SECOND QUARTER 2022 RESULTS NASDAQ: FULT Data as of or for the period ended June 30, 2022 unless otherwise noted

This presentation may contain forward-looking statements with respect to the Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward-looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, including future credit losses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Management’s "2022 Outlook "contained herein is comprised of forward-looking statements. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, the statements are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2021, Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 and other current and periodic reports, which have been or will be filed with the Securities and Exchange Commission (the "SEC") and are or will be available in the Investor Relations section of the Corporation’s website (www.fultonbank.com) and on the SEC’s website (www.sec.gov). The Corporation uses certain financial measures in this presentation that have been derived by methods other than Generally Accepted Accounting Principles ("GAAP"). These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. FORWARD-LOOKING STATEMENTS 2

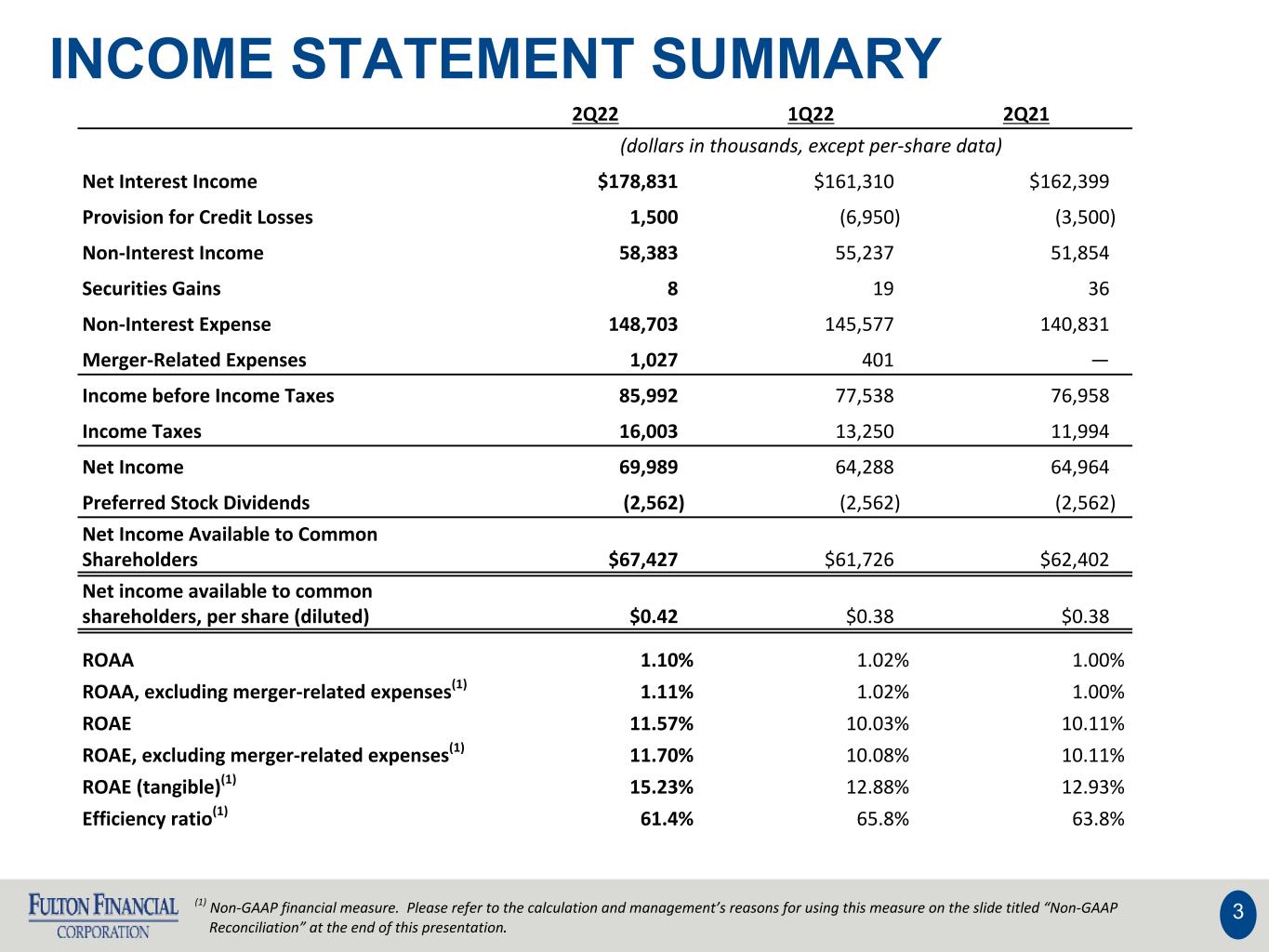

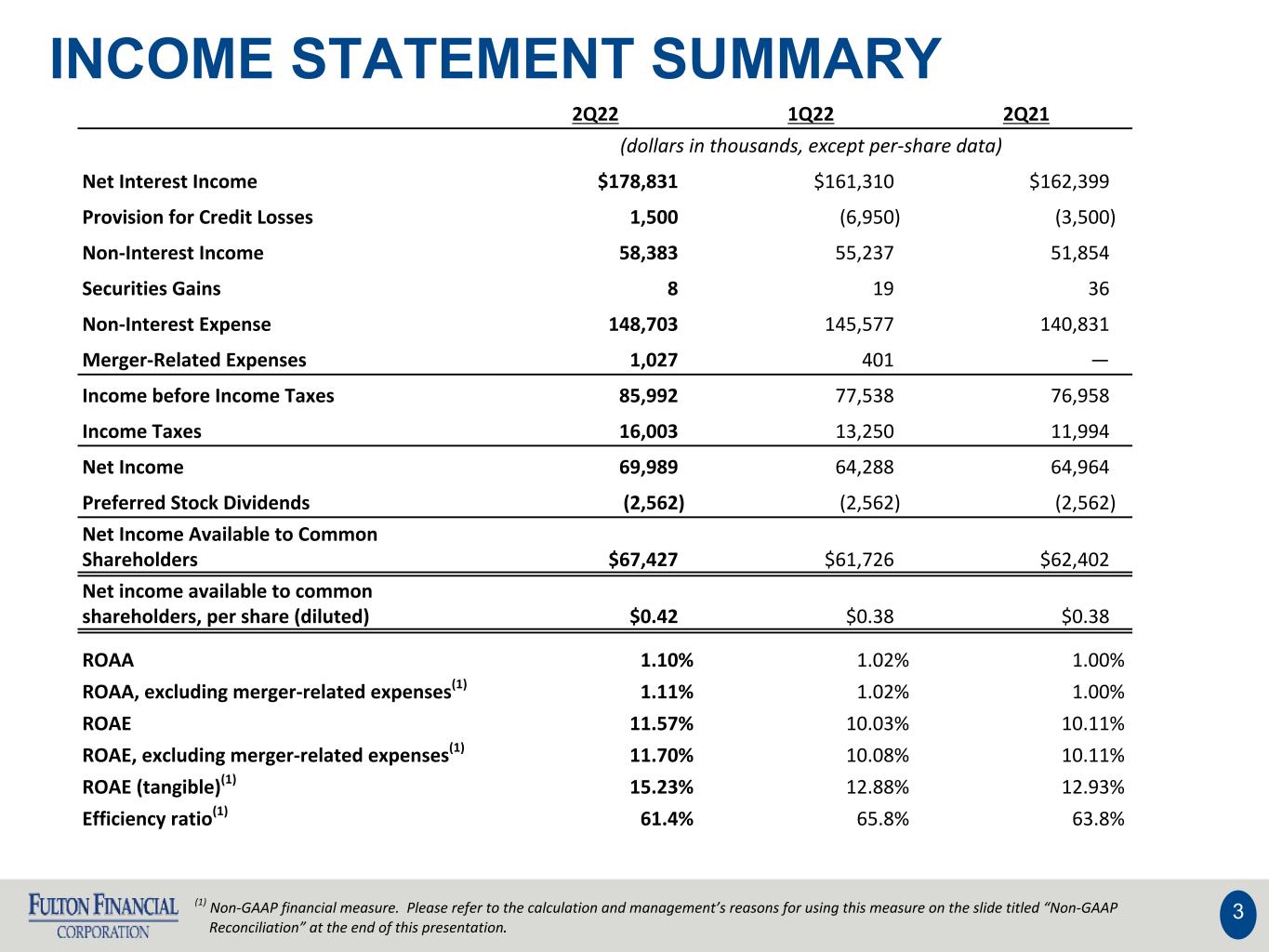

(1) Non-GAAP financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. INCOME STATEMENT SUMMARY 3 2Q22 1Q22 2Q21 (dollars in thousands, except per-share data) Net Interest Income $178,831 $161,310 $162,399 Provision for Credit Losses 1,500 (6,950) (3,500) Non-Interest Income 58,383 55,237 51,854 Securities Gains 8 19 36 Non-Interest Expense 148,703 145,577 140,831 Merger-Related Expenses 1,027 401 — Income before Income Taxes 85,992 77,538 76,958 Income Taxes 16,003 13,250 11,994 Net Income 69,989 64,288 64,964 Preferred Stock Dividends (2,562) (2,562) (2,562) Net Income Available to Common Shareholders $67,427 $61,726 $62,402 Net income available to common shareholders, per share (diluted) $0.42 $0.38 $0.38 ROAA 1.10% 1.02% 1.00% ROAA, excluding merger-related expenses(1) 1.11% 1.02% 1.00% ROAE 11.57% 10.03% 10.11% ROAE, excluding merger-related expenses(1) 11.70% 10.08% 10.11% ROAE (tangible)(1) 15.23% 12.88% 12.93% Efficiency ratio(1) 61.4% 65.8% 63.8%

