Exhibit 99.2

MSI to Sell Enterprise

Business

Global Leader in Mission-Critical Public Safety

Communications

APRIL 15, 2014

SAFE HARBOR

A number of forward-looking statements will be made during this presentation. Forward-looking statements are any statements that are not historical facts. These forward-looking statements are based on the current expectations of Motorola Solutions, and we can give no assurance that any future results or events discussed in these statements will be achieved. Any forward-looking statements represent our views only as of today and should not be relied upon as representing our views as of any subsequent date. Forward-looking statements are subject to a variety of risks and uncertainties that could cause our actual results to differ materially from the statements contained in this presentation.

Information about factors that could cause, and in some cases have caused, such differences can be found on pages 10 through 21 in Item 1A of Motorola Solutions’ 2013 Annual Report on Form 10-K, and in our other SEC filings available for free on the SEC’s website at www.sec.gov, and on Motorola Solutions’ website at www.motorolasolutions.com/investor

This presentation is being made on the 15th of April 2014. The content of this presentation contains time-sensitive information that is accurate only as of the time hereof. If any portion of this presentation is rebroadcast, retransmitted or redistributed at a later date, Motorola Solutions will not be reviewing or updating the material that is contained herein.

Page 2

USE OF NON-GAAP MEASURES

In addition to the GAAP results provided during this event, Motorola Solutions has provided certain non-GAAP measurements. Motorola Solutions has provided these non-GAAP measurements as a measure to help investors better understand its core operating performance, enhance comparisons of Motorola Solutions’ core operating performance from period to period and to allow better comparisons of Motorola Solutions’ operating performance to that of its competitors. Among other things, the Company’s management uses these operating results, excluding the identified items, to evaluate the performance of its businesses and to evaluate results relative to incentive compensation targets.

Management uses operating results excluding these items because they believe this measure enables them to make better period-to-period evaluations of the financial performance of its core business operations. There are inherent limitations in the use of operating results excluding these items because the company’s GAAP results include the impact of these items. The non-GAAP measures are intended only as a supplement to the comparable GAAP measures and the Company compensates for the limitations inherent in the use of non-GAAP measures by using GAAP measures in conjunction with the non-GAAP measures. As a result, investors should consider these non-GAAP measures in addition to, and not in substitution for, or as superior to, measures of financial performance prepared in accordance with GAAP.

Details of these items and reconciliations of the non-GAAP measurements provided during this presentation to GAAP measurements can be found in the Appendix to this presentation and on Motorola Solutions’ website at www.motorolasolutions.com/investor.

Page 3

TRANSACTION OVERVIEW

Strategic rationale

Government and Enterprise businesses have differentiated customer channels and opportunities Positions Zebra as an industry leader in enterprise asset intelligence

Positions MSI as a singularly focused leader in mission critical communications

Great franchise with an excellent leadership position and strong install base of customers More than $6B in revenue with presence in more than 100 countries Stable, long-term growth in core business with demonstrated operating leverage Improved cash flow stability and increasing recurring revenue streams

Attractive valuation for the Enterprise business for MSI shareholders

$3.45B valuation in all cash deal, effectively tax free to MSI

Expect proceeds to be returned to shareholders in timely manner

Provides opportunity for sustainable capital return and leverage aligned with stable business profile

Expect to close transaction by end of 2014

Subject to customary closing conditions and regulatory approvals

MSI REMAINING BUSINESS OVERVIEW

Products Services

$4.1B | | in sales* $2.1B in sales* |

Core public safety and commercial systems & Systems integration, managed services, smart

devices public safety

Worldwide leadership position

* Proforma 2013 sales are Government and iDEN combined. ** OE = Proforma non-GAAP operating earnings and includes corporate costs previously allocated to Enterprise business

