| | | | | |

| | | OMB APPROVAL |

| | |

|

| | | OMB Number: | | 3235-0059 |

| | | Expires: | | February 28, 2006 |

| | | Estimated average burden

hours per response | 12.75 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. 1)

| |

| | Filed by the Registrant o |

| | Filed by a Party other than the Registrant x |

| |

| | Check the appropriate box: |

| |

| | o Preliminary Proxy Statement |

| | o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | o Definitive Proxy Statement |

| | x Definitive Additional Materials |

| | o Soliciting Material Pursuant to §240.14a-12 |

NDCHealth Corporation

(Name of Registrant as Specified In Its Charter)MMI Investments, L.P.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box):

| |

| | x No fee required. |

| | o Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

| | 1) Title of each class of securities to which transaction applies: |

| |

| | 2) Aggregate number of securities to which transaction applies: |

| |

| | 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | 4) Proposed maximum aggregate value of transaction: |

| |

| | o Fee paid previously with preliminary materials. |

| |

| | o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| | 1) Amount Previously Paid: |

| |

| | 2) Form, Schedule or Registration Statement No.: |

| |

| SEC 1913 (02-02) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| OCTOBER 6th, 2004 THIS PRESENTATION SHOULD BE READ IN CONJUNCTION WITH MMI'S PROXY STATEMENT DATED 9/21/04, WHICH CONTAINS MORE DETAILED DISCUSSION OF A NUMBER OF MATTERS ADDRESSED HEREIN. MMI INVESTMENTS, L.P. PRESENTATION TO INSTITUTIONAL SHAREHOLDER SERVICES IN SUPPORT OF ITS STOCKHOLDER VALUE PROPOSAL AT THE 2004 ANNUAL MEETING OF NDCHEALTH CORPORATION |

| INTRODUCTION MMI Investments is a small-cap value investment fund Founded in 1996 MMI's executives have broad experience in operational management, investment banking and public service Clay B. Lifflander, President & Portfolio Manager Jerome J. Lande, Vice President Craig Rosenblum, Associate We have twice previously appeared before ISS: The Eastern Company, 1997 Simpson Industries, 2000 Focus on value creation for stockholders |

| THE STOCKHOLDER VALUE PROPOSAL "RESOLVED, that due to the prolonged poor performance of the stock and the failure to date of Management's "Eight-Quarter Plan", the stockholders of NDCHealth Corporation (the "Company" or "NDC") hereby request that the Board of Directors engage a leading investment bank to analyze, and provide a written report to the full Board on, all strategic alternatives available to the Company for maximization of stockholder value, including but not limited to acquisitions, divestitures, recapitalizations and sale to or merger with a third-party." |