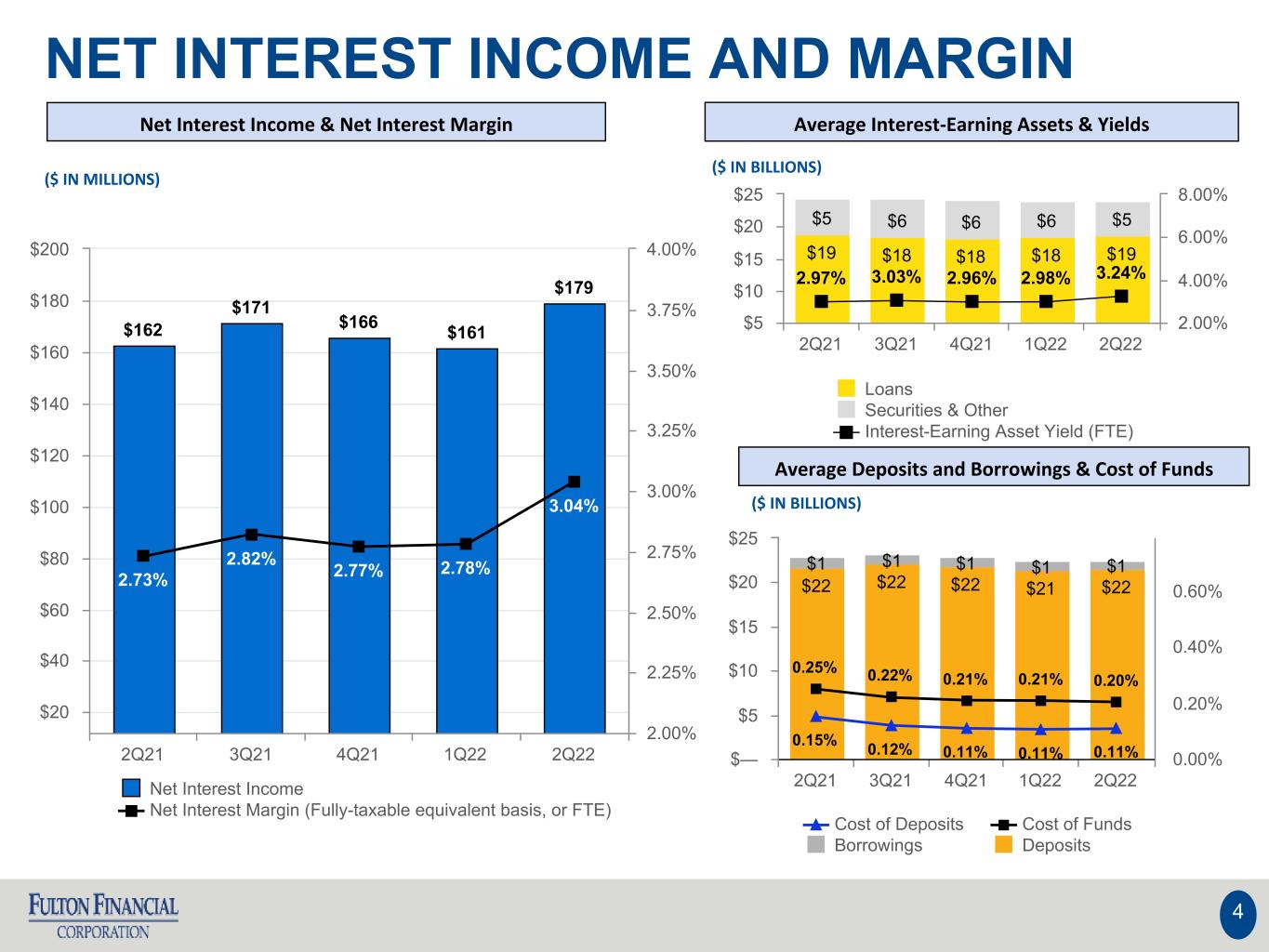

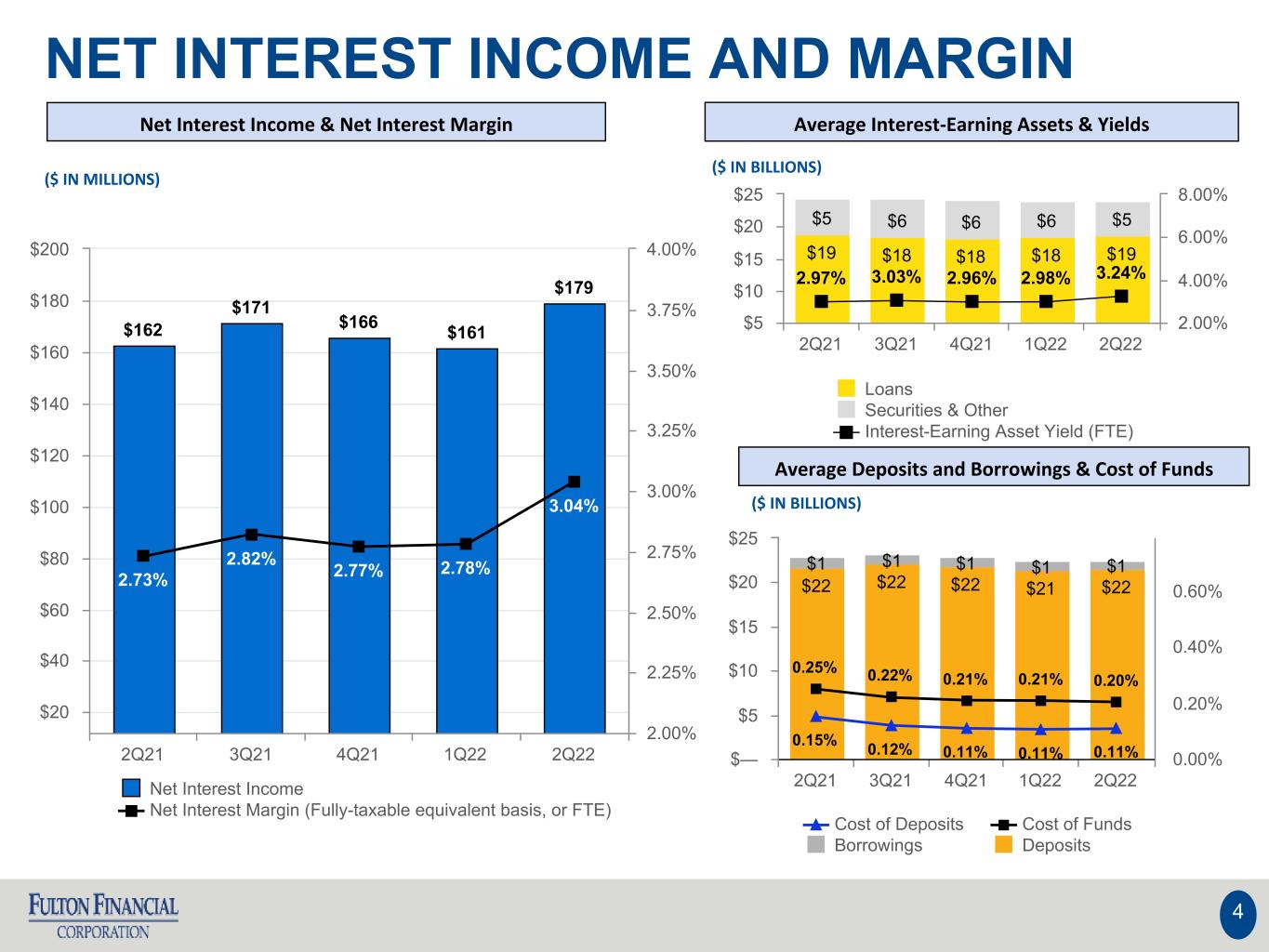

NET INTEREST INCOME AND MARGIN Net Interest Income & Net Interest Margin Average Interest-Earning Assets & Yields Average Deposits and Borrowings & Cost of Funds ($ IN MILLIONS) ($ IN BILLIONS) ($ IN BILLIONS) 4 $22 $22 $22 $21 $22 $1 $1 $1 $1 $1 0.25% 0.22% 0.21% 0.21% 0.20% 0.15% 0.12% 0.11% 0.11% 0.11% Cost of Deposits Cost of Funds Borrowings Deposits 2Q21 3Q21 4Q21 1Q22 2Q22 $— $5 $10 $15 $20 $25 0.00% 0.20% 0.40% 0.60% $162 $171 $166 $161 $179 2.73% 2.82% 2.77% 2.78% 3.04% Net Interest Income Net Interest Margin (Fully-taxable equivalent basis, or FTE) 2Q21 3Q21 4Q21 1Q22 2Q22 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 2.00% 2.25% 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% 4.00% $19 $18 $18 $18 $19 $5 $6 $6 $6 $5 2.97% 3.03% 2.96% 2.98% 3.24% Loans Securities & Other Interest-Earning Asset Yield (FTE) 2Q21 3Q21 4Q21 1Q22 2Q22 $5 $10 $15 $20 $25 2.00% 4.00% 6.00% 8.00%

