COMPREHENSIVE HEALTHCARE SOLUTIONS, INC.

(f/k/a – Nantucket Industries, Inc. and Subsidiaries)

The Company has a revolving line of credit with Park Avenue for up to $30,000. The interest rate on any amount of the line utilized is at prime plus 2%. The agreement expires and on August 1, 2005 with a provisions for a renewal of this agreement.

Deferred income taxes reflect the net effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amount used for income tax purposes. Deferred tax assets and liabilities are measured using enacted tax rates. Significant components of the Company’s deferred taxes at February 29, 2004, February 28, 2003 and February 28, 2002 are as follows:

COMPREHENSIVE HEALTHCARE SOLUTIONS, INC.

(f/k/a – Nantucket Industries, Inc. and Subsidiaries)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED FEBRUARY 29, 2004

The Company anticipates utilizing its deferred tax assets only to the extent of its deferred tax liabilities. Accordingly, the Company has fully reserved all remaining deferred tax assets, which it cannot presently utilize.

For tax purposes at February 29, 2004, the Company’s net operating loss carry forward was $834,000, which, if unused, will expire from 2017 to 2021. Certain tax regulations relating to the change in ownership may limit the Company’s ability to utilize its net operating loss carry forward if the ownership change, as computed under each regulation, exceeds 50%.

There was no income tax provision (benefit) for the fiscal years 2004 and 2003.

The following is a reconciliation of the normal expected statutory federal income tax rate to the effective rate reported in the financial statements.

| February 29, 2004 | February 28, 2003 |

Computed “expected” provision for: | | |

Federal income taxes | (35.0) % | (35.0) % |

Valuation allowance | | |

| | |

Actual provision for income taxes | -0- % | -0- % |

NOTE 8- STOCKHOLDERS’ EQUITY

Issuance of Preferred Stock

On March 22, 1994, the Company sold to its management group 5,000 shares of non-voting convertible preferred stock for $1,000,000. These shares were convertible into 200,000 shares of common stock at the rate of $5.00 per share. These shares provided for cumulative dividends at a floating rate equal to the prime rate. Such dividends were convertible into common stock at the rate of $5.00 per share. The conversion rights were waived in May 1998. These shares were redeemable, at the option of the Company, on or after February 27, 1999 and had a liquidation preference of $200 per share. As of February 28, 2001, February 27, 2000 dividends in arrears were $570,134, and $489,484, respectively. The liquidation preferences of $200 per share as well as any dividends in areas at that time were settled in full, pursuant to the approved plan of reorganization. (See Note 1).

In connection with the Company’s refinancing on March 22, 1994, the Company entered into a $2,000,000 term loan agreement with a financial institution. Pursuant to the agreement, the Company issued to the bank 10,000 treasury common shares related to

COMPREHENSIVE HEALTHCARE SOLUTIONS, INC.

(f/k/a – Nantucket Industries, Inc. and Subsidiaries)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED FEBRUARY 29, 2004

mandatory prepayments, which were not made. The treasury stock was retired in conjunction with the plan of reorganization.

Grant of Warrants

Warrants have been granted to NAN Investors LP to purchase 16,500,000 shares of the Company’s Common Stock for $.10 per share, with a five-year term effective May 21, 1998. All warrants were canceled in conjunction with the plan of reorganization.

Private Placements

At various dates during the current fiscal year the Company closed on private placements for 899,642 shares of common stock for an aggregate sales price of $222,400. The offers and sales were made only to “accredited investors” as defined in Rule 501(a) of Regulation D and the Company relied on Regulation D and Section 4(2) of the Securities act of 1933 to issue the securities without registration.

Convertible Debt

The Company issued $150,000 of 8% convertible debentures at various dates throughout the fiscal year ended February 29, 2004. These debentures were converted into 410,000 shares of common stock. In addition loans payable of $40,000 were converted into 160,000 shares of common stock.

Stock plans

The Company currently has no stock plans in effect.

NOTE 9-COMMITMENTS, CONTINGENCIES AND RELATED PARTY TRANSACTIONS

Agreement with Principal Stockholders

On March 1, 1994, in connection with the restructuring described in Note 4, the Company entered into agreements with its two principal stockholders and a group of employees (the “Management Group”). The agreements provide, among other things, for:

The reimbursement of the principal stockholders, limited to $1.50 per share to the extent that the gross proceeds per share from the sale of common stock by the stockholders during the two-year period beginning September 1, 1994 were less than $5.00 per share. Such guaranty was applicable to a maximum of 150,000 shares sold by such stockholders, subject to reductions under certain circumstances. The principal stockholders sold 157,875 shares including 88,400 at prices below $5.00 per share; 37,125 shares in the fiscal year ended March 1, 1997 and 51,275 shares in the year ended March 2, 1996 which resulted in a charge to operating results of $12,000 and $35,000, respectively.

Warrants to purchase up to 157,875 shares of common stock equal to the number of shares sold by the principal stockholders. The exercise price per share of such warrants would equal the gross proceeds per share from the corresponding sale by the principal

COMPREHENSIVE HEALTHCARE SOLUTIONS, INC.

(f/k/a – Nantucket Industries, Inc. and Subsidiaries)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED FEBRUARY 29, 2004

stockholders. Such warrants expired on February 28, 2000. All agreement with the principal stockholder was canceled in conjunction with the plan of reorganization.

Executive compensation

In accordance with employment agreement between the Company and John H. Treglia The Company’s President dated, April 3, 2000, Mr. Treglia was entitled to cash compensation of $150,000 per year, all such cash compensation was waived by Mr. Treglia. In accordance with Paragraph 6 of this employment agreement, Mr. Treglia may receive common stock of the Company valued at the average market price on a monthly basis. In accordance with the agreement on November 15, 2002, Mr. Treglia was issued 416,667 shares of restricted common stock of the Company. Compensation for the period March 1, 2002 and ending on February 28, 2003 such shares equating to approximately $25,000 in salary. Compensation for the period March 1, 2003 and ending on February 29, 2004 was $62,060 of which $25,000 was paid in common stock.

Consulting agreement

The Company terminated its consulting agreement with Westminster Holdings Ltd. and rescinded the 1,200,000 shares of common stock of Nantucket Industries, Inc. as of June 21, 2002.

During this fiscal year the Company entered into two consulting agreements and issued 1,250,000 shares of restricted common stock of Nantucket Industries, Inc.

Major Suppliers

During this fiscal year United Hearing Systems (“UHS”) became a major supplier of the Company. This occurred in the course of negotiating to purchase UHS. These negotiations were terminated in December 2002. Although there are a limited number of manufactures of hearing aids, management shifted its purchasing to include three other manufacturers who provide similar hearing aids on comparable terms. In the event of a disruption of supply from any one manufacture the Company could obtain comparable products from other manufacturers. Few manufacturers offer dramatic product differentiation. The Company has not experienced any significant disruptions in supply in the past.

Lease obligation

The Company leases office under any agreement that expires on February 2006. As of February 29, 2004 the future minimum lease payments are as follows:

COMPREHENSIVE HEALTHCARE SOLUTIONS, INC.

(f/k/a – Nantucket Industries, Inc. and Subsidiaries)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED FEBRUARY 29, 2004

February 28 | |

2005 | 27,627 |

2006 | 28,456 |

| $ 56,083 |

NOTE 10- SUBSEQUENT EVENTS

Acquisition

Effective March 1, 2004 the Company will issued 453,200 shares of common stock and $60,000 for working capital to acquire all the common stock of Comprehensive Network Solutions, Inc. a company providing non-insurance membership cards, which allow the members to receive a discount for certain medical services. As part of the acquisition the line of credit of Comprehensive Network Solutions Inc. was repaid by the certain stockholder.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None in the last two years.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of disclosure controls and procedures

Our Chief Executive Officer and Chief Financial Officer (collectively the “Certifying Officer”) maintains a system of disclosure controls and procedures that is designed to provide reasonable assurance that information, which is required to be disclosed, is accumulated and communicated to management timely. The Certifying Officer has concluded that the disclosure controls and procedures are effective at the “reasonable assurance” level. Under the supervision and with the participation of management, as of the end of the period covered by this report, the Certifying Officer evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule [13a-15(e)/15d-15(e)] under the Exchange Act). Furthermore, the Certifying Officer concluded that our disclosure controls and procedures in place were designed to ensure that information required to be disclosed by us, including our consolidated subsidiaries, in reports that we file or submit under the Exchange Act is (i) recorded, processed, summarized and reported on a timely basis in accordance with applicable Commission rules and regulations; and (ii) accumulated and communicated to our management, including our Certifying Officer and other persons that perform similar functions, if any, to allow us to make timely decisions regarding required disclosure in our periodic filings.

