Annual Shareholders Meeting

April 29, 2009

Safe Harbor statement

The following presentation may contain forward-looking statements with respect to our financial condition, results of operations and business. Forward-looking statements are encouraged by the Private Securities Litigation Reform Act of 1995. When words such as “believes”, “expects”, “anticipates” or similar expressions are used in this presentation, the Corporation is making forward-looking statements.

The following presentation may contain forward-looking statements with respect to our financial condition, results of

operations and business. Forward-looking statements are encouraged by the Private Securities Litigation Reform Act

of 1995. When words such as “believes”, “expects”, “anticipates” or similar expressions are used in this

presentation, the Corporation is making forward-looking statements.

Such forward-looking statements reflect the Corporation’s current views and expectations based largely on

information currently available to its management, and on its current expectations, assumptions, plan, estimates,

judgments, and projections about its business and its industry, and they involve inherent risks, contingencies,

uncertainties and other factors. Although the Corporation believes that these forward-looking statements are based

on reasonable estimates and assumptions, the Corporation is unable to provide any assurance that its expectations

will, in fact, occur or that its estimates or assumptions will be correct and actual results could differ materially from

those expressed or implied by such forward-looking statements and such statements are not guarantees of future

performance. The Corporation undertakes no obligation to update or revise any forward-looking statements.

Accordingly, investors and others are cautioned not to place undue reliance on such forward-looking statements.

Many factors could affect future financial results including, without limitation, acquisition and growth strategies,

market risk, changes or adverse developments in economic, political or regulatory conditions, a continuation or

worsening of the current disruption in credit and other markets, including the lack of or reduced access to, and the

abnormal functioning of, markets for mortgage and other asset-backed securities and for commercial paper and

other short-term corporate borrowings, the effect of competition and interest rates on net interest margin and net

interest income, investment strategy and income growth, investment securities gains, impairment of investment

securities, changes in rates of deposit and loan growth, asset quality and the impact on assets from adverse

changes in the economy and in credit and other markets and resulting effects on credit risk and asset values,

balances of risk-sensitive assets to risk-sensitive liabilities, employee benefits and other expenses, amortization of

intangible assets, goodwill impairment, capital and liquidity strategies and other financial and business matters for

future periods.

Today’s meeting

Tape recorders and cameras are not permitted in

the meeting.

The display of placards and signs is prohibited.

Please be considerate of others -- silence or turn

off your cell phone during the meeting.

Any questions and comments should be directed

to the chairperson of the meeting during the

Question and Answer period. Please remember to

state your name prior to asking your question.

Annual Shareholders Meeting

April 29, 2009

Scott Smith

Chairman and CEO

Welcome and Opening Remarks

Today’s agenda

Business Meeting

Proposals:

Election of directors

Approval of management compensation

Ratification of appointment of independent auditor

Introductions

Results of Voting

Conclusion of Business Meeting

Management Presentation

Questions and Answers

Board of Directors

Jeffrey G. Albertson,Esq.

John M. Bond, Jr.

Donald M. Bowman, Jr.

Dana A. Chryst

Craig A. Dally, Esq.

Patrick J. Freer

Rufus A. Fulton, Jr.

George W. Hodges

Carolyn R. Holleran

Willem Kooyker

Donald W. Lesher, Jr.

Abraham S. Opatut

John O. Shirk, Esq.

