UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended March 3, 2012 |

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from to |

Commission File Number 0-6365

APOGEE ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| | |

| Minnesota | | 41-0919654 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

4400 West 78th Street—Suite 520,

Minneapolis, Minnesota 55435

(Address of principal executive offices, including zip code)

(952) 835-1874

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.33 1/3 Par Value | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

As of August 27, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, the approximate aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $252,321,000 (based on the closing price of $8.91 per share as reported on the NASDAQ Stock Market LLC as of that date).

As of April 11, 2012, there were 28,078,799 shares of the registrant’s Common Stock, $0.33 1/3 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required in Part III hereof is incorporated by reference to the Proxy Statement for the registrant’s 2012 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form 10-K.

APOGEE ENTERPRISES, INC.

Annual Report on Form 10-K

For the fiscal year ended March 3, 2012

TABLE OF CONTENTS

2

PART I

The Company

Apogee Enterprises, Inc. was incorporated under the laws of the State of Minnesota in 1949. The Company believes it is a world leader in certain technologies involving the design and development of value-added glass products, services and systems. Unless the context otherwise requires, the terms “Company,” “Apogee,” “we,” “us” and “our” as used herein refer to Apogee Enterprises, Inc. and its subsidiaries.

The Company is comprised of two reporting segments to match the markets it serves:

| | • | | TheArchitectural Products and Servicessegment designs, engineers, fabricates, installs, maintains and renovates the walls of glass and windows comprising the outside skin and entrances of commercial and institutional buildings. For fiscal 2012, our Architectural Products and Services segment accounted for approximately 88 percent of our net sales. |

| | • | | TheLarge-Scale Optical Technologies segment manufactures value-added glass and acrylic products primarily for the custom picture framing market. For fiscal 2012, our Large-Scale Optical Technologies segment accounted for approximately 12 percent of our net sales. |

On November 19, 2010, the Company acquired 100 percent of the stock of Glassec Vidros de Segurança Ltda. (Glassec). The business operates under the name GlassecViracon and its results of operations are included in our Architectural Products and Services segment and represent the only non-domestic business within Apogee. For further information, see “Acquisition of Glassec” below.

Financial information about the Company’s segments and geographic regions can be found in Item 8, Note 16 to the Consolidated Financial Statements of the Company contained elsewhere in this report.

Products

Apogee provides distinctive value-added glass solutions for enclosing commercial buildings and framing art. We operate in two product segments as described in the following paragraphs.

Architectural Products and Services (Architectural) Segment.The Architectural segment primarily fabricates, installs and renovates the outside skin of commercial buildings. Through complex processes, we add ultra-thin coatings to uncoated architectural glass to create colors and energy efficiency, especially important with the industry trend of “green” buildings. We also laminate layers of glass and vinyl to create glass that helps protect against hurricanes and bomb blasts. Glass can also be tempered to provide additional strength. We have the ability to design, build and install windows, curtainwall, storefront and entrances using our coated glass and metal products or those supplied by others. We also provide finishing services for the metal and plastic components used to frame architectural glass windows and walls and other products.

Our product choices allow architects to create distinctive looks for office towers, hotels, education facilities and dormitories, health care facilities, government buildings, retail centers and multi-family buildings. Our services allow our customers to meet the timing and cost requirements of their jobs.

3

The following table describes the products and services provided by the Architectural segment.

| | | | |

Products and

Services | | Product Attributes | | Description |

| Architectural Glass Fabrication | | High-Performance Glass | | We offer a wide range of glass colors and high-performance coatings that allow us to create unique designs, achieve specific light transmission levels and provide solar options. Additional value-added processes, such as silk-screening and heat soaking, can be incorporated into the glass. High-performance glass is typically fabricated into custom insulating units and/or laminated units to allow for installation into window frames, curtainwall, storefront or entrance systems. |

| | |

| Aluminum Framing Systems | | Standard, Custom and Engineered-to-Order | | Varying degrees of customization of our window, curtainwall, storefront and entrance systems are available depending on the customer’s project requirements. In-house engineering capabilities allow us to meet the architect’s design requirements. Our window systems can be operable or non-operable. Our curtainwall systems may be unitized (shop fabricated) or field fabricated. Depending on the requirements, we apply paint to the aluminum components. Alternatively, we can use anodizing to create a strong, weather-resistant film of aluminum oxide, often colored, on the surface of the aluminum. Our capabilities also allow us to apply ultra-violet (UV) protection and durable paint to polyvinyl chloride parts, such as interior shutters. |

| | |

| Glass Installation | | New Construction and Renovation Services | | We install curtainwall, window, storefront and entrance systems for non-monumental, new commercial and institutional buildings as well as for renovating existing buildings. By integrating technical capabilities, project management skills and shop and field installation services, we provide design, engineering, fabrication and installation expertise for the building envelope to owners, architects and general contractors. |

All of the businesses within the Architectural segment manufacture their products by fabricating glass and/or metals in a job-shop environment. Products are shipped to the job site or other location where further assembly or installation may be required.

Large-Scale Optical Technologies (LSO) Segment. The LSO segment primarily provides coated glass and acrylic for use in custom picture framing applications. The variables in the glass used for picture framing products are the size and coatings to give the glass UV protection and/or anti-reflective properties. The following table describes the products provided by the LSO segment.

| | | | |

Products and

Services | | Product

Attributes | | Description |

| Value-Added Picture Framing Glass and Acrylic | | UV, Anti-Reflective and/ or Security Features | | Our coatings reduce the reflectivity of picture framing glass and protect pictures and art from the sun’s damaging UV rays. Anti-reflective coatings on acrylic reduce glare and static charge on the surface. |

Markets and Distribution Channels

Architectural Segment.Our customers and those that influence the projects include architects, building owners, general contractors and glazing subcontractors in the commercial construction market. Our high-performance architectural glass is marketed using a direct sales force and independent sales representatives. We market our custom and standard windows, curtainwall, storefront and entrance systems using a combination of a direct sales force, independent sales representatives and directly to distributors. Our installation and renovation services are marketed by a direct sales force, primarily in the major metropolitan areas we serve in the United States and also where we have the ability to work with our customers in other markets. The market for Architectural products and services is a subset of the construction industry and is differentiated by building type, geographic location, project size and level of customization required. Published market data are not readily available for the market segments that we serve; however, we estimate market size by analyzing overall construction industry data.

Building type – The construction industry is typically represented by residential construction and non-residential construction, which includes commercial, industrial and institutional construction. Apogee is a leading supplier of architectural glass products and services to the non-residential construction industry. Our architectural glass products and services are primarily used in commercial buildings (office towers, hotels and retail centers) and institutional buildings (education facilities and dormitories, health care facilities and government buildings), as well as high-end multi-family buildings (a subset of residential construction).

4

Geographic location – From our domestic glass fabrication locations, we supply products primarily to the U.S. market, with some international distribution of our high-performance architectural glass. We estimate the U.S. market for architectural glass fabrication in commercial buildings is approximately $1.5 billion in annual sales. From our Brazilian glass fabrication facility, we primarily supply architectural glass to the Brazilian market. We estimate this market to be approximately $0.4 billion in annual sales. Our aluminum framing systems, including custom and standard windows, storefront and entrances, are marketed in North America, where we estimate the market size is approximately $2.0 billion in annual sales. We estimate the U.S. market for installation services is approximately $7.5 billion in annual sales. Within the installation services market, Apogee is one of only a few companies to have a national presence, with offices in eight locations serving multiple U.S. markets, and will be expanding into two locations in the Texas market. We estimate that these areas represent approximately 20 percent of the total installation market. Although installation of building glass in new commercial and institutional construction projects is the primary focus of our business, we also offer installation retrofits or renovations for the outside skin of older commercial and institutional buildings.

