UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03407

Fidelity Boylston Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | March 31 |

| |

Date of reporting period: | March 31, 2016 |

Item 1.

Reports to Stockholders

Strategic Advisers® Multi-Manager Target Date Funds (to be renamed Fidelity® Multi-Manager Target Date Funds) - Income, 2005, 2010, 2015, 2020, 2025, 2030, 2035, 2040, 2045, 2050, 2055, 2060

Class L & Class N

Annual Report March 31, 2016 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-835-5095 (plan participants) or 1-877-208-0098 (Advisors and Investment Professionals) to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2016 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Strategic Advisers® Multi-Manager Income Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (0.57)% | 2.70% |

| Class N | (0.90)% | 2.50% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager Income Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager Income Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

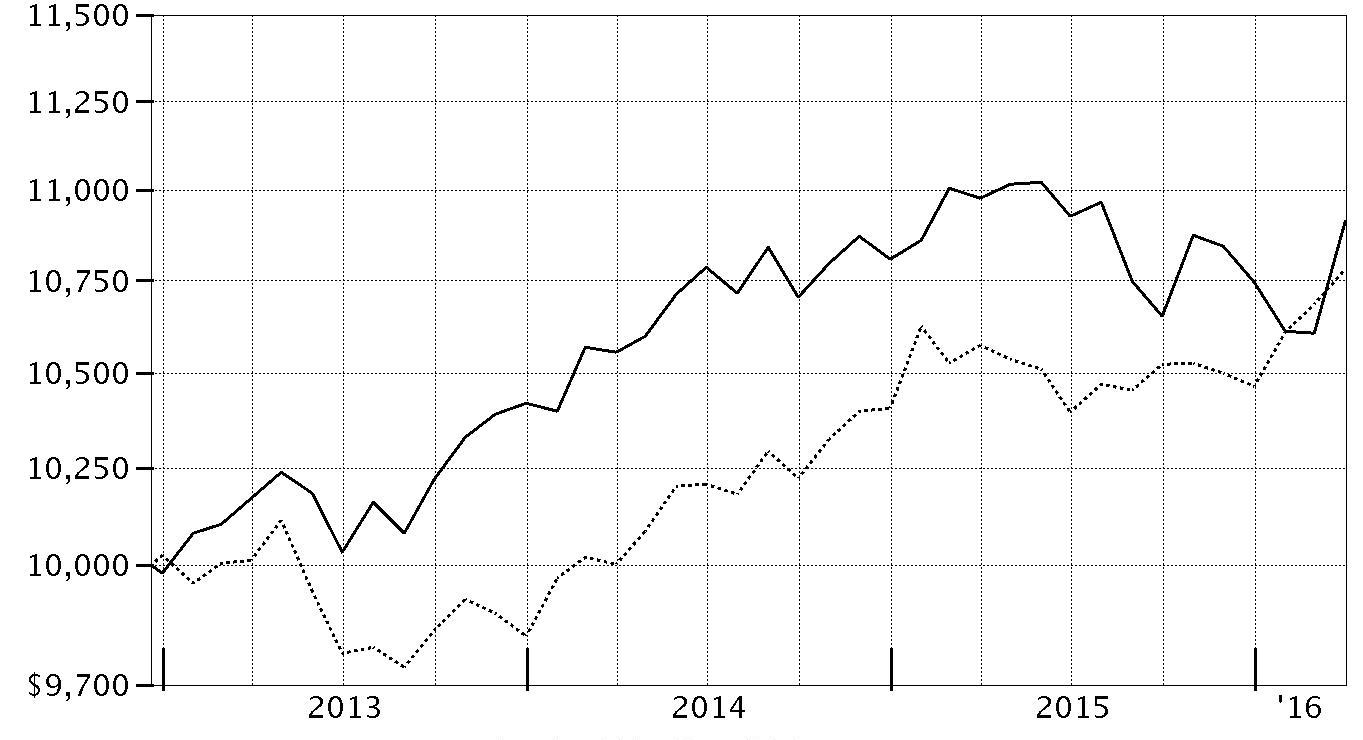

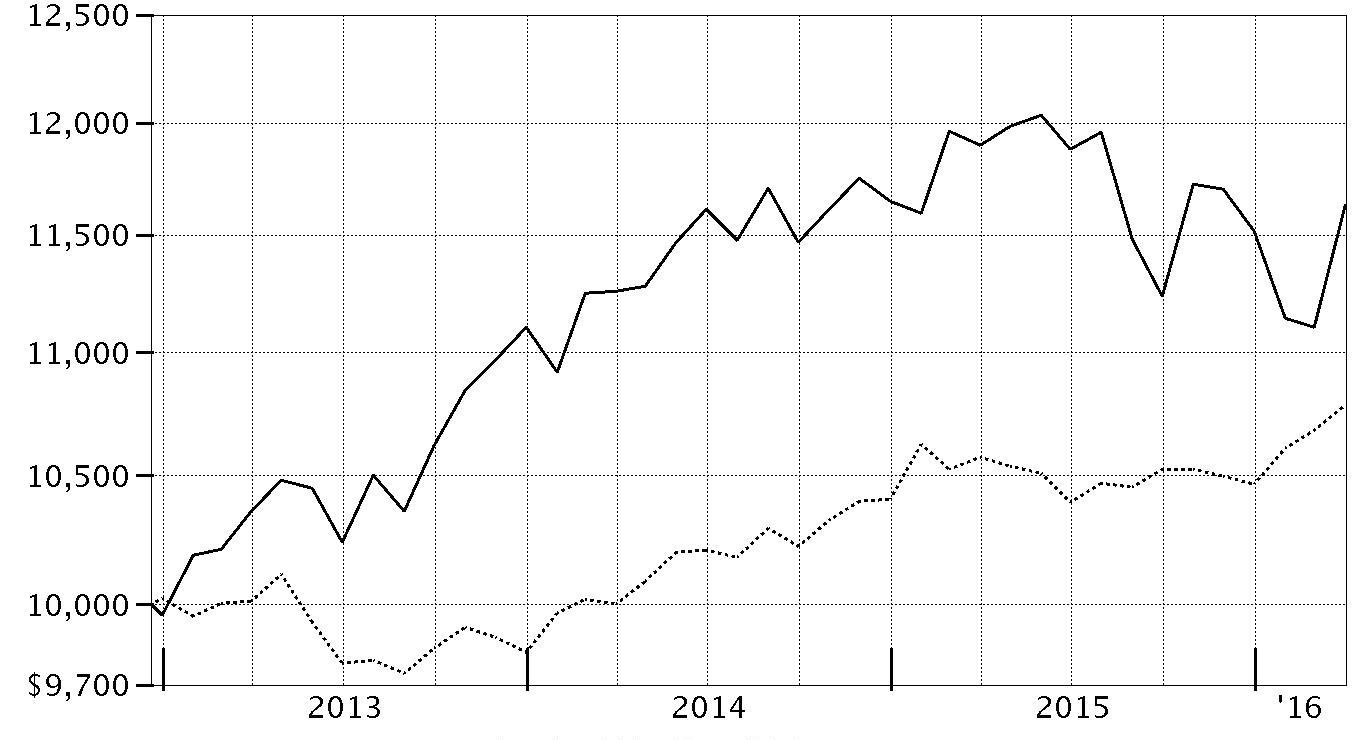

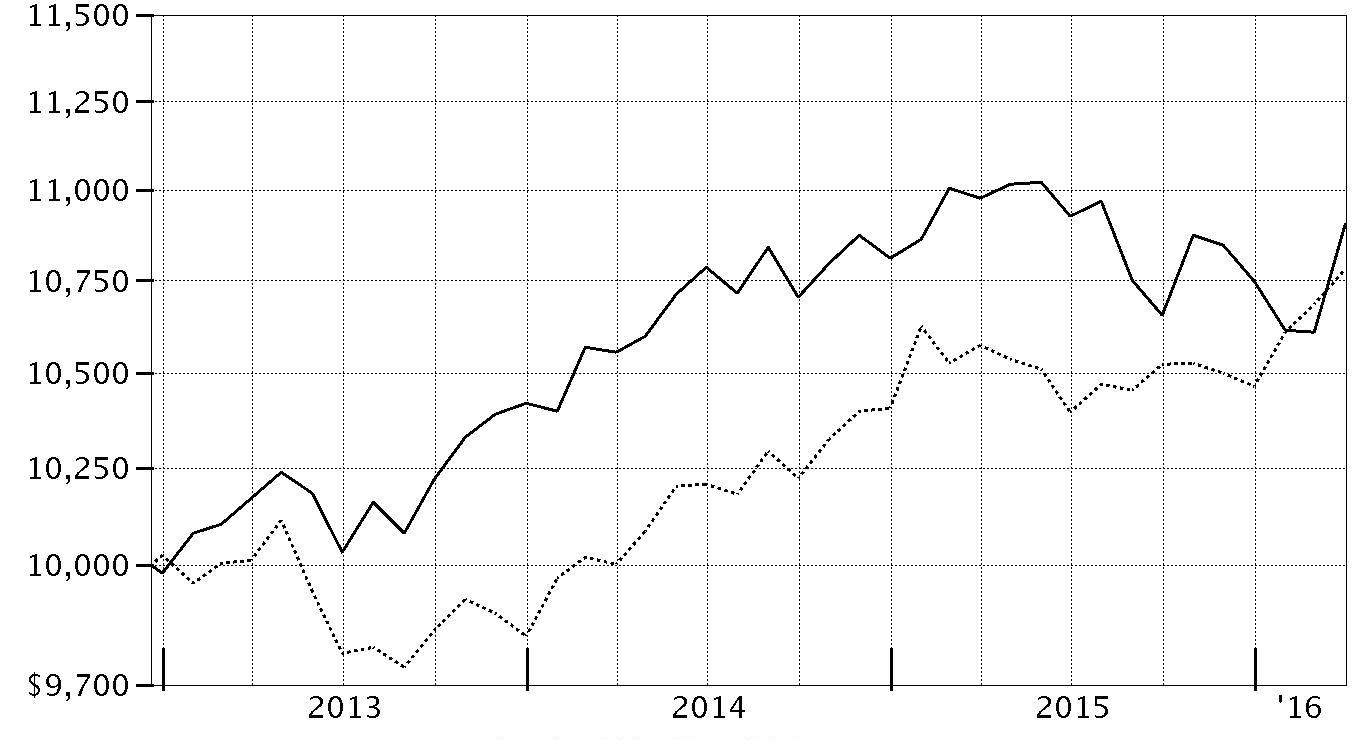

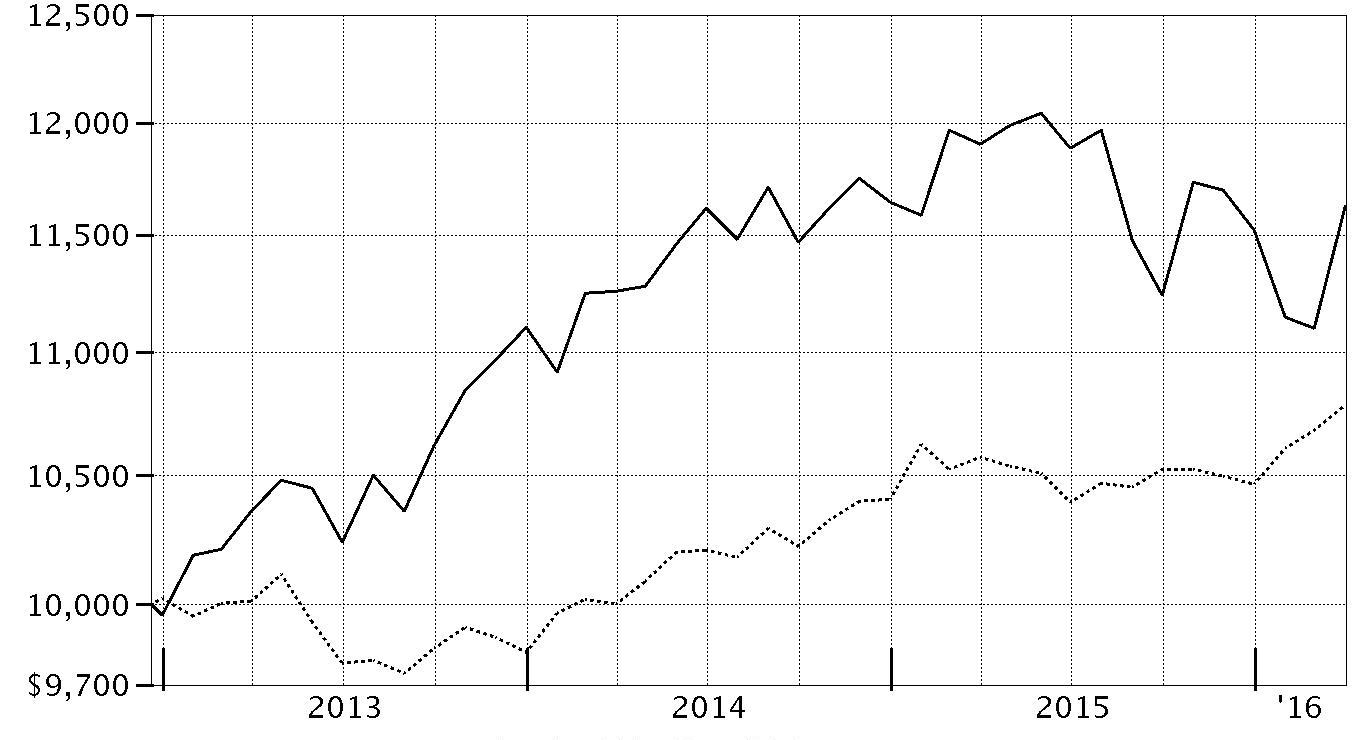

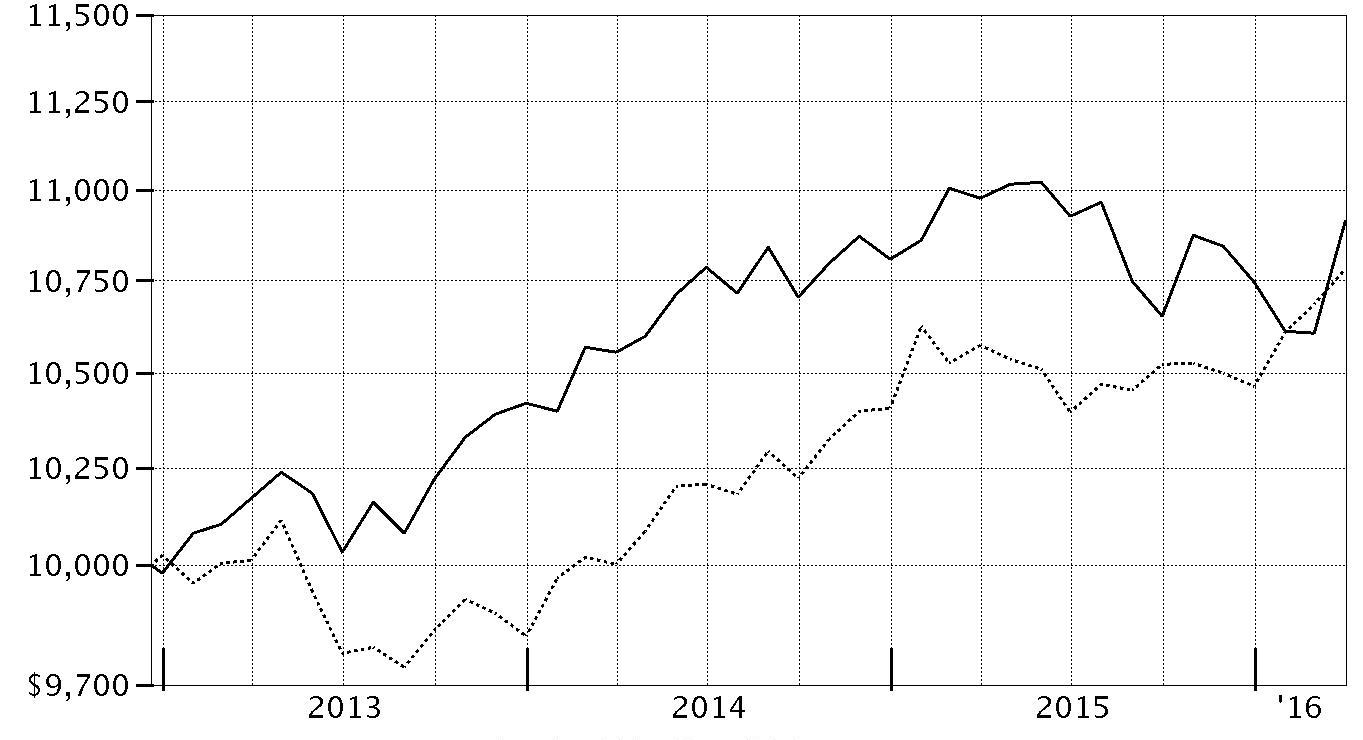

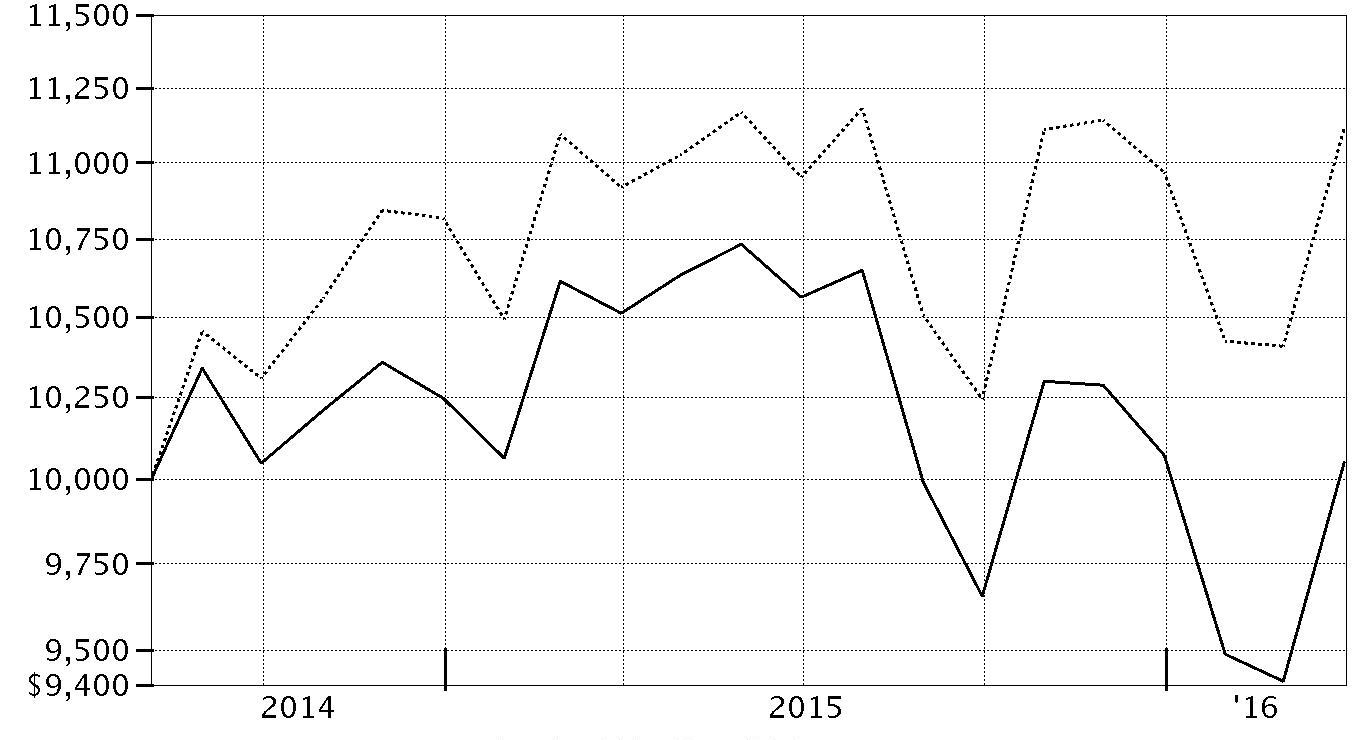

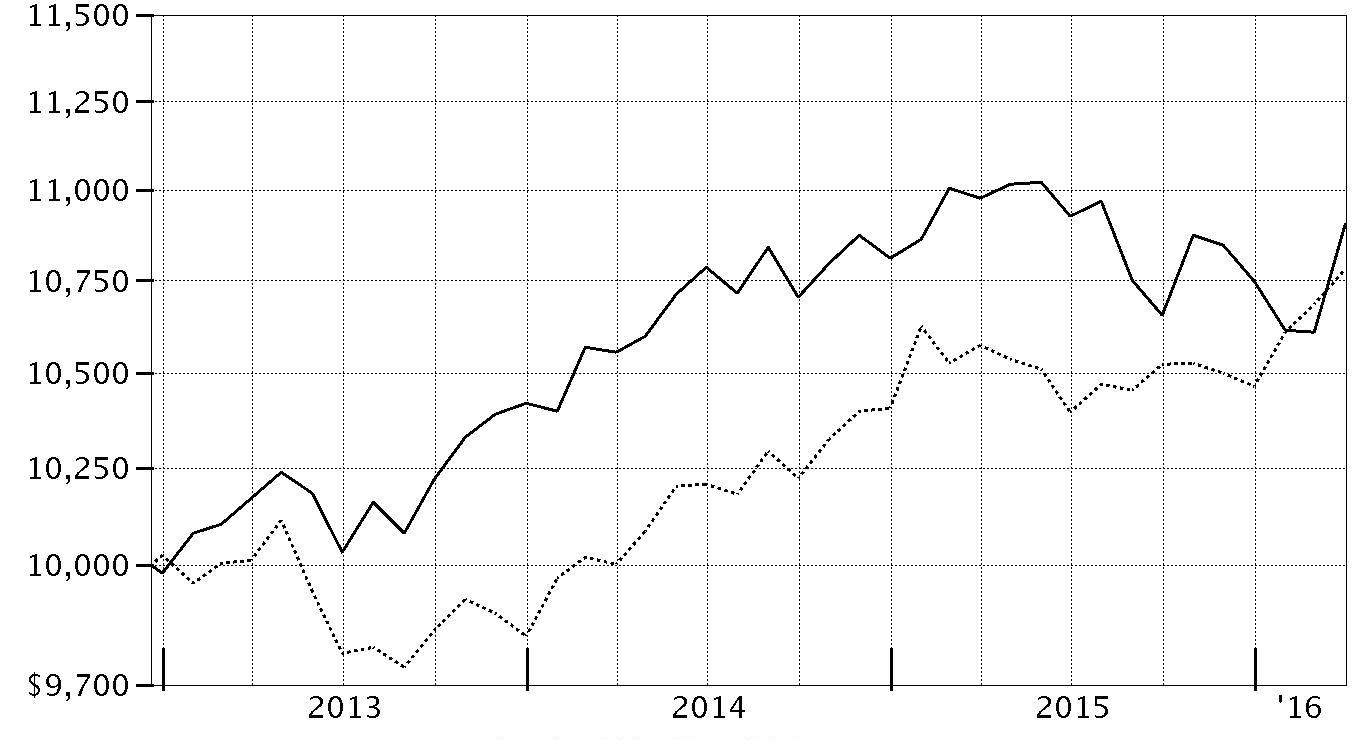

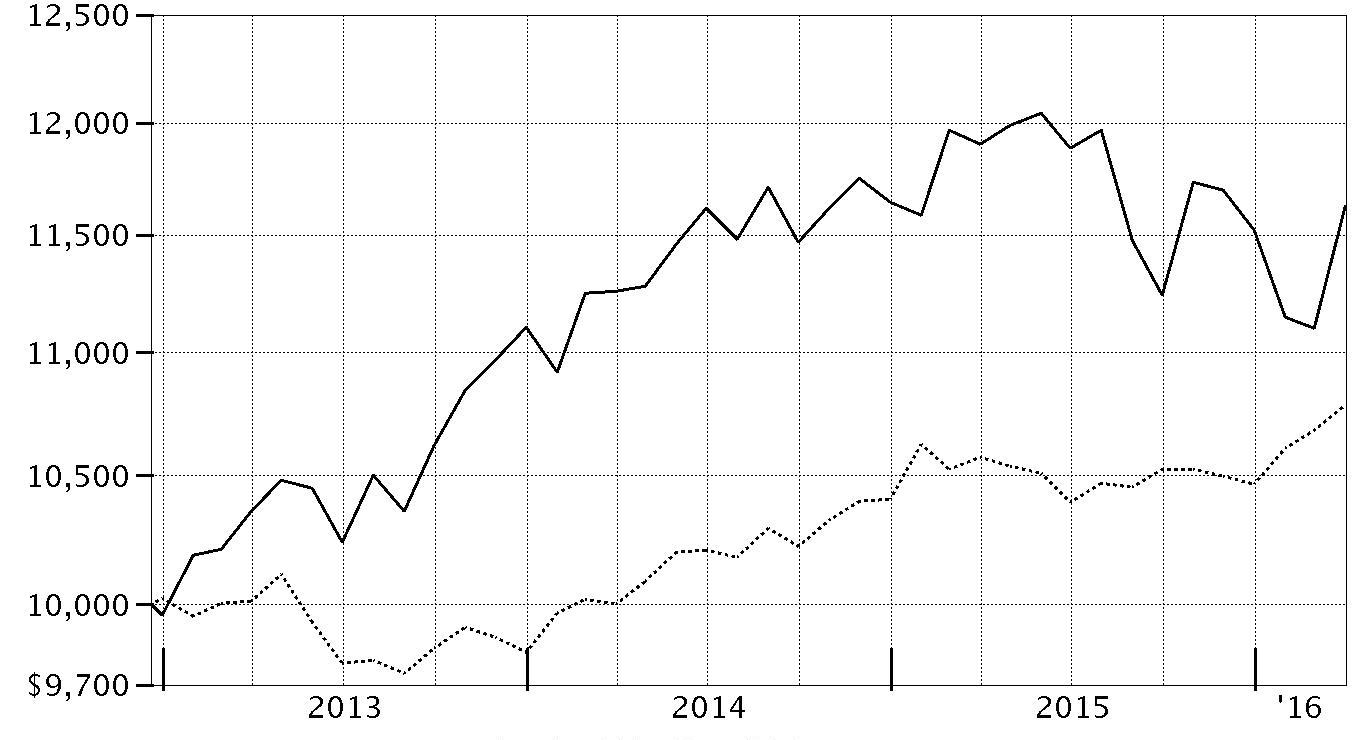

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager Income Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the Barclays® U.S. Aggregate Bond Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $10,914 | Strategic Advisers® Multi-Manager Income Fund - Class L |

| $10,782 | Barclays® U.S. Aggregate Bond Index |

Strategic Advisers® Multi-Manager 2005 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (1.39)% | 3.68% |

| Class N | (1.64)% | 3.49% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2005 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2005 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

