Exhibit 99.4

Fulton Financial Corporation

Lancaster, PA

(NASDAQ: FULT)

and

Resource Bankshares Corporation

Virginia Beach, VA

(NASDAQ: RBKV)

August 25, 2003

Page 1

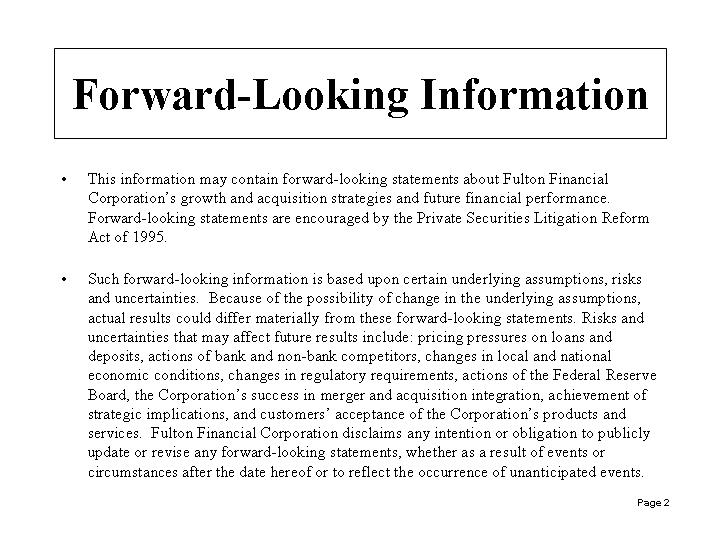

Forward-Looking Information

| | • | | This information may contain forward-looking statements about Fulton Financial Corporation’s growth and acquisition strategies and future financial performance. Forward-looking statements are encouraged by the Private Securities Litigation Reform Act of 1995. |

| | • | | Such forward-looking information is based upon certain underlying assumptions, risks and uncertainties. Because of the possibility of change in the underlying assumptions, actual results could differ materially from these forward-looking statements. Risks and uncertainties that may affect future results include: pricing pressures on loans and deposits, actions of bank and non-bank competitors, changes in local and national economic conditions, changes in regulatory requirements, actions of the Federal Reserve Board, the Corporation’s success in merger and acquisition integration, achievement of strategic implications, and customers’ acceptance of the Corporation’s products and services. Fulton Financial Corporation disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. |