Changes in internal controls

We have not made any changes to our internal controls or procedures subsequent to the Evaluation Date. We have not identified any deficiencies or material weaknesses or other factors that could materially affect these controls or procedures, and therefore, no corrective action was taken.

34

PART III

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS; COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT.

Directors, Executive Officers and Significant Employees

The following sets forth, as of June 10, 2004, the names and ages of our directors, executive officers, and other significant employees; the date when each director was appointed; and all positions and offices held by each. Each director will hold office until the next annual meeting of shareholders and until his or her successor has been elected and qualified:

Name | Age | Positions

Held | Date

Appointed

Director |

| | | |

John H. Treglia | 61 | Director, President, and CEO and CFO | January 18, 2000 |

| | | |

Dr. Frank Castanaro | 53 | Secretary and Director | February 17, 2000 |

Set forth below is information regarding the principal occupations of each current director during the past five years or more. None of the directors or principal executive officers holds the position of director in any other public company.

John H. Treglia is a graduate of Iona College, from which he received a BBA in Accounting in 1964. Since January 18, 2000, he has served as our president, secretary, and a director, devoting such time to our business and affairs as is required for the performance of his duties. From 1964 until 1971, Mr. Treglia was employed as an accountant by Ernst & Ernst. Thereafter, he founded and operated several businesses in various areas. From 1994 through 1998, Mr. Treglia served as a consultant to several companies which were in Chapter 11.These included J.R.B. Contracting, Inc., Laguardia Contracting, and Melli-Borrelli Associates. In 1996, Mr. Treglia founded Accutone Inc., a company engaged in the business of manufacturing and distributing hearing aids. He has served as its president and CEO since such time.

Dr. Frank Castanaro received a Bachelor of Science degree from the University of Scranton in 1974. In 1978, he graduated from Georgetown University School of Dentistry and has been in private practice as a dentist since such time. Dr. Castanaro was appointed as our director on February 17, 2000. Dr. Castanaro has assisted two large ophthalmology practices to introduce and expand their activities in Laser therapy, including, but not limited to, Lasik procedures. Dr. Castanaro presently practices dentistry in partnership with Dr.’s Joseph C. Fontana and John B. Fontana in Peekskill, New York, and has a solo practice in Yonkers, New York. Dr. Castanaro is a member of the American Dental Association, the Dental Society of the State of New York, the Ninth District Dental Society, and the Peekskill-Yorktown Dental Society.

35

Code of Ethics. The company has adopted a Code of Ethics applicable to its Chief Executive Officer and Chief Financial Officer. This Code of Ethics is filed herewith as an exhibit.

ITEM 11. EXECUTIVE COMPENSATION

Compensation of Directors

Until June of 2000, when our board of directors eliminated compensation for directors other than those employed by us, such persons were paid $5,000 annually and an additional $500 for each Board or committee meeting attended in person. No payments have been made during the fiscal year ended February 29, 2004.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee was disbanded in May 1998. As of the date hereof, the Board of Directors has not established a new Compensation Committee and it has no plans to do so until such time as our financial position and prospects improve significantly.

SUMMARY COMPENSATION TABLE

The Summary Compensation Table shows compensation information for each of the fiscal years ended February 29, 2004 February 28, 2003 and February 28, 2002 for all persons who served as our chief executive officer. No other executive officers received compensation in excess of $100,000 during the fiscal year ended February 29, 2004.

ANNUAL COMPENSATION

Name and Principal

and Position | Year | | Salary | Other Compensation |

| | | | |

John H. Treglia | 2004 | $ | 37,060 | 357,142 shares |

President, Chief Executive | 2003 | | -0- | 357,142 shares |

Officer, Secretary and Director | 2002 | | -0- | 630,397 shares |

| | | | |

Dr. Frank Castanaro | 2004 | $ | -0- | 0 |

Secretary and Director | 2003 | | -0- | 0 |

| 2002 | | -0- | 0 |

Pursuant to his employment agreement, John H. Treglia is to receive a total of $150,000 per year. For the fiscal year end February 29, 2004, Mr. Treglia received $37,060 in salary and $25,000 worth of our restricted common stock. Mr. Treglia agreed to waive his rights to the balance of $87,940 owed to him under his employment agreement.

36

ITEM NO. 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth information as of June 10, 2004, with respect to the persons known to us to be the beneficial owners of more than 5% of our common stock, $.10 par value.

PRINCIPAL SHAREHOLDERS

We know of no person, other than those listed in the Management’s Shareholdings Table, below, who owns more than 5% of our common stock. The following table sets forth information as of June 10, 2004, with respect to the beneficial ownership of our common stock, $.10 par value, of each of our executive officers and directors and all executive officers and directors as a group:

PRINCIPAL SHAREHOLDERS TABLE

Title

Of

Beneficial

Owner | Name and

Address of

Beneficial

Ownership | Amount and

Nature of

Class | Percent of

Class |

| | | |

Common | Carlyn A. Barr (1)

13-44 Henrietta Court

Fair Lawn, NJ 07410 | 2,837,026 | 23.35% |

| | | |

Common | Park Avenue Health Care Management

One North Lexington Avenue

White Plains, New York 10601 | 1,200,000 | 9.88% |

| | | |

Common | Dr. Frank J. Castanaro

71 Bradford Boulevard

Yonkers, NY 10710 | 733,000 | 6.03% |

(1) Carlyn A. Barr is the wife of John H. Treglia. John Treglia has disavowed any interest in the shares of common stock owned by Ms. Barr.

Security Ownership of Management

The following table sets forth information as of June 10, 2004, with respect to the shareholdings of the Company’s executive officers and directors.

37

Title

Of

Beneficial

Owner | Name and

Address of

Beneficial

Ownership | Amount and

Nature of

Class (1) | Percent of

Class |

| | | |

Common | John H. Treglia

13-44 Henrietta Court

Fair Lawn, NJ 07410 | 0 | 0 |

| | | |

Common | Dr. Frank J. Castanaro

71 Bradford Boulevard

Yonkers, NY 10710 | 733,000 | 6.03% |

| | | |

Common | All directors and

officers as a group

(2 persons) | 733,000 | 6.03% |

Pursuant to the rules of the Securities and Exchange Commission, shares of our common stock, which an individual or member of a group has a right to acquire within 60 days pursuant to the exercise of options or warrants, are deemed to be outstanding for the purpose of computing the ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Accordingly, where applicable, each individual or group member’s rights to acquire shares pursuant to the exercise of options or warrants are noted below.

Medical and Professional Advisory Board

We have formed a Medical and Professional Advisory Board which consists of individuals with experience and expertise in otolaryngology, audiology, geriatric care (both medical and psychological), and new hearing aid product developments. The purpose of establishing this advisory board was to assist us with any complex questions or issues which may arise in connection with their fields of expertise. W we consult with the members with respect to current developments in their fields of expertise and, where appropriate, for advice respecting our business strategy.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The following is a description of any transactions during the fiscal year ended February 29, 2004 or any presently proposed transactions, to which we were, or are, to be a party, in which the amount involved in such transaction (or series of transactions) was $60,000 or more and which any of the following persons had or is to have a direct or indirect material interest: (ii) any of our directors or executive officers; (ii) any person who owns or has the right to acquire 5%or more of our issued and outstanding common stock; and (iii) any member of the immediate family of any such persons. Current management is not aware of any requirements, which may have been in effect prior to January 2000, with respect to the approval of related transactions by independent directors. Because of its current limited management resources, the company does not presently

38

have any requirement respecting the necessity for independent directors to approve transactions with related parties. All transactions are approved by the vote of the majority, or the unanimous written consent, of the full board of directors. All member so the board of directors all members of the board of directors, individually and/or collectively, could have possible conflicts of interest with respect to transactions with related parties.

Employment Agreement with John H. Treglia

On April 3, 2000, we entered into an employment agreement with John H. Treglia, our President and CEO. The agreement provides for an annual salary in the amount of $150,000 and a term of three years. On April 3, 2003 we entered into an amendment to such employment agreement extending the terms of the agreement for an additional five years based on the same terms and conditions. Mr. Treglia has agreed to waive the right to be paid in cash until, in the opinion of the board of directors, we have sufficient financial resources to make such payments. Inlieu of cash salary payments, Mr. Treglia may accept shares of common stock at, or at a discount from the market price. His agreement provides for the possibility of both increases in salary and the payment of bonuses at the sole discretion of the board of directors, participation in any pension plan, profit-sharing plan, life insurance, hospitalization of surgical program or insurance program adopted by us (to the extent that the employee is eligible to do so under the provisions of such plan or program), reimbursement of business related expenses, for the non-disclosure of information which we deem to be confidential to it, for non-competition with us for the two-year period following termination of employment with us and for various other terms and conditions of employment. We do not intend to provide any of our employees with medical, hospital or life insurance benefits until our board of directors determines that we have sufficient financial resources to do so.

