Fulton Financial

Corporation

-------------------------------------------------

August, 2009

Investor Presentation

Data as of June 30, 2009

The following presentation may contain forward-looking statements about Fulton Financial Corporation’s

financial condition, business, strategies, products and services. Forward-looking statements are encouraged

by the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect the

Corporation’s current views and expectations based largely on information currently available to its

management, and on its current expectations, assumptions, plan, estimates, judgments, and projections about

its business and its industry, and they involve inherent risks, contingencies, uncertainties and other factors.

Although the Corporation believes that these forward-looking statements are based on reasonable estimates

and assumptions, the Corporation is unable to provide any assurance that its expectations will, in fact, occur

or that its estimates or assumptions will be correct and actual results could differ materially from those

expressed or implied by such forward-looking statements and such statements are not guarantees of future

performance. The Corporation undertakes no obligation to update or revise any forward-looking statements.

Accordingly, investors and others are cautioned not to place undue reliance on such forward-looking

statements.

Many factors could affect future financial results including, without limitation, acquisition and growth

strategies; market risk; changes or adverse developments in economic, political or regulatory conditions; a

continuation or worsening of the current disruption in credit and other markets, including the lack of or

reduced access to, and the abnormal functioning of markets for mortgage and other asset-backed securities

and for commercial paper and other short-term borrowings; the effect of competition and interest rates on net

interest margin and net interest income; investment strategy and income growth; investment securities gains;

declines in the value of securities which may result in charges to earnings; changes in rates of deposit and

loan growth; asset quality and the impact on assets from adverse changes in the economy and in credit and

other markets and resulting effects on credit risk and asset values; balances of risk-sensitive assets to risk-

sensitive liabilities; salaries and employee benefits and other expenses; amortization of intangible assets;

goodwill impairment; capital and liquidity strategies; and other financial and business matters for future

periods.

For a more complete discussion of certain risks and uncertainties affecting the Corporation, please see the

sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” set forth in the Corporation’s filings with the Securities and Exchange Commission.

Forward-Looking Statement

Presentation Outline

Corporate Overview

Franchise and Markets

Customer Experience / Satisfaction

Capital

Credit

Second Quarter Performance

Summary

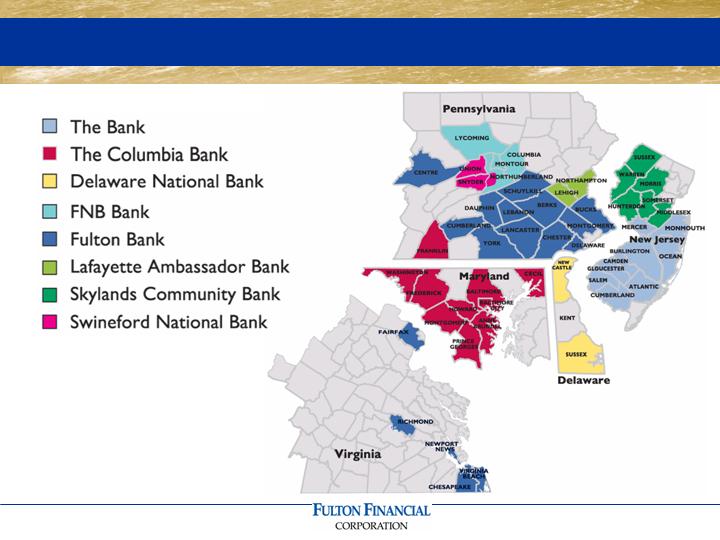

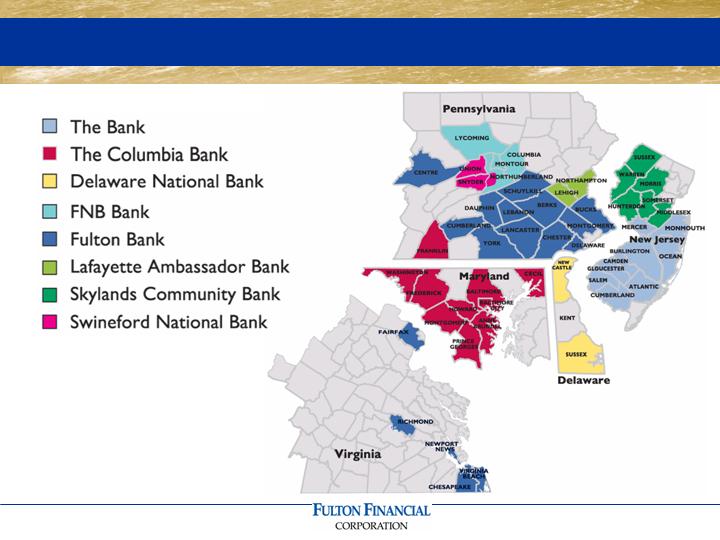

Fulton Financial Profile

Mid-Atlantic regional financial holding company

A family of 8 community banks in 5 states

Fulton Financial Advisors

Fulton Mortgage Company

270 community banking offices

Asset size: $ 16.9 billion

3850 Team Members

Market capitalization: $ 1 billion

Book value per common share: $ 8.56

Tangible book value per common share: $ 5.40

Shares outstanding: 175 million

A Valuable Geographic Franchise

*Source: SNL, Median HH Income, 2009 data

Serving PA’s Strongest Markets*

County

Rank

#

Branches

Projected Population

Change 2009-2014 (%)

Median HH

Income 2009 ($)

Projected HH

Income Change

2009-2014 (%)