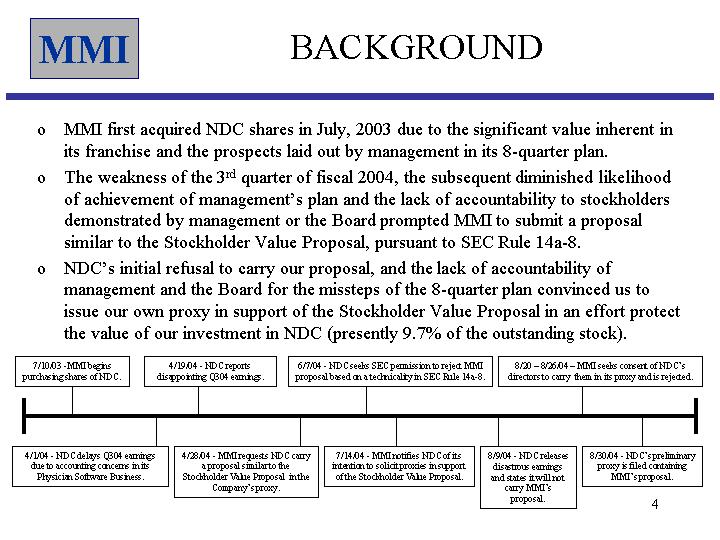

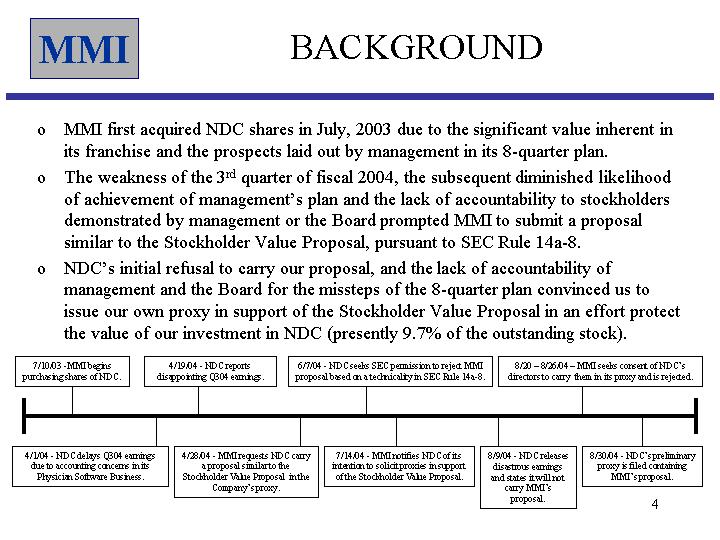

| BACKGROUND MMI first acquired NDC shares in July, 2003 due to the significant value inherent in its franchise and the prospects laid out by management in its 8-quarter plan. The weakness of the 3rd quarter of fiscal 2004, the subsequent diminished likelihood of achievement of management's plan and the lack of accountability to stockholders demonstrated by management or the Board prompted MMI to submit a proposal similar to the Stockholder Value Proposal, pursuant to SEC Rule 14a-8. NDC's initial refusal to carry our proposal, and the lack of accountability of management and the Board for the missteps of the 8-quarter plan convinced us to issue our own proxy in support of the Stockholder Value Proposal in an effort protect the value of our investment in NDC (presently 9.7% of the outstanding stock). 7/10/03 -MMI begins purchasing shares of NDC. 4/1/04 - NDC delays Q304 earnings due to accounting concerns in its Physician Software Business. 4/19/04 - NDC reports disappointing Q304 earnings. 4/28/04 - MMI requests NDC carry a proposal similar to the Stockholder Value Proposal in the Company's proxy. 6/7/04 - NDC seeks SEC permission to reject MMI proposal based on a technicality in SEC Rule 14a-8. 7/14/04 - MMI notifies NDC of its intention to solicit proxies in support of the Stockholder Value Proposal. 8/9/04 - NDC releases disastrous earnings and states it will not carry MMI's proposal. 8/30/04 - NDC's preliminary proxy is filed containing MMI's proposal. 8/20 - 8/26/04 - MMI seeks consent of NDC's directors to carry them in its proxy and is rejected. |

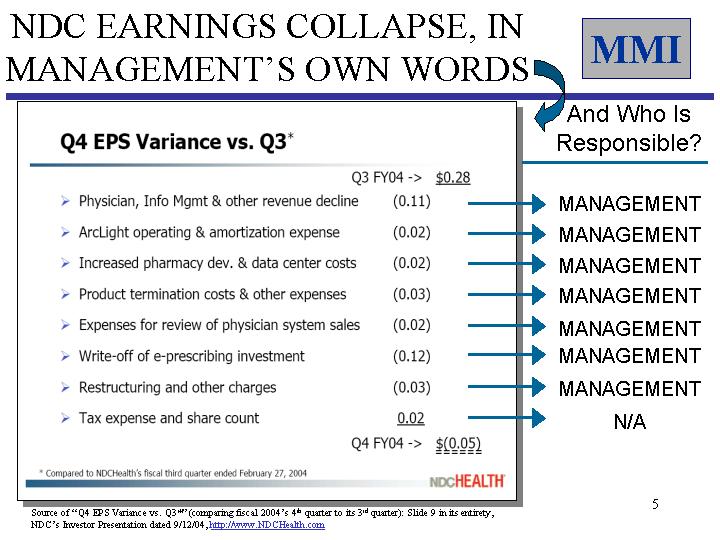

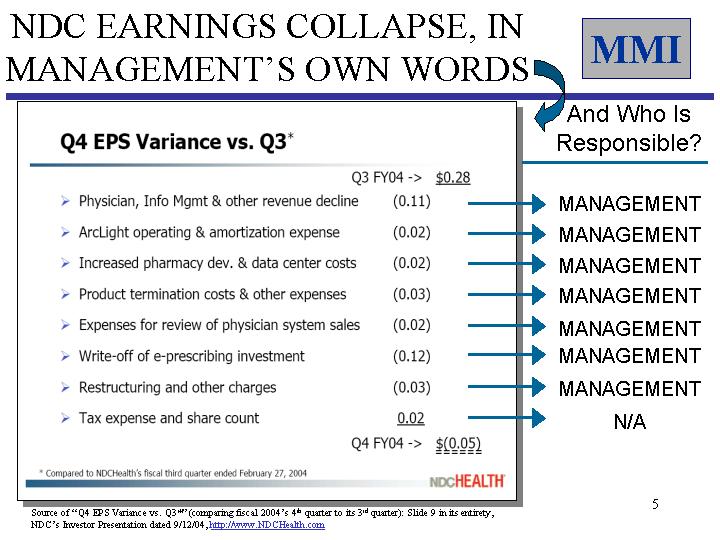

| NDC EARNINGS COLLAPSE, IN MANAGEMENT'S OWN WORDS MANAGEMENT MANAGEMENT MANAGEMENT MANAGEMENT MANAGEMENT MANAGEMENT MANAGEMENT N/A And Who Is Responsible? Source of "Q4 EPS Variance vs. Q3*" (comparing fiscal 2004's 4th quarter to its 3rd quarter): Slide 9 in its entirety, NDC's Investor Presentation dated 9/12/04, http://www.NDChealth.com MMI |

