EXHIBIT 99.1

Another year of good solid growthFulton Financial Corporation

Safe Harbor statement

- The following presentation may contain forward-looking statements about Fulton Financial Corporation’s growth and acquisition strategies, new products and services, and future financial performance, including earnings and dividends per share, return on average assets, return on average equity, efficiency ratio and capital ratio. Forward-looking statements are encouraged by the Private Securities Litigation Reform Act of 1995.

- Such forward-looking information is based upon certain underlying assumptions, risks and uncertainties. Because of the possibility of change in the underlying assumptions, actual results could differ materially from these forward-looking statements. Risks and uncertainties that may affect future results include: pricing pressures on loans and deposits, actions of bank and non-bank competitors, changes in local and national economic conditions, changes in regulatory requirements, actions of the Federal Reserve Board, the Corporation’s success in merger and acquisition integration, and customers’ acceptance of the Corporation’s products and services.

Photo Slides

(Photos of the board of directors,

senior management, and affiliate

CEOs appear here)

Another year of good solid growth

Fulton Financial Corporation

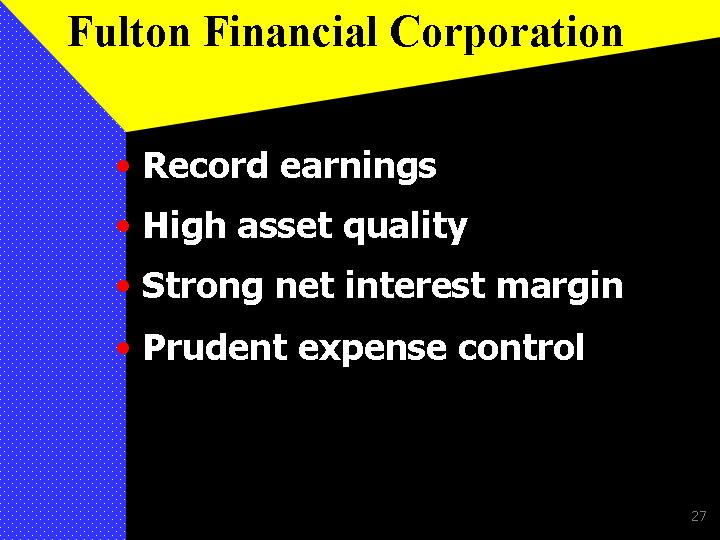

Highlights of 2002

Fulton Financial Corporation

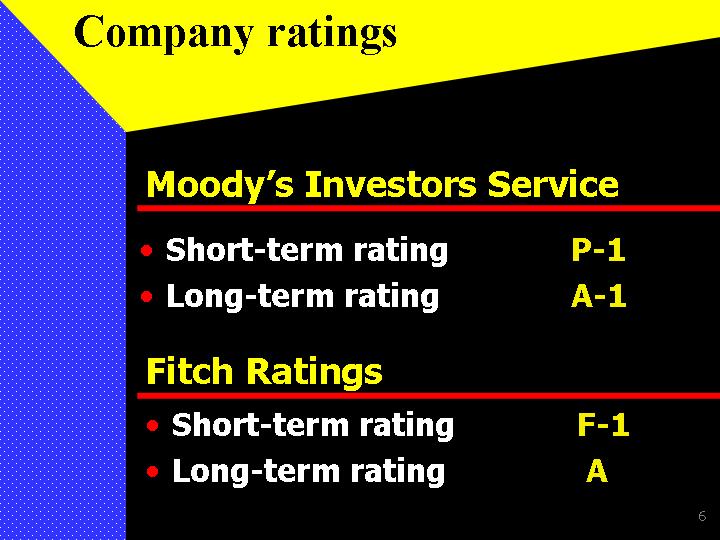

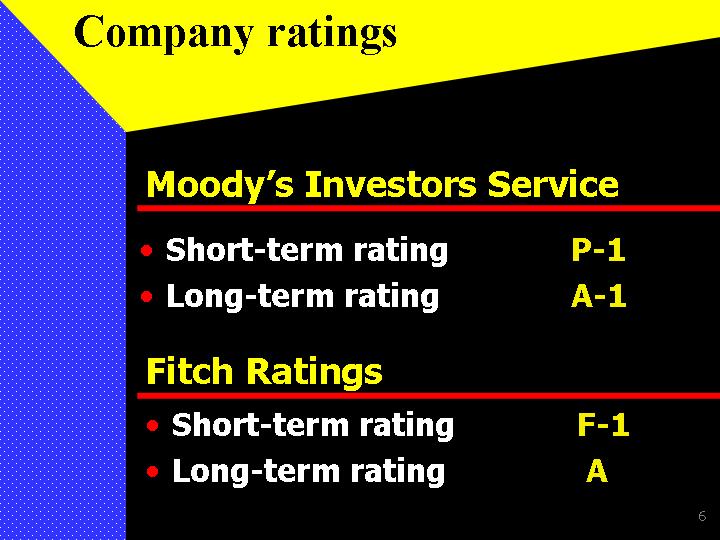

Company ratings

Moody’s Investors Service

Short-term rating P-1Long-term rating A-1Fitch Ratings

Short-term rating F-1Long-term rating A

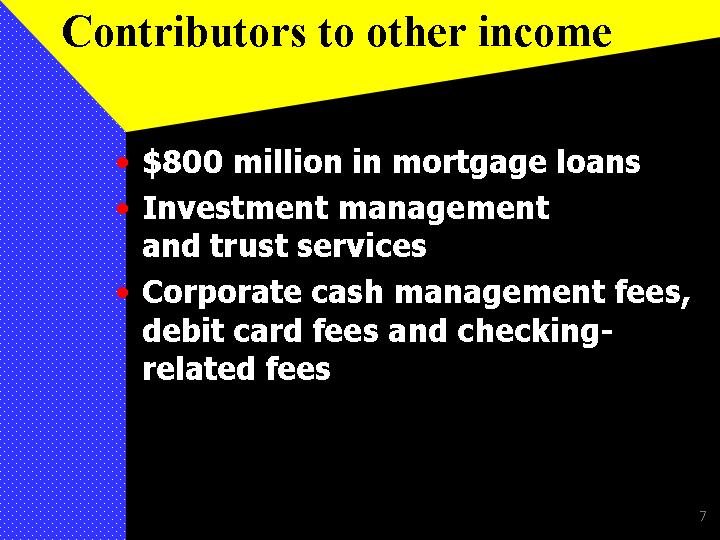

Contributors to other income

$800 million in mortgage loansInvestment management and trust servicesCorporate cash management fees, debit card fees and checking-related fees

The Bank/Woodstown National merger

The Bank(SM)

South Jersey’s

Best Community Bank

Pillars of the Community award

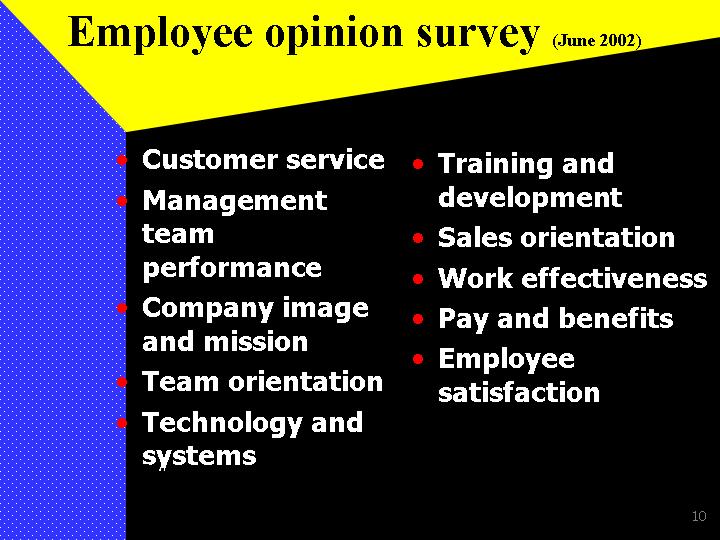

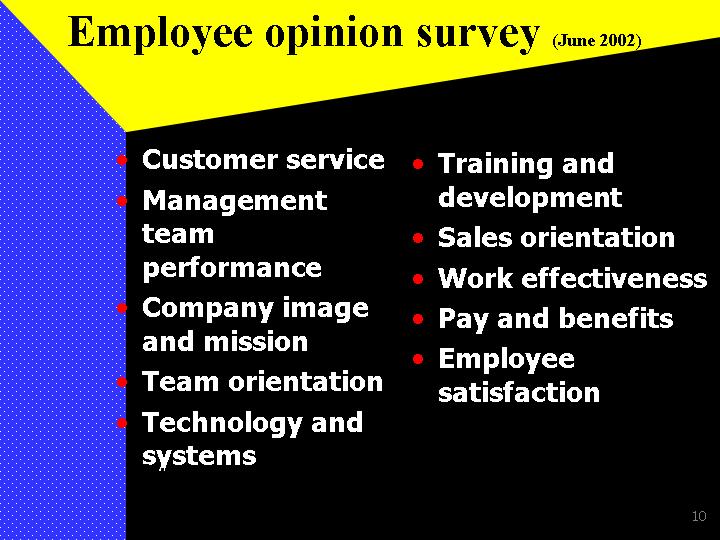

Employee opinion survey (June 2002)