Chester, PA

1

7

6.64

87,308

7.36

Montgomery, PA

2

3

1.85

80,212

5.01

Bucks, PA

3

6

2.22

79,444

4.95

Delaware, PA

4

1

0.10

66,300

5.25

Cumberland, PA

5

3

4.06

61,622

6.42

Northampton, PA

6

15

5.48

60,207

6.11

Lancaster, PA

8

28

3.46

59,484

5.61

York, PA

9

15

6.36

59,123

3.89

Berks, PA

10

9

3.73

58,885

4.18

Lehigh, PA

11

8

4.76

58,555

4.95

Average

3.87

67,114

5.37

Average of all

other (57)

-0.33

44,560

5.97

FFC Affiliates in Affluent Markets*

*Source: SNL Financial, 2009

County

# FFC

Branches

National

Ranking

Ranking in

State

Median HH

Ranking

Hunterdon, NJ

3

#3

#1

$110,147

Fairfax, VA

1

#4

#1

$109,067

Morris, NJ

6

#6

#2

$104,797

Somerset, NJ

7

#8

#3

$102,357

Howard, MD

12

#9

#1

$101,954

Unemployment Rates*

FFC Counties

Unemployment

Rate (%)**

State

Unemployment

Rate (%)***

United States

9.4

9.4

Delaware

8.4

8.7

Maryland

8.0

7.5

New Jersey

9.1

9.2

Pennsylvania

8.2

8.4

Virginia

7.6

7.3

*FFC Averages are an average of the unemployment

rates of the counties in which FFC has branches.

*Source: SNL & US Department of Labor

** County Data is as of June 2009

***State Data is as of June 2009

US Home Price Index*

*Source: Freddie Mac, Q1 2009 Data

Metropolitan Statistical Area

Annual Change

Q1 2008 - Q1 2009

# Branches

United States

-4.0

Average FFC Regions

-4.6

Harrisburg-Carlisle, PA

-0.6

12

Lebanon, PA

-0.6

9

York-Hanover, PA

-3.4

15

Lancaster, PA

-2.0

27

Philadelphia, PA

-2.6

16

Reading, PA

-2.0

9

Allentown-Bethlehem-Easton, PA

-5.0

24

Wilmington, DE-MD-NJ

-4.0

14

Camden, NJ

-5.1

27

Trenton-Ewing, NJ

-5.3

5

Edison, NJ

-5.2

20

Baltimore-Towson, MD

-7.1

13

Newark-Union, NJ-PA

-5.7

12

Hagerstown-Martinsburg, MD-WV

-10.4

11

Washington-Arlington-Alexandria, DC-VA

-10.5

10

Our Brand

COMMUNITY BANKING

SMALL BUSINESS

HIGH NET WORTH

RETAIL BANKING

LISTENING IS JUST THE BEGINNING.

Superior Customer Experience

Care, Listen, Understand, Deliver

Superior Customer Satisfaction

*Retail:

90% extremely/very satisfied

Commercial:

