z INVESTOR PRESENTATION

Forward-Looking Statements 2 This presentation may contain forward-looking statements with respect to the financial condition, results of operations and business of Fulton Financial Corporation (the “Corporation”). Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward-looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, including future credit losses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Management’s "2022 Outlook "contained herein is comprised of forward-looking statements. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, the statements are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2021, Quarterly Report on Form 10-Q for quarter ended March 31, 2022 and other current and periodic reports, which have been or will be filed with the Securities and Exchange Commission (the "SEC”) and are or will be available in the Investor Relations section of the Corporation’s website (www.fultonbank.com) and on the SEC’s website (www.sec.gov). The Corporation uses certain non-GAAP (Generally Accepted Accounting Principles) financial measures in this presentation. These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation.

Deep Executive Bench With Continuity; Compelling Markets and Opportunities 3 (1) Includes years of service in public accounting and investment banking as a financial services industry specialist. (2) Includes years of service in public accounting as a financial services industry specialist. Name Position Years at Fulton Years in Financial Services Prior Experience Phil Wenger Chairman/CEO 43 43 Various roles since joining in 1979 Curt Myers President/COO 32 32 Various roles since joining in 1990 Mark McCollom (1) Chief Financial Officer 4 35 PwC, Banking and Investment Banking; Joined Fulton in November 2017 Angela Snyder Chief Banking Officer 20 37 Various roles since joining in 2002 Meg Mueller Head of Commercial Banking 26 36 Various roles since joining in 1996 Angie Sargent Chief Information Officer 30 30 Various roles since joining in 1992 Betsy Chivinski (2) Chief Risk Officer 28 40 Various roles since joining in 1994 Valuable Franchise in Attractive Markets Relationship Banking Strategy Focused on the Customer Experience Granular, Well-Diversified Loan Portfolio Fee Income Generating Products and Business Lines Attractive Low-Cost Core Deposit Profile Prudent Expense Management with Opportunities to Further Improve Continued Progress in Digital Transformation Strong and Diverse Liquidity Position Solid Asset Quality and Reserves Strong Capital Position

