FOURTH QUARTER 2024 RESULTS NASDAQ: FULT Data as of or for the period ended December 31, 2024 unless otherwise noted

This presentation may contain forward-looking statements with respect to Fulton Financial Corporation's (the "Corporation“ or “Fulton”) financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward-looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, including future credit losses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Management’s "2025 Operating Guidance" contained herein is compri sed of forward-looking statements. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, the statements are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024 and other current and periodic reports, which have been, or will be, filed with the Securities and Exchange Commission (the "SEC") and are, or will be, available in the Investor Relations section of the Corporation’s website (www.fultonbank.com) and on the SEC’s website (www.sec.gov). The Corporation uses certain financial measures in this presentation that have been derived by methods other than generally accepted accounting principles ("GAAP"). These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. 2

3 Fourth Quarter 2024 Financial Highlights (1) Non-GAAP financial measures. Please refer to the calculation and management’s reason for using this measure on the slide titled “Non -GAAP Reconciliation” at the end of this presentation. • Operating Net Income Available to Common Shareholders of $0.48 per Diluted Share • Continued improvements in Efficiency and Operating Expense levels • Solid operating profitability metrics • Increases to PPNR and PPNR / Average Assets • Continued progress on key strategic initiatives 4Q24 3Q24 4Q24 3Q24 Net Income Available to Common Shareholders ($ in millions) $66.1 $60.6 $88.9 $91.3 Return on Average Assets (annualized) 0.85% 0.79% 1.14% 1.17% Return on Average Tangible Common Equity (annualized; non-GAAP) -- -- 14.83% 15.65% Efficiency Ratio (non-GAAP) -- -- 58.4% 59.6% Operating Expenditures / Average Assets (annualized) 2.68% 2.82% 2.36% 2.45% Diluted Earnings Per Share $0.36 $0.33 $0.48 $0.50 Pre-Provision Net Revenue ("PPNR") ($ in millions; non-GAAP) -- -- $131.2 $128.3 PPNR / Average Assets (annualized; non-GAAP) -- -- 1.63% 1.61% GAAP Reported Operating (1)

4 Deepening Our Commitment to Purpose, Vision, & Strategic Execution Simplicity in the operating model - Realign value propositions and coverage models by customer size and complexity - Redesign end-to-end processes with single ownership to deliver superior customer experience - Simplify organizational structures Focus on Fulton’s core relationships - Invest in “relationship” products & specialties to capture full wallet share while reducing emphasis on non- relationship activities - Concentrate on higher-value markets with a “right to win” while streamlining the presence elsewhere - Identify cost efficiencies in operational activities that do not drive customer experience Productivity across the Bank - Unlock time and training for sales excellence vs. service on front line, customer facing roles - Enhance digital experiences aligned with the strategy, including consumer digital transactions - Deliver operational excellence in the back-office, with enhanced speed and efficiency

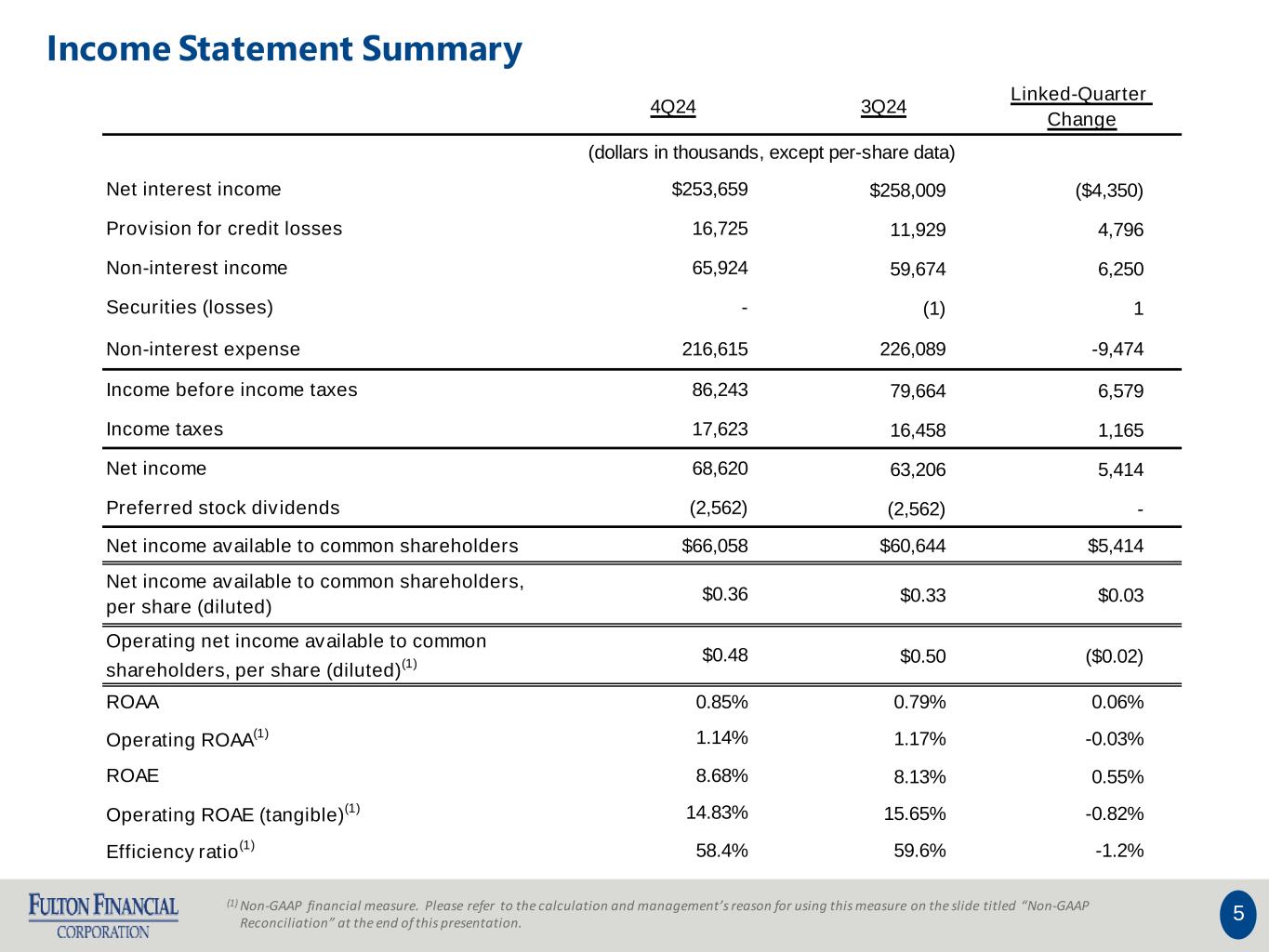

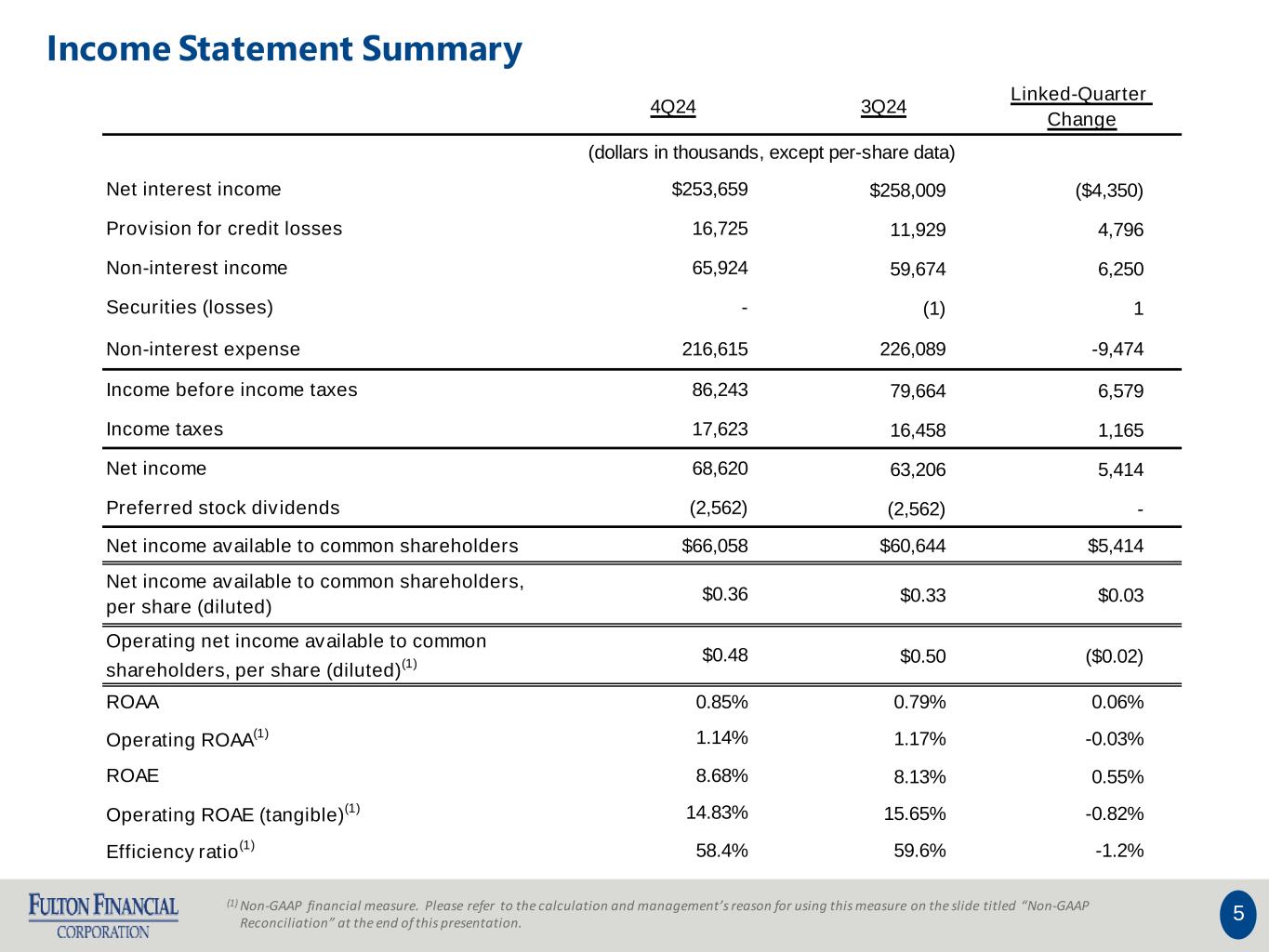

(1) Non-GAAP financial measure. Please refer to the calculation and management’s reason for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 5 Income Statement Summary 4Q24 3Q24 Linked-Quarter Change Net interest income $253,659 $258,009 ($4,350) Provision for credit losses 16,725 11,929 4,796 Non-interest income 65,924 59,674 6,250 Securities (losses) - (1) 1 Non-interest expense 216,615 226,089 -9,474 Income before income taxes 86,243 79,664 6,579 Income taxes 17,623 16,458 1,165 Net income 68,620 63,206 5,414 Preferred stock dividends (2,562) (2,562) - Net income available to common shareholders $66,058 $60,644 $5,414 Net income available to common shareholders, per share (diluted) $0.36 $0.33 $0.03 Operating net income available to common shareholders, per share (diluted)(1) $0.48 $0.50 ($0.02) ROAA 0.85% 0.79% 0.06% Operating ROAA(1) 1.14% 1.17% -0.03% ROAE 8.68% 8.13% 0.55% Operating ROAE (tangible)(1) 14.83% 15.65% -0.82% Efficiency ratio(1) 58.4% 59.6% -1.2% (dollars in thousands, except per-share data)

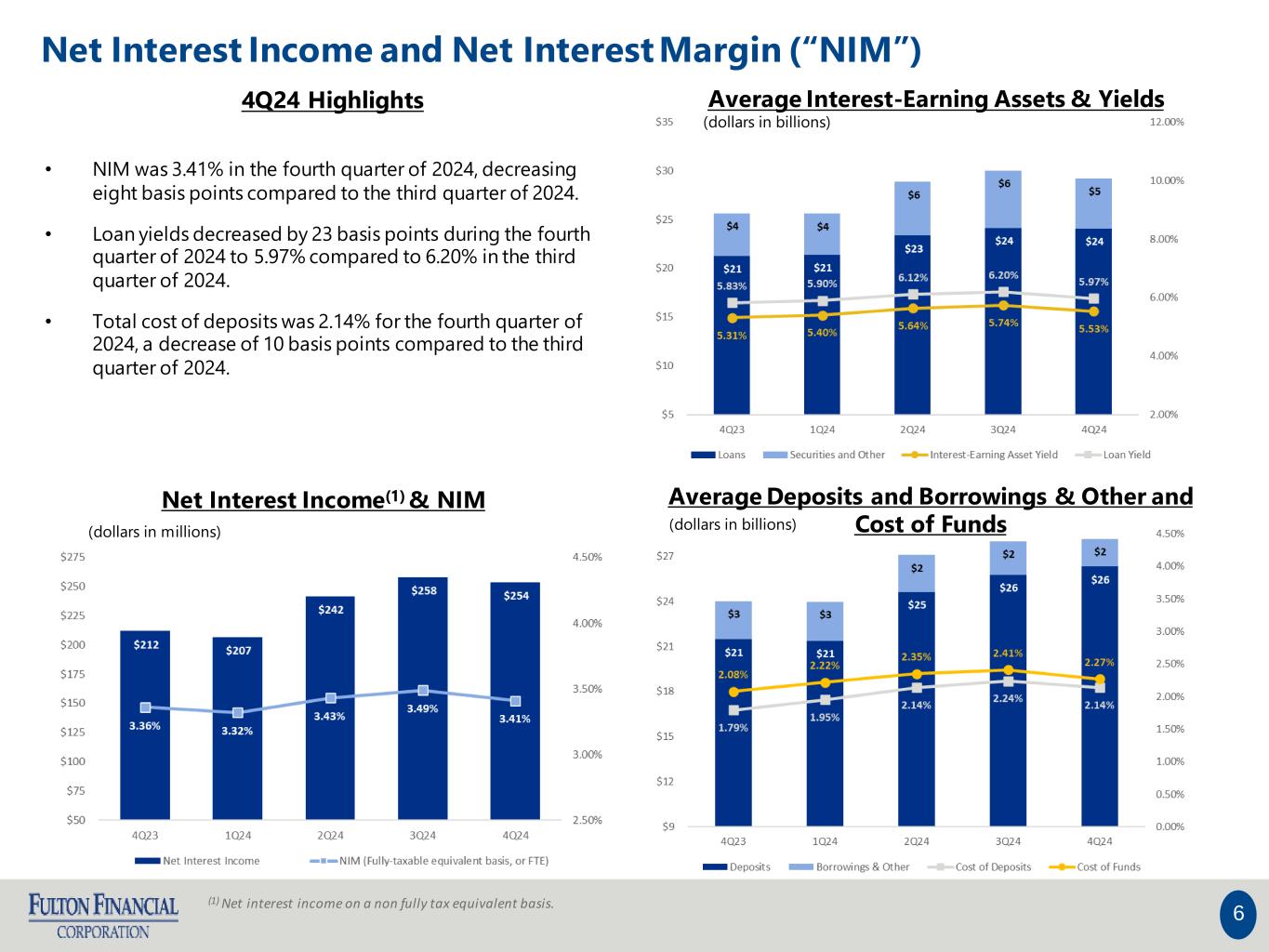

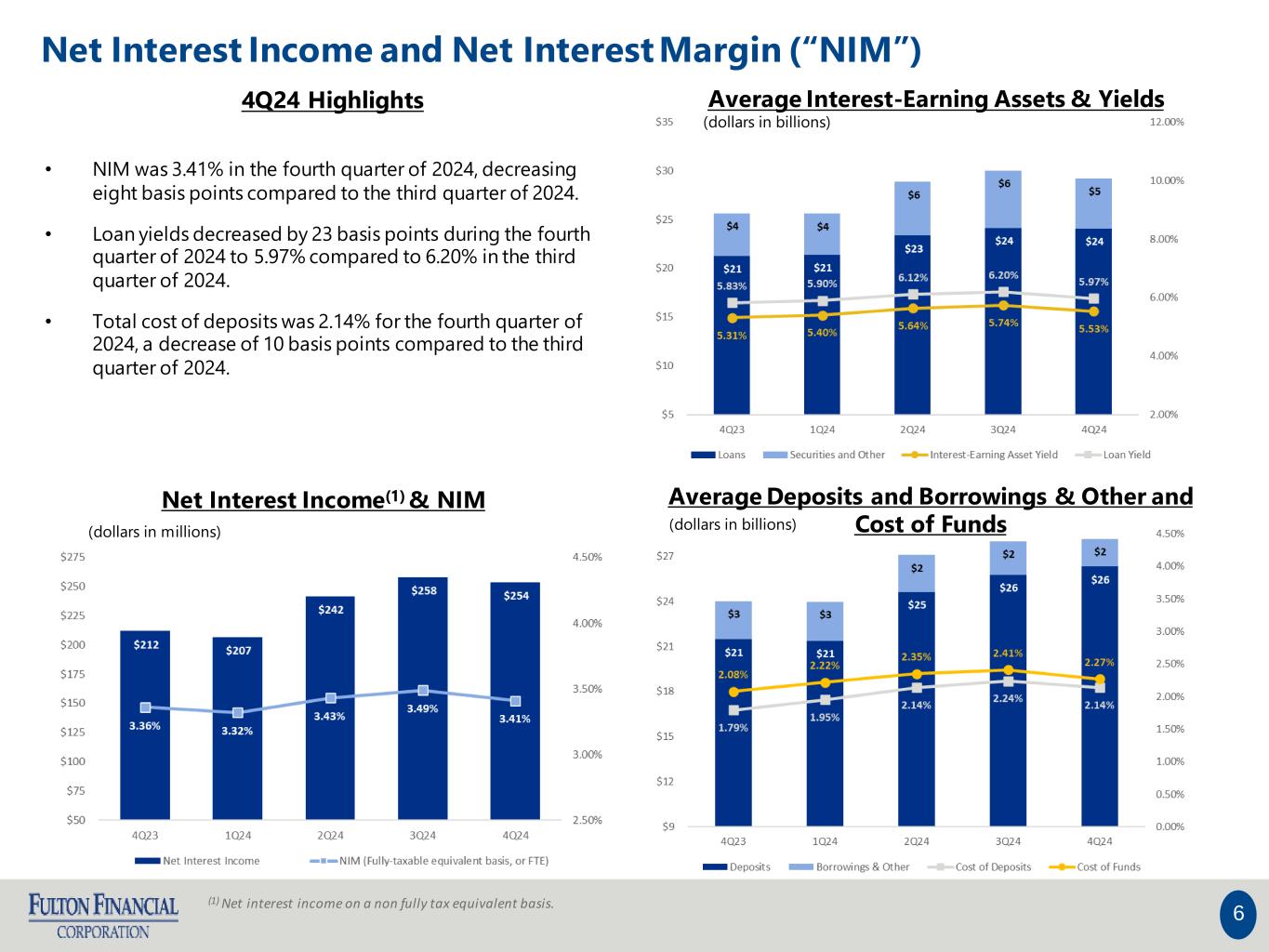

• NIM was 3.41% in the fourth quarter of 2024, decreasing eight basis points compared to the third quarter of 2024. • Loan yields decreased by 23 basis points during the fourth quarter of 2024 to 5.97% compared to 6.20% in the third quarter of 2024. • Total cost of deposits was 2.14% for the fourth quarter of 2024, a decrease of 10 basis points compared to the third quarter of 2024. 6 Net Interest Income and Net Interest Margin (“NIM”) 4Q24 Highlights Net Interest Income(1) & NIM Average Deposits and Borrowings & Other and Cost of Funds Average Interest-Earning Assets & Yields (dollars in millions) (dollars in billions) (dollars in billions) (1) Net interest income on a non fully tax equivalent basis.

