SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrant | [X] |

| Filed by a Party other than the Registrant | [ ] |

| Check the appropriate box: |

| | [ ] | Preliminary Proxy Statement |

| | [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | [X] | Definitive Proxy Statement |

| | [ ] | Definitive Additional Materials |

| | [ ] | Soliciting Material Pursuant to §240.14a-12 |

MONTGOMERY STREET INCOME SECURITIES

THREE CANAL PLAZA, SUITE 600

PORTLAND, MAINE 04101

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total Fee Paid: |

| | |

| [ ] | Fee paid previously with preliminary materials. |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

Notice of

Special Meeting

of Stockholders

and

Proxy Statement

Montgomery Street Income Securities, Inc.

(Ticker: MTS)

October 21, 2015

To the Stockholders:

The Special Meeting of Stockholders of Montgomery Street Income Securities, Inc. (the “Fund”) is to be held at 10:00 a.m. (Pacific Time) on Monday, November 16, 2015 at 4 Embarcadero Center, 22nd Floor, San Francisco, California. A Proxy Statement regarding the meeting, a proxy card for your vote at the meeting, and a postage-prepaid envelope, in which to return your proxy card, are enclosed.

At the meeting, the stockholders will vote on the proposed dissolution and liquidation of the Fund (the “Proposal”). The enclosed Proxy Statement provides greater detail about the Proposal beginning on page 6 under the heading, “Reasons for the Plan.”

The Board of Directors of the Fund unanimously recommends that stockholders vote in favor of the Proposal. Approval of the Proposal requires the affirmative vote of two-thirds of the outstanding shares of common stock on the Fund.

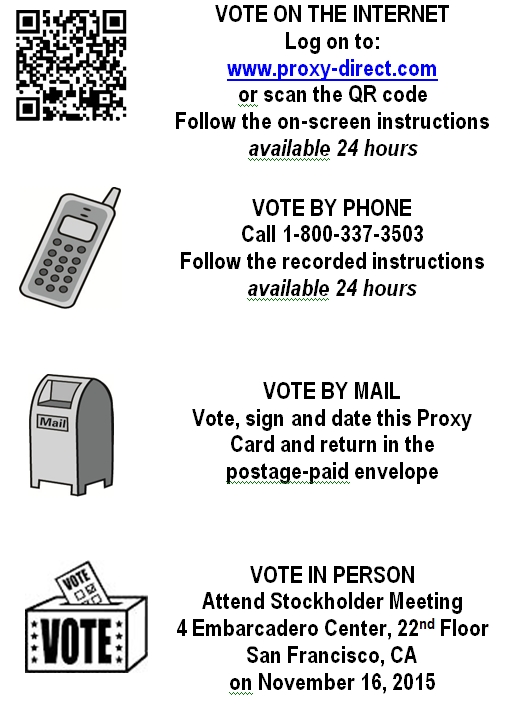

To vote, simply fill out, sign and date the enclosed proxy card, and return it to us in the enclosed postage-prepaid envelope. You also may vote through the Internet by visiting the website address on your proxy card, by telephone using the toll-free number on your proxy card, or in person at the meeting.

For additional information, please call Atlantic Fund Services, the Fund’s current administrator, toll free at (855) 422-4512. If you plan to attend the meeting in person, please notify Atlantic at this number.

Your vote is very important to us. Thank you for your response.

Respectfully,

| Richard J. Bradshaw | | Stacey E. Hong | |

| Chairman of the | | President and | |

| Board of Directors | | Chief Executive Officer | |

MONTGOMERY STREET INCOME SECURITIES, INC.

Notice of Special Meeting of Stockholders

To the Stockholders of Montgomery Street Income Securities, Inc.:

Please take notice that a Special Meeting of Stockholders (the “Special Meeting”) of Montgomery Street Income Securities, Inc. (the “Fund”) has been called to be held at 4 Embarcadero Center, 22nd Floor, San Francisco, California, on Monday, November 16, 2015 at 10:00 a.m. (Pacific Time), to vote on the dissolution and liquidation of the Fund (the “Proposal”).

Those present at the meeting together with the appointed proxies also will transact such other business, if any, as may properly come before the Special Meeting or any adjournments or postponements thereof.

Holders of record of the shares of common stock of the Fund at 5:00 p.m. (Eastern Time) on October 12, 2015 are entitled to vote at the Special Meeting or any adjournments or postponements thereof.

In the event that the necessary quorum to transact business or the vote required to approve the Proposal is not obtained at the Special Meeting, the persons named as proxies on the enclosed proxy card may propose one or more adjournments of the Special Meeting to permit, in accordance with applicable law, further solicitation of proxies with respect to the Proposal. Any such adjournment will require the affirmative vote of the holders of a majority of the shares present in person or by proxy at the session of the Special Meeting to be adjourned. The persons named as proxies on the enclosed proxy card will vote FOR any such adjournment those proxies which they are entitled to vote in favor of the Proposal. They will vote AGAINST any such adjournment those proxies required to be voted against the Proposal.