Page 2

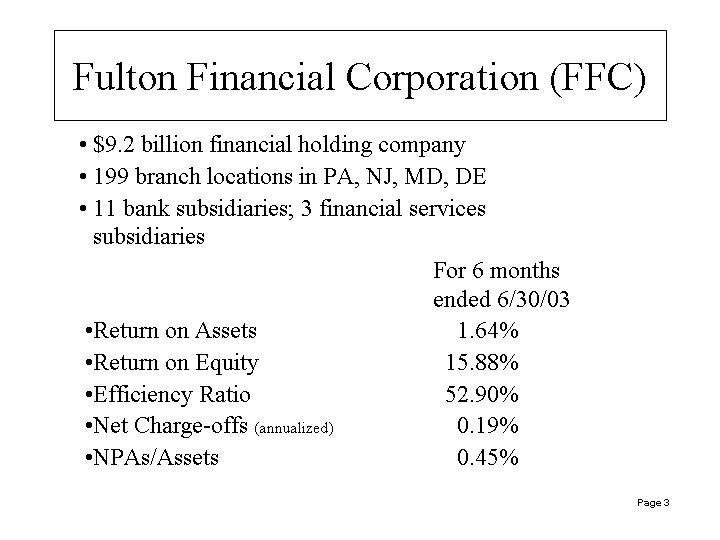

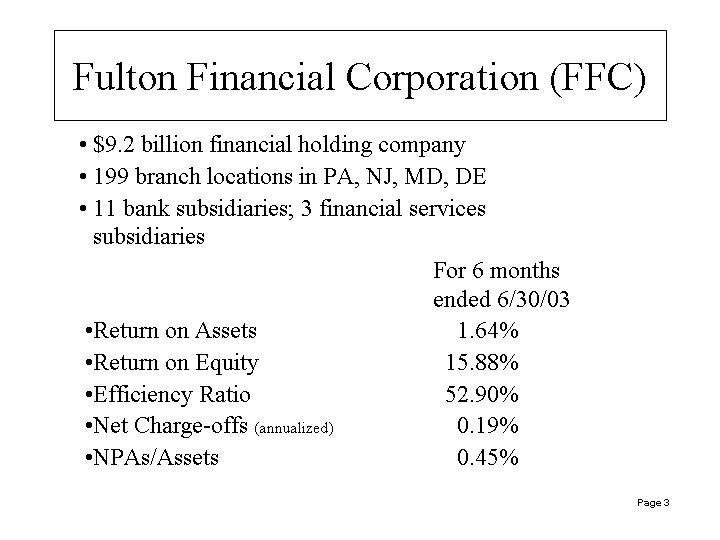

Fulton Financial Corporation (FFC)

