- MTSC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

MTS Systems (MTSC) DEF 14ADefinitive proxy

Filed: 25 Apr 17, 12:00am

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| MTS Systems Corporation | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| MTS Systems Corporation 14000 Technology Drive Eden Prairie, MN 55344-2290 Telephone 952-937-4000 Fax: 952-937-4515 Info@mts.com www.mts.com | |

| April 25, 2017 | ||

Dear MTS Shareholder: | ||

MTS is holding a virtual Annual Meeting of Shareholders this year on Tuesday, June 6, 2017, at 9:00 a.m. Central Standard Time. You may attend the Annual Meeting, vote and submit a question during the Annual Meeting by visiting www.virtualshareholdermeeting.com/MTSC2017. You will need to provide your 16-digit control number that is on your Notice of Internet Availability of Proxy Materials or on your proxy card if you receive materials by mail. | ||

Your vote is important to us. Last year, approximately 96% of the Company's shares were voted at the Annual Meeting and we thank our shareholders for their response. We urge you to cast your vote, as instructed in the Notice of Internet Availability of Proxy Materials, over the Internet or by telephone as promptly as possible. You may also request a paper proxy card to submit your vote by mail, if you prefer. And, as indicated above, you may vote during the Annual Meeting online at www.virtualshareholdermeeting.com/MTSC2017. | ||

I encourage you to attend our virtual Annual Meeting of Shareholders on June 6, 2017, at 9:00 a.m., Central Standard Time by visiting www.virtualshareholdermeeting.com/MTSC2017. | ||

Very truly yours, | ||

| ||

David J. Anderson Chairman of the Board |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

DATE AND TIME

June 6, 2017; 9:00 a.m. (Central time)

VIRTUAL MEETING

The annual meeting of shareholders of MTS Systems Corporation (the "Company") will be held on Tuesday, June 6, 2017, as a virtual meeting at www.virtualshareholdermeeting.com/MTSC2017.

ITEMS OF BUSINESS

The foregoing items of business are more fully described in the proxy statement made available over the internet and, upon request, in paper copy.

April 25, 2017

On behalf of the Board of Directors,

David J. Anderson

Chairman of the Board

MTS Systems Corporation

14000 Technology Drive

Eden Prairie, MN 55344-2290

The Board of Directors has set the close of business on April 17, 2017, as the Record Date for the determination of shareholders entitled to notice of and to vote at, the meeting and at any adjournments or postponements thereof.

HOW TO VOTE

All shareholders are cordially invited to attend the virtual Annual Meeting of Shareholders atwww.virtualshareholdermeeting.com/MTSC2017. Whether or not you expect to attend, please vote:

By Internet: www.proxyvote.com

By Phone: Call 1.800.690.6903

By Mail: You may request a paper proxy

card, which you may complete, sign

and return by mail.

The proxy is solicited by the Board of Directors and may be revoked or withdrawn by you at any time before it is exercised.

TABLE OF CONTENTS

MTS SYSTEMS CORPORATION

14000 Technology Drive

Eden Prairie, Minnesota 55344

PROXY STATEMENT

This proxy statement is furnished to the shareholders of MTS Systems Corporation (the "Company," "we," "us," or "our") in connection with the solicitation of proxies by the Board of Directors of the Company (the "Board") to be voted at the virtual Annual Meeting of Shareholders to be held on Tuesday, June 6, 2017 (the "Annual Meeting"), at 9:00 a.m., Central Standard Time, or any adjournments or postponements thereof. This proxy statement and the form of proxy, along with the Annual Report for the fiscal year ended October 1, 2016 ("fiscal 2016"), is being first sent or given to shareholders on or about April 25, 2017.

PROPOSAL 1

ELECTION OF DIRECTORS

Eight directors will be elected at the Annual Meeting. Upon the recommendation of the Governance and Nominating Committee, the Board has nominated for election the eight persons named below. Each has consented to being named a nominee and will, if elected, serve until the next annual meeting of shareholders or until a successor is elected. Other than Maximiliane C. Straub, each nominee listed below is currently a director of the Company and each was elected by the shareholders. Ms. Straub was elected to serve as a director by our Board on January 1, 2017 and identified as a board candidate by a third-party search firm retained for this purpose by our Governance and Nominating Committee and is standing for election by our shareholders as a director of the Company for the first time at the Annual Meeting. In addition to the nominees listed below, Emily M. Liggett and Barb J. Samardzich served as a member of our Board during fiscal 2016. Ms. Liggett did not stand for re-election at last year's annual meeting of shareholders and Ms. Samardzich is not standing for re-election at this year's Annual Meeting. Proxies solicited by the Board will, unless otherwise directed, be voted to elect the eight nominees named below to constitute the entire Board.

The names of the nominees, their principal occupations for at least the past five years and other information are set forth below:

1

| David J. Anderson – Age 69 Director since 2009 Chair since 2011

| Director of Modine Manufacturing Company since 2010 and a member of its Corporate Governance and Nominating Committee, Audit Committee, and Technology Committee; Director of Schnitzer Steel Industries, Inc. (a steel manufacturing and scrap metal recycling company) since 2009 and a member of its Audit Committee and Compensation Committee; Co-Vice Chairman of Sauer-Danfoss, Inc. (developer and manufacturer of fluid power and electronic components and systems for mobile equipment applications) from 2008 until June 2009; President, Chief Executive Officer and Director of Sauer-Danfoss Inc. from 2002 until he retired in 2009; various senior management positions with Sauer-Danfoss Inc. from 1984 to 2008; and prior to 1984, various positions in sales, marketing and applications engineering within several manufacturing and distribution businesses. Mr. Anderson's qualifications to serve on our Board and to serve as the Chair of the Board include his more than 40 years of international, industrial business experience and his chief executive officer and operations experience. He also has technology and engineering experience, the ability to formulate and execute strategy and financial expertise. | |

Jeffrey A. Graves – Age 55 Director since 2012

| President and Chief Executive Officer of the Company since May 2012; President, Chief Executive Officer and a director of C&D Technologies, Inc. (a manufacturer, marketer and distributer of electrical power storage systems for the standby power storage market) from July 2005 until May 2012; various executive positions at Kemet Electronics Corporation from 2001 to 2005, including Chief Executive Officer; various leadership positions with General Electric Company's Power Systems Division and Corporate Research & Development Center from 1995 to 2001; prior to 1995, various positions of increasing responsibility at Rockwell International Corporation and Howmet Corporation. Dr. Graves has served as a director of Teleflex Incorporated and Hexcel Corporation since 2007. As the only member of management serving on our Board, Dr. Graves contributes an in-depth understanding of the opportunities and challenges facing our Company. His experience in both executive and board positions at various technology companies gives him insight into strategic, financial and personnel matters, as well as the considerations particular to public companies. | |

David D. Johnson – Age 61 Director since 2013

| Retired; Director of Nuvectra Corporation since 2016 and a member of its Audit Committee; Executive Vice President, Treasurer and Chief Financial Officer of Molex LLC (manufacturer of electronic connectors) from 2005 to 2016; Vice President, Treasurer and Chief Financial Officer of Sypris Solutions, Inc., from 1996 to 2005; served as Regional Controller for Molex's Far East Region; Financial Director for New Ventures and Acquisitions; and Financial Director for the Far East South Region from 1984 to 1996. From 1978 to 1984, Mr. Johnson worked for the public accounting firm KPMG LLP. Mr. Johnson's qualifications to serve on our Board include his chief financial officer experience for a global industrial company. Mr. Johnson has had executive-level responsibility for financial and accounting matters in a number of settings, including international contexts. |

