UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ PreliminaryProxy Statement | | ¨ Confidential, For Use of the Commission Only (as |

x DefinitiveProxy Statement | | permitted by Rule 14a-6(e)(2)) |

| ¨ Definitive Additional Materials | | |

| ¨ Soliciting Material Pursuant to 167;240.14a-12 | | |

COMFORCE Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

COMFORCE Corporation

415 Crossways Park Drive, P.O. Box 9006

Woodbury, New York 11797

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on August 13, 2003

As a stockholder of COMFORCE Corporation (the “Company”), you are invited to be present, or represented by proxy, at the Company’s 2003 Annual Meeting of Stockholders, to be held at the Company’s offices at 415 Crossways Park Drive, Woodbury, New York on August 13, 2003 at 10:00 a.m., New York City time, and any adjournments thereof, for the following purposes:

| | 1. | | To elect John C. Fanning, Harry V. Maccarrone, Rosemary Maniscalco, Kenneth J. Daley, Daniel Raynor and Gordon Robinett to the Board of Directors of the Company for terms of one (1) year. See “Proposal No. 1—Election of Directors” in the proxy statement. |

| | 2. | | To approve the issuance of 13,650,000 additional shares of common stock. See “Proposal No. 2—Issuance of Additional Shares of Common Stock” in the proxy statement. |

| | 3. | | To ratify the appointment of KPMG LLP as the Company’s independent auditors for the fiscal year ending December 28, 2003. See “Proposal No. 3—Selection of Auditors” in the proxy statement. |

| | 4. | | To transact such other business as may properly be brought before the meeting or any adjournment thereof. |

Stockholders of record at the close of business on June 30, 2003 are entitled to vote at the Annual Meeting of Stockholders and all adjournments thereof. Since a majority of the outstanding shares of the Company’s common stock must be represented at the meeting in order to constitute a quorum, all stockholders are urged either to attend the meeting or to be represented by proxy.

If you do not expect to attend the meeting in person, please sign, date and return the accompanying proxy in the enclosed reply envelope. Your vote is important regardless of the number of shares you own. If you later find that you can be present and you desire to vote in person or, for any other reason, desire to revoke your proxy, you may do so at any time before the voting.

If you plan to vote at the meeting in person and your shares are held in the name of your broker, bank or other nominee, please request from such broker, bank or other nominee a letter to present to the judge of the election evidencing your ownership of the shares and your authority to vote the shares at the meeting.

By Order of the Board of Directors

Harry V. Maccarrone

Secretary

July 2, 2003

COMFORCE Corporation

415 Crossways Park Drive, P.O. Box 9006

Woodbury, New York 11797

ANNUAL MEETING OF STOCKHOLDERS

To be held on August 13, 2003

PROXY STATEMENT

This proxy statement and the Notice of Annual Meeting and Form of Proxy accompanying this proxy statement, which will be mailed on or about July 11, 2003, are furnished in connection with the solicitation by the Board of Directors of COMFORCE Corporation, a Delaware corporation (the “Company” or “COMFORCE”), of proxies to be voted at the annual meeting of stockholders to be held at the Company’s offices at 415 Crossways Park Drive, Woodbury, New York on August 13, 2003 at 10:00 a.m., New York City time, and any adjournments thereof.

Holders of record of the Company’s common stock at the close of business on June 30, 2003 (the “record date”) will be entitled to one vote at the meeting or by proxy for each share then held. On the record date, there were 16,659,363 shares of common stock of the Company outstanding. All shares represented by proxy will be voted in accordance with the instructions, if any, given in such proxy. A stockholder may withhold authority to vote for the nominees by marking the appropriate box on the accompanying proxy card, or may withhold authority to vote for an individual nominee by drawing a line through such nominee’s name in the appropriate place on the accompanying proxy card. Unless instructions to the contrary are given, each properly executed proxy will be voted (1) to elect John C. Fanning, Harry V. Maccarrone, Rosemary Maniscalco, Kenneth J. Daley, Daniel Raynor and Gordon Robinett as directors of the Company, (2) to approve the issuance of 13,650,000 additional shares of common stock, (3) to ratify the appointment of KPMG LLP as the Company’s independent auditors for the fiscal year ending December 28, 2003 and (4) to transact such other business as may properly be brought before the meeting or any adjournment thereof.

All proxies may be revoked and execution of the accompanying proxy will not affect a stockholder’s right to revoke it by giving written notice of revocation to the Secretary at any time before the proxy is voted or by the mailing of a later-dated proxy. Any stockholder attending the meeting in person may vote his or her shares even though he or she has executed and mailed a proxy. A majority of all of the issued and outstanding shares of the Company’s common stock is required to be present in person or by proxy to constitute a quorum. Directors are elected by a plurality. The favorable vote of the holders of a majority of the shares of common stock represented in person or by proxy at the meeting is required to approve or adopt the other proposals presented to the meeting.

This proxy statement is being solicited by the Board of Directors of the Company. The expense of making this solicitation is being paid by the Company and consists of the preparing, assembling and mailing of the Notice of Meeting, proxy statement and Proxy, tabulating returns of proxies, and charges and expenses of brokerage houses and other custodians, nominees or fiduciaries for forwarding documents to stockholders. In addition to solicitation by mail, officers and regular employees of the Company may solicit proxies by telephone, facsimile or in person without additional compensation therefor.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Election of Directors

The Company’s Bylaws provide that the Board of Directors shall consist of from three to nine persons as fixed by the Board. Six persons have been nominated to serve as directors to hold office until the next annual meeting or until their successors shall be duly elected and qualified. It is intended that proxies in the form enclosed granted by the stockholders will be voted, unless otherwise directed, in favor of electing the following persons as directors: John C. Fanning, Harry V. Maccarrone, Rosemary Maniscalco, Kenneth J. Daley, Daniel Raynor and Gordon Robinett.

Unless you indicate to the contrary, the persons named in the accompanying proxy will vote it for the election of the nominees named above. If, for any reason, a nominee should be unable to serve as a director at the time of the meeting, which is not expected to occur, the persons designated herein as proxies may not vote for the election of any other person not named herein as a nominee for election to the Board of Directors. See “Information Concerning Directors and Nominees.”

Recommendation

The Board of Directors recommends a vote “FOR” the election of each of the nominees. Proxies solicited by the Board of Directors will be voted in favor of this proposal unless a contrary vote or authority withheld is specified.

INFORMATION CONCERNING DIRECTORS AND NOMINEES

Directors and Nominees

Set forth below is information concerning each director and nominee for director of the Company, including his or her business experience during at least the past five years, his or her positions with the Company and the Company’s wholly-owned subsidiary, COMFORCE Operating, Inc. (“COI”), and certain directorships held by him or her. Each nominee is currently a director of the Company. There are no family relationships among any of the directors or nominees, nor, except as hereinafter described, are there any arrangements or understandings between any director or nominee and another person pursuant to which he or she was selected as a director or nominee. Each director is to hold office until the next annual meeting of the stockholders or until his or her successor has been elected and qualified.

Name

| | Age

| | Current Position with the Company

|

John C. Fanning | | 71 | | Chairman of the Board, Chief Executive Officer and Director |

Harry V. Maccarrone | | 55 | | Executive Vice President, Chief Financial Officer, Secretary and Director |

Rosemary Maniscalco | | 62 | | Vice Chairman of the Board and Director |

Kenneth J. Daley | | 65 | | Director |

Daniel Raynor | | 43 | | Director |

Gordon Robinett | | 67 | | Director |

2

John C. Fanning has served as Chairman of the Board of Directors and Chief Executive Officer of the Company since 1998. From 1997 to 1998 he was President of the Company’s Financial Outsourcing Services and Human Capital Management divisions. Mr. Fanning was the founder of Uniforce Services, Inc. (“Uniforce”) and served as its Chairman, Chief Executive Officer and President and as one of its directors from 1961, the year in which Uniforce’s first office was opened, until its acquisition by the Company in 1997. Mr. Fanning entered the employment field in 1954, when he founded the Fanning Personnel Agency, Inc., his interest in which he sold in 1967 to devote his efforts solely to Uniforce’s operations. He also founded and served as the first president of the Association of Personnel Agencies of New York.