ITEM 14. PRINCIPAL ACCOUNTANTING FEES AND SERVICES

Audit Fees

For the Company’s fiscal year ended February 29, 2004, we were billed approximately $12,000 for professional services rendered for the audit of our financial statements. We also were billed approximately $3,000 for the review of financial statements included in our periodic and other reports filed with the Securities and Exchange Commission for our year ended February 29, 2004.

Tax Fees

For the Company’s fiscal year ended February 29, 2004, we were billed $2,000 for professional services rendered for tax compliance, tax advice, and tax planning.

All Other Fees

The Company did not incur any other fees related to services rendered by our principal accountant for the fiscal year ended February 29, 2004.

39

ITEM 15. - EXHIBITS AND REPORTS ON FORM 8K

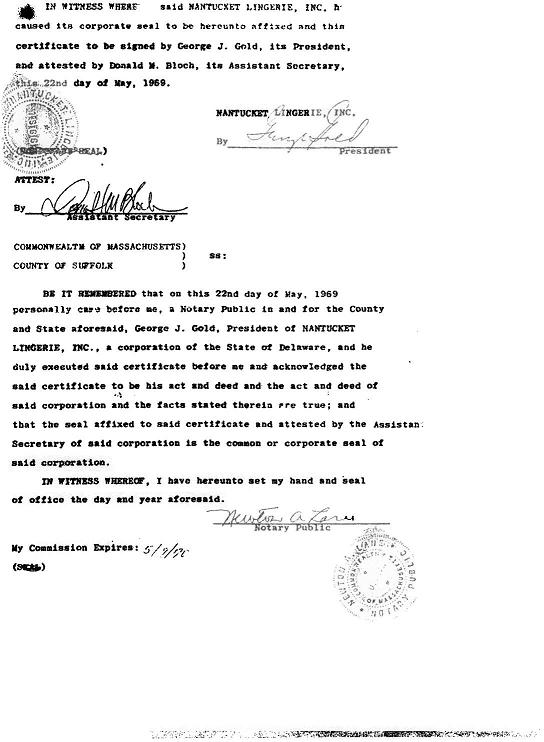

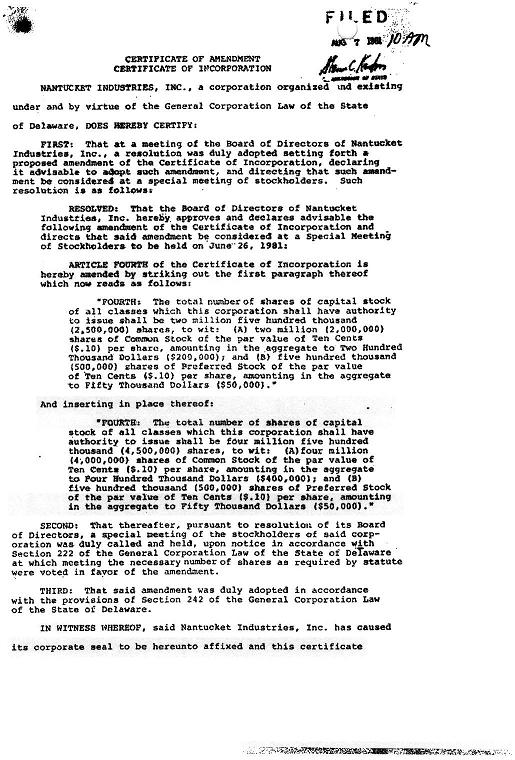

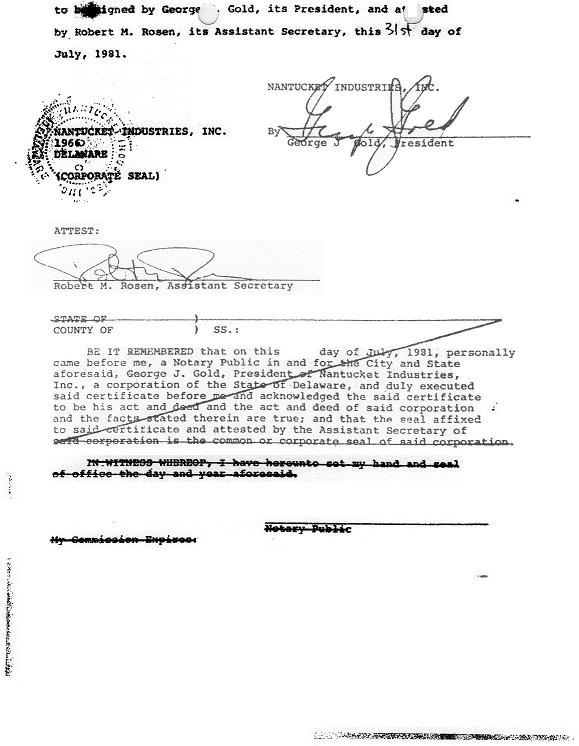

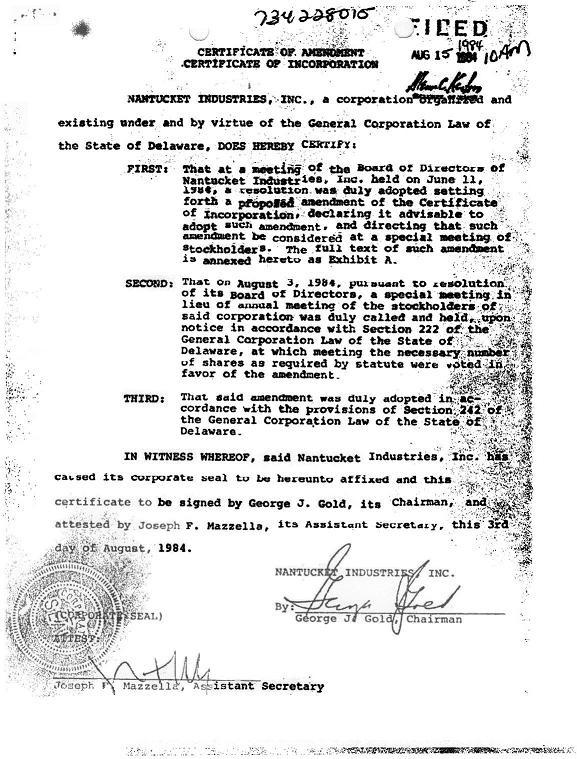

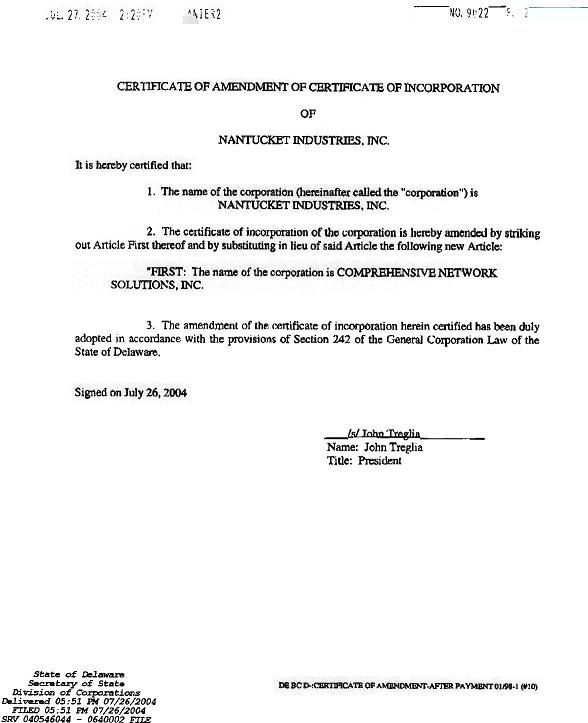

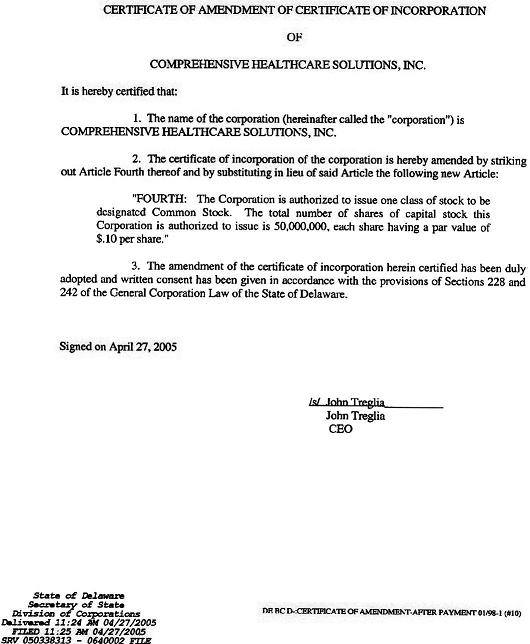

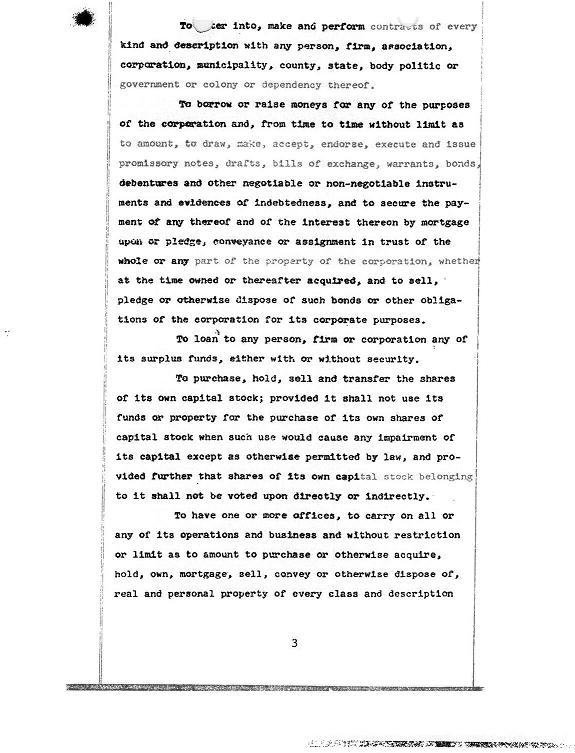

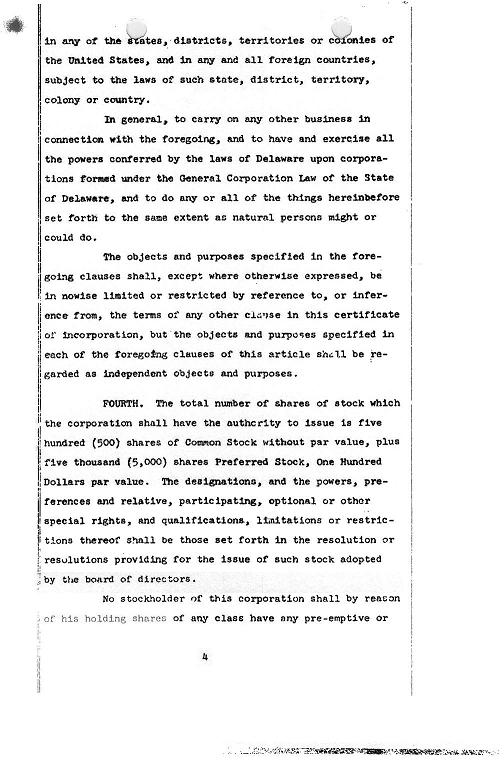

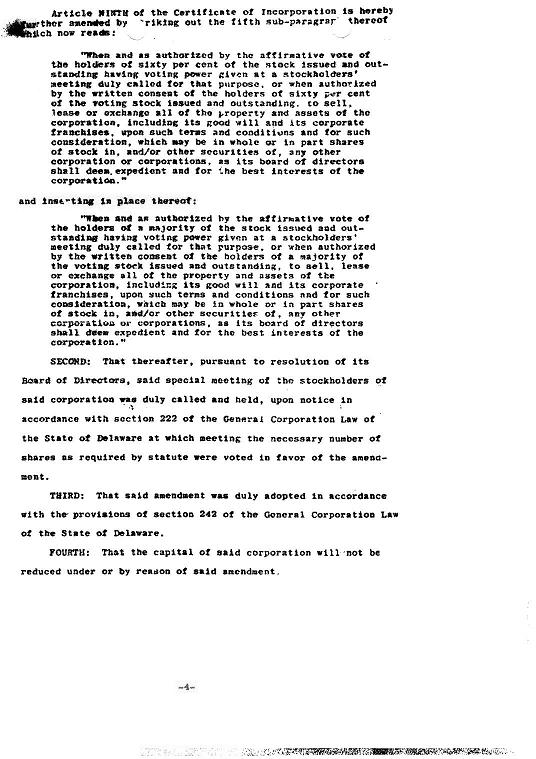

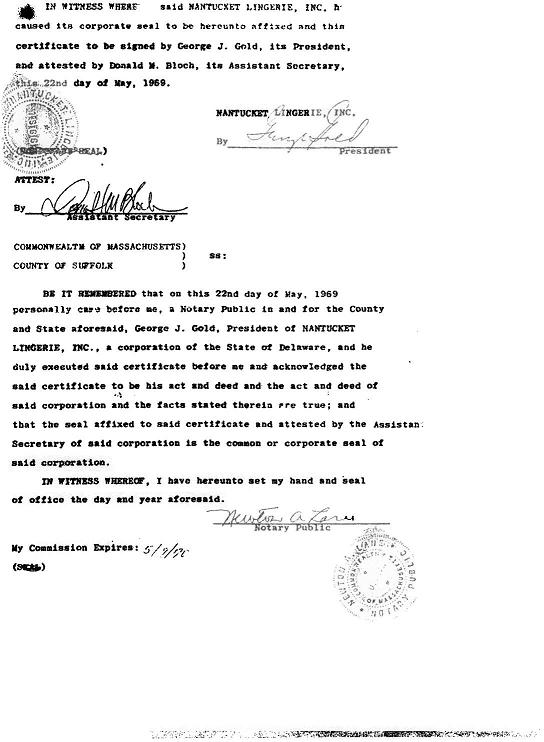

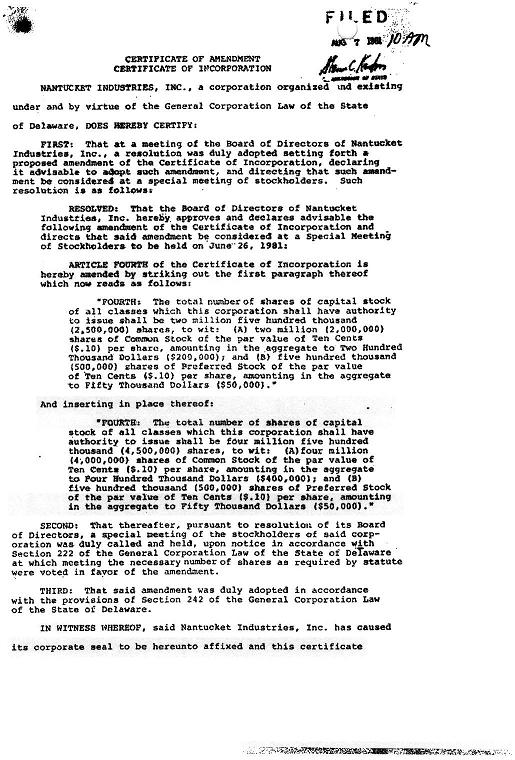

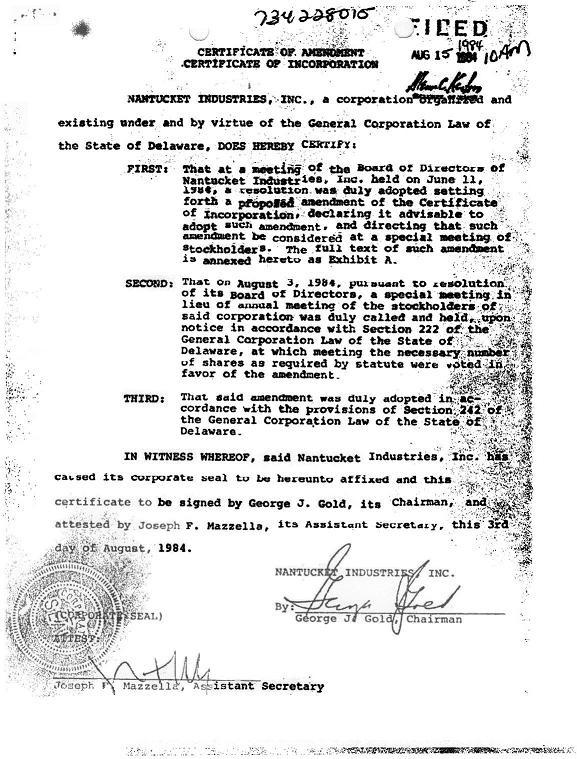

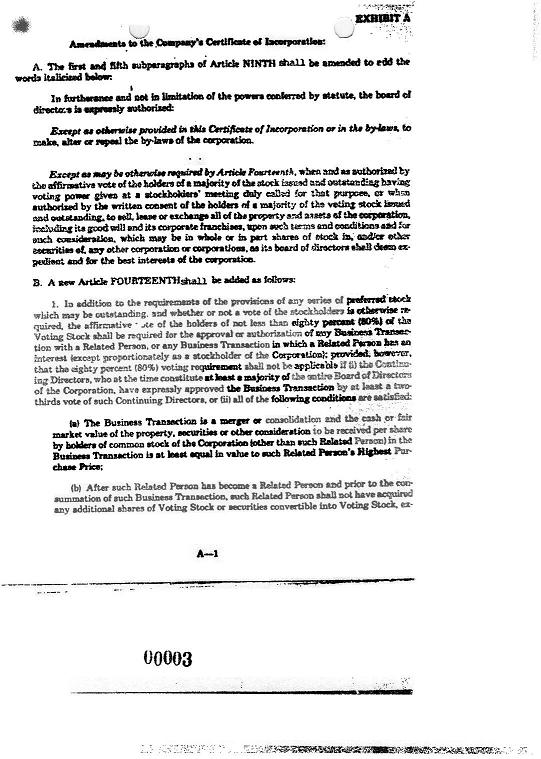

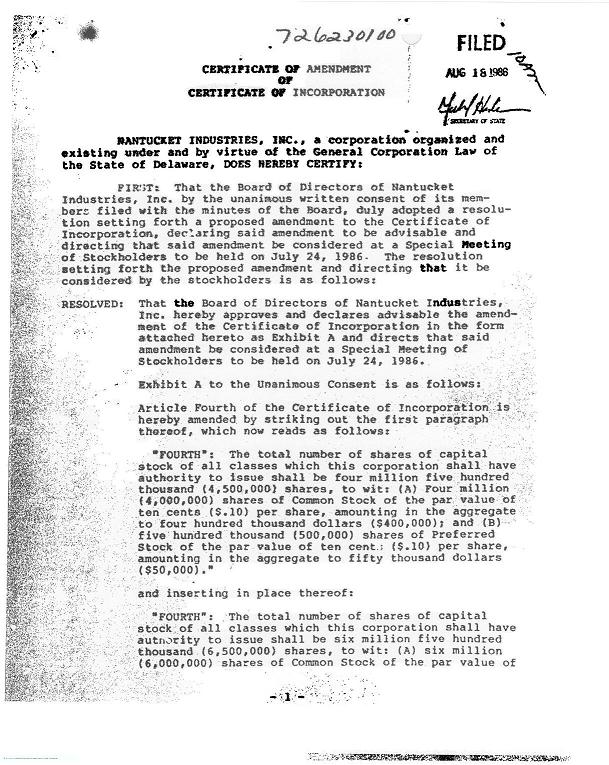

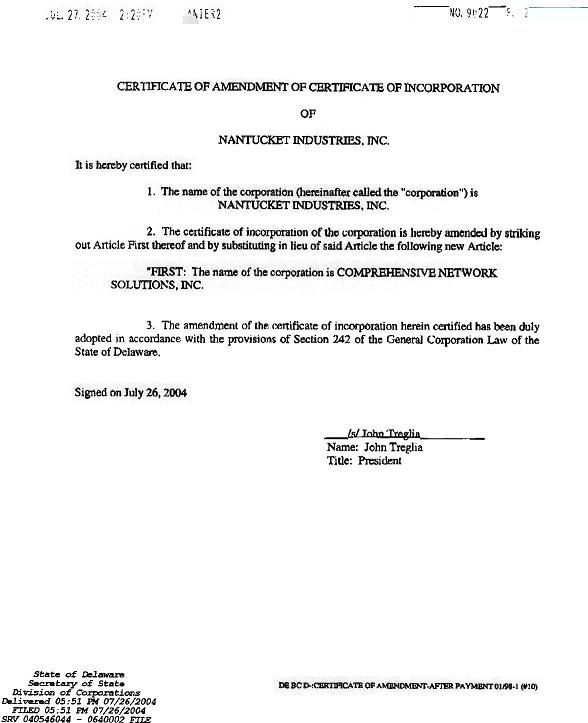

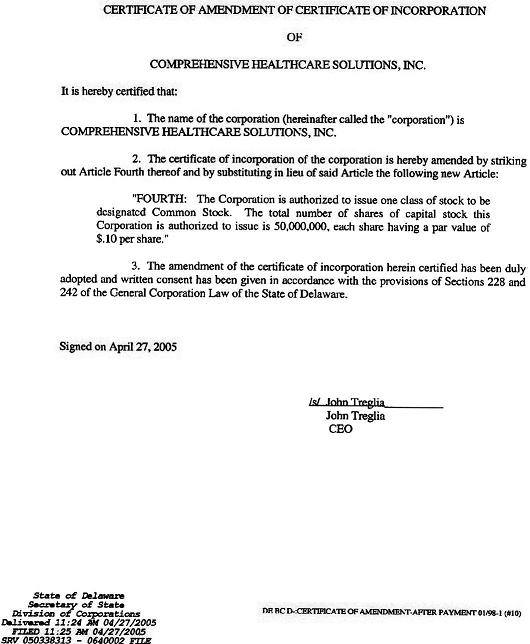

3.1 – Certificate of Incorporation and amendments | |

3.2 – Bylaws | |

10.1 – Joint Venture Agreement with Alliance Healthcare, Inc. |

10.2 – Joint Marketing Agreement with Thesco benefits, LLC | |

31.1 – 302 Certification of Chief Executive Officer and Chief Financial Officer | |

32.1 – 906 Certification of Chief Executive Officer and Chief Financial Officer | |

| | | |

(b) | Reports of Form 8-K filed in fourth quarter of the fiscal year: |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Yonkers, State of New York.

