EXHIBIT 99.2

Better together! March 21, 2023

2 A Strategic Acquisition Combining Strength and Stability Forward Looking Statements This document may contain certain forward - looking statements about First Mid and Blackhawk, such as discussions of First Mid’s and Blackhawk’s pricing and fee trends, credit quality and outlook, liquidity, new business results, expansion plans, anticipated expenses and planned schedules. First Mid intends such forward - looking statements to be covered by the safe harbor provisions for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward - looking statements, which are based on certain assumptions and describe future plans, strategies and expectations of First Mid and Blackhawk, are identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or similar expressions. Actual results could differ materially from the results indicated by these statements because the realization of those results is subject to many risks and uncertainties, including, among other things, the possibility that any of the anticipated benefits of the proposed transactions between First Mid and Blackhawk will not be realized or will not be realized within the expected time period; the risk that integration of the operations of Blackhawk with First Mid will be materially delayed or will be more costly or difficult than expected; the inability to complete the proposed transactions due to the failure to satisfy conditions to completion of the proposed transactions, including failure to obtain the required regulatory, shareholder and other approvals; the failure of the proposed transactions to close for any other reason; the effect of the announcement of the proposed transactions on customer relationships and operating results; the possibility that the proposed transactions may be more expensive to complete than anticipated, including as a result of unexpected factors or events; changes in interest rates; general economic conditions and those in the market areas of First Mid and Blackhawk; legislative and/or regulatory changes; monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; the quality or composition of First Mid’s and Blackhawk’s loan or investment portfolios and the valuation of those investment portfolios; demand for loan products; deposit flows; competition, demand for financial services in the market areas of First Mid and Blackhawk; accounting principles, policies and guidelines; and the impact of the global COVID - 19 pandemic on First Mid’s or Blackhawk’s businesses, the ability to complete the proposed transactions or any of the other foregoing risks. Additional information concerning First Mid, including additional factors and risks that could materially affect First Mid’s financial results, are included in First Mid’s filings with the SEC, including its Annual Reports on Form 10 - K and Quarterly Reports on Form 10 - Q. Forward - looking statements speak only as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the SEC, we do not undertake any obligation to update or review any forward - looking information, whether as a result of new information, future events or otherwise. Disclosures

3 A Strategic Acquisition Combining Strength and Stability Important Information about the Merger and Additional Information First Mid will file a registration statement on Form S - 4 with the SEC in connection with the proposed transaction . The registration statement will include a proxy statement of Blackhawk that also constitutes a prospectus of First Mid, which will be sent to the shareholders of Blackhawk . Investors in Blackhawk are urged to read the proxy statement/prospectus, which will contain important information, including detailed risk factors, when it becomes available . The proxy statement/prospectus and other documents which will be filed by First Mid with the SEC will be available free of charge at the SEC’s website, www . sec . gov . These documents also can be obtained free of charge by accessing First Mid’s website at www . firstmid . com under the tab “Investors Relations” and then under “SEC Filings . ” Alternatively, when available, these documents can be obtained free of charge from First Mid upon written request to First Mid Bancshares, P . O . Box 499 , Mattoon, IL 61938 , Attention : Investor Relations ; or from Blackhawk upon written request to Blackhawk Bancorp, Inc . , 400 Broad St . , Beloit, WI 53511 - 6223 , Attention : Todd J . James, President & CEO . A final proxy statement/prospectus will be mailed to the shareholders of Blackhawk . Participants in the Solicitation First Mid and Blackhawk, and certain of their respective directors, executive officers and other members of management and employees, are participants in the solicitation of proxies in connection with the proposed transactions . Information about the directors and executive officers of First Mid is set forth in the proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on March 15 , 2023 . These documents can be obtained free of charge from the sources provided above . Investors may obtain additional information regarding the interests of such participants in the proposed transactions by reading the proxy statement/prospectus for such proposed transactions when it becomes available . No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Disclosures