90% extremely/very satisfied

*Compared to national average of 63%

Source: American Banker/Gallup Consumer Survey

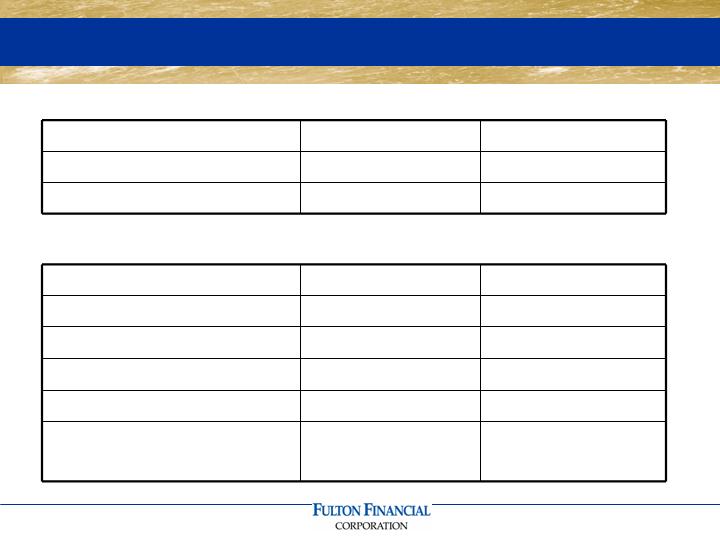

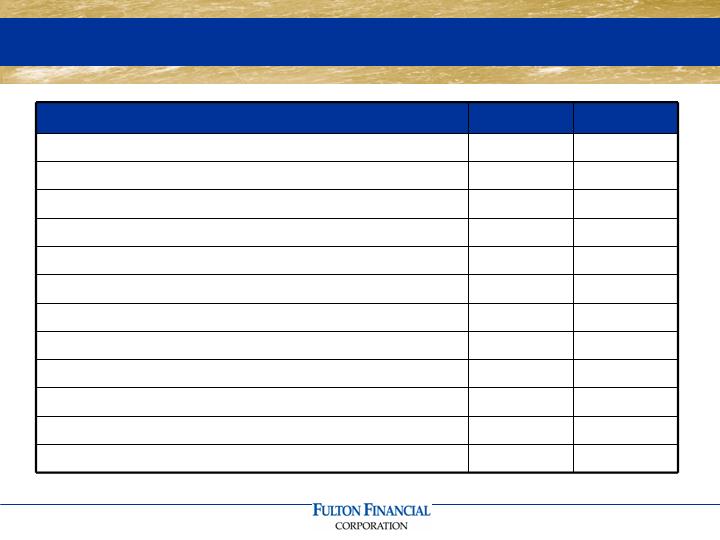

Customer Satisfaction Metrics

Attribute

Q1/2008

Q1/2009

Employees are friendly and helpful

9.6

9.6

Bank seems easy to work with

9.5

9.5

Safety and security of a local bank

NA

9.3

Wait times are brief

9.1

9.3

Wide range of products and services

9.0

9.1

Listens to my needs

9.1

9.1

Convenient branches and ATMs

8.9

8.8

Resolves problems quickly

8.8

9.1

Offers ability to conduct transactions on Internet

8.2

8.4

Fees are generally low

8.0

8.3

Competitive interest rates

8.1

8.8

Bank is involved in the community

7.9

8.4

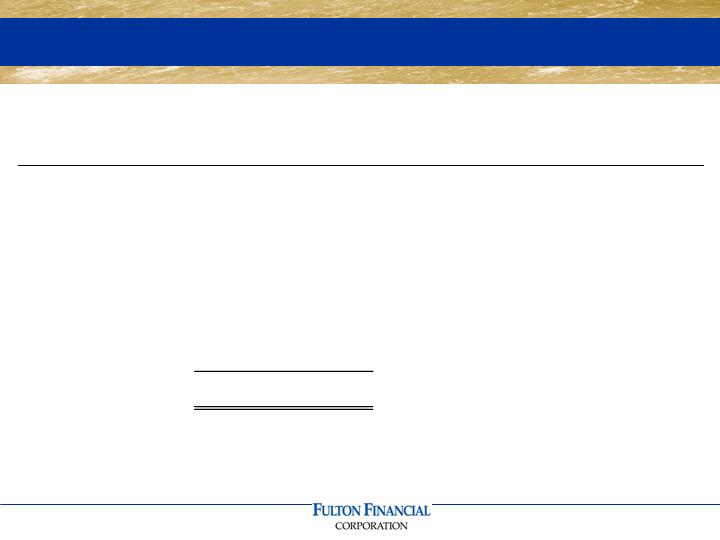

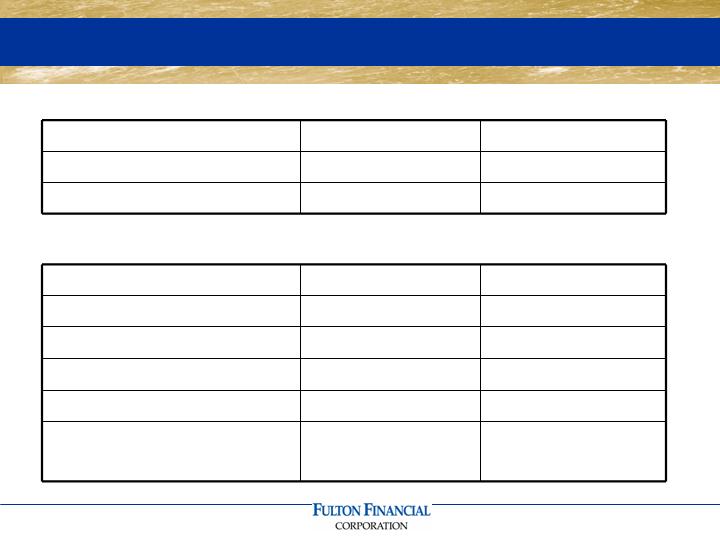

Capital (6/30/09)

With CPP

Without CPP

GAAP Capital

$1.87 billion

$1.50 billion

Total Risk-Based Capital

$1.87 billion

$1.49 billion

Ratios:

With CPP

Without CPP

Total Risk-Based Capital

13.90%

11.10%

Tier 1 Risk-Based Capital

11.20%

8.40%

Leverage Capital

9.40%

7.00%

Tangible Common Equity

5.80%

5.80%

Tangible Common Equity

to Risk-Weighted Assets

7.10%

7.10%

Loan Distribution by State (Second Quarter)

Average

% of

09 v. 08

%

Balance

Total

Growth

Growth

(dollars in thousands)

Pennsylvania

6,437,000

$

53.8%

380,000

$

6%

New Jersey

2,498,000

20.9%

148,000

6%

Maryland

1,563,000

13.1%

(10,000)

-1%

Virginia

1,117,000

9.3%

7,000

1%

Delaware

345,000

2.9%

12,000

4%

11,960,000

$

Residential Mortgage and HE Loans

Q2 2009

% of

Avg. Bal.

Total

Pennsylvania

1,326,000

$

50.9%

Maryland

459,000

17.6%

New Jersey

458,000

17.6%

Virginia

204,000

7.8%

Delaware

158,000

6.1%

2,605,000

$

(dollars in thousands)

Commercial Loans by Industry

Industry

%

Services

17.1

Manufacturing

14.7

RE - Rental and Leasing

12.2

Construction

11.6

Agriculture

8.5

Retail

8.5

Wholesale

7.7

Other

6.2

Health Care

5.7

Financial Services

3.5

Transportation

2.2

Arts and Entertainment

2.1

100.0

Commercial Loans by State

Q2 2009

% of

Avg. Bal.