| | • | | $9.2 billion financial holding company |

| | • | | 199 branch locations in PA, NJ, MD, DE |

| | • | | 11 bank subsidiaries; 3 financial services subsidiaries |

| | | For 6 months ended 6/30/03

| |

• Return on Assets | | 1.64 | % |

• Return on Equity | | 15.88 | % |

• Efficiency Ratio | | 52.90 | % |

• Net Charge-offs (annualized) | | 0.19 | % |

• NPAs/Assets | | 0.45 | % |

Page 3

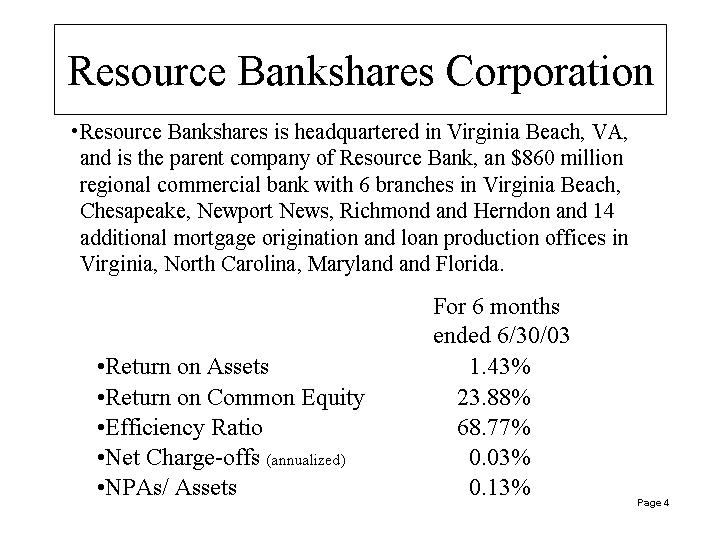

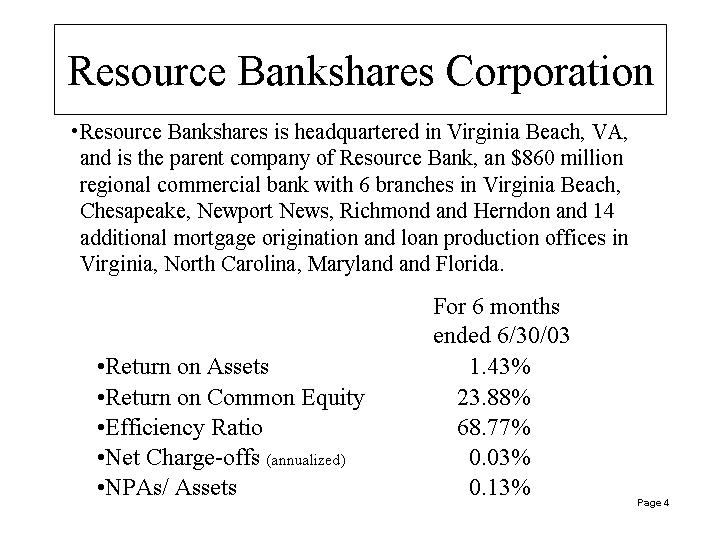

Resource Bankshares Corporation

| | • | | Resource Bankshares is headquartered in Virginia Beach, VA, and is the parent company of Resource Bank, an $860 million regional commercial bank with 6 branches in Virginia Beach, Chesapeake, Newport