UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under §240.14a-12

National Penn Bancshares, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

| (1) | Title of each class of securities to which transaction applies: N/A |

| |

| (2) | Aggregate number of securities to which transaction applies: N/A |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

| |

| (4) | Proposed maximum aggregate value of transaction: N/A |

[ ] Fee paid previously with preliminary materials.

|

| |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| |

| | 1) Amount Previously Paid: |

| | 2) Form, Schedule or Registration Statement No.: |

| | 3) Filing Party: |

| | 4) Date Filed: |

NOTICE OF ANNUAL SHAREHOLDERS’ MEETING

Dear National Penn Shareholder:

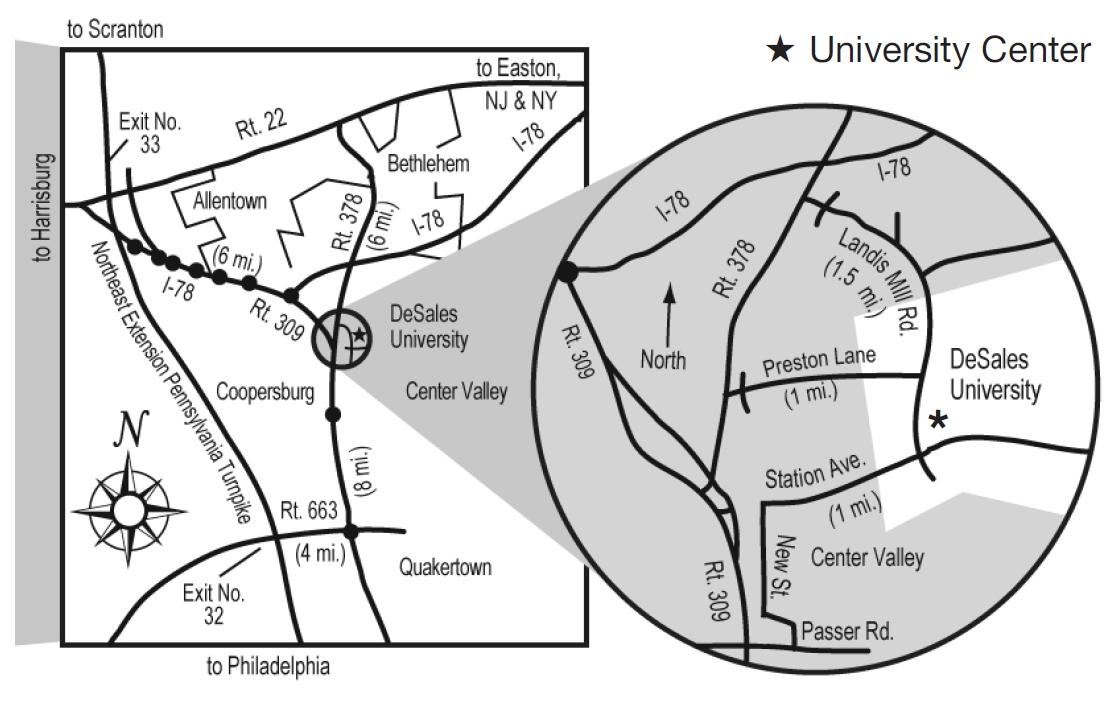

On Tuesday, April 22, 2014, National Penn Bancshares, Inc. will hold its Annual Meeting of Shareholders at DeSales University, University Center - Gerald White Pavilion, 2755 Station Avenue, Center Valley, Pennsylvania 18034. The meeting will begin at 9:30 a.m. Eastern Time.

Only shareholders who owned stock at the close of business on February 27, 2014 can attend and vote at the meeting or any postponement or adjournment. At the meeting, we will:

| |

| 1. | Elect four Class III directors for terms expiring at the 2017 Annual Meeting of Shareholders; |

| |

| 2. | Consider and act upon a proposal to approve a Long-Term Incentive Compensation Plan; |

| |

| 3. | Ratify the Audit Committee’s appointment of KPMG LLP as National Penn’s independent auditor for 2014; |

| |

| 4. | Approve an advisory (non-binding) resolution relating to the compensation of National Penn’s executive officers; and |

| |

| 5. | Transact other business, if any, that may properly come before the 2014 Annual Meeting of Shareholders. |

Your Board of Directors recommends that you vote FOR the election of the Class III director nominees; FOR approval of the Long-Term Incentive Compensation Plan; FOR the ratification of the independent auditors selected for 2014; and FOR the approval of the advisory resolution relating to the compensation of National Penn’s executive officers.

At the meeting, we will also report on our 2013 business results and other matters of interest to shareholders.

We are enclosing with this proxy statement a copy of our 2013 Annual Report on Form 10-K. This proxy statement and card(s) or a Notice of Internet Availability of Proxy Materials are being mailed to shareholders on or about March 12, 2014.

IMPORTANT: This mailing contains an Admission Ticket. FOR SECURITY PURPOSES, YOU WILL NEED THIS ADMISSION TICKET TO ATTEND THE MEETING.

|

| |

| | By Order of the Board of Directors, |

| | |

| |

| |

| March 12, 2014 | H. Anderson Ellsworth, Secretary |

|

|

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be held on April 22, 2014 — You can

view the Annual Report and Proxy Statement on the Internet at: www.envisionreports.com/npbc. |

[THIS PAGE INTENTIONALLY LEFT BLANK]

[THIS PAGE INTENTIONALLY LEFT BLANK]

NATIONAL PENN BANCSHARES, INC.

PROXY STATEMENT

________________________________________________________________________________________________________

This proxy statement is furnished in connection with the solicitation of proxies by National Penn Bancshares, Inc. (“National Penn”), on behalf of the Board of Directors (the “Board”), for the 2014 Annual Meeting of Shareholders. Proxy materials or a Notice of Internet Availability of Proxy materials are being mailed to shareholders on or about March 12, 2014.

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of the Company’s proxy materials to each shareholder of record, we have elected to provide access to our proxy materials primarily over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to many share- holders. The Notice contains instructions on how to access the proxy materials over the Internet and how to request a printed copy.

You can vote your shares by completing and returning the enclosed written proxy card. If you received a Notice of Internet Availability of Proxy Materials, you may request a printed proxy card by following the instructions included in the Notice.

You can also vote by telephone (toll-free) or online if you have Internet access. Registered shareholders with addresses outside the United States may not be able to vote by telephone. The Internet and telephone voting facilities for shareholders of record are available 24 hours a day until they close at 1:00 a.m. Eastern Time on April 22, 2014. The Internet and telephone voting procedures are described on the enclosed proxy form and are designed to authenticate shareholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or through the Internet, you need not return a proxy card. Whether you vote by proxy card, by telephone or through the Internet, your shares will be voted as you direct.

You can also vote in person at the meeting. Submitting your voting instructions by returning a proxy card or by voting over the telephone or the Internet will not affect your right to attend the meeting and vote.

|

| | | | |

| | | | | |

| PROPOSAL 1 - ELECTION OF CLASS III DIRECTORS |

The first proposal to be voted on at the meeting is the election of four directors. These directors will serve a three-year term as Class III directors. The Board has nominated Thomas A. Beaver, Jeffrey P. Feather, Patricia L. Langiotti and Natalye Paquin for election as Class III directors.

The Board recommends a vote “FOR” all of its nominees.

The Board has no reason to believe that any nominee will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, the Board will either select a substitute nominee or reduce the size of the Board. If you have submitted a proxy and a substitute nominee is selected, your shares will be voted for the election of the substitute nominee.

National Penn’s articles of incorporation provide that the Board shall consist of between eight and twenty directors, the exact number of which shall be set by resolution of the Board, and shall be divided into three classes equal or nearly equal in size as is possible. In accordance with these provisions, the Board has set the size of the Board at 12 directors, and the size of Classes I, II and III at four directors each.

National Penn’s bylaws permit shareholders to nominate candidates for election as directors. A nomination must be made in compliance with the advance notice and information requirements of the bylaws. As of February 27, 2014, National Penn has not received any notice of a nomination.