By order of the Board of Directors,

| | Zac Tackett, Secretary | | |

| | October 21 , 2015 | | |

| | | | |

| | | | | | | | |

| | IMPORTANT—We urge you to sign and date the enclosed proxy card and return it in the enclosed addressed envelope, which requires no postage and is intended for your convenience. You may also vote through the Internet by visiting the website address on your proxy card or by telephone by using the toll-free number on your proxy card. Your prompt vote may save the Fund the cost of further solicitations to ensure a quorum and the required vote at the Special Meeting. If you can attend the Special Meeting and wish to vote your shares in person at that time, you will be able to do so. | |

| | | | | | | | |

Montgomery Street Income Securities, Inc.

c/o Atlantic Fund Services

3 Canal Plaza, Suite 600

Portland, Maine 04101

(855) 422-4512

PROXY STATEMENT

RECORD DATE: October 12, 2015

MAILING DATE: October 21 , 2015

Introduction

The Board of Directors of Montgomery Street Income Securities, Inc. (the “Fund”) is soliciting proxies for use at the Special Meeting of Stockholders (the “Special Meeting”). The Special Meeting will be held at 4 Embarcadero Center, 22nd Floor, San Francisco, California, on Monday, November 16, 2015, at 10:00 a.m. (Pacific Time). The Board of Directors also is soliciting proxies for use in the event of any adjournment or postponement of the Special Meeting. This Proxy Statement is furnished in connection with this solicitation. To obtain directions to the Special Meeting, please call Atlantic Fund Services, the Fund’s administrator (the “Administrator”), toll-free at (855) 422-4512.

Important Notice Regarding the Internet Availability of Proxy and Other Materials for the Special Meeting

This Proxy Statement and the accompanying Notice of the Special Meeting of Stockholders and form of proxy card also are available on the Fund’s website at www.montgomerystreetincome.com.

You may, without charge, view the annual report of the Fund for the fiscal year ended December 31, 2014 as well as the Fund’s semi-annual report for the period ended June 30, 2015, under the “Financial Reports” tab on the Fund’s website at www.montgomerystreetincome.com or request a copy of the annual report or the semi-annual report by calling toll-free (877) 437-3938 or writing to the Fund care of Computershare Shareowner Services LLC, P.O. Box 30170, College Station, Texas 77842-3170.

Voting Information

The Fund may solicit proxies by mail, telephone, telegram, and personal interview. Computershare Fund Services, 280 Oser Avenue, Hauppauge, New York 11788, has been engaged to assist in the solicitation of proxies for the Fund, at an estimated cost of approximately $16,000 plus expenses. In addition, the Fund may request personnel of the Administrator to assist in the solicitation of proxies for no separate compensation. It is anticipated that the Fund will request brokers, custodians, nominees, and fiduciaries who are record owners of stock to forward proxy materials to their principals and obtain authorization for the execution of proxies. Upon request, the Fund will reimburse the brokers, custodians, nominees, and fiduciaries for their reasonable expenses in forwarding proxy materials to their principals. The Fund will bear the cost of soliciting proxies.

You may revoke the enclosed proxy at any time insofar as it has not yet been exercised by the appointed proxies. You may revoke the enclosed proxy by the following methods:

| · | Providing written notice to the Fund at the following address: |

Montgomery Street Income Securities, Inc.

c/o Proxy Tabulator

P.O. Box 18011

Hauppauge, NY 11788-8811;

| · | Giving a later proxy; or |

| · | Attending the Special Meeting and voting your shares in person. |

In order to obtain the quorum necessary to transact business, a majority of the shares entitled to be voted must have been received by proxy or be present at the Special Meeting. Proxies that are marked to abstain , as well as proxies returned by brokers or others who have not received voting instructions and do not have discretion to vote for their clients (“broker non-votes”), will be counted toward this quorum. Abstentions and broker non-votes will not be counted in favor of and will have no effect on the Proposal. Votes represented by the proxy will be cast as specified in the proxy. If no specification is made in the proxy, votes represented by the proxy will be cast FOR the Proposal.

Your vote is important, regardless of the number of shares you own. In order for your vote to be counted, you must either attend the Special Meeting in person or complete the enclosed proxy card and return it promptly in the postage-paid envelope provided.

Alternatively, you may vote electronically, including by telephone, by following the instructions attached to the proxy card.

In the event that the necessary quorum to transact business or the vote required to approve the Proposal is not obtained at the Special Meeting, the persons named as proxies on the enclosed proxy card may propose one or more adjournments of the Special Meeting to permit, in accordance with applicable law, further solicitation of proxies. Any such adjournment will require the affirmative vote of the holders of a majority of the shares present in person or by proxy at the session of the Special Meeting to be adjourned. The persons named as proxies on the enclosed proxy card will vote FOR any such adjournment those proxies which they are entitled to vote in favor of the Proposal. They will vote AGAINST any such adjournment those proxies required to be voted against the Proposal.

The record date for determination of stockholders entitled to receive notice of the Special Meeting and to vote at the Special Meeting or any adjournments or postponements thereof was October 12, 2015 at 5:00 p.m. (Eastern Time) (the “Record Date”).

As of the Record Date, there were issued and outstanding 10,365,209 shares of common stock of the Fund, constituting all of the Fund’s then outstanding securities. Each share of common stock is entitled to one vote.

Security Ownership

To the Fund’s knowledge, as of September 30 , 2015, the following entities owned beneficially more than 5% of the Fund’s outstanding shares.

