SECOND QUARTER 2024 RESULTS NASDAQ: FULT Data as of or for the period ended June 30, 2024 unless otherwise noted

This presentation may contain forward-looking statements with respect to Fulton Financial Corporation's (the "Corporation") financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward-looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, including future credit losses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Management’s "2024 Outlook" contained herein is comprised of forward-looking statements. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, the statements are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 and other current and periodic reports, which have been, or will be, filed with the Securities and Exchange Commission (the "SEC") and are, or will be, available in the Investor Relations section of the Corporation’s website (www.fultonbank.com) and on the SEC’s website (www.sec.gov). The Corporation uses certain financial measures in this presentation that have been derived by methods other than generally accepted accounting principles ("GAAP"). These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. 2

3 MEANINGFUL CONTRIBUTION: SIMILAR LENDING PRODUCTS, SERVICES AND MARKETS OF OPERATION Loan Portfolio (June 30,2024) Deposit Portfolio (June 30,2024) $25.6B $24.1B 11 basis point improvement to net interest margin (“NIM”) in 2Q24 ~$34.8 million improvement to net interest income in 2Q24 Transaction $2.5B$21.6B $3.8B$21.8B

(1) Non-GAAP financial measure. Please refer to the calculation and management’s reason for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 4 INCOME STATEMENT SUMMARY 2Q24 1Q24 Linked-Quarter Change Net interest income $241,720 $206,937 $34,783 Provision for credit losses 32,056 10,925 21,131 Non-interest income 113,276 57,140 56,136 Securities gains (losses) (20,282) — (20,282) Non-interest expense 199,488 177,600 21,888 Income before income taxes 103,170 75,552 27,618 Income taxes 8,195 13,611 (5,416) Net income 94,975 61,941 33,034 Preferred stock dividends (2,562) (2,562) - Net income available to common shareholders $92,413 $59,379 $33,034 Net income available to common shareholders, per share (diluted) $0.52 $0.36 $0.16 Operating net income available to common shareholders, per share (diluted)(1) $0.47 $0.40 $0.07 ROAA 1.24% 0.91% 0.33% Operating ROAA(1) 1.11% 1.00% 0.11% ROAE 13.47% 9.28% 4.19% Operating ROAE (tangible)(1) 15.56% 13.08% 2.48% Efficiency ratio(1) 62.6% 63.2% -0.6% (dollars in thousands, except per-share data)

5 SECOND QUARTER PURCHASE ACCOUNTING ACCRETION(1) (1) Categories based on third-party valuation as of April 26, 2024. Balances may differ in financial statement presentation. Remaining Term is the weighted average remaining contractual term of the pool of loans. Duration is the weighted average expected life of the cash flows of the pool of loans. $ in thousands Credit Remaining Q2 2024 Loan Balance Interest Rate Non- Term Duration Interest Rate Credit- Total Acquired Mark PCD (months) (months) Mark Non-PCD Accretion CRE $1,159,451 $89,052 $6,027 59 33 $5,109 $204 $5,313 Residential mortgage 1,021,567 183,775 15,049 301 75 3,085 221 $3,306 C&I 219,441 623 694 33 18 (7) 53 $46 Multi-family 249,650 14,605 742 39 27 1,150 60 $1,210 Construction 140,310 5,776 487 34 22 281 20 $301 Home equity 90,882 5,712 424 200 35 175 12 $187 Other consumer 2,629 (6) 21 100 27 2 1 $3 $2,883,930 $299,537 $23,444 144 46 $9,795 $571 $10,366 Republic Transaction - Loan Accretion as of June 30, 2024 Q2 2024 Accretion

• NIM was 3.43% in the second quarter of 2024, increasing 11 basis points compared to the first quarter of 2024. • Loan yield improved by 22 basis points during the second quarter of 2024, increasing to 6.12% compared to 5.90% in the first quarter of 2024. • Total cost of deposits was 2.14% for the second quarter of 2024, an increase of 19 basis points compared to the first quarter of 2024. 6 NET INTEREST INCOME AND NIM 2Q24 Highlights Net Interest Income & NIM Average Deposits and Borrowings & Other and Cost of Funds Average Interest-Earning Assets & Yields (dollars in millions) (dollars in billions) (dollars in billions)

7 ASSET QUALITY Provision for Credit Losses Non-Performing Loans (“NPLs”) & NPLs to Loans Net Charge-offs (“NCOs”) and NCOs to Average Loans ACL(1) to NPLs & Loans (1) The allowance for credit losses (“ACL”) relates specifically to “Loans, net of unearned income” and does not include reserves related to off-balance sheet credit exposures.

8 NON-INTEREST INCOME(1) Non-interest Income (percentage of total non-interest income, three months ended June 30, 2024) (1) Excluding investment securities gains and losses. Increases due to: • Broad-based commercial banking increases (all categories) • Record wealth management income • Strong incremental consumer banking fees from the Republic Transaction • Gain on sale of mortgage loans Preliminary Gain on Acquisition: • Represents the after-tax impact of the bargain purchase gain (dollars in thousands) 2Q24 Fulton Organic 2Q24 Republic Transaction 2Q24 Consolidated 1Q24 Linked- Quarter Change Commercial Banking 21,027$ 383$ 21,410$ 18,829$ 2,581$ Wealth Management 20,990 - 20,990 20,155 835 Consumer Banking 12,256 2,344 14,600 11,668 2,932 Mortgage Banking 3,951 - 3,951 3,090 861 Gain On Acquisition, net of tax - 47,392 47,392 - 47,392 Other 4,874 59 4,933 3,398 1,535 Total 63,098$ 50,178$ 113,276$ 57,140$ 56,136$