A Strategic Acquisition Combining Strength and Stability Strategic Rationale Strategically Compelling Financially Attractive Culturally Aligned x Advances First Mid’s strategic expansion and diversification strategy with access to new, yet similar markets in Wisconsin and Illinois. x Significant liquidity flexibility and expansion with Blackhawk’s ~65% loan - to - deposit ratio and investment securities marked to fair value through purchase accounting. x Blackhawk’s core deposit franchise strengthens First Mid’s existing deposit base. Core deposits account for ~96% of total pro - forma deposits. x Creates a $8.1 billion asset Midwest community bank with a rich history and strong community ties. x Significantly accretive to EPS, ~22% in the first full year. x Manageable TBV dilution of 7.7% and a comparably low TBV earn back of 1.9 years (crossover method). x Achievable cost synergies of ~31% (100% expected in 2024). x Provides opportunity to expand First Mid Wealth Management and First Mid Insurance business lines into new markets (not included in pro - forma modeling). x Blackhawk and First Mid have a lending relationship dating back to 2013 and multi - year collaboration between management and other operational areas of the bank. x Similar credit profiles and underwriting discipline confirmed during comprehensive due diligence. x Both organizations possess relationship - driven business models with a strong commitment to the communities served. x Retention of nearly all key talent and customer facing staff. 4 (1) Pricing data based on First Mid’s closing price of $27.13 as of 3/20/23 (2) Financial metrics based on 12/31/22 results

