Fulton Financial Corporation

2005 Annual Meeting April 13, 2005

1

Safe Harbor statement

The following presentation may contain forward-looking statements about Fulton Financial Corporation’s growth and acquisition strategies, new products and services, and future financial performance, including earnings and dividends per share, return on average assets, return on average equity, efficiency ratio and capital ratio. Forward-looking statements are encouraged by the Private Securities Litigation Reform Act of 1995.

Such forward-looking information is based upon certain underlying assumptions, risks and uncertainties. Because of the possibility of change in the underlying assumptions, actual results could differ materially from these forward-looking statements. Risks and uncertainties that may affect future results include: pricing pressures on loans and deposits, actions of bank and non-bank competitors, changes in local and national economic conditions, changes in regulatory requirements, actions of the Federal Reserve Board, the Corporation’s success in merger and acquisition integration, and customers’ acceptance of the Corporation’s products and services.

2

Fulton Financial Corporation

2005 Annual Meeting April 13,

2005

3

Board of Directors

Fulton Financial Corporation

4

Slides 5-21

[Slides 5-21 contain pictures of directors, which have been omitted from the filed document]

5-21

Senior Management

Fulton Financial Corporation

22

Slides 23-24

[Slides 23-24 contain pictures of Senior Management, which have been omitted from the filed document]

23-24

Fulton Financial

Corporation

2005 Annual Meeting April 13, 2005

25

Fulton Financial Corporation

Affiliate Chief Executive Officers

26

Slides 27-40

[Slides 27-40 contain pictures of Chief Executive Officer of Affiliate Banks, which have been omitted from the filed document]

27-40

Fulton Financial

Corporation

2005 Annual Meeting April 13, 2005

41

Rufus A. Fulton, Jr.

Chairman and Chief Executive Officer

2

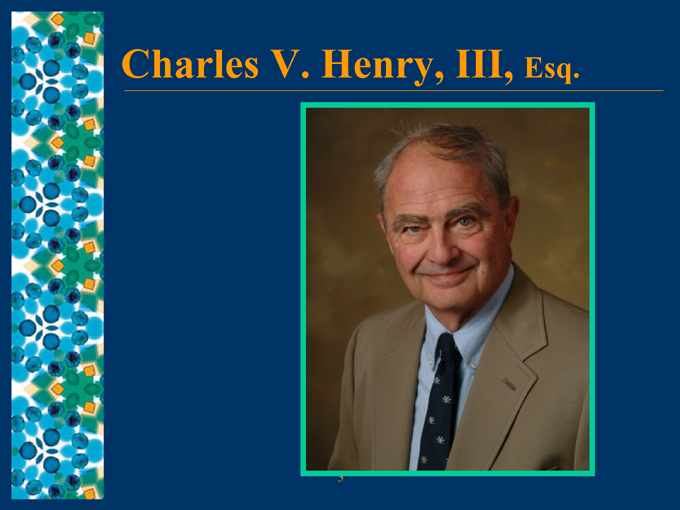

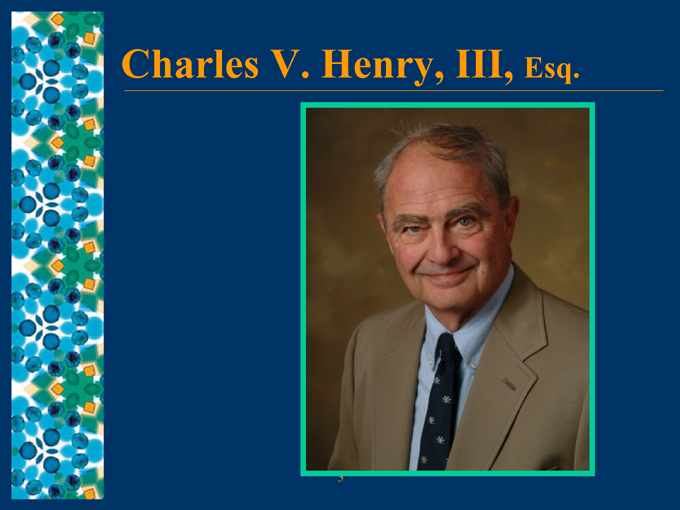

Charles V. Henry, III, Esq.

