UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

Montgomery Street Income Securities, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

Notice of 2009

Annual Meeting

of Stockholders

and

Proxy Statement

MONTGOMERY STREET INCOME SECURITIES, INC.

(TICKER: MTS)

May 22, 2009

To the Stockholders:

The Annual Meeting of Stockholders of Montgomery Street Income Securities, Inc. (the “Fund”) is to be held at 10:00 a.m. (Pacific time) on Thursday, July 9, 2009 at 3 Embarcadero Center, 7th Floor, San Francisco, California. A Proxy Statement regarding the meeting, a proxy card for your vote at the meeting and a postage-prepaid envelope, in which to return your proxy card, are enclosed.

At the meeting, the stockholders will elect the Fund’s Directors. In addition, the stockholders present will hear a report by the Fund’s investment manager, Hartford Investment Management Company. There will be an opportunity to discuss matters of interest to you as a stockholder.

The enclosed Proxy Statement provides greater detail about the election of the Fund’s Directors. The Board of Directors of the Fund recommends that the stockholders vote in favor of electing each of the nominees proposed.

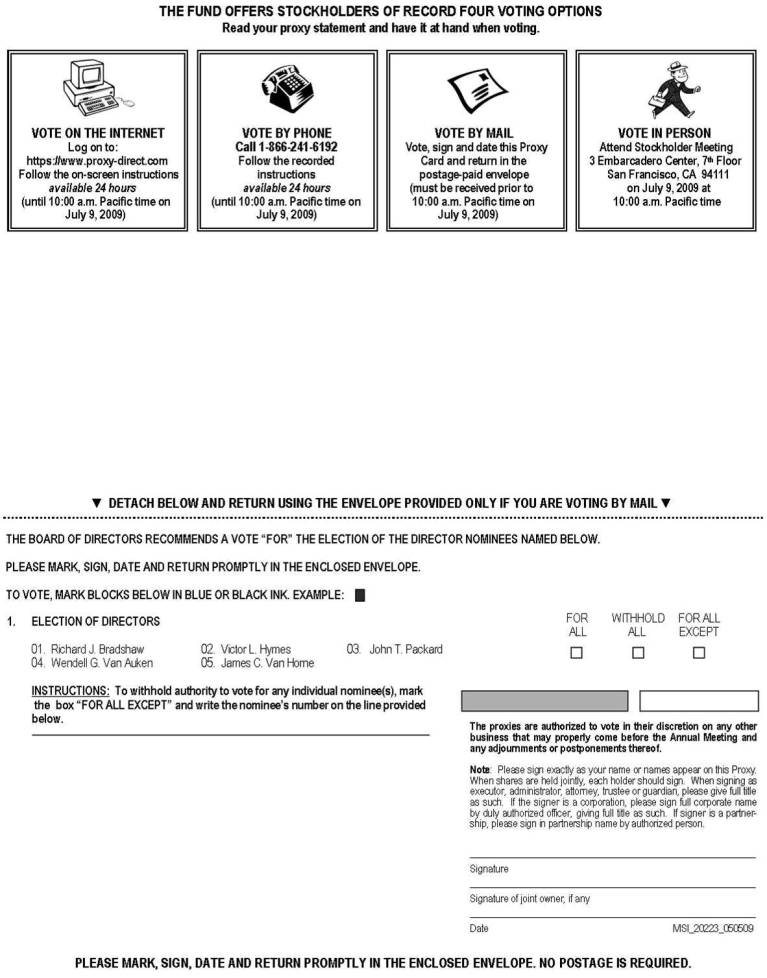

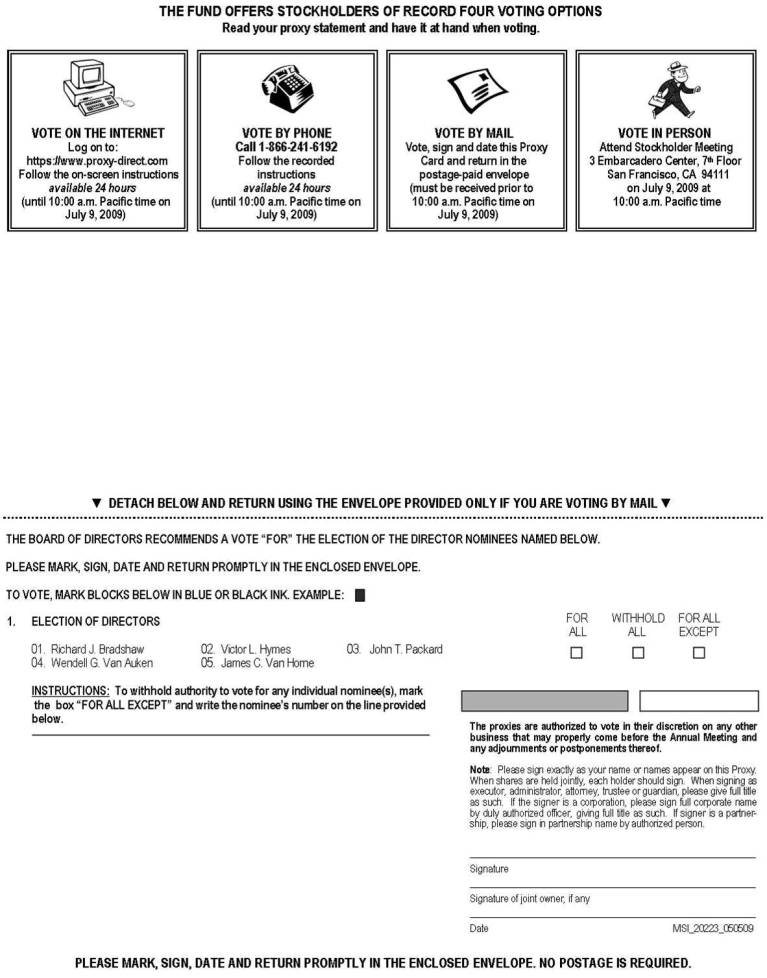

To vote, simply fill out, sign and date the enclosed proxy card, and return it to us in the enclosed postage-prepaid envelope. You also may vote through the internet by visiting the website address on your proxy card, by telephone by using the toll-free number on your proxy card, or in person at the meeting.

For additional information, please call Jackson Fund Services, the Fund’s administrator, toll free at (866) 255-1935.

Your vote is very important to us. Thank you for your response and for your continued investment with the Fund.

Respectfully,

Richard J. Bradshaw | Mark D. Nerud |

Chairman of the | President and |

Board of Directors | Chief Executive Officer |

MONTGOMERY STREET INCOME SECURITIES, INC.

Notice of Annual Meeting of Stockholders

To the Stockholders of Montgomery Street Income Securities, Inc.:

Please take notice that the Annual Meeting of Stockholders (the “Annual Meeting”) of Montgomery Street Income Securities, Inc. (the “Fund”) has been called to be held at 3 Embarcadero Center, 7th Floor, San Francisco, California, on Thursday, July 9, 2009 at 10:00 a.m. (Pacific time), to elect five Directors of the Fund to hold office until the next Annual Meeting or until their respective successors shall have been duly elected and qualified.

Those present and the appointed proxies also will transact such other business, if any, as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Holders of record of the shares of common stock of the Fund at 5:00 p.m. (Eastern time) on May 8, 2009 are entitled to vote at the Annual Meeting or any adjournments or postponements thereof.

In the event that the necessary quorum to transact business or the vote required to approve any proposal is not obtained at the Annual Meeting, the persons named as proxies on the enclosed proxy card may propose one or more adjournments of the Annual Meeting to permit, in accordance with applicable law, further solicitation of proxies with respect to that proposal. Any such adjournment as to a matter will require the affirmative vote of the holders of a majority of the shares present in person or by proxy at the session of the Annual Meeting to be adjourned. The persons named as proxies on the enclosed proxy card will vote FOR any such adjournment those proxies which they are entitled to vote in favor of the proposal for which further solicitation of proxies is to be made. They will vote AGAINST any such adjournment those proxies required to be voted against such proposal.

| By order of the Board of Directors, |

Susan S. Rhee, Secretary

May 22, 2009

IMPORTANT—We urge you to sign and date the enclosed proxy card and return it in the enclosed addressed envelope, which requires no postage and is intended for your convenience. You may also vote through the internet by visiting the website address on your proxy card or by telephone by using the toll-free number on your proxy card. Your prompt vote may save the Fund the necessity of further solicitations to ensure a quorum at the Annual Meeting. If you can attend the Annual Meeting and wish to vote your shares in person at that time, you will be able to do so. |

Montgomery Street Income Securities, Inc.