Project size – The projects on which our Architectural segment businesses bid and work vary in size. Our aluminum framing systems, storefront and entrance systems, and glass installation products and services, are targeted toward mid-size projects, while our high-performance architectural glass fabrication products range from mid-size to monumental high-profile projects.

Level of customization – Most projects have some degree of customization, as the end product or service is based on customer specifications. The only constant is the substrates of the products and the processes we utilize to fabricate, manufacture or install the products. However, within our aluminum framing systems businesses, we also produce glass windows and storefront and entrance products in standard, modified standard and custom configurations.

LSO Segment.The Company’s Tru Vue brand is the largest domestically manufactured brand for value-added glass and acrylic for the custom picture framing market. Under this brand, products are distributed primarily in North America through independent distributors, which supply national and regional chains and local picture framing shops, as well as through national retailers. The Company has also been successful in supplying products directly to museums and public and private galleries. We also have limited distribution in global markets through independent distributors, and we view this as a focus area for future growth of this segment.

Through the Company’s leadership, the custom picture framing industry continues to convert from clear glass to value-added picture framing glass and acrylic, a trend that is expected to continue and has helped the Company offset market softness over the past several years. We believe that our share of the U.S. market for custom picture framing glass is approximately 70 percent, and that we have the majority of the market share for the valued-added glass market, which is our target sector.

Warranties

We offer product warranties which we believe are competitive for the markets in which those products are sold. The nature and extent of these warranties depend upon the product, the market and, in some cases, the customer being served. Our standard warranties are generally from two to 10 years for our architectural glass, curtainwall and window system products, while we offer warranties of two years or less on our other products and installation services. In the event of a claim against a product for which we have received a warranty from the supplier, we pass the claim back to our supplier. Although we carry liability insurance with very high deductibles for product failures, we reserve for warranty exposures, as our insurance does not cover warranty claims. There can be no assurance that our insurance will be sufficient to cover all product failure claims in the future; that the costs of this insurance and the related deductibles will not increase materially; or that liability insurance for product failures will be available on terms acceptable to the Company in the future.

Sources and Availability of Raw Materials

Materials used within the Architectural segment include raw glass, aluminum billet and extrusions, vinyl, metal targets, insulated glass spacer frames, silicone, plastic extrusions, desiccant, chemicals, paints, lumber and urethane. All of these materials are readily available from a number of sources, and no supplier delays or shortages are anticipated. While certain glass products may only be available at certain times of the year, all standard glass types and colors are available throughout the year in reasonable quantities from multiple suppliers. Glass manufacturers have applied surcharges to the cost of glass over the past several years to help offset increases in energy and fuel costs, which we try to pass on to our customers through surcharges. We have also seen recent volatility in the cost and supply of aluminum that is used in our window, storefront, entrance and curtainwall systems. Where applicable, we have passed the changes in cost of materials on to our customers in the form of pricing adjustments and/or surcharges. Chemicals purchased range from commodity to specifically formulated chemistries.

5

Materials used within the LSO segment include glass, hard-coated acrylic, acrylic substrates, coating materials and chemicals. This segment has also incurred energy surcharges from glass manufacturers over the past several years. Historically, we have passed on these costs to our customers in the form of price increases where possible.

A majority of our raw materials are available from a variety of domestic and international sources.

Trademarks and Patents

The Company has several trademarks and trade names which it believes have significant value in the marketing of its products, including APOGEE®. Trademark registrations in the United States are generally for a term of 10 years, renewable every 10 years as long as the trademark is used in the regular course of trade. Within the Architectural segment, VIRACON®, LINETEC®, WAUSAU WINDOW AND WALL SYSTEMS®, TUBELITE®, HARMON GLASS®, FINISHER OF CHOICE®, VIRAGUARD®, ADVANTAGE BY WAUSAU®, VIRACON VUE-50®, 300ES®, GUARDVUE®, STORMGUARD®, DFG®, ECOLUMINUM®, HI—5000®, HI—7000®, THE LEADER IN GLASS FABRICATION®, ALUMINATE®, FORCEFRONT®, and VIRACONSULTING® are registered trademarks of the Company. In addition, GLASSEC®, INSULATTO® and BLINDATTO® are registered trademarks in Brazil. 500LS™, THERML=BLOCK™, CLEAR POINT™, CYBERSHIELD™, MAXBLOCK™ and INvent™ are unregistered trademarks of the Company.

Within the LSO segment, TRU VUE®, CONSERVATION CLEAR®, CONSERVATION MASTERPIECE ACRYLIC®, CONSERVATION REFLECTION CONTROL®, SCRATCH GUARD®, MUSEUM GLASS®, OPTIUM®, PREMIUM CLEAN®, REFLECTION CONTROL®, AR REFLECTION – FREE®, TRU VUE AR®, OPTIUM ACRYLIC®, OPTIUM MUSEUM ACRYLIC®, and CONSERVATION MASTERPIECE® are registered trademarks. ULTRAVUE™ is an unregistered trademark of the Company.

The Company has several patents pertaining to our glass coating methods and products, including our UV coating and etch processes for anti-reflective glass for the picture framing industry. Despite being a point of differentiation from its competitors, no single patent is considered to be material to the Company.

Seasonality

Within the Architectural segment, our domestic businesses experience a slight seasonal effect following the domestic commercial construction industry, with higher demand May through December. Our non-domestic Architectural segment business does not have a significant seasonal trend. A bigger impact to net sales is the fact that the construction industry is highly cyclical in nature and can be influenced differently by the effects of the localized economy in geographic markets.

Within the LSO segment, picture framing glass sales tend to increase in the September to December timeframe. However, the timing of customer promotional activities may offset some of this seasonal impact.

Working Capital Requirements

Within the Architectural segment, receivables relating to contractual retention amounts can be outstanding throughout the project duration. Payment terms offered to our customers are similar to those offered by others in the industry. Inventory requirements are not significant to the businesses within this segment since we make-to-order rather than build-to-stock for the majority of our products. As a result, inventory levels follow customer demand for the products produced.

Since the LSO segment builds-to-stock for the majority of its products, it requires greater inventory levels to meet the demands of its customers.

Dependence on a Single Customer

We do not have any one customer that exceeds 10 percent of the Company’s consolidated net sales. However, there are important customers within each of our segments; the loss of one or more customers could have an adverse effect on the Company.

6

Backlog

At March 3, 2012, the Company’s total backlog of orders considered to be firm was $243.9 million, compared with $238.4 million at February 26, 2011. Of these amounts, approximately $242.0 million and $237.2 million of the orders were in the Architectural segment at March 3, 2012 and February 26, 2011, respectively. We expect to produce and ship $183.4 million, or 76 percent, of the Company’s March 3, 2012 backlog in fiscal 2013 compared to $199.9 million, or 84 percent, of the February 26, 2011 backlog that was expected to be produced and shipped in fiscal 2012.

The Company views backlog as an important statistic in evaluating the level of sales activity and short-term sales trends in its business. However, as backlog is only one indicator, and is not an effective indicator of the ultimate profitability of the Company, we do not believe that backlog should be used as the sole indicator of future earnings of the Company.