Customer serviceManagement team performanceCompany image and missionTeam orientationTechnology and systemsTraining and developmentSales orientationWork effectivenessPay and benefitsEmployee satisfaction

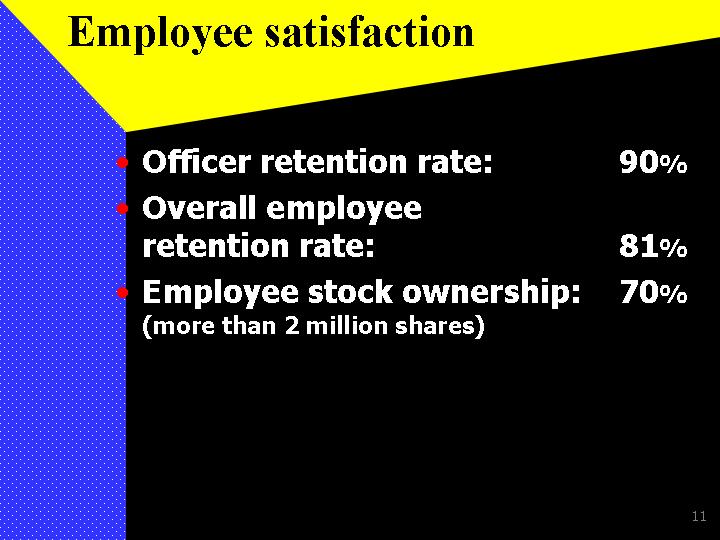

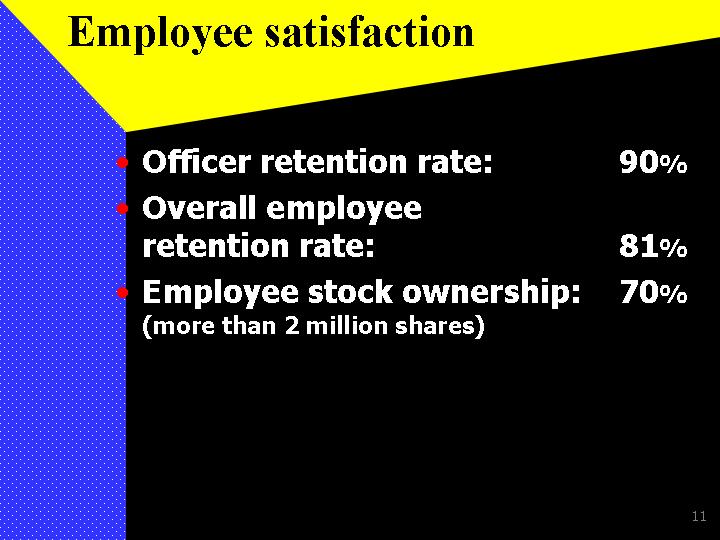

Employee satisfaction

Officer retention rate: 90%Overall employee retention rate: 81%Employee stock ownership: 70%(more than 2 million shares)