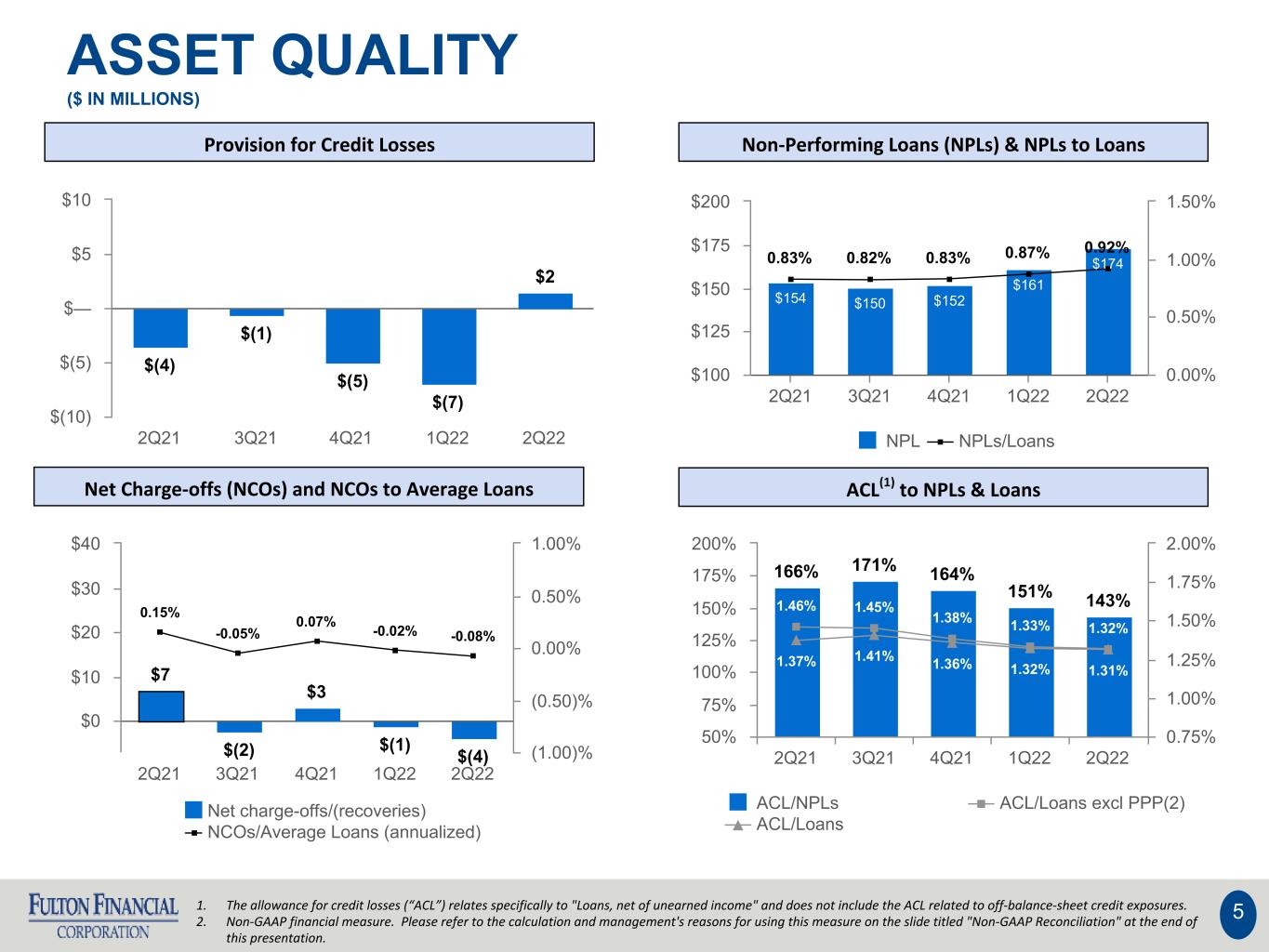

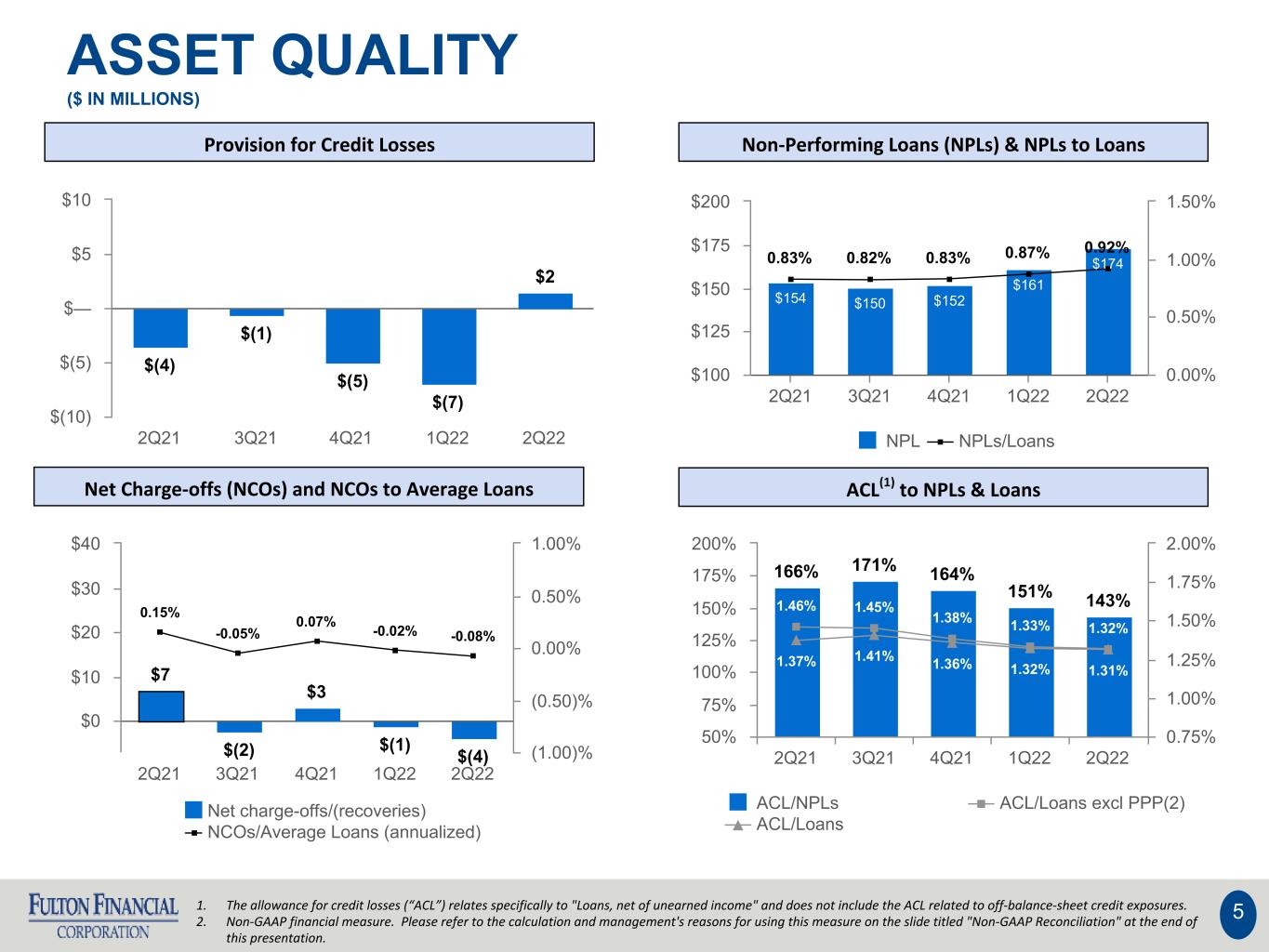

ASSET QUALITY ($ IN MILLIONS) Provision for Credit Losses Non-Performing Loans (NPLs) & NPLs to Loans Net Charge-offs (NCOs) and NCOs to Average Loans ACL(1) to NPLs & Loans 51. The allowance for credit losses (“ACL”) relates specifically to "Loans, net of unearned income" and does not include the ACL related to off-balance-sheet credit exposures. 2. Non-GAAP financial measure. Please refer to the calculation and management's reasons for using this measure on the slide titled "Non-GAAP Reconciliation" at the end of this presentation. $(4) $(1) $(5) $(7) $2 2Q21 3Q21 4Q21 1Q22 2Q22 $(10) $(5) $— $5 $10 $154 $150 $152 $161 $1740.83% 0.82% 0.83% 0.87% 0.92% NPL NPLs/Loans 2Q21 3Q21 4Q21 1Q22 2Q22 $100 $125 $150 $175 $200 0.00% 0.50% 1.00% 1.50% $7 $(2) $3 $(1) $(4) 0.15% -0.05% 0.07% -0.02% -0.08% Net charge-offs/(recoveries) NCOs/Average Loans (annualized) 2Q21 3Q21 4Q21 1Q22 2Q22 $0 $10 $20 $30 $40 (1.00)% (0.50)% 0.00% 0.50% 1.00% 166% 171% 164% 151% 143%1.46% 1.45% 1.38% 1.33% 1.32% 1.37% 1.41% 1.36% 1.32% 1.31% ACL/NPLs ACL/Loans excl PPP(2) ACL/Loans 2Q21 3Q21 4Q21 1Q22 2Q22 50% 75% 100% 125% 150% 175% 200% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00%