Harry V. Maccarrone has served as Executive Vice President, Secretary and a Director of the Company since 1998 and as the Chief Financial Officer of the Company since 2000. Mr. Maccarrone, who joined Uniforce in 1988 as Assistant Vice President—Finance, served as Vice President—Finance of Uniforce from 1989 to 1997. From 1989 until 1997 he also served as Uniforce’s Treasurer and Chief Financial Officer.

Rosemary Maniscalcohas served as the Vice Chairman of the Company since August 2001 and as a Director of the Company since June 2001. She has also served since 1999 as the president of Corporate ImageMakers, Inc., a consulting company that advises corporations on critical employment and timely workplace issues. Prior thereto, Ms. Maniscalco served with Uniforce from 1981 until its 1997 merger with the Company, including as a member of Uniforce’s board of directors (from 1984 to 1997) and as its president and chief operating officer (from 1992 to 1997). Following Uniforce’s merger with the Company, she served as the president of the Company’s Staff Augmentation division until joining Corporate ImageMakersTM in 1999.

Kenneth J. Daleyhas served as a Director of the Company since 1999. From 1957 until his retirement in 1998, Mr. Daley held various positions with Chase Manhattan Bank (“Chase”) and, prior to its acquisition by Chase, Chemical Banking Corporation, most recently as Division Executive responsible for middle market business in the Long Island region. He currently serves as a director of National Medical Health Card Systems Inc., a provider of prescription benefit management services, a consultant to Key Span Energy and Citicorp, a trustee of Briarcliff College and a trustee of the Long Island Catholic Charities.

Daniel Raynor has served as a Director of the Company since 1998. He is a managing partner of The Argentum Group, a private equity firm, a position he has held since 1987. Mr. Raynor also serves as a director of NuCO2, Inc. and TCI Solutions, Inc., both of which are reporting companies under the Securities Exchange Act of 1934. In addition, Mr. Raynor serves on the boards of several privately-held companies. He received a B.S. in economics from The Wharton School, University of Pennsylvania.

Gordon Robinett has served as a Director of the Company since 1998. He is currently a consultant to Command Security, a security services firm based in Poughkeepsie, New York. Mr. Robinett retired as the vice president—finance and treasurer of Uniforce in 1989, after more than 20 years of service.

Meetings of the Board of Directors

In fiscal 2002, the Board of Directors of the Company conducted three meetings. Each director of the Company attended at least 75% of the meetings held during the time he or she served as director.

Committees

The standing committees of the Board of Directors include the Audit Committee, the Compensation Committee and the Stock Option Committee.

The Audit Committee has responsibility for performing all functions customarily performed by audit committees of public companies, including without limitation recommending independent auditors to be retained by the Company; conferring with the independent auditors regarding their audit of the Company’s financial statements and other financial

3

matters; reviewing the fees of such auditors and other terms of their engagement; considering the adequacy of internal financial controls and the results of fiscal policies and financial management of the Company; recommending changes in financial policies or procedures as suggested by the auditors; and performing such other functions and duties as may be charged to or expected of it by the Securities and Exchange Committee and the American Stock Exchange. The current members of the Audit Committee, Messrs. Daley, Robinett and Raynor, are independent directors as defined by the rules of the American Stock Exchange. The Audit Committee held five meetings during fiscal 2002. All of the members of the Committee attended at least 75% of these meetings. See “Report of the Audit Committee.”

The Compensation Committee has responsibility for reviewing and approving executive and employee salaries, bonuses, non-cash incentive compensation and benefits, exclusive of stock options and stock appreciation rights. Messrs. Daley and Robinett are currently members of the Compensation Committee. The Compensation Committee did not meet in fiscal 2002 but acted on one occasion by unanimous consent.

The Stock Option Committee has responsibility for administering the Company’s Long-Term Investment Plan and 2002 Stock Option Plan and awarding and fixing the terms of stock option grants thereunder. Messrs. Daley and Robinett are currently members of the Stock Option Committee. The Stock Option Committee did not meet in fiscal 2002 but acted on one occasion by unanimous consent.

PROPOSAL NO. 2—ISSUANCE OF ADDITIONAL SHARES OF COMMON STOCK

Description of the Transactions

Convertible Notes

In September 2001, the Company completed the exchange of $18.0 million principal amount of its 15% Senior Secured PIK Debentures due 2009 (the “PIK Debentures”) for its 8% Subordinated Convertible Note due December 2, 2009 (the “Convertible Note”) in the principal amount of $8.0 million, plus $1.0 million in cash. Fanning CPD Assets, LP, a limited partnership in which John C. Fanning, the Company’s Chairman and Chief Executive Officer, holds the principal economic interest (the “Fanning Partnership”), was the holder of the $18.0 million of PIK Debentures that were exchanged for the Convertible Note and cash. The Convertible Note permits payment of semi-annual interest on an in-kind basis until December 1, 2003 through the issuance of additional Convertible Notes. In accordance with this provision, the Company issued additional Convertible Notes to the Fanning Partnership in the aggregate principal amount of $783,553 as in-kind interest payments on December 1, 2001, June 1, 2002 and December 1, 2002. Rosemary Maniscalco, the Vice Chairman of the Company, is the general partner of the Fanning Partnership. By virtue of this position, she is deemed to be the beneficial owner of the Convertible Notes.

The Convertible Notes are convertible into the Company’s common stock based on a price of $1.70 per share of common stock, provided that if such conversion would result in the occurrence of a “change of control” under the terms of the indenture governing the Senior Notes, the Convertible Notes will be convertible into shares of non-voting participating preferred stock having a nominal liquidation preference (but no other preferences) to be created by the Company. This participating preferred stock is intended to be the economic equivalent of the common stock under circumstances in which the conversion could not otherwise occur. Once the change of control restriction is removed, the participating preferred stock will in turn be convertible into common stock on the same basis as if a direct conversion from Convertible Notes into common stock had been permitted.

The purpose of this transaction was to improve the Company’s balance sheet through the exchange of higher interest rate debt (15% per annum) for lower interest rate debt (8% per annum) and elimination of $10.0 million of debt. No other holder of PIK Debentures accepted the Company’s offer of exchange and repurchase on these terms. The Company obtained the opinion of an independent investment banking firm that this transaction was fair to the Company from a financial point of view, and the Company’s independent directors approved the terms of the transaction.

4

Series 2003A Preferred Stock

In February 2003, the Company issued $6.1 million face amount of its new Series 2003A Convertible Preferred Stock (“Series 2003A Preferred Stock”) having a fair market value of $4.3 million in exchange for $12.3 million of its outstanding 15% Senior Secured PIK Debentures, due 2009 (“PIK Debentures”) (including accrued interest) from the Fanning Partnership. By virtue of her position as the general partner of the Fanning Partnership, Rosemary Maniscalco is deemed to be the beneficial owner of the Series 2003A Preferred Stock issued to the Fanning Partnership.

Each share of Series 2003A Preferred Stock has a face amount of $1,000, bears annual cumulative dividends of $75.00 per share (7.5% per annum), payable if and when declared by the Company’s board of directors, and is convertible into common stock based upon a price of $1.05 per share for such common stock (or, in certain circumstances, into a participating preferred stock which in turn will be convertible into common stock at the same effective rate). Upon liquidation, the holders of the Series 2003A Preferred Stock will be entitled to a liquidation preference of $1,000 per share plus the amount of accumulated, unpaid dividends before any distributions shall be made to the holders of common stock or any other junior series or class of stock of the Company. Unless the holders of two-thirds of the shares of Series 2003A Preferred Stock outstanding shall have otherwise consented, no series or class of preferred stock having rights or preferences that are not junior to the Series 2003A Preferred Stock shall be issued by the Company.