2

| Randy J. Martinez – Age 62 Director since 2014

| Corporate Vice President of Strategy and Business Development for AAR CORP. (a provider of aviation services to the worldwide commercial aerospace and governmental/defense industries) since August 2015. Prior to his current role, Mr. Martinez held other leadership roles within AAR, including Group Vice President, Aviation Services and President and Chief Executive Officer, AAR Airlift Group (March 2012 to August 2015) and Group Vice President, Government and Defense Services and Senior Vice President, Government and Defense Programs (2009 to 2012). Before joining AAR in 2009, Mr. Martinez was the Chief Executive Officer at World Air Holdings, Inc. (NASDAQ). As a graduate of the United States Air Force Academy, Mr. Martinez served with distinction in the U.S. Air Force for over 21 years, holding a wide variety of leadership roles, including both line command and senior staff positions. Mr. Martinez currently serves on the Board of the National Defense Transportation Association (NDTA), serving as Chair for the Aviation Sector. Mr. Martinez's qualifications to serve on our Board include his experience as a chief executive officer at a public company and his particular knowledge of the aviation and defense industries. His diverse industry experience assists in helping to understand our customers who are also diverse by industry and geography. | |

Michael V. Schrock – Age 64 Director since 2014

| Advisor for Oak Hill Capital Partners (a private equity investment firm) since March 2014; President and Chief Operating Officer of Pentair LLC (a global water, fluid, thermal management and equipment protection company) from 2006 through 2013. Prior to that role, Mr. Schrock held several leadership positions at Pentair over his 16-year career, including President of Water Technologies Americas, President of the Pump and Pool Group and President/COO of Pentair Technical Products. Before joining Pentair, Mr. Schrock held numerous senior leadership roles in both the US and Europe at Honeywell International Inc. Mr. Schrock has served on the Board of Directors of Plexus Corporation since 2016. Mr. Schrock's experience includes more than 35 years in senior roles at major industrial companies. His deep management and operating experience both domestically and internationally and strong track record leading and integrating strategic acquisitions give our Board valuable insight into global business and acquisition matters. |

3

| Gail P. Steinel – Age 60 Director since 2009

| Owner of Executive Advisors (provider of leadership development services and strategic/profit improvement consulting) since 2007; Executive Vice President, Consumer, Industrial & Technology business unit at BearingPoint (a global technology and management consulting company) from 2002 to 2007; and progressive management positions at Arthur Andersen (provider of audit, tax and consulting services), where her final position was Global Managing Partner of the Business Consulting Division, from 1979 to 2002. Ms. Steinel serves on several boards, including the Board of Trustees of Federal Realty Investment Trust and is Chairperson of its Audit Committee. Ms. Steinel's qualifications to serve on our Board include her global managing partner experience running a large global business, more than 35 years of business management consulting providing global strategy, policy development, complex problem solving and operations consulting services, as well as her financial expertise and experience as a certified public accountant. | |

Maximiliane C. Straub – Age 52 Director since 2017

| Chief Financial Officer of Bosch LLC (the U.S. subsidiary of Bosch Group, a global engineering and electronics manufacturer) and Executive VP Finance, Controlling and Administration of Bosch North America from 2010 to present; President Full Brake Systems North America of Robert Bosch LLC from 2006 to 2010; and other roles of increasing responsibility with various Bosch affiliates from 1993 to 2006. Ms. Straub's qualifications to serve on our Board include her chief financial officer experience for a global industrial company. She has developed significant responsibility for finance and accounting matters, as well as profit and loss responsibility, strategic planning experience and mergers and acquisitions experience, all in an international context. | |

Chun Hung (Kenneth) Yu – Age 67 Director since 2013

| Retired; Vice President, Global Channel Services, International Operations for 3M Company (diversified manufacturer of consumer, industrial and health products) from May 2013 to December 2013; President, China Region and 3M China from 2000 to May 2013; President, 3M Taiwan from 1999 to 2000; served in several Director and leadership roles within the 3M organization from 1969 to 1999, located in St. Paul, Minnesota and the Asian-Pacific region. Mr. Yu's qualifications to serve on our Board include his extensive operations experience in the Asian-Pacific region, a market we have identified as a growth opportunity for our Company's products and services. Mr. Yu also contributes significant leadership, planning and management skills developed during his long tenure with a successful and growing global manufacturing company. |

Voting Information and Board Voting Recommendation

In accordance with Minnesota law, directors are elected by a plurality of votes cast. The eight nominees receiving the highest number of votes will be elected. If any nominee is unable to serve as a director, the Board may act to reduce the number of directors or the persons named in the proxies may vote for the election of such substitute nominee as the Board may propose. It is intended that proxies will be voted for such nominees in the latter circumstance. The proxies cannot be voted for a greater number of persons than eight.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" EACH NOMINEE LISTED.

4

Other Information Regarding the Board

Meetings and Independence. The Board met ten times during fiscal 2016. All of the directors attended at least 75% of the number of Board meetings and meetings of Board committees on which he or she served that were held during fiscal 2016. It is our policy that all directors should attend the Annual Meeting and all of the directors who were serving at the time of last year's annual meeting of shareholders did so.

Independence determinations concerning the Board are made by the Governance and Nominating Committee and, with regard to related party transactions, by the Audit Committee. The Governance and Nominating Committee of the Board has determined that Messrs. Anderson, Johnson, Martinez, Schrock and Yu and Mses. Liggett, Steinel and Samardzich are independent, as defined by the applicable rules for companies listed on the NASDAQ Stock Market. The Governance and Nominating Committee of the Board has determined that Ms. Straub is not independent as defined by the applicable rules for companies listed on the NASDAQ Stock Market because her sibling is a partner of KPMG Germany, an affiliate of our independent registered public accounting firm. Dr. Graves is not independent due to his service as Chief Executive Officer of the Company. In making the independence determination with respect to related party transactions during fiscal 2016, the Audit Committee considered with regard to: Ms. Samardzich that the Company sold approximately $22.7 million in vehicle testing goods and services to Ford Motor Company; Mr. Anderson that the Company sold less than $200,000 in goods and services to Modine Manufacturing Company; and Mr. Johnson that the Company sold less than $10,000 in goods and services to Molex Incorporated. The Audit Committee determined that the aggregate dollar amount of the transactions are below the threshold for the NASDAQ Stock Market independence rules and/or that the transactions do not present a real, potential or perceived conflict between the Company's interests and the direct or indirect interests of Ms. Samardzich, Mr. Anderson, and Mr. Johnson as applicable.

Board Committees. Each of our three standing committees operates under a written charter adopted by the Board. These charters are available to shareholders on our website at www.mts.com (select "Investor Relations" and click on "Corporate Governance").

The Audit Committee of the Board, composed of Mr. Johnson (Chair), Ms. Steinel and Messrs. Anderson, and Martinez, held sixteen meetings during fiscal 2016. All members of the Audit Committee during fiscal 2016 satisfied the NASDAQ Stock Market listing standards for Audit Committee membership. The Board determined that Ms. Steinel and Messrs. Anderson, Johnson and Martinez are each an "audit committee financial expert" under the Sarbanes-Oxley Act of 2002. Among other duties, the Audit Committee:

5

A report of the Audit Committee is contained in this proxy statement.

The Compensation and Leadership Development Committee (the "Compensation Committee") of the Board, composed of Mr. Schrock (Chair), Ms. Samardzich and Messrs. Johnson and Martinez, held six meetings during fiscal 2016. All members of the Compensation Committee are independent directors as defined by the rules applicable to companies listed on the NASDAQ Stock Market, are "non-employee directors" as that term is defined in Rule 16b-3 under the Securities Exchange Act of 1934 and are "outside directors" as that term is used in Section 162(m) of the Internal Revenue Code. Among other duties, the Compensation Committee:

A report of the Compensation Committee is contained in this proxy statement.

