Fulton Financial Corporation

Ferris Baker, Watts Inc.

Mid-Atlantic Bank Conference

August 8, 2007

1

Forward-Looking Statement

The following presentation may contain forward-looking statements about

Fulton Financial Corporation’s growth and acquisition strategies, new

products and services, and future financial performance, including

earnings and dividends per share, return on average assets, return on

average equity, efficiency ratio and capital ratio. Forward-looking

statements are encouraged by the Private Securities Litigation Reform Act

of 1995.

Such forward-looking information is based upon certain underlying

assumptions, risks and uncertainties. Because of the possibility of

change in the underlying assumptions, actual results could differ

materially from these forward-looking statements. Risks and uncertainties

that may affect future results include: pricing pressures on loans and

deposits, actions of bank and non-bank competitors, changes in local and

national economic conditions, changes in regulatory requirements,

actions of the Federal Reserve Board, the Corporation’s success in merger

and acquisition integration, and customers’ acceptance of the

Corporation’s products and services.

2

Presentation Outline

Overview

Strategic Issues and Responses

Challenges

Recent trends

Financial Performance

Summary

Questions

3

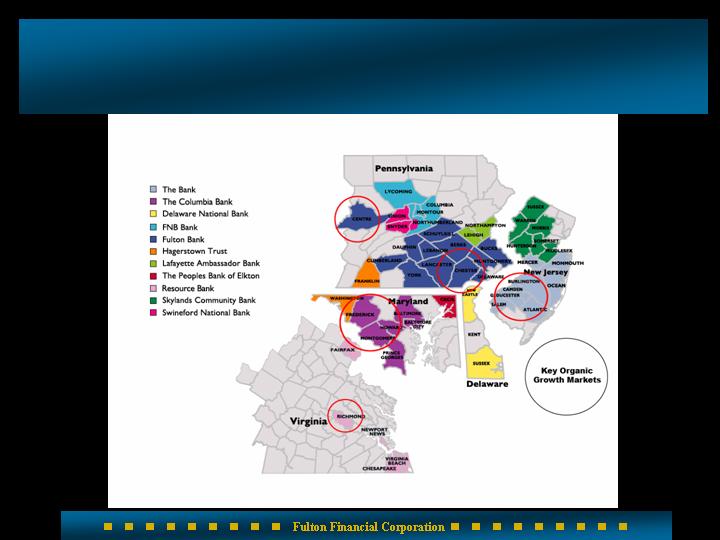

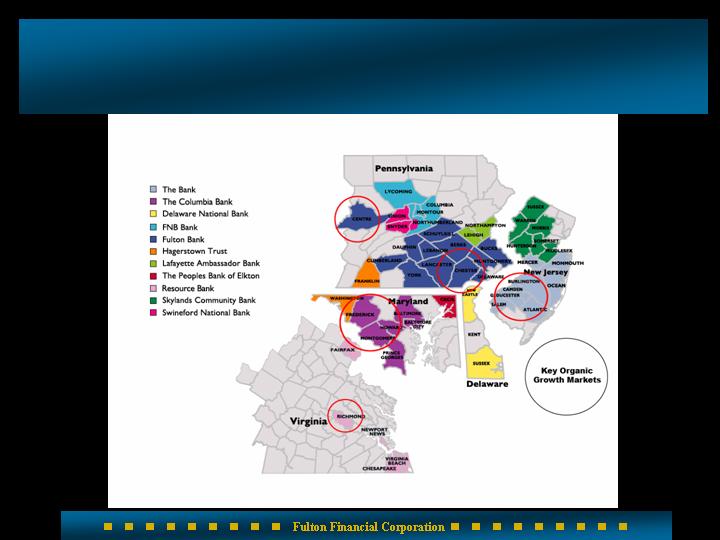

Key Organic Growth Markets

4

Organic Growth Initiatives

Additional cash management product

options to keep funds on balance sheet

Market segmentation / targeted direct mail

Corporate-wide sales / incentive programs

Remote deposit item capture / business

clients

Corporate credit card rewards program

Small business segment

Affiliate CEO scorecard

5

FFC Affiliates in Affluent

Markets*

*Source: SNL, Median HH Income, 2006 data

6

County

National

Ranking

Ranking in

State

Median HH

Ranking

FFC Affiliate