Name and Address of Beneficial Owner | Amount of Shares Beneficially Owned in the Fund | Percentage of Outstanding Shares of the Fund(1) |

Karpus Management, Inc. 183 Sully’s Trail Pittsford, NY 14534 | 2,408,727 (2) | 23.24% |

1607 Capital Partners, LLC 4991 Lake Brook Drive, Suite 125 Glen Allen, VA 23060 | 1,573,321(3) | 15.18% |

Wells Fargo and Company 420 Montgomery Street San Francisco, CA 94104 | 1.060,011(4) | 10.23% |

| (1) | At September 30 , 2015, there were issued and outstanding 10,365,209 shares of common stock of the Fund. |

| (2) | The information as to beneficial ownership is based on statements furnished in the Schedule 13G filed with the U.S. Securities and Exchange Commission (“SEC”) on August 10, 2015 by or on behalf of the beneficial owner. |

| (3) | The information as to beneficial ownership is based on statements furnished in the Form 13F filed with the SEC on August 14, 2015 by or on behalf of the beneficial owner. |

| (4) | The information as to beneficial ownership is based on statements furnished in the Schedule 13G filed with the SEC on July 10, 2015 by or on behalf of the beneficial owners. Includes 1,034,955 shares beneficially owned by Wells Capital Management Incorporated, 525 Market Street, 10th Floor, San Francisco, CA 94105, which constituted 9.98% of the outstanding shares of the Fund at September 30 , 2015 . |

The following table sets forth for each Director of the Fund, the Principal Executive and Principal Financial Officers of the Fund, and the Directors and Executive Officers of the Fund as a group as of September 30 , 2015 the amount of shares beneficially owned in the Fund, the dollar range of securities owned in the Fund, and the aggregate dollar range of all shareholdings in all funds overseen by each Director in the same family of investment companies. Each Director’s, the Principal Executive Officer’s and the Principal Financial Officer’s individual beneficial

shareholdings in the Fund constituted less than 1% of the outstanding shares of the Fund; and, as a group, the Directors and Executive Officers owned beneficially less than 1% of the outstanding shares of the Fund.

Name and Position | Amount of Shares Beneficially Owned in the Fund(1) | Dollar Range of Equity Securities in the Fund(2) | Aggregate Dollar Range of Equity Securities in all Funds Overseen in Family of Investment Companies(3) |

Independent Directors | | | |

Richard J. Bradshaw Chairman and Director | 16,725(4) | Over $100,000 | Over $100,000 |

Victor L. Hymes Director | 7,263 | Over $100,000 | Over $100,000 |

Richard H. Stanton Director | 0 | $0- $10,000 | $0- $10,000 |

Wendell G. Van Auken Director | 43,846(5) | Over $100,000 | Over $100,000 |

Nancy E. Wallace Director | 1,391 | $10,001-$50,000 | $10,001-$50,000 |

| Executive Officers | | | |

Stacey E. Hong President, Chief Executive Officer and Principal Executive Officer | 0 | 0 | 0 |

Michael J. McKeen Treasurer, Chief Financial Officer and Principal Financial Officer | 0 | 0 | 0 |

| All Directors and Executive Officers as a Group | 69,225 (4), (5) | | |

| (1) | The information as to beneficial ownership is based on statements furnished to the Fund by each Director and executive officer. Unless otherwise indicated, each person has sole voting and investment power over the shares reported. |

| (2) | Based on market value. |

| (3) | Consists of all funds overseen by the Director, managed by Pacific Investment Management Company LLC, and holding themselves out as related for purposes of investment and investor services. The Fund is the only fund meeting these criteria. |

| (4) | Includes 11,815 shares held with sole voting and investment power and 4,910 shares held with shared voting and investment power. |

| (5) | Includes 36,040 shares held with sole voting and investment power and 7,806 shares held with shared voting and investment power. |

PROPOSAL: DISSOLUTION AND LIQUIDATION OF THE FUND

Board Recommendation and Required Vote

On October 2, 2015, the Board unanimously approved a Plan of Dissolution and Liquidation for the Fund (the “Plan”). The Plan provides for the dissolution of the Fund, the liquidation of its assets, and the distribution to stockholders of the cash proceeds of the liquidation and cancellation of their shares, after paying or providing for all debts, claims and obligations of the Fund, in accordance with Maryland law. Under Section 3-403 of the Maryland General Corporation Law (the “MGCL”), the affirmative vote of two-thirds of the outstanding shares is required for the dissolution of the Fund.

THE BOARD HAS DETERMINED THAT DISSOLUTION AND LIQUIDATION OF THE FUND IS ADVISABLE AND IN THE BEST INTERESTS OF THE STOCKHOLDERS AND RECOMMENDS THAT THE STOCKHOLDERS OF THE FUND VOTE IN FAVOR OF THE PROPOSAL.

Reasons for the Plan

The Fund is a closed-end investment company that was first offered to the public in 1973. It was originally intended as a means by which individual investors could invest in a diversified portfolio of fixed-income securities, including those with equity features, that might only be available in relatively large dollar amounts and, in the case of privately placed securities, that might only be available to institutional investors. The Fund was also sold as a means for individual investors to engage in certain investment techniques, such as portfolio trading and leverage through borrowings.

Since the Fund’s inception, the fund industry has grown dramatically, and there are many larger closed-end, open-end and other funds that offer the same features as those of the Fund. In addition, since that time, the composition of the Fund’s stockholders has changed from one of predominantly individual investors seeking income to one of primarily institutional investors with a variety of investment objectives. As of the date of the most recent regulatory filings relating to share ownership, 54.37 % of the Fund’s shares were held by institutional investors and just three of these investors held approximately 49% of the Fund’s shares.

