UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under ss. 240.14a-12

National Penn Bancshares, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

[ ] Fee paid previously with preliminary materials.

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) Amount Previously Paid: |

| 2) Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL SHAREHOLDERS' MEETING

Dear National Penn Shareholder:

On Tuesday, April 25, 2006, National Penn Bancshares, Inc. will hold its Annual Meeting of Shareholders at the Sheraton Reading Hotel, Route 422 West and Paper Mill Road, Wyomissing, Pennsylvania. The meeting will begin at 4:00 p.m.

Only shareholders who owned stock at the close of business on March 3, 2006 can attend and vote at the meeting or any postponement or adjournment. At the meeting, we will:

| 1. | Elect four directors; |

| | |

| 2. | Consider and act upon a proposal to approve an amended and restated Directors’ Fee Plan; |

| | |

| 3. | Consider and act upon a proposal to ratify the Audit Committee’s selection of National Penn’s independent auditors for 2006; and |

| | |

| 4. | Attend to other business, if any, properly presented at the meeting. |

Your Board of Directors recommends that you vote in favor of the election of directors, in favor of approval of the amended and restated Directors’ Fee Plan, and in favor of ratification of the independent auditors selected for 2006, as described in this proxy statement.

At the meeting, we also will report on our 2005 business results and other matters of interest to shareholders.

We are enclosing with this proxy statement a copy of our 2005 Annual Report on Form 10-K. The approximate date this proxy statement and card(s) are being mailed is March 29, 2006.

IMPORTANT: This mailing contains an Admission Ticket. FOR SECURITY PURPOSES, YOU WILL NEED THIS ADMISSION TICKET TO ATTEND THE MEETING.

| | By Order of the Board of Directors |

| | |

| | Sandra L. Spayd |

| March 29, 2006 | Secretary |

TABLE OF CONTENTS

| | |

| Notice of Annual Shareholders’ Meeting | |

| Proxy Statement | 1 |

| Proposal 1 - Election of Directors | 1 |

Director Information | 2 |

Corporate Governance | 4 |

Board Committees, Meetings and Attendance | 11 |

Director Compensation | 12 |

Executive Compensation | 15 |

Compensation Committee Report | 15 |

Summary Compensation Table | 19 |

Stock Options | 20 |

Pension Benefits | 22 |

Employment, Change-in-Control and Consulting Agreements | 23 |

| Performance Graph | 28 |

| Stock Ownership | 29 |

Guidelines | 29 |

Directors and Executive Officers | 31 |

Five Percent Shareholders | 33 |

| Other Director and Executive Officer Information | 33 |

Related Party and Similar Transactions | 33 |

Section 16(a) Beneficial Ownership Reporting Compliance | 34 |

| Proposal 2 - Directors’ Fee Plan | 34 |

| Equity Compensation Plan Table | 40 |

| Proposal 3 - Ratification of Auditors | 41 |

| Audit Committee Report | 42 |

| Additional Information | 44 |

“Householding” of Proxy Materials and Annual Reports | 44 |

Record Date; Shares Outstanding | 45 |

Quorum | 45 |

Proxies; Right to Revoke | 45 |

Default Voting | 46 |

Voting by Street Name Holders | 46 |

Tabulation of Votes | 46 |

Proxy Solicitation | 46 |

Shareholder Proposals and Nominations | 47 |

Shareholder List | 49 |

Annual Report for 2005 | 49 |

| Exhibit A - Directors’ Fee Plan | A-1 |

| Exhibit B - Audit Committee Charter | B-1 |

NATIONAL PENN BANCSHARES, INC.

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by National Penn Bancshares, Inc. ("National Penn"), on behalf of the Board of Directors, for the 2006 Annual Meeting of Shareholders. This Proxy Statement and the related proxy form are being distributed on or about March 29, 2006.

You can vote your shares by completing and returning the enclosed written proxy card. You can also vote by telephone, toll-free, or online if you have Internet access. Registered shareholders with addresses outside the United States may not be able to vote by telephone. The Internet and telephone voting facilities for shareholders of record are available 24 hours a day until they close at 4:00 p.m. on April 25, 2006. The Internet and telephone voting procedures are described on the enclosed proxy form and are designed to authenticate shareholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or through the Internet, you need not return a proxy card. Whether you vote by proxy card, by telephone or through the Internet, your shares will be voted as you direct.

You can also vote in person at the meeting. Submitting your voting instructions by returning a proxy card or by voting over the telephone or the Internet will not affect your right to attend the meeting and vote.

National Penn carried out a five-for-four stock split of its common shares on September 30, 2005. All share and per share information preceding the date of the stock split has been proportionately adjusted in this proxy statement.

PROPOSAL 1 - ELECTION OF DIRECTORS

The first proposal scheduled to be voted on at the meeting is the election of four directors. These directors will serve a three-year term as Class I directors. The Board of Directors has nominated J. Ralph Borneman, Jr., George C. Mason, Glenn E. Moyer, and Robert E. Rigg for election as Class I directors. All of these individuals are currently serving as National Penn directors.

The Board of Directors recommends a vote "FOR" all its nominees.

The Board has no reason to believe that any nominee will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, the Board will either select a substitute nominee or will reduce the size of the Board. If you have submitted a proxy and a substitute nominee is selected, your shares will be voted for the election of the substitute nominee.

John H. Body, who is currently serving in the class of directors whose terms end in 2006, will be retiring from the Board effective with the 2006 annual meeting of shareholders.

National Penn's articles of incorporation provide that the Board shall consist of between eight and twenty directors, the exact number of which shall be set by resolution of the Board, and shall be divided into three classes equal or nearly equal in size as is possible. In accordance with these provisions, the Board has set the size of the Board at 13 directors and the size of Class II at five directors and the size of both Class I and III at four directors, effective as of the 2006 annual meeting of shareholders.

The bylaws permit shareholders to nominate candidates for election as directors. A nomination must be made in compliance with the advance notice and information requirements of the bylaws. National Penn has not received any such notice of a nomination.

In accordance with the bylaws, directors are elected by a plurality of the votes of shares present and entitled to be voted at the meeting. That means the four nominees of the Board will be elected if they receive more affirmative votes than any other nominees. In January 2006, the Board of Directors amended National Penn’s Corporate Governance Guidelines to provide that, in an uncontested election of directors (where the only nominee are those recommended by the Board), any nominee who receives a greater number of votes “withheld” than votes “for” his or her election is expected to offer his or her resignation. In any such event, the Nominating/Corporate Governance Committee will promptly consider the matter and make a recommendation to the Board, and the Board will decide whether to accept the resignation.

Director Information

The Board is separated into three classes, each with a three-year term. The terms of the persons nominated as Class I directors will expire in 2009. The terms of the continuing Class II directors expire in 2007, and the terms of the continuing Class III directors expire in 2008.

Below is biographical and other information about the nominees for election as Class I directors, and the continuing Class II and Class III directors, as of March 3, 2006.

Nominees as Class I Directors to serve until 2009:

J. Ralph Borneman, Jr., age 67, has been a director since 1988. Mr. Borneman is President and CEO of Body-Borneman Insurance & Financial Services, LLC, an insurance agency. Mr. Borneman is also a member of the boards of directors of Erie Indemnity Co. and Erie Family Life Insurance Co.

George C. Mason, age 71, has been a director since June 2004. He is a Consultant to National Penn. He is the retired Chairman of Peoples First, Inc. and its subsidiary, The Peoples Bank of Oxford, companies which National Penn acquired in June 2004. He was initially elected a director in accordance with the provisions of the Peoples First acquisition agreement.

Glenn E. Moyer, age 54, has been a director since 2002. Mr. Moyer has been President of National Penn and Chief Executive Officer of National Penn Bank since December 2003, and was Executive Vice President of National Penn since April 2001 and President and Chief Operating Officer of National Penn Bank since January 2001.

Robert E. Rigg, age 53, has been a director since 1999. Mr. Rigg is the President of Rigg Darlington Group Inc., an insurance agency. Mr. Rigg was first elected a director when National Penn acquired Elverson National Bank, as provided in the acquisition agreement.