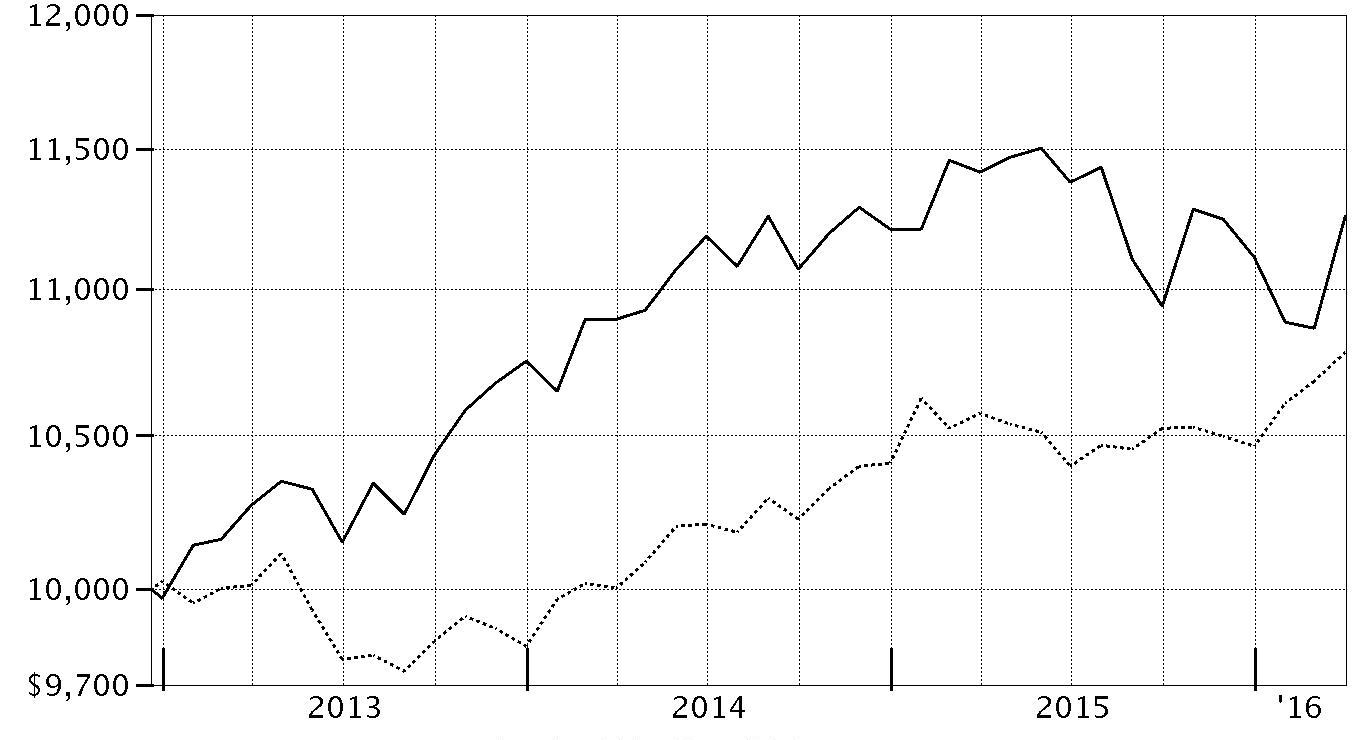

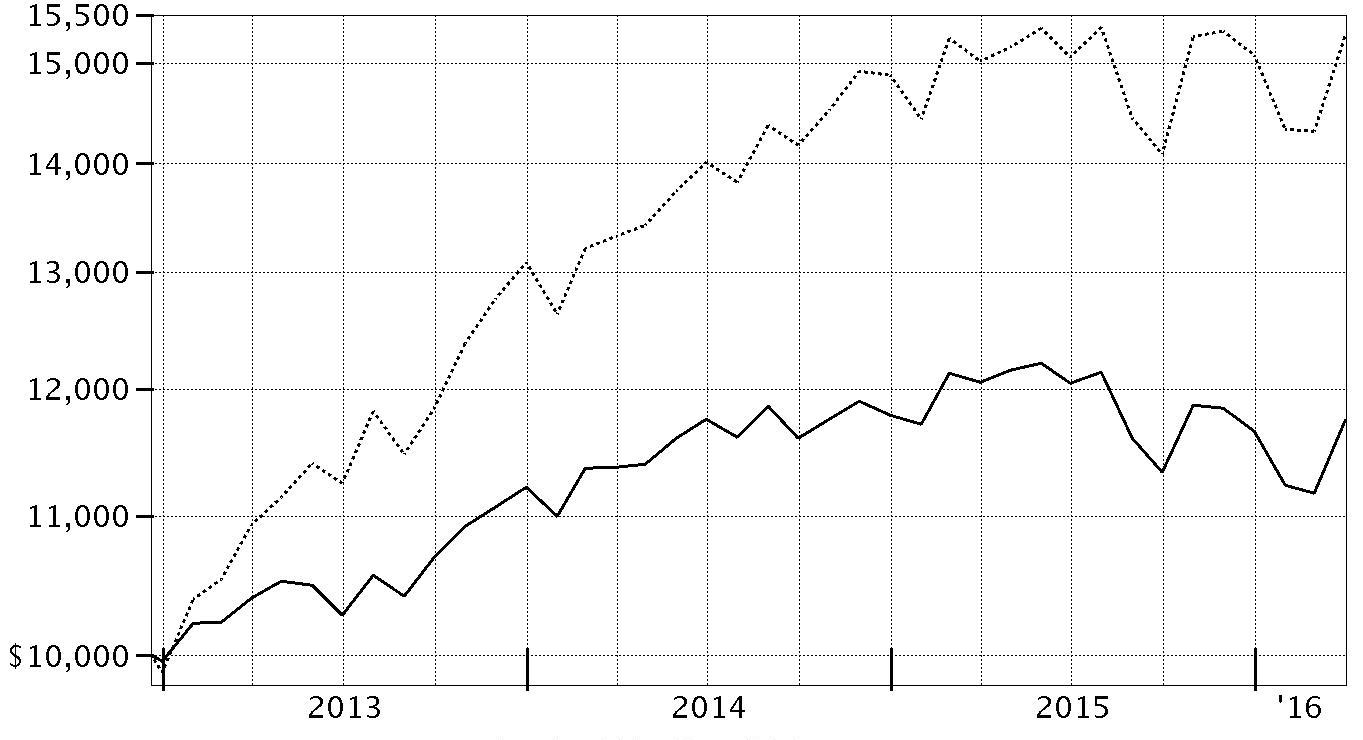

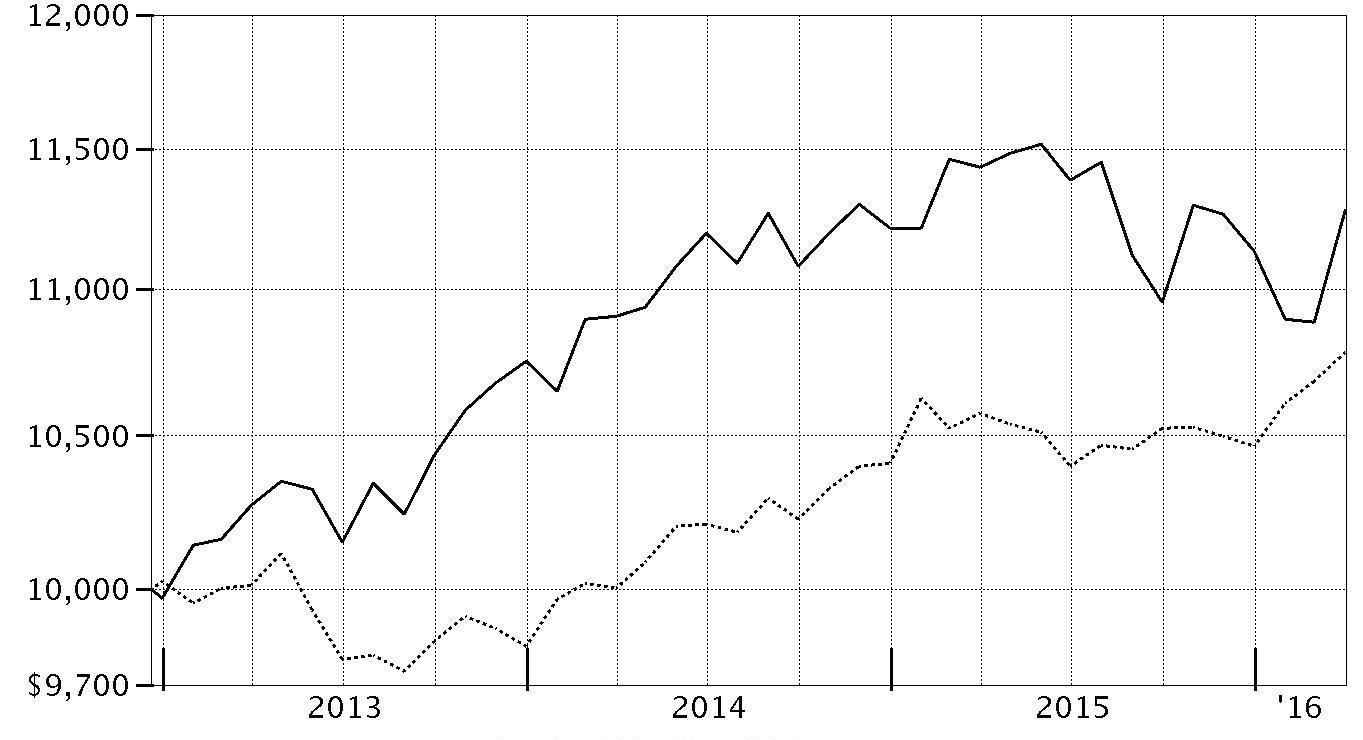

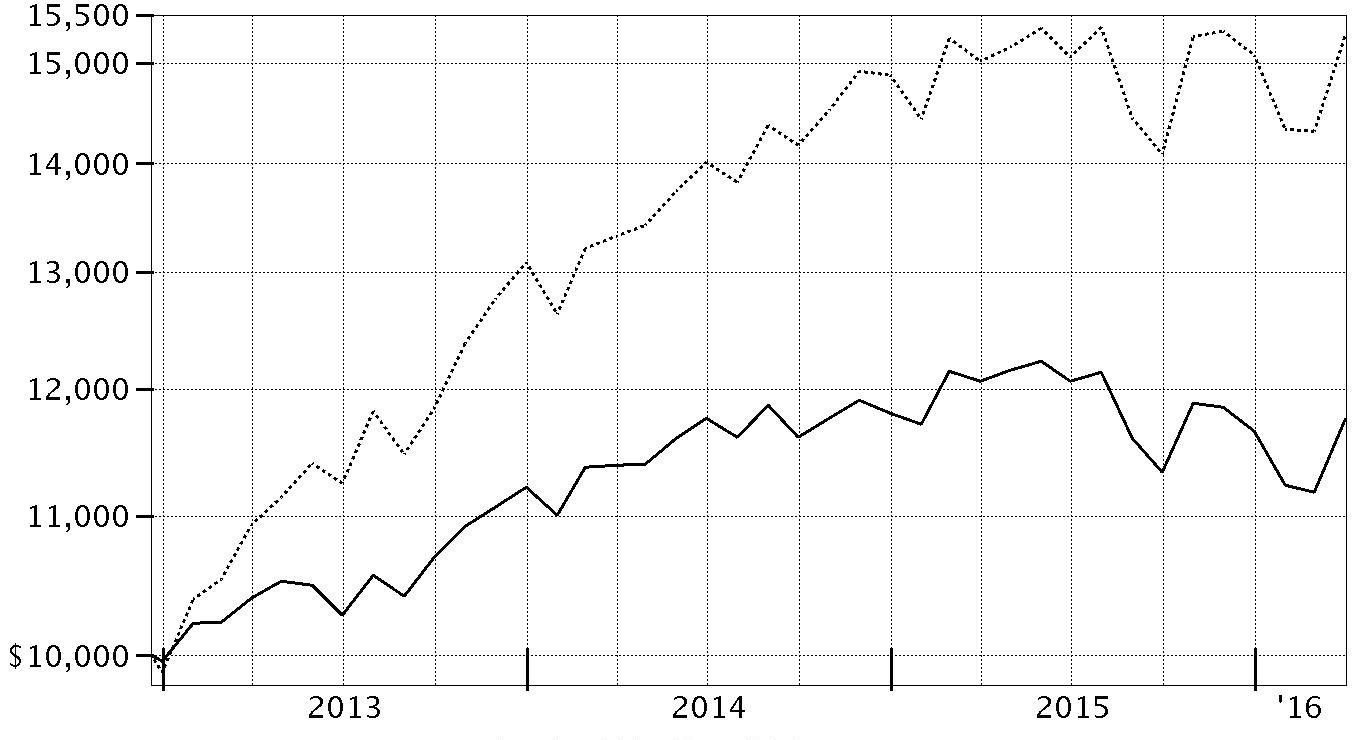

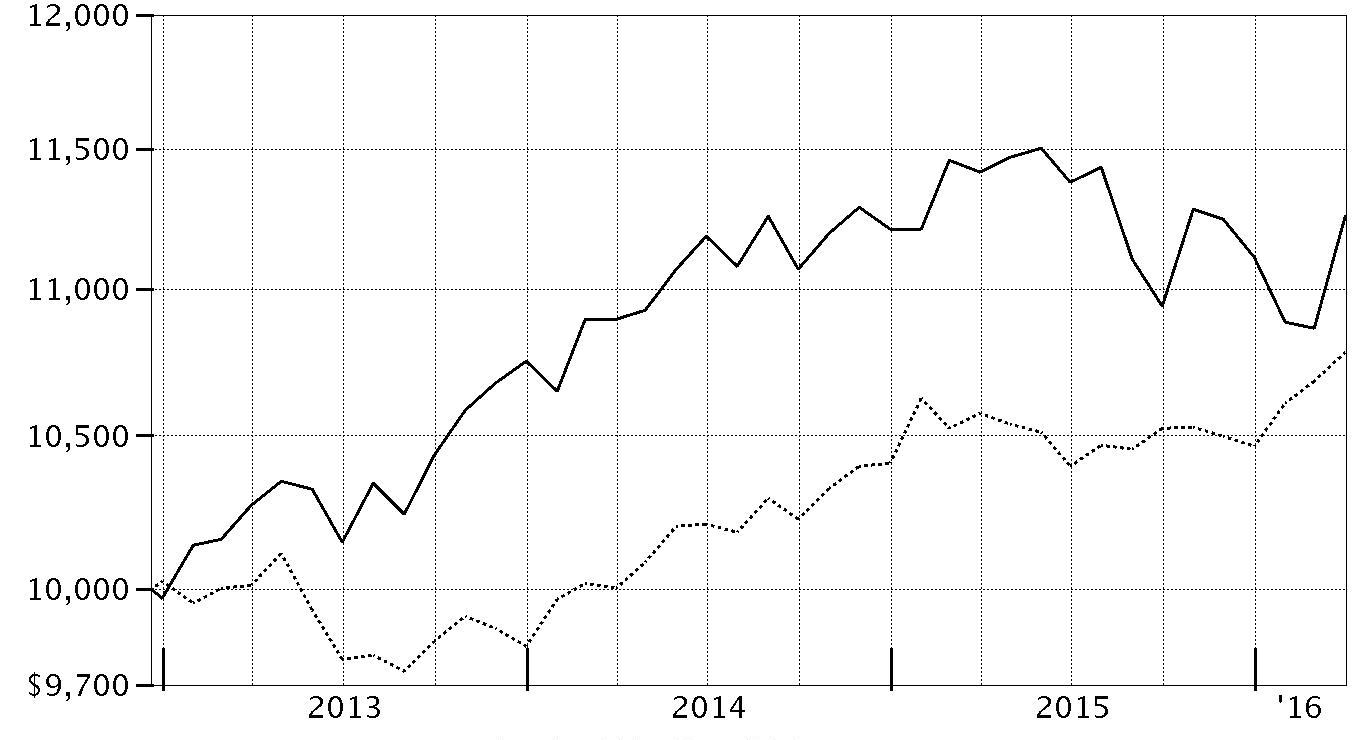

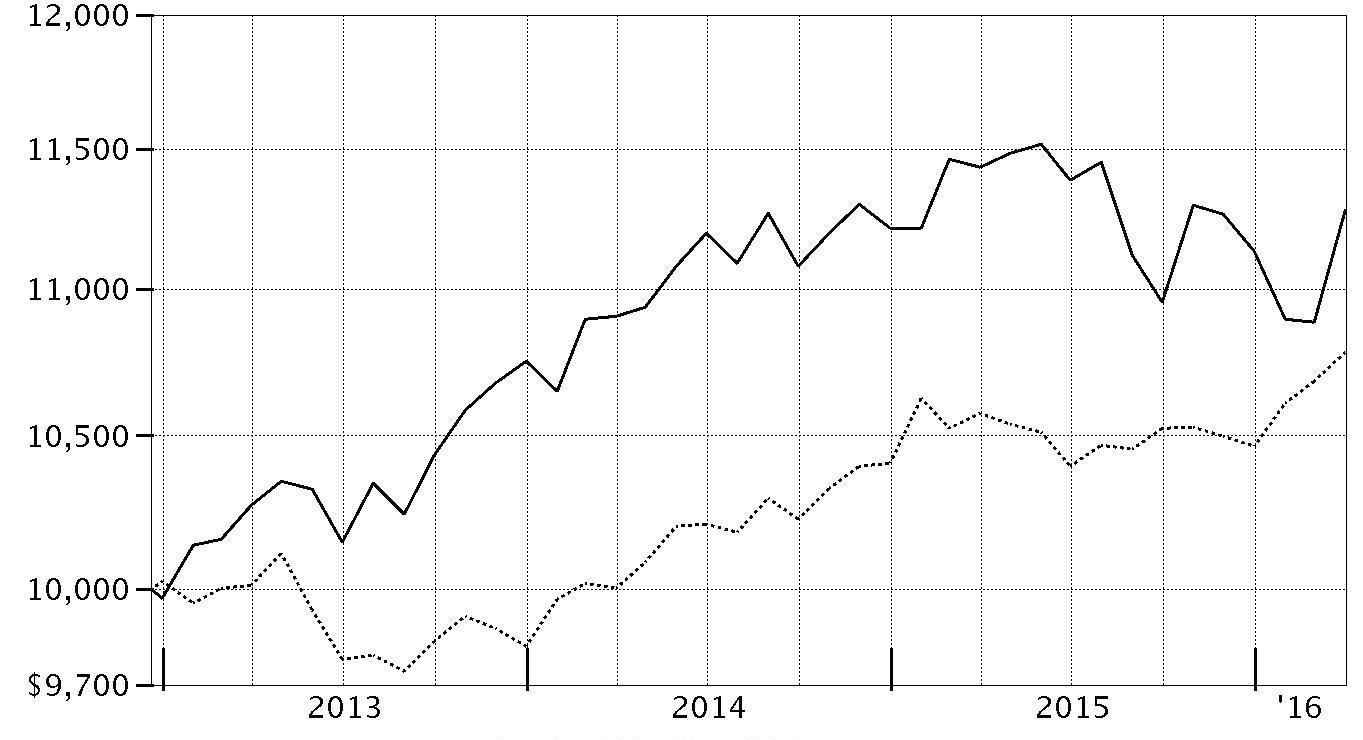

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2005 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the Barclays® U.S. Aggregate Bond Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $11,259 | Strategic Advisers® Multi-Manager 2005 Fund - Class L |

| $10,782 | Barclays® U.S. Aggregate Bond Index |

Strategic Advisers® Multi-Manager 2010 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (1.86)% | 4.51% |

| Class N | (2.11)% | 4.32% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2010 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2010 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