In accordance with the bylaws, directors are elected by a plurality of the votes of shares present and entitled to be voted at the meeting. That means the nominees of the Board will be elected if they receive more affirmative votes than any other nominees. National Penn’s Corporate Governance Guidelines provide that in an uncontested election of directors (where the only nominees are those recommended by the Board), if any nominee receives a greater number of votes “withheld” than votes “for” his or her election, the Nominating/Corporate Governance Committee will promptly consider whether to recommend to the Board that it request such nominee to resign from the Board as of the date of his or her election, and if that committee makes such a recommendation, the Board will promptly act upon such recommendation. National Penn expects that any such nominee will comply with any such request.

The Board is separated into three classes, with the directors in each class serving up to a three-year term. The terms of the persons elected as Class III directors will expire in 2017. The terms of the continuing Class I directors will expire in 2015 and the terms of the continuing Class II directors will expire in 2016.

Nominees as Class III Directors for a term expiring at the 2017 Annual Meeting |

| |

| Thomas A. Beaver, CPA

Director since 2005

Age 61 Mr. Beaver is the independent chair of the boards of National Penn and National Penn Bank. He has been a director of National Penn and National Penn Bank since 2005. In February 2008, Mr. Beaver was appointed lead independent director. Mr. Beaver, a certified public accountant (CPA), is a retired partner of Reinsel Kuntz Lesher LLP, a regional accounting, tax and consulting firm (1979 to present). He currently serves as a consultant to the firm in the business consulting group. He was the managing partner and CEO of its predecessor, Reinsel & Company, from 1994 to 2004. Mr. Beaver’s educational background includes a bachelor of science degree in Civil Engineering and an MBA from Lehigh University. The Board believes that Mr. Beaver’s financial, business and accounting experience, including his experience consulting on issues relating to banking and bank financing, gives him the qualifications and skills to serve as a National Penn director.

|

| Jeffrey P. Feather

Director since 2008

Age 71 Mr. Feather is the Managing Partner of Feather Ventures, LLC, a private investment firm (1999 to present), and Vice Chairman of National Penn. Previously, Mr. Feather served as Chairman of SunGard Pentamation, Inc., an administrative software and processing services company (1970 to 2006). Mr. Feather was initially elected as a director on February 1, 2008, in accordance with the merger agreement with KNBT Bancorp, Inc. Mr. Feather previously was a director of KNBT and its predecessor, Keystone Savings Bank, since 1979, where he served as chair since 2000. Mr. Feather’s educational background includes a bachelor of science degree in Industrial Engineering from Lafayette College and graduate work in Management Science at Lehigh University. The Board believes that Mr. Feather’s technology and business expertise, along with his years of experience serving on other boards, gives him the qualifications and skills to serve as a National Penn director. |

| | |

| Patricia L. Langiotti, PMC

Director since 1986

Age 67 Ms. Langiotti, a professional management consultant (PMC), is President of Creative Management Concepts, a management consulting firm (1982 to present). Ms. Langiotti has been a director of National Penn since 1986. In addition to her work with National Penn, Ms. Langiotti is a director of two privately held corporations and various not-for-profit organizations. Ms. Langiotti’s educational background includes a bachelor of business administration degree from the University of Virginia. The Board believes that Ms. Langiotti’s nationally-recognized expertise as a speaker and educator in the areas of corporate governance, risk management and bank audit committee work, along with her years of experience as a director of National Penn and other organizations, gives her the qualifications and skills to serve as a National Penn director. |

| Natalye Paquin, Esq.

Director since 2006

Age 53 Ms. Paquin is Chief Executive Officer of the Girl Scouts of Eastern Pennsylvania (GSEP) (November 2010 to present). Previously, Ms. Paquin served as Executive Vice President and Chief Operating Officer of The Kimmel Center, Inc., Philadelphia’s premier performing arts center, where she was responsible for overseeing the day-to-day operations of the Kimmel Center, the Merriam Theatre and the historic Academy of Music (2006 to 2010). Ms. Paquin served as Chief Operating Officer and Chief of Staff for the School District of Philadelphia (2002 to 2006). Ms. Paquin has been a director of National Penn since 2006. Ms. Paquin’s educational background includes a bachelor of science degree from Florida A&M University and a juris doctorate from DePaul University College of Law. Ms. Paquin also completed executive education programs from Harvard University’s School of Business and is a distinguished graduate of the Broad Academy for Urban Superintendents. The Board believes that Ms. Paquin’s years in senior management and legal positions gives her the qualifications and skills to serve as a National Penn director. |

Continuing as Class I Directors for a term expiring at the 2015 Annual Meeting:

|

| |

| Scott V. Fainor

Director since January 2010

Age 52 Mr. Fainor is President and Chief Executive Officer of National Penn (January 2010 to present) and of National Penn Bank (2008 to present). Mr. Fainor was Senior Executive Vice President and Chief Operating Officer of National Penn from February 2008 through January 2010. Mr. Fainor was President and Chief Executive Officer of KNBT Bancorp, Inc. from October 2003 to February 2008. He has been a director of National Penn since January 2010 and a director of National Penn Bank since February 2008. Mr. Fainor’s educational background includes a bachelor of science degree in Marketing and Finance from DeSales University. The Board believes that Mr. Fainor’s career in banking, including executive positions with KNBT, First Colonial Group, Inc./Nazareth National Bank & Trust Co. and Wachovia/First Union, gives him the qualifications and skills to serve as a National Penn director. |

| | |

| Donna D. Holton

Director since 2008

Age 68 Mrs. Holton is the retired President & Chief Operating Officer of Turn of the Century Solution, Inc., an intellectual property company (1997 to 2006). Mrs. Holton was initially elected as a director on February 1, 2008, in accordance with the merger agreement with KNBT Bancorp, Inc. She previously served as a director of KNBT and its predecessor, Keystone Savings Bank, since 2002. Mrs. Holton’s educational background includes a bachelor of arts degree in Economics from the University of Michigan. The Board believes that Mrs. Holton’s experience in senior executive and managerial positions, along with her experience as a director in the public and private sectors, gives her the qualifications and skills to serve as a National Penn director. |

| | |

| Thomas L. Kennedy, Esq.

Director since 2008

Age 69 Mr. Kennedy is President of the law firm of Kennedy & Lucadamo, P.C., Hazleton, Pennsylvania (1969 to present). Mr. Kennedy was initially elected as director on February 1, 2008, in accordance with the merger agreement with KNBT Bancorp, Inc. He previously served as a director of KNBT since 2005. Mr. Kennedy is an attorney-at-law and concentrates his practice on business and estate planning and related litigation. In 1998, as Chairman of the Board of First Federal Savings and Loan Association of Hazleton (a mutual thrift), a position he had held since 1988, Mr. Kennedy oversaw the company’s initial public offering. Mr. Kennedy’s educational background includes a bachelor of arts degree in English from the University of Scranton and a juris doctorate from the Boston College Law School. The Board believes that Mr. Kennedy’s extensive legal and business experience in the financial services industry gives him the qualifications and skills to serve as a National Penn director. |

| | |

| Michael E. Martin

Director since 2011

Age 58 Mr. Martin is Head of the Financial Institutions Group of Warburg Pincus LLC, a private equity firm (2009 to present). Previously, Mr. Martin served as President of Brooklyn NY Holdings, LLC, a private investment company (2006 to 2009). Mr. Martin was Vice Chairman and Managing Director of UBS Investment Bank where he also served as a member of the UBS Investment Bank Board and its Global Executive Committee. Mr. Martin’s educational background includes a bachelor of arts degree in Economics from Claremont Men’s College and a juris doctorate from Columbia University School of Law. The Board believes that Mr. Martin’s extensive legal and business experience in the financial services industry gives him the qualifications and skills to serve as a National Penn director. |

Continuing as Class II Directors for a term expiring at the 2016 Annual Meeting:

|

| |

| Christian F. Martin IV

Director since 2008

Age 58 Mr. Martin is Chairman and Chief Executive Officer of C. F. Martin & Co., Inc., a guitar manufacturer (1986 to present). Mr. Martin was initially elected as a director on February 1, 2008, in accordance with the merger agreement with KNBT Bancorp, Inc. He previously served as a director of KNBT and its predecessor, Keystone Savings Bank, since 2003. Mr. Martin’s educational background includes a bachelor’s degree from Boston University’s School of Management. The Board believes that Mr. Martin’s financial and business experience gives him the qualifications and skills to serve as a National Penn director. |

| | |

| R. Chadwick Paul Jr. Director since 2008 Age 60

Mr. Paul is President & Chief Executive Officer of Ben Franklin Technology Partners of Northeastern Pennsylvania, a technology-based economic development company (2002 to present). Mr. Paul was initially elected as a director on February 1, 2008, in accordance with the merger agreement with KNBT Bancorp, Inc. He previously served as a director of KNBT and its predecessor, Keystone Savings Bank, since 1984. Mr. Paul’s educational background includes a bachelor of science degree in Business and Economics and an MBA, both from Lehigh University. The Board believes that Mr. Paul’s entrepreneurial business experience gives him the qualifications and skills to serve as a National Penn director.