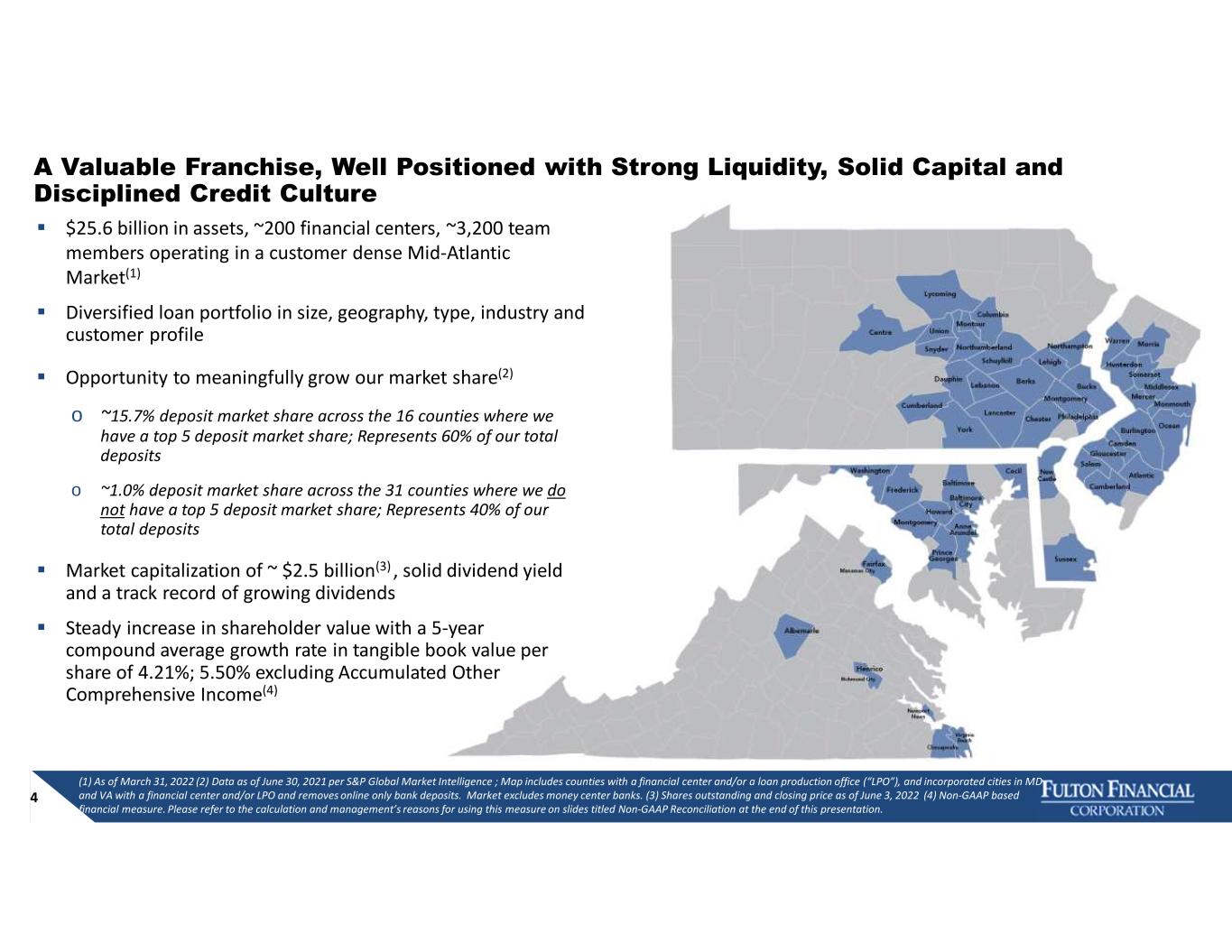

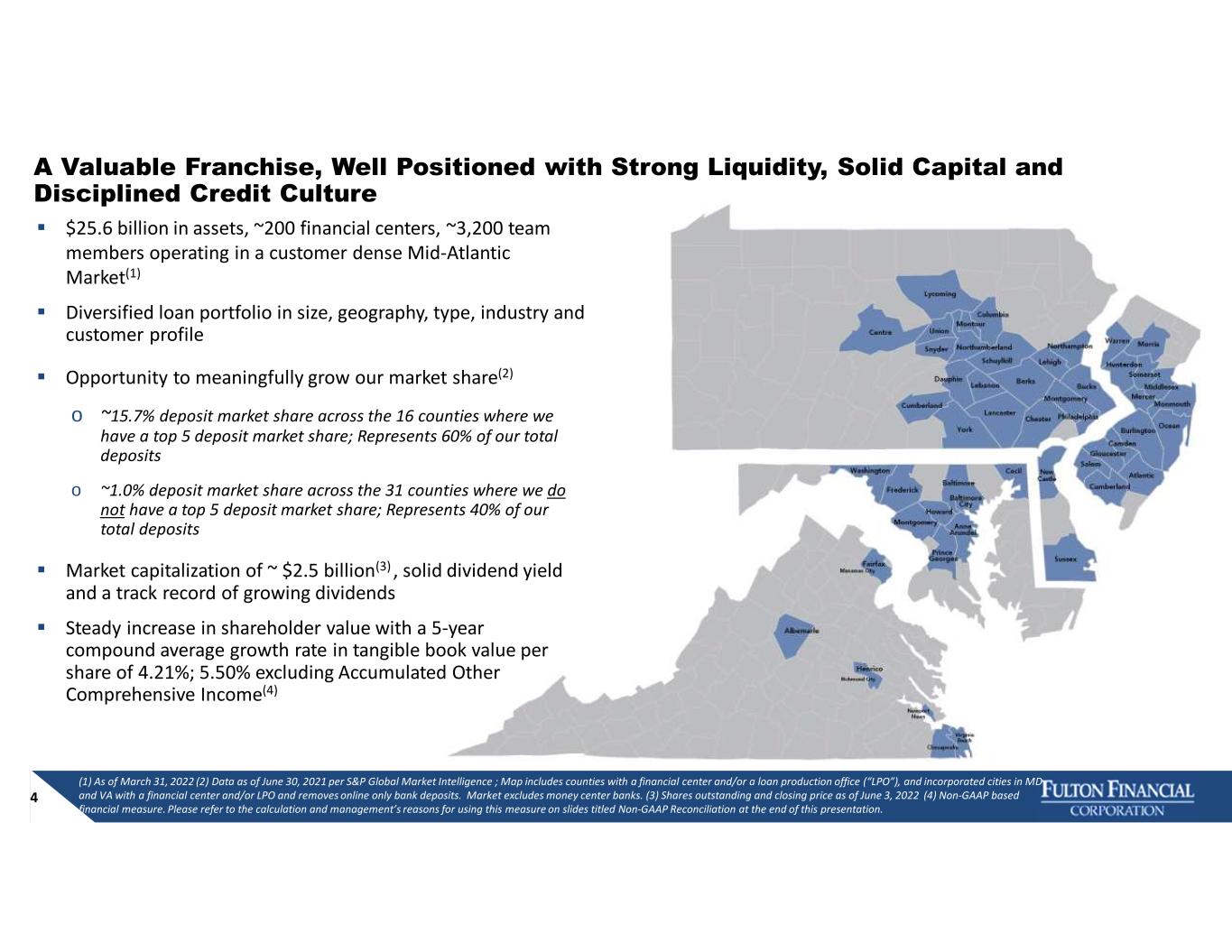

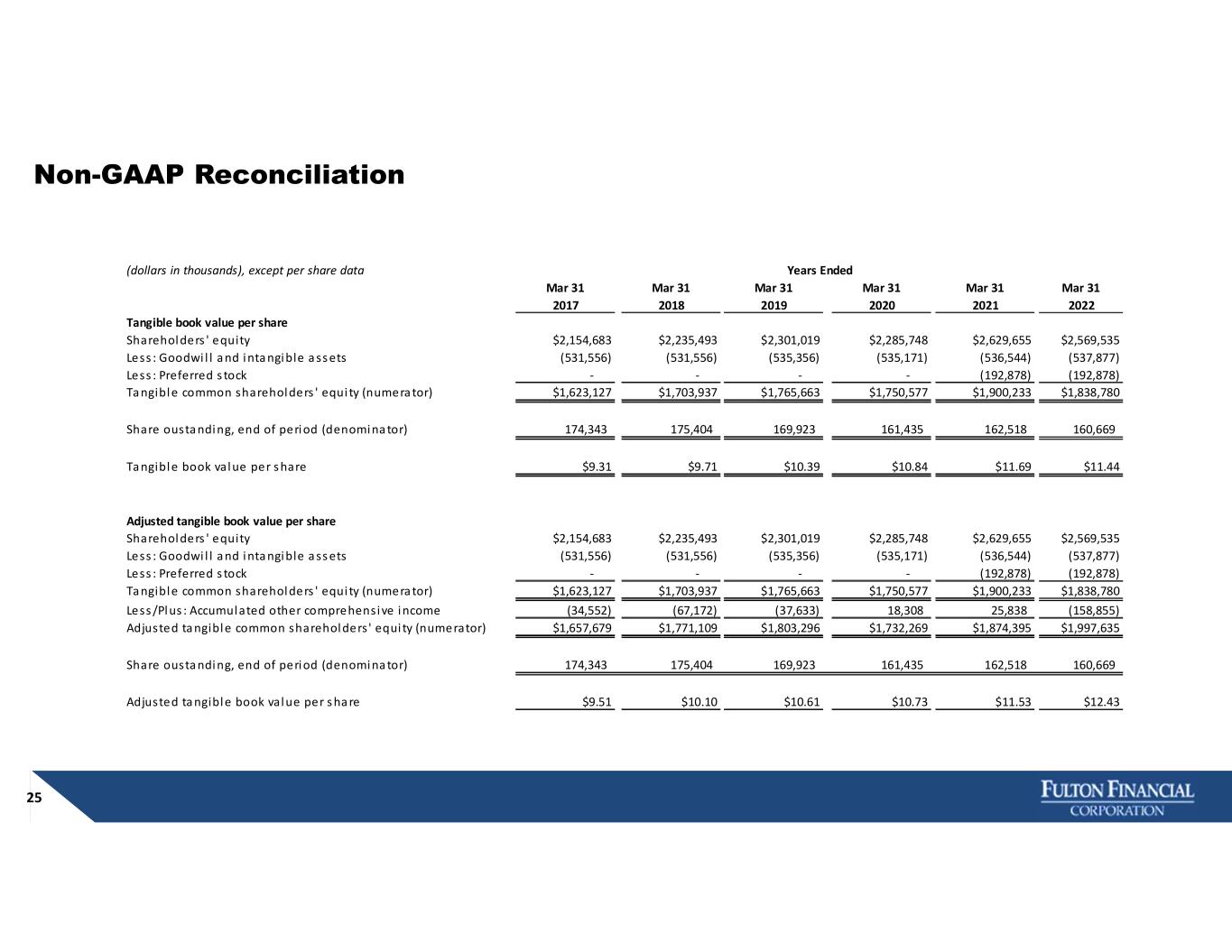

4 (1) As of March 31, 2022 (2) Data as of June 30, 2021 per S&P Global Market Intelligence ; Map includes counties with a financial center and/or a loan production office (“LPO”), and incorporated cities in MD and VA with a financial center and/or LPO and removes online only bank deposits. Market excludes money center banks. (3) Shares outstanding and closing price as of June 3, 2022 (4) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on slides titled Non-GAAP Reconciliation at the end of this presentation. A Valuable Franchise, Well Positioned with Strong Liquidity, Solid Capital and Disciplined Credit Culture $25.6 billion in assets, ~200 financial centers, ~3,200 team members operating in a customer dense Mid-Atlantic Market(1) Diversified loan portfolio in size, geography, type, industry and customer profile Opportunity to meaningfully grow our market share(2) o ~15.7% deposit market share across the 16 counties where we have a top 5 deposit market share; Represents 60% of our total deposits o ~1.0% deposit market share across the 31 counties where we do not have a top 5 deposit market share; Represents 40% of our total deposits Market capitalization of ~ $2.5 billion(3) , solid dividend yield and a track record of growing dividends Steady increase in shareholder value with a 5-year compound average growth rate in tangible book value per share of 4.21%; 5.50% excluding Accumulated Other Comprehensive Income(4)