Fairfax, VA

#3

#2

$101,762

Resource Bank

Hunterdon, NJ

#4

#1

$100,485

Skylands Bank

Morris, NJ

#7

#2

$96,965

Skylands Bank

Somerset, NJ

#8

#3

$96,350

Skylands Bank

Howard, MD

#9

#1

$92,433

Columbia Bank

Montgomery, MD

#19

#2

$87,053

Columbia Bank

Chester, PA

#24

#1

$83,001

Fulton Bank

Serving PA’s Strongest Markets*

*Source: SNL, Median HH Income, 2006 data

7

County

Rank

Projected

Change

2006 - 2011

Median

HH Income

2006

Projected HH

Income Change

2006 - 2011

Chester, PA

1

9.63%

$83,001

25.46%

Montgomery, PA

2

3.05

77,383

23.86

Bucks, PA

3

4.06

76,234

23.89

Delaware, PA

4

0.17

63,220

20.68

Cumberland, PA

5

4.37

58,384

18.62

Northampton, PA

6

8.45

56,249

18.97

Lancaster, PA

8

4.62

55,546

17.63

York, PA

9

6.18

55,118

17.39

Lehigh, PA

10

5.46

55,107

19.86

Berks, PA

11

5.62

55,089

17.50

Average

4.66

63,533

19.82

Average of all other (57)

1.20

42,366

16.64

Fulton Financial Profile

Regional financial holding company

(formed in 1982)

11 community banks and 3 financial

services affiliates in 5 states

260 community banking offices

Asset size: $15.1 billion

Market capitalization: $2.3 billion

8

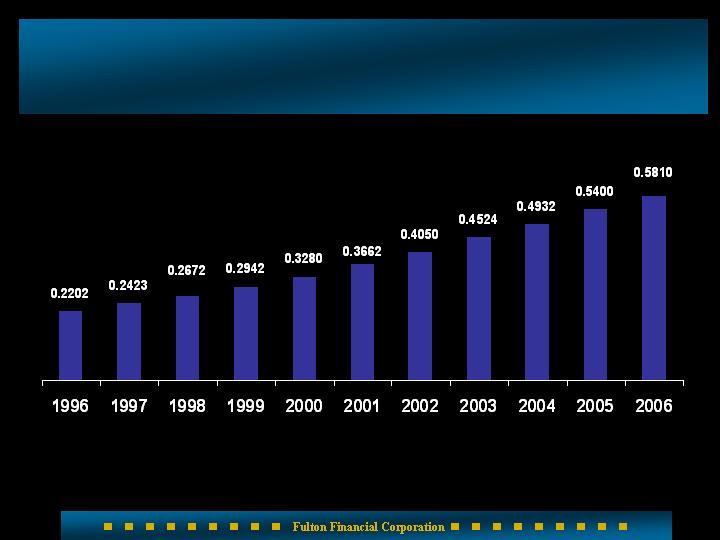

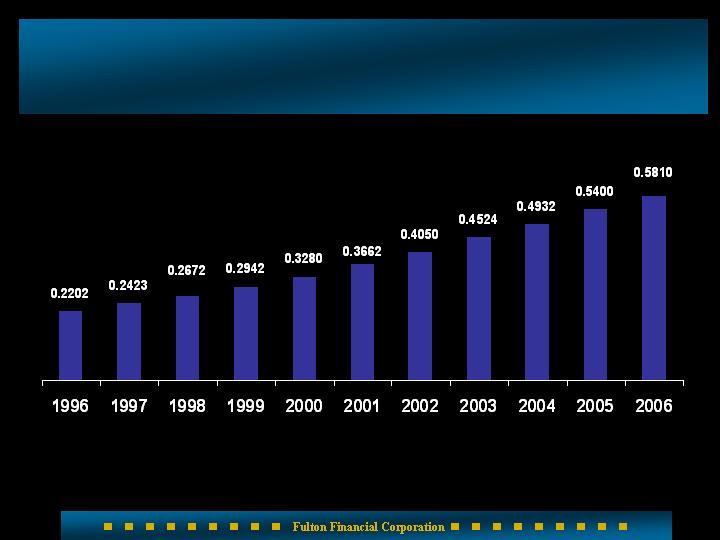

25 consecutive years of record earnings

33 consecutive years of dividend

increases

10.1% compounded annual growth rate in

dividends per share

8.5% compounded annual growth rate in

earnings per share (last 5 years = 7.0%)

25 bank acquisitions

What have we accomplished?

9

10-year Dividend History

10

Quarterly Cash Dividend

15 cents

Dividend yield:

approximately 4.40%

11

Capital (6/30/07 estimates)

Total Capital (GAAP): $1.5 billion

Total Regulatory Capital: $1.4 billion

Ratios (estimated):

Total Risk-Based Capital 12.80%

Tier 1 Risk-Based Capital 10.00%

Leverage Capital 7.80%

12

Stock Repurchase

April 2007: 1 million share buyback

in progress through 12/31/07.