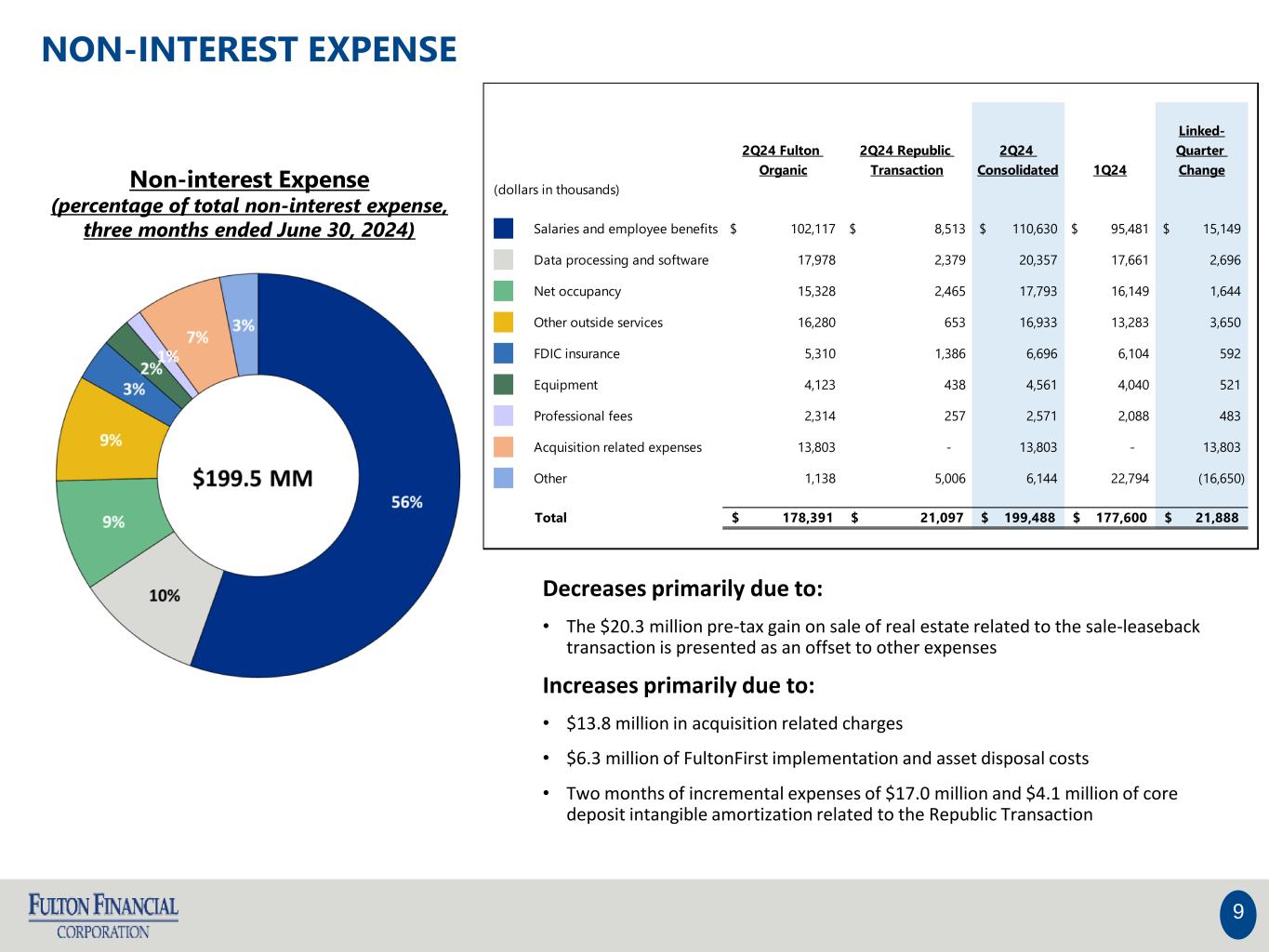

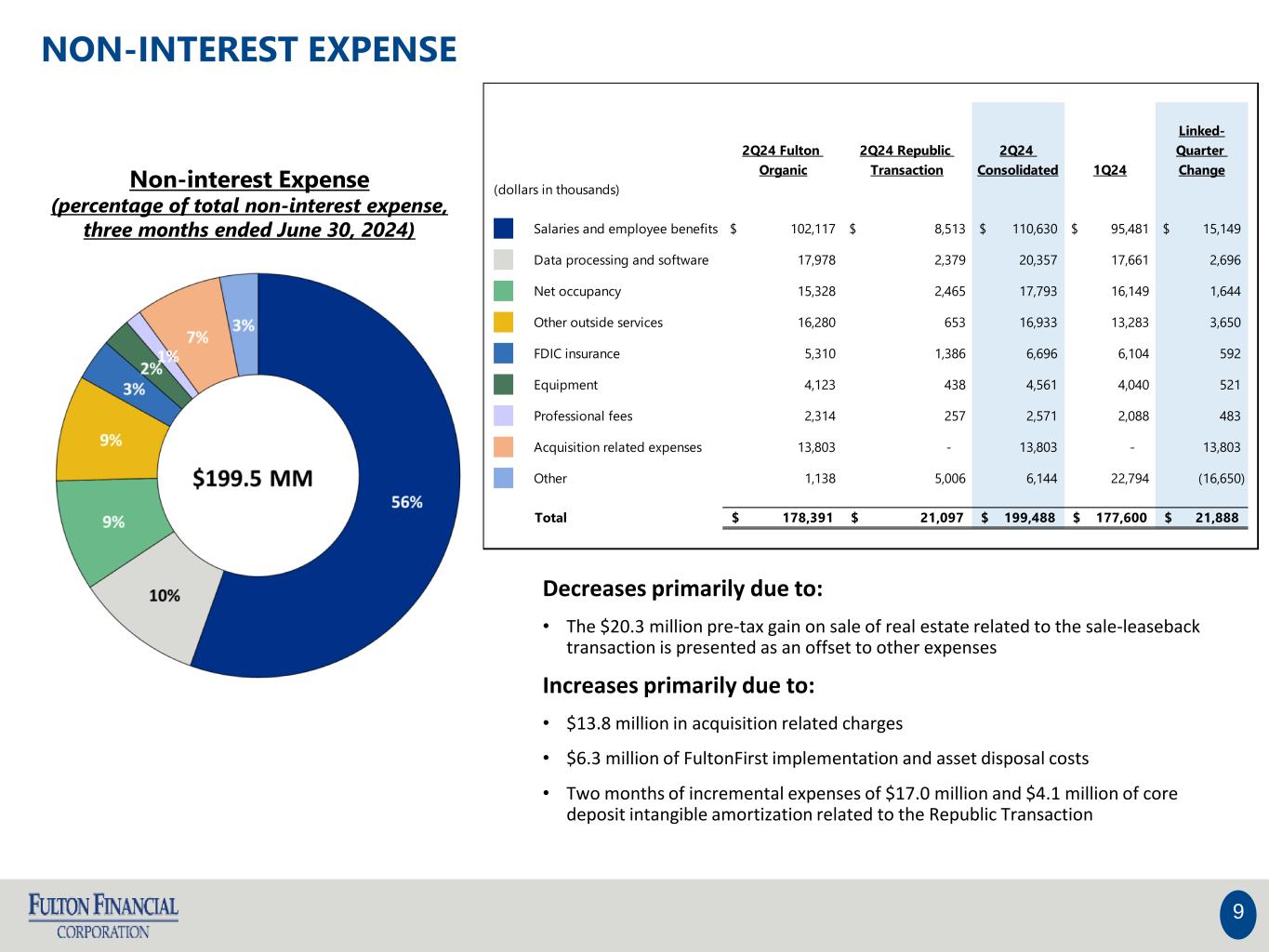

9 NON-INTEREST EXPENSE Non-interest Expense (percentage of total non-interest expense, three months ended June 30, 2024) Decreases primarily due to: • The $20.3 million pre-tax gain on sale of real estate related to the sale-leaseback transaction is presented as an offset to other expenses Increases primarily due to: • $13.8 million in acquisition related charges • $6.3 million of FultonFirst implementation and asset disposal costs • Two months of incremental expenses of $17.0 million and $4.1 million of core deposit intangible amortization related to the Republic Transaction 2Q24 Fulton Organic 2Q24 Republic Transaction 2Q24 Consolidated 1Q24 Linked- Quarter Change (dollars in thousands) Salaries and employee benefits 102,117$ 8,513$ 110,630$ 95,481$ 15,149$ Data processing and software 17,978 2,379 20,357 17,661 2,696 Net occupancy 15,328 2,465 17,793 16,149 1,644 Other outside services 16,280 653 16,933 13,283 3,650 FDIC insurance 5,310 1,386 6,696 6,104 592 Equipment 4,123 438 4,561 4,040 521 Professional fees 2,314 257 2,571 2,088 483 Acquisition related expenses 13,803 - 13,803 - 13,803 Other 1,138 5,006 6,144 22,794 (16,650) Total 178,391$ 21,097$ 199,488$ 177,600$ 21,888$

10 (1) Regulatory capital ratios and excess capital amounts as of June 30, 2024 are preliminary estimates. (2) Excesses shown are to regulatory minimums, including the 250 basis point capital conservation buffer, except for Tier 1 Leverage which is the well- capitalized minimum. $1,181 $581 $730 $790 (as of June 30, 2024) (dollars in millions) (2) CAPITAL RATIOS(1)

2024 OUTLOOK 11 Net Interest Income: $925 - $950 million(1) Provision for Credit Losses: $40 - $60 million Non-Interest Income: $240 - $260 million(2) Non-Interest Expense: $750 - $770 million(3) Effective Tax Rate: 16% - 18% (1) Assumes Fed Funds Rate decrease of 25 basis points in September 2024. (2) Excludes investment securities gains and losses and gain on acquisition, net of tax. (3) Excludes non-operating expenses.

