34th Annual Shareholders Meeting

April 25, 2008

1

Safe Harbor Statement

Many factors could affect future financial results including, without limitation, acquisition and growth strategies, market

risk, changes or adverse developments in economic, political or regulatory conditions, a continuation or worsening of the

current disruption in credit and other markets, including the lack of or reduced access to, and the abnormal functioning of,

markets for mortgage and other asset-backed securities and for commercial paper and other short-term corporate

borrowings, the effect of competition and interest rates on net interest margin and net interest income, investment strategy

and income growth, investment securities gains, impairment of investment securities, changes in rates of deposit and loan

growth, asset quality and the impact on assets from adverse changes in the economy and in credit and other markets and

resulting effects on credit risk and asset values, balances of risk-sensitive assets to risk-sensitive liabilities, employee

benefits and other expenses, amortization of intangible assets, goodwill impairment, capital and liquidity strategies and

other financial and business matters for future periods.

The following presentation may contain forward-looking statements with respect to our financial condition, results of

operations and business. Forward-looking statements are encouraged by the Private Securities Litigation Reform Act of

1995. When words such as “believes”, “expects”, “anticipates” or similar expressions are used in this presentation, the

Corporation is making forward-looking statements.

Such forward-looking statements reflect the Corporation’s current views and expectations based largely on information

currently available to its management, and on its current expectations, assumptions, plan, estimates, judgments, and

projections about its business and its industry, and they involve inherent risks, contingencies, uncertainties and other

factors. Although the Corporation believes that these forward-looking statements are based on reasonable estimates and

assumptions, the Corporation is unable to provide any assurance that its expectations will, in fact, occur or that its

estimates or assumptions will be correct and actual results could differ materially from those expressed or implied by such

forward-looking statements and such statements are not guarantees of future performance. The Corporation undertakes no

obligation to update or revise any forward-looking statements. Accordingly, investors and others are cautioned not to place

undue reliance on such forward-looking statements.

2

Scott Smith

Chairman, President and CEO

Business Meeting

3

Management Presentation

4

Changes implemented

To reduce the risk

To provide for potential losses

Fulton Mortgage Company named to

oversee all mortgage lending

activities

5

Quarterly cash dividend

Maintaining quarterly cash dividend

15 cents per share

Payable on July 15 to shareholders

of record as of June 20

6

Cyclical business

Poised for

changing

cycles

7

Investors

Growing interest

in bank stocks

Can provide

growth

and income

8

Federal Advisory Committee

9

International Bancshares Corporation

Old National Bancorp

South Financial Group, Inc.

Susquehanna Bancshares, Inc.

TCF Financial Corporation

Trustmark Corporation

UMB Financial Corporation

United Bankshares, Inc.

Valley National Bancorp

Whitney Holding Corporation

Wilmington Trust Corporation

Associated Banc-Corp

BancorpSouth, Inc.

Bank of Hawaii Corporation

BOK Financial Corporation

Citizens Republic Bancorp

City National Corporation

Colonial BancGroup, Inc.

Commerce Bancshares, Inc.

Cullen/Frost Bankers, Inc.

First Citizens BancShares, Inc.

First Midwest Bancorp, Inc.

First Merit Corporation

Peer group

10

Stock price

$14.53 on 3/31/07

$11.22 on 12/31/07

$12.29 on 3/31/08

Up 9.5% from year-end 2007

11

Earnings per share growth

Wilmington Trust

Valley National

Fulton Financial

Susquehanna Bancshares

Peer Median

28.2%

- 4.5%

- 17.0%

- 25.9%

- 3.5%

12

Organic loan growth

2007

2006

$

%

(dollars in millions)