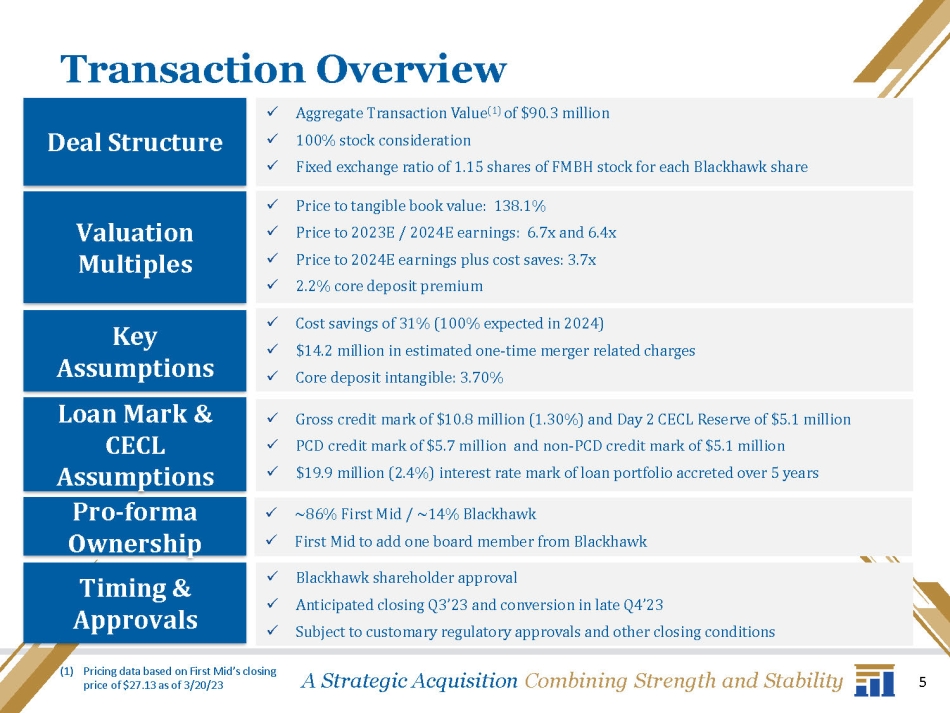

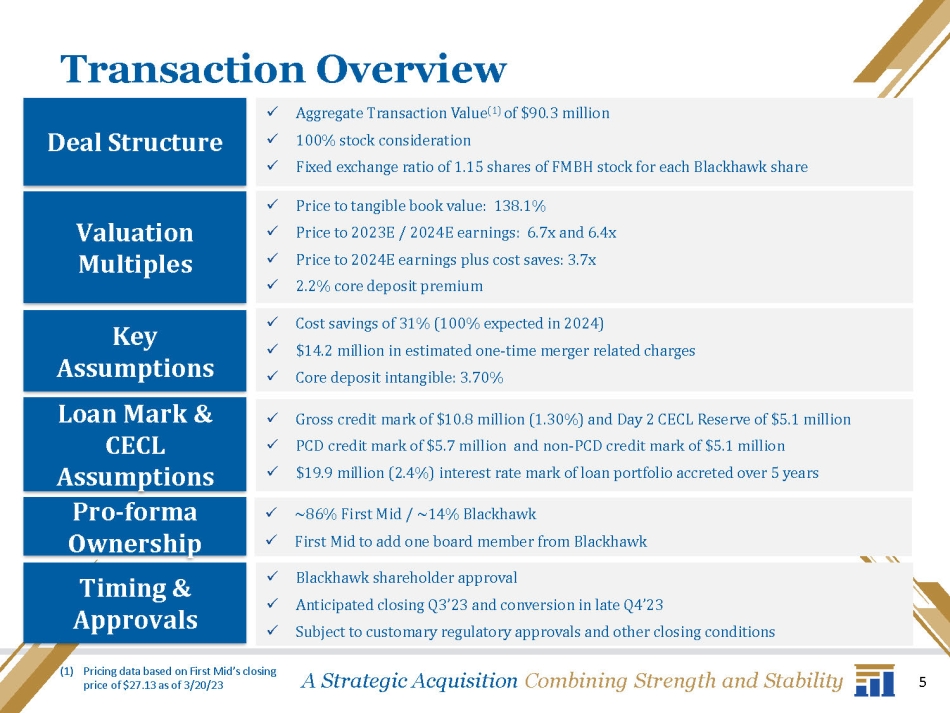

A Strategic Acquisition Combining Strength and Stability x Aggregate Transaction Value (1) of $90.3 million x 100% stock consideration x Fixed exchange ratio of 1.15 shares of FMBH stock for each Blackhawk share (1) Pricing data based on First Mid’s closing price of $27.13 as of 3/20/23 x ~86% First Mid / ~14% Blackhawk x First Mid to add one board member from Blackhawk Deal Structure Loan Mark & CECL Assumptions Pro - forma Ownership Timing & Approvals 5 Transaction Overview x Blackhawk shareholder approval x Anticipated closing Q3’23 and conversion in late Q4’23 x Subject to customary regulatory approvals and other closing conditions x Gross credit mark of $10.8 million (1.30%) and Day 2 CECL Reserve of $5.1 million x PCD credit mark of $5.7 million and non - PCD credit mark of $5.1 million x $19.9 million (2.4%) interest rate mark of loan portfolio accreted over 5 years Valuation Multiples x Price to tangible book value: 138.1% x Price to 2023E / 2024E earnings: 6.7x and 6.4x x Price to 2024E earnings plus cost saves: 3.7x x 2.2% core deposit premium Key Assumptions x Cost savings of 31% (100% expected in 2024) x $14.2 million in estimated one - time merger related charges x Core deposit intangible: 3.70%