12 A LARGER DEPOSIT PORTFOLIO THAT REMAINS GRANULAR, TENURED AND DIVERSIFIED WITH SIGNIFICANT LIQUIDITY COVERAGE Deposit Mix By Customer (June 30, 2024) Deposit Portfolio Highlights(1) 883,000 deposit accounts $28,770 average account balance ~10 year average account age 23% estimated uninsured deposits 259% coverage of estimated uninsured deposits Deposit Mix By Product(2) (1) As of June 30, 2024. Estimated uninsured deposits net of collateralized municipal deposits and inter-company deposits. For the calculation of the coverage of estimated uninsured deposits, please refer to the slide titled “Liquidity Profile.” (2) Deposit balances are ending balances. (dollars in millions)

THE LOAN PORTFOLIO REMAINS DIVERSIFIED AND GRANULAR WITH LOW OFFICE CONCENTRATION AT 3% OF TOTAL LOANS 13 Office Only Profile • $896 million in office loan commitments • $824 million in office loans outstanding • representing 3% of total loans • Average loan size is $2.3 million • Weighted average loan-to-value(1) (“LTV”) ratio of 63% • Weighted average debt service coverage ratio (“DSCR”) of 1.34x • 84% of loans with full recourse; 65% LTV; 1.29x DSCR • 16% of loans non-recourse; 51% LTV; 1.58x DSCR • Nine relationships over $20 million, totaling $226 million in commitments, including: • Six relationships in central business districts • $219 million in commitments located in central business districts • Classification • 28% Class A • 21% Class B • 4% Class C • 47% Not Classified Total Loan Portfolio (June 30, 2024) (1) LTV as of most recent appraisal.

THE ACQUIRED OFFICE PORTFOLIO HAS SIMILAR CHARACTERISTICS TO FULTON’S WITH SOME SEASONING AND LONGER MATURITY TERM 14 Originated Over Time Maturing Over Time Granular Loan Portfolio Geographically Diverse by MSA(1) (1) Metropolitan Statistical Areas or “MSA” titled in short name for presentation purposes.