3

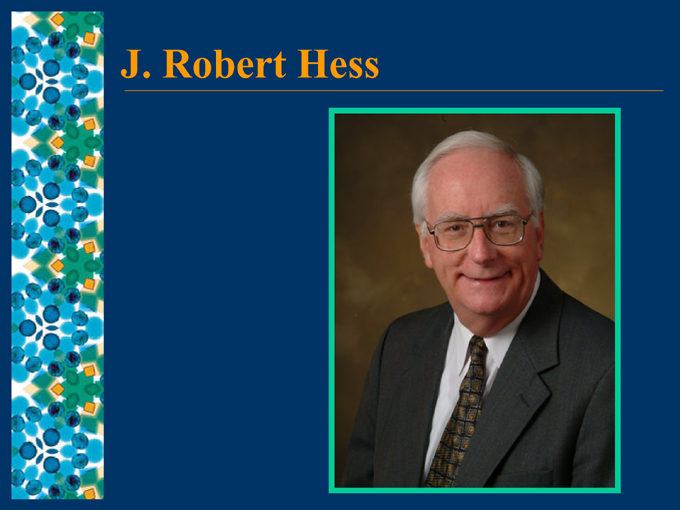

J. Robert Hess

4

Working together beautifully.

Fulton financial corporation

2004 annual report

5

2005 Annual Report:

Working Together Beautifully

6

Working Together Beautifully

7

Working Together Beautifully

8

Highlights of 2004

Fulton Financial Corporation

9

10

Resource Bank

Acquired on April 1, 2004 Current assets of $1.1 billion; headquartered in Virginia Beach, Virginia The only

Virginia-based bank with offices in Virginia’s three major markets Market area accounts for over 71% of all deposits in state of Virginia

11

New FFC director

Tom Hunt

12

First Washington State Bank

Assets of $585 million Headquartered in Windsor, NJ 16 branches in Mercer, Monmouth and Ocean Counties Enhances our existing northern and southern New Jersey franchise by extending our presence into the central part of the state

13

New FFC director

Abe Opatut

14

SVB Financial Services, Inc.

Assets of $475 million

Headquartered in Somerville, NJ Banking subsidiary: Somerset Valley Bank 11 branches in Somerset, Hunterdon and Middlesex counties Our 4th New Jersey affiliate

15

Our Presence in New Jersey

The bank

Skylands community bank

First washington state bank

Somerset valley bank(pending)

SUSSEX

WARREN

MORRIS

SOMERSET

HUNTERDON

MIDDLESEX

MERCER

MONMOUTH

NEW JERSEY

CAMDEN

OCEAN

GLOUCESTER

SALEM

ATLANTIC

CAPE MAY

16

Acquisitions

Somerset Valley Bank (pending) First Washington State Bank Resource Bank Premier Bank Drovers & Mechanics Bank 18 Sovereign Bank Branches Dearden, Maguire, Weaver and Barrett, Inc.

Skylands Community Bank Ambassador Bank of the Commonwealth Lebanon Valley National Bank Peoples Bank of Elkton

Woodstown National Bank & Trust Company Bank of Gloucester County Delaware National Bank Central Pennsylvania Savings Association Hagerstown Trust Company Denver National Bank Great Valley Savings Assn. First National Bank of Danville Second National Bank of Nazareth Lafayette Trust Bank Pen Argyl National Bank