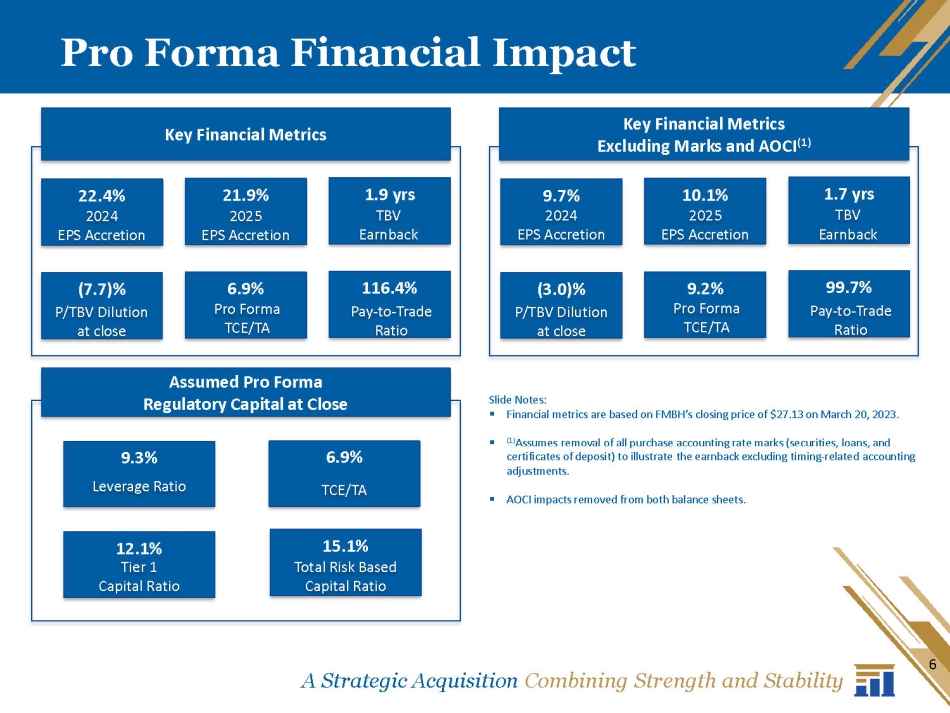

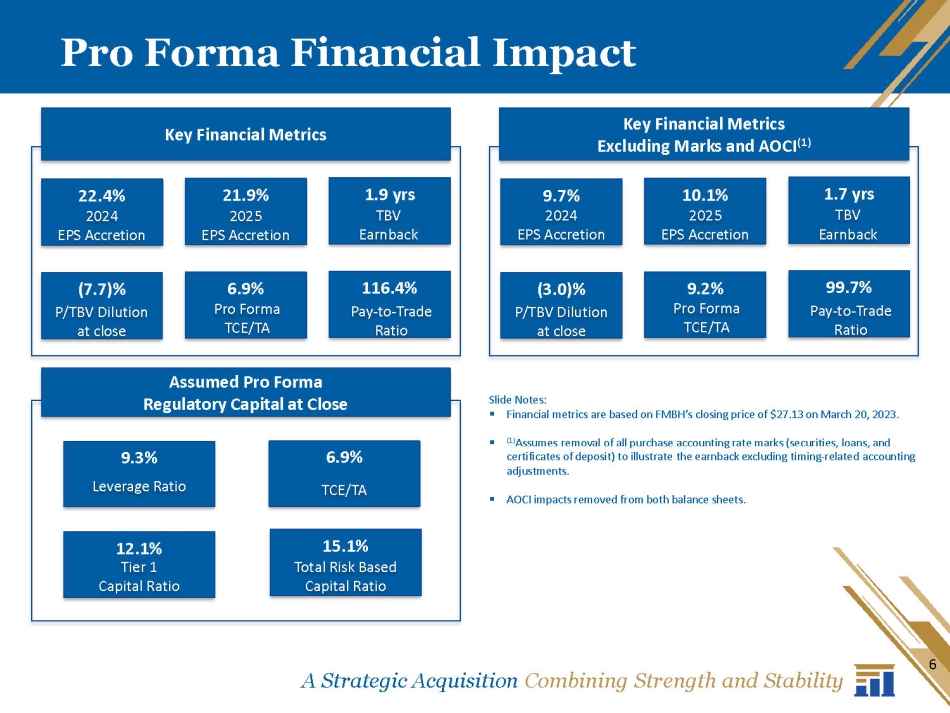

6 A Strategic Acquisition Combining Strength and Stability Pro Forma Financial Impact Key Financial Metrics Key Financial Metrics Excluding Marks and AOCI (1) Assumed Pro Forma Regulatory Capital at Close 9.3% Leverage Ratio 6.9% TCE/TA 15.1% Total Risk Based Capital Ratio 12.1% Tier 1 Capital Ratio 22.4% 2024 EPS Accretion 21.9% 2025 EPS Accretion 1.9 yrs TBV Earnback 116.4% Pay - to - Trade Ratio 6.9% Pro Forma TCE/TA (7.7)% P/TBV Dilution at close 9.7% 2024 EPS Accretion 10.1% 2025 EPS Accretion 1.7 yrs TBV Earnback 99.7% Pay - to - Trade Ratio 9.2% Pro Forma TCE/TA (3.0)% P/TBV Dilution at close Slide Notes: ▪ Financial metrics are based on FMBH’s closing price of $27.13 on March 20, 2023. ▪ (1) Assumes removal of all purchase accounting rate marks (securities, loans, and certificates of deposit) to illustrate the earnback excluding timing - related accounting adjustments. ▪ AOCI impacts removed from both balance sheets.