COMPREHENSIVE HEALTHCARE SOLUTIONS, INC. |

September 23, 2005 | By: | /s/ John H. Treglia | |

| John H. Treglia, President, Director and CEO |

| By: /s/ Frank Castanaro | |

September 23, 2005 | Dr. Frank Castanaro, Secretary and Director |

| | |

40

BYLAWS

OF

NANTUCKET INDUSTRIES, INC.

ARTICLE I

BUSINESS OFFICES

1.1 Office Nantucket Industries, Inc. (the “Corporation”) shall have such offices as its business may require within or without the State of Delaware.

ARTICLE II

REGISTERED OFFICES AND REGISTERED AGENT

The address of the registered office in the State of Delaware and the name of the registered agent of the Corporation at such address are set forth in the Articles of Incorporation. The Corporation may, from time to time, designate a different address as its registered office or a different person as its registered agent, or both; provided, however, that such designation shall become effective upon the filing of a statement of such change with the Department of State of the State of Delaware as required by law.

In the event the Corporation desires to qualify to do business in one or more states other than Delaware, the Corporation shall designate the location of the registered office or location of the registered or resident agent in each such state and designate the registered or resident agent for service of process at such address in the manner provided by the law of the state in which the Corporation elects to be qualified.

| ARTICLE III | |

SHAREHOLDERS MEETINGS |

| | |

Meetings of the shareholders shall be held at the principal office of the Corporation unless another place (within or without the State of Delaware) is designated in the notice of the meeting.

An annual meeting of the shareholders shall be held on the last Monday of each June, or on such other day as the board of directors may from time to time determine, at a time and place designated by the board of directors, for the election of directors and for the transaction of other business.

