Fulton Financial Corporation

Investor Presentation

September 16, 2008

The following presentation may contain forward-looking statements about

Fulton Financial Corporation’s growth and acquisition strategies, new

products and services, and future financial performance, including earnings

and dividends per share, return on average assets, return on average

equity, efficiency ratio and capital ratio. Forward-looking statements are

encouraged by the Private Securities Litigation Reform Act of 1995.

Such forward-looking information is based upon certain underlying

assumptions, risks and uncertainties. Because of the possibility of change

in the underlying assumptions, actual results could differ materially from

these forward-looking statements. Risks and uncertainties that may affect

future results include: pricing pressures on loans and deposits, actions of

bank and non-bank competitors, changes in local and national economic

conditions, changes in regulatory requirements, actions of the Federal

Reserve Board, the Corporation’s success in merger and acquisition

integration, and customers’ acceptance of the Corporation’s products and

services.

Forward-Looking Statement

Presentation Outline

Corporate Overview

Growth Initiatives

Quarterly Comments

Challenges / Responses

Loan Summary

Financial Performance

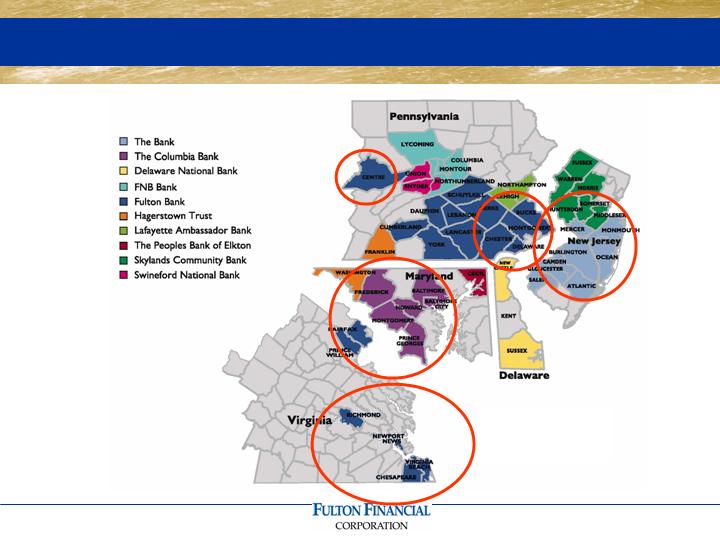

