UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___to ___

|

| | | |

| (Exact name of registrant as specified in its charter) | Commission file number | State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

| Questar Corporation | 001-08796 | Utah | 87-0407509 |

| Questar Gas Company | 333-69210 | Utah | 87-0155877 |

| Questar Pipeline Company | 000-14147 | Utah | 87-0307414 |

333 South State Street, P.O. Box 45433, Salt Lake City, Utah 84145-0433

(Address of principal executive offices)

Registrants' telephone number, including area code (801) 324-5900

Web site http://www.questar.com

Securities registered pursuant to Section 12(b) of the Act:

|

| |

| Questar Corporation | Common stock without par value, listed on the New York Stock Exchange |

| Questar Gas Company | None |

| Questar Pipeline Company | None |

Securities registered pursuant to Section 12(g) of the Act:

|

| |

| Questar Corporation | None |

| Questar Gas Company | None |

| Questar Pipeline Company | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

| |

| Questar Corporation | Yes [X] No [ ] |

| Questar Gas Company | Yes [ ] No [X] |

| Questar Pipeline Company | Yes [ ] No [X] |

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

| |

| Questar Corporation | Yes [X] No [ ] |

| Questar Gas Company | Yes [X] No [ ] |

| Questar Pipeline Company | Yes [X] No [ ] |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

| |

| Questar Corporation | Yes [X] No [ ] |

| Questar Gas Company | Yes [X] No [ ] |

| Questar Pipeline Company | Yes [X] No [ ] |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

| |

| Questar Corporation | [ ] |

| Questar Gas Company | [ ] |

| Questar Pipeline Company | [ ] |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. Do not check non-accelerated filer if a smaller reporting company (Check one).

|

| | | | |

| Questar Corporation | Large accelerated filer [X] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [ ] |

| Questar Gas Company | Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [X] | Smaller reporting company [ ] |

| Questar Pipeline Company | Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [X] | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

| |

| Questar Corporation | Yes [ ] No [X] |

| Questar Gas Company | Yes [ ] No [X] |

| Questar Pipeline Company | Yes [ ] No [X] |

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2015). The aggregate market value was calculated by excluding all shares held by directors and executive officers of the registrant and three nonprofit foundations established by the registrant without conceding that all such persons are affiliates for purposes of federal securities laws.

|

| |

| Questar Corporation | $3.6 billion |

| Questar Gas Company | None |

| Questar Pipeline Company | None |

Indicate the number of shares outstanding of each of the registrants' classes of common stock, as of January 31, 2016.

|

| | |

| Questar Corporation | without par value | 175,008,184 |

| Questar Gas Company | $2.50 per share par value | 9,189,626 |

| Questar Pipeline Company | $1.00 per share par value | 6,550,843 |

Documents Incorporated by Reference:

None

Questar Gas Company and Questar Pipeline Company, as wholly-owned subsidiaries of a reporting company, meet the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K and are therefore filing this form with the reduced disclosure format.

Explanatory Note

On February 18, 2016, Questar Corporation ("Questar" or the "Company") and its subsidiaries, Questar Gas Company ("Questar Gas") and Questar Pipeline Company ("Questar Pipeline"), filed a combined Annual Report on Form 10-K for the fiscal year ended December 31, 2015 (the “Original Form 10-K”). This Amendment No. 1 on Form 10-K/A (the “Amendment”) is being filed solely for the purpose of including the information required by Items 10 through 14 of Part III of Form 10-K. This information was omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the Part III information to be incorporated by reference to Questar’s definitive proxy statement for its 2016 Annual Meeting of Shareholders if it is filed no later than 120 days after the end of Questar’s fiscal year. This Amendment is being filed to include Part III information in the Original Form 10-K because a definitive proxy statement containing such information will not be filed within 120 days after the end of the fiscal year covered by the Original Form 10-K. The reference on the cover page of the Original Form 10-K to the incorporation by reference to portions of Questar’s definitive proxy statement into Part III of the Original Form 10-K is hereby deleted.

As required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part III, Items 10 through 14 of the Original Form 10-K are hereby amended and restated in their entirety. In addition, new certifications of the principal executive officer and principal financial officer for each of Questar, Questar Gas and Questar Pipeline are filed as exhibits to this Amendment under Item 15 of Part IV hereof.

Except as described above, this Amendment does not modify or update disclosure in, or exhibits to, the Original Form 10-K. Furthermore, this Form 10-K/A does not change any previously reported financial results, nor does it reflect events occurring after the date of the Original Form 10-K. Information not affected by this Form 10-K/A remains unchanged and reflects the disclosures made at the time the Original Form 10-K was filed. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K and with our filings with the Securities and Exchange Commission (the "SEC") subsequent to the Original Form 10-K.

|

| | |

| TABLE OF CONTENTS | |

| | Page |

| | | |

|

| | | |

| Item 10. | | |

| | | |

| Item 11. | | |

| | | |

| Item 12. | | |

| | | |

| Item 13. | | |

| | | |

| Item 14. | | |

| | | |

|

| | | |

| Item 15. | | |

| | | |

| | | |

|

| | |

| Questar 2015 Form 10-K/A | 4 | |

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The Company has a Business Ethics and Compliance Policy (the "Ethics Policy") that applies to all of its directors, officers (including its Chief Executive Officer and Chief Financial Officer) and employees. Questar has posted the Ethics Policy on its internet site, www.questar.com. Any waiver of the Ethics Policy for executive officers must be approved only by the Company's Board of Directors (the "Board"). Questar will post on its internet site any amendments to or waivers of the Ethics Policy that apply to executive officers.

Executive Officers.

Information about the Company's executive officers can be found in Item 1 of Part I of the Original From 10-K.

Directors.

Each director's biographical information appears below. The directors have engaged in the same principal occupation for the past five years unless otherwise indicated. Ages are current as of December 31, 2015.

|

| |

Teresa Beck age 61 | Director since 1999 Finance and Audit Committee

Governance and Nominating Committee |

Ms. Beck served as President of American Stores Co., a supermarket and drugstore holding company, from 1998 to 1999, and as American Stores' Chief Financial Officer from 1993 to 1998. Prior to joining American Stores, Ms. Beck served as an audit manager for Ernst & Young LLP.

|

Outside boards: Ms. Beck has served as a director of Albertsons Inc., Amylin Pharmaceuticals, Inc., ICOS Corporation, and Lexmark International, Inc.

|

Director qualifications, attributes, skills and experience: Ms. Beck brings to the Board significant executive, financial and public company director experience. Ms. Beck has chaired audit committees for two other public companies and chaired the nominations committee for another public company. Ms. Beck also brings a broad background in environmental, health and educational areas.

|

| | |

Laurence M. Downes age 58 | Director since 2010 Finance and Audit Committee (Chair) Management Performance Committee |

Mr. Downes has been with New Jersey Resources Corporation, a retail and wholesale energy company, since 1985. He has served as New Jersey Resources' President and Chief Executive Officer since 1995 and its Chairman of the Board since 1996.

|

Outside boards: In addition to serving as Chairman of New Jersey Resources, Mr. Downes is a director and past chairman of the American Gas Association; trustee of the Natural Gas Council; and member of the Board of the New Jersey Economic Development Authority, as well as a trustee of the American Gas Foundation.

|

Director qualifications, attributes, skills and experience: Mr. Downes brings to the Board significant executive leadership and public company director experience. From his years as an executive and director of New Jersey Resources, Mr. Downes has extensive knowledge in the areas of business strategy, safety, risk oversight, management and corporate governance. He also has significant financial expertise as well as a wealth of experience and knowledge in the energy industry, particularly the natural gas utility business. Mr. Downes' board positions at natural gas trade organizations have positioned him to bring industry knowledge to our Board.