Continuing Class II Directors to serve until 2007:

Fred D. Hafer, age 64, has been a director since 2003 and a director of National Penn Bank since 2002. He is the retired Chairman of FirstEnergy Corporation, having retired in 2001. He was formerly Chairman, President and Chief Executive Officer of GPU Corporation.

Kenneth A. Longacre, age 72, has been a director since October 2001, and was a director from 1990 through 2000. Mr. Longacre is Chairman of Farm & Home Oil Company.

C. Robert Roth, age 58, has been a director since 1990. Mr. Roth is a Bucks County Magisterial District Judge.

Wayne R. Weidner, age 63, has been a director since 1985. Mr. Weidner is Chairman and Chief Executive Officer of National Penn, and was Chairman, President and Chief Executive Officer of National Penn from January 2002 until December 2003. He was President and Chief Executive Officer of National Penn in 2001. He is also Chairman of National Penn Bank.

Donald P. Worthington, age 61, has been a director since March 2004. He is Executive Vice President of National Penn Bank and Chairman of the Bank's FirstService Division. He served as President of the FirstService Division from February 2003 until March 2004. Prior to that, he was Executive Vice President of FirstService Bank. He was initially elected a director in accordance with the provisions of the FirstService Bank acquisition agreement.

Continuing Class III Directors to serve until 2008:

Thomas A. Beaver, age 53, has been a director since July 2005. Mr. Beaver is a senior partner in the business consulting group of Reinsel Kuntz Lesher LLP, a regional accounting, tax and consulting firm.

Robert L. Byers, age 67, has been a director since April 2005. Mr. Byers is the founder and Chairman of Byers’ Choice, Ltd., a firm specializing in the handcrafting and retailing of Caroler® figurines (seasonal collectibles). Mr. Byers was a director of FirstService Bank, which was acquired by National Penn in 2003. He was initially elected a director in accordance with the provisions of the FirstService Bank acquisition agreement.

Frederick P. Krott, age 59, has been a director since 2001. Mr. Krott is President of Lamm & Witman Funeral Home, Inc. Mr. Krott was first elected a director when National Penn acquired Community Independent Bank, Inc., as provided in the acquisition agreement.

Patricia L. Langiotti, age 59, has been a director since 1986. Ms. Langiotti is President of Creative Management Concepts, a management consulting firm.

Corporate Governance

National Penn's governing body is its Board of Directors. The Board is elected by the shareholders to direct and oversee National Penn's management in the long-term interests of shareholders.

Corporate Governance Guidelines

The Board has adopted a set of Corporate Governance Guidelines that, together with National Penn's articles of incorporation, bylaws, and the charters of Board committees, provide a framework for the governance of National Penn. The Guidelines are intended to assist the Board in the exercise of its responsibilities. As the operation of the Board is a dynamic process, these Guidelines are reviewed periodically and are changed by the Board from time to time as deemed appropriate. National Penn's Corporate Guidelines are available on National Penn's website, www.nationalpennbancshares.com. To access the guidelines, select "Governance Documents."

Director Independence

Under the Nasdaq Stock Market’s Marketplace Rules, a Nasdaq-listed company's board of directors must be comprised of a majority of independent directors. The Board has determined that each of Messrs. Beaver, Body, Borneman, Byers, Hafer, Krott, Longacre, Rigg, Roth and Ms. Langiotti is an independent director, as defined in the Nasdaq Stock Market Marketplace Rules. Specifically, the Board determined that none of these persons has any relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the

responsibilities of a National Penn director. In that regard, none of these persons is a person who:

| | · | Is, or during the past three years was, employed by National Penn or by any subsidiary of National Penn; |

| | · | Accepted, or who has a relative by blood, marriage or adoption or who has the same residence as such director (a "Family Member") who accepted, any payments from National Penn or any subsidiary of National Penn in excess of $60,000 during any period of twelve consecutive months within the past three years, other than: |

| | | · | Compensation for board or committee service as a director of National Penn or a National Penn subsidiary; |

| | · | Payments arising solely from investments in National Penn's securities; |

| | · | Payments to a Family Member who is a non-executive employee of National Penn or a National Penn subsidiary; |

| | · | Benefits under a tax-qualified retirement plan or non-discretionary compensation; |

| | · | Loans or payments from a financial institution, provided such loans or payments were made in the ordinary course of business, on substantially the same terms as those prevailing at the time for comparable transactions with the general public, and in the case of loans did not present more than a normal degree of risk or other unfavorable factors, and were not otherwise subject to the public disclosure requirements of the Securities and Exchange Commission; or |

| | | · | Loans permitted by Section 13(k) of the Securities Exchange Act of 1934, including loans from a financial institution permitted by Federal Reserve Board Regulation O. |

| | · | Has a Family Member who is, or during the past three years was, employed by National Penn or by any subsidiary of National Penn as an executive officer; |

| | · | Is or has a Family Member who is a partner in, or a controlling shareholder or an executive officer of, any organization to which National Penn made, or from which National Penn received, payments that exceed 5% of the recipient's consolidated gross revenues for that year, or $200,000, whichever is more, in fiscal year 2005 or any of the past three fiscal years, other than: |

| · | Payment arising solely from investments in National Penn’s securities; or |

| · | Payments under non-discretionary charitable contribution matching programs. |

| | · | Is or has a Family Member who is employed as an executive officer of another entity where at any time during the past three years any of the executive officers of National Penn serve on the compensation committee of such other entity; |

| | · | Is or has a Family Member who is a partner in National Penn's independent auditors; or |

| | · | Was or has a Family Member who was a partner or employee of National Penn’s independent registered public accounting firm who worked on National Penn’s audit during any of the past three years. |

A majority of Board members are independent directors as defined above, and as defined by the Securities and Exchange Commission and other regulatory authorities. The independent directors periodically meet in executive session without management present.

Lead Independent Director

In July 2005, the Board of Directors formalized the position of lead independent director, a role then performed by Kenneth A. Longacre, Chairman of the Nominating/Corporate Governance Committee of the Board. As the director formally designated as lead independent director, Mr. Longacre continues to coordinate the activities of the other non-employee independent directors, chair the meetings of the non-employee independent directors in executive session, and coordinate Board meetings, agendas and related matters with Chairman and CEO Wayne R. Weidner.

In February 2006, the Board of Directors, after consideration of the recommendation of the Nominating/Corporate Governance Committee, exempted Mr. Longacre, as lead independent director, from the mandatory retirement provisions of National Penn’s bylaws for a one-year period beginning April 25, 2006, the meeting date for the 2006 annual meeting of shareholders.

Board Membership Criteria

Each member of the Board must possess the individual qualities of integrity and accountability, informed judgment, financial literacy, maturity and high performance standards. Candidates for membership on the Board are selected for their character, judgment, business experience and acumen. Board members are expected to devote the time and effort necessary to be productive members of the Board, which includes learning the business of National Penn and the Board, actively participating in Board meetings, and attending meetings of the Board and its committees.

Each non-employee director is also expected to, and currently does, meet National Penn's stock ownership guidelines, which require an equity investment in National Penn stock of at least $100,000. See “Stock Ownership - Guidelines” herein.

Board Committees

The Board maintains five standing committees: Executive, Audit, Compensation, Enterprise Risk Management and Nominating/Corporate Governance. Each committee operates under its own separate charter which is approved by the Board. These charters are available on National Penn's website. To access these items, log on to

National Penn's website, www.nationalpennbancshares.com, and select "Governance Documents."

Executive Committee. The Executive Committee is authorized to act on behalf of the Board during intervals between meetings of the Board. The Executive Committee can respond quickly to time-sensitive business and legal matters when they arise. The Executive Committee is currently comprised of eight directors.

Audit Committee. National Penn's Audit Committee is currently comprised of five directors, all of whom are independent as described under “Director Independence.” In addition to the above Nasdaq independence requirements, the SEC has issued heightened independence standards pursuant to the Sarbanes-Oxley Act of 2002 that apply to audit committee members. These standards provide that a member of a Nasdaq-listed company's audit committee may not, in his or her capacity as a member of the audit committee, the board of directors, or any other board committee:

| | · | Accept directly or indirectly any consulting, advisory or other compensatory fee from National Penn or any subsidiary of National Penn, except for certain retirement benefits; or |

| | · | Be an "affiliated person" of National Penn or any subsidiary of National Penn, as defined by SEC rules. |

Each of the members of National Penn's audit committee meets these heightened independence standards.

