FIRST QUARTER 2021 RESULTS NASDAQ: FULT Data as of or for the three months ended March 31, 2021 unless otherwise noted

This presentation may contain forward-looking statements with respect to the Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward-looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, including future credit losses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Management’s 2021 Outlook contained herein is comprised of forward-looking statements. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, they are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2020 and other current and periodic reports, which have been, or will be, filed with the Securities and Exchange Commission and are or will be available in the Investor Relations section of the Corporation’s website (www.fult.com) and on the Securities and Exchange Commission’s website (www.sec.gov). The Corporation uses certain non-GAAP financial measures in this presentation. These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. FORWARD-LOOKING STATEMENTS 2

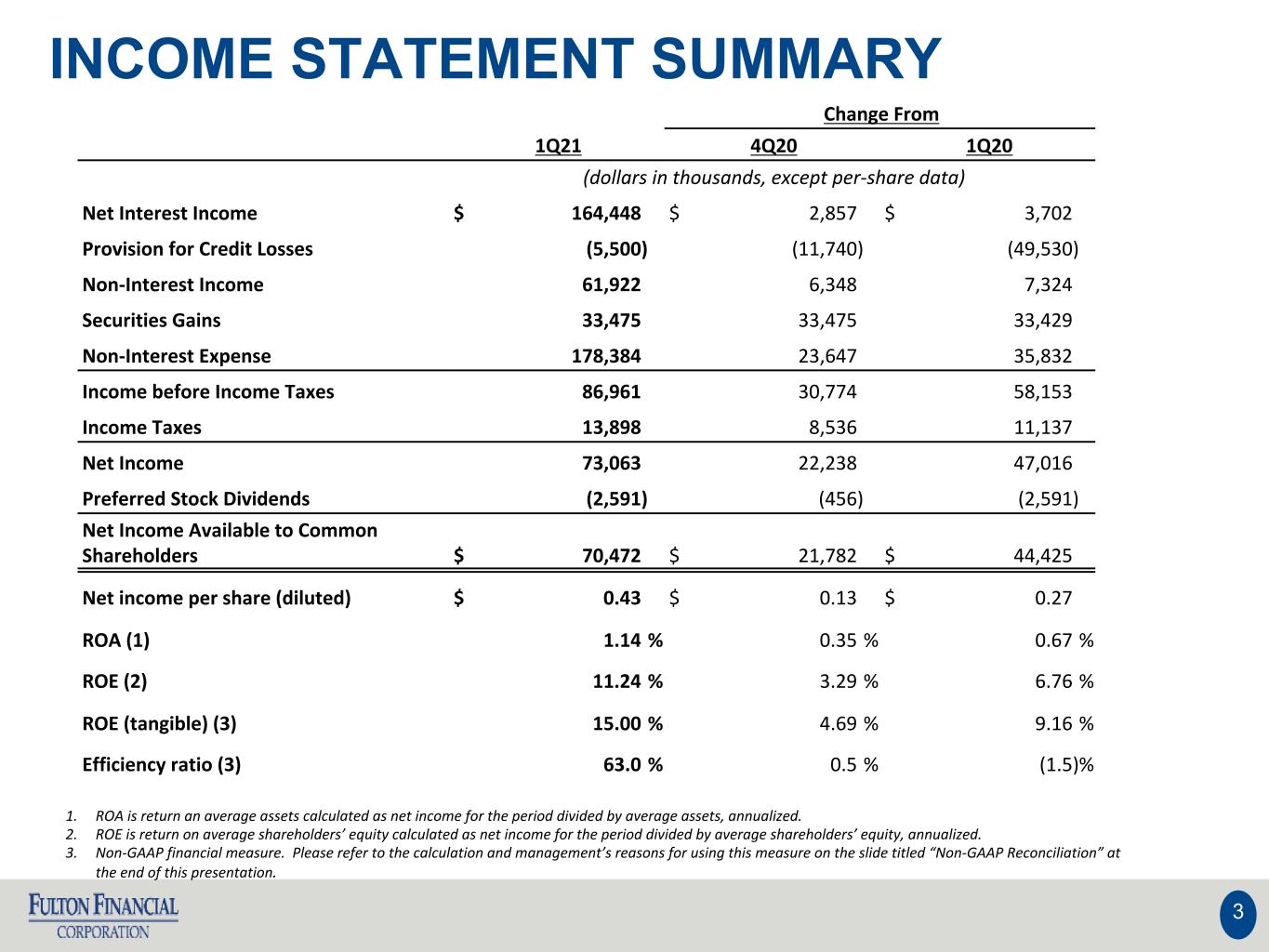

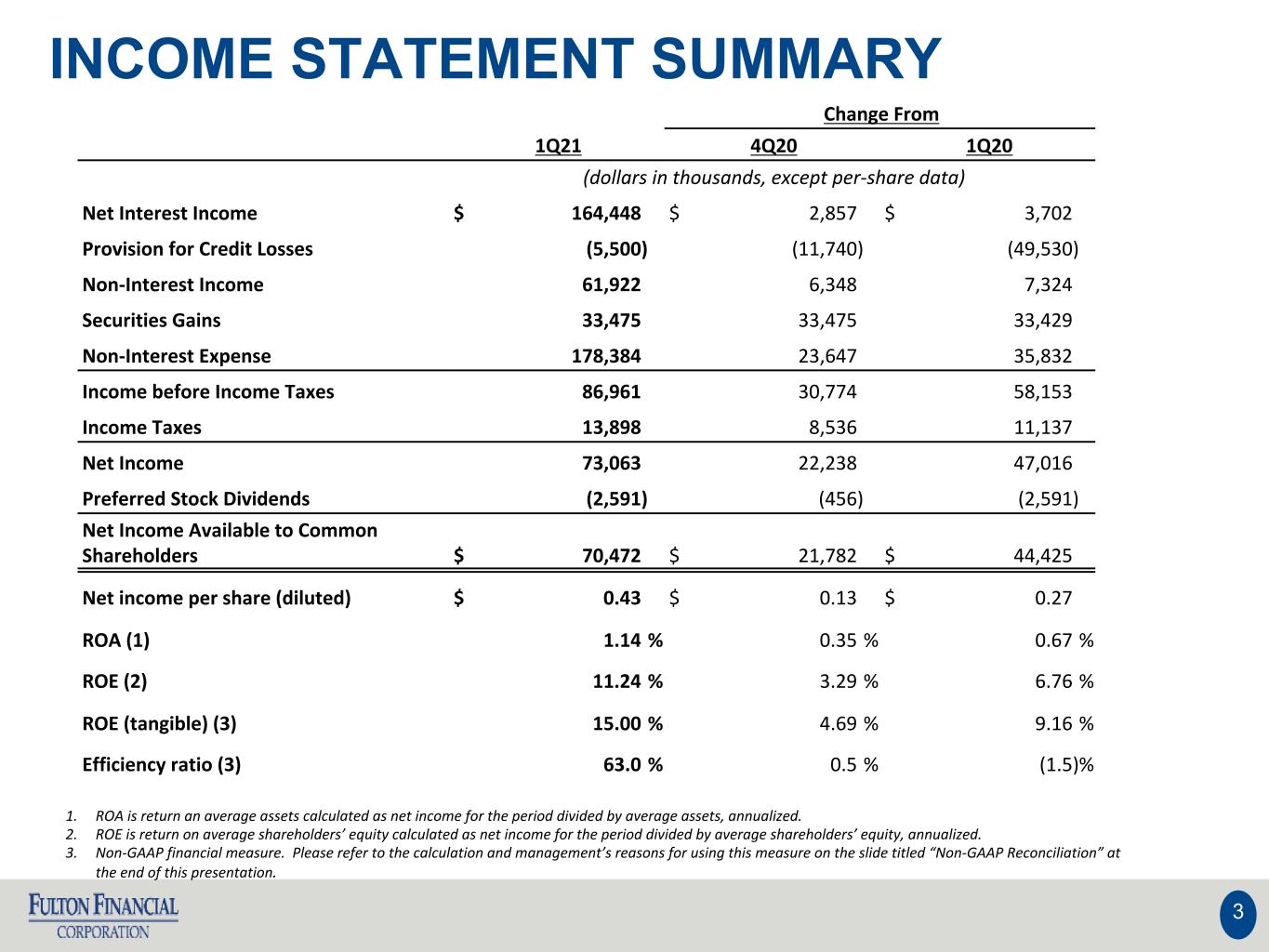

1. ROA is return an average assets calculated as net income for the period divided by average assets, annualized. 2. ROE is return on average shareholders’ equity calculated as net income for the period divided by average shareholders’ equity, annualized. 3. Non-GAAP financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. INCOME STATEMENT SUMMARY 3 Change From 1Q21 4Q20 1Q20 (dollars in thousands, except per-share data) Net Interest Income $ 164,448 $ 2,857 $ 3,702 Provision for Credit Losses (5,500) (11,740) (49,530) Non-Interest Income 61,922 6,348 7,324 Securities Gains 33,475 33,475 33,429 Non-Interest Expense 178,384 23,647 35,832 Income before Income Taxes 86,961 30,774 58,153 Income Taxes 13,898 8,536 11,137 Net Income 73,063 22,238 47,016 Preferred Stock Dividends (2,591) (456) (2,591) Net Income Available to Common Shareholders $ 70,472 $ 21,782 $ 44,425 Net income per share (diluted) $ 0.43 $ 0.13 $ 0.27 ROA (1) 1.14 % 0.35 % 0.67 % ROE (2) 11.24 % 3.29 % 6.76 % ROE (tangible) (3) 15.00 % 4.69 % 9.16 % Efficiency ratio (3) 63.0 % 0.5 % (1.5) %