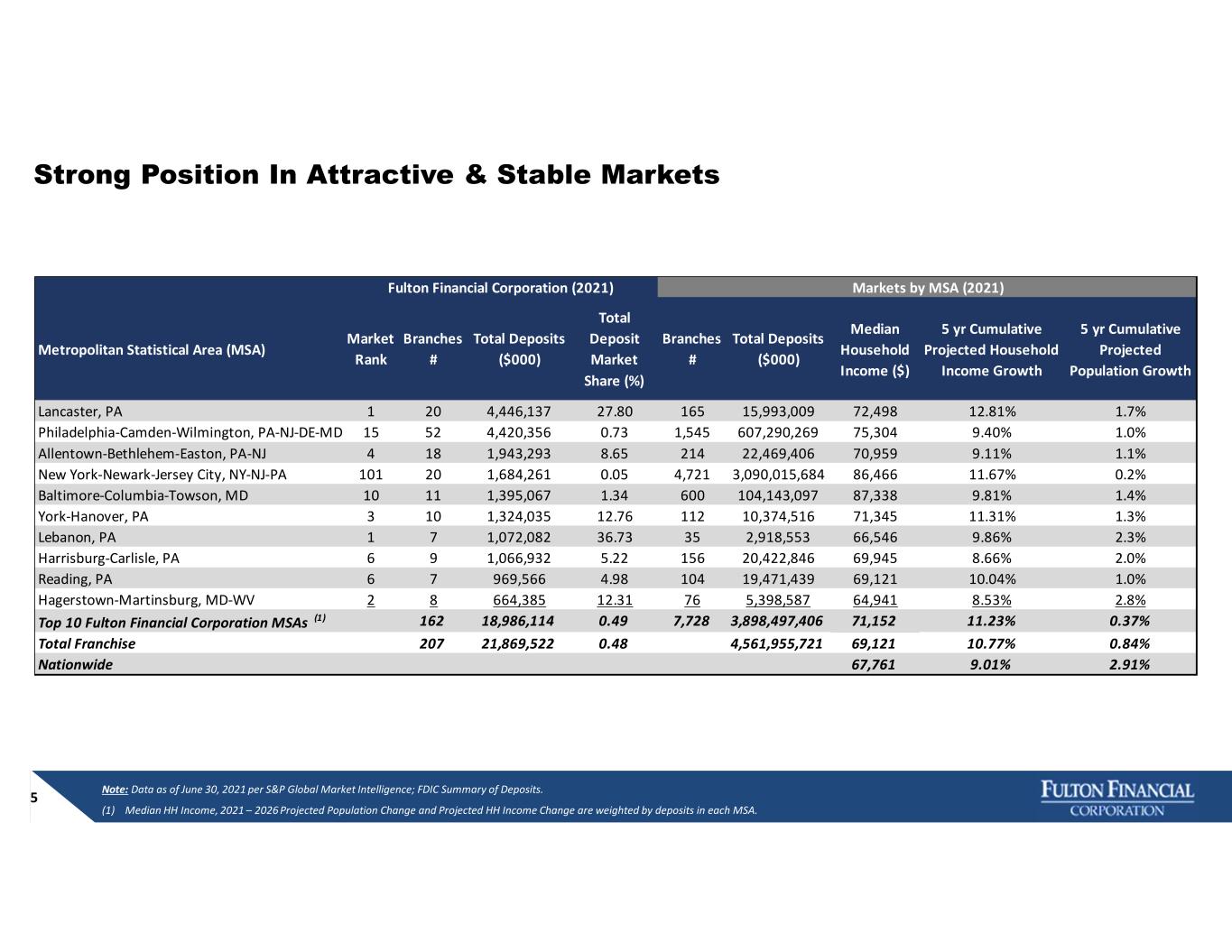

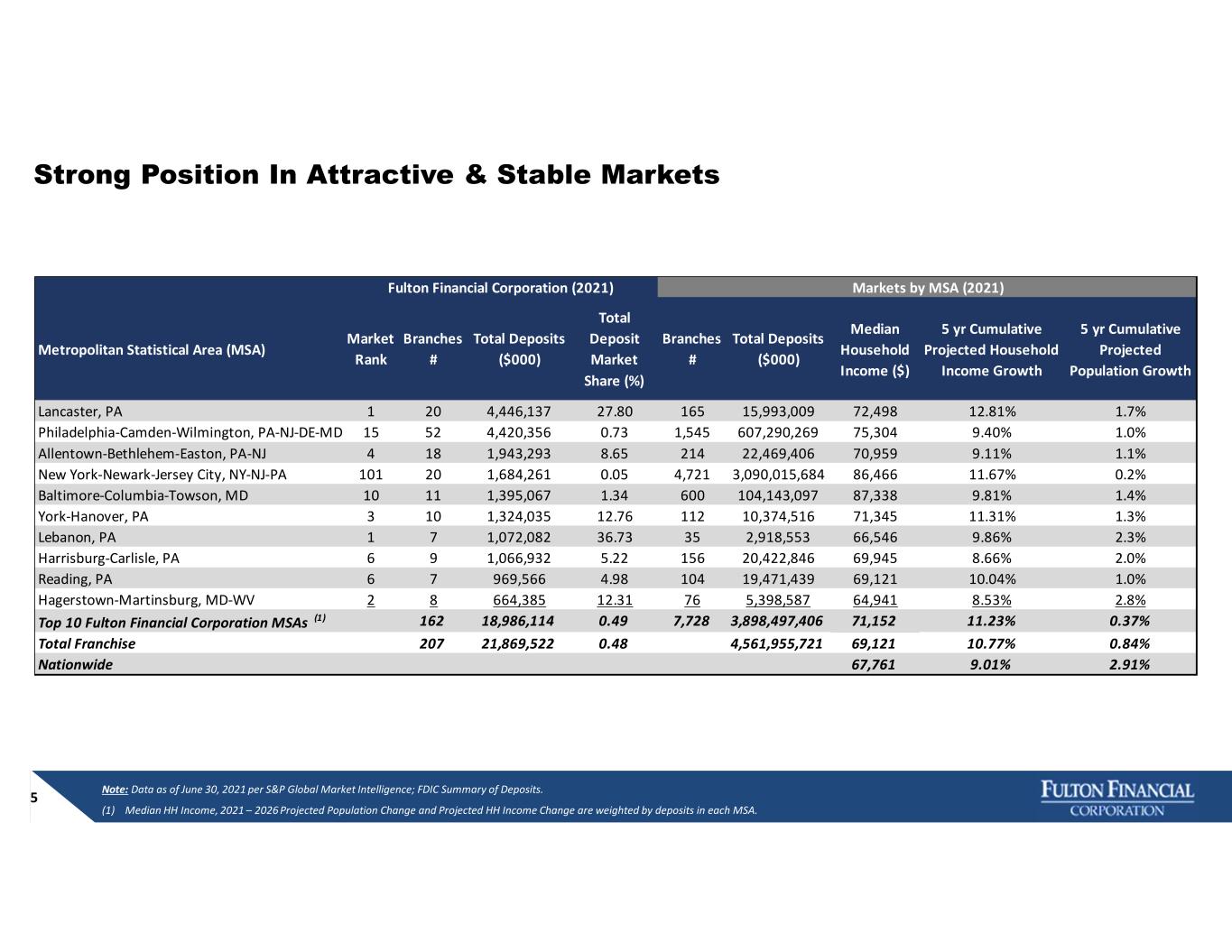

Strong Position In Attractive & Stable Markets 5 Note: Data as of June 30, 2021 per S&P Global Market Intelligence; FDIC Summary of Deposits. (1) Median HH Income, 2021 – 2026 Projected Population Change and Projected HH Income Change are weighted by deposits in each MSA. Fulton Financial Corporation (2021) Markets by MSA (2021) Metropolitan Statistical Area (MSA) Market Rank Branches # Total Deposits ($000) Total Deposit Market Share (%) Branches # Total Deposits ($000) Median Household Income ($) 5 yr Cumulative Projected Household Income Growth 5 yr Cumulative Projected Population Growth Lancaster, PA 1 20 4,446,137 27.80 165 15,993,009 72,498 12.81% 1.7% Philadelphia-Camden-Wilmington, PA-NJ-DE-MD 15 52 4,420,356 0.73 1,545 607,290,269 75,304 9.40% 1.0% Allentown-Bethlehem-Easton, PA-NJ 4 18 1,943,293 8.65 214 22,469,406 70,959 9.11% 1.1% New York-Newark-Jersey City, NY-NJ-PA 101 20 1,684,261 0.05 4,721 3,090,015,684 86,466 11.67% 0.2% Baltimore-Columbia-Towson, MD 10 11 1,395,067 1.34 600 104,143,097 87,338 9.81% 1.4% York-Hanover, PA 3 10 1,324,035 12.76 112 10,374,516 71,345 11.31% 1.3% Lebanon, PA 1 7 1,072,082 36.73 35 2,918,553 66,546 9.86% 2.3% Harrisburg-Carlisle, PA 6 9 1,066,932 5.22 156 20,422,846 69,945 8.66% 2.0% Reading, PA 6 7 969,566 4.98 104 19,471,439 69,121 10.04% 1.0% Hagerstown-Martinsburg, MD-WV 2 8 664,385 12.31 76 5,398,587 64,941 8.53% 2.8% Top 10 Fulton Financial Corporation MSAs (1) 162 18,986,114 0.49 7,728 3,898,497,406 71,152 11.23% 0.37% Total Franchise 207 21,869,522 0.48 4,561,955,721 69,121 10.77% 0.84% Nationwide 67,761 9.01% 2.91%

Extending Footprint Into Fast-Growing Urban Markets 6 Philadelphia is a natural fill-in opportunity within our current footprint o Opened 3 financial centers in 2019 o 1 financial center opened in 1Q22 and 1 financial center targeted to open in 1Q23 Philadelphia Market: o The announced acquisition of Prudential Bancorp will add 8 locations in Philadelphia County. o The top 5 banks have ~80% of the deposit market share o Presents a tremendous growth opportunity for Fulton Health Care, Technology and Professional Services are major economic forces, which are target business segments for Fulton Baltimore is another targeted area for growth o Opened 1 financial center and 1 LPO in 2019; 1 financial center in 2020; 1 financial center in 4Q21 and 1 financial center in 1Q22 Note: Deposit data as of June 30, 2021 per S&P Global Market Intelligence (excludes non-retail deposits and closed/proposed branches); FDIC Summary of Deposits Commentary Philadelphia, PA County Deposit Market Share - Top 20 Deposit Rank 2021 Parent Company Name Number of Branches Total Deposits In Market ($000) Total Deposit Market Share(%) 1 The PNC Financial Services Group, Inc. (PA) 35 14,102,622 19.87 2 Bank of America Corporation (NC) 18 13,569,967 19.12 3 Wells Fargo & Company (CA) 33 11,920,510 16.80 4 Citizens Financial Group, Inc. (RI) 45 8,582,799 12.10 5 Banco Santander, S.A. 16 8,369,077 11.79 6 The Toronto-Dominion Bank 20 4,986,512 7.03 7 WSFS Financial Corporation (DE) 17 1,809,473 2.55 8 M&T Bank Corporation (NY) 5 1,402,659 1.98 9 Firstrust Savings Bank (PA) 5 1,132,786 1.60 10 Republic First Bancorp, Inc. (PA) 7 912,046 1.29 11 Truist Financial Corporation (NC) 9 864,596 1.22 12 Prudential Bancorp, Inc. (PA) 8 652,324 0.92 13 JPMorgan Chase & Co. (NY) 15 544,021 0.77 14 Univest Financial Corporation (PA) 6 482,077 0.68 15 Asian Financial Corporation (PA) 2 221,154 0.31 16 United Savings Bank (PA) 3 200,805 0.28 17 S&T Bancorp, Inc. (PA) 2 162,163 0.23 18 Parke Bancorp, Inc. (NJ) 2 155,585 0.22 19 Hyperion Bancshares, Inc. (PA) 1 143,365 0.20 20 William Penn Bancorporation (PA) 2 128,957 0.18 21 Fulton Financial Corporation (PA) 3 93,178 0.13 All Others 21 521,813 0.73 Total - Philadelphia County 275 70,958,489 100.00

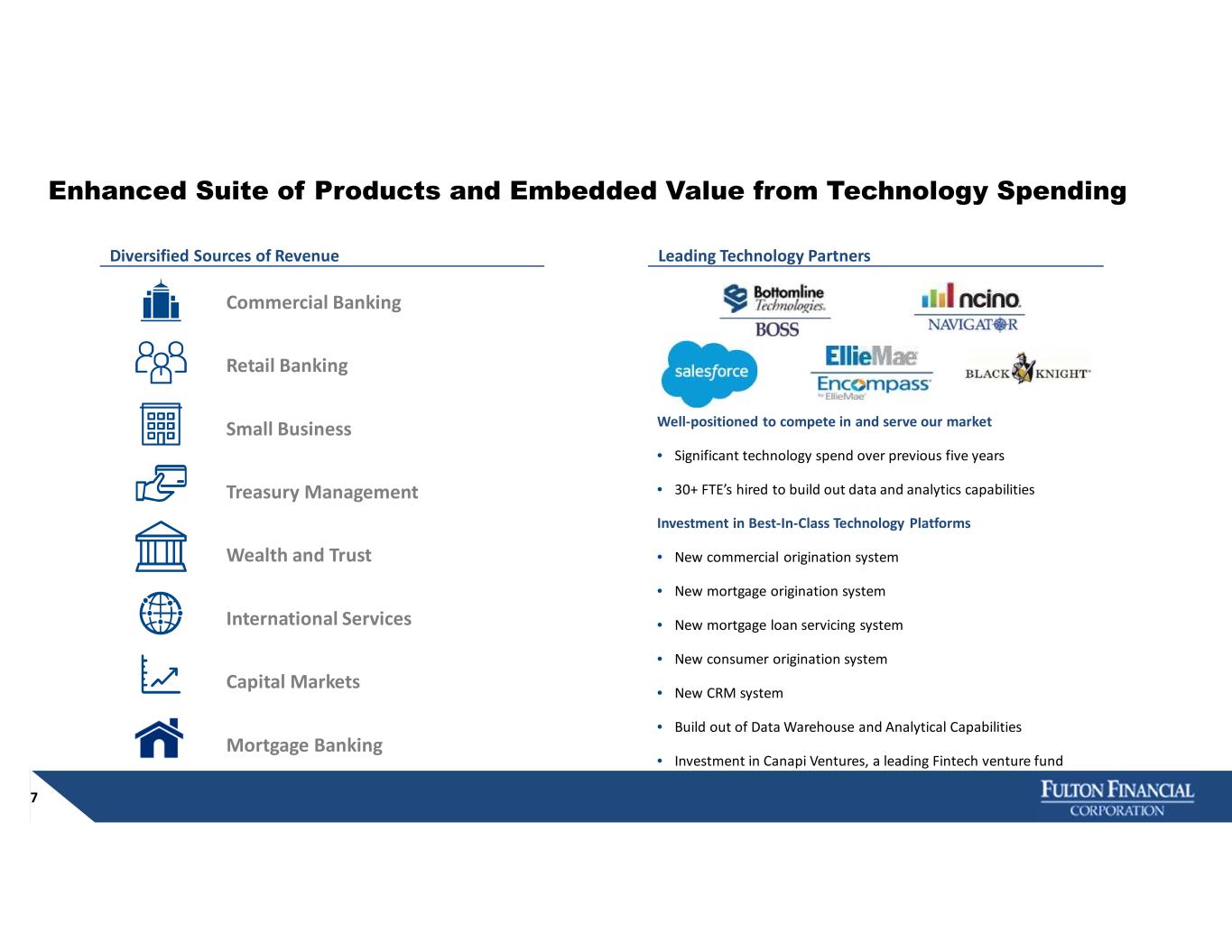

Enhanced Suite of Products and Embedded Value from Technology Spending Leading Technology Partners Well-positioned to compete in and serve our market • Significant technology spend over previous five years • 30+ FTE’s hired to build out data and analytics capabilities Investment in Best-In-Class Technology Platforms • New commercial origination system • New mortgage origination system • New mortgage loan servicing system • New consumer origination system • New CRM system • Build out of Data Warehouse and Analytical Capabilities • Investment in Canapi Ventures, a leading Fintech venture fund Diversified Sources of Revenue Commercial Banking Retail Banking Small Business Treasury Management Wealth and Trust International Services Capital Markets Mortgage Banking 7