Total

Pennsylvania

2,361,000

$

64.6%

Maryland

410,000

11.2%

New Jersey

547,000

15.0%

Virginia

306,000

8.4%

Delaware

31,000

0.8%

3,655,000

$

(dollars in thousands)

Construction Loans (June 30, 2009)

Ending

% of

NPL

Specific

Balance

Total

Balance

Allocations

(dollars in thousands)

Pennsylvania

297,000

$

27.0%

10,270

$

3,670

$

Maryland

286,000

26.0%

37,150

22,640

New Jersey

223,000

20.3%

23,610

4,640

Virginia

278,000

25.3%

31,950

10,380

Delaware

16,000

1.5%

-

130

1,100,000

$

102,980

$

41,460

$

Construction Loans by Type

Ending

% of

Balance

Total

(dollars in thousands)

Commercial

279,000

$

25.3%

Commercial Residential

726,000

66.0%

Other Commercial

24,000

2.2%

Real Estate

71,000

6.5%

1,100,000

$

CRE Loans by State (June 30, 2009)

Ending

% of

NPL

Specific

Balance

Total

Balance

Allocations

(dollars in thousands)

Pennsylvania

2,125,000

$

51.6%

17,140

$

10,600

$

New Jersey

1,193,000

28.9%

26,320

7,410

Maryland

348,000

8.4%

8,440

400

Virginia

323,000

7.8%

3,950

2,520

Delaware

132,000

3.2%

1,940

1,080

4,121,000

$

57,790

$

22,010

$

Loan Delinquency (Key Sectors)

Category

Total (%)

6/30/08

90-Days

6/30/08

Total (%)

6/30/09

90-Days

6/30/09

Commercial

Loans

1.65

1.12

2.24

1.77

Consumer

Direct

.81

.32

1.36

0.52

Commercial

Mortgage

1.62

1.03

1.95

1.22

Residential

Mortgage

5.50

2.58

7.36

3.36

Construction

3.75

2.71

10.36

9.31

Total

Portfolio

2.06

1.25

3.22

2.20

Automotive Related Loans

Ending

Balance

(dollars in thousands)

New Cars

80,853

$

Used Cars

46,430

Floor Plans

67,803

195,086

$

Delinquency Rate .64%

Shared National Credits

Ending

Balance

(dollars in thousands)

Commercial / Industrial

112,035

$

Commercial Real Estate

40,834

Total Outstanding

152,869

$

Delinquency: None

Net Charge-offs (Q2 2009)

Comm'l

Res. Mtg.

Comm'l

Mortgage

Constr.

and HE

Other

Total

(in thousands)

Pennsylvania

1,359

$

1,524

$

1,531

$

164

$

1,975

$

6,553

$

Maryland

583

795

6,362

306

515

8,561

New Jersey

3,923

3,617

1,442

226

546

9,754

Virginia

101

-

1,745

939

1,003

3,788

Delaware

2

-

-

48

403

453

5,968

$

5,936

$

11,080

$

1,683

$

4,442

$

29,109

$

Avg Loans

3,656,000

4,091,000

1,152,000

2,605,000

456,000

11,960,000

NCO %

0.65%

0.58%

3.85%

0.26%

3.90%

0.97%

Net Charge-offs (YTD June 2009)

Comm'l

Res. Mtg.

Comm'l

Mortgage

Constr.

and HE

Other

Total

(in thousands)

Pennsylvania

1,694

$

1,942

$

3,975

$

1,689

$

3,101

$

12,401

$

Maryland

791

2,676

13,768

423

957

18,615

New Jersey

6,257

4,685

2,138

224

1,049

14,353

Virginia

6,883

-

3,329

1,051

1,131

12,394

Delaware

61

583

-

232

544

1,420

15,686

$

9,886

$

23,210

$

3,619

$

6,782

$

59,183

$

Avg Loans

3,656,000

4,070,000

1,191,000

2,630,000

453,000

12,000,000

NCO %

0.86%

0.49%

3.90%

0.28%

2.99%

0.99%

Non-performing Loans* (June 30, 2009)

Comm'l

Res. Mtg.

Comm'l

Mortgage

Constr.

and HE

Other

Total

(in thousands)

Pennsylvania

19,709

$

17,142

$

10,271

$

9,359

$

4,924

$

61,405

$

Maryland

3,979

8,442

37,150

3,612

1,150

54,333

New Jersey

17,522

26,323

23,611

5,926

2,879

76,261

Virginia

16,801

3,947

31,945

16,820

575

70,088

Delaware

422

1,932

-

1,514

1,312

5,180

58,433

$

57,786

$

102,977

$

37,231

$

10,840

$

267,267

$

End Loans

3,614,000

4,121,000

1,096,000

2,578,000

457,000

11,866,000

NPL%

1.62%

1.40%

9.40%

1.44%

2.37%

2.25%

* Includes accruing loans > 90 days past due.

53 relationships with commitments to lend

of $20 million or more

Maximum individual commitment- $33

million

Maximum commitment land development-

$28 million

Average commercial lending relationship

size is $471,587

Loans and corresponding relationships are

within Fulton’s geographic market area

Summary of Larger Loans

Overview of Second Quarter

Strong core deposit growth

Stable net interest margin despite

reduction in total loans outstanding

Continued high level of residential

mortgage activity

Good growth in other income

Core expenses flat

Financial Performance

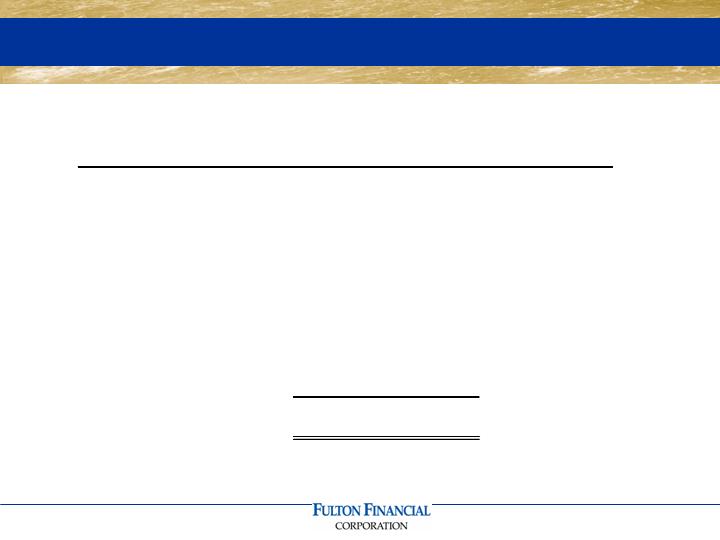

2009 Financial Results (Second Quarter)

2009

2008

Net income

13,110,000

$

25,680,000

$

Cost of preferred stock

(5,045,000)