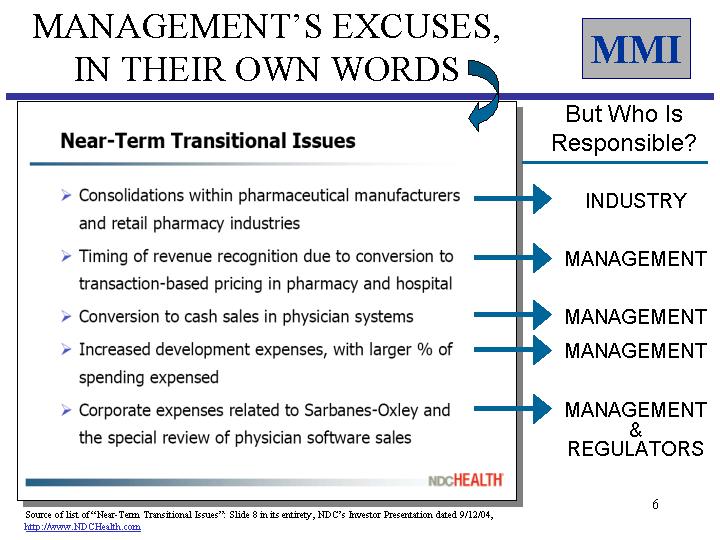

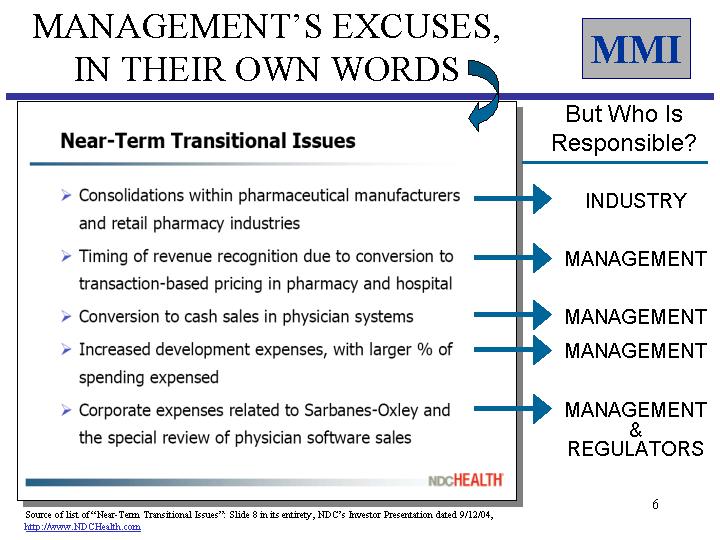

| MANAGEMENT'S EXCUSES, IN THEIR OWN WORDS But Who Is Responsible? INDUSTRY MANAGEMENT MANAGEMENT MANAGEMENT MANAGEMENT & REGULATORS Source of list of "Near-Term Transitional Issues": Slide 8 in its entirety, NDC's Investor Presentation dated 9/12/04, http://www.NDCHealth.com MMI |

