Fulton Financial Corporation

Investor Presentation

November 2004

1

Forward-looking statement

The following presentation may contain forward-looking statements about Fulton Financial Corporation’s growth and acquisition strategies, new products and services, and future financial performance, including earnings and dividends per share, return on average assets, return on average equity, efficiency ratio and capital ratio. Forward-looking statements are encouraged by the Private Securities Litigation Reform Act of 1995.

Such forward-looking information is based upon certain underlying assumptions, risks and uncertainties. Because of the possibility of change in the underlying assumptions, actual results could differ materially from these forward-looking statements. Risks and uncertainties that may affect future results include: pricing pressures on loans and deposits, actions of bank and non-bank competitors, changes in local and national economic conditions, changes in regulatory requirements, actions of the Federal Reserve Board, the Corporation’s success in merger and acquisition integration, and customers’ acceptance of the Corporation’s products and services.

2

Presentation outline

Corporate profile

Strategic initiatives

Asset quality

Future direction

Financial performance

3

Fulton Financial profile

Regional financial holding company (formed in 1982)

12 community banks and 3 financial services affiliates in 5 states

Asset size: $10.6 billion

Second largest commercial bank headquartered in Third Federal Reserve District

Fulton Bank founded in 1882

4

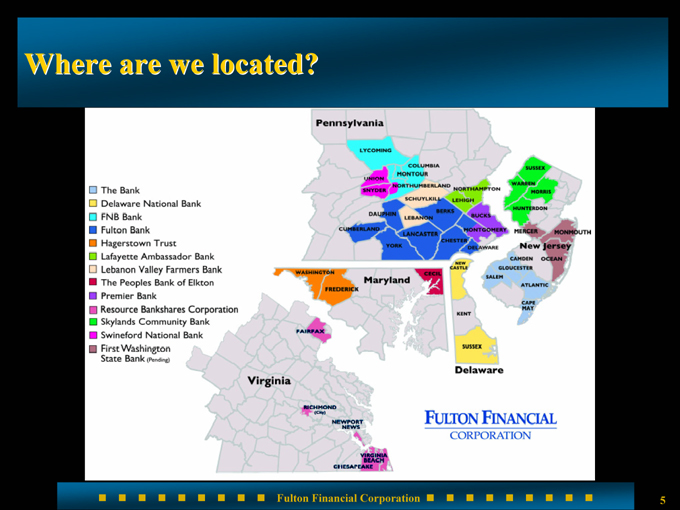

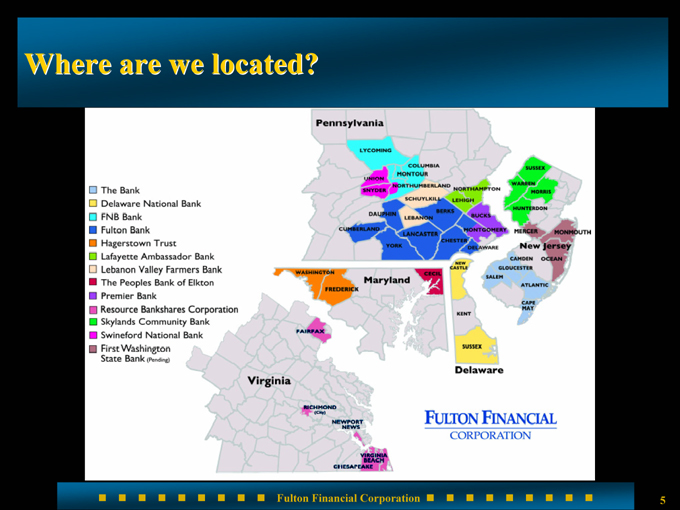

Where are we located?

The Bank

Delaware National Bank

FNB Bank

Fulton Bank

Hagerstown Trust

Lafayette Ambassador Bank

Lebanon Valley Farmers Bank

The Peoples Bank of Elkton

Premier Bank

Resource Bankshares Corporation

Skylands Community Bank

Swineford National Bank

First Washington

State Bank (Pending)

Fulton Financial Corporation

5

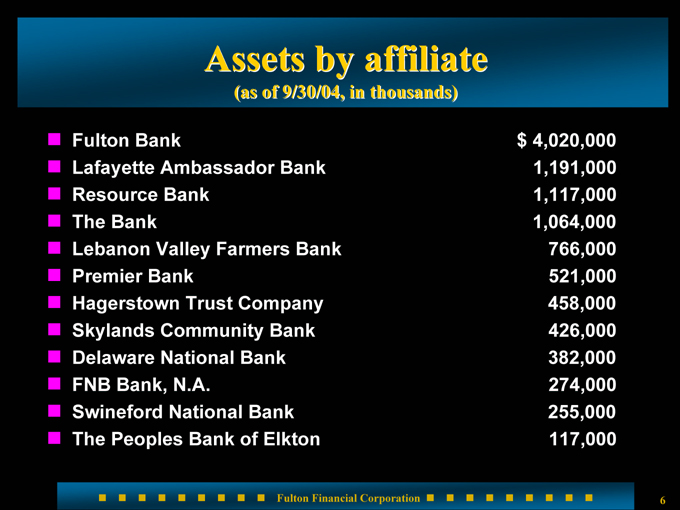

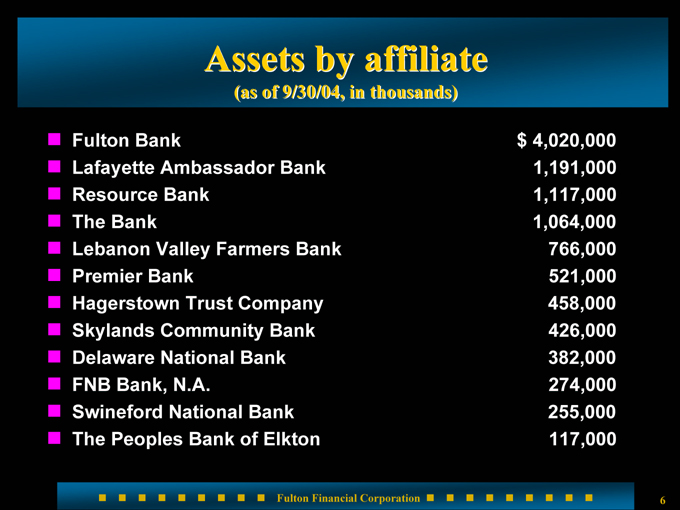

Assets by affiliate (as of 9/30/04, in thousands)

Fulton Bank $ 4,020,000

Lafayette Ambassador Bank 1,191,000

Resource Bank 1,117,000

The Bank 1,064,000

Lebanon Valley Farmers Bank 766,000

Premier Bank 521,000

Hagerstown Trust Company 458,000

Skylands Community Bank 426,000

Delaware National Bank 382,000

FNB Bank, N.A. 274,000

Swineford National Bank 255,000

The Peoples Bank of Elkton 117,000

6

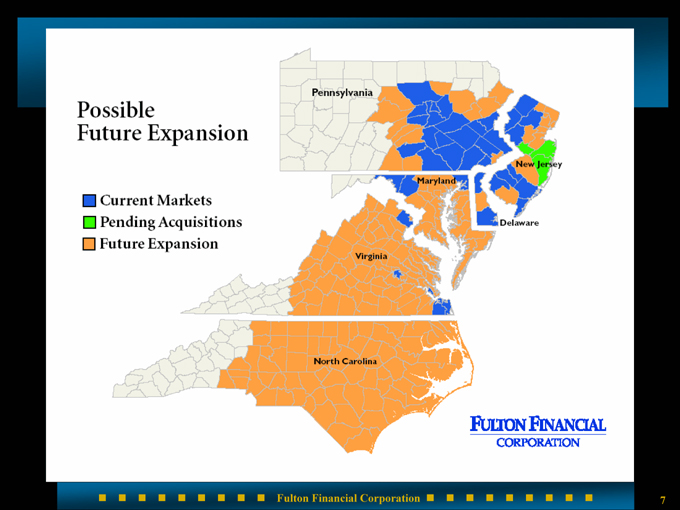

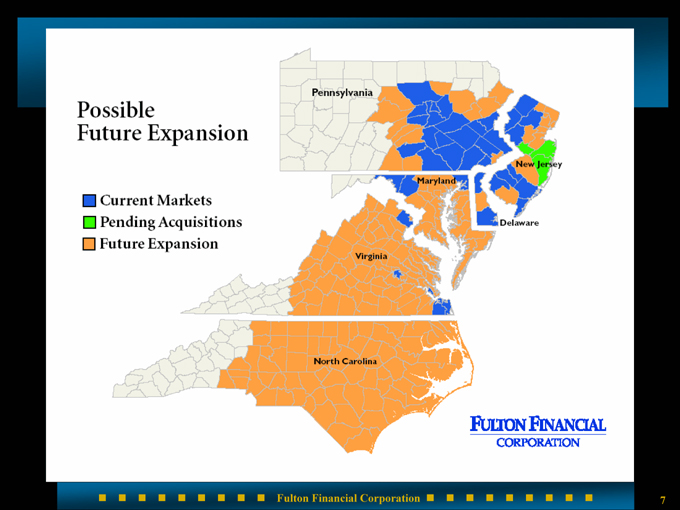

Possible Future Expansion

Current Markets

Pending Acquisitions

Future Expansion

Fulton Financial Corporation

Pennsylvania

Maryland

New Jersey

Delaware

Virginia

North Carolina

7

Mission statement

We will increase shareholder value and enrich the communities we serve by creating financial success together with our customers and career success together with our employees. We will conduct all of our business with honesty and integrity.

8

Corporate ethics

Longstanding written code of conduct

No “gray” areas

Expectations clearly outlined

9

8.8% compounded annual growth rate in earnings per share

22 consecutive years of record earnings

30 consecutive years of dividend increases

10.3% compounded annual growth rate in dividends per share (approximate dividend yield: 3.10%)

Proven business model

Consistent performance

What have we accomplished?

10

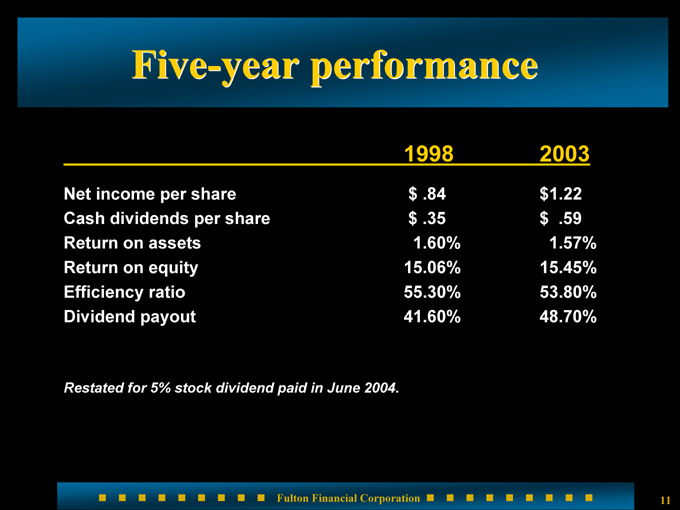

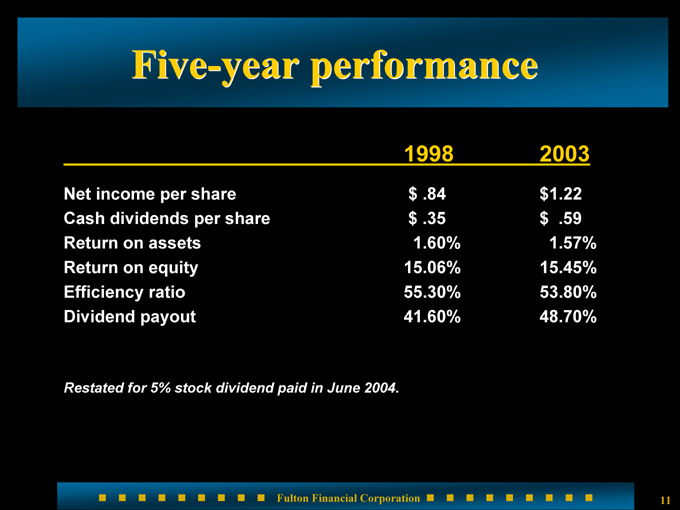

Five-year performance

1998 2003

Net income per share $.84 $1.22

Cash dividends per share $.35 $.59

Return on assets 1.60% 1.57%

Return on equity 15.06% 15.45%

Efficiency ratio 55.30% 53.80%

Dividend payout 41.60% 48.70%

Restated for 5% stock dividend paid in June 2004.