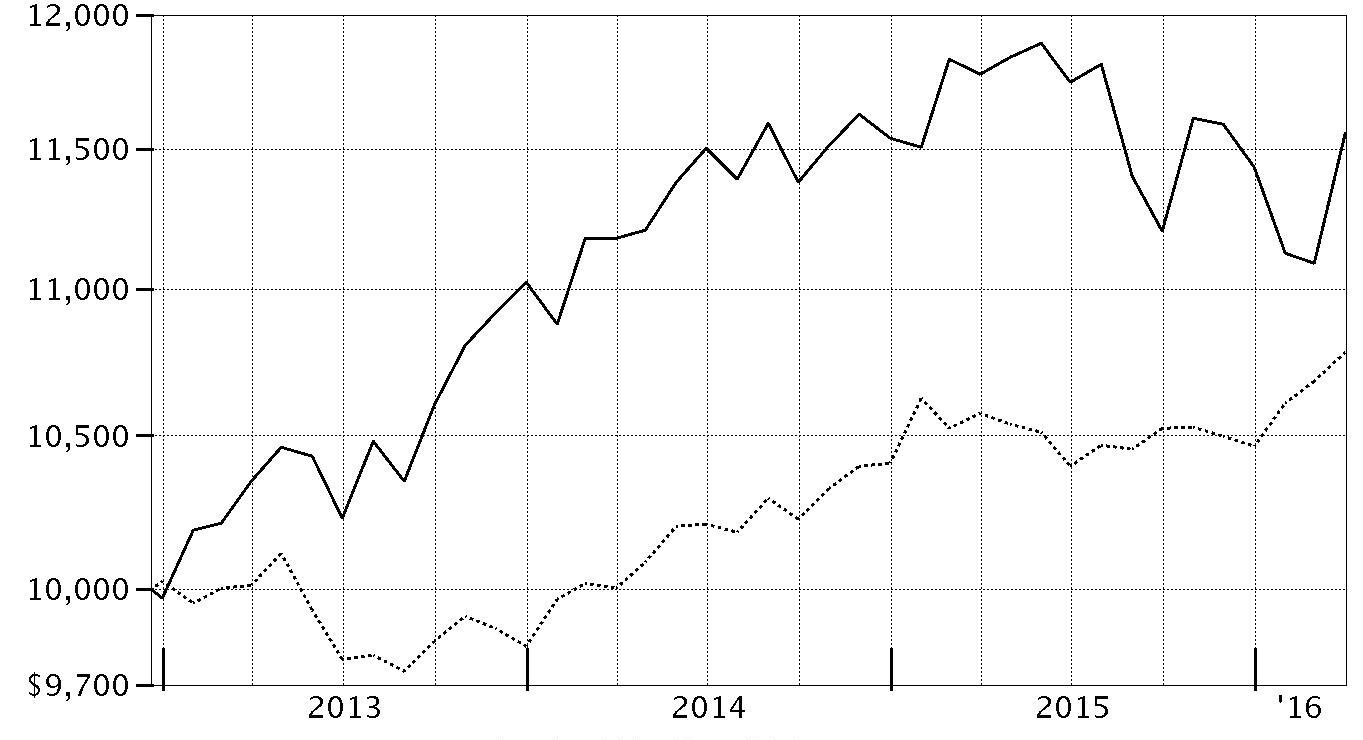

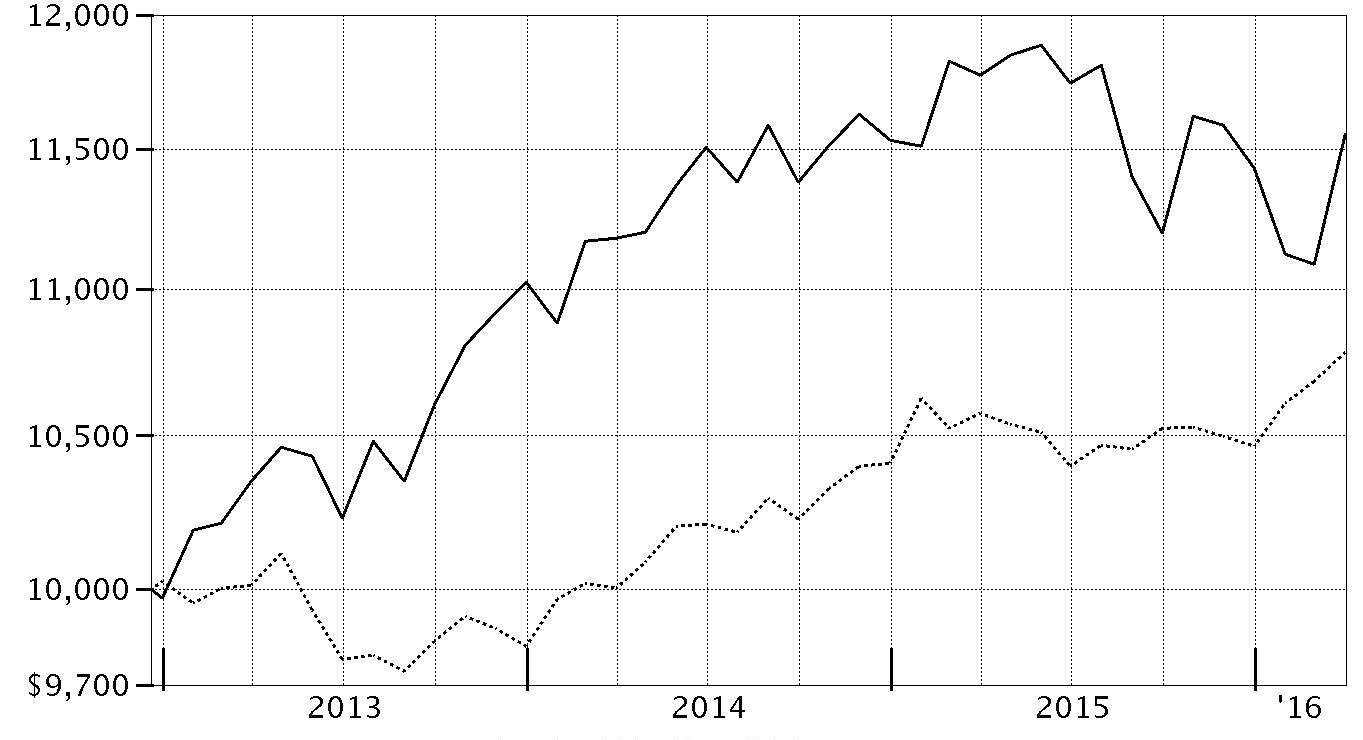

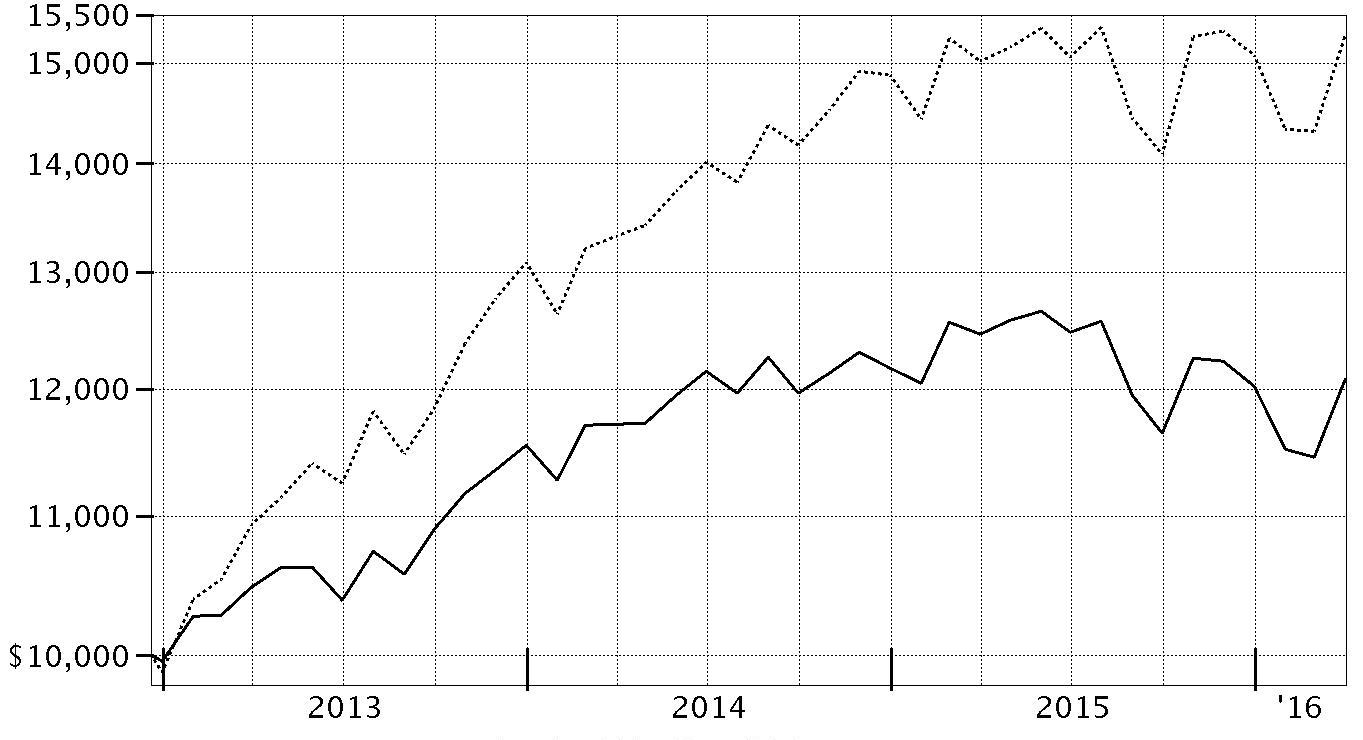

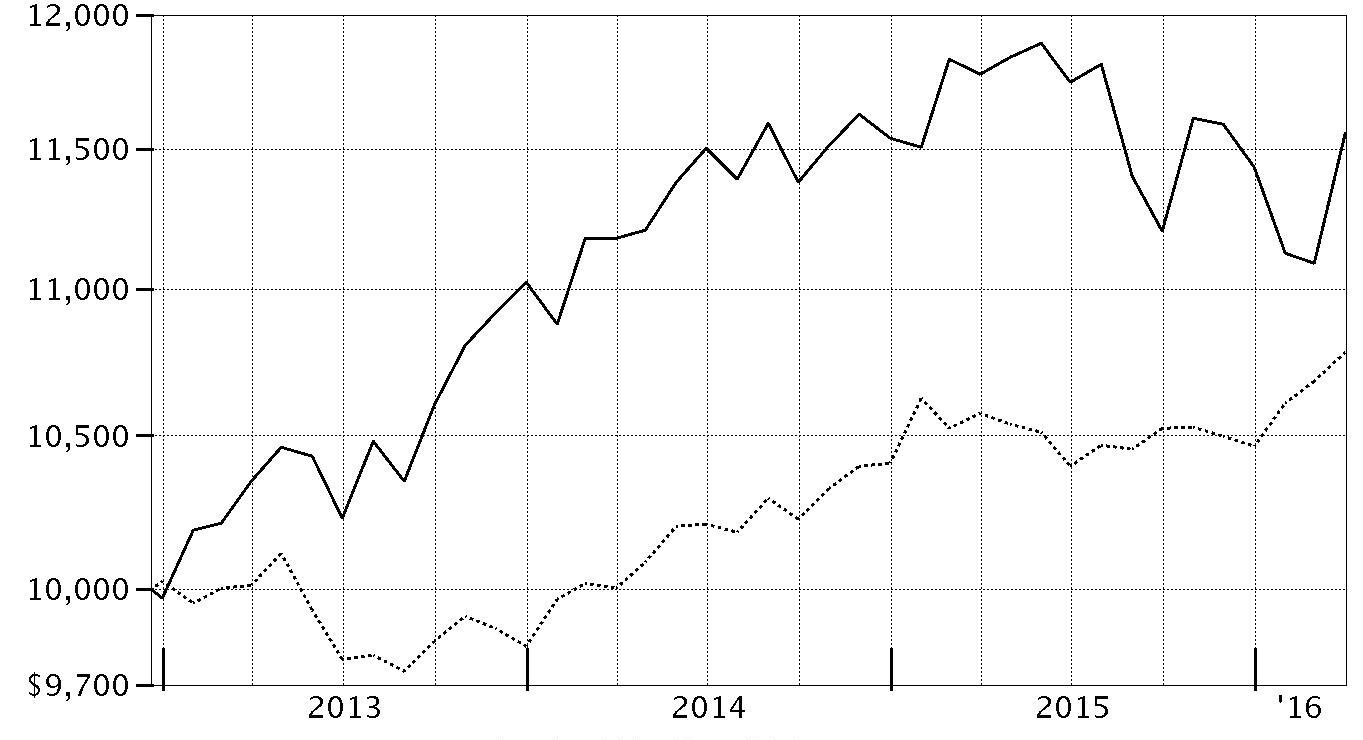

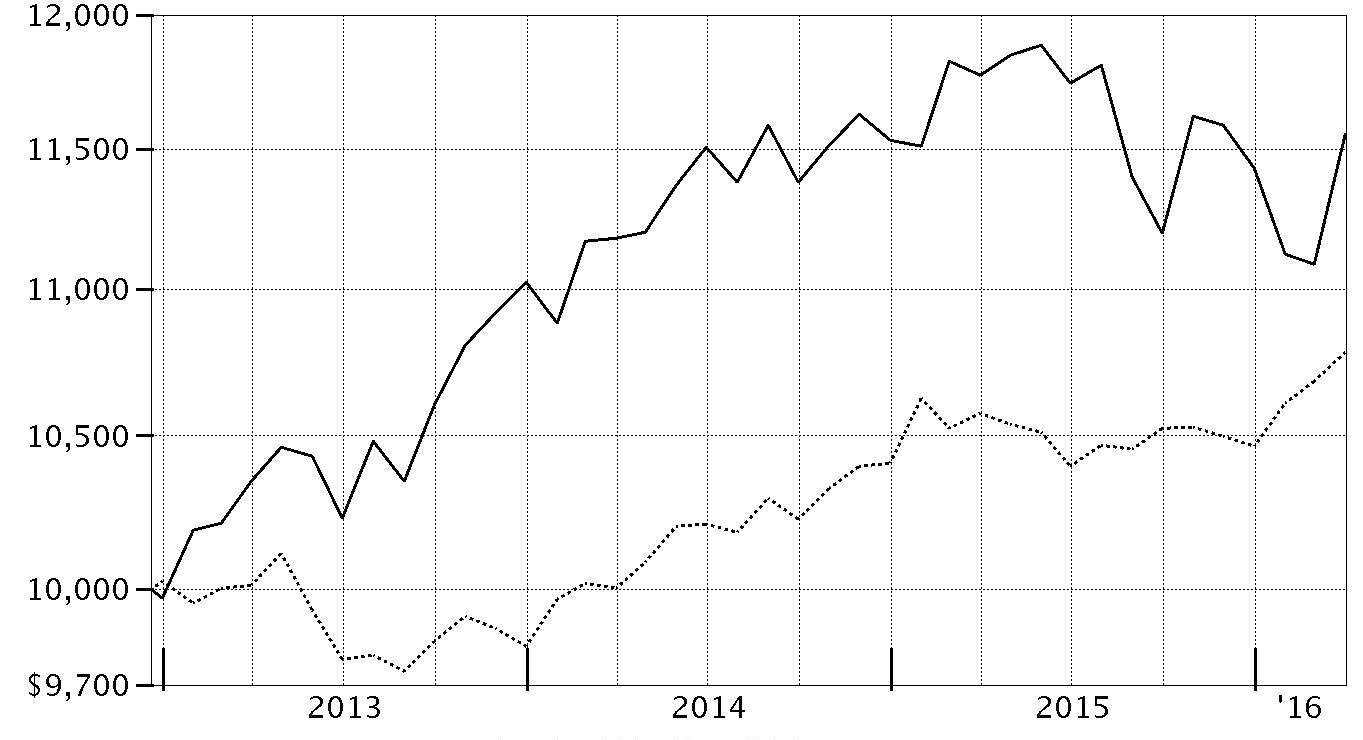

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2010 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the Barclays® U.S. Aggregate Bond Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $11,558 | Strategic Advisers® Multi-Manager 2010 Fund - Class L |

| $10,782 | Barclays® U.S. Aggregate Bond Index |

Strategic Advisers® Multi-Manager 2015 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (2.24)% | 4.71% |

| Class N | (2.57)% | 4.52% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2015 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2015 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

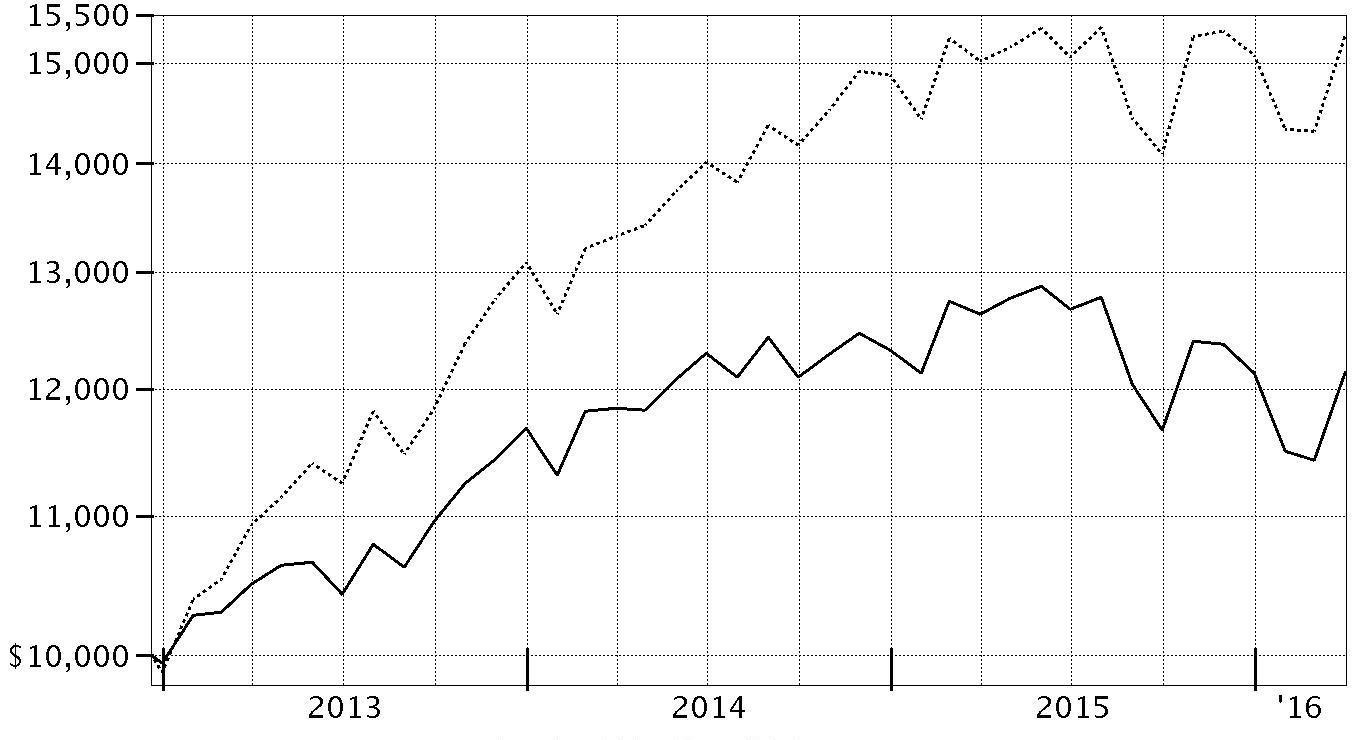

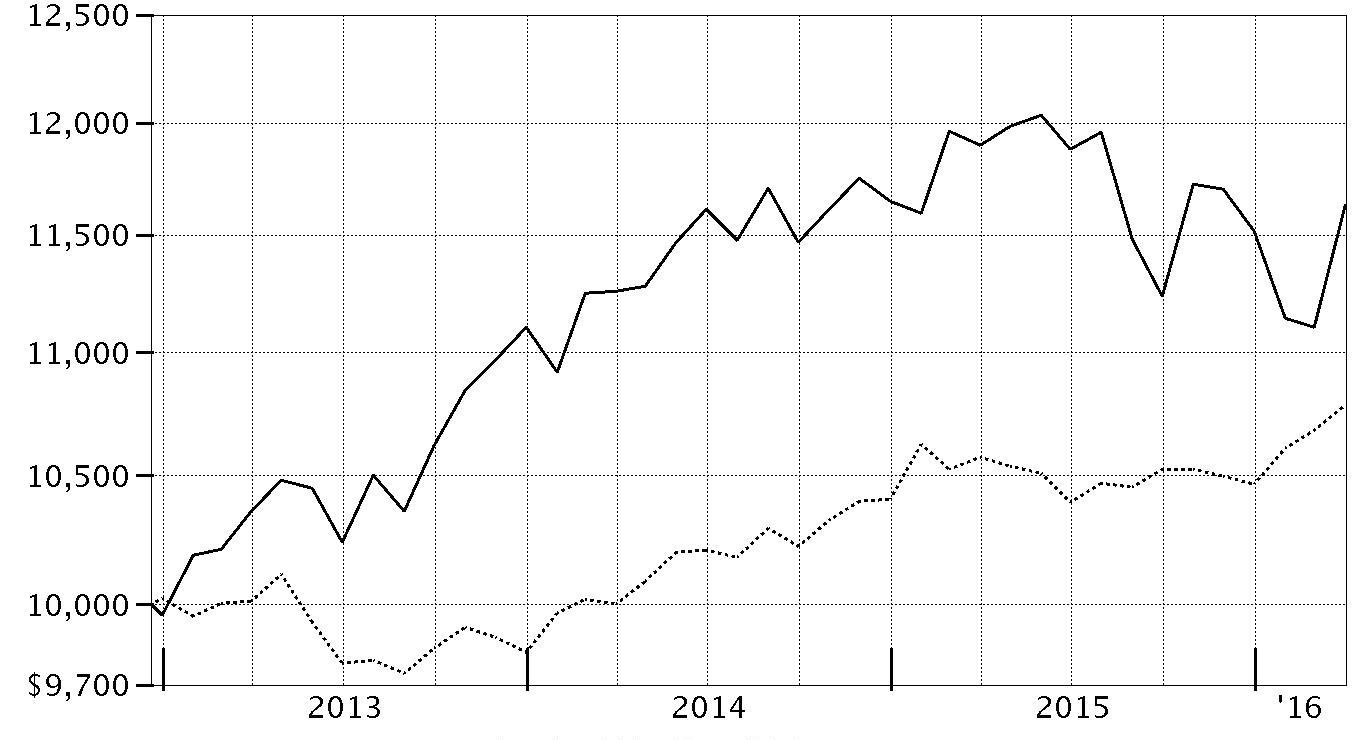

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2015 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the Barclays® U.S. Aggregate Bond Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $11,631 | Strategic Advisers® Multi-Manager 2015 Fund - Class L |

| $10,782 | Barclays® U.S. Aggregate Bond Index |

Strategic Advisers® Multi-Manager 2020 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (2.58)% | 5.03% |

| Class N | (2.82)% | 4.84% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2020 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2020 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