Competitive Conditions

Architectural Segment. The markets served by the businesses within the Architectural segment are very competitive, price and lead-time sensitive, and are primarily affected by changes in the North American commercial construction industry as well as changes in general economic conditions. Specifically, interest rates, credit availability for commercial construction projects, material costs, employment rates, office vacancy rates, building construction starts and office absorption rates are key indicators to the commercial construction market conditions. As each of these economic indicators moves favorably, our businesses typically experience sales growth, and vice-versa. The U.S. and world economies over the past three years have had a significant adverse impact on the commercial construction industry as a whole. As a result, the competitive environment in which the Architectural segment operates has become more competitive, increasing the number of re-bid construction projects and length of time between bidding and award of a project, reducing selling prices and causing competitors to expand the geographic scope and type of projects on which they bid. The companies within the Architectural segment primarily serve the custom portion of the commercial construction market, which is generally highly fragmented. The primary competitive factors are price, product quality, reliable service, on-time delivery, warranty and the ability to provide technical engineering and design services. The competitive environment in Brazil is similar to that of the United States; however, the Brazilian commercial construction market appears to be relatively strong as the Brazilian economy has recovered from the recent worldwide economic downturn. Additionally, we believe we are in the midst of an increasing worldwide trend in commercial construction – building with energy efficient or “green” products. This has the potential to increase demand for some of our segment’s products and services due to their premium energy-efficiency properties combined with custom aesthetics. The potential for increased renovation of the exteriors of commercial and institutional buildings for improved energy efficiency may also offset some competitive pressures.

Throughout a construction project, the Architectural segment must maintain significant relationships with general contractors, who are normally each business’ direct or indirect customers, and architects, who influence the selection of products and services on a project. This is due to the high degree of dependence on general contractors and architects for project initiation and development of specifications. Additionally, the timing of a project depends on the schedule established by the general contractors and their ability to maintain this schedule. If a general contractor fails to keep a construction project on its established timeline, the timing and profitability of the project for our Architectural segment could be negatively impacted.

We believe that our domestic competition does not provide the same level of custom coatings to the market, but regional glass fabricators can provide somewhat similar products with similar attributes. Regional fabricators incorporate high performance, post-temperable glass products, procured from primary glass suppliers, into their insulated glass products. The availability of these products has enabled regional fabricators in some cases to bid on more complex projects than in the past. Since we typically target the more complex projects, of which there are currently fewer in the market because of the recent economic downturn, we have encountered significant competition from these glass suppliers. Conversely, since the commercial construction cycle has slowed and demand for high-end products is lower, our architectural glass fabrication business increasingly competes for business at the lower end of the high-performance spectrum, where these regional fabricators vigorously compete and pricing is generally lower.

The commercial window manufacturing market is highly fragmented, and we compete against several major aluminum window and storefront manufacturers in various market niches. With window products at the high-end of the performance scale and one of the industry’s best standard window warranties for repair or replacement of defective product, we effectively leverage a reputation for engineering quality and delivery dependability into a position as a preferred provider for high-performance products. Our custom and standard windows business and storefront and entrance business typically compete on quality and service levels, price, lead-time and delivery services. Within the architectural finishing market, we compete against regional paint and anodizing companies, typically on price and delivery. With the slowdown in the commercial construction markets, there is a higher level of competition for these products.

7

When providing glass installation and services, we largely compete against local and regional construction companies and installation contractors, and more recently against other larger national companies. The primary competitive factors are quality, engineering, price and service.

LSO Segment.Product attributes, pricing, quality, marketing, and marketing services and support are the primary competitive factors in the markets within the LSO segment. The Company’s competitive strengths include our excellent relationships with our customers and the product performance afforded by our proprietary and/or patented processes. While there is significant price sensitivity in regard to sales of clear glass to picture framers, there is somewhat less price sensitivity on our value-added glass products since there is less competition for these products.

Although there has been recent activity with respect to new entrants in the North American valued-added products market for picture framing, this segment competes against many suppliers of clear glass. Our customers’ selection of value-added products is driven by product attributes, price, quality and service.

Research and Development

The amount spent on research and development activities was $7.2 million, $6.3 million and $6.8 million in fiscal 2012, 2011 and 2010, respectively. Of this amount, $0.8 million, $1.8 million and $3.2 million, respectively, was focused primarily upon design of custom window and curtainwall systems in accordance with customer specifications and is included in cost of sales in the accompanying consolidated financial statements.

Environment

We use hazardous materials in our manufacturing operations, and have air and water emissions that require controls. As a result, we are subject to stringent federal, state and local regulations governing the storage, use and disposal of wastes. We contract with outside vendors to collect and dispose of waste at our production facilities in compliance with applicable environmental laws. In addition, we have procedures in place that we believe enable us to properly manage the regulated materials used in our manufacturing processes and wastes created by the production processes, and we have implemented a program to monitor our compliance with environmental laws and regulations. Although we believe we are currently in material compliance with such laws and regulations, current or future laws and regulations could require us to make substantial expenditures for compliance with chemical exposure, waste treatment or disposal regulations. During fiscal 2012, we spent approximately $0.2 million, and in each of fiscal 2011 and 2010, we spent $0.3 million, to reduce wastewater solids and hazardous air emissions at our facilities. We expect to incur costs to continue to comply with laws and regulations in the future for our ongoing manufacturing operations but do not expect these to be material to our financial statements.

As part of the acquisition of Tubelite Inc. (Tubelite) on December 21, 2007, we acquired a manufacturing facility which has historical environmental conditions. We believe that Tubelite is a “responsible party” for certain of these historical environmental conditions, and the Company intends to remediate those conditions. The Company believes the remediation activities can be conducted without significant disruption to manufacturing operations at this facility. As of March 3, 2012, the environmental reserve balance was $2.0 million.

Employees

The Company employed 3,636 and 3,555 persons on March 3, 2012 and February 26, 2011, respectively. At March 3, 2012, 449 of these employees were represented by U.S. labor unions and 274 of these employees were represented by labor unions in Brazil.

The Company is a party to approximately 50 collective bargaining agreements in the United States with several different unions. The number of collective bargaining agreements to which the Company is a party varies with the number of cities in which our glass installation and services business has active construction contracts. The Company considers its employee relations to be very good, and has not experienced any loss of workdays due to strike. We are highly dependent upon the continued employment of certain technical and management personnel.

Acquisition of Glassec

On November 19, 2010, the Company acquired 100 percent of the stock of Glassec Vidros de Segurança Ltda., a privately held business, for $20.6 million, net of cash acquired of $1.1 million. Glassec is a leading architectural glass fabricator in Brazil. The business operates under the name GlassecViracon as part of the Company’s architectural glass business.

8

GlassecViracon’s fiscal year ends December 31 and is reported in the consolidated financial statements within our Architectural segment on a two-month lag. The purchase is part of our strategy to increase our architectural glass penetration in international markets. Item 8, Note 6 of the Notes to Consolidated Financial Statements contains further information regarding this acquisition.

Foreign Operations and Export Sales

During the years ended March 3, 2012, February 26, 2011 and February 27, 2010, the Company’s export sales from domestic operations, principally from the sale of architectural glass, amounted to approximately $75.7 million, $79.4 million and $68.3 million, respectively, or 11 percent of net sales in fiscal 2012, 14 percent of net sales in fiscal 2011, and 10 percent of net sales in fiscal 2010. Fiscal 2012 and 2011 consolidated net sales included GlassecViracon sales of $34.1 million and $3.7 million, respectively, or five percent of net sales in fiscal 2012 and approximately one percent of net sales in fiscal 2011, all of which were non-U.S. sales.

Available Information

The Company maintains a website atwww.apog.com. Through a link to a third-party content provider, this corporate website provides free access to the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the Exchange Act), as soon as reasonably practicable after electronic filing such material with, or furnishing it to, the Securities and Exchange Commission. Also available on our website are various corporate governance documents, including our Code of Business Ethics and Conduct, Corporate Governance Guidelines, and charters for the Audit, Compensation, Strategy and Enterprise Risk, and Nominating and Corporate Governance Committees of the Board of Directors.