Long history of repurchasing our

shares

13

Financial Performance

14

Q2/07

Tough quarter

Reported EPS of .23/share

Significant, aggressive steps to

improve earnings

Optimistic about developing trends

Additional Alt-A repayment requests

Costs of workforce initiatives

Good loan and deposit growth

15

Challenges

Improving our earnings

Loan loss provision returning to

more normal levels

Reduced level of bank stock gains

Consumer loan growth

Resource Mortgage repurchase

requests

16

Recent Positive Trends

Strong commercial loan growth and pipeline

Linked quarter core deposit growth

Increased margin normalization

Declining CD re-pricing differential

Improved loan yields

Slightly steeper yield curve

Reduced Alt-A exposure

17

RMC: Future Exposure

*All 1st Lien

**$1 million 1st Lien

.6 2nd

$1.3 million

Estimated EPD exposure

$15.3 million

Total

$1.6** million

=

Pre 3/31/07 – Monitoring Loans

$13.7* million

=

New Fundings - 2nd Quarter

18

Increasing Non-interest Income

Company-wide promotions to

increase referrals for fee-generating

products and services:

Investment management and trust services

Cash Management

Credit and debit cards

Leasing

International services

19

Fulton Financial Advisors

New senior leadership

Reduction of overhead

Recurring fee new business pipeline

20

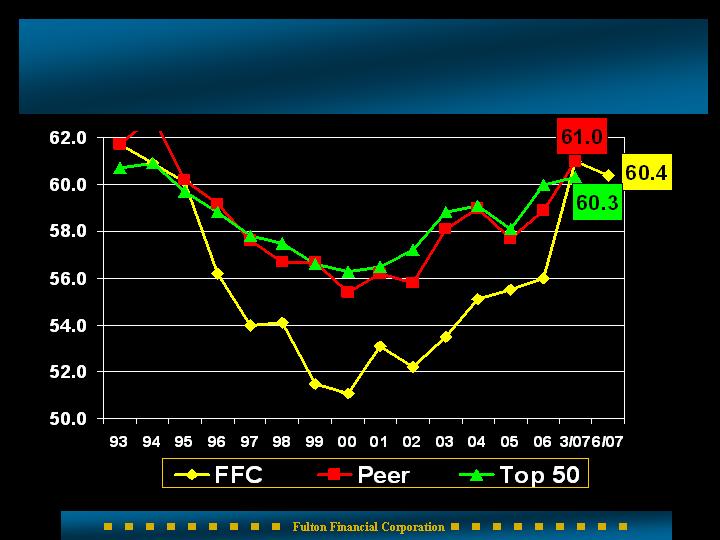

Operating Efficiency

21

Consolidation, Standardization

and Centralization

22

Benefits of Consolidation

15 banking affiliates reduced to 11 in

seven months

Market and geographic efficiencies

Leverage brand over wider market

Larger affiliate provides strong

leadership and management expertise

Business model intact

Fewer affiliates, faster standardization

23

Reducing Expenses

Product standardization that

simplifies customer choices

Departmental centralization

Workforce management – job

elimination and attrition

Employee benefit plan consistency

24

Anticipated Impact

$1.5 million per month

beginning 2008

25

Customer Experience

26

Customer Satisfaction

*Retail:

90% extremely/very satisfied

Commercial:

90% extremely/very satisfied

Fulton Financial Advisors:

80+% very satisfied/satisfied

Fulton Mortgage Company:

99% of expectations met/exceeded

98% would recommend FMC to others

*Compared to national average of 62%

Source: American Banker/Gallup Consumer Survey

27

Customer Experience

Customer experience champion in

every affiliate and department

Simplified product choices

Standardization of process and

procedures across all affiliates

28

Market Opportunities

In market M&A = opportunity to grow

households

Leverage our high customer

satisfaction

Increased targeted advertising and

promotion

“Local” = perceived value

Customer retention is a key strength

29

43 relationships with commitments to lend

of $20 million or more

Maximum individual commitment of

$33 million

Average commercial lending relationship size is

$394,444

Loans and corresponding relationships are within

Fulton’s geographic market area

Summary of Larger Loans

30

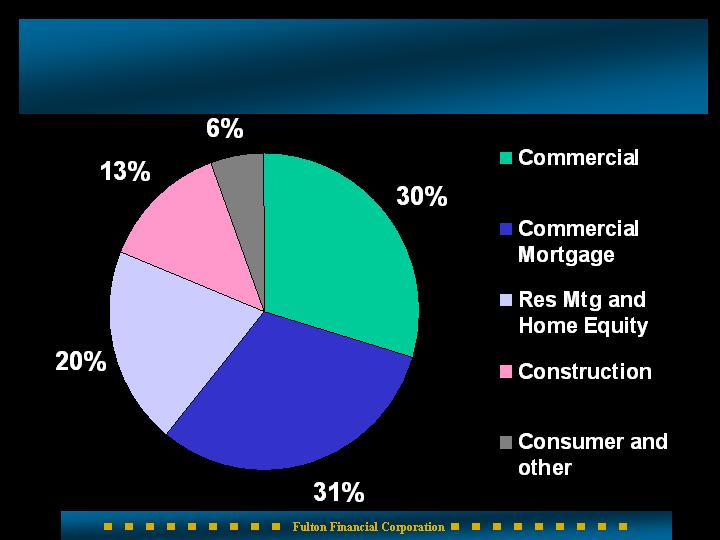

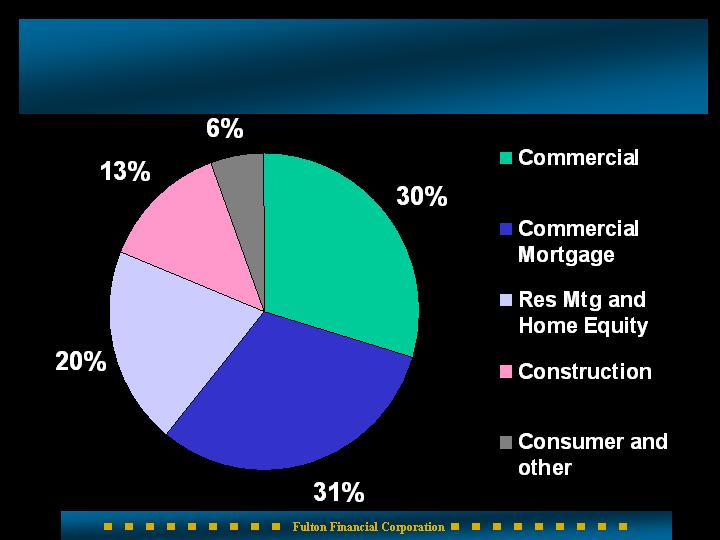

Loan Diversification (6/30/07)

31

Commercial Loan Concentration

By Industry (as of 6/30/07)

32

Industry

%

Construction

28.0

RE - Investor - Owned

22.1

Services

13.5

Manufacturing

7.6

Retail

6.3

Health Care

5.8

Agriculture

4.9

Wholesale

4.2

Other

2.7

Financial Services

2.1

Arts and Entertainment

1.6

Transportation

1.2

100.0

Short-term rating P-1

Long-term rating

Issuer A-2

Lead Bank Deposits A-1

Outlook Stable

Credit Ratings

Moody’s Investor Services

Short-term rating F-1

Long-term rating A

Outlook Stable

Fitch Ratings

Standard & Poors

Credit rating BBB+

Outlook Stable

Dominion Bond Rating Service

Credit rating A

Outlook Stable

33

Quarter Ended June 30, 2007

$39.8 million Net income

(14.7% decrease from 2006)

$ 0.23 Net income per share

(14.8% decrease from 2006)

$ 0.150 Cash dividends per share

(1.7% increase over 2006)

1.08% Return on assets

10.52% Return on equity

19.30% Return on tangible equity

34

Year Ended December 31, 2006

$185.5 million Net income

(11.7% increase over 2005)

$ 1.06 Net income per share

(6.0% increase over 2005)

$ 0.581 Cash dividends per share

(7.6% increase over 2005)

1.30% Return on assets

12.84% Return on equity

23.87% Return on tangible equity

35

Greater Bay Bancorp *

International Bancshares Corporation

Old National Bancorp

South Financial Group, Inc.

Susquehanna Bancshares, Inc.

TCF Financial Corporation

Trustmark Corporation

UMB Financial Corporation

United Bankshares, Inc.

Valley National Bancorp

Whitney Holding Corporation

Wilmington Trust Corporation

*acquired

Peer Group

Associated Banc-Corp

BancorpSouth, Inc.

Bank of Hawaii Corporation

BOK Financial Corporation

Citizens Banking Corporation

City National Corporation

Colonial BancGroup, Inc.

Commerce Bancshares, Inc.

Cullen/Frost Bankers, Inc.

First Citizens BancShares, Inc.

First Midwest Bancorp, Inc.