In the event that the conversion of Series 2003A Preferred Stock into common stock of the Company would result in either (i) the occurrence of a “change of control” as defined in the indenture governing the Senior Notes, or (ii) require stockholder approval in accordance with the rules and regulations of the Securities and Exchange Commission or the American Stock Exchange (or any other exchange or quotation system on which the Company’s shares are then listed), then the Series 2003A Preferred Stock held by such holder shall not be convertible into common stock, but rather shall be convertible into a shares of non-voting participating preferred stock having a nominal liquidation preference (but no other preferences) to be created by the Company. This participating preferred stock is intended to be the economic equivalent of the common stock under circumstances in which the conversion could not otherwise occur. Once the change of control restriction is removed and stockholder approval is obtained, the participating preferred stock will in turn be convertible into common stock on the same basis as if a direct conversion from Series 2003A Preferred Stock into common stock had been permitted.

The purpose of this transaction was to improve the Company’s balance sheet through the elimination of $12.0 million of high interest rate debt (15% per annum) through the issuance of equity securities. The Company also extended an offer to the other holders of PIK Debentures to either exchange them for Series 2003A Preferred Stock on the same basis as offered to the Fanning Partnership or, alternatively, to purchase the PIK Debentures held by them for cash at a substantial discount. The Company obtained the opinion of an independent investment banking firm that the terms of the exchange transaction with the Fanning Partnership were fair to the Company from a financial point of view, and the Company’s independent directors approved the terms of the transaction.

Request for Approval to Issue Common Stock

The Company is seeking approval from stockholders to issue up to 13,650,000 shares of common stock upon conversion of the Convertible Notes and Series 2003A Preferred Stock, which represents the amount convertible on such instruments assuming that (i) interest on the Convertible Notes is paid in-kind through December 1, 2003, with the additional Convertible Notes issued in payment of interest at the rate of 8.0% per annum to also be convertible into common stock and (ii) dividends on the Series 2003A Convertible Preferred Stock cumulate at the rate of 7.5% per annum through the maturity date of the Senior Notes, December 1, 2007, with the amount of cumulated dividends to also be convertible into common stock. This approval is being sought to ensure compliance with the rules of the American Stock Exchange and as a condition to the listing of the shares of common stock issuable to the Fanning Partnership upon conversion of the Series 2003A Preferred Stock on the American Stock Exchange. If all 13,650,000 shares of common stock issuable upon conversion of the Series 2003A Preferred Stock and the Convertible Notes were to be issued, these shares would represent 45.0% of the Company’s outstanding common stock (based upon the number of shares currently outstanding). However, under the terms of the rights and preferences of the Series 2003A Preferred Stock and the

5

Convertible Notes, the issuance of common stock to the Fanning Partnership is not permissible since such issuance would trigger a “change of control” under the terms of the indenture governing the Senior Notes. Accordingly, so long as the Senior Notes remain outstanding and the Fanning Partnership or an affiliate continues to hold the Series 2003A Preferred Stock and the Convertible Notes, shares of non-voting preferred stock (that are economically equivalent to the Company’s common stock) would be issued in lieu of common stock upon exercise of the conversion rights.

The shares of common shares (or shares of non-voting preferred stock) issuable upon exercise of the conversion rights will be restricted securities and will be tradable only to the extent of the availability of an exemption from registration in accordance with the rules of the Securities and Exchange Commission. Unless the Company registers the shares of common stock issuable upon conversion of the Series 2003A Preferred Stock for resale under the Securities Act of 1933, any resale of those shares by the Fanning Partnership, as an affiliate of the Company, will be conducted in compliance with the volume limitations and other conditions of Rule 144 of the Securities Act (other than the holding period requirement). If the issuance of the common stock is approved by the stockholders as requested hereby, then, at such time as the issuance of common stock becomes permissible, the Company expects to seek to list the shares of common stock issuable upon conversion of the Series 2003A Preferred Stock on the American Stock Exchange.

Financial and Other Information

Accompanying this proxy statement are the Company’s annual report on Form 10-K for the year ended December 29, 2002 and its quarterly report on Form 10-Q for the quarter ended March 30, 2003. Items 7, 7A, 8 and 9 of Part II of the Company’s annual report on Form 10-K for the year ended December 29, 2002; and Items 1, 2 and 3 of Part I of the Company’s quarterly report on Form 10-Q for the quarter ended March 30, 2003 are incorporated by reference herein. The independent auditor’s report relating to the financial statements included in the Company’s annual report on Form 10-K for the year ended December 29, 2002 is set forth in Annex B to this proxy statement.

Recommendation

The Board of Directors recommends that the shareholders vote “FOR” this proposal. Proxies solicited by the Board of Directors will be voted in favor of this proposal unless a contrary vote or abstention is specified.

PROPOSAL NO. 3—SELECTION OF AUDITORS

The Proposal

The Board of Directors appointed KPMG LLP, independent public accountants, to audit the financial statements of the Company and its wholly owned subsidiaries for the fiscal year ending December 28, 2003. This appointment is being presented to stockholders for ratification. KPMG LLP has audited the Company’s financial statements for the past four years.

Representatives of KPMG LLP will be present at the meeting and will make a statement if they desire to do so, and will respond to appropriate questions that may be asked by stockholders.

Audit Fees

KPMG LLP billed the Company an aggregate of $208,000 in fees for professional services rendered in connection with the audit of the Company’s financial statements and for the reviews of the financial statements included in each of the Company’s quarterly reports on Form 10-Q during the year ended December 29, 2002.

6

Financial Information Systems Design and Implementation Fees

KPMG LLP did not bill the Company or any of its affiliates for the year ended December 29, 2002 for professional services rendered in connection with financial information systems design or implementation, the operation of the Company’s information system or the management of its local area network, nor did KPMG LLP perform any of these services for the Company during fiscal 2002.

All Other Fees

KPMG LLP billed the Company an aggregate of $72,000 in fees for other services rendered to the Company and its affiliates for the year ended December 29, 2002. This category consists of fees for tax services provided.

Recommendation

The Board of Directors recommends that the stockholders vote “FOR” the proposal. Proxies solicited by the Board of Directors will be voted in favor of this proposal unless a contrary vote or abstention is specified.

INFORMATION REGARDING EXECUTIVE OFFICERS

The following table sets forth certain information concerning each individual who currently serves as an executive officer or key employee of the Company, including such person’s business experience during at least the past five years and positions held with the Company. Executive officers are appointed by the Board of Directors and serve at the discretion of the Board. There are no family relationships among the executive officers, nor are there any arrangements or understandings between any executive officer and another person pursuant to which he or she was selected as an officer except as may be hereinafter described.

Name

| | Age

| | Position

|

John C. Fanning | | 71 | | Chairman of the Board, Chief Executive Officer and Director |

Harry V. Maccarrone | | 55 | | Executive Vice President, Chief Financial Officer, Secretary and Director |

Robert F. Ende | | 44 | | Senior Vice President, Finance |

Linda Annicelli | | 46 | | Vice President, Administration |

John C. Fanning. See “Information Concerning Directors and Nominees” for additional information concerning Mr. Fanning’s business experience.

Harry V. Maccarrone. See “Information Concerning Directors and Nominees” for additional information concerning Mr. Maccarrone’s business experience.

Robert F. Endehas served as the Company’s Senior Vice President, Finance since April 2002, having previously served as the Company’s Vice President, Finance from 2000 to April 2002, as its Vice President of Financial Services from 1999 to 2000 and as its Vice President and Controller from the time of Uniforce’s merger with the Company in 1997 until 1999. Mr. Ende previously served as the Controller of Uniforce from 1994 to 1997. Prior to joining Uniforce, he held various financial executive positions in the service industry from 1983 to 1994. Mr. Ende was associated with Ernst & Young from 1980 to 1983 and is a certified public accountant.