Page 5

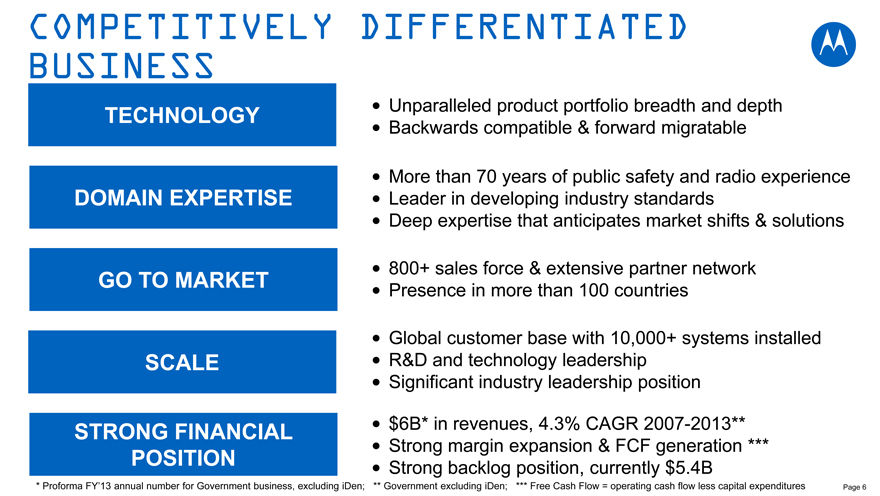

COMPETITIVELY DIFFERENTIATED BUSINESS

TECHNOLOGY

DOMAIN EXPERTISE

GO TO MARKET

SCALE

STRONG FINANCIAL POSITION

Unparalleled product portfolio breadth and depth Backwards compatible & forward migratable

More than 70 years of public safety and radio experience Leader in developing industry standards Deep expertise that anticipates market shifts & solutions

800+ sales force & extensive partner network Presence in more than 100 countries

Global customer base with 10,000+ systems installed R&D and technology leadership Significant industry leadership position

$6B* in revenues, 4.3% CAGR 2007-2013** Strong margin expansion & FCF generation *** Strong backlog position, currently $5.4B

* Proforma FY’13 annual number for Government business, excluding iDen; ** Government excluding iDen; *** Free Cash Flow = operating cash flow less capital expenditures

Page 6

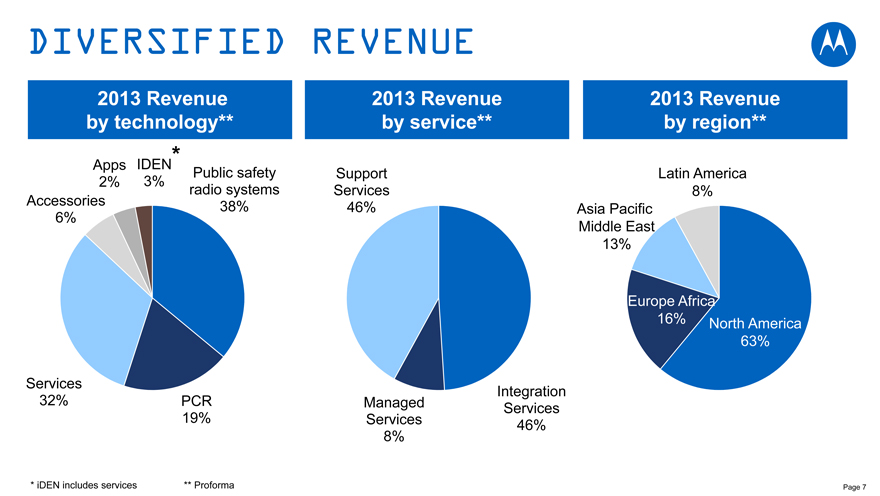

DIVERSIFIED REVENUE

2013 Revenue 2013 Revenue 2013 Revenue by technology** by service** by region**

Apps IDEN

Public safety Support Latin America

2% 3% radio systems Services 8% Accessories 38% 46% Asia Pacific 6% Middle East 13%