First Republic Bank*

First Merit Corporation

36

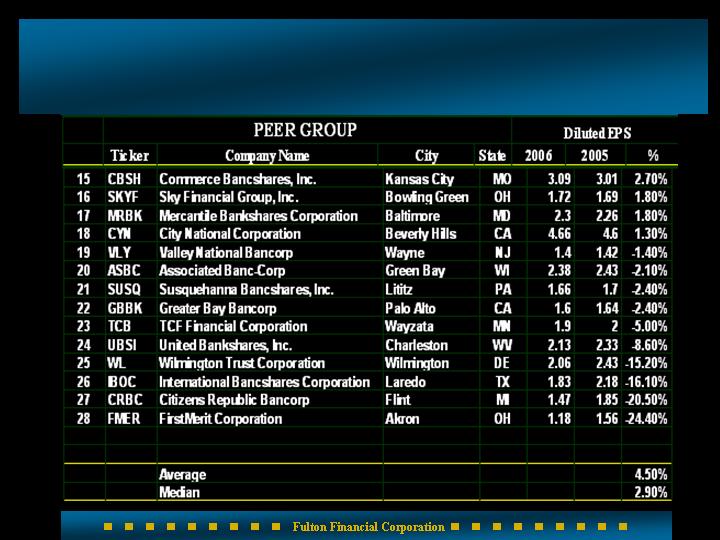

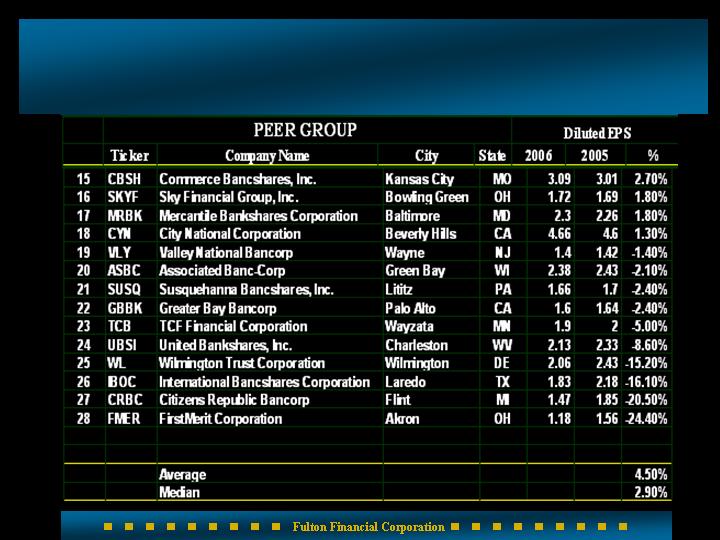

2006 EPS growth - Peer Group

37

EPS Growth (continued)

38

Income Statement Summary

(6/30/07)

39

2007

2006

$

%

Net Interest Income

242,680

$

237,890

$

4,790

$

2%

Loan Loss Provision

(3,660)

(1,880)

(1,780)

95%

Other Income

73,660

68,540

5,120

7%

Securities Gains

2,410

4,070

(1,660)

-41%

Other Expenses

(199,010)

(178,800)

(20,210)

11%

Income Taxes

(35,110)

(39,240)

4,130

-11%

Net Income

80,970

$

90,580

$

(9,610)

$

-11%

Earnings Per Share

$0.46

$0.52

-$0.06

-12%

(dollars in thousands)

Income Statement Summary

(linked quarter)

40

2nd Qtr

1st Qtr

$

%

Net Interest Income

120,910

$

121,780

$

(870)

$

-1%

Loan Loss Provision

(2,700)

(960)

(1,740)

181%

Other Income

36,380

37,290

(910)

-2%

Securities Gains

630

1,780

(1,150)

-65%

Other Expenses

(98,110)

(100,910)

2,800

-3%

Income Taxes

(17,260)

(17,850)

590

-3%

Net Income

39,850

$

41,130

$

(1,280)

$

-3%

Earnings Per Share

$0.23

$0.24

-$0.01

-4%

(dollars in thousands)

Loan Growth

(6/30/07)

41

2007

2006

$

%

(dollars in millions)

Commercial

3,100

$

2,750

$

350

$

13%

Comm'l Mort

3,260

3,020

240

8%

Resid Mort/HE

2,140

2,020

120

6%

Construction

1,390

1,340

50

4%

Cons./Other

610

590

20

3%

Total Loans

10,500

$

9,720

$

780

8%

Average Loan Growth

Linked Quarter

42

2nd Q 07

1st Q 07

$

%

(dollars in millions)

Commercial

3,170

$

3,030

$

140

$

5%

Comm'l Mort

3,290

3,240

50

2%

Resid Mort/HE

2,150

2,140

10

0%

Construction

1,380

1,400

(20)

-1%

Cons./Other

590

600

(10)