The SEC and Nasdaq also have requirements regarding financial expertise and sophistication. The Board has determined that Patricia L. Langiotti, President of Creative Management Concepts, and Fred D. Hafer, retired Chairman of FirstEnergy Corporation and formerly Chairman, President and Chief Executive Officer of GPU Corporation, each meet the SEC's definition of "audit committee financial expert" and are "financially sophisticated" under Nasdaq-listed company audit committee rules.

The Audit Committee's duties include:

| | · | Appointing, approving compensation for, and providing oversight of, National Penn's independent registered public accounting firm; |

| | · | Approving all audit and non-audit services to be performed by the independent registered public accounting firm; |

| | · | Reviewing the scope and results of the audit plans of the independent registered public accounting firm and internal auditors; |

| | · | Overseeing the scope and adequacy of internal accounting control and record-keeping systems; |

| | · | Reviewing the objectivity, effectiveness and resources of the internal audit function; |

| | · | Conferring independently with, and reviewing various reports generated by, the independent registered public accounting firm; |

| | · | Resolving any disagreements between management and the independent registered public accounting firm; and |

| | · | Establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

A more comprehensive description of the duties and responsibilities may be found in the Audit Committee Charter, which is attached to this proxy statement as Exhibit B. It also may be accessed on National Penn's website, www.nationalpennbancshares.com, by selecting "Governance Documents."

Compensation Committee. National Penn's Compensation Committee generally reviews, approves and reports to the Board on compensation and related programs and plans. The Compensation Committee is currently comprised of five directors, all of whom are independent, as described under “Director Independence.” The Compensation Committee's duties include:

| | · | Recommending compensation to the Board of Directors (meeting in Executive Session with only independent directors present) for National Penn’s Chairman and Chief Executive Officer and National Penn’s President; |

| | · | Determining compensation for, and approving promotions of, other executive officers; |

| | · | Reviewing the annual performance objectives of National Penn’s Chief Executive Officer and, with input from the other independent directors, annually evaluating the performance of the Chief Executive Officer; |

| | · | Establishing compensation policies for National Penn's directors, officers and employees generally; and |

| | · | Administering National Penn's stock-based compensation plans and employee benefit plans. |

The Compensation Committee charter may be accessed on National Penn's website, www.nationalpennbancshares.com, by selecting "Governance Documents."

Enterprise Risk Management Committee. National Penn’s Enterprise Risk Management Committee assists the Board of Directors in providing oversight, direction and authority to management regarding National Penn’s enterprise-wide risk management process. The Enterprise Risk Management Committee is currently comprised of four directors, including the Chairs of the Audit, Compensation and Nominating/Corporate Governance Committees, all of whom are independent, as described under “Director Independence.”

The Enterprise Risk Management Committee charter may be accessed on National Penn’s website, www.nationalpennbancshares.com, by selecting “Governance Documents.”

Nominating/Corporate Governance Committee. National Penn's Nominating/Corporate Governance Committee identifies and recommends nominees for election to the Board, and oversees matters of corporate governance processes, including Board performance. The Nominating/Corporate Governance Committee is currently comprised of five directors, all of whom are independent, as described under "Director Independence."

The Nominating/Corporate Governance Committee's duties specifically include:

| | · | Screening and recommending candidates as nominees for election to the Board (see also "Consideration of Director Nominees" below); |

| | · | Evaluating Board performance—over-all, and individually by director; |

| | · | Overseeing the training and orientation of directors; |

| | · | Reviewing corporate policies such as Code of Conduct, stock ownership of directors and management, insider trading and director attendance; and |

| | · | Ensuring an appropriate structure for management succession and development. |

The Nominating/Corporate Governance Committee charter may be accessed on National Penn's website, www.nationalpennbancshares.com, by selecting "Governance Documents."

Consideration of Director Nominees

The Nominating/Corporate Governance Committee selects individuals for nomination to the Board based on the criteria set forth in National Penn’s corporate governance guidelines. Under these criteria, a majority of the directors are to be independent, as described under “Director Independence.”

The Board believes independent directors add balance and diversity to the composition of the Board, and should be selected from fields related to important strategic needs of National Penn. Selection is to be made from individuals whose leadership and effectiveness have been demonstrated or whose specialized training or experience will be of value to National Penn. Candidates for the Board are to meet the following qualifications:

| | · | High-level leadership experience in business or administrative roles. |

| | · | Breadth of knowledge about issues affecting National Penn. |

| | · | Ability and willingness to contribute special competencies to Board activities. |

| | · | Unquestioned personal integrity. |

| | · | Loyalty to National Penn and concern for its success. Courage to criticize and to apply sound business ethics. Sound and independent judgment. |

| | · | Awareness of a director’s vital part in National Penn’s good corporate citizenship and corporate image. |

| | · | Time available for meetings and consultation on National Penn matters. |

The Board endorses the value of seeking qualified directors from diverse backgrounds. The Nominating/Corporate Governance Committee considers from time to time, individuals who in the judgment of the Committee would be best qualified to fill a vacancy on the Board. The Committee will consider the experience and expertise already present on the Board so as to broaden the collective experience and expertise of the Board. Candidates for membership on the Board may be provided by a director or shareholder, and the committee may retain professional search firms. Shareholders who wish to suggest candidates as nominees should write to National Penn Bancshares, Inc., Philadelphia and Reading Avenues, Boyertown, PA 19512 (Attention: Corporate Secretary), stating in detail the qualifications of the persons they recommend.

Code of Conduct

National Penn has adopted a Code of Conduct that addresses, among other things, ethical conduct, conflicts of interest, integrity of financial reports, legal compliance and the reporting of violations. The Code applies to all directors, officers and employees. All directors, officers and employees are required annually to affirm

their acceptance of, and compliance with, the Code of Conduct. The Code of Conduct may be accessed on National Penn's website, www.nationalpennbancshares.com, by selecting "Governance Documents."

Contacting the Board of Directors

The Board welcomes communications from shareholders and has adopted a procedure for receiving and addressing them. Shareholders may write to either the entire Board or to individual directors. To do so, you should send your communication to National Penn Bancshares, Inc., Philadelphia and Reading Avenues, Boyertown, PA 19512 (Attention: Corporate Secretary). Likewise, e-mail communications should be addressed to the Corporate Secretary at slspayd@natpennbank.com. The Corporate Secretary does not screen letters or e-mails for content, but will forward a letter or e-mail to an individual director or Board committee as the Corporate Secretary feels appropriate if no specific direction is provided.

Board Committees, Meetings and Attendance

The following table summarizes the Board Committees on which each National Penn director serves as of March 3, 2006, and the number of Committee meetings held in 2005.

Name | Audit | Compensation | Enterprise Risk Management | Executive | Nominating/ Corporate Governance |

Non-Employee Directors: | | | | | |

| Thomas A. Beaver(1) | | | | | |

| John H. Body(2) | | Member | | Member | Member |

| J. Ralph Borneman, Jr. | | Chair | Member | Member | Member |

| Robert L. Byers | | Member | | | |

| Fred D. Hafer | Member | Member | | | |

| Frederick P. Krott | Member | | | | |

| Patricia L. Langiotti | Chair | | Member | Member | Member |

| Kenneth A. Longacre | | Member | Member | Member | Chair |

| George C. Mason | | | | Member | |

| Robert E. Rigg | Member | | | | Member |

| C. Robert Roth | Member | | Chair | Member | |

| | | | | | |

Employee Directors: | | | | | |

| Glenn E. Moyer | | | | Member | |

| Wayne R. Weidner | | | | Chair | |

| Donald P. Worthington | | | | | |

| | | | | | |

| Number of Meetings in 2005 | 11 | 6 | 4 | 0 | 4 |

All directors attended at least 75% of the meetings of the full Board and the meetings of the committees on which they served.

National Penn directors are expected to attend annual meetings of shareholders and, barring unforeseen circumstances, generally do so. Last year's annual meeting was attended by all thirteen persons serving as National Penn directors at that time.

