ANNUAL SHAREHOLDERS’ MEETING May 5, 2015 1

REMINDER: If you have not yet voted your shares, please do so now by visiting the Judge of Election table at the side of the room. 2

FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements with respect to Fulton Financial Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as “may,” “should,” “will,” “could,” “estimates,” “predicts,” “potential,” “continue,” “anticipates,” “believes,” “plans,” “expects,” “future,” “intends” and similar expressions which are intended to identify forward-looking statements. Management’s “2015 Outlook” contained herein is comprised of forward-looking statements. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, some of which are beyond the Corporation’s control and ability to predict, that could cause actual results to differ materially from those expressed in the forward- looking statements. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2014, which has been filed with the Securities and Exchange Commission and is available in the Investor Relations section of the Corporation’s website (www.fult.com) and on the Securities and Exchange Commission’s website (www.sec.gov). The Corporation uses certain non-GAAP financial measures in this presentation. These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. 3

RULES OF CONDUCT • Cameras, recording devices and cell phones are not permitted to be used in the meeting. • The display of placards and/or signs is prohibited. • Questions from shareholders should be directed to the Chairperson of the meeting during the Question and Answer (Q&A) period. • During the Q&A period, please remember to state your name prior to asking your question. • During the Q&A period, please limit yourself to one question to give other shareholders the opportunity to speak. 4

WELCOME AND OPENING REMARKS Phil Wenger, Chairman, President and CEO 5

TODAY’S AGENDA • Business Meeting • Proposals: • Election of Directors • Say on Pay • Ratification of appointment of independent auditor • Introductions • Results of Voting • Conclusion of Business Meeting • Management Presentation • Questions and Answers 6

BOARD OF DIRECTORS 7

BOARD OF DIRECTORS 8 John M. Bond, Jr.

BOARD OF DIRECTORS 9 Lisa Crutchfield

BOARD OF DIRECTORS 10 Denise L. Devine

BOARD OF DIRECTORS 11 Patrick J. Freer

BOARD OF DIRECTORS 12 George W. Hodges

BOARD OF DIRECTORS 13 Albert Morrison III

BOARD OF DIRECTORS 14 Rob Moxley

BOARD OF DIRECTORS 15 R. Scott Smith, Jr.

BOARD OF DIRECTORS 16 Gary A. Stewart

BOARD OF DIRECTORS 17 Ernest J. Waters

18 RECOGNITION OF RETIRING DIRECTOR

RETIRING DIRECTOR 19 Craig A. Dally

20 SENIOR MANAGEMENT

SENIOR MANAGEMENT 21 Pat Barrett

SENIOR MANAGEMENT 22 Phil Rohrbaugh

SENIOR MANAGEMENT 23 Craig Roda

SENIOR MANAGEMENT 24 Meg Mueller

SENIOR MANAGEMENT 25 Curt Myers

SENIOR MANAGEMENT 26 Angie Sargent

RETIRING MANAGEMENT 27 Craig Hill Jim Shreiner

28 COMMUNITY BANKING LEADERSHIP

COMMUNITY BANKING LEADERSHIP 29 Gerry Nau North central and Northeastern Pennsylvania

COMMUNITY BANKING LEADERSHIP 30 Jeff Rush Southcentral/Southeastern Pennsylvania and Delaware