7 Non-Interest Income Increases due to: • A $2.7 million adjustment to the gain on acquisition, net of tax, down from $7.7 million in the third quarter • Mortgage banking income due to wider gain on sale spreads and higher originations • Wealth management revenue modestly higher • Commercial banking activities remain stable Offset by: • Lower consumer banking revenues (dollars in thousands) 4Q24 Fulton Organic 4Q24 Republic Transaction 4Q24 Consolidated 3Q24 Fulton Organic 3Q24 Republic Transaction 3Q24 Consolidated Linked- Quarter Change Commercial Banking $21,666 $788 $22,454 $21,905 $384 $22,289 $165 Wealth Management 22,002 - 22,002 21,596 - 21,596 406 Consumer Banking 12,943 1,366 14,309 12,790 2,138 14,928 (619) Mortgage Banking 3,759 - 3,759 3,142 - 3,142 617 Gain On Acquisition, net of tax - (2,689) (2,689) - (7,706) (7,706) 5,017 Other 5,908 181 6,089 5,348 77 5,425 664 Non-interest income before investment securities gains (losses) 66,278 (354) 65,924 64,780 (5,106) 59,674 6,250 Investment securities gains (losses), net - - - (1) - (1) 1 Total Non-Interest Income $66,278 ($354) $65,924 $64,779 ($5,106) $59,673 $6,251

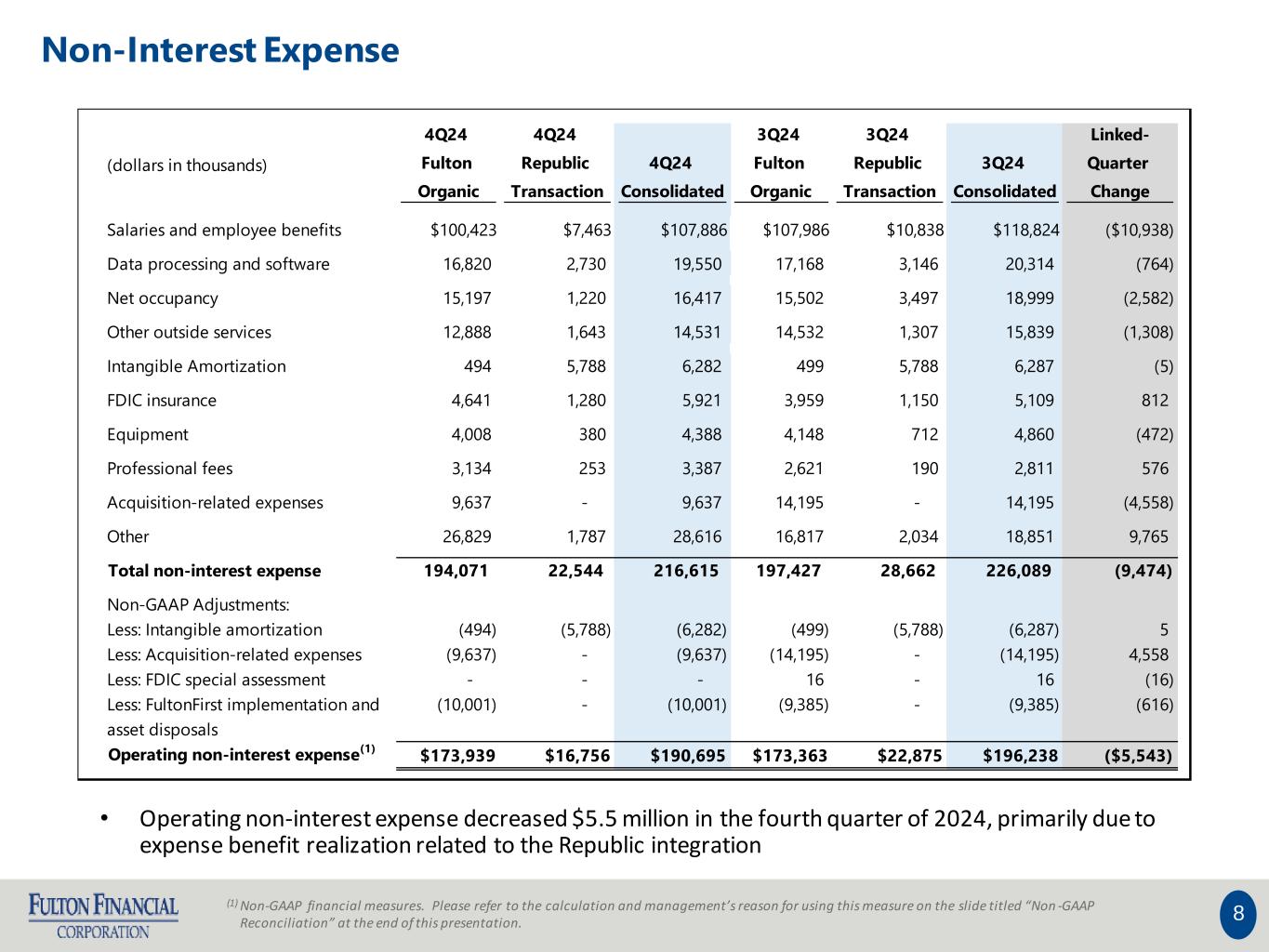

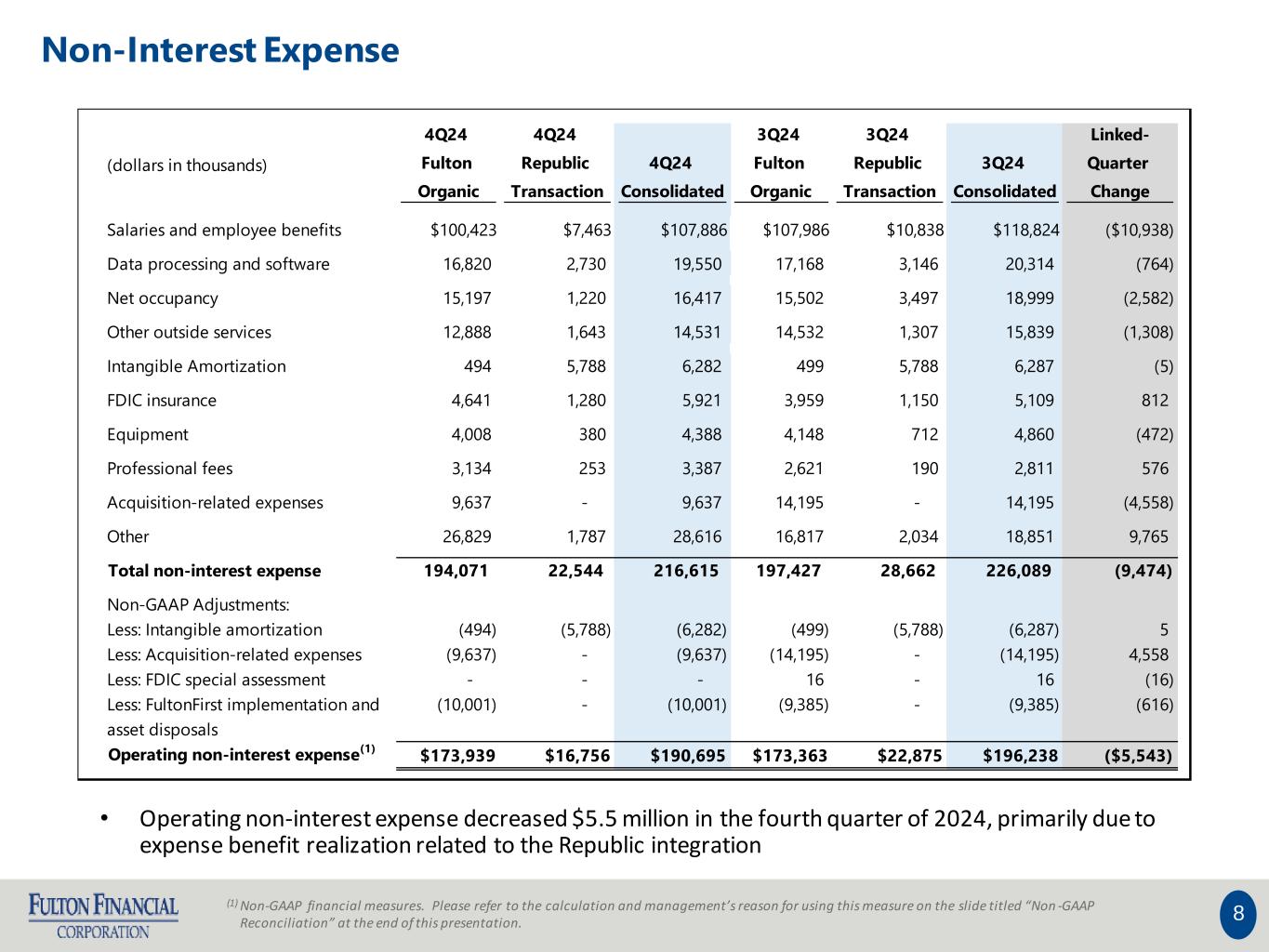

8 Non-Interest Expense • Operating non-interest expense decreased $5.5 million in the fourth quarter of 2024, primarily due to expense benefit realization related to the Republic integration (dollars in thousands) 4Q24 Fulton Organic 4Q24 Republic Transaction 4Q24 Consolidated 3Q24 Fulton Organic 3Q24 Republic Transaction 3Q24 Consolidated Linked- Quarter Change Salaries and employee benefits $100,423 $7,463 $107,886 $107,986 $10,838 $118,824 ($10,938) Data processing and software 16,820 2,730 19,550 17,168 3,146 20,314 (764) Net occupancy 15,197 1,220 16,417 15,502 3,497 18,999 (2,582) Other outside services 12,888 1,643 14,531 14,532 1,307 15,839 (1,308) Intangible Amortization 494 5,788 6,282 499 5,788 6,287 (5) FDIC insurance 4,641 1,280 5,921 3,959 1,150 5,109 812 Equipment 4,008 380 4,388 4,148 712 4,860 (472) Professional fees 3,134 253 3,387 2,621 190 2,811 576 Acquisition-related expenses 9,637 - 9,637 14,195 - 14,195 (4,558) Other 26,829 1,787 28,616 16,817 2,034 18,851 9,765 Total non-interest expense 194,071 22,544 216,615 197,427 28,662 226,089 (9,474) Non-GAAP Adjustments: Less: Intangible amortization (494) (5,788) (6,282) (499) (5,788) (6,287) 5 Less: Acquisition-related expenses (9,637) - (9,637) (14,195) - (14,195) 4,558 Less: FDIC special assessment - - - 16 - 16 (16) Less: FultonFirst implementation and asset disposals (10,001) - (10,001) (9,385) - (9,385) (616) Operating non-interest expense(1) $173,939 $16,756 $190,695 $173,363 $22,875 $196,238 ($5,543) (1) Non-GAAP financial measures. Please refer to the calculation and management’s reason for using this measure on the slide titled “Non -GAAP Reconciliation” at the end of this presentation.

FultonFirst + full-year Republic Bank cost saves should drive 2025 total operating expense efficiencies Success to Date Positions Fulton Well for 2025 & Beyond Positioning for GrowthEstimated FultonFirst Financial Benefits 9 •Anticipate ~45% in 1H25; balance in 2H25 2025 estimated cost saves of ~$25 million •Fully realized in 2026 Estimated annual full realized benefit of greater than $50 million •Based on full implementation run-rate Anticipated earn-back period of less than 12 months •Reorganizing commercial segments based on customer needs and expectations •Focus and dedicated leadership of our Business Banking segment •Market realignment for quicker decisioning Reinvestment towards revenue generating initiatives evident in 2026 and later Implementation costs associated with FultonFirst should abate through 2025: • Implementation-to-date costs of approximately $35 million (4Q23 – 4Q24) • 2025 anticipated related spend of ~$14 million Creating Efficiency & Operating Leverage