Swineford National Bank Farmers Trust Bank

17

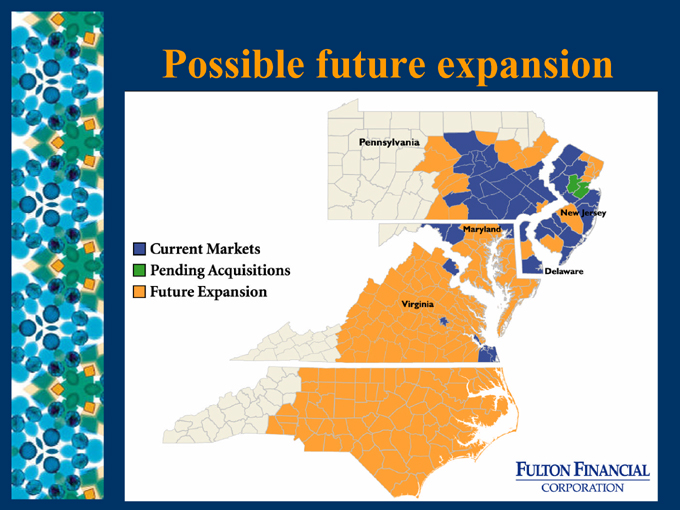

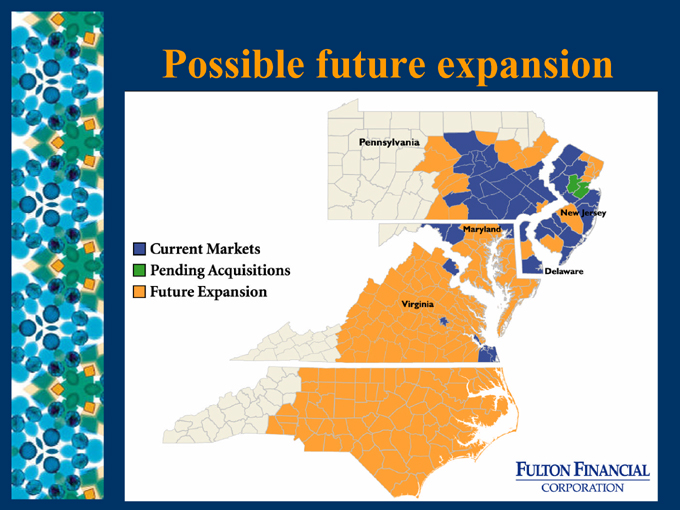

Possible future expansion

Pennsylvania

Maryland

New jersey

Delaware

Viginia

Current markets

Pending applications

Future expansion

18

Fulton Financial Corporation

2005 Annual Meeting April 13, 2005

19

R. Scott Smith, Jr.

President and Chief Operating Officer

20

Fulton Financial profile

Asset size: $11.2 billion

Market Capitalization: $2.9 billion Second largest commercial bank headquartered in Third Federal

Reserve District One of the Top 50 banks in the country

21

Where are we located?

The Bank

Delaware National Bank

FNB Bank

Fulton Bank

Hagerstown Trust

Lafayette Ambassador Bank

Lebanon Valley Farmers Bank

The Peoples Bank of Elkton

Premier Bank

Resource Bankshares Corporation

Skylands Community Bank Swineford National Bank

First Washington State Bank

Somerset Valley Bank (Pending)

Pennsylvania

LYCOMING

COLUMBIA

MORRIS

UNION

SOMERSET

NORTHUMBERLAND

HUNTERDON

MIDDLESEX

MONMOUTH

NEW JERSEY

OCEAN

ATLANTIC

VIRGINIA

MONTOUR

SNYDER

SCHUYLKILL

LEHIGH

WARREN

BERKS

BUCKS

DAUPHIN

LEBANON

CUMBERLAND

MONTGOMERY

MERCER

YORK

LANCASTER

CHESTER

DELAWARE

NEW astle

CAMDEN

GLOUCESTER

WASHINGTON

SALEM

Maryland

FREDERICK

CAPE MAY

SUSSEX

KENT

RICHMOND (City)