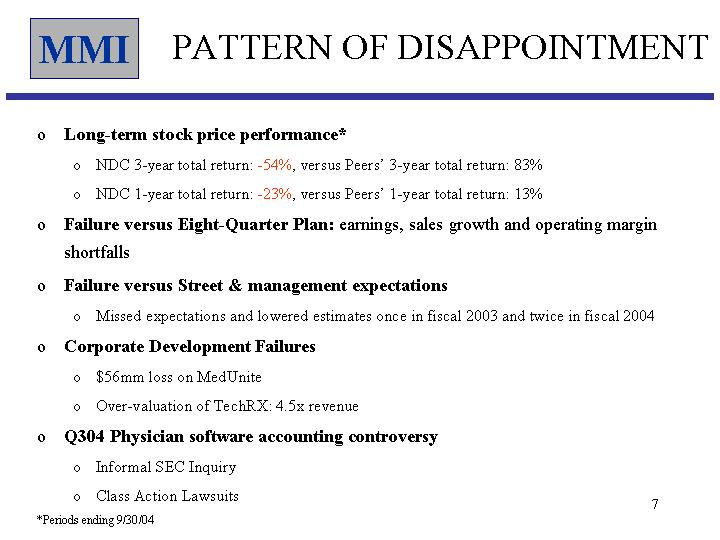

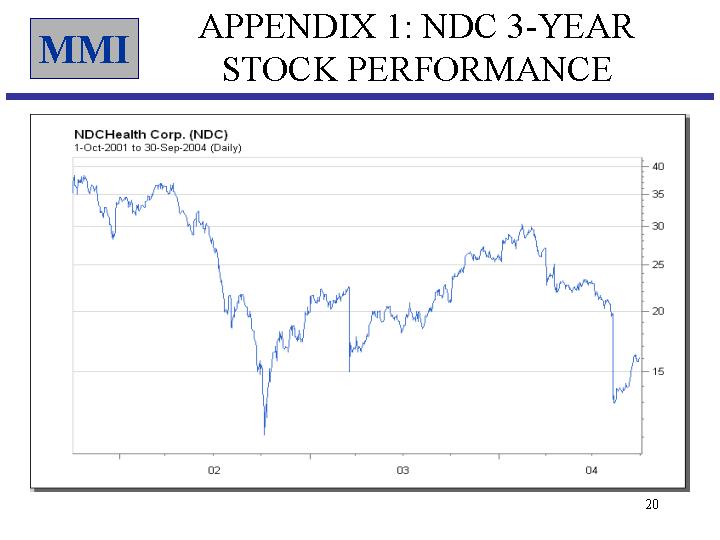

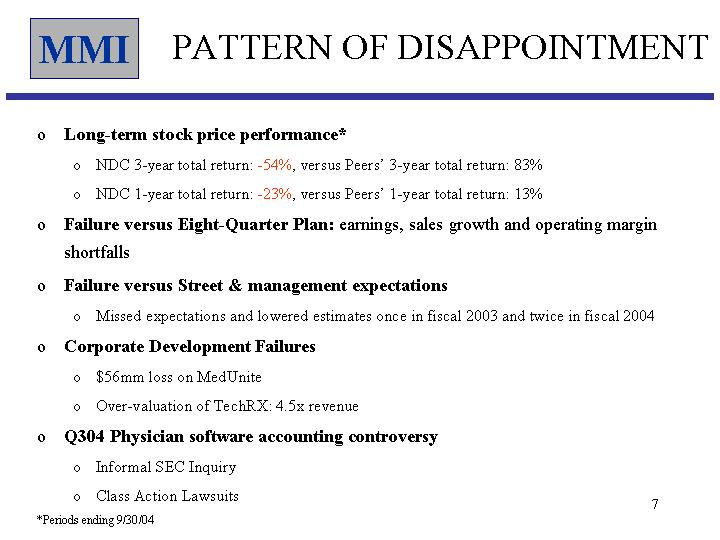

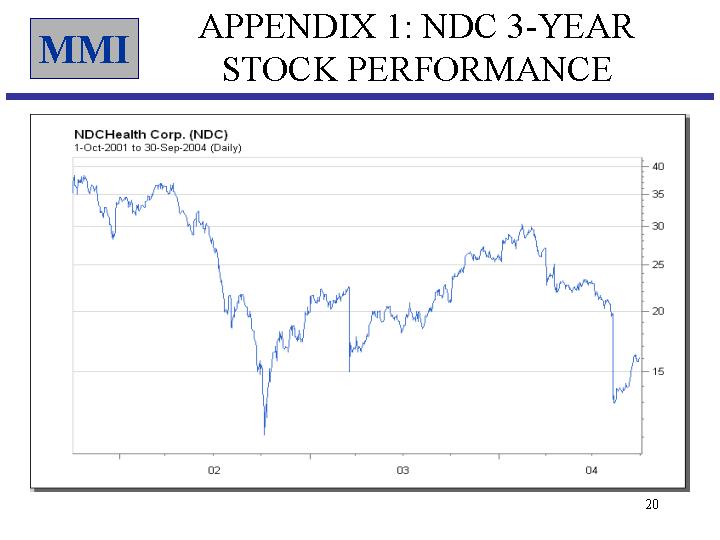

| PATTERN OF DISAPPOINTMENT Long-term stock price performance* NDC 3-year total return: -54%, versus Peers' 3-year total return: 83% NDC 1-year total return: -23%, versus Peers' 1-year total return: 13% Failure versus Eight-Quarter Plan: earnings, sales growth and operating margin shortfalls Failure versus Street & management expectations Missed expectations and lowered estimates once in fiscal 2003 and twice in fiscal 2004 Corporate Development Failures $56mm loss on MedUnite Over-valuation of TechRX: 4.5x revenue Q304 Physician software accounting controversy Informal SEC Inquiry Class Action Lawsuits *Periods ending 9/30/04 |

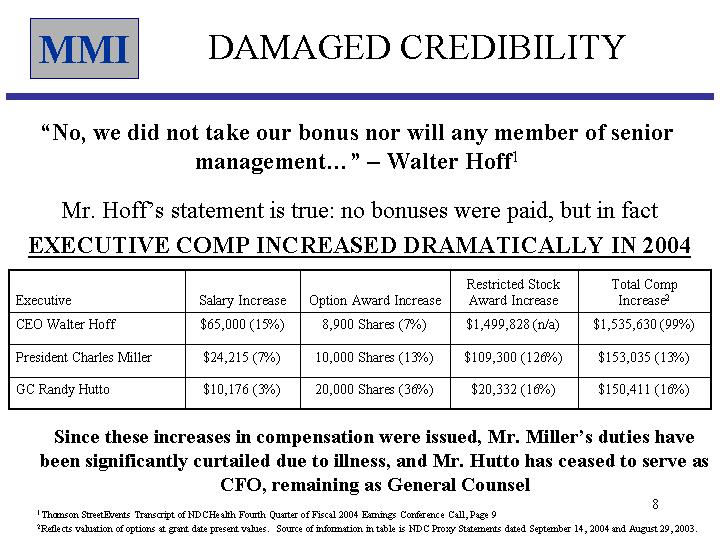

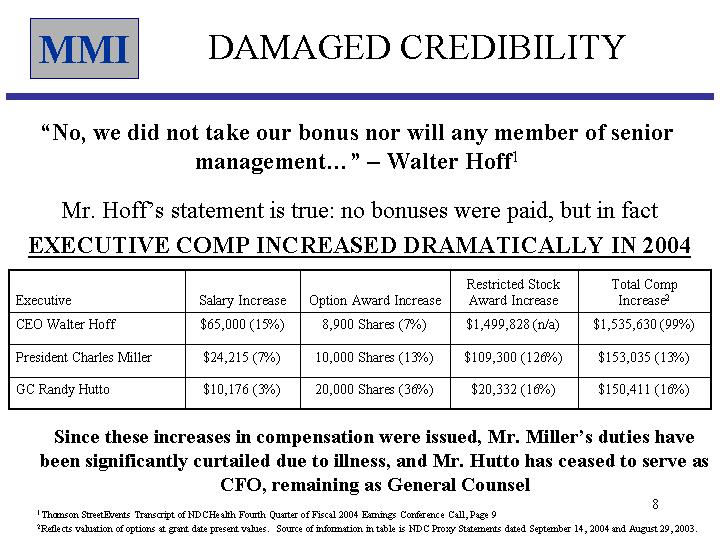

| DAMAGED CREDIBILITY Mr. Hoff's statement is true: no bonuses were paid, but in fact EXECUTIVE COMP INCREASED DRAMATICALLY IN 2004 "No, we did not take our bonus nor will any member of senior management..." - Walter Hoff1 Executive Salary Increase Option Award Increase Restricted Stock Award Increase Total Comp Increase2 CEO Walter Hoff $65,000 (15%) 8,900 Shares (7%) $1,499,828 (n/a) $1,535,630 (99%) President Charles Miller $24,215, (7%) 10,000 Shares (13%) $109,300 (126%) $153,035 (13%) GC Randy Hutto $10,176 (3%) 20,000 Shares (36%) $20,332 (16%) $150,411 (16%) Since these increases in compensation were issued, Mr. Miller's duties have been significantly curtailed due to illness, and Mr. Hutto has ceased to serve as CFO, remaining as General Counsel 1Thomson StreetEvents Transcript of NDCHealth Fourth Quarter of Fiscal 2004 Earnings Conference Call, Page 9 2Reflects valuation of options at grant date present values. Source of information in table is NDC Proxy Statements dated September 14, 2004 and August 29, 2003. |