Special meetings of the shareholders shall be convened if called by the president or the board of directors, or if requested in writing by the holders of not less than one-tenth (1/10) of all the shares entitled to vote at the meeting. The call for the meeting shall be issued by the secretary, unless the president, board of directors or shareholders requesting the meeting shall designate another person to do so.

Written notice stating the place, day, and hour of the meeting and, in the case of a special meeting, the purpose or purposes for which the meeting is called, shall be delivered to each shareholder of record entitled to vote at such meeting not less than ten (10) nor more than sixty (60) days before the date named for the meeting, either personally or by first-class United States mail, by or at the direction of the president, the secretary, or the officer or persons calling the meeting, unless other notice provisions are required by law in a particular case. If mailed, such notice shall be deemed to be delivered when deposited in the United States mail addressed to the shareholder at that shareholder’s address as it appears on the stock transfer books of the Corporation, with postage thereon prepaid.

3.5. | Notice of Adjourned Meetings |

When a meeting is adjourned to another time or place, it shall not be necessary to give any notice of the adjourned meeting if the time and place to which the meeting is adjourned are announced at the meeting at which the adjournment is taken, and any business may be transacted at the adjourned meeting that might have been transacted on the original date of the meeting. If, however, after the adjournment the board of directors fixes a new record date for the adjourned meeting, a notice of the adjourned meeting shall be given as provided in paragraph 3.4 above, to each shareholder of record on the new record date who is entitled to vote at such meeting.