Newport news

Fulton Financial CORPORATION

VIRGINIA BEACH

Fairfax

Frederick

Newport news

CHESAPEAKE

22

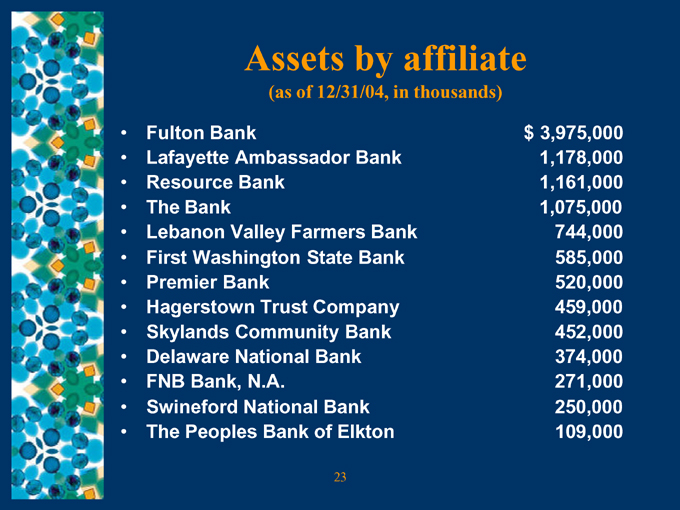

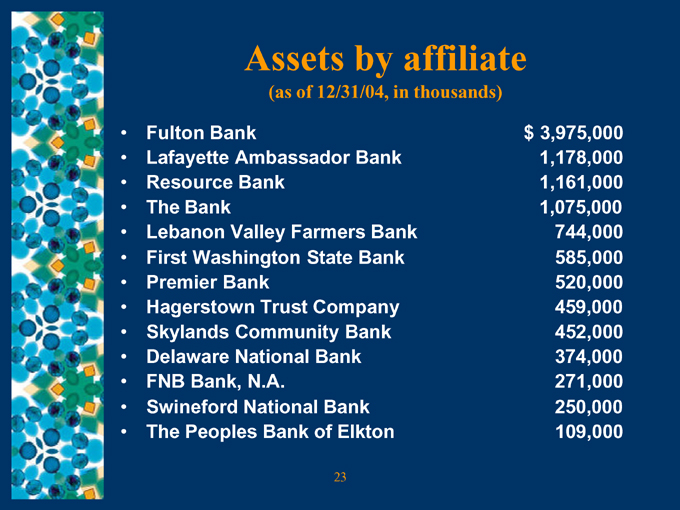

Assets by affiliate

(as of 12/31/04, in thousands)

Fulton Bank $3,975,000

Lafayette Ambassador Bank 1,178,000

Resource Bank 1,161,000

The Bank 1,075,000

Lebanon Valley Farmers Bank 744,000

First Washington State Bank 585,000

Premier Bank 520,000

Hagerstown Trust Company 459,000

Skylands Community Bank 452,000

Delaware National Bank 374,000

FNB Bank, N.A. 271,000

Swineford National Bank 250,000

The Peoples Bank of Elkton 109,000

23

What have we accomplished?

23 consecutive years of record earnings 8.8% compounded annual growth rate in earnings per share 30 consecutive years of dividend increases 10.3% compounded annual growth rate in dividends per share Proven business model Consistent performance

24

Fulton Financial Corporation

Record earnings High asset quality

Strong net interest margin Prudent expense control

25

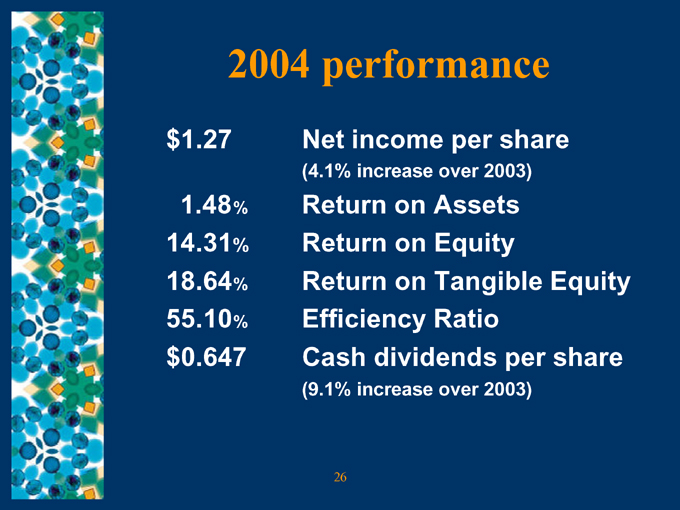

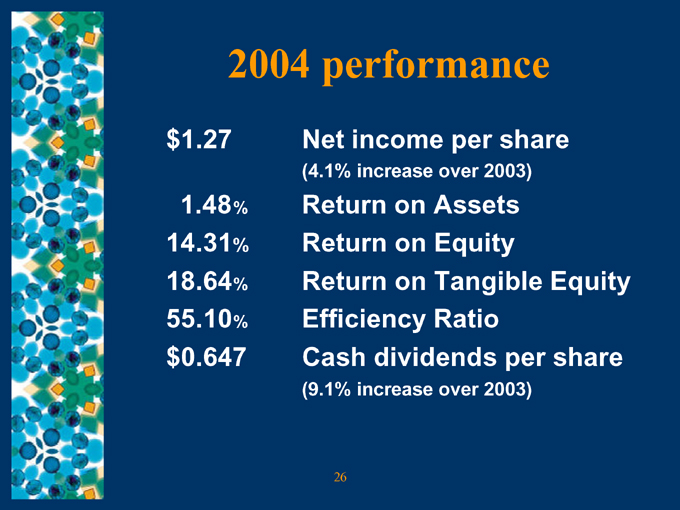

2004 performance

$1.27 Net income per share

(4.1% increase over 2003)