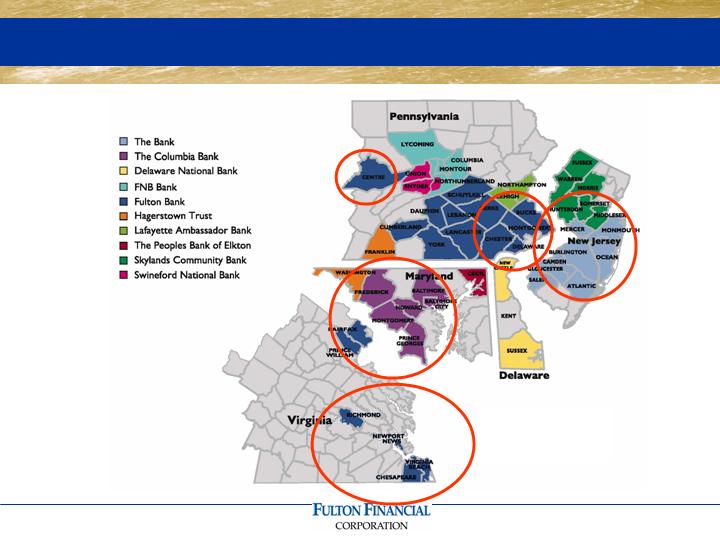

Fulton Financial Profile

Mid-Atlantic regional financial holding company

A family of 10 community banks

Fulton Financial Advisors

Fulton Mortgage Company

Serving strong /stable markets in 5 states

267 community banking offices

Asset size: $16 billion

Market capitalization: $ 2 billion

Book value (6/30/08) : $9.15

Tangible book value (6/30/08): $5.41

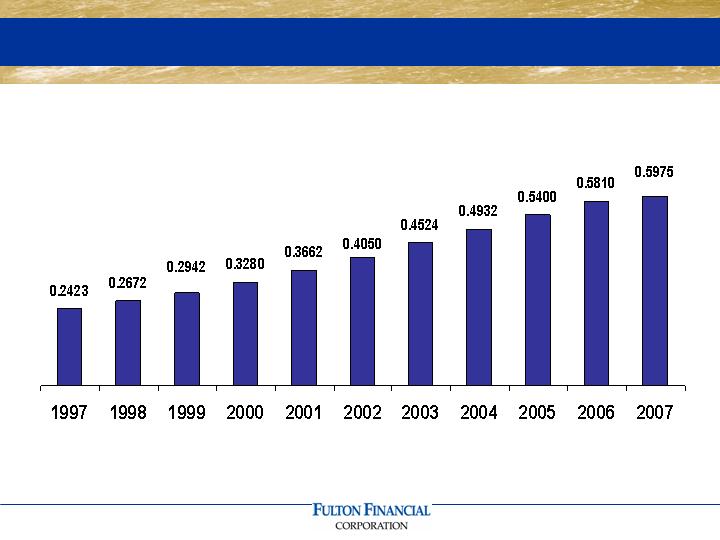

34 consecutive years of dividend increases

(1973-2007)

9.8% compounded annual growth rate in

dividends per share (1982 – 2007)

7.3% compounded annual growth rate in

earnings per share (1982 – 2007)

25 bank acquisitions since 1982

Created a valuable geographic franchise

Accomplishments

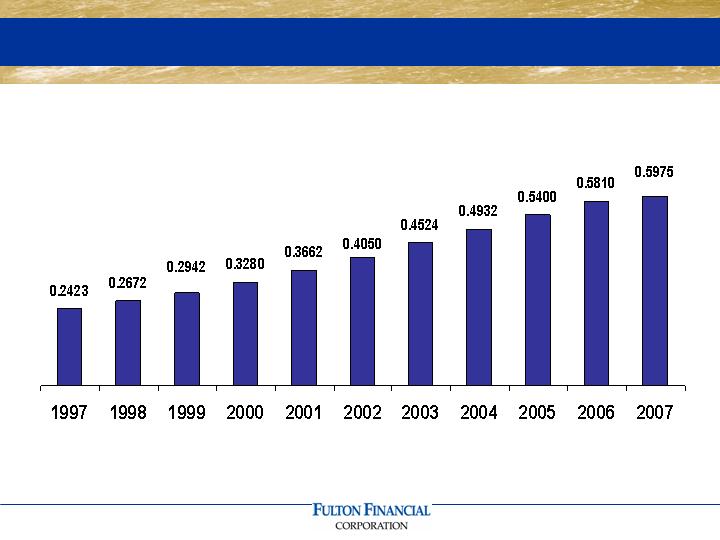

10-year Dividend History

Quarterly Cash Dividend

15 cents

Dividend yield:

approximately 5%

Capital (as of 06/30/08)

Total Capital (GAAP): $1.59 billion

Total Regulatory Capital: $1.46 billion

Regulatory Capital Ratios:

Total Risk-Based Capital 11.70%

Tier 1 Risk-Based Capital 9.10%

Leverage Capital 7.40%

Strategic Plan

Superior

Employee Satisfaction

Superior

Customer Experience

Superior

Operating Efficiency

Superior

Financial Results

Key organic growth markets

Q2/08 Quarterly Comments

Reported EPS of $0.15

Impact of three significant events:

- Sale of credit card portfolio

- Bank stock portfolio write-down

- Auction rate certificates

Excluding above events: EPS of $0.24

Strong capital position

Q3/08 cash dividend declared at current

level

Q2/08 Quarterly Comments

Solid results from core banking operations

Net interest income growth

Expansion of net interest margin

Good loan growth

New loan pipeline stable

Strong growth in select non-interest

income categories

Revenue generation and cost-cutting

initiatives producing meaningful results

Q2/08 Quarterly Comments

Asset quality deterioration

Housing-related businesses continue

to struggle

Little evidence that economic

conditions are improving

Sluggish deposit growth

Bank stock write-down

Two Greatest Challenges

Retail Funding

Credit Quality

Retail Funding - Action Steps

Continued denovo expansion in existing

and new markets

DDA Switch Kit w/cash or gift incentives

Targeted direct mail

Superior customer experience

Relationship banking incentives

Team Advantage Banking (small business)

Appointed Chief Deposit Officer

Credit Quality – Action Steps

Internal emphasis on loan review /

workout

Watching all loan portfolios very

carefully, real estate in particular

Early customer intervention /

remediation as problems arise

New loans underwritten to traditional

conservative standards

Superior Customer Satisfaction

*Retail:

90% extremely/very satisfied

Commercial:

90% extremely/very satisfied

*Compared to national average of 63%

Source: American Banker/Gallup Consumer Survey

46 relationships with commitments to lend

of $20 million or more

Maximum individual commitment of

$33 million

Average commercial lending relationship size is

$417,538

Loans and corresponding relationships are within

Fulton’s geographic market area

Summary of Larger Loans

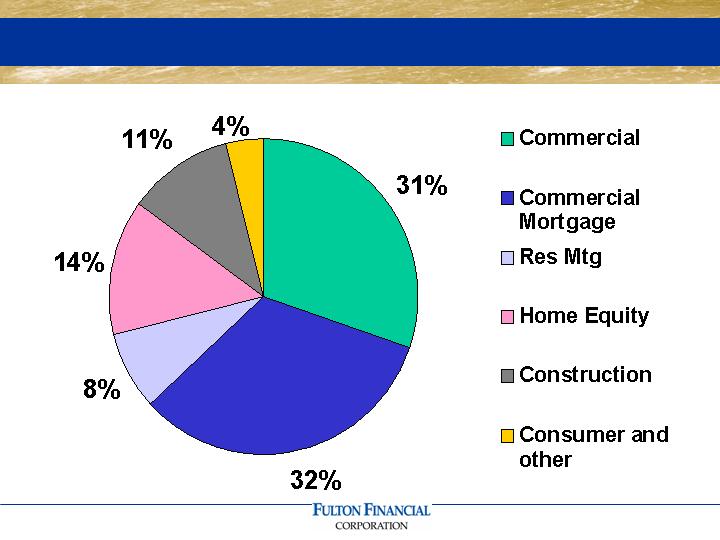

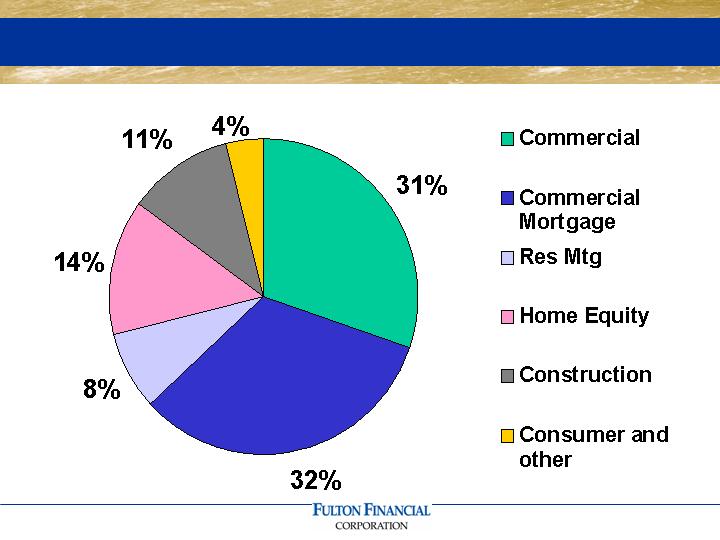

Loan Diversification (as of 06/30/08)