The Governance and Nominating Committee of the Board, composed of Ms. Steinel (chair) and Messrs. Schrock and Yu, held five meetings in fiscal 2016. All members are independent directors

6

as defined by the rules applicable to companies listed on the NASDAQ Stock Market. Among other duties, the Governance and Nominating Committee:

Director Nomination Process. In identifying prospective director candidates, the Governance and Nominating Committee (for purposes of thisDirector Nomination Process sub-section, the "Committee") considers recommendations from shareholders and recommendations from business and professional sources, including executive search firms.

In evaluating director candidates, the Committee believes that all members of the Board should have personal and professional integrity, an absence of conflicts of interest and an ability to understand and respect the advisory and proactive oversight responsibility of the Board. In addition, all non-employee members of the Board should meet independence requirements, comply with director orientation and education guidelines, commit sufficient time to attend Board and committee meetings and fully perform the duties of a director.

In addition to these threshold criteria, the Committee also considers the contributions a candidate is expected to make to the collective functioning of the Board. The Committee seeks directors who will contribute to the Board in areas such as strategy and policy development, technology and engineering, human capital development, financial expertise, international business development and best practices, industrial business value creation, acquisition expertise and public company chief executive officer perspective.

Candidates are expected to effectively perform the role of a director by demonstrating broad perspectives and an inquiring mind, being well prepared for and actively participating in Board and committee meetings, contributing expertise to the Board and committees, listening well, expressing views candidly, applying experience and expertise, being respectful of others and appropriately representing the shareholders.

While it does not have a specific written policy with regard to the consideration of diversity in identifying director nominees, the Committee believes the Board should reflect a variety of opinions, perspectives, personal and professional experiences and backgrounds. The goal is to have a balanced and diverse Board, with members whose skills, backgrounds and experiences will enhance the quality of the Board's deliberations and decisions and cover the spectrum of areas that impact the Company's business. Each member of the Board should contribute to the overall Board composition, with the goal of creating a diverse Board that works collaboratively to guide the success of the Company and represent shareholder interests.

7

The Committee's policy is to consider qualified candidates for positions on the Board who are recommended in writing by shareholders. Shareholders wishing to recommend candidates for Board membership rather than directly nominating an individual should submit the written recommendations to our Secretary at least 90 days prior to the date corresponding to the date of the previous year's annual meeting of shareholders, with the submitting shareholder's name, address and pertinent information about the proposed nominee. See "Other Information – Shareholder Proposals" for additional information regarding the submission of candidates for Board membership in the event of a change in the annual meeting date from the previous year, which we anticipate will be the case for next year's annual meeting of shareholders to be held in early calendar 2018.

A shareholder intending to nominate an individual as a director at an annual meeting of shareholders, rather than recommend the individual to the Committee for consideration as a nominee, must comply with the advance notice requirements set forth in our Bylaws. Our Bylaws provide that any shareholder entitled to vote generally in the election of directors may nominate one or more persons for election as directors provided that such shareholder has provided written notice of such intention to our Secretary. Such notice must be given not fewer than 90 days nor more than 120 days prior to the date corresponding to the date of the previous year's annual meeting of shareholders, except in certain circumstances and must contain certain required information about the nominee.

Shareholders wishing to recommend for nomination or nominate a director should contact the Company's Secretary for a copy of the relevant procedure and the criteria considered by the Committee when evaluating potential new directors or the continued service of existing directors.

Board Leadership Structure. Our Board leadership structure currently includes a non-executive Chairman of the Board and a separate Chief Executive Officer. The Board has not adopted a policy of separateness and will periodically re-evaluate its leadership structure.

The primary role of our Chief Executive Officer is to manage the business affairs of the Company and the primary role of our Chairman is to preside over all Board activities and ensure the effectiveness of the Board in all aspects of its areas of responsibility. This role includes working with the Chief Executive Officer to set the Board agenda; ensuring that clear, accurate and timely information is provided to the Board; managing Board meetings to allow time for discussion of complex or difficult issues; and promoting active participation by all Board members. The Chairman may also assist the Chief Executive Officer in managing the Company's relationships with investors and other external stakeholders.

The Board has determined that the separation of the Chairman and Chief Executive Officer roles is appropriate for the Company at this time because it enables the Chief Executive Officer to focus more closely on the day-to-day operations of the Company. The Board also values the involvement of Mr. Anderson as a leader and, through his service as Chairman, benefits more directly from his extensive industry and executive experience than it would if he did not hold such position.

Board Role in Risk Management Oversight.Management is responsible for designing and implementing the Company's day-to-day risk management processes, controls and oversight. The Board, as a whole and through its committees, has broad responsibility for the oversight of risk management. The Board has the responsibility to satisfy itself that risk management processes and controls are adequate and functioning as designed and that Company business is conducted in compliance with proper governance procedures and applicable laws and regulations. The Board views risk in the context of major strategic and operational decisions relative to the anticipated benefits. The Board recognizes that it is neither possible nor prudent to eliminate all risk because

8

purposeful and appropriate risk taking is essential for the Company to be competitive and to achieve its performance goals.

The Board believes the Company has good internal processes, controls and resources to identify, manage and mitigate risk, including a robust code of conduct and the compliance oversight role held by the Chief Risk Officer. As a critical part of its risk management oversight role, the Board encourages full, open and ongoing communication with management. The Board regularly engages in discussions with management on strategic, operational and governance matters to ensure that processes and controls are in place so risks are identified, managed and mitigated in a timely fashion.

The Board implements its risk management oversight function both as a whole and through committees. Much of the work is delegated to various committees, which meet regularly and report back to the full Board. All committees have significant roles in carrying out the risk management oversight function. The chair of each committee provides a committee report at each Board meeting that enables the Board to fulfill its risk management oversight responsibilities. Since risk management oversight is an ongoing process and inherent in the Company's strategic and operational decisions, the Board also discusses risk in relation to specific proposed actions.

Each committee is comprised entirely of independent directors and is responsible for overseeing risks associated with its respective area of responsibility.

The Audit Committee:

The Compensation Committee:

9

The Governance and Nominating Committee:

A separate discussion regarding the risk considerations in our compensation programs, including the processes that have been put in place by the Compensation Committee and management to identify, manage and mitigate potential risks in compensation, can be found on pages 31 to 32 of this proxy statement.

Communications with the Board. The Board provides a process for shareholders to communicate with its members. The manner in which shareholders may send communications to the Board is set forth on our website at www.mts.com (select "Investor Relations" and click on "Corporate Governance").

Board Evaluation.The Governance and Nominating Committee leads the Board in an annual evaluation of its performance as a board of directors. Our Corporate Governance Guidelines provide that the Board annually evaluate its performance to determine whether the Board, its committees and its individual members are functioning effectively.

Code of Conduct.We adhere to a code of ethics, known as the "MTS Code of Conduct." It applies to our directors, officers, employees and contractors. The MTS Code of Conduct sets forth guidelines for ensuring that all personnel act in accordance with the highest standards of integrity. The MTS Code of Conduct, as well as any waivers from and amendments to it, are posted on our website at www.mts.com (select "Investor Relations" and click on "Corporate Governance").

Non-Employee Director Compensation

During fiscal 2016, the Board reviewed the market competitive pay of our compensation peer companies, as prepared by Willis Towers Watson. Based on the information presented, the Board determined that cash and equity compensation for fiscal 2017 will be adjusted to align the fees and restricted stock units that our non-employee directors receive with market as compared to our peer companies.