7

Linda Annicellihas served as the Company’s Vice President, Administration since 1999, having previously served as the Company’s General Manager and Director of Corporate Services from 1998 to 1999 and as its General Manager from the time of Uniforce’s merger with the Company in 1997 until 1998. Prior thereto, Ms. Annicelli held various marketing and administrative positions with Uniforce, including as General Manager from 1992 to 1997 and as Director of Communications and Administration from 1989 to 1992.

EXECUTIVE COMPENSATION

Director Compensation and Arrangements

During fiscal 2002, all directors received fees of $10,000 ($2,500 per quarter). In addition to this cash compensation, during fiscal 2002 each director received options to purchase 10,000 shares of common stock under the Company’s Long-Term Stock Investment Plan at an exercise price of $1.10 per share. Each director is entitled to receive options to purchase 10,000 shares of the Company’s common stock upon his or her initial election to the Board and, annually thereafter, upon his or her reelection to the Board, at an exercise price equal to the market price on the date of grant. All of the options awarded to date are for terms of 10 years, subject to earlier termination following the conclusion of a director’s service as a director and under certain other circumstances as provided, in the case of options issued to date, under the Company’s Long-Term Stock Investment Plan, or, in the case of options to be issued in fiscal 2003 or thereafter, under the Company’s 2002 Stock Option Plan.

Executive Officer Compensation

The following table shows all compensation paid by the Company and its subsidiaries for the fiscal years ended December 29, 2002, December 30, 2001 and December 31, 2000 to (1) the person who has served as the chief executive officer of the Company throughout fiscal 2002 (John C. Fanning) and (2) the three other persons who served as executive officers of the Company during fiscal 2002 and whose income exceeded $100,000 (collectively, the “Named Executive Officers”).

Summary Compensation Table (1)

| | | | | Annual Compensation

| | Long Term

Compensation

| | | |

Name and Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Securities Underlying

Options/SAR’s (#)

| | | All Other

Compensation ($)

(2)

|

John C. Fanning, Chairman and Chief Executive Officer | | 2002 2001 2000 | | 389,877 389,877 129,034 | | — — 188,211 | | 85,000 10,000 200,000 | (3) (4) (5) | | 23,961 33,501 6,657 |

| | | | | |

Harry V. Maccarrone, Executive Vice President, Chief Financial Officer and Secretary | | 2002 2001 2000 | | 258,558 249,524 208,950 | | — — 25,000 | | 85,000 10,000 120,000 | (3) (4) (5) | | 8,483 17,440 5,134 |

| | | | | |

Robert F. Ende, Senior Vice President, Finance | | 2002 2001 2000 | | 170,077 163,760 141,539 | | — — 25,000 | | 50,000 — 25,000 | (6) (5) | | 7,296 8,610 — |

| | | | | |

Linda Annicelli, Vice President, Administration | | 2002 2001 2000 | | 144,116 139,608 123,019 | | — — 25,000 | | 15,000 — 10,000 | (6) (5) | | 2,994 2,950 3,189 |

8

| (1) | | Does not include perquisites and other personal benefits, securities or other property, if any, received by any such executive officer which did not exceed the lesser of $50,000 or 10% of such executive officer’s salary and bonus for the year indicated. |

| (2) | | Represents deferred compensation under deferred compensation arrangements. |

| (3) | | Represents options to purchase the Company’s common stock at an exercise price of $1.10 per share for 10,000 shares and $1.45 for 75,000 shares. |

| (4) | | Represents options to purchase the Company’s common stock at an exercise price of $1.50 per share. |

| (5) | | Represents options to purchase the Company’s common stock at an exercise price of $2.00 per share. |

| (6) | | Represents options to purchase the Company’s common stock at an exercise price of $1.45 per share. |

Option Awards and Values

In 1993, the Company adopted with stockholder approval a Long-Term Stock Investment Plan (the “1993 Plan”) which authorized the grant of options to purchase up to 5,000,000 shares of the Company’s common stock to executives, key employees and agents of the Company and its subsidiaries. All executive officers and other officers, directors and employees, as well as independent agents and consultants, of the Company and its subsidiaries were eligible to participate in the 1993 Plan and to receive grants made before December 31, 2002. Effective as of December 31, 2002, the Company can no longer make option grants under the 1993 Plan.

In 2002, the Company adopted with stockholder approval the 2002 Stock Option Plan (the “2002 Plan”) which authorizes the grant of options to purchase up to 1,000,000 shares of the Company’s common stock to executives, key employees and agents of the Company and its subsidiaries. All executive officers and other officers, directors and employees, as well as independent agents and consultants, of the Company and its subsidiaries are eligible to participate in the 2002 Plan and to receive grants. No option grants were issued under the 2002 Plan in fiscal 2002.

The following table shows options awarded to the Named Executive Officers under the 1993 Plan in fiscal 2002 and the assumed appreciated value of such options. None of the Named Executive Officers received stock appreciation rights in fiscal 2002.

9

Option Grants in Fiscal Year 2002

| | | Number of

Securities

Underlying

Option/SARs

Granted (#)

| | % of Total

Options/SARs

Granted to

Employees

in Fiscal Year

| | | Exercise or

Base Price

($/Sh)

| | Expiration

Date

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term (1)

|

| | | | | | | | | | | | 5% ($)

| | 10% ($)

|

John C. Fanning | | 10,000

75,000 | | 1.7 12.6 | % % | | 1.10 1.45 | | 6/13/2012 6/13/2012 | | 6,900 25,500 | | 17,500 105,000 |

Harry V. Maccarrone | | 10,000

75,000 | | 1.7 12.6 | % % | | 1.10 1.45 | | 6/13/2012 6/13/2012 | | 6,900 25,500 | | 17,500 105,000 |

Robert Ende | | 50,000 | | 8.4 | % | | 1.45 | | 6/13/2012 | | 17,000 | | 70,000 |

Linda Annicelli | | 15,000 | | 2.5 | % | | 1.45 | | 6/13/2012 | | 5,100 | | 21,000 |

| (1) | | The potential realizable value shown is calculated based upon appreciation of the Company’s common stock issuable under options, calculated over the full term of the options assuming 5% and 10% annual appreciation in the value of the common stock from the date of grant, net of the exercise price of the options. |

The following table shows information concerning the aggregate number and values of options granted under the 1993 Plan that were held by the Named Executive Officers as of December 29, 2002. None of the Named Executive Officers holds stock appreciation rights and none of such persons exercised any options in fiscal 2002.

Aggregated Option Exercises in Last Fiscal Year

and FY-End Option Values (1)

Name

| | Shares Acquired or Exercise

(#)

| | Value Realized

($)

| | Number of Securities Underlying

Unexercised Options at Fiscal Year End (#) Exercisable/ Unexercisable

| | Value of

Unexercised In-the-Money Options at Fiscal Year End ($) Exercisable/ Unexercisable

| |

John C. Fanning | | — | | — | | 435,000/60,000 | | 0/0 | (2) |

Harry V. Maccarrone | | — | | — | | 295,000/60,000 | | 0/0 | (2) |

Robert Ende | | — | | — | | 51,667/33,333 | | 0/0 | (2) |

Linda Annicelli | | — | | — | | 30,000/10,000 | | 0/0 | (2) |

| (1) | | This information is presented as of December 29, 2002. |

| (2) | | The exercise prices of these options are less than the closing market price of the Company’s common stock on December 29, 2002. See the notes to the “Summary Compensation Table” for a description of the terms of the options listed in this table. |

The following table shows additional information concerning options and warrants issued as part of equity compensation plans.

10

Equity Compensation Plan Information

The following table describes options and warrants issued as part of the Company’s equity compensation plans.