NET INTEREST INCOME AND MARGIN Net Interest Income & Net Interest Margin Average Interest-Earning Assets & Yields Average Liabilities & Rates ($ IN MILLIONS) ($ IN BILLIONS) ($ IN BILLIONS) 4 $17 $19 $20 $21 $21$2 $2 $2 $2 $2 1.02% 0.72% 0.62% 0.54% 0.51% Cost of Interest-bearing Liabilities Borrowings Deposits 1Q20 2Q20 3Q20 4Q20 1Q21 $— $5 $10 $15 $20 $25 0.00% 1.00% 2.00% 3.00% $161 $153 $154 $162 $164 3.21% 2.81% 2.70% 2.75% 2.79% Net Interest Income Net Interest Margin (Fully-taxable equivalent basis, or FTE) 1Q20 2Q20 3Q20 4Q20 1Q21 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 2.00% 2.25% 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% 4.00% $17 $18 $19 $19 $19 $4 $4 $4 $5 $5 3.97% 3.32% 3.13% 3.12% 3.13% Loans Securities & Other Interest-Earning Asset Yield (FTE) 1Q20 2Q20 3Q20 4Q20 1Q21 $5 $10 $15 $20 $25 2.00% 4.00% 6.00% 8.00%

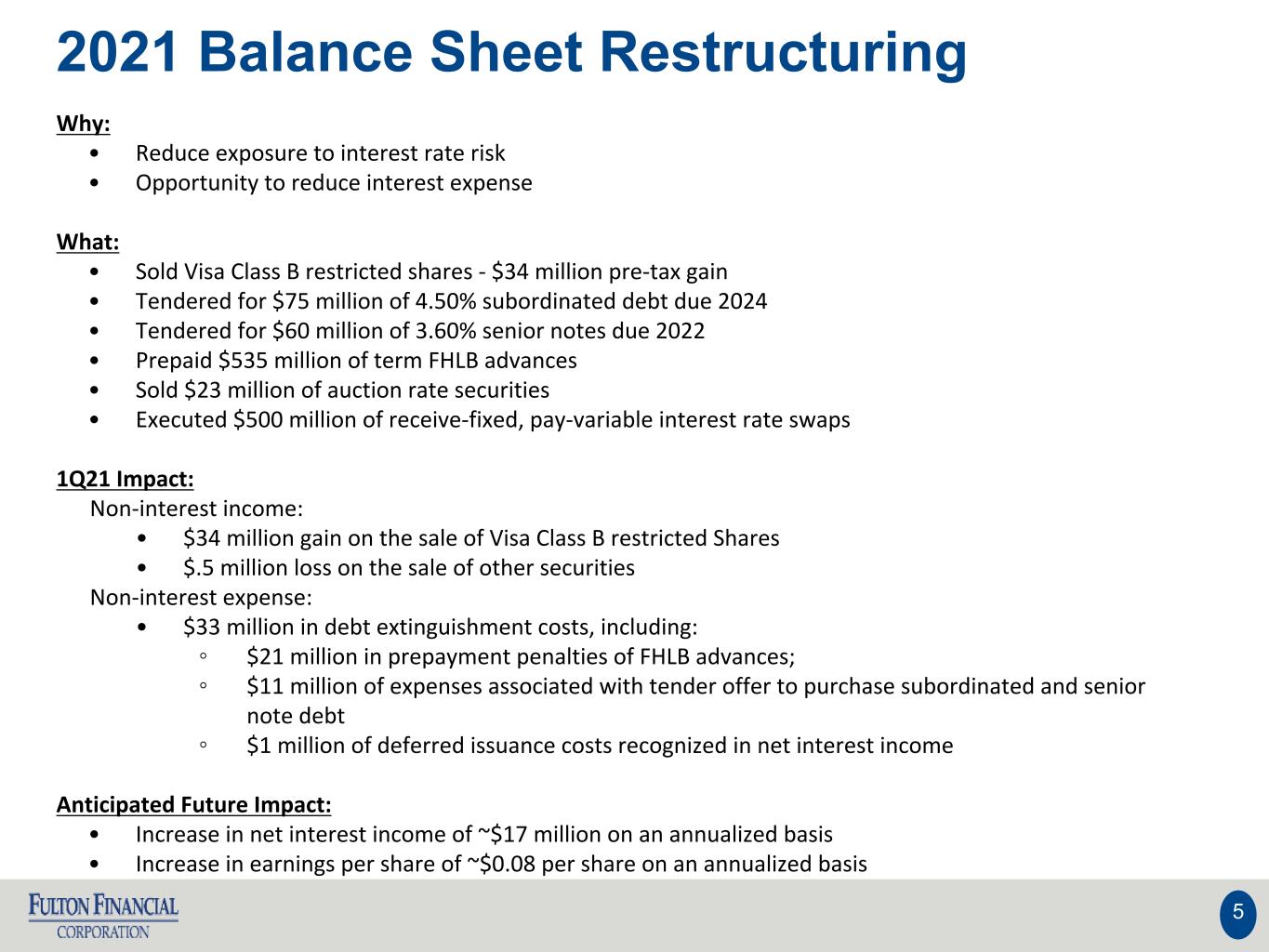

2021 Balance Sheet Restructuring 5 Why: • Reduce exposure to interest rate risk • Opportunity to reduce interest expense What: • Sold Visa Class B restricted shares - $34 million pre-tax gain • Tendered for $75 million of 4.50% subordinated debt due 2024 • Tendered for $60 million of 3.60% senior notes due 2022 • Prepaid $535 million of term FHLB advances • Sold $23 million of auction rate securities • Executed $500 million of receive-fixed, pay-variable interest rate swaps 1Q21 Impact: Non-interest income: • $34 million gain on the sale of Visa Class B restricted Shares • $.5 million loss on the sale of other securities Non-interest expense: • $33 million in debt extinguishment costs, including: ◦ $21 million in prepayment penalties of FHLB advances; ◦ $11 million of expenses associated with tender offer to purchase subordinated and senior note debt ◦ $1 million of deferred issuance costs recognized in net interest income Anticipated Future Impact: • Increase in net interest income of ~$17 million on an annualized basis • Increase in earnings per share of ~$0.08 per share on an annualized basis