-

Net income available

to common shareholders

8,065,000

$

25,680,000

$

Earnings per share

0.05

$

0.15

$

Return on tangible equity

3.83%

11.03%

Income Statement Summary (Second Quarter)

2009

2008

$

%

(dollars in thousands)

Net Interest Income

127,940

$

131,890

$

(3,950)

$

-3%

Loan Loss Provision

(50,000)

(16,710)

(33,290)

199%

Other Income

45,300

39,890

5,410

14%

Credit Card Sale Gain

-

13,910

(13,910)

nm

Securities Gains (Losses)

80

(21,650)

21,730

-100%

Other Expenses

(107,810)

(109,730)

1,920

-2%

Pre-Tax Income

15,510

37,600

(22,090)

-59%

Income Taxes

(2,400)

(11,920)

9,520

-80%

Net Income

13,110

$

25,680

$

(12,570)

$

-49%

Pre-Tax Income Summary (Second Quarter)

2009

2008

$

%

(dollars in thousands)

Net Interest Income

127,940

$

131,890

$

(3,950)

$

-3%

Other Income

45,300

39,890

5,410

14%

Other Expenses

(107,810)

(109,730)

1,920

-2%

Pre-Tax Income Before

Provision, CC Gain

Securities Gains (Losses)

65,430

62,050

3,380

5%

Loan Loss Provision

(50,000)

(16,710)

(33,290)

199%

Credit Card Sale Gain

-

13,910

(13,910)

nm

Securities Gains (Losses)

80

(21,650)

21,730

-100%

Pre-Tax Income

15,510

$

37,600

$

(22,090)

-59%

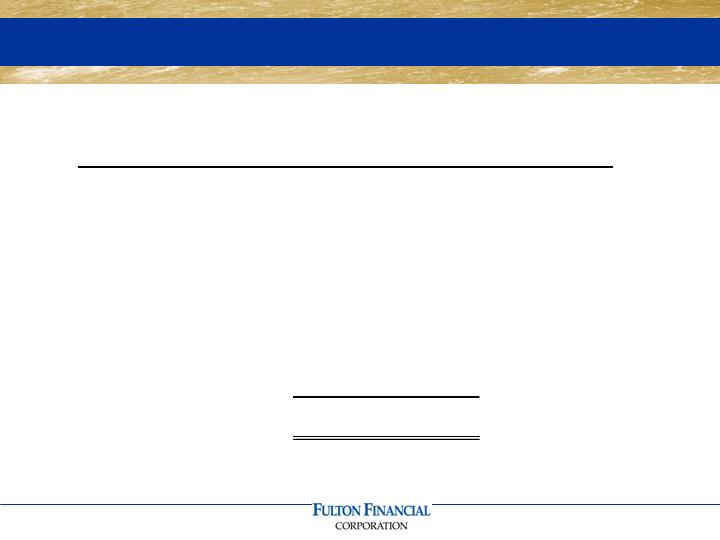

2009 Financial Results (YTD June)

2009

2008

Net income

26,200,000

$

67,170,000

$

Cost of preferred stock

(10,080,000)

-

Net income available

to common shareholders

16,120,000

$

67,170,000

$

Earnings per share

0.09

$

0.39

$

Return on tangible equity

3.85%

14.65%

Income Statement Summary (YTD June)

2009

2008

$

%

(dollars in thousands)

Net Interest Income

252,060

$

257,790

$

(5,730)

$

-2%

Loan Loss Provision

(100,000)

(27,930)

(72,070)

258%

Other Income

89,300

76,320

12,980

17%

Credit Card Sale Gain

-

13,910

(13,910)

nm

Securities Gains (Losses)

3,000

(20,400)

23,400

-115%

Other Expenses

(214,180)

(206,400)

(7,780)

4%

Pre-Tax Income

30,180

93,290

(63,110)

-68%

Income Taxes

(3,980)

(26,120)

22,140

-85%

Net Income

26,200

$

67,170

$

(40,970)

$

-61%

Pre-Tax Income Summary (YTD June)

2009

2008

$

%

(dollars in thousands)

Net Interest Income

252,060

$

257,790

$

(5,730)

$

-2%

Other Income

89,300

76,320

12,980

17%

Other Expenses

(214,180)

(206,400)

(7,780)

4%

Pre-Tax Income Before

Provision, CC Gain

Securities Gains (Losses)

127,180

127,710

(530)

0%

Loan Loss Provision

(100,000)

(27,930)

(72,070)

258%

Credit Card Sale Gain

-

13,910

(13,910)

nm

Securities Gains (Losses)

3,000

(20,400)

23,400

-115%

Pre-Tax Income

30,180

$

93,290

$

(63,110)

-68%

2009 Financial Results (Q2 vs. Q1 2009)

Q2 2009

Q1 2009

Net income

13,110,000

$

13,085,000

$

Cost of preferred stock

(5,045,000)

(5,030,000)

Net income available

to common shareholders

8,065,000

$

8,055,000

$

Earnings per share

0.05

$

0.05

$

Return on tangible equity

3.83%

3.88%

Income Statement Summary (Q2 vs. Q1 2009)