|

| | |

| C. Robert Roth

Director since 1990

Age 66 Mr. Roth is a Bucks County Magisterial District Judge (1992 to present). Mr. Roth owned and operated a retail business for 19 years. Mr. Roth has been a director of National Penn since 1990. The Board believes that Mr. Roth’s judicial and business experience, coupled with his years of service as a director of National Penn, provide the Board with valuable industry experience and knowledge of National Penn. |

| | |

| Wayne R. Weidner

Director since 1985

Age 71 Mr. Weidner has been a director of National Penn since 1985, serving as its Chairman from 2002 until 2009. Mr. Weidner’s entire career was spent with National Penn, where he began in 1962. During his career with National Penn, Mr. Weidner served in various roles including President and CEO of National Penn Bank from 1991 to 2001. He was also President of National Penn from 1998-2001; President and CEO in 2001; Chairman, President and CEO from 2002-2004; Chairman and CEO from 2004 to 2006; and Chairman in 2007. Mr. Weidner is now Vice Chairman of the Board of National Penn. Mr. Weidner served three years on the board of directors of the Federal Reserve Bank of Philadelphia. Mr. Weidner’s service as an executive, Chairman and director of National Penn, and his business and financial expertise, provide the Board with valuable industry experience and knowledge of National Penn. |

National Penn’s governing body is its Board. The Board is elected by the shareholders to direct and oversee National Penn’s management in the long-term interests of the shareholders.

Corporate Governance Guidelines

The Board has adopted a set of Corporate Governance Guidelines that, together with National Penn’s articles of incorporation, bylaws and the charters of Board committees, provide a framework for the governance of National Penn. Such guidelines are intended to assist the Board in the exercise of its responsibilities. As the operation of the Board is a dynamic process, these guidelines are reviewed periodically and changed by the Board from time to time as deemed appropriate. National Penn’s Corporate Governance Guidelines are available on National Penn’s Web site, www.nationalpennbancshares.com. To access the guidelines, select “Governance Documents.”

Director Independence

Under The NASDAQ Stock Market’s Marketplace Rules, a NASDAQ-listed company’s board of directors must be comprised of a majority of independent directors. The Board has determined, after an initial review and determination by the Nominating/Corporate Governance Committee, that each of directors Beaver, Feather, Holton, Kennedy, Langiotti, C. Martin, M. Martin, Paquin, Paul, Roth and Weidner is independent as provided under NASDAQ rules. Messrs. Christian F. Martin IV and Michael E. Martin are not related. There are no family relationships among the executive officers and directors of National Penn.

Specifically, the Board determined that none of these persons has any relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a National Penn director. NASDAQ rules preclude a determination of independence for any director who: |

| | |

| Ÿ | Is, or during the past three years was, employed by National Penn or by any subsidiary of National Penn; |

| Ÿ | Either has a spouse, parent, child or sibling, by blood, marriage or adoption or shares the same residence as any person (a “Family Member”) who is, or during the past three years was, employed by National Penn or by any subsidiary of National Penn as an executive officer; |

| Ÿ | Accepted, or who has a Family Member who accepted, any compensation from National Penn or any subsidiary of National Penn in excess of $120,000 during any period of 12 consecutive months within the three years preceding the determination of independence, other than: |

| | - | Compensation for Board or Board committee service; |

| | - | Compensation paid to a Family Member who is an employee (other than an executive officer) of National Penn or a National Penn subsidiary; or |

| | - | Benefits under a tax-qualified retirement plan or non-discretionary compensation; |

| Ÿ | Is, or has a Family Member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which National Penn or any National Penn subsidiary made, or from which National Penn or any National Penn subsidiary received, payments for property or services that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, in the current or any of the past three fiscal years, other than: |

| | - | Payments arising solely from investments in National Penn’s securities; or |

| | - | Payments under non-discretionary charitable contribution matching programs; or |

| Ÿ | Is, or has a Family Member who is, a current partner of National Penn’s independent auditors or who worked on National Penn’s audit during any of the past three years. |

A majority of Board members are independent directors as defined above and as defined by the SEC and other regulatory authorities. The independent directors periodically meet in executive session without management present.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee are directors Holton (Chair), Beaver, Feather, C. Martin and Roth. None of these directors is or was formerly an officer or employee of National Penn, nor did any of them engage in any “related party transaction” with National Penn during 2013. In addition, none of our directors is an executive officer of another entity of which one of National Penn’s executive officers serves on the compensation committee or the board of directors.

Non-Employee Chairman

In accordance with National Penn’s bylaws, the Board has discretion to combine or separate the offices of Chairman and CEO. Since December 31, 2007, the Board has kept the offices of Chairman of the Board and CEO separate. The Board believes that this Board leadership structure effectively represents the best interests of shareholders in maximizing value, managing risk and maintaining confidence in National Penn.

Board Membership Criteria

Each member of the Board must possess the individual qualities of competence, collegiality, integrity, accountability and high performance standards. Candidates for membership on the Board are selected for their character, judgment, business experience and acumen. Board members are expected to devote the time and effort necessary to be productive members of the Board, including learning the business of National Penn and doing all that is necessary to attend and actively participate in meetings of the Board and its committees.

Each non-employee director is also expected to meet National Penn’s stock ownership guidelines, which require an equity investment in National Penn stock of at least $200,000. See “Stock Ownership - Guidelines.”

Board Committees

Currently, the Board maintains five committees established pursuant to National Penn’s bylaws - Executive, Audit, Compensation, Directors’ Enterprise Risk Management and Nominating/Corporate Governance. Each committee operates under its own separate charter, which is approved by the Board. A comprehensive description of the duties and responsibilities of each committee is set forth in the committee’s charter. These charters are available on National Penn’s website. To access these documents, log on to National Penn’s Web site, www.nationalpennbancshares.com, and select “Governance Documents.”

Executive Committee. The Executive Committee is authorized to act on behalf of the Board during intervals between meetings of the Board. The Executive Committee can respond quickly to time-sensitive business and legal matters when they arise. The Executive Committee is currently comprised of seven directors.

Audit Committee. National Penn’s Audit Committee is currently comprised of five directors, all of whom are independent as described under “Director Independence.” In addition to the above NASDAQ independence requirements, the SEC has issued heightened independence standards pursuant to the Sarbanes-Oxley Act of 2002 that apply to audit committee members. These standards provide that a member of a NASDAQ-listed company’s audit committee may not, in his or her capacity as a member of the audit committee, the board of directors or any other board committee:

| |

| • | Accept, directly or indirectly, any consulting, advisory or other compensatory fee from National Penn or any subsidiary of National Penn, except for certain retirement benefits; or |

| |

| • | Be an “affiliated person” of National Penn or any subsidiary of National Penn, as defined by SEC rules. |

The Board has determined that each member of National Penn’s Audit Committee meets these standards.

The SEC and NADSDAQ also have requirements regarding financial expertise and sophistication of Audit Committee members. The Board has determined that each of the following members of the Audit Committee meets the SEC’s definition of “audit committee financial expert” under NASDAQ-listed company audit committee rules: Chair Thomas L. Kennedy, Esq.; Thomas A. Beaver, CPA; Patricia L. Langiotti, PMC; R. Chadwick Paul Jr.; and Wayne R. Weidner. In addition, the Board has identified other members of the Board who, while not presently members of the Audit Committee, would qualify as “audit committee financial experts.” They are Jeffrey P. Feather, Christian F. Martin IV, Michael E. Martin, and Natalye Paquin.