Gary A. Stewart

Phil Wenger

Senior Management

Charlie Nugent

Jim Shreiner

Craig Hill

Affiliate CEOs

Jill Carson

Lou Giustini

Dick Grafmyre

Dave Hanson

Steve Miller

Bob Palsgrove

Craig Roda

Bob Rupel

John Scaldara

Angela Snyder

Randy Taylor

Mike Wimer

Report of Judge of Election

Annual Shareholders Meeting

April 29, 2009

Scott Smith

Chairman and CEO

Management Presentation

Factors affecting our 2008 performance

Mark-to-market write-downs in our

investment portfolio

Goodwill write-off

Increased loan losses

Continued global and regional

economic issues

Reasons for decline

Unanticipated severity and length of

the economic crisis

Investors moved away from bank

stocks

Industry- and sector-oriented

challenges

Protecting the balance sheet

Set aside reserves to cover expected

losses

Participated in Capital Purchase

Program

Reduced quarterly cash dividend

Our response to reduce expenses

Reduced workforce

Centralized non-customer contact areas

No payments in variable compensation plan

Froze merit pay increases for 12 months

Reduced retirement plan benefits

Limited discretionary spending

Lean process improvements –

$2 million in savings

Deferred opening some new branches

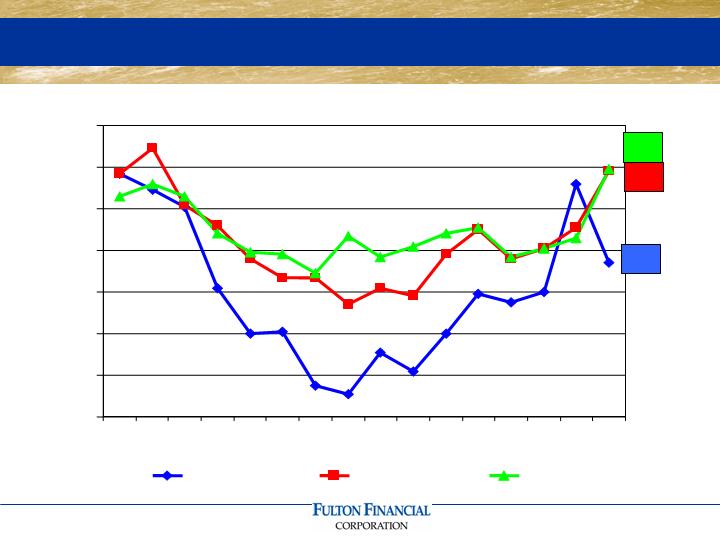

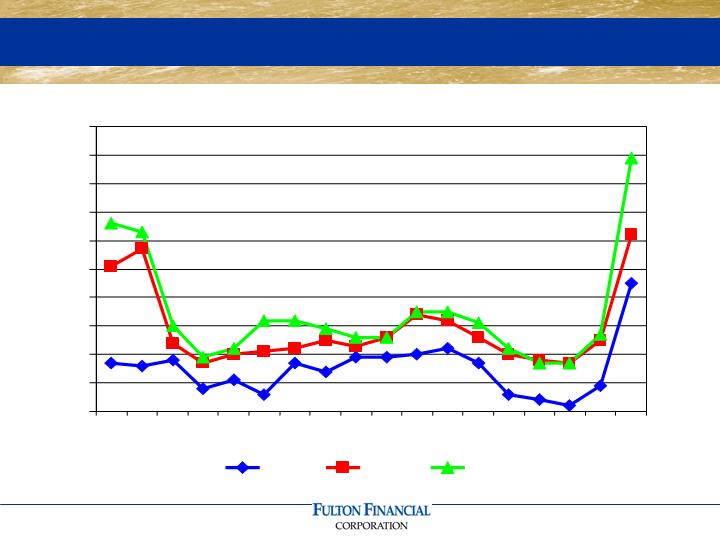

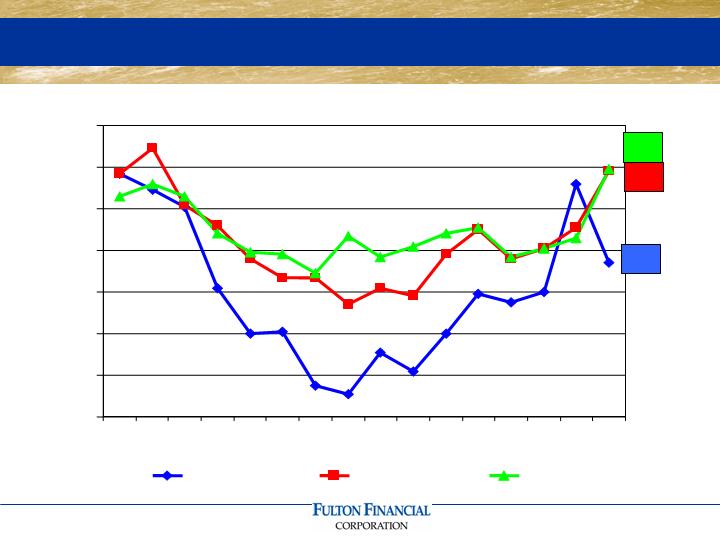

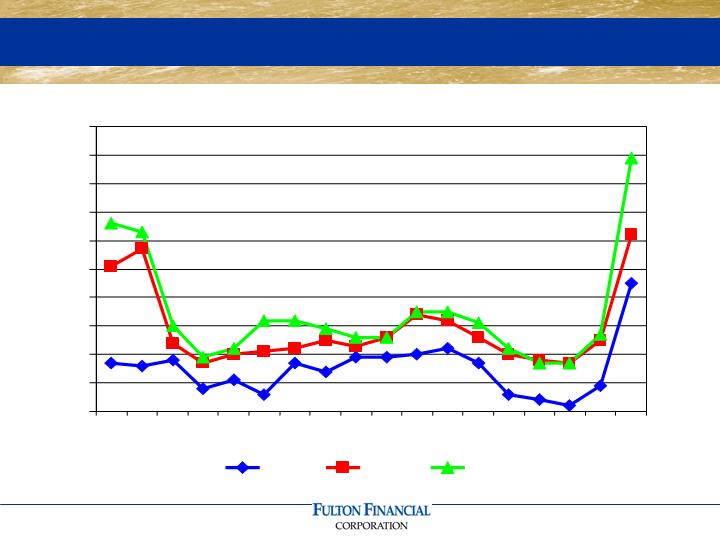

Efficiency ratio

57.4

61.8

61.9

50.0

52.0

54.0

56.0

58.0

60.0

62.0

64.0

93

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

FFC

Peer

Top 50

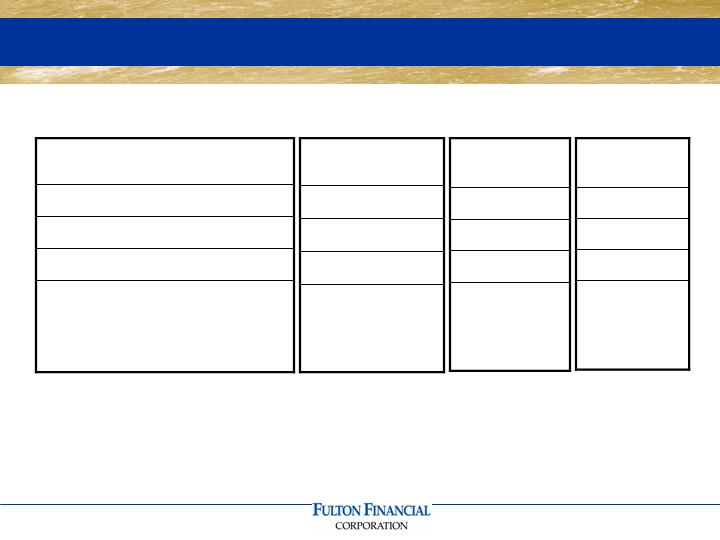

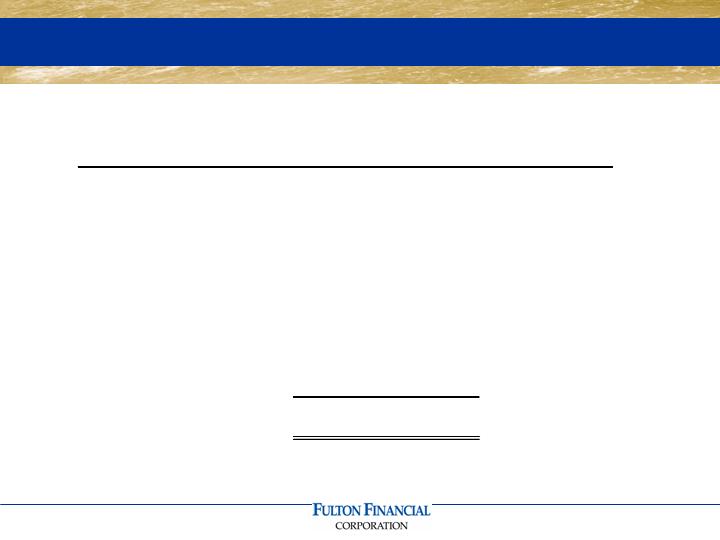

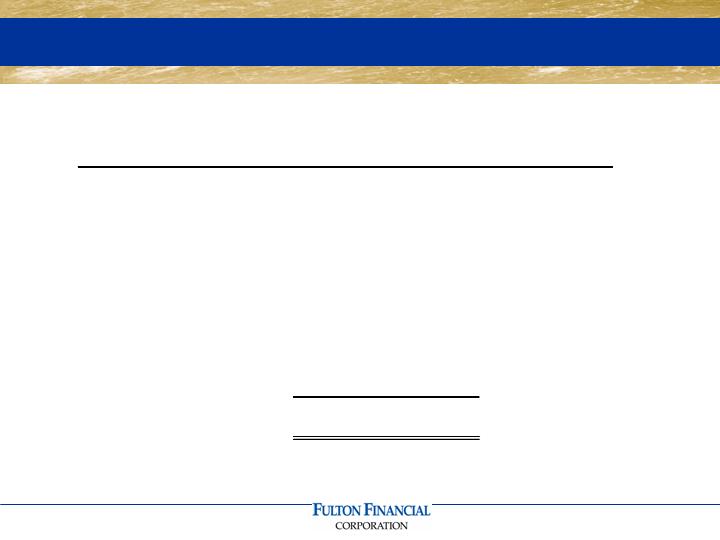

Capital

5.97%

9.57%

11.46%

14.25%

FFC with

Cap. Purch.

Tangible Common Equity

Leverage Capital

Tier 1 Risk-Based Capital

Total Risk-Based Capital

Ratio:

Guideline:

3%

5.00%

6.00%

10.00%

Regulatory Well

Capitalized

5.97%

7.16%

8.57%

11.36%

FFC without

Cap. Purch.