The Newcomen Society award

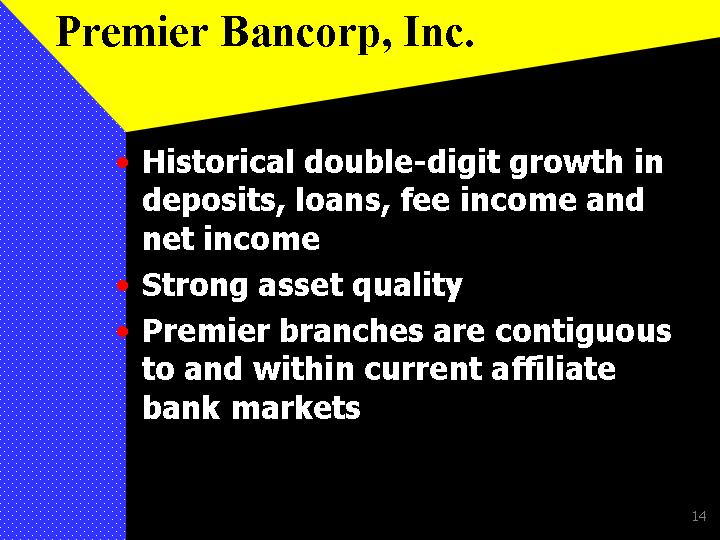

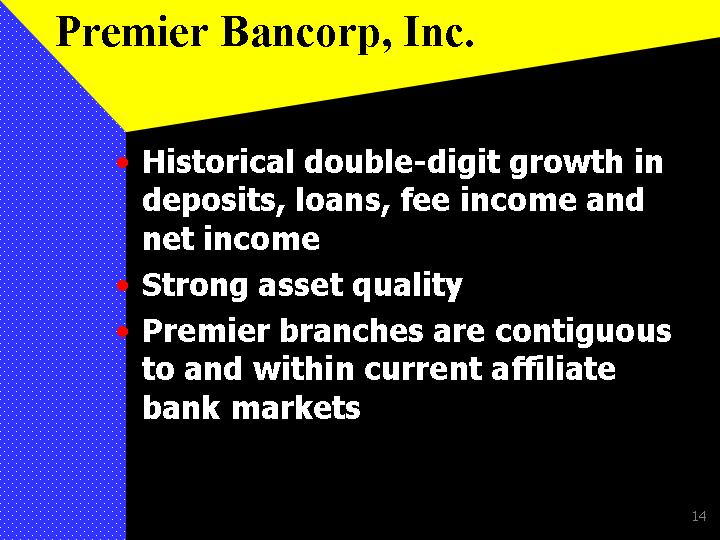

Premier Bancorp, Inc.

Premier Bancorp, Inc.

Historical double-digit growth in deposits, loans, fee income and net income

Strong asset qualityPremier branches are contiguous to and within current affiliate bank markets

Strategic implications

Increased non-interest income opportunitiesExpansion of markets for Fulton Mortgage Company and Fulton Financial AdvisorsProvides Premier with increased lending capacity and additional capitalRetail banking expansion

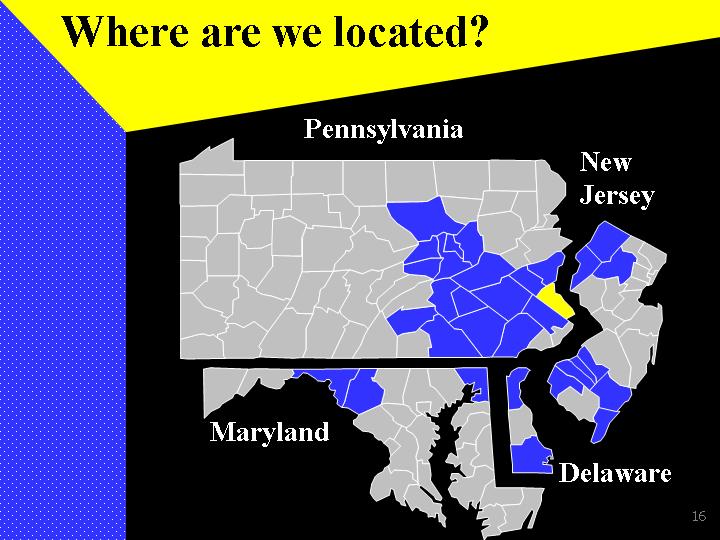

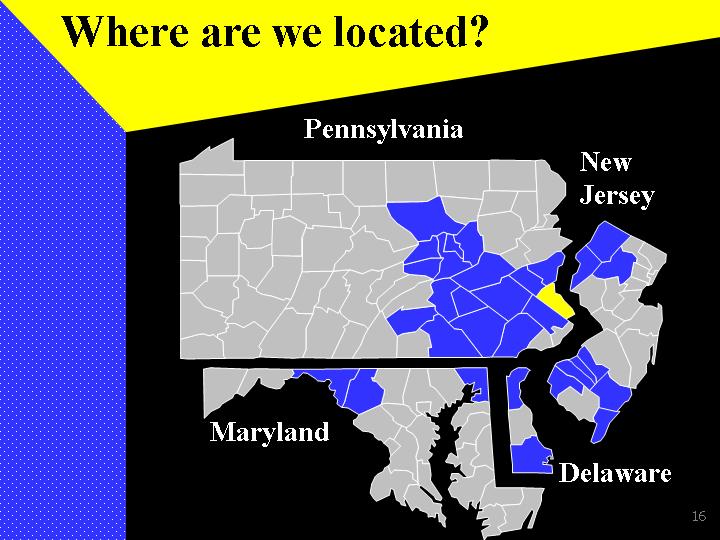

Where are we located?