MULTI-FAMILY LOANS REPRESENT 8% OF THE TOTAL LOAN PORTFOLIO WITH A SMALL AVERAGE LOAN SIZE, LOW LTV’S AND SOLID DSCR 15 (1) LTV as of most recent appraisal. Multi-Family Profile • $2.4 billion in multi-family loan commitments • $1.9 billion in multi-family loans outstanding • representing 8% of total loans • Average loan size is $3.3 million • Weighted average LTV(1) ratio of 60% • Weighted Average DSCR of 1.27x • 90% of loans with recourse • 36% construction; 64% stabilized • Classification o 42% Class A o 12% Class B o 3% Class C o 43% Not Classified Total Loan Portfolio (June 30, 2024)

THE MAJORITY OF THE MULTI-FAMILY PORTFOLIO HAS BEEN RECENTLY ORIGINATED AND APPRAISED AND HAS A LONG-DATED MATURITY HORIZON 16 Recently Originated and Appraised Maturing Over Time Diversified by Size Diversified by Geographical MSA

17 NONINTEREST-BEARING DEPOSIT TRENDS • Growth in the Corporation’s commercial banking business, as well as the historically low levels of interest rates for much of the post-2008 period, led to a generally increasing trend in the percentage of noninterest-bearing deposits. • Prior to 2008, noninterest-bearing deposits averaged 15%-20% of total deposits. As of June 30, 2024, noninterest-bearing deposits were 21.9% of total deposits down from a peak of 35% in June 2022. • Deposit growth, including growth in noninterest-bearing deposits, remains a key component of the Corporation’s relationship banking strategy. Source: S&P Global Market Intelligence, Federal Reserve Bank of New York and Board of Governors of the Federal Reserve System (US); Corporation’s reported results for NIM and percentage of noninterest-bearing deposits at June 30,2024. % Noninterest-Bearing Deposits, NIM and Fed Funds Effective Rate

Estimated Uninsured Deposits June 30, 2024 Total Deposits $25,560 Estimated Uninsured Deposits $8,668 Estimated Uninsured Deposits to Total Deposits 34% Estimated Uninsured Deposits $8,668 Less: Collateralized Municipal Deposits (2,801) Net Estimated Uninsured Deposits (4) $5,867 Net Estimated Uninsured Deposits to Total Deposits 23% Committed Liquidity to Net Estimated Uninsured Deposits 143% Available Liquidity to Net Estimated Uninsured Deposits 259% Available Liquidity June 30, 2024 Cash On-Hand (1) 1,133$ Federal Reserve Capacity 1,859 Total Available @ Federal Reserve 1,859$ FHLB Borrowing Capacity 10,842 Advances(2) (759) Letters of Credit (3,559) Total Available @ FHLB 6,524$ Total Committed Liquidity 8,383$ Fed Funds Lines 2,556 Outstanding Net Fed Funds - Total Fed Funds Lines Available 2,556$ Brokered Deposit Capacity (3) 4,100 Brokered & Wholesale Deposits (996) Total Brokered Deposit Availability 3,104$ Total Uncommitted Available Liquidity 5,660$ Total Available Liquidity 15,176$ 18 LIQUIDITY PROFILE (1) Includes cash at the FHLB and Federal Reserve and vault cash for liquidity purposes only. (2) Includes accrued interest, fees, and other adjustments. (3) Brokered deposit availability is based upon internal policy limit. (4) Net estimated uninsured deposits are net of collateralized municipal deposits and inter-company deposits. (dollars in thousands)