Europe Africa

16% North America 63%

Services

Integration 32% PCR Managed Services 19% Services 46% 8%

* | | iDEN includes services ** Proforma Page 7 |

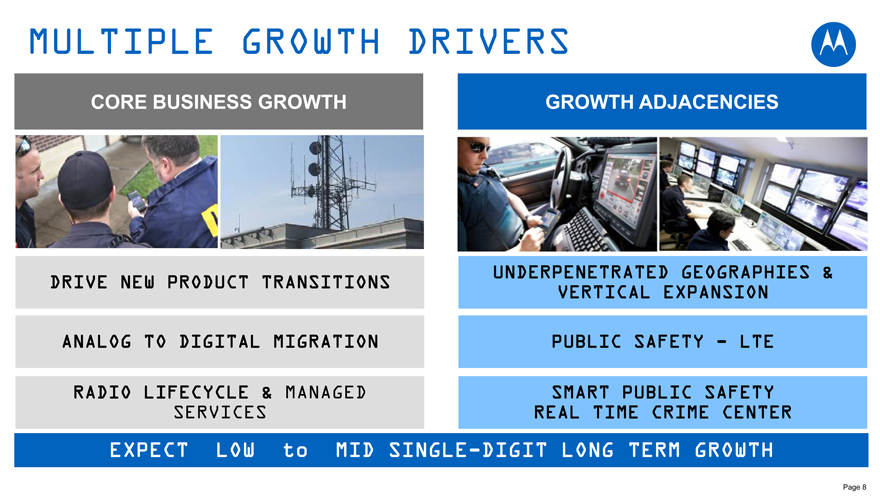

MULTIPLE GROWTH DRIVERS

CORE BUSINESS GROWTH GROWTH ADJACENCIES

UNDERPENETRATED GEOGRAPHIES & DRIVE NEW PRODUCT TRANSITIONS

VERTICAL EXPANSION

ANALOG TO DIGITAL MIGRATION PUBLIC SAFETY—LTE

RADIO LIFECYCLE & MANAGED SMART PUBLIC SAFETY SERVICES REAL TIME CRIME CENTER

EXPECT LOW to MID SINGLE-DIGIT LONG TERM GROWTH

Page 8

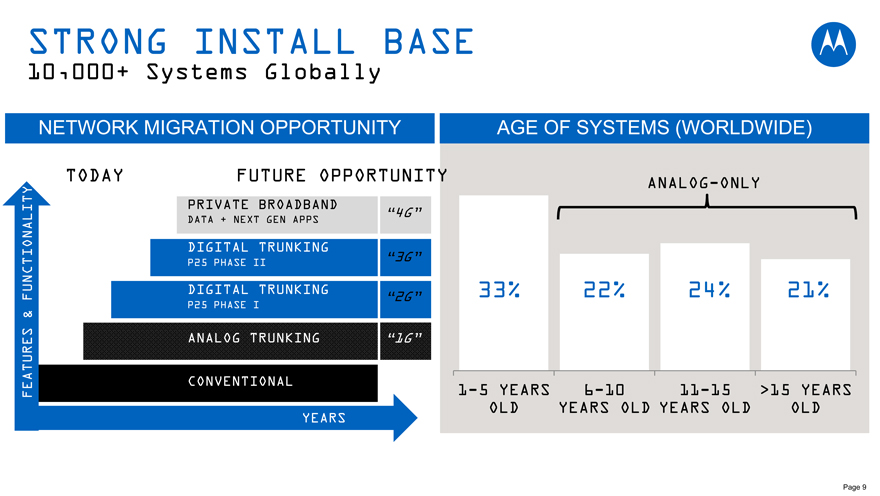

STRONG INSTALL BASE

10,000+ Systems Globally

NETWORK MIGRATION OPPORTUNITY AGE OF SYSTEMS (WORLDWIDE)

TODAY FUTURE OPPORTUNITY ANALOG-ONLY

MUCH OF

PRIVATE BROADBAND

“4G”

DATA + NEXT GEN APPS

ONALITY MUCH OF DIGITAL TRUNKING

“3G”

P25 PHASE II

DIGITAL TRUNKING 33% 22% 24% 21%

“2G”

FUNCTIONALITY & P25 PHASE I

ANALOG TRUNKING “1G”