10

The table below reflects the cash compensation for annual service during fiscal 2016 to our non-employee directors along with the approved adjustments for fiscal 2017:

| Role | Fiscal 2016 Annual Cash Retainer | Fiscal 2017 Annual Cash Retainer | |||||

|---|---|---|---|---|---|---|---|

| |||||||

Chairman of the Board | $110,000 | $120,000 | |||||

All other non-employee directors | $45,000 | $55,000 | |||||

Audit Committee | |||||||

Chair | $19,000 | $20,000 | |||||

All other committee members | $9,000 | $10,000 | |||||

Compensation Committee | |||||||

Chair | $12,500 | $15,000 | |||||

All other committee members | $5,000 | $7,500 | |||||

Governance and Nominating Committee | |||||||

Chair | $11,000 | $11,000 | |||||

All other committee members | $5,000 | $5,000 | |||||

Upon election or re-election to the Board at each of our annual meetings of shareholders, the directors receive an annual grant of restricted stock units under our 2011 Stock Incentive Plan with the number of shares equal to the amounts set forth in the table below. The annual restricted stock unit award to be granted in June 2017 will be under the 2017 Stock Incentive Plan that is the subject of shareholder approval at this Annual Meeting, and will vest on the one year anniversary of the date of grant.

| | | | | | | | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | |

| | Name | | Fiscal 2016 Award Amount | | Fiscal 2017 Award Amount | | Calculation | | ||||||||||

| | | | | | | | | | | | | | | | | | | |

| David Anderson (Chairman of the Board) | $134,000 | $154,000 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| David Johnson | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Randy Martinez | FMV ÷ Grant Date Stock | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Barb Samardzich(1) | Price rounded down to the | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Michael Schrock | $95,000 | $115,000 | next whole number | |||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Gail Steinel | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Kenneth Yu | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Maximiliane Straub(2) | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

If a non-employee director is appointed to the Board prior to the annual meeting of shareholders, the non-employee director may receive a pro-rated restricted stock unit award depending upon, among other factors, the length of time until the next annual meeting of shareholders. If a non-employee director resigns, retires or otherwise terminates his or her service as a director, a pro-rata portion of

11

any restricted stock units held by such director shall vest prior to the date that the restrictions would otherwise vest.

Non-employee directors are also reimbursed for travel expenses to Board meetings.

Non-employee directors are also eligible to participate in the Executive Deferred Compensation Plan and may elect to defer up to 100% of the director's fees we pay in cash and to defer the settlement of up to 100% of the restricted stock unit awards that they are eligible to receive. At the time of the deferral election, participants must select a distribution date and form of distribution. The plan provides for the crediting of dividend equivalents on such deferred settlement restricted stock units and for the crediting of interest on cash amounts (deferred director fees and dividend equivalents amounts) that are credited to a participant's deferred account. The interest rate utilized is approved by the Compensation Committee in November of each year for the following calendar year. Historically, the ten-year government treasury note rate as of the first business day of the calendar year has been used. The interest rate for calendar 2016 was 2.24%. For fiscal 2016, Mr. Johnson elected to defer 100% of his director's fees and settlement of 100% of his restricted stock unit grant and associated dividend equivalents paid on that grant and Mr. Anderson and Ms. Steinel elected to defer settlement of 100% of their restricted stock unit grant and associated dividend equivalents paid on that grant. Earnings on the deferred compensation accounts (dividend equivalents and interest credits) do not represent above-market or preferential earnings.

The table below shows cash compensation earned by non-employee directors for fiscal 2016 and either paid in cash or deferred at the election of the director as described above. The table also shows the dollar amounts recognized by us for financial statement reporting purposes during fiscal 2016 for restricted stock unit awards granted for service during fiscal 2016.

Director Compensation for Fiscal 2016

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2)(3) | All Other Compensation ($)(4) | Total ($) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

David Anderson | 119,000 | 134,006 | 4,634 | 257,640 | |||||||||

David Johnson | 69,833 | 95,004 | 4,874 | 169,711 | |||||||||

Emily Liggett(5) | 12,500 | — | 403 | 12,903 | |||||||||

Randy Martinez | 59,417 | 95,004 | 2,078 | 156,499 | |||||||||

Barb Samardzich | 50,000 | 95,004 | 2,078 | 147,082 | |||||||||

Michael Schrock | 63,125 | 95,004 | 2,078 | 160,207 | |||||||||

Gail Steinel | 65,917 | 95,004 | 4,080 | 165,001 | |||||||||

Kenneth Yu | 50,000 | 95,004 | 2,078 | 147,082 | |||||||||

12

restricted stock units and each of Mr. Johnson, Mr. Martinez, Ms. Samardzich, Mr. Schrock, Ms. Steinel and Mr. Yu were awarded 1,861 restricted stock units with a grant date fair value of $51.05 per share.

13

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

THIS SECTION SHOULD BE READ IN CONJUNCTION

WITH THE "AUDIT COMMITTEE REPORT" BELOW.

KPMG LLP ("KPMG"), an independent registered public accounting firm, has been our independent registered public accounting firm since May 31, 2002. The Audit Committee has selected KPMG to serve as our independent registered public accounting firm and to serve as auditors for the fiscal year ending September 30, 2017. Shareholder ratification of the appointment is requested. Consistent with our Audit Committee Charter and the requirements of the Sarbanes Oxley Act of 2002 and applicable rules and regulations of the SEC and the NASDAQ Stock Market, the ratification of the appointment of independent auditors by the shareholders will in no manner impinge upon or detract from the authority and power of the Audit Committee to appoint, retain, oversee and, if necessary, disengage the independent auditors. In the event the appointment of KPMG is not ratified by the shareholders, the Audit Committee will reconsider the appointment.

Representatives of KPMG are expected to be present at the virtual Annual Meeting. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The following table presents aggregate fees for professional services rendered by KPMG in fiscal 2016 and fiscal year 2015 for the audit of our annual financial statements and for other services.

| | Fiscal Year ($000's) | ||||||

|---|---|---|---|---|---|---|---|

| | 2016 | 2015 | |||||

Audit Fees(1) | $ | 4,253 | $ | 1,779 | |||

Audit-Related Fees(2) | 1,830 | 16 | |||||

Tax Fees(3) | 177 | 97 | |||||

All Other Fees(4) | - | - | |||||

| | | | | | | | |

Total fees | $ | 6,260 | $ | 1,892 | |||

The amounts in the table include out-of-pocket expenses incurred by KPMG. The Audit Committee pre-approved all non-audit services described in the table. The Audit Committee has determined

14

that the provision of the services identified in the table is compatible with maintaining the independence of KPMG.

The Audit Committee's current practice on pre-approval of services performed by the independent registered public accounting firm is to require pre-approval of all audit services and permissible non-audit services. The Audit Committee reviews each non-audit service to be provided and assesses the impact of the service on the firm's independence. In addition, the Audit Committee has delegated authority to grant certain pre-approvals to the Audit Committee Chair. Pre-approvals granted by the Audit Committee Chair are reported to the full Audit Committee at its next regularly scheduled meeting.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE

RATIFICATION OF THE APPOINTMENT OF KPMG LLP.

15

The Audit Committee is currently composed of four directors who are independent, as defined by the applicable rules for companies listed on the NASDAQ Stock Market. The Audit Committee operates under a written charter adopted by the Board, a copy of which is available to shareholders on our website at www.mts.com (select "Investor Relations" and click on "Corporate Governance").

Management is responsible for preparing the financial statements, establishing and maintaining the system of internal controls over the financial reporting processes, and assessing the effectiveness of the Company's internal control over financial reporting. The independent registered public accounting firm is responsible for performing an independent audit of our consolidated financial statements and internal controls in accordance with auditing standards generally accepted in the United States and for issuing reports on such audit. The Audit Committee's responsibility is to monitor and oversee these processes.