Pennsylvania

New Jersey

Maryland

Delaware

Highlights of 2002

Fulton Financial Corporation

Fulton Financial Corporation

Business Ethics

&

Corporate Governance

Already in place

Expedited two-business-day reporting of insider stock transactions

CEO and CFO certifications of quarterly and annual SEC filings

Disclosure Committee formed

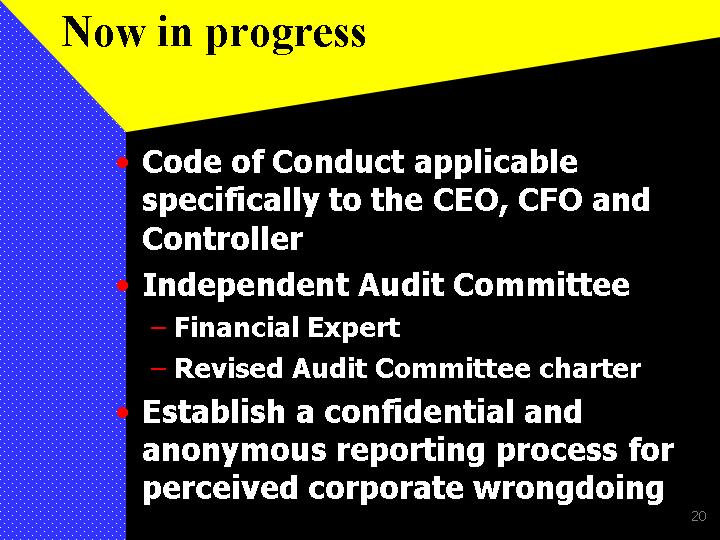

Now in progress

Code of Conduct applicable specifically to the CEO, CFO and ControllerIndependent Audit Committee— Financial Expert— Revised Audit Committee charterEstablish a confidential and anonymous reporting process for perceived corporate wrongdoing

Fulton Financial Corporation

Code of Conduct

Scott Smith

President and Chief Operating Officer

2002 Financial Performance

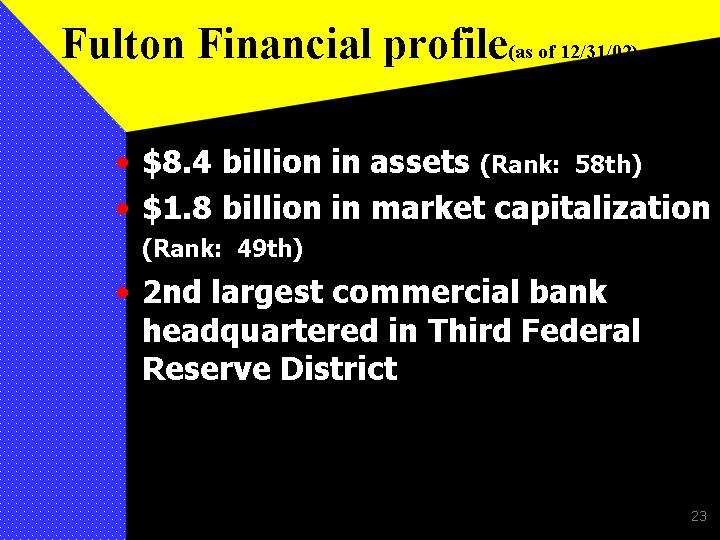

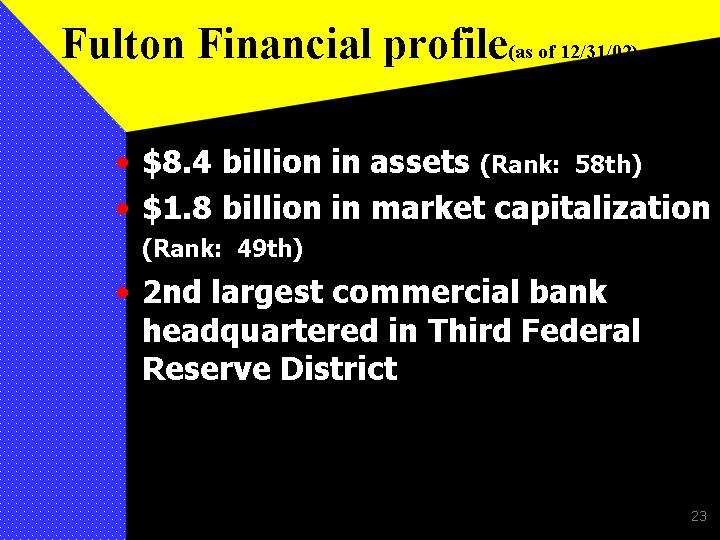

Fulton Financial profile(as of 12/31/02)