1.48% Return on Assets

14.31% Return on Equity

18.64% Return on Tangible Equity

55.10% Efficiency Ratio

$0.647 Cash dividends per share

(9.1% increase over 2003)

26

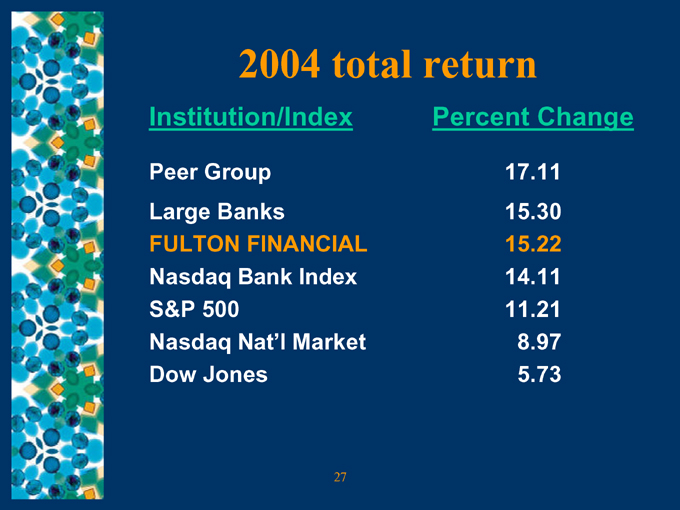

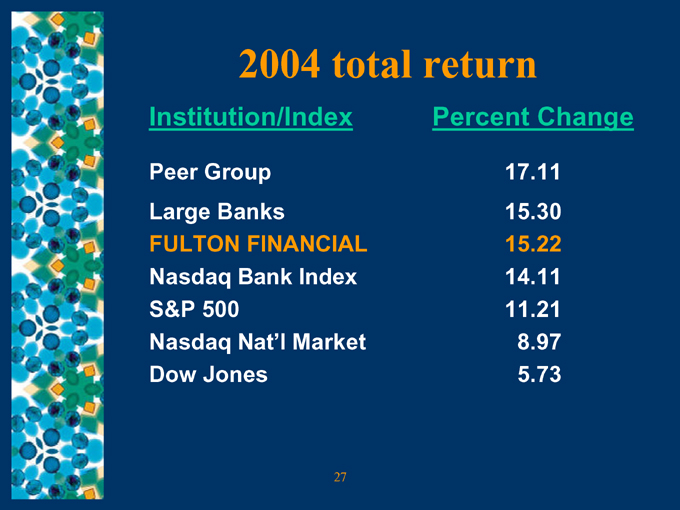

2004 total return

Institution/Index Percent Change

Peer Group 17.11

Large Banks 15.30

FULTON FINANCIAL 15.22

Nasdaq Bank Index 14.11

S&P 500 11.21

Nasdaq Nat’l Market 8.97