ASSET QUALITY ($ IN MILLIONS) Provision for Credit Losses Non-Performing Loans (NPLs) & NPLs to Loans Net Charge-offs (NCOs) and NCOs to Average Loans ACL(1) to NPLs & Loans 61. The allowance for credit losses (“ACL”) relates specifically to "Loans, net of unearned income" and does not include the ACL related to off-balance-sheet credit exposures. 2. Non-GAAP financial measure. Please refer to the calculation and management's reasons for using this measure on the slide titled "Non-GAAP Reconciliation" at the end of this presentation. $44 $20 $7 $6 $(6) 1Q20 2Q20 3Q20 4Q20 1Q21 $— $10 $20 $30 $40 $50 $140 $140 $142 $147 $152 0.82% 0.75% 0.75% 0.78% 0.80% NPL NPLs/Loans 1Q20 2Q20 3Q20 4Q20 1Q21 $100 $125 $150 $175 $200 0.00% 0.50% 1.00% 1.50% $11 $4 $(2) $(3) $6 0.26% 0.09% -0.05% -0.07% 0.13% Net charge-offs/(recoveries) NCOs/Average Loans (annualized) 1Q20 2Q20 3Q20 4Q20 1Q21 $0 $10 $20 $30 $40 (1.00)% (0.50)% 0.00% 0.50% 1.00% 170% 183% 188% 189% 174% 1.40% 1.53% 1.56% 1.60% 1.54% 1.40% 1.37% 1.40% 1.47% 1.40% ACL/NPLs ACL/Loans excl PPP(2) ACL/Loans 1Q20 2Q20 3Q20 4Q20 1Q21 50% 75% 100% 125% 150% 175% 200% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00%

NON-INTEREST INCOME(1) (1) Excluding investment securities gains Three months ended March 31, 2021 (percent of total non-interest income) 7 Non-interest income(1) increased 11% from 4Q20 Increases in: n Mortgage Banking driven by a reversal of a mortgage service assets valuation allowance of $6 million n Wealth management income, specifically brokerage income Partially offset by a decrease in: n Capital markets revenue - primarily commercial loan interest rate swaps 28% 22%18% 26% 6% Wealth Management Mortgage Banking Consumer Banking Commercial Banking Other 1Q21 4Q20 Change (dollars in thousands) n Wealth Management $ 17,347 $ 15,653 $ 1,694 n Mortgage Banking 13,960 9,311 4,649 n Consumer Banking 10,754 10,797 (43) n Commercial Banking 16,342 16,809 (467) n Other 3,519 3,004 515 Total $ 61,922 $ 55,574 $ 6,348