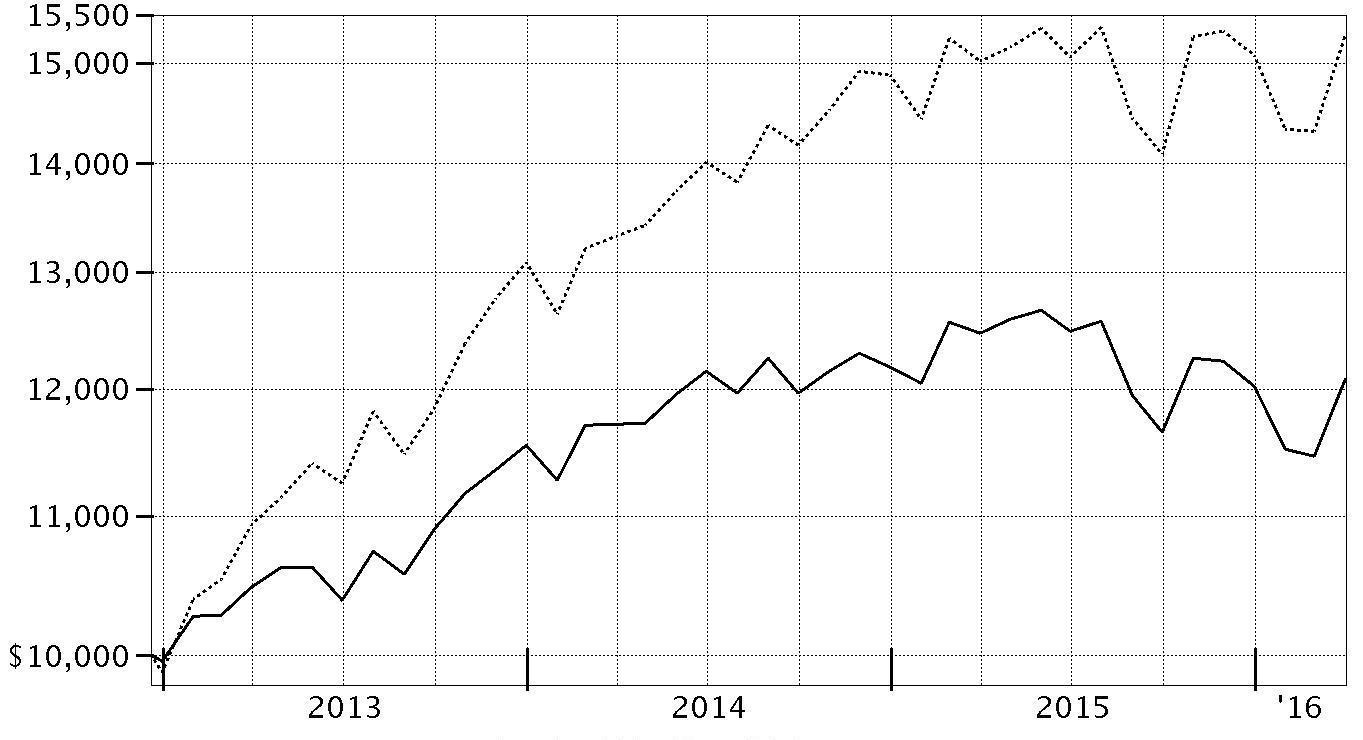

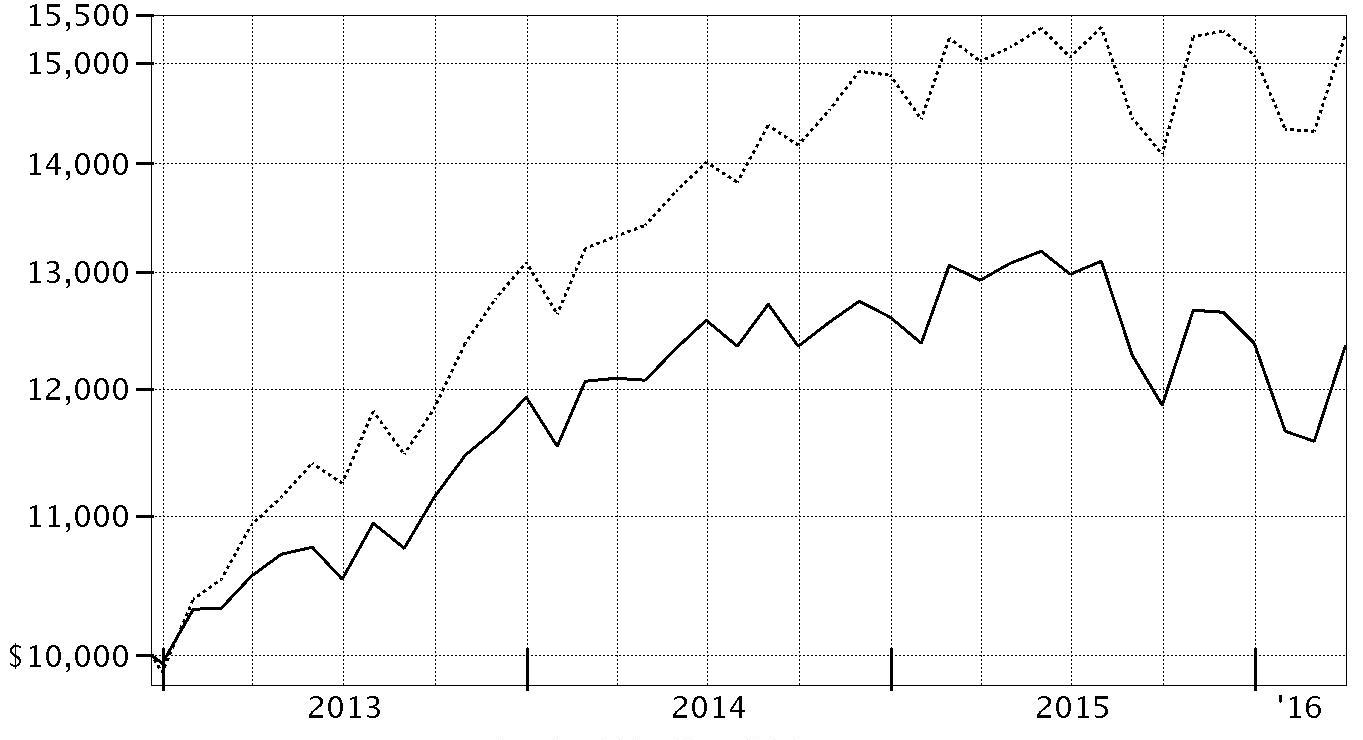

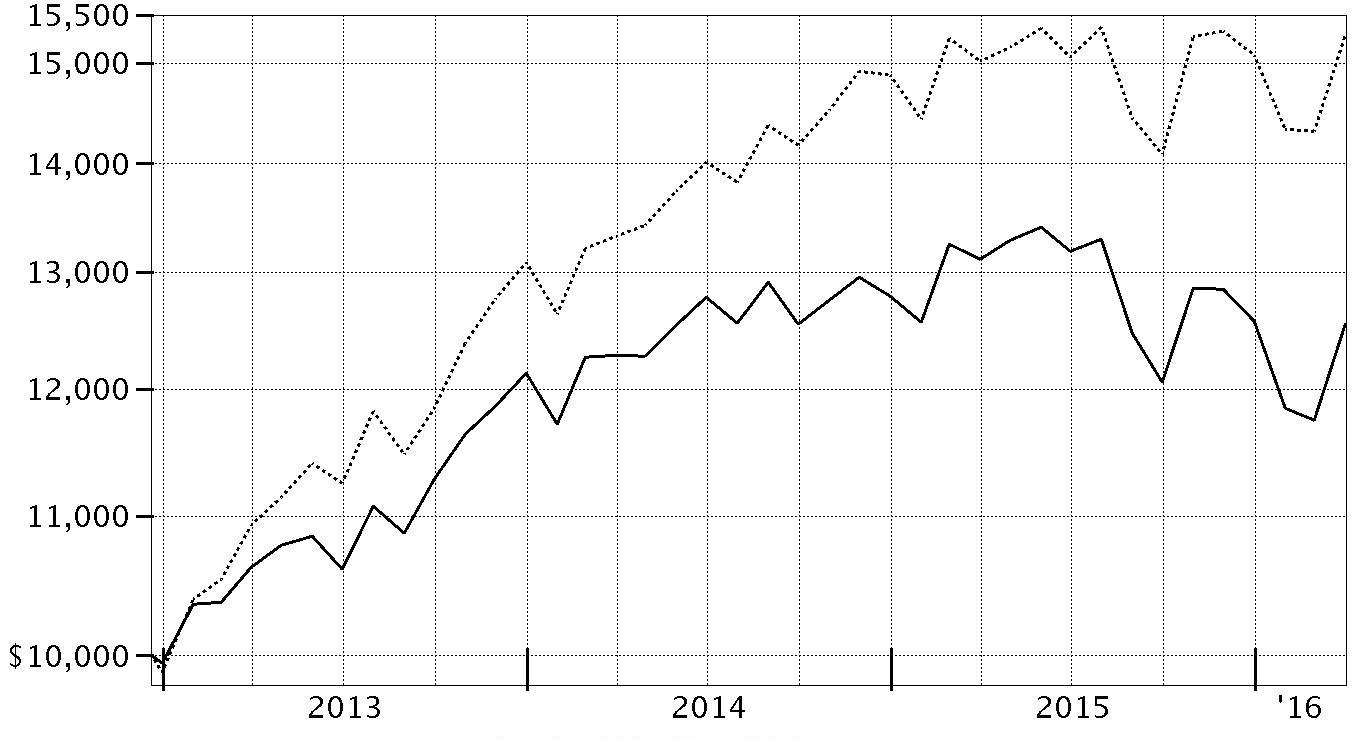

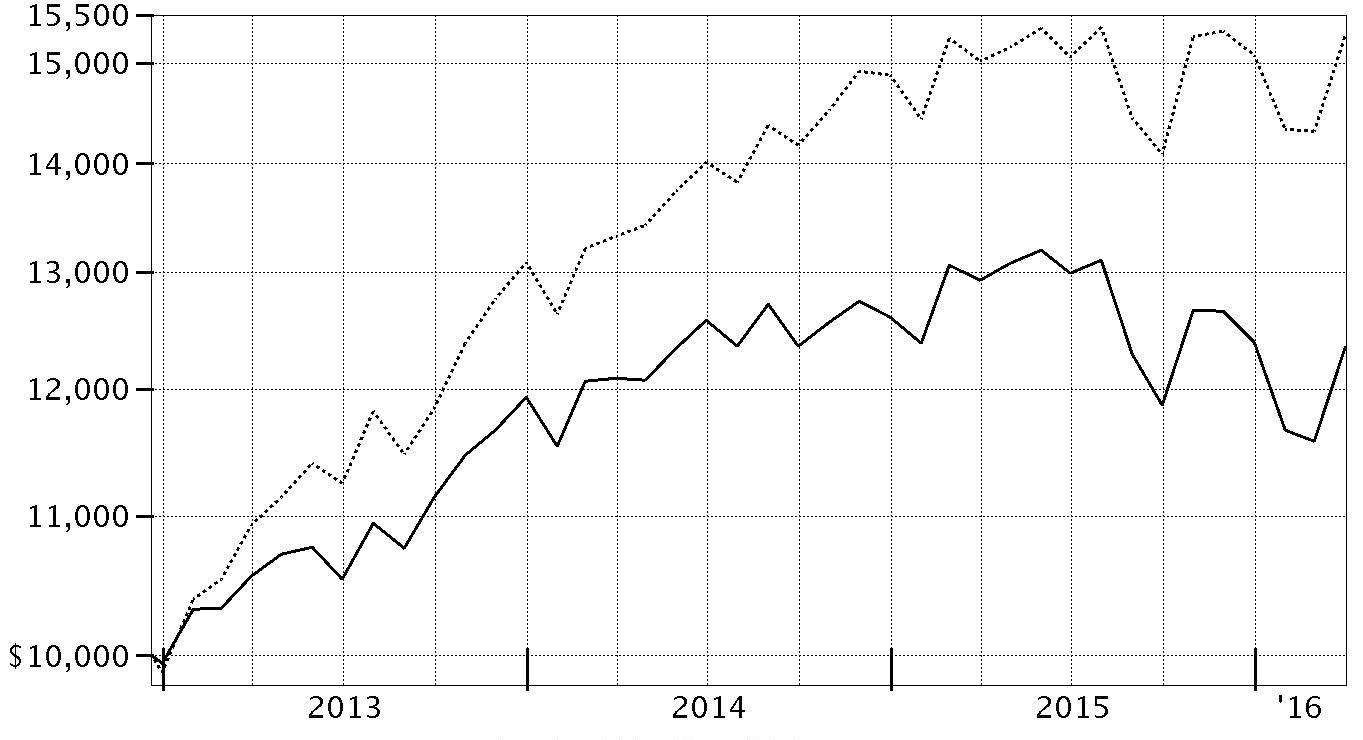

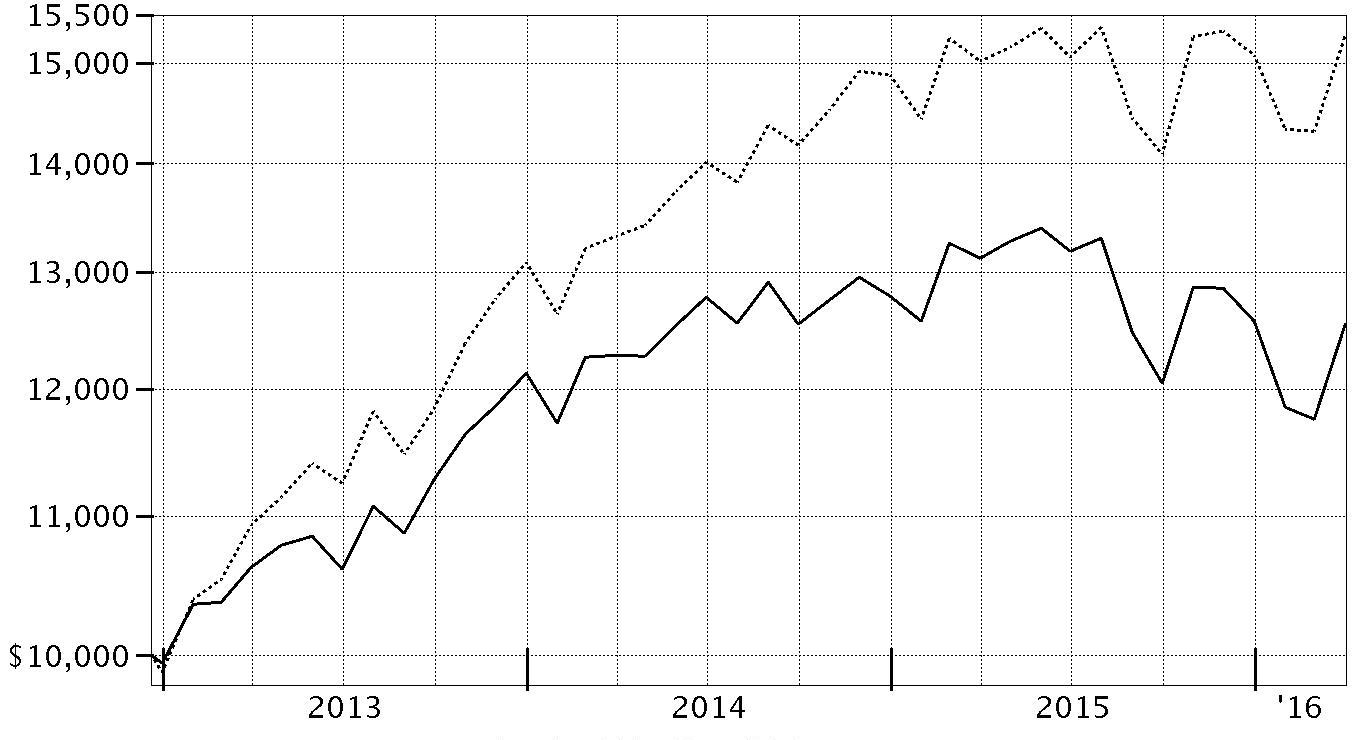

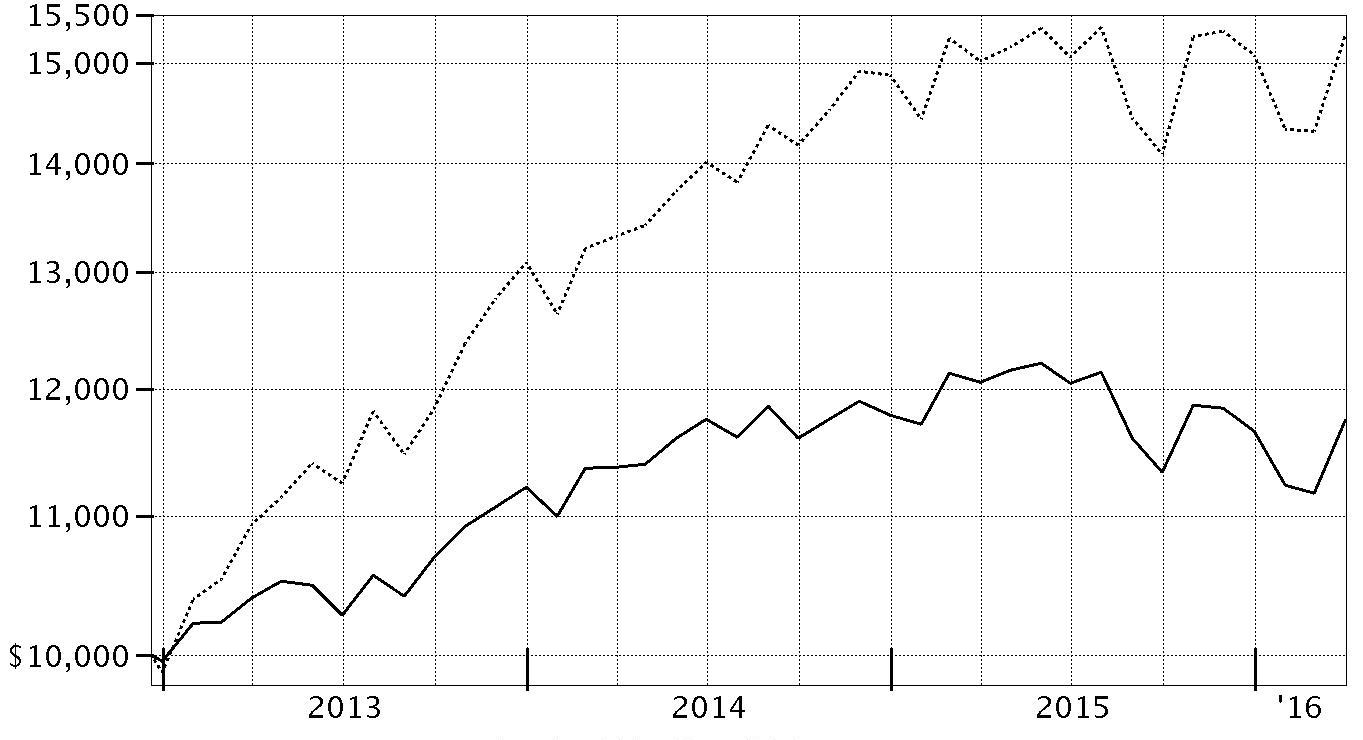

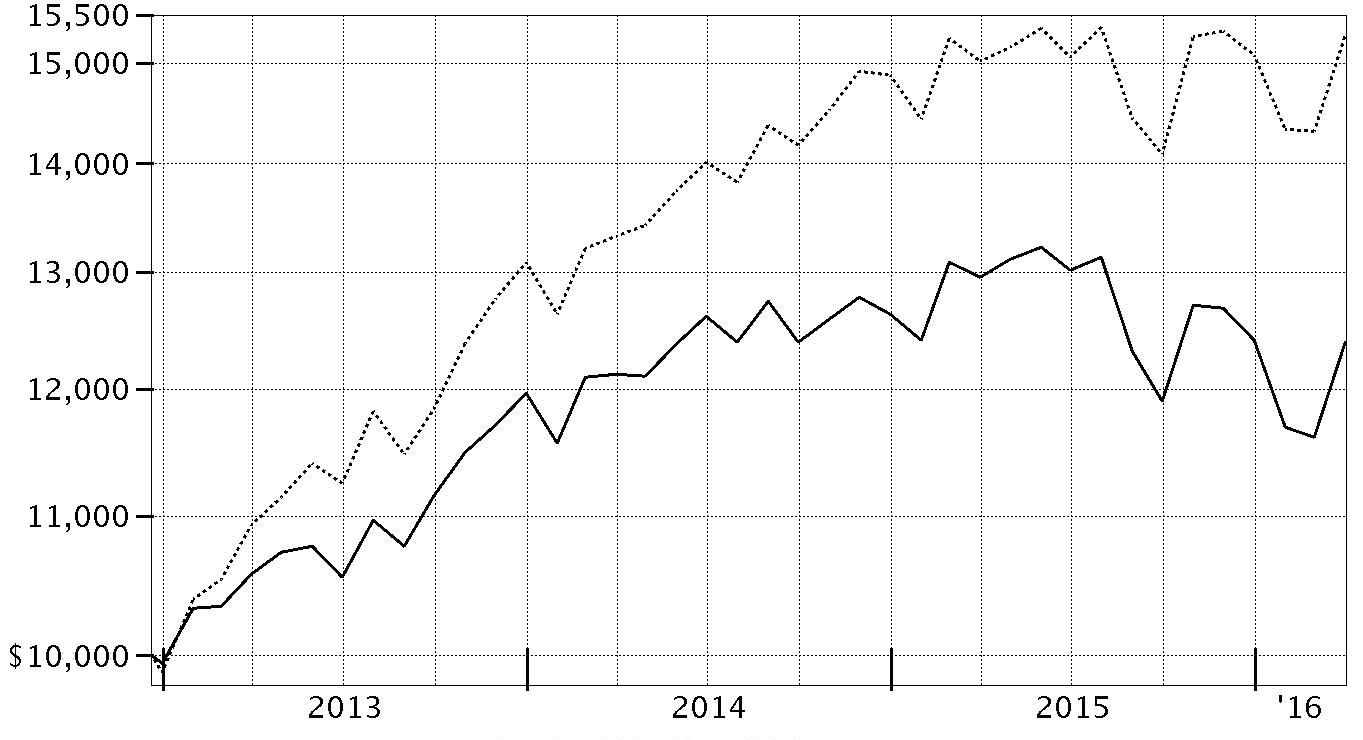

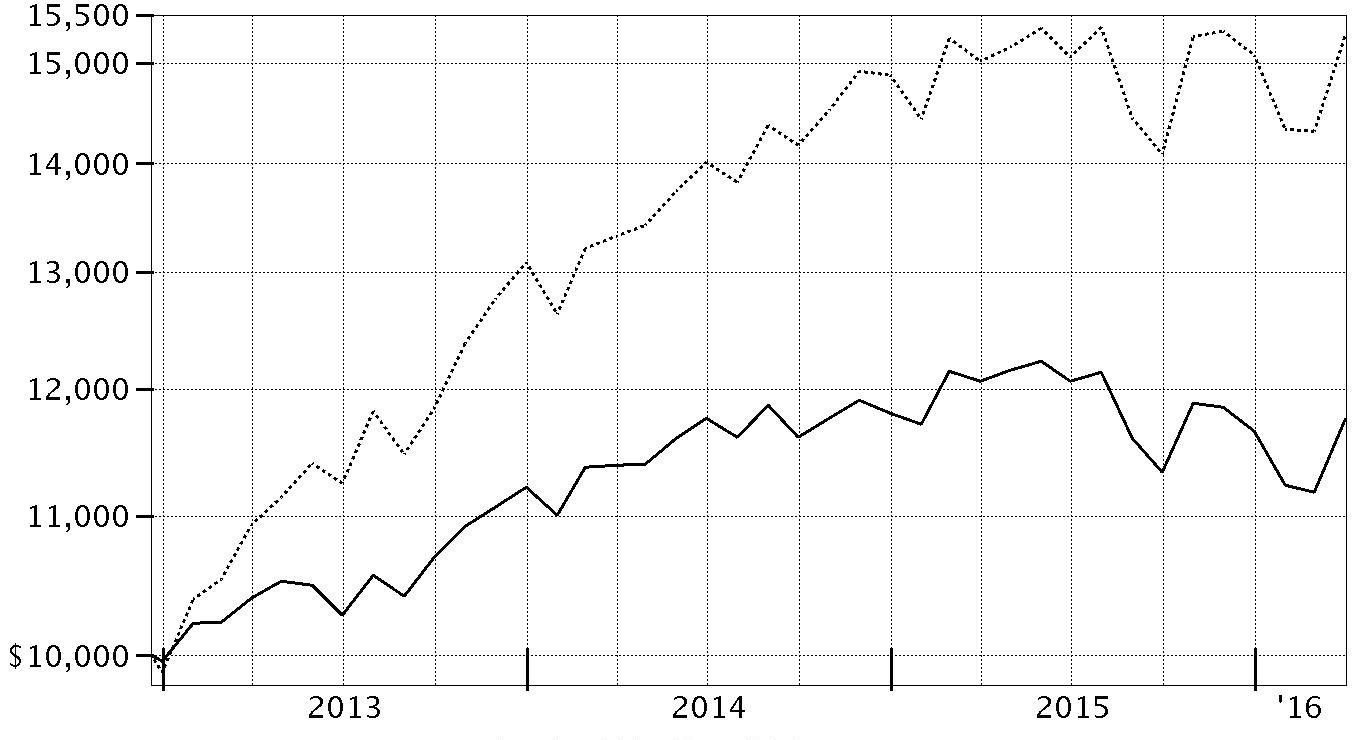

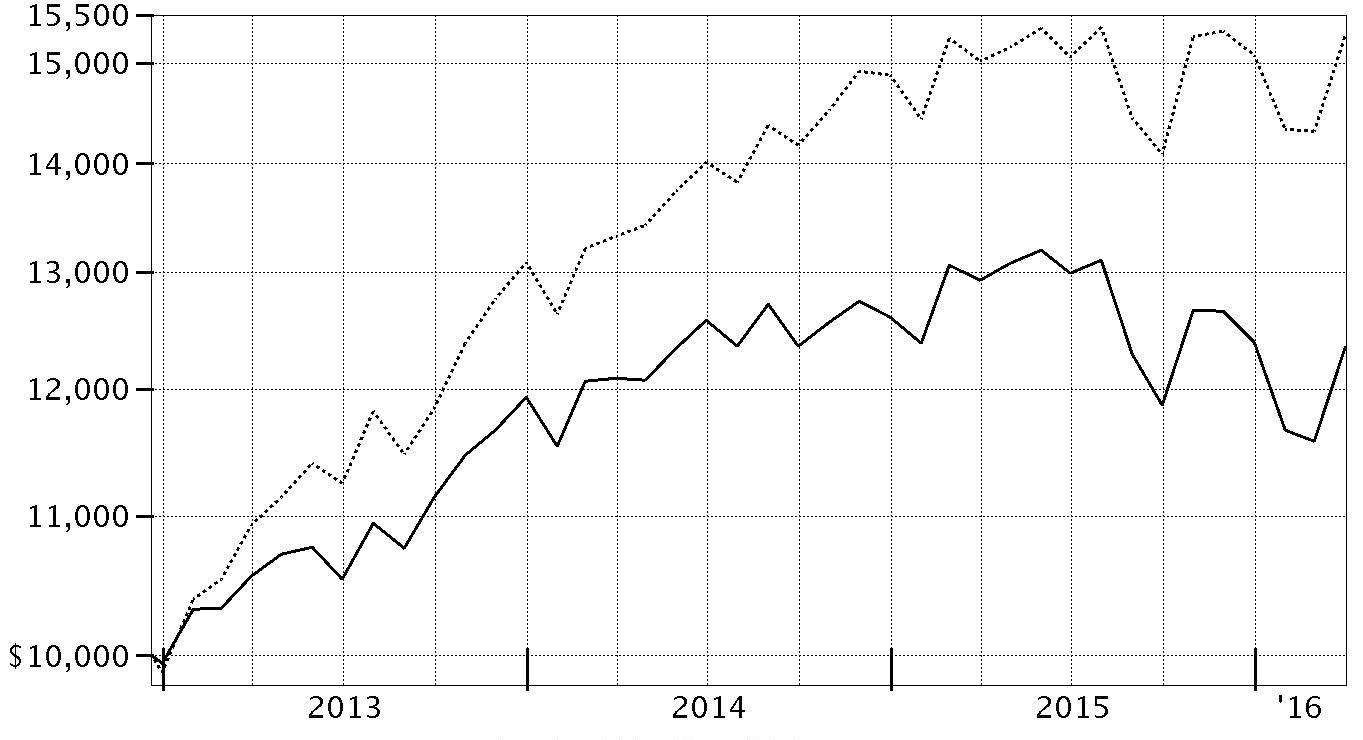

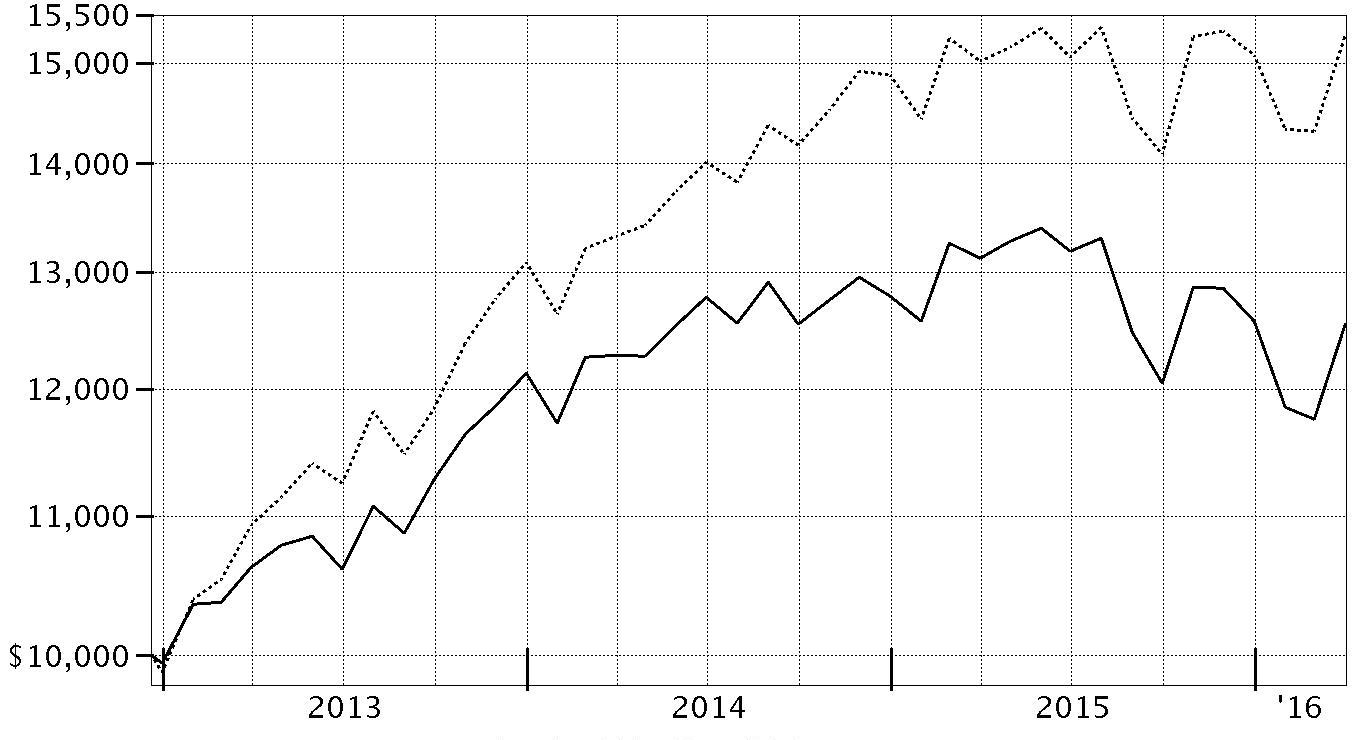

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2020 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $11,747 | Strategic Advisers® Multi-Manager 2020 Fund - Class L |

| $15,285 | S&P 500® Index |

Strategic Advisers® Multi-Manager 2025 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (3.05)% | 5.94% |

| Class N | (3.31)% | 5.75% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2025 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2025 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