News, Richmond and Herndon and 14 additional mortgage origination and loan production offices in Virginia, North Carolina, Maryland and Florida. |

| | | For 6 months

ended 6/30/03

| |

• Return on Assets | | 1.43 | % |

• Return on Common Equity | | 23.88 | % |

• Efficiency Ratio | | 68.77 | % |

• Net Charge-offs (annualized) | | 0.03 | % |

• NPAs/ Assets | | 0.13 | % |

Page 4

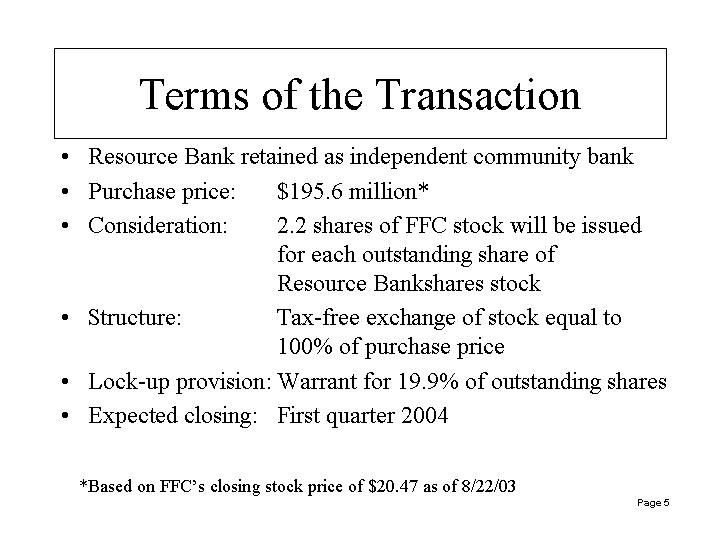

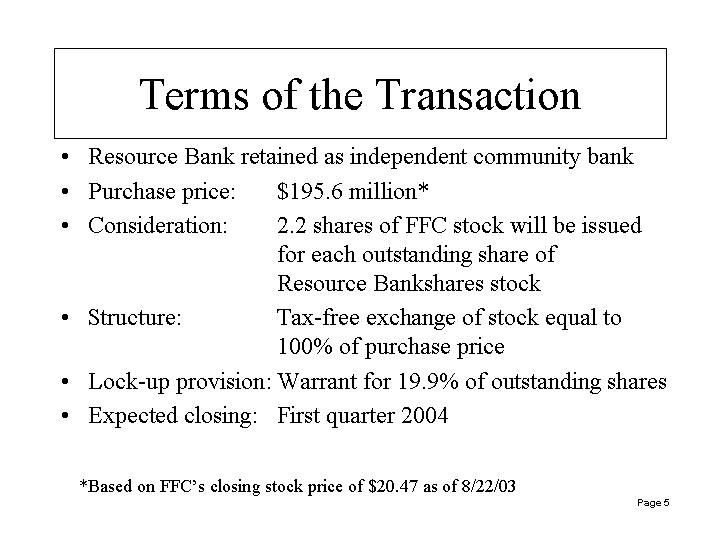

Terms of the Transaction

• Resource Bank retained as independent community bank | | |

| |

• Purchase price: | | $195.6 million* |

| |

• Consideration: | | 2.2 shares of FFC stock will be issued for each outstanding share of Resource Bankshares stock |