The Audit Committee’s duties include:

| |

| • | Appointing, approving compensation for and providing oversight of, National Penn’s independent registered public accounting firm; |

| |

| • | Approving all audit and non-audit services to be performed by the independent registered public accounting firm; |

| |

| • | Reviewing the scope and results of the audit plans of the independent registered public accounting firm and internal auditors; |

| |

| • | Overseeing the scope and adequacy of internal accounting control and record-keeping systems; |

| |

| • | Reviewing the objectivity, effectiveness and resources of National Penn’s internal audit function; |

| |

| • | Conferring independently with, and reviewing various reports generated by, the independent registered public accounting firm; |

| |

| • | Resolving any disagreements between management and the independent registered public accounting firm; and |

| |

| • | Establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

Compensation Committee. National Penn’s Compensation Committee generally reviews, approves and reports to the Board on compensation and related programs and plans. The Compensation Committee is currently comprised of five directors, all of whom are independent as described under “Director Independence.” NASDAQ has issued heightened independence standards pursuant to The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act that apply to Compensation Committee members. These standards require consideration of any consulting, advisory or other compensatory fees paid by National Penn as well as other compensation received by the director. The Board has determined that each member of the Compensation Committee meets these standards. The Compensation Committee’s responsibilities are described below in the section of “Compensation Discussion & Analysis” entitled “Role of the Committee.”

The Compensation Committee has authority under its charter to retain outside counsel, compensation consultants or other experts of its choice and receives adequate funding from National Penn to engage such advisors. For information on Towers Watson, the compensation consultant retained by the committee since August 2011, see the section of “Compensation Discussion & Analysis” entitled “Compensation Consultant.” Fees paid to Towers Watson for services performed during 2013 were $191,088.

Nominating/Corporate Governance Committee. National Penn’s Nominating/Corporate Governance Committee identifies and recommends nominees for election to the Board and oversees matters of corporate governance, including Board performance. The Nominating/Corporate Governance Committee is currently comprised of five directors, all of whom are independent as described under “Director Independence.”

The Nominating/Corporate Governance Committee’s duties include:

| |

| • | Screening and recommending candidates as nominees for election to the Board (see also “Consideration of Director Nominees” below); |

| |

| • | Managing the annual Board and individual director performance assessments; |

| |

| • | Overseeing the orientation and education of directors; |

| |

| • | Reviewing corporate policies such as Code of Conduct, stock ownership of directors and management, insider trading and director attendance; and |

| |

| • | Ensuring an appropriate structure for management succession and development. |

Directors’ Enterprise Risk Management Committee. National Penn’s Directors’ Enterprise Risk Management Committee assists the Board in providing oversight, direction and authority to management regarding National Penn’s enterprise-wide risk management process. The Directors’ Enterprise Risk Management Committee is currently comprised of six directors, all of whom are independent as described under “Director Independence.”

Consideration of Director Nominees

The Nominating/Corporate Governance Committee selects individuals for nomination to the Board based on the criteria set forth in National Penn’s Corporate Governance Guidelines. Under these criteria, a majority of the directors are to be independent as described under “Director Independence.”

The Board believes independent directors add balance and diversity to the composition of the Board and should bring expertise and experience in areas related to important strategic needs of National Penn. Selection of directors is to be made from among individuals whose leadership and effectiveness have been demonstrated or whose specialized training or experience will be of value to National Penn. Candidates for the Board are to meet the following qualifications:

| |

| • | High-level competence and leadership experience in business or administrative roles; |

| |

| • | Breadth of knowledge about issues affecting National Penn; |

| |

| • | Ability and willingness to work on a collegial basis with other National Penn directors and National Penn management and to contribute special competencies to Board activities; |

| |

| • | Unquestioned personal integrity; |

| |

| • | Loyalty to National Penn and concern for its success; |

| |

| • | Courage to criticize and to apply sound business ethics; |

| |

| • | Ability to exercise sound and independent judgment; |

| |

| • | Awareness of a director’s vital part in National Penn’s good corporate citizenship and corporate image; and |

| |

| • | Time available for meetings and consultation on National Penn matters. |

In considering individual director candidates, the Nominating/Corporate Governance Committee considers individuals who, in the judgment of the committee, would be best qualified to serve on the Board. The committee considers the experience and expertise already present on the Board so as to broaden the collective experience and expertise of the Board. Moreover, the Board endorses the committee’s seeking qualified directors from diverse backgrounds in the context of the Board as a whole. Diversity of backgrounds is considered along with other such factors, including experience, qualifications and skills. While diversity of backgrounds is a significant factor in nominating candidates, the Nominating/Corporate Governance Committee has not adopted a formal policy on diversity in board composition.

Candidates for membership on the Board may be suggested by a director or shareholder and may be recommended by professional search firms retained by the Nominating/Corporate Governance Committee. Shareholders who wish to suggest candidates as nominees should write to National Penn Bancshares, Inc., 645 Hamilton Street, Suite 1100, Allentown, PA 18101 (Attention: Corporate Secretary), stating in detail the qualifications of the persons they recommend. Likewise, e-mail communications should be addressed to the Corporate Secretary at andy.ellsworth@nationalpenn.com. The Nominating/Corporate Governance Committee evaluates candidates suggested by shareholders in the same manner it evaluates any other nominee. For information on how to submit the name of a person to be considered by the Nominating/Corporate Governance Committee for possible nomination as a director, please see “Contacting the Board” below and the discussion of “Shareholder Proposals and Nominations.”

Code of Conduct

National Penn has adopted a Code of Conduct that addresses, among other things, ethical conduct, conflicts of interest, integrity of financial reports, legal compliance and the reporting of violations. The Code of Conduct applies to all directors, officers and employees. All directors, officers and employees are required annually to affirm their acceptance of, and compliance with, the Code of Conduct. The Code of Conduct may be accessed on National Penn’s Web site, www.nationalpennbancshares.com, by selecting “Governance Documents.”

Contacting the Board

The Board welcomes communications from shareholders and has adopted a procedure for receiving and addressing them. Shareholders may write to either the entire Board or individual directors. To do so, shareholders should send their communications to National Penn Bancshares, Inc., 645 Hamilton Street, Suite 1100, Allentown, PA 18101 (Attention: Corporate Secretary). Likewise, e-mail communications should be addressed to the Corporate Secretary at andy.ellsworth@nationalpenn.com. The Corporate Secretary does not screen letters or e-mails for content, but will forward a letter or e-mail to an individual director or Board committee as the Corporate Secretary feels appropriate if no specific direction is provided.

|

| | | | |

| | | | | |

| Board Committees, Meetings and Attendance |

The following table summarizes the Board committees on which each National Penn director serves as of February 27, 2014, as well as each director’s position on such committee (C = Chair; M = Member).

|

| | | | | |

| Name | Executive | Audit | Compensation | Nominating/ Corporate Governance | Directors’ Enterprise Risk Management |

| Non-Employee Directors: |

| Thomas A. Beaver (l) | C | M | M | M | |

| Jeffrey P. Feather | M | | M | C | |

| Donna D. Holton | M | | C | | M |

| Thomas L. Kennedy | M | C | | | M |

| Patricia L. Langiotti | M | M | | M | C |

| Christian F. Martin IV | | | M | | |

| Michael E. Martin | M | | | M | |

| Natalye Paquin | | | | M | M |

| R. Chadwick Paul Jr. | | M | | | M |

| C. Robert Roth | | | M | | M |

| Wayne R. Weidner | | M | | | |

| Employee Director: |

| Scott V. Fainor | M | | | | |

| | | | | | |

| Number of Meetings Held in 2013: | 8 | 8 | 4 | 3 | 4 |

|

| |

| (1) | In his capacity as non-executive Chairman, Mr. Beaver regularly attends all Committee meetings, |

| | including those committees of which he is not a formal member. |

___________________

During 2013, the Board met 8 times. Each director attended at least 75% or more of the aggregate of (1) the total number of meetings of the Board and (2) the total number of meetings held by Board committees on which he or she served.

Under National Penn’s current corporate governance guidelines, National Penn directors are required to attend annual meetings of shareholders. All twelve directors attended the 2013 annual meeting of shareholders.