Commercial

3,210

$

2,840

$

370

$

13%

Commercial Mortgage

3,340

3,090

250

8%

Residential Mortgage

760

640

120

19%

Home Equity

1,450

1,430

20

1%

Construction

1,380

1,380

-

0%

Consumer

600

600

-

0%

Total Loans

10,740

$

9,980

$

760

8%

13

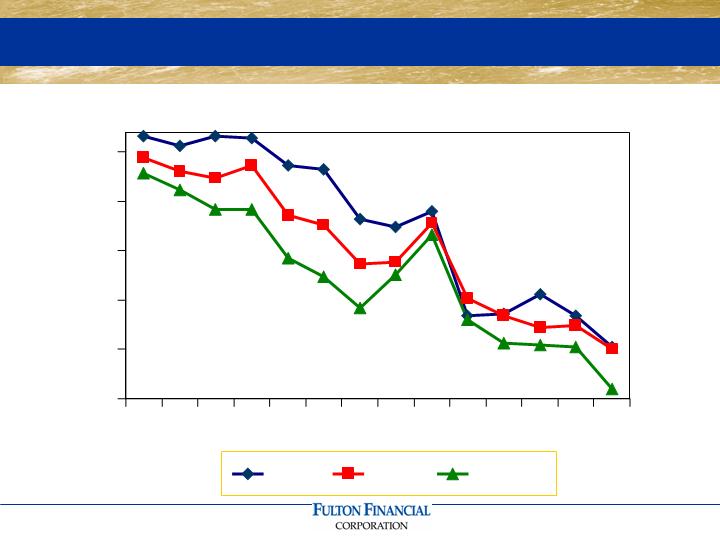

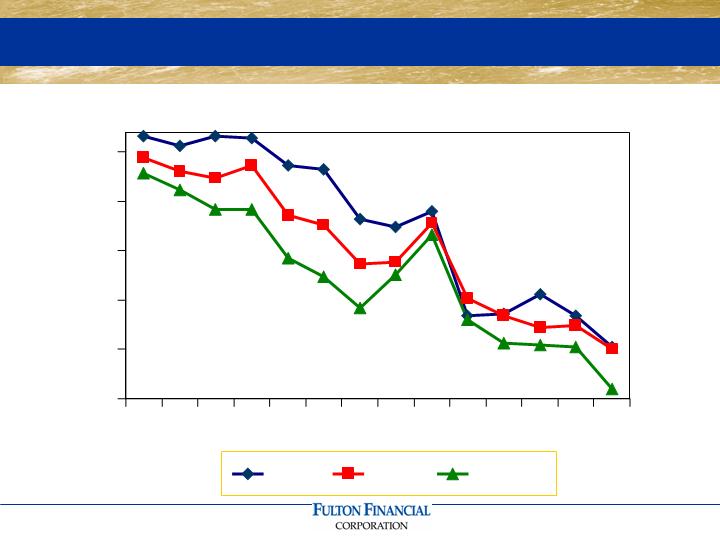

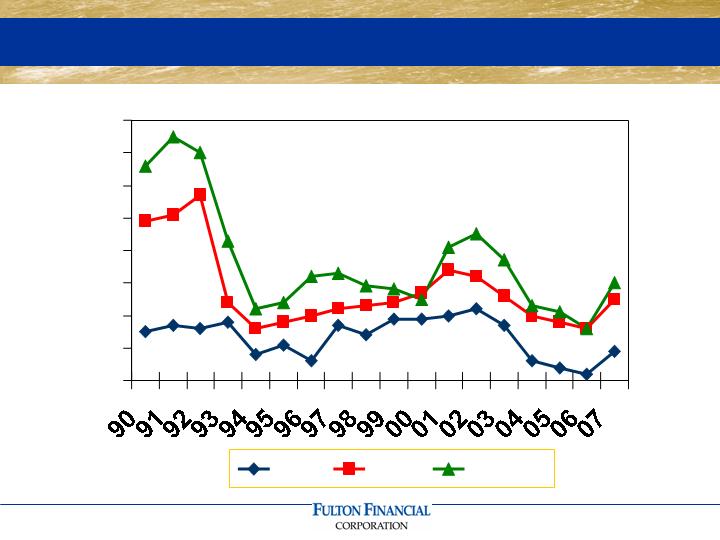

Net interest margin trend

3.66

3.65

3.45

3.40

3.65

3.90

4.15

4.40

4.65

94

95

96

97

98

99

00

01

02

03

04

05

06

07

FFC

Peer

Top 50

14

2007

2006

$

%

(dollars in millions)