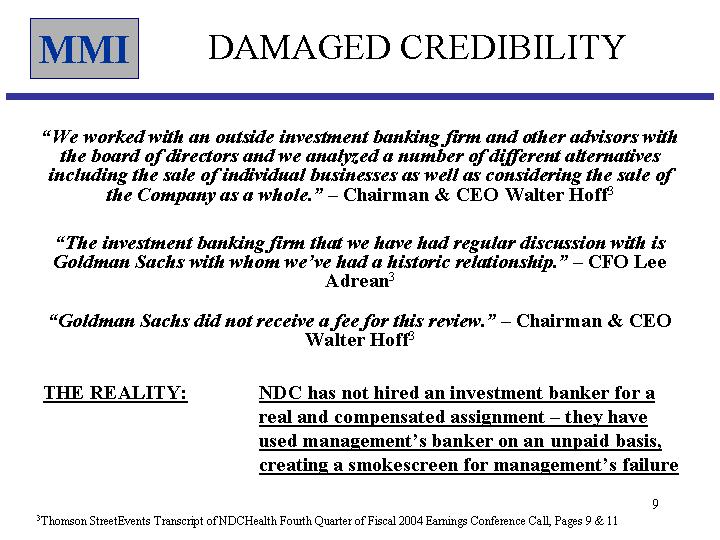

| DAMAGED CREDIBILITY "We worked with an outside investment banking firm and other advisors with the board of directors and we analyzed a number of different alternatives including the sale of individual businesses as well as considering the sale of the Company as a whole." - Chairman & CEO Walter Hoff2 The investment banking firm that we have had regular discussion with is Goldman Sachs with whom we've had a historic relationship" - CFO Lee Adrean2 "Goldman Sachs did not receive a fee for this review." - Chairman & CEO Walter Hoff2 2Thomson StreetEvents Transcript of NDCHealth Fourth Quarter of Fiscal 2004 Earnings Conference Call, Pages 9 & 11 THE REALITY: NDC has not hired an investment banker for a real and compensated assignment - they have used management's banker on an unpaid basis, creating a smokescreen for management's failure |

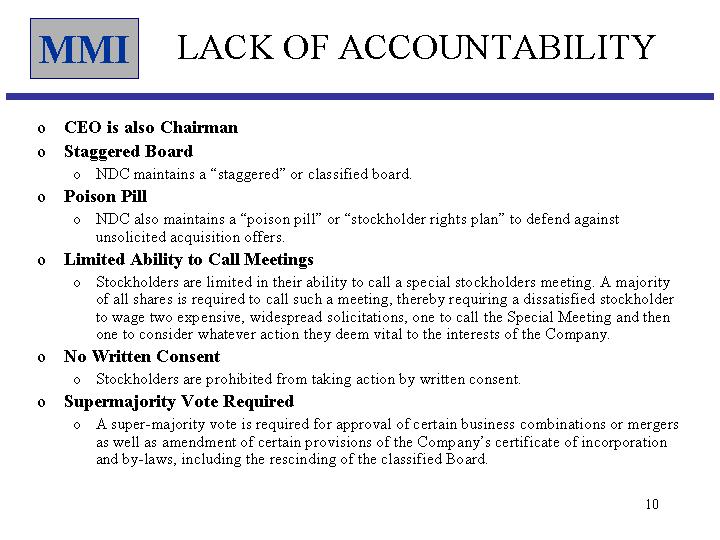

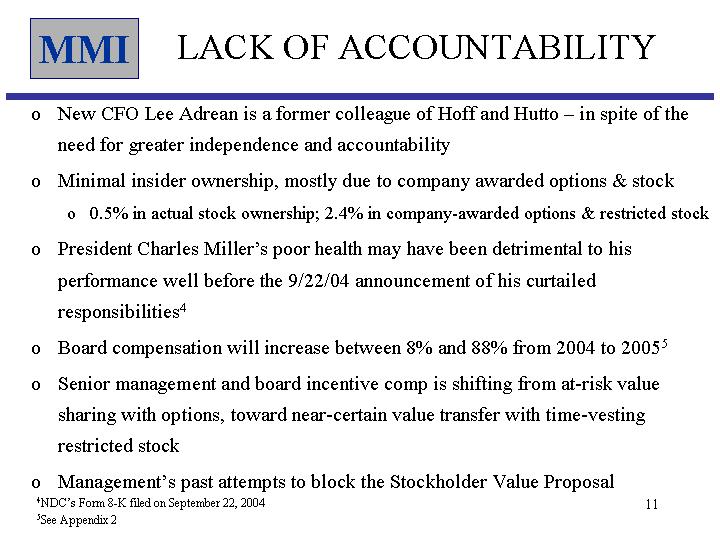

| LACK OF ACCOUNTABILITY CEO is also Chairman Staggered Board NDC maintains a "staggered" or classified board. Poison Pill NDC also maintains a "poison pill" or "stockholder rights plan" to defend against unsolicited acquisition offers. Limited Ability to Call Meetings Stockholders are limited in their ability to call a special stockholders meeting. A majority of all shares is required to call such a meeting, thereby requiring a dissatisfied stockholder to wage two expensive, widespread solicitations, one to call the Special Meeting and then one to consider whatever action they deem vital to the interests of the Company. No Written Consent Stockholders are prohibited from taking action by written consent. Supermajority Vote Required A super-majority vote is required for approval of certain business combinations or mergers as well as amendment of certain provisions of the Company's certificate of incorporation and by-laws, including the rescinding of the classified Board. |

| LACK OF ACCOUNTABILITY New CFO Lee Adrean is a former colleague of Hoff and Hutto - in spite of the need for greater independence and accountability Minimal insider ownership, mostly due to company awarded options & stock 0.5% actual stock ownership - 2.4% of company-awarded options & restricted stock President Charles Miller's poor health may have been detrimental to his performance well before the 9/22/04 announcement of his curtailed responsibilities3 Board compensation will increase between 8% and 88% from 2004 to 20054 Senior management and board incentive comp is shifting from at-risk value sharing with options, toward near-certain value transfer with time-vesting restricted stock Management's past attempts to block the Stockholder Value Proposal 3NDC's Form 8-K filed on September 22, 2004 4See chart on page 17 |