The following table sets forth information on compensation of National Penn non-employee directors for the fiscal year ended December 31, 2013:

|

| | | | | | | |

Name (a) | Fees Earned or Paid in Cash (b) (2) ($) | Restricted Stock Awards (c) (3) ($) | Option Awards(d) (4) ($) | Non-Equity Incentive Plan Compensation (e) ($) | Change in Pension Value and Non-Qualified Deferred Compensation Earnings (f) (5) ($) | All Other Compensation (g) ($) | Total (h) ($) |

| Thomas A. Beaver | 120,000 | 70,000 | 0 | 0 | 28,496 | 0 | 218,496 |

| Jeffrey P. Feather | 49,980 | 61,200 | 0 | 0 | 10,383 | 0 | 121,563 |

| Donna D. Holton | 40,800 | 61,200 | 0 | 0 | 10,383 | 0 | 112,383 |

| Thomas L. Kennedy | 53,040 | 61,200 | 0 | 0 | 10,383 | 0 | 124,623 |

| Patricia L. Langiotti | 56,100 | 61,200 | 0 | 0 | 10,383 | 0 | 127,683 |

| Christian F. Martin IV | 35,700 | 54,060 | 0 | 0 | 17,721 | 0 | 107,481 |

| Michael E. Martin (1) | 41,820 | 54,060 | 0 | 0 | 3,576 | 0 | 99,456 |

| Natalye Paquin | 35,700 | 54,060 | 0 | 0 | 9,967 | 0 | 99,727 |

| R. Chadwick Paul Jr. | 38,760 | 54,060 | 0 | 0 | 9,328 | 0 | 102,148 |

| C. Robert Roth | 35,700 | 54,060 | 0 | 0 | 9,651 | 0 | 99,411 |

| Wayne R. Weidner | 41,820 | 54,060 | 0 | 0 | 9,346 | 0 | 105,226 |

| |

| (1) | In accordance with the policy of Warburg Pincus LLC, Mr. Martin remits all cash directors’ fees to Warburg Pincus. |

| |

| (2) | Amounts reported are cash retainers and Board special meeting fees. Under the Directors’ Fee Plan, each non-employee director may choose to be paid these fees, in lieu of cash, in (a) shares of National Penn common stock, (b) National Penn common stock units or (c) deferred cash. National Penn common stock units are credited with dividend equivalents (at National Penn’s cash dividend rate) in the form of additional common stock units. All common stock units are converted to actual shares of National Penn common stock and issued to an individual upon his or her termination of service as a director or attaining age 65. Deferred cash is credited with interest at a money market rate and is paid out to an individual upon his or her termination of service as a director or attaining age 65. |

| |

| (3) | Amounts reported are the grant date fair value for restricted stock unit awards (“RSUs”) made in 2013 for each individual under the Long-Term Incentive Compensation Plan. RSUs, like common stock units under the Directors’ Fee plan, are credited with dividend equivalents (at National Penn’s cash dividend rate) in the form of additional RSUs, and are converted to actual shares of National Penn common stock and issued to an individual at a future date, subject to satisfaction of an award’s service restrictions and other terms and conditions. As of December 31, 2013, each individual has the following aggregate number of common stock units (including RSUs) credited to his or her account: Thomas A. Beaver: 55,820; Jeffrey P. Feather: 35,279; Donna D. Holton: 35,279; Thomas L. Kennedy: 35,279; Patricia L. Langiotti: 35,279; Christian F. Martin IV: 31,694; Michael E. Martin: 12,150; Natalye Paquin: 33,672; R. Chadwick Paul Jr.: 31,694; C. Robert Roth: 32,792; and Wayne R. Weidner: 31,694. |

| |

| (4) | As of December 31, 2013, each individual has the following aggregate number of option awards outstanding: Thomas A. Beaver: 0; Jeffrey P. Feather: 33,475; Donna D. Holton: 33,475; Thomas L. Kennedy: 5,665; Patricia L. Langiotti: 4,556; Christian F. Martin IV: 33,475; Michael E. Martin: 0; Natalye Paquin: 0; R. Chadwick Paul Jr.: 33,475; C. Robert Roth: 4,556; and Wayne R. Weidner: 0. |

| |

| (5) | Amounts reported are the interest credited in 2013 on deferred cash balances under the Director’s Fee Plan and the fair market value of additional common stock units (including RSUs) credited in 2013 on a dividend reinvestment of common stock units (including RSU balance) under the Directors’ Fee Plan and the Long-Term Incentive Compensation Plan. |

The following table summarizes the cash compensation arrangements with non-employee directors (outside directors)

for 2014:

|

| | | |

| NATIONAL PENN BANCSHARES / NATIONAL PENN BANK | |

| Outside Directors only | |

| Retainers: Board members must attend in person or by phone 75% of meetings (Board and Committee Meetings combined) to be paid retainer. Committees include: National Penn Audit, Executive, Compensation, Nominating/Corporate Governance, Directors’ Enterprise Risk Management | |

| Chairman of Board |

| $120,000 |

|

| Chairman of National Penn Board Committee (if other than Chairman of the Board) | 35,374 |

|

| Other Directors | 30,172 |

|

| Special National Penn/National Penn Bank Board Meeting Fees - per meeting attended | 1,561 |

|

| National Penn/National Penn Bank Executive Committee Retainer | 9,364 |

|

National Penn/National Penn Bank Audit Committee Retainer

| 6,243 |

|

| National Penn/National Penn Bank Committee Member Retainer | 3,122 |

|

| Director Emeritus (none currently) - Retainer | 2,000 |

|

|

| | | | |

| Compensation Committee Report |

The committee has reviewed with National Penn management the section of this proxy statement captioned “Compensation Discussion & Analysis,” or the CD&A, and has recommended to the Board of Directors that this CD&A be included in this proxy statement and in National Penn’s Annual Report on Form 10-K for the year ended December 31, 2013.

|

|

| Donna D. Holton, Chair |

| Thomas A. Beaver |

| Jeffrey P. Feather |

| Christian F. Martin IV |

| C. Robert Roth |

|

| |

| Compensation Discussion & Analysis | |

This Compensation Discussion & Analysis, or CD&A, is intended to assist shareholders in understanding and evaluating the information found in this proxy statement under the captions “Executive Compensation” and “Potential Payments Upon Termination or Change-in-Control.” These two sections provide information about the compensation and benefits provided to the persons who served as National Penn’s principal executive officer or principal financial officer in 2013, as well as the three other most highly compensated National Penn executive officers in 2013. These “named executive officers” are identified below in this CD&A under the caption “2013 Named Executive Officers.”

An Overview of 2013 National Penn Executive Compensation

At the beginning of 2013, National Penn’s Compensation Committee, which we refer to as the committee, approved the overall compensation program for 2013 for National Penn’s Chief Executive Officer (CEO) and other named executive officers (NEOs). Among the committee’s primary considerations in approving the 2013 compensation program was to provide incentives for achieving and maintaining profitability in 2013 and long-term financial performance. Also in January 2013, the committee made incentive compensation awards to various National Penn officers, including each of the 2013 NEOs, in the form of service-based restricted stock. See “Executive Compensation Decisions - Long-Term Incentive Compensation Plan.”

Compensation for 2013 consisted of three primary elements - base salary, potential cash incentive awards and equity incentive awards. Except for Mr. Kennedy, the salaries of our NEOs were the same in 2013 as in 2012. See “Executive Compensation Decisions - Base Salary” below.

To implement the non-salary components, the committee, in January 2013, first established performance goals for 2013 under National Penn’s Executive Incentive Plan. These goals included a combination of corporate performance goals, which include profitability, as measured by return on average assets and return on average tangible common equity, and individual performance goals reflecting National Penn’s performance under four other key strategic business objectives.

In January 2014, the committee evaluated National Penn’s 2013 financial performance, which is described in our 2013 annual report. Based on the 2013 financial results, the committee concluded that National Penn exceeded the target level on both return on average assets goal and the return on average tangible common equity goal, and that the strategic business objective goals were attained. Accordingly, the committee approved company performance awards for the NEOs under the Executive Incentive Plan at an interpolated amount between target and maximum performance levels. See “Executive Compensation Decisions - Executive Incentive Plan.”