|

| | |

|

| | |

| Questar 2015 Form 10-K/A | 5 | |

|

| |

Christopher Helms age 61 | Director since 2013 Finance and Audit Committee

Management Performance Committee (Chair) |

Mr. Helms is the President and Chief Executive Officer of US Shale Energy Advisors LLC, and its direct and indirect subsidiaries including US Shale Energy Midstream, LLC, RMCO Holdings LLC and Rocky Mountain Crude Oil LLC. Rocky Mountain Crude Oil is a crude oil logistics company serving various Rocky Mountain markets. Mr. Helms previously served as Executive Vice President and Group Chief Executive Officer of NiSource Inc., and Chief Executive Officer and Executive Director of NiSource Gas Transmission and Storage. Prior to NiSource, Mr. Helms was the President and Chief Executive Officer of CMS Panhandle Companies, wholly-owned by CMS Energy Corporation (1999-2003); and from 1990 to 1999, held various positions of increasing responsibility with Duke Energy Corporation.

|

Outside boards: Mr. Helms serves as a director of Range Resources Corporation and MPLX GP LLC, a midstream crude oil and products pipeline limited partnership formed by Marathon Petroleum Corporation. He has previously served on the boards of the Millennium Pipeline Company LLC and Centennial Pipeline Company LLC. He also has served as a director of the Marcellus Shale Coalition; Vice Chair of the Interstate Natural Gas Association of America; and Chair of the Southern Gas Association.

|

Director qualifications, attributes, skills and experience: Mr. Helms brings to the Board strong executive leadership and strategic management skills. He has more than 38 years of experience in the industry, with extensive involvement in the midstream energy business including operations, joint ventures, mergers and acquisitions, which enables him to provide insight on issues impacting the Company's business. He also has experience and skills in the areas of law, corporate governance, finance, accounting, compliance, and strategic planning and risk oversight.

|

| | |

Ronald W. Jibson age 62 | Director since 2010 Chairman since 2012 |

Mr. Jibson has served as the Company’s President and Chief Executive Officer and a director since June 2010. He was appointed Chairman of the Board effective July 1, 2012. Mr. Jibson is also Chairman, President and CEO of Wexpro, and Chairman and CEO of Questar Gas and Questar Pipeline.

|

Outside boards: Mr. Jibson serves as a director of IdaCorp, Inc. and its subsidiary Idaho Power, and National Fuel Gas Company. He is past chair of the Board of Directors of the American Gas Association and past chair of Western Energy Institute. He also serves on the Board of Gas Technology Institute, is Chair of Utah State University's Board of Trustees and past Chair of the Salt Lake Chamber Board of Governors and the Economic Development Corporation of Utah. |

Director qualifications, attributes, skills and experience: Mr. Jibson brings to the Board 35 years of service at Questar, during which time he has gained extensive leadership and natural gas industry experience. As both Chairman of the Board and Questar's President and CEO, Mr. Jibson provides strong leadership and communicates to the Board on Questar's strategic business plans, operations, performance, regulatory issues and any other developments. With his participation in industry organizations, he brings a broad knowledge of the natural gas industry as well as current industry trends and developments.

|

| | |

James T. McManus, II age 57 | Director since 2014 Finance and Audit Committee Nominating and Governance Committee |

Mr. McManus is Chairman, President and Chief Executive Officer of Energen Corporation, an oil and gas exploration and production (E&P) company. He has been employed by Energen and its subsidiaries in various capacities since 1986. He was elected CEO in July 2007 and Chairman in January 2008. In 1997 he became President of Energen Resources and, over the next decade, led the growth of the E&P company from a small niche player in coalbed methane development in Alabama to one of the top independent oil and gas producers in the United States. Prior to joining Energen, Mr. McManus worked for Price Waterhouse Coopers.

|

Outside boards: Mr. McManus serves on the board of the Independent Producers Association of America (IPAA), U.S. Oil and Gas Association, and American Exploration Production Council (AXPC). He is past director of the National Petroleum Council (NPC), American Gas Association (AGA), and Gas Technology Institute (GTI).

|

Director qualifications, attributes, skills and experience. In addition to his extensive knowledge and experience in oil and gas development, Mr. McManus has broad business experience in the fields of leadership, management, utility distribution, regulatory affairs, corporate governance and public relations.

|

| | |

|

| | |

| Questar 2015 Form 10-K/A | 6 | |

|

| |

Rebecca Ranich age 58 | Director since 2013 Governance and Nominating Committee (Chair)

Management Performance Committee |

Ms. Ranich is a former director of Deloitte Consulting LLP, where she led the firm's Federal Government Energy Advisory and Sustainability practice which focused on sustainable business practices, working with the federal government and industry clients advising on mitigating and managing risks related to energy supply/demand and climate-change issues. After leaving Deloitte in 2013, she became an investor in and advisor to emerging technology companies. Prior to joining Deloitte, Ms. Ranich was responsible for a number of major oil and gas pipeline projects, including working at PSG International to develop/lead negotiations and implement the TransCaspian Gas pipeline; and as an executive with Michael Baker Corporation, a large U.S. engineering firm providing services for transportation, energy and infrastructure investments, with responsibility for Europe and former Soviet Union operations.

|

Outside boards: Ms. Ranich is currently Vice Chair of the Board of Directors for the Gas Technology Institute, and serves as Chair of the Investment Committee. Ms. Ranich serves as a member of the Supervisory Board of Uniper, is on the Advisory Board of Yet Analytics, Inc. and is a member of the National Petroleum Council. She also serves on the Commercialization Advisory Board for the Applied Physics Laboratory of Johns Hopkins University.

|

Director qualifications, attributes, skills and experience: With her strong background and wealth of experience in energy development and risk management at the executive and operational levels, Ms. Ranich is well positioned to make significant Board contributions. Her addition brings greater diversity to the Board with her work on sustainable environmental practices and strong global industry experience. Ms. Ranich also brings to the Board her successful track record of establishing, building and leading businesses.

|

| | |

Harris H. Simmons age 61 | Director since 1992 Finance and Audit Committee

Governance and Nominating Committee

Lead Director since May 2013 |

Mr. Simmons has served as President and Chief Executive Officer of Zions Bancorporation(Zions), a bank holding company, since 1990 and as Chairman of Zions’ Board since 2002. He has served in a variety of positions at Zions and Zions First National Bank for more than 33 years, including Chief Financial Officer for Zions for five years. Zions is a financial services company that operates about 450 full-service banking offices in 11 states.

|

Outside boards: Mr. Simmons serves as a director and member of the audit committee of O. C. Tanner Company and a director and member of the audit and compensation committees of National Life Group. He is past chair of the American Bankers Association and a member of the Financial Services Roundtable.

|

Director qualifications, attributes, skills and experience: Mr. Simmons brings extensive financial, executive management and public company director experience, as well as intimate knowledge of the community, public and political environment in which the Company operates its utility business. His local knowledge helps the Board understand the perspective of the Company's utility customers.

|

| | |

Bruce A. Williamson age 56 | Director since 2006 Finance and Audit Committee Management Performance Committee |

Mr. Williamson is the former President, Chief Executive Officer and director of Cleco Corporation, an energy services company. His position with Cleco ended upon the merger of Cleco with Cleco Partners L.P. and Cleco Merger Sub, Inc. in April, 2016. Prior to joining Cleco in 2011, Mr. Williamson served as Dynegy Inc.'s President and Chief Executive Officer and a director from 2002 to 2011 and as Chairman of Dynegy's Board of Directors from 2004 to 2011. Mr. Williamson served as Senior Vice President Finance & Corporate Development at PanEnergy Corporation and led the negotiations of the merger with Duke Energy where he became President and Chief Executive Officer of Duke Energy Global Markets. He began his career with Shell Oil Company where he advanced to Treasurer.

|

Outside boards: Mr. Williamson is currently a director of Southcross Energy. He was formerly a director of Cleco and Dynegy Inc. Mr. Williamson also is on the Dean's Board of the University of Houston.

|

Director qualifications, attributes, skills and experience: Mr. Williamson brings extensive experience in executive management as well as an over 31-year career in virtually all facets of the energy industry, including exploration, production, midstream and downstream pipelines and electric power. He also has significant experience in finance, mergers and acquisitions and restructuring transactions.

|

|

| | |

| Questar 2015 Form 10-K/A | 7 | |

Corporate Governance

The Company is committed to strong corporate governance. The Board has established Corporate Governance Guidelines that include information regarding the Board's role and responsibilities, director qualifications and determination of director independence, as well as the establishment of Board committees. Each committee also is governed by a separate charter defining its roles and responsibilities. The Board regularly reviews developments in corporate governance and updates the Corporate Governance Guidelines, committee charters and other governance materials as it deems necessary and appropriate.