Director Compensation

Messrs. Weidner, Moyer and Worthington are the only directors who are also National Penn employees. National Penn does not pay any of these directors any additional compensation for serving as directors of National Penn or any subsidiary.

The following table summarizes the compensation arrangements with non-employee directors for 2005 and 2006:

| | | |

| | 2005 | 2006 |

National Penn Bancshares Board Annual Retainers(1) Chair - Audit Committee Chair - Other Committees (Compensation, Enterprise Risk Management and Nominating/Corporate Governance) Additional Retainer - Lead Independent Director All Other Board Members | $15,000 $12,500 N/A $10,000 | $15,000 $12,500 $5,000 $10,000 |

| | | |

National Penn Bancshares Board Fees Paid Per Monthly Meeting Attended Phone Meetings | N/A N/A | $1,000 $1,000 |

| | | |

National Penn Bancshares Committee Fees Paid Per Meeting Attended Audit Committee Chair and Members Audit Committee Meeting by Conference Call Chair of Audit Committee also receives fee per phone meeting with accountants Audit Committee Chair attendance at Subsidiary Board Meeting Audit Committee Members attendance at Executive Disclosure Committee meeting All Other Committee Chairs and Members (Compensation, Enterprise Risk Management, and Nominating/CorporateGovernance) Committee Phone Meetings | $750 $375 $250 $750 $750 $500 $250 | $750 $750 $250 $750 $750 $500 $500 |

| | | |

National Penn Bank Board Fees Paid Per Quarterly Meeting Attended Phone Meetings | $3,000 $1,500 | $3,000 $3,000 |

| | | |

National Penn Bank Committee Fees Paid Per Meeting Attended Committee Phone Meetings | $350 $175 | $350 $350 |

| | | |

Director Education - Attendance at educational programs, seminars, conferences | $500 per day | $750 per day (includes travel day) |

| | | |

Stock Options(2) | 2,000 | N/A |

| | | |

Stock, Restricted Stock, or Restricted Stock Unit Awards (3) | 800(4) | 1,100(5) |

| (1) | Non-employee directors must attend in person or by phone 75% of all meetings (Board and Committee Meetings combined) to be paid the retainer at the end of each year. |

| (2) | Stock options were granted on May 3, 2005 at an exercise price of $18.744 per share (as adjusted for the 5-for-4 stock split effective September 30, 2005) under the National Penn Long-Term Incentive Compensation Plan. |

| (3) | Awards of stock, “performance-restricted” restricted stock or restricted stock units (“RSUs”) were made on January 25, 2006, by the Compensation Committee under the National Penn Long-Term Incentive Compensation Plan. |

| (4) | For National Penn’s corporate performance in 2005, each non-employee director received either 800 shares of common stock or 800 RSUs. These RSUs will be paid to a director as shares of National Penn common stock upon the director’s termination of service as a director. |

| (5) | For National Penn’s corporate performance in 2006, each non-employee director received either 1,100 shares of “performance-restricted” restricted stock or 1,100 “performance-restricted” RSUs. These awards are subject to forfeiture if National Penn’s corporate performance goals incorporated into the awards are not met or if the director ceases to serve as a director before January 25, 2007. If vested, these RSUs will be paid to a director as shares of National Penn common stock upon the director’s termination of service as a director. |

The following table sets forth directors’ fees paid to each National Penn non-employee director for 2005. Under the Directors’ Fee Plan, non-employee directors may elect to receive payment of directors’ fees, as a current cash payment, deferred cash payment, current National Penn stock payment, or deferred National Penn stock payment. For more information on the Directors’ Fee Plan, see Proposal 2 - Directors’ Fee Plan, herein.

Name | Cash Retainer | Committee Fees | Other Meeting Fees | | Total |

| | | | | | |

| Thomas A. Beaver(1) | $ 4,165 | $ 0 | $ 7,750 | | $ 11,915 |

| John H. Body | 10,000 | 9,300 | 14,500 | | 33,800 |

| J. Ralph Borneman, Jr. | 12,500 | 13,550 | 16,000 | | 42,050 |

| Robert L. Byers(2) | 7,500 | 2,000 | 16,000 | (3) | 25,500 |

| Fred D. Hafer | 10,000 | 12,625 | 11,500 | | 34,125 |

| Frederick P. Krott | 10,000 | 4,875 | 23,200 | (4) | 38,075 |

| Patricia L. Langiotti | 15,000 | 27,500 | 16,000 | | 58,500 |

| Kenneth A. Longacre | 12,500 | 10,500 | 16,500 | | 39,500 |

| George C. Mason | 10,000 | 3,000 | 14,000 | (5) | 27,000 |

| Robert E. Rigg | 10,000 | 8,750 | 11,000 | | 29,750 |

| C. Robert Roth | 12,500 | 17,400 | 16,000 | | 45,900 |

| (1) | Mr. Beaver was initially elected a National Penn director on July 27, 2005, and received a pro-rated annual cash retainer. |

| | |

| (2) | Mr. Byers was initially elected a National Penn director on April 25, 2005, and received a pro-rated annual cash retainer. |

| | |

| (3) | Mr. Byers serves as a non-employee member of National Penn Bank’s FirstService Bank Divisional Board and in 2005 received fees for such services in accordance with the agreement relating to the FirstService Bank acquisition. In 2005, these fees totaled $9,000 and are included in ”Other Meeting Fees”. |

| | |

| (4) | Mr. Krott serves as a non-employee member of National Penn Bank’s Berks Divisional Board and in 2005 received fees for such services in accordance with the agreement relating to the Community Independent Bank (Bernville Bank) acquisition. In 2005, these fees totaled $7,200 and are included in “Other Meeting Fees”. |

| | |

| (5) | Mr. Mason serves as a non-employee member of National Penn’s Peoples Bank of Oxford Divisional Board and in 2005 received fees for such services in accordance with the agreement relating to the Peoples First, Inc. acquisition. In 2005, these fees totaled $10,000 and are included in “Other Meeting Fees”. |

EXECUTIVE COMPENSATION

Compensation Committee Report

The Compensation Committee of National Penn's Board of Directors, comprised of five independent directors, generally establishes the compensation levels of National Penn's executive officers. In the case of National Penn's two most senior executive officers, Wayne R. Weidner (Chairman and Chief Executive Officer) and Glenn E. Moyer (President), the Compensation Committee makes recommendations on compensation (except for long-term incentive plan awards made by the Committee) to the Board of Directors. The Board then considers and acts on these recommendations in Executive Session with only independent directors present.

Compensation Philosophy and Strategy. The overall compensation philosophy and strategy is to administer a competitive total compensation program that recognizes team and individual accomplishments. National Penn's compensation program has three components:

| �� | · | Annual incentive compensation; and |

| | · | Long-term incentive compensation. |

Annual and long-term incentive compensation constitutes a significant portion of overall compensation for executive management. The Committee feels that this approach is essential in fostering a strong commitment to long-term growth in shareholder value.

Shareholder value is improved by company growth and strong financial performance. Company growth is achieved via mergers and acquisitions, new ventures, and internal growth. Strong financial performance is attained through team and individual employee performance in managing broad and profitable relationships with the company’s entire client base. These two key determinants of shareholder value are prominent in the variable pay programs in the company.

The three components of executive compensation are discussed separately below.

Base Salary. The Committee reviews base salaries of executive officers annually, considering:

| | · | Job scope and responsibilities; |

| | · | Corporate, unit and individual performance; and |

| | · | Salary rates for similar positions at other companies. |

The Committee generally targets base salaries for executive management in the range of (but toward the lower end of) median salary levels of comparable level executives at similarly sized regional financial services companies in the mid-Atlantic area. The Committee makes its salary decisions based on overall Company performance as well as individual performance. Although salary decisions are made independently of decisions on other components of compensation, they are made in the context of overall compensation.