2013 Named Executive Officers

Mr. Fainor and four other persons are National Penn’s NEOs for 2013. The following table identifies our NEOs for 2013, as well as the positions held by our NEOs in 2013:

|

| |

| Name | Position at 12/31/2013 |

| Scott V. Fainor | President and Chief Executive Officer |

| Michael J. Hughes | Senior Executive Vice President and Chief Financial Officer |

| Sandra L. Bodnyk | Senior Executive Vice President and Chief Risk Officer |

| David B. Kennedy | Senior Executive Vice President and Chief Banking Officer |

| H. Anderson Ellsworth | Group Executive Vice President, Chief Legal Officer and Corporate Secretary |

Role of the Committee

The committee operates under a written charter reviewed, updated and approved annually by National Penn’s Board of Directors. In June of 2013, the Board of Directors approved changes to the committee’s written charter to conform with recent amendments to NASDAQ rules intended to enhance “independence” of the committee and its advisors. These changes were also intended to assure transparency of the committee in relationships of the committee’s advisors with National Penn. The committee’s areas of responsibilities and authorities regarding executive compensation are to:

| |

| • | Develop an overall executive compensation philosophy and strategy, including determining appropriate levels of executive compensation, the mix between fixed and incentive compensation and the mix between short-term and long-term compensation, without encouraging unnecessary and excessive risk-taking. |

| |

| • | In its sole discretion, have the authority to retain or obtain the advice of consultants, outside counsel and other advisors as it determines appropriate to assist it in the full performance of its functions, including any compensation consultant used to assist in the evaluation of executive compensation. |

| |

| • | Maintain direct responsibility for the appointment, compensation and oversight of the work of any consultants, outside counsel and other advisors retained by the committee, and determine appropriate funding required from National Penn for payment of compensation to any such advisors. |

| |

| • | Assess the independence of consultants, outside counsel and other advisors (whether retained by the committee or management) who provide advice to the committee, prior to selecting or receiving advice from them, in accordance with NASDAQ listing standards. |

| |

| • | Conduct regular and independent reviews of executive officer compensation; develop executive compensation procedures and programs consistent with the approved compensation philosophy and strategy; and approve any peer group(s) used for the purposes of executive or board compensation. |

| |

| • | Approve participation, performance measures and performance parameters for awards under the Executive Incentive Plan and the Long-Term Incentive Compensation Plan. |

| |

| • | Review and approve corporate goals and objectives relevant to CEO compensation, evaluate our CEO’s performance in light of those goals and objectives and approve our CEO’s compensation level based on this evaluation, without the CEO’s presence during such voting or deliberation by the committee on the CEO’s compensation. |

| |

| • | Review and approve the compensation of National Penn’s Section 16 reporting executive officers as recommended by National Penn’s CEO (which reviews generally include a review of competitive market data for these individuals and consideration of market conditions). |

| |

| • | Review and approve employment, severance and/or change-in-control agreements for National Penn’s Section 16 reporting executive officers. |

| |

| • | Oversee administration of executive incentive plans, long-term incentive compensation plans for employees and directors, employee stock purchase plans, and other executive and director compensation arrangements; approve all officer long-term incentive compensation awards and awards for executive officers under executive incentive plans. |

| |

| • | Oversee the Company’s compliance with regulatory requirements associated with compensation programs under its purview. |

Compensation Consultant

The committee has historically retained a compensation consultant. To assist the committee in carrying out its responsibilities, the committee has engaged Towers Watson as the committee’s independent compensation consultant. Towers Watson provides the committee with peer executive and non-employee director compensation data, as well as expertise and advice on various matters brought before the committee. As described in its written charter, the committee has the sole authority to retain and terminate the independent compensation consultant and approve fees and other engagement terms. In addition, the committee has considered the six “independence” factors listed in the NASDAQ listing requirements and has determined that Towers Watson does not have a conflict of interest.

Peer Group Comparison & Benchmarking

The committee regularly reviews the competitive market to compare executive pay and performance to market norms and to provide guidance for setting total compensation guidelines. The peer group, which was approved by the committee in 2011, is based on objective criteria and includes 19 institutions (with National Penn positioned at median of total assets, market capitalization and total employees) located in the mid-Atlantic or northeastern United States, of similar asset size and with generally similar business models. While the peer group is reviewed annually and updated based on various economic and business factors as appropriate, the peer group approved by the committee for 2011 was unchanged for both 2012 and 2013.

The peer group is listed below.

|

| | |

| Company Name | City, State | Ticker Symbol |

| Astoria Financial Corporation | Lake Success, NY | AF |

| Beneficial Mutual Bancorp, Inc. | Philadelphia, PA | BNCL |

| Community Bank System, Inc. | De Witt, NY | CBU |

| F.N.B. Corporation | Hermitage, PA | FNB |

| First Commonwealth Financial Corp. | Indiana, PA | FCF |

| First Financial Bancorp. | Cincinnati, OH | FFBC |

| FirstMerit Corporation | Akron, OH | FMER |

| Fulton Financial Corporation | Lancaster, PA | FULT |

| Investors Bancorp, Inc. | Short Hills, NJ | ISBC |

| NBT Bancorp, Inc. | Norwich, NY | NBTB |

| Northwest Bancshares, Inc. | Warren, PA | NWBI |

| Park National Corporation | Newark, OH | PRK |

| Provident Financial Services, Inc. | Jersey City, NJ | PFS |

| S&T Bancorp, Inc. | Indiana, PA | STBA |

| Signature Bank | New York, NY | SBNY |

| Susquehanna Bancshares, Inc. | Lititz, PA | SUSQ |

| United Bankshares, Inc. | Charleston, WV | UBSI |

| Valley National Bancorp | Wayne, NJ | VLY |

| Webster Financial Corporation | Waterbury, CT | WBS |

| | | |

In addition to the peer group, Towers Watson used its own industry survey, the Towers Watson 2013 Financial Services Executive Compensation Survey, which reflects data from 76 banks and is size-adjusted for banks approximately our asset size.

Data and competitive perspective were assessed by component (e.g., base salary, annual cash incentives, and long-term equity incentives) and in aggregate to provide a comprehensive review of total compensation. The relationship between pay and performance between National Penn and the peer group was also analyzed. Data from Towers Watson’s analysis was used to assess the effectiveness of the current compensation program in meeting desired objectives, as well as to develop total compensation guidelines and serve as a reference for decisions going forward.

In addition, in the interest of keeping current with emerging market awareness, the committee receives and reviews other available information on executive compensation practices, executive compensation trends, industry trends, pay levels and regulatory updates throughout the year. Such sources range from reviewing available compensation surveys and databases to attending industry meetings. While benchmarking relative to peers is important to the committee’s analysis of the compensation of our executives, it is based on historical data and may not in all cases represent best practice going forward. Such data, while a helpful resource, are not meant to supplant the committee’s review of National Penn executives’ performance, internal pay equity information and other market information, all of which the committee believes are necessary when making compensation decisions. Thus, the committee retains discretion to set compensation levels that are higher or lower than targeted “market” benchmarks.

Role of Executives in Establishing Compensation

During 2013, our CEO worked with the committee in designing and implementing National Penn’s compensation programs for all executive officers, excluding himself. His role included:

| |

| • | Recommending performance targets, goals and objectives; |

| |

| • | Evaluating executive performance; |

| |

| • | Advising and consulting with the committee regarding corporate titles, base salaries, annual incentive plan categories, long-term incentive compensation awards, general awards and employment terms for executives; and |

| |

| • | Providing background information for committee meeting agenda items. |

In 2013, our CEO generally attended committee meetings, but was not present during executive sessions of the committee when matters related to him were discussed. Periodically, National Penn’s Chief Financial Officer, Chief Risk Officer and Chief Banking Officer also attended committee meetings in order to keep the committee informed with regard to National Penn’s financial position and risk balancing activities that may affect compensation decisions. In addition, National Penn’s Corporate Secretary/Chief Legal Officer generally attended committee meetings to provide reports, information and advice about agenda topics.

Philosophy and Strategy of Executive Compensation

Overall Objective

The overall executive compensation philosophy and strategy at National Penn is to provide a total compensation package that is balanced and competitive in the external market and correlates to National Penn’s strategic business plan. The package is also intended to compensate superior individual and corporate performance appropriately based on financial and strategic performance measures that increase longer-term shareholder value, all without encouraging excessive or undue risk-taking.

Benchmark References

As noted above, the committee regularly reviews and considers market and peer data as well as other available best practice information to facilitate their assessment of executive compensation and performance. The committee references several resources, including, but not limited to, peer group information, industry compensation surveys and industry performance data. These resources are used to assist the committee in assessing the competitiveness of current pay levels as well as to set compensation program guidelines.

Total Compensation Positioning and Mix

National Penn generally targets its total compensation package (both individual components and in the aggregate) to be competitive with market (i.e., to approximate the 50th percentile). While targets are set to provide competitive pay for meeting expected performance, actual pay levels (by component and in the aggregate) vary to reflect performance relative to goals and industry performance over both short- and long-term timeframes.