-2%

Total Loans

10,580

$

10,410

$

170

2%

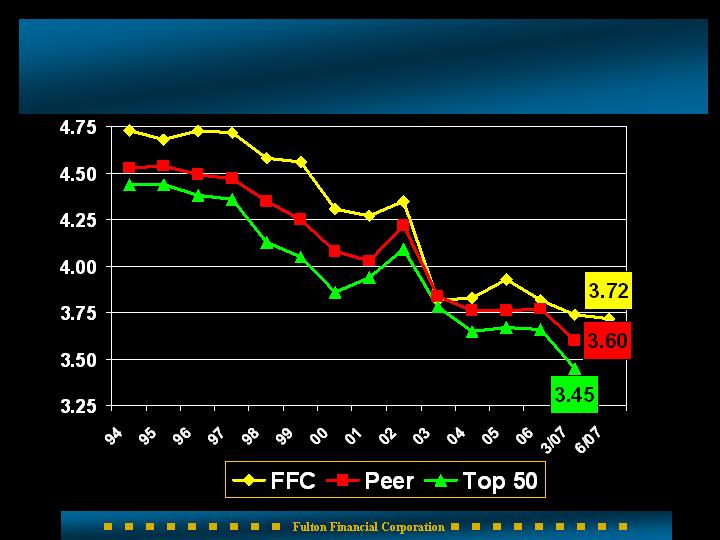

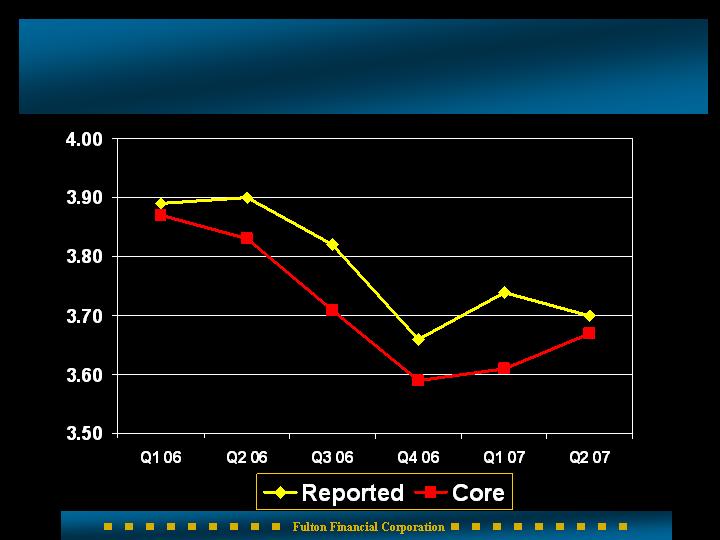

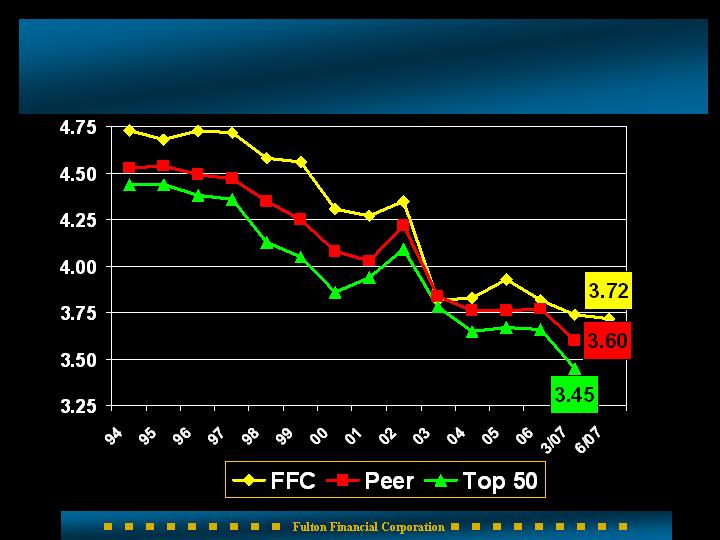

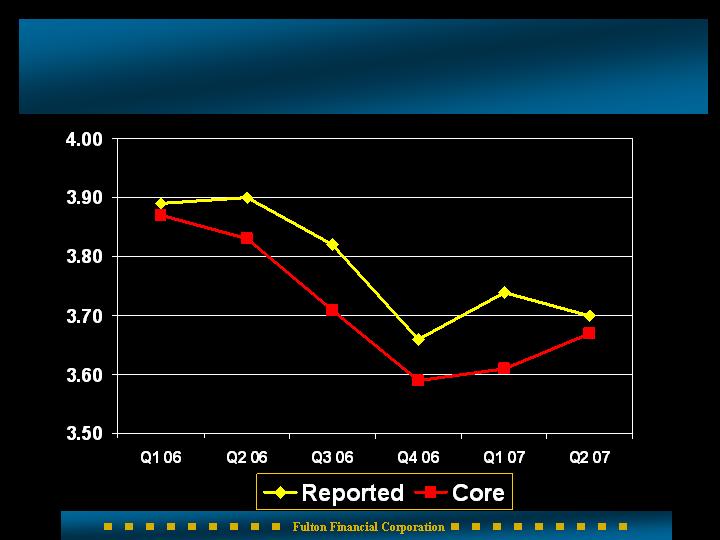

Net Interest Margin

(6/30/07)

43

Net Interest Margin Trend

44

Interest Rate Shocks

(6/30/07)

Rate Change NII Change (Annual) % Change

+300 bp + $ 11.5 million + 2.3%

+200 bp + $ 7.7 million + 1.6%

+100 bp + $ 3.9 million + .8%

- 100 bp - $ 5.4 million - 1.1%

- 200 bp - $ 13.1 million - 2.7%

- 300 bp - $ 22.3 million - 4.5%

6 month cumulative gap – 0.90

45

Investment Portfolio

(06/30/2007)

46

ENDING

MODIFIED

BALANCE

DURATION

CREDIT RATING

(000's)

Mortgage-backed securities

1,279.0

$

2.92

AAA

Municipal bonds

503.6

4.21

AAA

Collateralized mortgage obligations

467.0

3.05

AAA

U.S. Treasuries and agencies

282.1

2.23

AAA

Corporate & trust preferred securities

75.0

6.55

Various

Bank stocks

91.5

NA

Not rated

FHLB stock

92.1

NA

AAA

Other investments

21.5

NA

Unrealized gain - bank stock

(8.8)

Unrealized loss-bonds

(52.7)

Total Investments

2,750.4

$

3.22

Deposit Growth

(6/30/07)

47

2007

2006

$

%

(dollars in millions)

Nonint DDA

1,740

$

1,860

$

(120)

$

-6%

Int DDA

1,670

1,680

(10)

-1%

Savings/MMDA

2,300

2,360

(60)

-3%

CD's

4,490

3,990

500

13%

Cash Mgt

600

490

110

22%

Total Deposits

10,800

$

10,380

$

420

$

4%

Average Deposit Growth

Linked Quarter

48

2nd Q 07

1st Q 07

$

%

(dollars in millions)