GOVERNANCE HIGHLIGHTS

| |

| • | Annual election of all directors by majority vote |

| |

| • | Seven of the eight director nominees are independent |

| |

| • | Independent lead director |

| |

| • | Independent audit, compensation and governance committees |

| |

| • | Regular executive sessions of independent directors |

| |

| • | All directors attended at least 75 percent of meetings |

| |

| • | Annual board and committee self-evaluations |

BOARD LEADERSHIP STRUCTURE

The Company's governance documents allow the Board to select the appropriate leadership structure for Questar. The Board believes that while there is no single model that is most effective in all circumstances, the shareholders’ interests are best served by allowing the Board flexibility in determining the optimal organizational structure at a given time. This includes determining if the Chairman role should be held by an independent director or by the CEO serving on the Board. Board members possess considerable experience and unique knowledge of Questar's challenges and opportunities, and are in the best position to evaluate how to effectively organize director and management roles to meet Company needs.

The current leadership structure is comprised of a combined Chairman of the Board and Chief Executive Officer, an independent director serving as Lead Director, and strong, active independent directors. Mr. Jibson, as Chairman and CEO, has more than 35 years of service with the Company in a variety of positions of increasing responsibility and leadership, and holds senior leadership positions in organizations in the community and industry. As the primary individual responsible for day-to-day management of business operations, he is best positioned to chair regular Board meetings as the directors discuss key business and strategic issues. Questar believes Mr. Jibson's combined roles as CEO and Chairman allow the Board to benefit from his insight and perspective regarding Company affairs, risks and opportunities during deliberations.

Lead Independent Director

To ensure that the independent directors play a leading role in our current leadership structure, pursuant to the Corporate Governance Guidelines, the Board's independent directors have designated Mr. Simmons as our Lead Director. The Lead Director supports the independent directors by providing leadership to them and working closely with the Chairman of the Board and CEO. Among other powers and responsibilities, the Lead Director:

| |

| • | Presides over the executive sessions of the independent directors |

| |

| • | Collaborates with the Chairman and CEO and Corporate Secretary on setting the annual calendar for all regular Board and committee meetings, as well as setting agendas for all Board and committee meetings |

| |

| • | Maintains close contact with Board committee chairs |

| |

| • | Facilitates communication between the directors and the CEO |

| |

| • | Communicates the results of the Board's CEO evaluation to the CEO |

The Board believes this leadership structure provides a well-functioning, effective balance between strong Company leadership and productive Board meetings, with appropriate safeguards and oversight by independent directors.

|

| | |

| Questar 2015 Form 10-K/A | 8 | |

BOARD MEETINGS AND COMMITTEES

In 2015, the Board held four regular meetings and five special meetings. Board committees held 13 meetings. All directors attended at least 75 percent of the Board and their assigned committee meetings. The directors are expected to attend the Company's Annual Meeting. All directors attended our 2015 Annual Meeting of Shareholders.

The Board has three standing committees: audit (Finance and Audit); nominating (Governance and Nominating); and compensation (Management Performance). Only independent directors serve on the committees, which are governed by written charters. The charters, along with Questar’s Business Ethics and Compliance Policy and Corporate Governance Guidelines, are available on the Company's website at http://investor.shareholder.com/questarcorp/documents.cfm and in print without charge at any shareholder’s request to the Corporate Secretary.

The table below lists the committee members and chairs as of December 31, 2015, as well as the total number of meetings held in 2015.

|

| | | |

| Director | Finance and Audit | Management Performance | Governance and Nominating |

| Teresa Beck | X | | X |

| Laurence M. Downes | Chair | X | |

| Christopher A. Helms | X | Chair | |

| Ronald W. Jibson | | | |

| James T. McManus, II | X | | X |

| Rebecca Ranich | | X | Chair |

| Harris H. Simmons | X | | X |

| Bruce A. Williamson | X | X | |

| | | | |

| Number of committee meetings | 5 | 5 | 3 |

Finance and Audit Committee

The Finance and Audit Committee reviews auditing, accounting, financial reporting, risk management and internal control functions; appoints the Company's independent auditor; monitors financing requirements, dividend policy and investor-relations activities; and oversees compliance activities. The Board has determined that each Finance and Audit Committee member meets the independence requirements of the New York Stock Exchange (the "NYSE") and the SEC rules, meets the NYSE's financial literacy requirements and, except for Ms. Ranich, qualifies as an audit committee financial expert as defined by the SEC. The Finance and Audit Committee frequently meets in executive sessions with our independent and internal auditors.

Governance and Nominating Committee

The Governance and Nominating Committee functions as our nominating committee and is responsible for governance activities, particularly board and committee evaluations and committee assignments. All members are independent directors.

The Governance and Nominating Committee determines the criteria for director nominees, including nominees recommended by shareholders and self-nominees. The Governance and Nominating Committee also considers shareholder nominations using the criteria as described above in the Election of Directors section. Shareholders interested in submitting names of candidates who satisfy most or all of the above criteria should submit written notice of the candidates' names and qualifications to the Governance and Nominating Committee chair at the Company's address. Nomination letters are forwarded to the Committee chair without screening.

Management Performance Committee

The Management Performance Committee (the "MPC") serves as Questar’s compensation committee and is responsible for various aspects of Questar's executive compensation program including:

| |

| • | Reviewing the recommended base salaries as well as the annual and long-term incentive award opportunities for our President and CEO and other officers, considering the competitiveness of each officer's total compensation package |

| |

| • | Reviewing and selecting the Company's peer group for compensation benchmarking purposes |

|

| | |

| Questar 2015 Form 10-K/A | 9 | |

| |

| • | Reviewing the recommended financial and operating goals and objectives for the short and long-term incentive programs, and verifying the achievement of these goals |

| |

| • | Administering our equity-based and other executive compensation plans |

For additional information on the MPC's executive compensation-related activities, see the "Compensation Discussion and Analysis" (the "CD&A") section below. The MPC also oversees Board compensation decisions. It frequently reviews leadership development and succession planning, with the full Board's regular review of executive succession planning. The MPC chair works with the Company's CEO and Corporate Secretary to establish MPC meeting agendas. The MPC frequently meets in executive session to discuss and approve compensation decisions, particularly with respect to the CEO. All independent Board members also must approve the CEO's total compensation. The MPC reports regularly to the Board on its activities.

Management Performance Committee Interlocks and Insider Participation

The 2015 MPC members were Mr. Helms as Chair, Messrs. Downes and Williamson, and Ms. Ranich. No Company officer or other employee has been an MPC member. Additionally, no MPC member had any relationship with Questar requiring disclosure under Item 404 of Regulation S-K. No Company executive officer has served on the compensation committee of any other entity that has or has had one or more executive officers who served as a MPC member during the 2015 fiscal year.

DIRECTOR RETIREMENT POLICY

The Board's retirement policy allows an outside director to serve until the Annual Meeting following his or her 72nd birthday. Former director, Mr. Cash, retired at the 2015 Annual Meeting due to the policy. The Board otherwise does not limit the number of terms a director may serve.

The Board's Role in Risk Oversight

The Company has an enterprise risk management program (the "ERM Program") to identify risks across Questar, assess the likelihood and potential impact of these risks and develop and monitor strategies to prevent, mitigate or manage them. The ERM Program's goal is to maintain a high level of awareness and control over operational, financial, environmental, compliance, strategic, cyber and other risks that could adversely affect achieving Questar's business objectives. The ERM Program is administered by the Chief Risk Officer and General Counsel.

The full Board is responsible for overseeing and reviewing with management the ERM Program, including actions taken to identify, assess and mitigate risks. The Chief Risk Officer and General Counsel make semi-annual Board presentations about the ERM Program. The Board reviews with management the ERM Program's effectiveness, the elements of the risk-management framework and specific risk mitigation strategies implemented. Management also provides regular Board updates on specific risks and mitigation strategies during the Board's review of the annual corporate capital and operating budgets, corporate strategy, and any new business opportunities as well as in other reports to the Board and its committees. Additional review, or reporting on, specific enterprise risks is conducted as needed or as requested by the Board or a committee.