COMMUNITY BANKING LEADERSHIP 31 John Scaldara Maryland and Virginia

COMMUNITY BANKING LEADERSHIP 32 Angela Snyder New Jersey

33 Jill Carson Fulton Mortgage Company

34 Dave Hanson Fulton Financial Advisors/ Clermont Wealth Strategies

35 REPORT OF THE JUDGE OF ELECTION

ANNUAL SHAREHOLDERS’ MEETING May 5, 2015 36

37 Phil Wenger, Chairman, President and CEO A LOOK BACK AND A LOOK AHEAD

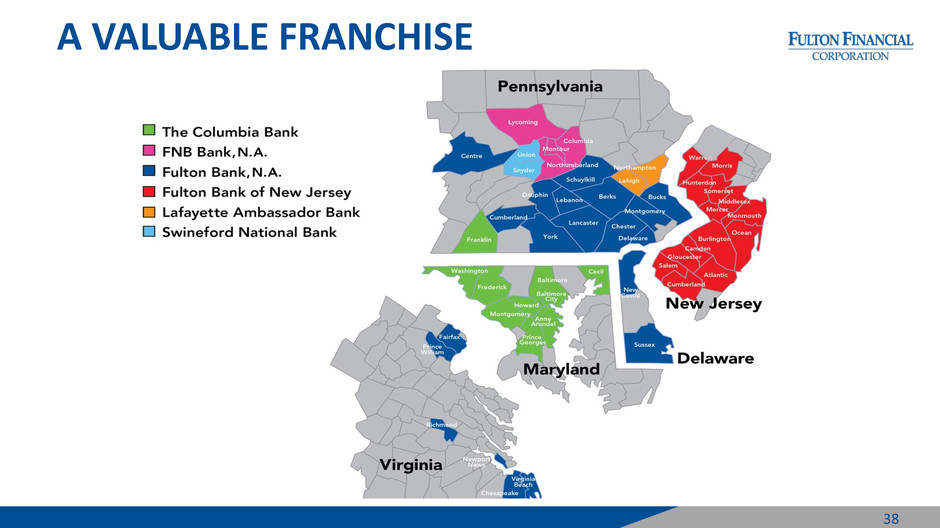

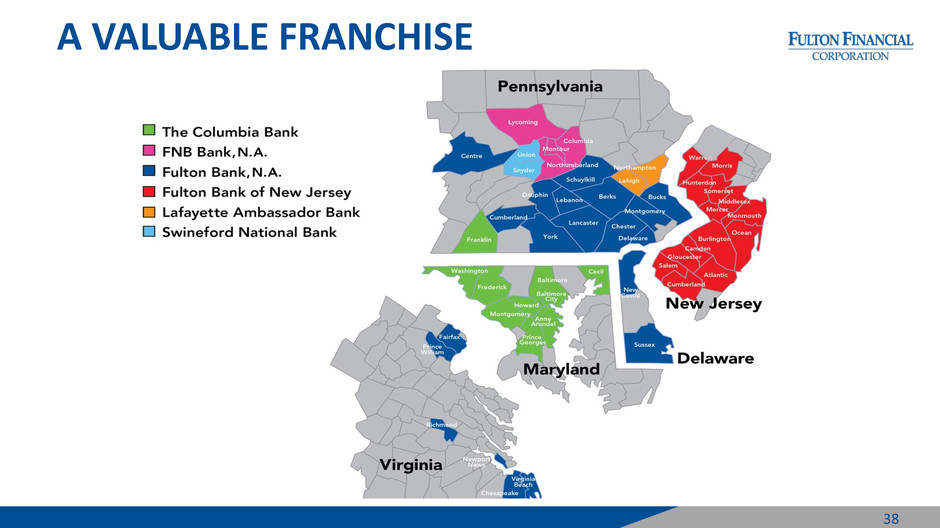

A VALUABLE FRANCHISE 38

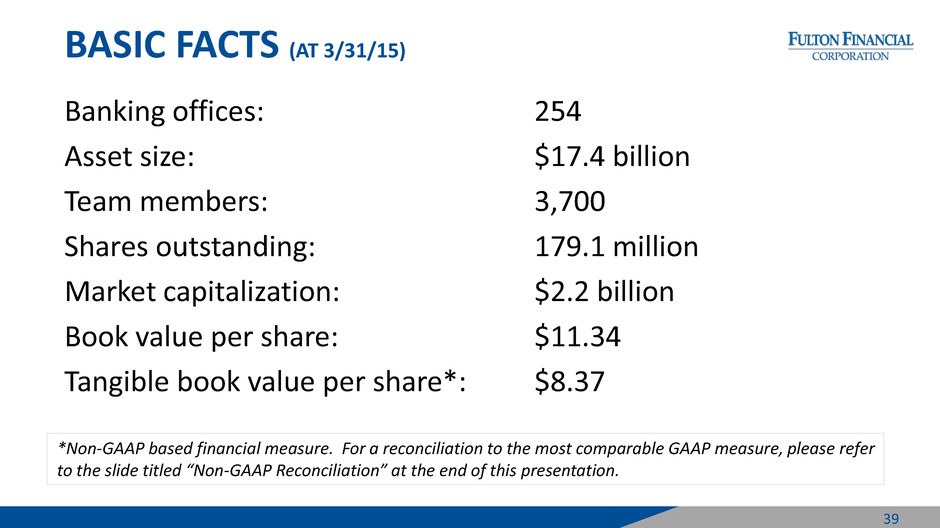

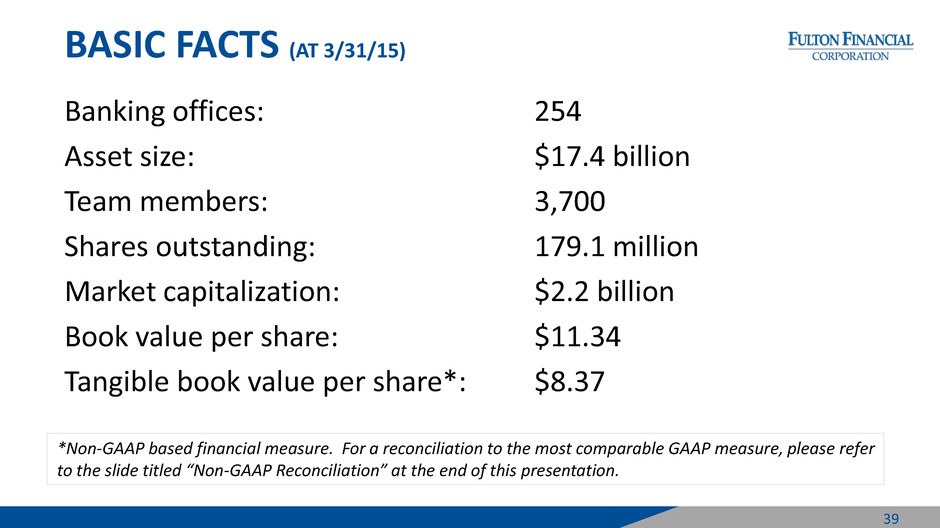

39 Banking offices: 254 Asset size: $17.4 billion Team members: 3,700 Shares outstanding: 179.1 million Market capitalization: $2.2 billion Book value per share: $11.34 Tangible book value per share*: $8.37 BASIC FACTS (AT 3/31/15) *Non-GAAP based financial measure. For a reconciliation to the most comparable GAAP measure, please refer to the slide titled “Non-GAAP Reconciliation” at the end of this presentation.

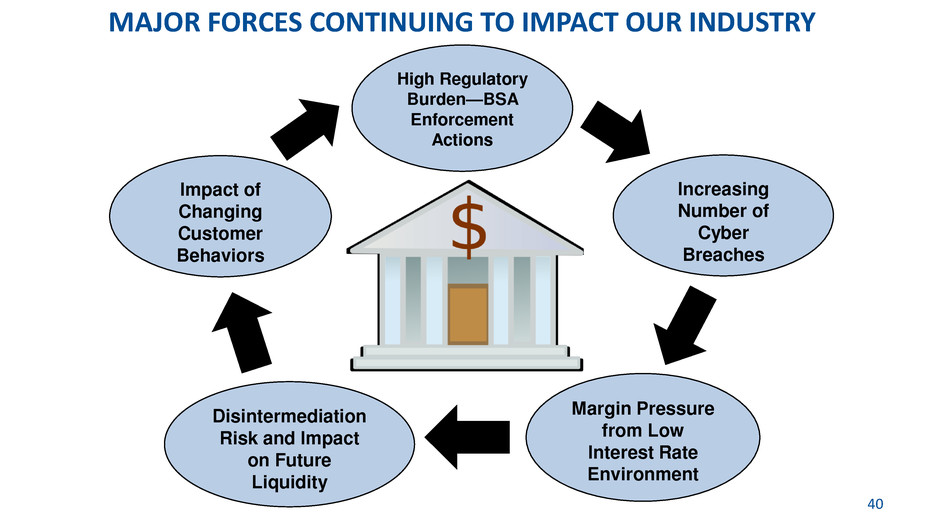

MAJOR FORCES CONTINUING TO IMPACT OUR INDUSTRY 40 High Regulatory Burden—BSA Enforcement Actions Increasing Number of Cyber Breaches Impact of Changing Customer Behaviors Disintermediation Risk and Impact on Future Liquidity Margin Pressure from Low Interest Rate Environment

41 FINANCIAL PERFORMANCE

2014 HIGHLIGHTS • Diluted Earnings Per Share Growth • Average Loan Growth • Core Deposit Growth • Revenue challenges due to a persistent low interest rate environment • Asset Quality improvement • Decrease in Non-Interest Expenses • Strong capital levels 42

OTHER 2014 EVENTS • Received enforcement actions from our regulators; devoted considerable resources to strengthen and improve our BSA/AML program • Implemented cost-savings initiatives • Initiated capital actions which resulted in the issuance of $100 million of subordinated debt, the proceeds of which were used to repurchase outstanding shares 43