Whenever notice is required to be given to any shareholder, a waiver thereof in writing, signed by the person or persons entitled to such notice, whether signed before, during, or after the time stated in the waiver, shall be the equivalent of the giving of such notice. Attendance of a person at a meeting shall constitute a waiver of notice of such meeting, except when the person attends a meeting for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened. Neither the business to be transacted at, nor the purpose of, any regular or special meeting of the shareholders need be specified in the written waiver of notice.

3.7. | Closing of Transfer Books and Fixing Record Date |

The board of directors may close the stock transfer books of the Corporation or otherwise make a determination of shareholders for any purpose, in accordance with the

provisions of the Delaware Statutes.

3.8. | Record of Shareholders Having Voting Rights |

If the Corporation shall have more than five (5) shareholders, the officer or agent having charge of the stock transfer books for shares of the Corporation shall make, at least ten (10) days before each meeting of shareholders, a complete list of the shareholders entitled to vote at such meeting or any adjournment thereof, with the address of, and the number and class and series, if any, of shares held by, each. The list, for a period of ten (10) days prior to such meeting, shall be kept on file at the registered office of the Corporation, at the principal place of business of the Corporation, or at the office of the transfer agent or registrar of the Corporation; and any shareholder shall be entitled to inspect the list at any time during usual business hours. The list shall also be produced and kept open at the time and place of the meeting and shall be subject to the inspection of any shareholder at any time during the meeting. If the requirements of this section have not been substantially complied with, then on demand of any shareholder in person or by proxy, the meeting shall be adjourned until there has been compliance with the requirements. If no such demand is made, failure to comply with the requirements of this section shall not affect the validity of any action taken at such meeting.

The holders of a majority of the shares entitled to vote, represented in person or by proxy, shall constitute a quorum at a meeting of shareholders. When a specified item of business is required to be voted on by a class or series of stock, the holders of a majority of the shares of such class or series shall constitute a quorum for the transaction of such item of business by that class or series. If a quorum is present at a properly held meeting of the shareholders, the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the subject matter under consideration, shall be the act of the shareholders, unless the vote of a greater number or voting by classes (i) is required by the Articles of Incorporation, or (ii) has been provided for in an agreement among all shareholders entered into pursuant to and enforceable under the Section 216 of the Delaware General Corporation Law. After a quorum has been established at a shareholders meeting, the subsequent withdrawal of shareholders or their proxies, reducing the number of shares represented and entitled to vote at the meeting below the number required for a quorum, shall not affect the validity of any action taken at the meeting or any adjournment thereof.

Every shareholder entitled to vote at a meeting of shareholders or to express consent or dissent without a meeting, or a shareholder’s duly authorized attorney-in-fact, may authorize another person or persons to act for that shareholder by proxy in accordance with the provisions of Section 212 of the Delaware General Corporation Law.

3.11. | Action by Shareholders Without a Meeting |

Shareholder action may be taken by written consent in lieu of a meeting in accordance with the provisions of Section 228 of the Delaware General Corporation Law.

Except as otherwise provided in Section 141 of the Delaware General Corporation Law or in the Articles of Incorporation, all corporate powers shall be exercised by or under the authority of, and the business and affairs of the Corporation shall be managed under the direction of, the board of directors.

Directors need not be residents of Delaware or shareholders of the Corporation; however, each director shall meet such qualifications as may be set forth in the Articles of Incorporation and in the laws of the State of Delaware.

The board of directors shall have authority to fix the compensation of directors. Nothing herein contained shall be construed to preclude any director from serving the Corporation in any other capacity and receiving compensation therefor.

The number of directors shall no more that ten (10) and no less than one (1), regardless of the number of shareholders, such number may be increased or decreased from time to time by amendment to these Bylaws or the articles of incorporation or by the board of directors or the shareholders of the Corporation.

4.5.1. Each person named in the Articles of Incorporation as a member of the initial board of directors shall hold office until the first annual meeting of shareholders and until his successor shall have been elected and qualified or until his earlier resignation, removal from office, or death.

4.5.2. At the first annual meeting of shareholders and at each annual meeting thereafter, the shareholders shall elect directors to hold office until the next succeeding annual meeting. Each director shall hold office for the term for which he is elected and until his successor shall have been elected and qualified, or until his earlier resignation, removal from office, or death.

Any director, or the entire board of directors, may be removed, with or without cause, at a meeting of the shareholders called expressly for that purpose, in accordance with the provisions of Section 141 of the Delaware General Corporation Law.

Any vacancy occurring in the board of directors, including any vacancy created by reason of an increase in the number of directors, may be filled by the affirmative vote of a majority of the remaining directors, though less than a quorum of the board of directors.

A majority of the number of directors fixed in accordance with these Bylaws shall constitute a quorum for the transaction of business. Subject to other provisions of these Bylaws, the act of the majority of the directors present at a meeting at which a quorum is present shall be the act of the board of directors. If at any meeting of the board of directors there shall be less than a quorum present, a majority of those present may adjourn the meeting from time to time until a quorum is obtained. Notice of any such adjourned meeting shall be given to the directors who were not present at the time of the adjournment and, unless the time and place of the adjourned meeting were announced at the time of the adjournment, to the other directors.

4.9. | Executive and Other Committees |

4.9.1. The board of directors, by resolution adopted by a majority of the full board of directors, may designate from among its members an Executive Committee and one or more other committees, each of which, to the extent provided in such resolution, shall have and may exercise all the authority of the board of directors, as limited by Section 142 of the Delaware General Corporation Law.

4.9.2. The board of directors, by resolution adopted in accordance with paragraph 4.9.1 above, may designate one or more directors as alternate members of any such committee, who may act in the place and stead of any absent member or members at any meeting of such committee.

Regular or special meetings of the board of directors may be held within or without the State of Delaware.

4.11. | Time, Notice and Call of Meetings |

4.11.1. Regular meetings of the board of directors shall be held immediately following the annual meeting of shareholders each year; regular meetings may be held at such other times as the board of directors may fix; special meetings may be held at such times as called by the chairman of the board, the president of the Corporation or any two directors.

Written notice of the time and place of special meetings of the board of directors shall be given to each director by personal delivery or by first-class United States mail, telegram, or cablegram at least two (2) days before the meeting.

4.11.2. Notice of a meeting of the board of directors need not be given to any director who signs a waiver of notice either before, during or after the meeting. Attendance of a director at a meeting shall constitute a waiver of notice of such meeting and a waiver of any and all objections to the place of the meeting, the time of the meeting, or the manner in which it has been called or convened, except when a director states, at the beginning of the meeting, any objection to the transaction of business because the meeting is not lawfully called or convened.

4.11.3. Members of the board of directors may participate in a meeting of such board by conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other at the same time. Participation by such means shall constitute presence in person at a meeting.

4.12. | Action Without a Meeting |

Any action which is required to be taken, or which may be taken, at a meeting of the directors or a committee thereof, may be taken without a meeting if a consent in writing, setting forth the action so to be taken, signed by all the directors, or all the members of the committee, as the case may be, is filed in the minutes of the proceedings of the directors or of the committee. Such consent shall have the same effect as a unanimous vote.

4.13. | Director Conflicts of Interest |

4.13.1. No contract or other transaction between the Corporation and one or more of its directors or any other corporation, firm, association, or entity in which one or more of its directors are directors or officers or are financially interested, shall be either void or voidable because of such relationship or interest, or because such director or directors are present at the meeting of the board of directors or a committee thereof which authorizes, approves, or ratifies such contract or transaction, or because his or their votes are counted for such purpose, if: (i) the fact of such relationship or interest is disclose or known to the board of directors or committee which authorizes, approves, or ratifies the contract or transaction by a vote or consent sufficient for the purpose without counting the votes or consents of such interested directors; or (ii) the fact of such relationship or interest is disclosed or known to the shareholders entitled to vote and they authorize, approve, or ratify such contract or transaction by vote or written consent; or (iii) the contract or transaction is fair and reasonable as to the Corporation at the time it is authorized by the directors, a committee, or the shareholders.

4.13.2. Common or interested directors may be counted in determining the presence of a quorum at a meeting of the board of directors or a committee thereof which authorizes, approves, or ratifies such contract or transaction.

The board of directors shall determine from time to time the offices of the Corporation, which may consist of chairman of the board, president, any number of vice presidents, a secretary, assistant secretary (ies), a treasurer, assistant treasurer(s), and such other offices as may be determined from time to time by the board of directors. Any two or more offices may be held by the same person. The officers shall be elected by the board of directors and shall meet such qualifications as shall be determined by the board of directors under the authority of the Articles of Incorporation and of the laws of the State of Delaware.