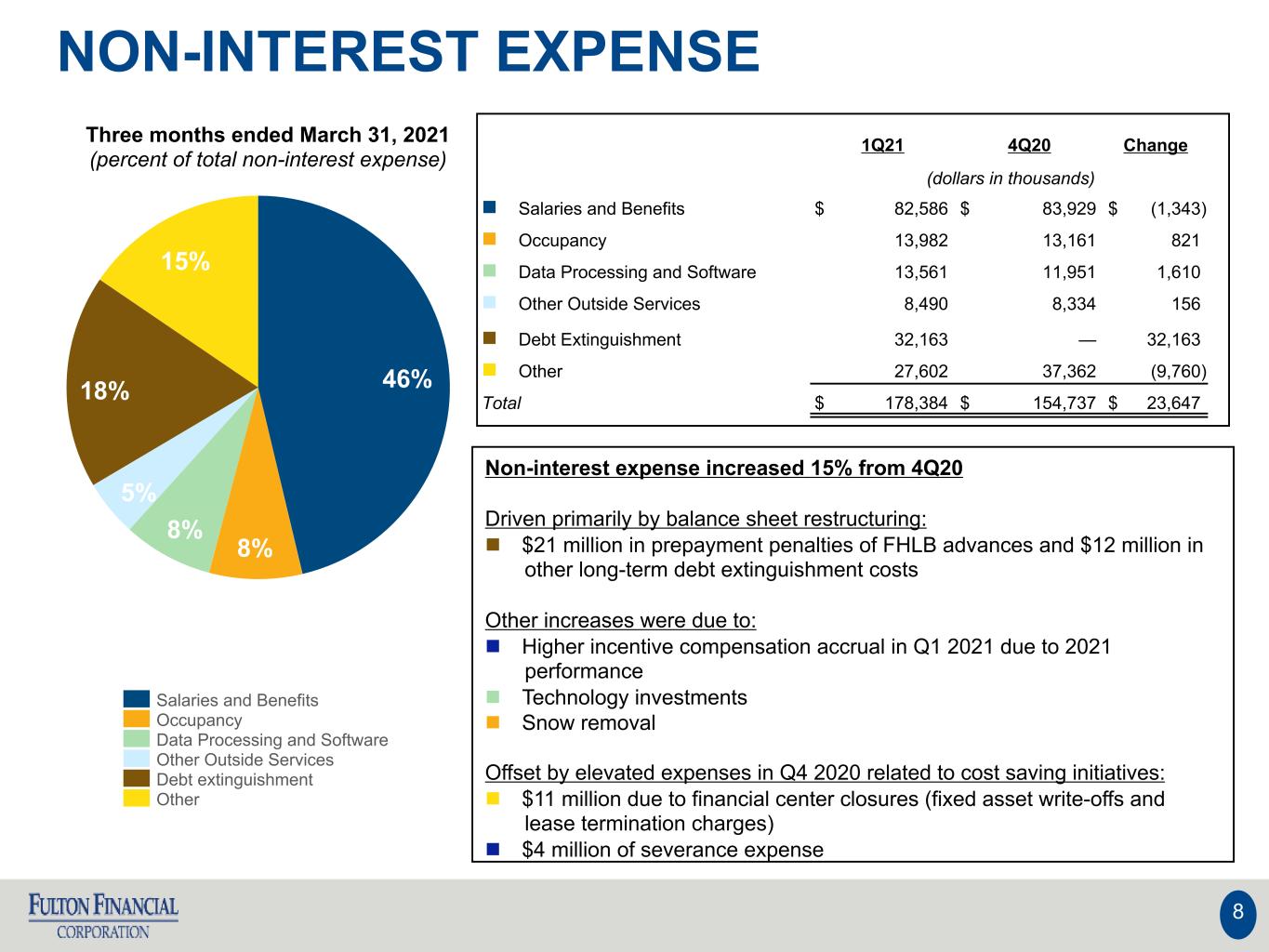

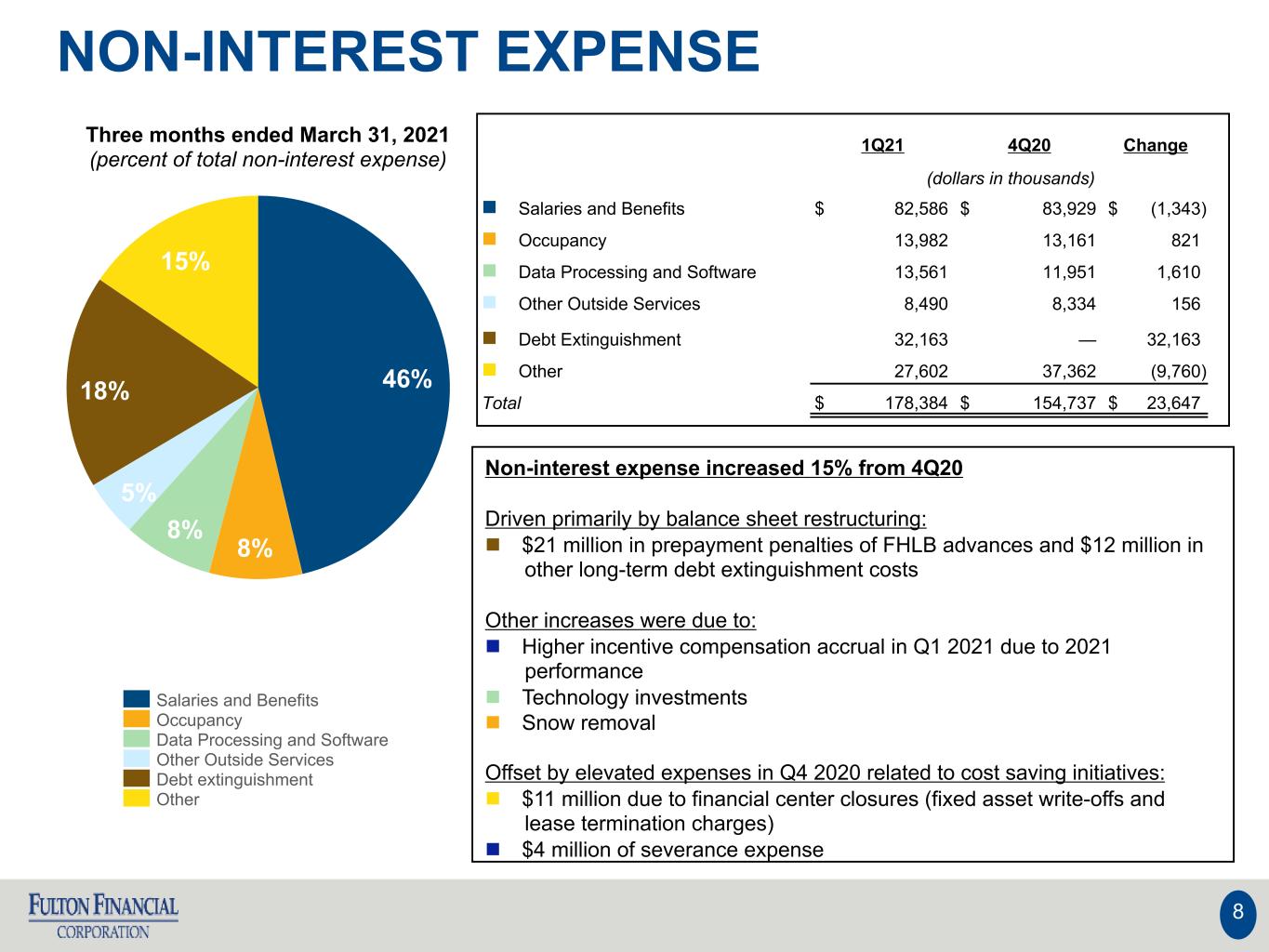

NON-INTEREST EXPENSE Three months ended March 31, 2021 (percent of total non-interest expense) 8 46% 8% 8% 5% 18% 15% Salaries and Benefits Occupancy Data Processing and Software Other Outside Services Debt extinguishment Other 1Q21 4Q20 Change (dollars in thousands) n Salaries and Benefits $ 82,586 $ 83,929 $ (1,343) n Occupancy 13,982 13,161 821 n Data Processing and Software 13,561 11,951 1,610 n Other Outside Services 8,490 8,334 156 n Debt Extinguishment 32,163 — 32,163 n Other 27,602 37,362 (9,760) Total $ 178,384 $ 154,737 $ 23,647 Non-interest expense increased 15% from 4Q20 Driven primarily by balance sheet restructuring: n $21 million in prepayment penalties of FHLB advances and $12 million in other long-term debt extinguishment costs Other increases were due to: n Higher incentive compensation accrual in Q1 2021 due to 2021 performance n Technology investments n Snow removal Offset by elevated expenses in Q4 2020 related to cost saving initiatives: n $11 million due to financial center closures (fixed asset write-offs and lease termination charges) n $4 million of severance expense

