100.0 | % | | | 103,580 | | | | 755,000 | | | | 7.29 | | | | 1.8 | | | | 10,200,000 | | | | 3,000,099 | |

| 82 | | Pittsburgh Glass Works, LLC, a Division of VITRO | | O’ Fallon (St. Louis) | | MO | | | 1994 | | | | 100.0 | % | | | 102,135 | | | | 508,000 | | | | 4.97 | | | | 5.0 | | | | 4,249,615 | | | | -0- | |

| 83 | | FedEx Ground Package System, Inc. | | Green Bay | | WI | | | 2013 | | | | 100.0 | % | | | 99,102 | | | | 468,000 | | | | 4.72 | | | | 1.9 | | | | 6,570,000 | | | | 1,702,945 | |

| 84 | | Dakota Bodies, LLC | | Liberty (Kansas City) | | MO | | | 1998 | | | | 100.0 | % | | | 96,687 | | | | 416,000 | | | | 4.30 | | | | 4.8 | | | | 7,797,827 | | | | -0- | |

| 85 | | FedEx Corporation | | Jacksonville | | FL | | | 1999 | | | | 100.0 | % | | | 95,883 | | | | 536,000 | | | | 5.59 | | | | 7.9 | | | | 6,584,384 | | | | -0- | |

| 86 | | FedEx Corporation | | Tampa | | FL | | | 2006 | | | | 100.0 | % | | | 95,662 | | | | 603,000 | | | | 6.30 | | | | 6.4 | | | | 8,305,383 | | | | -0- | |

| 87 | | Amazon.com Services, Inc. | | Hanahan (Charleston) | | SC | | | 2005 | | | | 100.0 | % | | | 91,776 | | | | 803,000 | | | | 8.75 | | | | 8.0 | | | | 9,306,108 | | | | -0- | |

| 88 | | National Oilwell Varco, Inc. | | Houston | | TX | | | 2010 | | | | 100.0 | % | | | 91,295 | | | | 801,000 | | | | 8.77 | | | | 8.3 | | | | 8,190,901 | | | | 671,412 | |

| 89 | | Joseph T. Ryerson and Son, Inc. | | Elgin (Chicago) | | IL | | | 2002 | | | | 100.0 | % | | | 89,123 | | | | 519,000 | | | | 5.82 | | | | 3.6 | | | | 7,184,598 | | | | -0- | |

| 90 | | FedEx Corporation | | Omaha | | NE | | | 1999 | | | | 100.0 | % | | | 89,115 | | | | 446,000 | | | | 5.00 | | | | 2.3 | | | | 5,963,626 | | | | -0- | |

| 91 | | FedEx Ground Package System, Inc. | | Huntsville | | AL | | | 2005 | | | | 100.0 | % | | | 88,890 | | | | 605,000 | | | | 6.81 | | | | 5.1 | | | | 6,661,819 | | | | -0- | |

| 92 | | CHEP USA, Inc. | | Roanoke | | VA | | | 2007 | | | | 100.0 | % | | | 83,000 | | | | 509,000 | | | | 6.13 | | | | 3.7 | | | | 7,463,672 | | | | -0- | |

| 93 | | FedEx Corporation | | Bedford Heights (Cleveland) | | OH | | | 2007 | | | | 100.0 | % | | | 82,269 | | | | 438,000 | | | | 5.32 | | | | 7.2 | | | | 7,304,467 | | | | -0- | |

| 94 | | United Parcel Service, Inc. | | Halfmoon (Albany) | | NY | | | 2012 | | | | 100.0 | % | | | 75,000 | | | | 595,000 | | | | 7.93 | | | | 9.8 | | | | 6,741,021 | | | | -0- | |

| 95 | | FedEx Corporation | | Schaumburg (Chicago) | | IL | | | 1997 | | | | 100.0 | % | | | 73,500 | | | | 478,000 | | | | 6.50 | | | | 5.8 | | | | 5,447,053 | | | | -0- | |