Focusing on our STRATEGIC PRIORITIES Overview of Company Overview Financial Highlights • Franchise Highlight: Blackhawk Bancorp, Inc. is a community focused organization • Headquartered : Beloit, Wisconsin • OTCQX Listed: BHWB • Core Business: Blackhawk Bank, with roots dating back to 1881, offers a full - line of consumer, business banking, and financial advisory services. • Branch Footprint: 10 branches with 3 in Southern Wisconsin and 7 in Northern Illinois. 2020 2021 2022 Assets $1,142M $1,341M $1,322M Loans (HFI) $673M $707M $780M Deposits $987M $1,197M $1,191M Core Deposits (%) 96.0% 96.7% 96.2% Net Income $10.8M $13.6M $13.6M Branch Footprint 7 A Strategic Acquisition Combining Strength and Stability

A Strategic Acquisition Combining Strength and Stability Blackhawk Market Highlights Operating Market Overview • Janesville - Beloit is the 10 th largest MSA in Wisconsin (~164 thousand people) • Rockford is the 5 th largest MSA in Illinois (~334 thousand people) • The largest industries in the Janesville - Beloit MSA and the Rockford MSA are manufacturing, healthcare & social assistance, and retail trade • In 2022, the Janesville - Beloit and Rockford MSA’s had 3,587 and 6,781 private businesses, respectively Major Employers in Market Market Demographics Deposit Market Share Projected HHI Growth ’23 – ’28 (%) Median HHI ’23 ($) Janesville - Beloit MSA / Rockford MSA Total # of Deposi Rank Institutuion Branches 5 1 Heartland Financial USA Inc. (CO) 2 JPMorgan Chase & Co. (NY) 3 Bank of Montreal 4 Midland States Bancorp Inc. (IL) 5 Associated Banc - Corp (WI) 6 Blackhawk Bancorp 7 Centre 1 Bancor 8 Foresight F 9 Johns 10 $65,947 $69,234 $67,573 FMBH Beloit Rockford FMBH 13.2% 11.8% 13.0% Beloit Rockford Source: S&P Capital IQ; U.S. Bureau of Labor Statistics; Data USA 8

A Strategic Acquisition Combining Strength and Stability Pro Forma Franchise 9 Assets $8.1B Loans $6.4B Deposits $5.5B Financially Compelling Transaction • Strong, low - cost deposit franchise • Expanded and enhanced liquidity flexibility • Significant earnings accretion at 22.4% and below market TBV earnback at 1.9 years • Long history of working together provides strong cultural alignment Wealth AUM $5.5B (1) Pricing data based on First Mid’s closing price of $27.13 as of 3/20/23 (2) Financial metrics based on 12/31/22 results

A Strategic Acquisition Combining Strength and Stability Pro Forma Deposit Composition *As of December 31, 2022; excludes purchase accounting adjustments Deposit Mix Pro Forma Non - Int . Bearing 26 . 1 % NOW & Other 7.5% Time <$100 9.5% Time >$100 3.5% Non - Int . Bearing 29 . 5 % Savings & MMDA 32.9% Time >$100 Time 3.8% <$100 3.5% Non - Int. Bearing 27% NOW & Other 12% Savings & MMDA 50% Time <$100 8% Time >$100 3% $5.4B Total Savings & MMDA 53 . 4 % 4Q’22 Cost: 0.70% $1.2B Total NOW & Other 30.4% 4Q’22 Cost: 0.51% $6.6B Total 4Q’22 Cost: 0.67% Uninsured Deposits: 21.1% 10 Deposit Mix Highlights ▪ Strong pro - forma funding profile comprised of ~96% low - cost core deposits. ▪ The pro - forma loan/deposit ratio reduces to an attractive 85%. ▪ Pro - forma uninsured deposits (excluding preferred deposits) equate to 21% of total deposits. Uninsured Deposits: 24.4% Uninsured Deposits: 8.5% *Uninsured deposits account for the estimated uninsured deposits, less preferred deposits divided by total deposit liabilities.