11

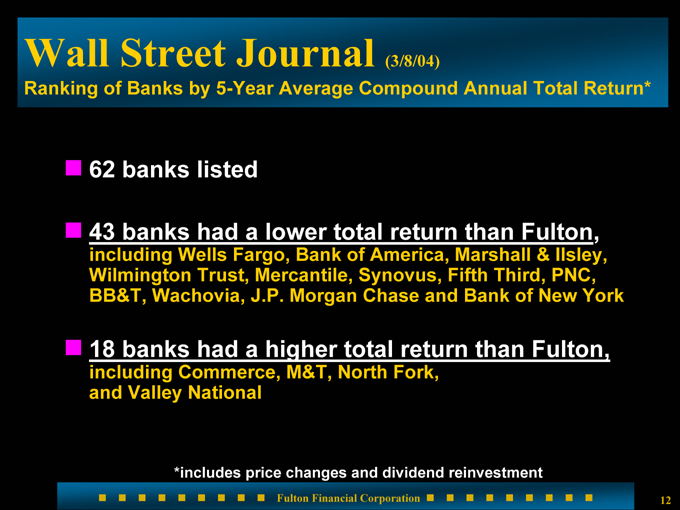

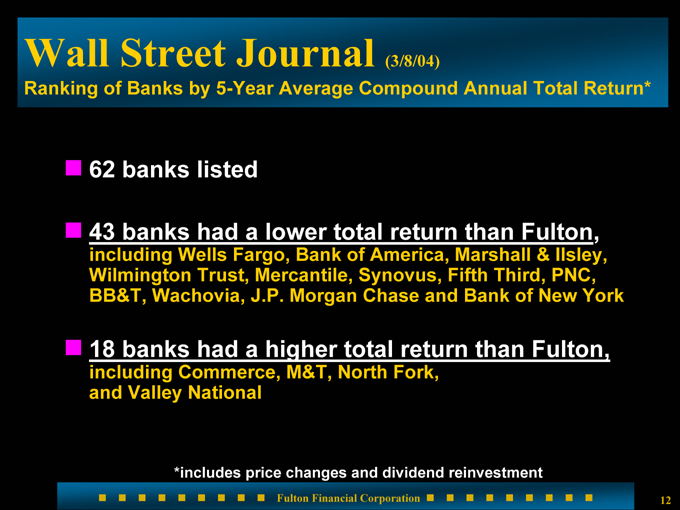

Wall Street Journal (3/8/04) Ranking of Banks by 5-Year Average Compound Annual Total Return*

62 banks listed

43 banks had a lower total return than Fulton, including Wells Fargo, Bank of America, Marshall & Ilsley, Wilmington Trust, Mercantile, Synovus, Fifth Third, PNC, BB&T, Wachovia, J.P. Morgan Chase and Bank of New York

18 banks had a higher total return than Fulton, including Commerce, M&T, North Fork, and Valley National

*includes price changes and dividend reinvestment

12

Five-year total return Peer analysis - 12/31/03

1

INTERNATIONAL BANCSHARES CORP

220.60

2

TCF FINANCIAL CORP

142.46

3

SOUTHWEST BANCORPORATION OF TX

117.92

4

FIRST REPUBLIC BANK

115.89

5

BANK OF HAWAII CORP

102.83

6

WHITNEY HOLDING CORP

96.03

7

ASSOCIATED BANC-CORP

91.25

8

VALLEY NATIONAL

88.61

9

GREATER BAY BANCORP

85.06

10

HIBERNIA CORP

83.48

11

FULTON FINANCIAL

81.15

12

FIRST MIDWEST

79.54

13

COLONIAL BANCGROUP

74.70

14

CULLEN FROST BANKERS

68.39

15

BOK FINANCIAL CORP

68.36

16

HUDSON UNITED

67.53

17

CITY NATIONAL CORP

63.47

18

COMMERCE BANKSHARES

60.18

19

BANCORP SOUTH

54.76

20

SUSQUEHANNA BANCSHS

49.05

21

TRUSTMARK CORP

46.26

22

SKY FINANCIAL GROUP

44.24

23

FIRST CITIZENS BANCSHARES

41.98

24

UNITED BANKSHARES INC

40.65

25

WILMINGTON TRUST CORP

37.82

26

MERCANTILE BANKSHARES

37.27

27

UMB FINANCIAL CORP

32.15

28

SOUTH FINANCIAL GROUP (The)

23.55

29

FIRSTMERIT CORP

22.32

30

CITIZENS BANKING CORP

20.73

31

OLD NATIONAL CORP

-9.53

32

RIGGS NATIONAL

-13.12

AVERAGE

66.74

13

Stock highlights (as of 09/30/04)

Average daily trading volume

139,500 shares

Number of analysts

12

Number of market makers

42

Number of shares outstanding

121.0 million

Market capitalization

$2.6 billion

Annual meeting attendance

2,000 shareholders

14

Employee stock ownership

80% of our employees collectively own more than 2 million shares of Fulton Financial Corporation stock

Stock options help us to retain key high-performing employees

15

Stock performance (1982 - 2003)

WITHOUT dividend reinvestment: 15% compounded annual rate of return

WITH dividend reinvestment: 19% compounded annual rate of return

16

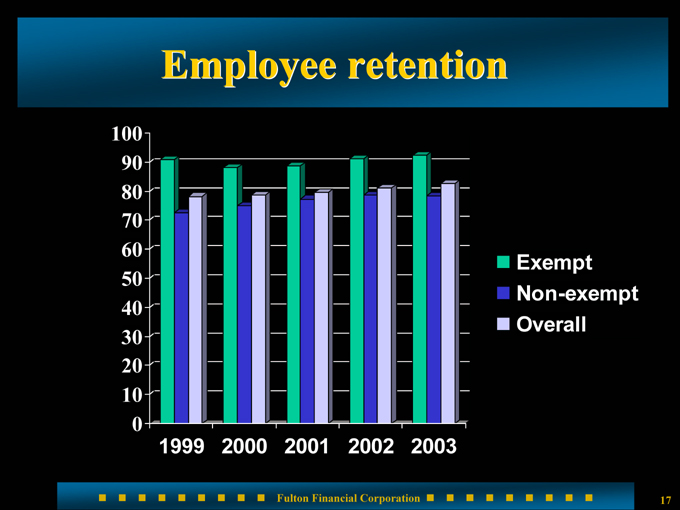

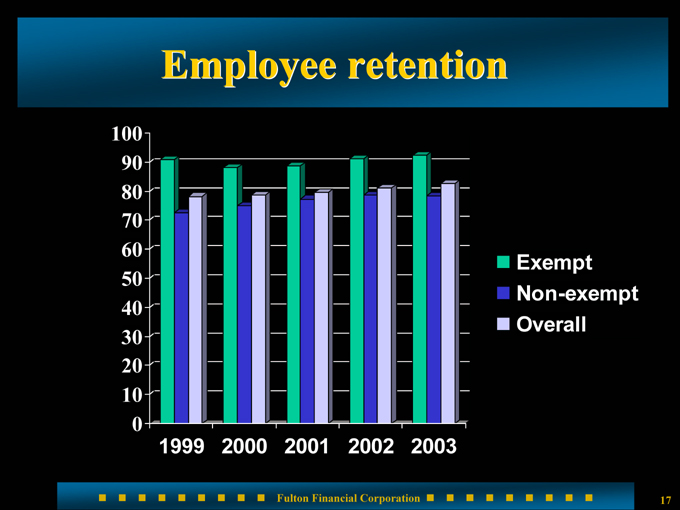

Employee retention

0

10

20

30

40

50

60

70

80

90

100

1999

2000

2001

2002

2003

Exempt

Non-exempt

Overall

17

Employee opinion survey

Customer service

Management team performance

Company image and mission

Team orientation

Technology and systems

Training and development

Sales orientation

Work effectiveness

Pay and benefits

Employee satisfaction

(Survey administered by BAI Survey Services)

18

Customer satisfaction

96% of our customers are Extremely or Very Satisfied with their Fulton Financial affiliate bank

86% of our commercial customers are Satisfied or Very Satisfied with us

Compared to national average of 55% of customers who are very satisfied with their financial institution*

*Source: 2003 American Banker/Gallup consumer survey

19

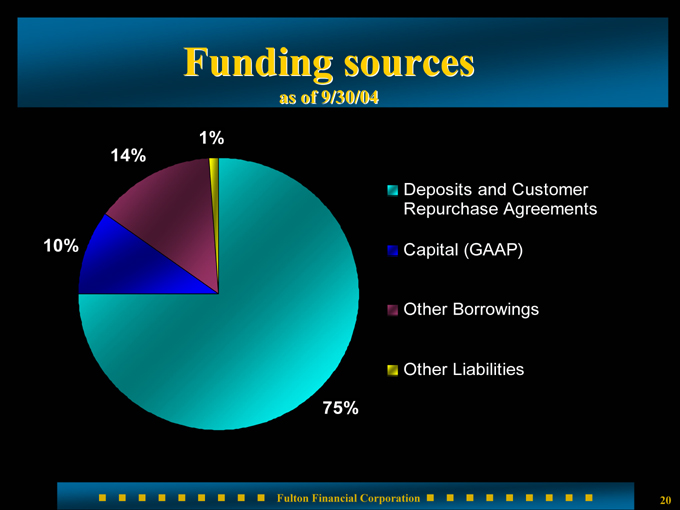

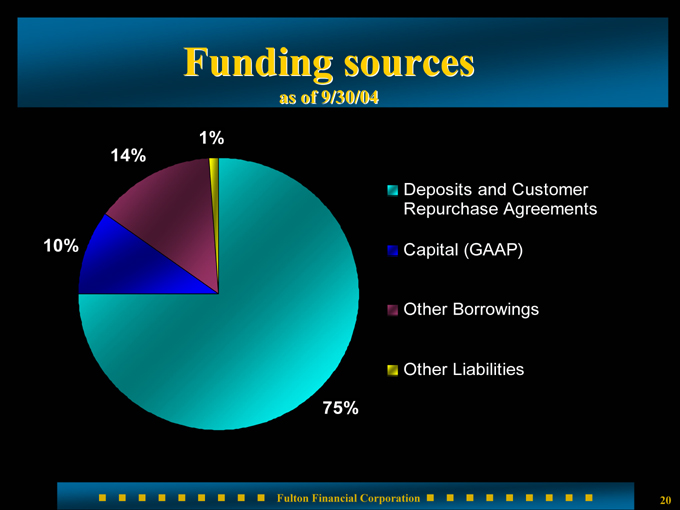

Funding sources as of 9/30/04

75%

10%

14%

1%

Deposits and Customer

Repurchase Agreements

Capital (GAAP)