Granular, Well-Diversified Loan Portfolio 8 $6.3 $6.5 $6.9 $7.1 $7.3 $4.3 $4.5 $5.5 $5.1 $4.2 $1.5 $1.4 $1.3 $1.1 $1.1 $2.1 $2.4 $2.9 $3.5 $3.9$1.0 $0.9 $1.0 $1.1 $1.1 $0.6 $0.7 $0.7 $0.7 $0.7 4.38% 4.55% 3.63% 3.46% 3.32% 3.00% 3.50% 4.00% 4.50% 5.00% $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 2018 2019 2020 2021 Q1 2022 Comm'l Mtg Comm'l Home Equity Res Mtg Construction Consumer/Other FTE loan yield (1) $18.3 A ve ra g e L o a n P o rt fo li o B a la n ce s T o ta l Lo a n P o rtfo lio Y ie ld (1 ) $15.8 $16.4 $18.6 $18.3 ($ in billions) Note: Loan portfolio composition is based on average balances for the years ended December 31, 2018 to 2021 and the three months ended March 31, 2022. (1) Presented on a fully-taxable equivalent (“FTE”) basis using a 21% federal tax rate and statutory interest expense disallowances. Average loans for YTD 2022 are down 1.3% compared to 2021 average loans and up 0.6% compared to 2020 average loans Excluding PPP loans, average loans for YTD 2022 are up 3.7% compared to 2021 average loans Since 2Q 2020, following reductions in the federal funds target rate, loan yields have declined modestly The Corporation remains asset sensitive with approximately 70% of the loan portfolio contractually variable or adjustable rate

Attractive Core Deposit Profile 9 Solid growth in core deposits, particularly noninterest-bearing deposits Deposits costs remain at historically low levels Excess liquidity provides the ability to manage deposit costs in a rising rate environment $2.7 $2.9 $2.5 $1.9 $1.7 $4.3 $4.2 $5.7 $7.2 $7.4 $4.0 $4.4 $5.3 $6.0 $5.7$3.1 $3.6 $3.9 $4.2 $4.2 $1.5 $1.5 $1.7 $2.1 $2.2 $0.1 $0.2 $0.3 $ 0.55% 0.79% 0.36% 0.15% 0.11% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% $- $4.0 $8.0 $12.0 $16.0 $20.0 $24.0 2018 2019 2020 2021 Q1 2022 Time Non-Int DDA Int DDA Money Mkt Savings Brokered Deposits Costs (1) $19.4 A ve ra g e D e p o si t B a la n ce s D e p o sit C o sts (1 ) $15.7 $16.8 $21.7 $21.5 ($ in billions) Note: Deposit composition is based on average balances for the years ended December 31, 2018 to 2021 and the three months ended March 31, 2022. Average brokered deposits were $122 million for 2018, $245 million for 2019, $311 million for 2020, $287 million for 2021 and $250 million for the three months ended March 31, 2022.. Core Deposits equal total deposits less brokered and time deposits. (1) Deposit costs calculated by dividing interest expense on interest-bearing deposits by total average deposits.

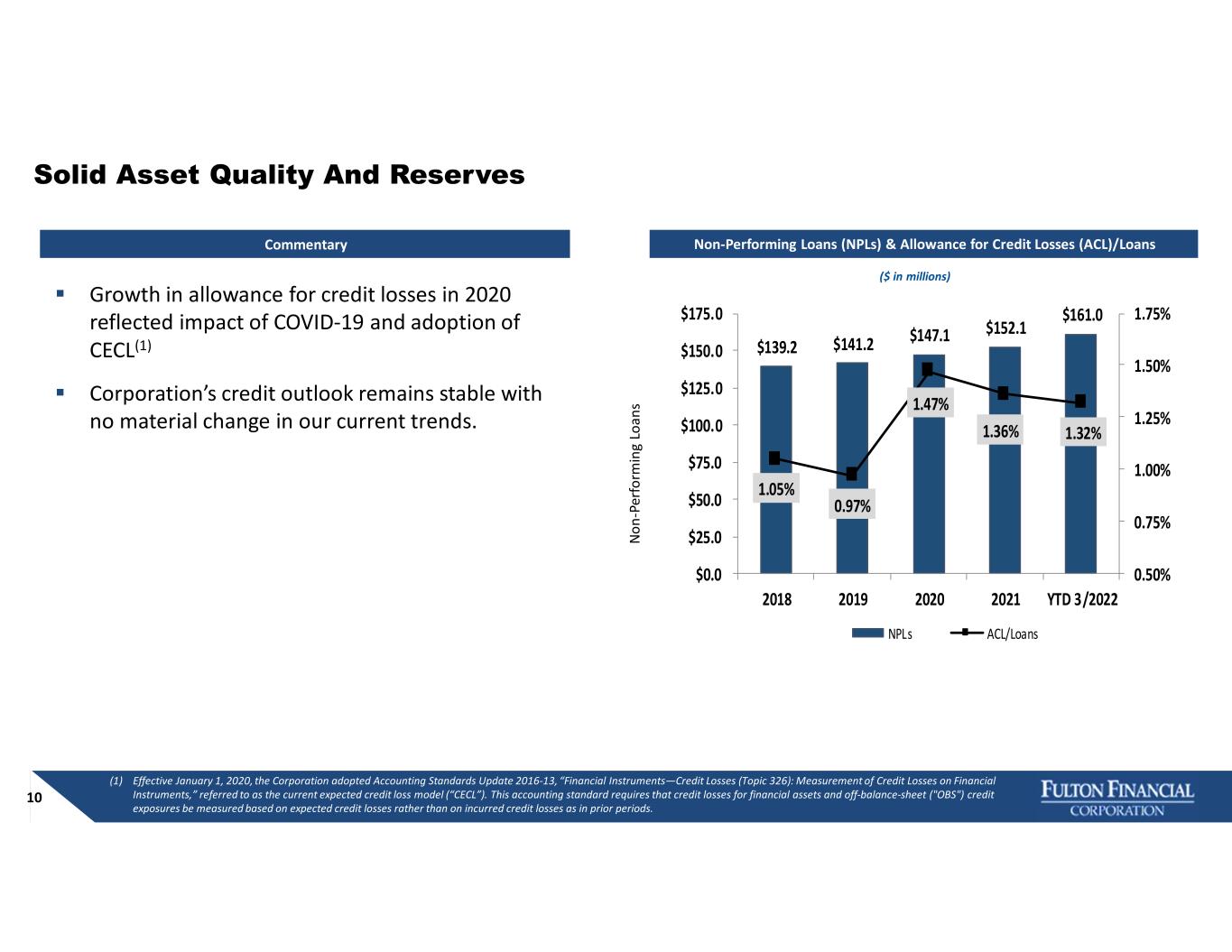

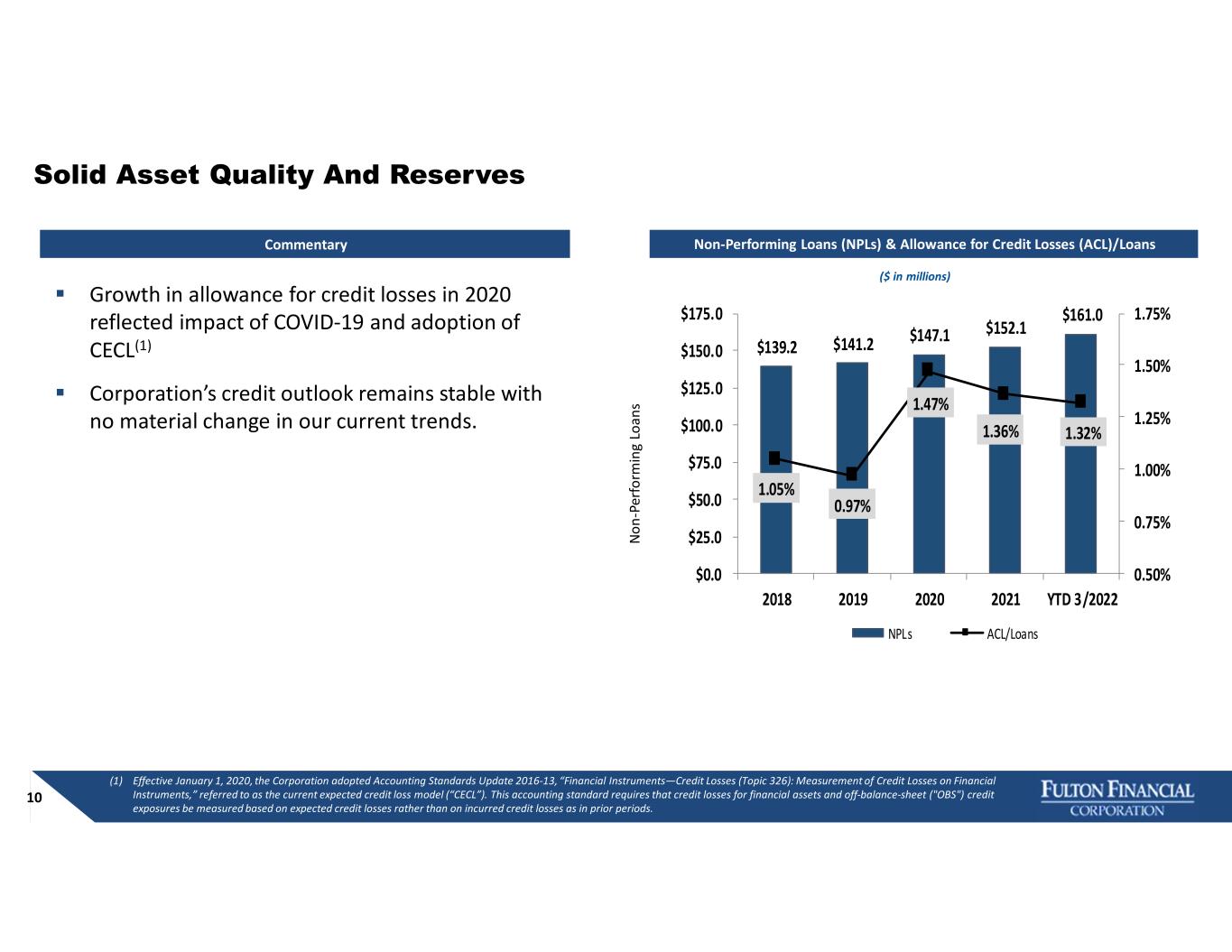

10 Solid Asset Quality And Reserves Commentary Non-Performing Loans (NPLs) & Allowance for Credit Losses (ACL)/Loans ($ in millions) N o n -P e rf o rm in g L o a n s $139.2 $141.2 $147.1 $152.1 $161.0 1.05% 0.97% 1.47% 1.36% 1.32% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% $0.0 $25.0 $50.0 $75.0 $100.0 $125.0 $150.0 $175.0 2018 2019 2020 2021 YTD 3/2022 NPLs ACL/Loans Growth in allowance for credit losses in 2020 reflected impact of COVID-19 and adoption of CECL(1) Corporation’s credit outlook remains stable with no material change in our current trends. (1) Effective January 1, 2020, the Corporation adopted Accounting Standards Update 2016-13, “Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments,” referred to as the current expected credit loss model (“CECL”). This accounting standard requires that credit losses for financial assets and off-balance-sheet ("OBS") credit exposures be measured based on expected credit losses rather than on incurred credit losses as in prior periods.