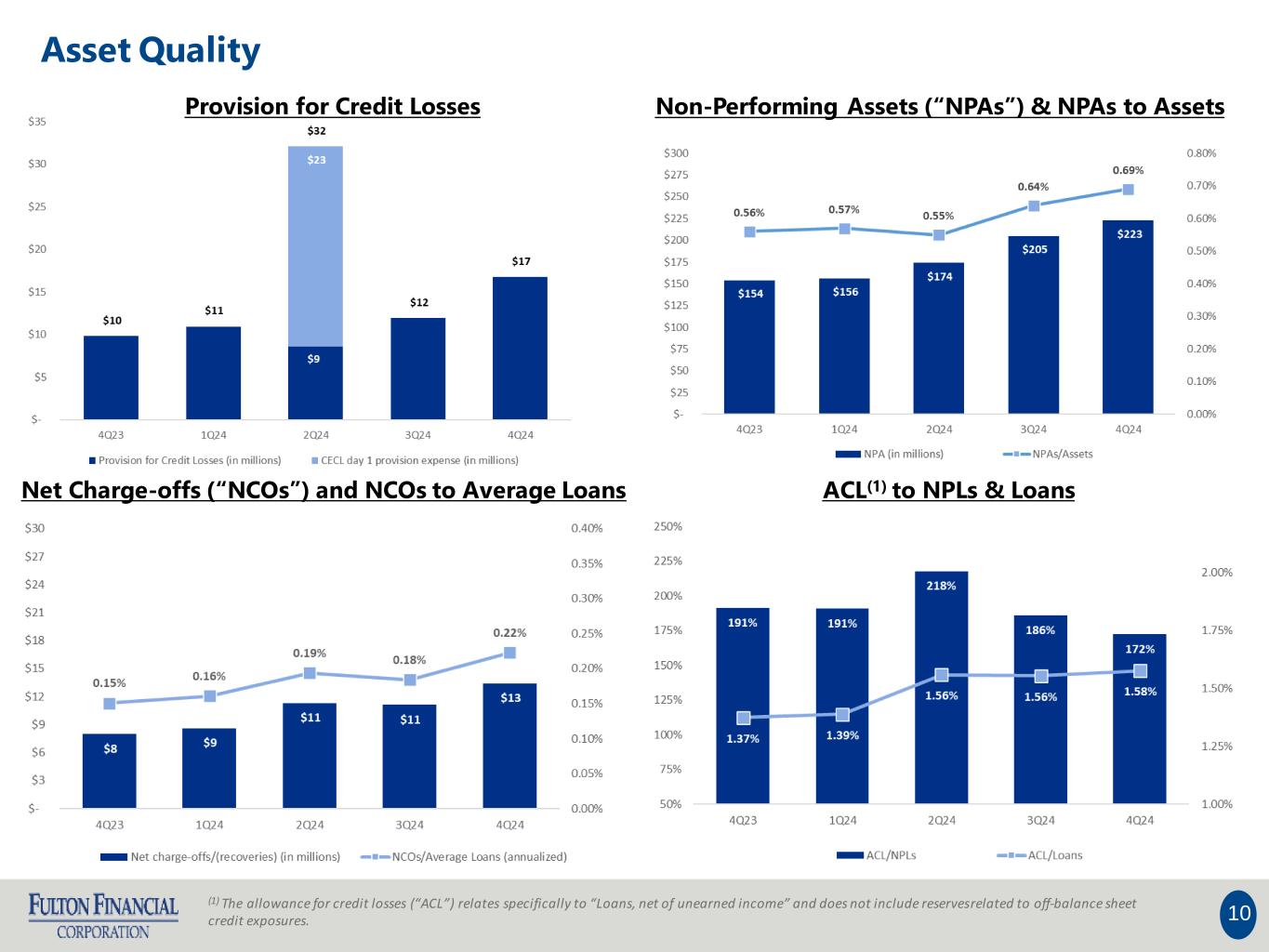

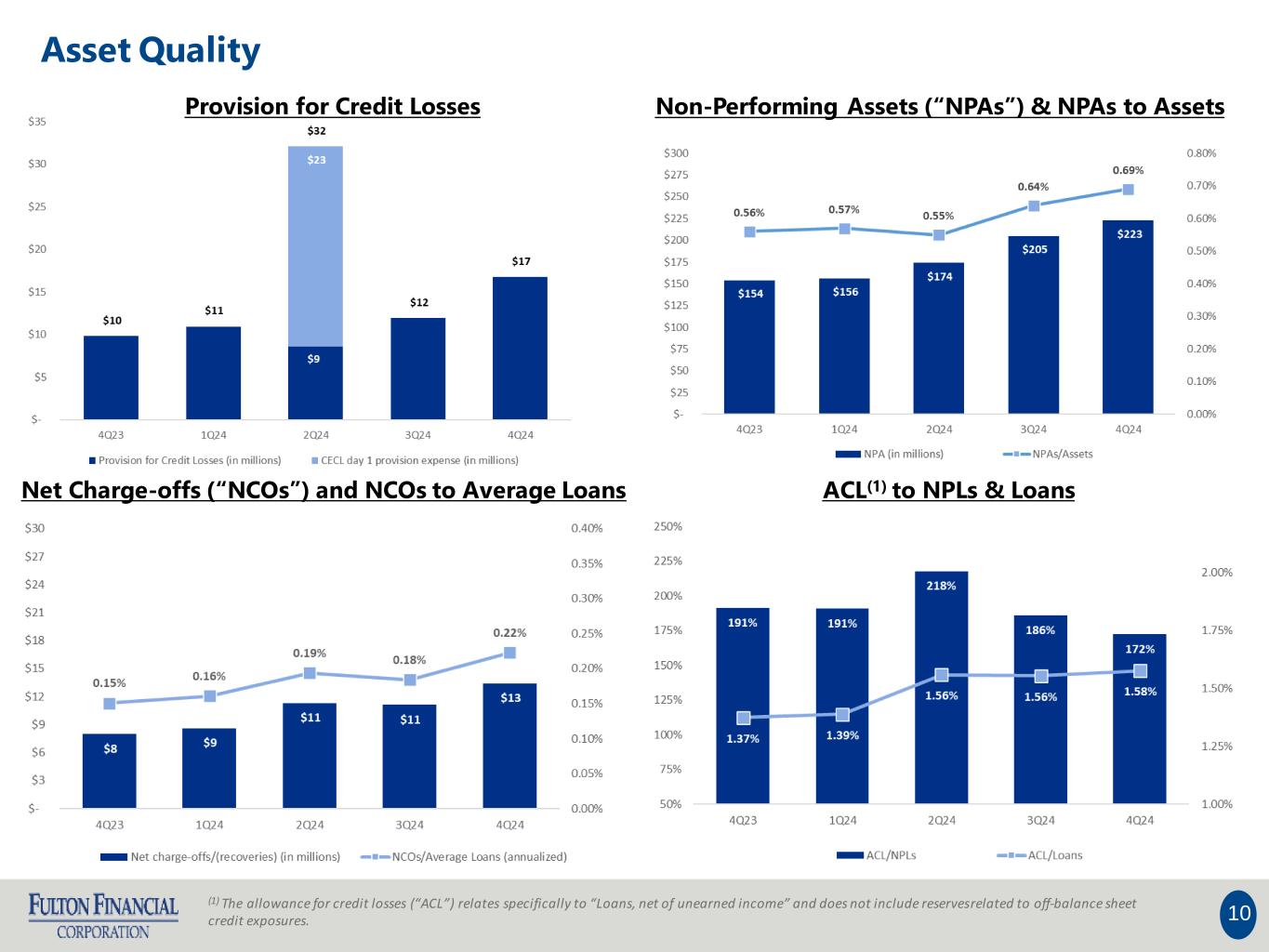

10 Asset Quality Provision for Credit Losses Non-Performing Assets (“NPAs”) & NPAs to Assets Net Charge-offs (“NCOs”) and NCOs to Average Loans ACL(1) to NPLs & Loans (1) The allowance for credit losses (“ACL”) relates specifically to “Loans, net of unearned income” and does not include reserves related to off-balance sheet credit exposures.

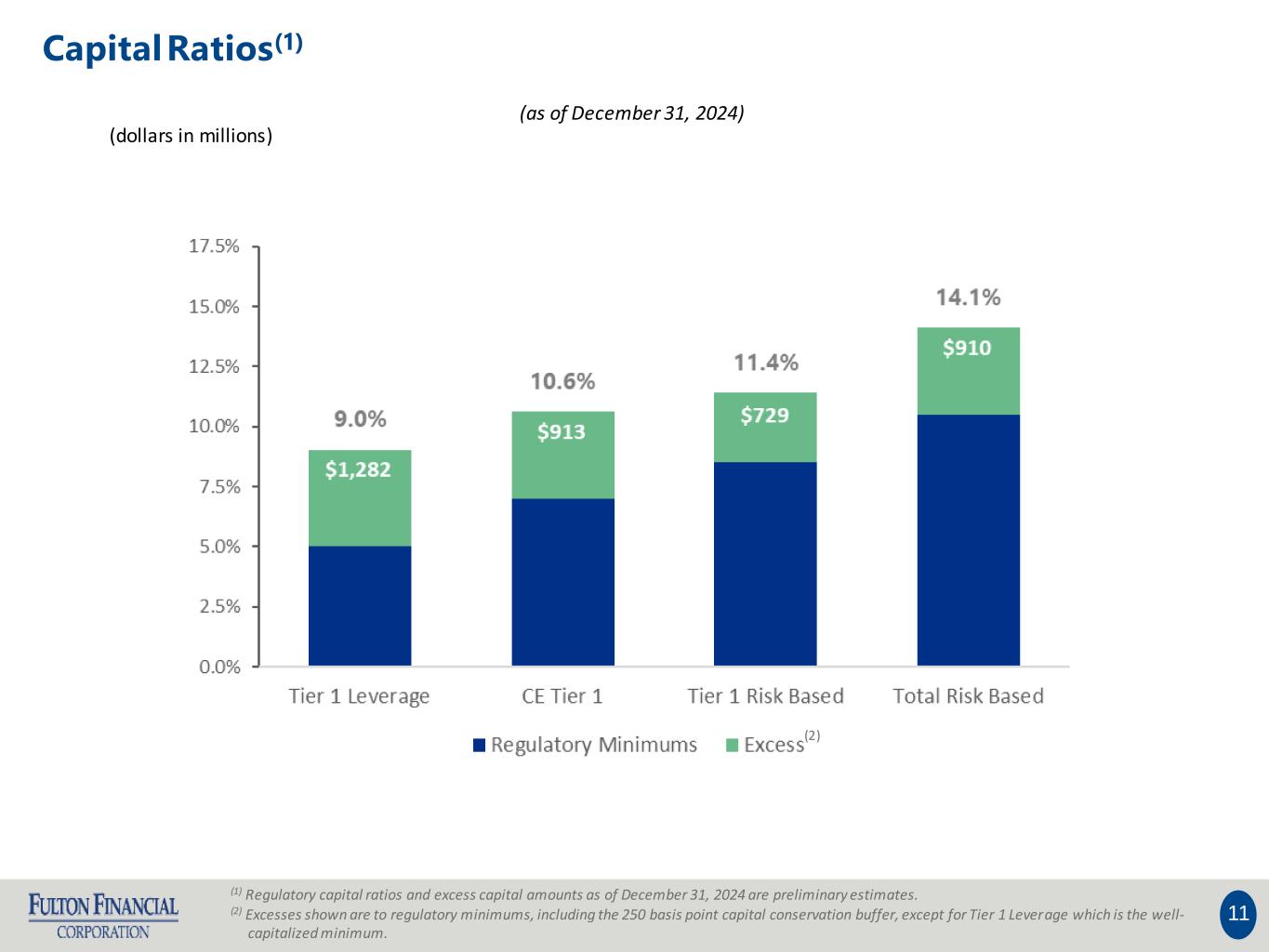

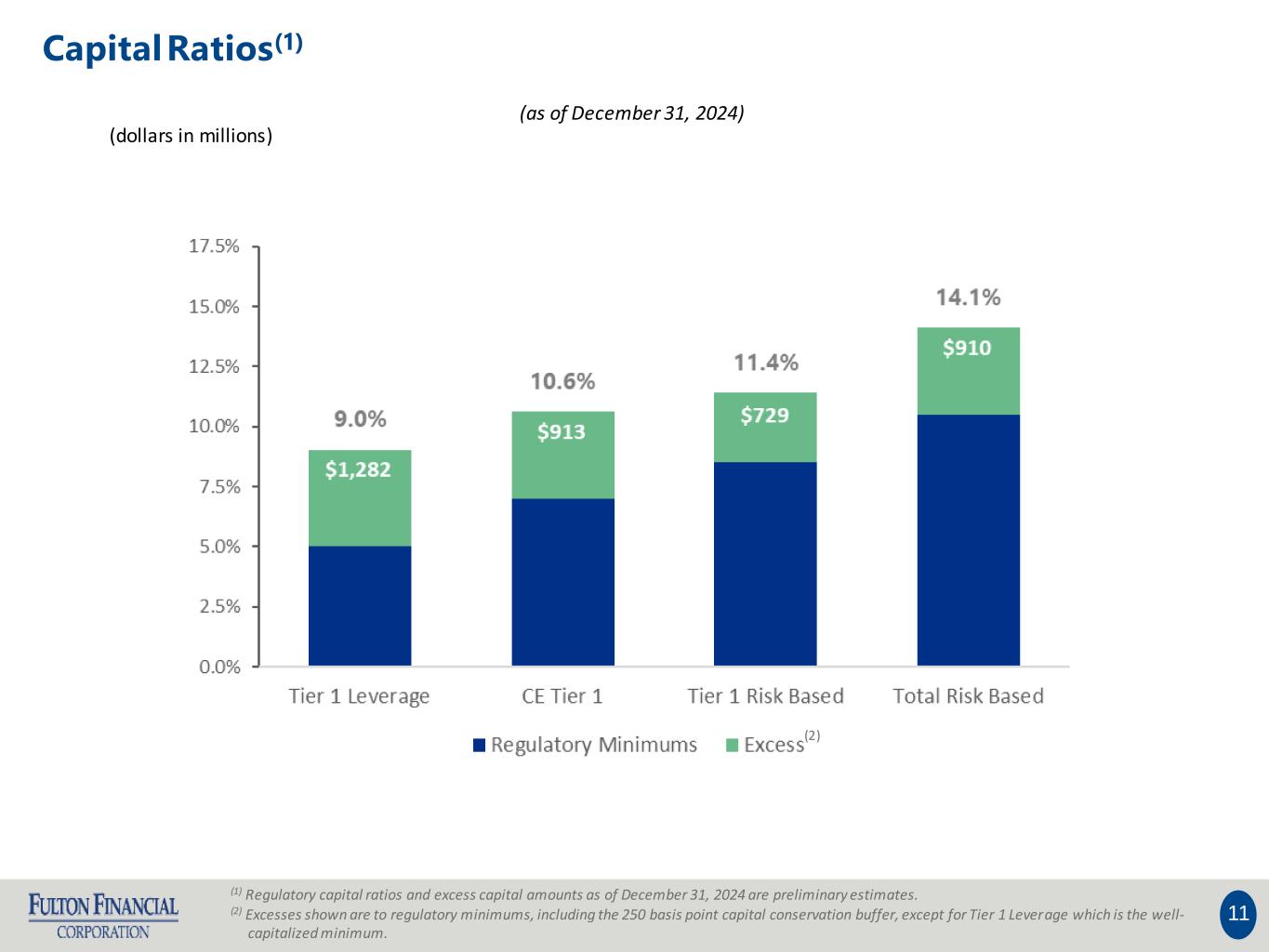

11 (1) Regulatory capital ratios and excess capital amounts as of December 31, 2024 are preliminary estimates. (2) Excesses shown are to regulatory minimums, including the 250 basis point capital conservation buffer, except for Tier 1 Leverage which is the well- capitalized minimum. (as of December 31, 2024) (dollars in millions) (2) Capital Ratios(1)

Income Statement Line Item Expected Range Outlook and Highlights Non-FTE Net Interest Income ("NII") (1) $995 million - $1.020 billion Low to mid single digit interest earning asset growth [ FTE Adjustment for NIM calculation ] [ ~$17 million annualized ] Provision for Credit Losses $60 - $80 million Low to mid single digit loan growth and continued credit trends Non-Interest Income $265 - $280 million Steady customer activity offset by the impact of higher rates on transactional businesses Non-Interest Expense (Operating) (2) $755 - $775 million Relatively flat to 2024 due to full impact of Republic and phasing in of FultonFirst initiatives Non Operating Assumptions: [ 2025 CDI expense ] [ $22.5 million ] [2H '25 steps down to $5.2 mm / qtr from $6.1 mm / qtr. ] [ Non-Operating Expenses ] [ $14 million ] [ Estimated 2025 FultonFirst implementation expenses ] Effective Tax Rate: 18.0% +/- 2025 Operating Guidance 12 (1)NII is on a Non-fully taxable-equivalent (“FTE”) basis; Incorporates Fed Funds Rate decreases of 25 basis points in March and 25 basis points in June of 2025. (2) Excludes non-operating expenses and Core Deposit Intangible (“CDI”) Amortization.