Other Borrowings

Other Liabilities

20

Community involvement

Employees are actively involved in their own communities

The community benefits from this support

The banks receive additional business as a result of the relationships and goodwill that are developed

21

Corporate strategic initiatives

Achieving consistent earnings growth

Maintaining high asset quality

Expanding the franchise through our well-developed acquisition strategy

Diversifying revenue stream by increasing the contribution of non-interest income

Managing capital

22

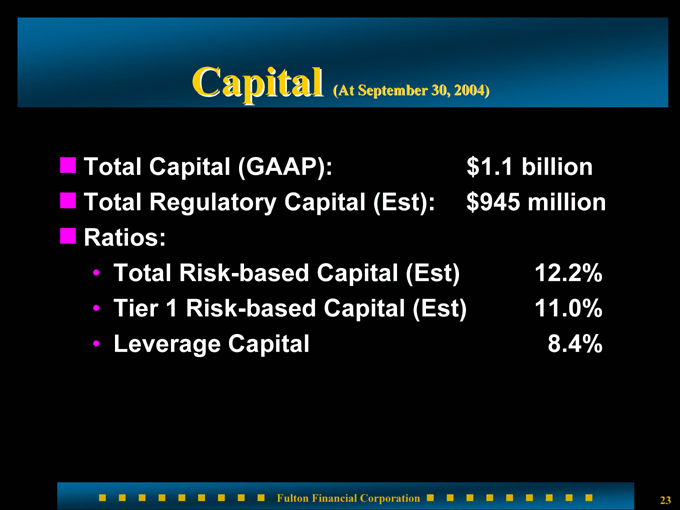

Capital (At September 30, 2004)

Total Capital (GAAP): $1.1 billion

Total Regulatory Capital (Est): $945 million

Ratios:

Total Risk-based Capital (Est) 12.2%

Tier 1 Risk-based Capital (Est) 11.0%

Leverage Capital 8.4%

23

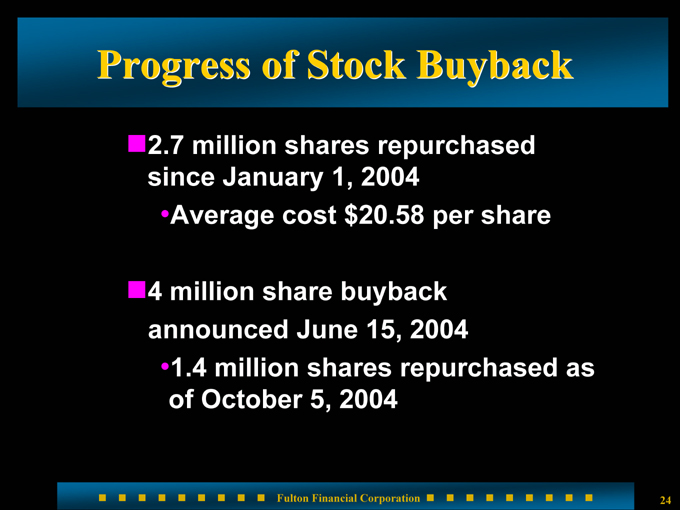

Progress of Stock Buyback

2.7 million shares repurchased since January 1, 2004

Average cost $20.58 per share

4 million share buyback

announced June 15, 2004

1.4 million shares repurchased as of October 5, 2004

24

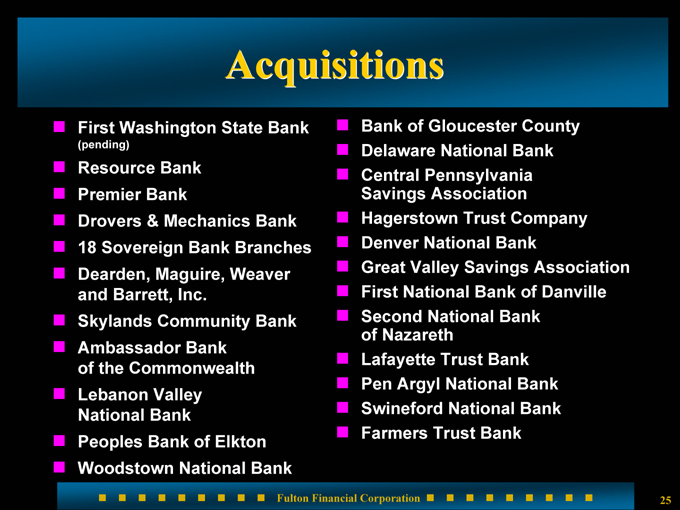

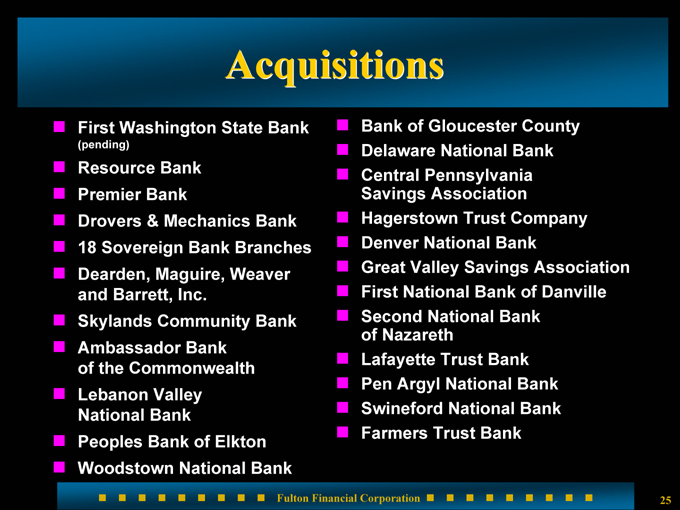

First Washington State Bank (pending)

Resource Bank

Premier Bank

Drovers & Mechanics Bank

18 Sovereign Bank Branches

Dearden, Maguire, Weaver and Barrett, Inc.

Skylands Community Bank

Ambassador Bank of the Commonwealth

Lebanon Valley National Bank

Peoples Bank of Elkton

Woodstown National Bank

Bank of Gloucester County

Delaware National Bank

Central Pennsylvania Savings Association

Hagerstown Trust Company

Denver National Bank

Great Valley Savings Association

First National Bank of Danville

Second National Bank of Nazareth

Lafayette Trust Bank

Pen Argyl National Bank

Swineford National Bank

Farmers Trust Bank

Acquisitions

25

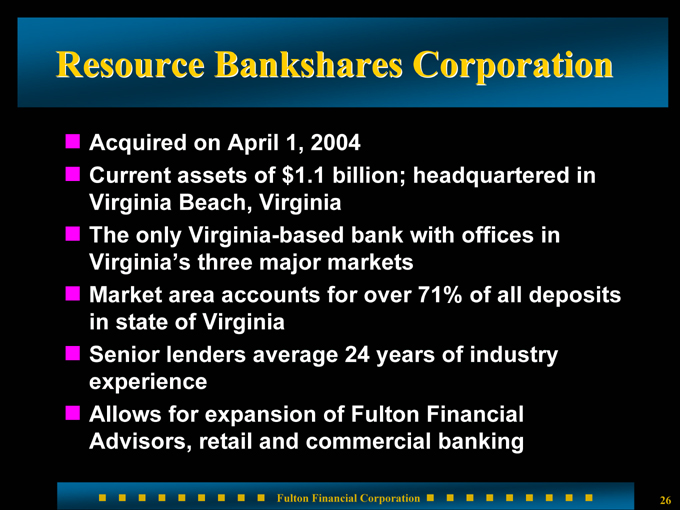

Resource Bankshares Corporation

Acquired on April 1, 2004

Current assets of $1.1 billion; headquartered in Virginia Beach, Virginia

The only Virginia-based bank with offices in Virginia’s three major markets

Market area accounts for over 71% of all deposits in state of Virginia

Senior lenders average 24 years of industry experience

Allows for expansion of Fulton Financial Advisors, retail and commercial banking

26

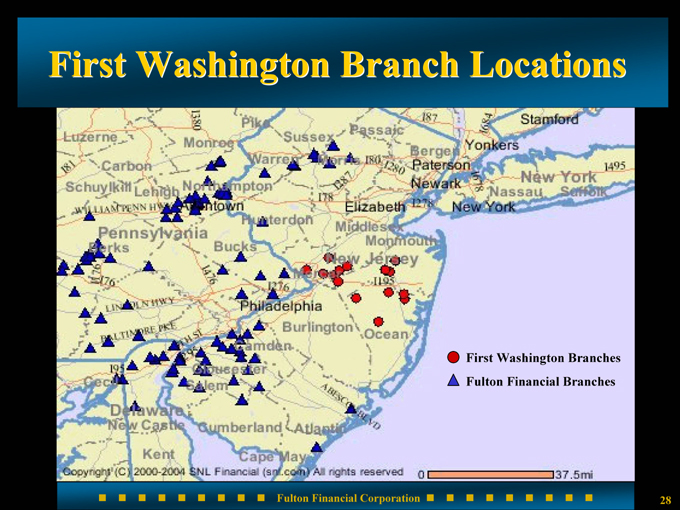

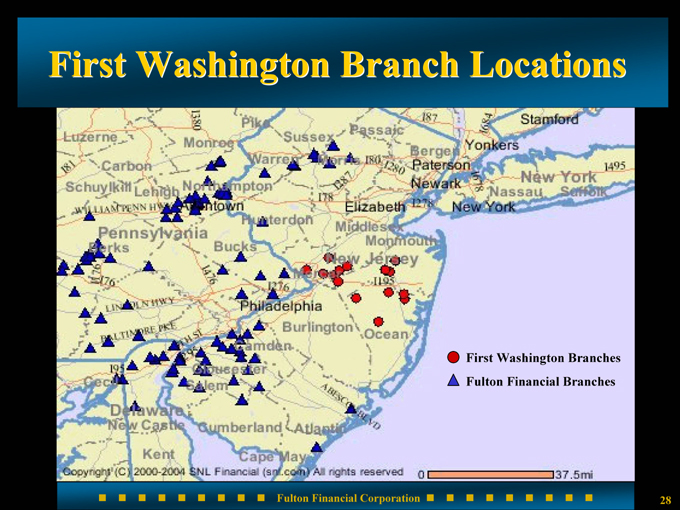

First Washington FinancialCorp

Assets of $486 million

Headquartered in Windsor, NJ

Banking subsidiary: First Washington State Bank

16 branches in Mercer, Monmouth and Ocean Counties in New Jersey

Enhances our existing northern and southern New Jersey franchise by extending our presence into the central part of the state

Transaction will be completed by April 15, 2005

FWFC has very strong asset quality and strong CAGR in EPS, deposits and loans

Market areas are robust with strong projected demographic trends

27

First Washington Branch Locations

First Washington Branches

Fulton Financial Branches

28

High growth areas

Dynamic market demographics

Strong performance

Asset quality

Talented and dedicated staff

Compatible corporate culture

What do we look for?