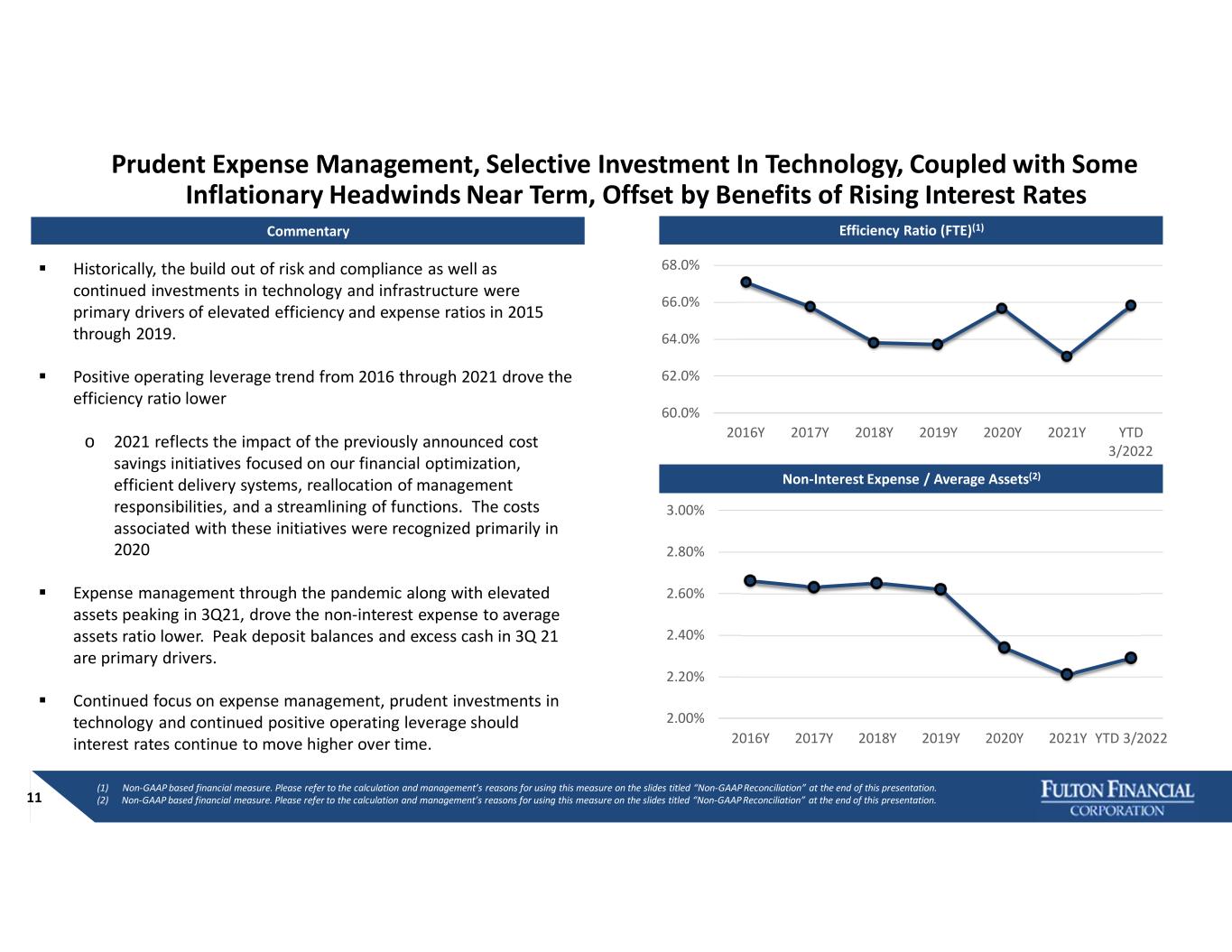

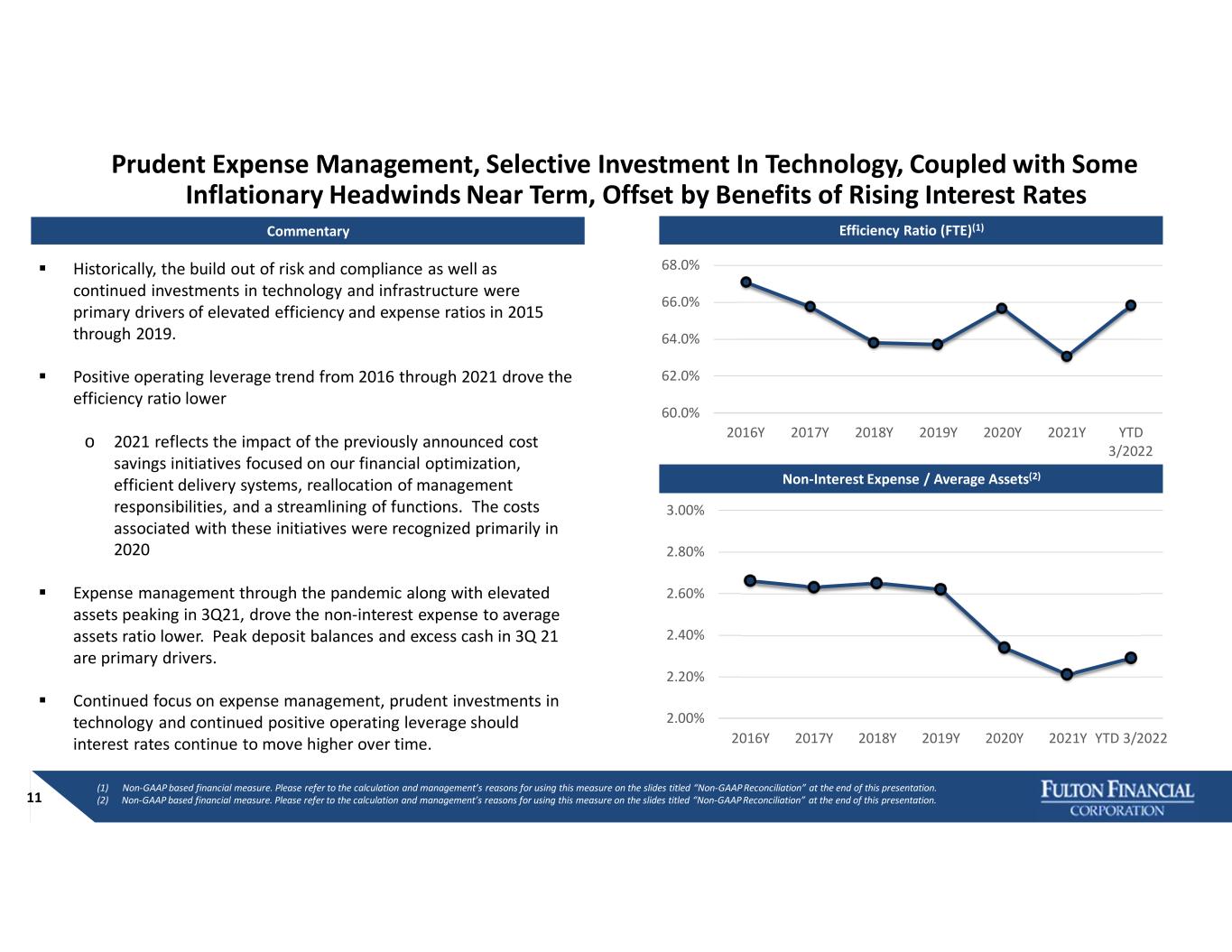

Prudent Expense Management, Selective Investment In Technology, Coupled with Some Inflationary Headwinds Near Term, Offset by Benefits of Rising Interest Rates 11 ~ $730 million ~ $610 million Historically, the build out of risk and compliance as well as continued investments in technology and infrastructure were primary drivers of elevated efficiency and expense ratios in 2015 through 2019. Positive operating leverage trend from 2016 through 2021 drove the efficiency ratio lower o 2021 reflects the impact of the previously announced cost savings initiatives focused on our financial optimization, efficient delivery systems, reallocation of management responsibilities, and a streamlining of functions. The costs associated with these initiatives were recognized primarily in 2020 Expense management through the pandemic along with elevated assets peaking in 3Q21, drove the non-interest expense to average assets ratio lower. Peak deposit balances and excess cash in 3Q 21 are primary drivers. Continued focus on expense management, prudent investments in technology and continued positive operating leverage should interest rates continue to move higher over time. 60.0% 62.0% 64.0% 66.0% 68.0% 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y YTD 3/2022 2.00% 2.20% 2.40% 2.60% 2.80% 3.00% 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y YTD 3/2022 Commentary Efficiency Ratio (FTE)(1) Non-Interest Expense / Average Assets(2) (1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation. (2) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation.