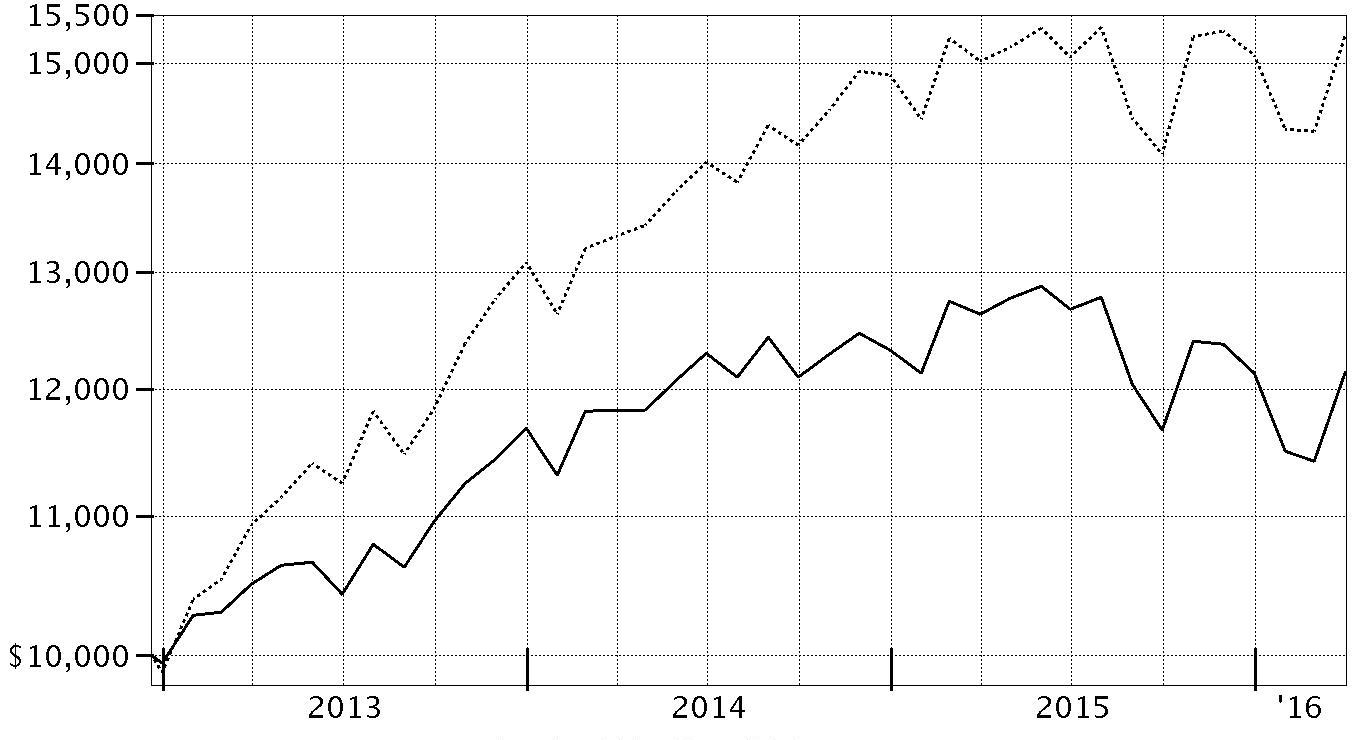

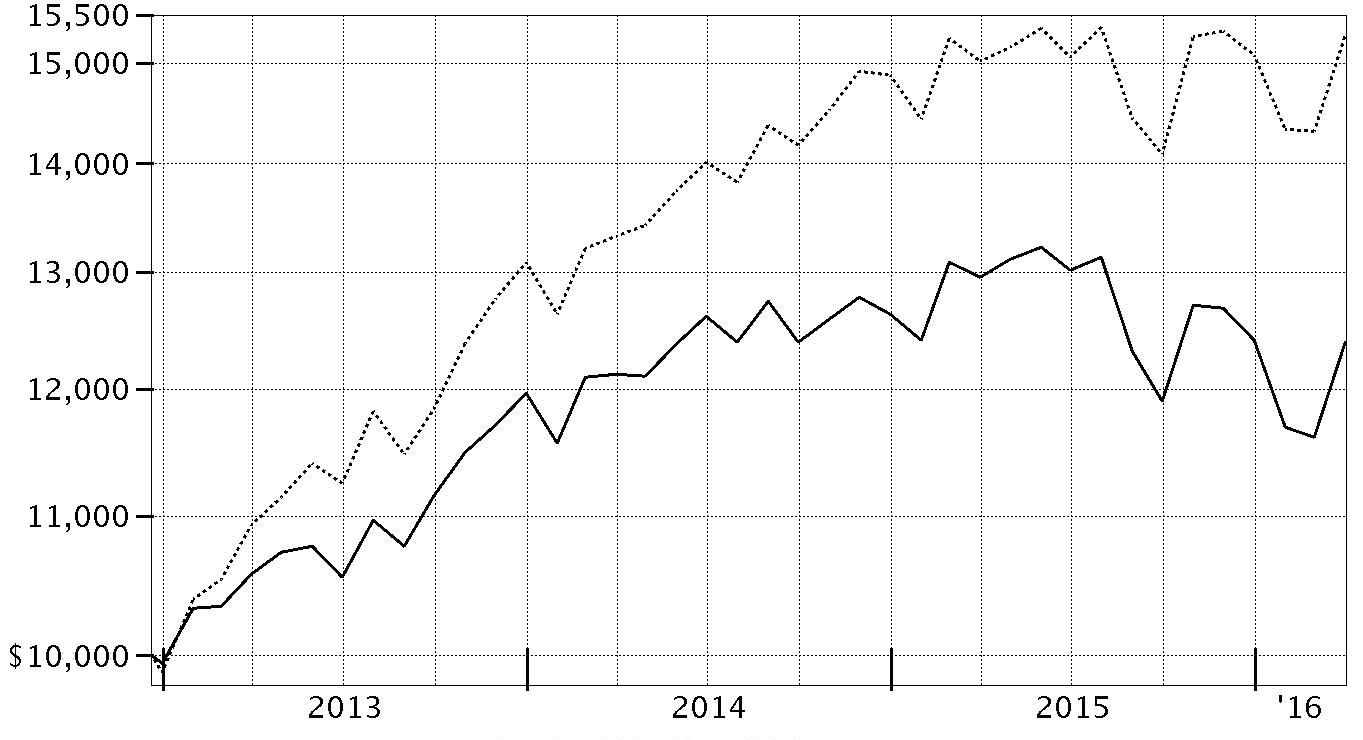

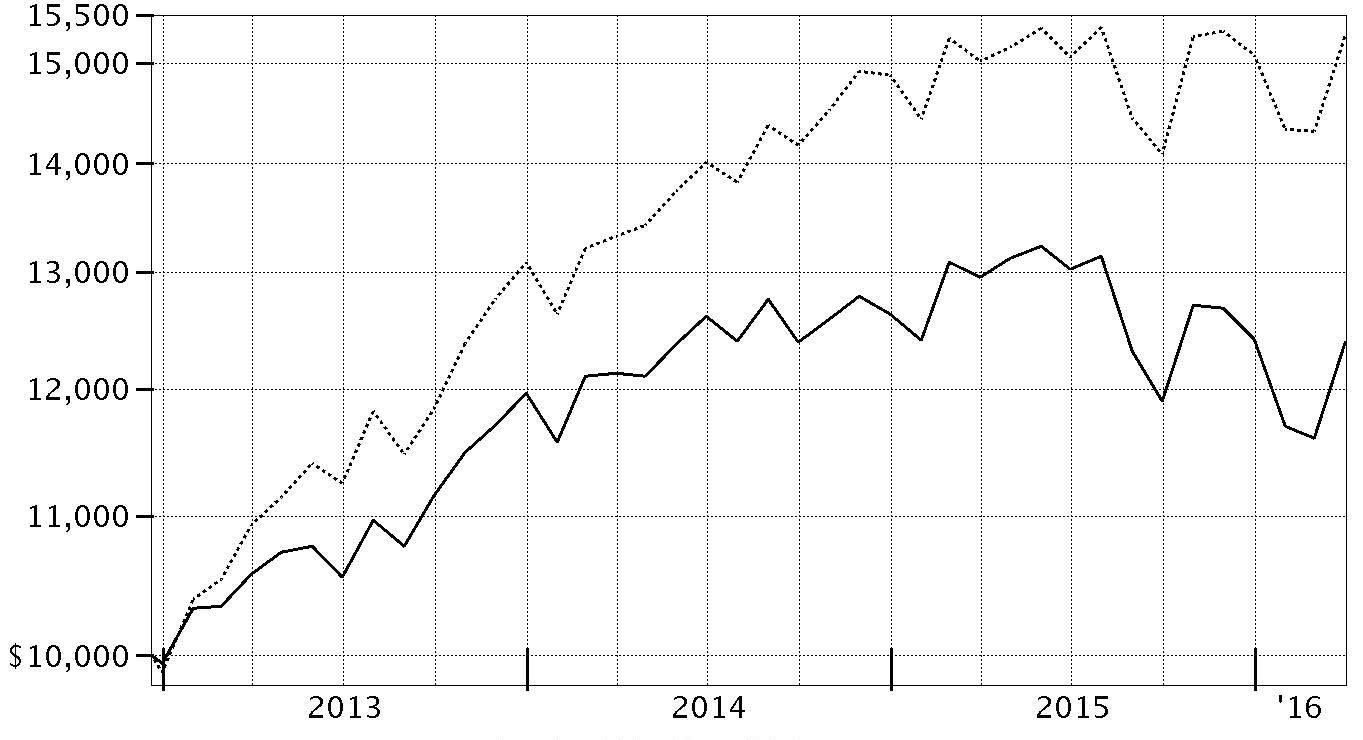

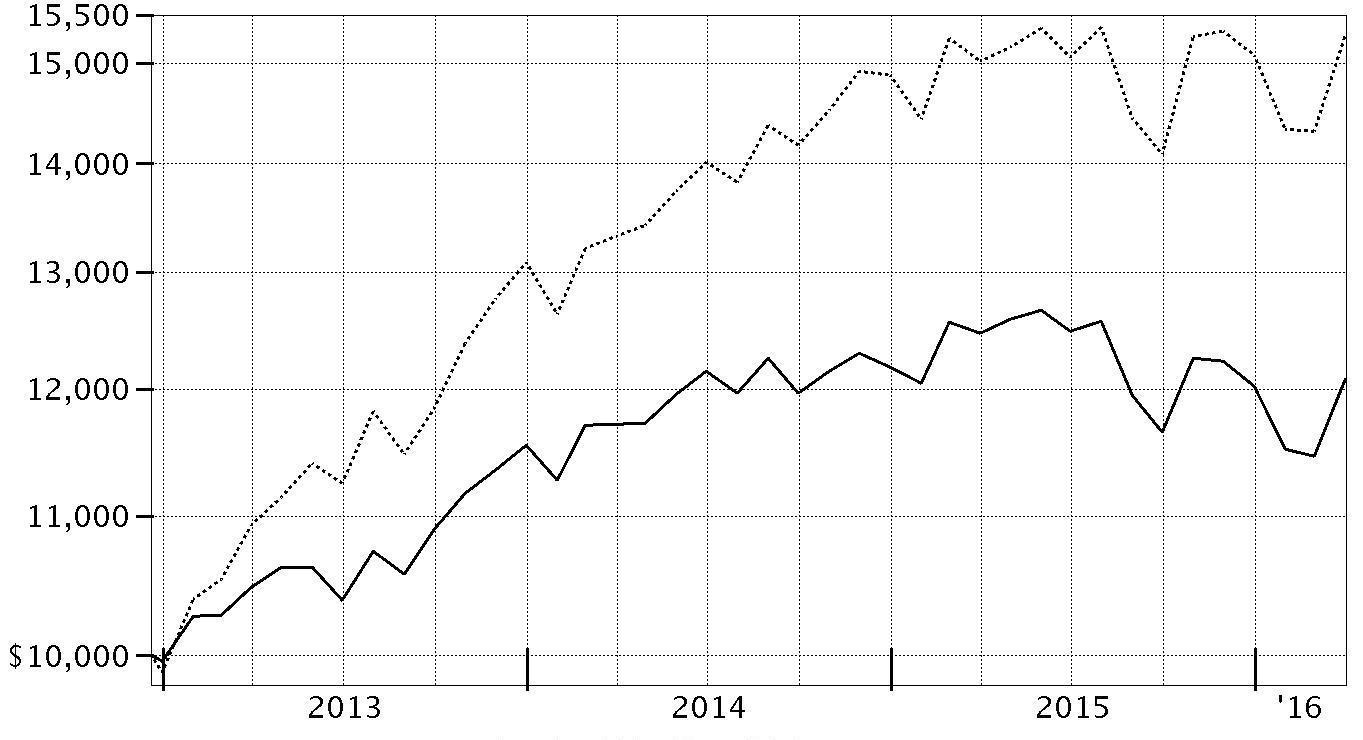

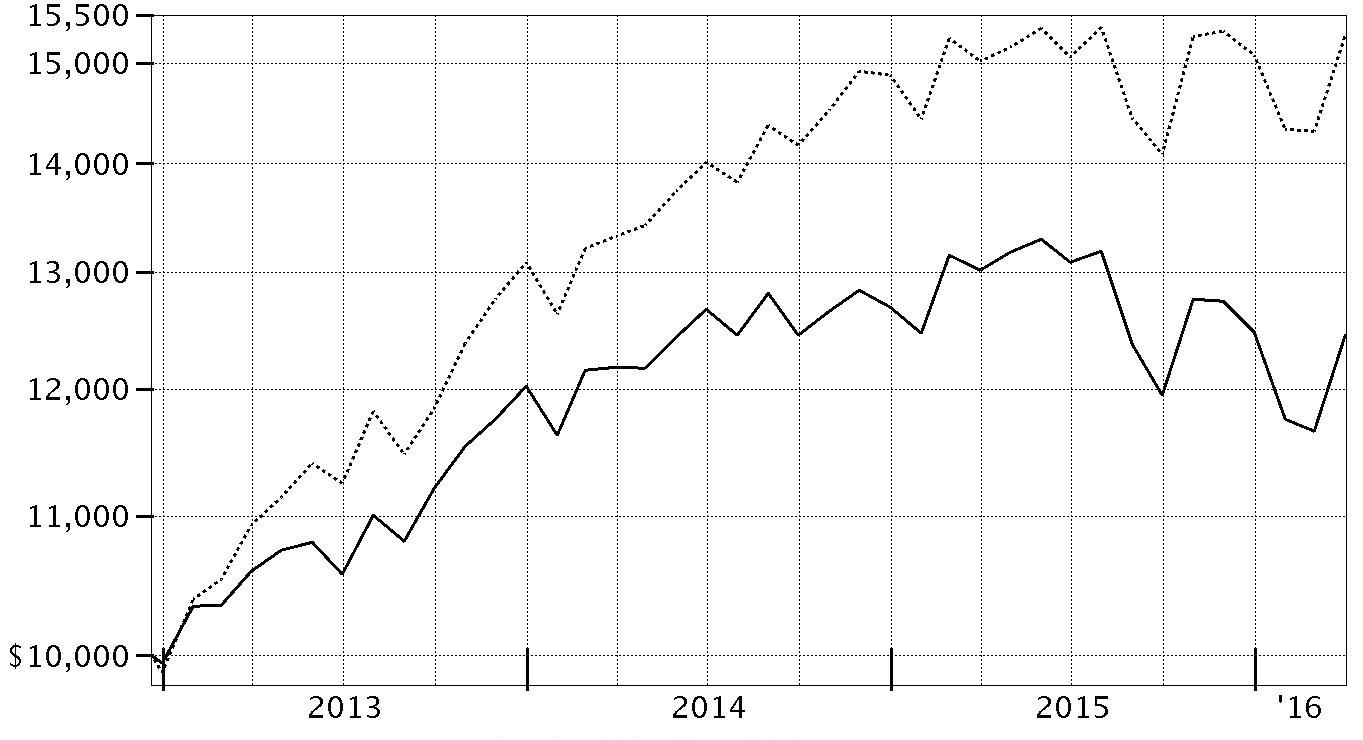

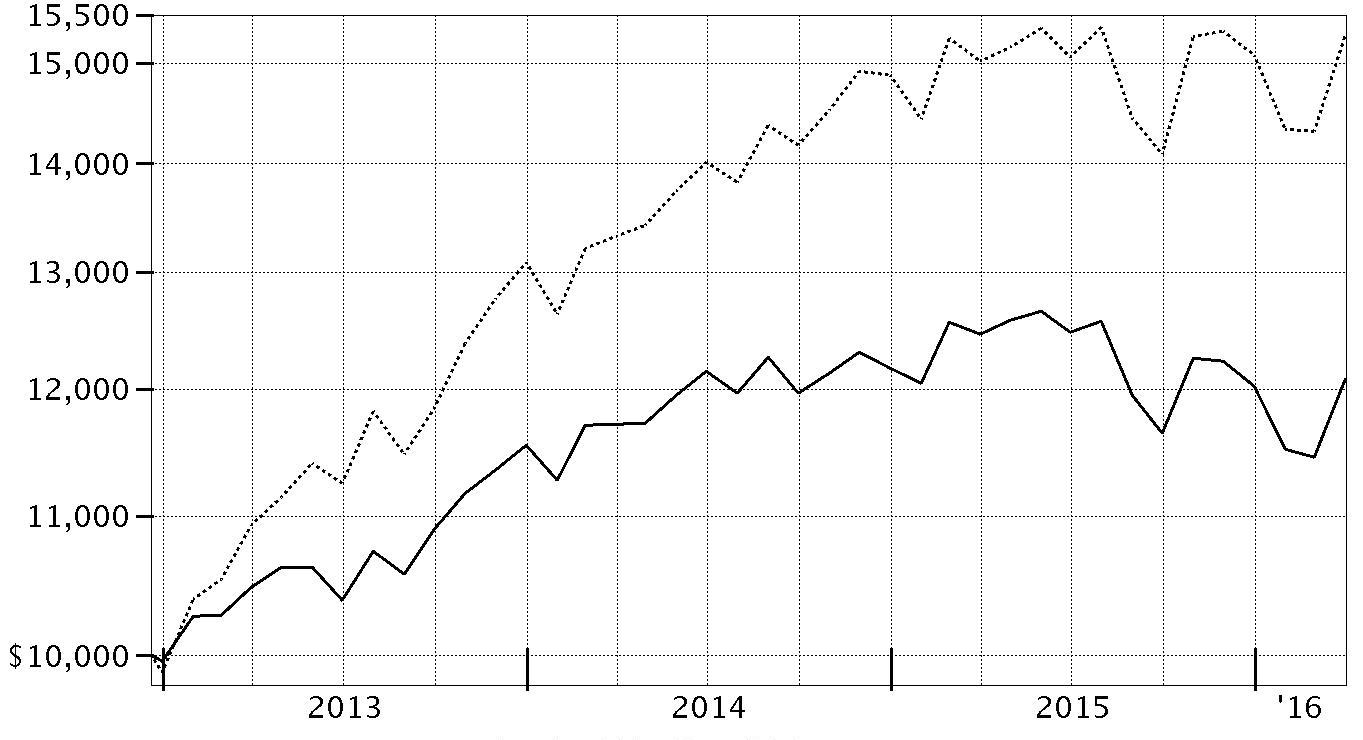

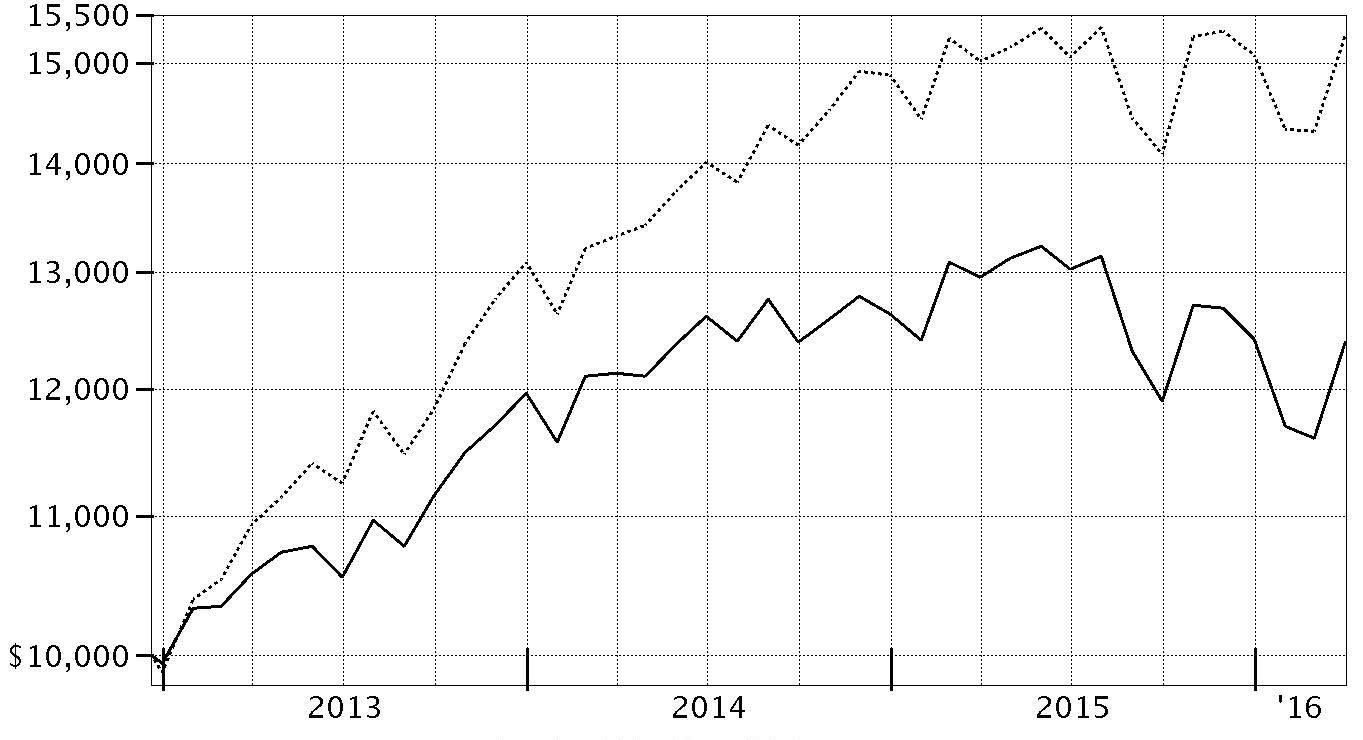

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2025 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $12,084 | Strategic Advisers® Multi-Manager 2025 Fund - Class L |

| $15,285 | S&P 500® Index |

Strategic Advisers® Multi-Manager 2030 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (3.90)% | 6.09% |

| Class N | (4.12)% | 5.90% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2030 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2030 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

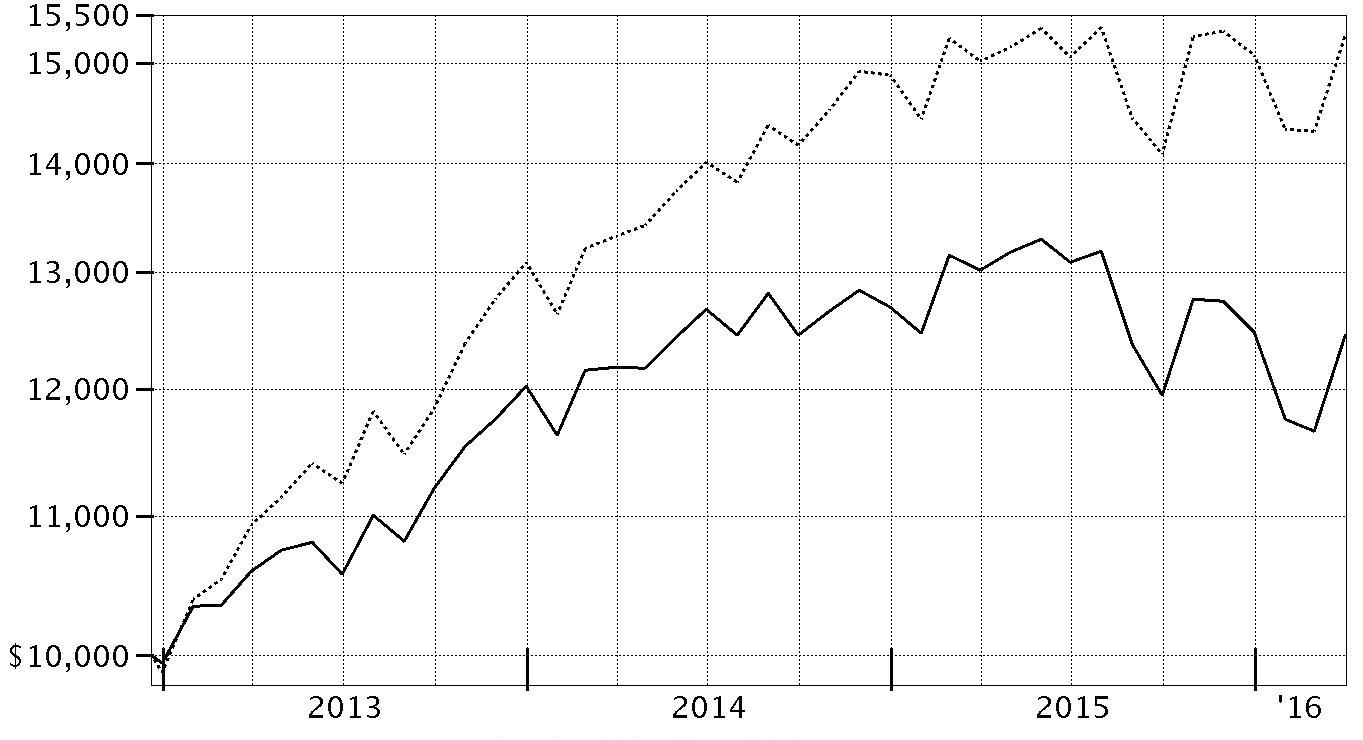

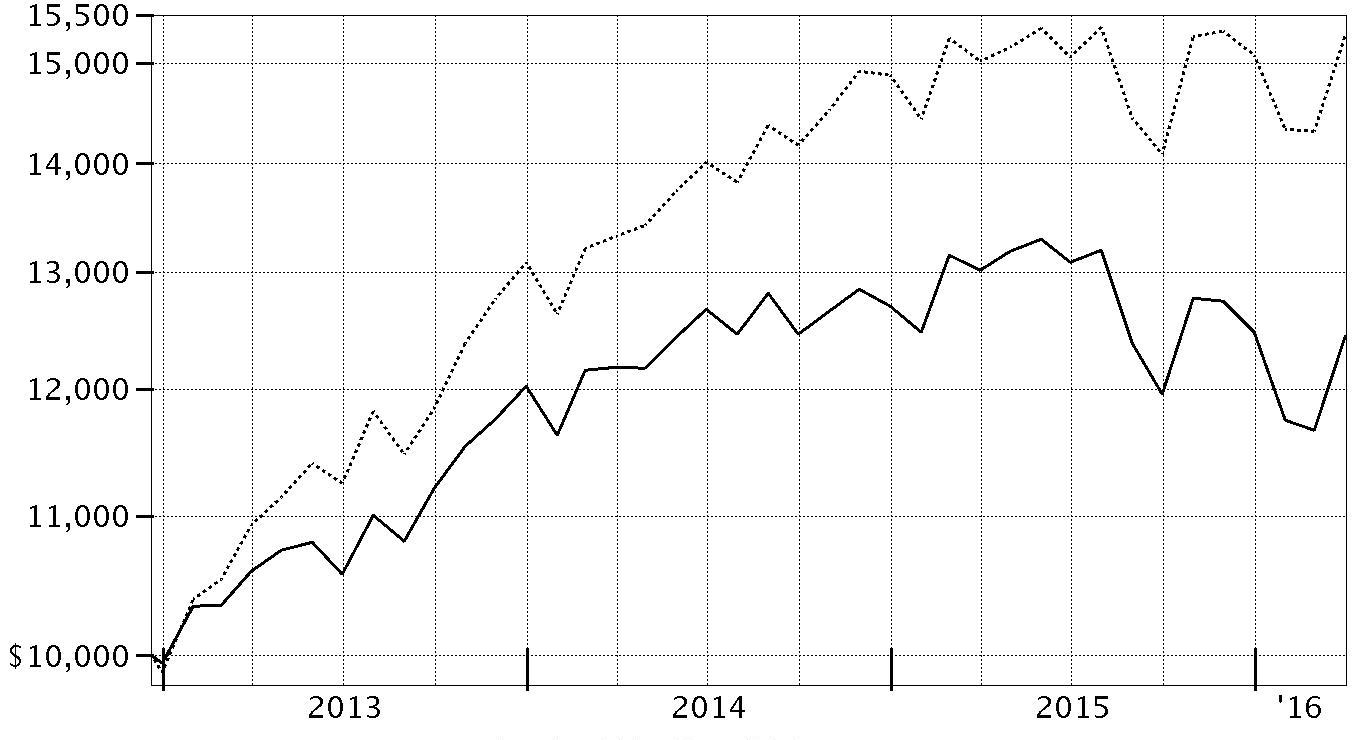

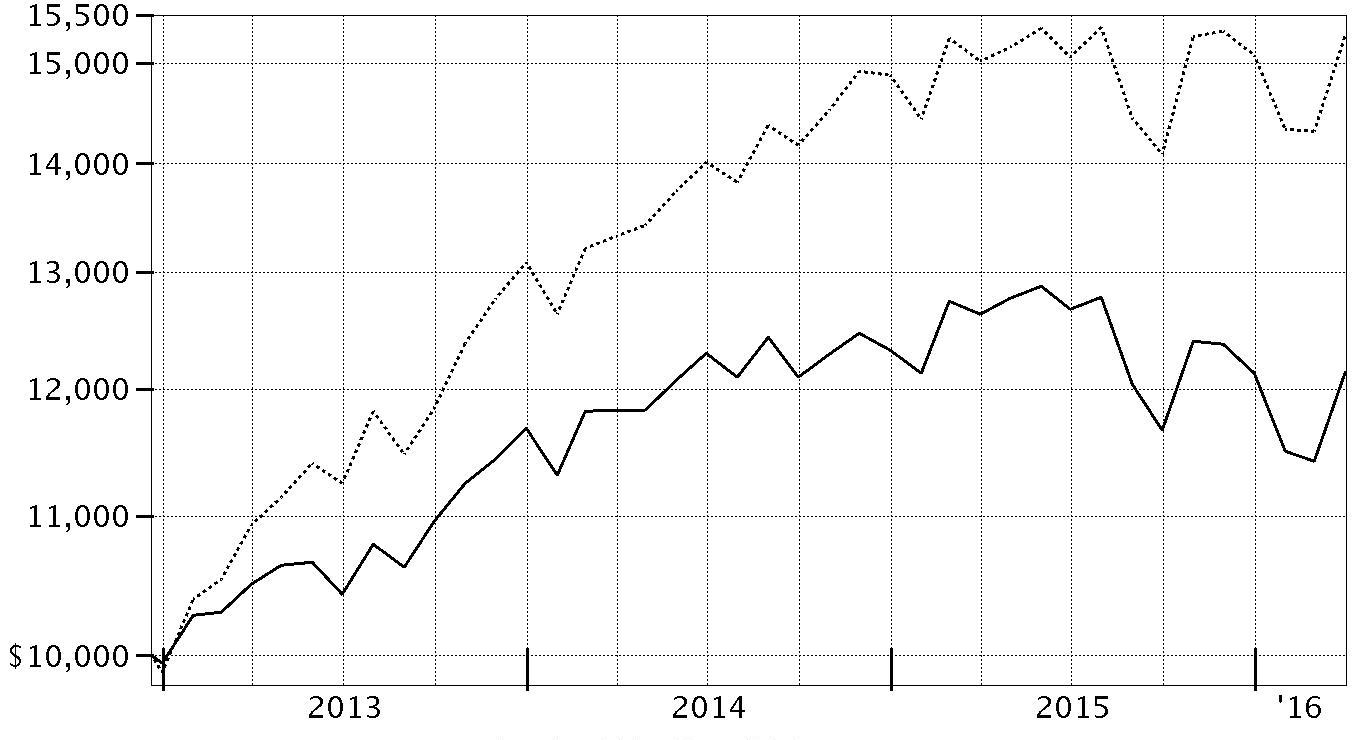

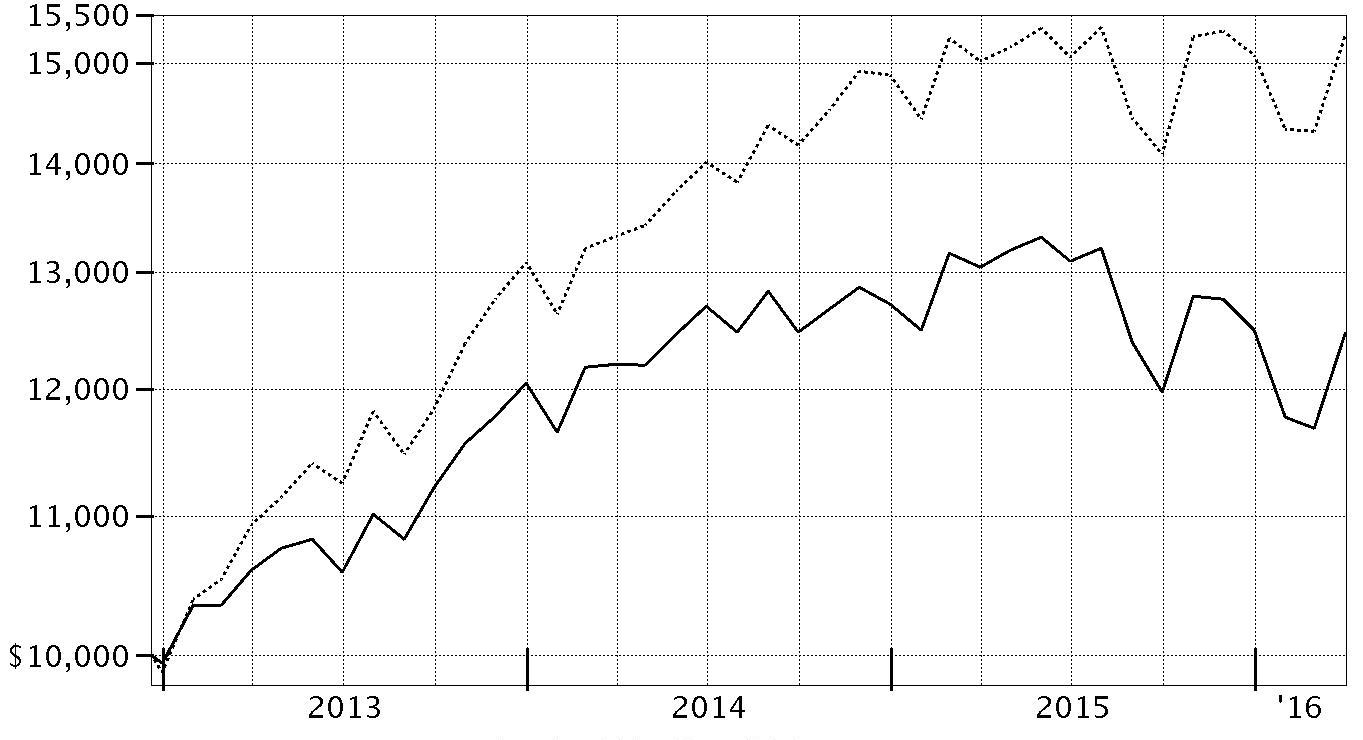

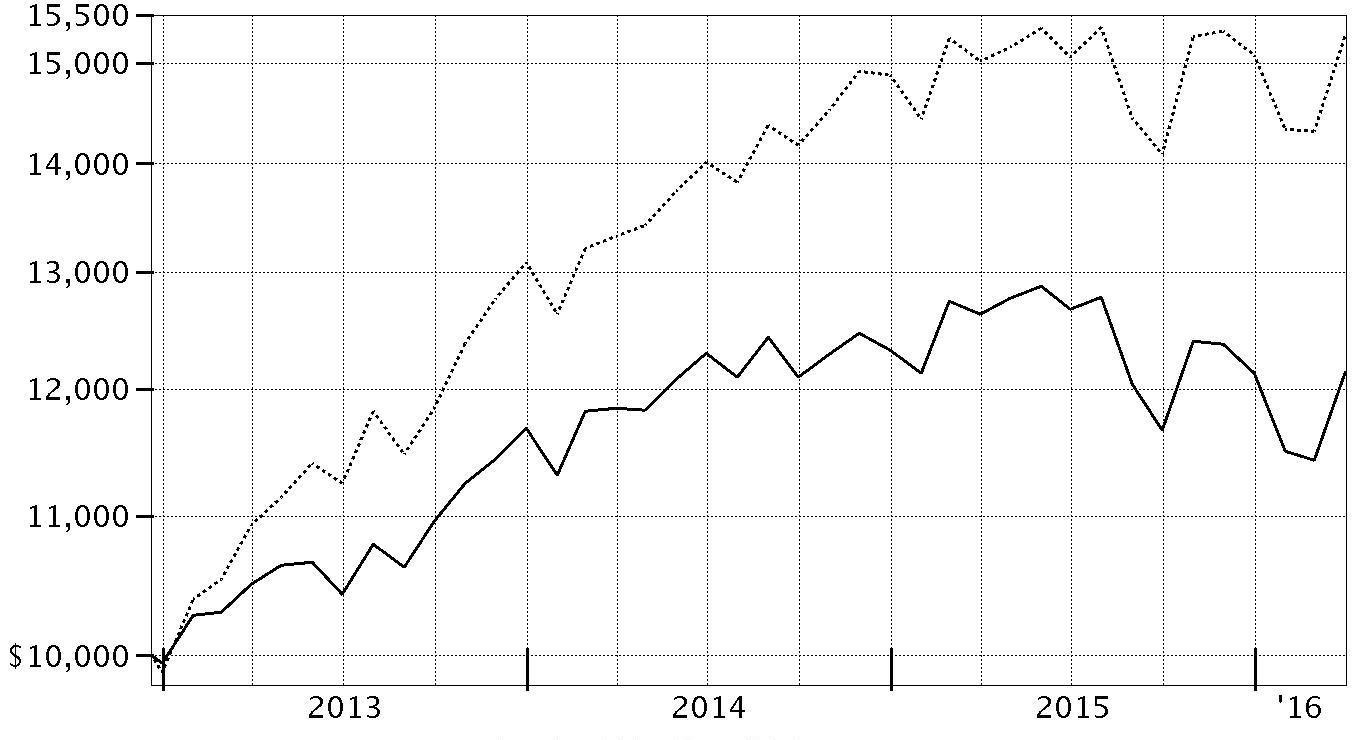

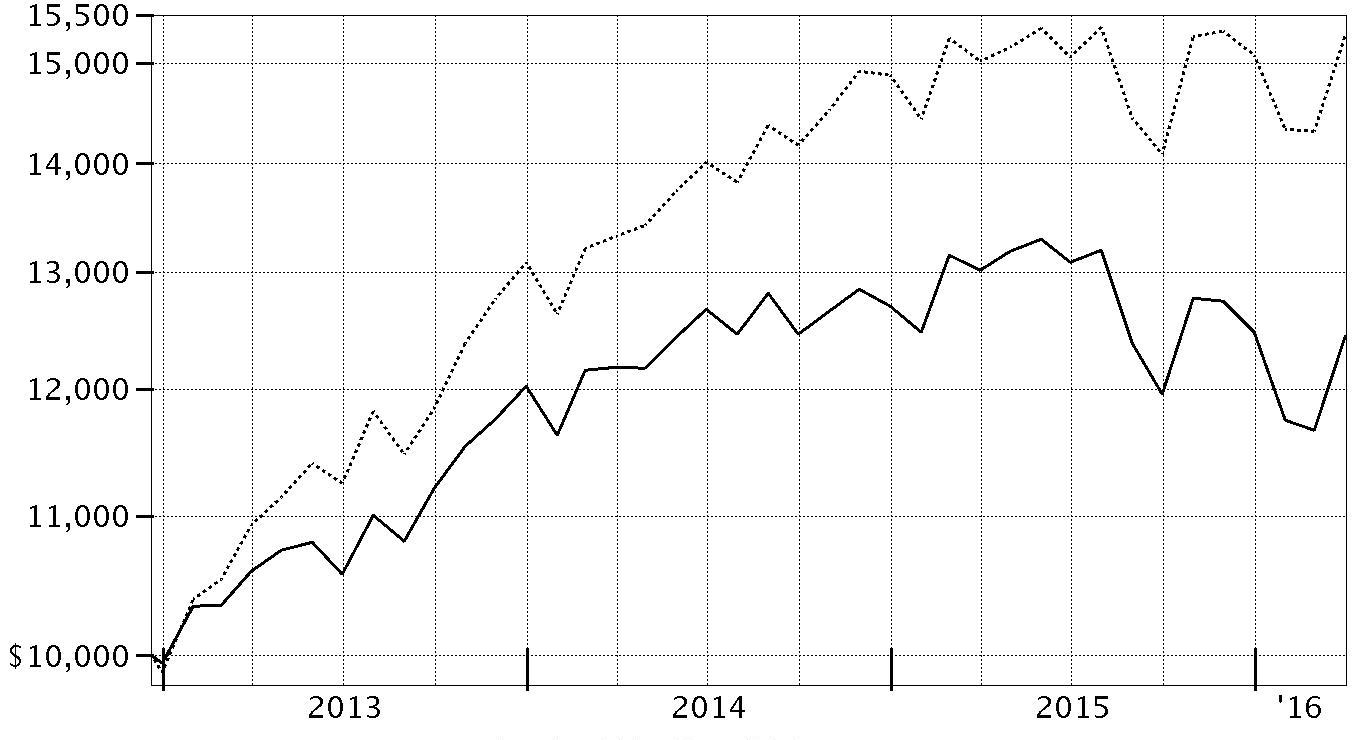

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2030 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $12,141 | Strategic Advisers® Multi-Manager 2030 Fund - Class L |

| $15,285 | S&P 500® Index |

Strategic Advisers® Multi-Manager 2035 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (4.36)% | 6.67% |

| Class N | (4.65)% | 6.46% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2035 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2035 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