Management has represented to the Audit Committee that our consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States and the Audit Committee has reviewed and extensively discussed the consolidated financial statements with management and KPMG, our independent registered public accounting firm.

In reviewing our fiscal 2016 audited consolidated financial statements, the Audit Committee discussed with KPMG matters required to be discussed by the applicable Public Company Accounting Oversight Board (PCAOB) Standards. In addition, the Audit Committee received from the independent registered public accounting firm the written disclosures required by the PCAOB regarding the independent registered public accounting firm's communications with the Audit Committee concerning independence and discussed with them their independence from us and our management. The Audit Committee determined that the tax services provided to our Company by our independent registered public accounting firm are compatible with the independent registered public accounting firm's independence.

Based upon the Audit Committee's discussions with management and KPMG and the Audit Committee's review of the representations of management and the reports of KPMG, the Audit Committee recommended that the Board include the audited consolidated financial statements in the Company's Annual Report on Form 10-K for the fiscal year ended October 1, 2016.

SUBMITTED BY THE AUDIT COMMITTEE

OF THE COMPANY'S BOARD OF DIRECTORS

David D. Johnson (Chair)

David J. Anderson

Randy J. Martinez

Gail P. Steinel

16

Compensation Discussion and Analysis

This CD&A describes our executive compensation program for the Chief Executive Officer ("CEO"), Chief Financial Officer and other named executive officers of the Company. The Compensation and Leadership Development Committee (for purposes of this Executive Compensation Section, the "Committee") administers and makes decisions regarding our executive compensation and benefit programs. The following discussion should be read in conjunction with the Summary Compensation Table and related tables and footnote disclosure setting forth the compensation of our fiscal 2016 named executive officers:

Mr. Oldenkamp provided a resignation notice to the Company on April 20, 2017 and his employment with the Company will end effective May 12, 2017.

Mr. Bachrach retired from the Company on January 13, 2017.

Mr. Emholz is one of our named executive officers for whom disclosure would have been provided because he was one of our three other most highly paid executive officers, but for the fact that he was not serving as an executive officer at the end of fiscal 2016. Mr. Emholz transitioned from the role of Senior Vice President, Sensors, effective as of July 6, 2016. In connection with such transition, we entered into a transition bonus agreement with Mr. Emholz and he remained employed by the Company as Senior Vice President, Sensors, including the corresponding compensation and benefits, until September 6, 2016, at which time Mr. Emholz's employment with the Company was terminated. He continues to be eligible to receive compensation pursuant to the Company's Executive Severance Plan.

Ms. Powell and the Company entered into a mutual separation agreement on April 18, 2017 pursuant to which the parties mutually agreed that Ms. Powell's employment with the Company will end effective May 5, 2017.

The objectives of the Committee are to provide a market competitive compensation program that:

17

A discussion of recent Company performance and the corresponding executive pay outcomes, demonstrates that our compensation program is functioning according to our established goals in most respects.

| | | | | | ||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| Performance Highlights | Compensation Outcomes | |||||||

| | | | | | | | | |

| Fiscal 2016 Results Related to Target Levels for Incentive Plans • Total Adjusted Revenue, a non-GAAP financial measure, was $605.6 million(1), up from the previous year's GAAP revenue of $563.9 million. • Adjusted ROIC, a non-GAAP financial measure, of 16.3%(2), compared to 15.5%(3) in fiscal year 2015. • Adjusted diluted earnings per share (EPS), a non-GAAP financial measure, of $3.01(2), compared to the previous year's GAAP diluted EPS of $3.00. • Adjusted Working Capital Rate to Revenue ("WCRR"), a non-GAAP financial measure, was 24.0%(4), compared to WCRR of 30.4%(5) in fiscal year 2015. | Annual Incentives • Based on achieving 92% of the adjusted EPS goal, 100% of the adjusted revenue goal and 121% of the adjusted WCRR goal, the fiscal year 2016 annual incentive payout for our CEO was 100% of target. • The payout was capped at target, as our incentive compensation plan restricts over-ranging in the event that the adjusted EPS goal is not achieved. Without the cap, payouts for the CEO would have been 123% of target during fiscal year 2016. Long-Term Incentives • Three of the four outstanding stock option grants for our CEO were underwater as of October 1, 2016. • The performance-based restricted stock units granted in fiscal years 2016 and 2015 were tracking below target payout levels. o Adjusted ROIC performance was below target levels in both fiscal years 2016 and 2015. o Share prices were below the grant levels. The overall result is compensation below the targeted opportunity. | |||||||

| | | | | | | | | |

(1) For purposes of our incentive compensation plans, we use adjusted revenue, which is not a measure of performance presented in accordance with GAAP. Adjusted revenue is calculated by excluding PCB revenue for the three months ended October 1, 2016 of approximately $44,503,000 from our total fiscal year 2016 revenue of approximately $650,147,000. We use adjusted revenue as an incentive compensation measure as defined in the plan documents. This measure should not be construed as an alternative to revenue determined in accordance with GAAP.

(2) For purposes of our incentive compensation plans, we have calculated adjusted ROIC and adjusted diluted EPS for fiscal year 2016, which are not financial measures of performance presented in accordance with GAAP. Adjusted ROIC is calculated by dividing adjusted net income by average adjusted invested capital. Adjusted diluted EPS is calculated by

18

dividing adjusted net income by adjusted diluted weighted average common shares outstanding. Adjusted net income is calculated by excluding the following from reported net income: PCB net income, acquisition-related expense, net of tax; acquisition integration expenses, net of tax; acquisition inventory step-up, net of tax; restructuring expense, net of tax; acquisition interest expense, net of tax; and after-tax interest expense. Adjusted diluted weighted average common shares outstanding is calculated by excluding the impact of our common stock offering and the issuance of 8.75% tangible equity units, or TEUs. Average invested capital is defined as the aggregate of average adjusted interest-bearing debt and average adjusted shareholders' equity and is calculated as the sum of current and prior year ending amounts divided by two. Because the calculations are not prescribed or authorized by GAAP, the adjusted ROIC percentage and adjusted diluted EPS amount are non-GAAP financial measures. We use adjusted ROIC and adjusted diluted EPS as incentive compensation measures as defined in the plan documents. These measures should not be construed as an alternative to return on equity, diluted EPS or any other measure determined in accordance with GAAP. For a reconciliation of these non-GAAP financial measures to the nearest GAAP measures, see page 58 of our Annual Report on Form 10-K for fiscal 2016.

(3) For the calculation of fiscal year 2015 ROIC, see page 20 of our Annual Report on Form 10-K for fiscal 2016.

(4) For purposes of our incentive compensation plans, we use adjusted WCRR for fiscal year 2016, which is not a measure of performance presented in accordance with GAAP. Adjusted WCRR is calculated by dividing the adjusted 12 month average net working capital by adjusted revenue. The adjusted 12 month average net working capital is calculated by excluding PCB accounts receivable, net, unbilled accounts receivable, inventories, net, accounts payable and advance payments from customers and averaging the quarterly adjusted net working capital for fiscal year 2016. Adjusted revenue is calculated by excluding PCB revenue for the three months ended October 1, 2016 of approximately $44,503,000 from fiscal year 2016 revenue of approximately $650,147,000. Because the ratio is not prescribed or authorized by GAAP, the adjusted WCRR is a non-GAAP financial measure. We use adjusted WCRR as an incentive compensation measure as defined in the plan documents. For a reconciliation of this non-GAAP financial measure to the nearest GAAP measures for fiscal year 2016, see page 59 of our Annual Report on Form 10-K for fiscal 2016.