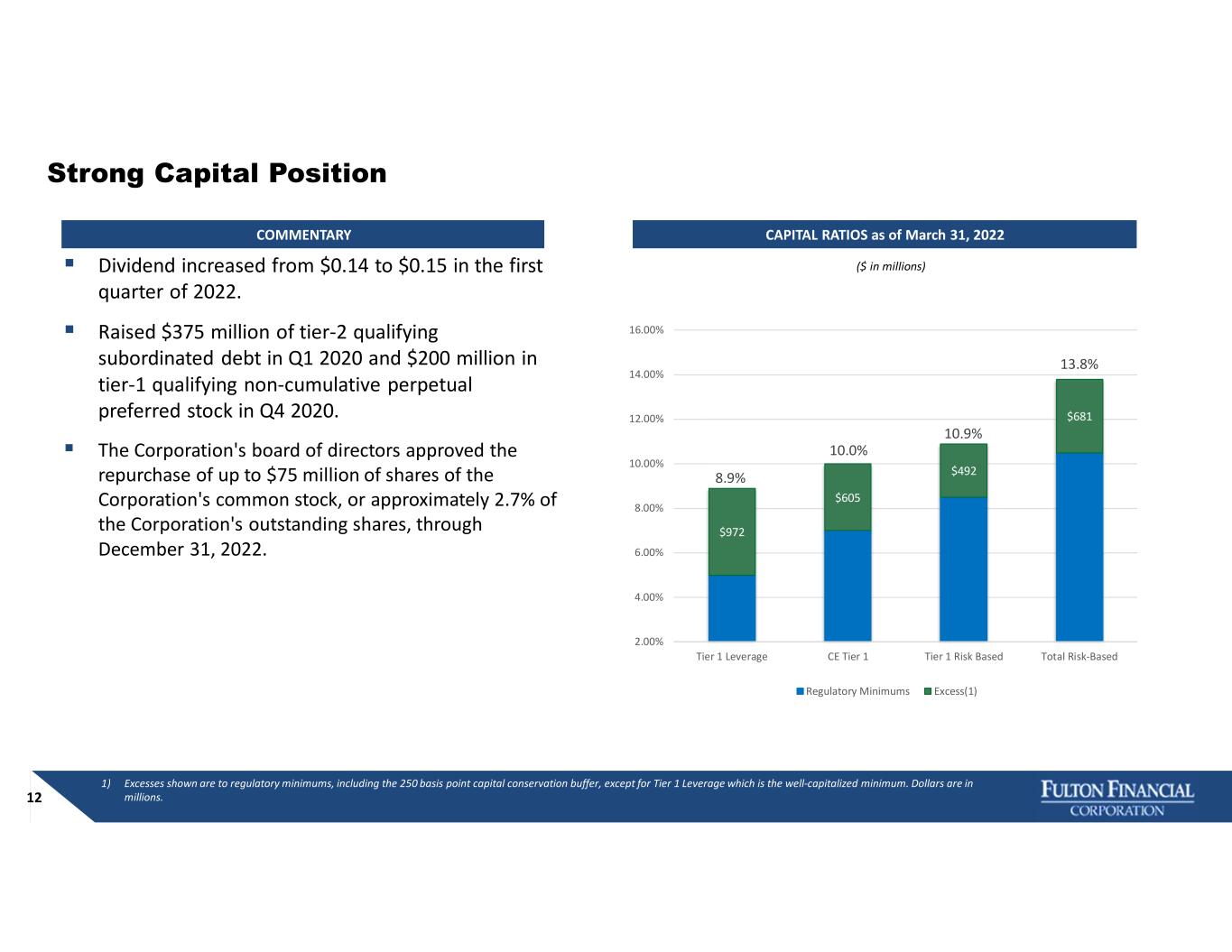

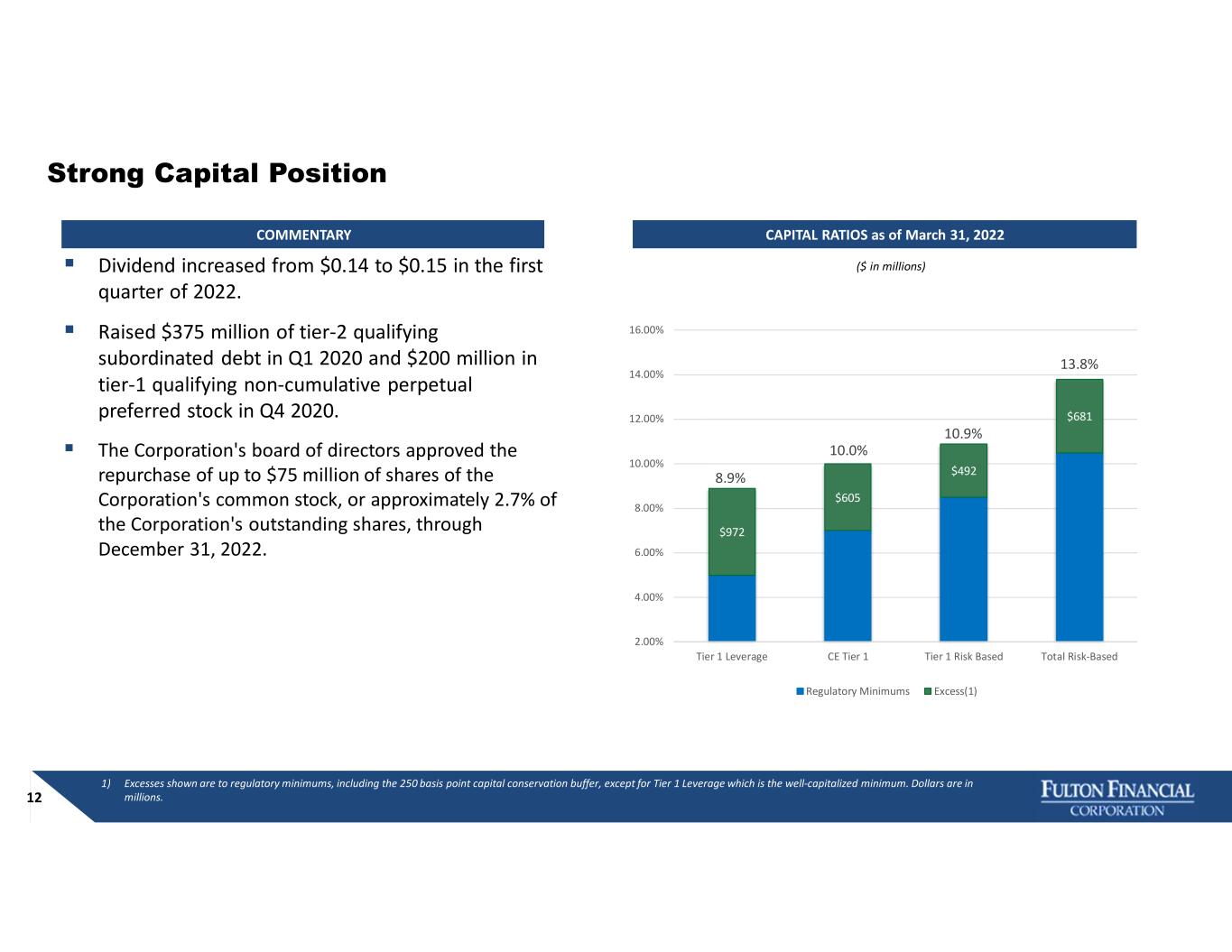

12 Strong Capital Position Dividend increased from $0.14 to $0.15 in the first quarter of 2022. Raised $375 million of tier-2 qualifying subordinated debt in Q1 2020 and $200 million in tier-1 qualifying non-cumulative perpetual preferred stock in Q4 2020. The Corporation's board of directors approved the repurchase of up to $75 million of shares of the Corporation's common stock, or approximately 2.7% of the Corporation's outstanding shares, through December 31, 2022. 8.9% 10.0% 10.9% 13.8% $972 $605 $492 $681 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% Tier 1 Leverage CE Tier 1 Tier 1 Risk Based Total Risk-Based Regulatory Minimums Excess(1) CAPITAL RATIOS as of March 31, 2022COMMENTARY 1) Excesses shown are to regulatory minimums, including the 250 basis point capital conservation buffer, except for Tier 1 Leverage which is the well-capitalized minimum. Dollars are in millions. ($ in millions)

RECENT FINANCIAL PERFORMANCE & HIGHLIGHTS

(1) ROA is return an average assets determined by dividing net income for the period indicated by average assets, annualized. (2) ROE is return on average shareholders’ equity determined by dividing net income for the period indicated by average shareholders’ equity, annualized. (3) Non-GAAP financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation. Income Statement Summary 14

Net Interest Income And Margin 15 ~ $730 million ~ $610 million (1) Using a 21% federal tax rate and statutory interest expense disallowances. (1)