c/o Jackson Fund Services

225 West Wacker Drive, Suite 1200

Chicago, Illinois 60606

(866) 255-1935

PROXY STATEMENT

RECORD DATE: May 8, 2009 | MAILING DATE: May 22, 2009 |

Introduction

The Board of Directors of Montgomery Street Income Securities, Inc. (the “Fund”) is soliciting proxies for use at the Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held at 3 Embarcadero Center, 7th Floor, San Francisco, California, on Thursday, July 9, 2009 at 10:00 a.m. (Pacific time). The Board of Directors also is soliciting proxies for use at any adjournment or postponement of the Annual Meeting. This Proxy Statement is furnished in connection with this solicitation. To obtain directions to the Annual Meeting, please call Jackson Fund Services, the Fund’s administrator (the “Administrator”), toll-free at (866) 255-1935.

Important Notice Regarding the Internet Availability of Proxy and Other Materials for the Annual Meeting

This Proxy Statement and the accompanying Notice of Annual Meeting of Stockholders and form of proxy card also are available on the Fund’s website at www.montgomerystreetincome.com.

You may, without charge, view the annual report of the Fund for the fiscal year ended December 31, 2008 in the “Financial Reports” tab on the Fund’s website at www.montgomerystreetincome.com or request an additional copy of the annual report by calling toll-free (877) 437-3938 or writing the Fund care of BNY Mellon Shareowner Services, P.O. Box 3315, South Hackensack, New Jersey 07606-1915.

Voting Information

The Fund may solicit proxies by mail, telephone, telegram, and personal interview. Computershare Fund Services, 280 Oser Avenue, Hauppauge, New York 11788, has been engaged to assist in the

solicitation of proxies for the Fund, at an estimated cost of $3,550 plus expenses. In addition, the Fund may request personnel of the Fund’s Administrator to assist in the solicitation of proxies for no separate compensation. It is anticipated that the Fund will request brokers, custodians, nominees, and fiduciaries who are record owners of stock to forward proxy materials to their principals and obtain authorization for the execution of proxies. Upon request, the Fund will reimburse the brokers, custodians, nominees, and fiduciaries for their reasonable expenses in forwarding proxy materials to their principals. The Fund will bear the cost of soliciting proxies.

You may revoke the enclosed proxy at any time insofar as it has not yet been exercised by the appointed proxies. You may revoke the enclosed proxy by the following methods:

| • | Providing written notice to the Fund at the following address: |

Montgomery Street Income Securities, Inc.

c/o Proxy Tabulator

P.O. Box 18011

Hauppauge, NY 11788-8811;

| • | Giving a later proxy; or |

| • | Attending the Annual Meeting and voting your shares in person. |

In order to obtain the quorum necessary to transact business, a majority of the shares entitled to be voted must have been received by proxy or be present at the Annual Meeting. Proxies that are marked to withhold voting, as well as proxies returned by brokers or others who have not received voting instructions and do not have discretion to vote for their clients (“broker non-votes”), will be counted towards this quorum. Withheld votes and broker non-votes will not be counted in favor of, but will have no other effect on, the election of Directors. Broker non-votes are not likely to be relevant to the Annual Meeting because the New York Stock Exchange currently considers an uncontested election of Directors to be routine and within the discretion of brokers to vote if customer instructions are not received.

In the event that the necessary quorum to transact business or the vote required to elect the proposed nominees is not obtained at the Annual Meeting, the persons named as proxies on the enclosed proxy card may propose one or more adjournments of the Annual Meeting to permit, in accordance with applicable law, further solicitation of proxies. Any such adjournment as to a matter will require the affirmative vote of

the holders of a majority of the shares present in person or by proxy at the session of the Annual Meeting to be adjourned. The persons named as proxies on the enclosed proxy card will vote FOR any such adjournment those proxies which they are entitled to vote in favor of the proposal for which further solicitation of proxies is to be made. They will vote AGAINST any such adjournment those proxies required to be voted against such proposal.

The record date for determination of stockholders entitled to receive notice of the Annual Meeting and to vote at the Annual Meeting or any adjournments or postponements thereof was May 8, 2009 at 5:00 p.m. Eastern time (the “Record Date”).

As of the Record Date, there were issued and outstanding 10,382,243 shares of common stock of the Fund, constituting all of the Fund’s then outstanding securities. Each share of common stock is entitled to one vote.