Dow Jones 5.73

27

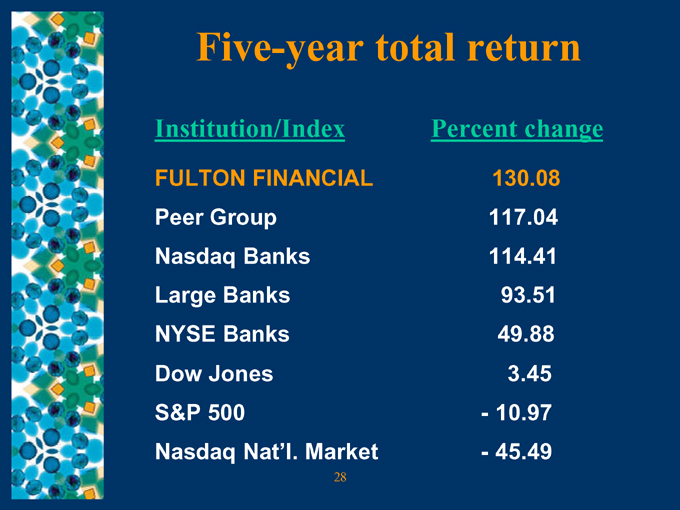

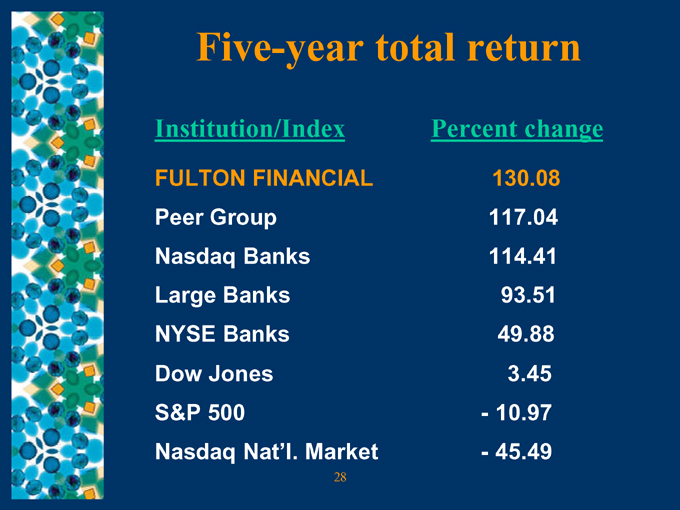

Five-year total return

Institution/Index Percent change

FULTON FINANCIAL 130.08

Peer Group 117.04

Nasdaq Banks 114.41

Large Banks 93.51

NYSE Banks 49.88

Dow Jones 3.45

S&P 500 - 10.97

Nasdaq Nat’l. Market - 45.49

28

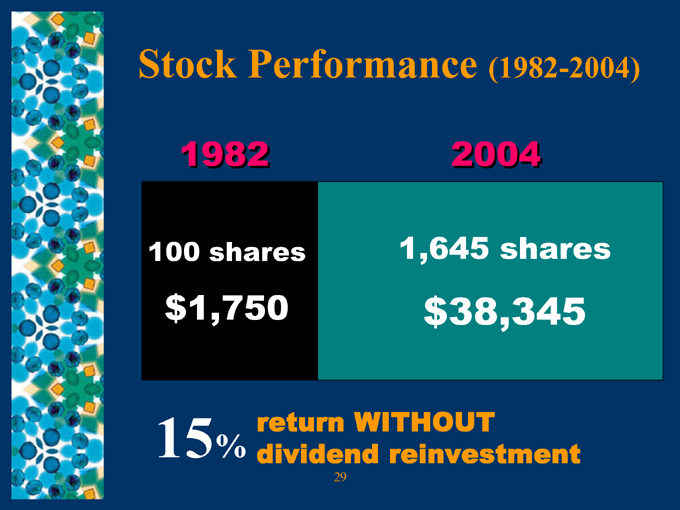

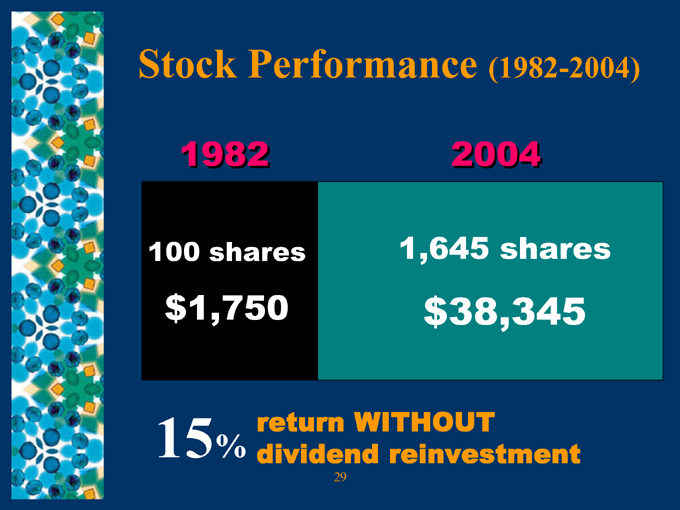

Stock Performance (1982-2004)