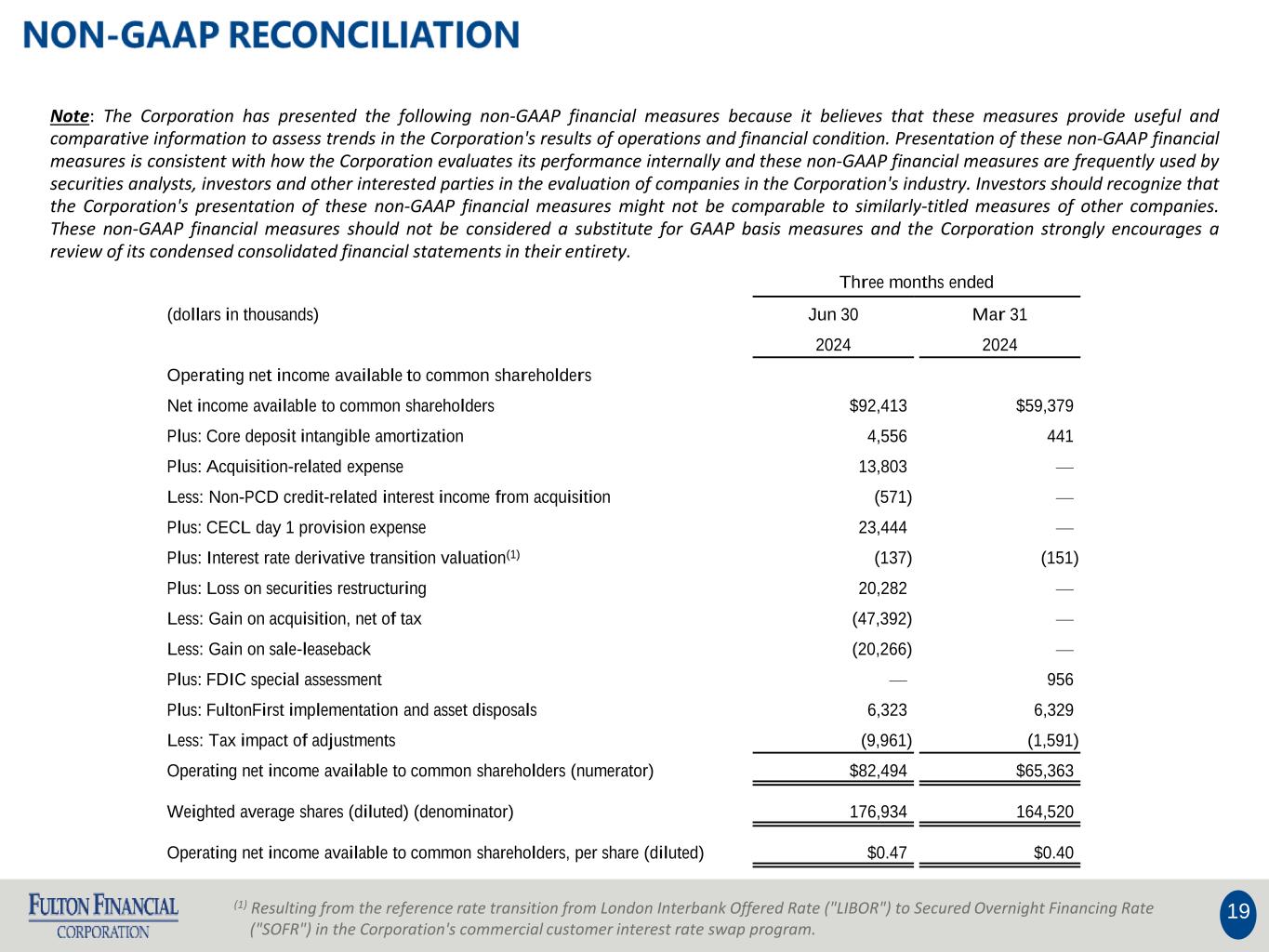

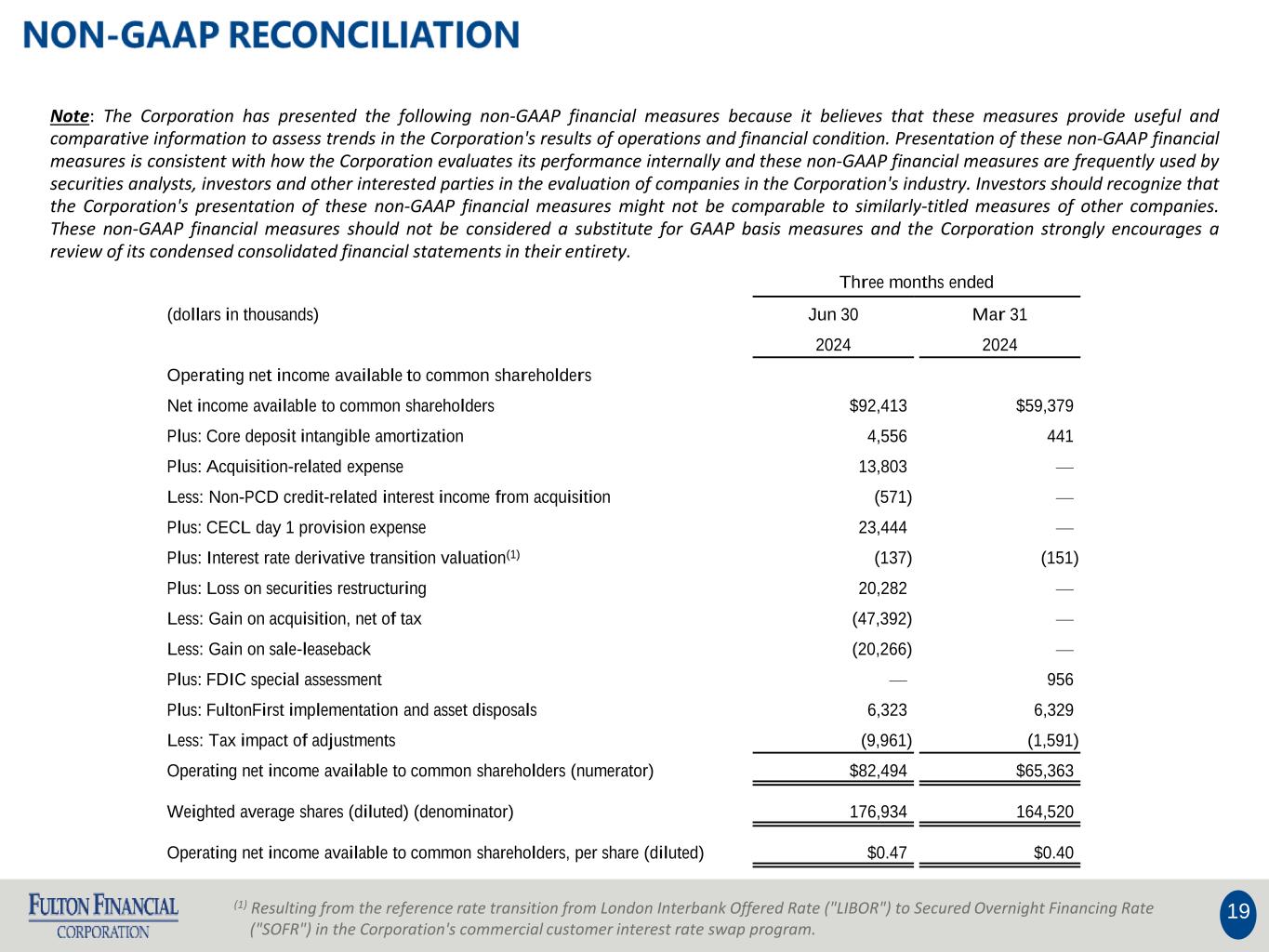

19 Note: The Corporation has presented the following non-GAAP financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. Three months ended (dollars in thousands) Jun 30 Mar 31 2024 2024 Operating net income available to common shareholders Net income available to common shareholders $92,413 $59,379 Plus: Core deposit intangible amortization 4,556 441 Plus: Acquisition-related expense 13,803 — Less: Non-PCD credit-related interest income from acquisition (571) — Plus: CECL day 1 provision expense 23,444 — Plus: Interest rate derivative transition valuation(1) (137) (151) Plus: Loss on securities restructuring 20,282 — Less: Gain on acquisition, net of tax (47,392) — Less: Gain on sale-leaseback (20,266) — Plus: FDIC special assessment — 956 Plus: FultonFirst implementation and asset disposals 6,323 6,329 Less: Tax impact of adjustments (9,961) (1,591) Operating net income available to common shareholders (numerator) $82,494 $65,363 Weighted average shares (diluted) (denominator) 176,934 164,520 Operating net income available to common shareholders, per share (diluted) $0.47 $0.40 (1) Resulting from the reference rate transition from London Interbank Offered Rate ("LIBOR") to Secured Overnight Financing Rate ("SOFR") in the Corporation's commercial customer interest rate swap program.