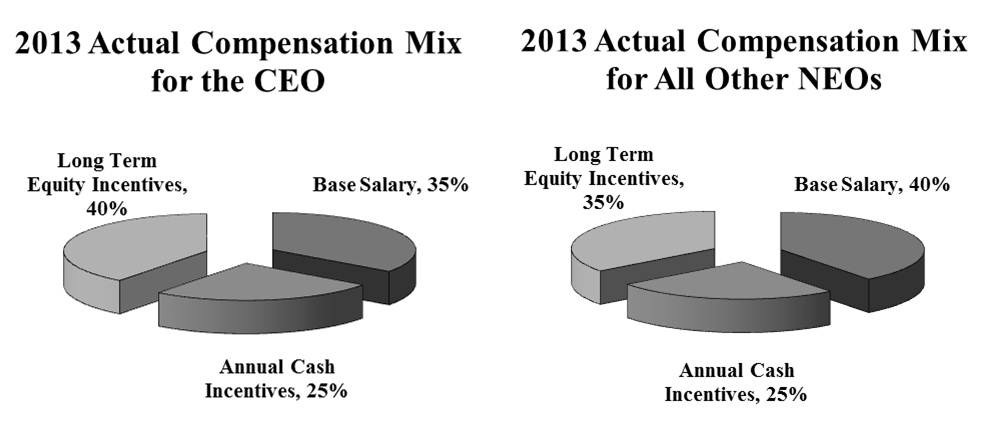

In the aggregate, the objective of National Penn’s total compensation program is to provide an appropriate “mix” and balance of fixed and variable (i.e., incentive/performance) compensation. The target mix of compensation will vary based on the executive’s role, and the actual mix will vary based on actual performance (e.g., in a year when no annual incentive is paid, the percentage of total compensation paid in salary will increase). The focus on mix is to ensure our total compensation program appropriately balances fixed versus variable compensation.

In general, the committee targets the following elements as a percentage of total direct compensation (salary plus target annual cash and long-term equity incentive) for its NEOs:

| |

| • | Base salary will comprise between 40% and 55%; |

| |

| • | Target annual cash incentives will comprise between 20% and 30%; and |

| |

| • | Long-term equity incentives will comprise between 20% and 30%. |

The result is that approximately 60% of a Named Executive Officer’s total compensation will vary based on performance. The committee recognizes, however, that certain components of its NEOs’ 2013 actual compensation mix have slightly deviated from the target percentages discussed above. Going forward, the committee expects that the compensation mix will continue to trend toward having an increasing percentage of compensation tied to performance.

The following graphic illustrates the actual compensation mix for our CEO (individually) and the aggregate mix for the other NEOs for 2013. The percentages depicted below are derived from the aggregate value of cash compensation earned in 2013 and the grant date fair market value of equity compensation received in 2013, as reported in the Summary Compensation Table of this proxy statement.

NOTE: The category "Other Executive Benefits" as it appears in the Summary Compensation Table aggregates the value of certain additional benefits, such as the executives' 401(k) match, imputed value of life insurance benefits, automobile allowance, telephone allowance and costs to attend certain industry events. The value of these ancillary benefits has been excluded for purposes of illustrating the 2013 compensation mix.

Elements of Executive Compensation Agreements with Executives

|

| | |

| Element | Description & Purpose | Other Features |

| Base Salary | The purpose of base salary is to provide competitive and fair compensation that reflects the position and the individual’s value to the organization based on National Penn’s business strategy. Base salary reflects fixed compensation that is the foundation for other compensation components (such as incentives and benefits). Executive base salaries at National Penn are to be structured and targeted “at market” or approximately 50th percentile for comparably sized financial services organizations. Actual salaries are set to reflect each executive’s individual role, contribution, experience and performance. | The committee reviews and determines executive salary levels annually. |

| Annual Cash Incentives | Awards under our Executive Incentive Plan are designed to motivate and compensate executives for the achievement of our annual business plan/objectives. Target award levels are set to be consistent with market practice (with National Penn positioned at the median), but actual award levels will vary from 0% to approximately 150% of target to reflect achievement of performance goals to hold executives accountable for corporate and individual performance. Company performance goals are tied primarily to financial performance measures as determined/approved by the committee and, where appropriate, individual performance goals that reflect each executive’s accountability for driving business success. All performance goals are periodically reviewed by the committee in order to ensure that they do not promote excessive or undue risk taking. Financial objectives may also include a measured comparison of how well National Penn performs versus its peer group. Objectives will have specific assigned levels of achievement for threshold, target and maximum performance. | The committee establishes the specific terms and conditions for the payment of annual cash incentive awards at the beginning of the applicable year. Additionally, the committee has discretion to consider unusual business factors and their resulting effect on corporate performance and adjust (upwards or downwards) in any award(s) granted. |

| Long-Term Equity Incentives | Awards under our Long-Term Equity Incentive Compensation Plan are intended to compensate executives for sustained long-term performance that is aligned with shareholder interests and to encourage employee retention through vesting schedules. We also expect our executives to own National Penn stock to ensure long-term perspectives and serve as a mitigating factor against any tendency towards excessive or undue risk taking. Long-term equity incentive awards may take a variety of forms, such as stock options and restricted stock grants. Levels and frequency of awards are determined by the committee and designed to reflect the executive’s level of responsibility and performance, competitive parameters and desired compensation philosophy and objectives. While initial grants are targeted to be competitive with market, actual award values will reflect National Penn’s actual long-term performance (through stock price appreciation and achievement of long-term performance goals). Service-based restricted stock awards can also be granted as appropriate to recognize performance and provide an ownership/retention focus. Long-term incentives have the capacity to be the largest component of executive compensation, if our performance and stock price exceed our expectations. | The committee evaluates and establishes the form, mix and terms of the long-term equity incentive awards annually. Additionally, the committee has discretion to consider unusual business factors and their resulting effect on corporate performance and adjust (upwards or downwards) any award(s) granted. |

| Executive Benefits & Perquisites | National Penn provides executives with a level of executive benefits and perquisites to remain competitive, retain key executives and address contribution caps that may be placed on their participation in several employee benefit programs (e.g., retirement contributions in a 401(k) plan). Perquisites are provided only where appropriate and where they facilitate job performance (e.g., automobile and telephone allowances). | Details on executive benefits and perquisites are included in footnote 2 to the Summary Compensation Table, which begins on page 26. |

Agreements with Executives

An important aspect of overall executive employment relationships are employment and change-in-control agreements. These agreements are designed to promote stability and continuity of senior executives and ensure their interests are aligned with shareholders. Terms of these agreements consider marketplace practices and National Penn’s unique needs, and are tailored to the individual executive with a focus on retention and recruitment. Details on employment agreements and change-in-control agreements are included under “Employment, Change-in-Control and Other Agreements” on page 32. Please note that, in an effort to align the contracts for the Senior Executive Vice Presidents, on February 8, 2013, National Penn entered into an amendment to Mr. Hughes' employment agreement and also entered into an amended and restated employment agreement with Ms. Bodnyk. Under these amended agreements, neither Ms. Bodnyk nor Mr. Hughes is entitled to an excise tax gross-up in change-in-control situations.

Link Between Financial Performance and Executive Compensation

National Penn is committed to ensuring a strong correlation between pay and performance. The following graph shows the direct relationship between our financial performance and our CEO total compensation levels by comparing our return on average assets, or ROAA, to the total annual compensation for Mr. Fainor, since he was named CEO of National Penn in January 2010:

National Penn’s executive compensation philosophy and strategy is intended to be competitive and compensate executives commensurate with actual performance. Because a significant portion of our total compensation is performance-based (through annual cash and long-term equity incentives), we expect our compensation will vary on an annual basis, but evolve over the long-term to align with our performance relative to our business strategy, peers and the financial services industry overall. We believe our total compensation program provides an appropriate balance that enables National Penn to ensure proper pay-performance alignment and reduces the potential that our plans might motivate excessive or undue risk taking. Our program balances:

| |

| • | Short-term and long-term performance; |

| |

| • | Company and individual performance; |

| |

| • | Quantitative/financial performance and qualitative/discretionary performance; and |

| |

| • | Absolute performance (our internal goals) and relative performance (compared to industry). |

When corporate performance exceeds National Penn’s objectives and peer performance, total compensation is intended to be above market median. In years where short-term performance goals are not achieved or fall below expectations, total compensation will be below market median. Over a long-term horizon, total compensation should reflect the level of sustained performance achieved by National Penn.