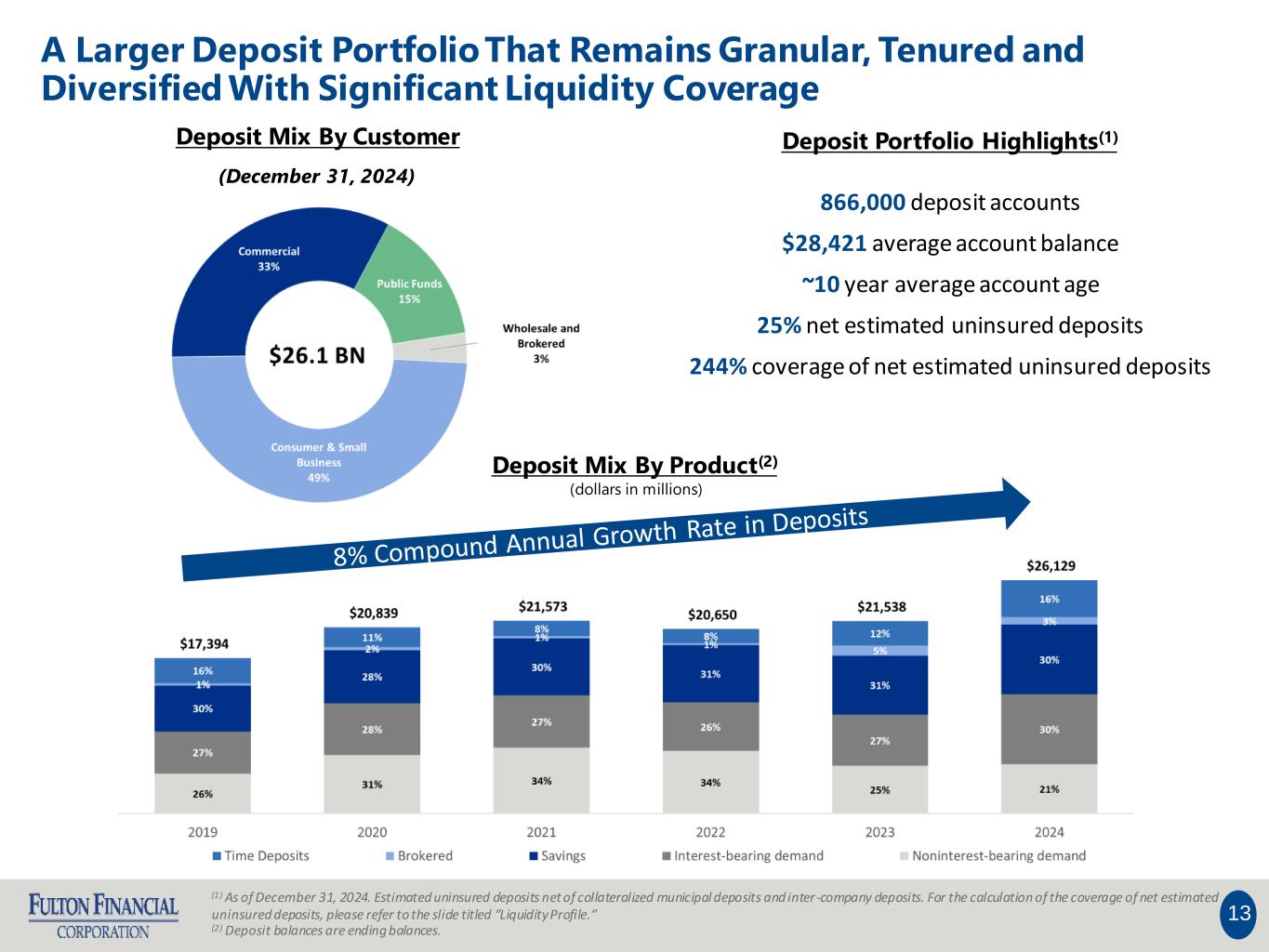

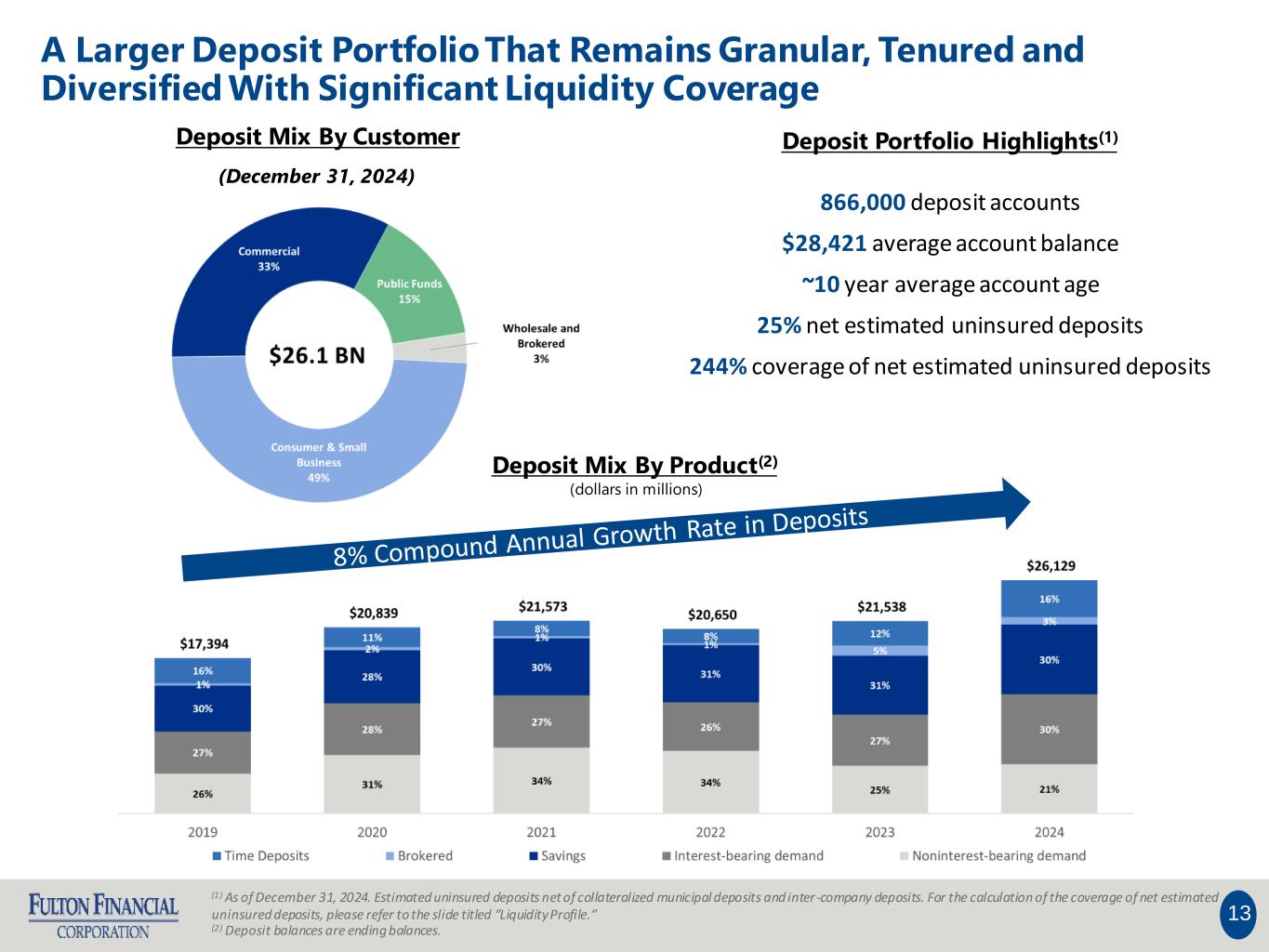

13 A Larger Deposit Portfolio That Remains Granular, Tenured and Diversified With Significant Liquidity Coverage Deposit Mix By Customer (December 31, 2024) Deposit Portfolio Highlights(1) 866,000 deposit accounts $28,421 average account balance ~10 year average account age 25% net estimated uninsured deposits 244% coverage of net estimated uninsured deposits Deposit Mix By Product(2) (1) As of December 31, 2024. Estimated uninsured deposits net of collateralized municipal deposits and inter-company deposits. For the calculation of the coverage of net estimated uninsured deposits, please refer to the slide titled “Liquidity Profile.” (2) Deposit balances are ending balances. (dollars in millions)

14 Balance Sheet Maintains Flexibility (1) Time deposits include brokered CDs. Time deposits provide gradual tailwind in current environment Deposit Mix by Product Type(1) (December 31, 2024) Loan Mix by Rate Type (December 31, 2024) CD Maturities (next twelve months) Balance ($ in millions) Average Cost (%) 1st Quarter 2025 $1,472 4.57% 2nd Quarter 2025 1,234 4.47% 3rd Quarter 2025 991 4.20% 4th Quarter 2025 778 4.02% Total $4,475 4.36% The majority of adjustable-rate loans reprice beyond two years Loan Repricing Schedule Balance ($ in millions) Weighted Average Contractual Repricing Date (years) Variable $9,781 0.06 Fixed 8,540 - - Adjustable 5,724 4.48

The Loan Portfolio Remains Diversified and Granular With Low Office Concentration at 3% of Total Loans 15 (1) LTV as of most recent appraisal. (2) Metropolitan Statistical Areas or “MSA” titled in short name for presentation purposes. Total Office Loan Commitments: $864 million Total Office Loans Outstanding: $814 million Average Loan Size: $2.3 million Weighted Average loan-to-value(1) ("LTV"): 61% Weighted Average Debt Service Coverage Ratio ("DSCR"): 1.32x Class A: 30% Class B: 23% Class C: 12% Not Classified: 35% Geographically Diverse by MSA(2)Maturing Over Time Total Loan Portfolio (December 31, 2024) Office Only Profile

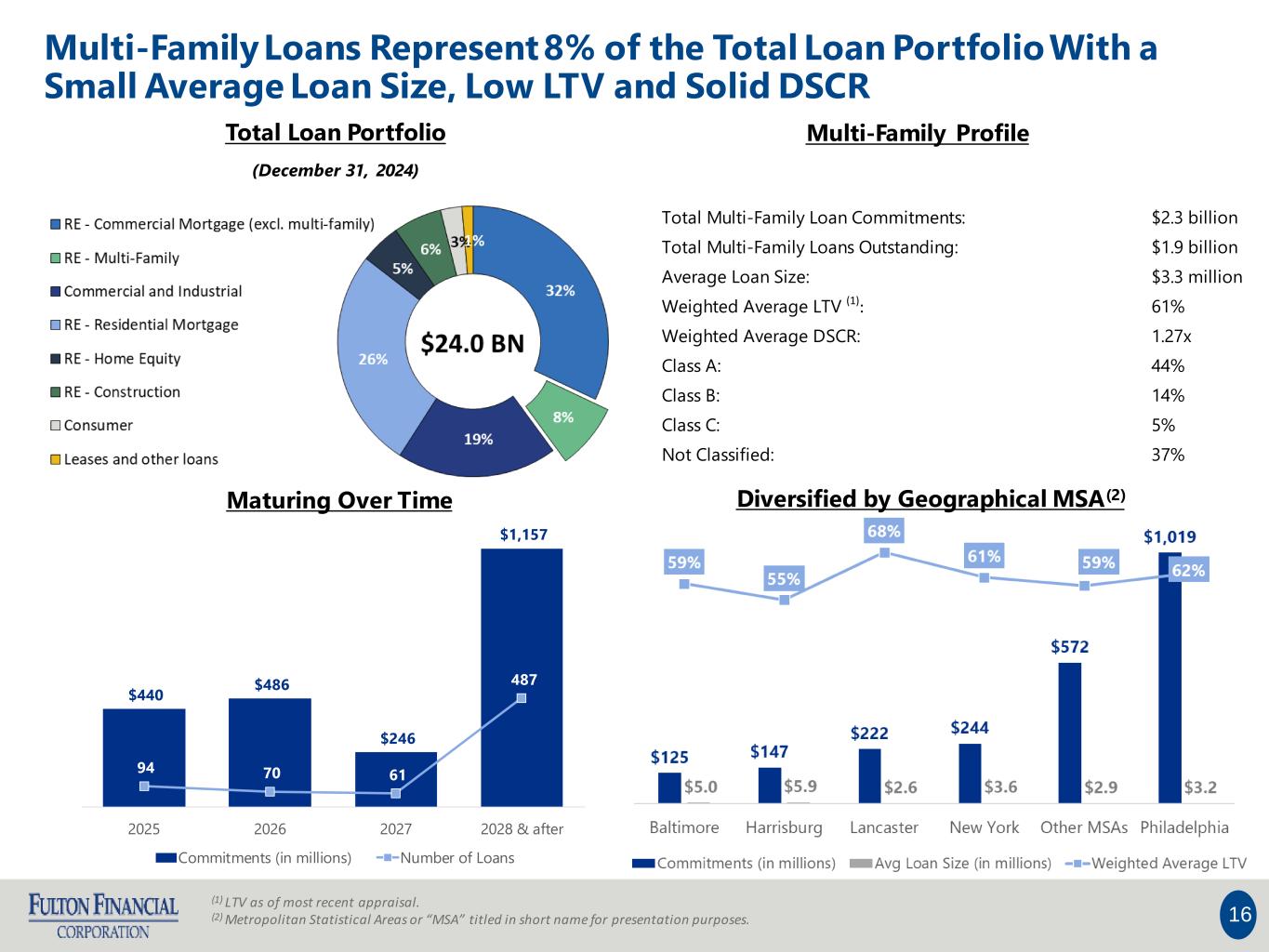

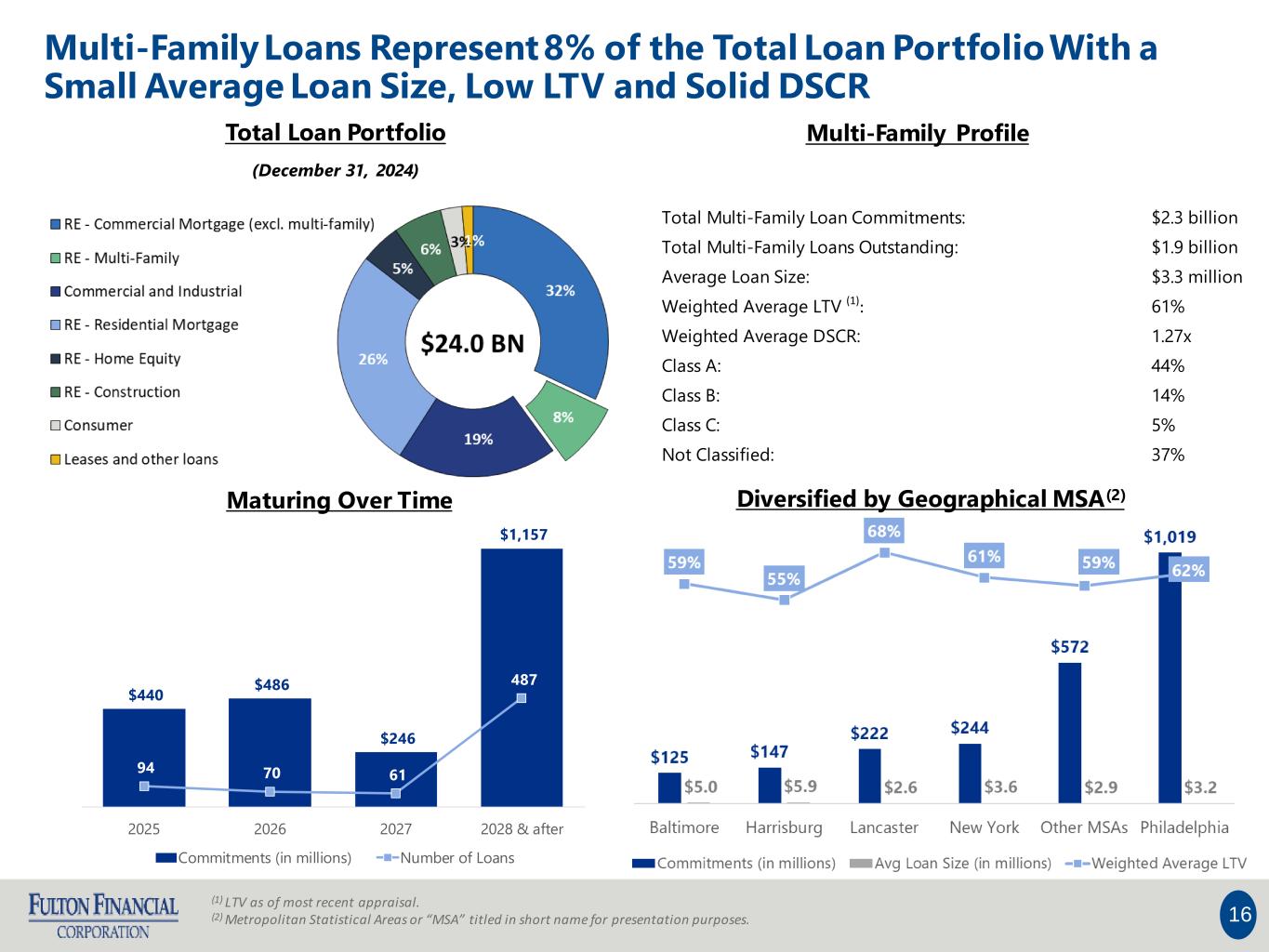

Multi-Family Loans Represent 8% of the Total Loan Portfolio With a Small Average Loan Size, Low LTV and Solid DSCR 16 Total Multi-Family Loan Commitments: $2.3 billion Total Multi-Family Loans Outstanding: $1.9 billion Average Loan Size: $3.3 million Weighted Average LTV (1): 61% Weighted Average DSCR: 1.27x Class A: 44% Class B: 14% Class C: 5% Not Classified: 37% $440 $486 $246 $1,157 94 70 61 487 2025 2026 2027 2028 & after Commitments (in millions) Number of Loans Diversified by Geographical MSA(2) Total Loan Portfolio (December 31, 2024) Multi-Family Profile Maturing Over Time (1) LTV as of most recent appraisal. (2) Metropolitan Statistical Areas or “MSA” titled in short name for presentation purposes.