A Strategic Acquisition Combining Strength and Stability Pro Forma Loan Composition *As of December 31, 2022; excludes purchase accounting adjustments Loan Mix Pro Forma CRE 42.1% 1 - 4 Family 9.1% C&D 3.0% Multifamily 6.1% C&I 22.4% Ag 12.0% Consumer & Other 5.3% CRE 43.9% 1 - 4 Family 16.4% C&D 3.7% Multifamily 3.2% C&I 26.4% Ag 1.0% Consumer & Other 5.5% CRE 42.3% C&D 3.1% 1 - 4 Family 10.1% Multifamily 5.7% C&I 23.0% Ag 10.4% Consumer & Other 5.3% $4.8B Total $782M Total $5.6B Total 4Q’22 Yield: 4.47% 4Q’22 Yield: 5.11% 4Q’22 Yield: 4.56% 11 Loan Portfolio Highlights ▪ The pro - forma loan portfolio is well diversified geographically and in composition. ▪ First Mid’s exceptional credit underwriting standards have led to historically low net charge - offs over the last 20 years averaging only 15 bps over that period. ▪ Blackhawk maintains a similar credit culture that is bolstered by the combined teams’ credit experience of managing through various credit cycles.

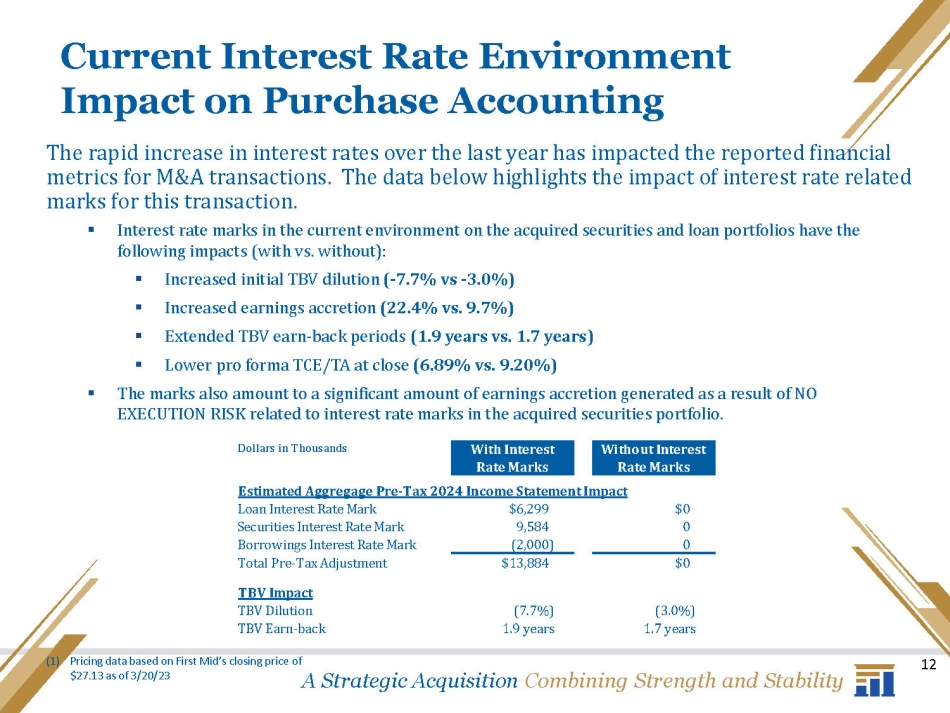

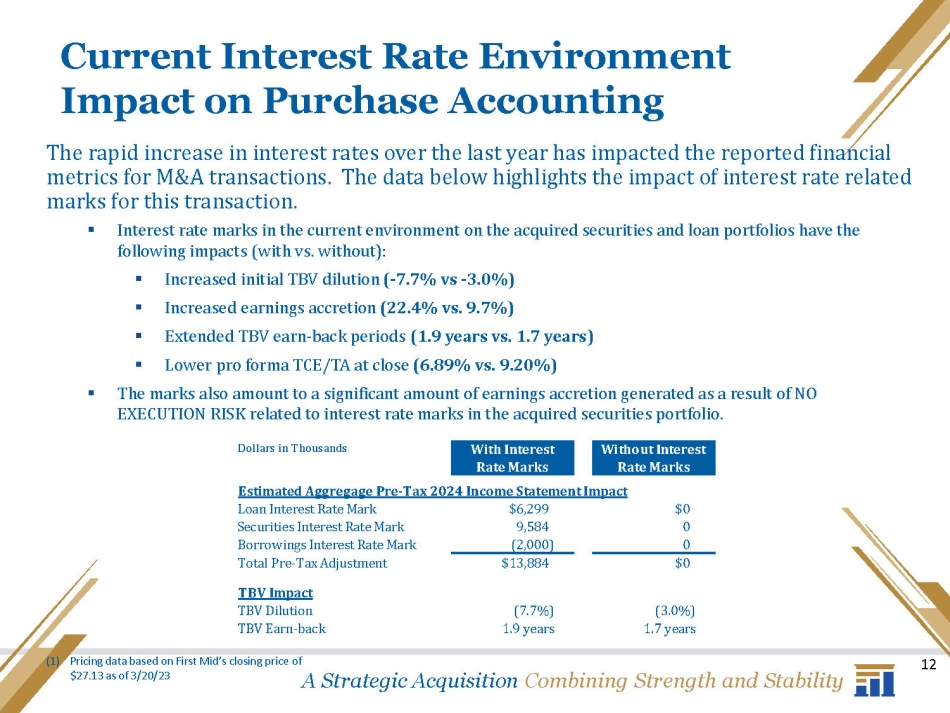

A Strategic Acquisition Combining Strength and Stability Current Interest Rate Environment Impact on Purchase Accounting 12 Loan Interest Rate Mark $6,299 $0 Securities Interest Rate Mark 9,584 0 Borrowings Interest Rate Mark (2,000) 0 Total Pre - Tax Adjustment $13,884 $0 TBV Impact TBV Dilution (7.7%) (3.0%) TBV Earn - back 1.9 years 1.7 years The rapid increase in interest rates over the last year has impacted the reported financial metrics for M&A transactions. The data below highlights the impact of interest rate related marks for this transaction. ▪ Interest rate marks in the current environment on the acquired securities and loan portfolios have the following impacts (with vs. without): ▪ Increased initial