In December 2004, the Committee met to consider executive officer salaries for 2005. The Committee reviewed an independent salary study of mid-Atlantic regional financial services companies, broken down by asset size, including data on chief executive officer compensation. These companies are more comparable to National Penn than the companies in the NASDAQ Bank Stock Index included in the graph on page 28, as that index includes larger companies throughout the United States. The Committee also reviewed Mr. Weidner's performance evaluation just completed by the Board of Directors (with favorable conclusions). At the same time, the Committee conferred with its outside compensation consultant. The Committee then approved a base salary for Mr. Weidner of $393,765 for 2005. This was a 5% increase over his 2004 salary level, and in the range of median salary levels of the chief executive officers of the companies covered by the study. This action was reviewed and approved by the Board of Directors (meeting in Executive Session with only independent directors present) later in December 2004.

Annual Incentive Compensation. Superior growth and performance in the short-term is rewarded with annual incentive compensation paid under National Penn's Executive Incentive Compensation Plan. This compensation tool is designed to motivate Plan participants to accomplish and improve on-going operating results. All performance measures are identifiable, support overall business objectives, and may have both qualitative and quantitative parameters. Additionally, the level of awards is structured to be competitive with peer organizations.

Each year in advance, the Committee selects the persons who are to participate in the Executive Incentive Plan, and establishes National Penn's financial performance goals and an award schedule for the ensuing year.

In January 2005, the Committee selected 35 persons, including Messrs. Weidner and Moyer and the other executive officers identified in this Proxy Statement as the "Named Executive Officers", to participate in the Plan in 2005, and established National Penn's financial performance goals for 2005 utilizing earnings per share as the primary corporate measure. 2005 performance goal levels included "Threshold" (below which no award would be paid), "Market Target," "NPB Target," and "Optimum." The Committee established award levels for each category of Plan participants using various percentage amounts of base salary at the various 2005 earnings per share target levels. For Messrs. Weidner and Moyer, the Committee set the award level at 40% of base salary if the "Market Target" performance goal was met, and 50% of base salary if the "NPB Target" performance goal was met.

After year-end, the Committee determines the extent to which the financial performance goals have been met. If National Penn does not meet the Threshold goal, no incentive awards are made. Awards for performance between Threshold and Market Target, Market Target and Company Target, or Company Target and Optimum are interpolated. Performance above Optimum is interpolated at half the rate of award increase between Company Target and Optimum.

The Plan also provides for discretionary additional annual incentive awards, based on individual performance. Such an award may not exceed 20% of the participant's base salary. In the case of Messrs. Weidner and Moyer, such an award may not exceed 20% of their cash award based on National Penn's financial performance.

Each year, the Compensation Committee determines, in advance, the matching amount, if any, of the cash incentive awards that will be subject to mandatory deferral and the risk of forfeiture for five years. For Plan year 2005, the Committee set this additional amount at one-third of the cash incentive award. At the end of five years, if the participant is still employed, has retired at age 60 or later, or has died, the participant (or his or her designated beneficiary) becomes entitled to the deferred incentive award plus interest, together with a 100% matching contribution from National Penn. Interest accrues on the mandatory deferral at a money market rate, adjusted quarterly. The participant forfeits the deferred incentive award if the requirements for a matching contribution are not satisfied. If there is a change-in-control of National Penn, each participant becomes entitled to an amount equal to all incentive awards still deferred under the Plan plus interest, together with a matching contribution from National Penn. On the date of the change-in-control, the Plan terminates and all amounts are to be paid out within 30 days.

In January 2006, the Committee met to determine incentive awards under the Executive Incentive Plan based on National Penn's financial performance for 2005. In 2005 National Penn earned $1.36 per share. These earnings were at the “NPB Target” level ($1.33 to $1.36 per share). The Committee determined the cash incentive awards for 2005 participants accordingly. For Messrs. Weidner and Moyer, the Committee recommended, and the Board of Directors (meeting in Executive Session with only independent directors present) approved, cash incentive awards of $226,407 and $181,133, respectively. Under the Plan's mandatory deferral provision, Messrs. Weidner and Moyer also received deferred incentive awards of $75,469 and $60,378, respectively. The cash awards for Messrs. Weidner and Moyer included discretionary additional incentive awards calculated at 15% of the National Penn performance-based awards.

Long-Term Incentive Compensation. The Committee believes that ownership of National Penn stock by executives who play significant roles in the success of National Penn is a key to building long-term shareholder value. To that end, equity-based incentive compensation is an effective compensation tool. While the Committee encourages executives to retain stock acquired via the long-term incentive plan, the Committee recognizes that personal circumstances often lead executives to sell some or all of the stock acquired within the plan. National Penn utilizes stock ownership guidelines, based on percentage of annual salary at various executive officer levels, to encourage stock ownership instead of stock option retention rules.

Currently, the Committee grants stock options annually to executive officers and others under a long-term incentive compensation plan approved by shareholders in 2005. Under the 2005 plan, options have an exercise price equal to the stock's fair market value on the date of grant and vest according to a schedule determined by the Committee. Upon termination of an optionee’s employment, non-vested options vest or terminate, depending on the circumstances, as provided in the plan and as determined by the Committee. If there is a change-in-control of National Penn, all non-vested options vest immediately.

In determining the number of options to be granted in 2005 to executive officers and others, the Committee considered:

| | · | The number of options previously granted and outstanding; |

| | · | The number of shares outstanding; |

| | · | National Penn's financial performance; and |

| | · | Competitive peer marketplace data. |

Based on the foregoing criteria, the Committee using its best judgment granted executive officers and others non-qualified stock options for a total of 391,700 shares or .9% of National Penn's shares outstanding at September 30, 2005, including stock options for 50,000 shares granted to Mr. Weidner. These 2005 non-qualified stock options were granted on December 1, 2005 at fair market value and have a vesting schedule of 20% per year for five years.

Tax Law. Under the federal income tax law, compensation to executives of public companies in excess of $1 million per year is not deductible for income tax purposes if it is not "performance-based." The Committee continues to monitor this situation. To the extent the Committee develops new executive compensation programs, it intends to structure them so that compensation will be deemed "performance-based" under this income tax law.

J. Ralph Borneman, Jr., Chairman

John H. Body

Robert L. Byers

Fred D. Hafer

Kenneth A. Longacre

Summary Compensation Table

The following table summarizes the total compensation, for each of the last three years, for Mr. Weidner, National Penn's chief executive officer during 2005, and the four other most highly compensated persons who were serving as executive officers at the end of 2005. These individuals are referred to as the "Named Executive Officers."

| | | | | | | Long-Term Compensation | | | |

| | | Annual Compensation | | Awards | | Payouts | | | |

Name and Principal Position | | Year | | Salary(1) ($) | | Bonus (2) ($) | | Other Annual Compensation ($) | | Restricted Stock Awards ($) | | Securities Underlying Options/ SARs (3) (#) | | LTIP Payouts ($) | | All Other Compensation ($) | |

(a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) | |

| | | | | | | | | | | | | | | | | | |

| Wayne R. Weidner | | 2005 | | $405,765 | | $301,876 | | 0 | | 0 | | 50,000 | | 0 | | $60,872 | (4) |

| Chairman and Chief | | 2004 | | 387,003 | | 228,552 | | 0 | | 0 | | 58,750 | | 0 | | 59,363 | |

| Executive Officer | | 2003 | | 378,688 | | 239,167 | | 0 | | 0 | | 72,094 | | 0 | | 56,664 | |

| | | | | | | | | | | | | | | | | | |

| Glenn E. Moyer | | 2005 | | 326,416 | | 241,511 | | 0 | | 0 | | 37,500 | | 0 | | 37,813 | (4) |

| President; also | | 2004 | | 310,937 | | 182,839 | | 0 | | 0 | | 43,750 | | 0 | | 8,643 | |

| President & Chief | | 2003 | | 303,991 | | 191,833 | | 0 | | 0 | | 54,079 | | 0 | | 7,554 | |

| Executive Officer of | | | | | | | | | | | | | | | | | |

| National Penn Bank | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Bruce G. Kilroy | | 2005 | | 200,059 | | 97,875 | | 0 | | 0 | | 11,000 | | 0 | | 28,430 | (4) |

| Group Executive Vice | | 2004 | | 182,050 | | 72,588 | | 0 | | 0 | | 12,500 | | 0 | | 28,932 | |

| President | | 2003 | | 180,137 | | 80,455 | | 0 | | 0 | | 14,844 | | 0 | | 22,769 | |

| | | | | | | | | | | | | | | | | | |

| Paul W. McGloin | | 2005 | | 199,306 | | 98,105 | | 0 | | 0 | | 11,000 | | 0 | | 7,616 | (4) |

| Group Executive Vice | | 2004 | | 178,227 | | 71,528 | | 0 | | 0 | | 12,500 | | 0 | | 7,384 | |

| President | | 2003 | | 172,700 | | 77,167 | | 0 | | 0 | | 14,844 | | 0 | | 7,259 | |

| | | | | | | | | | | | | | | | | | |

| Sharon L. Weaver | | 2005 | | 182,790 | | 91,149 | | 0 | | 0 | | 11,000 | | 0 | | $23,045 | (4) |

| Group Executive Vice | | 2004 | | 174,658 | | 70,932 | | 0 | | 0 | | 12,500 | | 0 | | 23,789 | |

| President | | 2003 | | 172,273 | | 78,824 | | 0 | | 0 | | 14,844 | | 0 | | 22,304 | |

______________

(1) Includes automobile and telephone allowances furnished by National Penn to facilitate job performance. These are included in income because they have an inherent personal use component.