DILUTED EARNINGS PER SHARE 44 $ 0.59 $ 0.73 $ 0.80 $0.83 0.84 $- $0.25 $0.50 $0.75 $1.00 2010 2011 2012 2013 2014

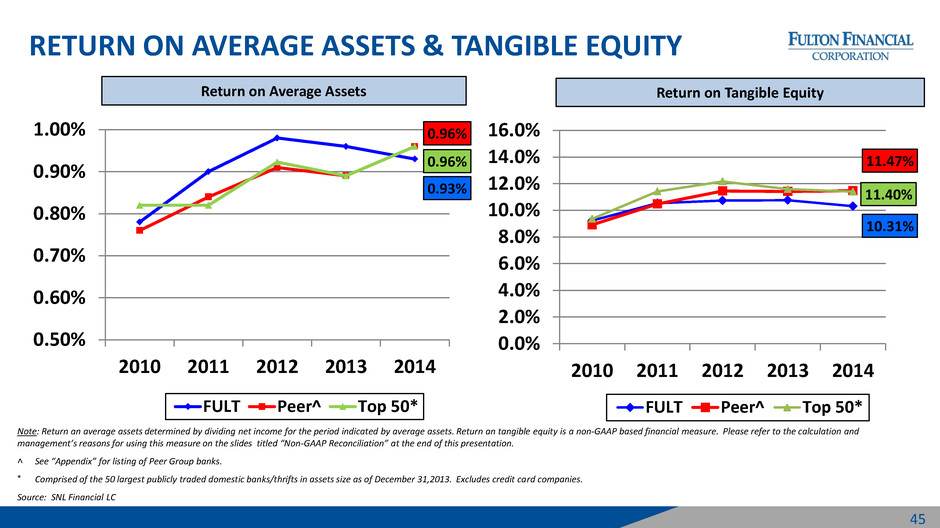

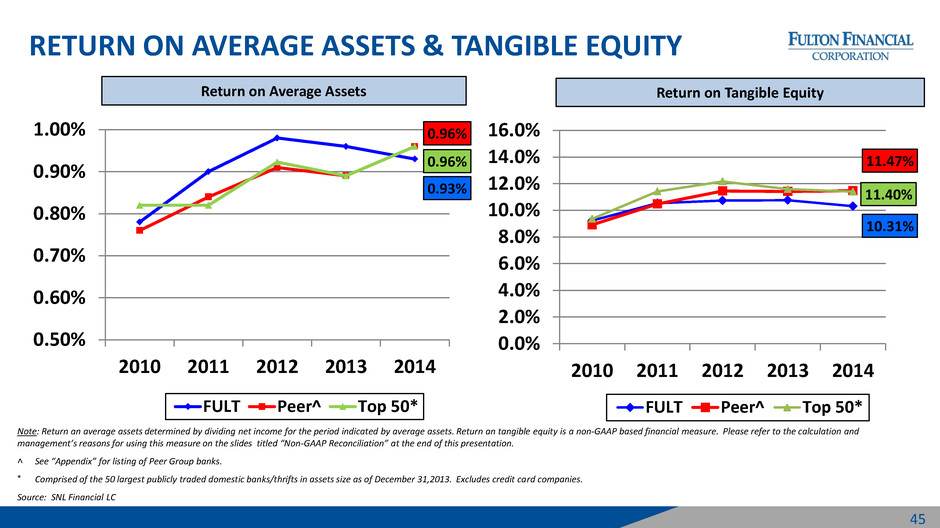

RETURN ON AVERAGE ASSETS & TANGIBLE EQUITY 45 0.93% 0.96% 0.96% 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 2010 2011 2012 2013 2014 FULT Peer^ Top 50* Note: Return an average assets determined by dividing net income for the period indicated by average assets. Return an tangible equity is a non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation. ˄ See “Appendix” for listing of Peer Group banks. * Comprised of the 50 largest publicly traded domestic banks/thrifts in assets size as of December 31,2013. Excludes credit card companies. Source: SNL Financial LC 10.31% 11.47% 11.40% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2010 2011 2012 2013 2014 FULT Peer^ Top 50* Return on Average Assets Return on Tangible Equity

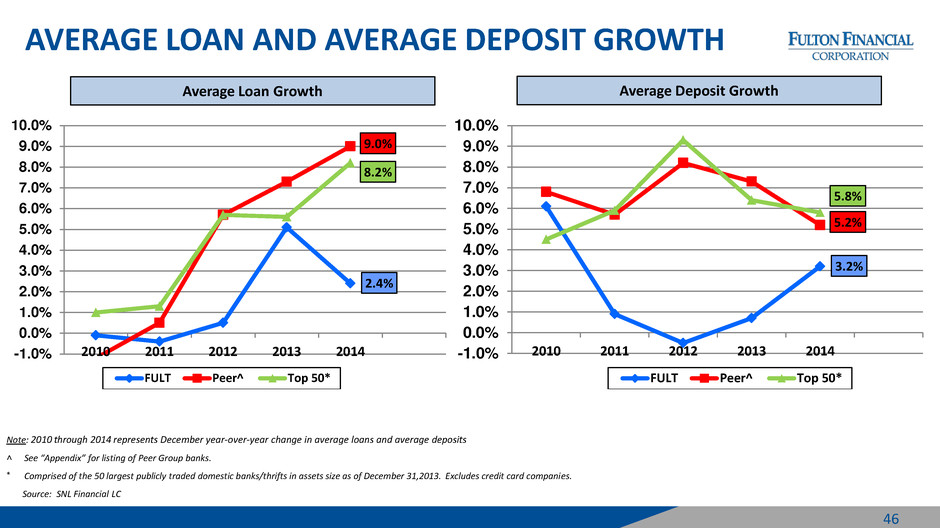

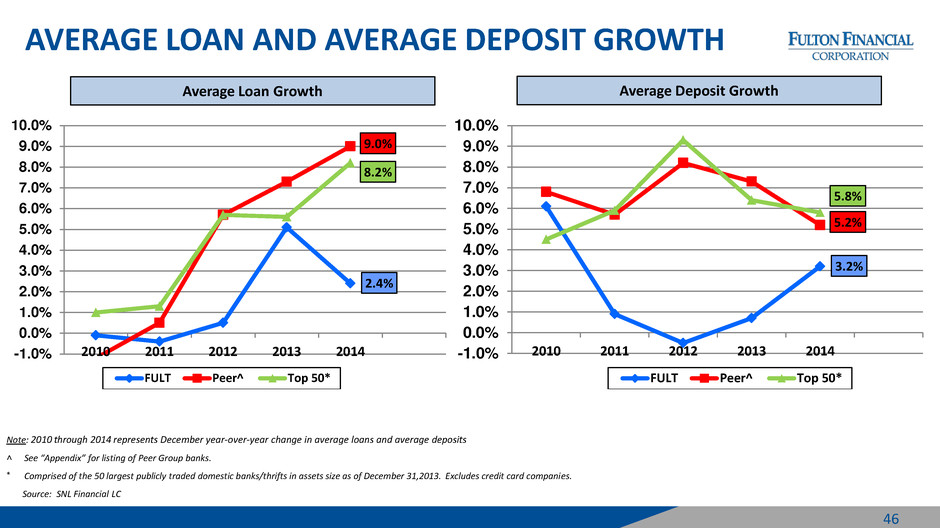

AVERAGE LOAN AND AVERAGE DEPOSIT GROWTH 46 2.4% 9.0% 8.2% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 2010 2011 2012 2013 2014 FULT Peer^ Top 50* Note: 2010 through 2014 represents December year-over-year change in average loans and average deposits ˄ See “Appendix” for listing of Peer Group banks. * Comprised of the 50 largest publicly traded domestic banks/thrifts in assets size as of December 31,2013. Excludes credit card companies. Source: SNL Financial LC 3.2% 5.2% 5.8% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 2010 2011 2012 2013 2014 FULT Peer^ Top 50* Average Loan Growth Average Deposit Growth

NON-PERFORMING LOANS (NPLS) & NPLS TO LOANS ($ IN MILLIONS) 47 $328.8 $286.5 $211.1 $154.3 $138.5 2.75% 2.39% 1.74% 1.21% 1.06% 0.00% 1.00% 2.00% 3.00% $- $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 2010 2011 2012 2013 2014 NPLs NPLs/Loans Note: NPLs consist of nonaccrual loans and accruing loans 90 days or more past due.