| |

• Structure: | | Tax-free exchange of stock equal to 100% of purchase price |

| |

• Lock-up provision: | | Warrant for 19.9% of outstanding shares |

| |

• Expected closing: | | First quarter 2004 |

| * | | Based on FFC’s closing stock price of $20.47 as of 8/22/03 |

Page 5

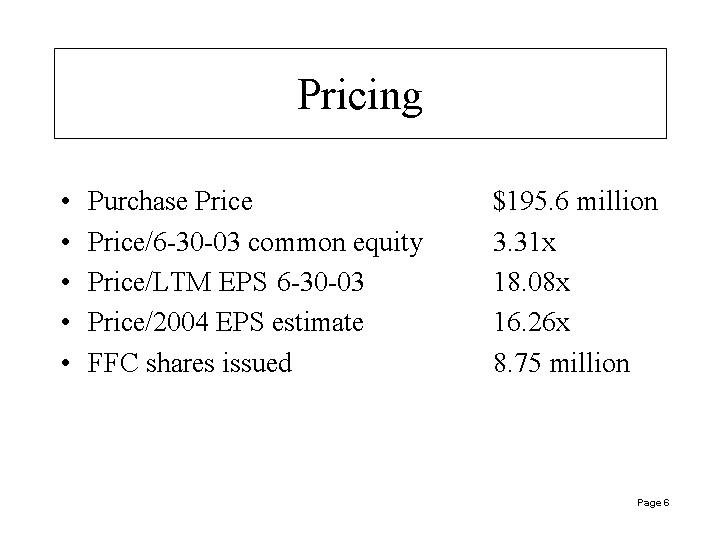

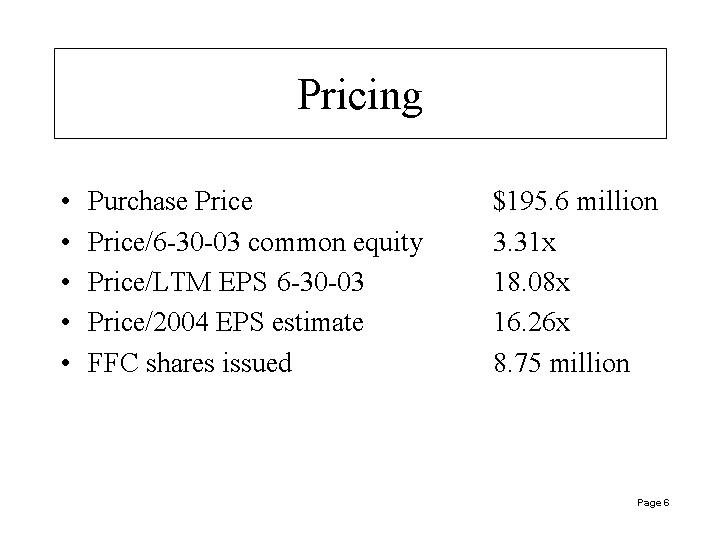

Pricing

• Purchase Price | | $ | 195.6 million |

• Price/6-30-03 common equity | | | 3.31x |

• Price/LTM EPS 6-30-03 | | | 18.08x |

• Price/2004 EPS estimate | | | 16.26x |

• FFC shares issued | | | 8.75 million |

Page 6

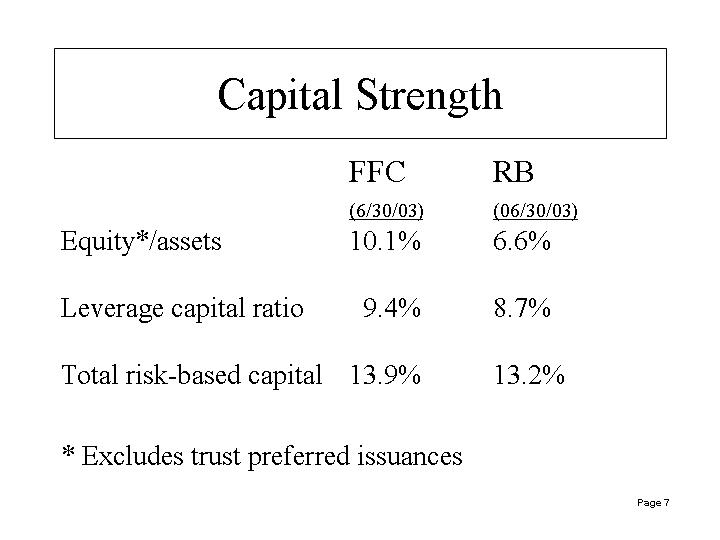

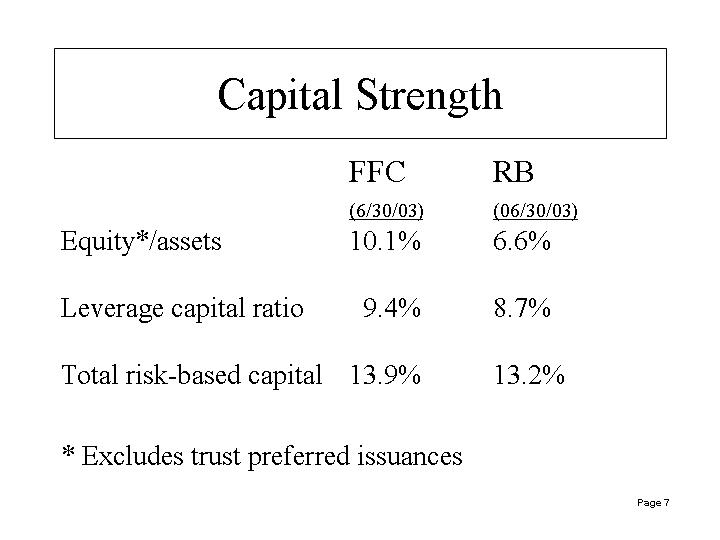

Capital Strength

| | | FFC (06/30/03)

| | | RB

(6/30/03)