(2) Includes mandatory deferral award equal to one-third of the cash award under National Penn’s Executive Incentive Plan. Mandatory deferral percentage amounts, if any, are determined annually, in advance of the Plan year, by the Compensation Committee of the Board of Directors. Interest accrues on the mandatory deferral at a money market rate, adjusted quarterly (in fourth quarter 2005, the rate was 3.33 percent). The mandatory deferral plus interest is forfeited if the employee voluntarily terminates employment before age 60. If no forfeiture occurs, a mandatory deferral plus accrued interest is payable after five years, together with a 100% matching contribution. When paid, it is reported in the Proxy Statement for that year in the Summary Compensation Table in the column headed “All Other Compensation.”

(3) Stock option grants for 2004 and 2003 are adjusted for subsequent stock dividends and stock splits, as

provided in the stock compensation plan.

(4) Includes:

| (a) | 50% matching contributions by National Penn in 2005 under the Capital Accumulation Plan (a 401(k) plan) ($9,000 for Mr. Weidner, $9,000 for Mr. Moyer, $6,300 for Mr. Kilroy, $6,300 for Mr. McGloin, and $5,727 for Ms. Weaver); |

| (b) | National Penn's matching contribution with respect to mandatory deferral amounts awarded in 2000 under National Penn's Executive Incentive Plan and paid in 2005 in accordance with the Plan ($48,369 for Mr. Weidner, $28,059 for Mr. Moyer, $21,599 for Mr. Kilroy, and $16,930 for Ms. Weaver). Matching contribution provision of Executive Incentive Plan did not apply to Mr. McGloin for plan year 2000. |

| (c) | Imputed value of life insurance benefits ($1,991 for Mr. Weidner, $754 for Mr. Moyer, $531 for Mr. Kilroy, $1,316 for Mr. McGloin, and $388 for Ms. Weaver); and |

| (d) | Long-term disability insurance premiums of $1,512 for Mr. Weidner. |

Stock Options

The following table shows certain information about the stock option awards that were made to the Named Executive Officers during 2005.

Stock Option Grants in 2005

| | | Individual Grants | | Grant Date Value | |

Name | | Number of Securities Underlying Options Granted(1) (#) | | % of Total Options Granted to Employees in Fiscal Year | | Exercise or Base Price(2) ($/Share) | | Expiration Date(3) | | Grant Date Present Value Based on Black-Scholes Model(4) ($) | |

(a) | | (b) | | (c) | | (d) | | (e) | | (f) | |

| | | | | | | | | | | | |

| Wayne R. Weidner | | 50,000 | | 12.78% | | $20.63 | | 1/2/2016 | | $267,000 | |

| | | | | | | | | | | | |

| Glenn E. Moyer | | 37,500 | | 9.59% | | $20.63 | | 1/2/2016 | | 200,250 | |

| | | | | | | | | | | | |

| Bruce G. Kilroy | | 11,000 | | 2.81% | | $20.63 | | 1/2/2016 | | 58,740 | |

| | | | | | | | | | | | |

| Paul W. McGloin | | 11,000 | | 2.81% | | $20.63 | | 1/2/2016 | | 58,740 | |

| | | | | | | | | | | | |

| Sharon L. Weaver | | 11,000 | | 2.81% | | $20.63 | | 1/2/2016 | | 58,740 | |

_______________

| (1) | Each option becomes exercisable, if the holder remains an employee after the grant date, as follows: 20% per year on the first through fifth anniversary dates of the grant. All amounts represent stock options. Each option is transferable under specified conditions. |

| (2) | National Penn's stock compensation plan provides that all options must be granted with an exercise price equal to the fair market value (as defined in the plan) of the stock on the date of grant. The exercise price for an option must be paid in cash; an optionee exercising a non-qualified stock option may elect to pay the exercise price and to cover required withholding taxes through the delivery or withholding of National Penn stock, as set forth in the plan. |

| (3) | If the optionee terminates employment voluntarily other than for retirement at age 60 or later, the non-vested portion of any option will lapse immediately and the unexercised vested portion of any option will lapse no later than three months after termination of employment. If employment terminates upon retirement at age 60 or later, disability, death, or involuntarily but not for “cause”, the nonvested portion of any option will vest immediately and the option, to the extent remaining unexercised, will lapse no later than five years after termination of employment. If employment terminates for "cause," all unexercised options lapse immediately. |

| (4) | Based upon the Black-Scholes option valuation model, which estimates the present dollar value of National Penn's common stock options to be $5.34 per share under option. The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised. Therefore, there is no assurance the value realized will be at or near the value estimated by the Black-Scholes model. The assumptions underlying the Black-Scholes model include: (a) an expected volatility of 28.6%; (b) a risk-free rate of return of 4.61%, which approximates the 6-year, 6-month zero-coupon Treasury bond rate; (c) National Penn's average common shares dividend yield of 3.5% on the grant date; (d) an expected term of 7.6 years; and (e) an expected turnover of 5.1%. |

| | The following table shows certain information about option exercises during 2005 by the Named Executive Officers and the value of their unexercised options as of December 31, 2005. |

Aggregated Option/SAR Exercises in Last Fiscal Year

and Fiscal Year End Option/SAR Values

| | | | | | | Number of Securities Underlying Unexercised Options/SARs at FY-End | | Value of Unexercised In the Money Options/SARs at FY-End(2) | |

Name | | Shares Acquired On Exercise | | Value Realized (1) | | Exercisable # | | Unexercisable (#) | | Exercisable ($) | | Unexercisable ($) | |

(a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | |

| | | | | | | | | | | | | | |

| Wayne R. Weidner | | | 71,422 | | | $979,338 | | | 523,104 | | | 183,393 | | | $2,949,923 | | | $177,228 | |

| | | | | | | | | | | | | | | | | | | | |

| Glenn E. Moyer | | | 7,500 | | | 98,980 | | | 169,381 | | | 135,526 | | | 886,875 | | | 123,551 | |

| | | | | | | | | | | | | | | | | | | | |

| Bruce G. Kilroy | | | 0 | | | 0 | | | 69,942 | | | 38,604 | | | 316,666 | | | 35,692 | |

| | | | | | | | | | | | | | | | | | | | |

| Paul W. McGloin | | | 0 | | | 0 | | | 24,320 | | | 37,540 | | | 68,528 | | | 30,073 | |

| | | | | | | | | | | | | | | | | | | | |

| Sharon L. Weaver | | | 5,932 | | | 77,225 | | | 97,249 | | | 38,604 | | | 534,852 | | | 35,692 | |

_____________

| | (1) | Represents the total market value of the underlying common shares on the date of exercise minus the total exercise price for the options exercised. |

| | (2) | “In-the-Money Options” are stock options where the market value of the underlying common shares exceeded the exercise price at December 31, 2005. The value of such options is determined by subtracting the total exercise price for such options from the total fair market value of the underlying common shares on December 31, 2005. |

Pension Benefits

National Penn has a non-contributory, defined benefit Pension Plan generally covering employees who have reached 20 1/2 years of age and completed 1,000 hours of service with National Penn.