Commercial Loan Concentration By Industry (as of

06/30/08)

Industry

%

Construction

25.9

RE - Investor - Owned

23.6

Services

14.2

Manufacturing

7.0

Retail

6.1

Health Care

5.4

Agriculture

5.0

Wholesale

4.5

Other

3.1

Financial Services

2.0

Arts and Entertainment

2.0

Transportation

1.2

100.0

Long-term rating

Issuer A-2

Lead Bank Deposits A-1

Outlook Negative

Moody’s Investor Services

Short-term rating F-1

Long-term rating A-

Outlook Stable

Fitch Ratings

Dominion Bond Rating Service

Credit rating A

Outlook Negative

Credit Ratings

Financial Performance

Quarter Ended June 30, 2008

$25.7 million Net income

$ 0.15 Net income per share

$ 0.15 Cash dividends per share

0.85% Return on assets

8.40% Return on equity

14.65% Return on tangible equity

International Bancshares Corporation

Old National Bancorp

South Financial Group, Inc.

Susquehanna Bancshares, Inc.

TCF Financial Corporation

Trustmark Corporation

UMB Financial Corporation

United Bankshares, Inc.

Valley National Bancorp

Whitney Holding Corporation

Wilmington Trust Corporation

Associated Banc-Corp

BancorpSouth, Inc.

Bank of Hawaii Corporation

BOK Financial Corporation

Citizens Republic Bancorp

City National Corporation

Colonial BancGroup, Inc.

Commerce Bancshares, Inc.

Cullen/Frost Bankers, Inc.

First Citizens BancShares, Inc.

First Midwest Bancorp, Inc.

First Merit Corporation

Peer Group

Income Statement Summary

(Six Months Ended June 30 th)

2008

2007

$

%

(dollars in thousands)

Net Interest Income

257,790

$

242,680

$

15,110

$

6%

Loan Loss Provision

(27,930)

(3,660)

(24,270)

n/m

Other Income

76,320

73,660

2,660

4%

Credit Card Sale Gain

13,910

-

13,910

n/m

Securities Gains

(20,400)

2,410

(22,810)

n/m

Other Expenses

(206,390)

(199,010)

(7,380)

4%

Income Taxes

(26,130)

(35,110)

8,980

-26%

Net Income

67,170

$

80,970

$

(13,800)

$

-17%

Income Statement Summary

(Linked Quarter)

2nd Q 08

1st Q 08

$

%

(dollars in thousands)

Net Interest Income

131,890

$

125,900

$

5,990

$

5%

Loan Loss Provision

(16,710)

(11,220)

(5,490)

n/m

Other Income

39,890

36,430

3,460

9%

Credit Card Sale Gain

13,910

-

13,910

n/m

Securities Gains

(21,650)

1,250

(22,900)

n/m

Other Expenses

(109,740)

(96,660)

(13,080)

14%

Income Taxes

(11,910)

(14,200)

2,290

-16%

Net Income

25,680

$

41,500

$

(15,820)

$

-38%

Average Loans

(Six Months Ended June 30th)

2008

2007

$

%

(dollars in millions)

Commercial

3,490

$

3,100

$

390

$

13%

Comm'l Mort

3,620

3,260

360

11%

Resid Mort

880

710

170

24%

Home Equity

1,550

1,440

110

8%

Construction

1,310

1,390

(80)

-6%

Cons./Other

510

600

(90)

-15%

Total Loans

11,360

$

10,500

$

860

8%

Average Loans

(Linked Quarter)

2nd Q 08

1st Q 08

$

%

(dollars in millions)