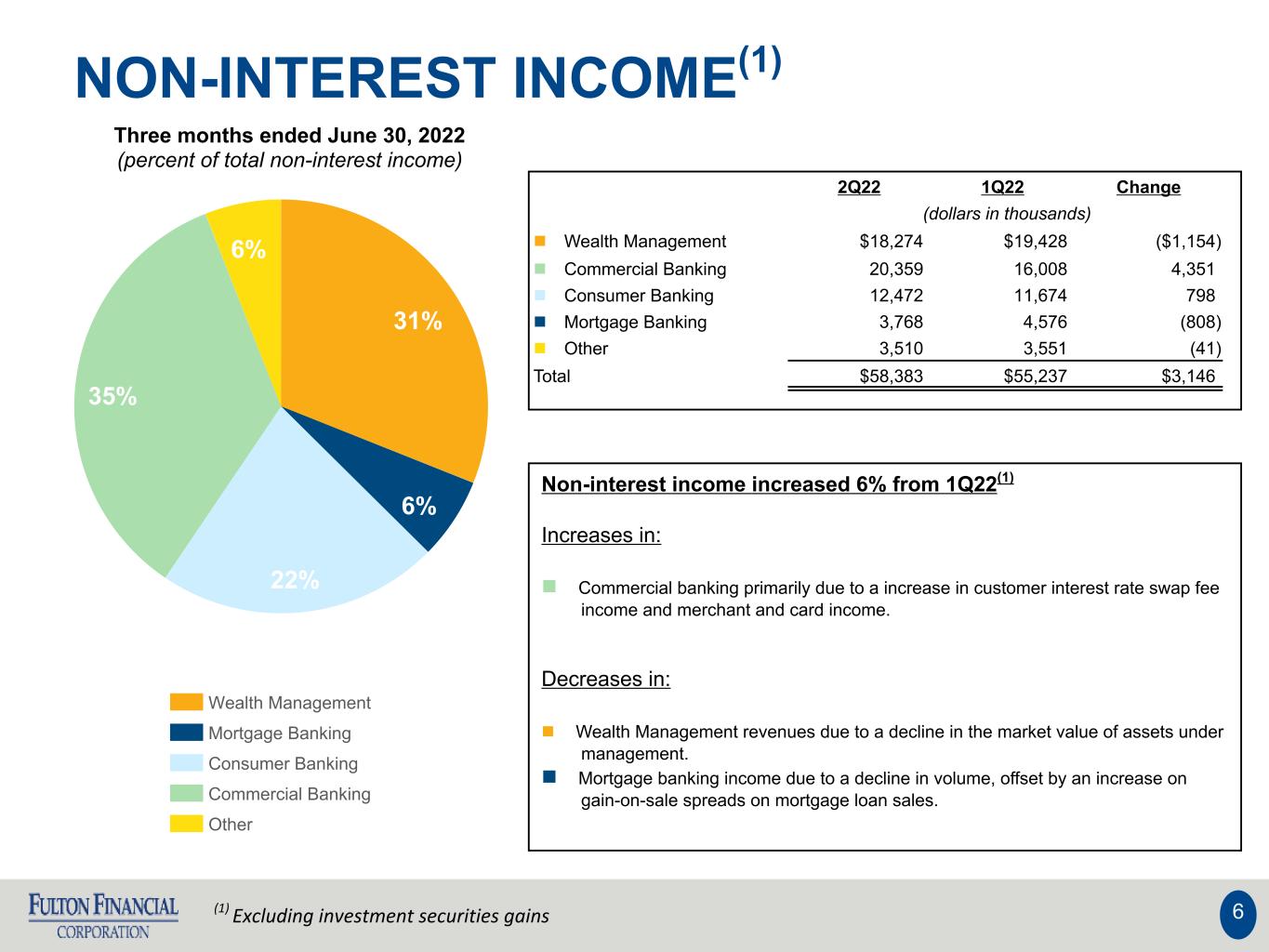

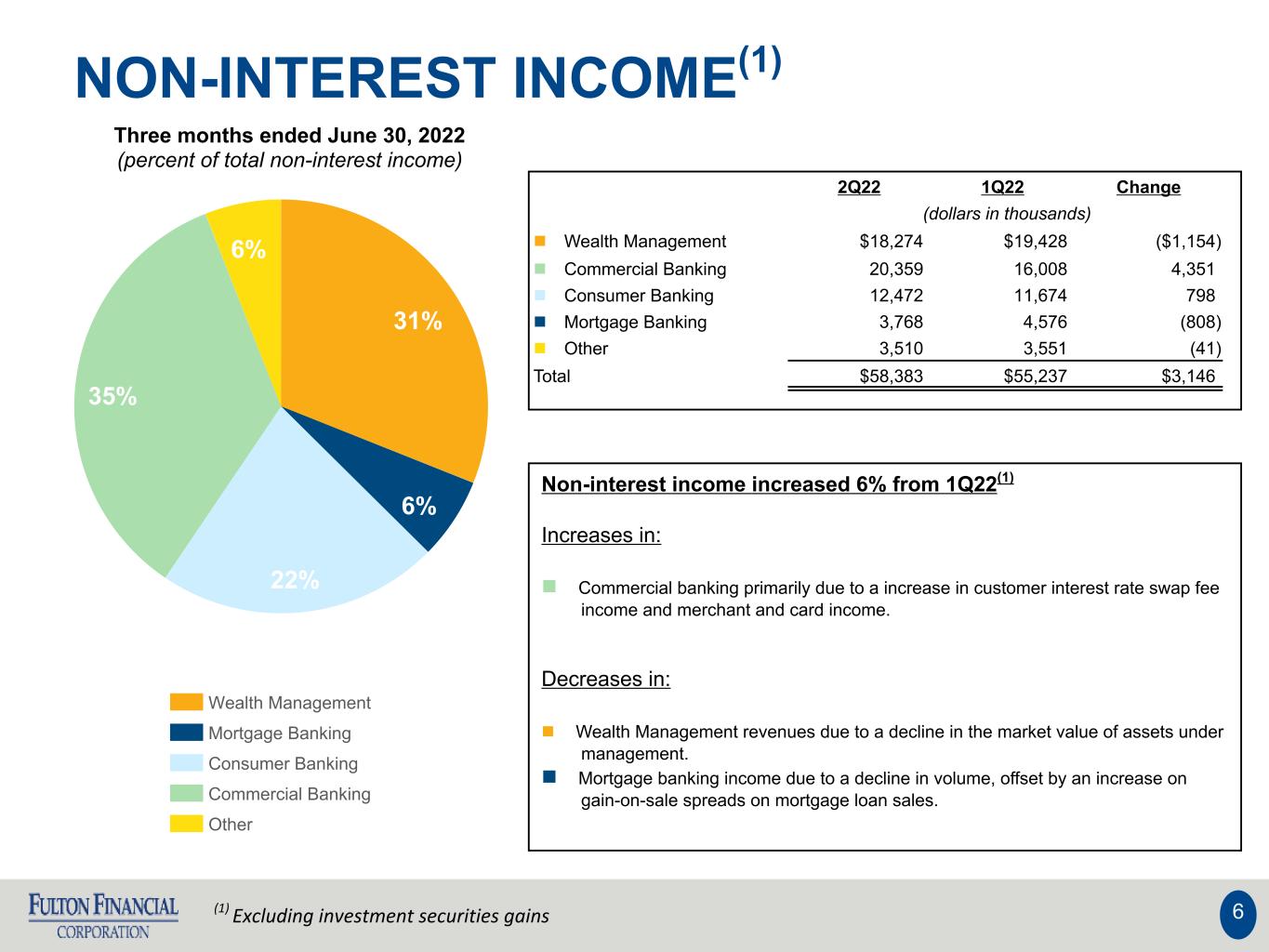

NON-INTEREST INCOME(1) (1) Excluding investment securities gains Three months ended June 30, 2022 (percent of total non-interest income) 6 Non-interest income increased 6% from 1Q22(1) Increases in: n Commercial banking primarily due to a increase in customer interest rate swap fee income and merchant and card income. Decreases in: n Wealth Management revenues due to a decline in the market value of assets under management. n Mortgage banking income due to a decline in volume, offset by an increase on gain-on-sale spreads on mortgage loan sales. 31% 6% 22% 35% 6% Wealth Management Mortgage Banking Consumer Banking Commercial Banking Other 2Q22 1Q22 Change (dollars in thousands) n Wealth Management $18,274 $19,428 ($1,154) n Commercial Banking 20,359 16,008 4,351 n Consumer Banking 12,472 11,674 798 n Mortgage Banking 3,768 4,576 (808) n Other 3,510 3,551 (41) Total $58,383 $55,237 $3,146

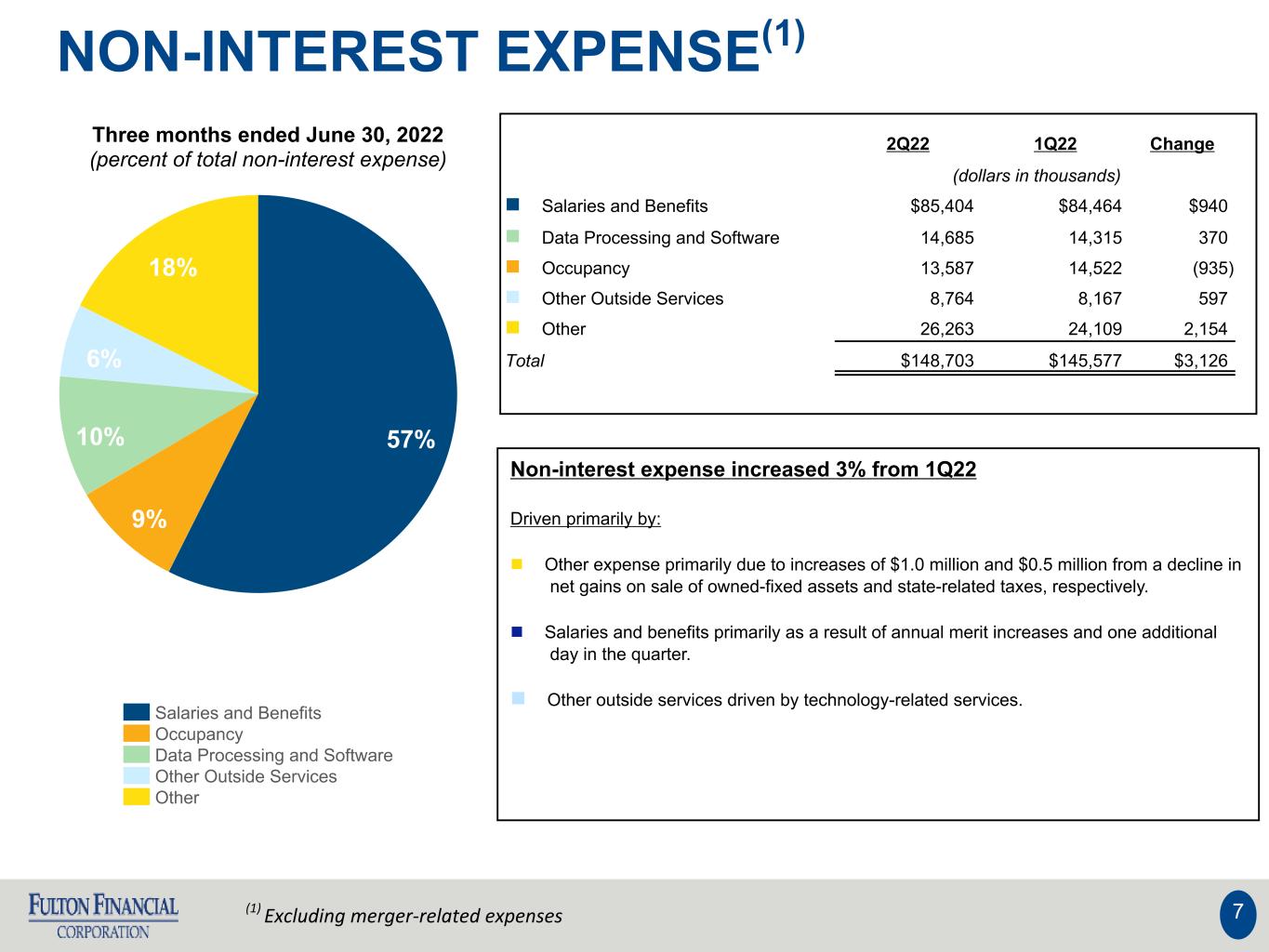

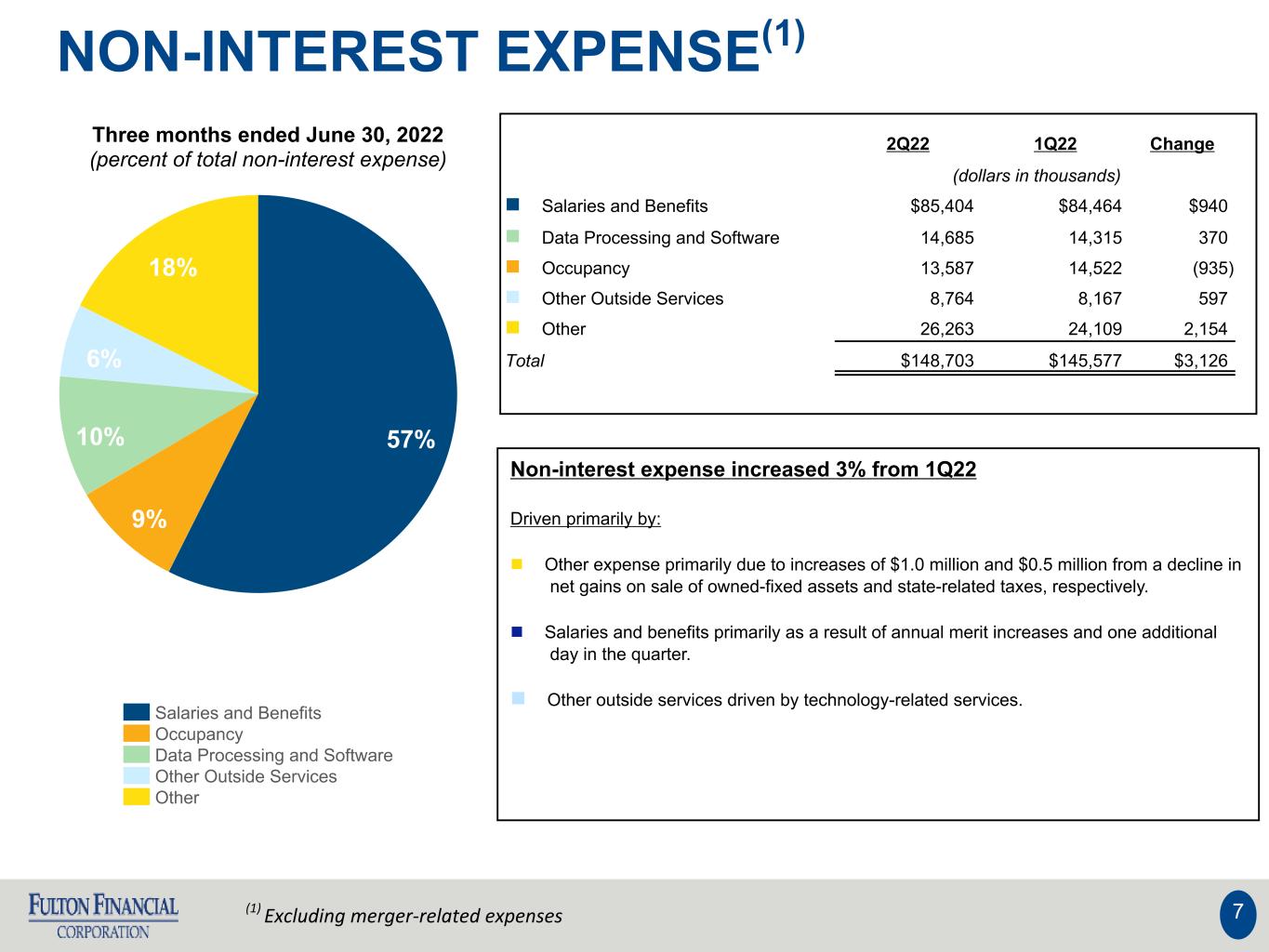

NON-INTEREST EXPENSE(1) Three months ended June 30, 2022 (percent of total non-interest expense) 7 57% 9% 10% 6% 18% Salaries and Benefits Occupancy Data Processing and Software Other Outside Services Other 2Q22 1Q22 Change (dollars in thousands) n Salaries and Benefits $85,404 $84,464 $940 n Data Processing and Software 14,685 14,315 370 n Occupancy 13,587 14,522 (935) n Other Outside Services 8,764 8,167 597 n Other 26,263 24,109 2,154 Total $148,703 $145,577 $3,126 Non-interest expense increased 3% from 1Q22 Driven primarily by: n Other expense primarily due to increases of $1.0 million and $0.5 million from a decline in net gains on sale of owned-fixed assets and state-related taxes, respectively. n Salaries and benefits primarily as a result of annual merit increases and one additional day in the quarter. n Other outside services driven by technology-related services. (1) Excluding merger-related expenses