$8.4 billion in assets (Rank: 58th)$1.8 billion in market capitalization (Rank: 49th)2nd largest commercial bank headquartered in Third Federal Reserve District

Fulton Financial profile (as of 12/31/02)

- Eleven affiliate banks

- 188 banking offices

- 210 automated teller machines

What have we accomplished?

- 21 consecutive years of record earnings

- 9.3% compounded annual growth rate in earnings per share

Fulton Financial Corporation

What have we accomplished?

28 consecutive years of dividend increases

10.3% compounded annual growth

rate in dividends per share

Proven business model

Consistently high performance

Fulton Financial Corporation

Fulton Financial Corporation

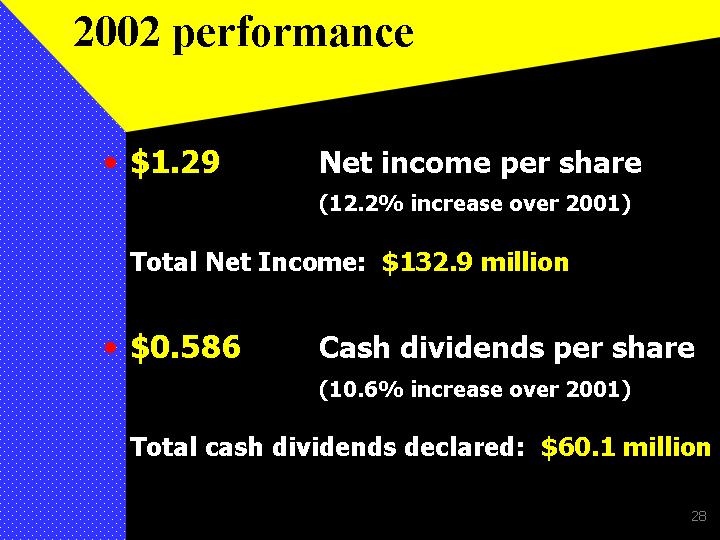

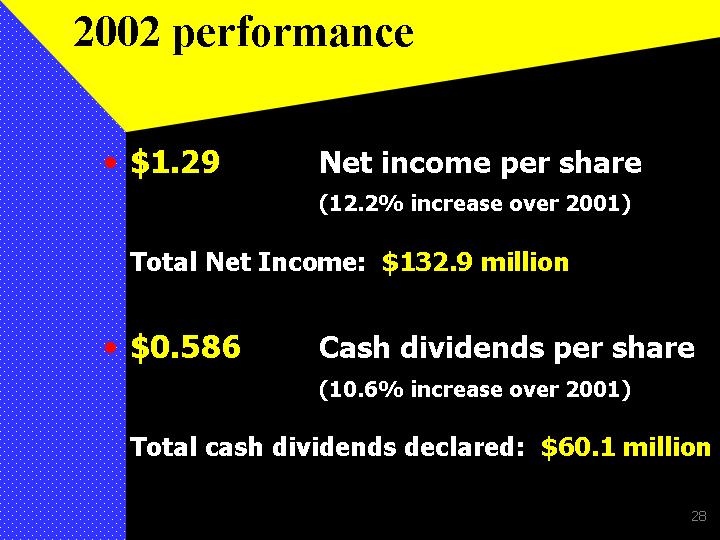

2002 performance

$1.29 Net income per share (12.2% increase over 2001)

Total Net Income: $132.9 million

$0.586 Cash dividends per share (10.6% increase over 2001)