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

| | Weighted-

average

exercise price

of outstanding

options,

warrants and

rights

| | Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in first

column).

|

Equity compensation plans approved by security holders (1) | | 3,467,220 | | $ | 4.66 | | 1,559,636 |

Equity compensation plans not approved by security holders (2) | | 724,628 | | $ | 2.27 | | — |

| | |

| |

|

| |

|

Total | | 4,191,848 | | $ | 4.25 | | 1,559,636 |

| | |

| |

|

| |

|

| (1) | | At December 29, 2002, the Company had two equity compensation plans that had been approved by stockholders, the Long-Term Stock Investment Plan (the “1993 Plan”) and the 2002 Stock Option Plan (the “2002 Plan”). All securities shown as being issuable pursuant to outstanding options, warrants and rights in the first column represent option grants made under the 1993 Plan. No options or other rights are issuable under the 1993 Plan after December 31, 2002; however, since options were issuable under the 1993 Plan as of the end of the Company’s 2002 fiscal year (December 29, 2002), the number of securities shown in the third column as being available for future issuance include 559,636 shares of common stock which are no longer available for issuance as well as 1,000,000 shares of common stock issuable upon exercise of options or other rights that may be granted under the 2002 Plan. |

| (2) | | Includes options to purchase 555,628 shares of the Company’s common stock issued to Austin Iodice and Anthony Giglio, former officer’s of the Company, as settlement of litigation concerning the continuing validity of options originally granted to them under a plan approved by the stockholders. Although these options were issued outside of the 1993 Plan, the Board elected to treat them as issued under the 1993 Plan solely for the purpose of determining the shares remaining available for issuance under the 1993 Plan. The balance of these securities are warrants issued as additional compensation to debtholders for extending credit to the Company. |

Employment Agreements

Effective as of January 1, 1999, the Company entered into an employment agreement with John C. Fanning, Chairman and Chief Executive Officer of the Company. As amended, the agreement provides for a salary of $385,000 per year, subject to annual increases of the higher of 7% or the percentage increase in the Consumer Price Index, annual incentive compensation equal to 5% of the Company’s pre-tax operating income in excess of $2.5 million and less than $3.0 million and 3.5% of the Company’s pre-tax operating income in excess of $3.0 million, and participation in the Company’s benefit programs. As amended to date, the agreement continues until December 31, 2005 and provides for a non-accountable expense allowance of $20,000 annually. In 2001 and 2002, Mr. Fanning elected to receive cash payments of less than $5,000 in lieu of the Company’s payment of medical insurance premiums on his behalf. At Mr. Fanning’s request, the agreement was amended to (i) eliminate the salary increases that otherwise would have gone into effect in January 2002 and 2003 and (ii) ensure that he would realize no benefit from an increase in pre-tax operating

11

income resulting from the elimination of goodwill amortization in accordance with the Financial Accounting Standards Board Statement No. 142,Goodwill and Other Intangible Assets.

The agreement is terminable by the Company only for “just cause,” and imposes customary non-competition and confidentiality restrictions. The agreement provides that, if it is terminated or not extended, other than for just cause, Mr. Fanning will be entitled to a severance payment equal to one year’s compensation (with the bonus calculated at the highest rate during the last three years) and reimbursement for health insurance costs for three years. Furthermore, the agreement provides that, if Mr. Fanning resigns within one year following a “change of control,” or if the agreement is terminated or not extended within three years following a change of control, other than for just cause, he will be entitled to receive three times the amount of the Company’s pension, deferred compensation and like contributions made by the Company on his behalf, if any, and his annual base salary and bonus (calculated at the highest rate during the last three years). In addition, in the event the agreement is terminated or not extended prior to a change of control or within three years after a change of control, other than for just cause, or if Mr. Fanning resigns within one year after a change of control, all unvested stock options shall immediately vest and remain exercisable throughout their original term. Mr. Fanning is also entitled to receive a payment equal to the excise taxes payable by him in respect of any of the termination payments described above plus a “gross up” payment based on projected federal, state and local income taxes payable by him due to his receipt of this additional compensation.

Effective as of January 1, 1999, the Company entered into an employment agreement with Harry V. Maccarrone, who then served as the Company’s Executive Vice President and Secretary of the Company. As amended to date, the agreement provides for a salary of $257,500 per year, subject to annual increases of the higher of 7% or the percentage increase in the Consumer Price Index, and participation in the Company’s benefit programs. His agreement is in other respects substantially the same as Mr. Fanning’s agreement.

Compensation Committee Interlocks and Insider Participation

Kenneth J. Daley and Gordon Robinett serve on the Company’s Compensation Committee. There are no interlocking relationships, as defined in the regulations of the Securities and Exchange Commission, involving any of these individuals.

Performance Information

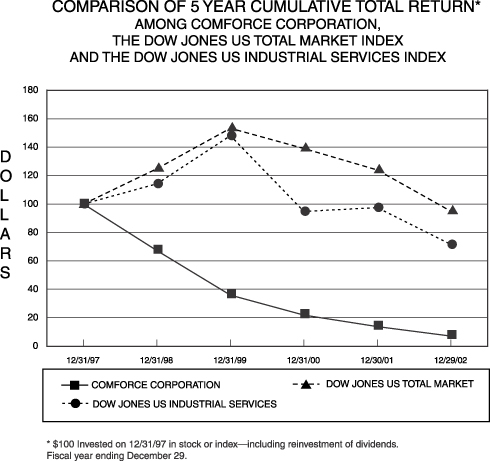

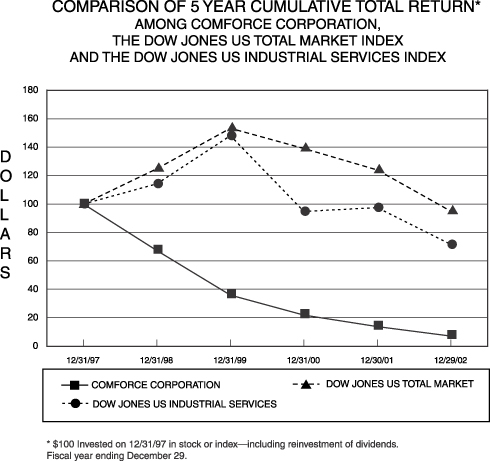

Set forth below in tabular form is a comparison of the total stockholder return (annual change in share price plus dividends paid, assuming reinvestment of dividends when paid) assuming an investment of $100 on the starting date for the period shown for the Company, the Dow Jones US Total Market Index (a broad equity market index which includes the stock of companies traded on the American Stock Exchange) and the Dow Jones US Industrial Services Index (an industry index which includes providers of staffing services).

No dividends were paid on the Company’s common stock during the period shown. The return shown is based on the percentage change from December 31, 1997 through December 29, 2002.

12

| | | Cumulative Total Return ($)

|

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

|

COMFORCE CORPORATION | | 100.00 | | 67.19 | | 35.94 | | 21.88 | | 13.75 | | 7.19 |

DOW JONES US TOTAL MARKET | | 100.00 | | 124.90 | | 153.28 | | 139.07 | | 123.85 | | 94.96 |

DOW JONES US INDUSTRIAL SERVICES | | 100.00 | | 114.18 | | 147.98 | | 94.76 | | 97.47 | | 71.48 |

REPORT OF THE COMPENSATION COMMITTEE

Overview and Philosophy

The Company’s executive compensation policy is to provide compensation to employees at such levels as will enable the Company to attract and retain employees of the highest caliber, to compensate employees in a manner best calculated to recognize individual, group and Company performances and to seek to align the interests of the employees with the interests of the Company’s stockholders. The Compensation Committee has responsibility for reviewing and approving executive and employee salaries, bonuses, non-cash incentive compensation and benefits, exclusive of stock options and stock appreciation rights.

The Company’s Stock Option Committee administers the Stock Option Plan under which awards of incentive stock options, non-qualified stock options and stock appreciation rights may be made to key management personnel and thereby provide additional incentives for such persons to devote themselves to the maximum extent practicable to the business of the Company. The Stock Option Plan is also intended to aid in attracting persons of outstanding ability to enter and remain in the employ of the Company. During fiscal 2002, grants were awarded to specific key managers based on the salary ranges applicable to such officers and employees at the time of the award and various subjective factors such as the executive’s responsibilities, individual performance and anticipated contribution to the Company’s performance. Kenneth Daley and Gordon Robinett currently serve on the Stock Option Committee.