TBV dilution ( - 7.7% vs - 3.0%) ▪ Increased earnings accretion (22.4% vs. 9.7%) ▪ Extended TBV earn - back periods (1.9 years vs. 1.7 years) ▪ Lower pro forma TCE/TA at close (6.89% vs. 9.20%) ▪ The marks also amount to a significant amount of earnings accretion generated as a result of NO EXECUTION RISK related to interest rate marks in the acquired securities portfolio. Dollars in Thousands With Interest Rate Marks Without Interest Rate Marks Estimated Aggregage Pre - Tax 2024 Income Statement Impact (1) Pricing data based on First Mid’s closing price of $27.13 as of 3/20/23

Thorough Due Diligence Process Legal, Regulatory & Audit Accounting, Tax & Capital Management HR, Benefit Plans, Agreements, & Key Talent Finance & Balance Sheet Management Risk Management & Compliance IT, Systems, Data Processing, & Cyber Commercial Banking & Relationship Opportunities Retail Banking & Product Offerings Risk & Compliance Cultural Alignment Vendor Management & Key Contracts Operations First Mid is a proven experienced and disciplined acquirer with a successful track record of completing an extensive diligence process to ensure success throughout the acquisition including modeling, announcement, employee engagement, closing, and integration . Due Diligence Focus Areas Diligence Highlights ▪ Evaluated the stability of the top deposit relationships. ▪ Similar credit profiles and alignment of loan personnel validated during comprehensive diligence. ▪ 76% of Blackhawk’s loan portfolio reviewed, including: ▪ 88% of commercial portfolio ▪ 100% of criticized and classified loans >$250k ▪ 100% of NPAs ▪ 100% of top 25 relationships ▪ Alignment of Wealth Management teams operating under the same Raymond James platform. 13 A Strategic Acquisition Combining Strength and Stability