Total cash dividends declared: $60.1 million

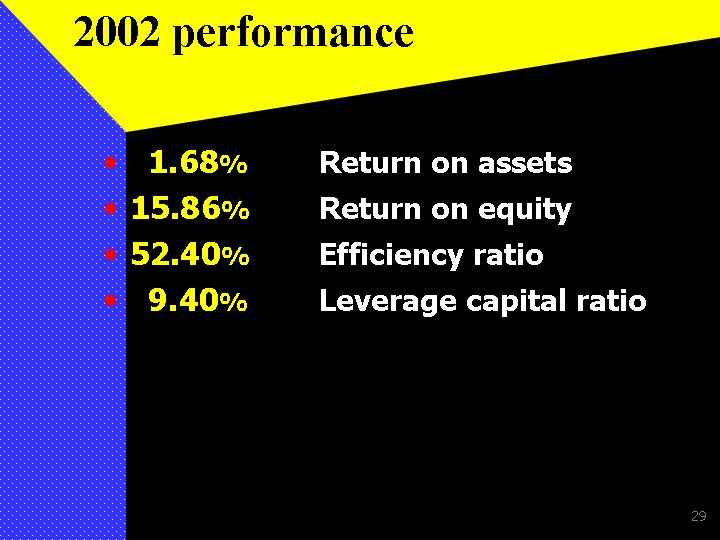

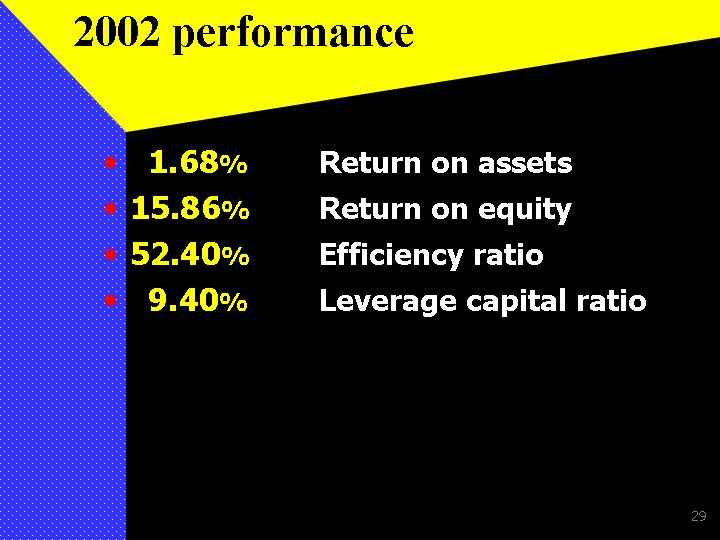

2002 performance

- 1.68% Return on assets

- 15.86% Return on equity

- 52.40% Efficiency ratio

- 9.40% Leverage capital ratio

2002 total return

Institution/Index Change

Nasdaq Bank Index 7.32

Fulton Financial 4.42

Peer Group 2.56

Large Banks -2.70

NYSE Bank Index -11.55

Dow Jones -15.48

S&P 500 -22.56

Nasdaq Nat'l Mkt. -32.56

Five-year total return

Institution/Index Percent change

Peer Group 24.33%

Nasdaq Banks 19.89

Fulton Financial 19.48

NYSE Banks 15.83

Dow Jones Ind. Avg. 15.12

Large Banks 7.23

S&P 500 -2.88

Nasdaq Nat'l. Mkt. -13.56

2003 stock performance (year-to-date)

- $17.66 12/31/02

- $19.72 4/14/03

A 11.66% increase

since year-end 2002.

Analysts who follow our company

- Cohen Bros. Outperform

- Ferris Baker Watts Buy

- Janney Montgomery Scott Buy

- Keefe Bruyette & Woods Market Perform

- Legg Mason Wood Walker Buy

- McConnell, Budd & Romano Outperform

- McDonald Investments Hold

- RBC Capital Markets Sector perform

- Ryan Beck Outperform

- Salomon Smith Barney In-line

- Sandler O'Neill & Partners Maintain

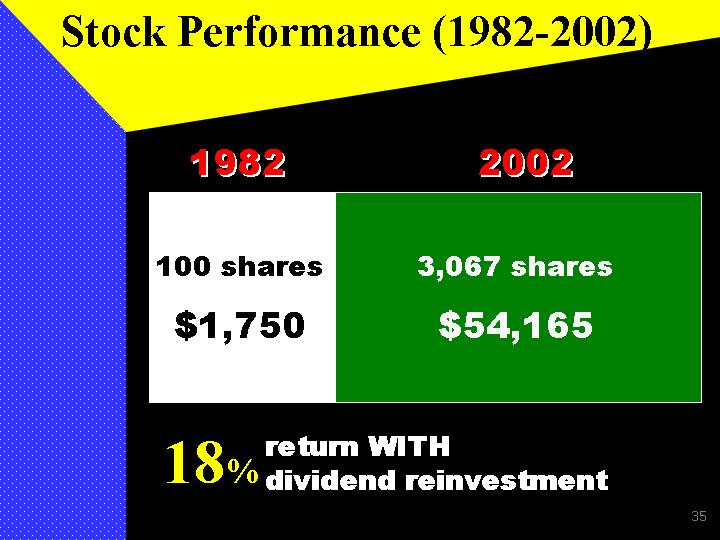

Stock Performance (1982-2002)