13

Compensation of Executive Officers

Salary determinations for executive officers are based upon various subjective factors such as the executive’s responsibilities, position, qualifications, individual performance and experience. The Company did not utilize quantitative measures of Company or individual performance for purposes of fixing the salaries or bonuses of its executives except as described below under “—Compensation of Chief Executive Officer.”

Compensation of Chief Executive Officer

John C. Fanning was appointed as the Company’s Chief Executive Officer in October 1998. In determining the appropriate compensation for Mr. Fanning, the Compensation Committee engaged PricewaterhouseCoopers LLP to undertake an analysis of the salaries and incentive compensation paid to the chief executive officers of 15 other public staffing companies with annual revenues of from $142 million to $7.2 billion. To ensure comparability, the report size-adjusted the compensation data from these companies through regression analysis and reported competitive practices at the 50th and 75th percentile pay levels. In considering Mr. Fanning’s compensation and the terms of his employment agreement with the Company, the Committee considered this report and considered the size and earnings history of the Company as compared to the companies listed in the report. The Committee also considered various subjective factors such as Mr. Fanning’s responsibilities, position, qualifications and experience. The Committee approved Mr. Fanning’s employment agreement in January 1999.

The Committee subsequently approved a restructuring of Mr. Fanning’s compensation to lower his base salary and create greater performance incentives, and the Company and Mr. Fanning entered into an amendment to his employment agreement to reflect these terms in March 2000. In the fourth quarter of 2000, the Committee again reviewed Mr. Fanning’s compensation and concluded that the revised terms did not fairly compensate him in challenging market conditions. Accordingly, the Committee recommended that the Company enter into an amendment to his employment agreement to restore the original compensation terms. This amendment was executed in January 2001.

The decisions of the Compensation Committee to approve the restructured term, to subsequently restore the original terms, to twice extend the term of the agreement and to provide for a non-accountable expense allowance were based in each instance upon various subjective factors, including Mr. Fanning’s qualifications and years of experience and the perceived benefits to the Company’s stockholders of performance incentives. In no instance did the Committee undertake a new survey or analysis of the compensation paid to chief executives by other similarly situated companies.

At Mr. Fanning’s request, the agreement was amended to (i) eliminate the salary increases that otherwise would have gone into effect in January 2002 and 2003 and (ii) ensure that he would realize no benefit from an increase in pre-tax operating income resulting from the elimination of goodwill amortization in accordance with the Financial Accounting Standards Board Statement No. 142,Goodwill and Other Intangible Assets.

Deductibility of Compensation

Under Section 162(m) of the Code, the Internal Revenue Service will generally deny the deduction of compensation paid to certain executives to the extent such compensation exceeds $1 million, subject to an exception for compensation that meets certain “performance-based” requirements. The Company has taken actions designed to increase its opportunity to deduct all compensation paid to highly compensated officers for federal income tax purposes. However, no assurance can be given that such actions will ensure the deductibility for federal income tax purposes of all executive compensation paid by the Company. Furthermore, neither the Board nor the Compensation Committee subscribes to the view that any executive’s compensation should be limited to the amount deductible if such executive deserves compensation in excess of $1 million and it is not reasonably practicable to compensate him or her in a manner such that the compensation payable is fully deductible by the Company.

Compensation Committee: |

Kenneth J. Daley |

Gordon Robinett |

14

REPORT OF THE AUDIT COMMITTEE

The Audit Committee is comprised of three independent directors and operates under a written Audit Committee Charter adopted by the Board of Directors in accordance with rules of the American Stock Exchange. As part of its annual review of the Audit Committee Charter, in November 2002, the Board of Directors amended and restated the Audit Committee Charter to reflect (i) the Sarbanes-Oxley Act of 2002, (ii) current thinking on the proper role of an audit committee as part of the corporate governance structure, and (iii) proposed amendments to the rules of the American Stock Exchange. The Audit Committee Charter, as amended and restated in November 2002, is set forth as Annex A to this proxy statement.

The Committee recommends to the Board of Directors, subject to stockholder ratification, the selection of the Company’s independent auditors. Management is responsible for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

In this context, the Audit Committee has met and held discussions with management and the independent auditors. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Company’s independent auditors also provided to the Audit Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent auditors that firm’s independence.

Based upon the Audit Committee’s discussion with management and the independent auditors and the Audit Committee’s review of the representations of management and the report of the independent auditors to the Audit Committee, the Audit Committee will make a recommendation whether the Board of Directors should include the audited consolidated financial statements in the Company’s annual report on Form 10-K for the year ended December 29, 2002 to be filed with the Securities and Exchange Commission.

The Audit Committee also considered whether the provision of non-audit services is compatible with maintaining the principal auditors’ independence.

| | | | | Audit Committee: |

| | | | | Kenneth J. Daley |

| | | | | Daniel Raynor |

| | | | | Gordon Robinett |

PRINCIPAL STOCKHOLDERS

Securities Ownership of Certain Beneficial Owners and Management

The following table sets forth the number of shares and percentage of common stock known to the Company (based upon representations made to it or public filings with the Securities and Exchange Commission) to be beneficially owned as of June 30, 2003 by (i) each person who beneficially owns more than 5% of the shares of common stock, (ii) each director and executive officer of the Company, and (iii) all directors and executive officers of the Company as a group. Unless stated otherwise, each person so named exercises sole voting and investment power as to the shares of

15

common stock so indicated. Unless otherwise indicated below, the business address for each person shown is 415 Crossways Park Drive, P.O. Box 9006, Woodbury, NY 11797. There were 16,659,363 shares of common stock issued and outstanding as of June 30, 2003.

Name and Address of Beneficial Owner

| | Number (1)

| | Percentage (1)

| |

| | |

Management: | | | | | |

John C. Fanning (2)(3) | | 5,522,379 | | 32.2 | % |

Harry V. Maccarrone, individually (4) | | 340,552 | | 2.0 | % |

Harry V. Maccarrone, as trustee of the John C. Fanning Irrevocable Trust (4) | | 5,028,179 | | 30.2 | % |

Rosemary Maniscalco (3)(5) | | 51,667 | | * | |

Daniel Raynor (6) | | 50,000 | | * | |

Gordon Robinett (7) | | 51,043 | | * | |

Kenneth J. Daley (8) | | 40,000 | | * | |

Robert Ende (9) | | 71,755 | | * | |

Linda Annicelli (10) | | 37,031 | | * | |

Directors and officers as a group (11) | | 6,164,427 | | 34.8 | % |

| | |

Other Significant Stockholders: | | | | | |

ARTRA GROUP Incorporated (12) 500 Central Avenue Northfield, Illinois 60093 | | 1,525,500 | | 9.2 | % |

Alberta, Canada Alberta Treasury, Room 530 Terrace Building 9515 107th Street Edmonton, Alberta T5K 2C3 | | 1,400,000 | | 8.4 | % |

| (1) | | For purposes of this table, shares are considered “beneficially owned” if the person directly or indirectly has the sole or shared power to vote or direct the voting of the securities or the sole or shared power to dispose of or direct the disposition of the securities. A person is also considered to beneficially own shares that such person has the right to acquire within 60 days, and options exercisable within such period are referred to herein as “currently exercisable.” |

| (2) | | The shares beneficially owned by Mr. Fanning, the Chairman and Chief Executive Officer of the Company, are (i) 24,200 shares currently held of record by him, (ii) 3,606,564 shares owned by the John C. Fanning Irrevocable Trust, of which Mr. Fanning is the beneficiary, (iii) 1,421,615 shares held by a limited partnership of which the John C. Fanning Irrevocable Trust is the general partner, (iv) 200,000 shares issuable upon exercise of a currently exercisable option at an exercise price of $5.25 per share, (v) 200,000 shares issuable upon exercise of a currently exercisable option at an exercise price of $2.00 per share, (vi) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.50 per share, (vii) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.10 per share and (viii) 50,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.45 per share. Mr. Fanning disclaims beneficial ownership of shares owned by the limited partnership in excess of his proportionate interest in the limited partnership. Harry V. Maccarrone holds sole voting power with respect to the shares held by the limited partnership and the John C. Fanning Irrevocable Trust. |