Security Ownership

The following table sets forth for each Director of the Fund, the Principal Executive and Principal Financial Officers of the Fund, and the Directors and Executive Officers of the Fund as a group as of March 31, 2009 the amount of shares beneficially owned in the Fund, the dollar range of securities owned in the Fund, and the aggregate dollar range of all shareholdings in all funds overseen by each Director in the same family of investment companies. Each Director’s, the Principal Executive Officer’s and the Principal Financial Officer’s individual beneficial shareholdings in the Fund constituted less than 1% of the outstanding shares of the Fund; and, as a group, the Directors and Executive Officers owned beneficially less than 1% of the outstanding shares of the Fund.

Name and Position | Amount of Shares Beneficially Owned in the Fund(1) | Dollar Range of Equity Securities in the Fund | Aggregate Dollar Range of Equity Securities in all Funds Overseen in Family of Investment Companies(2) |

Independent Directors | | | |

Richard J. Bradshaw Chairman and Director | 13,550 (3) | Over $100,000 | Over $100,000 |

Victor L. Hymes Director | 5,873 (4) | $50,001 -$100,000 | $50,001 -$100,000 |

John T. Packard Director | 1,500 | $10,001 - $50,000 | $10,001 - $50,000 |

Wendell G. Van Auken Director | 38,090 (5) | Over $100,000 | Over $100,000 |

James C. Van Horne Director | 2,500 | $10,001 - $50,000 | $10,001 - $50,000 |

Executive Officers | | | |

Mark D. Nerud President, Chief Executive Officer and Principal Executive Officer | 0 | 0 | 0 |

Daniel W. Koors Treasurer, Chief Financial Officer and Principal Financial Officer | 0 | 0 | 0 |

All Directors and Executive Officers as a Group | 61,513 (3), (4), (5) | Over $100,000 | |

(1) | The information as to beneficial ownership is based on statements furnished to the Fund by each Director, nominee and executive officer. Unless otherwise indicated, each person has sole voting and investment power over the shares reported. |

(2) | Consists of all funds overseen by the Director, managed by Hartford Investment Management Company, and holding themselves out as related for purposes of investment and investor services. The Fund is the only fund meeting these criteria. |

(3) | Includes 10,040 shares held with sole voting and investment power and 3,510 shares held with shared voting and investment power. |

(4) | Shares are held with shared voting and investment power. |

(5) | Includes 30,575 shares held with sole voting and investment power and 7,515 shares held with shared voting and investment power. |

To the Fund’s knowledge, as of December 31, 2008, the following entity owned beneficially more than 5% of the Fund’s outstanding shares:

Name and Address of Beneficial Owner | Amount of Shares Beneficially Owned in the Fund(1) | Percentage of Outstanding Shares of the Fund(2) |

Sit Investment Associates, Inc. 3300 IDS Center 80 South Eighth Street Minneapolis, MN 55402 | 732,466 | 7.05% |

(1) | The information as to beneficial ownership is based on statements furnished in the Schedule 13G filed with the U.S. Securities and Exchange Commission on February 5, 2009 by or on the behalf of the beneficial owner. |

(2) | At December 31, 2008, there were issued and outstanding 10,384,967 shares of common stock of the Fund. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and Section 30(h) of the Investment Company Act of 1940, as amended (the “1940 Act”), as applied to a closed-end fund, require a fund’s officers and directors, investment adviser, affiliated persons of the investment adviser, and persons who beneficially own more than ten percent of a registered class of the fund’s outstanding securities (“Reporting Persons”) to file reports of ownership of the fund’s securities and changes in such ownership with the U.S. Securities and Exchange Commission (the “SEC”) and any exchange on which the fund’s securities are traded. Such persons are required by SEC regulations to furnish the fund with copies of all such reports.

Based on a review of reports filed by the Fund’s Reporting Persons, and written representations by the Reporting Persons that no year-end reports were required for such persons, all filings required by Section 16(a) of the 1934 Act for the fiscal year ended December 31, 2008, were timely.

PROPOSAL: ELECTION OF DIRECTORS

At the Annual Meeting, stockholders will be asked to elect five individuals to constitute the Board of Directors of the Fund. Each Director so elected will hold office until the next annual meeting or until the election and qualification of a successor. The five individuals listed below under “Information Concerning Nominees” were nominated for election as Directors of the Fund by the Fund’s present Board of Directors. Each of the nominees is currently a Director of the Fund and was elected to serve as a Director at the 2008 Annual Meeting of Stockholders.