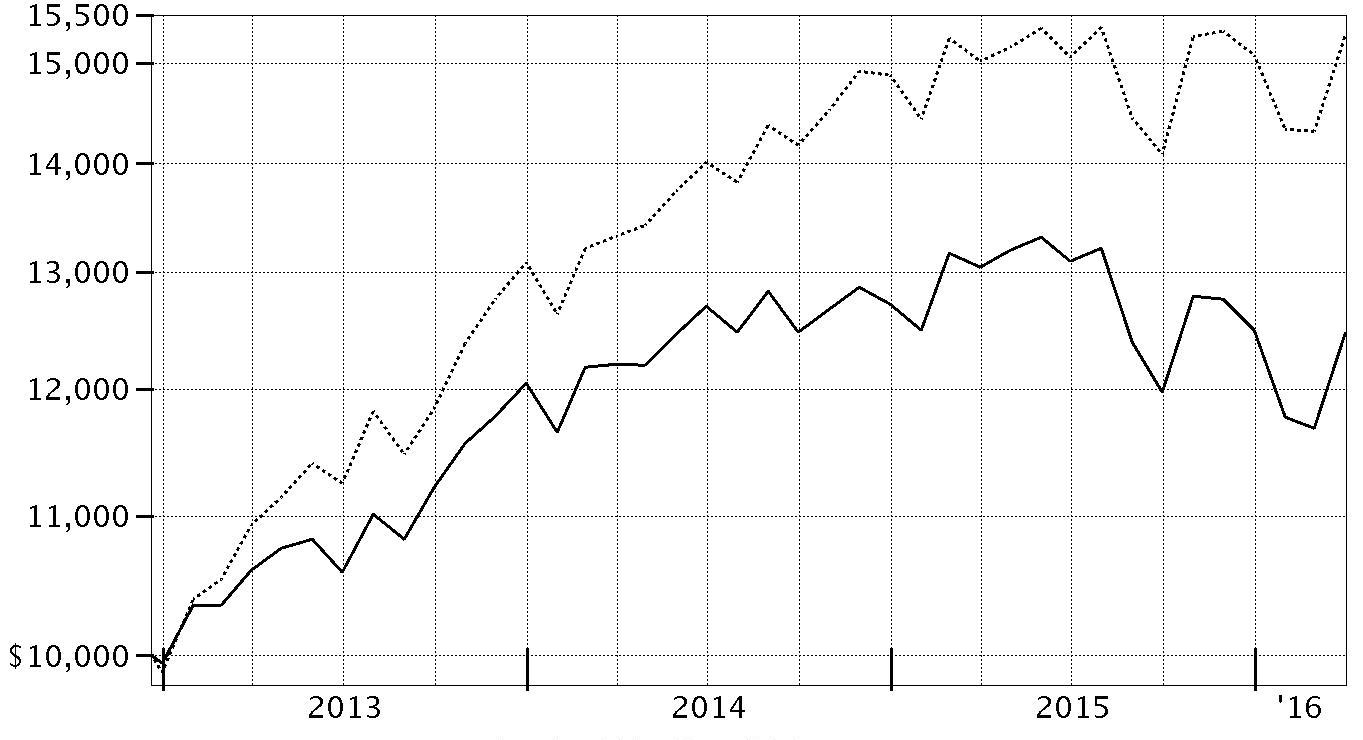

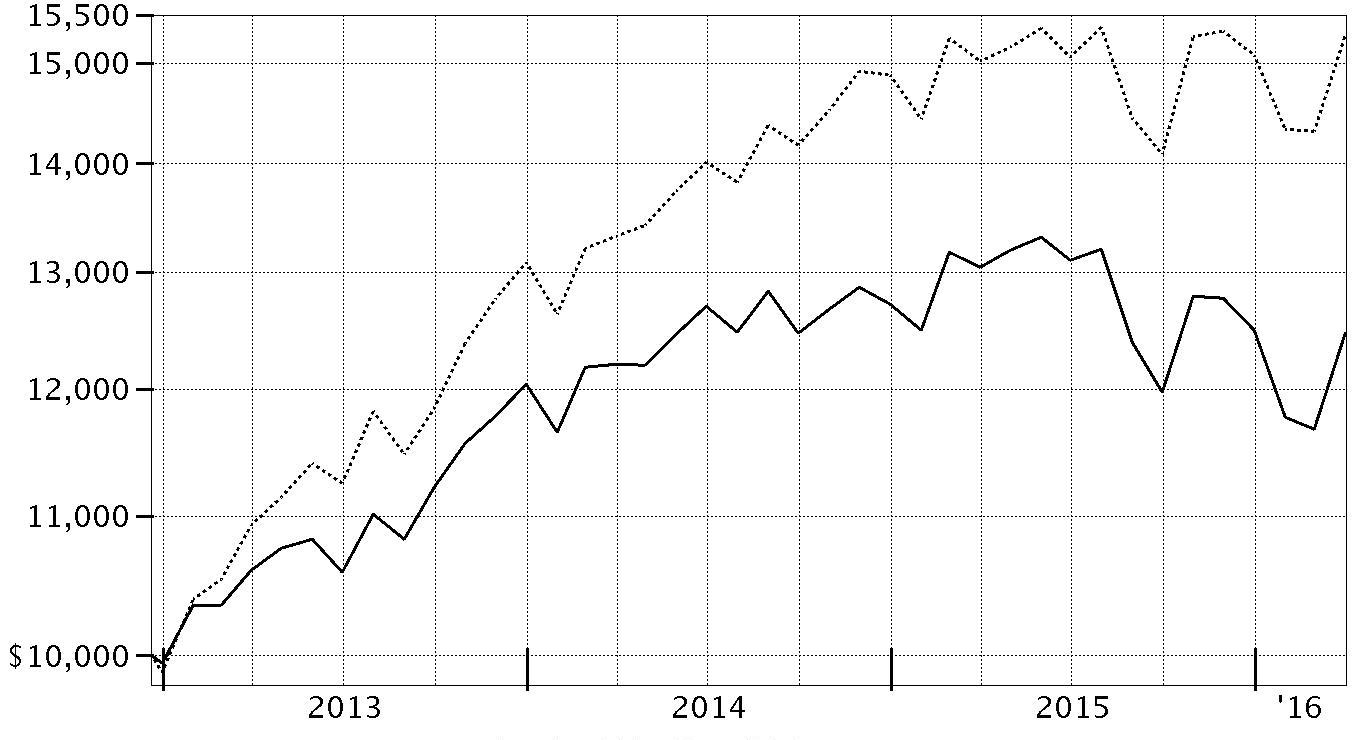

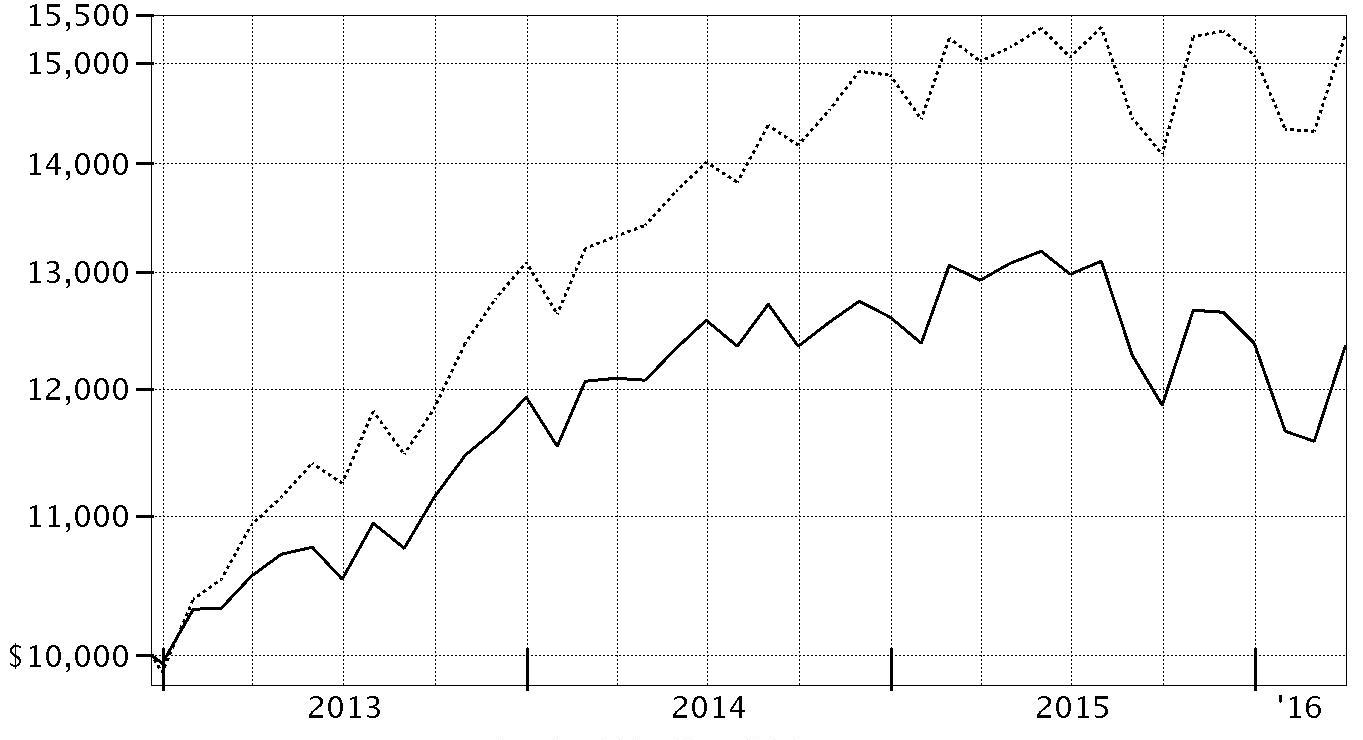

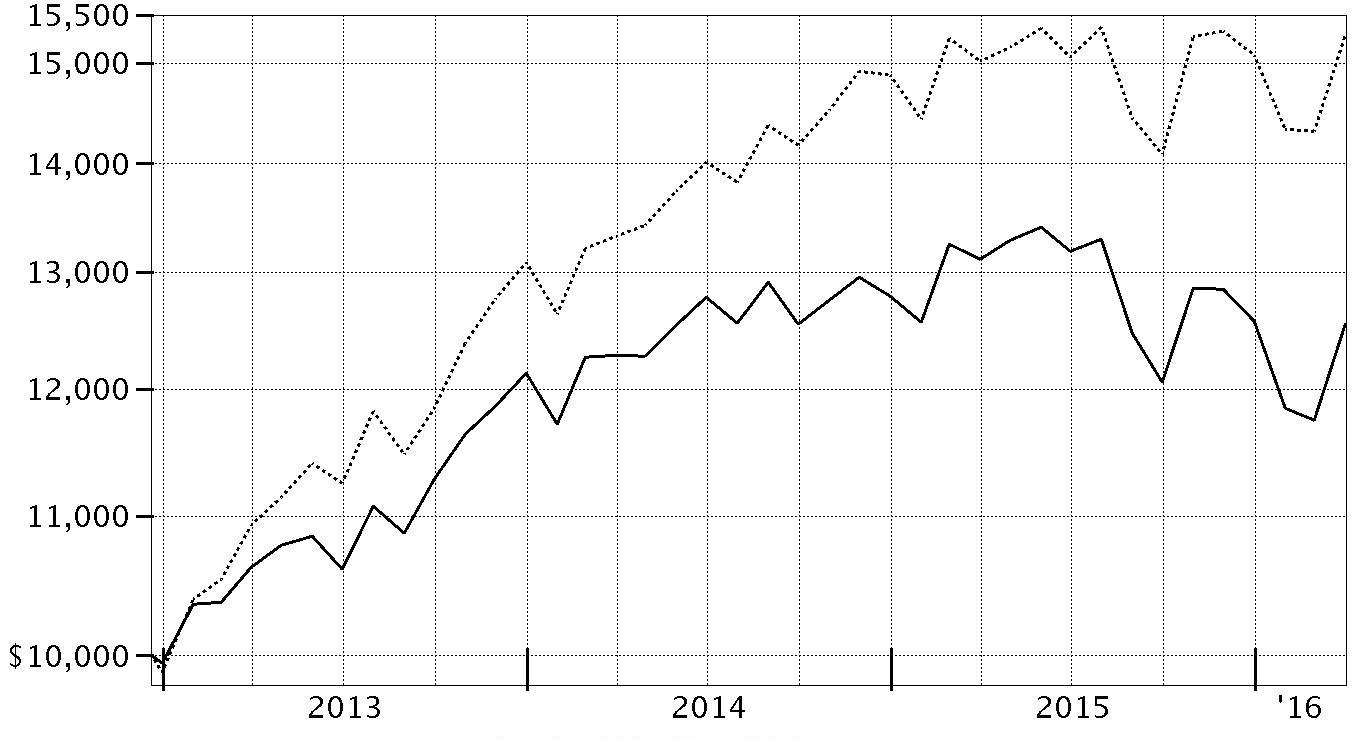

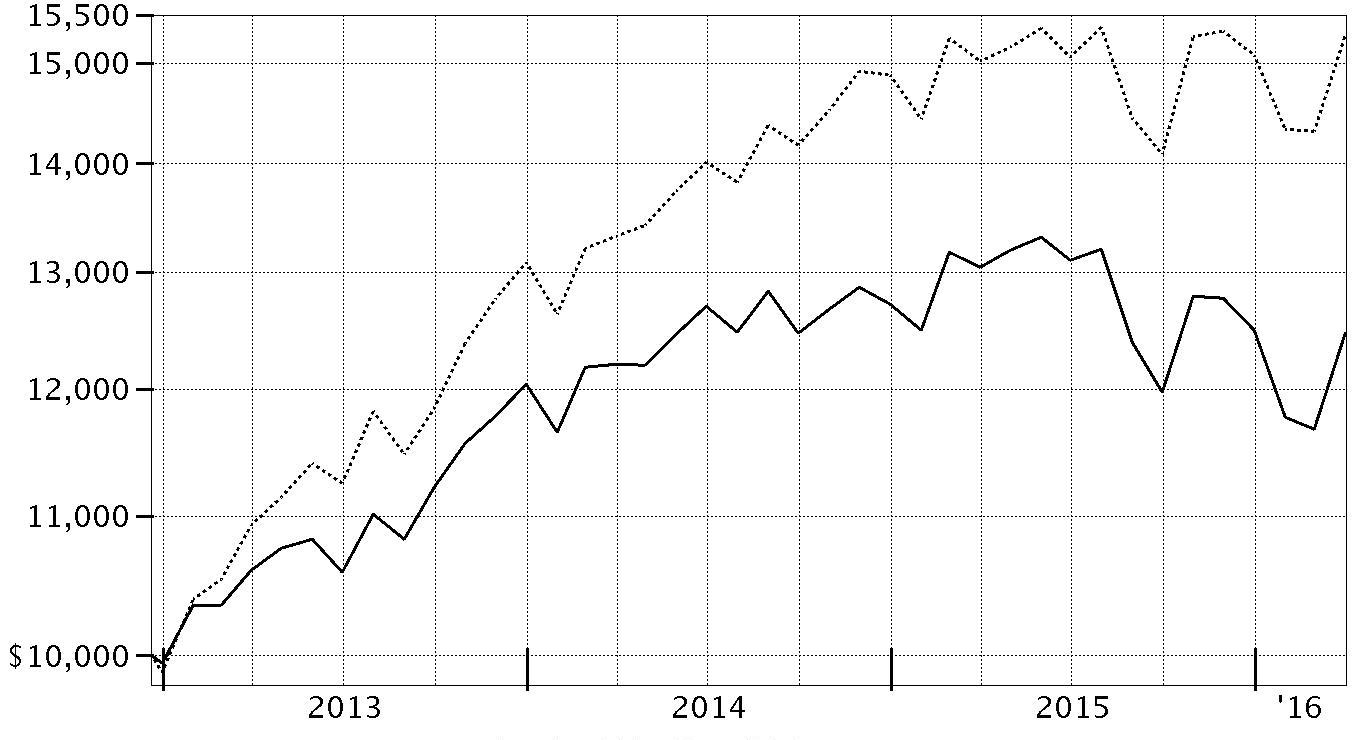

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2035 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $12,360 | Strategic Advisers® Multi-Manager 2035 Fund - Class L |

| $15,285 | S&P 500® Index |

Strategic Advisers® Multi-Manager 2040 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (4.36)% | 6.74% |

| Class N | (4.60)% | 6.55% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2040 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2040 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2040 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $12,387 | Strategic Advisers® Multi-Manager 2040 Fund - Class L |

| $15,285 | S&P 500® Index |

Strategic Advisers® Multi-Manager 2045 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (4.33)% | 6.91% |

| Class N | (4.65)% | 6.72% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2045 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2045 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2045 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $12,450 | Strategic Advisers® Multi-Manager 2045 Fund - Class L |

| $15,285 | S&P 500® Index |

Strategic Advisers® Multi-Manager 2050 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (4.39)% | 6.95% |

| Class N | (4.62)% | 6.76% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2050 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2050 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2050 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $12,466 | Strategic Advisers® Multi-Manager 2050 Fund - Class L |

| $15,285 | S&P 500® Index |

Fidelity® Multi-Manager 2055 Fund

Strategic Advisers® Multi-Manager 2055 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (4.39)% | 7.15% |

| Class N | (4.57)% | 6.98% |

A From December 20, 2012

The initial offering of Class L shares took place on December 4, 2013. Returns prior to December 4, 2013 are those of Strategic Advisers® Multi-Manager 2055 Fund, the original class of the fund.

Class N shares bear a 0.25% 12b-1 fee. The initial offering of Class N shares took place on December 4, 2013. Returns prior to December 4, 2013, are those of Strategic Advisers® Multi-Manager 2055 Fund, the original class of the fund, which has no 12b-1 fee. Had Class N's 12b-1 fee been reflected, returns prior to December 4, 2013, would have been lower.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2055 Fund - Class L on December 20, 2012, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

See above for additional information regarding the performance of Class L.

| Period Ending Values |

| $12,543 | Strategic Advisers® Multi-Manager 2055 Fund - Class L |

| $15,285 | S&P 500® Index |

Strategic Advisers® Multi-Manager 2060 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended March 31, 2016 | Past 1 year | Life of fundA |

| Class L | (4.38)% | 0.32% |

| Class N | (4.57)% | 0.07% |

A From August 5, 2014

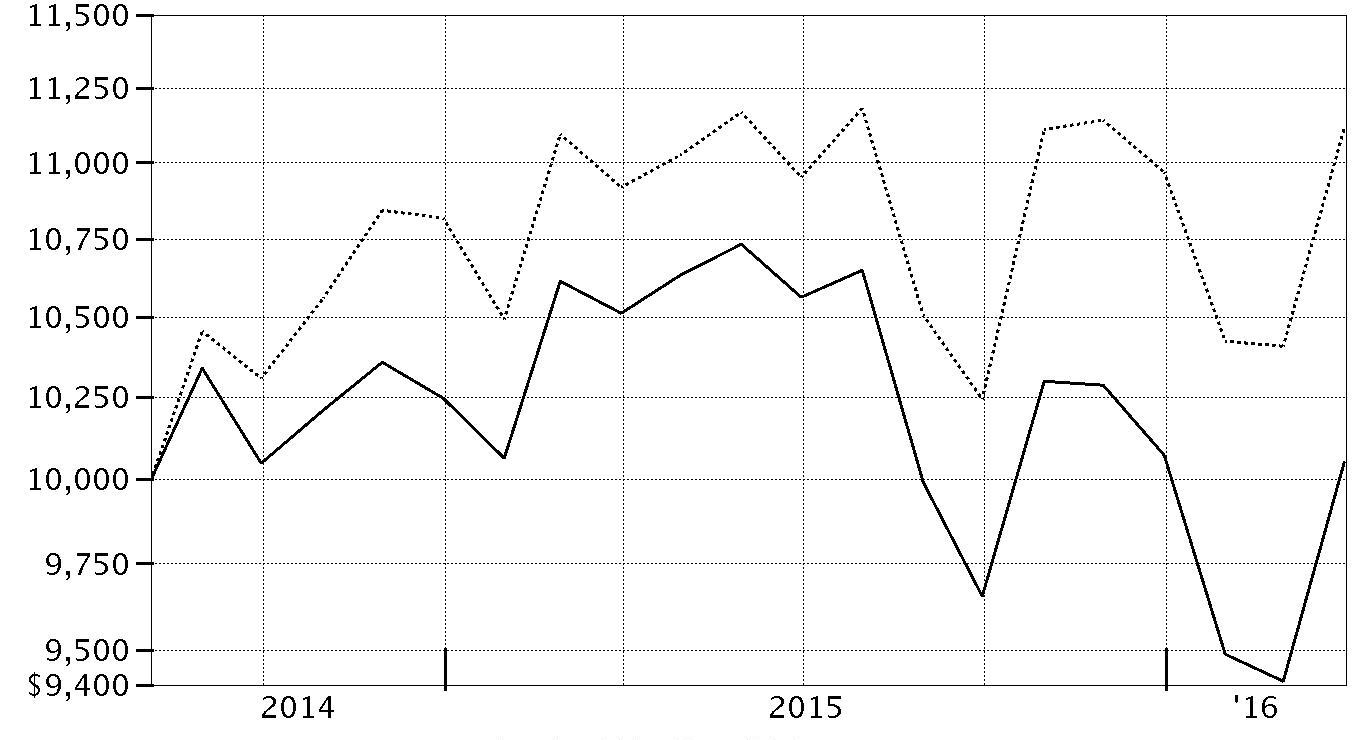

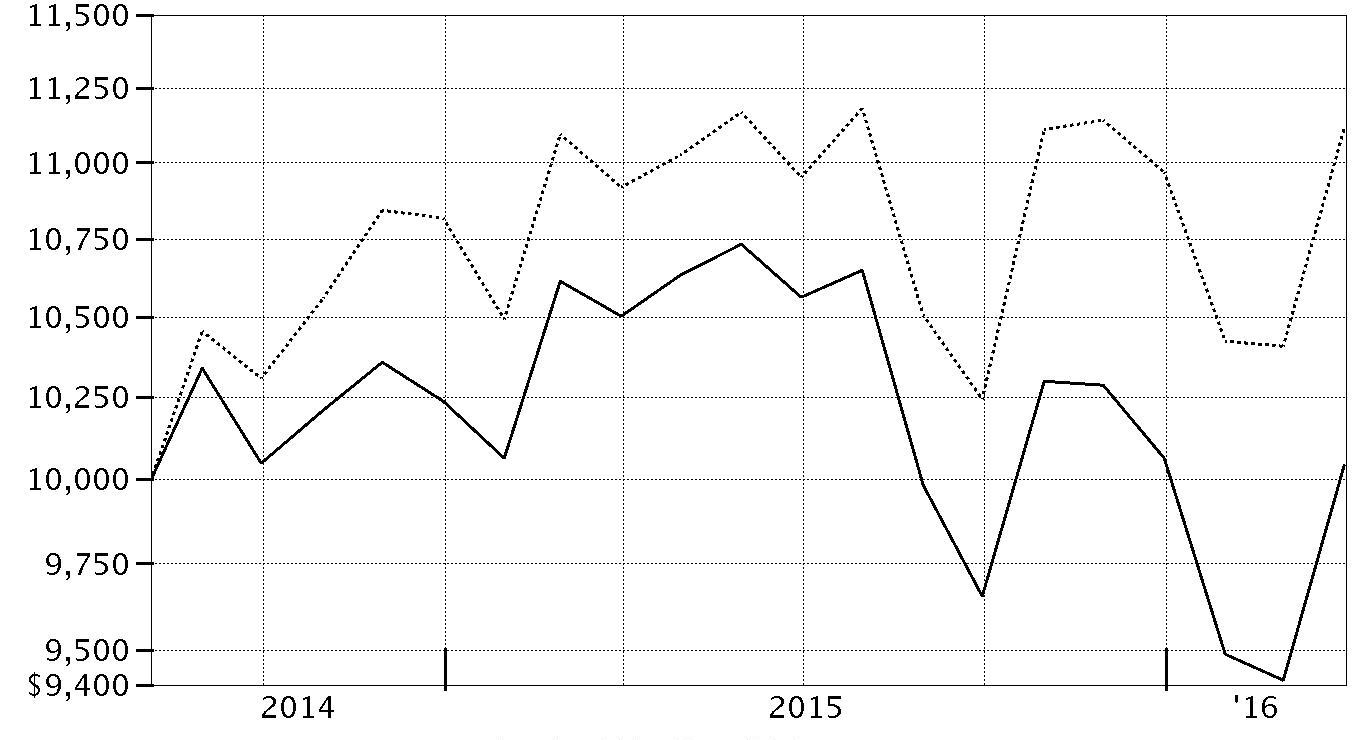

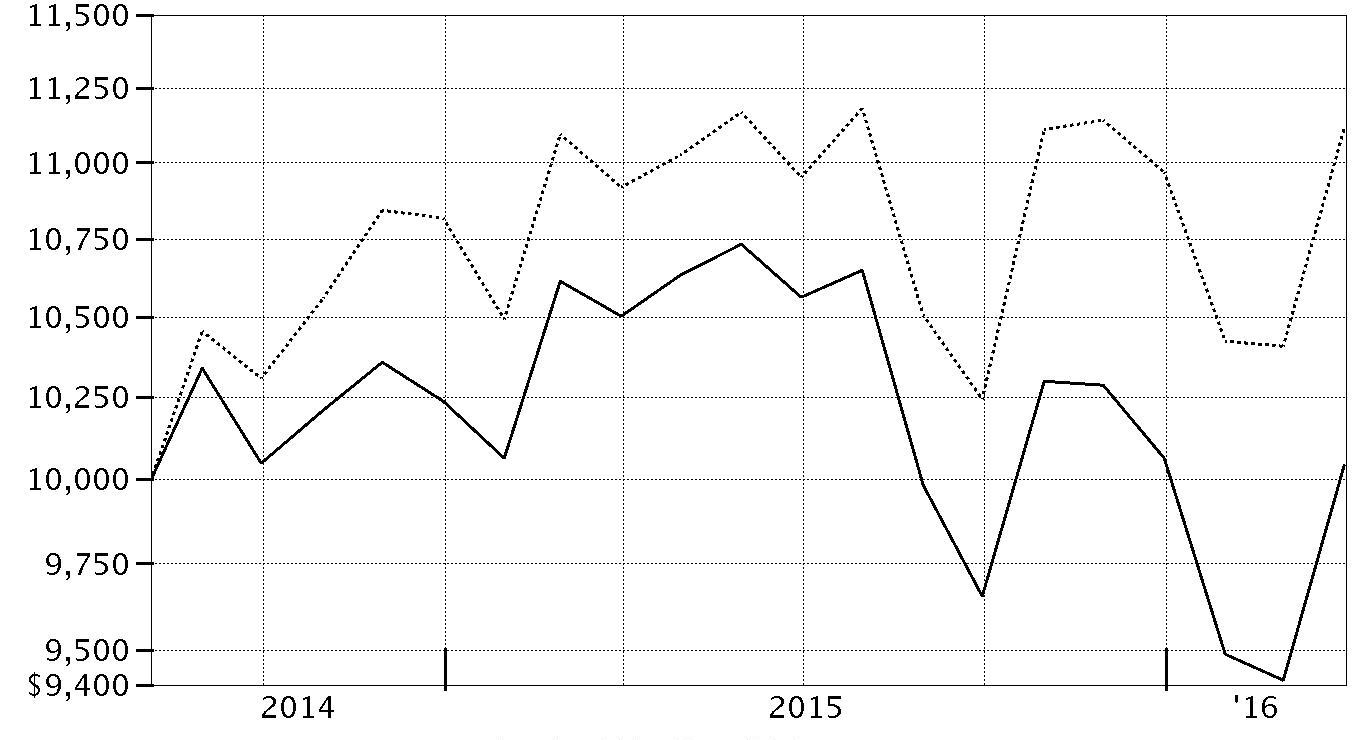

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Multi-Manager 2060 Fund - Class L on August 5, 2014, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values |