Non-interest DDAs

1,710

$

1,830

$

(120)

$

-7%

Interest DDAs

1,700

1,680

20

1%

Savings/Money Market

2,260

2,350

(90)

-4%

Certificates of Deposits

4,550

4,170

380

9%

Cash Management

650

530

120

23%

Total Deposits

10,870

$

10,560

$

310

$

3%

Organic deposit growth

15

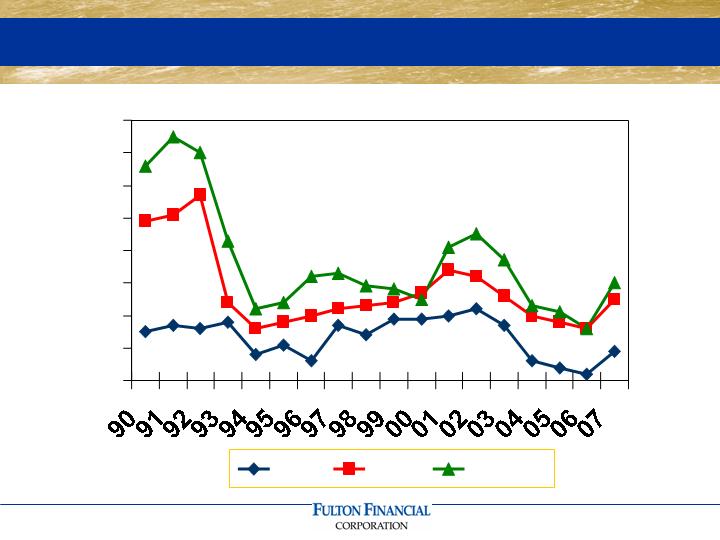

Net charge-offs to loans

0.09

0.25

0.30

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

FFC

Peer

Top 50

16

First quarter 2008

Earned $41.5 million

0.9% increase over 1st quarter 2007

8.7% increase over 4th quarter 2007

24 cents per share

Unchanged from 1st quarter 2007

9.1% increase from 4th quarter 2007

17

Enhanced credit card services

Partnering with Elan Financial Services

FFC affiliate banks continue to sell and

service credit cards

Marketing services from Elan

Selling credit card portfolio of

$85 million

Approximate 2008 pre-tax gain:

$10 million

18

34th Annual Shareholders Meeting

April 25, 2008

19

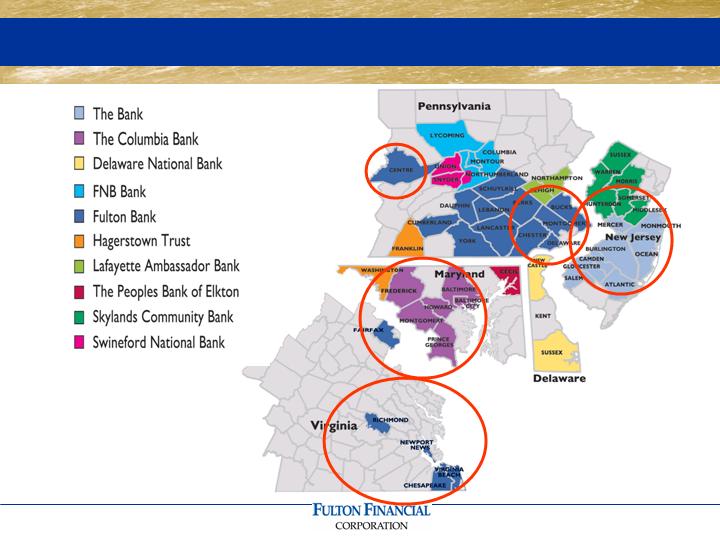

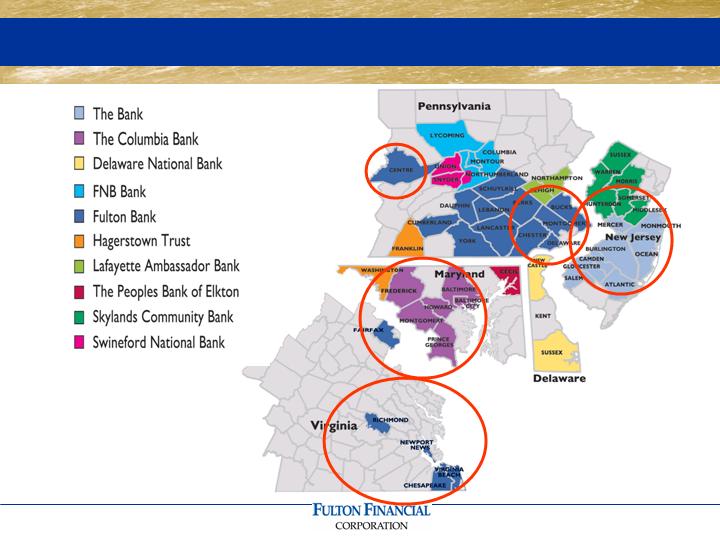

Fulton Financial profile

Asset size: $16 billion

3,900 employees

266 community banking offices

10 community banks and 3 financial

services affiliates in 5 states

Market capitalization:

$2.0 billion

20

Strategic Plan

Superior

Employee Satisfaction

Superior

Customer Experience

Superior

Operating Efficiency

Superior

Financial Results

21

Controlling expenses

Workforce management

Realignment of retirement plan

benefits

22

“Lean” process

23

Analyzing procedures and processes

More nimble

More creative

More flexible

Focus on the

customer

24

Technology

25

New bank websites

26

Automated teller technology

Corporation-wide

training

Information

Technology

support

27

28

Investment platform

Customized

personal

services

Currently

unmatched by

most companies

29

Tax Expertise

Investment

Solutions

Goal

Integration

The Clermont approach: Integrated Wealth Strategies

30

31

Customer service

32

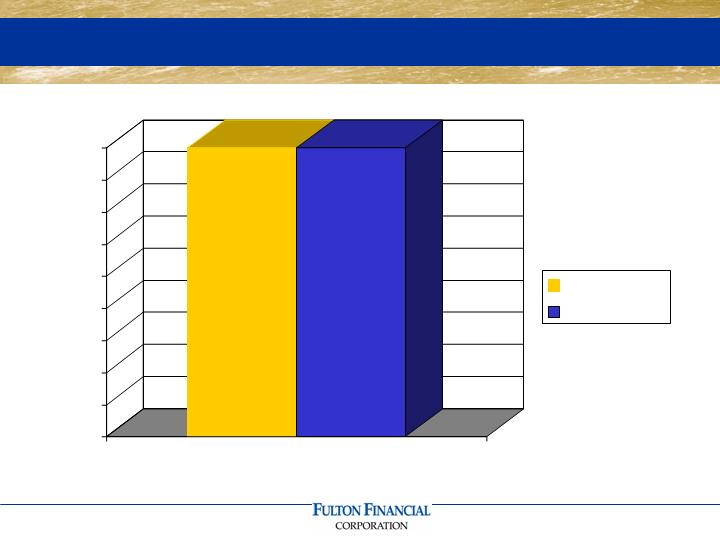

Customer satisfaction surveys

0

10

20

30

40

50

60

70

80

90

Satisfied customers

Retail

Commercial

33

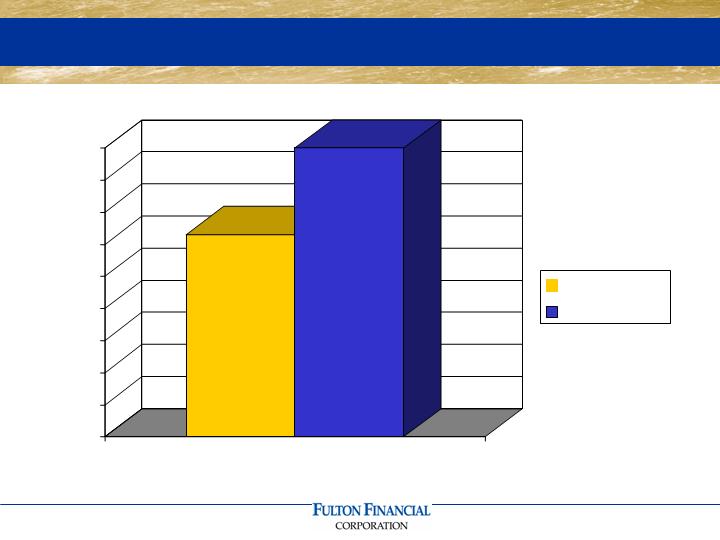

Customer satisfaction surveys

0

10

20

30

40

50

60

70

80

90

Satisfied customers

Other banks

Our banks

Other

banks

FFC

banks

34

Proven success

35

Internal mergers

First Washington State Bank into

The Bank

Somerset Valley Bank into

Skylands Community Bank

Lebanon Valley Farmers Bank into

Fulton Bank

Resource Bank into Fulton Bank

36

Serving a broader audience

Personalized professional banking

+ Thriving geographic markets

+ Areas rich with potential

= Internal/Organic growth for

Fulton Financial

37

Branching focus

38

Since 2005

Opened 24 new branches

12 additional branches planned

Deposits: $406 million (51% core)

Loans: $485 million

39

FFC affiliates in affluent markets*

*Source: Bancology Vol. 24, September 2007

County

National

Ranking

Ranking

in State

Median

HH

Ranking

Affiliate

Hunterdon, NJ

2

1

$95,981

Skylands Bank

Loudoun, VA

3

1

$93,034

Fulton Bank/SD

Fairfax, VA

4

2

$91,851

Fulton Bank/SD

Morris, NJ

6

2

$90,417

Skylands Bank

Somerset, NJ

7

3

$90,411

Skylands Bank

Howard, MD

9

1

$86,370

Columbia Bank

40

*Source: SNL, Median HH Income, 2007 data

Serving PA’s strongest markets*

County

Rank

Projected Population

Change 2007-2012 (%)

Median HH

Income 2007 ($)

Projected HH

Income Change

2007-2012 (%)

Chester, PA

1

9.02

85,956

22.09

Montgomery, PA

2

3.58

79,785

21.29

Bucks, PA

3

4.64

78,883

21.22

Delaware, PA

4

1.20

65,392

19.82

Cumberland, PA

5

5.15

59,921

18.76

Northampton, PA

6

7.77

58,306

18.27

Lancaster, PA

8

4.78

57,258

15.49

York, PA

9

7.43

56,775

15.13

Lehigh, PA

10

5.61

56,725

19.15

Berks, PA

11

5.88

56,332

16.44

Average

5.51

65,533

18.77

Average of all other (58)

2.65

43,673

15.89

41

Funding

New branches

Switch kit/cash incentives

Relationship-based

interest rate incentives

Team Advantage Banking

42

Superior customer experience

Direct mail uses customer segmentation

Leveraging our existing customers to

generate new business

Asking for referrals;

Word-of-mouth

testimonials

43

Chief Deposit Officer

Developed a Deposit Committee

Coordinates all deposit-gathering

activities corporation-wide

44

OptionLine

Home equity

loan

Fixed rate

Floating rate

45

Sharp focus. Broad perspective.

46

Questions

&

Answers

47

34th Annual Shareholders Meeting

April 25, 2008

48