Experienced Acquirer Transaction Date Closed 8/14/15 Closed 9/08/16 Closed 5/01/18 Closed 11/15/18 Closed 4/21/20 Closed 2/22/21 Closed 9/10/21 Closed 2/14/22 Announced 3/21/23 Transaction Value $16 Million $89 Million $72 Million $70 Million - - - $161 Million -- - $107 Million $90 Million Deal Type Branch Whole Bank Whole Bank Whole Bank Loan Book and Team Whole Bank Loan Book and Team Whole Bank Whole Bank Assets $441 Million $659 Million $475 Million $458 Million - - - $1.2 Billion -- - $718 Million $1.3 Billion Loans $156 Million $449 Million $371 Million $254 Million $183 Million $839 Million $208 Million $424 Million $780 Million Deposits $453 Million $535 Million $384 Million $341 Million $60 Million $988 Million $215 Million $560 Million $1.2 Billion # of Branches 12 7 7 10 - - - 14 -- - 5 10 *Figures noted above exclude fair value adjustments made at closing *Blackhawk figures as of December 31, 2022. Transaction value Is based on the closing stock price on March 20, 2023. A Strategic Acquisition Combining Strength and Stability 14

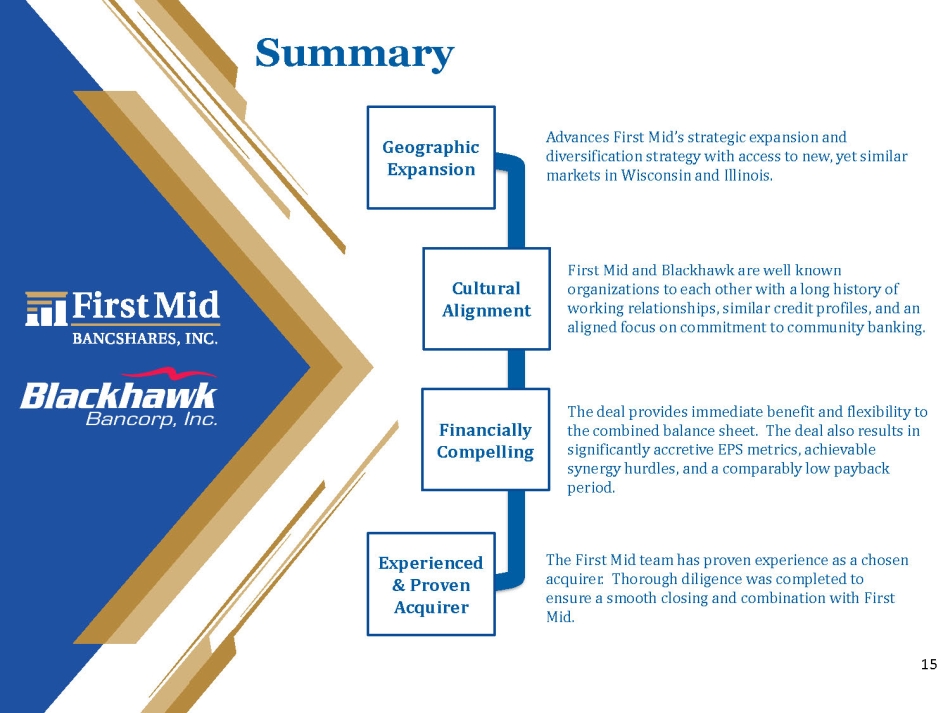

Summary Geographic Expansion Cultural Alignment Financially Compelling Experienced & Proven Acquirer Advances First Mid’s strategic expansion and diversification strategy with access to new, yet similar markets in Wisconsin and Illinois. First Mid and Blackhawk are well known organizations to each other with a long history of working relationships, similar credit profiles, and an aligned focus on commitment to community banking. The deal provides immediate benefit and flexibility to the combined balance sheet. The deal also results in significantly accretive EPS metrics, achievable synergy hurdles, and a comparably low payback period. The First Mid team has proven experience as a chosen acquirer. Thorough diligence was completed to ensure a smooth closing and combination with First Mid. 15