| $10,052 | Strategic Advisers Multi-Manager 2060 Fund - Class L |

| $11,115 | S&P 500® Index |

Management's Discussion of Fund Performance

Market Recap: Around the globe, equities declined for the 12 months ending March 31, 2016. The Dow Jones U.S. Total Stock Market Index℠, a broad measure of U.S. equity performance, returned -0.43%. With no particular regional bias, the non-U.S. major-markets MSCI World ex USA Index fell further, returning -8.44%. And despite a robust, late-period rally, the MSCI Emerging Markets Index delivered a return of -11.70%.

Stocks took a late-summer dive on fear of an economic slowdown in China, recovering in October after the U.S. Federal Reserve delayed raising target interest rates until mid-December. A rate cut in China and stimulus in Europe also helped. Nevertheless, persistent commodity weakness and U.S.-dollar strength pushed many markets to their worst January in years. A volatile February saw central banks in Europe, Japan and China take aggressive action aimed at reigniting their economies; the Fed added fuel by softening its schedule for future rate hikes.

Large-cap stocks handily outpaced small-caps in the U.S.; overseas, rankings reversed. Globally, growth bested value-oriented stocks. Volatility helped traditionally defensive sectors outperform cyclicals, while falling bond yields only strengthened demand within these same dividend-rich corners of the market - telecommunication services, utilities and consumer staples, in particular. Conversely, commodity-related sectors such as energy and materials declined substantially, despite an impressive turnaround near period end.

Fixed-income investors shunned riskier debt for much of the year. The Barclays

® U.S. Aggregate Bond Index rose 1.96%, led by Treasury and agency mortgage-backed securities; investment-grade corporate credit lagged. Emerging-markets debt and real estate income-oriented securities each had solid runs, ranking among the top-performing asset classes for the year. Meanwhile, high-yield bonds, as measured by The BofA Merrill Lynch US High Yield Constrained Index℠, returned -3.96%. A spirited, late-period comeback could not overcome earlier spread-widening.

Comments from Co-Managers Andrew Dierdorf and Brett Sumsion: For the 12 months ending March 31, 2016, the share classes of each Fund posted a negative return. Results moved along a spectrum, with nearer-term, more conservative Funds posting modest negatives and longer-dated, more aggressive Funds posting somewhat larger negatives. On a relative basis, each Fund lagged its respective Composite benchmark.

(For specific Fund results, please refer to the performance section of this report.) Overall, allocation decisions detracted from Composite-relative results, largely due to underweighting investment-grade debt. Allocations to portfolio diversifiers, such as the commodity and high-yield debt segments, also detracted; however, we believe such exposures remain important. Commodities may help protect against inflation, and Fund exposure to high-yield debt is an expression of value we see relative to investment-grade bonds. Selection effects also detracted, as the market proved challenging for a subset of underlying equity managers, particularly among U.S. large-cap growth investments. In the non-U.S. equity asset class, allocation decisions contributed to relative results overall; selection effects were mixed. At period end, our positions align with a view that the U.S. economy is experiencing signs of late cycle. We believe the environment remains favorable to risk assets and supports the Funds’ modest overweightings in equities and corporate credit, underweightings in core fixed income. We recently increased Fund exposure to emerging-markets equities, Treasury Inflation-Protected Securities and commodities, while reducing exposure to nominal bonds.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Note to Shareholders: On April 1, 2016, Fidelity

® Commodity Strategy Central Fund shifted from an index-tracking to an enhanced-index approach, providing the Funds greater investment flexibility in managing commodity exposure.

Strategic Advisers® Multi-Manager Income Fund

Investment Summary (Unaudited)

The information in the following tables is based on the direct investments of the Fund.

Fund Holdings as of March 31, 2016

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Domestic Equity Funds | | |

| Fidelity Series Commodity Strategy Fund Class F | 1.2 | 0.7 |

| Strategic Advisers Core Multi-Manager Fund Class F | 5.2 | 5.6 |

| Strategic Advisers Growth Multi-Manager Fund Class F | 4.3 | 4.6 |

| Strategic Advisers Small-Mid Cap Multi-Manager Fund Class F | 2.6 | 2.8 |

| Strategic Advisers Value Multi-Manager Fund Class F | 5.2 | 5.6 |

| | 18.5 | 19.3 |

| International Equity Funds | | |

| Strategic Advisers Emerging Markets Fund of Funds Class F | 4.5 | 3.3 |

| Strategic Advisers International Multi-Manager Fund Class F | 4.5 | 4.1 |

| | 9.0 | 7.4 |

| Bond Funds | | |

| Fidelity Series Emerging Markets Debt Fund Class F | 0.6 | 0.6 |

| Fidelity Series Floating Rate High Income Fund Class F | 0.2 | 0.2 |

| Fidelity Series Inflation-Protected Bond Index Fund Class F | 3.8 | 3.5 |

| Fidelity Series Real Estate Income Fund Class F | 0.5 | 0.5 |

| Strategic Advisers Core Income Multi-Manager Fund Class F | 38.9 | 41.0 |

| Strategic Advisers Income Opportunities Fund of Funds Class F | 3.0 | 3.2 |

| | 47.0 | 49.0 |

| Short-Term Funds | | |

| Fidelity Institutional Money Market Government Portfolio Institutional Class 0.27% | 16.5 | 0.0 |

| Fidelity Series Short-Term Credit Fund Class F | 9.0 | 7.3 |

| Fidelity Institutional Money Market Portfolio Class F 0.39% | 0.0 | 17.0 |

| | 25.5 | 24.3 |

| Net Other Assets (Liabilities) | 0.0 | 0.0 |

| | 100.0 | 100.0 |

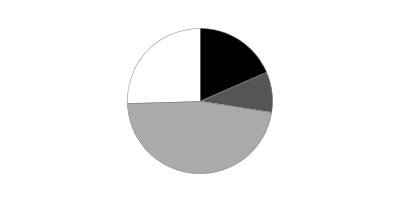

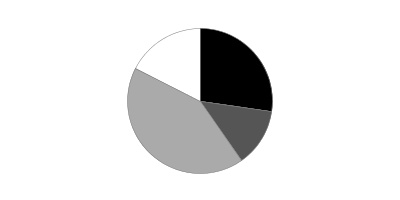

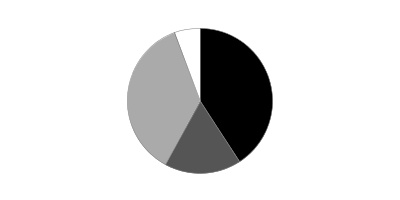

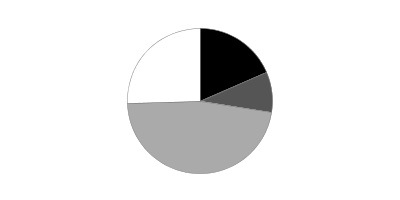

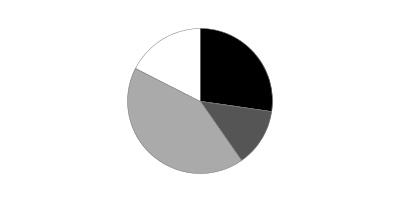

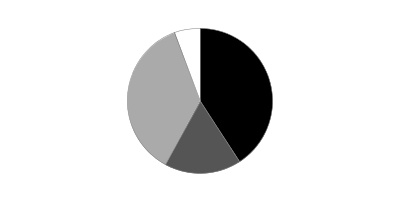

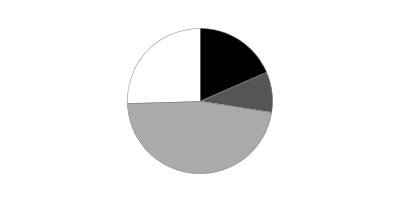

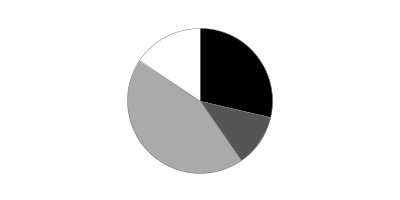

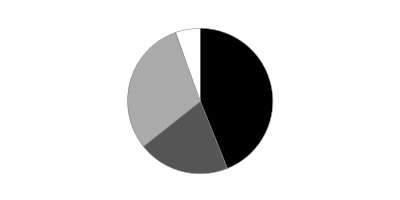

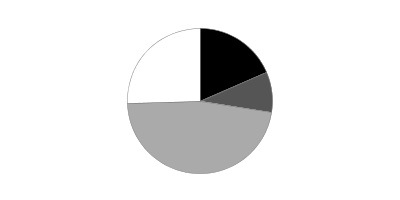

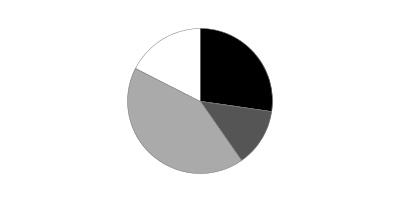

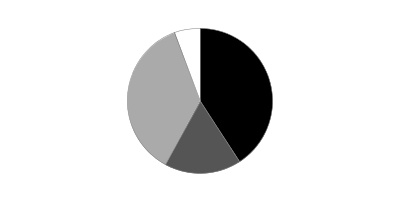

Asset Allocation (% of fund's net assets)

| Period end |

| | Domestic Equity Funds | 18.5% |

| | International Equity Funds | 9.0% |

| | Bond Funds | 47.0% |

| | Short-Term Funds | 25.5% |

| Six months ago |

| | Domestic Equity Funds | 19.3% |

| | International Equity Funds | 7.4% |

| | Bond Funds | 49.0% |

| | Short-Term Funds | 24.3% |

Domestic Equity Funds category includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments. Percentages shown as 0.0% may reflect amounts less than 0.05%.

Strategic Advisers® Multi-Manager Income Fund

Investments March 31, 2016

Showing Percentage of Net Assets

| Domestic Equity Funds - 18.5% | | | |

| | | Shares | Value |

| Fidelity Series Commodity Strategy Fund Class F (a)(b) | | 2,595 | $12,821 |

| Strategic Advisers Core Multi-Manager Fund Class F (b) | | 4,514 | 53,445 |

| Strategic Advisers Growth Multi-Manager Fund Class F (b) | | 3,436 | 44,598 |

| Strategic Advisers Small-Mid Cap Multi-Manager Fund Class F (b) | | 2,720 | 26,768 |

| Strategic Advisers Value Multi-Manager Fund Class F (b) | | 4,023 | 53,390 |

| TOTAL DOMESTIC EQUITY FUNDS | | | |

| (Cost $206,647) | | | 191,022 |

|

| International Equity Funds - 9.0% | | | |

| Strategic Advisers Emerging Markets Fund of Funds Class F (b) | | 5,430 | 45,826 |

| Strategic Advisers International Multi-Manager Fund Class F (b) | | 4,274 | 46,760 |

| TOTAL INTERNATIONAL EQUITY FUNDS | | | |

| (Cost $99,245) | | | 92,586 |

|

| Bond Funds - 47.0% | | | |

| Fidelity Series Emerging Markets Debt Fund Class F (b) | | 685 | 6,498 |

| Fidelity Series Floating Rate High Income Fund Class F (b) | | 287 | 2,578 |

| Fidelity Series Inflation-Protected Bond Index Fund Class F (b) | | 3,961 | 39,172 |

| Fidelity Series Real Estate Income Fund Class F (b) | | 456 | 4,962 |

| Strategic Advisers Core Income Multi-Manager Fund Class F (b) | | 40,625 | 400,970 |

| Strategic Advisers Income Opportunities Fund of Funds Class F (b) | | 3,363 | 31,145 |

| TOTAL BOND FUNDS | | | |

| (Cost $488,007) | | | 485,325 |

|

| Short-Term Funds - 25.5% | | | |

| Fidelity Institutional Money Market Government Portfolio Institutional Class 0.27% (b)(c) | | 170,557 | 170,557 |

| Fidelity Series Short-Term Credit Fund Class F (b) | | 9,252 | 92,426 |

| TOTAL SHORT-TERM FUNDS | | | |

| (Cost $262,919) | | | 262,983 |

| TOTAL INVESTMENT PORTFOLIO - 100.0% | | | |

| (Cost $1,056,818) | | | 1,031,916 |

| NET OTHER ASSETS (LIABILITIES) - 0.0% | | | (60) |

| NET ASSETS - 100% | | | $1,031,856 |

Legend

(a) Non-income producing

(b) Affiliated Fund

(c) The rate quoted is the annualized seven-day yield of the fund at period end.

Affiliated Underlying Funds

Information regarding the Fund's fiscal year to date purchases and sales of the affiliated Underlying Funds and income earned by the Fund from investments in affiliated Underlying Funds is as follows:

| Affiliate | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value, end of period |

| Fidelity Institutional Money Market Government Portfolio Institutional Class 0.27% | $- | $171,648 | $1,092 | $37 | $170,557 |

| Fidelity Institutional Money Market Portfolio Class F 0.39% | 156,406 | 83,354 | 239,759 | 355 | - |

| Fidelity Series Commodity Strategy Fund Class F | 9,834 | 7,799 | 3,052 | - | 12,821 |

| Fidelity Series Emerging Markets Debt Fund Class F | 6,076 | 1,890 | 1,258 | 426 | 6,498 |

| Fidelity Series Floating Rate High Income Fund Class F | 5,691 | 609 | 3,473 | 167 | 2,578 |

| Fidelity Series Inflation-Protected Bond Index Fund Class F | 39,687 | 7,605 | 8,569 | 81 | 39,172 |

| Fidelity Series Real Estate Income Fund Class F | 5,486 | 854 | 1,151 | 271 | 4,962 |

| Fidelity Series Short-Term Credit Fund Class F | 117,519 | 42,033 | 66,952 | 1,097 | 92,426 |

| Strategic Advisers Core Income Multi-Manager Fund Class F | 468,643 | 58,798 | 117,196 | 12,146 | 400,970 |

| Strategic Advisers Core Multi-Manager Fund Class F | 61,298 | 18,498 | 20,987 | 539 | 53,445 |

| Strategic Advisers Emerging Markets Fund of Funds Class F | 29,047 | 30,923 | 8,847 | 610 | 45,826 |

| Strategic Advisers Growth Multi-Manager Fund Class F | 50,991 | 14,307 | 17,313 | 253 | 44,598 |

| Strategic Advisers Income Opportunities Fund of Funds Class F | 38,623 | 6,008 | 9,274 | 2,023 | 31,145 |

| Strategic Advisers International Multi-Manager Fund Class F | 51,072 | 21,146 | 21,087 | 599 | 46,760 |

| Strategic Advisers Small-Mid Cap Multi-Manager Fund Class F | 30,902 | 10,926 | 9,853 | - | 26,768 |

| Strategic Advisers Value Multi-Manager Fund Class F | 61,542 | 17,513 | 19,874 | 721 | 53,390 |

| Total | $1,132,817 | $493,911 | $549,737 | $19,325 | $1,031,916 |

Investment Valuation

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Strategic Advisers® Multi-Manager Income Fund

Financial Statements

Statement of Assets and Liabilities

| | | March 31, 2016 |

| Assets | | |

| Investment in securities, at value (cost $1,056,818) — See accompanying schedule | | $1,031,916 |

| Receivable for investments sold | | 14,467 |

| Receivable for fund shares sold | | 1,771 |

| Total assets | | 1,048,154 |

| Liabilities | | |

| Payable for investments purchased | $16,237 | |

| Distribution and service plan fees payable | 22 | |

| Other affiliated payables | 39 | |

| Total liabilities | | 16,298 |

| Net Assets | | $1,031,856 |

| Net Assets consist of: | | |

| Paid in capital | | $1,070,619 |

| Undistributed net investment income | | 881 |

| Accumulated undistributed net realized gain (loss) on investments | | (14,742) |

| Net unrealized appreciation (depreciation) on investments | | (24,902) |

| Net Assets | | $1,031,856 |

| Multi-Manager Income: | | |

| Net Asset Value, offering price and redemption price per share ($821,653 ÷ 82,874 shares) | | $9.91 |

| Class L: | | |

| Net Asset Value, offering price and redemption price per share ($105,407 ÷ 10,630 shares) | | $9.92 |

| Class N: | | |

| Net Asset Value, offering price and redemption price per share ($104,796 ÷ 10,574 shares) | | $9.91 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended March 31, 2016 |

| Investment Income | | |

| Income distributions from underlying funds | | $19,325 |

| Expenses | | |

| Transfer agent fees | $550 | |

| Distribution and service plan fees | 260 | |

| Independent trustees' compensation | 5 | |

| Total expenses | | 815 |

| Net investment income (loss) | | 18,510 |

| Realized and Unrealized Gain (Loss) | | |

| Realized gain (loss) on sale of underlying fund shares | (19,163) | |

| Capital gain distributions from underlying funds | 13,741 | |

| Total net realized gain (loss) | | (5,422) |

| Change in net unrealized appreciation (depreciation) on underlying funds | | (25,916) |

| Net gain (loss) | | (31,338) |

| Net increase (decrease) in net assets resulting from operations | | $(12,828) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended March 31, 2016 | Year ended March 31, 2015 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $18,510 | $18,193 |

| Net realized gain (loss) | (5,422) | 28,823 |

| Change in net unrealized appreciation (depreciation) | (25,916) | (8,319) |

| Net increase (decrease) in net assets resulting from operations | (12,828) | 38,697 |

| Distributions to shareholders from net investment income | (18,299) | (18,452) |

| Distributions to shareholders from net realized gain | (21,320) | (18,460) |

| Total distributions | (39,619) | (36,912) |

| Share transactions - net increase (decrease) | (48,542) | 225,410 |

| Total increase (decrease) in net assets | (100,989) | 227,195 |

| Net Assets | | |

| Beginning of period | 1,132,845 | 905,650 |

| End of period (including undistributed net investment income of $881 and undistributed net investment income of $949, respectively) | $1,031,856 | $1,132,845 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Strategic Advisers Multi-Manager Income Fund

| Years ended March 31, | 2016 | 2015 | 2014 | 2013 A |

| Selected Per–Share Data | | | | |

| Net asset value, beginning of period | $10.33 | $10.29 | $10.14 | $10.00 |

| Income from Investment Operations | | | | |

| Net investment income (loss)B | .17 | .18 | .14 | .04 |

| Net realized and unrealized gain (loss) | (.24) | .22 | .24 | .13 |

| Total from investment operations | (.07) | .40 | .38 | .17 |

| Distributions from net investment income | (.16) | (.19) | (.12) | (.03) |

| Distributions from net realized gain | (.19) | (.18) | (.11) | – |

| Total distributions | (.35) | (.36)C | (.23) | (.03) |

| Net asset value, end of period | $9.91 | $10.33 | $10.29 | $10.14 |

| Total ReturnD,E | (.65)% | 3.98% | 3.79% | 1.71% |

| Ratios to Average Net AssetsF,G | | | | |

| Expenses before reductions | .05% | .05% | .06% | .15%H |

| Expenses net of fee waivers, if any | .05% | .05% | .06% | .06%H |

| Expenses net of all reductions | .05% | .05% | .06% | .06%H |

| Net investment income (loss) | 1.66% | 1.77% | 1.43% | 1.52%H |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $822 | $921 | $702 | $102 |

| Portfolio turnover rate F | 44% | 23% | 40% | 0%I |

A For the period December 20, 2012 (commencement of operations) to March 31, 2013.

B Calculated based on average shares outstanding during the period.

C Total distributions of $.36 per share is comprised of distributions from net investment income of $.186 and distributions from net realized gain of $.177 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Amounts do not include the activity of the Underlying Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the underlying funds in which the Fund invests.

H Annualized

I Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Strategic Advisers Multi-Manager Income Fund Class L

| Years ended March 31, | 2016 | 2015 | 2014 A |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $10.33 | $10.29 | $10.19 |

| Income from Investment Operations | | | |

| Net investment income (loss)B | .17 | .18 | .05 |

| Net realized and unrealized gain (loss) | (.23) | .22 | .15 |

| Total from investment operations | (.06) | .40 | .20 |

| Distributions from net investment income | (.16) | (.19) | (.04) |

| Distributions from net realized gain | (.19) | (.18) | (.06) |

| Total distributions | (.35) | (.36)C | (.10) |

| Net asset value, end of period | $9.92 | $10.33 | $10.29 |

| Total ReturnD | (.57)% | 3.97% | 2.00% |

| Ratios to Average Net AssetsE,F | | | |

| Expenses before reductions | .05% | .06% | .06%G |

| Expenses net of fee waivers, if any | .05% | .06% | .06%G |

| Expenses net of all reductions | .05% | .06% | .06%G |

| Net investment income (loss) | 1.66% | 1.77% | 1.62%G |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $105 | $106 | $102 |

| Portfolio turnover rate E | 44% | 23% | 40% |

A For the period December 4, 2013 (commencement of sale of shares) to March 31, 2014.

B Calculated based on average shares outstanding during the period.

C Total distributions of $.36 per share is comprised of distributions from net investment income of $.185 and distributions from net realized gain of $.177 per share.

D Total returns for periods of less than one year are not annualized.

E Amounts do not include the activity of the Underlying Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the underlying funds in which the Fund invests.

G Annualized

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Strategic Advisers Multi-Manager Income Fund Class N

| Years ended March 31, | 2016 | 2015 | 2014 A |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $10.33 | $10.29 | $10.19 |

| Income from Investment Operations | | | |

| Net investment income (loss)B | .14 | .16 | .04 |

| Net realized and unrealized gain (loss) | (.23) | .22 | .16 |

| Total from investment operations | (.09) | .38 | .20 |

| Distributions from net investment income | (.14) | (.16) | (.04) |

| Distributions from net realized gain | (.19) | (.18) | (.06) |

| Total distributions | (.33) | (.34) | (.10) |

| Net asset value, end of period | $9.91 | $10.33 | $10.29 |

| Total ReturnC | (.90)% | 3.71% | 1.94% |

| Ratios to Average Net AssetsD,E | | | |

| Expenses before reductions | .30% | .31% | .32%F |

| Expenses net of fee waivers, if any | .30% | .31% | .32%F |

| Expenses net of all reductions | .30% | .31% | .32%F |

| Net investment income (loss) | 1.41% | 1.52% | 1.36%F |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $105 | $106 | $102 |

| Portfolio turnover rateD | 44% | 23% | 40% |

A For the period December 4, 2013 (commencement of sale of shares) to March 31, 2014.

B Calculated based on average shares outstanding during the period.

C Total returns for periods of less than one year are not annualized.

D Amounts do not include the activity of the Underlying Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the underlying funds in which the Fund invests.

F Annualized

See accompanying notes which are an integral part of the financial statements.

Strategic Advisers® Multi-Manager 2005 Fund

Investment Summary (Unaudited)

The information in the following tables is based on the direct investments of the Fund.