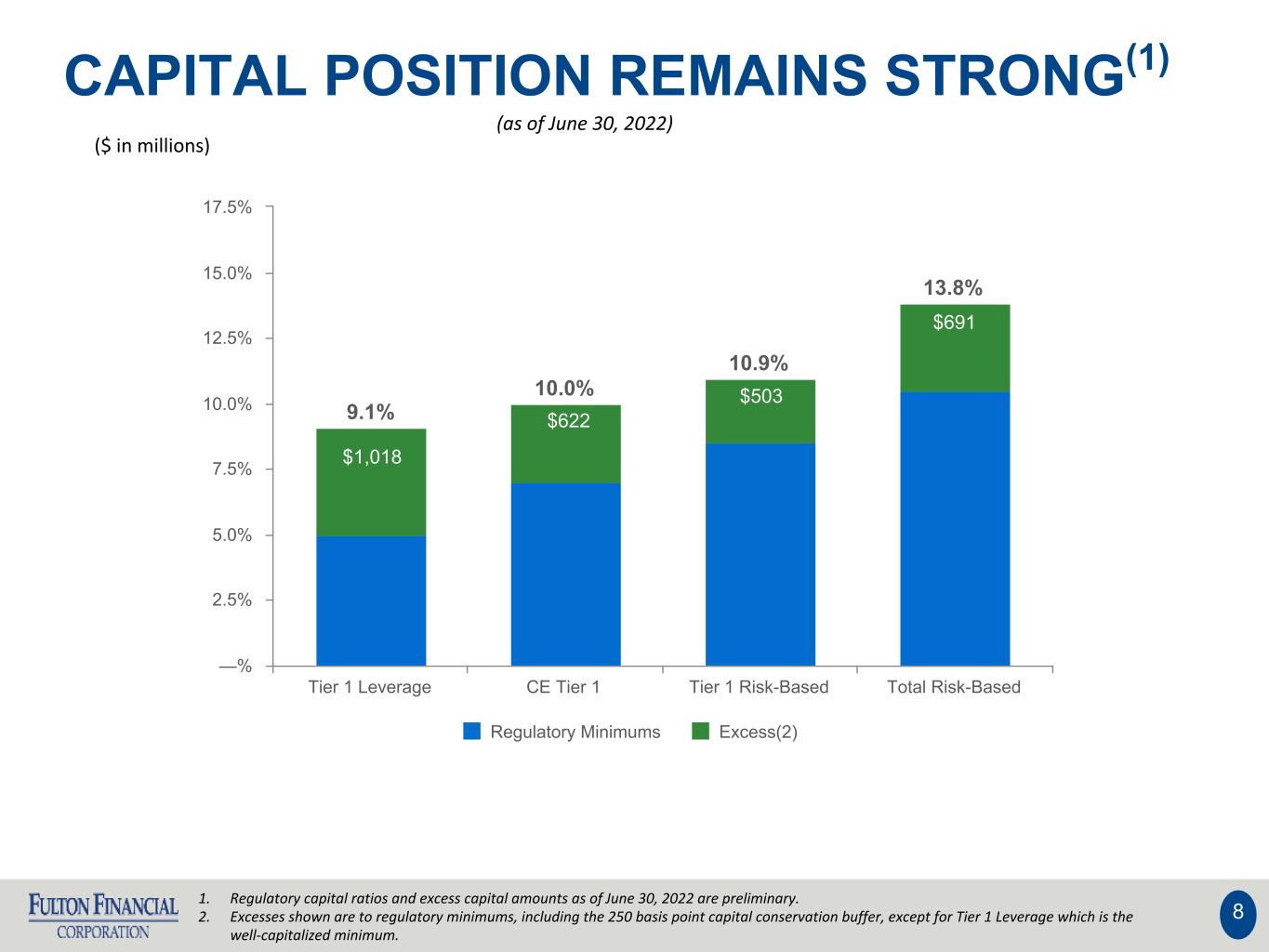

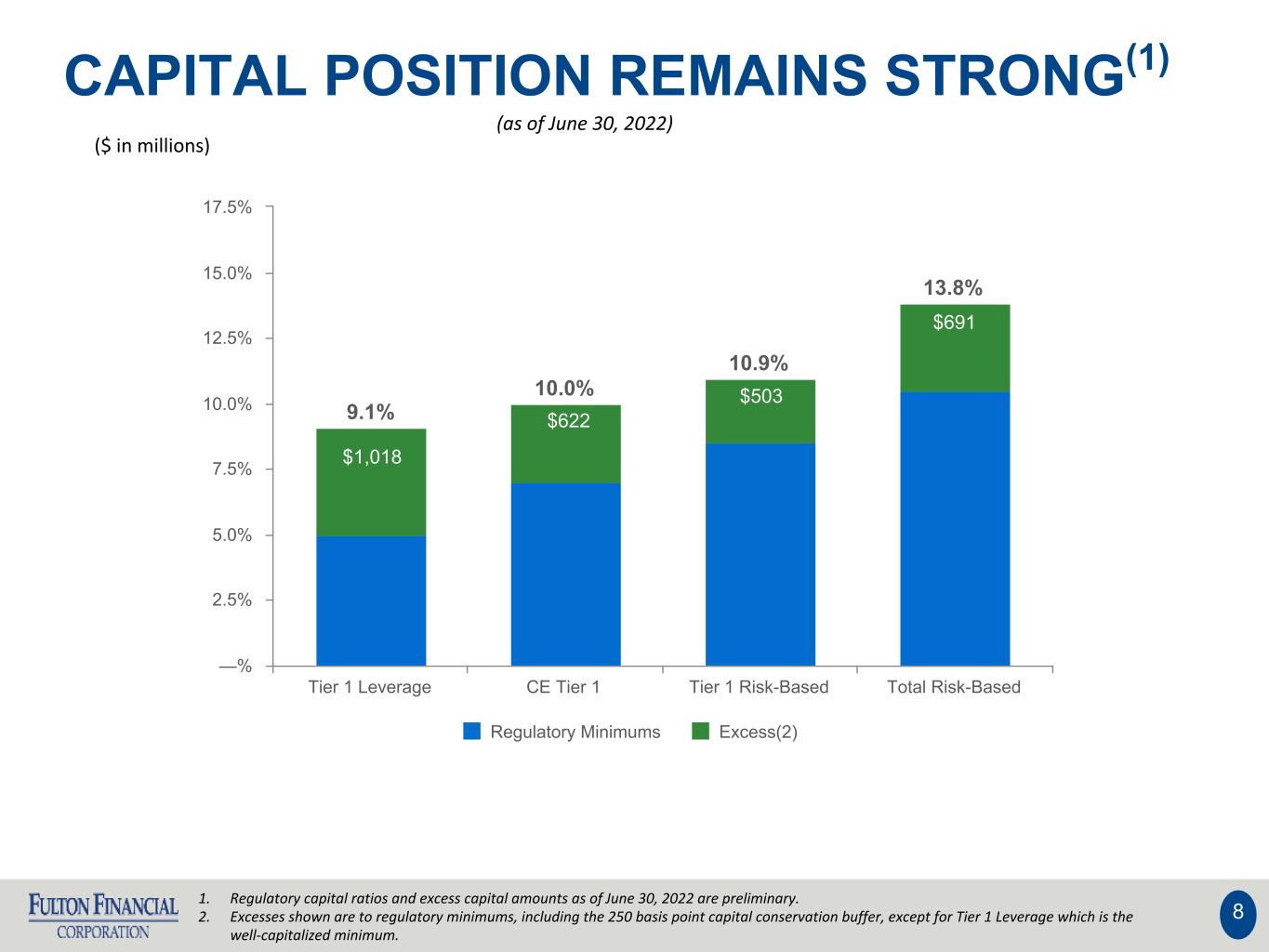

CAPITAL POSITION REMAINS STRONG(1) 8 1. Regulatory capital ratios and excess capital amounts as of June 30, 2022 are preliminary. 2. Excesses shown are to regulatory minimums, including the 250 basis point capital conservation buffer, except for Tier 1 Leverage which is the well-capitalized minimum. 9.1% 10.0% 10.9% 13.8% Regulatory Minimums Excess(2) Tier 1 Leverage CE Tier 1 Tier 1 Risk-Based Total Risk-Based —% 2.5% 5.0% 7.5% 10.0% 12.5% 15.0% 17.5% $1,018 $503 $622 $691 (as of June 30, 2022) ($ in millions)