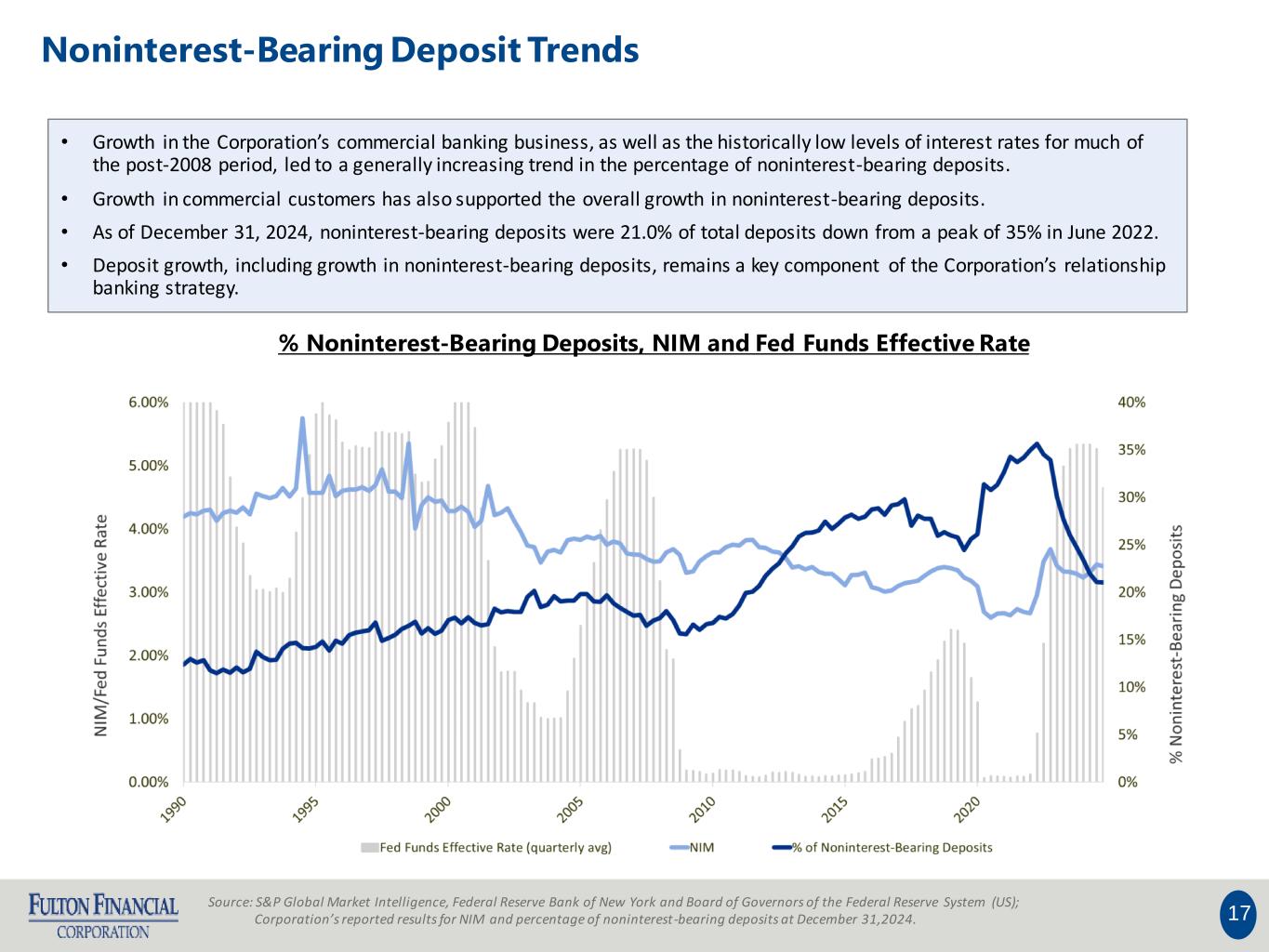

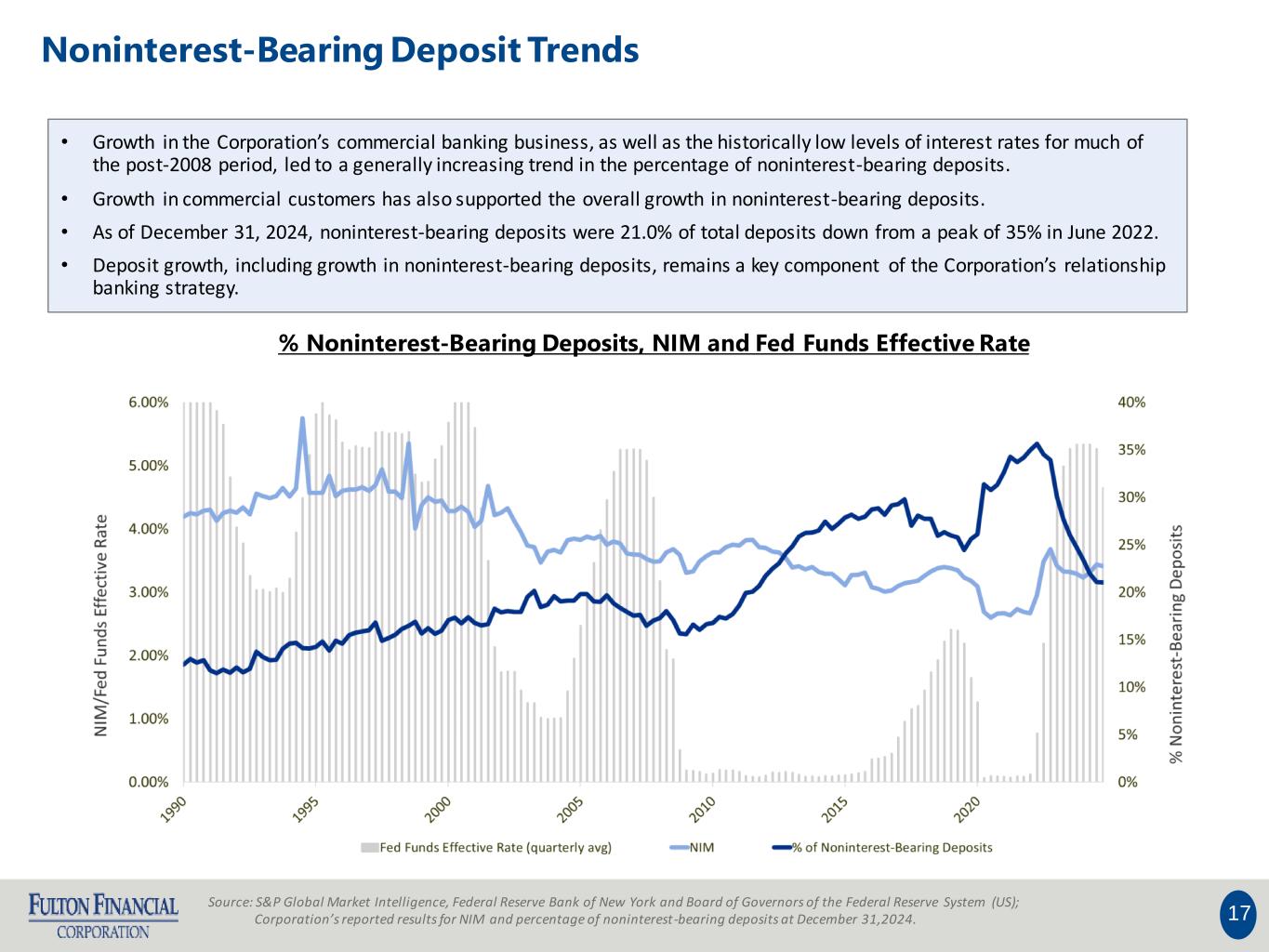

17 Noninterest-Bearing Deposit Trends • Growth in the Corporation’s commercial banking business, as well as the historically low levels of interest rates for much of the post-2008 period, led to a generally increasing trend in the percentage of noninterest-bearing deposits. • Growth in commercial customers has also supported the overall growth in noninterest-bearing deposits. • As of December 31, 2024, noninterest-bearing deposits were 21.0% of total deposits down from a peak of 35% in June 2022. • Deposit growth, including growth in noninterest-bearing deposits, remains a key component of the Corporation’s relationship banking strategy. Source: S&P Global Market Intelligence, Federal Reserve Bank of New York and Board of Governors of the Federal Reserve System (US); Corporation’s reported results for NIM and percentage of noninterest -bearing deposits at December 31,2024. % Noninterest-Bearing Deposits, NIM and Fed Funds Effective Rate

Estimated Uninsured Deposits December 31, 2024 Total Deposits $26,129 Estimated Uninsured Deposits $9,690 Estimated Uninsured Deposits to Total Deposits 37% Estimated Uninsured Deposits $9,690 Less: Collateralized Municipal Deposits (3,207) Net Estimated Uninsured Deposits (4) $6,483 Net Estimated Uninsured Deposits to Total Deposits 25% Committed Liquidity to Net Estimated Uninsured Deposits 141% Available Liquidity to Net Estimated Uninsured Deposits 244% Available Liquidity December 31, 2024 Cash On-Hand (1) 857$ Federal Reserve Capacity 3,146 Total Available @ Federal Reserve 3,146$ FHLB Borrowing Capacity 11,120 Advances(2) (869) Letters of Credit (4,259) Total Available @ FHLB 5,992$ Total Committed Liquidity 9,138$ Fed Funds Lines 2,556 Outstanding Net Fed Funds - Total Fed Funds Lines Available 2,556$ Brokered Deposit Capacity (3) 4,139 Brokered & Wholesale Deposits (844) Total Brokered Deposit Availability 3,295$ Total Uncommitted Available Liquidity 5,851$ Total Available Liquidity 15,846$ 18 Liquidity Profile (1) Includes cash at the FHLB and Federal Reserve and vault cash for liquidity purposes only. (2) Includes accrued interest, fees, and other adjustments. (3) Brokered deposit availability is based upon internal policy limit. (4) Net estimated uninsured deposits are net of collateralized municipal deposits and inter-company deposits. (dollars in thousands) (dollars in thousands) • Robust liquidity profile with additional capacity at the Federal Reserve, FHLB and other available funding sources • Total available liquidity significantly exceeds net estimated uninsured deposits • On balance sheet liquidity remains a focus

19 Note: The Corporation has presented the following non-GAAP financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidatedfinancial statements in their entirety. Non-GAAP Reconciliation Three months ended (dollars in thousands) Dec 31 Sep 30 2024 2024 Operating net income available to common shareholders Net income available to common shareholders $66,058 $60,644 Less: Other revenue (269) (677) Plus: Gain on acquisition, net of tax 2,689 7,706 Plus: Core deposit intangible amortization 6,155 6,155 Plus: Acquisition-related expense 9,637 14,195 Plus: FDIC special assessment - (16) Plus: FultonFirst implementation and asset disposals 10,001 9,385 Less: Tax impact of adjustments (5,360) (6,099) Operating net income available to common shareholders (numerator) $88,911 $91,293 Weighted average shares (diluted) (denominator) 183,867 183,609 Operating net income available to common shareholder, per share (diluted) $0.48 $0.50

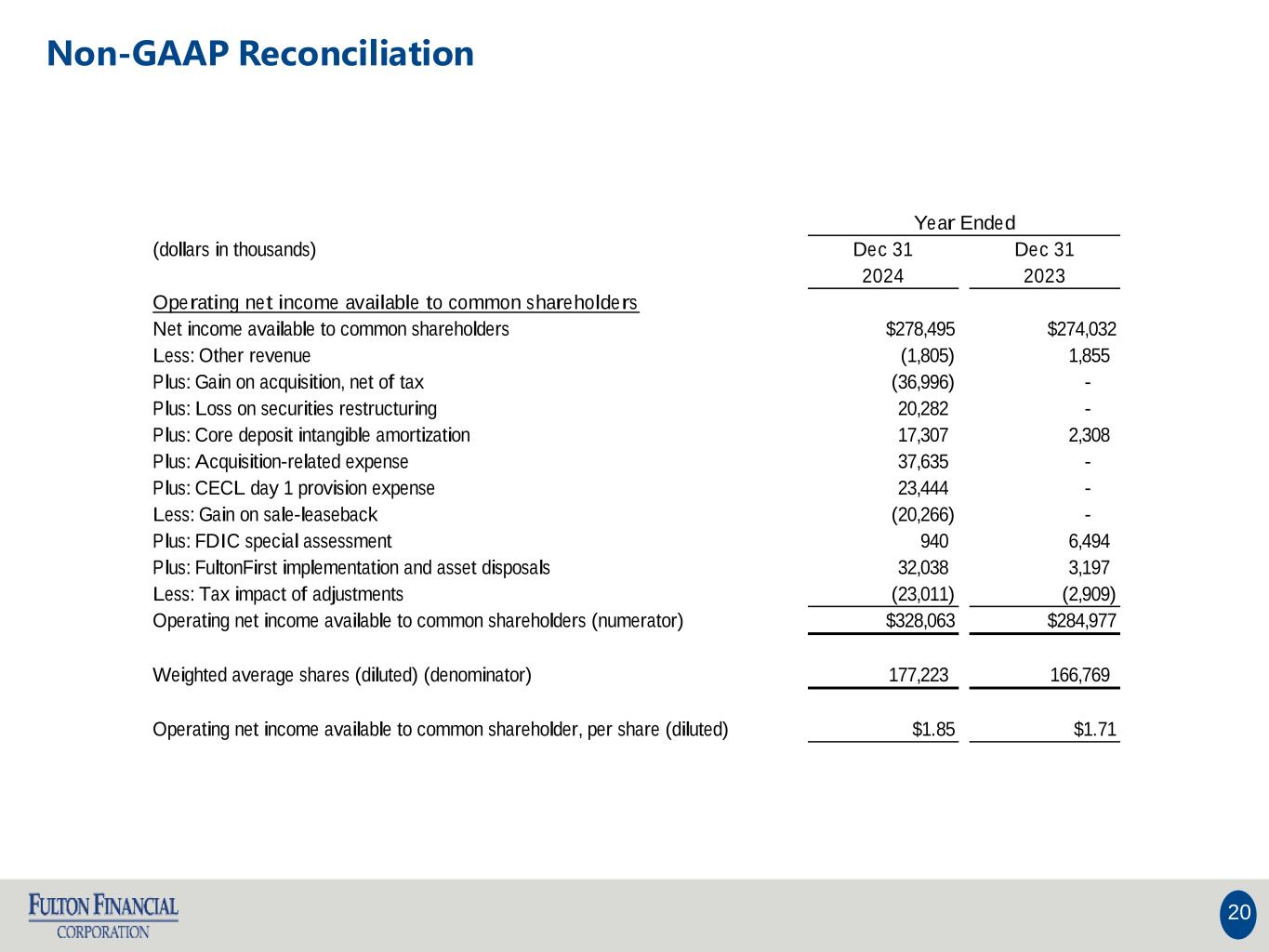

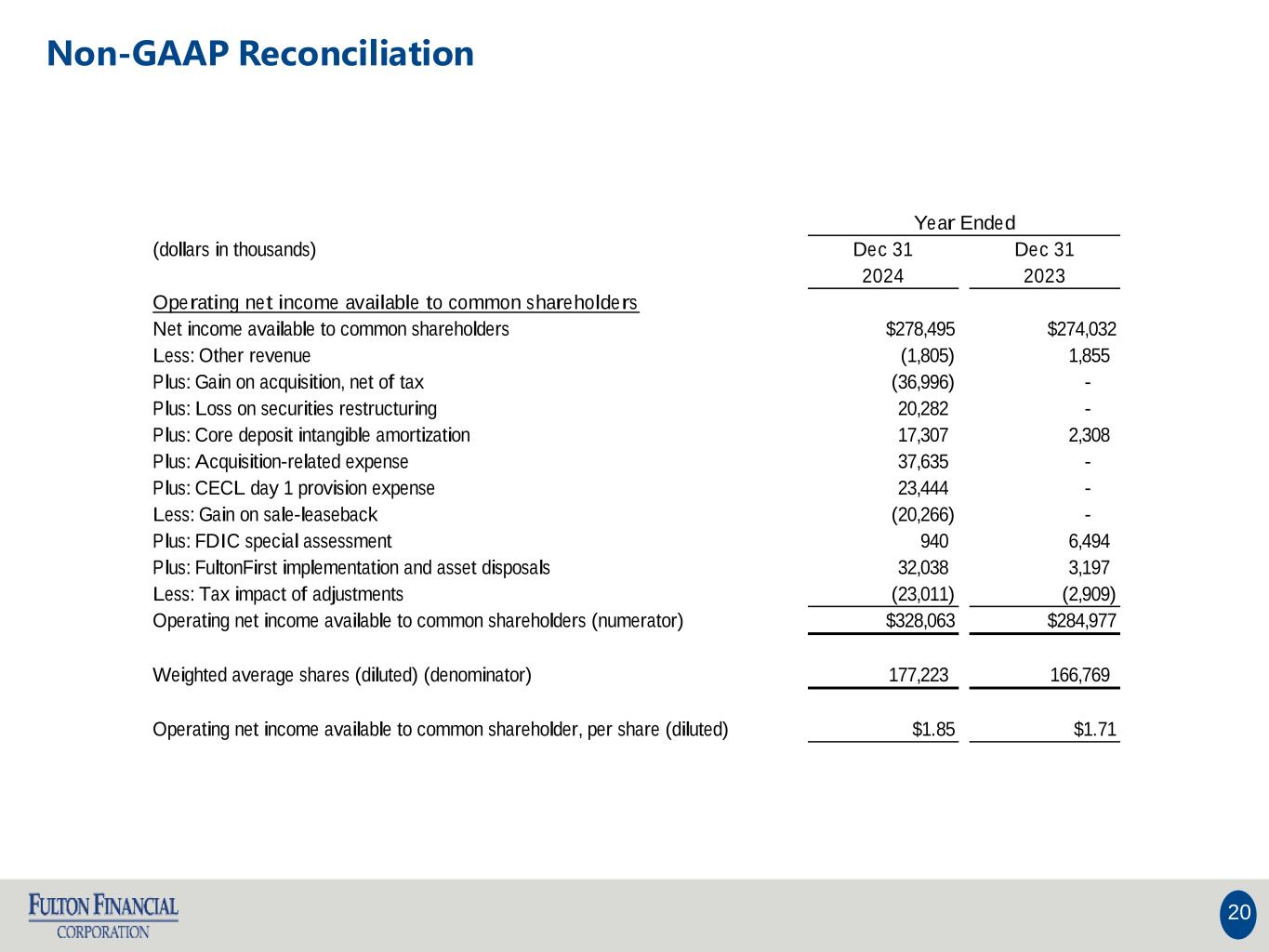

20 Non-GAAP Reconciliation Year Ended (dollars in thousands) Dec 31 Dec 31 2024 2023 Operating net income available to common shareholders Net income available to common shareholders $278,495 $274,032 Less: Other revenue (1,805) 1,855 Plus: Gain on acquisition, net of tax (36,996) - Plus: Loss on securities restructuring 20,282 - Plus: Core deposit intangible amortization 17,307 2,308 Plus: Acquisition-related expense 37,635 - Plus: CECL day 1 provision expense 23,444 - Less: Gain on sale-leaseback (20,266) - Plus: FDIC special assessment 940 6,494 Plus: FultonFirst implementation and asset disposals 32,038 3,197 Less: Tax impact of adjustments (23,011) (2,909) Operating net income available to common shareholders (numerator) $328,063 $284,977 Weighted average shares (diluted) (denominator) 177,223 166,769 Operating net income available to common shareholder, per share (diluted) $1.85 $1.71