Q2 2009

Q1 2009

$

%

(dollars in thousands)

Net Interest Income

127,940

$

124,120

$

3,820

$

3%

Loan Loss Provision

(50,000)

(50,000)

-

0%

Other Income

45,300

43,990

1,310

3%

Securities Gains (Losses)

80

2,920

(2,840)

-97%

Other Expenses

(107,810)

(106,370)

(1,440)

1%

Pre-Tax Income

15,510

14,660

850

6%

Income Taxes

(2,400)

(1,575)

(825)

52%

Net Income

13,110

$

13,085

$

25

$

0%

Pre-Tax Income Summary (Q2 vs. Q1 2009)

Q2 2009

Q1 2009

$

%

(dollars in thousands)

Net Interest Income

127,940

$

124,120

$

3,820

$

3%

Other Income

45,300

43,990

1,310

3%

Other Expenses

(107,810)

(106,370)

(1,440)

1%

Pre-Tax Income Before

Provision, CC Gain

Securities Gains (Losses)

65,430

61,740

3,690

6%

Loan Loss Provision

(50,000)

(50,000)

-

0%

Securities Gains (Losses)

80

2,920

(2,840)

-97%

Pre-Tax Income

15,510

$

14,660

$

850

6%

International Bancshares Corporation

Old National Bancorp

South Financial Group, Inc.

Susquehanna Bancshares, Inc.

TCF Financial Corporation

Trustmark Corporation

UMB Financial Corporation

United Bankshares, Inc.

Valley National Bancorp

Whitney Holding Corporation

Wilmington Trust Corporation

* All U.S. Banks from $7.5 to $25

billion in assets

Associated Banc-Corp

BancorpSouth, Inc.

Bank of Hawaii Corporation

BOK Financial Corporation

Citizens Republic Bancorp

City National Corporation

Colonial BancGroup, Inc.

Commerce Bancshares, Inc.

Cullen/Frost Bankers, Inc.

First Citizens BancShares, Inc.

First Midwest Bancorp, Inc.