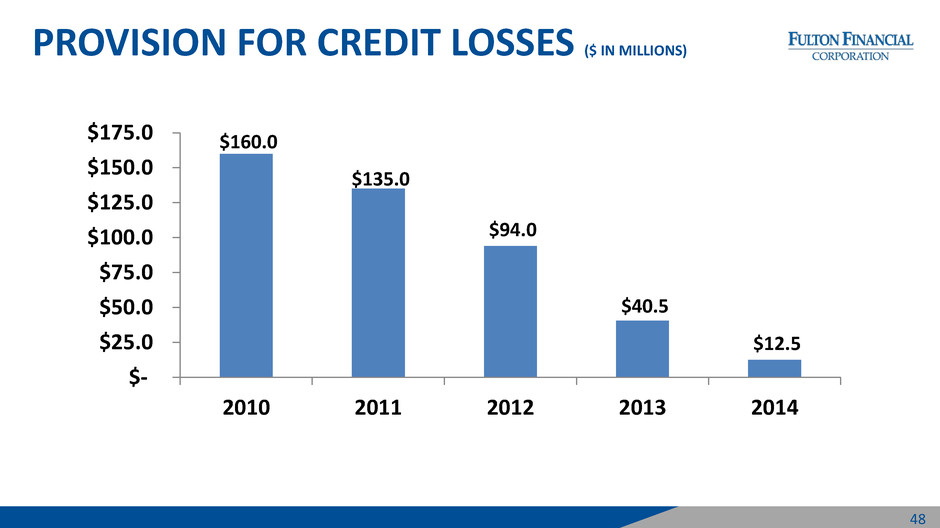

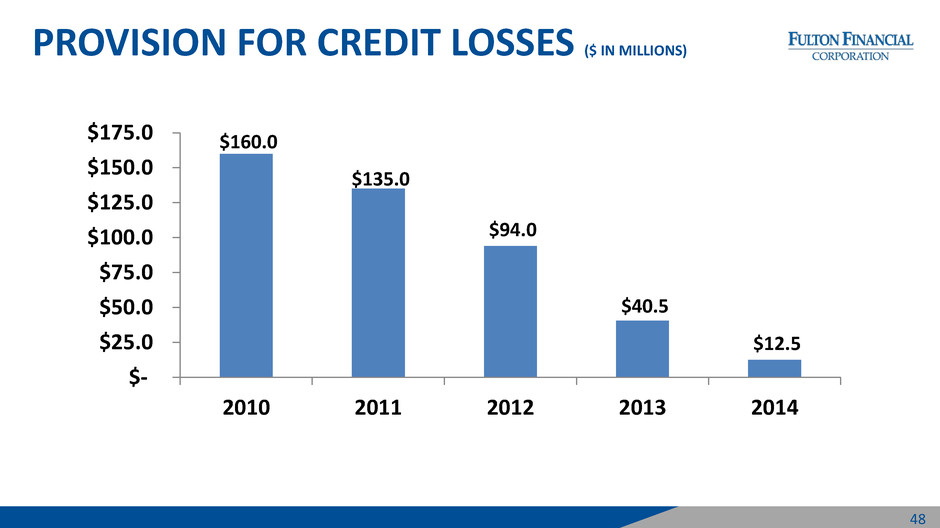

PROVISION FOR CREDIT LOSSES ($ IN MILLIONS) $160.0 $135.0 $94.0 $40.5 $12.5 $- $25.0 $50.0 $75.0 $100.0 $125.0 $150.0 $175.0 2010 2011 2012 2013 2014 48

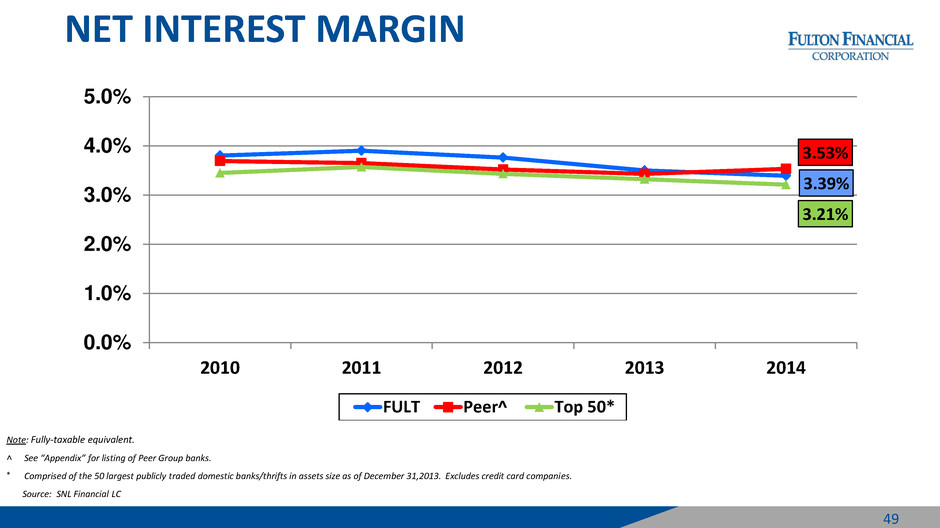

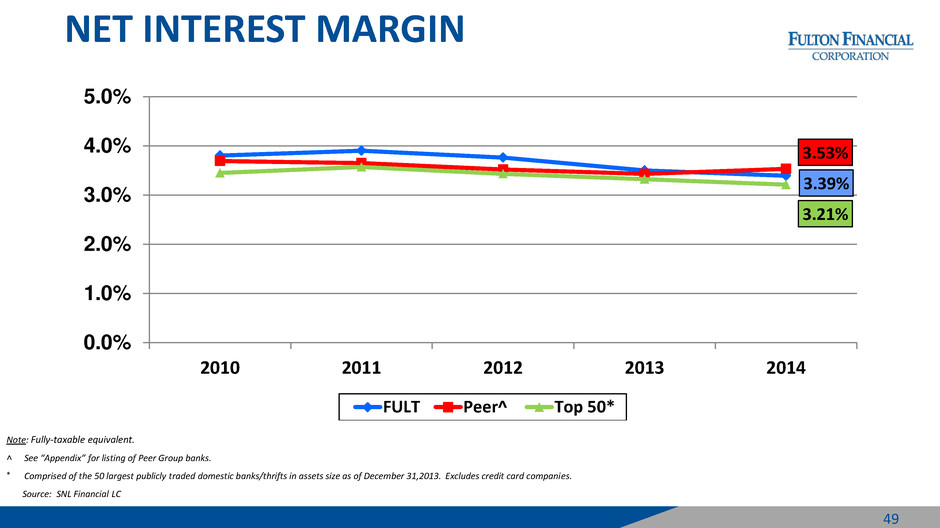

NET INTEREST MARGIN 49 3.39% 3.53% 3.21% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 2010 2011 2012 2013 2014 FULT Peer^ Top 50* Note: Fully-taxable equivalent. ˄ See “Appendix” for listing of Peer Group banks. * Comprised of the 50 largest publicly traded domestic banks/thrifts in assets size as of December 31,2013. Excludes credit card companies. Source: SNL Financial LC

EFFICIENCY RATIO 65.7% 61.7% 63.6% 50.0% 52.0% 54.0% 56.0% 58.0% 60.0% 62.0% 64.0% 66.0% 2010 2011 2012 2013 2014 FULT Peer^ Top 50* Note: The efficiency ratio is a non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation. ˄ See “Appendix” for listing of Peer Group banks. * Comprised of the 50 largest publicly traded domestic banks/thrifts in assets size as of December 31,2013. Excludes credit card companies. Source: SNL Financial LC 50