All of the components are balanced, integrated and designed to provide a total compensation environment that will enhance the executives’ relationship with National Penn and support the growth of overall shareholder value.

Executive Compensation Decisions

In this section, we discuss decisions made by the committee over the course of 2013 regarding the compensation of our 2013 NEOs. When considering various factors relative to the committee’s decisions, no specific formula was applied to determine the weight of each factor. Rather, the committee exercised its discretion and judgment when considering each factor and all factors, taken collectively.

Base Salary

2013 Base Salary Determinations. Messrs. Fainor, Hughes, Ellsworth and Ms. Bodnyk did not receive base salary increases for 2013. On December 18, 2012, the committee approved an increase in David Kennedy’s base salary for 2013 from $300,000 to $340,000. The committee approved Mr. Kennedy’s new base salary in consideration of his performance, as evaluated by Mr. Fainor, and his promotion to Senior Executive Vice President and Chief Banking Officer.

Executive Incentive Plan

The Executive Incentive Plan provides the opportunity for annual cash incentives to be awarded to executive officers based on annual company and individual performance goals. With input from our CEO, we annually review all components of the plan, including participation, performance measures, award levels and all other administrative features. At the beginning of the year, we approve performance parameters and award schedules for the upcoming year. National Penn’s parameters may be one or more financial or other performance measures established by National Penn and not mandated by the plan.

2013 Plan Year Goals and Results. In January 2013, the committee approved the company performance goals, targets and award schedule for the 2013 plan year. For the 2013 plan year, the Executive Incentive Plan had three categories of participants:

| |

| • | Category A included only our CEO, Mr. Fainor, and had the highest award potential; |

| |

| • | Category AA included our Chief Financial Officer, Mr. Hughes, our Chief Risk Officer, Ms. Bodnyk, and our Chief Banking Officer, Mr. Kennedy; and |

| |

| • | Category B included our other most senior executive officers with company-wide managerial responsibilities, which included, among others, Mr. Ellsworth. |

Individual performance awards were based on the attainment of specific objectives established at the beginning of the year. For example, the committee established a unique set of individual performance objectives for Mr. Fainor, which relate to his role in driving National Penn’s achievement of certain growth, financial, governance and infrastructure objectives. In addition, a participant must be continuously employed through the award payment date to receive any award, except for death, disability, involuntary termination (not for cause) and retirement, in which case, any provided award will be prorated.

The committee established the following company performance goals:

| |

| • | Financial Objectives include ranges of return on average assets (ROAA) and return on average tangible common equity (ROATCE), which are each weighted as 50% of the overall company performance criteria. While the committee has historically relied upon ROAA to determine achievement of company performance goals, ROATCE was newly introduced for 2013. The committee reasoned that ROATCE accurately reflects the relative strength of National Penn’s balance sheet and therefore may be relied upon to determine attainment of a portion of company performance goals. |

| |

| • | Strategic Business Objectives include National Penn’s success relative to attainment of four other key strategic business objectives previously established by the Board at the end of 2012 and approved by the Board for the 2013 Strategic Plan. The 2013 Strategic Business Objectives are (1) grow revenue and core earnings power of the franchise (i.e., ROAA, revenue per full-time equivalent employee); (2) utilize strength of balance sheet (i.e., ROATCE); (3) sustain a strong, balanced risk management program; and (4) pursue an accretive acquisition. Although achievement of these strategic business objectives are not weighted for purposes of the overall company performance criteria, the committee considers the achievement of these objectives as an additional parameter for annual incentive awards. |

The committee set the target levels for the financial objectives (i.e., ROAA, ROATCE) relating to potential 2013 Executive Incentive Plan awards, and concluded that the relationship between the payments generated at the various levels of achievement and the degree of difficulty of the performance goals was significant and reasonable given the business environment, risk and other related factors. In order to account for unforeseen external market factors, the committee also reserved the right to increase or decrease awards based on peer performance and to reduce awards if it determined that the company did not achieve its goals with regard to enterprise risk management for the year.

The award schedule for 2013 was based on three factors, the first two comprising the company performance award and the third being the individual performance award:

|

| | | | | |

| Company Performance Award Criteria |

| Performance Criteria | Threshold | | Target | | Maximum |

| 1) Return on average assets (ROAA) (50% of company portion) | 100% | | 1.12% | | 1.23% |

| 2) Return on average tangible common equity (ROATCE) (50% of company portion) | 9.07% | | 10.67% | | 11.74% |

| Participant Category | % of Base Pay if Threshold is Achieved | | % of Base Pay if Target is Achieved | | % of Base Pay if Maximum is Achieved |

| A | 15% | | 50% | | 75% |

| AA | 15% | | 45% | | 65% |

| B | 15% | | 35% | | 50% |

|

| |

| Individual Award Criteria |

3) Based on the respective objectives established for each participant at the beginning of the plan year. Individual Performance - % of base pay in addition to % of base pay for Company Performance |

| | |

| Participant Category | Award as a % of Base Pay |

| A | Range 0% to 10% - Target 5% |

| AA | Range 0% to 10% - Target 5% |

| B | Range 0% to 10% - Target 5% |

The following tables provide estimated incentive award payouts that each NEO would be eligible to receive, assuming achievement of the performance criteria (i.e., ROAA, ROATCE, and Individual Objectives) at each of the various levels of achievement (i.e., Threshold, Target and Maximum): |

| | | | | | | | |

| Projected Executive Incentive Plan Award Payouts at “MAXIMUM” Level of Achievement |

| Participant | Participant Category | Company Performance Award | | Individual Performance Award* | | Total Award at “MAXIMUM” |

| ROAA | | ROATCE |

| Scott Fainor | A | $281,250 | (+) | $281,250 | (+) | $75,000 | (=) | $637,500 |

| Michael Hughes | AA | $156,00 | (+) | $156,000 | (+) | $48,000 | (=) | $360,000 |

| Sandra Bodnyk | AA | $131,625 | (+) | $131,625 | (+) | $40,500 | (=) | $303,750 |

| David Kennedy | AA | $110,500 | (+) | $110,500 | (+) | $34,000 | (=) | $255,000 |

| H. Anderson Ellsworth | B | $62,500 | (+) | $62,500 | (+) | $25,000 | (=) | $150,000 |

* For purposes of this “Maximum” projection, individual performance awards achieved at “Maximum” are considered to be granted at the maximum percentage allowable under the individual performance criteria for each participant (i.e., 10% of base pay for each of the NEOs). |

|

| | | | | | | | |

| Projected Executive Incentive Plan Award Payouts at “TARGET” Level of Achievement |

| Participant | Participant Category | Company Performance Award | | Individual Performance Award** | | Total Award at “TARGET” |

| ROAA | | ROATCE |

| Scott Fainor | A | $187,500 | (+) | $187,500 | (+) | $37,500 | (=) | $412,500 |

| Michael Hughes | AA | $108,000 | (+) | $108,000 | (+) | $24,000 | (=) | $240,000 |

| Sandra Bodnyk | AA | $91,125 | (+) | $91,125 | (+) | $20,250 | (=) | $202,500 |

| David Kennedy | AA | $76,500 | (+) | $76,500 | (+) | $17,000 | (=) | $170,000 |

| H. Anderson Ellsworth | B | $43,750 | (+) | $43,750 | (+) | $12,500 | (=) | $100,000 |

** For purposes of this “Target” projection, individual performance awards achieved at “Target” are considered to be granted at the % of base pay for each participant’s respective category. (i.e., 5% for Mr. Fainor, 5% for category AA and category B participants). |

|

| | | | | | | | |

| Projected Executive Incentive Plan Award Payouts at “THRESHOLD” Level of Achievement |

| Participant | Participant Category | Company Performance Award | | Individual Performance Award*** | | Total Award at “THRESHOLD” |

| ROAA | | ROATCE |

| Scott Fainor | A | $56,250 | (+) | $56,250 | (+) | $0 | (=) | $112,500 |

| Michael Hughes | AA | $36,000 | (+) | $36,000 | (+) | $0 | (=) | $72,000 |

| Sandra Bodnyk | AA | $30,375 | (+) | $30,375 | (+) | $0 | (=) | $60,750 |

| David Kennedy | AA | $25,500 | (+) | $25,500 | (+) | $0 | (=) | $51,000 |