The persons named proxies on the enclosed proxy card intend to vote for all of the nominees named below, unless authority to vote for any or all of the nominees is withheld. In the unanticipated event that any nominee for Director cannot be a candidate at the Annual Meeting, the appointed proxies will vote their proxy in favor of the remainder of the nominees and, in addition, in favor of such substitute nominee(s) (if any) as the Board of Directors shall designate. Alternatively, the proxies may vote in favor of a resolution reducing the number of Directors to be elected at the Annual Meeting.

Information Concerning Nominees

Each of the nominees is listed below. The address of each nominee is Montgomery Street Income Securities, Inc., c/o Jackson Fund Services, 225 West Wacker Drive, Suite 1200, Chicago, Illinois 60606. Each nominee has consented to be nominated and to serve if elected.

Nominee (Age) | Principal Occupation or Employment during Past Five Years and Other Directorships in Publicly Held Companies | Year First Became a Director of the Fund |

Independent Directors | |

Richard J. Bradshaw (60) | Partner and Chief Operating Officer of Venrock (venture capital firm) (2008 – present). Formerly, Executive Director of Cooley Godward Kronish LLP (law firm) (1997 – 2008). Chairman of the Board of Directors of the Fund (since 2004). | 1991 |

Victor L. Hymes (51) | Chief Executive Officer, Chief Investment Officer, and Director of Legato Capital Management LLC (investment adviser) (2004 – present). Formerly, Chief Operating Officer and Chief Investment Officer of Cazenave Partners, LLC (investment adviser) (2003 – 2004); Managing Director, Zurich Scudder Investments, Inc. (a former adviser of the Fund) (1997 – 2002); and President of the Fund (2000 – 2002). | 2005 |

John T. Packard (75) | Of Counsel to Mt. Eden Investment Advisors LLC (2008 – present). Formerly, Executive Vice President of Mt. Eden Investment Advisors LLC (2005 – 2008); Managing Director, Weiss, Peck & Greer LLC (investment adviser and broker-dealer) (2002 – 2004); Advisory Managing Director of the same firm (2000 – 2002); Advisory Managing Director, Zurich Scudder Investments, Inc. (a former adviser of the Fund) (1999 – 2000); Managing Director of the same firm (1985 – 1998); and President of the Fund (1988 – 2000). | 2001 |

Wendell G. Van Auken (64) | Managing Director of several venture capital funds affiliated with Mayfield Fund. Directorship: Advent Software (portfolio software company). | 1994 |

James C. Van Horne (73) | A.P. Giannini Professor of Finance, emeritus, Graduate School of Business, Stanford University. Directorship: Synnex Corporation (information technology distributor). Formerly, Chairman of the Board of Directors of the Fund (1991 – 2004). | 1985 |

A majority of the board members of a registered investment company must not be interested persons (“Interested Persons”) of the company, as defined in the 1940 Act, for the company to take advantage of certain exemptive rules under the 1940 Act. Directors of the Fund who are not Interested Persons are referred to in this Proxy Statement as “Independent Directors.” If the nominees proposed for election as Directors of the Fund are elected, all the members of the Board of Directors will be Independent Directors. As required, each of the nominees who will be considered an Independent Director, if elected, was selected and nominated solely by the current Independent Directors of the Fund.

Each nominee currently serves as a Board member of one portfolio in the complex of funds that hold themselves out as related companies for purposes of investment or investor services or are managed by Hartford Investment Management Company (the “Investment Adviser”) or its affiliated persons (the “Fund Complex”). The Investment Adviser is located at 55 Farmington Avenue, Hartford, Connecticut 06105.

As of March 31, 2009, none of the nominees beneficially owned securities of the Investment Adviser or any person directly or indirectly controlling, controlled by or under common control with the Investment Adviser.

Board of Directors; Nominations; Board and Committee Meetings

The primary responsibility of the Board of Directors is to represent the interests of the stockholders of the Fund and to provide oversight of the management of the Fund.