First Merit Corporation

Peer Group*

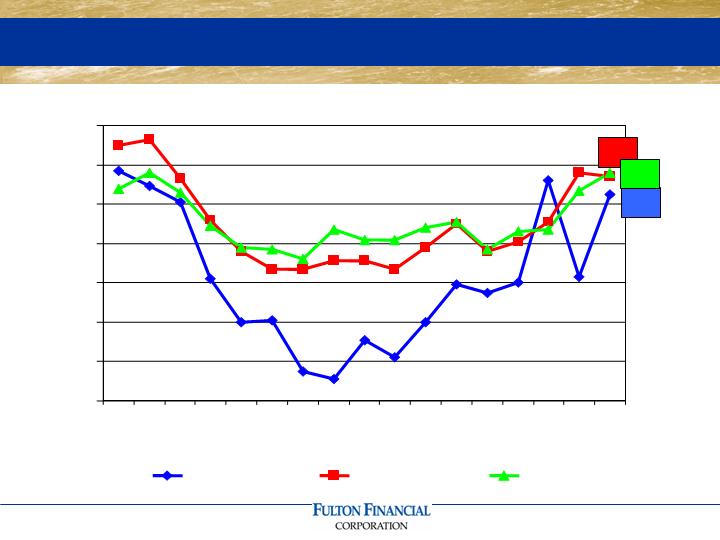

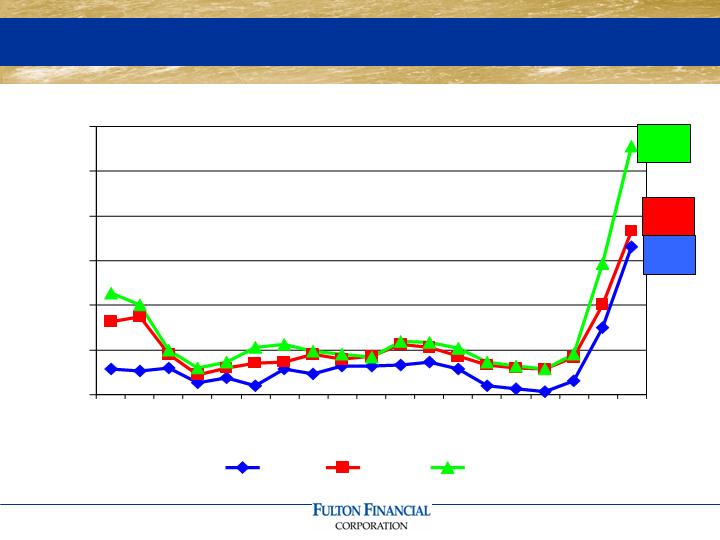

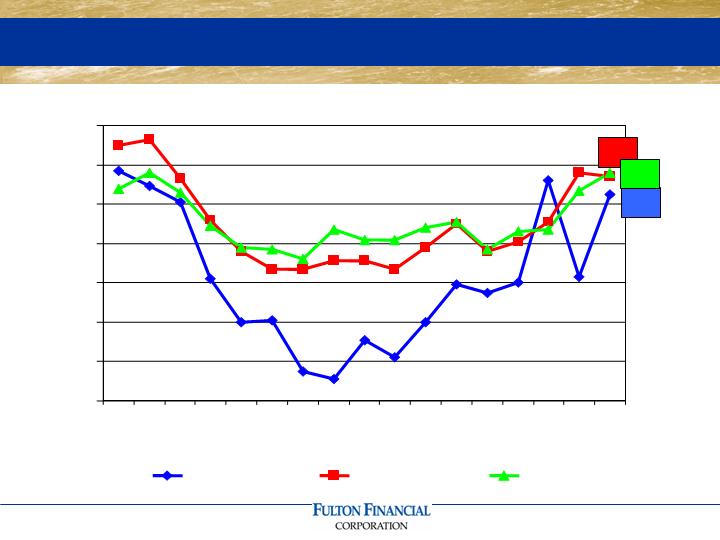

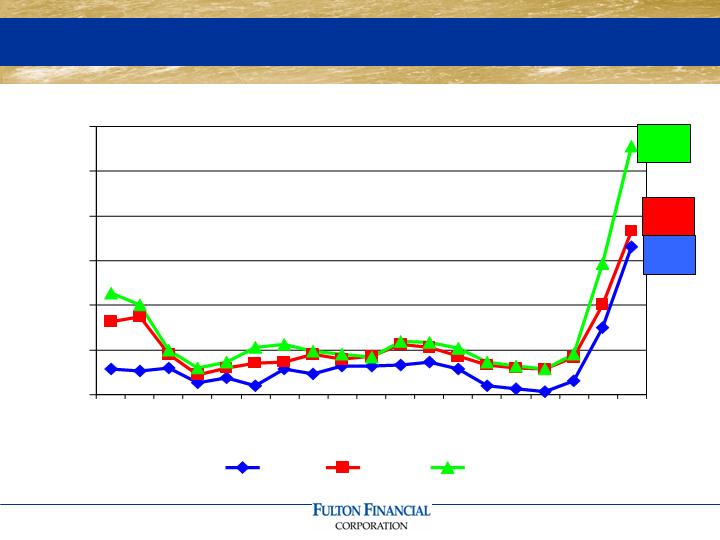

Net Interest Margin

3.44

3.54

3.15

3.00

3.50

4.00

4.50

5.00

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

YTD

6/09

FFC

Peer

Top 50

Average Loans (Q2 vs. Q1 2009)

Q2 2009

Q1 2009

$

%

(dollars in millions)

Commercial

3,660

$

3,660

$

-

$

0%

Comm'l Mort

4,090

4,050

��

40

1%

Resid Mort

940

960

(20)

-2%

Home Equity

1,670

1,700

(30)

-2%

Construction

1,150

1,230

(80)

-7%

Cons./Other

450

440

10

2%

Total Loans

11,960

$

12,040

$

(80)

-1%

Average Loans (Second Quarter)

2009

2008

$

%

(dollars in millions)

Commercial

3,660

$

3,500

$

160

$

5%

Comm'l Mort

4,090

3,680

410

11%

Resid Mort

940

890

50

6%

Home Equity

1,670

1,570

100

6%

Construction

1,150

1,320

(170)

-13%

Cons./Other

450

460

(10)

-2%

Total Loans

11,960

$

11,420

$

540

5%

Average Loans (YTD June)

2009

2008

$

%

(dollars in millions)

Commercial

3,660

$

3,480

$

180

$

5%

Comm'l Mort

4,070

3,610

460

13%

Resid Mort

950

870

80

9%

Home Equity

1,680

1,550

130

8%

Construction

1,190

1,340

(150)

-11%

Cons./Other

450

510

(60)

-12%

Total Loans

12,000

$

11,360

$

640

6%

Average Deposits (Q2 vs. Q1 2009)

Q2 2009

Q1 2009

$

%

(dollars in millions)

Nonint DDA

1,810

$

1,660

$

150

$

9%

Int DDA

1,820

1,750

70

4%

Savings/MMDA

2,310

2,060

250

12%

CD's

5,630

5,440

190

3%

Cash Management

550

580

(30)

-5%

Total Loans

12,120

$

11,490

$

630

5%

Average Deposits (Second Quarter)

2009

2008

$

%

(dollars in millions)

Nonint DDA

1,810

$

1,660

$

150

$

9%

Int DDA

1,820

1,710

110

6%

Savings/MMDA

2,310

2,210

100

5%

CD's

5,630

4,360

1,270

29%

Cash Management

550

690

(140)

-20%

Total Loans

12,120

$

10,630

$

1,490

14%

Average Deposits (YTD June)

2009

2008

$

%

(dollars in millions)

Nonint DDA

1,740

$

1,640

$

100

$

6%

Int DDA

1,790

1,700

90

5%

Savings/MMDA

2,180

2,170

10

0%

CD's

5,520

4,430

1,090

25%

Cash Management

570

700

(130)

-19%

Total Loans

11,800

$

10,640

$

1,160

11%

Other Income

$0

$20

$40

$60

$80

$100

$120

$140

$160

Millions

Other Income (Q2 vs. Q1 2009)

Q2 2009

Q1 2009

$

%

(dollars in thousands)

Overdraft & NSF Fees

8,790

$

8,440

$

350

$

4%

Invt Mgt & Trust

7,880

7,900

(20)

0%

Mort. Sales Gains

7,400

8,590

(1,190)

-14%

Service Charges

3,180

3,250

(70)

-2%

Cash Mgt Fees

3,090

3,200

(110)

-3%

Success Card Fees

2,750

2,440

310

13%

Credit Card Fees

1,360

1,190

170

N/A

Other

10,850

8,990

1,860

21%

Total

45,300

$

44,000

$

1,300

$

3%

Other Income (Second Quarter)

2009

2008

$

%

(dollars in thousands)

Overdraft & NSF Fees

8,790

$

8,640

$

150

$

2%

Invt Mgt & Trust

7,880

8,390

(510)

-6%

Mort. Sales Gains

7,400

2,670

4,730

177%

Service Charges

3,180

3,350

(170)