Capital Purchase Program

Ensure FFC could remain viable

Help the U.S. Treasury stabilize the

financial system and increase lending

Created to provide confidence in our

banking system

$376.5 million investment in Fulton

Financial Corporation will be repaid

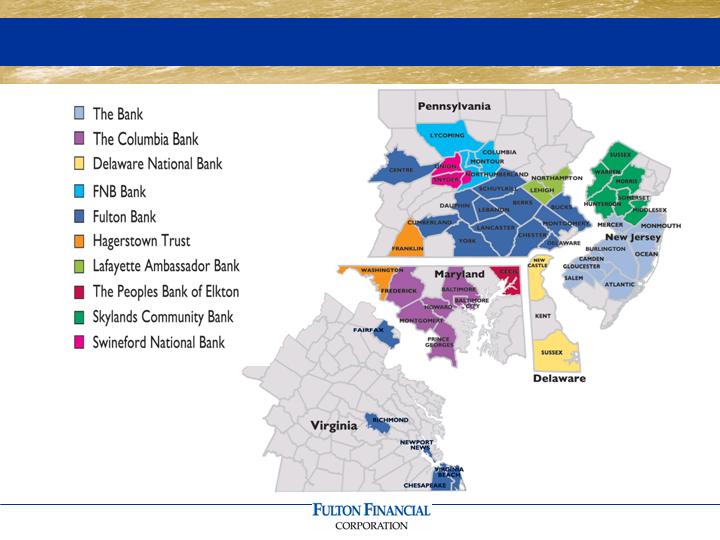

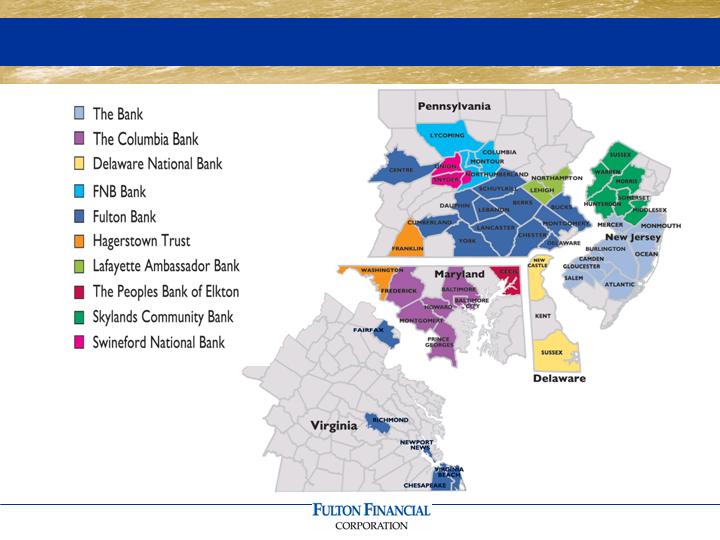

Fulton Financial Corporation

Family of community banks

Locally managed

Trusted employees

Local decision-making

Focused on the present, but also on

the future

Superior customer experience

Care, Listen, Understand and Deliver

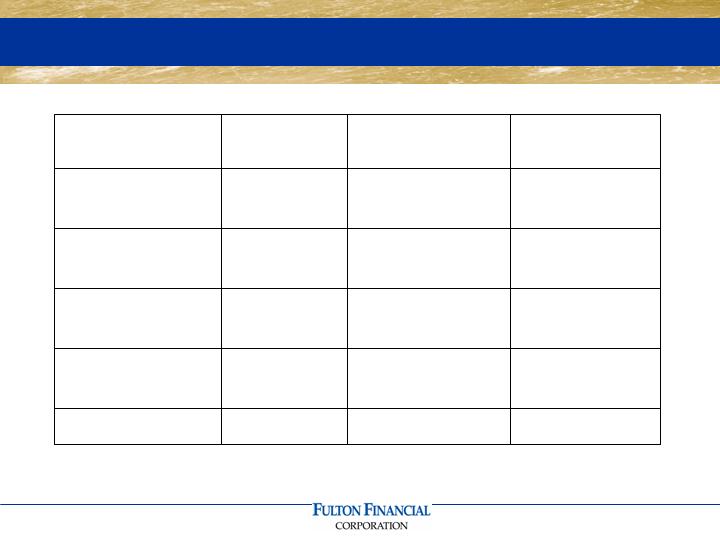

Customers’ satisfaction with FFC

8.5

6.8

Meeting the branch manager

8.5

7.7

Bank is involved in the community

8.4

7.8

Competitive interest rates

8.5

7.8

Fees are generally low

8.7

7.9

Offers ability to conduct transactions on Internet

9.2

8.7

Resolves problems quickly

9.0

9.1

Convenient branches and ATMs

9.3

9.1

Listens to my needs

9.3

9.1

Wide range of products and services

9.3

9.2

Wait times are brief

9.4

9.3

Employees are knowledgeable

9.6

9.5

Bank seems easy to work with

9.6

9.6

Employees are friendly and helpful

Q4/2008

Q4/2007

Attribute

A valuable geographic franchise

*Source: SNL, Median HH Income, 2008 data

Serving PA’s strongest markets*

9

11

Berks, PA

15

10

York, PA

3

9

Lehigh, PA

27

8

Lancaster, PA

3

6

Northampton, PA

3

5

Cumberland, PA

1

4

Delaware, PA

5

3

Bucks, PA

3

2

Montgomery, PA

7

1

Chester, PA

# Branches

Rank

County

FFC affiliates in affluent markets*

*Source: SNL Financial, 2008

#2

#22

3