The Board of Directors does not have a nominating committee or a charter relating to the nomination of Directors. The full Board considers possible candidates to fill vacancies on the Board of Directors, reviews the qualifications of candidates recommended by stockholders and others, and recommends the slate of nominees to be proposed for election by stockholders at each annual meeting. As noted above, individuals who would be considered Independent Directors, if elected, must be selected and nominated solely by the Independent Directors of the Fund. In light of the fact that all the members of the Board of Directors are Independent Directors, the Board believes that it is appropriate for the full Board to participate in the consideration of Director candidates. Stockholders wishing to recommend any Director candidate should submit in writing a brief description of the candidate’s business experience and other

information relevant to the candidate’s qualifications to serve as a Director. Submissions should be addressed to the Chairman of the Board of Directors, Montgomery Street Income Securities, Inc., c/o Jackson Fund Services, 225 West Wacker Drive, Suite 1200, Chicago, Illinois 60606. In order to be considered at the 2010 Annual Meeting of Stockholders (the “2010 Annual Meeting”), submission must be received by January 23, 2010.

The Board of Directors has an Executive Committee, a Valuation Committee and an Audit Committee. In 2008, the Board of Directors held seven meetings, the Valuation Committee held one meeting, and the Audit Committee held three meetings. The Executive Committee did not meet in 2008. Each Director attended at least 75% of the total number of meetings of the Board of Directors and of all Committees of the Board on which he served in 2008.

Communications with the Board of Directors

The Board of Directors provides a process for stockholders to send communications to the Board. Correspondence should be sent by U.S. mail or courier service to the Chairman of the Board of Directors, Montgomery Street Income Securities, Inc., c/o Jackson Fund Services, 225 West Wacker Drive, Suite 1200, Chicago, Illinois 60606. It is the general policy of the Fund that the Board of Directors should be represented at the Annual Meeting. All of the Directors attended the last Annual Meeting, which was held on July 10, 2008.

Executive Committee

The Executive Committee is authorized to exercise all powers of the Board of Directors permitted to be exercised under the Maryland General Corporation Law. The Committee is composed of two Independent Directors: Messrs. Bradshaw and Van Horne.

Valuation Committee

The Valuation Committee reviews the procedures for the pricing of the Fund’s portfolio assets adopted by the full Board of Directors (the “Pricing Procedures”), assists the Fund’s Administrator in determining the fair value of portfolio assets of the Fund as needed in accordance with the Pricing Procedures, and performs such other tasks as the full Board of Directors deems necessary. The Committee is composed of three Independent Directors: Messrs. Hymes (Chair), Van Auken and Van Horne.

Audit Committee

The Audit Committee oversees the accounting and financial reporting policies and practices of the Fund, its internal controls over financial reporting and, as the Audit Committee deems appropriate, the internal controls of certain service providers to the Fund. The Audit Committee also oversees the quality, objectivity and integrity of the Fund’s financial statements and the independent audit thereof, exercises direct responsibility for the appointment, compensation, retention and oversight of the work performed by the independent auditor, reviews the independent auditor’s qualifications and independence, and acts as a liaison between the Fund’s independent auditor and the full Board of Directors.

The Audit Committee is composed of three Independent Directors: Messrs. Van Auken (Chair), Packard and Van Horne. Each Committee member meets the independence requirements of the New York Stock Exchange listing standards. The Audit Committee is governed by a written charter adopted by the Board of Directors that sets forth in greater detail the Committee’s purposes, duties and powers. A copy of the current Audit Committee Charter is available on the Fund’s website at www.montgomerystreetincome.com.

Audit Committee Report

At a meeting of the Audit Committee held on February 17, 2009, the members of the Audit Committee and Board of Directors of the Fund reviewed the Fund’s audited financial statements and discussed the financial statements with management and the independent auditor. The Committee discussed with the independent auditor the matters required to be discussed by Statement of Auditing Standards No. 114, The Auditor’s Communication With Those Charged With Governance, as currently modified or supplemented. In addition, the Committee discussed with the independent auditor the auditor’s independence and received the related written disclosures and letter required by the Public Company Accounting Oversight Board.

Based on those reviews and discussions, the Committee recommended to the Board of Directors that the audited financial statements be included in the Fund’s annual report to stockholders for the fiscal year ended December 31, 2008.

Wendell G. Van Auken, Chair

John T. Packard

James C. Van Horne

Independent Auditor

The Fund’s financial statements for the fiscal years ended December 31, 2007 and 2008 were audited by Deloitte & Touche LLP (“Deloitte”).