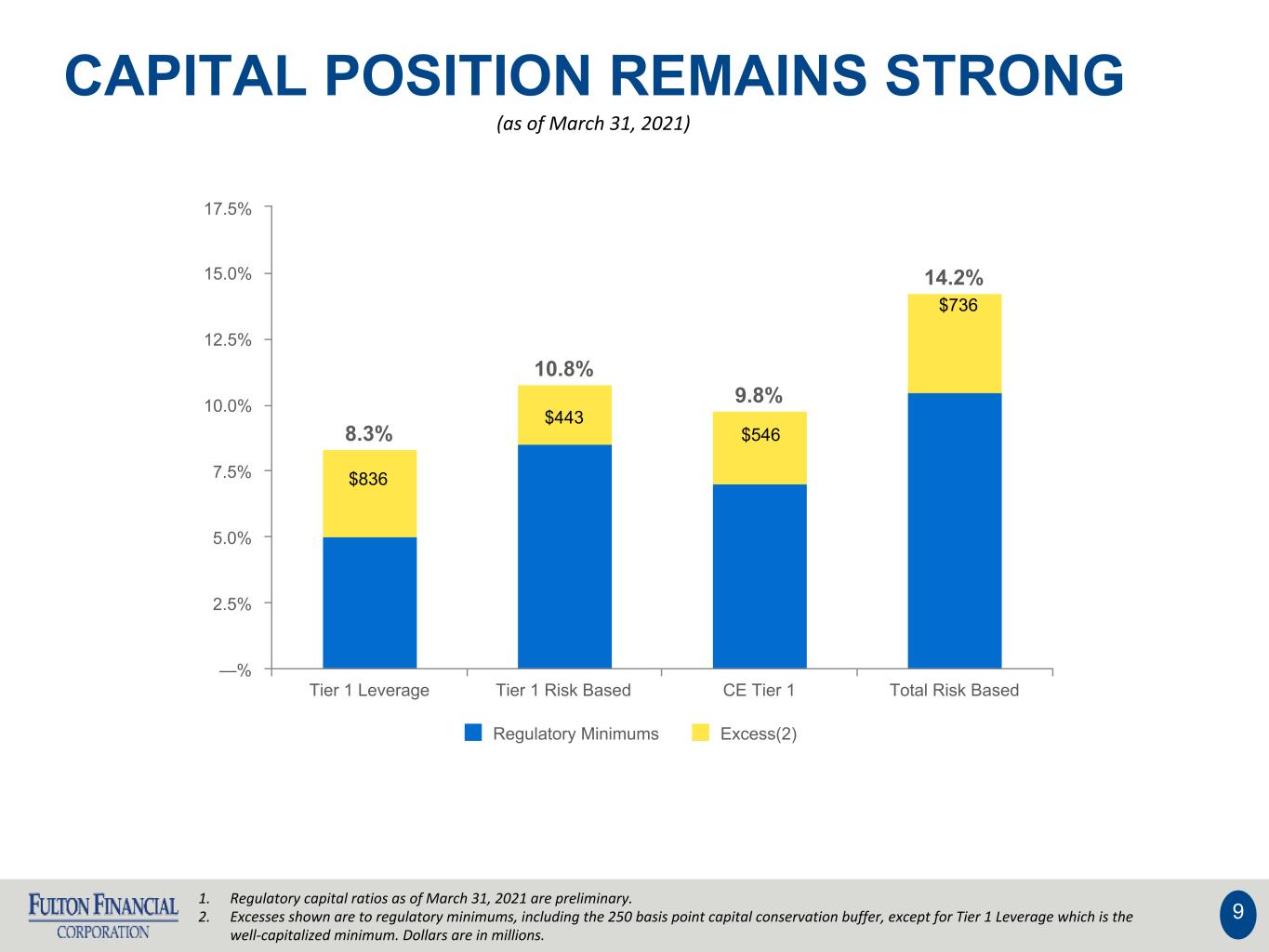

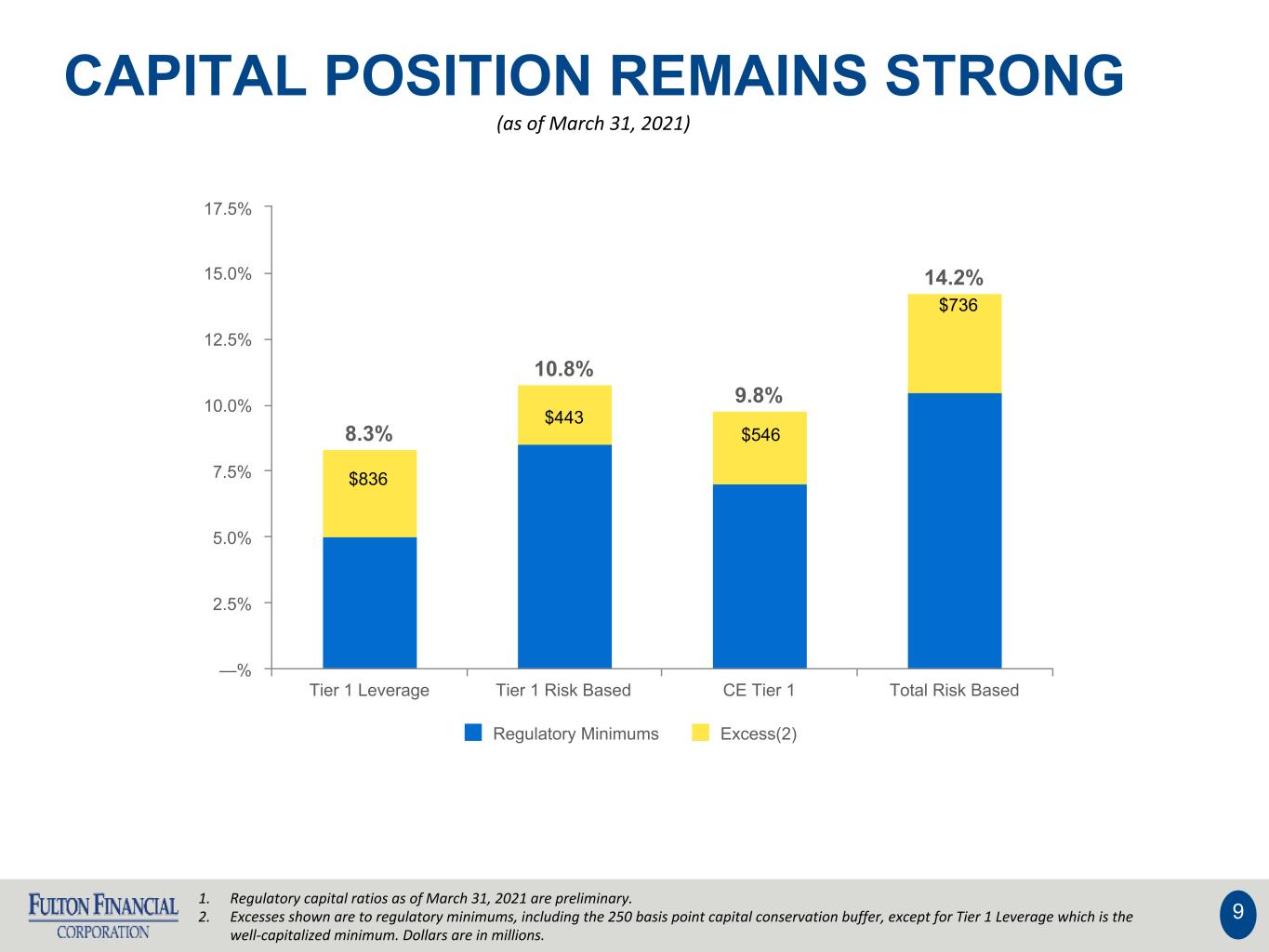

CAPITAL POSITION REMAINS STRONG 9 1. Regulatory capital ratios as of March 31, 2021 are preliminary. 2. Excesses shown are to regulatory minimums, including the 250 basis point capital conservation buffer, except for Tier 1 Leverage which is the well-capitalized minimum. Dollars are in millions. 8.3% 10.8% 9.8% 14.2% Regulatory Minimums Excess(2) Tier 1 Leverage Tier 1 Risk Based CE Tier 1 Total Risk Based —% 2.5% 5.0% 7.5% 10.0% 12.5% 15.0% 17.5% $836 $443 $546 $736 (as of March 31, 2021)