21 Non-GAAP Reconciliation Three months ended (dollars in thousands) Dec 31 Sep 30 2024 2024 Operating return on average assets Net income $68,620 $63,206 Less: Other revenue (269) (677) Less: Gain on acquisition, net of tax 2,689 7,706 Plus: Core deposit intangible amortization 6,155 6,155 Plus: Acquisition-related expense 9,637 14,195 Plus: FDIC special assessment - (16) Plus: FultonFirst implementation and asset disposals 10,001 9,385 Less: Tax impact of adjustments (5,360) (6,099) Operating net income (numerator) $91,473 $93,855 Total average assets $32,098,852 $31,895,235 Less: Average net core deposit intangible (83,173) (89,350) Total Operating average assets (denominator) $32,015,679 $31,805,885 Operating return on average assets 1.14% 1.17%

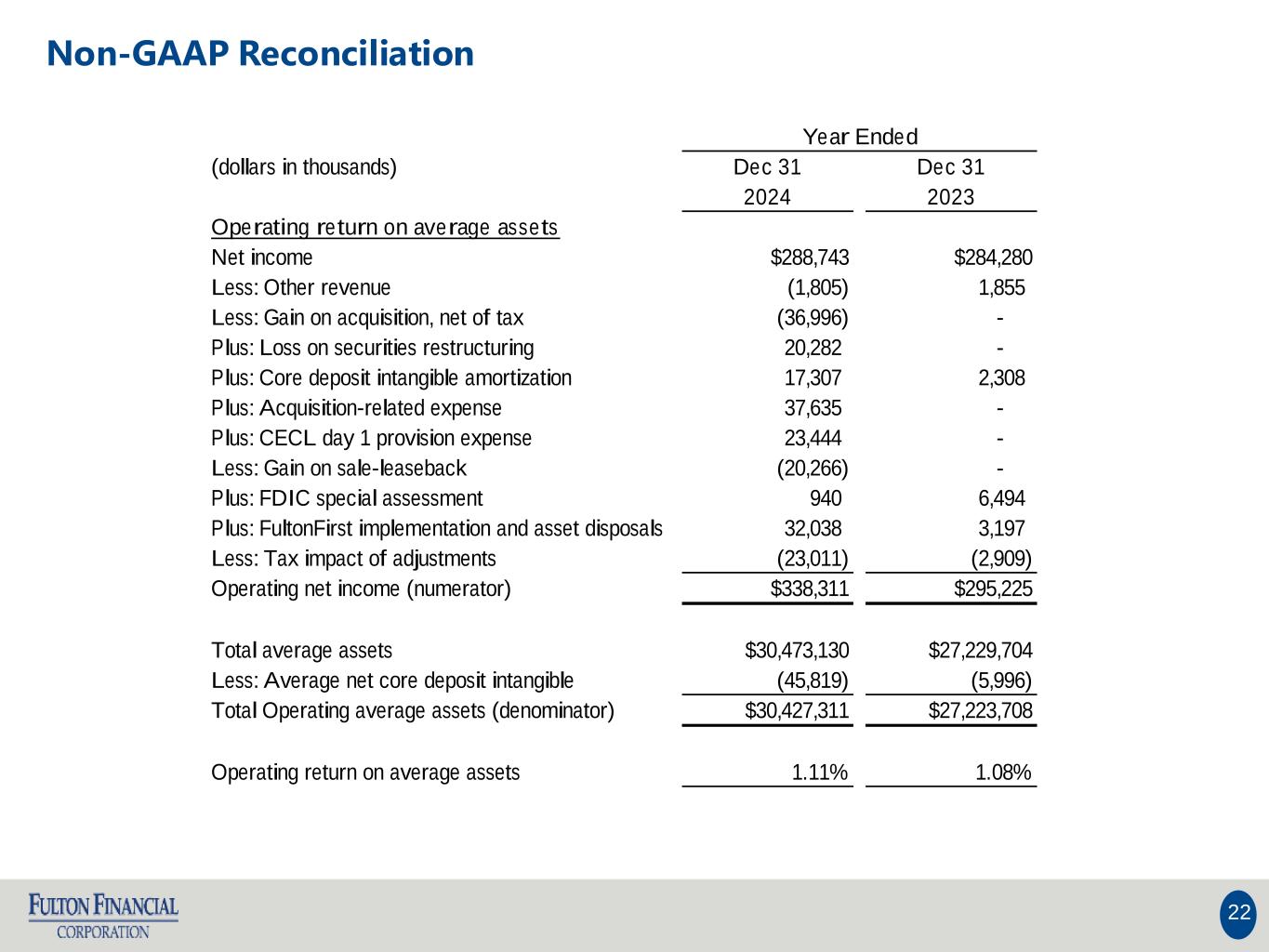

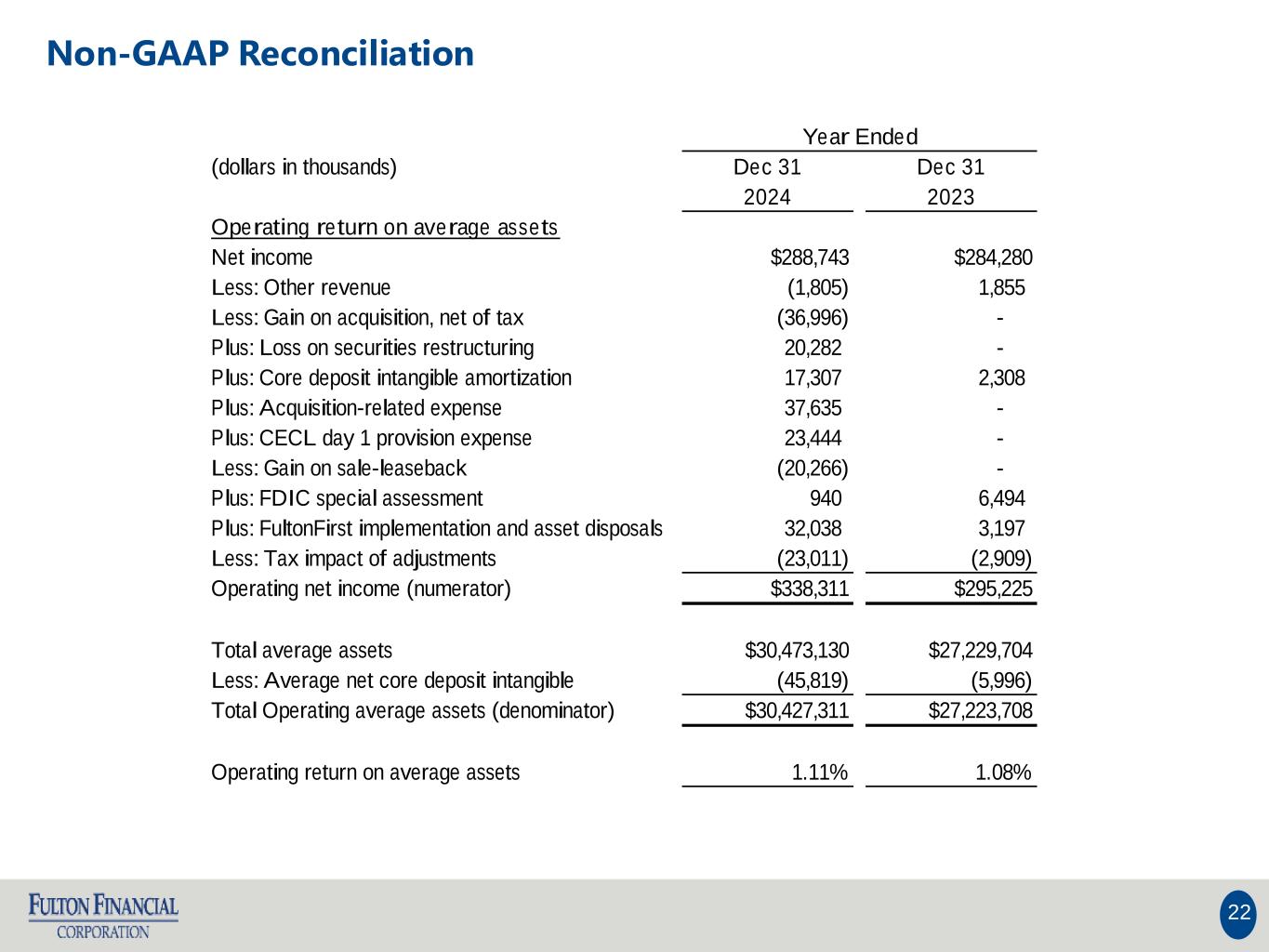

22 Non-GAAP Reconciliation Year Ended (dollars in thousands) Dec 31 Dec 31 2024 2023 Operating return on average assets Net income $288,743 $284,280 Less: Other revenue (1,805) 1,855 Less: Gain on acquisition, net of tax (36,996) - Plus: Loss on securities restructuring 20,282 - Plus: Core deposit intangible amortization 17,307 2,308 Plus: Acquisition-related expense 37,635 - Plus: CECL day 1 provision expense 23,444 - Less: Gain on sale-leaseback (20,266) - Plus: FDIC special assessment 940 6,494 Plus: FultonFirst implementation and asset disposals 32,038 3,197 Less: Tax impact of adjustments (23,011) (2,909) Operating net income (numerator) $338,311 $295,225 Total average assets $30,473,130 $27,229,704 Less: Average net core deposit intangible (45,819) (5,996) Total Operating average assets (denominator) $30,427,311 $27,223,708 Operating return on average assets 1.11% 1.08%

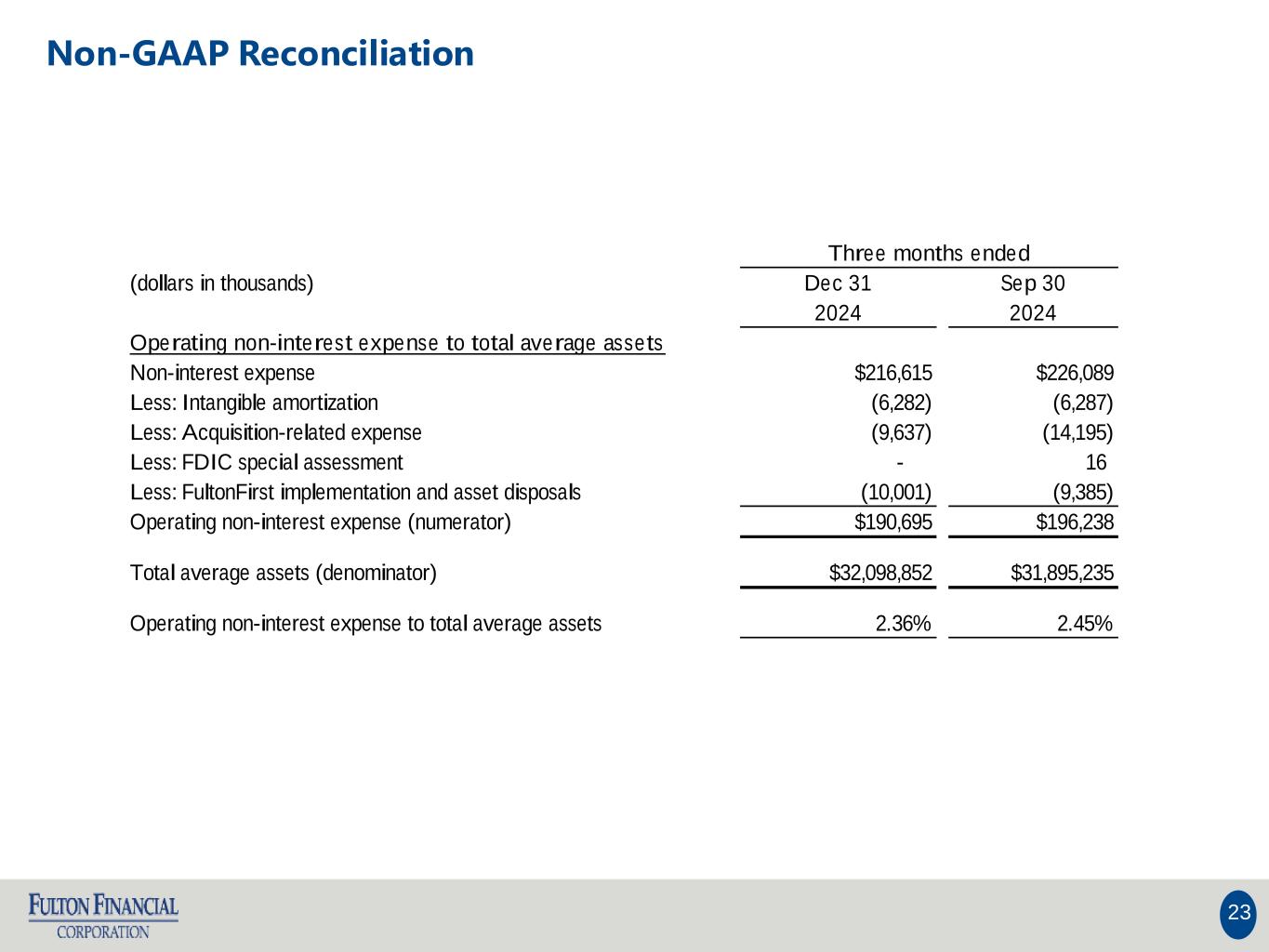

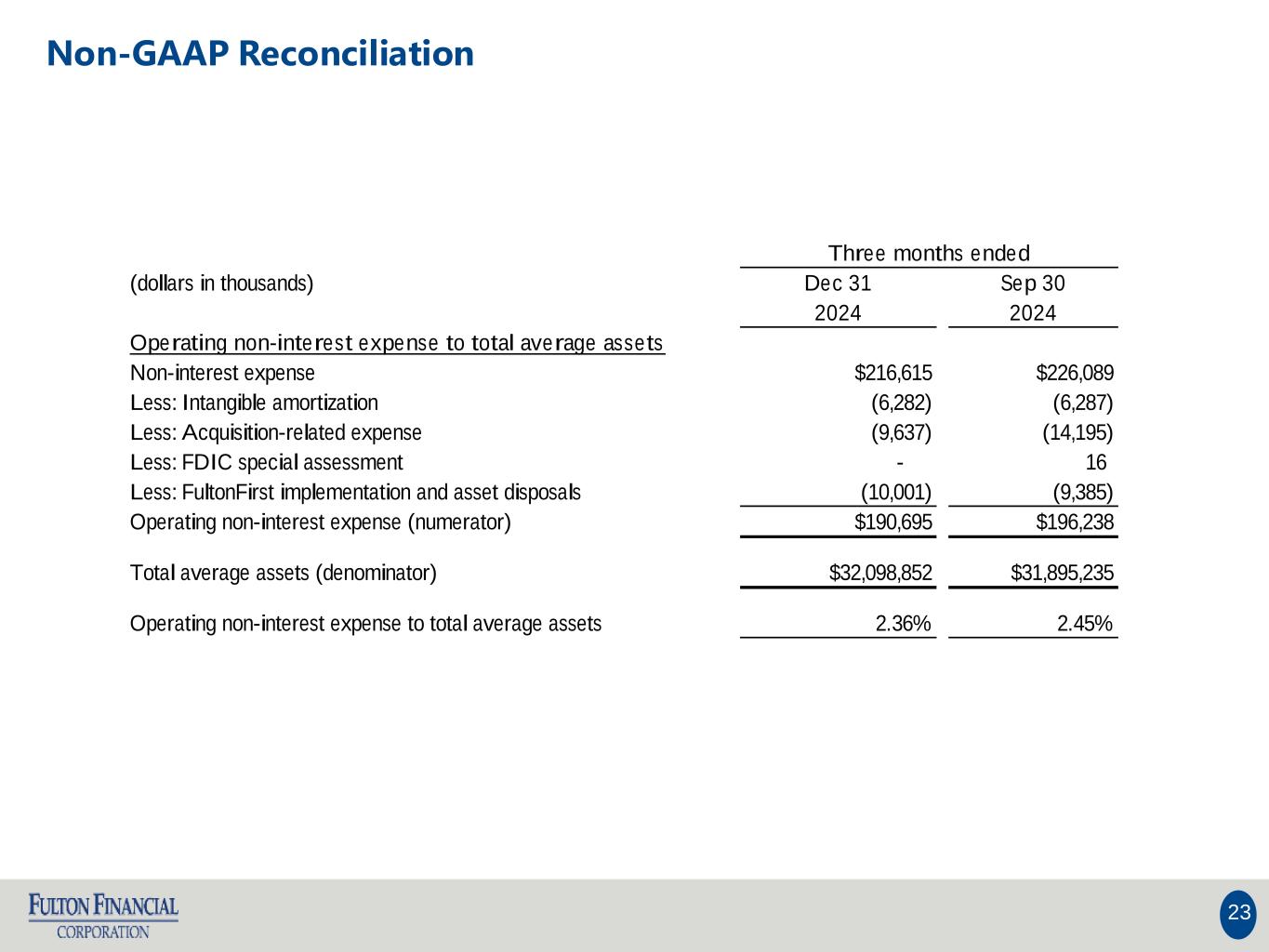

23 Non-GAAP Reconciliation Three months ended (dollars in thousands) Dec 31 Sep 30 2024 2024 Operating non-interest expense to total average assets Non-interest expense $216,615 $226,089 Less: Intangible amortization (6,282) (6,287) Less: Acquisition-related expense (9,637) (14,195) Less: FDIC special assessment - 16 Less: FultonFirst implementation and asset disposals (10,001) (9,385) Operating non-interest expense (numerator) $190,695 $196,238 Total average assets (denominator) $32,098,852 $31,895,235 Operating non-interest expense to total average assets 2.36% 2.45%