(5) WCRR is calculated by dividing the 12 month average net working capital by full fiscal year revenue. The 12 month average net working capital is calculated by averaging the quarterly adjusted net working capital for fiscal year 2015. Because the ratio is not prescribed or authorized by GAAP, WCRR is a non-GAAP financial measure. For a reconciliation of this non-GAAP financial measure to the nearest GAAP measures for fiscal year 2015, see page 60 of our Annual Report on Form 10-K for fiscal 2016.

While we believe our executive compensation program is meeting our stated objectives, we do accept shareholder feedback on the design and performance-orientation of our programs. Specifically, we received approximately 98% support of our executive compensation programs at our last annual meeting of shareholders held in fiscal 2016 related to the compensation of our named executive officers. We continue to solicit shareholder feedback regarding our compensation programs, and take this input into consideration as we design future incentive compensation.

Fiscal 2016 Executive Compensation Highlights

Detailed below are some of the key actions and decisions with respect to our executive compensation programs for fiscal 2016 as approved by the Committee, with counsel from its independent compensation consultant, Willis Towers Watson:

19

Employment Agreement has a two-year term and provides for potential payments in the event of a termination of Mr. Hore's employment. Therefore, during the term of the Hore Employment Agreement, Mr. Hore will not participate in our Executive Severance Plan or the Executive Change in Control Severance Plan. In addition, as one of our new executive officers, Mr. Hore received a restricted stock unit award on August 15, 2016 with a fair market value of $270,000 in accordance with our typical policy for newly hired executive officers. We believe that executive hire equity grants are important to align our officers' interests with our shareholders' interests.

20

Information Used in the Compensation Process

Independent Compensation Consultant

Under the Committee's charter, the Committee has the authority to select, retain and compensate executive compensation consultants and other advisors as it deems necessary to carry out its responsibilities. For assistance with fiscal 2016 compensation decisions, the Committee engaged Willis Towers Watson to provide it with information regarding compensation of executive officers, non-executive officers and directors. Specifically, Willis Towers Watson was asked by the Committee to:

Determining Competitive Compensation

The Committee annually assesses "competitive market" compensation for each component of compensation using a number of sources.

The Committee engaged Willis Towers Watson as its independent compensation consultant to review compensation levels for executive positions. For fiscal 2016, as in past years, a base salary benchmark tool was updated for the Committee based upon executive salary survey data that was adjusted for comparability by business, revenue, executive position and age of data. In setting salaries for fiscal 2016, executive salary survey data for executives was obtained from the 2015 Towers Watson Compensation DataBank Survey and the 2015 Towers Watson Compensation Survey Report for companies with less than $1 billion in revenue. The results of the benchmark tool

21

were then referenced against proxy compensation data from our compensation peer group described below, which is used as a supplemental data source.

For each position, the base salary benchmark tool produces a median and a competitive salary range, with the minimum and maximum end of the range at approximately 80% and 120% of the median, respectively. The Committee used the benchmark tool to assess the median and range of competitive salaries for fiscal 2016 and compared these to the base salaries for the named executive officers to determine the need for adjustments.

Our direct competitors are either privately-owned companies or business units within much larger public companies and, as a result, a broad and reliable base of compensation data from these companies is not readily available. Accordingly, the compensation peer group we use to confirm the base salary data from our benchmark tool consists of durable goods manufacturing companies, most of which do not compete with us directly but several of which compete with us for management talent. Our compensation peer group is reviewed on an annual basis by the Committee with the assistance of its independent compensation consultant. Our compensation peer group used when determining fiscal 2016 compensation consisted of the following companies:

| Badger Meter Inc. | GSI Group Inc. | |

Checkpoint Systems Inc. | John Bean Technologies Corporation | |

Cognex Corporation | Kimball Electronics, Inc. | |

Coherent Inc. | Methode Electronics, Inc. | |

CTS Corporation | National Instruments Corporation | |

Daktronics Inc. | Newport Corp. | |

ESCO Technologies Inc. | OSI Systems, Inc. | |

Fabrinet | RBC Bearings Inc. | |

FARO Technologies Inc. | Rofin-Sinar Technologies Inc. | |

FEI Company | Standex International Corporation |

In May 2016, the Committee evaluated its peer group in light of the acquisition of PCB and determined that its peer group should be revised to add the following companies: HEICO Corporation and MKS Instruments, Inc.

For short-term cash incentive compensation, which was delivered to the named executive officers through the EVC Plan, the Committee also reviewed market data and executive salary survey information that had been compiled and adjusted by Willis Towers Watson. For each of the named executive officers, the Committee compared the target amounts under the EVC Plan for fiscal 2016 to the survey information relating to the median amount of non-salary cash compensation paid to executive officers as a percentage of base salary.

Additionally, Willis Towers Watson prepares for the Committee an annual analysis of long-term equity incentive compensation. The analysis includes a market review of our equity grant structure, comparing the value of our long-term incentive award guidelines to market data. Comparative information was obtained from the Willis Towers Watson's Executive Compensation Database for long-term incentive tables for companies with revenues of less than $1 billion. The Committee used

22

this data to establish competitive guideline ranges and median values for equity awards made in December 2015 to the named executive officers.

Role of Management

In determining compensation for executive officers, other than the CEO, the Committee solicits input from the CEO regarding the duties and responsibilities of the other executive officers and the results of performance evaluations. The CEO also recommends to the Committee the base salary for all executive officers (other than his own) and, in developing his recommendations, may request input from the Chief Human Resources Officer from time to time relating to the compensation of those executive officers. The CEO, Chief Financial Officer and the Chief Human Resources Officer develop recommendations for the Committee regarding the financial performance goals under the EVC Plan and the minimum, target and maximum levels of achievement of the performance goals. The CEO, Chief Human Resources Officer and General Counsel are invited to attend meetings of the Committee from time to time. No executive officer attends any independent director executive session of the Committee or is present during deliberations or determination of his or her compensation.

The Committee establishes the compensation for the executive officers, other than the CEO. With respect to the CEO, the Committee makes recommendations to the independent directors of the Board of Directors.

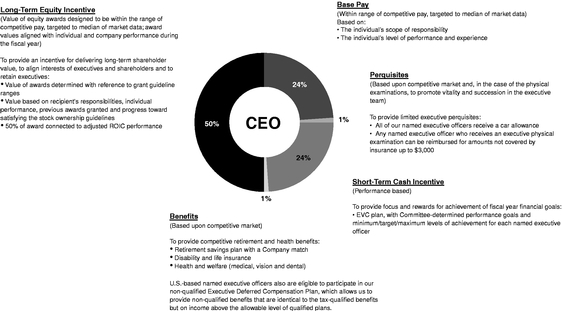

Compensation of our Named Executive Officers

During fiscal 2016, the components of our executive compensation program consisted of base salary, short-term cash incentive, long-term equity incentive awards, broad-based benefits and other perquisites. The named executive officers were eligible to participate in the same benefit programs as were available to our other salaried employees working in the same countries. The chart below reflects the relative weighting associated with each of these components paid or granted to the CEO for fiscal 2016.

23

For the named executive officers, other than the CEO, the average relative weighting associated with these components paid or granted for fiscal 2016 was base salary 38%; long-term equity incentive 38%; short-term cash incentive 20%; benefits 3% and perquisites 1%. Mr. Hore and Mr. Emholz were not included in the calculation of the pay mix for the named executive officers due to Mr. Hore's Employment Agreement and Mr. Emholz's transition bonus.

Determining Mix of Compensation

The Committee does not have a set policy or formula for weighting the elements of compensation for each named executive officer. Instead, the Committee considers market factors relevant to that executive and his or her tenure, role within the Company and contributions to the Company's performance. In general, as named executive officers assume greater responsibility, a larger portion of their total cash compensation is payable as short-term cash incentive, which is variable based on performance, as opposed to base salary and a larger portion of their total direct compensation (that is, compensation other than benefits and perquisites) comes in the form of long-term equity incentive.