At a meeting held on February 17, 2009, based on Audit Committee recommendations and approvals, the full Board of Directors unanimously voted to approve Deloitte as the Fund’s independent registered public accounting firm for the fiscal year ending December 31, 2009. Representatives of Deloitte are not expected to be present at the Annual Meeting but will be available by telephone to respond to appropriate questions and to make a statement if they desire to do so.

Fees for Services. The following table shows fees billed by Deloitte during the 2007 and 2008 fiscal years for audit, audit-related, tax and other services provided to the Fund.

Fees for Services Rendered to the Fund by the Independent Auditor

Fiscal Year | Audit Fees | Audit-Related Fees | Tax Fees(1) | All Other Fees |

2007 | $44,800 | $0 | $4,000 | $0 |

2008 | $46,800 | $0 | $4,200 | $0 |

(1) | Tax Fees for 2007 and 2008 represent fees for services rendered to the Fund for review of tax returns and income and capital gains distributions. |

The following table shows fees billed by Deloitte during the 2007 and 2008 fiscal years for audit-related, tax and other services provided to the Investment Adviser and entities controlling, controlled by, or under common control with the Investment Adviser that provide ongoing services to the Fund (the “Adviser Entities”) that were directly related to the Fund’s operations and financial reporting.

Fees for Services Rendered to Adviser Entities by the Independent Auditor

Fiscal Year | Audit-Related Fees(1) | Tax Fees | All Other Fees |

2007 | $62,859 | $0 | $0 |

2008 | $67,295 | $0 | $0 |

| (1) | Audit-Related Fees for 2007 and 2008 consisted of fees for an attestation engagement relating to the Investment Adviser’s performance presentations. |

The aggregate amount of non-audit fees billed by Deloitte for services rendered to the Fund and the Adviser Entities during the 2007 and 2008 fiscal years was $66,859 and $71,495, respectively, as detailed in the above tables. The Audit Committee considered whether Deloitte’s provision of non-audit services to the Adviser Entities that were not pre-approved by the Audit Committee was compatible with maintaining Deloitte’s independence.

Audit Committee Pre-Approval Procedures. The Audit Committee has adopted procedures for the pre-approval by the Audit Committee of the engagement of the Fund’s independent auditor to provide audit and non-audit services to the Fund and the engagement of the Fund’s independent auditor to provide non-audit services to the Fund’s investment adviser or its related entities that relate directly to the Fund’s operations and financial reporting. If time does not permit, the Chairman of the Audit Committee is authorized to pre-approve the engagement of the independent auditor on behalf of the Audit Committee. The independent auditor and the investment adviser are required to report on the initiation of any such engagement at the next regular Audit Committee meeting.

Officers of the Fund

The following table sets forth certain information concerning each officer of the Fund. The address of each officer is c/o Jackson Fund Services, 225 West Wacker Drive, Suite 1200, Chicago, Illinois 60606.

Name (Age) | Position with the Fund and Principal Occupation or Employment During the Past Five Years | Year First Became an Officer(1) |

Mark D. Nerud (42) | President, Chief Executive Officer, and Principal Executive Officer. President of Jackson National Asset Management, LLC (“JNAM”) and Jackson Fund Services (“JFS”) (2006 – present); President, CEO and Trustee/Manager of investment companies advised by JNAM (2007 – present); Managing Board Member of JNAM (2000 – 2003 and 2007 – present); Vice President – Fund Accounting & Administration of Jackson National Life Insurance Company (“Jackson”) (2000 – present). Formerly, Chief Financial Officer of JNAM and JFS (2000 – 2006); Vice President (1999 – 2006), Treasurer and Chief Financial Officer of investment companies advised by JNAM (2002 – 2006). | 2006 |

Daniel W. Koors (38) | Treasurer, Chief Financial Officer, and Principal Financial Officer. Senior Vice President of JNAM and JFS (2009 – present); Chief Financial Officer of JNAM and JFS (2007 – present); Vice President, Treasurer and Chief Financial Officer of investment companies advised by JNAM (2006 – present); Assistant Vice President – Fund Administration of Jackson (2006 – present). Formerly, Vice President of JNAM and JFS (2007 – 2008); Assistant Treasurer of investment companies advised by JNAM (2006); Partner of Deloitte & Touche LLP (2003 – 2006). | 2006 |