EXECUTIVE OFFICERS OF THE REGISTRANT

| | | | |

Name | | Age | | Positions with Apogee Enterprises and Five-Year Employment History |

| Joseph F. Puishys | | 53 | | Chief Executive Officer and President of the Company since August 2011. President of Honeywell’s Environmental and Combustion Controls division from 2008 through 2011, President of Honeywell’s Building Solutions from 2005 through 2008 and President of Honeywell Building Solutions, America from 2004 to 2005. |

| | |

| James S. Porter | | 51 | | Chief Financial Officer since October 2005. Vice President of Strategy and Planning from 2002 through 2005. Various management positions within the Company since 1997. |

| | |

| Patricia A. Beithon | | 58 | | General Counsel and Secretary since September 1999. |

| | |

| Gary R. Johnson | | 50 | | Vice President, Treasurer since January 2001. Various management positions within the Company since 1995. |

| | |

| Mark A. Augdahl | | 46 | | Vice President, Finance and Corporate Controller since May 2011. Corporate Controller from 2004 through 2011 and Assistant Corporate Controller from 2000 through 2004. |

Executive officers are elected annually by the Board of Directors and serve for a one-year period. There are no family relationships between any of the executive officers or directors of the Company.

9

Our business faces many risks. Any of the risks discussed below, or elsewhere in the Form 10-K or our other filings with the Securities and Exchange Commission, could have a material adverse impact on our business, financial condition or results of operations.

Operational Risks

Architectural Segment

Global economic conditions and the cyclical nature of the commercial construction industry have had and could continue to have an adverse impact on the profitability of this segment. There has traditionally been a lag between the general domestic economy and the North American commercial construction industry, and an additional lag of approximately eight months to when the products and services of our domestic-based Architectural segment businesses record net sales. Accordingly, these domestic Architectural segment businesses, which represented approximately 94 percent of the segment’s net sales during fiscal 2012, are primarily impacted by changes in the North American commercial construction industry, including unforeseen delays in project timing, work flow and lower prices. These and other economic conditions could impact the overall commercial construction industry and may adversely impact the markets we serve or the timing of the lag, resulting in lower net sales and earnings.

Our Brazilian operation is subject to the economic, political and tax conditions prevalent in the region. The economic conditions in this region are subject to different growth expectations, market weaknesses and business practices. We cannot predict how changing market conditions in this region will impact our financial results.

The Architectural segment’s markets are very competitive and actions of competitors, or new market entrants, as well as product or service preferences could result in a loss of customers or share of that customer’s purchases that would negatively impact our net sales and earnings.The markets that the Architectural segment serves are product-attribute, price and lead-time sensitive. The segment competes with several large, integrated glass manufacturers; numerous specialty architectural glass and window fabricators; and major contractors and subcontractors. Some of our competitors may have greater financial or other resources than the Company. Changes in our competitor’s products, prices or services could negatively impact our market share, net sales or margins. We have seen an increase in imports of our products from lower-cost, international suppliers that, if this were to continue, could impact our net sales or margins. Architectural trends or building code changes that reduce window-to-wall ratios could also negatively impact our net sales or margins.

The Architectural segment results could be adversely impacted by product quality and performance reliability problems. We manufacture and/or install a significant portion of our products based on specific requirements of each of our customers. We believe that future orders of our products or services will depend on our ability to maintain the performance, reliability and quality standards required by our customers. If our products or services have performance, reliability or quality problems, we may experience additional warranty and service expense; reduced, cancelled or discontinued orders; higher manufacturing or installation costs; or delays in the collection of accounts receivable. Additionally, performance, reliability or quality claims from our customers, with or without merit, could result in costly and time-consuming litigation that could require significant time and attention of management and involve significant monetary damages that could negatively impact our financial results.

The Architectural results could be adversely impacted by capacity utilization and changes in technology impacting capacity utilization.The Architectural segment’s near-term performance depends, to a significant degree, on its ability to utilize capacity at its production facilities. The failure to successfully utilize or manage capacity, and the impact of closing a facility in the future, or re-opening a currently closed facility, could adversely affect our operating results. Additionally, advances in product or process technologies on the part of existing or prospective competitors could have a significant impact on our ability to utilize our capacity and, therefore, have an adverse impact on our operating results.

The Architectural results could be adversely impacted by installation issues. The Company’s installation business typically is awarded as a fixed-price contract. Often, bids are required before all aspects of a construction project are known. An underestimate in the amount of labor required and/or cost of materials for a project; a change in the timing of the delivery of product; difficulties or errors in execution; or significant delays could result in failure to achieve the expected results. Any such issues could result in losses on individual contracts that could impact our operating results.

10

LSO Segment

The LSO segment is highly dependent on a relatively small number of customers for its sales.We continue to expect to derive a significant portion of our net sales from a small number of customers. Accordingly, loss of a significant customer or a significant reduction in pricing, or a shift to a less favorable mix of value-added picture framing glass products for one of those customers could materially reduce LSO net sales and operating results in any one year.

The LSO segment is highly dependent on U.S. consumer confidence and the U.S. economy.Our business in this segment depends on the strength of the retail picture framing market. This market is highly dependent on consumer confidence and the conditions of the U.S. economy. We have been able to partially offset the impact of economic slowdowns in the recent past with an increase in the mix of higher value-added picture framing products. If consumer confidence further declines, whether as a result of an economic slowdown, uncertainty regarding the future or other factors, our use of these strategies may not be as successful in the future, resulting in a potentially significant decrease in net sales and operating income.

The LSO segment results could be adversely impacted by capacity utilization.The LSO segment’s near-term performance depends, to a significant degree, on its ability to utilize its production capacity to manufacture our highest value-added picture framing glass and acrylic products. The failure to successfully manage this capacity could adversely impact operating results.

The LSO segment’s markets are becoming more competitive and actions of competitors, or new market entrants, could negatively impact our net sales and earnings.The markets that the LSO segment serves are product-attribute and price sensitive. The segment competes with several small international specialty glass manufacturers that have traditionally not penetrated the domestic markets. Although these competitors tend to be low price providers and have not been able to meet the specification level of our products, upgrades to our competitor’s products could drive prices down which could have a negative impact on our market share, net sales or margins.

Other Operational Risks

The Company’s results may be adversely impacted by implementation of an Enterprise Resource Planning (ERP) system. Since fiscal 2008, the Company has been implementing an ERP system to modernize its information system technologies and business processes at its business units. The complexities of an ERP implementation and large-scale process changes that are required could result in costs that exceed the project budget, business interruptions or reduced financial performance, adversely impacting operating results. To date we have completed a considerable portion of the project but still have significant modules at some of our larger business units to implement.

Financial Risks

Volatility in the global economy could adversely affect results of operations and our financial condition.Global financial markets have been experiencing disruption over the past several years, including, among other things, volatility in securities prices; diminished liquidity and credit availability; rating downgrades of certain investments; and changes in valuation of foreign currency against the U.S. dollar. These conditions have negatively impacted the markets we serve and as a result have had an adverse impact on our recent results of operations. Further volatility could lead to challenges in our business and negatively impact our financial condition or results of operations or lead to impairment of long-lived assets, including goodwill. The tightening of credit in financial markets could adversely affect our ability, as well as the ability of our customers and suppliers, to obtain and maintain financing. In addition, lack of financing for commercial construction projects could further result in a decrease in orders and spending for our products and services. We also maintain a significant amount of assets in the form of investments, primarily municipal bonds. The value of these investments and the timing of our need for cash could have a significant negative impact on our operating results.