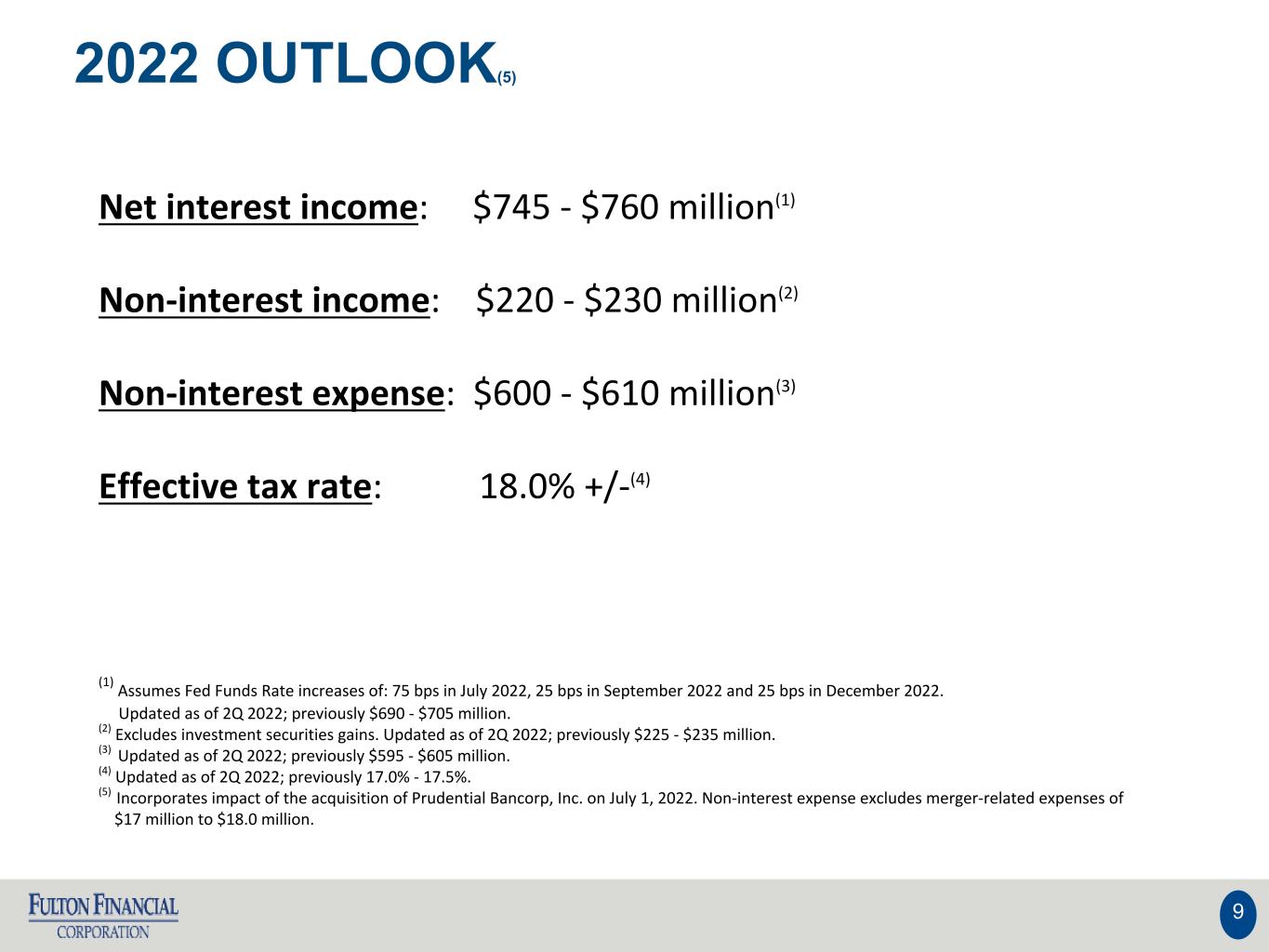

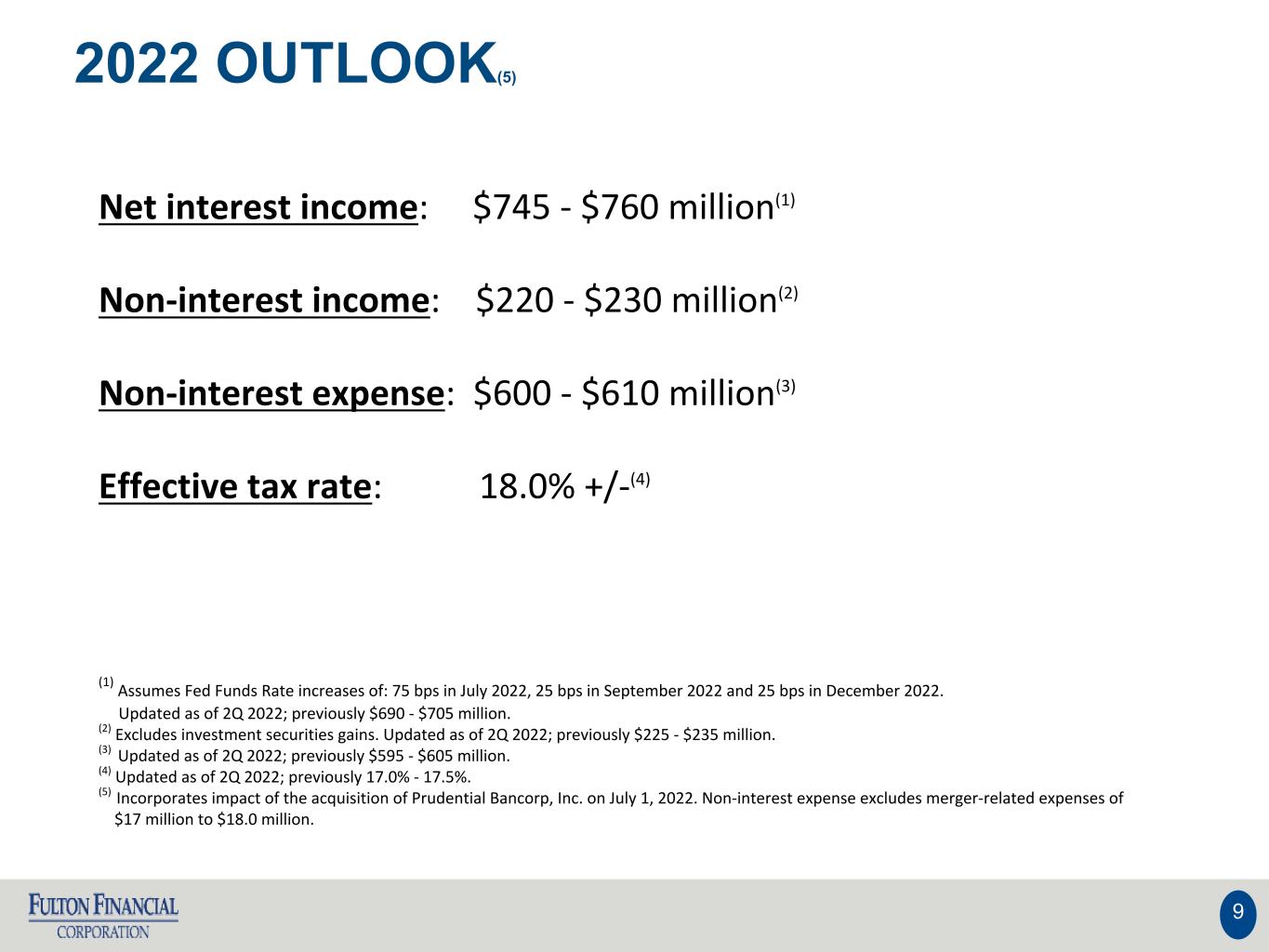

2022 OUTLOOK(5) 9 Net interest income: $745 - $760 million(1) Non-interest income: $220 - $230 million(2) Non-interest expense: $600 - $610 million(3) Effective tax rate: 18.0% +/-(4) (1) Assumes Fed Funds Rate increases of: 75 bps in July 2022, 25 bps in September 2022 and 25 bps in December 2022. Updated as of 2Q 2022; previously $690 - $705 million. (2) Excludes investment securities gains. Updated as of 2Q 2022; previously $225 - $235 million. (3) Updated as of 2Q 2022; previously $595 - $605 million. (4) Updated as of 2Q 2022; previously 17.0% - 17.5%. (5) Incorporates impact of the acquisition of Prudential Bancorp, Inc. on July 1, 2022. Non-interest expense excludes merger-related expenses of $17 million to $18.0 million.