The Committee determines base salaries for named executive officers, other than the CEO, and makes recommendations to the independent directors of the Board regarding the base salary of the CEO. These recommendations are based upon a number of factors, including competitive salaries and individual performance. Annual recommendations for executive officers are made in November of each year and any resulting adjustments to base salaries take effect that same month.

The Committee reviewed base salary datasets developed by Willis Towers Watson as the Committee considered adjustments to base salaries for fiscal year 2016. These datasets provided the Committee with information regarding a median level of base salary for each named executive officer position and a range of competitive base salaries.

Additionally, we have a systematic approach for evaluating the performance of our executive officers, with base salary adjustments affected primarily by the performance evaluation for the prior fiscal year. The process begins by establishing specific, individualized performance goals at the beginning of the fiscal year for each executive officer, as well as identifying or reaffirming the core competencies of the position and evaluating performance against the values that guide how we conduct ourselves and our business. The CEO proposes individual performance goals for himself that are reviewed by the Committee and approved by the independent members of the Board. The CEO works with each of the other named executive officers to establish appropriate performance goals for that individual. These individual performance goals relate to our customers and our market, organizational improvements and financial measures.

The CEO regularly provides reports and updates throughout the year regarding his progress toward achievement of these individual performance goals. The performance of the executive officer is assessed by the independent directors of the Board, in the case of the CEO, or by the CEO, in the case of the other executive officers. As part of this performance review, the independent directors of the Board or the CEO, as the case may be, consider the executive officer's demonstration of competencies of that executive's role, the behaviors that reinforce our values and achievement of the individual performance goals established for that fiscal year.

24

The following table shows the annualized base salaries for the named executive officers for fiscal year 2016 (other than Mr. Hore, who received the same base salary as provided in the employment agreement that he had in place with PCB prior to the acquisition), as well as the proximity of the fiscal year 2016 base salary to the median of the market data for the same or similar position.

| Named Executive Officer | Fiscal Year 2016 Annualized Base Salary | Fiscal Year 2016 Annualized Base Salary as a Percent of Median of Base Salary Comparable | |||

|---|---|---|---|---|---|

| | | | | | |

Jeffrey Graves | $ | 650,000 | 99.2% | ||

Jeffrey Oldenkamp | $ | 345,000 | 95.8% | ||

William Bachrach | $ | 360,000 | 100.0% | ||

John Emholz | $ | 320,000 | 103.2% | ||

Catherine Powell | $ | 300,000 | 96.8% | ||

Mr. Hore receives compensation under the terms of the Hore Employment Agreement, which provides for an annualized base salary of $500,000.

Design of EVC Plan and Review of Fiscal 2016 Performance

Under the EVC Plan, all of the named executive officers employed by the Company at the end of fiscal 2016, other than Mr. Hore, were eligible for cash bonuses as determined based upon our financial performance as compared to set performance goals. Mr. Hore does not participate under the EVC Plan because the Hore Employment Agreement provides that payment of any bonus is at the sole discretion of the Board.

The table below shows the target bonus amounts as a percentage of their respective base salaries that would be earned by the named executive officers, other than Mr. Hore, under the EVC Plan upon our achievement of target performance goals.

| Named Executive Officer | % of Fiscal Year 2016 Base Salary at Target Achievement | |

|---|---|---|

| | | |

Jeffrey Graves | 100% | |

Jeffrey Oldenkamp | 55% | |

William Bachrach | 55% | |

John Emholz | 45% | |

Catherine Powell | 45% |

The differences among the named executive officers of the cash incentive opportunity at the target level is primarily a function of their position within our Company and the corresponding grade level assigned to that position. Named executive officers with the same grade level were assigned the same cash incentive opportunity at the target level. The Committee usually sets the cash incentive opportunity at the target level at the same percentage for the same positions. However, the Committee reviews, primarily for trend information, data from our compensation survey analysis and our group of compensation peer companies relating to short-term compensation earned by executive officers in comparable positions. After this review, the Committee makes adjustments to the percentage of base salary that will be earned by our executive officers at target achievement as appropriate.

25

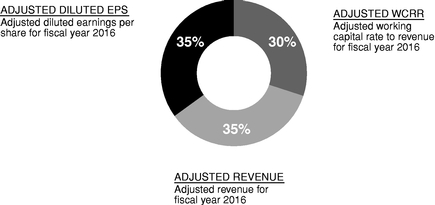

The Committee determined the performance goals under the EVC Plan as part of our annual planning process, selecting performance goals deemed critical to our success in fiscal 2016. The Committee believes the combination of performance goals are appropriately balanced between earnings-related and growth goals, while also focusing on shareholder value. The following is a summary of the performance goals and their relative weighting for the named executive officers, other than Mr. Hore.

Weighting for

Named Executive Officers

for Fiscal Year 2016

|

For Dr. Graves, Mr. Oldenkamp and Ms. Powell, all performance goals were based on total Company performance. For Messrs. Bachrach and Emholz, the adjusted diluted EPS performance goal was a total Company measure, but the remaining measures were determined based upon achievement of targets by the Test or Sensors segment, as applicable. The Committee established performance goals based on segment (rather than total Company) performance for these executives to reflect their accountability for the performance of that segment. The Committee believes that the leader of the segment has a meaningful opportunity to directly impact the achievement of the performance goals through his individual performance as the leader of that segment.

The Committee established minimum, target and maximum levels of achievement for each of the performance metrics, as shown in the following table:

| Corporate Goal (1) | Weight | Threshold(2) | Target | Maximum | Result | Percent of Target Performance Achieved | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

| Adjusted Diluted EPS(3) | 35% | $ 2.61 | $ 3.27 | $ 3.92 | $ 3.01 | 92% | ||||||

| Adjusted Revenue (000s)(4) | 35% | $ 484,320 | $ 605,400 | $ 726,480 | $ 605,644 | 100% | ||||||

| Adjusted WCRR(5) | 30% | 31.9% | 29.0% | 26.1% | 24.0% | 121% | ||||||

Payout as % of Target Bonus | 50% | 100% | 200% |

26

WCRR, minimum is equal to a 10% decrease in the expected results under the applicable segment's annual plan, target is equal to expected results and maximum is equal to a 10% increase in expected results.

In addition, since the Committee believes the adjusted diluted EPS performance goal provides a strong link between the incentive program and shareholder value, if the target level of adjusted diluted EPS achievement is not met, EVC Plan participants are limited to target payout under the plan regardless of the results of other performance goals. Within this provision of the EVC Plan, if the adjusted diluted EPS target is not met, an executive may receive a payout in excess of 100% for an individual performance goal so long as the executive's payout under the EVC Plan is not in excess of 100% of target, in the aggregate.

Based on the results for fiscal year 2016, the payouts to each named executive officer, other than Messrs. Emholz and Hore, under the EVC Plan by performance goal were calculated as follows based upon their respective fiscal year 2016 base salaries:

| Performance Goal | Percent of Target Payout Achieved | Jeffrey Graves | Jeffrey Oldenkamp | William Bachrach(1) | Catherine Powell | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | |

Adjusted diluted EPS | 80% | $ | 181,980 | $ | 52,290 | $ | 55,351 | $ | 35,569 | |||||||

Adjusted revenue | 100% | $ | 227,078 | $ | 65,249 | $ | 80,952 | $ | 44,496 | |||||||

Adjusted WCRR | 200% | $ | 388,500 | $ | 111,632 | $ | 118,167 | $ | 76,125 | |||||||

Total without cap | $ | 797,558 | $ | 229,171 | $ | 254,470 | $ | 156,190 | ||||||||

Total with cap(2) | $ | 647,500 | $ | 186,053 | $ | 196,945 | $ | 126,876 | ||||||||

Total as % of Target | 100% | 100% | 100% | 100% | ||||||||||||

Mr. Emholz did not qualify for a payout under the EVC Plan since he was no longer an employee of the Company as of the last day of fiscal 2016. Mr. Hore does not participate in the EVC Plan, so he also did not qualify for a payout. Pursuant to the terms of the Hore Employment Agreement, the Committee decided not to provide a discretionary bonus to Mr. Hore based on the short period of time that he was employed by the Company during fiscal 2016.