29

Acquisitions in new markets

What changes?

Loan review

Investments

Asset/liability management

Compliance

Common operating platform

Audit

30

What stays the same?

Bank name

Board of Directors

Management team

Employees

Acquisitions in new markets

31

Increased non-interest income due to introduction of new products and services

Additional capital

Increased lending capacity

Reduced expenses

Proven merger/conversion expertise

Continued local autonomy and decision-making

Benefits to new affiliates

32

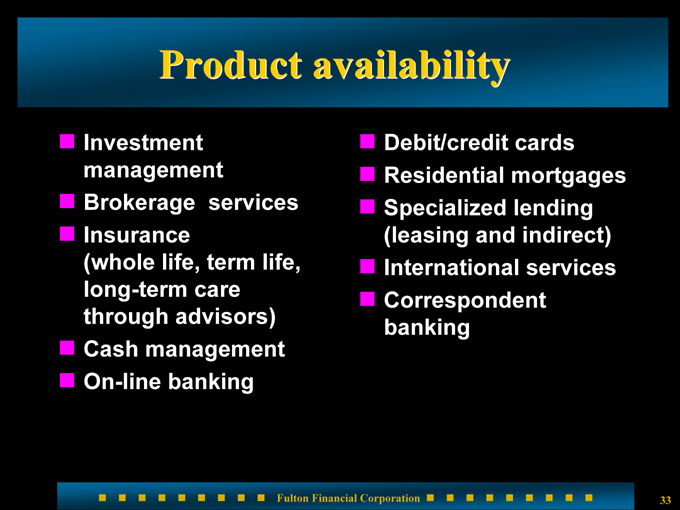

Investment management

Brokerage services

Insurance (whole life, term life, long-term care through advisors)

Cash management

On-line banking

Debit/credit cards

Residential mortgages

Specialized lending (leasing and indirect)

International services

Correspondent banking

Product availability

33

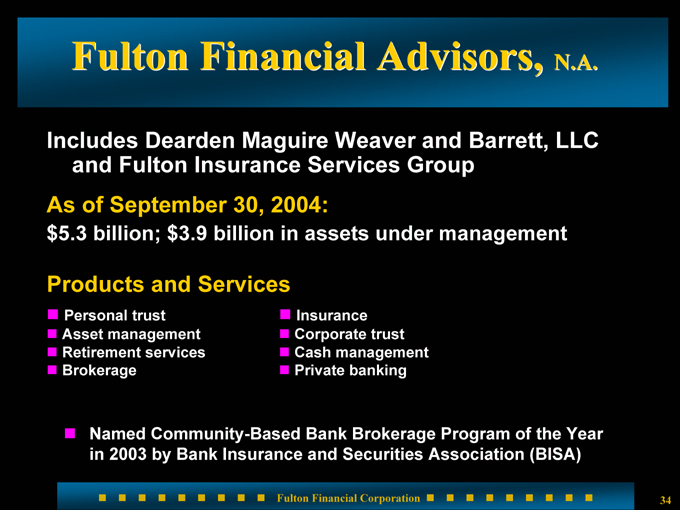

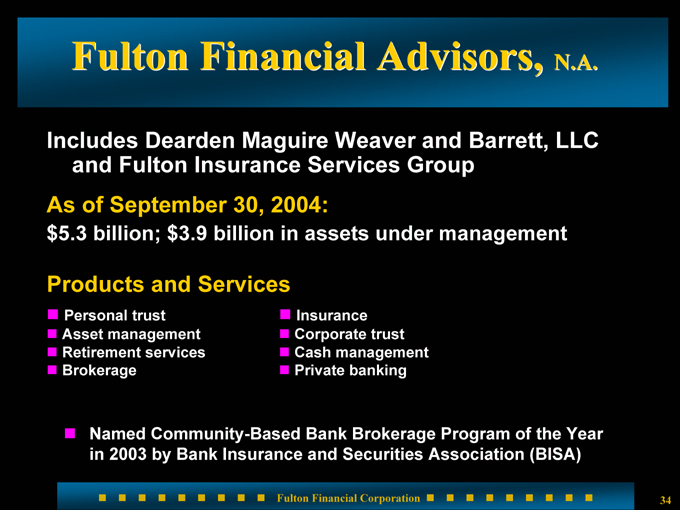

Includes Dearden Maguire Weaver and Barrett, LLC and Fulton Insurance Services Group

As of September 30, 2004:

$5.3 billion; $3.9 billion in assets under management

Products and Services

Personal trust

Asset management

Retirement services

Brokerage

Insurance

Corporate trust

Cash management

Private banking

Named Community-Based Bank Brokerage Program of the Year in 2003 by Bank Insurance and Securities Association (BISA)

Fulton Financial Advisors, N.A.

34

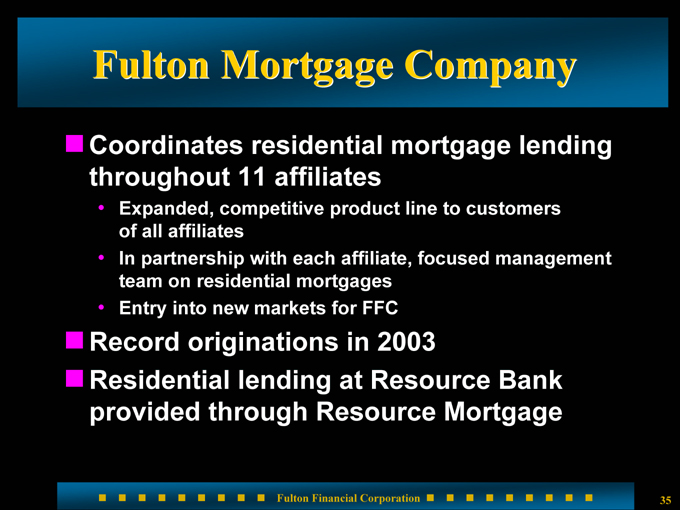

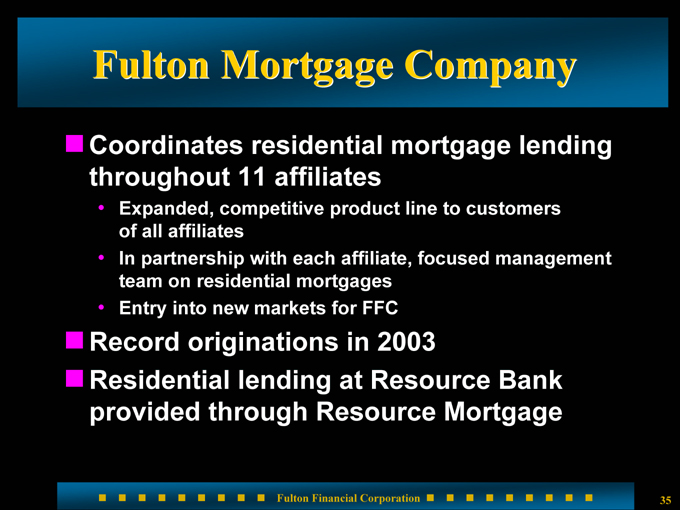

Fulton Mortgage Company

Coordinates residential mortgage lending throughout 11 affiliates

Expanded, competitive product line to customers of all affiliates

In partnership with each affiliate, focused management team on residential mortgages

Entry into new markets for FFC

Record originations in 2003

Residential lending at Resource Bank provided through Resource Mortgage

35

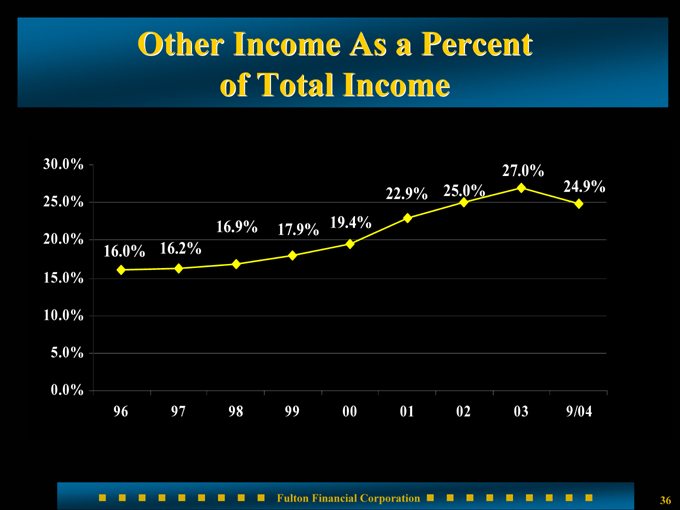

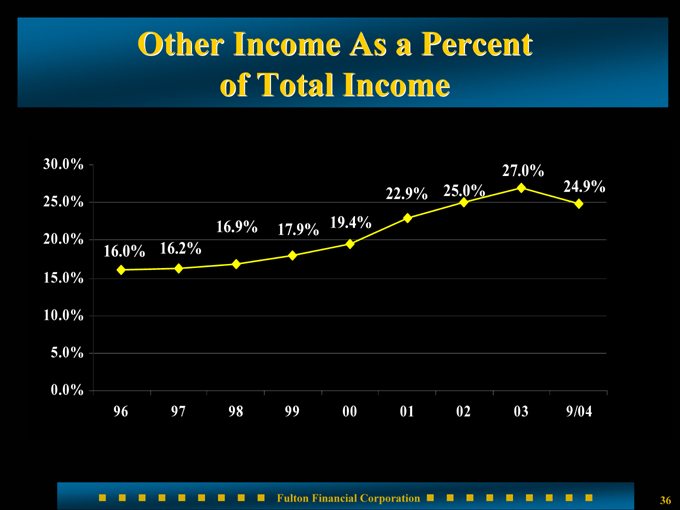

Other Income As a Percent of Total Income

24.9%

27.0%

25.0%

22.9%

19.4%

17.9%

16.0%

16.2%

16.9%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

96

97

98

99

00

01

02

03

9/04

36

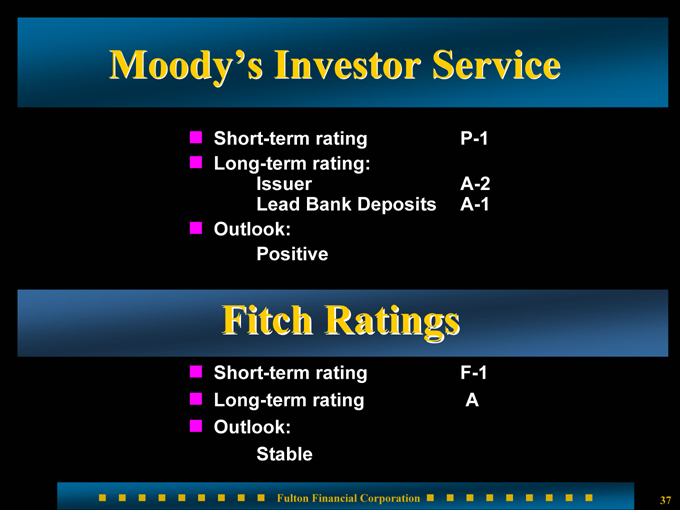

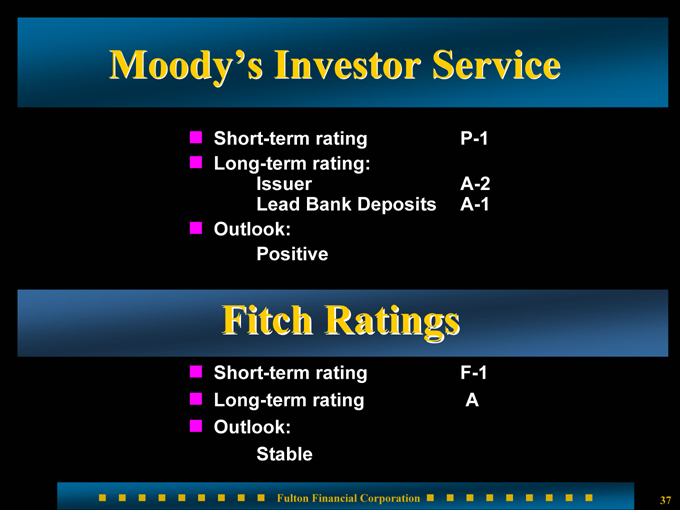

Moody’s Investor Service

Short-term rating P-1

Long-term rating: Issuer A-2 Lead Bank Deposits A-1

Outlook:

Positive

Fitch Ratings

Short-term rating F-1

Long-term rating A

Outlook:

Stable

37

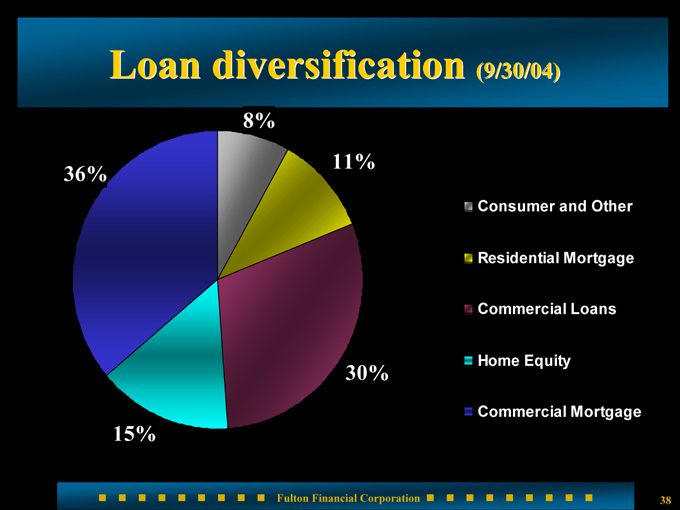

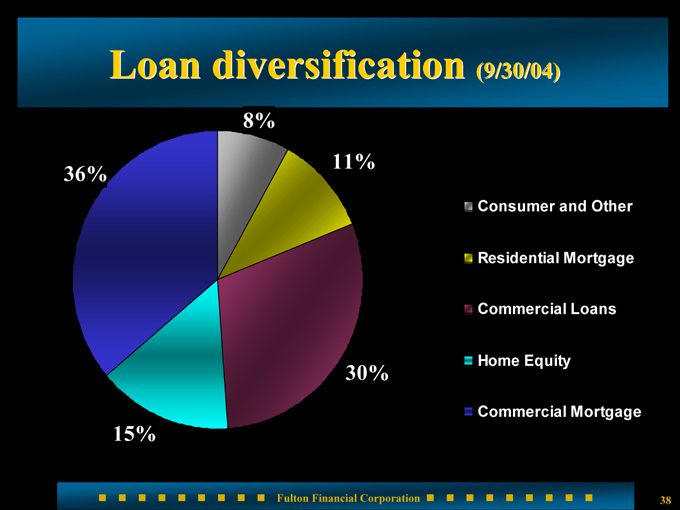

Loan diversification (9/30/04)

11%

30%

8%

15%

36%

Consumer and Other

Residential Mortgage

Commercial Loans

Home Equity

Commercial Mortgage

38

26 relationships with commitments to lend

of $20 million or more

Maximum individual commitment of $30 million

Average commercial loan commitment is $550,000

Loans and corresponding relationships are within Fulton’s geographical market area

Summary of larger loans

39

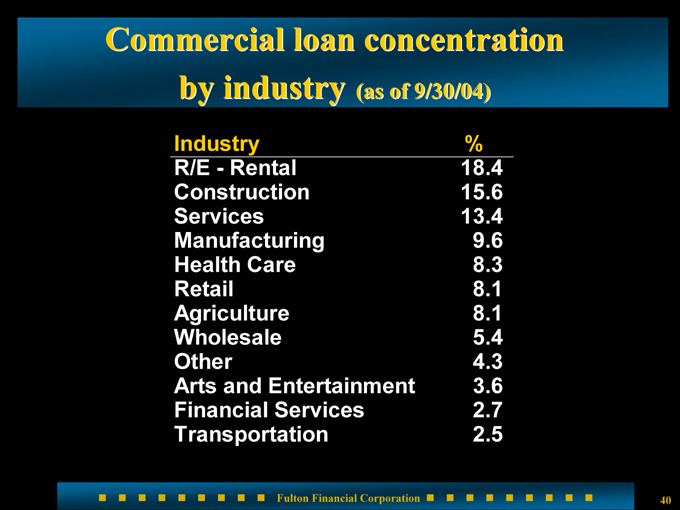

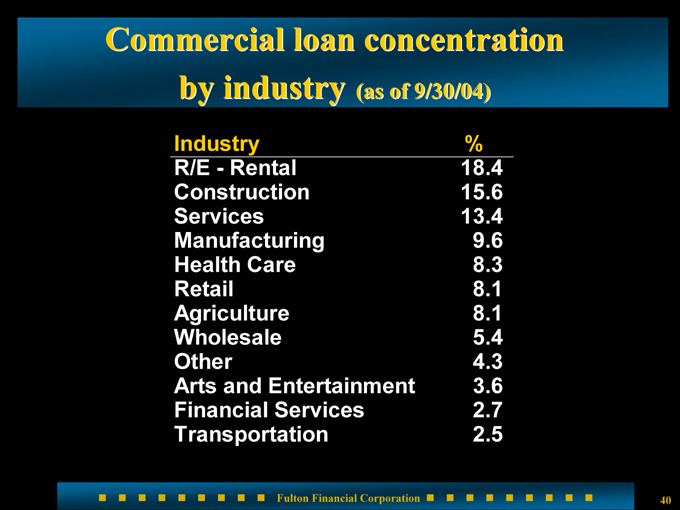

Commercial loan concentration by industry (as of 9/30/04)

Industry

%

R/E - Rental

18.4

Construction

15.6

Services

13.4

Manufacturing

9.6

Health Care

8.3

Retail

8.1

Agriculture

8.1

Wholesale

5.4

Other

4.3

Arts and Entertainment

3.6

Financial Services

2.7

Transportation

2.5

40

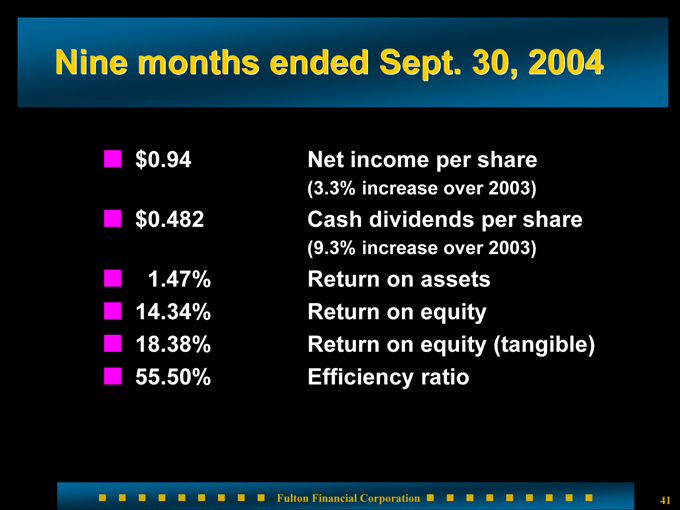

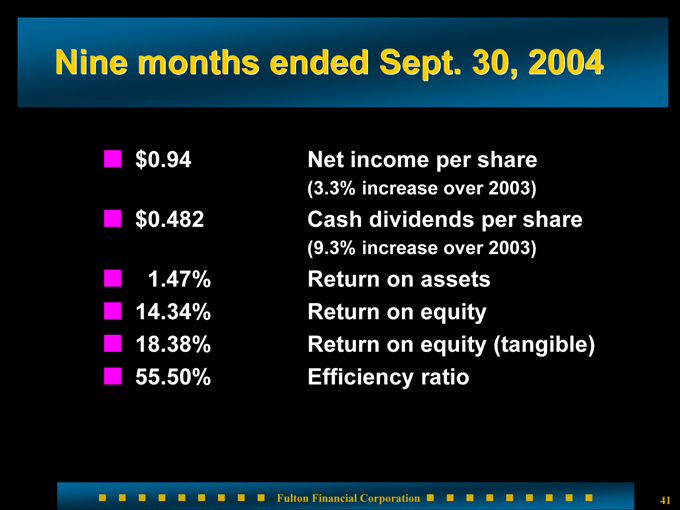

Nine months ended Sept. 30, 2004

$0.94 Net income per share (3.3% increase over 2003)

$0.482 Cash dividends per share (9.3% increase over 2003)

1.47% Return on assets

14.34% Return on equity

18.38% Return on equity (tangible)

55.50% Efficiency ratio

41

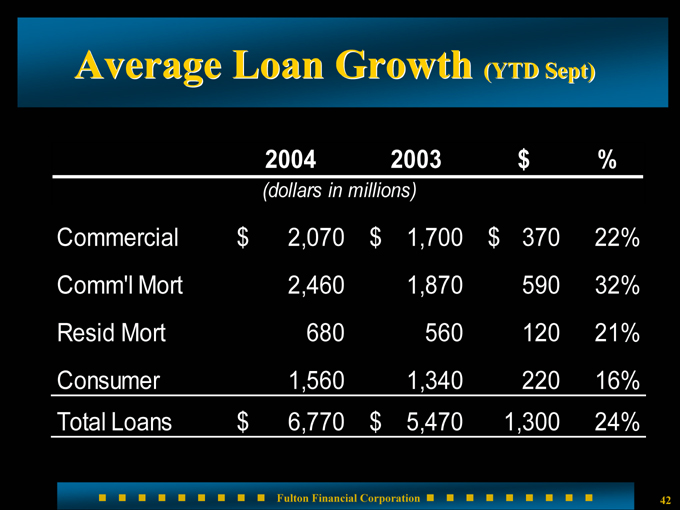

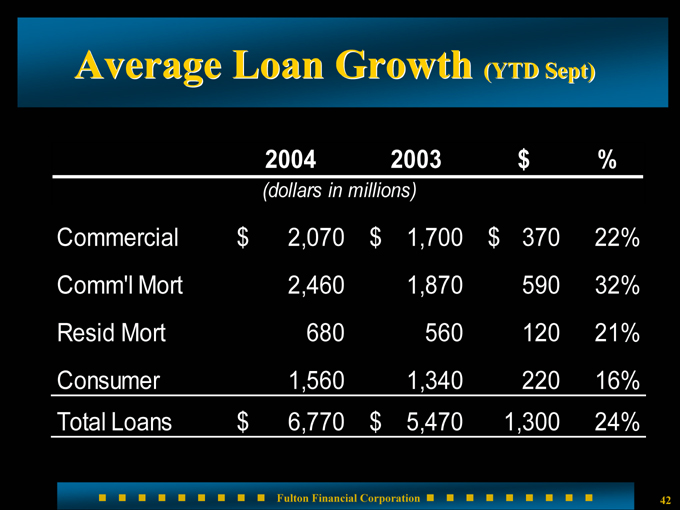

Average Loan Growth (YTD Sept)