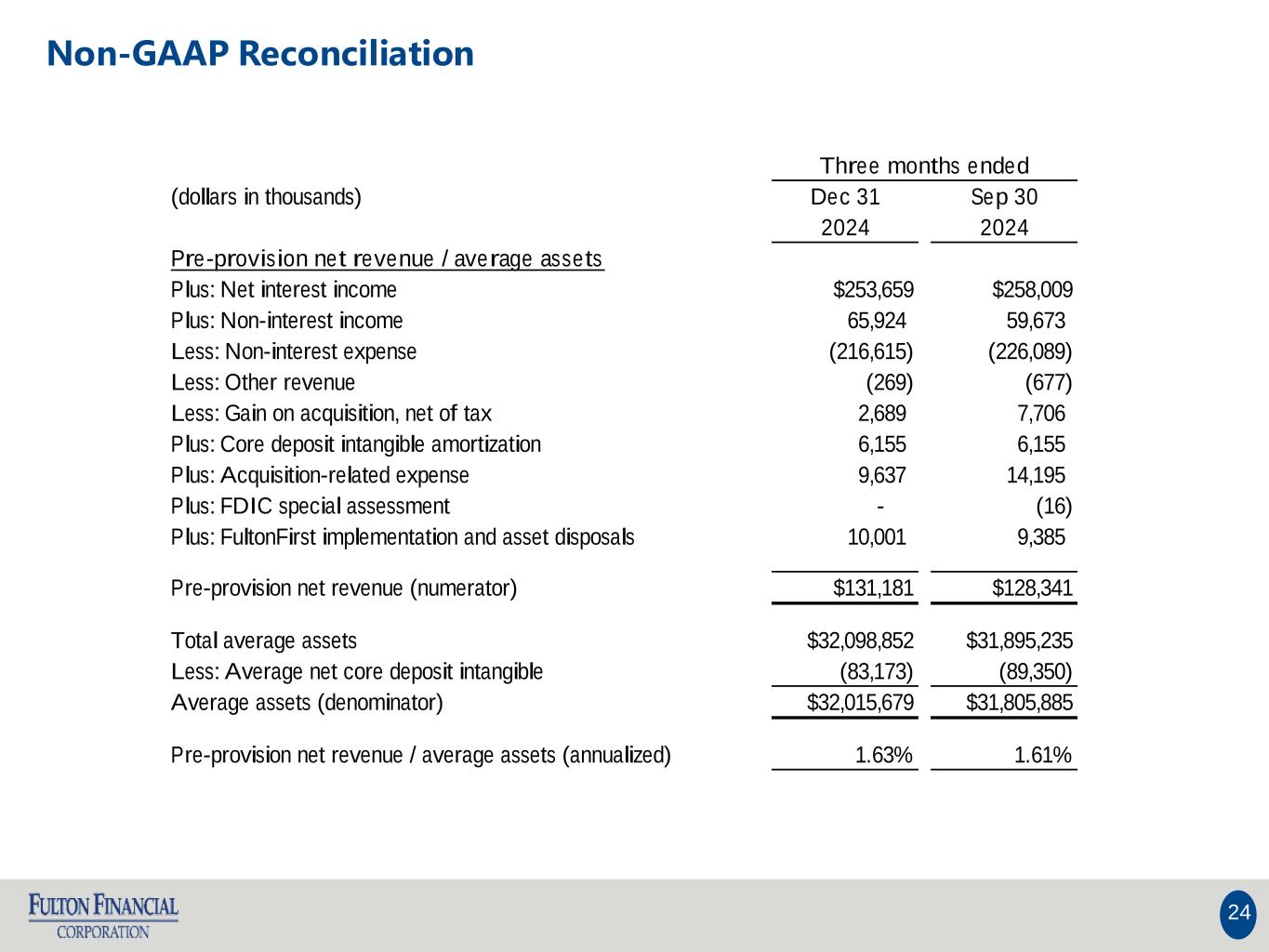

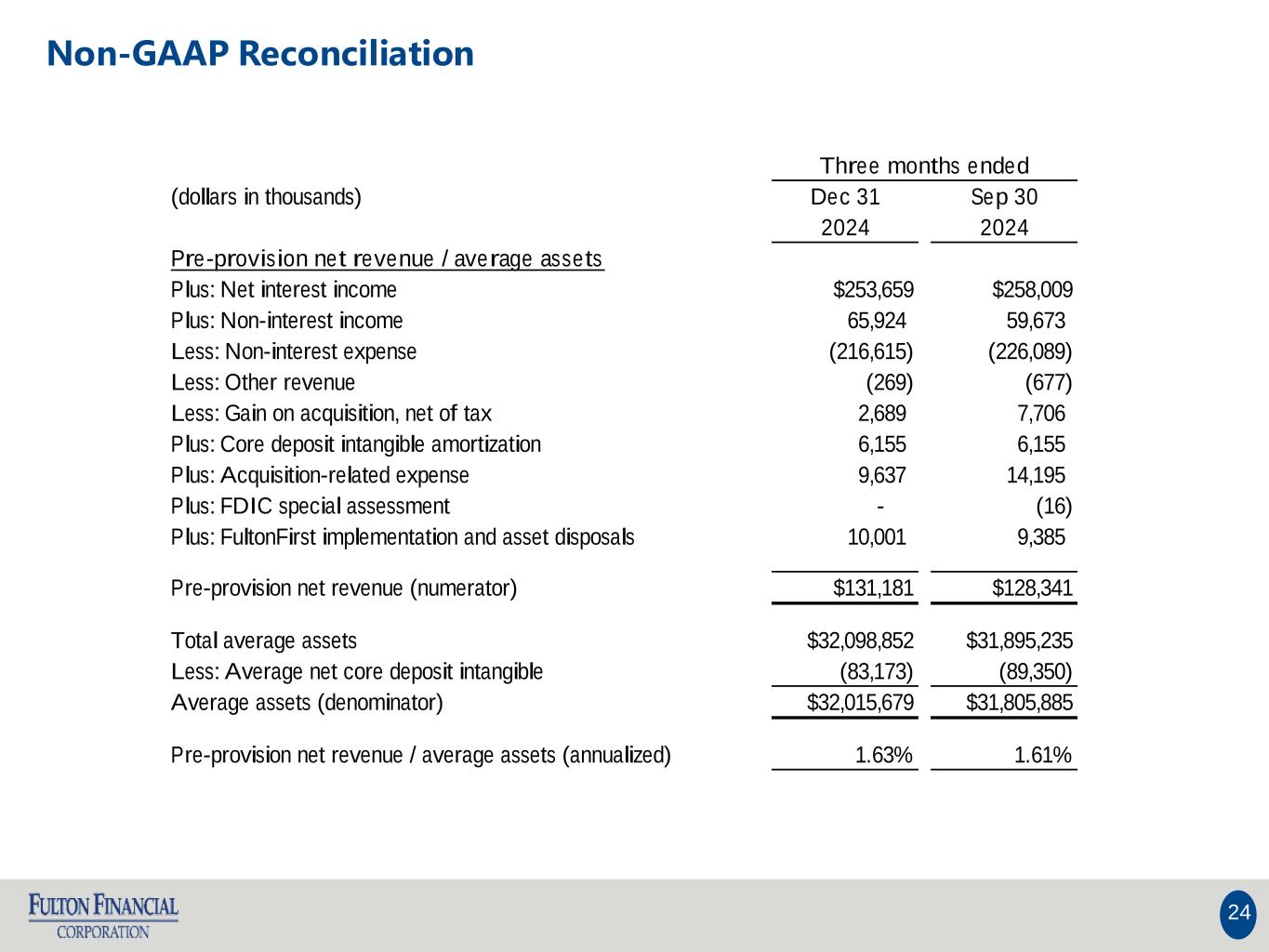

24 Non-GAAP Reconciliation Three months ended (dollars in thousands) Dec 31 Sep 30 2024 2024 Pre-provision net revenue / average assets Plus: Net interest income $253,659 $258,009 Plus: Non-interest income 65,924 59,673 Less: Non-interest expense (216,615) (226,089) Less: Other revenue (269) (677) Less: Gain on acquisition, net of tax 2,689 7,706 Plus: Core deposit intangible amortization 6,155 6,155 Plus: Acquisition-related expense 9,637 14,195 Plus: FDIC special assessment - (16) Plus: FultonFirst implementation and asset disposals 10,001 9,385 Pre-provision net revenue (numerator) $131,181 $128,341 Total average assets $32,098,852 $31,895,235 Less: Average net core deposit intangible (83,173) (89,350) Average assets (denominator) $32,015,679 $31,805,885 Pre-provision net revenue / average assets (annualized) 1.63% 1.61%

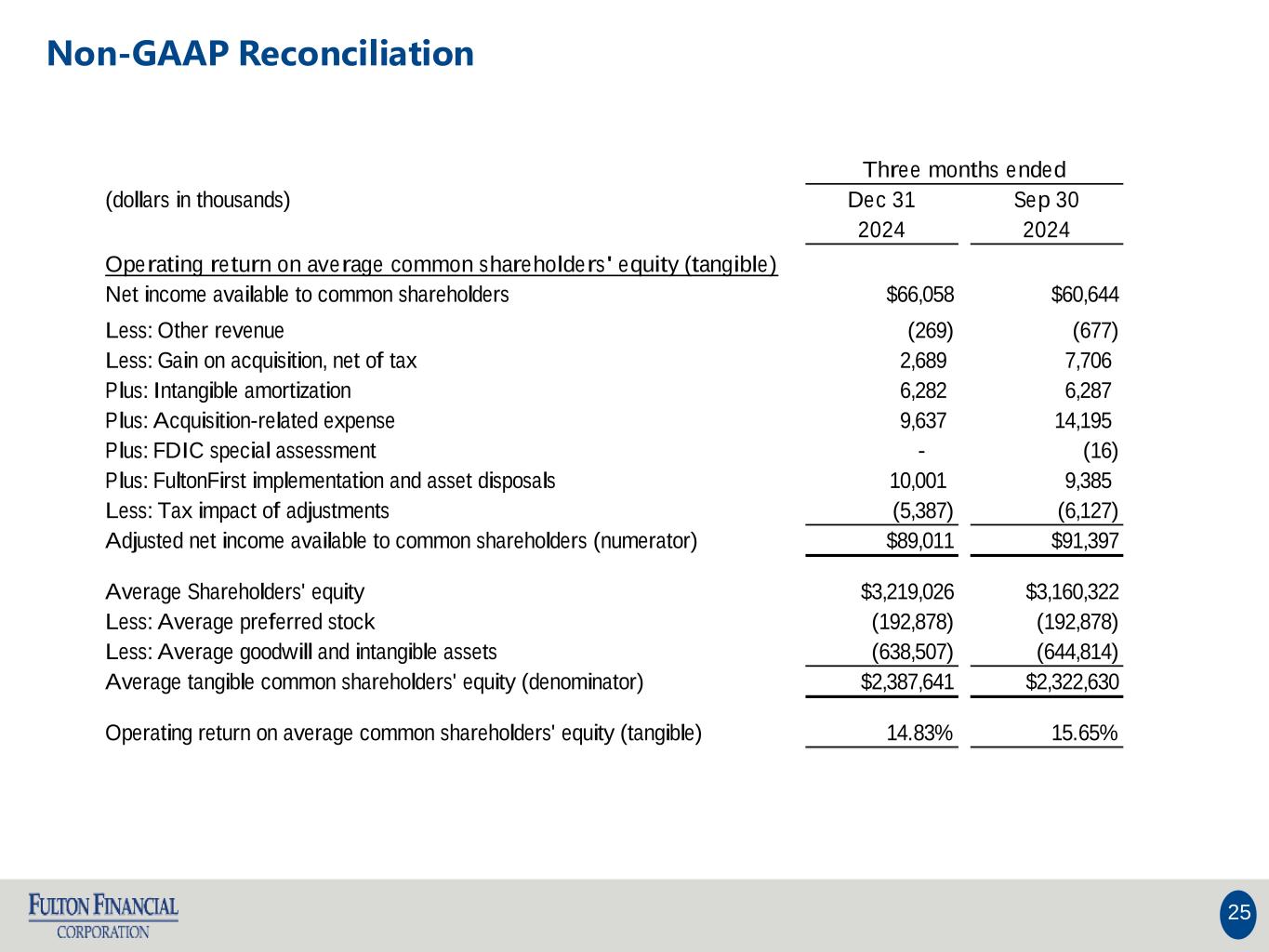

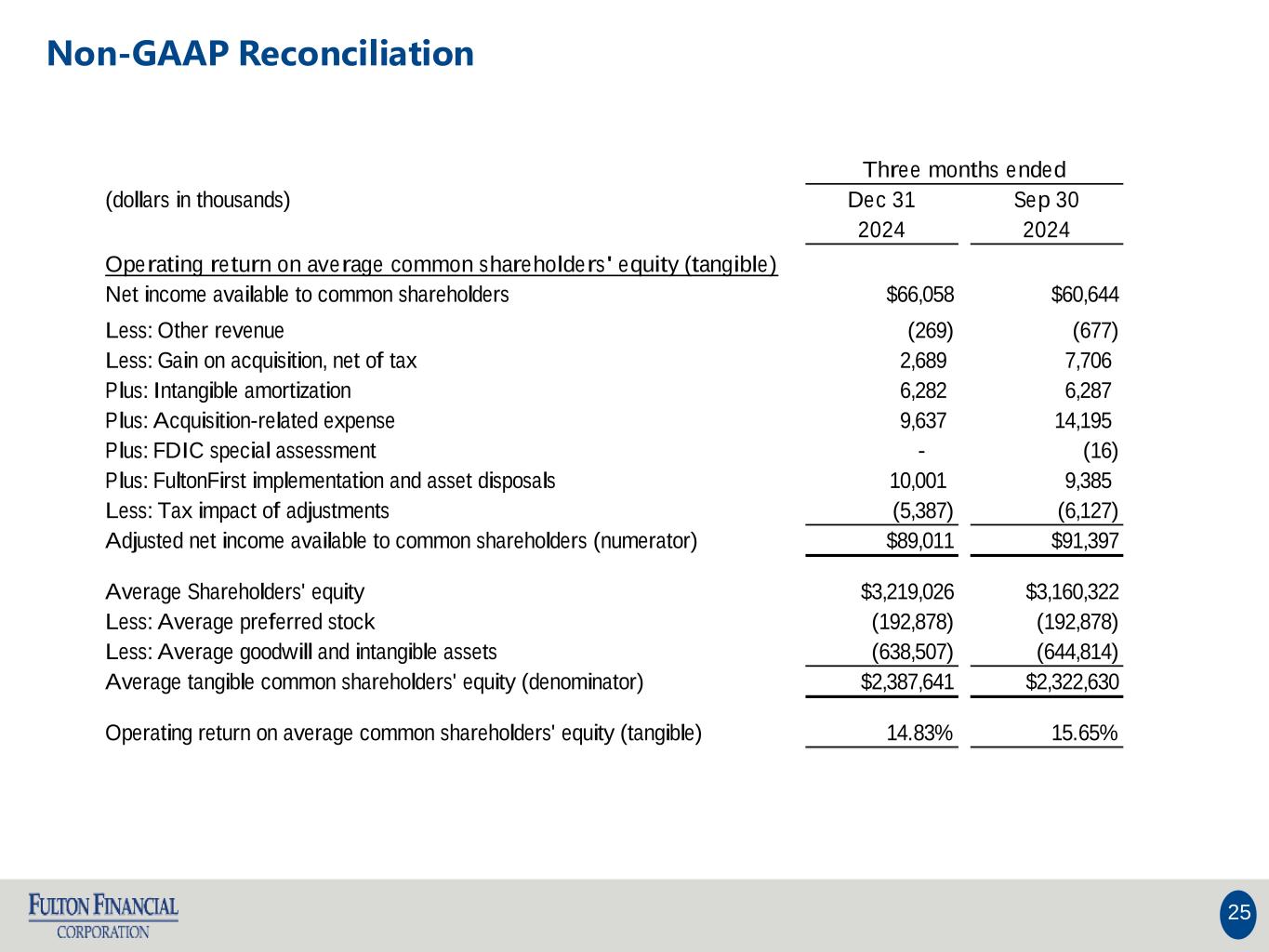

25 Non-GAAP Reconciliation Three months ended (dollars in thousands) Dec 31 Sep 30 2024 2024 Operating return on average common shareholders' equity (tangible) Net income available to common shareholders $66,058 $60,644 Less: Other revenue (269) (677) Less: Gain on acquisition, net of tax 2,689 7,706 Plus: Intangible amortization 6,282 6,287 Plus: Acquisition-related expense 9,637 14,195 Plus: FDIC special assessment - (16) Plus: FultonFirst implementation and asset disposals 10,001 9,385 Less: Tax impact of adjustments (5,387) (6,127) Adjusted net income available to common shareholders (numerator) $89,011 $91,397 Average Shareholders' equity $3,219,026 $3,160,322 Less: Average preferred stock (192,878) (192,878) Less: Average goodwill and intangible assets (638,507) (644,814) Average tangible common shareholders' equity (denominator) $2,387,641 $2,322,630 Operating return on average common shareholders' equity (tangible) 14.83% 15.65%