Montgomery, MD

#1

#9

9

Howard, MD

#3

#8

7

Somerset, NJ

#2

#7

6

Morris, NJ

#1

#3

3

Hunterdon, NJ

Ranking State

National Ranking

# Branches

County

Loans

2007 – 2008 loan growth: 7.5%

Percentage of loans in

Pennsylvania: 54%

Net charge-offs to loans

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

1.00

91

92

93

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

FFC

Peer

Top 50

Residential mortgage and home equity loans

Total

% of

Balance

Total

Pennsylvania

1,383,000

$

51.9%

Maryland

457,000

17.1%

New Jersey

459,000

17.2%

Virginia

206,000

7.7%

Delaware

162,000

6.1%

2,667,000

$

(dollars in thousands)

Oct-08

75,254,000

Nov-08

44,180,000

Dec-08

74,603,000

Jan-09

141,293,000

Feb-09

240,068,000

Mar-09

237,272,000

Mortgage activity

$

Month Closings

Loans to purchase new or

existing homes – 30% of

mortgage volume

$100 million in purchase

financing mortgages in first

quarter

Mortgage foreclosures

19,259 mortgages owned and/or

serviced by FFC

132 of these in foreclosure as of

March 31, 2009

Where are we today?

Solid fundamentals

Experiencing growth in:

Loans

Deposits

Net interest income and other income

Mortgage activity

Stable net interest margin

Improved efficiency

Where are we today?

Strongly capitalized

Positive market demographics

Loyal customer base

Lending to credit-worthy borrowers

Looking to the future

Reducing expenses

Managing credit issues

Creating a superior customer

experience

Engaging our employees

Positioned for economic rebound

Questions and Answers

Annual Shareholders Meeting

April 29, 2009