2004

2003

$

%

Commercial

$2,070

$1,700

$370

22%

Comm’l Mort

2,460

1,870

590

32%

Resid Mort

680

560

120

21%

Consumer

1,560

1,340

220

16%

Total Loans

$6,770

$5,470

1,300

24%

(dollars in millions)

42

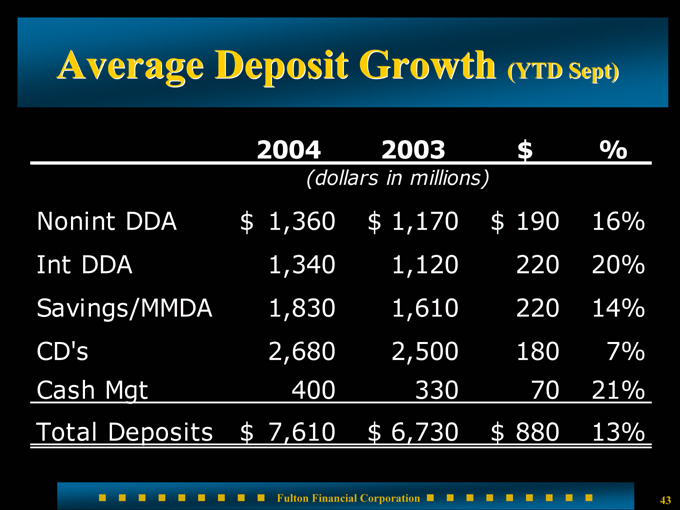

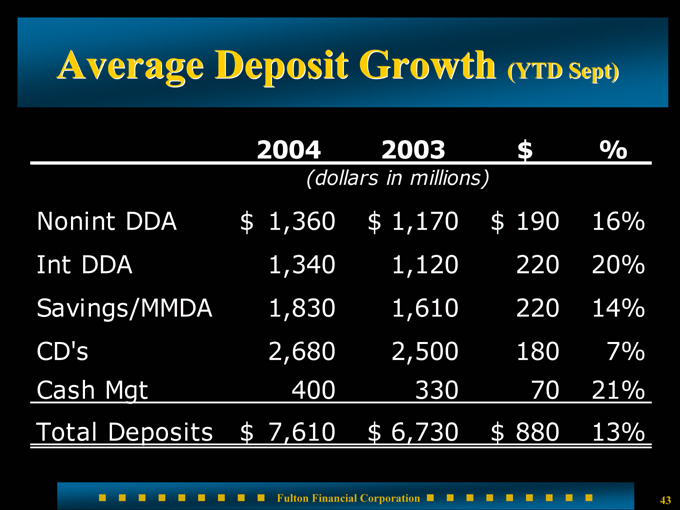

Average Deposit Growth (YTD Sept)

2004

2003

$

%

Nonint DDA

$1,360

$1,170

$190

16%

Int DDA

1,340

1,120

220

20%

Savings/MMDA

1,830

1,610

220

14%

CD’s

2,680

2,500

180

7%

Cash Mgt

400

330

70

21%

Total Deposits

$7,610

$6,730

$880

13%

(dollars in millions)

43

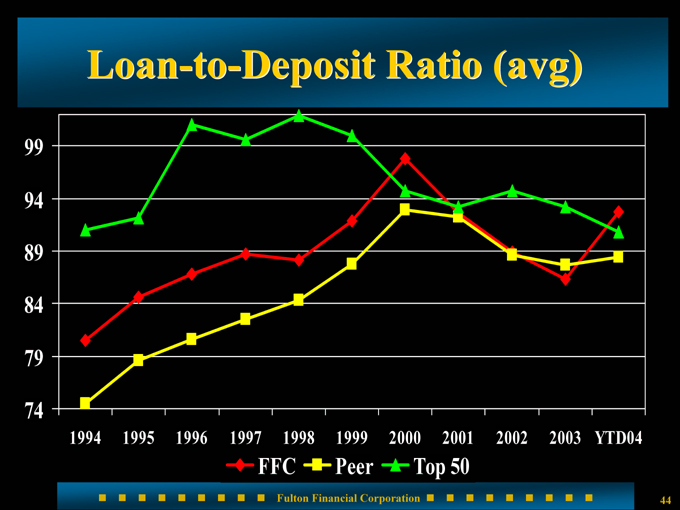

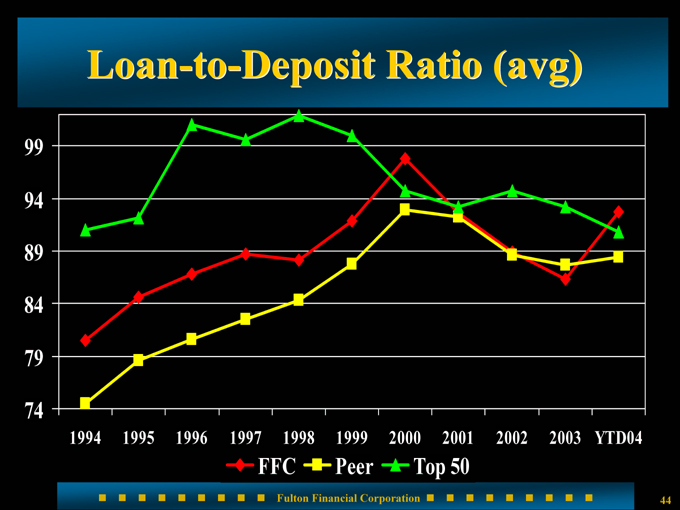

Loan-to-Deposit Ratio (avg)

74

79

84

89

94

99

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

YTD04

FFC

Peer

Top 50

44

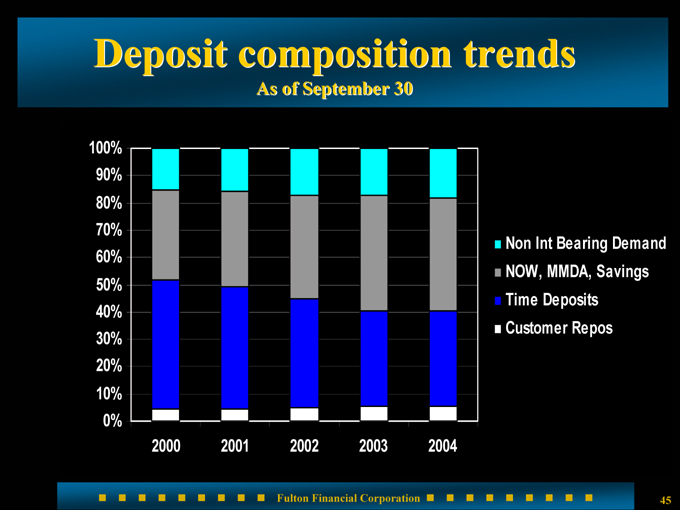

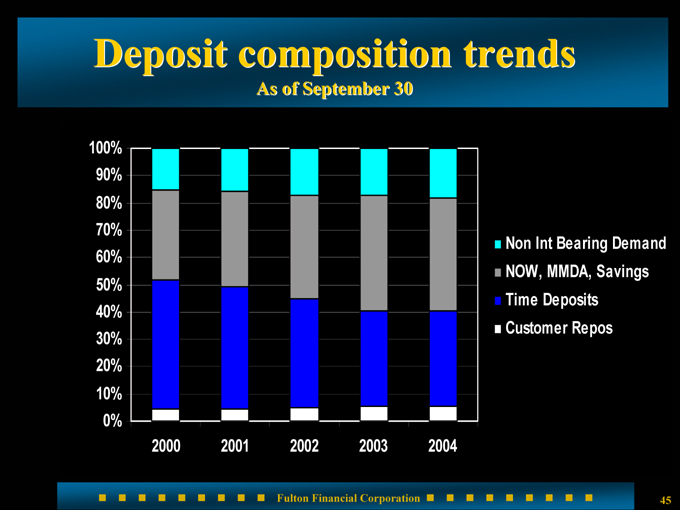

Deposit composition trends As of September 30

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2000

2001

2002

2003

2004

Non Int Bearing Demand

NOW, MMDA, Savings

Time Deposits

Customer Repos

45

Associated Banc-Corp

BancorpSouth, Inc.

Bank of Hawaii Corporation

BOK Financial Corporation

Citizens Banking Corporation

City National Corporation

Colonial BancGroup, Inc.

Commerce Bancshares, Inc.

Cullen/Frost Bankers, Inc.

First Citizens BancShares, Inc.

First Midwest Bancorp, Inc.

First Republic Bank

FirstMerit Corporation

Greater Bay Bancorp

Hibernia Corporation

Hudson United Bancorp

Peer group

International Bancshares Corporation

Mercantile Bankshares Corporation

Old National Bancorp

Riggs National Corporation

Sky Financial Group Inc.

South Financial Group, Inc. (The)

Southwest Bancorporation of Texas, Inc.

Susquehanna Bancshares, Inc.

TCF Financial Corporation

Trustmark Corporation

UMB Financial Corporation

United Bankshares, Inc.