26 Non-GAAP Reconciliation Year Ended (dollars in thousands) Dec 31 Dec 31 2024 2023 Operating return on average common shareholders' equity (tangible) Net income available to common shareholders $278,495 $274,032 Less: Other revenue (1,805) 1,855 Less: Gain on acquisition, net of tax (36,996) - Plus: Loss on securities restructuring 20,282 - Plus: Intangible amortization 17,830 2,944 Plus: Acquisition-related expense 37,635 - Plus: CECL day 1 provision expense 23,444 - Less: Gain on sale-leaseback (20,266) - Plus: FDIC special assessment 940 6,494 Plus: FultonFirst implementation and asset disposals 32,038 3,197 Less: Tax impact of adjustments (23,121) (3,043) Adjusted net income available to common shareholders (numerator) $328,476 $285,479 Average Shareholders' equity $3,025,642 $2,631,249 Less: Average preferred stock (192,878) (192,878) Less: Average goodwill and intangible assets (642,958) (561,858) Average tangible common shareholders' equity (denominator) $2,189,806 $1,876,513 Operating return on average common shareholders' equity (tangible) 15.00% 15.21%

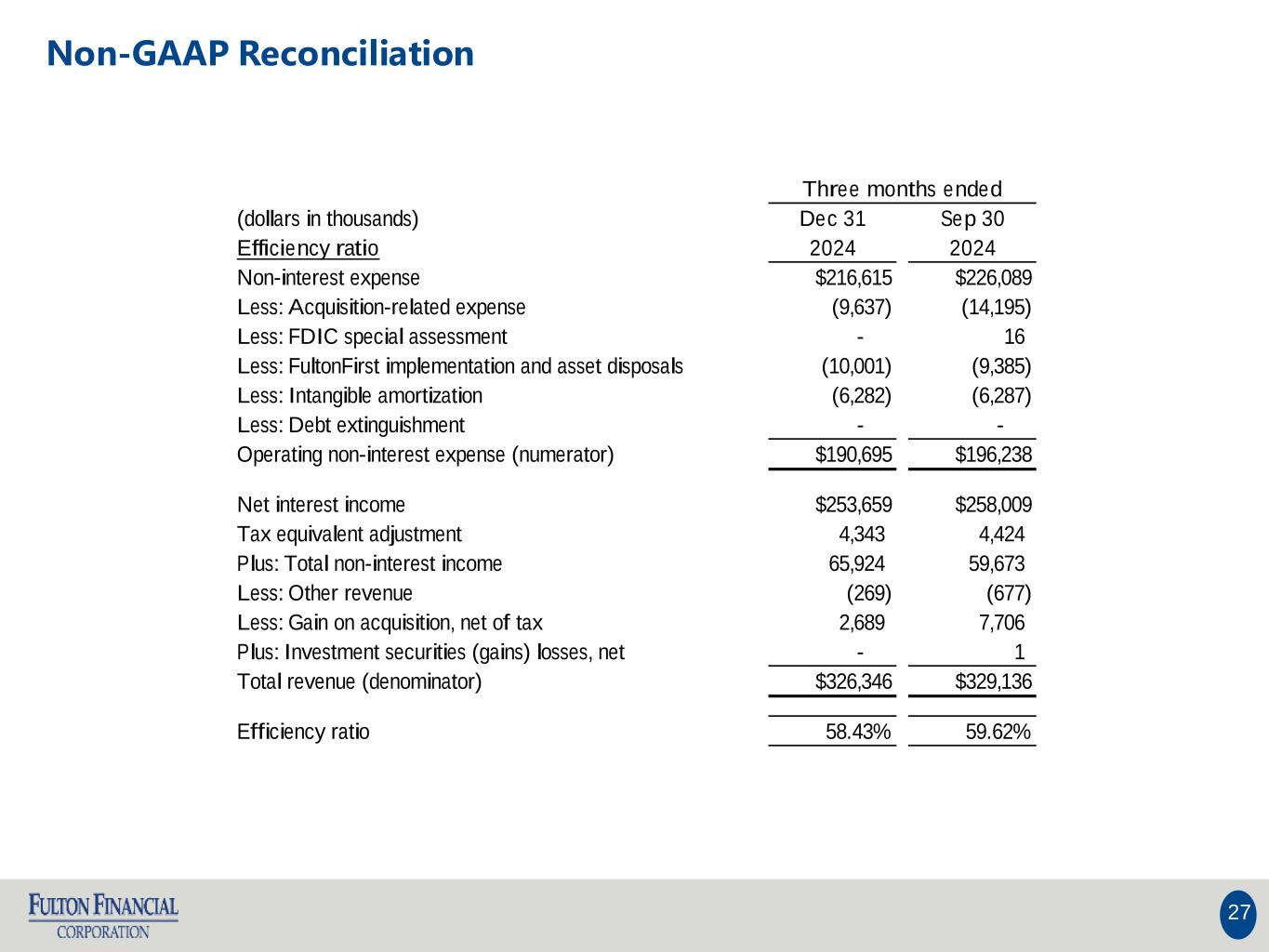

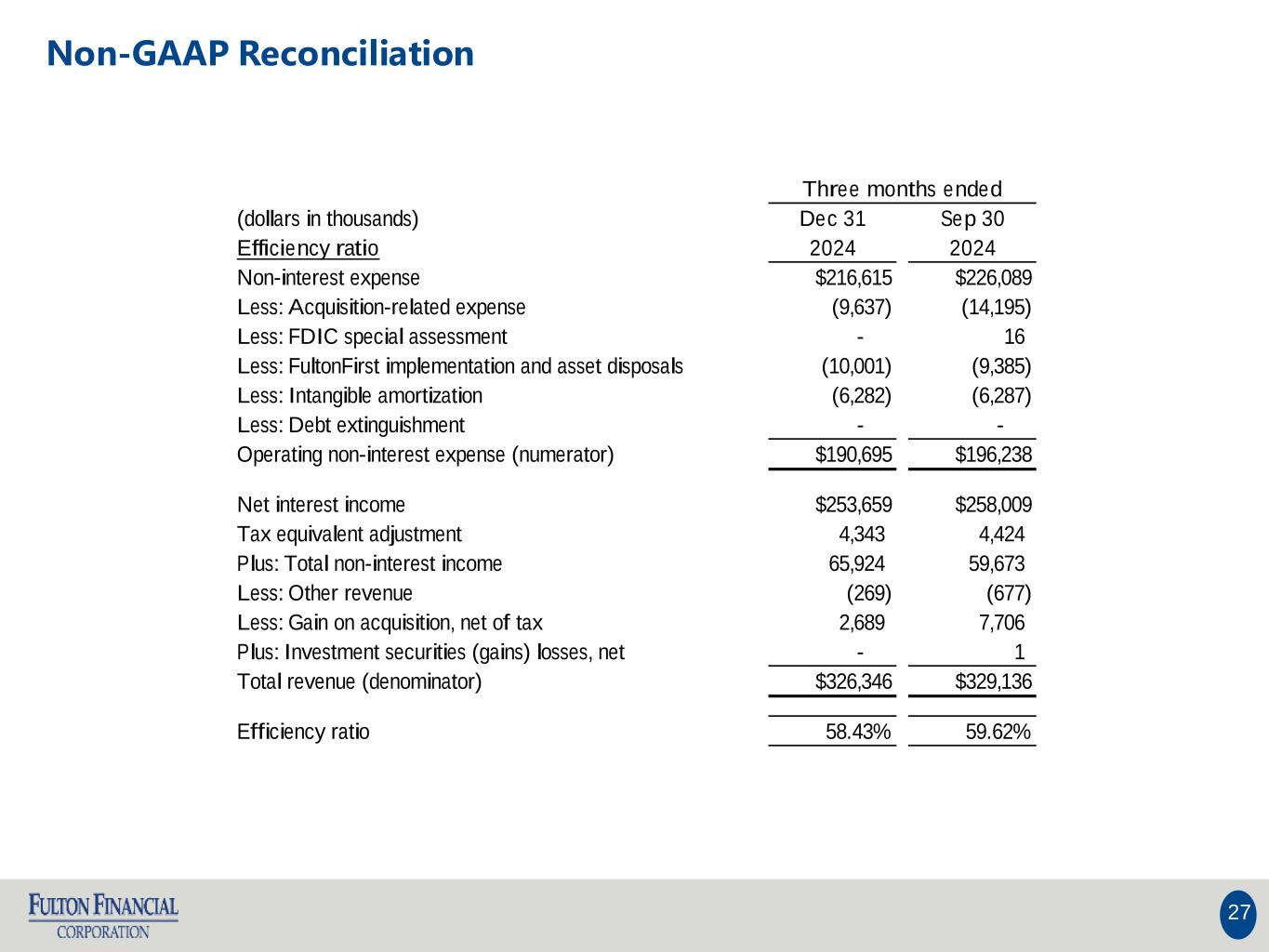

27 Non-GAAP Reconciliation Three months ended (dollars in thousands) Dec 31 Sep 30 Efficiency ratio 2024 2024 Non-interest expense $216,615 $226,089 Less: Acquisition-related expense (9,637) (14,195) Less: FDIC special assessment - 16 Less: FultonFirst implementation and asset disposals (10,001) (9,385) Less: Intangible amortization (6,282) (6,287) Less: Debt extinguishment - - Operating non-interest expense (numerator) $190,695 $196,238 Net interest income $253,659 $258,009 Tax equivalent adjustment 4,343 4,424 Plus: Total non-interest income 65,924 59,673 Less: Other revenue (269) (677) Less: Gain on acquisition, net of tax 2,689 7,706 Plus: Investment securities (gains) losses, net - 1 Total revenue (denominator) $326,346 $329,136 Efficiency ratio 58.43% 59.62%

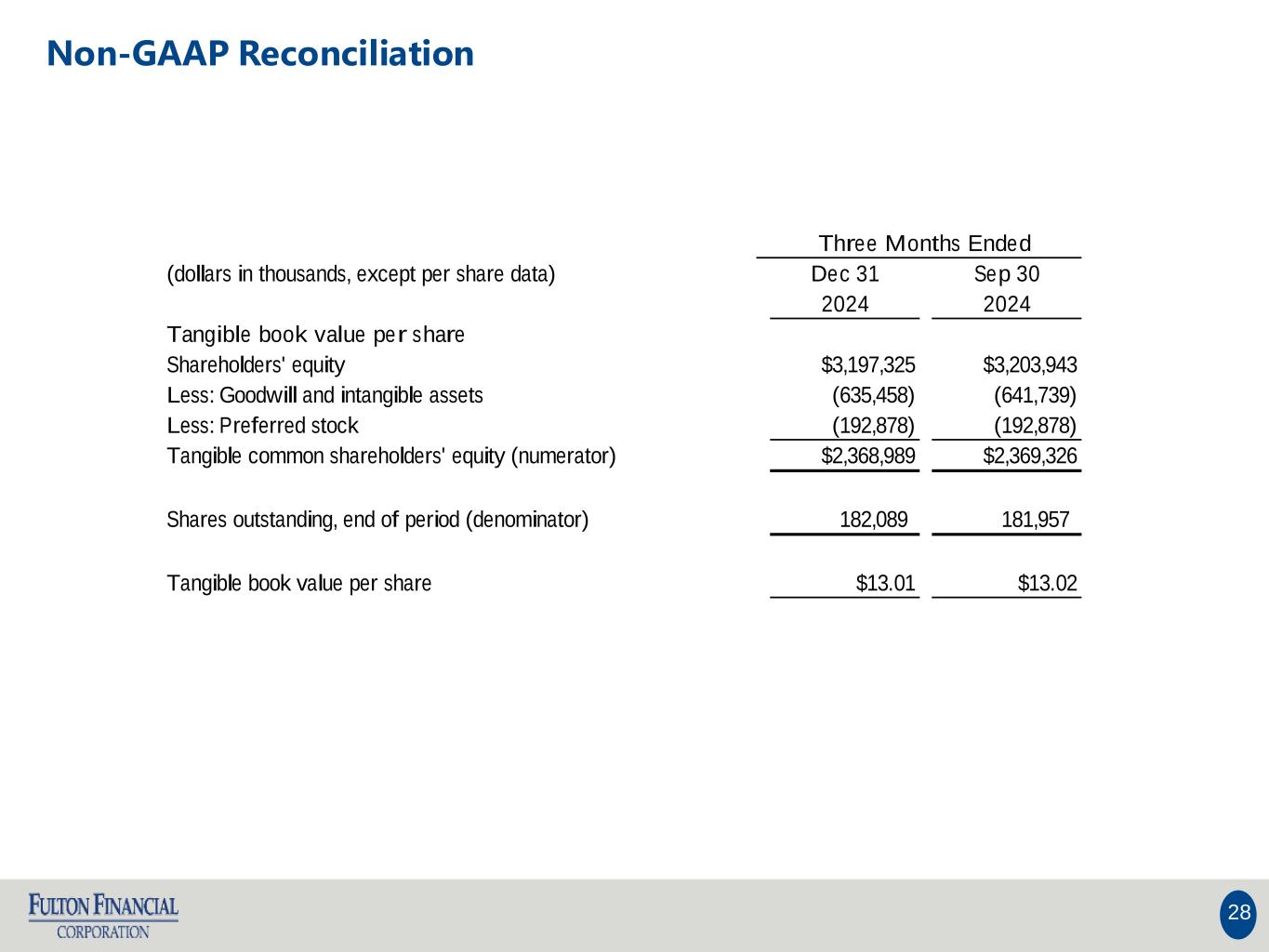

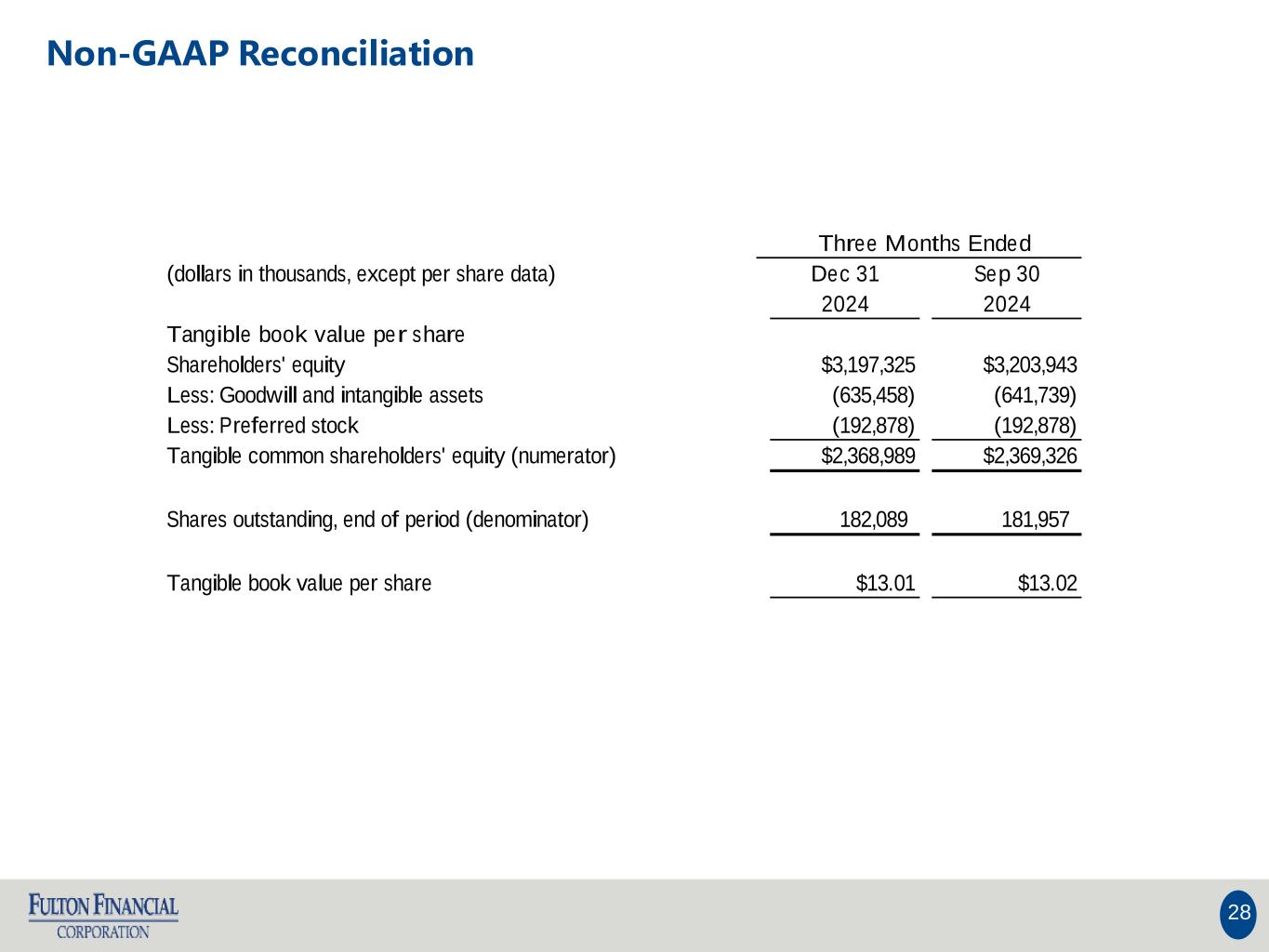

28 Non-GAAP Reconciliation (dollars in thousands, except per share data) Dec 31 Sep 30 2024 2024 Tangible book value per share Shareholders' equity $3,197,325 $3,203,943 Less: Goodwill and intangible assets (635,458) (641,739) Less: Preferred stock (192,878) (192,878) Tangible common shareholders' equity (numerator) $2,368,989 $2,369,326 Shares outstanding, end of period (denominator) 182,089 181,957 Tangible book value per share $13.01 $13.02 Three Months Ended