Commercial

3,510

$

3,470

$

40

$

1%

Comm'l Mort

3,700

3,550

150

4%

Resid Mort

890

860

30

3%

Home Equity

1,570

1,530

40

3%

Construction

1,290

1,330

(40)

-3%

Cons./Other

460

560

(100)

-18%

Total Loans

11,420

$

11,300

$

120

1%

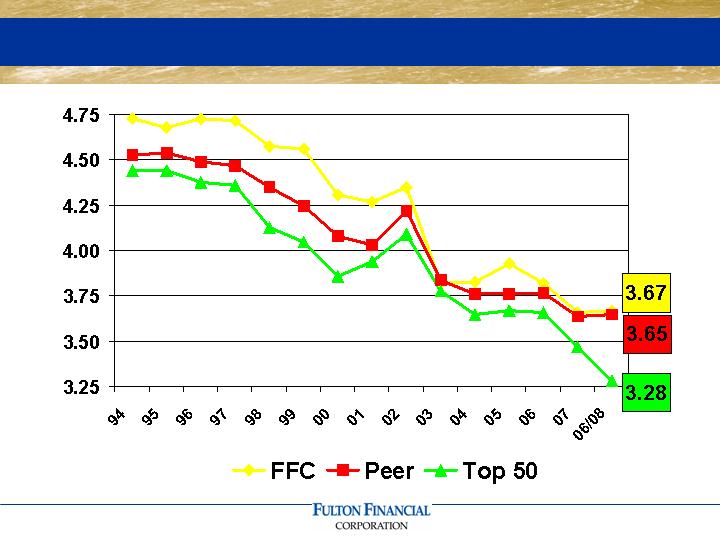

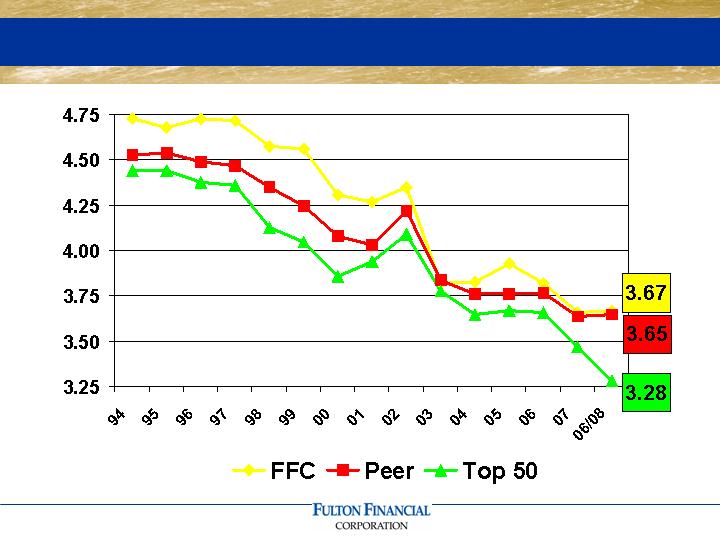

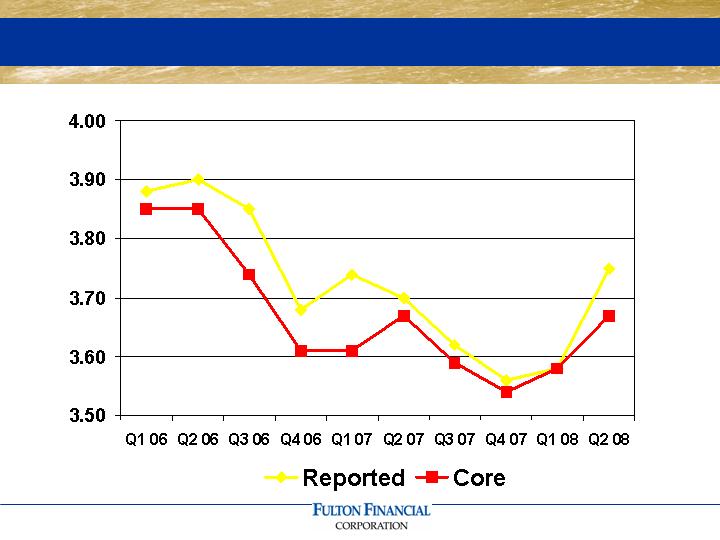

Net Interest Margin

(as of 06/30/08)