Valley National Bancorp

Whitney Holding Corporation

Wilmington Trust Corporation

46

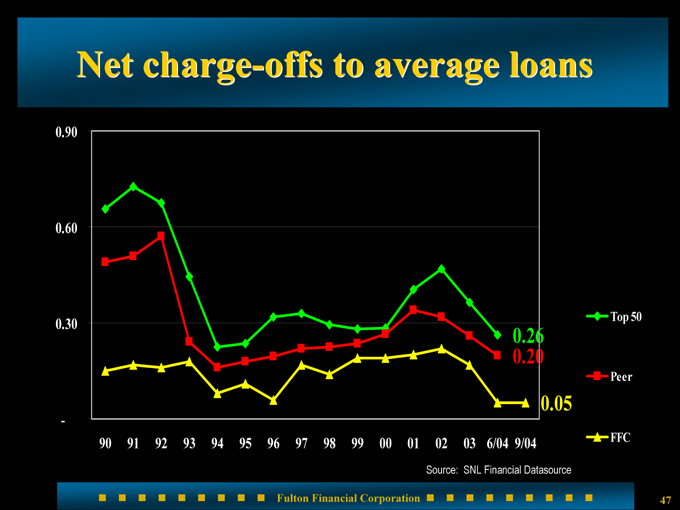

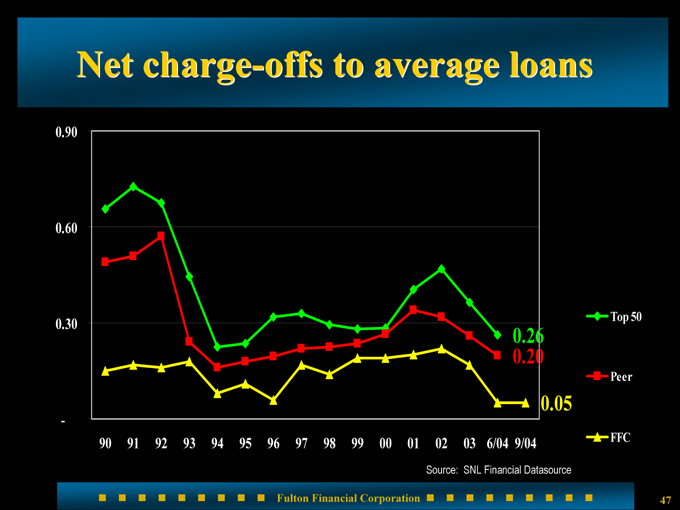

Source: SNL Financial Datasource

Net charge-offs to average loans

0.26

0.20

0.05

-

0.30

0.60

0.90

90

91

92

93

94

95

96

97

98

99

00

01

02

03

6/04

9/04

Top 50

Peer

FFC

47

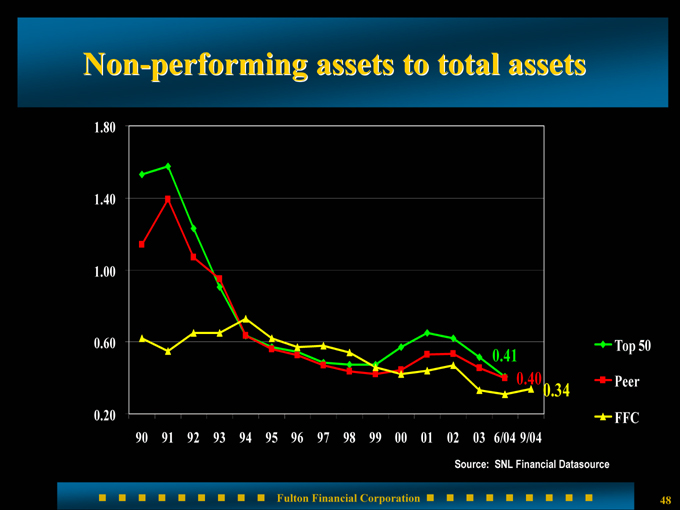

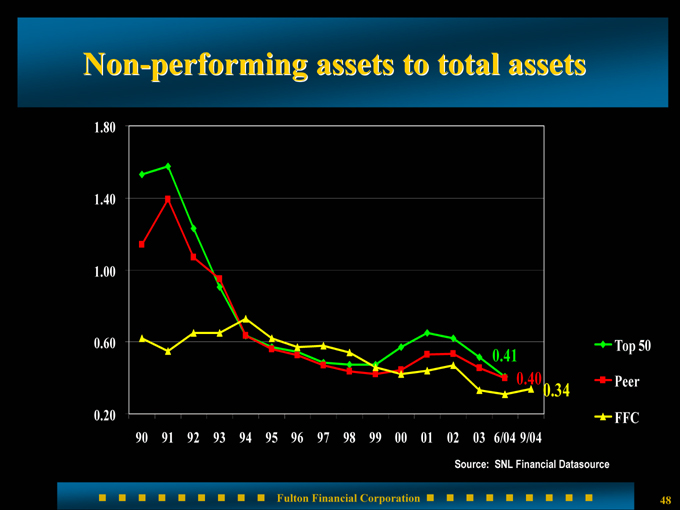

Source: SNL Financial Datasource

Non-performing assets to total assets

0.41

0.40

0.34

0.20

0.60

1.00

1.40

1.80

90

91

92

93

94

95

96

97

98

99

00

01

02

03

6/04

9/04

Top 50

Peer

FFC

48

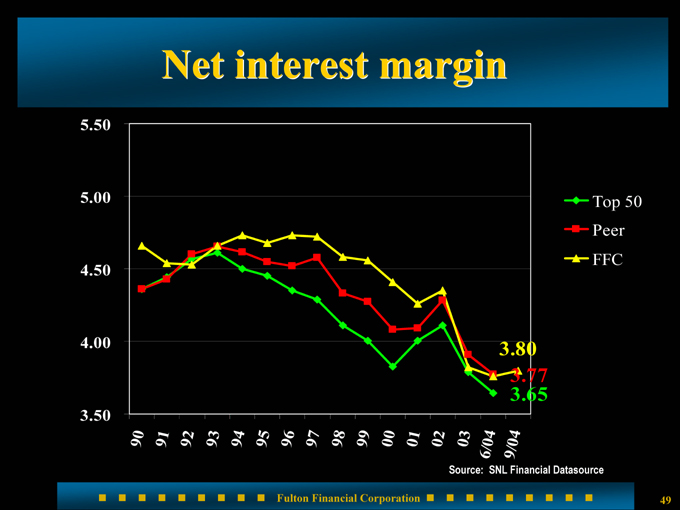

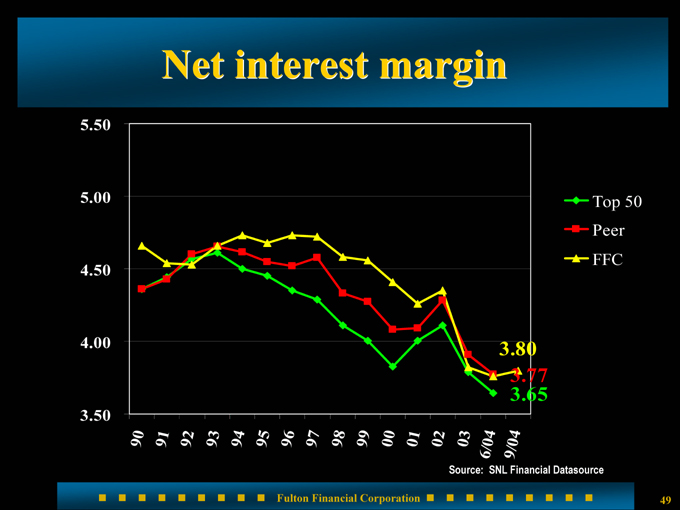

Source: SNL Financial Datasource

Net interest margin

3.65

3.77

3.80

3.50

4.00

4.50

5.00

5.50

90

91

92

93

94

95

96

97

98

99

00

01

02

03

6/04

9/04

Top 50

Peer

FFC

49

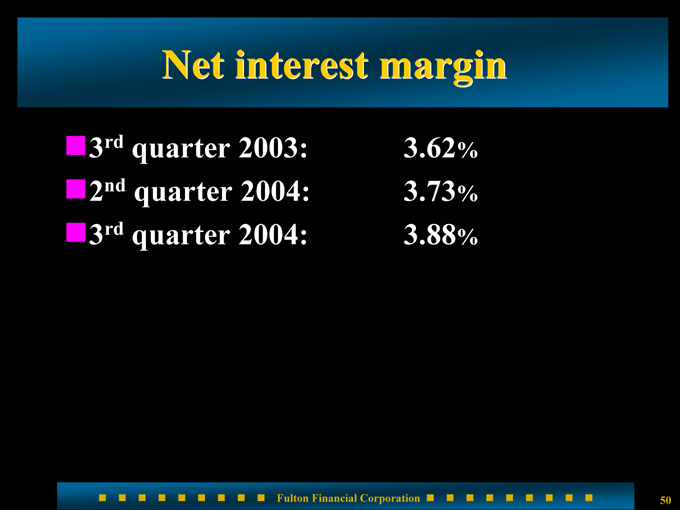

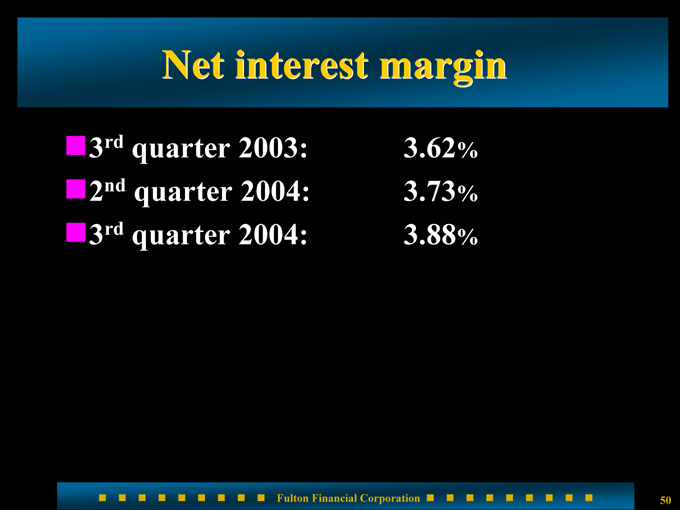

Net interest margin

3rd quarter 2003: 3.62%

2nd quarter 2004: 3.73%

3rd quarter 2004: 3.88%

50

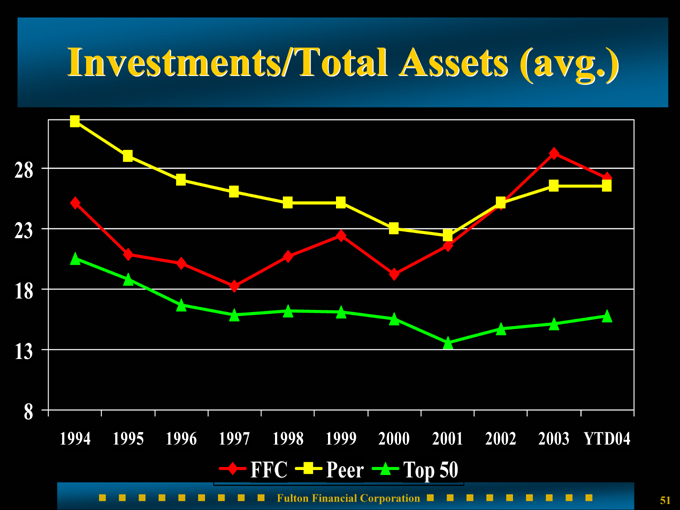

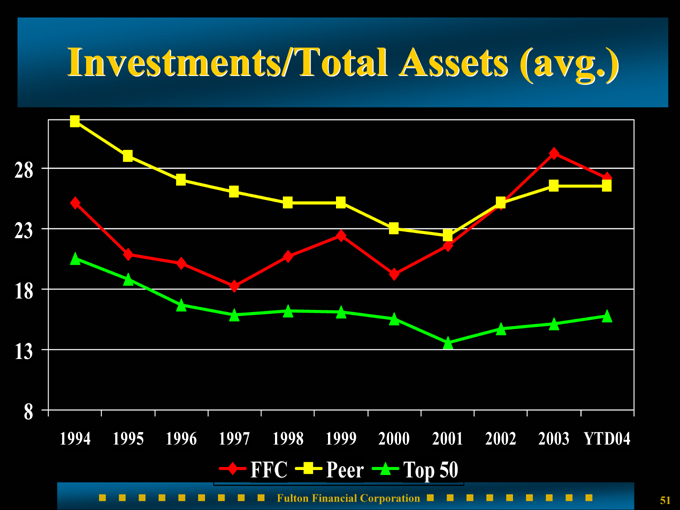

Investments/Total Assets (avg.)