Except as may be modified from time to time by the board of directors, the powers and duties of the officers shall be as follows:

5.2.1. The chairman of the board shall preside at all meetings of shareholders and of the board of directors, and shall have the powers and perform the duties usually pertaining to such office, and shall have such other powers and perform such other duties as may be from time to time prescribed by the board of directors.

5.2.2. The president shall be the chief executive officer of the Corporation, and shall have general and active management of the business and affairs of the Corporation, under the direction of the board of directors. Unless the board of directors has appointed another presiding officer, the president shall preside at all meetings of the shareholders.

5.2.3. Vice presidents shall have such powers and perform such duties as usually pertain to such office or as are properly required of him by the board of directors. In the absence or disability of the president, the vice president(s) (in order of their seniority) shall perform the duties and exercise the powers of the president.

5.2.4. The secretary shall have custody of, and maintain, all the corporate records except the financial records, and shall record the minutes of all meetings of the shareholders and the board of directors and its committees, send all notices of meetings, and perform such other duties as may be prescribed by the board of directors or the president.

5.2.5. The treasurer shall have custody of all corporate funds and financial records, shall keep full and accurate accounts of receipts and disbursements and render accounts thereof at the annual meetings of shareholders and whenever else required by the board of directors or the president, and shall perform such other duties as may be prescribed by the board of directors or the president.

5.2.6. The assistant secretary(ies), assistant treasurer(s), and other assistant officers may exercise, subject to supervision by the officer for whom they act as assistant(s),

except as otherwise provided for by the board of directors, the powers and duties that pertain to such offices respectively and any such other powers and duties which may be delegated to them.

Unless otherwise provided at the time of his election, each person named as an officer of the Corporation by the board of directors shall hold office until the meeting of the board of directors following or concurrent with the next succeeding annual meeting of the shareholders, and until his successor shall have been elected and qualified; or until his earlier resignation, removal from office, or death.

Any officer or agent elected or appointed by the board of directors may be removed by the board of directors whenever, in its judgment, the best interests of the Corporation will be served thereby.

Any vacancy, however occurring, in any office may be filled by the board of directors.

ARTICLE VI

STOCK CERTIFICATES

The Corporation may issue shares of stock authorized by and in accordance with its Articles of Incorporation, as same may be amended from time to time, and none other. Shares may be issued originally only pursuant to a resolution adopted by the board of directors. No shares may be validly issued or transferred in violation of any provision of these Bylaws or in violation of any agreement, to which the Corporation is a party, respecting the issuance or transfer of shares.

Every holder of shares in the Corporation shall be entitled to have a certificate representing all shares to which that holder is entitled. No certificate shall be issued for any share until such share is fully paid.

Certificates representing shares in the Corporation shall be signed by the president or a vice president and the secretary or an assistant secretary or by such other officers as may be designated from time to time by the board of directors and may be sealed with the seal of the Corporation or a facsimile thereof. The signatures of the president or vice president and the secretary or an assistant secretary or other designated officer may be facsimiles if the certificate

is manually signed on behalf of a transfer agent or a registrar other than the Corporation or an employee of the Corporation.

Each certificate representing shares shall state upon the face thereof: the name of the Corporation; that the Corporation is organized under the laws of Delaware; the name of the person or persons to whom issued; the number and class of shares and the designation of the series, if any, which such certificate represents; and the par value of each share represented by such certificate or a statement that the shares are without par value.

The Corporation shall cancel stock certificates presented to it for transfer and issue and register a new certificate or certificates in the name of a qualified transferee of such shares, if the certificate is properly endorsed by the holder of record or by his duly authorized attorney; provided, however, that the Corporation or its transfer agent may establish other reasonable requirements for transfer, including but not limited to the guarantee of the transferor’s signature by a commercial bank or trust company or by a member of the New York Stock Exchange or of the American Stock Exchange.

6.6. | Lost, Stolen, or Destroyed Certificates |

The Corporation shall issue a new stock certificate duplicating any certificate previously issued, if the holder of record of the certificate: (i) submits proof in affidavit form that it has been lost, destroyed, or wrongfully taken; (ii) requests the issuance of a new certificate, before the Corporation has notice that the certificate has been acquired by a purchaser for value in good faith and without notice of any adverse claim; (iii) gives bond, in such form as the Corporation may direct, to indemnify the Corporation, the transfer agent, and the registrar against any claim that may be made on account of the alleged loss, destruction, or theft of such certificate; and (iv) satisfies any other reasonable requirements imposed by the Corporation.

ARTICLE VII

BOOKS AND RECORDS

7.1.1. The Corporation shall keep correct and complete books and records of account and shall keep minutes of the proceedings of its shareholders, board of directors, and committees of directors.

7.1.2. The Corporation shall keep, at its registered office or principal place of business or at the office of its transfer agent or registrar, a record of its shareholders, giving the names and addresses of all shareholders, and the number, class, and series, if any, of the shares held by each.

7.1.3. Any books, records, and minutes may be in written form or in any other form capable of being converted into written form within a reasonable time.

7.2. | Shareholders’ Inspection Rights |

Shareholders of record shall have the right to examine and make extracts from the books and records of the Corporation to the extent provided in Section 220 of the Delaware General Corporation Law.

7.3. | Financial Information |

Unless modified by resolution of the shareholders not later than four (4) months after the close of each fiscal year, the Corporation shall prepare a balance sheet showing in reasonable detail the financial condition of the Corporation as of the close of its fiscal year, and a profit and loss statement showing the results of the operations of the Corporation during its fiscal year.

ARTICLE VIII

INDEMNIFICATION

Each person (including here and hereinafter, the heirs, executors, administrators, or estate of such person): (i) who is or was a director or officer of the Corporation; (ii) who is or was an agent or employee of the Corporation other than an officer and as to whom the Corporation has agreed to grant such indemnity; or (iii) who is or was serving at the request of the Corporation as its representative in the position of a director, officer, agent or employee of another corporation, partnership, joint venture, trust or other enterprise and as to whom the Corporation has agreed to grant such indemnity; shall be indemnified by the Corporation as of right to the fullest extent permitted or authorized by current or future legislation or by current or future judicial or administrative decision, against any fine, liability, cost or expense, including attorneys’ fees, asserted against him or incurred by him in his capacity as such director, officer, agent, employee, or representative, or arising out of his status as such director, officer, agent, employee or representative. The foregoing right of indemnification shall not be exclusive of other rights to which those seeking an indemnification may be entitled. The Corporation may maintain insurance, at its expense, to protect itself and any such person against any such fine, liability, cost or expense, whether or not the Corporation would have the legal power to directly indemnify him against such liability.

ARTICLE IX

APPLICABLE LAW

These Bylaws shall be construed and enforced in accordance with the laws of the State of Delaware. All references in these Bylaws to Section 109 of the Delaware General Corporation Law and to sections thereof shall refer to such sections as same may be amended from time to time; however, in the event any amendment thereto is not required to be retroactively applied to the Corporation, the board of directors may elect to continue to comply with the provisions theretofore in effect or to comply with the provisions as amended. In the event all the

shareholders enter into an agreement under the provisions of Section 109 of the Delaware General Corporation Law, any provisions of that agreement, which by the terms of the agreement are intended to supersede provisions of these Bylaws that are inconsistent therewith, as well as provisions of the Articles of Incorporation, shall govern and shall supersede these Bylaws.

ARTICLE X

AMENDMENT

These Bylaws may be repealed or amended, and new Bylaws may be adopted, by either the board of directors or the shareholders, but the board of directors may not amend or repeal any Bylaw adopted by shareholders if the shareholders specifically provide that such Bylaw is not subject to amendment or repeal by the directors.

JOINT VENTURE AGREEMENT

Between

Comprehensive Healthcare Solutions, Inc.

and

Alliance HealthCard, Inc.

This Joint Venture Agreement is made and entered into as of December 18, 2004, (“Effective Date”) by and between Comprehensive Healthcare Solutions, Inc. (“Comprehensive”), with offices at 45 Ludlow Street, Suite 602, Yonkers, New York 10705 and Alliance HealthCard, Inc. (“Alliance”), with offices at 3500 Parkway Lane, Suite 720, Norcross, GA 30092.

WHEREAS, Comprehensive specializes in creating, marketing, and distributing healthcare savings programs, services, and products, and presently has its common stock quoted on the OTC Bulletin Board (CMHS), and

WHEREAS, Alliance specializes in creating, marketing, fulfilling, servicing and distributing value added healthcare savings programs, services, and products and presently has its common stock quoted on the OTC Bulletin Board (ALHC), and

WHEREAS, Comprehensive and Alliance are desirous of entering into a joint venture relationship, to be designated by the parties, in order to create, market, fulfill, service and distribute value added healthcare savings programs, services, and products as set forth herein.