CONVENTIONAL

FEATURES 1-5 YEARS 6-10 11-15 >15 YEARS OLD YEARS OLD YEARS OLD OLD

YEARS

Page 9

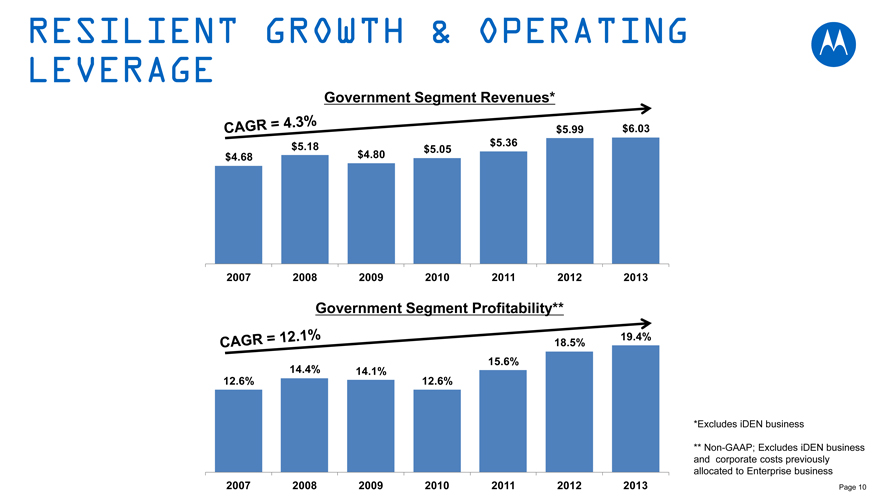

RESILIENT GROWTH & OPERATING LEVERAGE

Government Segment Revenues*

$5.99 $6.03 $5.18 $5.36 $5.05 $4.68 $4.80

CAGR=4.3%

2007 2008 2009 2010 2011 2012 2013

Government Segment Profitability**

19.4%

18.5%

15.6%

14.4% 14.1%

12.6% 12.6%

*Excludes iDEN business

CAGR=12.1%

** Non-GAAP; Excludes iDEN business and corporate costs previously allocated to Enterprise business

2007 2008 2009 2010 2011 2012 2013 Page 10

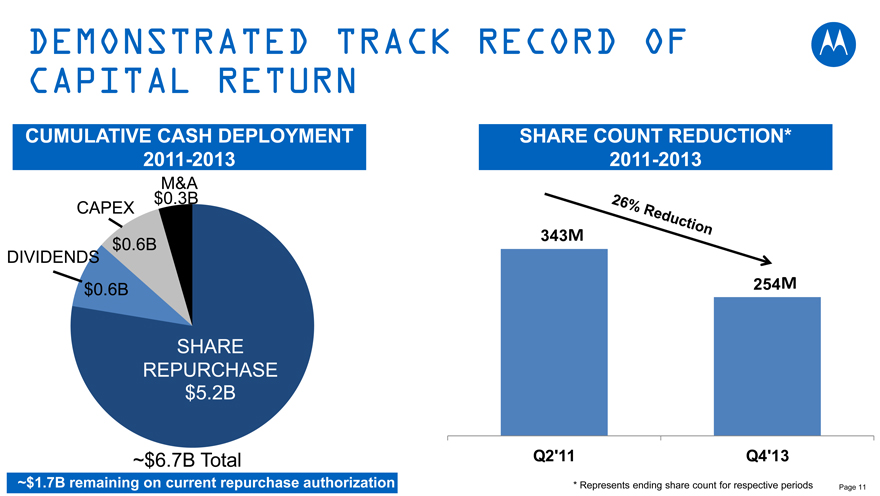

DEMONSTRATED TRACK RECORD OF CAPITAL RETURN

CUMULATIVE CASH DEPLOYMENT SHARE COUNT REDUCTION* 2011-2013 2011-2013

$M&A 0.3B CAPEX

343M

$0.6B

DIVIDENDS

REDUCTION 26%

$0.6B 254M

SHARE REPURCHASE

$5.2B

~$6.7B Total Q2’11 Q4’13

~$1.7B remaining on current repurchase authorization * Represents ending share count for respective periods Page 11

FUTURE CAPITAL STRUCTURE

Expect transaction proceeds to be returned to shareholders in timely fashion

Committed to strong balance sheet and investment grade rating

Capital expenditures ~20% of operating cash flow

Will retain sufficient flexibility to support “bolt-on” opportunities that are close to our core or support our targeted growth areas

Expect ongoing free cash flow returned through share repurchase and continued dividends