Our quarterly and annual net sales and operating results are volatile and difficult to predict. Our net sales and operating results may fall below the expectations of securities analysts or investors, and Company-provided guidance in future periods. Our annual net sales and operating results may vary depending on a number of factors, including, but not limited to, fluctuating customer demand, delay or timing of shipments, construction delays or cancellations due to lack of financing for construction projects, changes in product and project mix or market acceptance of new products. Manufacturing or operational difficulties that may arise due to quality control, capacity utilization of our production equipment or staffing requirements may also adversely impact our annual net sales and operating results. In addition, competition, including new entrants into our markets, the introduction of new products by competitors, adoption of competitive technologies by our customers, and competitive pressures on prices of our products and services, could adversely impact our annual net sales and operating results. Finally, our annual net sales and operating results may vary depending on raw material pricing and the potential for disruption of supply, and changes in legislation that could have an adverse impact on our labor or other costs. Our failure to meet net sales and operating result expectations would likely adversely affect the market price of our common stock.

11

Self-Insurance and Product Liability Risk

We retain a high level of uninsured risk; a material claim could impact our financial results. We obtain substantial amounts of commercial insurance for potential losses for general liability, employment practices, workers’ compensation and automobile liability risk. However, a high amount of risk is retained on a self-insured basis through a wholly-owned insurance subsidiary. Therefore, a material product liability event, such as a material rework event, could have a material adverse effect on our operating results.

Environmental Regulation Risks

We are subject to potential environmental remediation regulation and compliance risks that could adversely affect our financial results. We use hazardous chemicals in producing products at three facilities (two in our Architectural segment and one in our LSO segment). One facility in our Architectural segment has certain historical environmental conditions which we believe require remediation. Our inability to remediate the historical environmental conditions at the Architectural segment facility at or below the amounts estimated as part of the purchase price allocation could have a material adverse impact on future financial results. Additionally, we are subject to a variety of local, state and federal governmental regulations relating to storage, discharge, handling, emission, generation and disposal of toxic or other hazardous substances used to manufacture our products, compliance with which is expensive. Our failure to comply with current or future environmental regulations could result in the imposition of substantial fines on us, suspension of production, alteration of our manufacturing processes or increased costs. Our financial results could also be adversely impacted by rising energy and material costs associated with environmental regulations.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None

12

The following table lists, by segment, the Company’s major facilities as of March 3, 2012, the general use of the facility and whether it is owned or leased by the Company.

| | | | | | | | | | |

Facility | | Location | | Owned/

Leased | | Size (sq. ft.) | | | Function |

Architectural Segment | | | | | | | | | | |

Viracon | | Owatonna, MN | | Owned | | | 765,500 | | | Mfg/Admin |

Viracon | | Owatonna, MN | | Owned | | | 136,050 | | | Mfg/Admin |

Viracon | | Owatonna, MN | | Leased | | | 160,000 | | | Warehouse |

Viracon | | Owatonna, MN | | Leased | | | 6,400 | �� | | Maintenance |

Viracon | | Statesboro, GA | | Owned | | | 397,200 | | | Mfg/Warehouse |

Viracon | | St. George, UT | | Owned | | | 236,000 | | | Mfg/Warehouse |

GlassecViracon | | Nazaré Pulista, Brazil | | Owned(1) | | | 100,000 | | | Mfg/Admin |

Harmon, Inc. Headquarters | | Minneapolis, MN | | Leased | | | 12,954 | | | Admin |

Wausau Window and Wall Systems | | Wausau, WI | | Owned | | | 370,400 | | | Mfg/Admin |

Wausau Window and Wall Systems | | Stratford, WI | | Owned | | | 67,000 | | | Mfg |

Linetec | | Wausau, WI | | Owned | | | 430,000 | | | Mfg/Admin |

Tubelite | | Reed City, MI | | Owned | | | 245,000 | | | Mfg |

Tubelite | | Walker, MI | | Leased | | | 123,125 | | | Mfg/Admin |

| | | | |

LSO Segment | | | | | | | | | | |

Tru Vue | | McCook, IL | | Owned | | | 300,000 | | | Mfg/Admin |

Tru Vue | | Faribault, MN | | Owned | | | 274,600 | | | Mfg/Admin |

| | | | |

Other | | | | | | | | | | |

Apogee Headquarters | | Minneapolis, MN | | Leased | | | 13,492 | | | Admin |

| (1) | This is an owned facility; however, the land is leased from the city. |

In addition to the locations indicated above, the Architectural segment’s Harmon, Inc. operates eight leased locations, serving multiple markets.

One of the Viracon facilities, a portion of the Wausau Window and Wall Systems facility, a portion of the Linetec facility and the Tru Vue facilities were constructed with the use of proceeds from industrial revenue bonds issued by their applicable cities. These properties are considered owned since, at the end of the bond term, title reverts to the Company.

The Company has been a party to various legal proceedings incidental to its normal operating activities. In particular, like others in the construction supply industry, the Company’s construction supply businesses are routinely involved in various disputes and claims arising out of construction projects, sometimes involving significant monetary damages or product replacement. The Company has also been subject to litigation arising out of employment practices, workers’ compensation, general liability and automobile claims. Although it is very difficult to accurately predict the outcome of such proceedings, facts currently available indicate that no such claims will result in losses that would have a material adverse effect on the financial condition of the Company.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable

13

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Apogee common stock is traded on the NASDAQ Stock Market LLC (Nasdaq) under the ticker symbol APOG.

As of April 11, 2012, there were approximately 1,511 shareholders of record and 7,652 shareholders for whom securities firms acted as nominees.

The following chart shows the quarterly range and year-end closing prices for one share of the Company’s common stock over the past five fiscal years.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | | |

| | | First | | | Second | | | Third | | | Fourth | | | Year-end | |

| | | Low | | | | | | High | | | Low | | | | | | High | | | Low | | | | | | High | | | Low | | | | | | High | | | Close | |

2012 | | $ | 12.42 | | | | — | | | $ | 14.82 | | | $ | 8.21 | | | | — | | | $ | 13.45 | | | $ | 7.79 | | | | — | | | $ | 11.54 | | | $ | 9.42 | | | | — | | | $ | 15.05 | | | $ | 12.60 | |

2011 | | | 12.57 | | | | — | | | | 16.89 | | | | 9.05 | | | | — | | | | 13.89 | | | | 8.76 | | | | — | | | | 12.05 | | | | 10.79 | | | | — | | | | 14.72 | | | | 13.92 | |

2010 | | | 8.12 | | | | — | | | | 14.61 | | | | 11.17 | | | | — | | | | 15.14 | | | | 12.50 | | | | — | | | | 16.48 | | | | 12.91 | | | | — | | | | 16.35 | | | | 14.29 | |

2009 | | | 14.08 | | | | — | | | | 24.22 | | | | 15.07 | | | | — | | | | 25.99 | | | | 5.32 | | | | — | | | | 21.46 | | | | 6.08 | | | | — | | | | 12.77 | | | | 9.47 | |

2008 | | | 18.41 | | | | — | | | | 25.75 | | | | 24.23 | | | | — | | | | 30.30 | | | | 20.04 | | | | — | | | | 28.96 | | | | 14.30 | | | | — | | | | 23.25 | | | | 15.39 | |

Dividends

The Board of Directors quarterly evaluates declaring dividends based on operating results, available funds and the Company’s financial condition. Cash dividends have been paid each quarter since 1974. The chart below shows quarterly and annual cumulative cash dividends per share for the past five fiscal years.

| | | | | | | | | | | | | | | | | | | | |

| | | First | | | Second | | | Third | | | Fourth | | | Total | |

2012 | | $ | 0.0815 | | | $ | 0.0815 | | | $ | 0.0815 | | | $ | 0.0815 | | | $ | 0.3260 | |

2011 | | | 0.0815 | | | | 0.0815 | | | | 0.0815 | | | | 0.0815 | | | | 0.3260 | |

2010 | | | 0.0815 | | | | 0.0815 | | | | 0.0815 | | | | 0.0815 | | | | 0.3260 | |