16

| (3) | | Not included in the shares beneficially owned by either John C. Fanning or Rosemary Maniscalco are up to 13,580,303 shares of common stock issuable upon conversion of the Convertible Notes or Series 2003A Convertible Preferred Stock held by the Fanning CPD Assets, LP, a limited partnership in which John C. Fanning holds the principal economic interest. Ms. Maniscalco is the general partner of this limited partnership. Under their terms, neither the Convertible Notes nor the Series 2003A Preferred Stock can be converted into common stock if the conversion would result in the occurrence of a “change of control” under the indenture governing the Senior Notes. In such case, the Convertible Notes and the Series 2003A Preferred Stock are convertible into shares of non-voting participating preferred stock having a liquidation preference of $0.01 per share (but no other preferences) to be created by the Company. This participating preferred stock will in turn be convertible into common stock (on the same basis as if a direct conversion had been permitted) once the same restrictions are removed. As a result of Mr. Fanning’s current beneficial ownership position, a conversion into common stock is not permitted, nor is anticipated that it will be permitted prior to the repayment of the Senior Notes, which mature on December 1, 2007. |

| (4) | | The shares beneficially owned by Mr. Maccarrone, Executive Vice President, Chief Financial Officer and Secretary of the Company, are (i) 10,552 shares currently held of record by him, (ii) 30,000 shares issuable to him upon exercise of a currently exercisable option at an exercise price of $7.00 per share, (iii) 100,000 shares issuable upon exercise of a currently exercisable option at an exercise price of $5.25 per share, (iv) 130,000 shares issuable upon exercise of three currently exercisable options at an exercise price of $2.00 per share, (v) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.50 per share, (vi) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.10 per share, (vii) 50,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.45 per share, (viii) 3,606,564 shares owned by the John C. Fanning Irrevocable Trust, of which Mr. Maccarrone is the trustee, and (ix) 1,421,615 shares held by a limited partnership of which the John C. Fanning Irrevocable Trust is the general partner. Harry V. Maccarrone holds sole voting power with respect to the shares held by the limited partnership and the John C. Fanning Irrevocable Trust. |

| (5) | | The shares beneficially owned by Ms. Maniscalco, the Vice Chairman and a Director of the Company are (i) 15,000 shares currently held of record by her, (ii) 10,000 shares issuable to her upon the exercise of a currently exercisable option at an exercise price of $1.50 per share, (iii) 10,000 shares issuable to her upon the exercise of a currently exercisable option at an exercise price of $1.10 per share and (iv) 16,667 shares issuable to her upon the exercise of a currently exercisable option at an exercise price of $1.45 per share. |

| (6) | | The shares beneficially owned by Mr. Raynor, a Director of the Company, are (i) 10,000 shares issuable to him upon exercise of a currently exercisable option at an exercise price of $4.94 per share, (ii) 10,000 shares issuable to him upon exercise of a currently exercisable option at an exercise price of $3.13 per share, (iii) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.75 per share, (iv) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.50 per share, and (v) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.10 per share. |

| (7) | | The shares beneficially owned by Mr. Robinett, a Director of the Company, are (i) 1,043 shares owned of record, (ii) 10,000 shares issuable to him upon exercise of a currently exercisable option at an exercise price of $4.94 per share, (iii) 10,000 shares issuable to him upon exercise of a currently exercisable option at an exercise price of $3.13 per share, (iv) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.75 per share, (v) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.50 per share, and (vi) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.10 per share. |

17

| (8) | | The shares beneficially owned by Mr. Daley, a Director of the Company, are (i) 10,000 shares issuable to him upon exercise of a currently exercisable option at an exercise price of $3.13 per share, (ii) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.75 per share, (iii) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.50 per share, and (iv) 10,000 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.10 per share. |

| (9) | | The shares beneficially owned by Mr. Ende, Senior Vice President, Finance of the Company, are (i) 3,422 shares owned of record by him, (ii) 5,000 shares issuable to him upon exercise of a currently exercisable option at an exercise price of $10.00 per share, (iii) 30,000 shares issuable to him upon the exercise of currently exercisable options at an exercise price of $2.00 per share and (iv) 33,333 shares issuable to him upon the exercise of a currently exercisable option at an exercise price of $1.45 per share. |

| (10) | | The shares beneficially owned by Ms. Annicelli, the Vice President, Administration of the Company, are (i) 2,031 shares owned of record by her, (ii) 5,000 shares issuable to her upon exercise of a currently exercisable option at an exercise price of $10.00 per share, (iii) 20,000 shares issuable to her upon the exercise of currently exercisable options at an exercise price of $2.00 per share, and (iv) 10,000 shares issuable to her upon the exercise of a currently exercisable option at an exercise price of $1.45 per share. |

| (11) | | The shares shown to be beneficially owned by the directors and officers as a group include shares held of record by them or an affiliate and shares issuable upon the exercise of options. |

| (12) | | ARTRA Group Incorporated, a Delaware corporation, presently owns all of such shares of record directly or through a wholly-owned subsidiary, Fill-Mor Holding, Inc. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, certain of its officers and persons who own more than 10% of the Company’s common stock to file reports of ownership and changes in ownership with the SEC. Such persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on review of the copies of such forms furnished to the Company, the Company believes that all Section 16(a) filing requirements applicable to persons who are officers or directors of the Company or holders of 10% of the Company’s common stock were complied with in fiscal 2002 except that Form 4s were not filed for John Fanning on two occasions in fiscal 2002 to report the acquisition by the Fanning Partnership of the Convertible Notes and the non-voting preferred shares into which they are convertible, which transactions have since been reported on a Form 4. These transactions had previously been reported in the Company’s periodic reports.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In September 2001, the Company completed the exchange of $18.0 million principal amount of its 15% Senior Secured PIK Debentures due 2009 (the “PIK Debentures”) for its 8% Subordinated Convertible Note due December 2, 2009 (the “Convertible Note”) in the principal amount of $8.0 million, plus $1.0 million in cash. Fanning CPD Assets, LP, a limited partnership in which John C. Fanning, the Company’s Chairman and Chief Executive Officer, holds the principal economic interest (the “Fanning Partnership”), was the holder of the $18.0 million PIK Debentures that were exchanged for the Convertible Note and cash. The Convertible Note permits payment of semi-annual interest on an in-kind basis until December 1, 2003 through the issuance of additional Convertible Notes. In accordance with this provision, the Company issued additional Convertible Notes to the Fanning Partnership in the aggregate principal amount of $783,553 as in-kind interest payments on December 1, 2001, June 1, 2002 and December 1, 2002. Rosemary

18

Maniscalco, the Vice Chairman of the Company, is the general partner of the Fanning Partnership. By virtue of this position, she is deemed to be the beneficial owner of the Convertible Notes. Prior to the 2001 exchange, Ms. Maniscalco on behalf of the Fanning Partnership, which was then the record holder of a majority in principal amount of the PIK Debentures, consented to the elimination of certain of the covenants in the indenture governing the PIK Debentures.

The Convertible Notes are convertible into the Company’s common stock based on a price of $1.70 per share of common stock, provided that if such conversion would result in a “change of control” occurring under the terms of the indenture governing the Senior Notes, the Convertible Note will be convertible into shares of non-voting participating preferred stock having a nominal liquidation preference (but no other preferences), which in turn will be convertible into common stock at the holder’s option at any time so long as the conversion would not result in a change of control.