Net Interest Margin Trend

6 month cumulative gap – 0.97

Interest Rate Shocks

(as of 06/30/08)

Rate Change NII Change (Annual) % Change

+300 bp + $ 12.1 million + 2.3%

+200 bp + $ 9.4 million + 1.8%

+100 bp + $ 5.4 million + 1.0%

- 100 bp - $ 6.0 million - 1.1%

- 200 bp - $ 14.3 million - 2.7%

Investment Portfolio

(as of 06/30/08)

ENDING

MODIFIED

BALANCE

DURATION

CREDIT RATING

(in millions)

Mortgage-backed securities

1,238.4

$

3.16

AAA

Municipal bonds

511.3

4.28

AAA

Collateralized mortgage obligations

402.1

3.73

AAA

U.S. Treasuries and agencies

98.0

2.34

AAA

Corporate & trust preferred securities

177.9

9.30

Various

Auction rate securities

125.1

5.71

AA- AAA

Bank stocks

62.3

NA

Not rated

FHLB stock

104.8

NA

AAA

Other investments*

21.1

NA

Unrealized gain - bank stock

(9.0)

Unrealized loss-bonds

(24.9)

Total Investments

2,706.9

$

3.98

*Includes $324,900 in Freddie Mac preferred securities. The Corporation holds no other common or preferred

equity shares in Fannie Mae or Freddie Mac.

Average Deposits

(Six Months Ended June 30th)

2008

2007

$

%

(dollars in millions)

Nonint DDA

1,640

$

1,740

$

(100)

$

-6%

Int DDA

1,700

1,670

30

2%

Savings/MMDA

2,170

2,300

(130)

-6%

CD's

4,430

4,490

(60)

-1%

Cash Mgt

700

600

100

17%

Total Deposits

10,640

$

10,800

$

(160)

$

-1%

Average Deposits

Linked Quarter

2nd Q 08

1st Q 08

$

%

(dollars in millions)

Nonint DDA

1,660

$

1,620

$

40

$

2%

Int DDA

1,710

1,690

20

1%

Savings/MMDA

2,210

2,140

70

3%

CD's

4,360

4,510

(150)

-3%

Cash Mgt

690

700

(10)

-1%

Total Deposits

10,630

$

10,660

$

(30)

$

0%

Net Charge-Offs To Loans

(as of 06/30/08)

Other Income

(Six Months Ended June 30th)

2008

2007

$

%

(dollars in thousands)

Invt Mgt & Trust

17,150

$

20,080

$

(2,930)

$

-15%

Overdraft & NSF Fees

16,330

9,980

6,350

64%

Cash Mgt Fees

6,560

5,560

1,000

18%

Service Charges

6,390

6,310

80

1%

Mort. Sales Gains

4,980

9,580

(4,600)

-48%

Success Card Fees

4,820

4,140

680

16%

Merchant Fees

3,850

3,440

410

12%

Foreign Currency

3,320

1,840

1,480

80%

Letters of Credit

2,710

2,640

70

3%

Life Insurance (COLI)

1,760

1,960

(200)

-10%

ATM fees

1,410

1,480

(70)

-5%

Other Income

7,040

6,650

390

6%

Total

76,320

$

73,660

$

2,660

$

4%

Other Income

Linked Quarter

2nd Q 08

1st Q 08

$

%

(dollars in thousands)

Overdraft & NSF Fees

8,640

$

7,690

$

950

$

12%

Invt Mgt & Trust

8,390

8,760

(370)