2009 | | | 0.0740 | | | | 0.0740 | | | | 0.0815 | | | | 0.0815 | | | | 0.3110 | |

2008 | | | 0.0675 | | | | 0.0675 | | | | 0.0740 | | | | 0.0740 | | | | 0.2830 | |

Purchases of Equity Securities by the Company

The following table provides information with respect to purchases made by the Company of its own stock during the fourth quarter of fiscal 2012:

| | | | | | | | | | | | | | | | |

Period | | Total Number of

Shares

Purchased (a) | | | Average Price

Paid per Share | | | Total Number of

Shares Purchased

as Part of

Publicly

Announced Plans

or Programs (b) | | | Maximum

Number of

Shares that May

Yet Be

Purchased

under the Plans

or Programs (b) | |

Nov. 27, 2011 through Dec. 31, 2011 | | | 89 | | | $ | 10.41 | | | | — | | | | 970,877 | |

Jan. 1, 2012 through Jan. 28, 2012 | | | — | | | | — | | | | — | | | | 970,877 | |

Jan. 29, 2012 through Mar. 3, 2012 | | | 25,392 | | | | 13.43 | | | | — | | | | 970,877 | |

Total | | | 25,481 | | | $ | 12.67 | | | | — | | | | 970,877 | |

| | (a) | The shares in this column represent shares that were surrendered to us by plan participants in order to satisfy stock-for-stock option exercises or withholding tax obligations related to stock-based compensation. |

| | (b) | In April 2003, the Board of Directors authorized the repurchase of 1,500,000 shares of Company stock, which was announced on April 10, 2003. In January 2008, the Board of Directors increased the authorization by 750,000 shares, which was announced on January 24, 2008. In October 2008, the Board of Directors increased the authorization by 1,000,000 shares, which was announced on October 8, 2008. The Company’s repurchase program does not have an expiration date. |

14

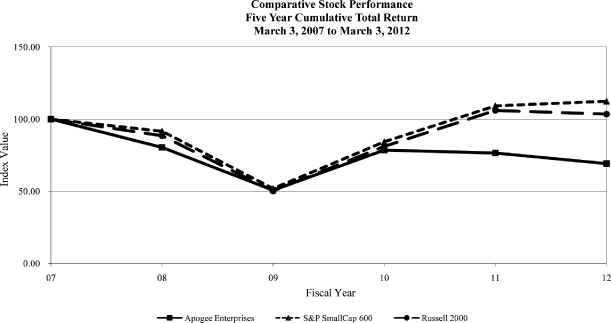

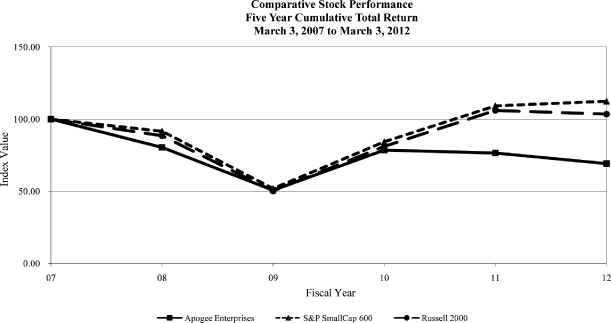

Comparative Stock Performance

The line graph below compares the cumulative total shareholder return on our common stock for the last five fiscal years with cumulative total return on the Standard & Poor’s Small Cap 600 Index and the Russell 2000 Index. This graph assumes a $100 investment in each of Apogee, the Standard & Poor’s Small Cap 600 Index and the Russell 2000 Index at the close of trading on March 3, 2007, and also assumes the reinvestment of all dividends.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal 2007 | | | Fiscal 2008 | | | Fiscal 2009 | | | Fiscal 2010 | | | Fiscal 2011 | | | Fiscal 2012 | |

Apogee | | $ | 100.00 | | | $ | 80.38 | | | $ | 50.71 | | | $ | 78.52 | | | $ | 76.48 | | | $ | 69.23 | |

S&P Small Cap 600 Index | | | 100.00 | | | | 91.60 | | | | 51.87 | | | | 84.29 | | | | 109.18 | | | | 112.38 | |

Russell 2000 Index | | | 100.00 | | | | 88.49 | | | | 50.17 | | | | 81.06 | | | | 106.00 | | | | 103.48 | |

For the fiscal year ended March 3, 2012, our primary business activities included architectural glass products and services (approximately 88 percent of net sales) and large-scale optical technologies (approximately 12 percent of net sales). We are not aware of any competitors, public or private, that are similar to us in size and scope of business activities. Most of our direct competitors are either privately owned or divisions of larger, publicly owned companies.

15

| ITEM 6. | SELECTED FINANCIAL DATA |

The following information should be read in conjunction with Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8—Financial Statements and Supplementary Data.

| | | | | | | | | | | | | | | | | | | | | | | | |

(In thousands, except per share data and percentages) | | 2012(1) | | | 2011(2) | | | 2010 | | | 2009 | | | 2008 | | | 2007(1) | |

Results from Operations Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 662,463 | | | $ | 582,777 | | | $ | 696,703 | | | $ | 925,502 | | | $ | 881,809 | | | $ | 778,847 | |

Gross profit | | | 117,120 | | | | 83,120 | | | | 162,095 | | | | 200,748 | | | | 185,150 | | | | 148,414 | |

Operating income (loss) | | | 3,816 | | | | (20,972 | ) | | | 45,430 | | | | 77,655 | | | | 66,459 | | | | 47,725 | |

Earnings (loss) from continuing operations | | | 4,697 | | | | (14,157 | ) | | | 31,217 | | | | 51,195 | | | | 43,170 | | | | 31,652 | |

Net earnings (loss) | | | 4,645 | | | | (10,332 | ) | | | 31,742 | | | | 51,035 | | | | 48,551 | | | | 31,653 | |

Earnings (loss) per share – basic | | | | | | | | | | | | | | | | | | | | | | | | |

Continuing operations | | | 0.17 | | | | (0.51 | ) | | | 1.14 | | | | 1.85 | | | | 1.52 | | | | 1.14 | |

Net earnings (loss) | | | 0.17 | | | | (0.37 | ) | | | 1.16 | | | | 1.84 | | | | 1.71 | | | | 1.14 | |

Earnings (loss) per share – diluted | | | | | | | | | | | | | | | | | | | | | | | | |

Continuing operations | | | 0.17 | | | | (0.51 | ) | | | 1.13 | | | | 1.82 | | | | 1.49 | | | | 1.12 | |

Net earnings (loss) | | | 0.17 | | | | (0.37 | ) | | | 1.15 | | | | 1.81 | | | | 1.67 | | | | 1.12 | |

| | | | | | |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | | | | |

Current assets | | $ | 229,439 | | | $ | 213,923 | | | $ | 246,586 | | | $ | 228,688 | | | $ | 259,229 | | | $ | 222,484 | |

Total assets(3) | | | 493,104 | | | | 511,098 | | | | 526,854 | | | | 527,684 | | | | 563,508 | | | | 449,161 | |

Current liabilities | | | 105,771 | | | | 113,946 | | | | 128,887 | | | | 157,292 | | | | 177,315 | | | | 145,859 | |

Long–term debt | | | 20,916 | | | | 21,442 | | | | 8,400 | | | | 8,400 | | | | 58,200 | | | | 35,400 | |

Shareholders’ equity | | | 321,198 | | | | 327,677 | | | | 343,590 | | | | 316,624 | | | | 284,582 | | | | 235,668 | |

| | | | | | |

Cash Flow Data | | | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | $ | 27,246 | | | $ | 28,218 | | | $ | 29,601 | | | $ | 29,307 | | | $ | 22,776 | | | $ | 18,536 | |