Each Board committee is tasked with the risk oversight relevant to its areas of responsibility:

Finance and Audit Committee – The Finance and Audit Committee has primary responsibility for oversight and evaluation of the Company's financial and compliance risks. It oversees the independent auditor, internal audit, financial reporting, and compliance with Questar's Business Ethics and Compliance Policy. The Finance and Audit Committee regularly asks management, internal audit staff and Questar's independent auditor about financial risks or exposures, including financial statement risks. It provides quarterly reviews of financial, internal controls, credit, compliance, security, legal and regulatory risks that may have material adverse effects on Questar.

Governance and Nominating Committee – The Governance and Nominating Committee oversees risks associated with corporate governance, including corporate governance practices, Board and committee leadership structure and composition as well as director qualifications and independence. The Governance and Nominating Committee reviews compliance with Questar's Corporate Governance Guidelines and changes or amendments to the Guidelines or to any committee charters.

Management Performance Committee – The MPC oversees compensation and human resources risks. The MPC, with an independent compensation consultant's assistance, periodically reviews the compensation programs to ensure they do not promote excessive risk. The MPC uses the risk assessment to determine that Questar’s compensation practices and policies

|

| | |

| Questar 2015 Form 10-K/A | 10 | |

do not create risks that are reasonably likely to have material adverse effects on the Company. The MPC determined in 2015 that the compensation policies and programs are balanced across multiple financial and operating metrics and time periods, thus supporting sound risk management.

Communication with Directors

Any Questar shareholder or other interested party may send communications to Questar's Board, including the independent directors as a group, the Lead Director or other individual Board members, by submitting communications to the following:

Julie A. Wray

Corporate Secretary

Questar Corporation

P.O. Box 45433

Salt Lake City, UT 84145-0433

The Board's independent directors have designated the Corporate Secretary to receive and process written communications addressed to directors. The Corporate Secretary will timely forward any written communication directly to the designated director(s), or to the Lead Director for communication relating to the entire Board. The Corporate Secretary has authority to discard solicitations, advertisements or other inappropriate communications.

DIRECTOR COMPENSATION

Non-employee directors receive a combination of cash and stock-based compensation designed to attract and retain qualified Board candidates. The MPC annually reviews fees and retainers paid to directors and recommends changes to the Board. An independent executive compensation consultant, Meridian Partners LLC ("Meridian"), also assists in reviewing of director compensation by providing benchmark compensation data and recommendations for compensation-program design. Company employees who serve as directors do not receive payment for those services.

Non-employee directors received the following 2015 cash retainers: |

| | |

| Description | Fees ($) |

| Annual board member retainer | 70,000 |

| Additional lead director retainer | 15,000 |

| Additional retainer for chair, Finance and Audit Committee and Management Performance Committee | 15,000 |

| Additional retainer for chair, Governance and Nominating Committee | 10,000 |

Directors may receive their fees in cash or they may defer receiving all fees according to the Questar Corporation Deferred Compensation Plan for Directors (the "Director Deferred Compensation Plan") described below.

DIRECTOR EQUITY UNDER LONG-TERM STOCK INCENTIVE PLAN

Questar's Long-term Stock Incentive Plan (the "Stock Plan") allows directors to receive stock options, stock appreciation rights, restricted stock and/or restricted stock units ("RSUs") and other awards referenced to our common stock. In 2015, directors received grants of RSUs. Directors may defer all, but not less than all, of the equity awarded to them according to the Director Deferred Compensation Plan.

DIRECTOR DEFERRED COMPENSATION PLAN

Non-employee directors can participate in the Director Deferred Compensation Plan, that allows them to defer their cash and equity compensation. For the deferral of cash fees, directors can elect to have them accounted for with “phantom shares” of Questar's common stock, or have them credited with interest as if invested in long-term certificates of deposit. Directors also may elect to defer their RSUs ("Deferred RSUs"). Both phantom shares and Deferred RSUs are credited with dividend equivalents. Phantom stock balances are paid in cash when a director retires, and Deferred RSUs are paid in company stock. The following 2015 fees and equity grants were received by individual directors:

|

| | |

| Questar 2015 Form 10-K/A | 11 | |

|

| | | | | | |

Name1 | Fees Earned or Paid in Cash ($) |

| Stock Awards2 ($) |

| Total ($) |

|

| Teresa Beck | 76,099 |

| 100,008 |

| 176,107 |

|

R. D. Cash3 | 17,500 |

| 100,008 |

| 117,508 |

|

| Laurence M. Downes | 82,968 |

| 100,008 |

| 182,976 |

|

| Christopher A. Helms | 78,901 |

| 100,008 |

| 178,909 |

|

| James T. McManus II | 70,000 |

| 100,008 |

| 170,008 |

|

| Rebecca Ranich | 75,934 |

| 100,008 |

| 175,942 |

|

| Harris H. Simmons | 85,000 |

| 100,008 |

| 185,008 |

|

| Bruce A. Williamson | 76,099 |

| 100,008 |

| 176,107 |

|

| |

1 | Excludes Ronald W. Jibson, who is an executive officer of the Company and did not receive additional compensation for his service as a director for the year 2015. Mr. Jibson's compensation is reflected in the Summary Compensation Table in the section entitled, "Compensation Tables" in the Compensation Discussion and Analysis section below. |

| |

2 | On February 18, 2015, each director received a grant of 4,097 RSUs with a grant date value of $100,008. The awards vested on March 5, 2016. Directors held the following aggregate stock awards (or phantom shares and dividend equivalents) as of December 31, 2015: |

|

| | | | | |

| Name | Vested Options (#) | Unvested RSUs/Deferred RSUs (#) |

| Vested Phantom Shares* (#) |

|

| Teresa Beck |

| 4,097 |

| 134,151 |

|

| R. D. Cash |

| 3,063 |

| 18,704 |

|

| Laurence M. Downes |

| 4,097 |

| 25,568 |

|

| Christopher A. Helms | | 4,097 |

|

|

|

| James T. McManus II | | 4,097 |

|

|

|

| Rebecca Ranich | | 4,097 |

| 3,756 |

|

| Harris H. Simmons |

| 4,097 |

| 321,914 |

|

| Bruce A. Williamson |

| 4,097 |

| 113,982 |

|

* Prior to 2014, directors who elected to defer their equity award received "phantom restricted shares" of Questar common stock. Similar to the phantom shares for deferred fees, the phantom restricted shares, once vested, are payable to the director in cash upon termination of service as a director. The vested phantom shares disclosed reflect both phantom restricted shares and phantom shares for deferred fees.

| |

3 | Mr. Cash retired as a Company director on May 27, 2015. His cash fees reflect a pro-rated share. His unvested Deferred RSUs vested in full as of his retirement date and a portion of these were distributed in 2015. The remainder will be distributed according to his election. |

Effect of Dominion Merger. Upon completion of the Dominion Merger (as described below under Item 11. Executive Compensation -- Executive Summary -- Executive Pay and Company Performance -- 2015 Company Performance Review), each RSU, Deferred RSU and phantom share held by our non-employee directors will become vested and will be canceled in exchange for a cash payment equal to the number of shares of Company common stock subject to such award multiplied by the merger consideration. In addition, at the effective time of the Dominion Merger, account balances under the Deferred Compensation Plan for Directors will be subject to accelerated vesting and distribution. As of March 1, 2016, the Company’s seven independent directors held, in the aggregate: (i) 16,212 unvested Company restricted stock units with an aggregate value of $405,300, (ii) 23,639 vested Deferred RSUs with an aggregate value of $590,970, (iii) 40,530 unvested Deferred RSUs with an aggregate value of $1,013,250, and (iv) 599,371 vested phantom shares with an aggregate value of $14,984,275, in each case based on the $25.00 merger consideration.