-5%

Cash Mgt Fees

3,090

3,330

(240)

-7%

Success Card Fees

2,750

2,550

200

8%

Credit Card Fees

1,360

1,090

270

N/A

Other

10,850

9,870

980

10%

Total

45,300

$

39,890

$

5,410

$

14%

Other Income (YTD June)

2009

2008

$

%

(dollars in thousands)

Overdraft & NSF Fees

17,230

$

16,330

$

900

$

6%

Mort. Sales Gains

15,990

4,980

11,010

221%

Invt Mgt & Trust

15,780

17,150

��

(1,370)

-8%

Service Charges

6,430

6,390

40

1%

Cash Mgt Fees

6,290

6,560

(270)

-4%

Success Card Fees

5,190

4,820

370

8%

Credit Card Fees

2,550

1,090

1,460

N/A

Other

19,840

19,000

840

4%

Total

89,300

$

76,320

$

12,980

$

17%

Efficiency Ratio

60.5

61.4

61.6

50.0

52.0

54.0

56.0

58.0

60.0

62.0

64.0

93

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

YTD

6/09

FFC

Peer

Top 50

Other Expense (Q2 vs. Q1 2009)

Q2 2009

Q1 2009

$

%

(dollars in thousands)

Salaries & Benefits

55,800

$

55,300

$

500

$

1%

Occupancy & Equip.

13,540

14,100

(560)

-4%

FDIC Insurance

12,210

4,290

7,920

185%

Data Proc. & Software

4,610

4,630

(20)

0%

Supplies & Postage

2,700

2,660

40

2%

Marketing

1,720

2,570

(850)

-33%

Operating Risk Loss

140

6,200

(6,060)

-98%

Other Expenses

17,090

16,620

470

3%

Total

107,810

$

106,370

$

1,440

$

1%

Other Expense (Second Quarter)

2009

2008

$

%

(dollars in thousands)

Salaries & Benefits

55,800

$

54,280

$

1,520

$

3%

Occupancy & Equip.

13,540

13,640

(100)

-1%

FDIC Insurance

12,210

680

11,530

nm

Data Proc. & Software

4,610

4,480

130

3%

Supplies & Postage

2,700

2,980

(280)

-9%

Marketing

1,720

3,520

(1,800)

-51%

Operating Risk Loss

140

14,390

(14,250)

-99%

Other Expenses

17,090

15,770

1,320

8%

Total

107,810

$

109,740

$

(1,930)

$

-2%

Other Expense (YTD June)

2009

2008

$

%

(dollars in thousands)

Salaries & Benefits

111,100

$

109,480

$

1,620

$

1%

Occupancy & Equip.

27,640

27,610

30

0%

FDIC Insurance

16,490

1,540

14,950

nm

Data Proc. & Software

9,240

9,140

100

1%

Operating Risk Loss

6,340

15,630

(9,290)

-59%

Supplies & Postage

5,370

5,800

(430)

-7%

Marketing

4,290

6,420

(2,130)

-33%

Other Expenses

33,710

30,780

2,930

10%

Total

214,180

$

206,400

$

7,780

$

4%

Allowance for Credit Losses

Q2 2009

Q1 2009

(dollars in thousands)

Balance at beginning of period

200,060

$

180,140

$

Loan Loss Provision

50,000

50,000

Net Charge-Offs

(29,110)

(30,080)

Balance at end of period

220,950

$

200,060

$

Allowance to Loans

1.86%

1.67%

Nonperforming Assets to Assets

1.73%

1.63%

Net Charge-offs to Loans

0.97%

1.00%

Allowance for Credit Losses (2nd Quarter)

2009

2008

(dollars in thousands)

Balance at beginning of quarter

200,060

$

119,070

$

Loan Loss Provision

50,000

16,710

Net Charge-Offs

(29,110)

(9,560)

Balance at June 30th

220,950

$

126,220

$

Allowance to Loans

1.86%

1.09%

Nonperforming Assets to Assets

1.73%

1.02%

Net Charge-offs to Loans

0.97%

0.33%

Allowance for Credit Losses (YTD June)

2009

2008

(dollars in thousands)

Balance at beginning of year

180,140

$

112,210

$

Loan Loss Provision

100,000

27,930

Net Charge-Offs

(59,190)

(13,920)

Balance at June 30th

220,950

$

126,220

$

Allowance to Loans

1.86%

1.09%

Nonperforming Assets to Assets

1.73%

1.02%

Net Charge-offs to Loans

0.99%

0.24%

Net Charge-Offs To Average Loans

0.99

1.10

1.67

0.00

0.30

0.60

0.90

1.20

1.50

1.80

91

92

93

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

YTD

6/09

FFC

Peer

Top 50

Investment Portfolio

ENDING

MODIFIED

BALANCE

DURATION

(in millions)

Agency mortgage-backed securities

1,269.7

$

2.39

Agency collateralized mortgage obligations

881.6

2.15

Municipal bonds

454.4

4.25

Auction rate securities

298.8

4.30

Corporate & trust preferred securities

157.1

10.60

U.S. Treasuries and agencies

141.3

3.51

FHLB & FRB stock

85.6

NA

Bank stocks

38.1

NA

Other investments

26.6

NA

Net unrealized loss

(18.2)

Total Investments

3,335.4

$

3.19

Status of the Corporation

Reliable retail funding base

Good growth in net interest income

and non-interest income

Strong capital position

Residential mortgage activity

Continued expense reduction

Positioned for economic rebound

Valuable 5-state franchise in strong

in-state markets

Fulton Financial Corporation

One Penn Square

Lancaster, PA 17602

www.fult.com