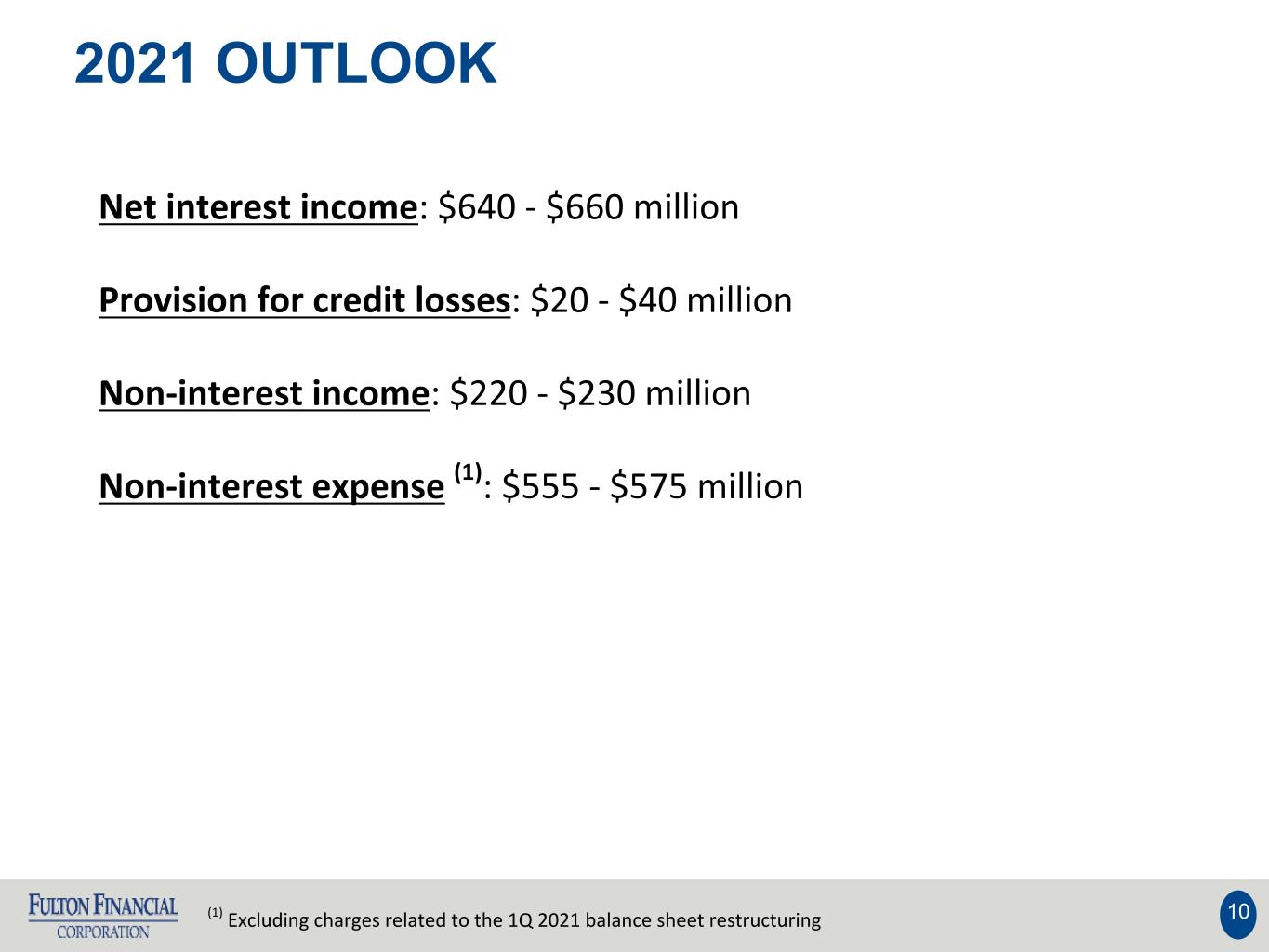

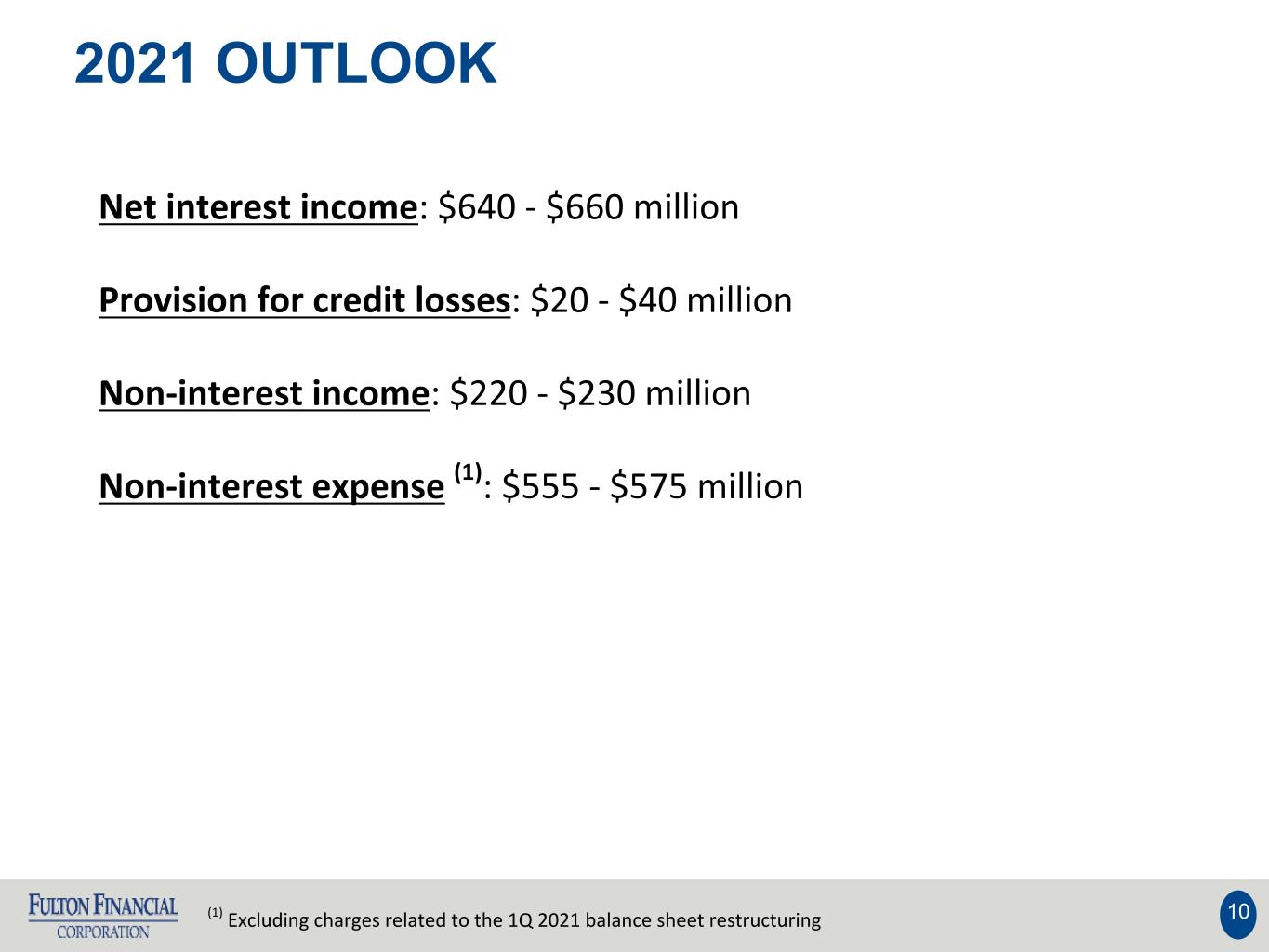

2021 OUTLOOK 10 Net interest income: $640 - $660 million Provision for credit losses: $20 - $40 million Non-interest income: $220 - $230 million Non-interest expense (1): $555 - $575 million (1) Excluding charges related to the 1Q 2021 balance sheet restructuring

NON-GAAP RECONCILIATION Note: The Corporation has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. 11 (dollars in thousands) Three months ended Mar 31 Dec 31 Mar 31 Return on average common shareholders' equity (tangible) 2021 2020 2020 Net income available to common shareholders $ 70,472 $ 48,690 $ 26,047 Plus: Intangible amortization, net of tax 90 104 104 (Numerator) 70,562 48,794 26,151 Average shareholders' equity $ 2,637,098 $ 2,544,866 $ 2,337,016 Less: Average preferred stock (192,878) (127,639) — Less: Average goodwill and intangible assets (536,601) (535,474) (535,235) Average tangible common shareholders' equity (denominator) 1,907,619 1,881,753 1,801,781 Return on average common shareholders' equity (tangible), annualized 15.00 % 10.32 % 5.84 %