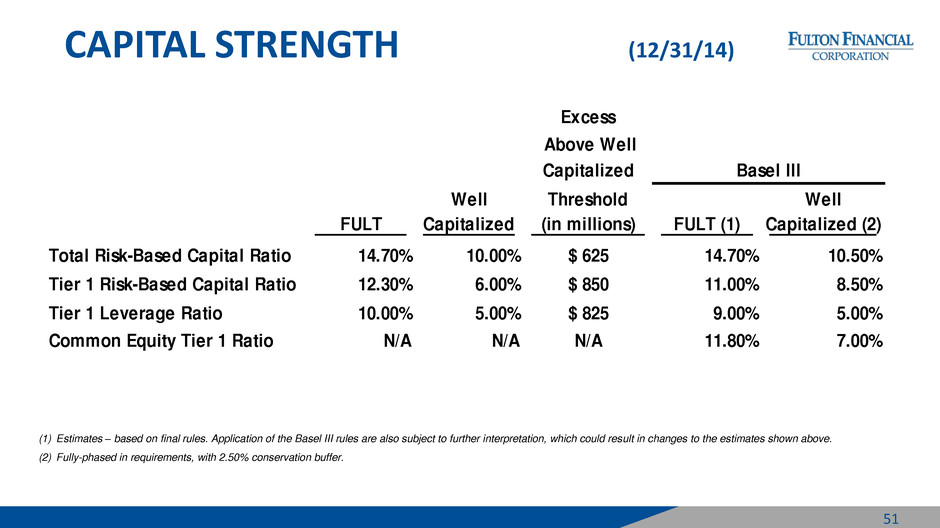

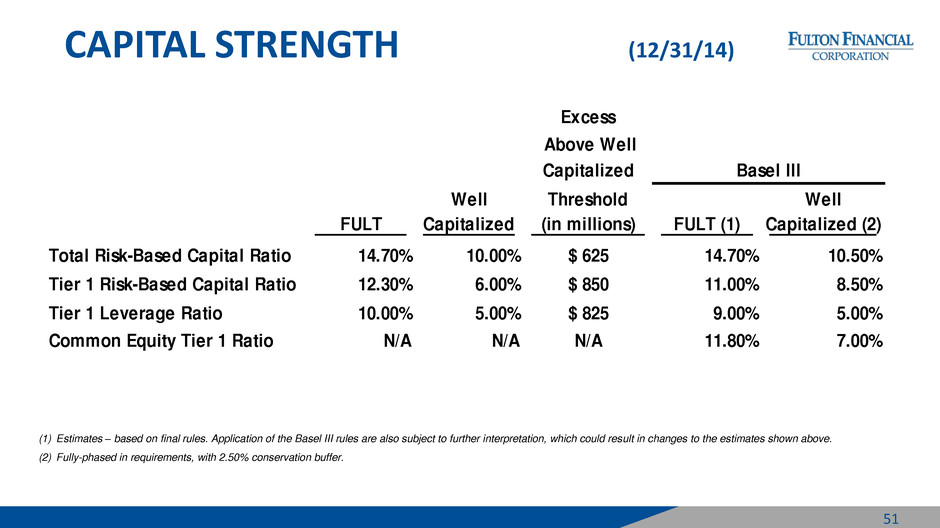

CAPITAL STRENGTH (12/31/14) 51 Excess Above Well Capitalized Well Threshold Well FULT Capitalized (in millions) FULT (1) Capitalized (2) Total Risk-Based Capital Ratio 14.70% 10.00% $ 625 14.70% 10.50% Tier 1 Risk-Based Capital Ratio 12.30% 6.00% $ 850 11.00% 8.50% Tier 1 Leverage Ratio 10.00% 5.00% $ 825 9.00% 5.00% Common Equity Tier 1 Ratio N/A N/A N/A 11.80% 7.00% Basel III (1) Estimates – based on final rules. Application of the Basel III rules are also subject to further interpretation, which could result in changes to the estimates shown above. (2) Fully-phased in requirements, with 2.50% conservation buffer.

DEPLOYING CAPITAL: COMPLETED STOCK REPURCHASE PROGRAMS June 2012 to April 2015 Repurchase Programs Shares Repurchased 26.4 million % of Outstanding Shares 14.9% (1) Amount Repurchased $307 million Average Purchase Price $11.61 52 (1) Total shares repurchased as a percentage of outstanding common stock on April 30, 2015. • In April 2015, the Board of Directors approved the repurchase of up to $50 million of our common stock, or 2.3% of outstanding shares, through December 31, 2015