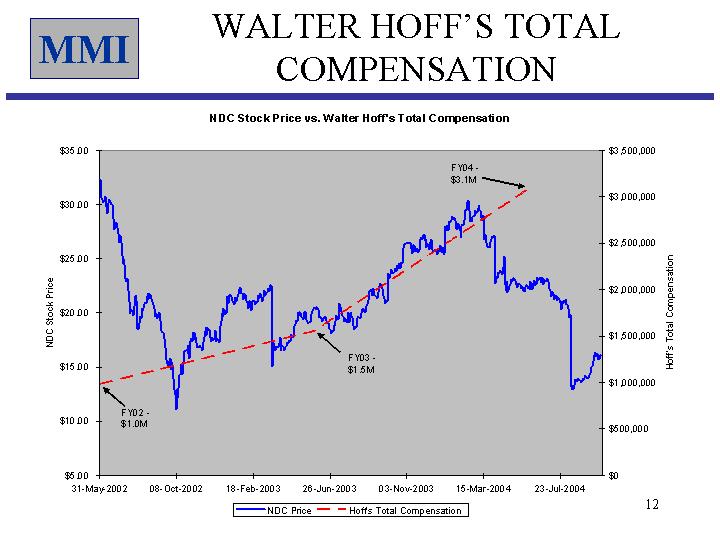

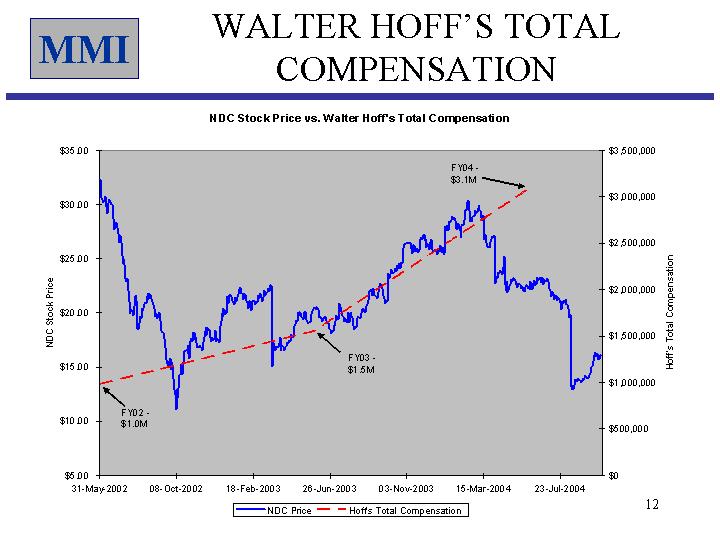

| WALTER HOFF'S TOTAL COMPENSATION COMPENSATION COMPENSATION |

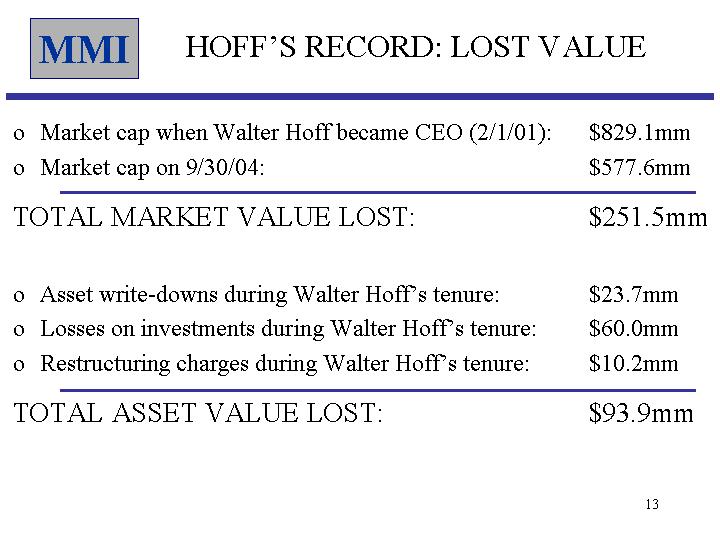

| HOFF'S RECORD: LOST VALUE Market cap when Walter Hoff became CEO (2/1/01): $829.1mm Market cap on 9/30/04: $577.6mm TOTAL MARKET VALUE LOST: $251.5mm Asset write-downs during Walter Hoff's tenure: $23.7mm Losses on investments during Walter Hoff's tenure: $60.0mm Restructuring charges during Walter Hoff's tenure: $10.2mm TOTAL ASSET VALUE LOST: $93.9mm |

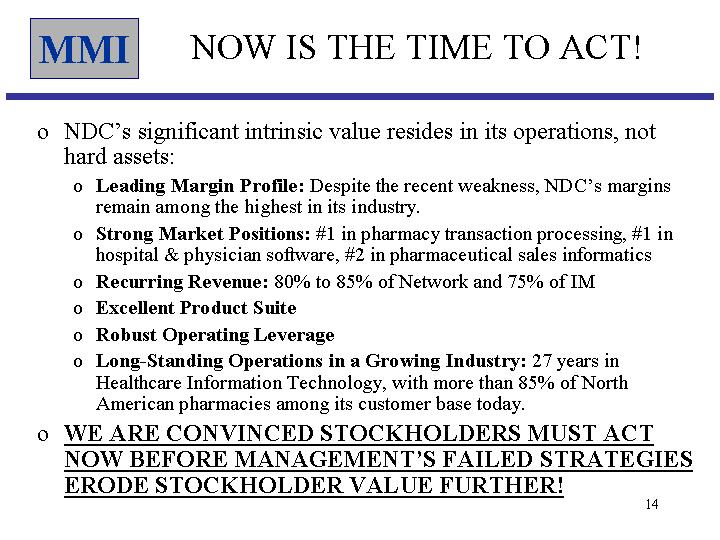

| NOW IS THE TIME TO ACT! NDC's significant intrinsic value resides in its operations, not hard assets: Leading Margin Profile: Despite the recent weakness, NDC's margins remain among the highest in its industry. Strong Market Positions: #1 in pharmacy transaction processing, #1 in hospital & physician software, #2 in pharmaceutical sales informatics Recurring Revenue: 80% to 85% of Network and 75% of IM Excellent Product Suite Robust Operating Leverage Long-Standing Operations in a Growing Industry: 27 years in Healthcare Information Technology, with more than 85% of North American pharmacies among its customer base today. WE ARE CONVINCED STOCKHOLDERS MUST ACT NOW BEFORE MANAGEMENT'S FAILED STRATEGIES ERODE STOCKHOLDER VALUE FURTHER! |