Susan S. Rhee (37) | Secretary and Chief Legal Officer. Secretary of JNAM (2000 – present); Chief Legal Officer of JNAM (2004 – present); Vice President, Counsel, and Secretary of investment companies advised by JNAM (2004 – present); Assistant Vice President of Jackson (2003 – present); Associate General Counsel of Jackson (2001 – present). | 2006 |

Toni M. Bugni (35) | Chief Compliance Officer. Director of Compliance of JNAM and JFS (2008 – present). Formerly, Compliance Manager of JNAM and JFS (2006 – 2008); Legal Assistant, MetLife Advisers, LLC (2004 – 2006); Regulatory Administration Senior Specialist, PFPC Inc. (2003 – 2004). | 2006 |

(1) | All officers are appointed annually by, and serve at the discretion of, the Board of Directors. |

Remuneration of Directors and Officers

Each Director receives remuneration from the Fund for his services. The Fund does not compensate its officers, since the Administrator makes these individuals available to the Fund to serve without compensation from the Fund. Remuneration to Directors consists of a quarterly retainer and a fee of $750 for each Board meeting attended and $500 for each Committee meeting attended, as well as any related expenses. Prior to July 10, 2008, the Directors received a quarterly retainer of $3,000 (except the Chairman of the Board, whose quarterly retainer was $7,000, and the Chairman of the Audit Committee, whose quarterly retainer was $4,000). After July 10, 2008, the Directors receive a quarterly retainer of $3,750 (except the Chairman of the Board, whose quarterly retainer is $8,000, and the Chairman of the Audit Committee, whose quarterly retainer is $5,000). For the fiscal year ended December 31, 2008, total compensation (including reimbursement of expenses) for all Directors as a group was $112,000.

The Compensation Table below provides the following data:

| Column (1): | Each Director who received compensation from the Fund. |

| Column (2): | Aggregate compensation received by a Director from the Fund. |

| Column (3): | Total compensation received by a Director from the Fund and Fund Complex. No member of the Board serves as a Director for any other fund in the Fund Complex nor does any Director receive any pension or retirement benefits from the Fund. |

Compensation Table |

For the Fiscal Year Ended December 31, 2008 |

(1) | (2) | (3) |

Name of Director and Position | Aggregate Compensation from the Fund | Total Compensation from the Fund and the Fund Complex |

Independent Directors | | |

Richard J. Bradshaw, Chairman of the Board of Directors and Director | $33,500 | $33,500 |

Victor L. Hymes, Valuation Committee Chair and Director | $17,750 | $17,750 |

John T. Packard, Director | $18,750 | $18,750 |

Wendell G. Van Auken, Audit Committee Chair and Director | $22,750 | $22,750 |

James C. Van Horne, Director | $19,250 | $19,250 |

Board Recommendation and Required Vote

Election of the nominees for Director requires the affirmative vote of a plurality of the votes cast in person or by proxy at the Annual Meeting.

The Board of Directors recommends that the stockholders of the Fund vote FOR the election of each of the nominees for Director.

STOCKHOLDER PROPOSALS FOR 2010 PROXY STATEMENT

Stockholders wishing to submit proposals for inclusion in the proxy statement for the 2010 Annual Meeting should send their written proposals to Montgomery Street Income Securities, Inc., c/o Jackson Fund Services, 225 West Wacker Drive, Suite 1200, Chicago, Illinois 60606, for receipt by January 23, 2010. The timely submission of a proposal does not guarantee its inclusion.

The Fund may exercise discretionary voting authority with respect to stockholder proposals for the 2010 Annual Meeting which are not included in the proxy statement and form of proxy, if notice of such proposals is not received by the Fund at the above address by April 8, 2010. Even if timely notice is received, the Fund may exercise

discretionary voting authority in certain other circumstances. Discretionary voting authority is the ability to vote proxies that stockholders have executed and returned to the Fund on matters not specifically reflected on the form of proxy.

OTHER MATTERS

The Board of Directors does not know of any matters to be presented at the Annual Meeting other than that mentioned in this Proxy Statement. The appointed proxies will vote on any other business that comes before the Annual Meeting or any adjournments or postponements thereof in accordance with their best judgment.

Please complete and sign the enclosed proxy card and return it in the envelope provided, or vote through the internet or by telephone, so that the Annual Meeting may be held and action may be taken on the matter described in this Proxy Statement with the greatest possible number of shares participating. This will not preclude your voting in person if you attend the Annual Meeting.