| |

Equity*/assets | | 10.1 | % | | 6.6 | % |

Leverage capital ratio | | 9.4 | % | | 8.7 | % |

Total risk-based capital | | 13.9 | % | | 13.2 | % |

* Excludes trust preferred issuances

Page 7

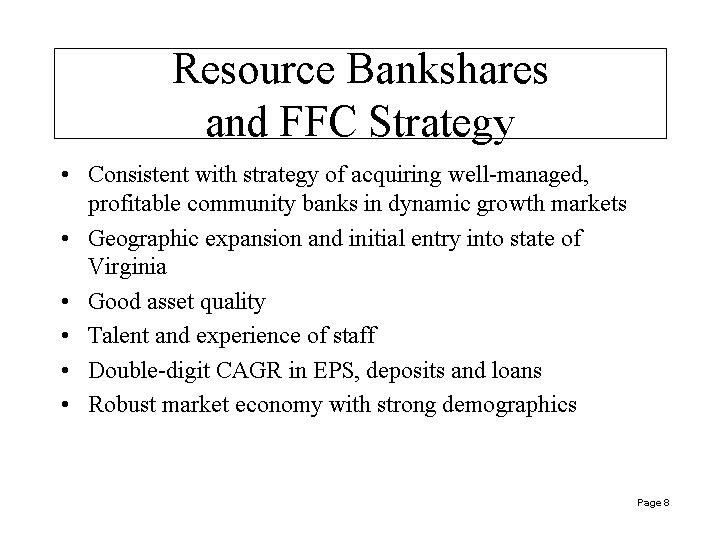

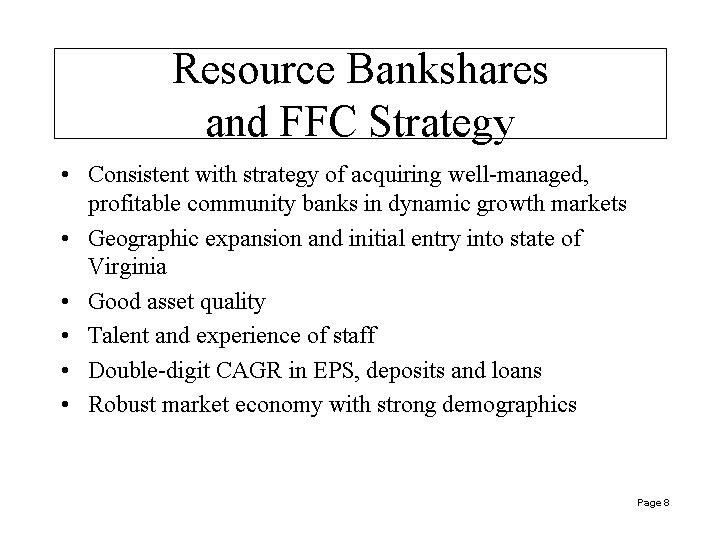

Resource Bankshares

and FFC Strategy

| | • | | Consistent with strategy of acquiring well-managed, profitable community banks in dynamic growth markets |

| | • | | Geographic expansion and initial entry into state of Virginia |

| | • | | Talent and experience of staff |

| | • | | Double-digit CAGR in EPS, deposits and loans |

| | • | | Robust market economy with strong demographics |

Page 8

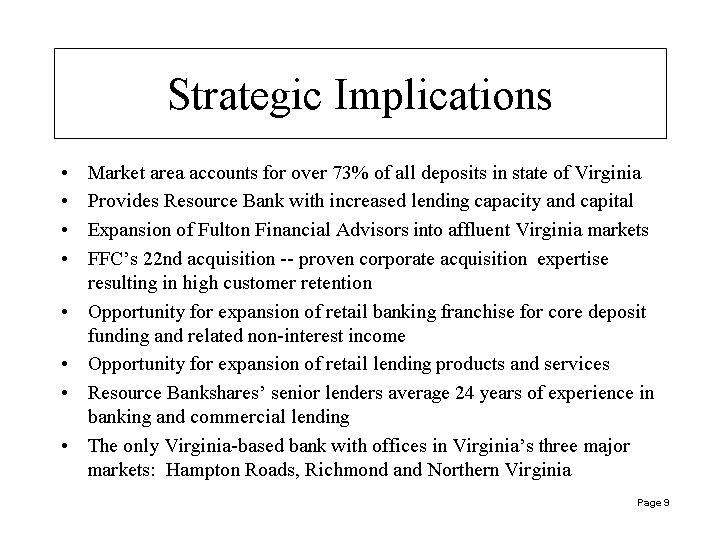

Strategic Implications

| | • | | Market area accounts for over 73% of all deposits in state of Virginia |

| | • | | Provides Resource Bank with increased lending capacity and capital |

| | • | | Expansion of Fulton Financial Advisors into affluent Virginia markets |

| | • | | FFC’s 22nd acquisition—proven corporate acquisition expertise resulting in high customer retention |

| | • | | Opportunity for expansion of retail banking franchise for core deposit funding and related non-interest income |

| | • | | Opportunity for expansion of retail lending products and services |

| | • | | Resource Bankshares’ senior lenders average 24 years of experience in banking and commercial lending |

| | • | | The only Virginia-based bank with offices in Virginia’s three major markets:Hampton Roads, Richmond and Northern Virginia |