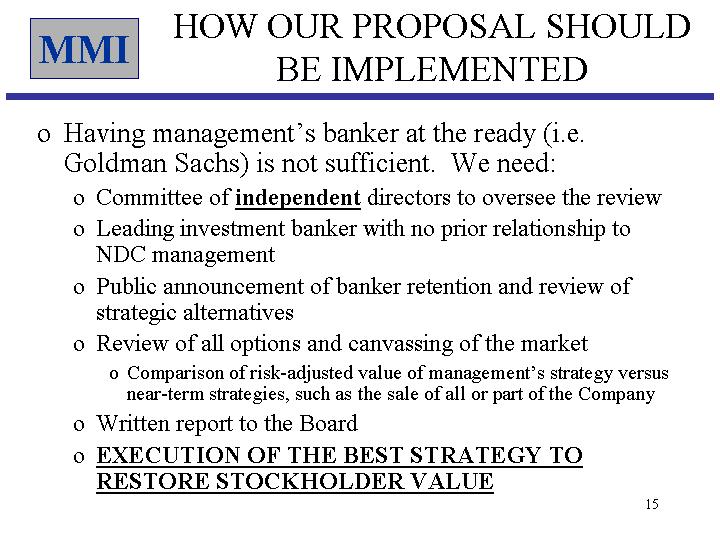

| HOW OUR PROPOSAL SHOULD BE IMPLEMENTED Having management's banker at the ready (i.e. Goldman Sachs) is not sufficient. We need: Committee of independent directors to oversee the review Leading investment banker with no prior relationship to NDC management Public announcement of banker retention and review of strategic alternatives Review of all options and canvassing of the market Comparison of risk-adjusted value of management's strategy versus near-term strategies, such as the sale of all or part of the Company Written report to the Board EXECUTION OF THE BEST STRATEGY TO RESTORE STOCKHOLDER VALUE |