Since the Fund’s inception, the business of a small, stand-alone closed-end fund has become more and more challenging. Because, as a closed-end fund, the Fund does not continuously offer its shares and there are limited opportunities to raise capital, and because, as a bond fund, the Fund does not generate significant capital appreciation and distributes all its income, the Fund’s assets have remained relatively static over the years. With inflation and increasing regulatory requirements, the Fund’s fixed costs are growing as a percentage of its assets, resulting in a higher expense ratio and lower net investment income in what is currently a low interest rate environment. The Fund’s small size, the changing structure of the fund industry, and more complex regulations have also reduced the number of quality service providers available to the Fund and limited its ability to make changes to its operations and investment strategies at a reasonable cost.

Shares of closed-end funds frequently trade at a discount to net asset value. For the two years prior to the announcement of the liquidation of the Fund on September 3, 2015, the Fund’s discount has ranged from 5.11% to 13.15%. The discount is affected by a number of factors, some of which are beyond the Fund’s control, and the options of the Fund to deal with the discount have been limited. The Fund believes that the reduction in the discount prior to the liquidation announcement was due primarily to the accumulation of the Fund’s shares by a few institutional investors, some of which are known as activists. As of September 30 , 2015, the Fund’s discount was 2.14 %. The Fund believes that the further reduction in the discount to this level was in anticipation of the liquidation of the Fund at net asset value, and that the discount would revert to its historic range if the liquidation does not occur.

Against this backdrop, the Chairman of the Board was informed on August 26, 2015 that Pacific Investment Management Company, LLC (“PIMCO”), the investment adviser of the Fund, intended to resign as investment adviser due to a number of factors, including the increasing ownership of the Fund by activist investors. The Board met with PIMCO

on August 27, 2015 to discuss PIMCO’s concerns and to explore the Fund’s alternatives. Among the alternatives, the Board considered that increasing distributions to stockholders might help narrow the discount, but would likely not satisfy the activist investors, which could be assumed to be looking for short-term liquidity at net asset value. Likewise, a partial tender offer would not allow the activist investors to liquidate their entire position and, in addition, would favor tendering stockholders. The Fund could change its form to that of an open-end fund, but it would lose the advantages of being a closed-end fund, and it would likely become smaller, with adverse effect on the remaining stockholders, including a higher expense ratio, less diversification, and greater transaction costs.

The Board discussed with PIMCO the potential to merge the Fund with an existing open-end PIMCO fund. It was noted that this would likely entail additional cost to the Fund, and it was not clear to what extent the new fund could succeed to attributes of the Fund, including its existing capital loss carryforwards, and to what extent the existing Fund stockholders might benefit from any such succession or otherwise. Moreover, separate proxy votes might be required to open-end and then to merge, resulting in more cost to the Fund and the possibility that some stockholders, like the activist investors, would redeem after the first vote, and that the second vote would fail or that the Fund would become too small for a merger to make sense. The Board determined that this type of transaction carried too much risk for stockholders.

The Board also discussed the prospect of hiring a new adviser to replace PIMCO. It concluded that it would be difficult to find another adviser of high quality that would not have the same concerns as PIMCO. In addition, the new adviser would be reluctant to incur the necessary startup costs for such an engagement, knowing that the Fund was relatively small and that the engagement might be terminated at any time. Even if such an adviser could be found, the Fund would have to expend time and resources to identify the adviser, to obtain stockholder approval, and to implement the transition. And, ultimately, hiring a new adviser would not address an activist’s desire for liquidity at net asset value. As a result, an activist investor could derail the Fund’s efforts at any step along the way by opposing the engagement of the new adviser, calling a special meeting, or advancing its own proposals at the next annual meeting, causing further cost to the Fund and, ultimately, to all stockholders.

The Board discussed the liquidation of the Fund. Among other factors, the Board considered that liquidation would provide all stockholders the net asset value of their shares (net of liquidation expenses) at the same time, no stockholders would be favored, and the Fund would avoid the

not insubstantial costs of seeking a new adviser, open-ending and/or merging, and at the same time dealing with activist investors. It was noted that liquidation of the Fund would effectively close the discount to market value of the Fund’s shares, which was then around 6%, but had likely been narrowed, at least temporarily, by the presence of the activist investors. It was also noted that, as the Fund does not generate significant capital appreciation and distributes all its income, the Fund’s share price has not increased substantially over the years and that most taxable stockholders should not recognize large taxable gains upon a liquidation. Stockholders would then have the opportunity to direct the proceeds of the liquidation to the investment or investments of their choice, including larger open-end and closed-end funds with similar characteristics. PIMCO committed to continue as the investment adviser of the Fund until the liquidation could be effected.

Given PIMCO’s intention to resign and the increasing involvement of activist investors in the Fund, the Board preliminarily concluded at its August 27, 2015 meeting that liquidation of the Fund would be in the best interests of all stockholders, subject to receipt of additional materials and further deliberation. The Board believed that it had explored all options, that there was no realistic alternative to liquidation, and that attempting to pursue another course would only prolong the inevitable at the expense of stockholders. It was noted that engaging in a costly proxy battle with an activist investor would result in a less certain, and might result in a less favorable, outcome for the Fund’s other stockholders.