8

13

18

23

28

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

YTD04

FFC

Peer

Top 50

51

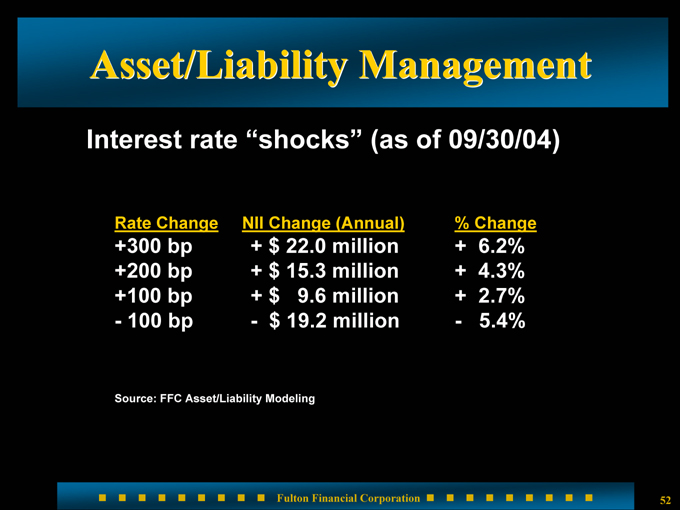

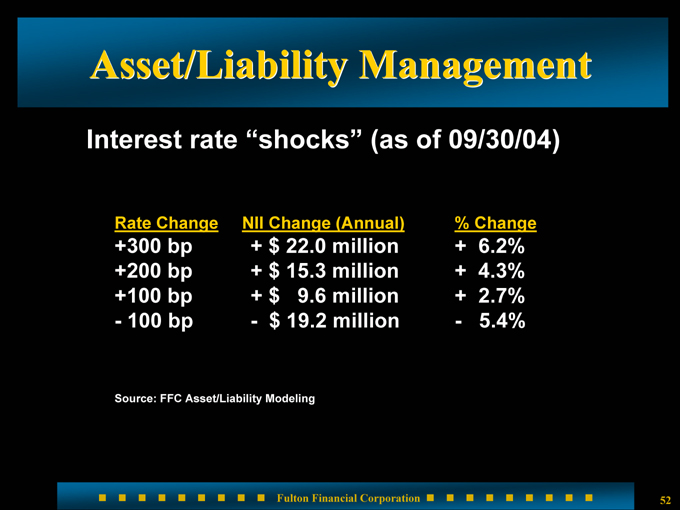

Asset/Liability Management

Interest rate “shocks” (as of 09/30/04)

Rate Change NII Change (Annual) % Change

+300 bp + $22.0 million + 6.2%

+200 bp + $15.3 million + 4.3%

+100 bp + $9.6 million + 2.7%

- 100 bp - $19.2 million - 5.4%

Source: FFC Asset/Liability Modeling

52

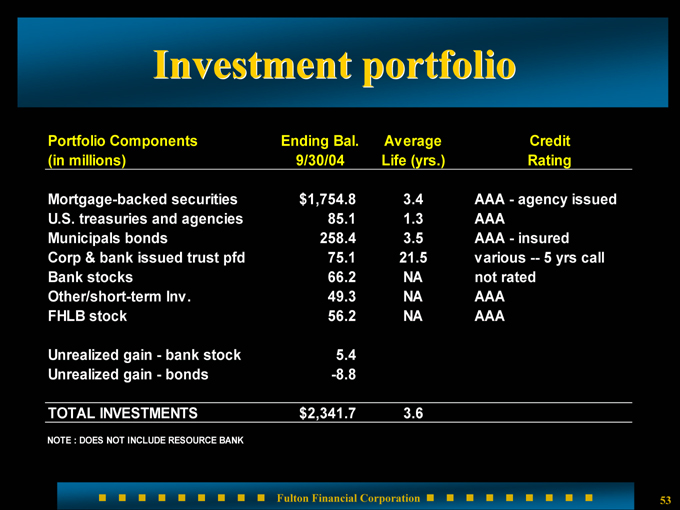

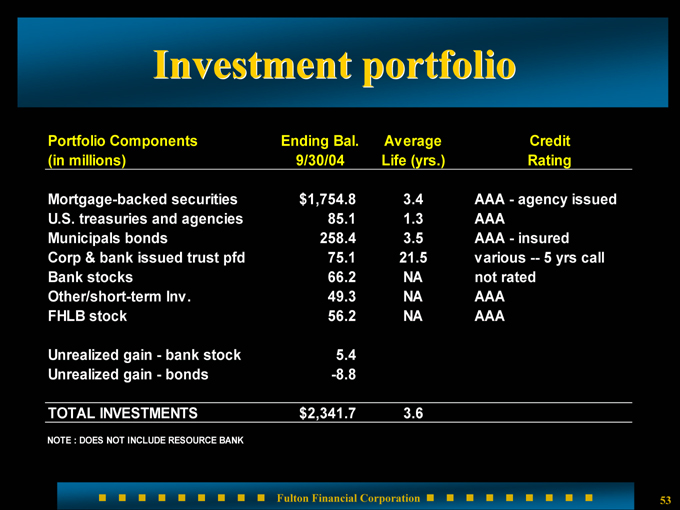

Investment portfolio

Portfolio Components

Ending Bal.

Average

Credit

Mortgage-backed securities

$1,754.8

3.4

AAA - agency issued

U.S. treasuries and agencies

85.1

1.3

AAA

Municipals bonds

258.4

3.5

AAA—insured

Corp & bank issued trust pfd

75.1

21.5

various — 5 yrs call

Bank stocks

66.2

NA

not rated

Other/short-term Inv.

49.3

NA

AAA

FHLB stock

56.2

NA

AAA

Unrealized gain—bank stock

5.4

Unrealized gain—bonds

-8.8

TOTAL INVESTMENTS

$2,341.7

3.6

NOTE : DOES NOT INCLUDE RESOURCE BANK

53

Loan Mix (9/30/04)

Fixed rate loans = 34%

Adjustable rate loans = 66%

54

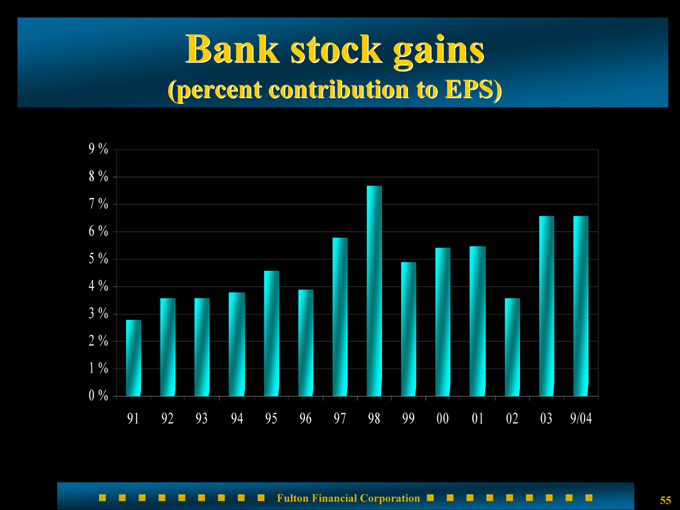

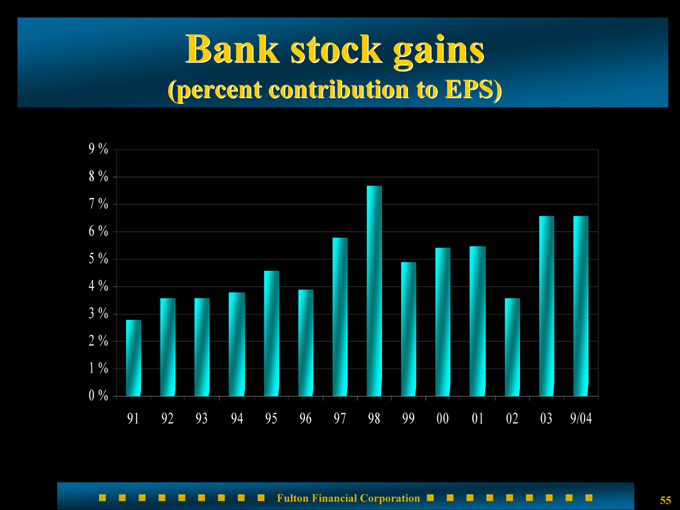

Bank stock gains (percent contribution to EPS)

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

91

92

93

94

95

96

97

98

99

00

01

02

03

9/04

55

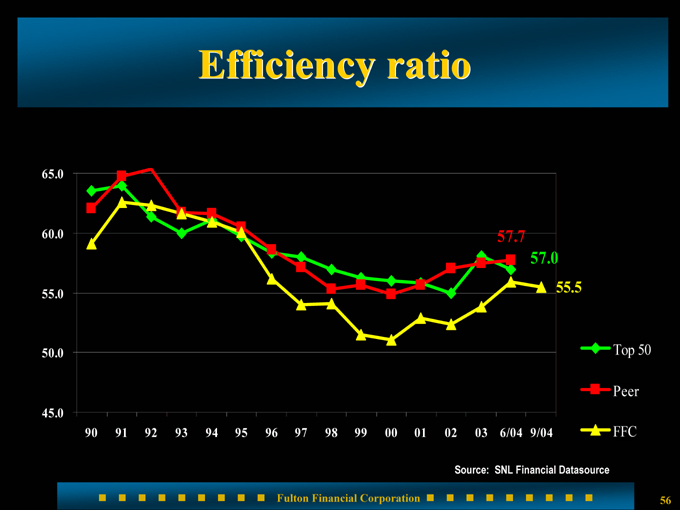

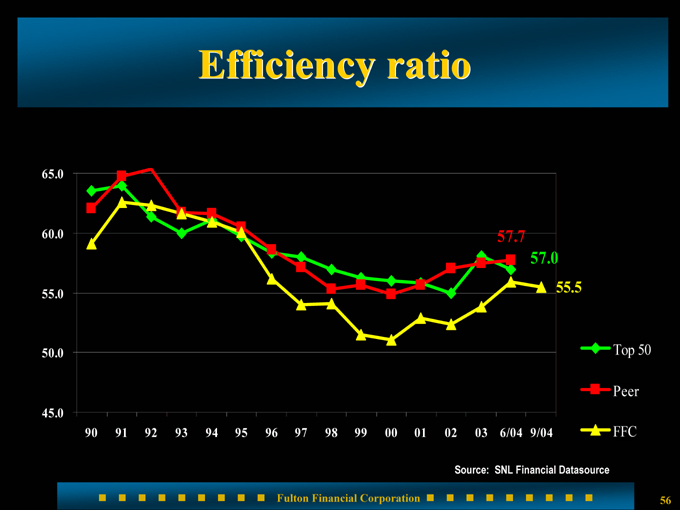

Source: SNL Financial Datasource

Efficiency ratio

55.5

57.0

57.7

45.0

50.0

55.0

60.0

65.0

90

91

92

93

94

95

96

97

98

99

00

01

02

03

6/04

9/04

Top 50

Peer

FFC

56

Corporate Governance

Internal controls over financial reporting process

SOX and NASDAQ listing standards

Financial expert designated

Independent directors determined

Executive sessions

Executive compensation and nominating committees

SOX compliant written Code of Conduct

Corporate disclosure committee and Audit committee—formal review process for relevant financial filings

57

Looking ahead

Continued focus on:

Strong asset quality

Growth in non-interest income, particularly from Advisors

Expansion of franchise geographically

Increased loan activity

Core deposit growth

58

Overview

Shareholders

maximize shareholder value

Customers

create financial success

Employees

create career success

Communities

create prosperity

59

Fulton Financial Corporation

One Penn Square

Lancaster, PA 17602

www.fult.com

60