Nonint DDA

1,760

$

1,720

$

40

$

2%

Int DDA

1,680

1,660

20

1%

Savings/MMDA

2,300

2,300

-

0%

CD's

4,530

4,460

70

2%

Cash Mgt

630

570

60

11%

Total Deposits

10,900

$

10,710

$

190

$

2%

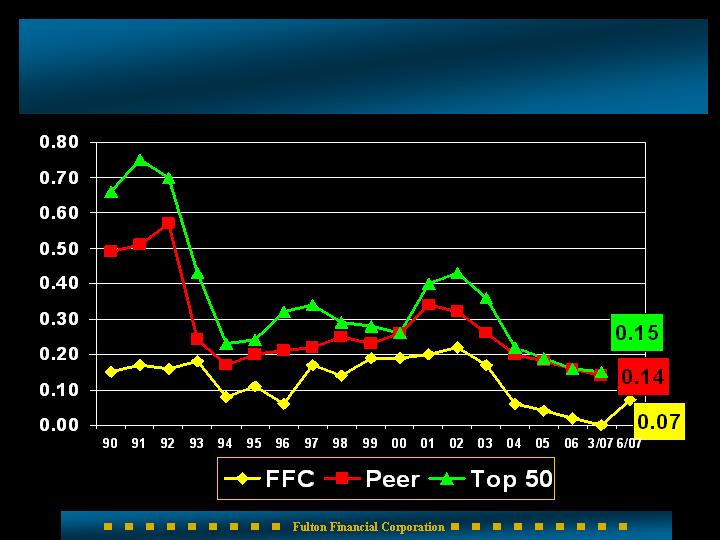

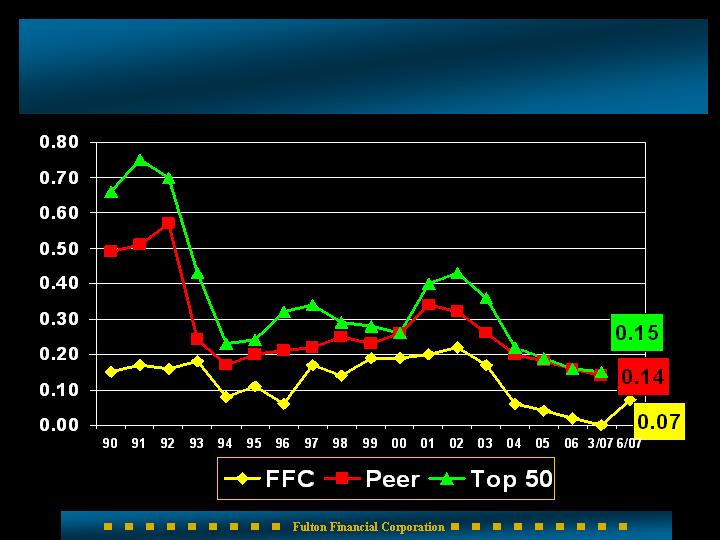

Net Charge-Offs To Loans

(6/30/07)

49

Other Income

(6/30/07)

50

2007

2006

$

%

(dollars in thousands)

Invt Mgt & Trust

20,080

$

19,130

$

950

$

5%

Mort. Sales Gains

9,580

10,060

(480)

-5%

Overdraft & NSF Fees

9,980

9,790

190

2%

Service Charges

6,310

6,660

(350)

-5%

Cash Mgt Fees

5,560

4,870

690

14%

Success Card Fees

4,140

3,620

520

14%

Other

18,010

14,850

3,160

21%

Total

73,660

$

68,980

$

4,680

$

7%

Other Income Detail

Linked Quarter

51

2nd Q 07

1st Q 07

$

%

(dollars in thousands)

Invt Mgt & Trust

10,270

$

9,810

$

460

$

5%

Mort. Sales Gains

4,190

5,390

(1,200)

-22%

Overdraft & NSF Fees

5,210

4,770

440

9%

Service Charges

3,150

3,150

-

0%

Cash Mgt Fees

2,860

2,700

160

6%

Success Card Fees

2,220

1,920

300

16%

Other

8,480

9,540

(1,060)

-11%

Total

36,380

$

37,280

$

(900)

$

-2%

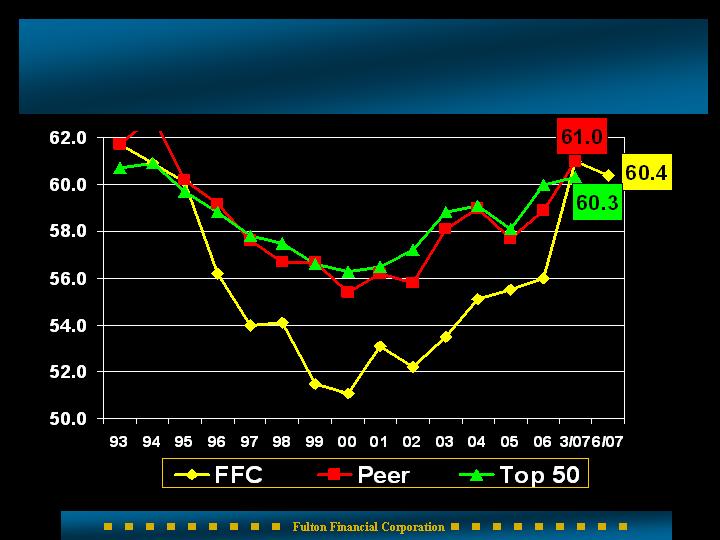

Efficiency Ratio

(6/30/07)

52

Other Expense

(6/30/07)

53

2007

2006

$

%

(dollars in thousands)

Salaries & Benefits

111,850

$

105,230

$

6,620

$

6%

Occupancy & Equip.

27,300

25,120

2,180

9%

DP/Software/Telecom

12,960

12,590

370

3%

Amortization

4,180

3,860

320

8%

Other Expenses

42,720

35,120

7,600

22%

Total

199,010

$

181,920

$

17,090

$

9%

Other Expense Detail

Linked Quarter

54

2nd Q 07

1st Q 07

$

%

(dollars in thousands)

Salaries & Benefits

55,550

$

56,290

$

(740)

$

-1%

Occupancy & Equip.

13,390

13,910

(520)

-4%

DP/Software/Telecom

6,630

6,320

310

5%

Amortization

2,200

1,980

220

11%

Other Expenses

20,340

22,400

(2,060)

-9%

Total

98,110

$

100,900

$

(2,790)

$

-3%

Positive Trends – Core Banking

Strong core deposit growth – DDA

Strong commercial loan growth and

pipeline

Loan yields improving

Improving normalized NIM

55

Fulton Financial Corporation

One Penn Square

Lancaster, PA 17602

www.fult.com

56