The Board met again on September 3, 2015 to review and discuss, among other matters, the estimated costs, steps to be taken, and timetable associated with a liquidation of the Fund. After further deliberation, the Board determined that, subject to the approval of the Fund’s stockholders, the dissolution and liquidation of the Fund was advisable and in the best interests of the Fund. The Board directed that a formal plan of dissolution and liquidation and preliminary proxy materials be prepared and presented to the Board. The Plan was approved by the Board by unanimous written consent on October 2, 2015.

Summary of the Plan

A description of certain material provisions of the Plan is set forth below. The description is qualified in its entirety by reference to the Plan, a copy of which is attached to this Proxy Statement as Exhibit A.

Dissolution of the Company and Liquidation of Assets. Following approval by the stockholders of the dissolution and liquidation of the Fund, the Fund will provide notice to its known creditors and file

appropriate documents with the State of Maryland to dissolve the Fund as a legal entity. The Fund will then sell all its portfolio securities and other assets for cash, cash equivalents and other liquid assets and reserve a portion of the proceeds to pay, or make reasonable provision to pay, all the outstanding debts, claims and obligations of the Fund, together with the expenses related to carrying out the Plan. After stockholder approval of the dissolution and liquidation, the Fund will not engage in any other business activity except for the purpose of winding up its business and affairs.

Liquidating Distributions. The Fund will distribute to each stockholder of record, as of the date the dissolution and liquidation is approved by stockholders, an initial cash liquidating distribution equal to the stockholder’s proportionate interest in the assets of the Fund that have not been reserved for payment of the Fund’s debts, claims and obligations and final expenses. It is expected that the initial distribution will be made on or about December 30, 2015. A second cash distribution may be made to the extent that any assets remain after payment of the Fund’s debts, claims and obligations and final expenses. It is expected that any second distribution will be less than $1.00 per share and will be made on or before March 31, 2016. In connection with each distribution, an ACH payment or a check in the amount owed to each stockholder will be transmitted or mailed to the last address of such stockholder appearing on the records of the Fund. Any assets remaining after the final distribution that the Treasurer or similar officer of the Fund determines to be de minimis, after taking into account all expenses associated with effecting the disposition thereof, may be donated to a charitable organization, to the extent consistent with applicable law, rule or regulation.

Trading; Cancellation of Shares; Surrender of Share Certificates. The Fund has been advised by the New York Stock Exchange (the “Exchange”) that its shares will continue to trade on the Exchange so long as the Fund continues to meet the Exchange’s listing standards or as may be determined otherwise by the Exchange. Upon payment of the final distribution to Computershare , the Fund's transfer agent, on behalf of the Fund’s stockholders of record, all outstanding shares will be cancelled and stockholders will no longer have any economic or legal interest in the Fund. In order to receive the final distribution, stockholders will be required to surrender their share certificates to Computershare pursuant to instructions that will be provided by Computershare via a letter of transmittal or exchange form. As a result, it is expected that there will be some delay before stockholders receive the final distribution.

Expenses. The Fund will bear all of the expenses of adopting and implementing the Plan, including but not limited to obtaining stockholder approval, dissolving the Fund under Maryland law, liquidating the Fund’s portfolio, terminating the Fund’s agreements, continuing the Fund’s

insurance policies for a period of time, delisting the Fund on the Exchange, deregistering the Fund as an investment company, and preparing and filing any other documents required under applicable securities, tax and other laws.

Amendment or Abandonment of the Plan. The Board may authorize variations from and amendments to the Plan, if it determines that such variations or amendments are necessary or appropriate to effect the dissolution and liquidation of the Fund and the distribution of the Fund’s net assets to the stockholders. The Board may abandon the Plan at any time, if it determines that abandonment would be advisable and in the best interests of the Fund and its stockholders.

Certain United States Federal Income Tax Considerations

The following is only a general summary of the significant United States federal income tax consequences of the Plan to the Fund and its stockholders and is limited in scope. This summary is based on the federal tax laws and applicable U.S. Treasury regulations in effect on the date of this Proxy Statement, all of which are subject to change by legislative or administrative action, possibly with retroactive effect. The Fund has not sought a ruling from the Internal Revenue Service (the “IRS”) with respect to the federal income tax consequences to the Fund or its stockholders that will result from the Fund’s liquidation. The statements below are not binding upon the IRS or a court, and there is no assurance that the IRS or a court will not take a view contrary to those expressed below. This summary assumes that a stockholder holds shares in the Fund as a capital asset for United States federal income tax purposes.

This summary addresses significant federal income tax consequences of the Plan, but does not discuss state or local tax consequences of the Plan. Implementing the Plan may impose unanticipated tax consequences on stockholders or affect stockholders differently, depending on their individual circumstances. Stockholders are encouraged to consult with their own tax advisors to determine the particular tax consequences that may be applicable in connection with the Plan.

If the dissolution and liquidation is approved by stockholders and the Fund proceeds to dissolve and liquidate, the Fund intends to continue to satisfy all of the qualification requirements for taxation as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, for its final taxable year. Accordingly, the Fund expects that it will not be taxed on any capital gains realized from the sale of the Fund’s assets or ordinary income that the Fund timely

distributes to stockholders. In the unlikely event the Fund fails to continue to so qualify during the liquidation period, it would be subject to federal income tax on its taxable income and net realized gains without being able to deduct the distributions it makes to its stockholders.