Stock-Ownership Guidelines. The Board has adopted stock-ownership guidelines for outside directors of five times their annual cash board retainers after serving five years on the Board. The stock ownership requirement is $350,000 based on the current cash retainer. Phantom stock units, Deferred RSUs and phantom restricted shares count toward the total shares held. All directors currently comply, or are on track to comply, with these guidelines.

Other Benefits. Directors participate in the Business Accident Insurance Plan that provides a benefit of up to $150,000 to the survivor of any director who dies, becomes totally disabled or suffers dismemberment due to an accident while traveling on Company business.

|

| | |

| Questar 2015 Form 10-K/A | 12 | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Exchange Act and SEC regulations, the Company's directors, certain executive officers and persons who own more than 10 percent of Questar's stock must file ownership reports and ownership changes with the SEC and NYSE. The Company also must receive copies of these reports. Questar's Corporate Secretary prepares and files reports for directors and executive officers based on information known and otherwise supplied. Based on a review of this information and responses to director and officer questionnaires, the Company believes that all 2015 filing requirements were satisfied.

ITEM 11. EXECUTIVE COMPENSATION.

This executive compensation program discussion and analysis should be read in conjunction with the tables and text below that describe the compensation awarded to, earned by or paid to the named executive officers described below.

EXECUTIVE SUMMARY

This Compensation Discussion and Analysis (the "CD&A") explains the principles, objectives and features of our executive compensation program. It also describes actions taken by the MPC to further align the interests of our named executive officers with Questar's corporate objectives and our shareholders' interests. This section also provides an understanding of how the MPC's pay decisions relate to 2015 Company performance. Although Questar’s executive compensation program generally applies to each executive officer, this CD&A focuses primarily on the program as applied to the CEO and other officers included in the Summary Compensation Table, who are collectively referred to in this CD&A as the named executive officers. Questar's named executive officers for the fiscal year ended December 31, 2015 were: |

| |

| Name | Title |

| Ronald W. Jibson | Chairman, President and Chief Executive Officer |

| Kevin W. Hadlock | Executive Vice President and Chief Financial Officer |

Thomas C. Jepperson1 | Chief Operating Officer |

| Craig C. Wagstaff | Executive Vice President and President, Questar Gas |

| Micheal G. Dunn | Executive Vice President, and President, Questar Pipeline |

James R. Livsey2 | Former Executive Vice President, Chief Operating Officer, Wexpro |

R. Allan Bradley2 | Former Executive Vice President, President and Chief Executive Officer, Questar Pipeline |

1 Mr. Jepperson retired from the Company, effective January 1, 2016.

2 Messrs. Livsey and Bradley both retired from the Company, effective June 1, 2015.

Executive Pay and Company Performance

In addition to other objectives, the MPC believes executive compensation should have a strong tie to Company performance, including financial and operating performance. It also believes that executive compensation should be tied to shareholder return over time. For 2015, the Company achieved consolidated net income slightly above 2014 resulting in continued record earnings at the top of our earnings guidance range. However, net income for two of our three main business units was impacted by the low-commodity-price environment. Pay for our executives was consistent with this performance.

2015 Company Performance Review

Questar is a Rockies-based integrated natural gas holding company with three main complementary lines of business operating through three principal subsidiaries:

| |

| • | Questar Gas Company ("Questar Gas") provides retail natural gas distribution to residential, industrial and commercial customers in Utah, southwestern Wyoming and southeastern Idaho, at gas rates historically among the lowest in the nation. |

| |

| • | Wexpro Company ("Wexpro"), develops and produces most of its natural gas from reserves contractually dedicated to Questar Gas under a 1981 agreement, known as the "Wexpro Agreement." Wexpro produces and delivers the natural gas to Questar Gas at its cost of service, which includes a competitive return. |

| |

| • | Questar Pipeline Company ("Questar Pipeline") provides FERC-regulated interstate natural gas transportation, underground storage services, and other energy services primarily in Utah, Wyoming and Colorado. |

|

| | |

| Questar 2015 Form 10-K/A | 13 | |

For fiscal year 2015, Questar reported net income of $226.9 million on an adjusted basis, compared to 2014 net income of $226.5 million. The earnings were adjusted for a noncash pension settlement accounting charge of $10.3 million after-tax and a noncash impairment charge of $7.9 million after tax on Wexpro leasehold properties. Most of the positive earnings came from Questar's regulated subsidiary, Questar Gas, which posted 16% earnings growth for the year, reflecting strong customer growth. Net income, however, was down 19% at Wexpro and 2% at Questar Pipeline, due primarily to the low commodity-price environment. Despite this challenge, the Company was able to perform at the high end of our guidance in 2015 due in large part to the extraordinary efforts of our employees to control costs, while improving both efficiency and effectiveness. This sustained effort resulted in an 11% decrease in our consolidated general and administrative expense.

Other 2015 highlights include:

| |

| • | Questar Gas invested $66.5 million in its infrastructure-replacement program. |

| |

| • | Questar Gas’s 2015 customer growth was 2.9%, or about 28,000 net new customers, including the addition of more than 6,500 customers from the acquisition of Eagle Mountain City’s municipal gas-distribution system. |

| |

| • | Utah and Wyoming regulators approved the addition of Wexpro’s 2014 Canyon Creek acquisition as a cost-of-service property and agreed to a lower return on future Wexpro development spending to enable Wexpro to resume its development-drilling program in 2016. |

| |

| • | Questar Pipeline successfully and safely completed the final portion of its multi-year Mainline-3 replacement project ahead of schedule and under budget. |

| |

| • | Questar Pipeline reduced its combined operating and maintenance ("O&M") and general and administrative ("G&A") expenses by 2% for the year through cost controls and improved efficiencies. |

| |

| • | Questar Pipeline terminated plans to recommission the western segment of the Southern Trails Pipeline as a crude-oil transport pipeline and commenced a process to divest the asset. |

| |

| • | Questar increased its first quarter 2016 dividend by 5% to $0.22 per share. This is in addition to an 11% increase in 2015 |

Dominion Merger - On February 1, 2016, Questar announced an agreement to combine with Dominion Resources, Inc.(“Dominion”) through a merger transaction with a subsidiary of Dominion, pursuant to which Questar shareholders have the right to receive $25.00 per share in cash, subject to the satisfaction of specified conditions (the “Dominion Merger”). Dominion is one of the nation’s largest producers and transporters of energy, with an existing strategic focus on core regulated infrastructure operations. If the Dominion Merger is completed, Questar would serve as the hub of Dominion’s Western operations. Questar will hold a Special Meeting of Shareholders on May 12, 2016 to consider and vote on a proposal to approve the Dominion Merger. If the Dominion Merger is approved by shareholders and the required regulatory approvals are obtained, we expect to complete the Dominion Merger by the end of 2016.

Company Performance and CEO Pay – This section highlights the directional relationship between the CEO's compensation and Company performance focusing on earnings for the last three years and total shareholder return.

Adjusted Earnings. Questar's CEO's annual incentive payment is tied to both financial and operational goals. The CEO's incentive payment has been consistent with Questar's adjusted earnings performance as shown in the chart below. For 2015, in light of the challenging commodity market, the MPC exercised its discretionary authority under the Company's annual incentive plan to lower the payout for our CEO to be consistent with the performance of the subsidiary receiving the lowest payout.

THREE-YEAR CEO ANNUAL INCENTIVE PAYMENT COMPARED TO ADJUSTED EARNINGS 1

|

| | |

| Questar 2015 Form 10-K/A | 14 | |

| |

1 | Adjusted earnings differs from net income by excluding one-time items that are outside the normal earnings process. In 2013, this included an after-tax impairment charge of $52.4 million for the Southern Trails Pipeline. No one-time items were recorded in 2014. In 2015, these items included a $10.3 million charge for pension settlement costs and a $7.9 million charge for the impairment of certain oil and gas properties. |

Total Shareholder Return. While our annual incentive payment is tied to financial and operating metrics, a large portion of our CEO's pay is tied to total shareholder return ("TSR") in the form of performance shares with the number of shares earned determined by Questar's TSR performance relative to its peer companies over a three-year period, with an absolute TSR modifier. For the three-year performance period January 1, 2013 through December 31, 2015, Questar's TSR relative to peer companies selected in 2013 ranked 11th. Based on this ranking, our CEO received .32 percent of target as a payout of his performance shares granted in 2013. As of December 31, 2015, for the other two outstanding performance periods, the payout for the January 1, 2014 through December 31, 2016 is above threshold but below target, and for the January 1, 2015 through December 31, 2017 is below threshold with no payout. Additional information regarding the performance share awards is discussed below in "Components of Our Compensation Program."