-4%

Service Charges

3,350

3,040

310

10%

Cash Mgt Fees

3,330

3,230

100

3%

Mort. Sales Gains

2,670

2,310

360

16%

Success Card Fees

2,550

2,260

290

13%

Merchant Fees

1,900

1,950

(50)

-3%

Foreign Currency

1,750

1,570

180

11%

Letters of Credit

1,450

1,260

190

15%

Life Insurance (COLI)

980

780

200

26%

ATM fees

730

680

50

7%

Other Income

4,150

2,900

1,250

43%

Total

39,890

$

36,430

$

3,460

$

9%

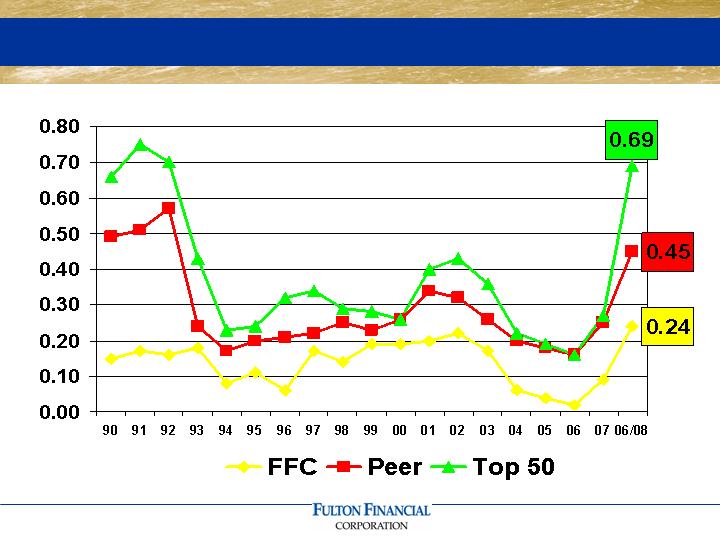

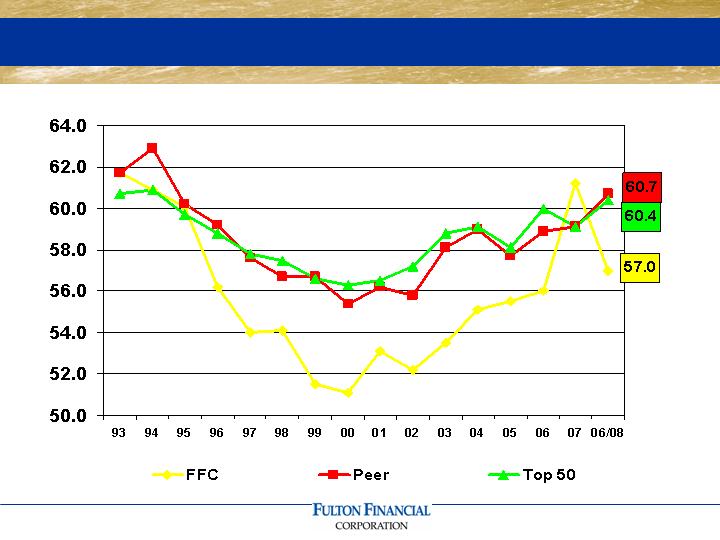

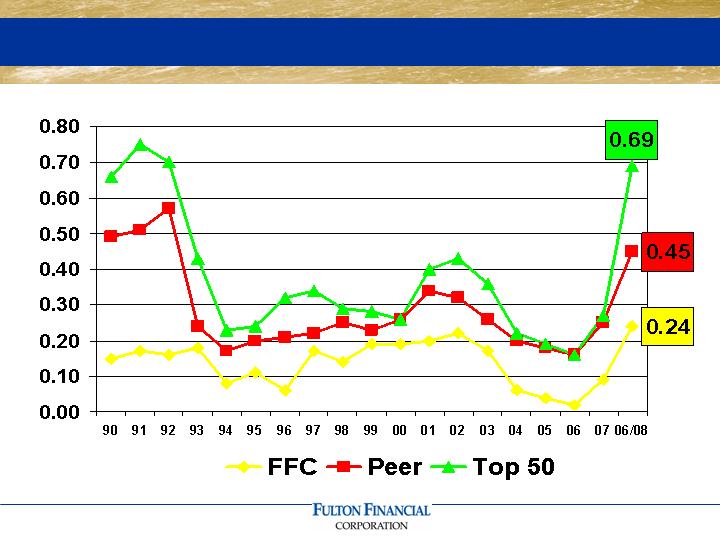

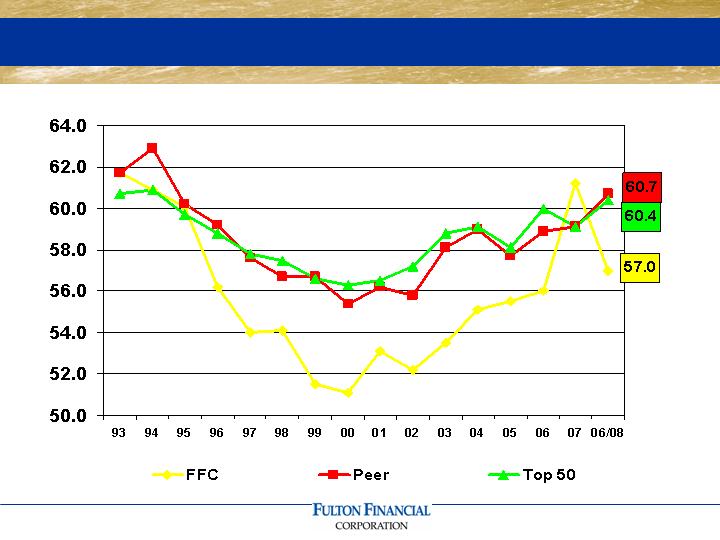

Efficiency Ratio

(as of 06/30/08)

Other Expense

(Six Months Ended June 30st)

2008

2007

$

%

(dollars in thousands)

Salaries & Benefits

109,480

$

111,850

$

(2,370)

$

-2%

Occupancy & Equip.

27,610

27,300

310

1%

Operating Risk Loss

15,630

10,120

5,510

54%

Data Proc. & Software

9,140

8,790

350

4%

Advertising

6,420

5,400

1,020

19%

Supplies & Postage

5,800

5,670

130

2%

Legal & Audit

4,140

2,580

1,560

60%