The Fund may elect tax accounting treatment that may eliminate the need to declare dividends (including dividends relating to the third and/or fourth quarters of 2015) necessary to satisfy the income and excise tax distribution requirements for its final taxable year . In the event this election is not made or the Fund otherwise determines a dividend is necessary, the Fund will declare any such dividend and make a dividend distribution either prior to or at the time of the liquidating distributions.

Each stockholder who receives a liquidating distribution will generally recognize gain (or loss) for federal income tax purposes equal to the amount by which the amount of the liquidating distribution exceeds (or is less than) the stockholder’s adjusted tax basis on the stockholder’s liquidating Fund shares. Any amount of cash distributed to a stockholder in liquidation of the Fund will in general be applied first to reduce the stockholder’s basis in such stockholder’s shares. Any gain or loss realized by a stockholder on the liquidating distribution generally will be treated as long-term capital gain or loss if the shares have been held for more than 12 months. Otherwise, the gain or loss on the liquidating distributions will be treated as short-term capital gain or loss.

The Fund is generally required to withhold and remit to the U.S. Treasury a percentage of the taxable liquidation proceeds paid to any stockholder who fails to provide the Fund with a correct taxpayer identification number, who has underreported dividend or interest income, or who fails to certify to the Fund that the stockholder is not subject to backup withholding. Backup withholding is not an additional tax. Rather, it may be credited against a taxpayer’s federal income tax liability.

Board Recommendation and Required Vote

The Board of Directors unanimously recommends that the stockholders of the Fund vote FOR the Proposal.

Approval of the Proposal requires the affirmative vote of two-thirds of the outstanding shares of common stock of the Fund.

If the stockholders do not approve the Proposal, the Fund will not be dissolved, and the Board will consider what action should be taken in the best interests of the stockholders.

STOCKHOLDER PROPOSALS FOR 2016 PROXY STATEMENT

In the event that the Fund is not dissolved and liquidated, stockholders wishing to submit proposals for inclusion in the proxy statement for the 2016 Annual Meeting should send their written proposals to Montgomery Street Income Securities, Inc., c/o Atlantic Fund Services, 3 Canal Plaza, Suite 600, Portland, Maine 04101, for receipt by January 20, 2016. The timely submission of a proposal does not guarantee its inclusion.

The Fund may exercise discretionary voting authority with respect to stockholder proposals for the 2016 Annual Meeting that are not included in the proxy statement and form of proxy, if notice of such proposals is not received by the Fund at the above address by April 4, 2016. Even if timely notice is received, the Fund may exercise discretionary voting authority in certain other circumstances. Discretionary voting authority is the ability to vote proxies that stockholders have executed and returned to the Fund on matters not specifically reflected on the form of proxy.

OTHER MATTERS

The investment adviser of the Fund is PIMCO, 650 Newport Center Drive, Newport Beach, California 92660. The administrator of the Fund is Atlantic Fund Services, 3 Canal Plaza, Suite 600 , Portland, Maine 04101.

The Board of Directors does not know of any matters to be presented at the Special Meeting other than that mentioned in this Proxy Statement. The appointed proxies will vote on any other business that comes before the Special Meeting or any adjournments or postponements thereof in accordance with their best judgment.

Please complete and sign the enclosed proxy card and return it in the envelope provided, or vote through the Internet or by telephone, so that the Special Meeting may be held and action may be taken on the matter described in this Proxy Statement with the greatest possible number of shares participating. This will not preclude your voting in person if you attend the Special Meeting.

Zac Tackett

Secretary

October 21 , 2015

MONTGOMERY STREET INCOME SECURITIES, INC.

PLAN OF DISSOLUTION AND LIQUIDATION

(As Amended as of October 16, 2015)

This Plan of Dissolution and Liquidation (the “Plan”) is made by Montgomery Street Income Securities, Inc. (the “Company”), a corporation organized and existing under the laws of the State of Maryland. The Company is a closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). This Plan is intended to accomplish the complete dissolution and liquidation of the Company and the cancellation of the Company’s outstanding stock in conformity with the laws of the State of Maryland, the 1940 Act, the Internal Revenue Code of 1986, as amended (the “Code”), the Company’s Articles of Incorporation dated June 13, 1996, as amended (the “Articles”), and the Company’s By-laws as amended and restated dated April 23, 2013 (the “By-laws”).

WHEREAS, Section 3-403 of the Maryland General Corporation Law (the “MGCL”) provides that the Company may be voluntarily dissolved at any time upon the approval of a majority of the entire Board of Directors of the Company (the “Board”) and two-thirds of the outstanding shares of common stock of the Company; and

WHEREAS, in accordance with Section 3-403(b) of the MGCL, at a meeting duly called and held on September 3, 2015, the Board, including all of the Directors who are not “interested persons” (as that term is defined in the 1940 Act), determined that the dissolution of the Company was advisable and in the best interests of the Company’s stockholders and directed that the proposed dissolution be submitted for consideration by the Company’s stockholders at a special meeting (the “Special Meeting”).

NOW THEREFORE, the dissolution and liquidation of the Company shall be carried out in the manner set forth herein:

1. Effective Date of Plan. This Plan shall become effective upon the approval of the dissolution and liquidation of the Company by two-thirds of the outstanding shares of common stock of the Company (the “Effective Date”).