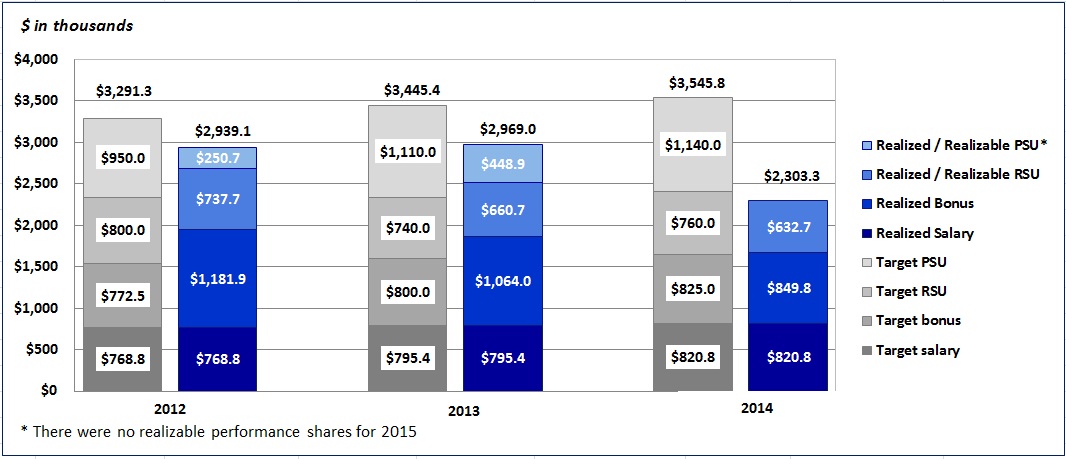

CEO's realized/realizable compensation. The following chart shows a more complete view of total direct compensation (base salary, annual incentive and long-term equity compensation) by providing the CEO's current (as of December 31, 2015) "realized" and "realizable" pay compared to the CEO's target compensation set each year.

TARGET1 CEO COMPENSATION COMPARED TO REALIZED/REALIZABLE2 COMPENSATION

| |

1 | Target amounts reflect actual base salary, target bonus, actual restricted stock units (RSUs) granted and target performance shares awarded for the applicable year multiplied by the grant date stock price. |

| |

2 | The amounts realized/realizable reflect amounts/shares actually paid/granted in the applicable year modified based on 1) for the annual bonus, the actual amount earned due to actual performance, 2) for RSUs, the shares granted multiplied by Questar's stock price as of December 31, 2015, and 3) for performance shares, the shares actually earned or on track to earn for all three performance periods based on performance and stock price as of December 31, 2015. The 2015-2018 performance shares are projected to be below threshold with no payout and therefore, no value is provided. |

2016 CEO pay - In February, 2016, the MPC also determined that it would not increase Mr. Jibson's base salary, target bonus or long-term incentives under the Stock Plan for 2016.

Results of 2015 Advisory Vote to Approve Executive Compensation

We held the fourth advisory vote on executive compensation at the 2015 Annual Meeting of Shareholders. Over 95 percent of votes cast favored this proposal. The MPC considered this favorable outcome and believed it conveyed shareholders' support of the MPC's decisions and the existing executive compensation programs. The Company will again hold an annual advisory vote to approve named executive officer compensation at the 2016 Annual Meeting of Shareholders. While the proposal vote is non-binding on the Company and Board and does not overrule a Company or Board decision, the MPC and Board value shareholders’ opinions. They consider the voting outcome when making future executive compensation decisions.

2015 Executive Compensation Program

|

| | |

| Questar 2015 Form 10-K/A | 15 | |

The MPC made no material structural changes to our compensation programs or pay-for-performance philosophy when considering the shareholders' strongly favorable advisory vote on executive compensation. Long-term incentives for most of the named executive officers continued to consist of 50 percent time-based RSUs and 50 percent performance share awards, with performance criteria based upon TSR during a three-year period compared with our peer group. Mr. Jibson's long-term incentive was weighted to 60 percent to performance shares and 40 percent to RSUs to put more of his pay at risk. The MPC determined this program appropriately motivated executive officers to generate, and rewarded them for, shareholder-value creation.

The graph below shows components of the 2015 total target compensation opportunity for each named executive officer except for Messrs. Livsey and Bradley, both of whom retired from the Company effective June 1, 2015, which highlights that a substantial part of the compensation is at risk and based on achieving specific performance measures.

2015 TOTAL TARGET COMPENSATION1

| |

1 | The percentages are based on the values stated in the 2015 Summary Compensation Table except 1) the target bonus is based on the 2015 target annual incentive set for each named executive officer, and 2) the performance shares are based on the target number of performance shares set for each named executive officer multiplied by the closing stock price on the grant date. |

EXECUTIVE COMPENSATION PRACTICES

What we do:

| |

| • | Pay for performance – The MPC, comprised of only independent directors, ties a significant portion of each named executive officer's total direct compensation opportunity to near-term financial and operational results and long-term shareholder returns. |

| |

| • | Annual executive compensation review – The MPC annually reviews all compensation elements provided to our named executive officers and, where appropriate, makes changes to incorporate current best practices. |

| |

| • | Independent compensation consultant – The MPC has retained its own independent compensation consultant since 2006 to assist with annual review. |

| |

| • | Annual benchmarking – The MPC reviews benchmark compensation data of Questar's peer group and generally targets compensation at the 50th percentile, although individual positioning varies. |

| |

| • | Annual risk analysis – The MPC annually reviews, analyzes and considers if our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company. |

| |

| • | Share-ownership guidelines – Questar has adopted share-ownership guidelines for all officers. |

| |

| • | Minimal perquisites – The Company provides officers with only one perquisite – the opportunity for an executive fitness evaluation. |

| |

| • | Clawback policy – Questar adopted a clawback policy in February 2014. |

| |

| • | Double trigger under CIC – The Company's change-in-control (CIC) severance plan provides for cash payments after a change in control only if an officer also is terminated following the event. |

|

| | |

| Questar 2015 Form 10-K/A | 16 | |

New in 2015:

| |

| • | Double trigger for accelerated equity upon CIC – Effective for equity awards made on or after February 2015, under the terms of the awards, unvested equity is accelerated due to a change in control only upon a double-triggering event. See "Treatment of Compensation Plans upon Effectiveness of Dominion Merger" in the Compensation Tables for information regarding treatment of awards in connection with the Dominion Merger. |

| |

| • | Minimum Vesting – The Company's Board approved a minimum vesting period of at least 12 months for restricted stock and RSUs (with limited exceptions). |

| |

| • | Performance Share Payout – In February 2015 Questar's Board added an absolute TSR requirement to our Performance Shares which requires annualized TSR of at least 15 percent to earn the maximum award. Additionally, the award would be further reduced if TSR is negative. |

What we don't do:

| |

| • | No employment agreements – Questar has no individual employment agreements with any officer. |

| |

| • | No separate change-in-control agreements – All officers participate in the same change-in-control severance plan. |

| |

| • | No excise tax gross-ups upon change in control – The Company does not provide excise tax gross-ups for severance benefits. |

| |

| • | No short-sales or hedging of Questar's common stock, and no excessive pledging. |

| |

| • | No repricing of underwater options. |

QUESTAR'S GUIDING COMPENSATION PHILOSOPHY AND OBJECTIVES

The Company’s executive compensation philosophy, set by the MPC, is designed to:

| |

| • | attract, motivate, reward and retain the management talent required to achieve Company objectives at compensation levels that are fair, equitable and competitive with comparable companies; |

| |

| • | focus management efforts on short and long-term drivers of shareholder value; |

| |

| • | tie a significant portion of executive compensation to Company long-term stock price performance and thus shareholder returns; |

| |

| • | foster a results-oriented culture while enhancing Questar’s reputation for ethics, integrity and safety; and |

| |

| • | create balance across multiple financial and operating metrics and time periods to support sound risk management. |

In keeping with our philosophy, executive compensation generally is comprised of: base salary; annual short-term cash incentive awards based upon achieving business, financial and operational goals; long-term performance-based awards; and restricted stock unit awards. Compensation components are discussed in more detail below under "Components of Our Compensation Program."