Telecommunications

3,960

4,170

(210)

-5%

Outside Services

3,960

3,010

950

32%

Amortization

3,660

4,180

(520)

-12%

Travel & Entertain.

2,990

3,120

(130)

-4%

State Tax

1,620

2,960

(1,340)

-45%

Other Expenses

11,980

9,860

2,120

22%

Total

206,390

$

199,010

$

7,380

$

4%

Other Expense

Linked Quarter

2nd Q 08

1st Q 08

$

%

(dollars in thousands)

Salaries & Benefits

54,280

$

55,200

$

(920)

$

-2%

Operating Risk Loss

14,390

1,240

13,150

n/m

Occupancy & Equip.

13,640

13,970

(330)

-2%

Data Proc. & Software

4,480

4,660

(180)

-4%

Advertising

3,520

2,910

610

21%

Supplies & Postage

2,980

2,810

170

6%

Outside Services

2,150

1,810

340

19%

Telecommunications

1,990

1,970

20

1%

Amortization

1,800

1,860

(60)

-3%

Legal & Audit

1,790

2,350

(560)

-24%

Travel & Entertain.

1,560

1,430

130

9%

State Tax

480

1,140

(660)

-58%

Other Expenses

6,680

5,310

1,370

26%

Total

109,740

$

96,660

$

13,080

$

14%

Fulton Financial Corporation

One Penn Square

Lancaster, PA 17602

www.fult.com