The purpose of this transaction was to improve the Company’s balance sheet through the exchange of higher interest rate debt (15% per annum) for lower interest rate debt (8% per annum) and elimination of $10.0 million of debt. No other holder of PIK Debentures accepted the Company’s offer of exchange and repurchase on these terms. The Company obtained the opinion of an independent investment banking firm that this transaction was fair to the Company from a financial point of view, and the Company’s independent directors approved the terms of the transaction.

In February 2003, the Company issued $6.1 million face amount of its new Series 2003A Preferred Stock having a fair market value of $4.3 million in exchange for $12.3 million of its outstanding PIK Debentures (including accrued interest) from the Fanning Partnership. By virtue of her position as the general partner of the Fanning Partnership, Rosemary Maniscalco is deemed to be the beneficial owner of the Series 2003A Preferred Stock issued to the Fanning Partnership.

Each share of Series 2003A Preferred Stock has a face amount of $1,000, bears annual cumulative dividends of $75.00 per share (7.5% per annum), payable if and when declared by the Company’s board of directors, and is convertible into common stock based upon a price of $1.05 per share for such common stock (or, in certain circumstances, into a participating preferred stock which in turn will be convertible into common stock at the same effective rate). Upon liquidation, the holders of the Series 2003A Preferred Stock will be entitled to a liquidation preference of $1,000 per share plus the amount of accumulated, unpaid dividends before any distributions shall be made to the holders of common stock or any other junior series or class of stock of the Company.

The purpose of this transaction was to improve the Company’s balance sheet through the elimination of high interest rate debt (15% per annum) through the issuance of equity securities. The Company also extended an offer to the other holders of PIK Debentures to either exchange them for Series 2003A Preferred Stock on the same basis as offered to the Fanning Partnership or, alternatively, to purchase the PIK Debentures held by them for cash at a substantial discount. The Company obtained the opinion of an independent investment banking firm that the terms of the exchange transaction with the Fanning Partnership were fair to the Company from a financial point of view, and the Company’s independent directors approved the terms of the transaction.

See “Proposal No. 2—Issuance of Additional Shares of Common Stock” for further discussion of the terms of the Convertible Notes and Series 2003A Preferred Stock.

Rosemary Maniscalco, through a company owned by her, provides consulting services to the Company at the rate of $1,000 per day, plus expenses. During fiscal 2002, the Company paid $92,000 for such consulting services.

See “Executive Compensation—Employment Agreements” for a description of the employment agreements entered into between the Company and each of John C. Fanning, the Chairman and Chief Executive Officer of the Company, and Harry V. Maccarrone, the Executive Vice President of the Company.

19

STOCKHOLDERS’ PROPOSALS

To be considered for inclusion in the Company’s proxy statement for next year’s annual meeting of stockholders, stockholder proposals must be sent to the Company, directed to the attention of Linda Annicelli, Vice President, Administration, at COMFORCE Corporation, 415 Crossways Park Drive, P.O. Box 9006, Woodbury, New York 11797, for receipt not later than January 12, 2004.

GENERAL AND OTHER MATTERS

Management knows of no matters, other than those referred to in this proxy statement, which will be presented to the meeting. However, if any other matters properly come before the meeting or any adjournment, the persons named in the accompanying proxy will vote it in accordance with their best judgment on such matters.

The Company will bear the expense of preparing, printing and mailing this proxy statement, as well as the cost of any required solicitation. In addition to the solicitation of proxies by use of the mails, the Company may use regular employees, without additional compensation, to request, by telephone or otherwise, attendance or proxies previously solicited.

A copy of the Company’s annual report on Form 10-K for the year ended December 29, 2002 accompanies this proxy. In addition, the Company will provide to stockholders upon request, without charge, copies of the exhibits to the annual report. Requests should be submitted to Linda Annicelli, Vice President, Administration, at COMFORCE Corporation, 415 Crossways Park Drive, P.O. Box 9006, Woodbury, New York 11797.

DOCUMENTS INCORPORATED BY REFERENCE

The following items are incorporated by reference in this proxy statement:

| | 1. | | Items 7, 7A, 8 and 9 of Part II of the Company’s annual report on Form 10-K for the year ended December 29, 2002; and |

| | 2. | | Items 1, 2 and 3 of Part I of the Company’s quarterly report on Form 10-Q for the quarter ended March 30, 2003. |

The independent auditor’s report relating to the financial statements included in the Company’s annual report on Form 10-K for the year ended December 29, 2002 is set forth in Annex B to this proxy statement.

By Order of the Board of Directors

Harry V. Maccarrone

Secretary

Woodbury, New York

July 2, 2003

20

ANNEX A

COMFORCE Corporation

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

CHARTER

as amended and restated effective November 5, 2002

I. Purpose

The primary purpose of the Audit Committee (the “Committee” or the “Audit Committee”) of COMFORCE Corporation (the “Corporation”) is to serve as the Corporation’s liaison with the registered public accounting firm engaged on behalf of the Corporation by the Committee (also known as the Corporation’s “auditor”); to assist the Board of Directors in fulfilling its responsibilities by reviewing financial reports and information provided by the Company to any governmental body or to the public; to oversee the Corporation’s systems of internal controls regarding finance and accounting that the Corporation’s chief executive and financial officers establish on behalf of the Corporation; and to otherwise supervise the Corporation’s auditing, accounting and financial reporting processes generally. In performing its duties, the Audit Committee shall be mindful of its need to:

| | • | | Serve as an independent and objective party to supervise the Corporation’s financial reporting process and monitor its internal controls systems; |

| | • | | Seek to ensure that the Corporation’s disclosure policies are designed to provide full, fair and prompt disclosure of all material information to the Corporation’s stockholders and the investment community generally; and |

| | • | | Provide an open avenue of communication among the auditor, all officers, agents and employees of the Corporation, the persons responsible for the internal controls function and the Board of Directors. |

The Audit Committee will primarily fulfill these responsibilities by carrying out the activities enumerated in Section IV of this Charter.

II. Composition

The Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent directors. In order to be considered independent, each member of the Committee (i) may not, other than in his or her capacity as a member of the Committee, the Corporation’s Board of Directors or another committee of the board, accept any consulting, advisory or other compensatory fee from the Corporation or be an affiliated person of the Corporation or any of its subsidiaries, and (ii) shall be free from any relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment. All members of the Committee shall have working knowledge of basic finance and accounting practices and at least one member of the Committee shall have accounting or related financial management experience and shall be a “financial expert” as such term may be defined by the Securities and Exchange Commission upon its adoption of regulations therefor in accordance with Section 407 of the Sarbanes-Oxley Act of 2002.

The members of the Committee shall be elected by the Board at its annual meeting. The members shall elect a Chairperson by majority vote of the full Committee membership.

III. Meetings

The Committee shall meet at least once quarterly, or more frequently as circumstances dictate. Additionally, the Committee Chairperson shall meet with the auditor and management on a quarterly basis to review the Corporation’s

A-1

financial information, and shall meet with the persons responsible for the Corporation’s internal controls function annually or more frequently as circumstances may require. To the extent the Committee deems it appropriate to foster candid discussion, it shall meet privately with the auditor and the persons responsible for the Corporation’s internal controls function without the participation of management.

IV. Responsibilities and Duties

A.Review of Reports

1. The Committee shall review and update this Charter at least annually, as conditions dictate.

2. The Committee shall review the Corporation’s annual financial statements and any other financial information or reports submitted to any governmental body, or the public, including any certification, report, opinion, or review rendered by the auditor.

3. The Committee shall review a summary of findings from completed internal audits and a progress report on the proposed internal audit plan, with explanations for any deviations from the original plan.

4. The Committee shall review with financial management and the auditor the quarterly report prior to its filing or prior to the release of earnings. The Chairperson shall represent the Committee at these meetings.

B.Engagement and Supervision of Auditor