The following table shows the annual retirement benefits payable under the plan in the form of a straight life annuity for a range of compensation and years of service classifications. The amounts shown in the table are based on an employee who is presently age 65 and has had a constant salary for the past five years. The amounts are not subject to offset for social security or other amounts.

As of December 31, 2005, Messrs. Weidner, Moyer, Kilroy, McGloin and Ms. Weaver were credited with 43, 7, 8, 4 and 27 years of service under the plan, respectively, for benefit calculation purposes.

Pension Benefits

| | | Years of Service |

Salary | | 15 | | 20 | | 25 | | 30 | | 35 |

| | | | | | | | | | | |

| $ 75,000 | | $14,085 | | $18,780 | | $23,475 | | $28,170 | | $32,865 |

| 100,000 | | 20,460 | | 27,280 | | 34,100 | | 40,920 | | 47,740 |

| 125,000 | | 26,835 | | 35,780 | | 44,725 | | 53,670 | | 62,615 |

| 150,000 | | 33,210 | | 44,280 | | 55,350 | | 66,420 | | 77,490 |

| 175,000 | | 39,585 | | 52,780 | | 65,975 | | 79,170 | | 92,365 |

| 200,000 | | 45,960 | | 61,280 | | 76,600 | | 91,920 | | 107,240 |

| 225,000 | (1) | 46,725 | | 62,300 | | 77,875 | | 93,450 | | 109,025 |

| 250,000 | (1) | 46,725 | | 62,300 | | 77,875 | | 93,450 | | 109,025 |

| 275,000 | (1) | 46,725 | | 62,300 | | 77,875 | | 93,450 | | 109,025 |

| 300,000 | (1) | 46,725 | | 62,300 | | 77,875 | | 93,450 | | 109,025 |

| 325,000 | (1) | 46,725 | | 62,300 | | 77,875 | | 93,450 | | 109,025 |

| 350,000 | (1) | 46,725 | | 62,300 | | 77,875 | | 93,450 | | 109,025 |

| 375,000 | (1) | 46,725 | | 62,300 | | 77,875 | | 93,450 | | 109,025 |

| | | | | | | | | | | |

_________

| (1) | Salary in excess of $210,000 is disregarded in determining a participant's retirement benefit. The 2005 compensation covered by the plan (all salary) for Messrs. Weidner, Moyer, Kilroy, McGloin and Ms. Weaver was $210,000, $210,000, $200,059, $199,306 and $182,790, respectively. |

Employment, Change-in-Control and Consulting Agreements

Wayne R. Weidner. Wayne R. Weidner, Chairman and Chief Executive Officer of National Penn and Chairman of National Penn Bank has an employment agreement with National Penn and National Penn Bank. This January 2003 agreement superseded a 1989 agreement that provided Mr. Weidner with a supplemental retirement benefit and a "change-in-control" benefit.

The current agreement provides for Mr. Weidner to continue service in his current executive positions. The current term of the agreement is for three years from January 22, 2004 through January 21, 2007.

Mr. Weidner's annual base compensation under the agreement is $405,577, effective January 1, 2006. Mr. Weidner is eligible for annual merit salary increases and awards of stock options, and he is entitled to participate in National Penn's Executive Incentive Plan and to participate in all health insurance and benefit plans, group insurance, pension or profit sharing plans or other plans providing benefits to National Penn employees generally. Mr. Weidner is also entitled to payment by National Penn of his regular country club dues and assessments and reimbursement for all eligible business expenses related thereto, life insurance coverage and long-term disability insurance coverage paid for by National Penn, and the receipt of an automobile allowance of at least $850 per month.

The current agreement also provides Mr. Weidner with a supplemental retirement benefit, namely, a retirement annuity for 15 years for up to 65% of his final average base salary, depending on the number of years served by him. If Mr. Weidner had retired at December 31, 2005, he would have been entitled to receive a retirement annuity of $211,562 per year for 15 years, with any concurrent payments under National Penn's pension plan credited toward the annuity payments.

Mr. Weidner's current agreement also contains a "change-in-control" benefit. This benefit is exercisable by Mr. Weidner at any time within three years after a "change-in-control" of National Penn occurs (including a "merger of equals"). If a change-in-control occurs, Mr. Weidner may elect to terminate employment and receive a lump-sum cash severance payment equal to 299% of his average annual compensation for the five years preceding the change-in-control.

National Penn may terminate the current agreement at any time with or without "cause," as defined in the agreement. If terminated without cause, the agreement will remain in effect for the remainder of its term, and Mr. Weidner will receive his base salary through the remaining term of the agreement and certain other benefits for one year. In addition, he will remain entitled to the supplemental retirement benefit and to the change-in-control benefit (should a change-in-control occur during the remaining term of the agreement). If terminated for cause, Mr. Weidner will only be entitled to receive accrued and unpaid salary through the date of termination. If terminated due to Mr. Weidner's disability, he will remain entitled to receive his base salary through the remaining term of the agreement and the supplemental retirement benefit. If terminated due to Mr. Weidner's death, Mr. Weidner's designated beneficiary will be entitled to receive a lump sum payment of his base salary through the remaining term of the agreement and the supplemental retirement benefit.

The current agreement may be terminated by Mr. Weidner at any time. In such event, Mr. Weidner will be entitled to receive accrued unpaid salary through the date of termination, the supplemental retirement benefit and the change-in-control benefit (if applicable).

The current agreement contains non-solicitation and non-competition provisions that restrict Mr. Weidner's right to compete with National Penn and National Penn Bank during the term of the agreement and, if he voluntarily terminates employment before reaching age 65, for the remainder of the term in effect at the time of termination. The current agreement also contains a non-disclosure provision binding on Mr. Weidner.

Glenn E. Moyer. Glenn E. Moyer, President of National Penn and President and Chief Executive Officer of National Penn Bank, has an employment agreement with National Penn and National Penn Bank. This agreement superseded a 1999 agreement that provided Mr. Moyer with a "change-in-control" benefit.

The current agreement provides for Mr. Moyer to continue service in his current or more senior executive positions. The current term of the agreement is for three years from December 18, 2004 through December 17, 2007. Unless terminated, the agreement is automatically extended by adding one year to the term of the agreement at the end of each year, until Mr. Moyer reaches the age of 62, after which there will be no further extensions.

Mr. Moyer's annual base compensation under the agreement is $324,466, effective January 1, 2006. Mr. Moyer is eligible for annual merit salary increases and awards of stock options, and he is entitled to participate in National Penn's Executive Incentive Plan and to participate in all health insurance and benefit plans, group insurance, pension or profit sharing plans or other plans providing benefits to National Penn employees generally. Mr. Moyer is also entitled to payment by National Penn of his regular country club dues and assessments and reimbursement for all eligible business expenses related thereto, life insurance coverage and long-term disability insurance coverage paid for by National Penn, and the receipt of an automobile allowance of at least $850 per month.

The current agreement also provides Mr. Moyer with a supplemental retirement benefit, namely, a retirement annuity for 15 years for up to 65% of his final average base salary, depending generally on the number of years served by him. Payments due to him under National Penn's pension plan will be credited toward the annuity payments.

Mr. Moyer's current agreement also contains a "change-in-control" benefit. This benefit is exercisable by Mr. Moyer at any time within three years after a "change-in-control" of National Penn occurs (including a "merger of equals"). If a change-in-control occurs, Mr. Moyer may elect to terminate employment and receive a lump-sum cash severance payment equal to 299% of his average annual compensation for the five years preceding the change-in-control.

National Penn may terminate the current agreement at any time with or without "cause," as defined in the agreement. If terminated without cause, the agreement will remain in effect for the remainder of its term, and Mr. Moyer will receive his base salary through the remaining term of the agreement and certain other benefits for one year. In addition, he will remain entitled to the supplemental retirement benefit (which, if less than 15/21 of the maximum amount based on his years of service, shall be increased to 15/21 of the maximum amount) and to the change-in-control benefit (should a change-in-control occur during the remaining term of the agreement). If terminated for cause, Mr. Moyer will only be entitled to receive accrued and unpaid salary through the date of termination. If terminated due to Mr. Moyer's disability, he will remain entitled to receive his base salary through the remaining term of the agreement and the supplemental retirement benefit. If terminated due to Mr. Moyer's death, Mr. Moyer's designated beneficiary will be entitled to receive a lump sum payment of his base salary through the remaining term of the agreement and the supplemental retirement benefit.