Net cash provided by (used in) continuing operating activities | | | 27,981 | | | | (7,985 | ) | | | 97,234 | | | | 116,298 | | | | 86,235 | | | | 48,071 | |

Capital expenditures | | | 9,650 | | | | 9,126 | | | | 9,765 | | | | 55,184 | | | | 55,208 | | | | 39,893 | |

Dividends* | | | 9,153 | | | | 9,161 | | | | 9,112 | | | | 8,800 | | | | 8,192 | | | | 9,312 | |

| | | | | | |

Other Data | | | | | | | | | | | | | | | | | | | | | | | | |

Gross margin – % of sales | | | 17.7 | | | | 14.3 | | | | 23.3 | | | | 21.7 | | | | 21.0 | | | | 19.1 | |

Operating margin – % of sales | | | 0.6 | | | | (3.6 | ) | | | 6.5 | | | | 8.4 | | | | 7.5 | | | | 6.1 | |

Effective tax rate – % | | | (28.8 | ) | | | 32.0 | | | | 32.1 | | | | 35.0 | | | | 30.7 | | | | 35.1 | |

Non–cash working capital | | $ | 44,374 | | | $ | 39,426 | | | $ | 15,064 | | | $ | 44,336 | | | $ | 69,650 | | | $ | 70,438 | |

Debt as a % of total capital | | | 6.1 | | | | 6.4 | | | | 2.4 | | | | 2.6 | | | | 17.0 | | | | 13.1 | |

Return on: | | | | | | | | | | | | | | | | | | | | | | | | |

Average shareholders’ equity – % | | | 1.4 | | | | (3.1 | ) | | | 9.6 | | | | 17.0 | | | | 18.7 | | | | 14.6 | |

Average invested capital**– % | | | 0.6 | | | | (3.4 | ) | | | 7.5 | | | | 12.6 | | | | 11.4 | | | | 10.0 | |

Dividend yield at year–end – % | | | 2.6 | | | | 2.3 | | | | 2.3 | | | | 3.3 | | | | 1.8 | | | | 1.4 | |

Book value per share | | | 11.45 | | | | 11.66 | | | | 12.29 | | | | 11.40 | | | | 9.90 | | | | 8.25 | |

Price/earnings ratio at year–end | | | 76:1 | | | | NM | | | | 12:1 | | | | 5:1 | | | | 9:1 | | | | 17:1 | |

Average monthly trading volume | | | 2,830 | | | | 4,790 | | | | 5,900 | | | | 8,400 | | | | 7,740 | | | | 3,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| * | See Item 5 for dividend per share data. |

| ** | [(Operating income + equity in earnings of affiliated companies) x (.65)]/average invested capital |

NM=Not meaningful

| | (1) | Fiscal 2012 and 2007 each included 53 weeks compared to 52 weeks in each of the other periods presented. |

| | (2) | See Item 8, Note 6 to the Consolidated Financial Statements for additional information related to the acquisition of Glassec in November 2010. |

| | (3) | Fiscal 2011 includes a retrospective adjustment of $4.2 million as described in Item 8, Note 6 to the Consolidated Financial Statements. |

16

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

This discussion contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect our current views with respect to future events and financial performance. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “should” and similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All forecasts and projections in this document are “forward-looking statements,” and are based on management’s current expectations or beliefs of the Company’s near-term results, based on current information available pertaining to the Company, including the risk factors noted under Item 1A in this Form 10-K. From time to time, we also may provide oral and written forward-looking statements in other materials we release to the public such as press releases, presentations to securities analysts or investors, or other communications by the Company. Any or all of our forward-looking statements in this report and in any public statements we make could be materially different from actual results.

Accordingly, we wish to caution investors that any forward-looking statements made by or on behalf of the Company are subject to uncertainties and other factors that could cause actual results to differ materially from such statements. These uncertainties and other risk factors include, but are not limited to, the risks and uncertainties set forth under Item 1A in this Form 10-K.

We wish to caution investors that other factors might in the future prove to be important in affecting the Company’s results of operations. New factors emerge from time to time; it is not possible for management to predict all such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or a combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Overview

We are a leader in certain technologies involving the design and development of value-added glass products, services and systems. The Company is comprised of two segments: Architectural Products and Services (Architectural) and Large-Scale Optical Technologies (LSO). Our Architectural segment companies design, engineer, fabricate, install, maintain and renovate the walls of glass, windows, storefront and entrances comprising the outside skin of commercial and institutional buildings. Businesses in this segment are: Viracon, Inc., including GlassecViracon, fabricator of coated, high-performance architectural glass for global markets; Harmon, Inc., one of the largest U.S. full-service building glass installation and renovation companies; Wausau Window and Wall Systems, a manufacturer of standard and custom aluminum window systems and curtainwall for the North American commercial construction market; Linetec, a paint and anodizing finisher of architectural aluminum and PVC shutters for U.S. markets; and Tubelite Inc. (Tubelite), a fabricator of aluminum storefront, entrance and curtainwall products for the U.S. commercial construction industry. Our LSO segment consists of Tru Vue, Inc., a manufacturer of value-added glass and acrylic for the custom picture framing market.

The following are the key items that impacted fiscal 2012:

| | • | | The Architectural segment’s net sales were up 15.1 percent, or 9.1 percent excluding the impact of GlassecViracon, which was acquired late in fiscal 2011, over the prior year even as we continued to be impacted by difficult U.S. commercial construction market conditions. Growth was driven by initiatives to improve market share in our metal fabrication businesses and improved pricing in our architectural glass fabrication business. Operating results were also favorable to last year largely due to the impact of the items above, partially offset by project margin declines at our installation business. |

| | • | | Despite soft market conditions, our LSO segment was able to increase net sales 4.1 percent, while operating income was down slightly due to spending on growth initiatives during fiscal 2012. |

| | • | | Our backlog was $243.9 million at March 3, 2012, compared to $238.4 million at February 26, 2011. |

| | • | | The Architectural segment backlog represents more than 99 percent of the backlog. Bidding activity has remained solid; however, bid-to-award and contract timing continues to be slow. |

17

Strategy. The following describes our business strategy for each of our segments.

Architectural segment.Our Architectural segment serves the commercial construction market, which is highly cyclical. We have five business units within this segment that participate at various stages of the glass fabrication, window and curtainwall supply chain – each with nationally recognized brands and leading positions in their target market segments. The glass and window and curtainwall systems enclose commercial buildings such as offices, hospitals, educational facilities, government facilities, high-end multi-family buildings and retail centers. We believe building contractors value our ability to deliver quality, customized window and curtainwall solutions to projects on time and on budget, helping to minimize costly job-site labor overruns. Their customers – building owners and developers – value the distinctive look, energy efficiency, and hurricane and blast protection features of our glass systems. These benefits can contribute to higher lease rates, lower operating costs due to the energy efficiency of our value-added glass, a more comfortable environment for building occupants, and protection for buildings and occupants from hurricanes and blasts.

We look at several market indicators, such as office space vacancy rates, architectural billing statistics, employment, and other economic indicators, to gain insight into the commercial construction market. One of our primary indicators is U.S. non-residential construction market activity as documented by McGraw-Hill Construction (McGraw-Hill), a leading independent provider of construction industry analysis, forecasts and trends. We utilize the information for the building types that we typically supply (office towers, hotels, retail centers, education facilities and dormitories, health care facilities, government buildings and high-end multi-family buildings) and adjust this information (which is based on construction starts) to align with our fiscal year and the lag that is required to account for when our products and services typically are initiated in a construction project – approximately eight months after project start. From the McGraw-Hill data, our U.S. markets had an annual compounded growth rate of negative 14 percent over our past three fiscal years, consistent with our segment’s domestic compounded annual growth rate over that same period.