WITHNESSETH

In consideration of the mutual covenants set forth herein, the parties hereto hereby agree to the following:

1. | Neither party will give up any benefits or responsibilities for any contractual relationship in existence prior to date of “joint venture” unless expressly agreed to by both parties to this agreement as being mutually beneficial to the joint venture; |

2. | Comprehensive will be responsible for the marketing of the joint venture products and services to entities including but not limited to associations, retail outlets, brokers, unions, employers, franchises, as well as any corporate opportunities to the joint venture. It is agreed that all contracts shall be executed by the joint venture and agreed to by both parties who will not unreasonably withhold their consent to the contracts; |

3. | Alliance’s responsibility will be to provide access to quality networks, all currently under contract and all future contracts, and back office service and fulfillment. This will include but not be limited to providing to the joint venture and Comprehensive can review all signed contracts and including all their terms and conditions; |

4. | The purpose of items 1 thru 3 above is to establish each parties responsibilities to closing sales contracts that allow the joint venture to negotiate in good faith and to price each contract to be saleable and profitable to both Alliance and Comprehensive in its “joint venture” arrangement; |

5. | Alliance will price its services at cost and will provide all back office, fulfillment and service for any contracts signed during the term of this arrangement (“joint venture”); Each contract will be priced according to it’s individual costs. |

6. | Comprehensive will contribute all proceeds of these contracts net of any direct costs to the joint venture. The parties agree to set the shared percentage of margins and profits from the proceeds from the sales under this joint venture, net of any direct costs to each party, when the intial pricing for each contract is established by the parties. The parties agree to open a joint bank account controlled by both parties for the sole purpose of holding and distributing the proceeds from these contracts. Any costs for administration of the joint venture shall be borne equally by the parties. The joint venture shall provide to both parties, within fifteen (15) days from the end of each month, a reconcilliation of all funds received and expended by the joint venture and to then share all net profits on each contract equally; |

7. | Comprehensive and Alliance will combine their knowledge and efforts to successfully bring joint venture clients to a close. Both parties agree to the abide by the terms and pricing of each contract used in the creation of the product developed for each contract, neither party will unreasonably withhold access to any agreements to such contracts unless such terms would be detrimental to either party; |

8. | Both parties agree that either party can cancel this Agreement with Cause on thirty (30) days notice based on breach of this agreement by one of the parties. Cause shall be defined as a material breach of the Agreement by either party or if either parties filed for bankrupcty during the term of the Agreement. In the event of a breach of the Agreement, the breaching party shall have thirty (30) days to cure the breach. In the event the joint venture has ongoing contracts at the time of the termination, both parties agree to continue to service these contracts in a professional manner as if the Agreement was still in full force and effect. Once these contracts have been completed, the proceeds will be distributed in the percentages agreed to and the bank account shall be closed. This Agreement can not be terminated without cause; |

9. | The term of this agreement will be for 90 days from the Effective Date of this agreement and is not renewable unless both parties agree to renew. It is the intent of the parties to form a Limited Liability Corporation to replace this agreement. |

10. | During the term of this Agreement, the parties will actively pursue and formulate an appropriate equitable combination of the business relationship into a more formal long term agreement; |

11. | Alliance agrees that it may be required from time to time to participate in sales presentations as applicable. In such event, Alliance shall comply by sending representatives as required at its sole expense and with advanced notice from Comprehensive. As required for marketing, seminars and sales presentations both parties will provide appropriate marketing brochures and sales literature, as well as but not limited to, samples of membership cards as required based upon a clients specific design |

needs. The costs of all the items mentioned in this paragraph will be utilized in the cost calculations outlined in paragraph 5. above;

12. | Both parties agree to execute, at the same time as they execute the agreement, a mutual non-disclosure and non-circumvent agreement which is made part of the agreement as addendum A to the agreement; |

13. | Both parties shall maintain at their own expense general liability insurance in the amount of one million dollars ($1,000,000) per occurrence and annual aggregate; |

14. | Notices: All notices with respect to this agreement will be forwarded to the following addresses: |

Comprehensive HealthCare Solutions, Inc..

45 Ludlow Street, Suite 602

Yonkers, New York, 10705

Attention: John Treglia

Alliance HealthCard, Inc.

3500 Parkway Lane, Suite 720

Norcross, GA 30092

Attention: Robert D. Garces

15. | Governing Laws: This Agreement and the obligations of the parties shall be interpreted, contrued, and enforced in accordance with the law of the State of Delaware; |

16. | Any matters disputed under this Agreement shall be resolved by submission to the American AribtrationAssociation pursuant to the rules therefore and any required hearing thereunder shall be held in a State to be mutually agreed upon by both parties prior to execution of this agreement. Neither party will unreasonably withhold a mutually agreeable venue so as to not hinder execution and implementation. The arbitration decision rendered as a result of any arbitration proceeding shall be binding on the parties hereto. The prevailing party in any arbitration proceeding shall be entitled to reasonable reimbursement for attorneys fees actually incurred, costs and other expenses associated with the arbitration proceeding; |

17. | This agreement may be executed in one or more counterparts, each of which shall for all purposes be deemed to be an original but all of which shall constitute one and the same Agreement; |

18. | Entire Agreement: This Agreement contains the entire agreement among the parties hereto relative to the formation of this joint venture. No variations, modifications or changees herein or hereto shall be binding upon any party unless set forth in a document duly executed by or on behalf of such party; |

19. | Severability: If any provision of this Agreement or the application thereof to any person or circumstance shall be invalid or unenforceable to any extent, the remainder of this |

Agreement and the application of such provisions to other persons or circumstances shall not be affected thereby and shall be enforced to the fullest extent permitted by law;

20. | Both parties warrant that the companys are legally able to enter into this Agreement, that the parties signing on behalf of the companies are legally authorized to do so, and that the trademarks are of legal property of the companies; |

21. | Binding Agreement: Subject to the restrictions on transfers and encumbrances set forth herein, this Agreement shall inure to the benefit of and be binding upon the undersigned parties and their respective representatives, heirs, successors and assigns; and |

22. | Headings: The heading of this Agreement are for convenience only and shall in no wise be deemed part of the terms, convenants or conditions of this Agreement or interpretive of the contents of this Agreement. |

IN WITNESS WHEREOF the parties hereunto have caused this Agreement to be signed by duly authorized representatives as of the day and year first above written.

Comprehensive HealthCare Solutions, Inc. | Alliance HealthCard, Inc. |

s/s Paul Rothman | s/s Robert Garces | |

Paul Rothman, President | Robert Garces, CEO |

| | | |

CERTIFICATION

OF CHIEF EXECUTIVE OFFICER

AND CHIEF FINANCIAL OFFICER

PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 302 OF

THE SARBANES-OXLEY ACT OF 2002

I, John H. Treglia, certify that:

1. | I have reviewed this Amended Form 10-K of Comprehensive Healthcare Solutions, Inc.; |

2. | Based on my knowledge, this amended report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this amended report; |

3. | Based on my knowledge, the financial statements, and other financial information included in this amended report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this amended report; |

4. | The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial amended reporting (as defined in Exchange Act Rules 13-a-15(f) and 15d-15(f)) for the registrant and have: |

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this amended report is being prepared;

(b) Designed such internal control over financial amended reporting, or caused such internal control over financial amended reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial amended reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this amended report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this amended report based on such evaluation; and

(d) Disclosed in this amended report any change in the registrant’s internal control over financing amended reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual amended report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial amended reporting; and

5. | The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial amended reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial amended reporting which are reasonable likely to adversely affect the registrant’s ability to record, process, summarize and amended report financial information; and

(b) Any fraud, whether or not material, that involved management or other employees who have a significant role in the registrant’s internal control over financial amended reporting.

Date: October , 2005 | /s/ John H. Treglia | |

| John H. Treglia | |

| Chief Executive Officer, |

| Chief Financial Officer | |

| | | | |

CERTIFICATE PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 906

OF THE SARBANES-OXLEY ACT OF 2002

In connection with the amended annual Report of Comprehensive Healthcare Solutions, Inc. (the “Company”) on Form 10-K for the year ended February 29, 2004 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, John H. Treglia, Chief Executive Officer and Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

(1) | The Amended Report fully complies with the requirements of section |

| 13(a) or 15(d) of the Securities Exchange Act of 1934; and | |

(2) | The information contained in the Amended Report fairly presents, in |

| all material respect, the financial condition and result of operations | |

| of the Company. | |

| | | |

A signed original of this written statement required by Section 906 has been provided to the Company and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request.

Name: John H. Treglia

Title: Chief Executive Officer and Chief Financial Officer

Date: October , 2005