The current agreement may be terminated by Mr. Moyer at any time. In such event, Mr. Moyer will be entitled to receive accrued unpaid salary through the date of termination, the supplemental retirement benefit (if he is at least 58 years old at the date of termination), and the change-in-control benefit (if applicable). Should Mr. Moyer terminate the agreement prior to reaching age 58, he will not receive any supplemental retirement benefit.

The current agreement contains non-solicitation and non-competition provisions that restrict Mr. Moyer's right to compete with National Penn and National Penn Bank during the term of the agreement and, if he voluntarily terminates employment before reaching age 65, for the remainder of the term in effect at the time of termination. The current agreement also contains a non-disclosure provision binding on Mr. Moyer.

Donald P. Worthington. On September 24, 2002, National Penn and National Penn Bank entered into an employment agreement with Donald P. Worthington, former Executive Vice President of FirstService Bank, under which he would become an Executive Vice President of National Penn Bank and President of the FirstService Bank Division of National Penn Bank. The agreement honors and continues an employment agreement entered into between FirstService and Mr. Worthington in 2001. The agreement retained the original five-year term of the FirstService employment agreement and its one-year extension provisions. As extended, the term of the agreement will end on March 24, 2009.

Effective February 1, 2006, Mr. Worthington’s salary is $203,445. Under his employment agreement, his salary is subject to review and increase, but not to decrease. Mr. Worthington is also entitled under the agreement to participate in National Penn's Executive Incentive Plan, and to participate in all health insurance and benefit plans, group insurance, pension or profit sharing plans or other plans providing benefits to National Penn employees generally. Mr. Worthington is also entitled to payment by National Penn of his regular country club dues and assessments and reimbursement for all eligible business expenses related thereto, life insurance coverage and long-term disability insurance coverage paid for by National Penn, and the receipt of an automobile allowance of at least $600 per month.

If Mr. Worthington is terminated without cause, National Penn will be required to continue his base salary, medical benefits and disability insurance benefits for the remainder of the term of the agreement. However, if Mr. Worthington secures new full-time employment, his wages from that new employment will be offset from the salary continuation payments otherwise payable under the employment agreement. Following any termination of Mr. Worthington, he is prohibited, for a period of two years, from engaging in any activity competitive with National Penn within 50 miles of the principal business location of National Penn, and from soliciting or otherwise interfering with National Penn's relationship with any client, supplier, employee, agent or representative of National Penn.

Mr. Worthington's employment agreement includes a change in control benefit that would entitle him, under certain circumstances, to a lump sum cash payment in the amount of 150% of his average annual compensation for the five years preceding a change in control of National Penn, limited to the maximum amount deductible by National Penn under Section 280G of the Internal Revenue Code.

In Mr. Worthington's agreement, National Penn has also agreed to honor the supplemental executive retirement plan entered into between Mr. Worthington and FirstService. The plan provides for a lifetime annuity to Mr. Worthington equal to 60% of his then current base compensation upon retirement, commencing at any time after he reaches age 70. Once retirement benefits commence under the supplemental executive retirement plan, they will be increased annually by the lesser of 4% or the annual percentage change in the consumer price index for the preceding year. If Mr. Worthington dies, his wife will be entitled to a lifetime spousal death benefit under this plan equal to 80% of the benefit that otherwise would have then been payable to Mr. Worthington but for his death. The merger of FirstService with National Penn triggered a provision of Mr. Worthington's supplemental executive retirement plan prohibiting any termination of his benefits under that plan for any reason. Any benefits paid to Mr. Worthington under National Penn's defined benefit pension plan will be offset against any benefits payable under the supplemental executive retirement plan.

George C. Mason. George C. Mason, former chairman of the board of Peoples First, Inc., serves as a consultant to National Penn and National Penn Bank under a consulting agreement dated as of December 17, 2003. Under this agreement, Mr. Mason provides general consulting and advisory services relating to National Penn’s business. The consulting agreement is for a term of two years, beginning June 10, 2004, the effective date of the merger of Peoples First into National Penn. On the effective date of the merger, Mr. Mason’s employment agreement with Peoples First terminated, and as consideration for the termination of his employment agreement and for the consulting services to be provided to National Penn over the two-year period, Mr. Mason is to be paid $230,000, payable in twenty-four monthly installments of $9,583.

Mr. Mason provides his own health and other insurance and he does not participate in any employee benefit or welfare plan that provides benefits to National Penn employees. Pursuant to the merger agreement with Peoples First, National Penn will honor the supplemental retirement benefit plan between Mr. Mason and Peoples First. National Penn also agreed to honor the change in control provision of Mr. Mason’s employment agreement with Peoples First and accordingly, paid Mr. Mason a change in control payment in the amount of $563,093 on the effective date of the merger.

The consulting agreement will terminate if Mr. Mason dies prior to the end of its term. However, in such event, Mr. Mason’s designated beneficiary will receive a lump sum payment equal to the remaining payments through the remainder of the term of the consulting agreement. Mr. Mason is free to provide consulting services to any party other than National Penn at any time during the term of the agreement. However, during the term of the agreement, Mr. Mason may not directly or indirectly engage as a director, officer, employee, partner, shareholder, consultant, or in any other capacity, for any financial institution that is within 50 miles of West Chester, Chester County, Pennsylvania.

Bruce G. Kilroy, Paul W. McGloin and Sharon L. Weaver. National Penn and National Penn Bank are parties to agreements with Bruce G. Kilroy, Group Executive Vice President-Financial Services/Enterprisewide Image, Sharon L. Weaver, Group Executive Vice President-Operations/Technology/HR Services/Retail Market Management, and Paul W. McGloin, Group Executive Vice President and Chief Lending Officer. These agreements provide each of them with "change-in-control" benefits.

The benefits provided by these agreements become payable if two events occur. First, there must be a "change-in-control" of National Penn or National Penn Bank (as defined in the agreements). Second, the executive's employment must be terminated without cause or the executive must resign after an adverse change in the terms of his or her employment. Adverse changes include reduction in title or responsibilities, reduction in compensation or benefits (except for a reduction for all employees generally), reassignment beyond a thirty-minute commute from Boyertown, Pennsylvania, or increased travel requirements. If these two events occur, the executive will receive a lump-sum cash severance payment equal to 200% of the executive's average annual compensation for the five years preceding the change-in-control.

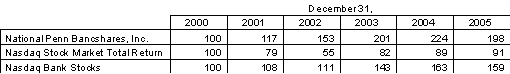

PERFORMANCE GRAPH

The following graph compares the performance of National Penn's common shares to the Nasdaq Stock Market Total Return Index and the Nasdaq Bank Stock Index during the last five years. The graph shows the value of $100 invested in National Penn common stock and both indices on December 31, 2000, and the change in the value of National Penn's common shares compared to the indices as of the end of each year. The graph assumes the reinvestment of all dividends. Historical stock price performance is not necessarily indicative of future stock price performance.

STOCK OWNERSHIP

Guidelines

To reinforce the importance of aligning the financial interests of our directors and executive officers with those of our shareholders, the Nominating/Corporate Governance Committee has approved minimum stock ownership guidelines for our directors, executive officers and for the other members of our “Leadership Group” (36 persons, including the executive officers).

Directors

For directors, the Guidelines require an equity investment in National Penn stock of $100,000.

Equity interests that count toward satisfaction of the Stock Ownership Guidelines include:

| | · | Shares owned outright by the Director. |

| | · | Shares owned jointly by the Director and his or her spouse. |

| | · | Shares owned outright by the Director’s spouse. |

| | · | Shares held in trust (to the extent for the benefit of the Director). |

| | · | Phantom shares held by the Director in the Directors’ Fee Plan. |

| | · | Shares subject to exercisable “in the money” stock options held by the Director (to the extent of the “spread” on the “in the money” options). |