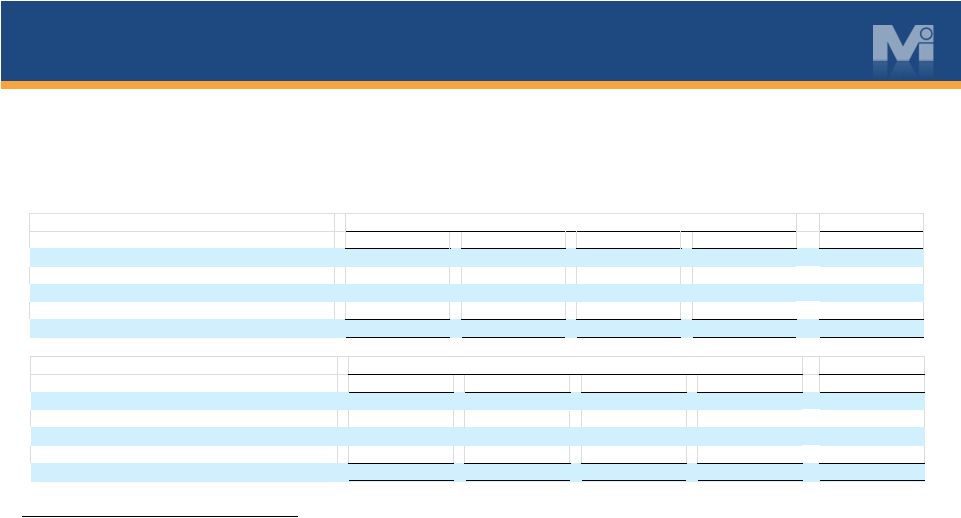

RECONCILIATION OF NON-GAAP MEASURES 12 MYERS INDUSTRIES, INC. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES COMBINED STATEMENTS OF INCOME (UNAUDITED) (Dollars in thousands) TTM June 30, 2015 September 30, 2015 December 31, 2015 March 31, 2016 March 31, 2016 Operating Income as reported from continuing operations 19,742 $ 2,578 $ 1,824 $ 1,129 $ 25,273 $ Add: one time unusual charges (2,560) 3,318 2,906 10,556 14,220 Add: depreciation 6,801 5,926 5,496 6,000 24,223 Add: amortization 2,641 2,575 2,413 2,499 10,128 EBITDA as adjusted 26,624 14,397 12,639 20,184 73,844 Quarter Ended TTM June 30, 2014 September 30, 2014 December 31, 2014 March 31, 2015 March 31, 2015 Operating Income as reported from continuing operations 11,286 $ (2,678) $ 5,127 $ 6,716 $ 20,451 $ Add: one time unusual charges 1,560 8,988 1,031 1,950 13,529 Add: depreciation 5,652 6,719 6,424 6,489 25,284 Add: amortization 670 2,814 2,724 2,638 8,846 EBITDA as adjusted 19,168 15,843 15,306 17,793 68,110 Quarter Ended Note on Reconciliation of Income and Earnings Data: EBITDA as adjusted is a financial measure that Myers Industries, Inc. calculates according to the schedule above using amounts from the unaudited Reconciliation of Non-GAAP Financial Measures Income (Loss) Before Taxes By Segment and GAAP amounts from the unaudited Condensed Consolidated Statement of Operations. The Company believes that EBITDA as adjusted provides useful information regarding a company's operating profitability. Management uses EBITDA as adjusted as well as other financial measures in connection with its decision-making activities. EBITDA as adjusted should not be considered in isolation or as a substitute for net income (loss), income (loss) before taxes or other consolidated income data prepared in accordance with GAAP. The Company's method for calculating EBITDA as adjusted may not be comparable to methods used by other companies. |