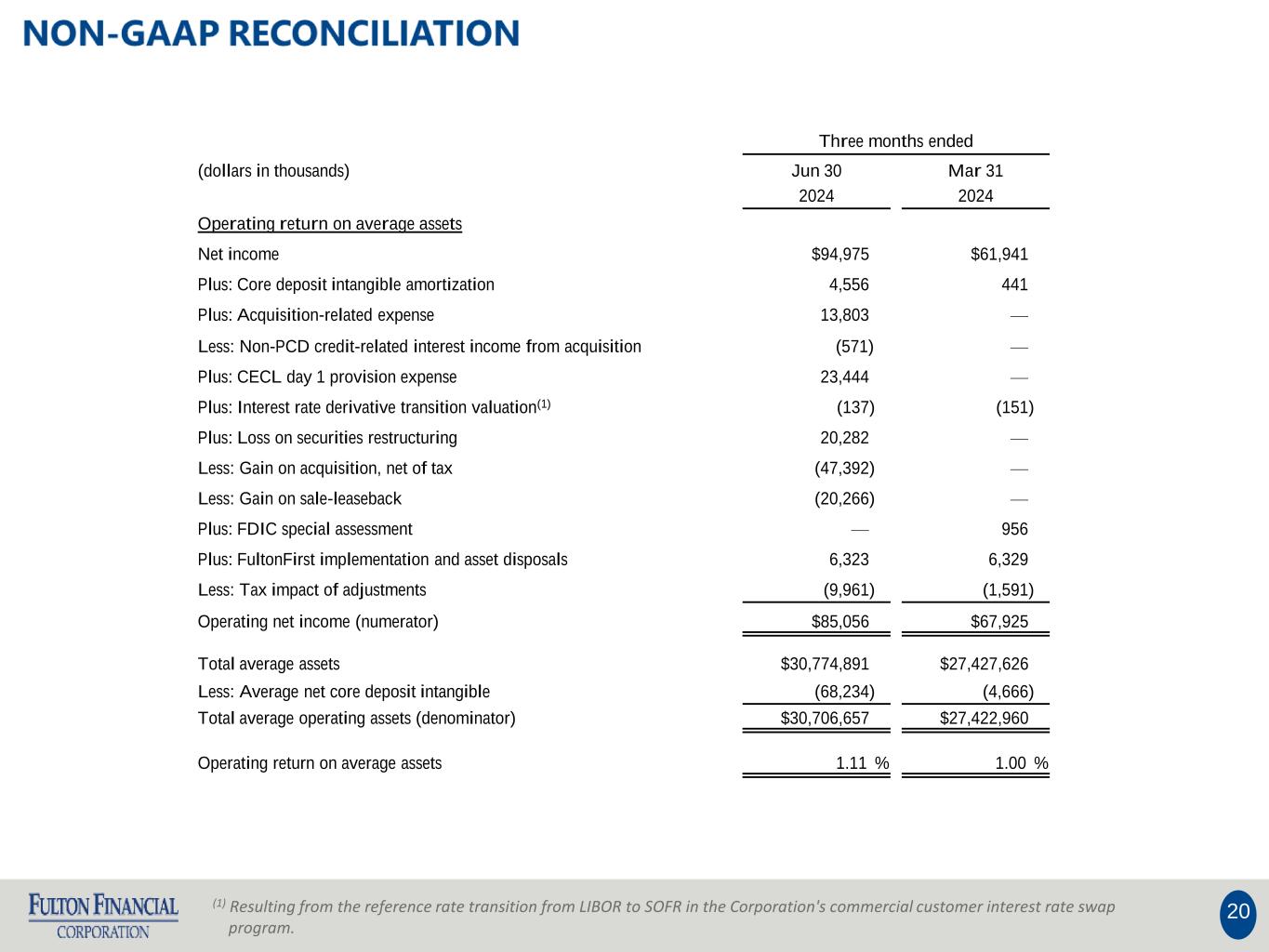

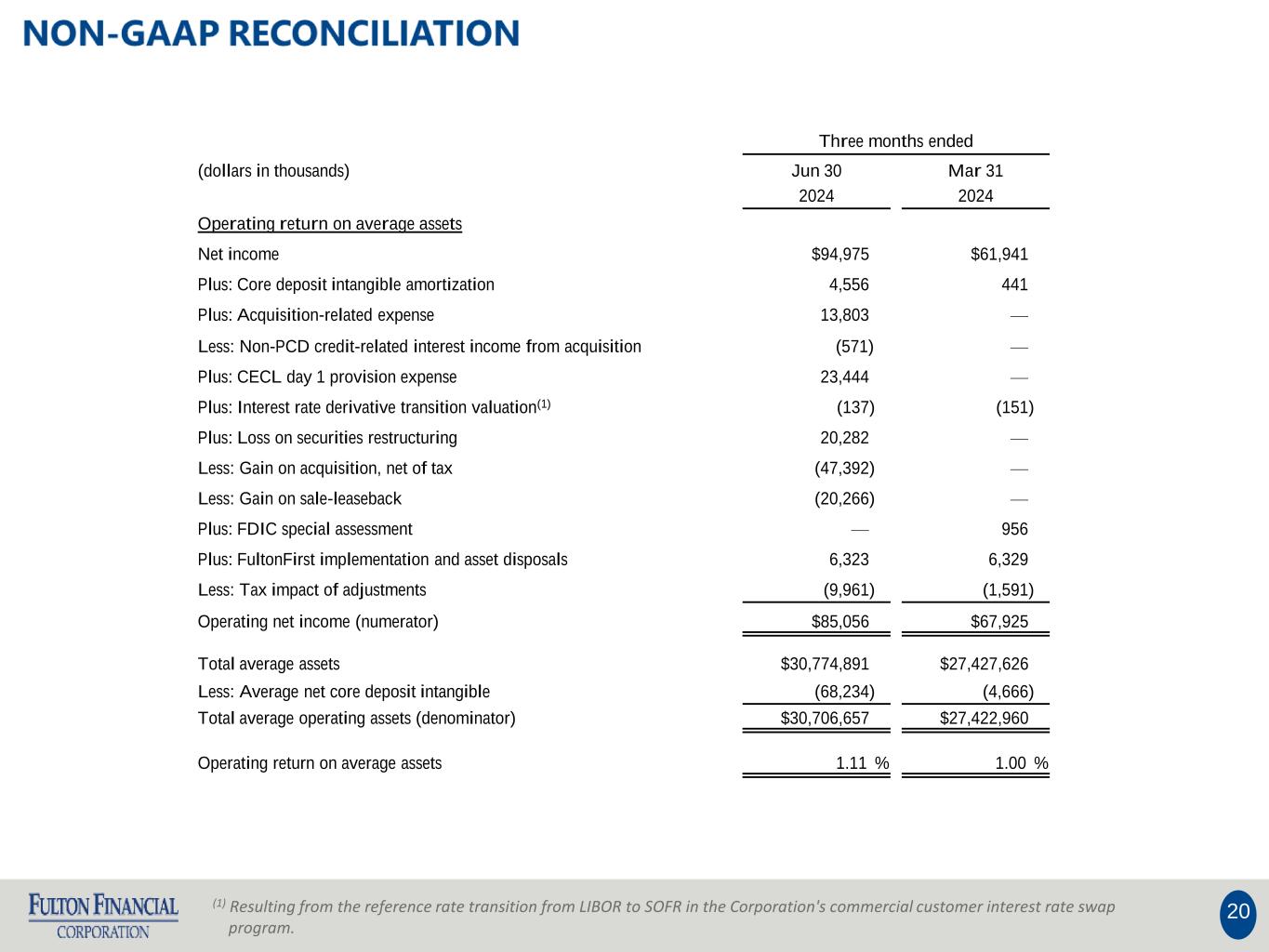

20 Three months ended (dollars in thousands) Jun 30 Mar 31 2024 2024 Operating return on average assets Net income $94,975 $61,941 Plus: Core deposit intangible amortization 4,556 441 Plus: Acquisition-related expense 13,803 — Less: Non-PCD credit-related interest income from acquisition (571) — Plus: CECL day 1 provision expense 23,444 — Plus: Interest rate derivative transition valuation(1) (137) (151) Plus: Loss on securities restructuring 20,282 — Less: Gain on acquisition, net of tax (47,392) — Less: Gain on sale-leaseback (20,266) — Plus: FDIC special assessment — 956 Plus: FultonFirst implementation and asset disposals 6,323 6,329 Less: Tax impact of adjustments (9,961) (1,591) Operating net income (numerator) $85,056 $67,925 Total average assets $30,774,891 $27,427,626 Less: Average net core deposit intangible (68,234) (4,666) Total average operating assets (denominator) $30,706,657 $27,422,960 Operating return on average assets 1.11 % 1.00 % (1) Resulting from the reference rate transition from LIBOR to SOFR in the Corporation's commercial customer interest rate swap program.