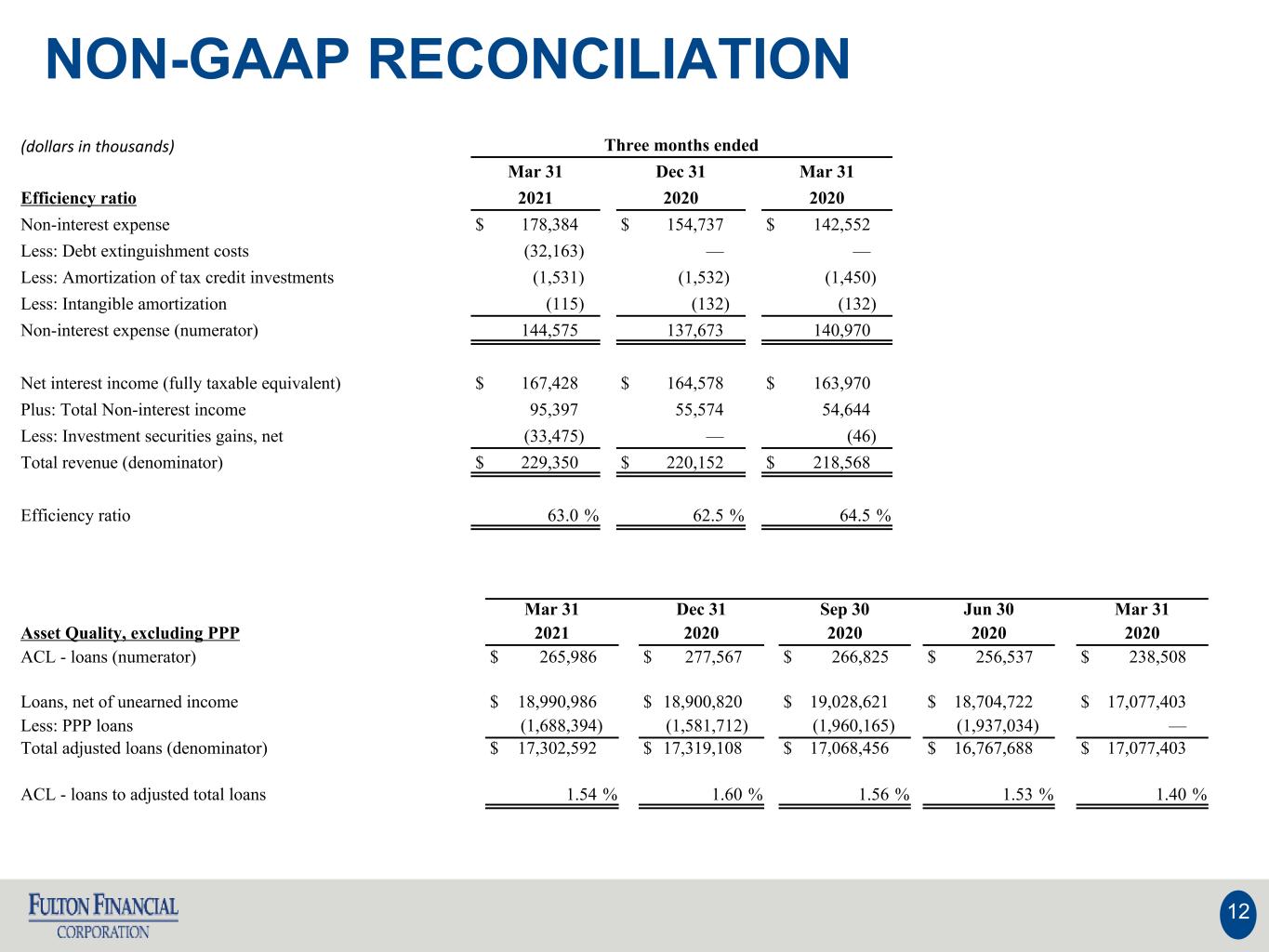

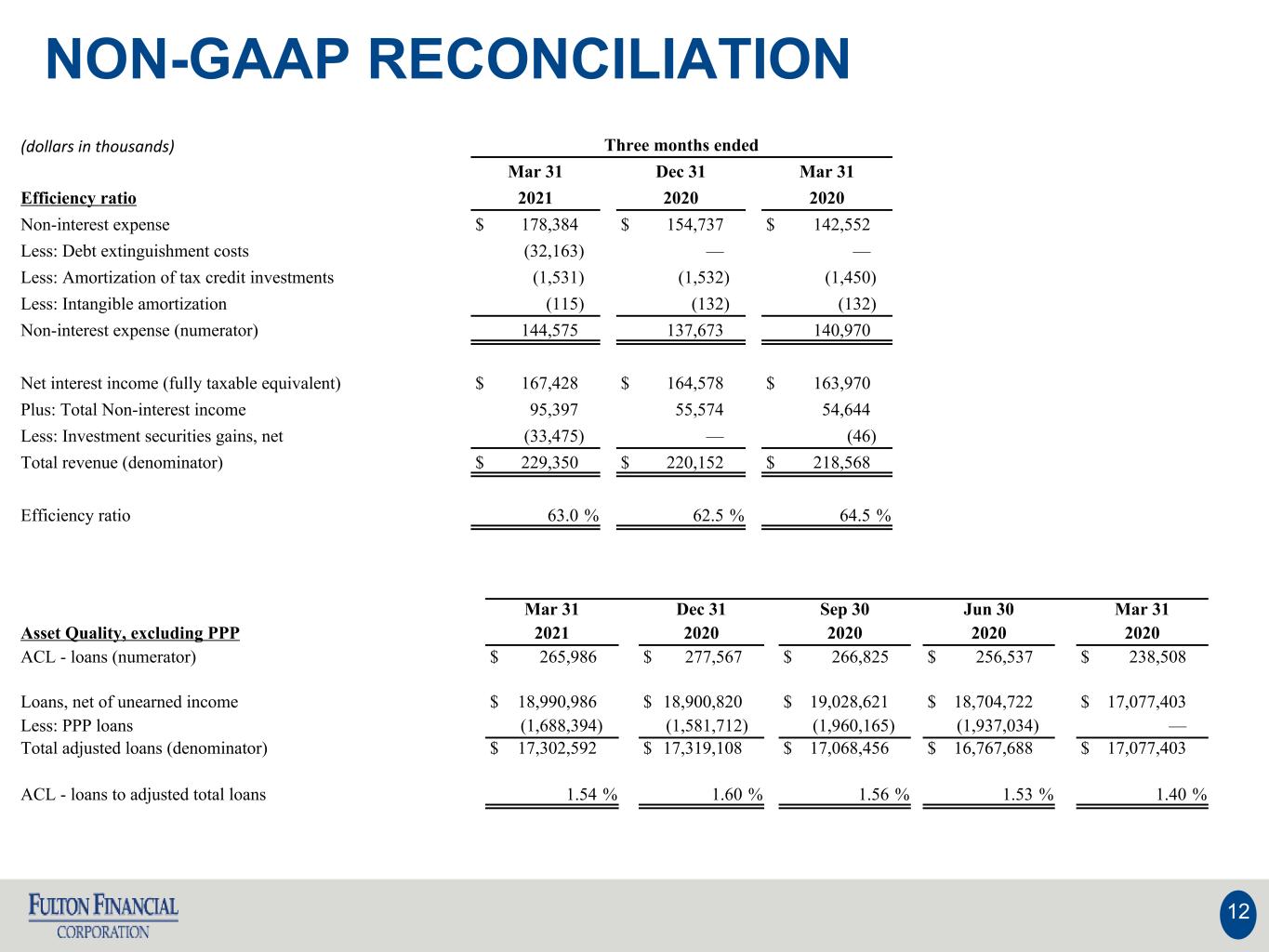

NON-GAAP RECONCILIATION 12 (dollars in thousands) Three months ended Mar 31 Dec 31 Mar 31 Efficiency ratio 2021 2020 2020 Non-interest expense $ 178,384 $ 154,737 $ 142,552 Less: Debt extinguishment costs (32,163) — — Less: Amortization of tax credit investments (1,531) (1,532) (1,450) Less: Intangible amortization (115) (132) (132) Non-interest expense (numerator) 144,575 137,673 140,970 Net interest income (fully taxable equivalent) $ 167,428 $ 164,578 $ 163,970 Plus: Total Non-interest income 95,397 55,574 54,644 Less: Investment securities gains, net (33,475) — (46) Total revenue (denominator) $ 229,350 $ 220,152 $ 218,568 Efficiency ratio 63.0 % 62.5 % 64.5 % Mar 31 Dec 31 Sep 30 Jun 30 Mar 31 Asset Quality, excluding PPP 2021 2020 2020 2020 2020 ACL - loans (numerator) $ 265,986 $ 277,567 $ 266,825 $ 256,537 $ 238,508 Loans, net of unearned income $ 18,990,986 $ 18,900,820 $ 19,028,621 $ 18,704,722 $ 17,077,403 Less: PPP loans (1,688,394) (1,581,712) (1,960,165) (1,937,034) — Total adjusted loans (denominator) $ 17,302,592 $ 17,319,108 $ 17,068,456 $ 16,767,688 $ 17,077,403 ACL - loans to adjusted total loans 1.54 % 1.60 % 1.56 % 1.53 % 1.40 %

APPENDIX - CREDIT DISCLOSURES 13 Additional detail on deferrals and selected industries (data as of March 31, 2021; all industry classifications based on NAICS codes)

Active COVID Deferrals(1) Continue to Decline 14 Commercial • At March 31, 2021, active deferrals declined to ~$153 million, or 1.1% of the commercial portfolio(2) • Majority of active deferrals are in the hospitality, entertainment, and fitness industries • Continued focus to obtain credit enhancements where appropriate to support the additional deferrals Consumer • At March 31, 2021, active deferrals and forbearances declined to ~$94 million, or 1.9%, of the consumer portfolio(3) 1) Deferrals consist of deferrals of principal and interest payments or deferrals of principal payments. 2) Includes real estate - commercial mortgage, commercial and industrial and equipment lease financing. 3) Includes real estate - residential mortgage, real estate - home equity and consumer.