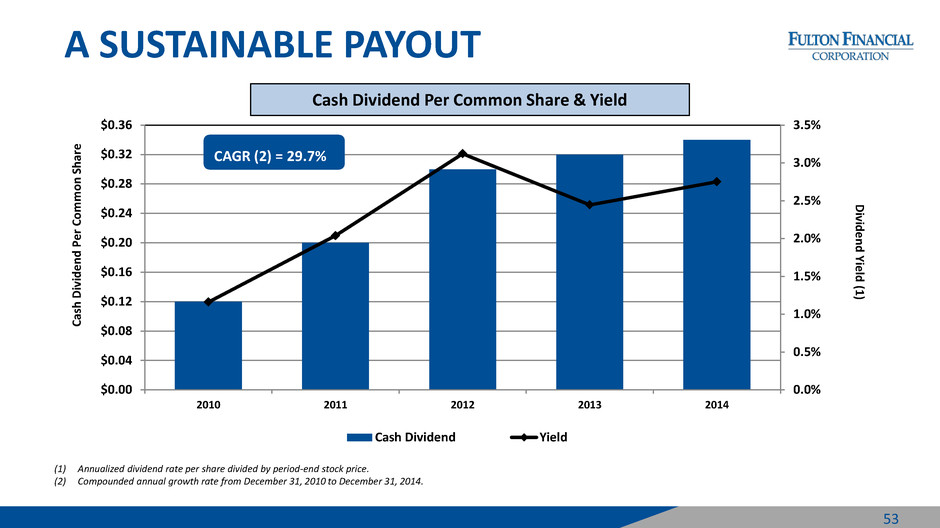

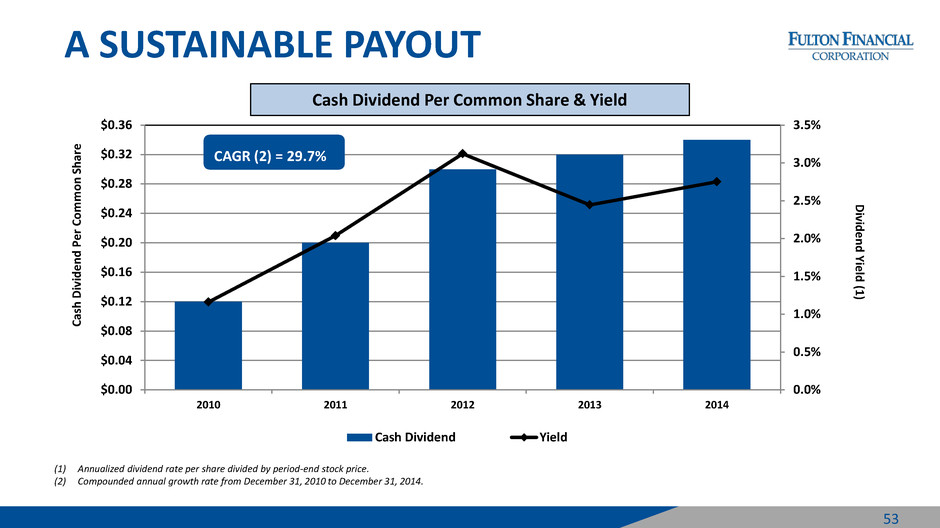

A SUSTAINABLE PAYOUT 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% $0.00 $0.04 $0.08 $0.12 $0.16 $0.20 $0.24 $0.28 $0.32 $0.36 2010 2011 2012 2013 2014 Cash Dividend Yield 53 (1) Annualized dividend rate per share divided by period-end stock price. (2) Compounded annual growth rate from December 31, 2010 to December 31, 2014. Cash Dividend Per Common Share & Yield CAGR (2) = 29.7% Cas h D iv id e n d Pe r C o m m o n S h ar e D ivid e n d Y ie ld (1 )

54 FIRST QUARTER 2015 PERFORMANCE • Diluted Earnings Per Share growth • Increase in Average Loans & Average Deposits • Decrease in Net Interest Income & Net Interest Margin • Asset Quality • Strong Capital Levels Note: In comparison to the fourth quarter of 2014

55 FULTON FINANCIAL STOCK PERFORMANCE AND ANALYSTS’ RECOMMENDATIONS

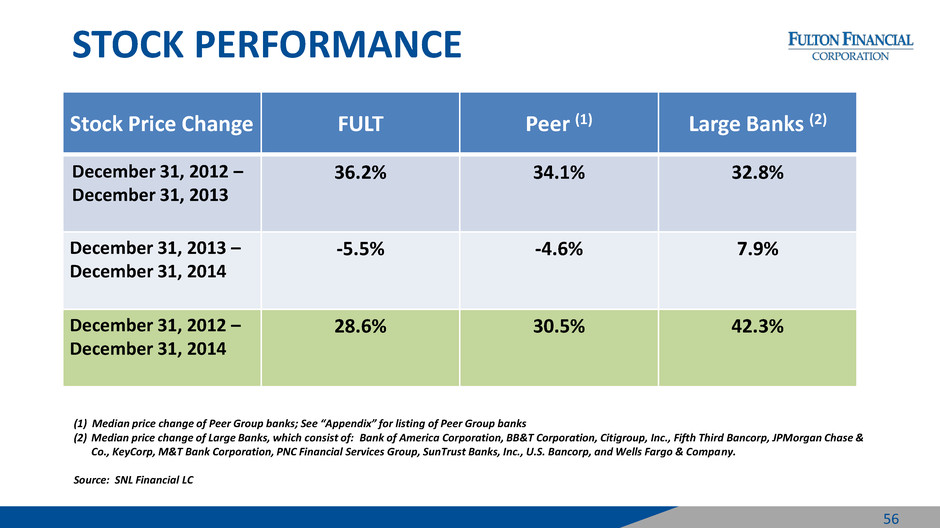

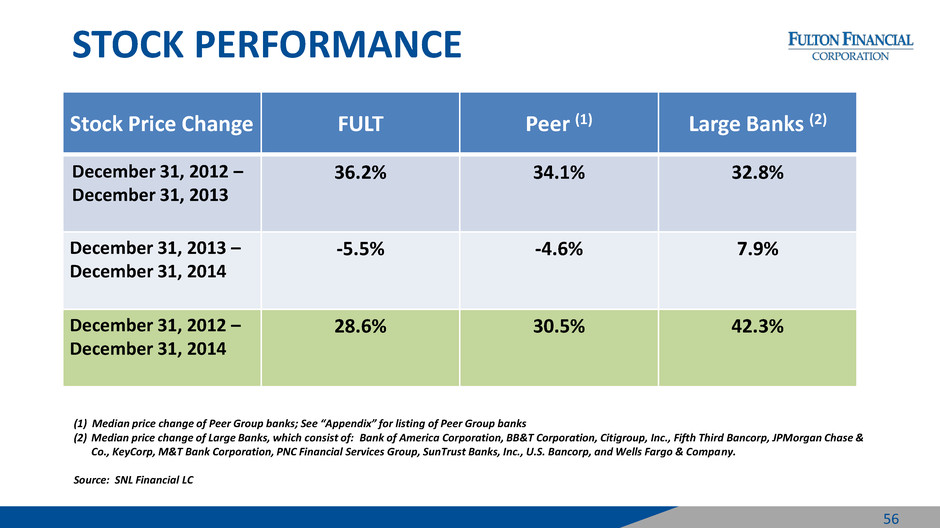

56 STOCK PERFORMANCE Stock Price Change FULT Peer (1) Large Banks (2) December 31, 2012 – December 31, 2013 36.2% 34.1% 32.8% December 31, 2013 – December 31, 2014 -5.5% -4.6% 7.9% December 31, 2012 – December 31, 2014 28.6% 30.5% 42.3% (1) Median price change of Peer Group banks; See “Appendix” for listing of Peer Group banks (2) Median price change of Large Banks, which consist of: Bank of America Corporation, BB&T Corporation, Citigroup, Inc., Fifth Third Bancorp, JPMorgan Chase & Co., KeyCorp, M&T Bank Corporation, PNC Financial Services Group, SunTrust Banks, Inc., U.S. Bancorp, and Wells Fargo & Company. Source: SNL Financial LC