Page 12

SUMMARY

Enterprise transaction expected to close by end of 2014, subject to customary closing conditions and regulatory approvals

Expect to return transaction proceeds to shareholders in timely fashion

MSI becomes a singularly focused, industry leading company

Strong competitive differentiation with leading portfolio and sales capabilities, positioned for continued operating leverage

Long-term growth driven by large installed base, differentiated portfolio, strong solutions capability and continued innovation

Sustainable capital deployment model aligned with a business that has generated dependable growth and strong cash flow

Page 13

USE OF NON-GAAP MEASURES

In addition to the GAAP results provided during this event, Motorola Solutions has provided certain non-GAAP measurements. Motorola Solutions has provided these non-GAAP measurements as a measure to help investors better understand its core operating performance, enhance comparisons of Motorola Solutions’ core operating performance from period to period and to allow better comparisons of Motorola Solutions’ operating performance to that of its competitors. Among other things, the Company’s management uses these operating results, excluding the identified items, to evaluate the performance of its businesses and to evaluate results relative to incentive compensation targets.

Management uses operating results excluding these items because they believe this measure enables them to make better period-to-period evaluations of the financial performance of its core business operations. There are inherent limitations in the use of operating results excluding these items because the company’s GAAP results include the impact of these items. The non-GAAP measures are intended only as a supplement to the comparable GAAP measures and the Company compensates for the limitations inherent in the use of non-GAAP measures by using GAAP measures in conjunction with the non-GAAP measures. As a result, investors should consider these non-GAAP measures in addition to, and not in substitution for, or as superior to, measures of financial performance prepared in accordance with GAAP.

Details of these items and reconciliations of the non-GAAP measurements provided during this presentation to GAAP measurements can be found in the Appendix to this presentation and on Motorola Solutions’ website at www.motorolasolutions.com/investor.

Page 15

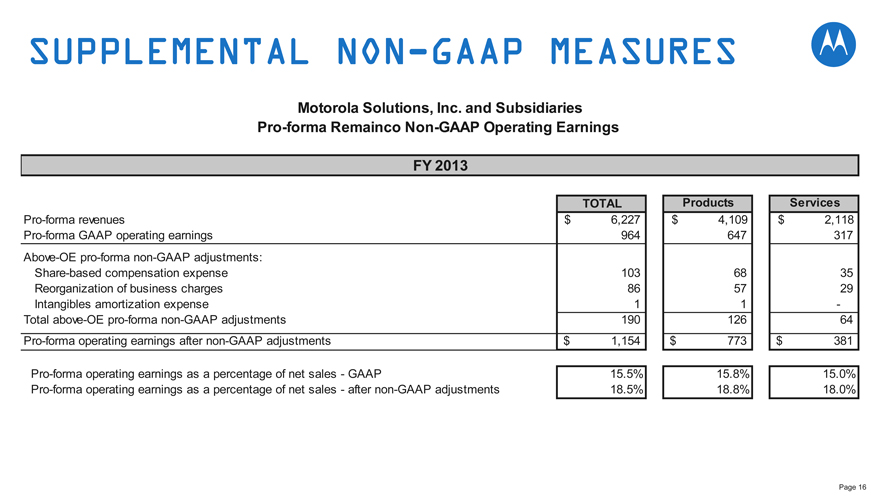

SUPPLEMENTAL NON-GAAP MEASURES

Motorola Solutions, Inc. and Subsidiaries Pro-forma Remainco Non-GAAP Operating Earnings

FY 2013

TOTAL Products Services

Pro-forma revenues $ 6,227 $ 4,109 $ 2,118

Pro-forma GAAP operating earnings 964 647 317

Above-OE pro-forma non-GAAP adjustments:

Share-based compensation expense 103 68 35

Reorganization of business charges 86 57 29

Intangibles amortization expense 1 1 -

Total above-OE pro-forma non-GAAP adjustments 190 126 64

Pro-forma operating earnings after non-GAAP adjustments $ 1,154 $ 773 $ 381

Pro-forma operating earnings as a percentage of net sales—GAAP 15.5% 15.8% 15.0%

Pro-forma operating earnings as a percentage of net sales—after non-GAAP adjustments 18.5% 18.8% 18.0%

Page 16