27

The awards for fiscal 2016 were weighted 50% of the value in stock options and 50% of the value in PRSUs restricted over a three-year period. In determining the number of stock options to grant, the Committee reviewed the stock options based on an average of the Black Scholes values over the last 90 days prior to the end of the fiscal year. This methodology was to better represent the value of our equity over the most current period prior to the date of the award. A more stable option grant size (in terms of the number of options) also sends a signal that pay realized from stock option grants will be more sensitive to future stock price appreciation and less sensitive to past stock price volatility. This approach, however, causes the accounting value of the stock options that are shown in the Summary Compensation and Grants of Plan-Based Awards tables to differ from the value of PRSUs, which would otherwise be unexpected with an equal-weighted mix of options and PRSUs. In determining the number of PRSUs to grant, half of the aggregate value of the grant is divided by the closing price of the Company's common stock on the date of grant.

The options are all non-qualified stock options that vest in incremental installments of one-third per year commencing on the first anniversary of the date of grant and expire seven years after the date of grant.

In fiscal 2016, the Committee continued to grant PRSUs using adjusted ROIC as a performance measure. The Committee believes that measuring adjusted ROIC over a three-year period is an appropriate measure for such PRSUs given its emphasis on profitability with a longer-term view. The performance measure of adjusted ROIC is expressed as annual targets for the applicable three-year period and the annual performance is averaged over the performance period. The performance range has threshold, target and maximum performance expectations each cycle, with a 75% guaranteed threshold of target and up to a 125% maximum opportunity of target.

The following table shows for each of the named executive officers (other than Mr. Hore who did not receive an award because he was not an officer of the Company at the time) the number of shares underlying the equity awards and the aggregate value of the awards granted in December 2015 for fiscal 2016.

| Named Executive Officer | Number of Shares Underlying Stock Options | Number of Performance Restricted Stock Units | Aggregate Value of Awards | ||||

|---|---|---|---|---|---|---|---|

Jeffrey Graves | 61,455 | 10,123 | $ | 1,250,000 | |||

Jeffrey Oldenkamp | 17,207 | 2,834 | $ | 350,000 | |||

William Bachrach | 14,749 | 2,430 | $ | 300,000 | |||

John Emholz | 9,833 | 1,620 | $ | 200,000 | |||

Catherine Powell | 8,850 | 1,458 | $ | 180,000 | |||

The table below sets forth for fiscal 2016 the threshold, target and maximum levels for the adjusted ROIC performance goal as well as the actual achievement of that performance goal for fiscal 2016 and the percentage of the target level of that achievement.

| Performance Goal | | | | Threshold | | Target | | Maximum | | Result | | Percent of Target Performance Achieved | | Percent of Target Payout Achieved |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | |

Adjusted ROIC | | | 10.6% | | 17.6% | | 22.6% | | 15.9% | | 90.3% | | 93.9% |

28

Based on the results for fiscal 2016, the payouts to each named executive officer (other than Mr. Emholz and Ms. Powell, who were not officers of the Company at the time of the date of grant) for the PRSUs with a date of grant of December 3, 2014, were calculated as follows based upon the respective PRSUs attributable to fiscal year 2015 and 2016 performance.

| | Target PRSUs | Actual PSRUs | ||||||

|---|---|---|---|---|---|---|---|---|

| Named Executive Officer(1) | Shares | Value(2) | Shares | Value(3) | ||||

| | | | | | | | | |

Jeffrey Graves | 2,670 | $178,837 | 2,508 | $134,805 | ||||

Jeffrey Oldenkamp | 672 | $45,011 | 631 | $33,916 | ||||

William Bachrach | 684 | $45,814 | 642 | $34,508 | ||||

John Emholz | — | — | — | — | ||||

Catherine Powell | — | — | — | — | ||||

Equity Incentive Grant Policy. The Committee recognizes the importance of adhering to specific practices and procedures in the granting of equity incentives. Accordingly, the Committee has developed a formal policy relating to the grant of equity incentives. Our policy is that grants of equity incentives, other than new hire or promotional grants, will be made by the Committee once per year as described above. Equity incentive awards to our CEO are approved by the independent directors of the Board following a recommendation by the Committee. Our policy is that the annual grant date for awards made by the Committee for the annual grant is on the later of (i) market close as of the first Wednesday in December in the first fiscal quarter, or (ii) market close as of the fifth business day after the fourth quarter earnings release is issued. Our policy also states that the grant date for awards made by the Committee to new hires will be the 15th day of the month following the month of hire or, if the market is closed that day, the first business day prior thereto in which the market is open.

Under our 2011 Stock Incentive Plan, the Committee may delegate authority to make awards to a subcommittee consisting only of independent directors or to one or more executive officers. We also included a similar provision to the 2017 Stock Incentive Plan that is the subject of shareholder approval at this Annual Meeting. The Committee has delegated authority to the CEO to make awards of stock options, restricted stock units or a combination of stock options and restricted stock units, other than to our executive officers. This delegation is subject to a maximum number of shares and other restrictions.

Executive Compensation Clawback Policy. We added a recoupment or "clawback" provision to our EVC Plan that was approved by shareholders at the fiscal year 2009 annual meeting of shareholders. Our 2011 Stock Incentive Plan contains a similar provision. We also included a similar provision to the 2017 Stock Incentive Plan that is the subject of shareholder approval at this Annual Meeting, with the addition of recoupment in the event of a violation of the MTS Code of Conduct. These clawback provisions require an executive officer to forfeit and allow us to recoup from the

29

executive officer any payments or benefits received by the executive officer under the EVC Plan or our equity plans under certain circumstances, such as certain restatements of our financial statements, termination of employment for cause, violation of the MTS Code of Conduct and breach of an agreement between us and the executive officer.

Stock Ownership Guidelines. To align our executive officers' interests with our shareholders' interests, the Committee expects our executive officers to acquire significant equity ownership in the Company. Accordingly, we have adopted stock ownership guidelines requiring each executive officer to achieve an equity ownership level equal to a specified multiple of his or her base salary within five years of being appointed as an executive officer or within five years of change in executive officer status resulting in an increased required level of ownership. The Committee revised the stock ownership guidelines in September 2014 and the current minimum equity ownership levels as a multiple of base pay are as follows: five times for the CEO; four times for the Chief Financial Officer; and a multiple equal to their executive salary grade level for any other Senior Vice President (ranging from two times to four times) and one time for a Vice President. As part of the revisions in September 2014, the policy now provides that failure by a participant to meet the required ownership level within the time period established will result in a requirement that participants must retain 100% of the net shares acquired (net of taxes) through the Company's equity compensation programs until the ownership levels are met. It also requires that our executive officers hold equity acquired through our equity compensation plans in a minimum amount of 75% of the net proceeds (net of taxes) until ownership levels are met.

Our independent directors have also imposed upon themselves a guideline for achieving significant equity ownership. Our independent directors are expected to achieve an ownership of our Common Stock equal to a minimum of five times their annual cash retainer.

The Committee reviews the progress of our executive officers toward the ownership guidelines on a regular basis and determined that all of the executive officers are on track for meeting the ownership guidelines within the established timeframes.