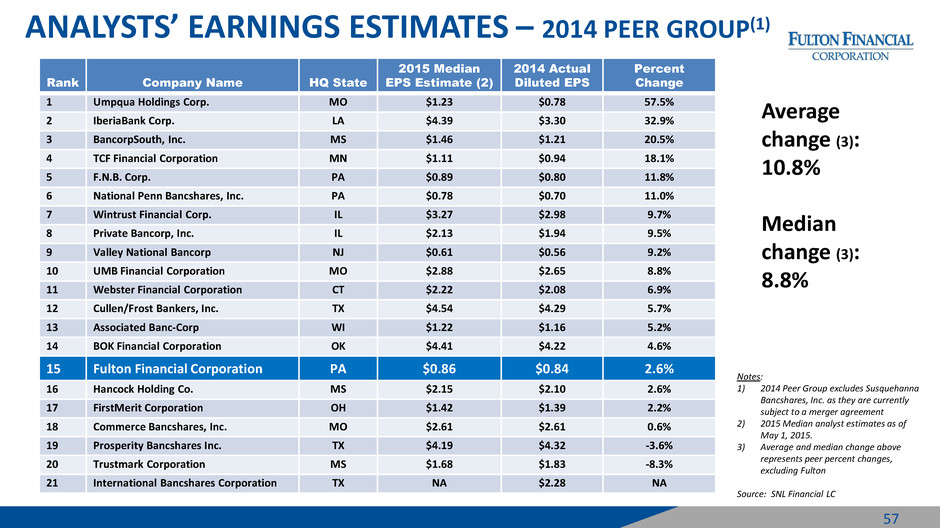

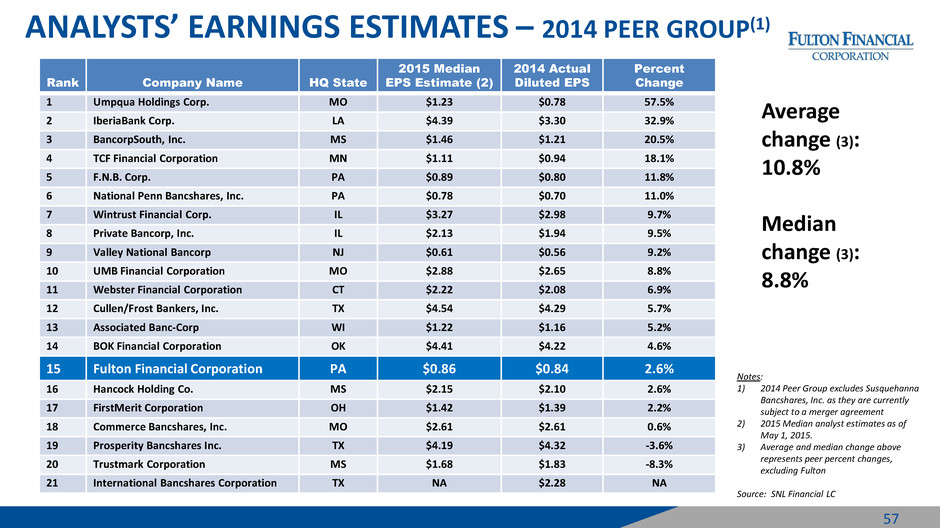

ANALYSTS’ EARNINGS ESTIMATES – 2014 PEER GROUP(1) 57 Average change (3): 10.8% Median change (3): 8.8% Rank Company Name HQ State 2015 Median EPS Estimate (2) 2014 Actual Diluted EPS Percent Change 1 Umpqua Holdings Corp. MO $1.23 $0.78 57.5% 2 IberiaBank Corp. LA $4.39 $3.30 32.9% 3 BancorpSouth, Inc. MS $1.46 $1.21 20.5% 4 TCF Financial Corporation MN $1.11 $0.94 18.1% 5 F.N.B. Corp. PA $0.89 $0.80 11.8% 6 National Penn Bancshares, Inc. PA $0.78 $0.70 11.0% 7 Wintrust Financial Corp. IL $3.27 $2.98 9.7% 8 Private Bancorp, Inc. IL $2.13 $1.94 9.5% 9 Valley National Bancorp NJ $0.61 $0.56 9.2% 10 UMB Financial Corporation MO $2.88 $2.65 8.8% 11 Webster Financial Corporation CT $2.22 $2.08 6.9% 12 Cullen/Frost Bankers, Inc. TX $4.54 $4.29 5.7% 13 Associated Banc-Corp WI $1.22 $1.16 5.2% 14 BOK Financial Corporation OK $4.41 $4.22 4.6% 15 Fulton Financial Corporation PA $0.86 $0.84 2.6% 16 Hancock Holding Co. MS $2.15 $2.10 2.6% 17 FirstMerit Corporation OH $1.42 $1.39 2.2% 18 Commerce Bancshares, Inc. MO $2.61 $2.61 0.6% 19 Prosperity Bancshares Inc. TX $4.19 $4.32 -3.6% 20 Trustmark Corporation MS $1.68 $1.83 -8.3% 21 International Bancshares Corporation TX NA $2.28 NA Notes: 1) 2014 Peer Group excludes Susquehanna Bancshares, Inc. as they are currently subject to a merger agreement 2) 2015 Median analyst estimates as of May 1, 2015. 3) Average and median change above represents peer percent changes, excluding Fulton Source: SNL Financial LC

ANALYSTS’ RECOMMENDATIONS (AS OF 4/30/15) 58 • Barclays Capital Equal Weight • BB&T Hold • Boenning & Scattergood Neutral • Drexel Hamilton Hold • FBR Capital Markets Market Perform • Guggenheim Partners Neutral • Jefferies & Company Hold • Keefe, Bruyette &Woods Market Perform • Sandler O’Neill Hold • Standard & Poors Buy • SunTrust Robinson Humphrey Neutral

59 LOOKING AHEAD

2015 OUTLOOK • Manage our Net Interest Margin • Grow Loans and Deposits • Grow Non-Interest Income • Control Expenses • Return Capital to Shareholders 60

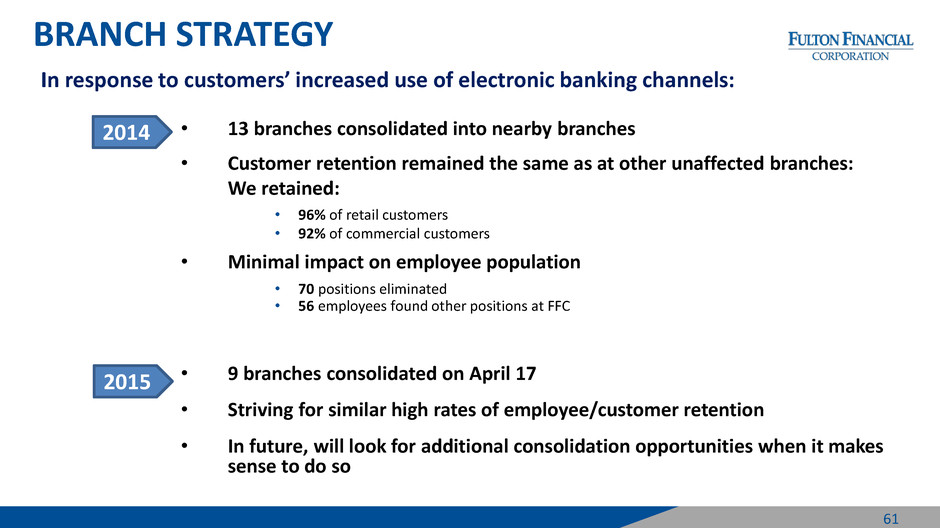

BRANCH STRATEGY • 13 branches consolidated into nearby branches • Customer retention remained the same as at other unaffected branches: We retained: • 96% of retail customers • 92% of commercial customers • Minimal impact on employee population • 70 positions eliminated • 56 employees found other positions at FFC • 9 branches consolidated on April 17 • Striving for similar high rates of employee/customer retention • In future, will look for additional consolidation opportunities when it makes sense to do so 61 2014 2015 In response to customers’ increased use of electronic banking channels:

LOAN/DEPOSIT GROWTH • Quality earning asset growth remains a top priority • Increase loan growth to help offset the impact of the current low interest rate environment • Continue to grow deposits to support loan growth 62

• 2014 accomplishments paved the way for our 2015 priorities: • Effective use of technology to strengthen our compliance program • Robust regulatory compliance training • Addition of key staff in regulatory compliance areas • Completing enhancement of our BSA/AML processes and controls • Preparing for major regulatory changes – RESPA and TILA • Ultimately emerge from the enforcement actions 63 RISK MANAGEMENT AND COMPLIANCE