21 Three months ended (dollars in thousands) Jun 30 Mar 31 2024 2024 Operating return on average common shareholders' equity (tangible), annualized Net income available to common shareholders $92,413 $59,379 Plus: Intangible amortization 4,688 573 Plus: Acquisition-related expense 13,803 — Less: Non-PCD credit-related interest income from acquisition (571) — Plus: CECL day 1 provision expense 23,444 — Plus: Interest rate derivative transition valuation(1) (137) (151) Plus: Loss on securities restructuring 20,282 — Less: Gain on acquisition (47,392) — Less: Gain on sale-leaseback (20,266) — Plus: FDIC special assessment — 956 Plus: FultonFirst implementation and asset disposals 6,323 6,329 Less: Tax impact of adjustments (9,989) (1,618) Adjusted net income available to common shareholders (numerator) $82,598 $65,468 Average shareholders' equity $2,952,671 $2,766,945 Less: Average preferred stock (192,878) (192,878) Less: Average goodwill and intangible assets (624,471) (560,393) Average tangible common shareholders' equity (denominator) $2,135,322 $2,013,674 Operating return on average common shareholders' equity (tangible) 15.56 % 13.08 % (1) Resulting from the reference rate transition from LIBOR to SOFR in the Corporation's commercial customer interest rate swap program.