Our overall strategy in this segment is to defend and grow market share over a cycle by extending our presence while remaining focused on distinctive solutions for enclosing commercial buildings. We draw upon our leading brands, energy-efficient products and reputation for high quality and service in pursuit of our strategy. Each of our existing businesses has the ability to grow through geographic or product line expansion, and we regularly evaluate acquisition opportunities in adjacent segments. Finally, we aspire to lead our markets in the development of practical, energy-efficient products for “green” buildings and the ability to deliver them in a sustainable manner. Our architectural businesses have introduced products and services designed to meet the growing demand for green building materials. These products have included new energy-efficient glass coatings, thermally enhanced aluminum framing systems and systems with a high percentage of recycled content.

While our lag-adjusted markets are projected to continue to contract slightly into fiscal 2013, we are pursuing the same basic strategy with some adjustment for market conditions. In fiscal 2011 we raised the pricing of our U.S. architectural glass products to better reflect the value our products deliver to the marketplace, and expect to see the full benefits of the price increases in fiscal 2013. In addition, we have been and continue to take measures to keep our cost structure in line with revenue, including continuing to focus on productivity while maintaining and upgrading our capacity to gain market share when our markets recover. We acquired Glassec, a leading architectural glass fabricator in Brazil, in November 2010, establishing an architectural glass footprint in a developing and fast-growing market where we can provide technical and operational excellence. We have been successful in winning and profitably executing installation work in new metropolitan markets to offset declines in core markets. We are focusing on renovation of window and curtainwall systems where all sectors are increasing their interest in upgrading their facades. We have tightened our capital spending criteria, although we continue to have cash available, and will be spending during fiscal 2013 for strategic investments for both international and domestic initiatives to drive growth and improve productivity. We expect to emerge from the current downturn poised to win market share from competitors who were not as well positioned or do not have funds available to weather the current down cycle.

LSO segment.Our basic strategy in this segment is to convert the custom picture framing market from clear uncoated glass to value-added glass that protects art from UV damage while minimizing reflection from the glass so that viewers see the art rather than the glass. We estimate that over 50 percent of the retail picture framing market has converted to value-added glass, and although we are finding it more difficult to convert, the ultimate potential is significantly higher. We offer a variety of products with varying levels of reflection control and promote the benefits to consumers with point-of-purchase displays and other promotional materials. We also work to educate the fragmented custom picture framing market regarding the opportunity to improve the profitability of their framing business by selling value-added glass.

Over the past two years, we have been extending our strategy to the fine art market, which includes museums and private collections. We also made capital investments to support the conversion to value-added picture framing products as well as to grow the fine art market. As part of that extension, we developed value-added acrylic products in addition to glass. Acrylic is a preferred material in the fine art markets because the art can be much larger and weight is an important consideration. In fiscal 2010, we expanded our strategies to include other markets that can be served with anti-reflective acrylic products.

18

In fiscal 2011, we established an initiative to begin selling our products in Europe, and in fiscal 2012, we began executing against this initiative. Historically, we have had very little presence in Europe. We believe our products and distribution networks will enable us to grow at a faster pace in Europe than in the United States.

Results of Operations

Net Sales

| | | | | | | | | | | | | | | | | | | | |

(Dollars in thousands) | | 2012 | | | 2011 | | | 2010 | | | 2012 vs. 2011 | | | 2011 vs. 2010 | |

Net sales | | $ | 662,463 | | | $ | 582,777 | | | $ | 696,703 | | | | 13.7 | % | | | (16.4 | )% |

Fiscal 2012 Compared to Fiscal 2011

Sales increased 13.7 percent during fiscal 2012 despite flat market conditions due to market share gains in the window and storefront businesses and improved architectural glass pricing. The GlassecViracon business that was acquired in the third quarter of fiscal 2011 accounted for 5.2 percentage points of the increase in fiscal 2012. In addition, fiscal 2012 included 53 weeks compared to the prior-year 52-week period, which had a 2 percent impact on current year sales.

Fiscal 2011 Compared to Fiscal 2010

Sales decreased 16.4 percent due to challenging commercial construction market conditions during fiscal 2011. This resulted in lower demand, driving lower volume across all Architectural segment business lines, and lower pricing, largely in our architectural glass business. GlassecViracon contributed $3.7 million of sales to our Architectural segment in fiscal 2011 for the period subsequent to acquisition.

Performance

The relationship between various components of operations, as a percentage of net sales, is illustrated below for the past three fiscal years.

| | | | | | | | | | | | |

(Percentage of net sales) | | 2012 | | | 2011 | | | 2010 | |

Net sales | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

Cost of sales | | | 82.3 | | | | 85.7 | | | | 76.7 | |

| | | | | | | | | | | | |

Gross profit | | | 17.7 | | | | 14.3 | | | | 23.3 | |

Selling, general and administrative expenses | | | 17.1 | | | | 17.9 | | | | 16.8 | |

| | | | | | | | | | | | |

Operating income (loss) | | | 0.6 | | | | (3.6 | ) | | | 6.5 | |

Interest income | | | 0.2 | | | | 0.1 | | | | 0.1 | |

Interest expense | | | 0.2 | | | | 0.1 | | | | 0.1 | |

Other income (expense), net | | | — | | | | — | | | | 0.1 | |

| | | | | | | | | | | | |

Earnings (loss) from continuing operations before income taxes | | | 0.6 | | | | (3.6 | ) | | | 6.6 | |

Income tax (benefit) expense | | | (0.1 | ) | | | (1.2 | ) | | | 2.1 | |

| | | | | | | | | | | | |

Earnings (loss) from continuing operations | | | 0.7 | | | | (2.4 | ) | | | 4.5 | |

Earnings from discontinued operations, net of income taxes | | | — | | | | 0.6 | | | | 0.1 | |

| | | | | | | | | | | | |

Net earnings (loss) | | | 0.7 | % | | | (1.8 | )% | | | 4.6 | % |

| | | | | | | | | | | | |

Effective income tax rate for continuing operations | | | (28.8 | )% | | | 32.0 | % | | | 32.1 | % |

Fiscal 2012 Compared to Fiscal 2011

Consolidated gross profit was up 3.4 percentage points due to the higher architectural glass pricing and the margin impact from the revenue growth in the window and storefront businesses, partially offset by lower margin work in the installation business. During fiscal 2011, we incurred unusually high costs to resolve architectural glass product quality issues from a vendor-supplied material, as well as other quality issues, which negatively impacted gross profit by approximately $3.4 million, or 0.6 percentage points.

Selling, general and administrative (SG&A) expenses decreased as a percent of sales to 17.1 percent in fiscal 2012 from 17.9 percent in fiscal 2011, while spending was up $9.2 million. Approximately half of the increase in spending relates to the impact of the addition of the GlassecViracon business. Transition costs related to our retiring CEO and hiring our new CEO, increased commissions as a result of increased sales, and increased promotional costs in our LSO segment also contributed to the increase in spending.

19

In the current year, income tax expense on pre-tax income was more than offset by tax benefits from credits and deductions on a low base of earnings and the impact of statute of limitation expirations for prior fiscal years.

Fiscal 2011 Compared to Fiscal 2010

Consolidated gross profit was down 9.0 percentage points due to lower pricing, primarily in our architectural glass business, as well as lower project margins and the impact of low capacity utilization from lower volume in our Architectural segment. During fiscal 2011, we incurred unusually high costs to resolve architectural glass product quality issues from a vendor-supplied material, as well as other quality issues, which negatively impacted gross profit by approximately $3.4 million, or 0.6 percentage points. Our LSO segment had favorable results for fiscal 2011 compared to fiscal 2010 due to the ongoing strong mix of value-added picture framing product and positive operating performance, partially offsetting the items above.