Market Data and Peer Groups

Questar believes that compensation for executive officers who successfully enhance shareholder value should be competitive with compensation offered by similar publicly-held companies to successfully attract and retain high-quality executive talent. The Company uses a peer group of companies to: gather input to develop base salary ranges, annual incentive targets and long-term incentive award ranges; benchmark the form and mix of equity awarded to executives; and assess the competitiveness of executive officers' total direct compensation.

Peer Selection – The MPC annually reviews and analyzes the selected peer group. In peer group selection, the MPC considers companies with a comparable business mix of natural gas utility/distribution, midstream natural gas transportation and natural gas exploration and production businesses, as well as a comparable size regarding enterprise value, market capitalization, revenues and assets. Finding peer companies is difficult due to Questar's integrated mix of three businesses, particularly Wexpro's unique nature and very few companies operate in all three industry segments. The MPC uses a more customized approach because it believes that enterprise value rather than revenues better reflects comparable peers, given the diverse business operations of the peers and the fact that Questar's revenues do not take into account intercompany revenues. The MPC believes the selected peer group to benchmark 2015 compensation was appropriate given it included integrated natural gas companies as well as other companies in the same individual businesses as Questar.

|

| | |

| Questar 2015 Form 10-K/A | 17 | |

The table below shows the natural gas industry segment represented by each peer company selected in setting 2015 compensation as well as the enterprise value, market capitalization, revenue and assets.

|

| | | | | | | |

| | | | | Comparative Data1 |

| Company Name | Distribution | Midstream | Production | Enterprise Value2 ($) | Market Cap. ($) | Revenue ($) | Assets ($) |

| | | | | (in billions) |

| AGL Resources, Inc. | X | X | | 10.44 | 6.13 | 4.62 | 14.66 |

| Atmos Energy Corp. | X | X | | 6.62 | 4.79 | 3.89 | 7.94 |

| Energen Corp. | X | | X | 7.08 | 5.29 | 1.74 | 6.62 |

| EQT Corporation | | X | X | 15.19 | 13.87 | 1.86 | 9.79 |

| MDU Resources Group Inc. | X | X | X | 7.61 | 5.39 | 4.46 | 7.06 |

| National Fuel Gas Company | X | X | X | 7.33 | 5.89 | 1.83 | 6.22 |

New Jersey Resources Corp.3 | X | X | | 2.77 | 2.13 | 3.20 | 3.01 |

| NiSource Inc. | X | X | | 19.10 | 12.92 | 5.66 | 22.65 |

| Northwest Natural Gas Co. | X | X | | 2.08 | 1.15 | 0.78 | 2.97 |

| Piedmont Natural Gas Co. | X | X | | 4.26 | 2.63 | 1.28 | 4.37 |

| South Jersey Industries, Inc. | X | X | | 2.87 | 1.77 | 0.73 | 2.93 |

| Southwest Gas Corp. | X | | | 3.94 | 2.26 | 1.95 | 4.57 |

| Vectren Corporation | X | | | 4.78 | 3.29 | 1.49 | 5.10 |

| WGL Holdings, Inc. | X | | | 3.20 | 2.19 | 2.47 | 4.26 |

| | | | | | | | |

| 50th Percentile | | | | 5.70 | 4.04 | 2.21 | 5.66 |

Questar Corporation4 | X | X | X | 5.57 | 3.91 | 1.22 | 4.05 |

| |

1 | Information obtained from Standard & Poor's Research Insight. Data reflects market capitalization values as of September 2014, and revenue and assets as of the most recent fiscal year as of October 2014 when the peer group was reviewed. |

| |

2 | Enterprise value represents market capitalization plus debt and preferred stock minus cash as of the most recent fiscal year end. |

| |

3 | CEO data from New Jersey Resources Corporation is not considered in setting our CEO compensation because New Jersey Resources' CEO serves on Questar's Board. |

| |

4 | Questar's revenues do not include approximately $372 million of affiliated company revenues. |

Peer Group Changes for 2015 LTI awards and 2016 Compensation – The MPC approved revisions to Questar's peers based on announced changes to companies in the peer group and based on recommendations from Meridian, its compensation consultant. It determined that Energen, EQT and NiSource would be replaced with Black Hills, The Laclede Group, Inc. and ONE Gas, Inc. Energen sold its gas distribution business to Laclede in late 2014. EQT sold its distribution business, and NiSource announced the separation of its business into two publicly traded companies – a fully regulated natural gas and electric utility company and a pure-play natural gas pipeline, midstream and storage company.

The MPC determined that the peer group changes would apply only to the comparator group under its 2015 performance share program and would not apply generally to executive compensation until 2016.

Market Surveys – The MPC also reviewed market data from various sources for 2015. This data supplements the proxy data from Questar's peer group. These sources include:

| |

| • | Towers Watson's Survey on Top Management Compensation, Utility Company Cut; and Mercer Benchmark Database, Executive, Utility Company Cut – both surveys of large utility companies. |

| |

| • | NGTI Survey – a survey of gas transmission-related positions. |

| |

| • | ECI – Oil and Gas E&P Industry Compensation Survey – a survey of oil and gas exploration and production organizations. |

|

| | |

| Questar 2015 Form 10-K/A | 18 | |

The following table shows the data sources used for each officer: |

| | | | |

| Officer | Peer Proxy Data | Towers | NGTI | ECI |

| Ronald W. Jibson | X | X | | |

| Kevin W. Hadlock | X | X | | |

| Thomas C. Jepperson | X | X | | |

| Craig C. Wagstaff | X | X | | |

Micheal G. Dunn1 | X | | X | |

James R. Livsey2 | X | | | X |

R. Allan Bradley1 | X | | X | |

| |

1 | Due to the limited proxy disclosures by the selected peer groups on an individual basis, Messrs. Dunn's and Bradley's peer group was expanded to include top executives at CenterPoint Energy, ONEOK and The Williams Companies that better reflect their role as head of a FERC-regulated natural gas pipeline. These incorporated companies that are beyond the primary peer group are significantly larger than Questar Pipeline, which the MPC considered when setting their total compensation. Mr. Dunn was hired in April, 2015 after the MPC set the compensation for Mr. Bradley, but the MPC considered the same data when approving the compensation offered to Mr. Dunn. |

| |

2 | The peer group proxy data failed to provide adequate comparative information for Mr. Livsey in his role as head of Wexpro, our unique natural gas-development subsidiary. Market data from ECI and other factors were utilized. |

COMPONENTS OF OUR COMPENSATION PROGRAM

The MPC believes it must offer key executives a competitive compensation package comprised of fixed and variable short and long-term components to attract, motivate and retain the executive talent required to achieve corporate performance objectives. The following table summarizes each component in the total compensation package:

|

| |

| Compensation Component | Role in Total Compensation |

| Base Salary | • Provides a fixed and market-based level of compensation to pay for an executive’s responsibility, relative expertise and experience |

Annual Cash Incentive • Annual Management Incentive Plan | • Variable compensation component based on performance. Motivates and rewards executives for achieving annual financial and operating goals aligned with shareholder and stakeholder interests |

Long-term Incentive - RSUs | • Delivers the majority of named executive officer compensation through long-term incentives aligned with shareholder interests• Motivates and rewards achieving long-term strategic Company objectives• Recognizes and rewards executives for Company performance relative to industry peers over multi-year time periods• Encourages long-term executive share ownership• Encourages executive retention by establishing multi-year incentive awards |

Benefits • Retirement (401(k), Pension)• Nonqualified Deferred Compensation• Other security benefits (health care, life, disability) | • Provides a tax-efficient way for employees to build financial security in retirement.• Rewards extended Company service• Provides minimum income protection against certain risks |

| Termination Benefits | • Provides a competitive level of income protection for a change-in-control event that results in employment termination |