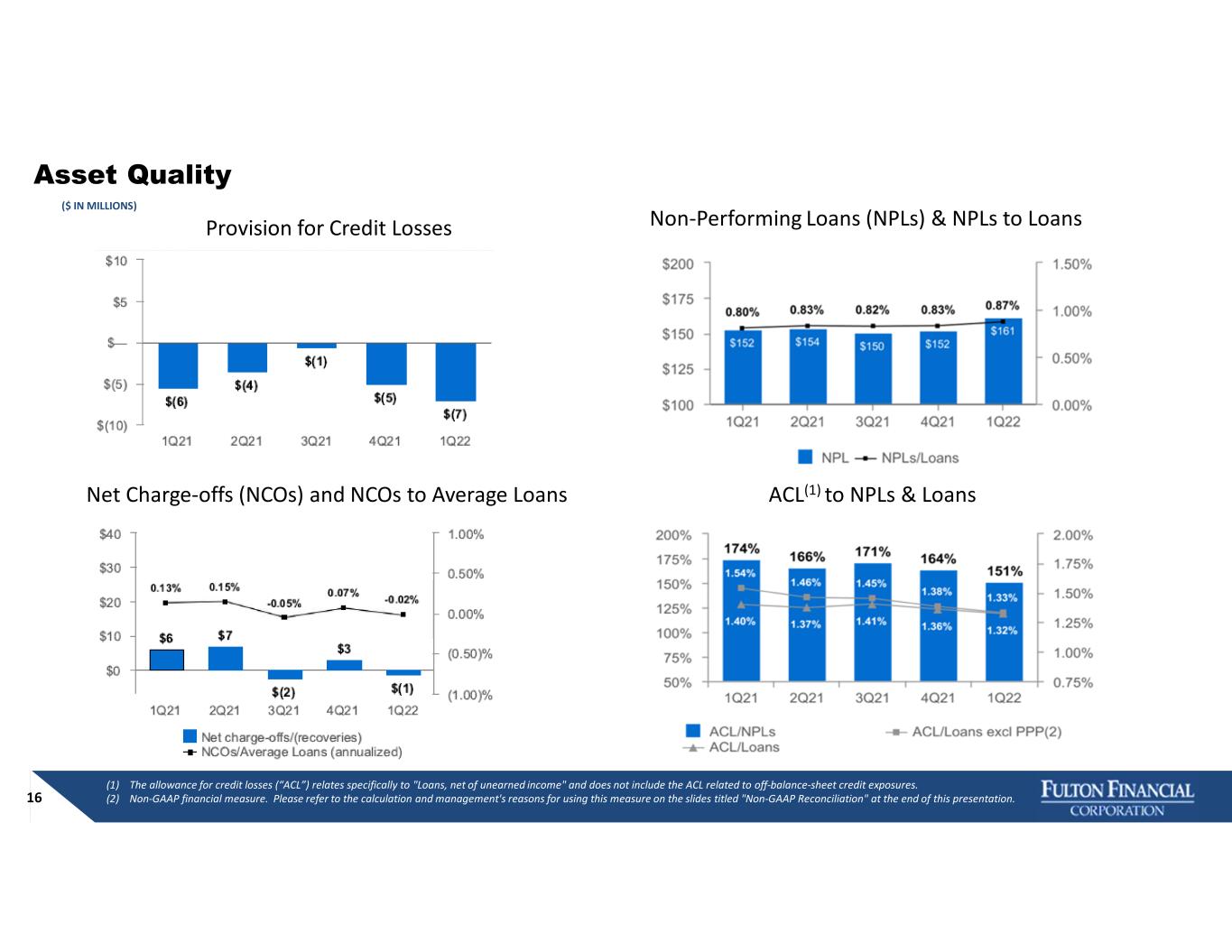

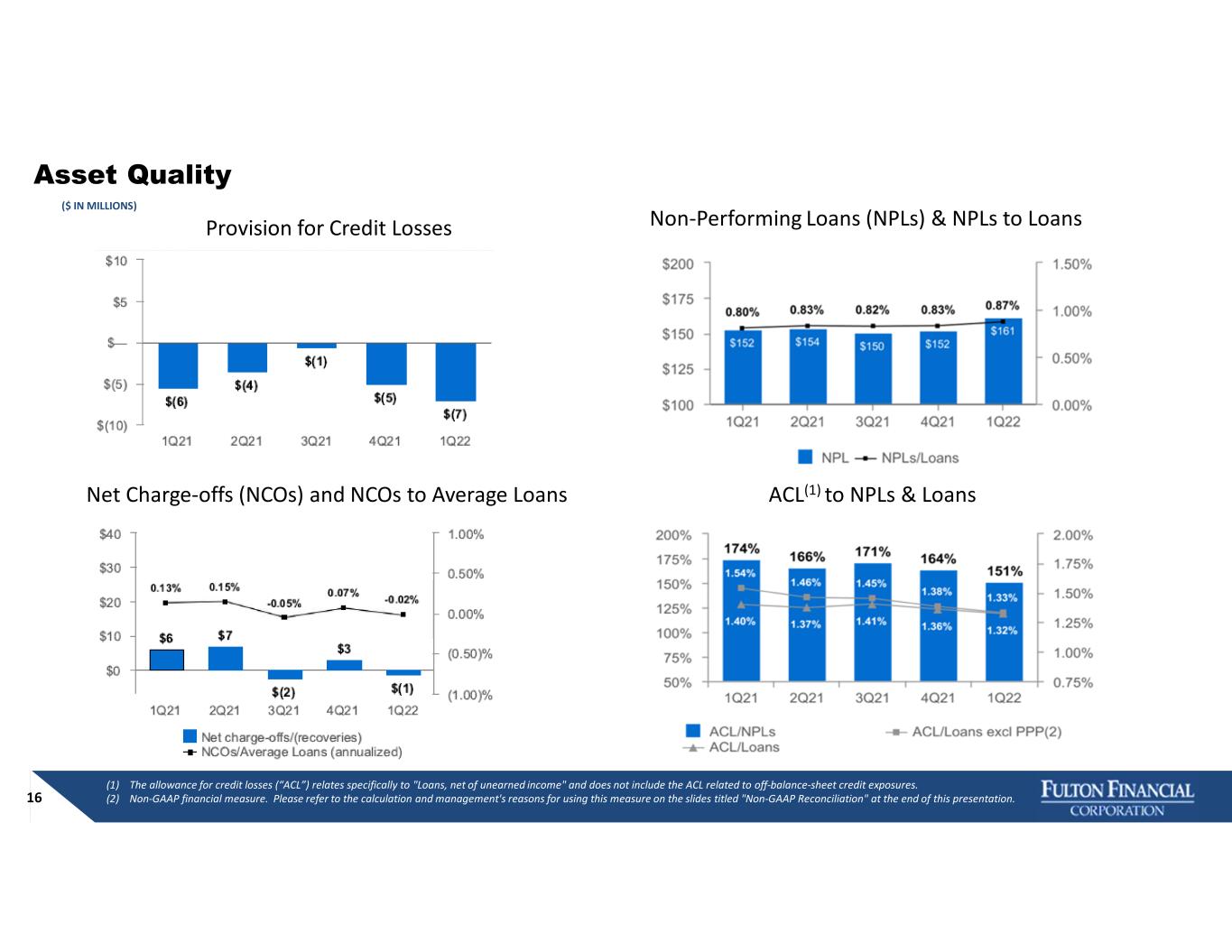

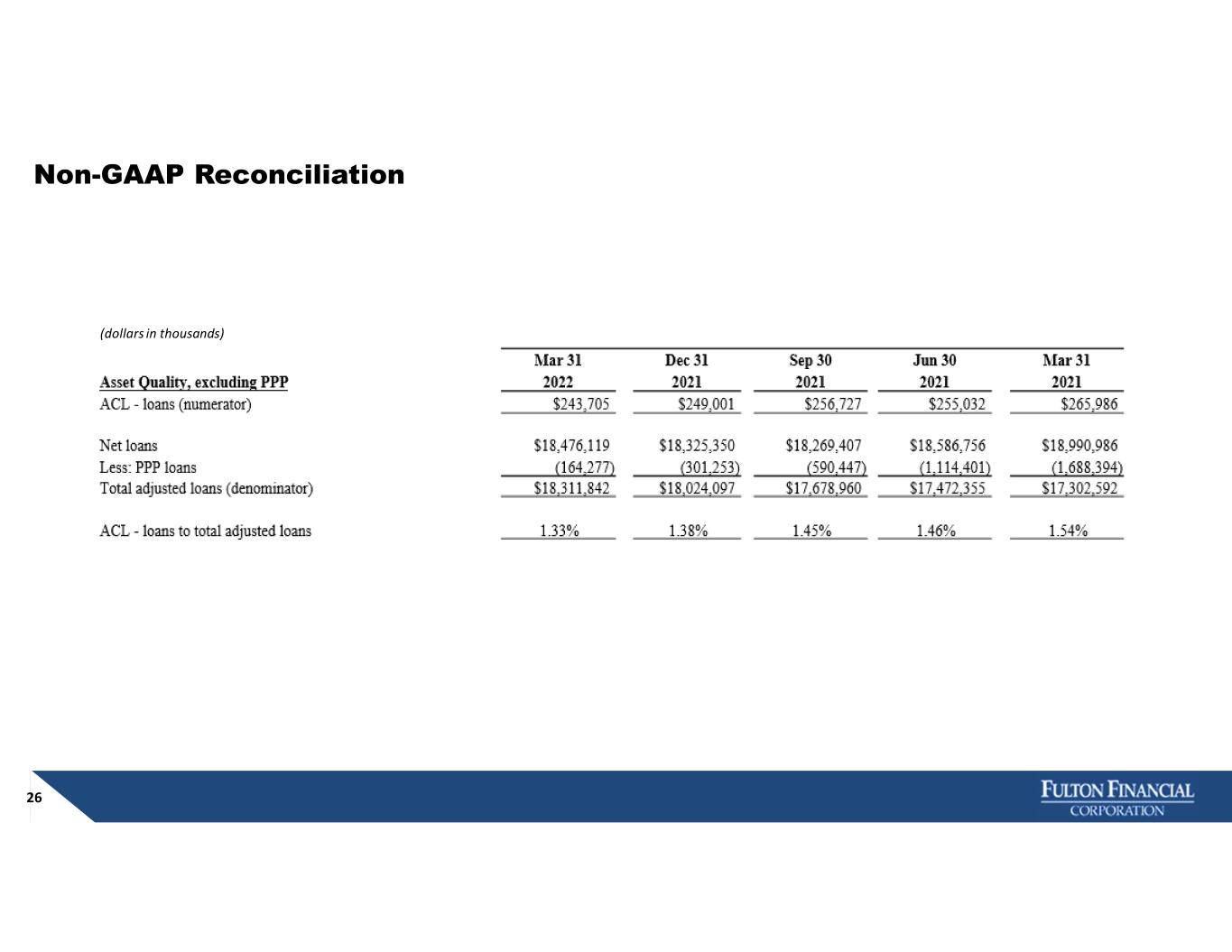

Asset Quality 16 ($ IN MILLIONS) (1) The allowance for credit losses (“ACL”) relates specifically to "Loans, net of unearned income" and does not include the ACL related to off-balance-sheet credit exposures. (2) Non-GAAP financial measure. Please refer to the calculation and management's reasons for using this measure on the slides titled "Non-GAAP Reconciliation" at the end of this presentation. Provision for Credit Losses Non-Performing Loans (NPLs) & NPLs to Loans Net Charge-offs (NCOs) and NCOs to Average Loans ACL(1) to NPLs & Loans

17 Non-Interest Income(1) (1) Excludes investment securities gains.

18 Non-interest Expense

2022 Outlook 19

APPENDIX

Non-GAAP Reconciliation 21 Note: The Corporation has presented the following non-GAAP financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety.

Non-GAAP Reconciliation 22 (dollars in thousands) Mar 31 2016 2017 2018 2019 2020 2021 2022 Efficiency ratio Non-interest expense $489,519 $525,579 $546,104 $567,736 $579,440 $617,830 $145,978 Less : Amortizati on of tax credi t inves tments - (11,028) (11,449) (6,021) (6,126) (6,187) (696) Less : Inta ngi ble Amortization - - - (1,427) (529) (589) (176) Less : Merger-rel ated expenses - - - - - - (401) Less : Debt extingui shment cos ts - - - (4,326) (2,878) (33,249) - Non-interest expense (numera tor) $489,519 $514,551 $534,655 $555,962 $569,907 $577,805 $144,705 Net interest income (ful l y ta xa ble-equi val ent) $541,271 $598,565 $642,577 $661,356 $641,509 $676,026 $164,598 Plus : Tota l Non-interest income 190,178 207,974 195,525 216,160 229,388 273,745 55,256 Less : Investment s ecurities ga ins (2,550) (9,071) (37) (4,733) (3,053) (33,516) (19) Net interest income (denominator) $728,899 $797,468 $838,065 $872,783 $867,844 $916,255 $219,835 Effici ency rati o 67.2% 64.5% 63.8% 63.7% 65.7% 63.1% 65.8% Excluding Cost Saving Initiatives Expenses: Year Ended 2020 Efficiency ratio Non-interest expense (numera tor) $569,907 Less : cost sa ving initi ati ves expenses (16,200) Non-interest expense excluding cos t sa ving i nitiatives expens es (numerator) $553,707 Net interest income (denominator) $867,844 Effici ency rati o excludi ng cos t s avi ng ini tia tives expens es 63.8% Years Ended Three Months Ended