Page 9

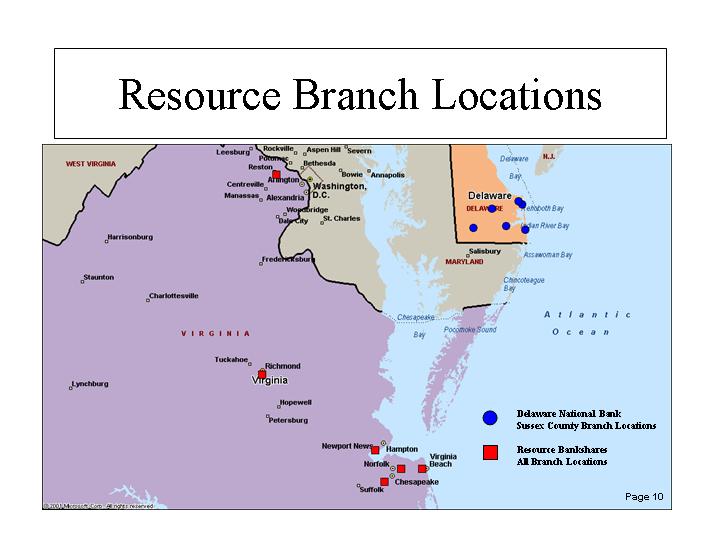

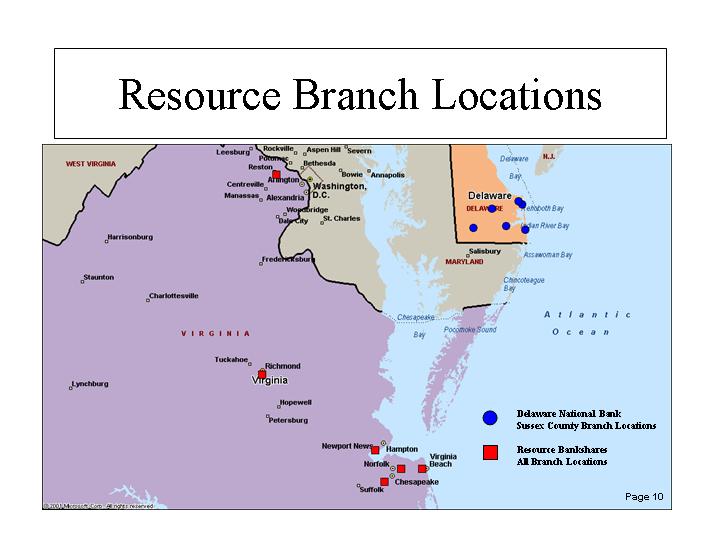

Resource Branch Locations

| | | l | | Delaware National Bank Sussex County Branch Locations |

| [GRAPH] | | | | |

| | | ¨ | | Resource Bankshares All Branch Locations |

Page 10

These materials may be deemed to be offering materials of Fulton Financial Corporation in connection with Fulton Financial’s proposed acquisition of Resource Bankshares Corporation on the terms and subject to the conditions in the Agreement and Plan of Merger, dated August 25, between Fulton Financial and Resource Bankshares. This filing is being made in connection with Regulation of Takeovers and Security Holder Communications (Release #’s 33-7760 and 34-42055) adopted by the Securities and Exchange Commission (“SEC”).

A proxy statement/prospectus will be included in the registration statement on Form S-4 which Fulton Financial will file with the SEC in connection with the proposed merger. Shareholders of Resource Bankshares Corporation and other investorsare urged to readthis proxy statement/prospectus because it will contain important information about Fulton Financial, Resource Bankshares, the merger, the persons soliciting proxies in the merger and their interests in the merger and related matters. After it is filed with the SEC, the proxy statement/prospectus will be available for free, both on the SEC’s web site(http://www.sec.gov) and from Resource Bankshares and Fulton Financial as follows:

Debra Dyckman | | George R. Barr |

Corporate Secretary | | Corporate Secretary |

Resource Bankshares Corporation | | Fulton Financial Corporation |

3720 Virginia Beach Boulevard | | One Penn Square |

Virginia Beach, VA, 23452 | | Lancaster, PA 17602 |

(757)-222-2407 | | (717 ) 291-2411 |

In addition to the proposed registration statement and proxy statement/prospectus, Fulton Financial and Resource Bankshares file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any reports, statements of other information filed by either company at the SEC’s public reference rooms at 450 Fifth Street, N.W., Washington, D.C. 20549 or at the SEC’s other public reference rooms in New York, New York and Chicago, Illinois. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. Fulton Financial’s and Resource Bankshares’ filings with the SEC are also available to the public from commercial document-retrieval services and on the SEC’s web site athttp://www.sec.gov.

Page 11