Base Salary

The MPC approves adjustments to all officers' base salaries, including those of the named executive officers, every February after reviewing competitive market and peer group benchmark data at the 25th, 50th and 75th percentiles. The MPC also considers the officer's scope of responsibilities, individual performance and other individual factors and internal comparisons. The table below reflects our named executive officers' base salaries approved in February 2015 and effective March 1, 2015. All names executive officers' base salary increases were about or below 3 percent. Each officer's total salary is included in the 2015 Summary Compensation Table.

|

| | |

| Questar 2015 Form 10-K/A | 19 | |

|

| | |

| Name | 2015 Base Salary | Percent increase from 2014 |

| Ronald W. Jibson | $825,000 | 3.13% |

| Kevin W. Hadlock | $391,834 | 2.00% |

| Thomas C. Jepperson | $388,672 | 3.00% |

| Craig C. Wagstaff | $375,899 | 3.00% |

| Micheal G. Dunn | $410,000 | NA |

| James R. Livsey | $430,985 | 3.00% |

| R. Allan Bradley | $421,656 | 3.00% |

Annual Cash Incentive Awards

Annual Management Incentive Plan ("AMIP") – Questar's named executive officers participate in AMIP which provides for an annual cash incentive payment based on achieving key financial and operating goals for the Company and each major business unit. Each year, the MPC reviews and approves specific annual performance targets for the entire Company and each major subsidiary. Performance targets are set early each year after reviewing that year’s budget and the prior-year actual results, to ensure the rigor of these targets. Targets generally are at or above the Board-approved budget for the year.

The Company calculates an overall payout factor that can range from zero to 200 percent based on each business unit's actual results compared to the measures. Each officer's payment is determined by multiplying his or her base salary on March 1 by the target percent established for each officer, multiplied by the respective payout factor.

2015 AMIP Components, Targets and Results – The 2015 AMIP motivated our executive officers by rewarding them when our annual financial and operating performance goals were met.

Consolidated goals for all business units. For all business units, 35 percent of the total payout was tied to consolidated goals including net income and two consolidated safety goals reflecting Questar's commitment to safety: |

| | | | | |

| Performance Measure | Weight | Performance Range (50% threshold to 200% max) | Target | Actual | Percent Payout |

| Questar adjusted income ($MM) | 25% | $199 - $250 | $221 | $226.5 | 119% |

Safety – DART1 injury rate | 5% | 1.70 - 1.00 | 1.40 | 1.43 | 95% |

Safety – Avoidable accident rate2 | 5% | 2.30 - 1.40 | 2.00 | 1.71 | 148% |

1 DART stands for "days away, restricted or transferred." The DART rate is calculated by taking the number of injuries that led to days away from work, job restriction and job transfer multiplied by 200,000, divided by the total number of hours worked by all employees during the year.

2 Avoidable accident rate is calculated by multiplying the number of vehicle accidents that could have been avoided by one million miles, divided by the total number of miles driven.

The remaining 65 percent of the performance goals for each business unit's AMIP payout was tied to that business unit's financial (net income) and operating measures, such as operational and maintenance costs ("O&M"), critical to its success as detailed in the tables below.

Key Initiatives. In setting each business unit's goals, 10 to 15 percent of the weighting for each business unit was tied to specific strategic and operational initiatives. These goals, which were formerly referred to as stakeholder value goals, may not have specific quantifiable metrics, but the MPC reviewed and agreed they were critical to Questar's success. A qualitative assessment of achieving these key initiatives allows the MPC to encourage management's efforts in areas that position the Company for future success, and to adjust for the results achieved. In February 2016, our CEO evaluated and scored each key initiative and reviewed his results with the MPC. The MPC considered this information when determining payouts.

|

| | |

| Questar 2015 Form 10-K/A | 20 | |

The specific goals, including key initiatives, and results for each business unit were:

|

| | | | | |

| Performance Measure | Weight | Performance Range

(50% threshold to 200% max) | Target | Actual | Percent Payout |

| QUESTAR GAS |

| Questar Gas adjusted income ($MM) | 25% | $57 - $67.2 | $60.0 | $64.3 | 160% |

| O&M per customer (excluding DSM) | 20% | $145 - $134 | $140 | $140.35 | 97% |

| Customer satisfaction | 2.5% | 6.1 - 6.5 | 6.3 | 6.44 | 170% |

| Calls answered in 60 seconds | 2.5% | 90% - 95% | 93% | 91.5% | 75% |

| Emergency call representative on site within 1 hour | 2.5% | 95% - 99.8% | 98% | 98.1% | 105% |

| Third-Party Damages | 2.5% | 3.5% - 3.2% | 3.4% | 3.07% | 200% |

Key Initiatives1 | 10% | Qualitative Assessment | 100% |

Weighted Result (including consolidated goals) | 125% |

1 Questar Gas key initiatives included: completing Eagle Mountain gas system acquisition and integration, and develop a comprehensive customer engagement plan.

|

| | | | | |

| Performance Measure | Weight | Performance Range

(50% threshold to 200% max) | Target | Actual | Percent Payout |

| WEXPRO |

| Wexpro adjusted income ($MM) | 25% | $95 - $124 | $108 | $105.9 | 92% |

| Lease operating expense per Mcfe | 15% | $0.45 - $0.38 | $0.42 | $0.38 | 190% |

| Acquisitions analyzed | 3.33% | 2 - 6 | $4.00 | $9.00 | 100% |

| Workover wells analyzed | 3.33% | 10 - 30 | 20 | 43 | 100% |

| Lease acreage bid on | 3.33% | 10,000 - 40,000 | 20,000 | 58,633 | 100% |

Key Initiatives1 | 15% | Qualitative Assessment | —% |

Weighted Result (including consolidated goals) | 103% |

1 Wexpro key initiatives focused on: completing the first phase of unitizing the Razor project, entering into a cost-of-service arrangement with a third party, and completing an E&P acquisition.

|

| | | | | |

| Performance Measure | Weight | Performance Range

(50% threshold to 200% max) | Target | Actual | Percent Payout |

| QUESTAR PIPELINE |

| Questar Pipeline adjusted income ($MM) | 25% | $55 - $66 | $59 | $59.5 | 107% |

| O&M per decatherm of demand | 15% | $14.65 - $13.50 | $14.15 | $13.55 | 190% |

| Transportation demand (Mdth/day) at year-end | 10% | 5,050 - 5,300 | 5,175 | 5,221 | 131% |

Key Initiatives1 | 15% | Qualitative Assessment | —% |

Weighted Result (including consolidated goals) | 110% |

1 Questar Pipeline key initiatives included: advancing the development of the Inland California Express project.

|

| | |

| Questar 2015 Form 10-K/A | 21 | |

Corporate AMIP goals and payout results were:

|

| | | | | |

| Performance Measure | Weight | Performance Range

(50% threshold to 200% max) | Target | Actual | Percent Payout |

| QUESTAR CORPORATION |

| Questar adjusted income ($MM) | 50% | $199 - $250 | $221 | $226.50 | 119% |

Safety – DART1 injury rate | 5% | 1.70 - 1.00 | $1.40 | $1.43 | 95% |

| Safety – Avoidable accident rate | 5% | 2.30 - 1.40 | $2.00 | $1.71 | 148% |

| O&M per customer (excluding DSM) - Questar Gas | 8% | $145 - $134 | $140.0 | $140.4 | 97% |

| Lease operating expense per Mcfe - Wexpro | 8% | $0.45 - $0.38 | $0.42 | $0.38 | 190% |

| O&M per decatherm of demand - Questar Pipeline | 8% | $14.65 - $13.50 | $14.2 | $13.6 | 190% |

| Corporate allocable O&M ($MM) | 6% | $45.0 - $39.0 | $43 | $59.20 | —% |

| Stakeholder value goals | 10% | Qualitative Assessment | 25% |

| Weighted Result | 113% |

| |

1 | Corporate key initiatives focused on: resolving the gathering litigation and supporting business unit stakeholder value goals. |