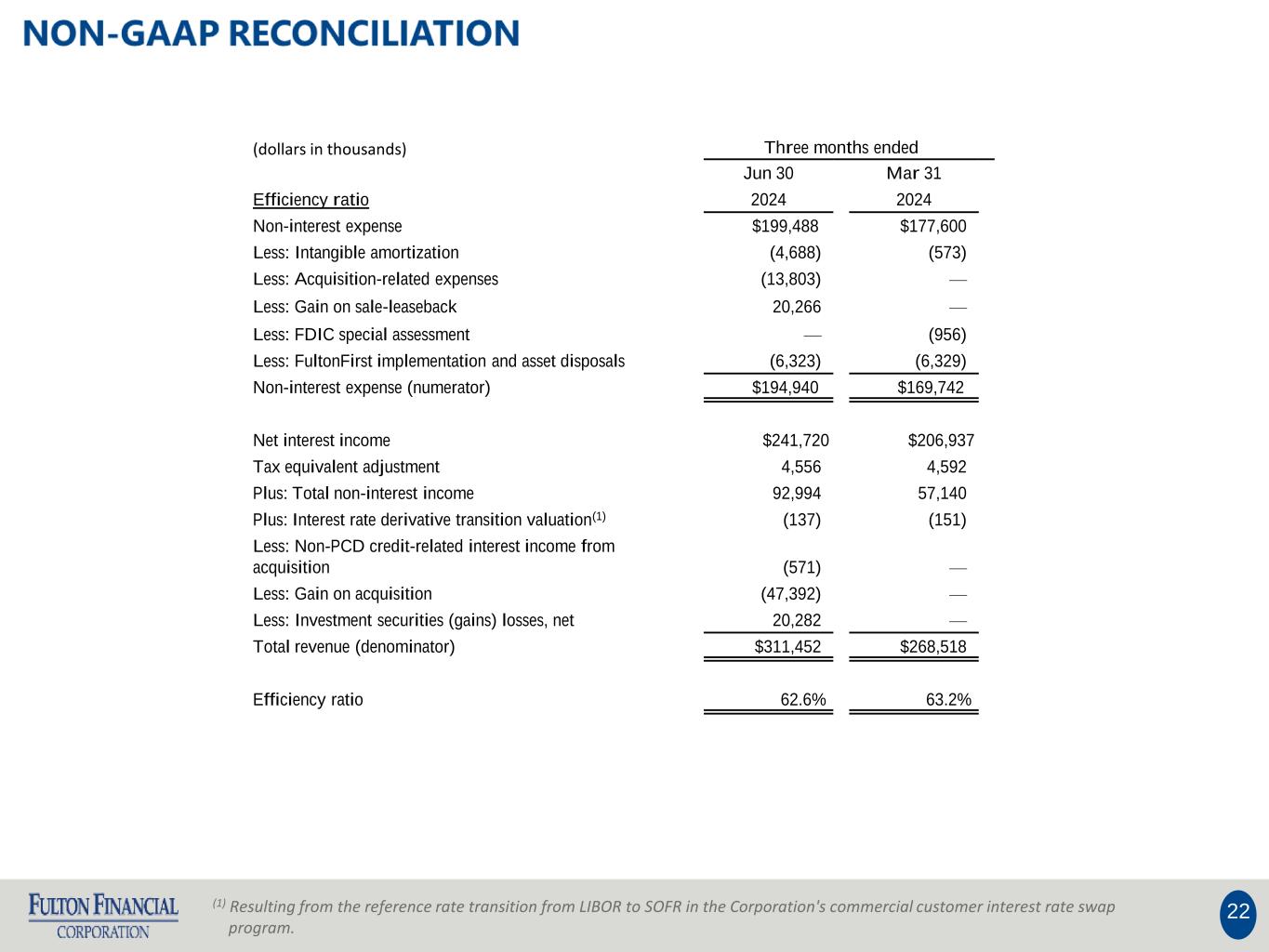

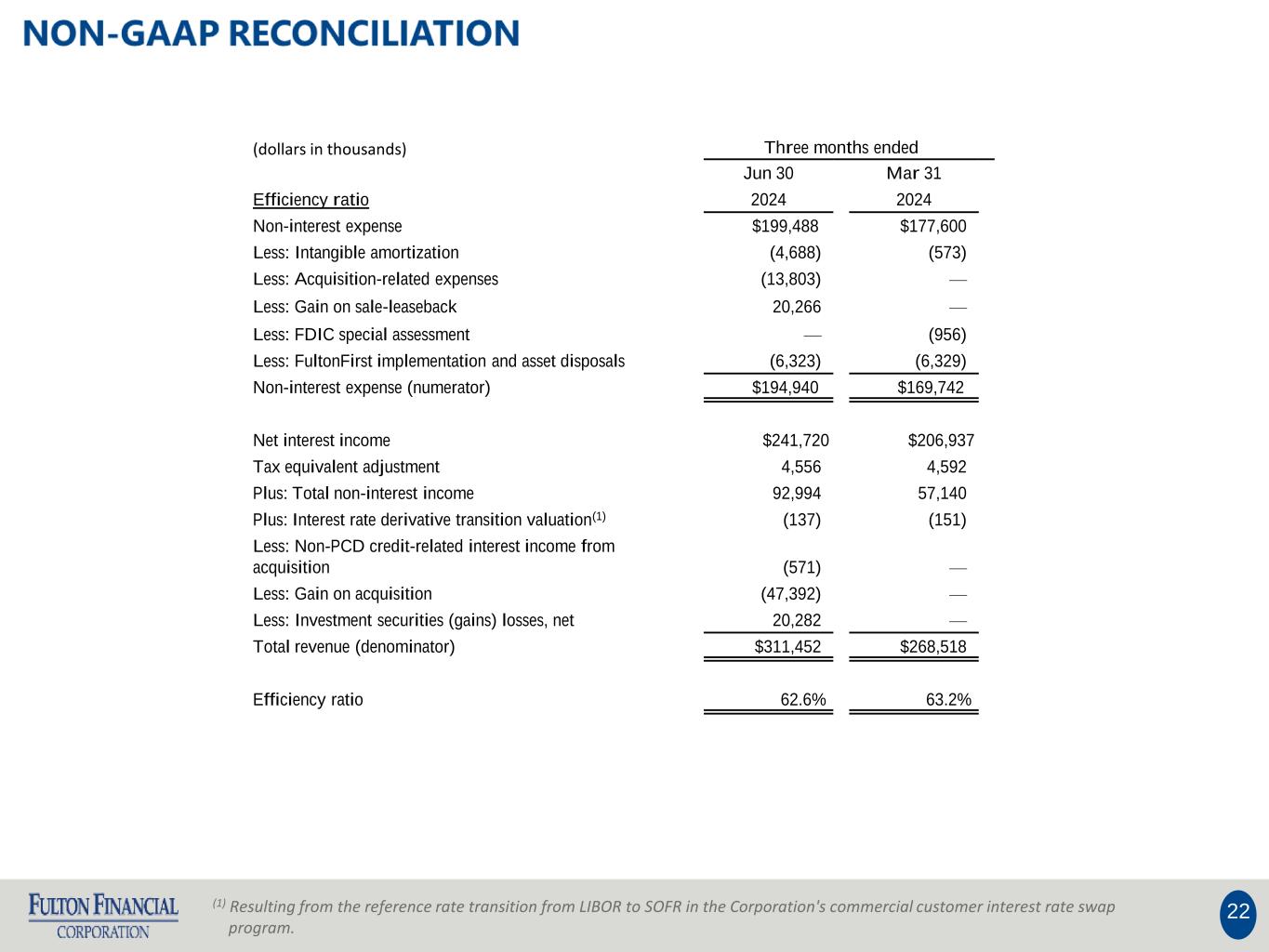

22 (dollars in thousands) Three months ended Jun 30 Mar 31 Efficiency ratio 2024 2024 Non-interest expense $199,488 $177,600 Less: Intangible amortization (4,688) (573) Less: Acquisition-related expenses (13,803) — Less: Gain on sale-leaseback 20,266 — Less: FDIC special assessment — (956) Less: FultonFirst implementation and asset disposals (6,323) (6,329) Non-interest expense (numerator) $194,940 $169,742 Net interest income $241,720 $206,937 Tax equivalent adjustment 4,556 4,592 Plus: Total non-interest income 92,994 57,140 Plus: Interest rate derivative transition valuation(1) (137) (151) Less: Non-PCD credit-related interest income from acquisition (571) — Less: Gain on acquisition (47,392) — Less: Investment securities (gains) losses, net 20,282 — Total revenue (denominator) $311,452 $268,518 Efficiency ratio 62.6% 63.2% (1) Resulting from the reference rate transition from LIBOR to SOFR in the Corporation's commercial customer interest rate swap program.