Non-GAAP Reconciliation 23

Non-GAAP Reconciliation 24 (dollars in thousands) Mar 31 2016 2017 2018 2019 2020 2021 2022 Non-interest expense to total average assets Non-interest expense $489,519 $525,579 $546,104 $567,736 $579,440 $617,830 $145,978 Les s: Amortization of ta x credit investments - (11,028) (11,449) (6,021) (6,126) (6,187) (696) Les s: Inta ngi bl e Amorti za ti on - - - (1,427) (529) (589) (176) Les s: Merger-rela ted expenses - - - - - - (401) Les s: Debt extingui shment costs - - - (4,326) (2,878) (33,249) - Non-interest expense (numerator) $489,519 $514,551 $534,655 $555,962 $569,907 $577,805 $144,705 Total a vera ge a ss ets (demonima tor) $18,371,173 $19,580,367 $20,183,202 $21,258,040 $24,333,717 $26,170,333 $25,622,462 Non-i nteres t expens e to tota l average a ss ets 2.66% 2.63% 2.65% 2.62% 2.34% 2.21% 2.29% Years Ended Three Months Ended

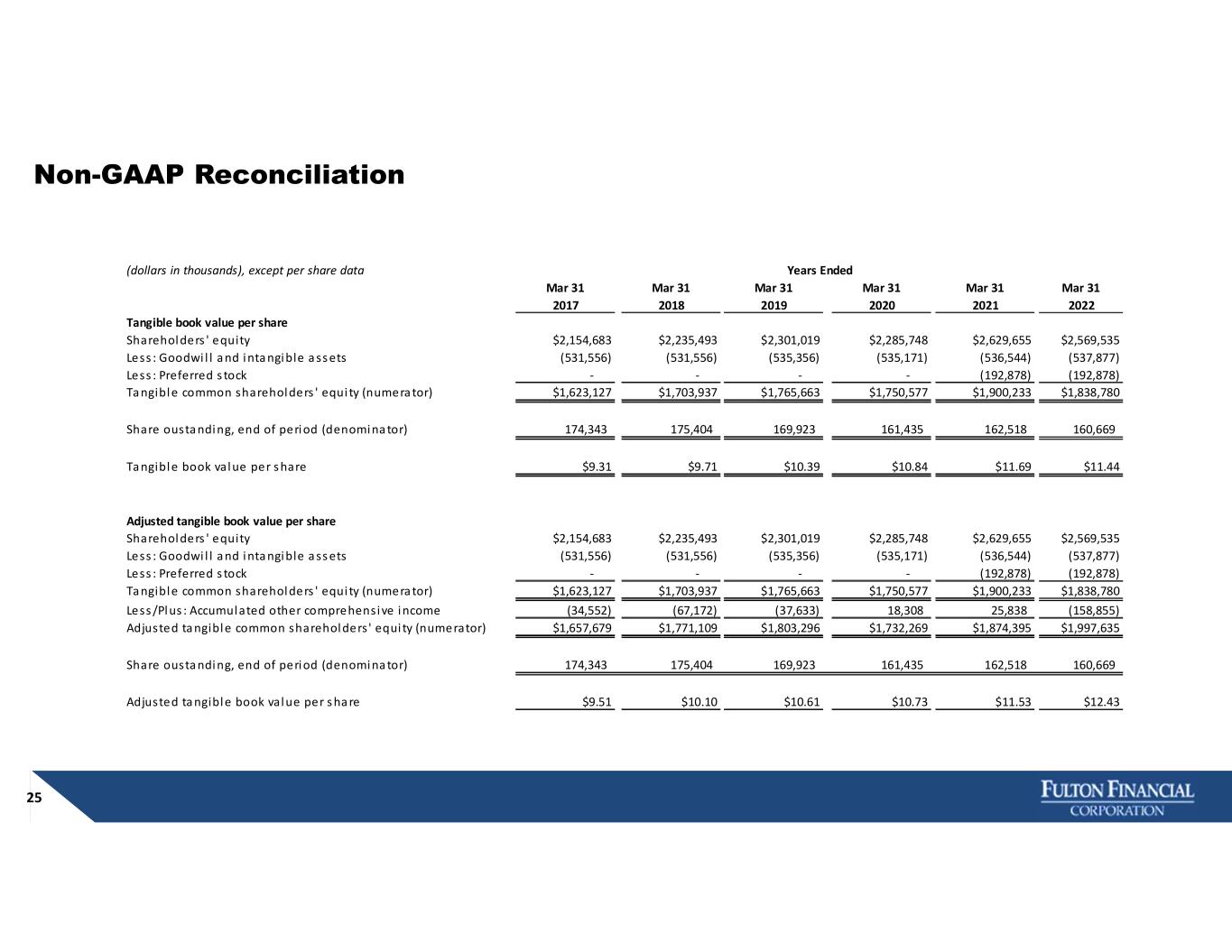

Non-GAAP Reconciliation 25 (dollars in thousands), except per share data Mar 31 Mar 31 Mar 31 Mar 31 Mar 31 Mar 31 2017 2018 2019 2020 2021 2022 Tangible book value per share Shareholders ' equity $2,154,683 $2,235,493 $2,301,019 $2,285,748 $2,629,655 $2,569,535 Less : Goodwi l l a nd inta ngible a ss ets (531,556) (531,556) (535,356) (535,171) (536,544) (537,877) Less : Preferred s tock - - - - (192,878) (192,878) Ta ngible common shareholders ' equi ty (numera tor) $1,623,127 $1,703,937 $1,765,663 $1,750,577 $1,900,233 $1,838,780 Share ousta nding, end of period (denomina tor) 174,343 175,404 169,923 161,435 162,518 160,669 Ta ngible book value per s hare $9.31 $9.71 $10.39 $10.84 $11.69 $11.44 Adjusted tangible book value per share Shareholders ' equity $2,154,683 $2,235,493 $2,301,019 $2,285,748 $2,629,655 $2,569,535 Less : Goodwi l l a nd inta ngible a ss ets (531,556) (531,556) (535,356) (535,171) (536,544) (537,877) Less : Preferred s tock - - - - (192,878) (192,878) Ta ngible common shareholders ' equi ty (numera tor) $1,623,127 $1,703,937 $1,765,663 $1,750,577 $1,900,233 $1,838,780 Less /Plus : Accumulated other comprehensive income (34,552) (67,172) (37,633) 18,308 25,838 (158,855) Adjusted ta ngible common shareholders ' equi ty (numerator) $1,657,679 $1,771,109 $1,803,296 $1,732,269 $1,874,395 $1,997,635 Share ousta nding, end of period (denomina tor) 174,343 175,404 169,923 161,435 162,518 160,669 Adjusted ta ngible book value per s ha re $9.51 $10.10 $10.61 $10.73 $11.53 $12.43 Years Ended

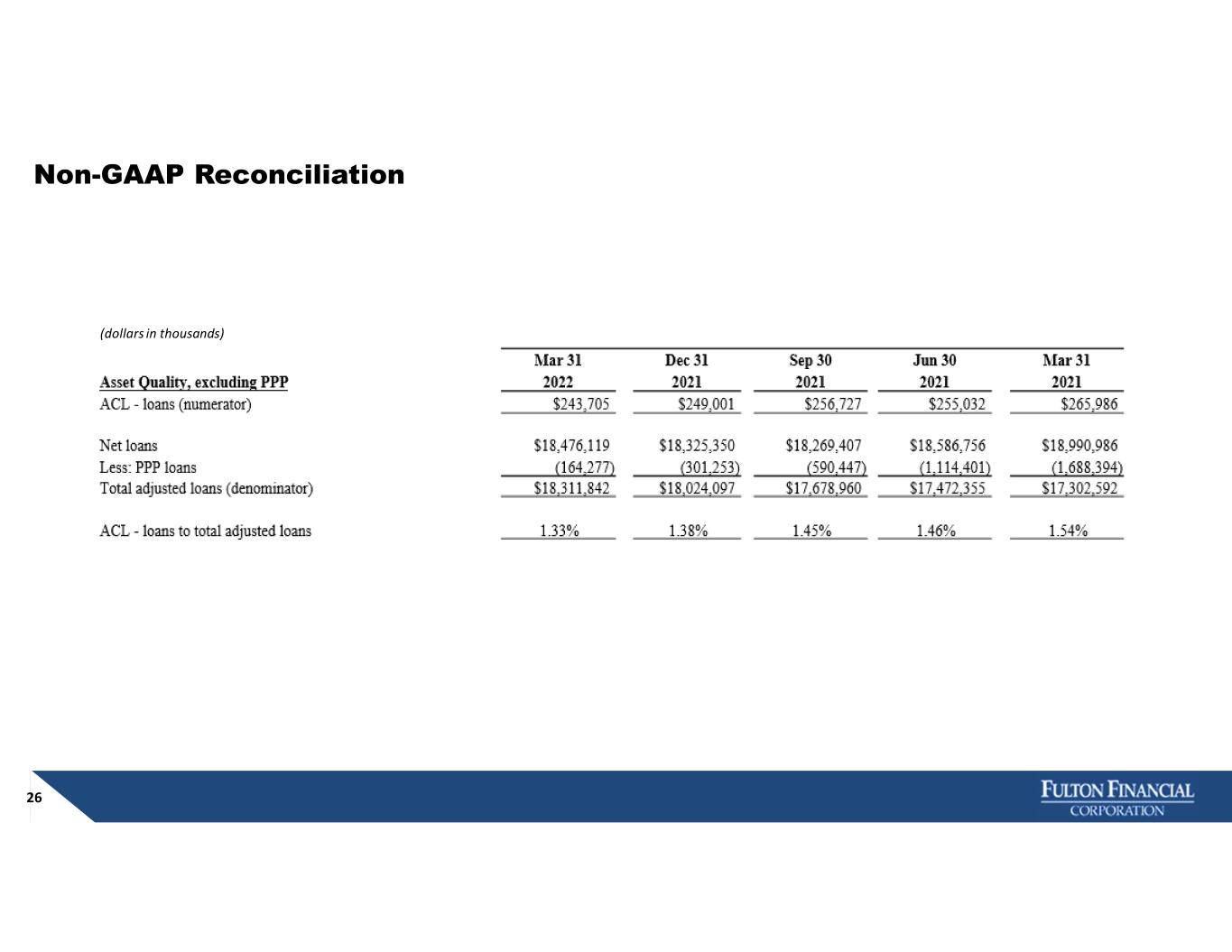

Non-GAAP Reconciliation 26 (dollars in thousands)

www.fultonbank.com