1982 2004

100 shares 1,645 shares

$1,750 $38,345

15 return WITHOUT

% dividend reinvestment

29

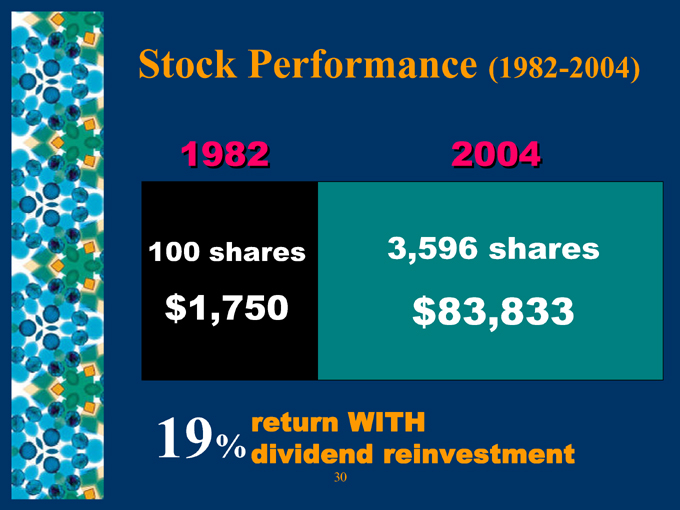

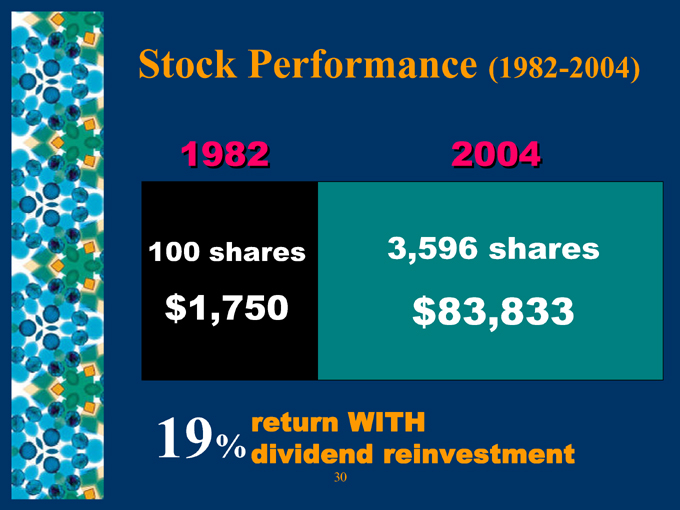

Stock Performance (1982-2004)

1982 2004

100 shares 3,596 shares

$1,750 $83,833

19 return WITH

%dividend reinvestment

30

Stock highlights (as of 12/31/04)

Average daily trading volume 139,000 shares

Number of analysts 13

Number of market makers 52

Number of shares outstanding 125.7 million

Market capitalization $2.9 billion

Annual meeting attendance 2,000 shareholders

31

Employee stock ownership

80% of our employees collectively own more than 3 million shares of Fulton Financial Corporation stock