2. Dissolution and Liquidation. Consistent with this Plan, and in accordance with the Articles, the By-laws, and all applicable laws and regulations, including but not limited to the MGCL and Section 331 of the Code, the Company shall be dissolved and liquidated as promptly as practicable following the Effective Date. This Plan is intended to, and shall, constitute a plan of liquidation constituting the complete liquidation of the Company, as described in Section 331 and Section 562(b) of the Code.

3. Notice to Creditors and Employees. Following the Effective Date, pursuant to Section 3-404 of the MGCL, the Company shall mail notice that the dissolution has been approved to all its known creditors, at their addresses as shown on the records of the Company, and to any employees, either at their home addresses as shown on the records of the Company or at their business addresses (the “Notice”).

4. Filing of Articles of Dissolution. Not less than 20 days after the Notice has been mailed, the Company shall file articles of dissolution with the State Department of Assessments and Taxation of Maryland (the “Department”) pursuant to Section 3-407(a) of the MGCL. The dissolution shall be effective when the Department accepts the articles of dissolution for record.

5. Cessation of Business and Winding Up. After the dissolution is effective, pursuant to Section 3-408(b) of the MGCL, the Company shall cease its business and shall not engage in any business activities except for the purpose of paying, satisfying and discharging any existing debts or obligations, collecting and distributing its assets, and doing all other acts required to liquidate and wind up its business and affairs. After the dissolution is effective, pursuant to Section 3-410(b) of the MGCL, the officers of the Company, under the direction of the Board, shall collect and distribute the assets, applying them to the payment, satisfaction and discharge of existing debts and obligations, including necessary expenses of liquidation; shall distribute the remaining assets among the stockholders; and may do all other acts provided by Section 3-410(c) of the MGCL.

6. Liquidation of Assets. As soon as practicable after the Effective Date, all of the Company’s portfolio securities and other assets shall be converted into cash, cash equivalents or other liquid assets.

7. Payment of Debts. As soon as practicable after the Effective Date, the Company shall determine and pay, or make reasonable provision to pay, in full the amount of the Company’s known, or unknown or not yet arisen but reasonably likely to become known or arise, claims and obligations, including all contingent, conditional or unmatured claims and obligations.

8. Liquidating Distributions. As soon as practicable after the Effective Date, the Company shall distribute ratably according to the number of shares held by each stockholder of record of the Company a liquidating distribution (or distributions, if more than one distribution shall be necessary) comprising all of the remaining assets of the Company, after paying or making reasonable provision to pay all claims and obligations pursuant to Section 7 above, in complete cancellation of all the outstanding shares of the Company, except for cash, bank deposits or cash equivalents in an estimated amount necessary to: (a) discharge any unpaid claims and obligations of the Company on the Company’s books, including but not limited to, income dividends and capital gains distributions, if any, payable through the date of the liquidating distribution, and (b) pay such contingent claims and obligations as shall be reasonably deemed to exist against the assets of the Company on the Company’s books.

9. Cancellation of Shares ; Surrender of Share Certificates . Upon payment of the final liquidating distribution to the Fund’s transfer agent on behalf of stockholders of record , the Company’s outstanding shares shall all be deemed cancelled. In order to receive the final liquidating distribution, stockholders will be required to surrender their share certificates to the Fund’s transfer agent. If the transfer agent is unable to make distributions to all stockholders of the Company because of an inability to locate stockholders to whom distributions are payable, the transfer agent will dispose of the distributions in accordance with applicable abandoned property laws.

10. Satisfaction of Federal Income and Excise Tax Distribution Requirements. The Fund may elect tax accounting treatment that may eliminate the need to declare dividends (including dividends relating to the third and/or fourth quarters of 2015) necessary to satisfy the income and excise tax distribution requirements for its final taxable year. In the event the election is not made or the Fund otherwise determines a dividend is necessary, the Fund will declare any such dividend and make a dividend distribution either prior to or at the time of the liquidating distributions.

11. Assets Remaining after the Final Liquidating Distribution. Following the final liquidating distribution, any assets remaining in the Fund that the Treasurer or similar officer of the Company determines to be de minimis , after taking into account all expenses associated with effecting the disposition thereof , shall be, at the discretion of the Treasurer or similar officer of the Company, donated to a charitable organization, to the extent consistent with applicable law, rule or regulation.

10. Satisfaction of Federal Income and Excise Tax Distribution Requirements. If necessary, the Company shall, by the date of the final liquidating distribution, have declared and paid a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to the Company’s stockholders all of the Company’s investment company taxable income for the taxable years ending at or prior to such date (computed without regard to any deduction for dividends paid), and all of the Company’s net capital gain, if any, realized in the taxable years ending at or prior to such date (after reduction for any available capital loss carry-forward), and undistributed net income from tax-exempt obligations and any additional amounts necessary to avoid any excise tax or income tax for such periods. Such dividends may be paid either prior to or at the same time as the liquidating distributions.

11. Receipt of Cash or Other Distributions after the Final Liquidating Distribution. Following the final liquidating distribution, if the Company receives any form of cash or is entitled to any other distributions that it had not previously recorded on its books, such cash or other distribution shall be disbursed to each stockholder of record ratably according to the number of shares held by the stockholder; provided, however, that the Company shall not be required to disburse to its stockholders of record any cash or other distribution that the Treasurer or similar officer of the Company determines to be de minimis after applying such cash or other distribution to any unpaid claims or obligations of the Company and taking into account all expenses associated with effecting the disposition thereof. Any cash or other distribution received by the Company, and so determined to be de minimis shall be, at the discretion of the Treasurer or similar officer of the Company, donated to a charitable organization, to the extent consistent with applicable law, rule or regulation.