Fund Holdings as of March 31, 2016

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Domestic Equity Funds | | |

| Fidelity Series Commodity Strategy Fund Class F | 1.3 | 0.7 |

| Strategic Advisers Core Multi-Manager Fund Class F | 7.8 | 8.4 |

| Strategic Advisers Growth Multi-Manager Fund Class F | 6.5 | 7.0 |

| Strategic Advisers Small-Mid Cap Multi-Manager Fund Class F | 3.9 | 4.2 |

| Strategic Advisers Value Multi-Manager Fund Class F | 7.8 | 8.4 |

| | 27.3 | 28.7 |

| International Equity Funds | | |

| Strategic Advisers Emerging Markets Fund of Funds Class F | 5.5 | 4.3 |

| Strategic Advisers International Multi-Manager Fund Class F | 7.5 | 7.4 |

| | 13.0 | 11.7 |

| Bond Funds | | |

| Fidelity Series Emerging Markets Debt Fund Class F | 0.6 | 0.6 |

| Fidelity Series Floating Rate High Income Fund Class F | 0.3 | 0.2 |

| Fidelity Series Inflation-Protected Bond Index Fund Class F | 3.3 | 3.1 |

| Fidelity Series Real Estate Income Fund Class F | 0.5 | 0.5 |

| Strategic Advisers Core Income Multi-Manager Fund Class F | 34.5 | 36.3 |

| Strategic Advisers Income Opportunities Fund of Funds Class F | 3.0 | 3.2 |

| | 42.2 | 43.9 |

| Short-Term Funds | | |

| Fidelity Institutional Money Market Government Portfolio Institutional Class 0.27% | 11.4 | 0.0 |

| Fidelity Series Short-Term Credit Fund Class F | 6.1 | 4.7 |

| Fidelity Institutional Money Market Portfolio Class F 0.39% | 0.0 | 11.0 |

| | 17.5 | 15.7 |

| Net Other Assets (Liabilities) | 0.0 | 0.0 |

| | 100.0 | 100.0 |

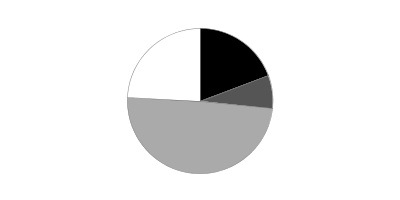

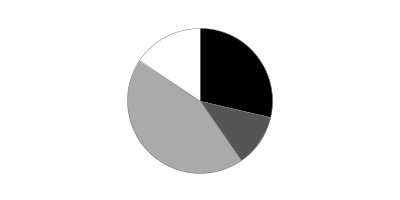

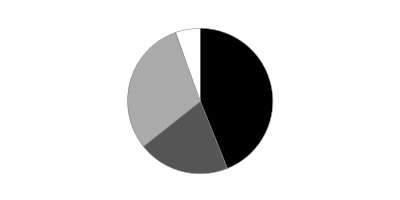

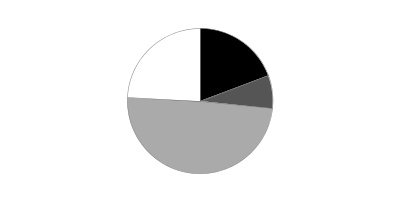

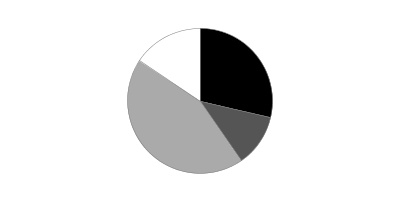

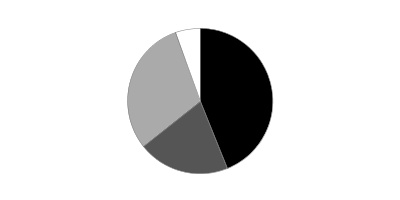

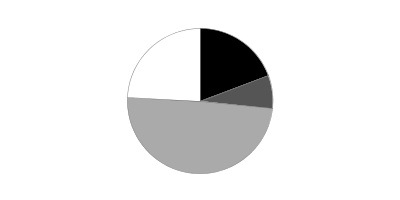

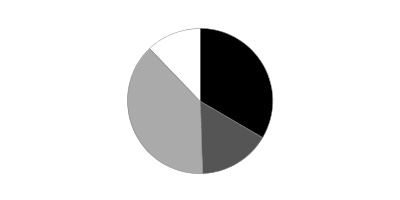

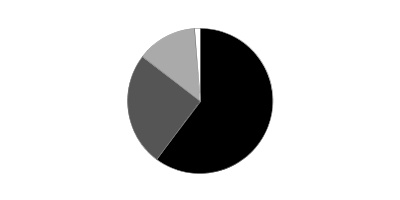

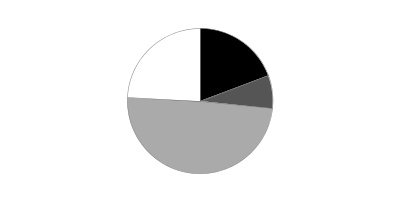

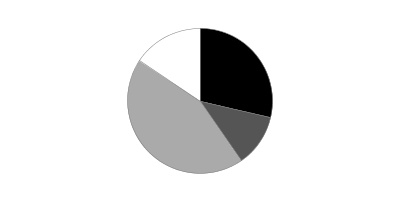

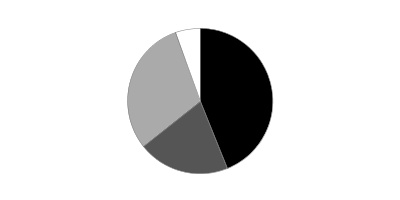

Asset Allocation (% of fund's net assets)

| Period end |

| | Domestic Equity Funds | 27.3% |

| | International Equity Funds | 13.0% |

| | Bond Funds | 42.2% |

| | Short-Term Funds | 17.5% |

| Six months ago |

| | Domestic Equity Funds | 28.7% |

| | International Equity Funds | 11.7% |

| | Bond Funds | 43.9% |

| | Short-Term Funds | 15.7% |

Domestic Equity Funds category includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments. Percentages shown as 0.0% may reflect amounts less than 0.05%.

Strategic Advisers® Multi-Manager 2005 Fund

Investments March 31, 2016

Showing Percentage of Net Assets

| Domestic Equity Funds - 27.3% | | | |

| | | Shares | Value |

| Fidelity Series Commodity Strategy Fund Class F (a)(b) | | 880 | $4,349 |

| Strategic Advisers Core Multi-Manager Fund Class F (b) | | 2,277 | 26,954 |

| Strategic Advisers Growth Multi-Manager Fund Class F (b) | | 1,733 | 22,492 |

| Strategic Advisers Small-Mid Cap Multi-Manager Fund Class F (b) | | 1,372 | 13,500 |

| Strategic Advisers Value Multi-Manager Fund Class F (b) | | 2,029 | 26,926 |

| TOTAL DOMESTIC EQUITY FUNDS | | | |

| (Cost $100,202) | | | 94,221 |

|

| International Equity Funds - 13.0% | | | |

| Strategic Advisers Emerging Markets Fund of Funds Class F (b) | | 2,253 | 19,015 |

| Strategic Advisers International Multi-Manager Fund Class F (b) | | 2,364 | 25,864 |

| TOTAL INTERNATIONAL EQUITY FUNDS | | | |

| (Cost $48,267) | | | 44,879 |

|

| Bond Funds - 42.2% | | | |

| Fidelity Series Emerging Markets Debt Fund Class F (b) | | 230 | 2,184 |

| Fidelity Series Floating Rate High Income Fund Class F (b) | | 95 | 850 |

| Fidelity Series Inflation-Protected Bond Index Fund Class F (b) | | 1,160 | 11,468 |

| Fidelity Series Real Estate Income Fund Class F (b) | | 153 | 1,668 |

| Strategic Advisers Core Income Multi-Manager Fund Class F (b) | | 12,047 | 118,898 |

| Strategic Advisers Income Opportunities Fund of Funds Class F (b) | | 1,120 | 10,370 |

| TOTAL BOND FUNDS | | | |

| (Cost $146,560) | | | 145,438 |

|

| Short-Term Funds - 17.5% | | | |

| Fidelity Institutional Money Market Government Portfolio Institutional Class 0.27% (b)(c) | | 39,271 | 39,271 |

| Fidelity Series Short-Term Credit Fund Class F (b) | | 2,107 | 21,047 |

| TOTAL SHORT-TERM FUNDS | | | |

| (Cost $60,305) | | | 60,318 |

| TOTAL INVESTMENT PORTFOLIO - 100.0% | | | |

| (Cost $355,334) | | | 344,856 |

| NET OTHER ASSETS (LIABILITIES) - 0.0% | | | (36) |

| NET ASSETS - 100% | | | $344,820 |

Legend

(a) Non-income producing

(b) Affiliated Fund

(c) The rate quoted is the annualized seven-day yield of the fund at period end.

Affiliated Underlying Funds

Information regarding the Fund's fiscal year to date purchases and sales of the affiliated Underlying Funds and income earned by the Fund from investments in affiliated Underlying Funds is as follows:

| Affiliate | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value, end of period |

| Fidelity Institutional Money Market Government Portfolio Institutional Class 0.27% | $- | $39,276 | $4 | $8 | $39,271 |

| Fidelity Institutional Money Market Portfolio Class F 0.39% | 28,335 | 27,324 | 55,659 | 75 | - |

| Fidelity Series Commodity Strategy Fund Class F | 2,677 | 2,937 | 688 | - | 4,349 |

| Fidelity Series Emerging Markets Debt Fund Class F | 2,044 | 782 | 585 | 140 | 2,184 |

| Fidelity Series Floating Rate High Income Fund Class F | 1,673 | 319 | 1,064 | 52 | 850 |

| Fidelity Series Inflation-Protected Bond Index Fund Class F | 10,183 | 4,092 | 2,937 | 22 | 11,468 |

| Fidelity Series Real Estate Income Fund Class F | 1,620 | 558 | 443 | 86 | 1,668 |

| Fidelity Series Short-Term Credit Fund Class F | 21,364 | 13,552 | 13,837 | 228 | 21,047 |

| Strategic Advisers Core Income Multi-Manager Fund Class F | 121,790 | 39,963 | 40,504 | 3,422 | 118,898 |

| Strategic Advisers Core Multi-Manager Fund Class F | 28,235 | 13,274 | 11,900 | 275 | 26,954 |

| Strategic Advisers Emerging Markets Fund of Funds Class F | 12,746 | 12,198 | 3,737 | 252 | 19,015 |

| Strategic Advisers Growth Multi-Manager Fund Class F | 23,499 | 10,457 | 9,873 | 131 | 22,492 |

| Strategic Advisers Income Opportunities Fund of Funds Class F | 11,811 | 3,869 | 3,973 | 649 | 10,370 |

| Strategic Advisers International Multi-Manager Fund Class F | 26,468 | 13,197 | 11,450 | 356 | 25,864 |

| Strategic Advisers Small-Mid Cap Multi-Manager Fund Class F | 14,257 | 7,246 | 5,576 | - | 13,500 |

| Strategic Advisers Value Multi-Manager Fund Class F | 28,345 | 12,278 | 10,919 | 368 | 26,926 |

| Total | $335,047 | $201,322 | $173,149 | $6,064 | $344,856 |

Investment Valuation

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Strategic Advisers® Multi-Manager 2005 Fund

Financial Statements

Statement of Assets and Liabilities

| | | March 31, 2016 |

| Assets | | |

| Investment in securities, at value (cost $355,334) — See accompanying schedule | | $344,856 |

| Receivable for investments sold | | 5,680 |

| Total assets | | 350,536 |

| Liabilities | | |

| Payable for investments purchased | $5,682 | |

| Distribution and service plan fees payable | 22 | |

| Other affiliated payables | 12 | |

| Total liabilities | | 5,716 |

| Net Assets | | $344,820 |

| Net Assets consist of: | | |

| Paid in capital | | $359,353 |

| Undistributed net investment income | | 819 |

| Accumulated undistributed net realized gain (loss) on investments | | (4,874) |

| Net unrealized appreciation (depreciation) on investments | | (10,478) |

| Net Assets | | $344,820 |

| Multi-Manager 2005: | | |

| Net Asset Value, offering price and redemption price per share ($133,309 ÷ 13,361 shares) | | $9.98 |

| Class L: | | |

| Net Asset Value, offering price and redemption price per share ($106,062 ÷ 10,639 shares) | | $9.97 |

| Class N: | | |

| Net Asset Value, offering price and redemption price per share ($105,449 ÷ 10,584 shares) | | $9.96 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended March 31, 2016 |

| Investment Income | | |

| Income distributions from underlying funds | | $6,064 |

| Expenses | | |

| Transfer agent fees | $281 | |

| Distribution and service plan fees | 263 | |

| Independent trustees' compensation | 1 | |

| Total expenses | | 545 |

| Net investment income (loss) | | 5,519 |

| Realized and Unrealized Gain (Loss) | | |

| Realized gain (loss) on sale of underlying fund shares | (7,530) | |

| Capital gain distributions from underlying funds | 6,832 | |

| Total net realized gain (loss) | | (698) |

| Change in net unrealized appreciation (depreciation) on underlying funds | | (10,838) |

| Net gain (loss) | | (11,536) |

| Net increase (decrease) in net assets resulting from operations | | $(6,017) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended March 31, 2016 | Year ended March 31, 2015 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $5,519 | $5,382 |

| Net realized gain (loss) | (698) | 15,183 |

| Change in net unrealized appreciation (depreciation) | (10,838) | (5,527) |

| Net increase (decrease) in net assets resulting from operations | (6,017) | 15,038 |

| Distributions to shareholders from net investment income | (5,516) | (5,317) |

| Distributions to shareholders from net realized gain | (10,129) | (11,687) |

| Total distributions | (15,645) | (17,004) |

| Share transactions - net increase (decrease) | 31,453 | 17,249 |

| Total increase (decrease) in net assets | 9,791 | 15,283 |

| Net Assets | | |

| Beginning of period | 335,029 | 319,746 |

| End of period (including undistributed net investment income of $819 and undistributed net investment income of $894, respectively) | $344,820 | $335,029 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Strategic Advisers Multi-Manager 2005 Fund

| Years ended March 31, | 2016 | 2015 | 2014 | 2013 A |

| Selected Per–Share Data | | | | |

| Net asset value, beginning of period | $10.58 | $10.65 | $10.27 | $10.00 |

| Income from Investment Operations | | | | |

| Net investment income (loss)B | .16 | .19 | .14 | .05 |

| Net realized and unrealized gain (loss) | (.30) | .31 | .49 | .22 |

| Total from investment operations | (.14) | .50 | .63 | .27 |

| Distributions from net investment income | (.16) | (.19) | (.10) | – |

| Distributions from net realized gain | (.30) | (.39) | (.15) | – |

| Total distributions | (.46) | (.57)C | (.25) | – |

| Net asset value, end of period | $9.98 | $10.58 | $10.65 | $10.27 |

| Total ReturnD,E | (1.34)% | 4.83% | 6.18% | 2.70% |

| Ratios to Average Net AssetsF,G | | | | |

| Expenses before reductions | .06% | .05% | .06% | .15%H |

| Expenses net of fee waivers, if any | .06% | .05% | .06% | .06%H |

| Expenses net of all reductions | .06% | .05% | .06% | .06%H |

| Net investment income (loss) | 1.63% | 1.76% | 1.32% | 1.63%H |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $133 | $120 | $115 | $103 |

| Portfolio turnover rateF | 48% | 17% | 44% | 1%I |

A For the period December 20, 2012 (commencement of operations) to March 31, 2013.

B Calculated based on average shares outstanding during the period.

C Total distributions of $.57 per share is comprised of distributions from net investment income of $.186 and distributions from net realized gain of $.385 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Amounts do not include the activity of the Underlying Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the underlying funds in which the Fund invests.

H Annualized

I Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Strategic Advisers Multi-Manager 2005 Fund Class L

| Years ended March 31, | 2016 | 2015 | 2014 A |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $10.57 | $10.64 | $10.51 |

| Income from Investment Operations | | | |

| Net investment income (loss)B | .16 | .18 | .06 |

| Net realized and unrealized gain (loss) | (.30) | .32 | .22 |

| Total from investment operations | (.14) | .50 | .28 |

| Distributions from net investment income | (.16) | (.18) | (.06) |

| Distributions from net realized gain | (.30) | (.39) | (.09) |

| Total distributions | (.46) | (.57) | (.15) |

| Net asset value, end of period | $9.97 | $10.57 | $10.64 |

| Total ReturnC,D | (1.39)% | 4.79% | 2.64% |

| Ratios to Average Net AssetsE,F | | | |

| Expenses before reductions | .09% | .10% | .07%G |

| Expenses net of fee waivers, if any | .09% | .10% | .07%G |

| Expenses net of all reductions | .09% | .10% | .07%G |

| Net investment income (loss) | 1.59% | 1.71% | 1.90%G |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $106 | $108 | $103 |

| Portfolio turnover rateE | 48% | 17% | 44% |

A For the period December 4, 2013 (commencement of sale of shares) to March 31, 2014.

B Calculated based on average shares outstanding during the period.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Amounts do not include the activity of the Underlying Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the underlying funds in which the Fund invests.

G Annualized

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Strategic Advisers Multi-Manager 2005 Fund Class N

| Years ended March 31, | 2016 | 2015 | 2014 A |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $10.56 | $10.63 | $10.51 |

| Income from Investment Operations | | | |

| Net investment income (loss)B | .14 | .16 | .05 |

| Net realized and unrealized gain (loss) | (.31) | .31 | .21 |

| Total from investment operations | (.17) | .47 | .26 |

| Distributions from net investment income | (.13) | (.16) | (.06) |

| Distributions from net realized gain | (.30) | (.39) | (.09) |

| Total distributions | (.43) | (.54)C | (.14)D |

| Net asset value, end of period | $9.96 | $10.56 | $10.63 |

| Total ReturnE,F | (1.64)% | 4.53% | 2.52% |

| Ratios to Average Net AssetsG,H | | | |

| Expenses before reductions | .34% | .35% | .33%I |

| Expenses net of fee waivers, if any | .34% | .35% | .33%I |

| Expenses net of all reductions | .34% | .35% | .33%I |

| Net investment income (loss) | 1.34% | 1.46% | 1.65%I |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $105 | $107 | $103 |

| Portfolio turnover rateG | 48% | 17% | 44% |

A For the period December 4, 2013 (commencement of sale of shares) to March 31, 2014.

B Calculated based on average shares outstanding during the period.

C Total distributions of $.54 per share is comprised of distributions from net investment income of $.155 and distributions from net realized gain of $.385 per share.

D Total distributions of $.14 per share is comprised of distributions from net investment income of $.055 and distributions from net realized gain of $.088 per share.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Amounts do not include the activity of the Underlying Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the underlying funds in which the Fund invests.

I Annualized

See accompanying notes which are an integral part of the financial statements.

Strategic Advisers® Multi-Manager 2010 Fund

Investment Summary (Unaudited)

The information in the following tables is based on the direct investments of the Fund.

Fund Holdings as of March 31, 2016

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Domestic Equity Funds | | |

| Fidelity Series Commodity Strategy Fund Class F | 1.2 | 0.7 |

| Strategic Advisers Core Multi-Manager Fund Class F | 9.7 | 10.2 |

| Strategic Advisers Growth Multi-Manager Fund Class F | 8.1 | 8.6 |

| Strategic Advisers Small-Mid Cap Multi-Manager Fund Class F | 4.8 | 5.1 |

| Strategic Advisers Value Multi-Manager Fund Class F | 9.7 | 10.3 |

| | 33.5 | 34.9 |

| International Equity Funds | | |

| Strategic Advisers Emerging Markets Fund of Funds Class F | 6.3 | 5.1 |

| Strategic Advisers International Multi-Manager Fund Class F | 9.6 | 9.5 |

| | 15.9 | 14.6 |

| Bond Funds | | |

| Fidelity Series Emerging Markets Debt Fund Class F | 0.6 | 0.6 |

| Fidelity Series Floating Rate High Income Fund Class F | 0.3 | 0.3 |

| Fidelity Series Inflation-Protected Bond Index Fund Class F | 2.7 | 2.4 |

| Fidelity Series Real Estate Income Fund Class F | 0.5 | 0.5 |

| Strategic Advisers Core Income Multi-Manager Fund Class F | 31.4 | 33.2 |

| Strategic Advisers Income Opportunities Fund of Funds Class F | 3.0 | 3.2 |

| | 38.5 | 40.2 |

| Short-Term Funds | | |

| Fidelity Institutional Money Market Government Portfolio Institutional Class 0.27% | 7.8 | 0.0 |

| Fidelity Series Short-Term Credit Fund Class F | 4.3 | 3.1 |

| Fidelity Institutional Money Market Portfolio Class F 0.39% | 0.0 | 7.2 |

| | 12.1 | 10.3 |

| Net Other Assets (Liabilities) | 0.0 | 0.0 |

| | 100.0 | 100.0 |

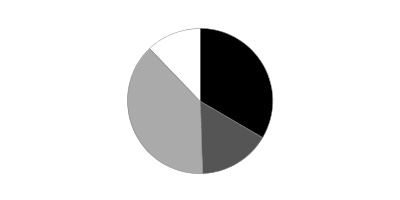

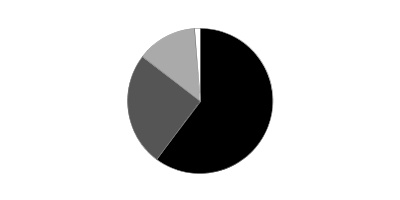

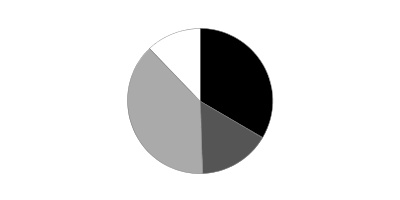

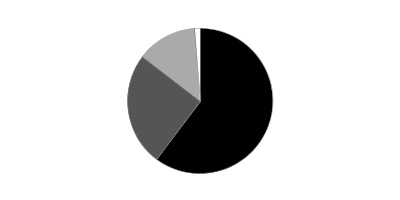

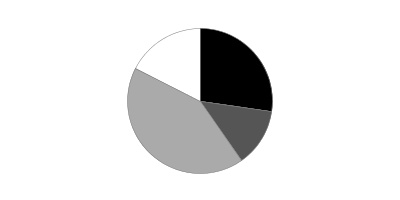

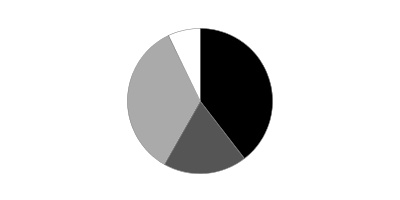

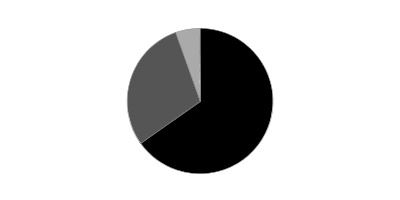

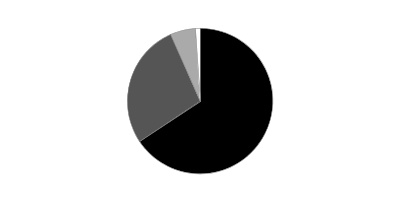

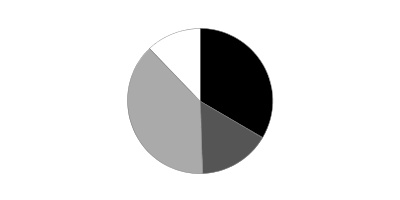

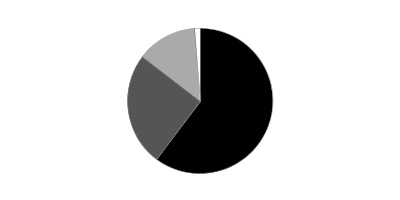

Asset Allocation (% of fund's net assets)

| Period end |

| | Domestic Equity Funds | 33.5% |

| | International Equity Funds | 15.9% |

| | Bond Funds | 38.5% |

| | Short-Term Funds | 12.1% |

| Six months ago |

| | Domestic Equity Funds | 34.9% |

| | International Equity Funds | 14.6% |

| | Bond Funds | 40.2% |

| | Short-Term Funds | 10.3% |

Domestic Equity Funds category includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments. Percentages shown as 0.0% may reflect amounts less than 0.05%.

Strategic Advisers® Multi-Manager 2010 Fund

Investments March 31, 2016

Showing Percentage of Net Assets

| Domestic Equity Funds - 33.5% | | | |

| | | Shares | Value |

| Fidelity Series Commodity Strategy Fund Class F (a)(b) | | 1,979 | $9,775 |

| Strategic Advisers Core Multi-Manager Fund Class F (b) | | 6,398 | 75,753 |

| Strategic Advisers Growth Multi-Manager Fund Class F (b) | | 4,870 | 63,213 |

| Strategic Advisers Small-Mid Cap Multi-Manager Fund Class F (b) | | 3,856 | 37,941 |

| Strategic Advisers Value Multi-Manager Fund Class F (b) | | 5,703 | 75,674 |

| TOTAL DOMESTIC EQUITY FUNDS | | | |

| (Cost $285,314) | | | 262,356 |

|

| International Equity Funds - 15.9% | | | |

| Strategic Advisers Emerging Markets Fund of Funds Class F (b) | | 5,877 | 49,602 |

| Strategic Advisers International Multi-Manager Fund Class F (b) | | 6,865 | 75,106 |

| TOTAL INTERNATIONAL EQUITY FUNDS | | | |

| (Cost $135,950) | | | 124,708 |

|

| Bond Funds - 38.5% | | | |

| Fidelity Series Emerging Markets Debt Fund Class F (b) | | 522 | 4,958 |

| Fidelity Series Floating Rate High Income Fund Class F (b) | | 217 | 1,952 |

| Fidelity Series Inflation-Protected Bond Index Fund Class F (b) | | 2,152 | 21,280 |

| Fidelity Series Real Estate Income Fund Class F (b) | | 348 | 3,787 |

| Strategic Advisers Core Income Multi-Manager Fund Class F (b) | | 24,942 | 246,174 |

| Strategic Advisers Income Opportunities Fund of Funds Class F (b) | | 2,529 | 23,422 |

| TOTAL BOND FUNDS | | | |

| (Cost $304,875) | | | 301,573 |

|

| Short-Term Funds - 12.1% | | | |

| Fidelity Institutional Money Market Government Portfolio Institutional Class 0.27% (b)(c) | | 61,062 | 61,062 |

| Fidelity Series Short-Term Credit Fund Class F (b) | | 3,323 | 33,200 |

| TOTAL SHORT-TERM FUNDS | | | |

| (Cost $94,233) | | | 94,262 |

| TOTAL INVESTMENT PORTFOLIO - 100.0% | | | |

| (Cost $820,372) | | | 782,899 |

| NET OTHER ASSETS (LIABILITIES) - 0.0% | | | (50) |

| NET ASSETS - 100% | | | $782,849 |

Legend

(a) Non-income producing

(b) Affiliated Fund

(c) The rate quoted is the annualized seven-day yield of the fund at period end.

Affiliated Underlying Funds

Information regarding the Fund's fiscal year to date purchases and sales of the affiliated Underlying Funds and income earned by the Fund from investments in affiliated Underlying Funds is as follows:

| Affiliate | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value, end of period |

| Fidelity Institutional Money Market Government Portfolio Institutional Class 0.27% | $- | $61,070 | $7 | $12 | $61,062 |

| Fidelity Institutional Money Market Portfolio Class F 0.39% | 41,289 | 36,363 | 77,653 | 107 | - |

| Fidelity Series Commodity Strategy Fund Class F | 6,129 | 5,653 | 849 | - | 9,775 |

| Fidelity Series Emerging Markets Debt Fund Class F | 4,632 | 1,126 | 693 | 302 | 4,958 |

| Fidelity Series Floating Rate High Income Fund Class F | 3,829 | 467 | 2,179 | 114 | 1,952 |

| Fidelity Series Inflation-Protected Bond Index Fund Class F | 18,496 | 5,402 | 2,913 | 40 | 21,280 |

| Fidelity Series Real Estate Income Fund Class F | 3,681 | 770 | 526 | 184 | 3,787 |

| Fidelity Series Short-Term Credit Fund Class F | 31,175 | 19,450 | 17,399 | 324 | 33,200 |

| Strategic Advisers Core Income Multi-Manager Fund Class F | 255,378 | 49,438 | 54,136 | 6,759 | 246,174 |

| Strategic Advisers Core Multi-Manager Fund Class F | 78,985 | 22,697 | 19,710 | 663 | 75,753 |

| Strategic Advisers Emerging Markets Fund of Funds Class F | 35,151 | 24,177 | 4,132 | 607 | 49,602 |

| Strategic Advisers Growth Multi-Manager Fund Class F | 65,753 | 18,209 | 16,802 | 312 | 63,213 |

| Strategic Advisers Income Opportunities Fund of Funds Class F | 26,605 | 5,270 | 5,666 | 1,395 | 23,422 |

| Strategic Advisers International Multi-Manager Fund Class F | 76,863 | 24,607 | 19,549 | 950 | 75,106 |

| Strategic Advisers Small-Mid Cap Multi-Manager Fund Class F | 39,907 | 13,382 | 9,196 | - | 37,941 |

| Strategic Advisers Value Multi-Manager Fund Class F | 79,069 | 21,944 | 18,643 | 886 | 75,674 |

| Total | $766,942 | $310,025 | $250,053 | $12,655 | $782,899 |

Investment Valuation

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Strategic Advisers® Multi-Manager 2010 Fund

Financial Statements

Statement of Assets and Liabilities

| | | March 31, 2016 |

| Assets | | |