1982 2002

100 shares $1,750 1,493 shares $26,366

14% return WITHOUT dividend reinvestment

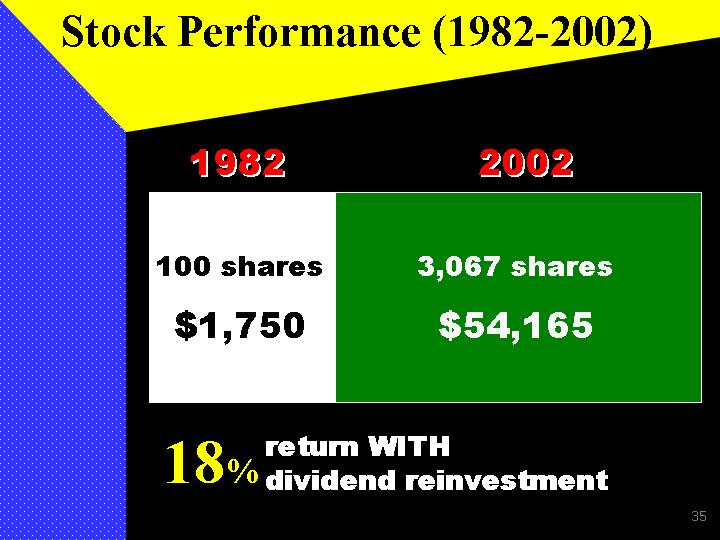

Stock Performance (1982-2002)

1982 2002

100 shares $1,750 3,067 shares $54,165

18% return WITH dividend reinvestment

Fulton Financial Corporation

Strategic Plan

Our mission statement

- We will increase shareholder value and enrich the communities we serve by creating financial success together with our customers and career success together with our employees.

- We will conduct all of our business with honesty and integrity.

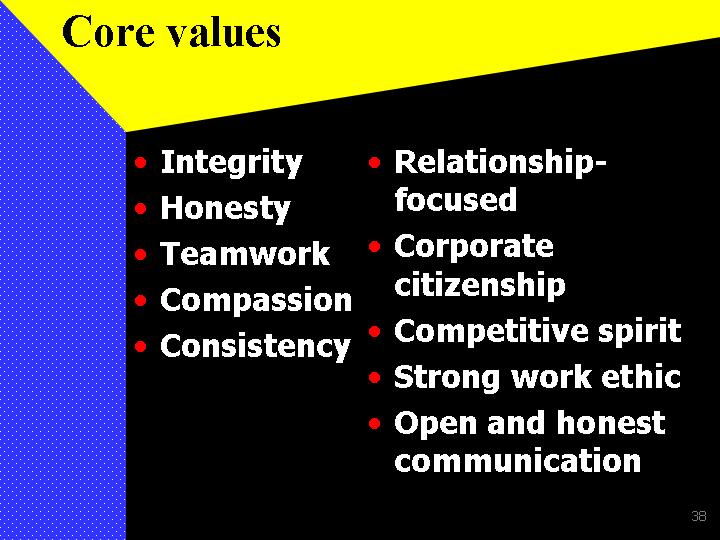

Core values

- Integrity

- Honesty

- Teamwork

- Compassion

- Consistency

| - Relationship-focused

- Corporate citizenship

- Competitive spirit

- Strong work ethic

- Open and honest communication

|

Our top priorities

- Sustaining strong earnings growth

- Maintaining high credit quality

- Creating financial success together with our clients

- Creating career success together with our employees

- Enriching the communities we serve

- Growing non-interest income

In-depth analysis

- Strengths, weaknesses, opportunities, challenges

- Greatest strength:

OUR PEOPLE

Scott Smith

President and Chief Operating Officer

2002 Accomplishments and Our Strategic Plan

Rufus Fulton

Chairman and Chief Executive Officer

- Announcements

- Questions and Answers

Another year of good solid growth

Fulton Financial Corporation