12. Termination of Agreements. At an appropriate time or times, the officers of the Company, with the assistance of counsel, shall take all such actions as they deem necessary or appropriate to terminate all advisory, administration, custody, transfer agency and other agreements to which the Company is a party.

13. Continuation of Insurance. The officers of the Company shall take such actions as they deem necessary or appropriate to continue the Company’s fidelity bond and liability insurance coverage.

14. Filings with Regulatory Authorities. The Company’s officers and other appropriate parties shall make such filings with the U.S. Securities and Exchange Commission, the Internal Revenue Service, the States of Maryland and California, and such other authorities as may be deemed necessary or appropriate to carry out the intent of this Plan.

15. Liquidation Expenses. The Company shall bear all expenses incurred in carrying out this Plan, including, but not limited to, brokerage expenses and printing, mailing, proxy solicitation, legal, accounting, custodian and transfer agency fees, whether or not the liquidation contemplated by this Plan is effected, provided that such accrued amounts are first applied to pay for the Company’s normal and customary fees and expenses.

16. Power of the Board and Delegation of Authority to the Company’s Officers. The Board, and subject to the authority of the Board, the Company’s officers, shall have authority to perform or authorize any actions provided for in this Plan, and any further actions as they may

consider necessary or desirable to carry out the purposes of this Plan, including the execution and filing of all certificates, documents, information returns, tax returns and other papers that may be necessary or appropriate to implement this Plan, or that may be required by the 1940 Act, the Code, the laws of the State of Maryland or California, or any other applicable law or regulation. The officers of the Company, collectively or individually, may modify or extend any of the dates specified in this Plan for the taking of any action in connection with the implementation of this Plan if such officer(s) determine, with the advice of counsel, that such modification or extension is necessary or appropriate in connection with the orderly dissolution and liquidation of the Company or to protect the interests of the stockholders of the Company.

17. Amendment or Abandonment of Plan. The Board may authorize and/or ratify variations from or amendments to this Plan as may be necessary or appropriate to effect the dissolution and liquidation of the Company and the distribution of the Company’s net assets to its stockholders in accordance with the laws of the State of Maryland, the 1940 Act, the Code, the Articles, and the By-laws, if the Board determines that such action would be advisable and in the best interests of the Company and its stockholders. The Board may abandon this Plan at any time if it determines that abandonment would be advisable and in the best interests of the Company and its stockholders.

18. Company Only. The obligations of the Company entered into in the name or on behalf thereof by any of the directors, officers, representatives or agents of the Company are made not individually, but only in such capacities, and are not binding upon any of such persons personally, but bind only the assets of the Company.

19. Governing Law. This Plan shall be subject to and construed consistently with the Articles and the By-laws and otherwise shall be governed by and in accordance with the laws of the State of Maryland.

EVERY STOCKHOLDER’S VOTE IS IMPORTANT!

EASY VOTING OPTIONS:

Please detach at perforation before mailing.

| PROXY | | MONTGOMERY STREET INCOME SECURITIES, INC. | | PROXY |

| | | THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS | | |

| | | SPECIAL MEETING OF STOCKHOLDERS – NOVEMBER 16, 2015 | | |

The undersigned stockholder hereby appoints Stacey E. Hong and Gino Malaspina as proxies of the undersigned, with full power of substitution to each, and hereby authorizes each of them to represent the undersigned and to vote at the Special Meeting of Stockholders of Montgomery Street Income Securities, Inc. (the “Fund”) to be held at 4 Embarcadero Center, 22nd Floor, San Francisco, California, on Monday, November 16, 2015 at 10:00 a.m. (Pacific Time) (the “Special Meeting”) and at any and all adjournments thereof, all shares of the Fund which the undersigned would be entitled to vote if personally present, in accordance with the following instructions. The undersigned hereby revokes any and all proxies with respect to such shares previously given by the undersigned. The undersigned acknowledges receipt of the Proxy Statement relating to the Special Meeting. This proxy may be revoked at any time prior to its exercise at the Special Meeting by execution of a subsequent proxy card, by written notice to the Fund, c/o Proxy Tabulator, P.O. Box 18011, Hauppauge, NY 11788-8811, or by voting at the Special Meeting.

This proxy, if properly executed, will be voted in the manner directed. If properly executed and no instructions are indicated, the undersigned’s vote will be cast FOR the proposal. The proxies are authorized to vote on the proposal presented on the reverse side of this card and to vote in their discretion on any other business that may properly come before the Special Meeting and any adjournments or postponements thereof.

PLEASE BE SURE TO SIGN AND DATE THIS PROXY AND MARK IT ON THE REVERSE SIDE

EVERY STOCKHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

Montgomery Street Income Securities, Inc. Special Meeting of Stockholders To Be Held on November 16, 2015

The Proxy Statement for the Special Meeting and the accompanying Notice of Special Meeting of Stockholders and

the form of proxy card are available on the Fund’s website at www.montgomerystreetincome.com.

Please detach at perforation before mailing.

| PLEASE MARK, SIGN AND DATE THIS PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. | |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK. Example: | | | |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PROPOSAL.