Stock options help us to retain key high-performing employees

32

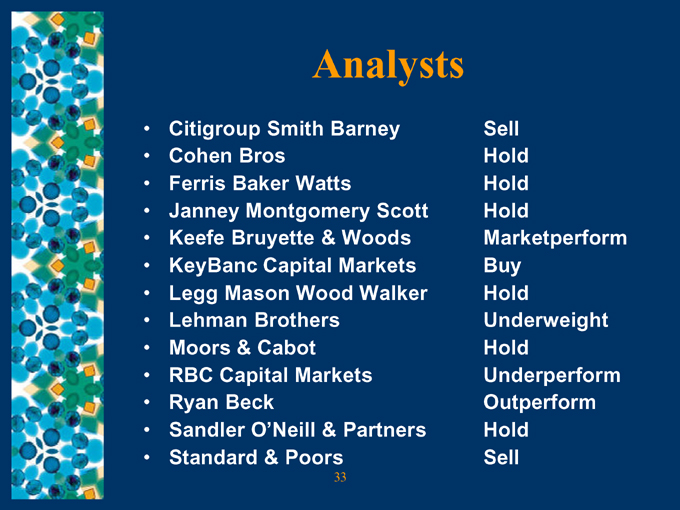

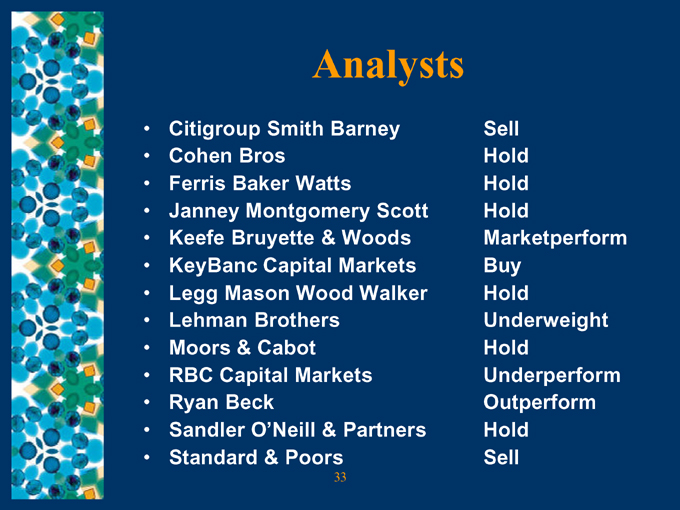

Analysts

Citigroup Smith Barney Sell

Cohen Bros Hold

Ferris Baker Watts Hold

Janney Montgomery Scott Hold

Keefe Bruyette & Woods Marketperform

KeyBanc Capital Markets Buy

Legg Mason Wood Walker Hold

Lehman Brothers Underweight

Moors & Cabot Hold

RBC Capital Markets Underperform

Ryan Beck Outperform

Sandler O’Neill & Partners Hold

Standard & Poors Sell

33

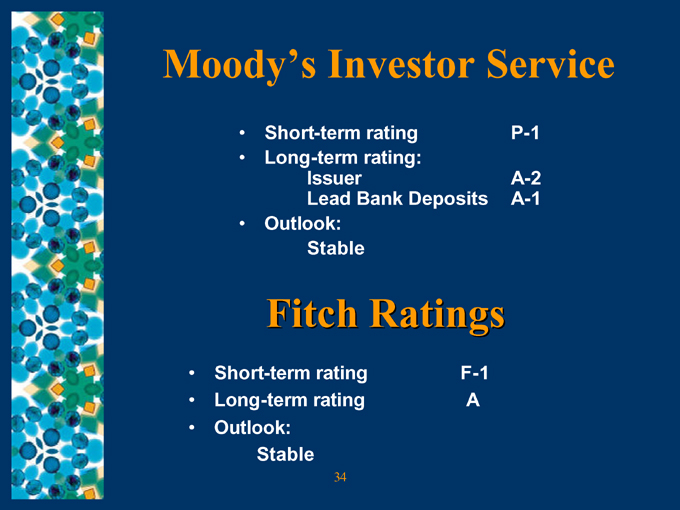

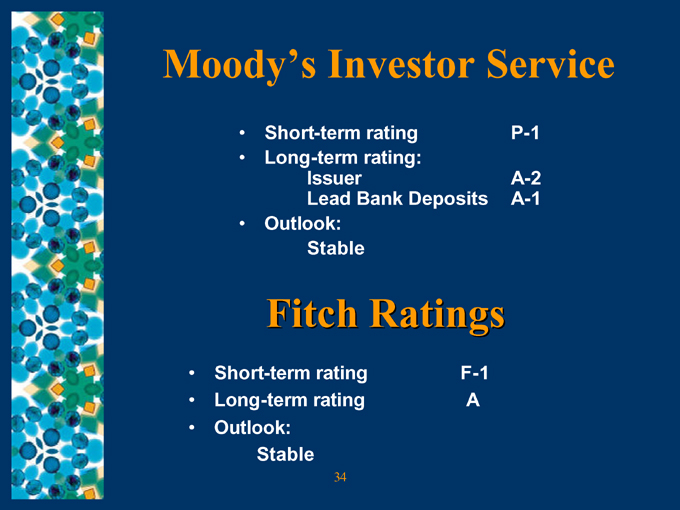

Moody’s Investor Service

Short-term rating P-1

Long-term rating:

Issuer A-2

Lead Bank Deposits A-1

Outlook:

Stable

Fitch Ratings

Short-term rating F-1

Long-term rating A

Outlook:

Stable

34

Sarbanes – Oxley Act

Internal control over financial reporting is effective No material weaknesses

35

Fulton Financial

Corporation

2005 Annual Meeting April 13, 2005

36