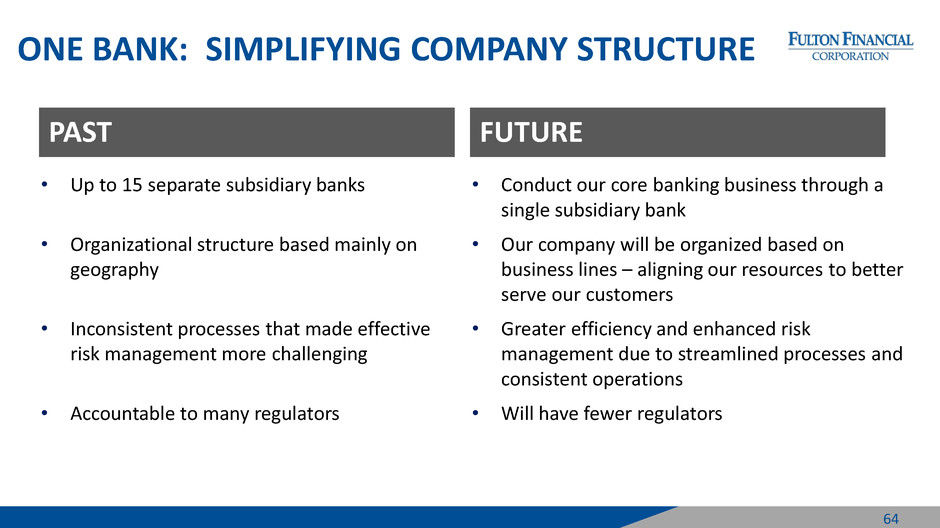

ONE BANK: SIMPLIFYING COMPANY STRUCTURE PAST FUTURE • Up to 15 separate subsidiary banks • Conduct our core banking business through a single subsidiary bank • Organizational structure based mainly on geography • Our company will be organized based on business lines – aligning our resources to better serve our customers • Inconsistent processes that made effective risk management more challenging • Greater efficiency and enhanced risk management due to streamlined processes and consistent operations • Accountable to many regulators • Will have fewer regulators 64

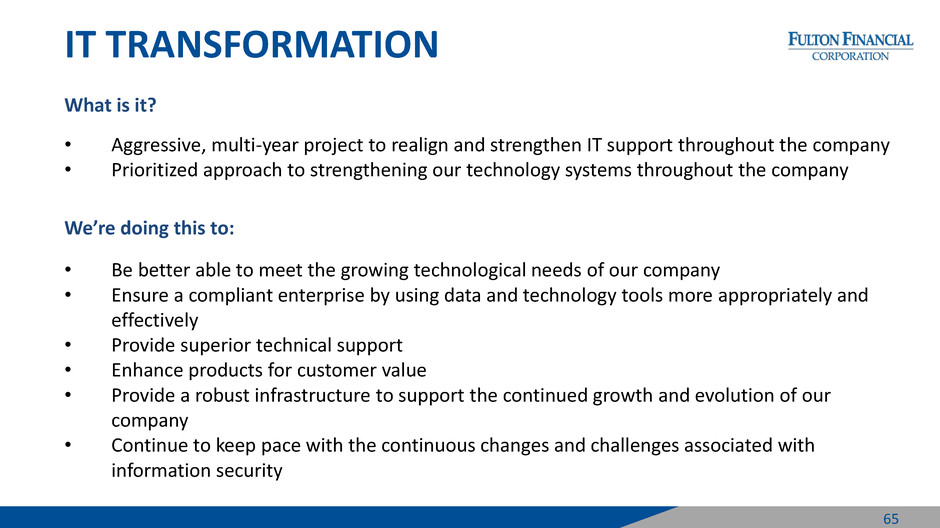

IT TRANSFORMATION What is it? • Aggressive, multi-year project to realign and strengthen IT support throughout the company • Prioritized approach to strengthening our technology systems throughout the company We’re doing this to: • Be better able to meet the growing technological needs of our company • Ensure a compliant enterprise by using data and technology tools more appropriately and effectively • Provide superior technical support • Enhance products for customer value • Provide a robust infrastructure to support the continued growth and evolution of our company • Continue to keep pace with the continuous changes and challenges associated with information security 65

INVESTING IN OUR TEAM We’re doing this to: • Attract and retain qualified and motivated employees who continue to grow and develop • Better serve our customers • Increase our company’s capacity and earning power 66

ANNUAL SHAREHOLDERS’ MEETING May 5, 2015 67

QUESTIONS & ANSWERS May 5, 2015 68

ANNUAL SHAREHOLDERS’ MEETING May 5, 2015 69

APPENDIX 70

NON-GAAP RECONCILIATION 2014 2013 2012 2011 2010 Eff iciency rat io Non-interest expense 459,246$ 461,433$ 449,294$ 416,242$ 408,254$ Less: Intangible amortization (1,259) (2,438) (3,031) (4,257) (5,240) Numerator 457,987$ 458,995$ 446,263$ 411,985$ 403,014$ Net interest income (fully taxable equivalent) 532,322$ 544,474$ 561,190$ 576,232$ 574,257$ P lus: Total Non-interest income 167,379 187,664 216,412 187,493 182,249 Less: Investment securities (gains) losses (2,041) (8,004) (3,026) (4,561) (701) Denominator 697,660$ 724,134$ 774,576$ 759,164$ 755,805$ Efficiency ratio 65.65% 63.39% 57.61% 54.27% 53.32% R eturn o n A verage Shareho lders' Equity (R OE) (T angible) Net income 157,894$ 161,840$ 159,845$ 145,573$ 112,029$ P lus: Intangible amortization, net of tax 818 1,585 1,970 2,767 3,406 Numerator 158,712$ 163,425$ 161,815$ 148,340$ 115,435$ Average shareholders' equity 2,071,640$ 2,053,821$ 2,050,994$ 1,953,396$ 1,780,148$ Less: Average goodwill and intangible assets (532,425) (534,431) (542,600) (545,920) (550,271) Average tangible shareholders' equity (denominator) 1,539,215$ 1,519,390$ 1,508,394$ 1,407,476$ 1,229,877$ Return on average common shareholders' equity (tangible), annualized 10.31% 10.76% 10.73% 10.54% 9.39% M arch 31, 2015 Shareho lders' equity ( tangible) , per share Shareholders' equity 2,031,513$ Less: Intangible assets (531,672) Tangible shareholders' equity (numerator) 1,499,841$ Shares outstanding, end of period (denominator) 179,098$ Tangible Common Equity to Tangible Assets 8.37$ Year Ended D ecember 31, Note: The Corporation has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. Dollar amounts in thousands. 71

PEER GROUP* Associated Banc-Corp BancorpSouth, Inc. BOK Financial Corporation Commerce Bancshares, Inc. Cullen/Frost Bankers, Inc. FNB Corporation FirstMerit Corporation Hancock Holding Company IBERIABANK Corporation International Bancshares Corp. National Penn Bancshares, Inc. Private Bancorp, Inc. Prosperity Bancshares, Inc. Susquehanna Bancshares, Inc. TCF Financial Corporation Trustmark Corporation UMB Financial Corporation Umpqua Holdings Corporation Valley National Bancorp Webster Financial Corporation Wintrust Financial Corporation *Fulton’s Peer group as of April 1, 2014. Changes from 2013 peer group include the addition of National Penn Bancshares, Inc., Private Bancorp, Inc. and Trustmark Corporation and the deletion of City National Corporation and People’s United Financial, Inc. Peer comparisons for all historical periods included within this presentation have been updated based on the above peer group for all periods presented. 72