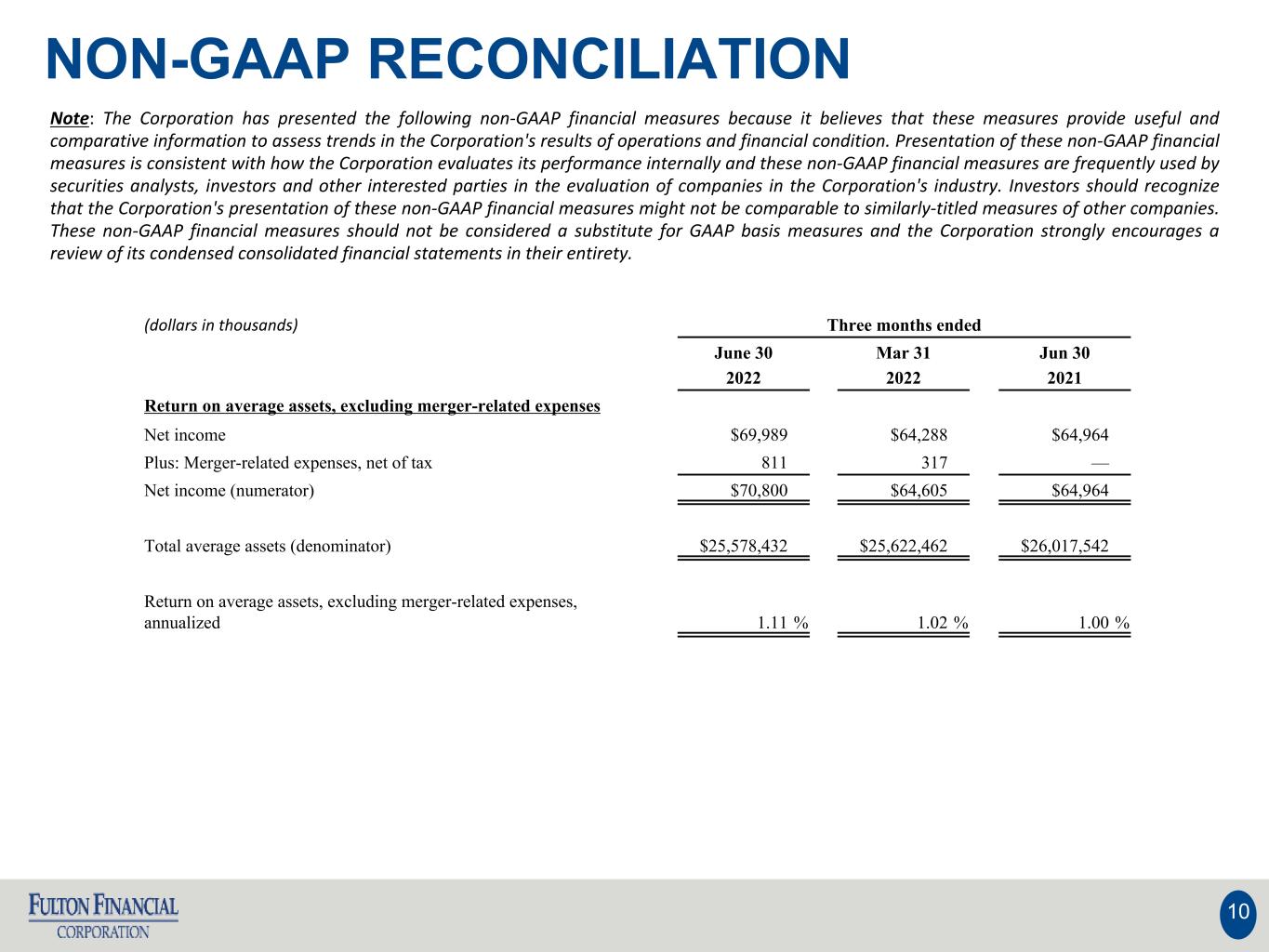

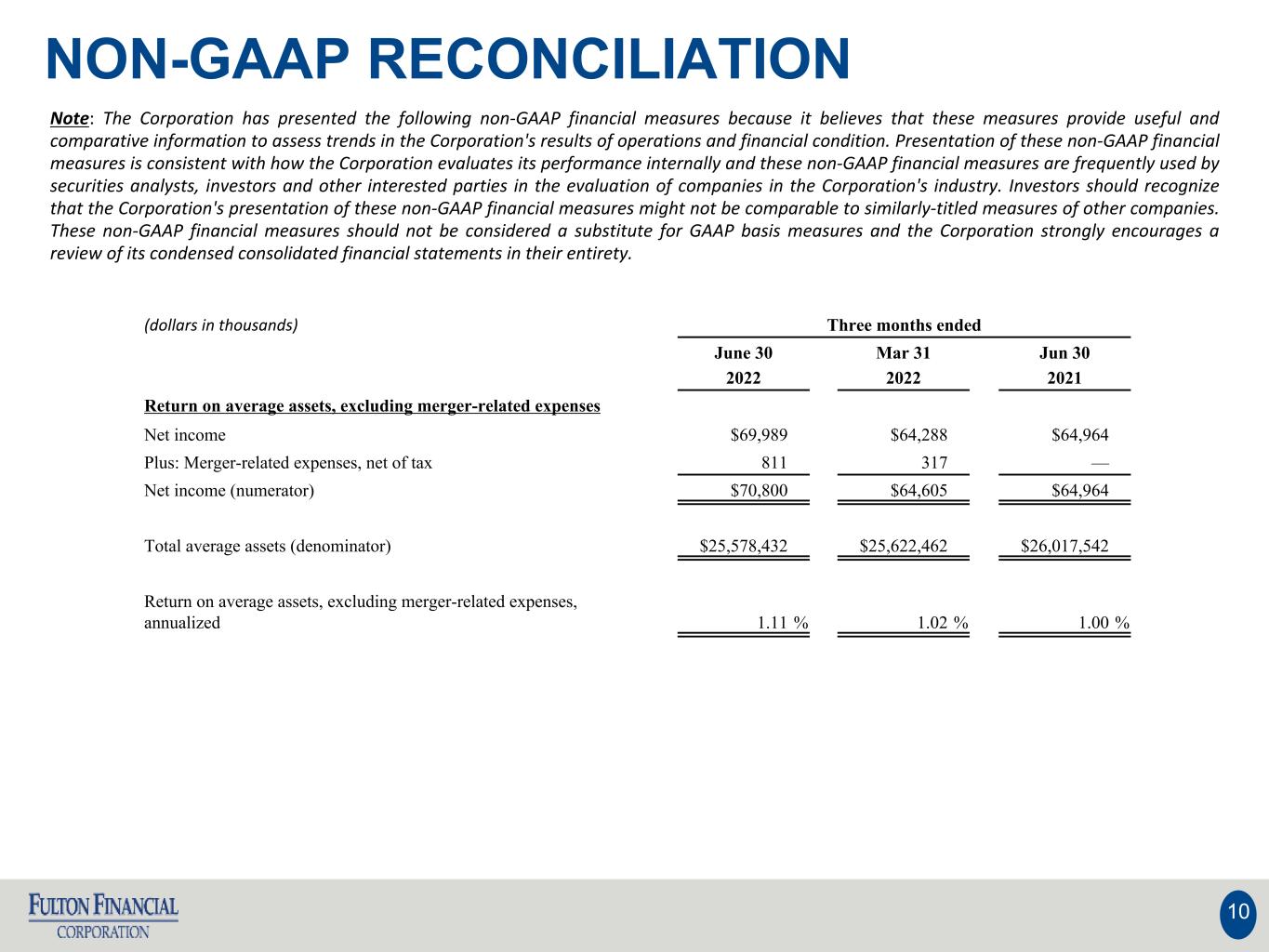

NON-GAAP RECONCILIATION Note: The Corporation has presented the following non-GAAP financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. 10 (dollars in thousands) Three months ended June 30 Mar 31 Jun 30 2022 2022 2021 Return on average assets, excluding merger-related expenses Net income $69,989 $64,288 $64,964 Plus: Merger-related expenses, net of tax 811 317 — Net income (numerator) $70,800 $64,605 $64,964 Total average assets (denominator) $25,578,432 $25,622,462 $26,017,542 Return on average assets, excluding merger-related expenses, annualized 1.11 % 1.02 % 1.00 %