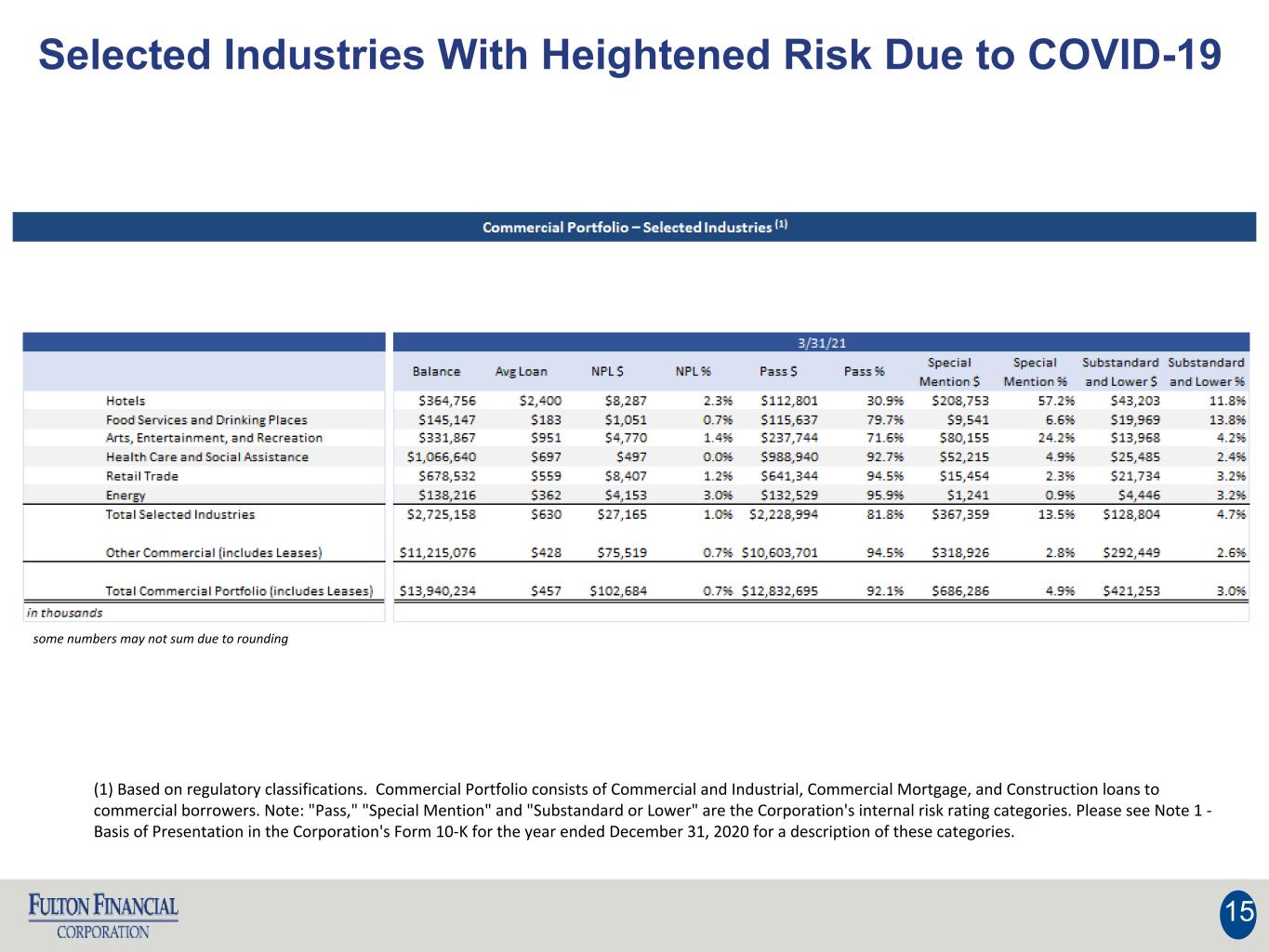

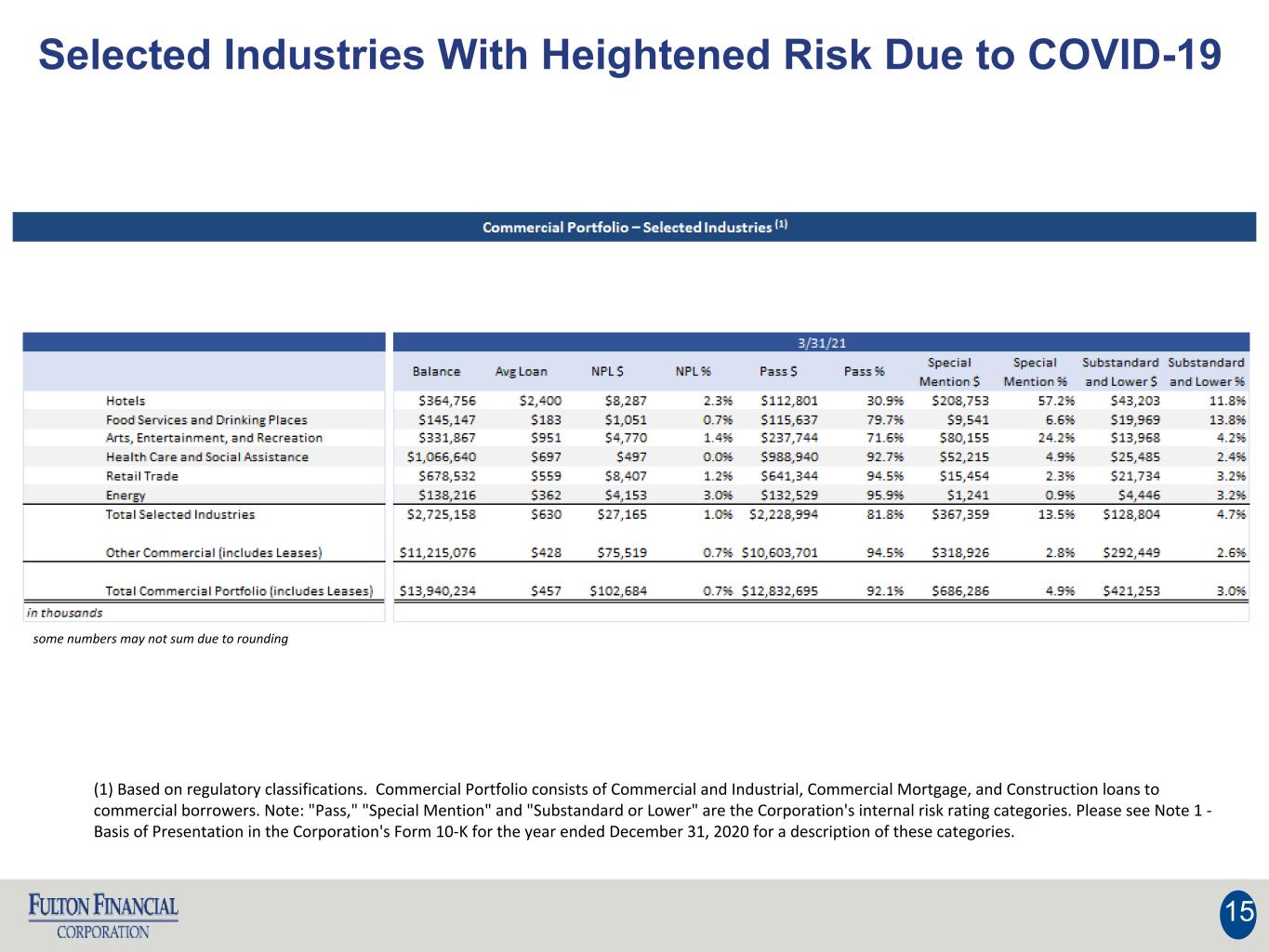

Selected Industries With Heightened Risk Due to COVID-19 15 (1) Based on regulatory classifications. Commercial Portfolio consists of Commercial and Industrial, Commercial Mortgage, and Construction loans to commercial borrowers. Note: "Pass," "Special Mention" and "Substandard or Lower" are the Corporation's internal risk rating categories. Please see Note 1 - Basis of Presentation in the Corporation's Form 10-K for the year ended December 31, 2020 for a description of these categories. some numbers may not sum due to rounding