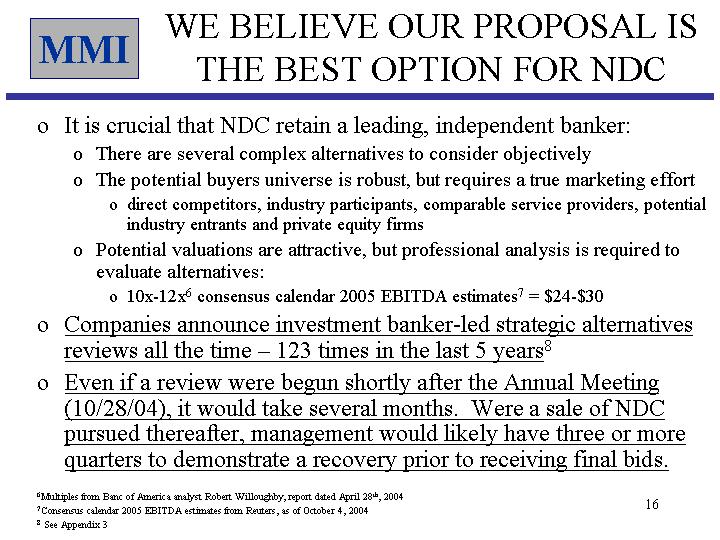

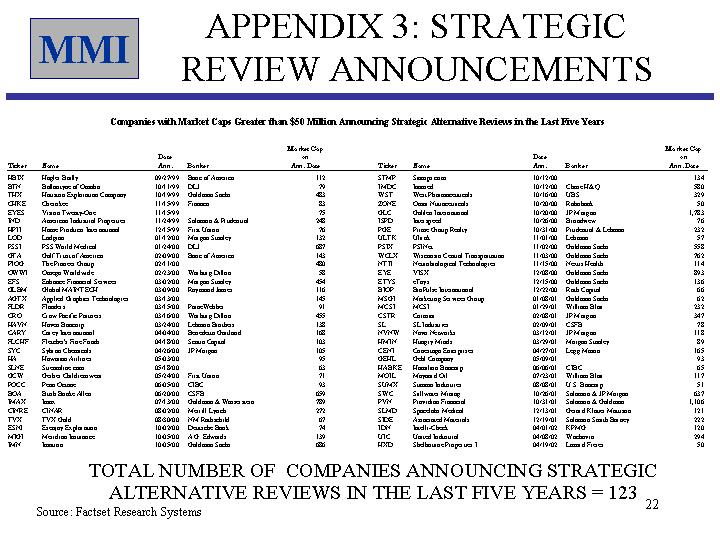

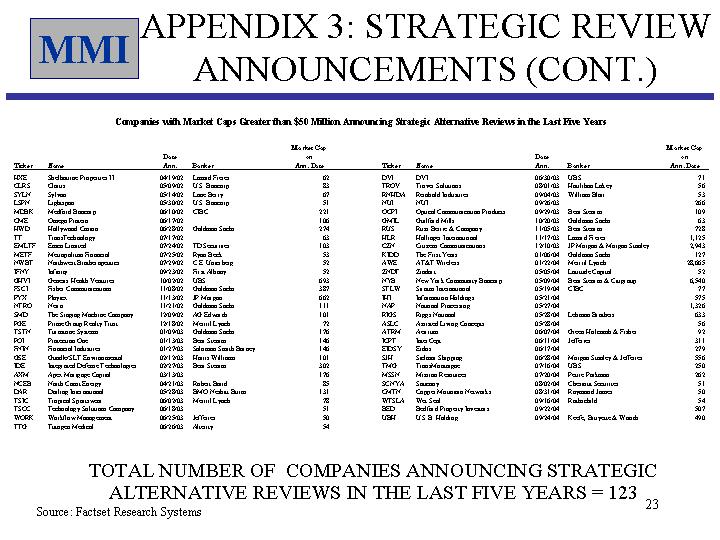

| WE BELIEVE OUR PROPOSAL IS THE BEST OPTION FOR NDC It is crucial that NDC retain a leading, independent banker: There are several complex alternatives to consider objectively The potential buyers universe is robust, but requires a true marketing effort direct competitors, industry participants, comparable service providers, potential industry entrants and private equity firms Potential valuations are attractive, but professional analysis is required to evaluate alternatives: 10x-12x5 consensus calendar 2005 EBITDA estimates6 = $24-$30 Companies announce investment banker-led strategic alternatives reviews all the time - 123 times in the last 5 years7 Even if a review were begun shortly after the Annual Meeting (10/28/04), it would take several months. Were a sale of NDC pursued thereafter, management would likely have three or more quarters to demonstrate a recovery prior to receiving final bids. 5Multiples from Banc of America analyst Robert Willoughby, report dated April 28th, 2004 6Consensus calendar 2005 EBITDA estimates from Reuter 7 See Appendix 3 |

| EVENTS SINCE MMI'S INVOLVEMENT BEGAN 4/7/04: MMI files its first 13d 4/22/04: Change in CFO 8/30/04: NDC files preliminary proxy materials carrying the Stockholder Value Proposal, having previously rejected it 9/22/04: President Charles Miller accepts a demotion 9/24/04: NDC's board changes its by-laws 9/29/04: NDC's Lead Independent Director, Neil Williams, meets with MMI in response to our request of 9/9/04. We believe that these developments indicate that, for a variety of reasons, NDC management has begun to get its house in order. We believe it is crucial to maintain the pressure on NDC to act in the best interests of stockholders |

| APPROVAL OF THE STOCKHOLDER VALUE PROPOSAL WILL HELP TO RESTORE STOCKHOLDER VALUE. CONTINUATION OF MANAGEMENT'S FAILURE TO DELIVER AND LACK OF ACCOUNTABILITY AND CREDIBILITY WILL FURTHER ERODE STOCKHOLDER VALUE. OUR CONCLUSION |

| APPENDIX 1: NDC 3-YEAR STOCK PERFORMANCE STOCK PERFORMANCE STOCK PERFORMANCE |

| APPENDIX 2: BOARD TOTAL COMPENSATION BOARD COMPENSATION WILL INCREASE BETWEEN 8% and 88% FROM FY04 to FY05 |

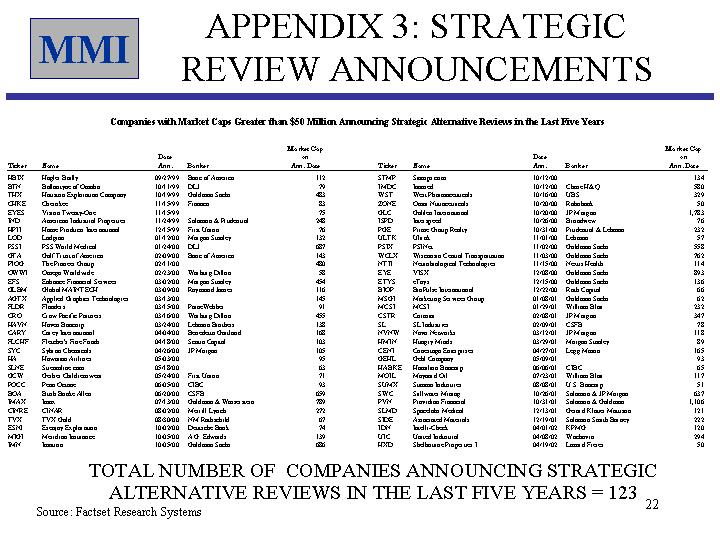

| APPENDIX 3: STRATEGIC REVIEW ANNOUNCEMENTS TOTAL NUMBER OF COMPANIES ANNOUNCING STRATEGIC ALTERNATIVE REVIEWS IN THE LAST FIVE YEARS = 123 Source: Factset Research Systems |

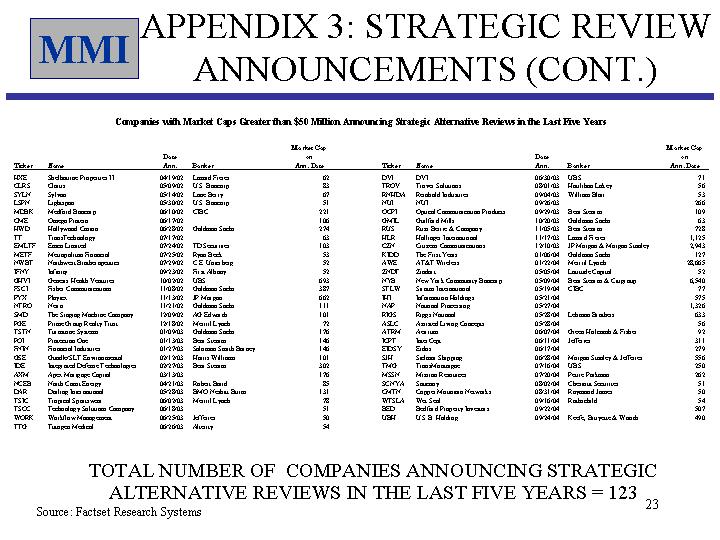

| APPENDIX 3: STRATEGIC REVIEW ANNOUNCEMENTS (CONT.) TOTAL NUMBER OF COMPANIES ANNOUNCING STRATEGIC ALTERNATIVE REVIEWS IN THE LAST FIVE YEARS = 123 Source: Factset Research Systems |