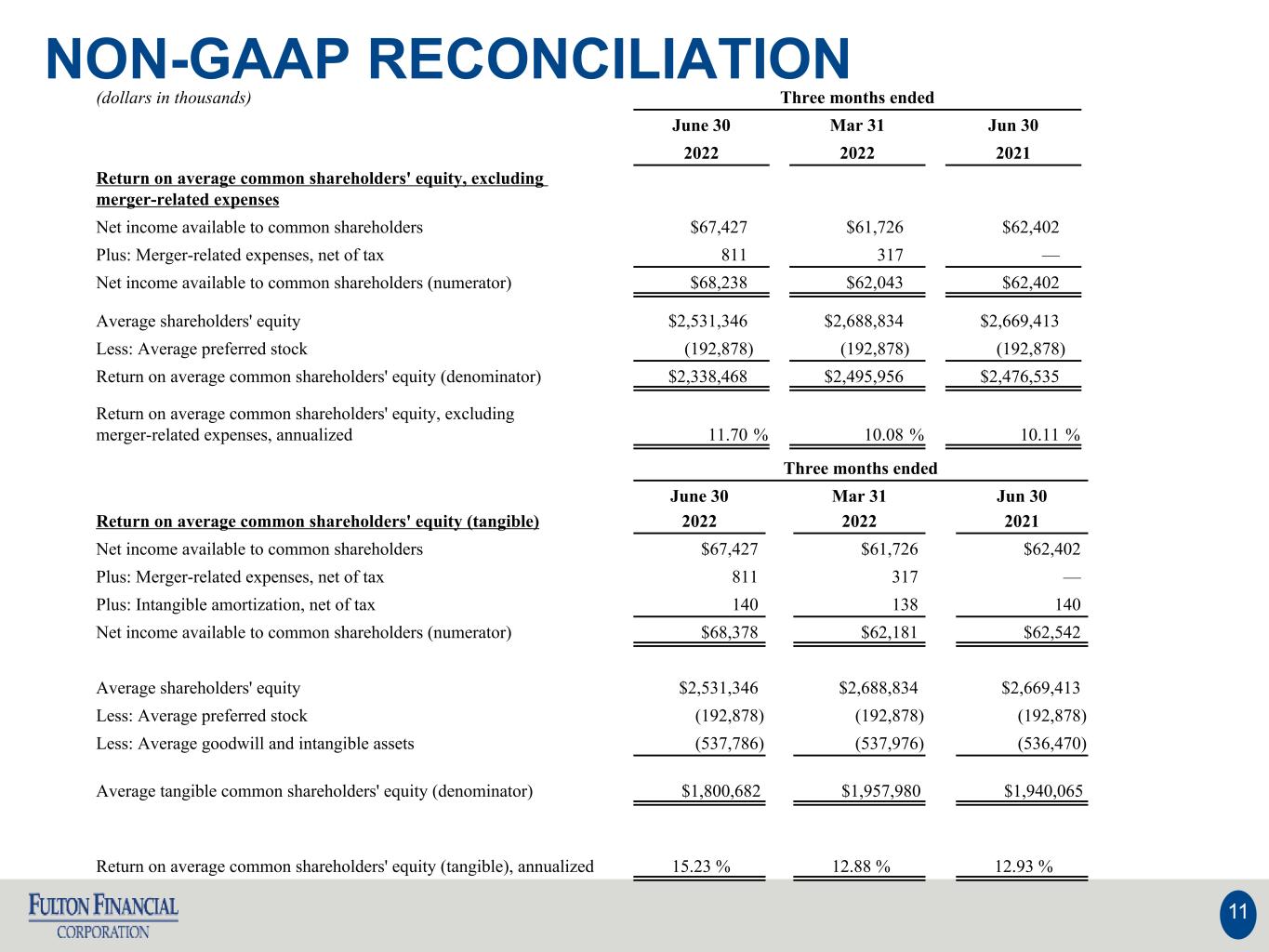

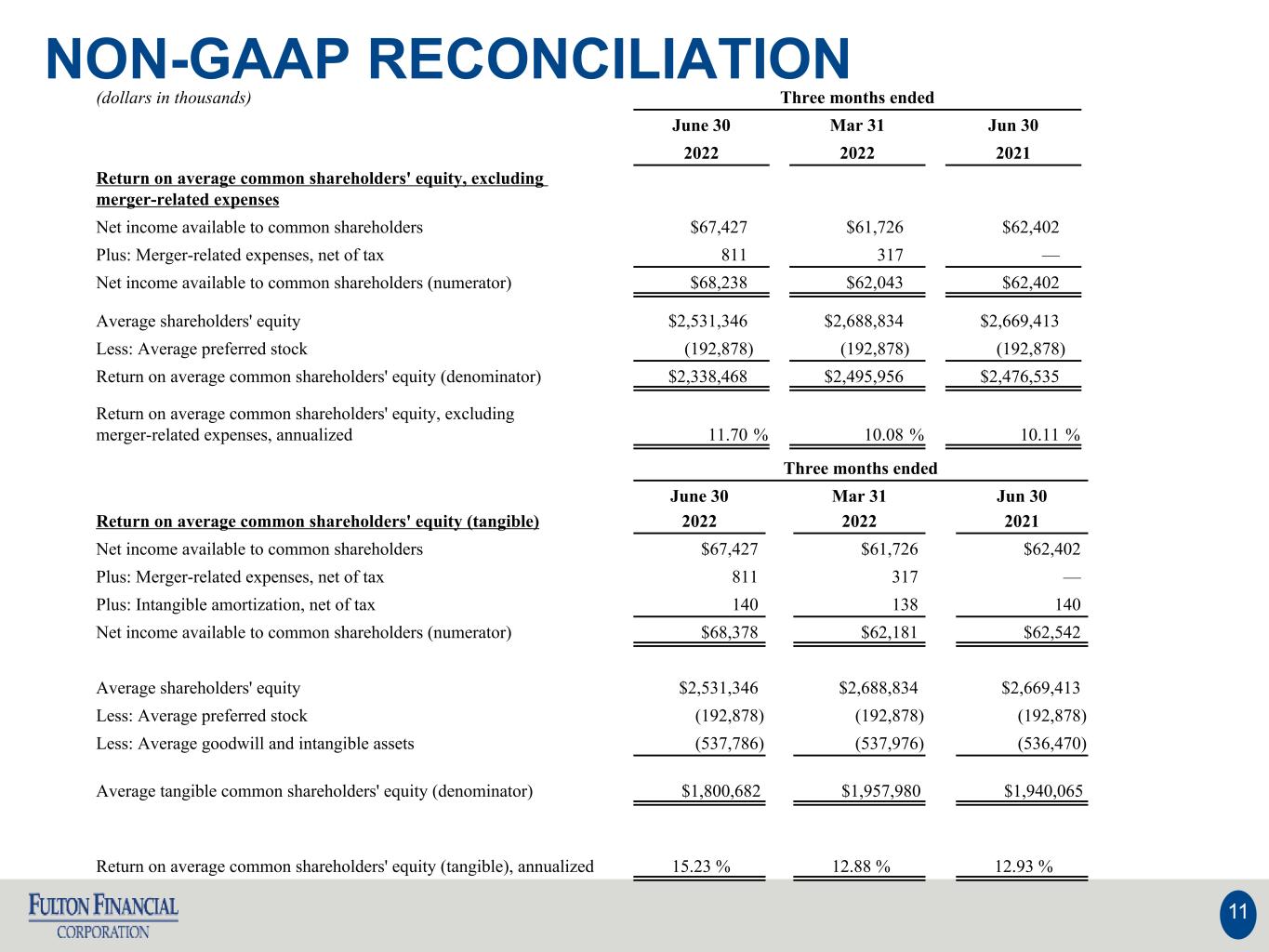

NON-GAAP RECONCILIATION 11 Three months ended June 30 Mar 31 Jun 30 Return on average common shareholders' equity (tangible) 2022 2022 2021 Net income available to common shareholders $67,427 $61,726 $62,402 Plus: Merger-related expenses, net of tax 811 317 — Plus: Intangible amortization, net of tax 140 138 140 Net income available to common shareholders (numerator) $68,378 $62,181 $62,542 Average shareholders' equity $2,531,346 $2,688,834 $2,669,413 Less: Average preferred stock (192,878) (192,878) (192,878) Less: Average goodwill and intangible assets (537,786) (537,976) (536,470) Average tangible common shareholders' equity (denominator) $1,800,682 $1,957,980 $1,940,065 Return on average common shareholders' equity (tangible), annualized 15.23 % 12.88 % 12.93 % (dollars in thousands) Three months ended June 30 Mar 31 Jun 30 2022 2022 2021 Return on average common shareholders' equity, excluding merger-related expenses Net income available to common shareholders $67,427 $61,726 $62,402 Plus: Merger-related expenses, net of tax 811 317 — Net income available to common shareholders (numerator) $68,238 $62,043 $62,402 Average shareholders' equity $2,531,346 $2,688,834 $2,669,413 Less: Average preferred stock (192,878) (192,878) (192,878) Return on average common shareholders' equity (denominator) $2,338,468 $2,495,956 $2,476,535 Return on average common shareholders' equity, excluding merger-related expenses, annualized 11.70 % 10.08 % 10.11 %

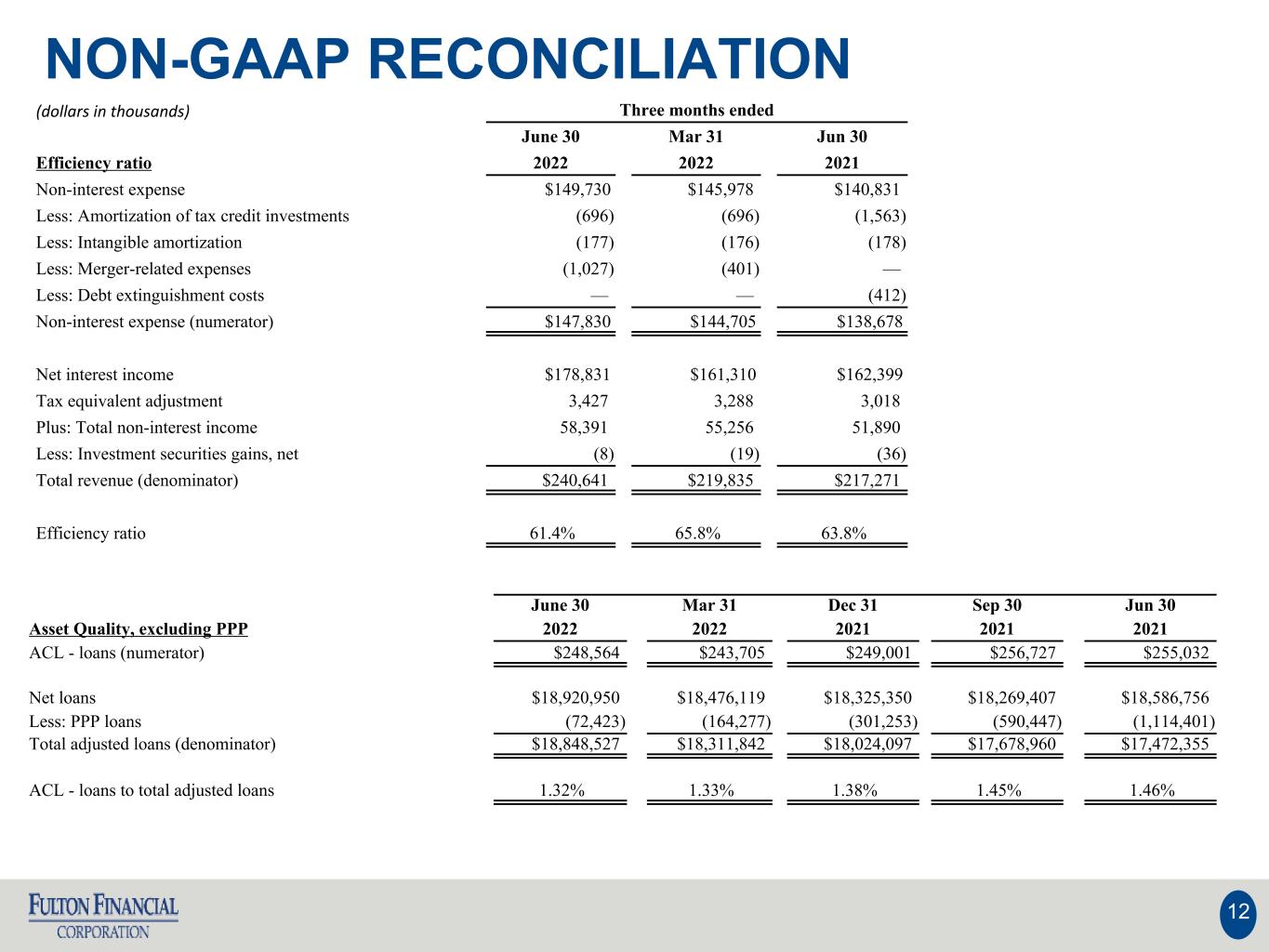

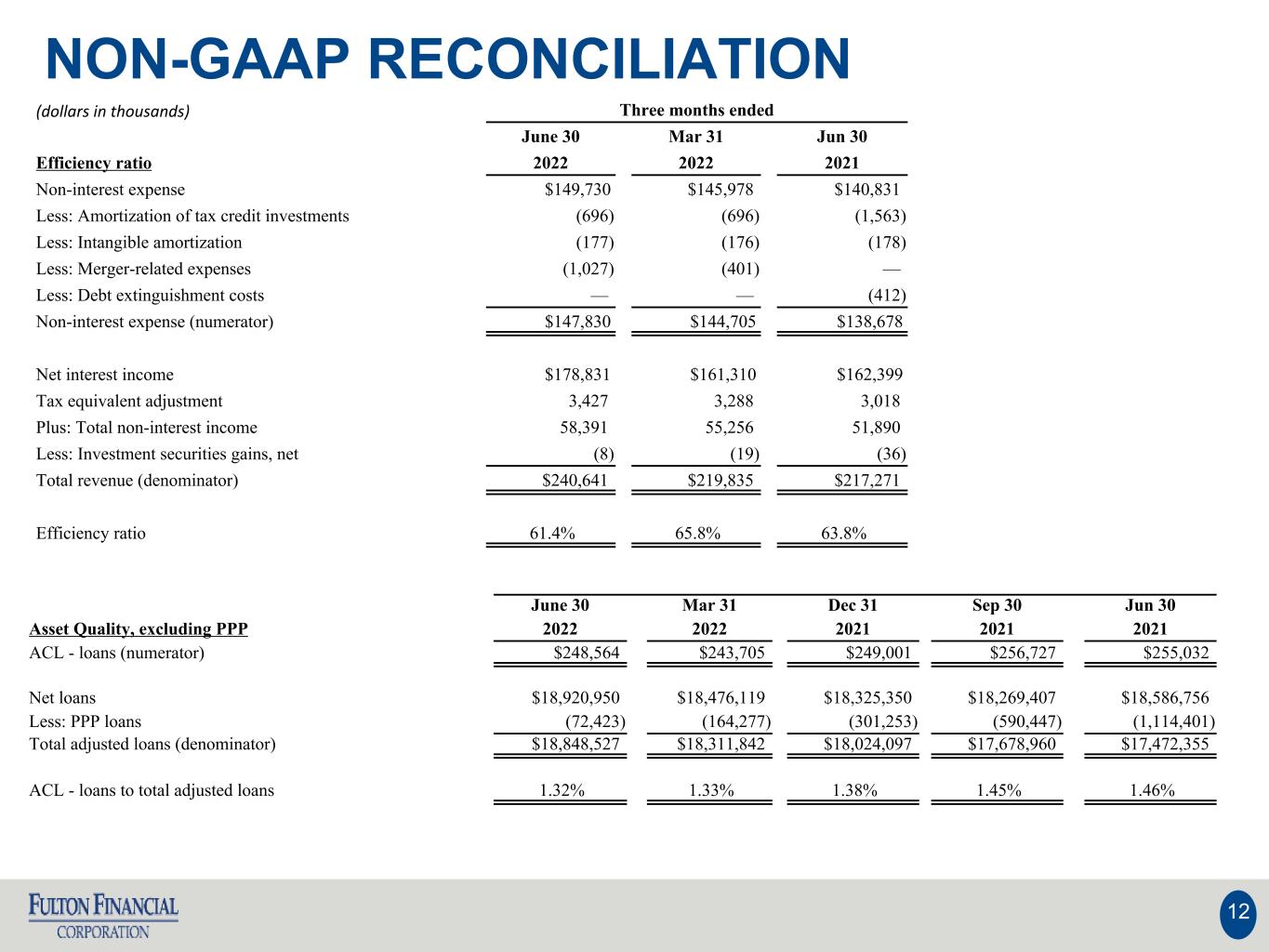

NON-GAAP RECONCILIATION 12 (dollars in thousands) Three months ended June 30 Mar 31 Jun 30 Efficiency ratio 2022 2022 2021 Non-interest expense $149,730 $145,978 $140,831 Less: Amortization of tax credit investments (696) (696) (1,563) Less: Intangible amortization (177) (176) (178) Less: Merger-related expenses (1,027) (401) — Less: Debt extinguishment costs — — (412) Non-interest expense (numerator) $147,830 $144,705 $138,678 Net interest income $178,831 $161,310 $162,399 Tax equivalent adjustment 3,427 3,288 3,018 Plus: Total non-interest income 58,391 55,256 51,890 Less: Investment securities gains, net (8) (19) (36) Total revenue (denominator) $240,641 $219,835 $217,271 Efficiency ratio 61.4% 65.8% 63.8% June 30 Mar 31 Dec 31 Sep 30 Jun 30 Asset Quality, excluding PPP 2022 2022 2021 2021 2021 ACL - loans (numerator) $248,564 $243,705 $249,001 $256,727 $255,032 Net loans $18,920,950 $18,476,119 $18,325,350 $18,269,407 $18,586,756 Less: PPP loans (72,423) (164,277) (301,253) (590,447) (1,114,401) Total adjusted loans (denominator) $18,848,527 $18,311,842 $18,024,097 $17,678,960 $17,472,355 ACL - loans to total adjusted loans 1.32% 1.33% 1.38% 1.45% 1.46%