Exhibit 99.1

Susquehanna Bancshares, Inc.

Lititz, Pennsylvania

William J. Reuter – Chairman and CEO

Drew K. Hostetter – Chief Financial Officer

Michael M. Quick – Chief Corporate Credit Officer

Forward-Looking Statements

During the course of this presentation, we may make projections and other forward-looking statements regarding events or the future financial performance of Susquehanna, including the impact of the acquisitions of Abington Bancorp and Tower Bancorp, as well as projected capital ratios, efficiency ratios, net income and earnings. We wish to caution you that these forward-looking statements may differ materially from actual results due to a number of risks and uncertainties. For a more detailed description of the factors that may affect Susquehanna’s operating results, we refer you to our filings with the Securities & Exchange Commission, including our annual report on Form 10-K for the year ended December 31, 2011. Susquehanna assumes no obligation to update the forward-looking statements made during this presentation.

For more information, please visit our Web site at:

www.susquehanna.net

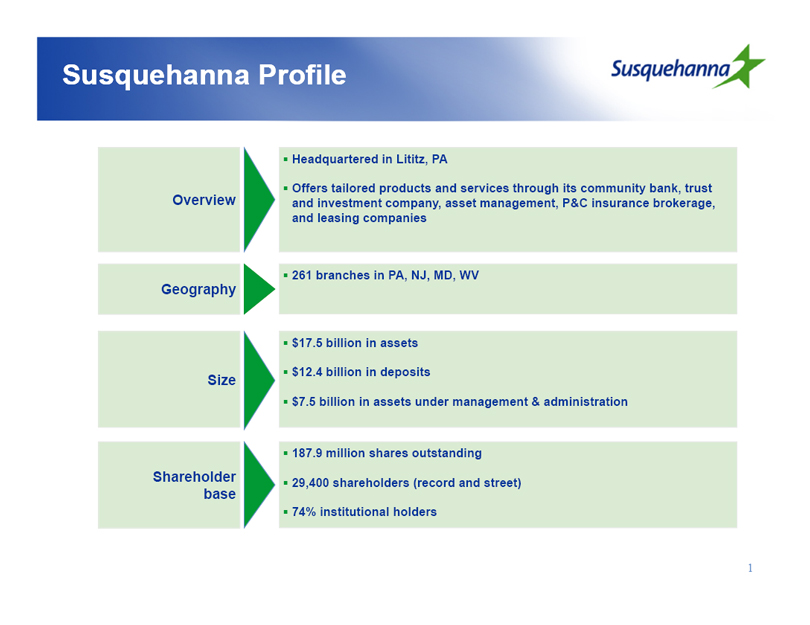

Susquehanna Profile

Overview

Headquartered in Lititz, PA

Offers tailored products and services through its community bank, trust and investment company, asset management, P&C insurance brokerage, and leasing companies

Geography

261 branches in PA, NJ, MD, WV

Size

$17.5 billion in assets

$12.4 billion in deposits

$7.5 billion in assets under management & administration

Shareholder base

187.9 million shares outstanding

29,400 shareholders (record and street)

74% institutional holders

1

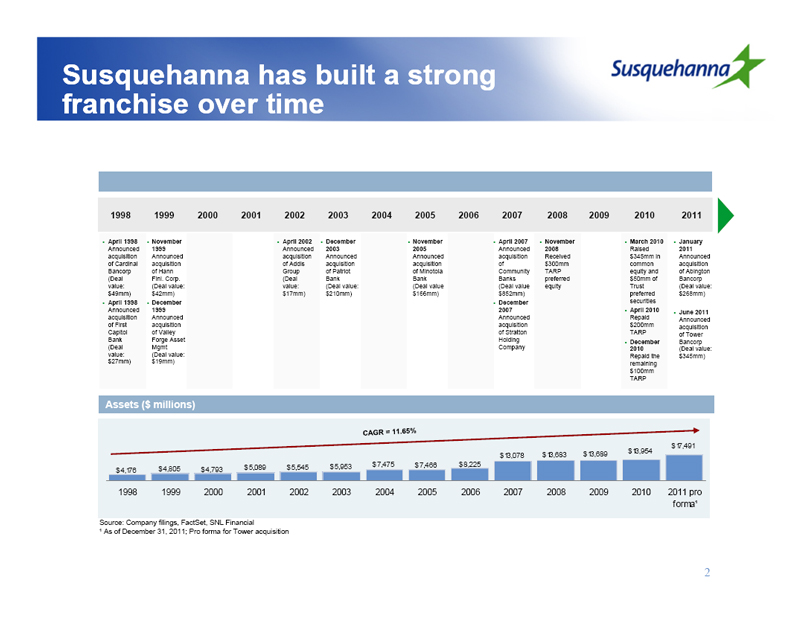

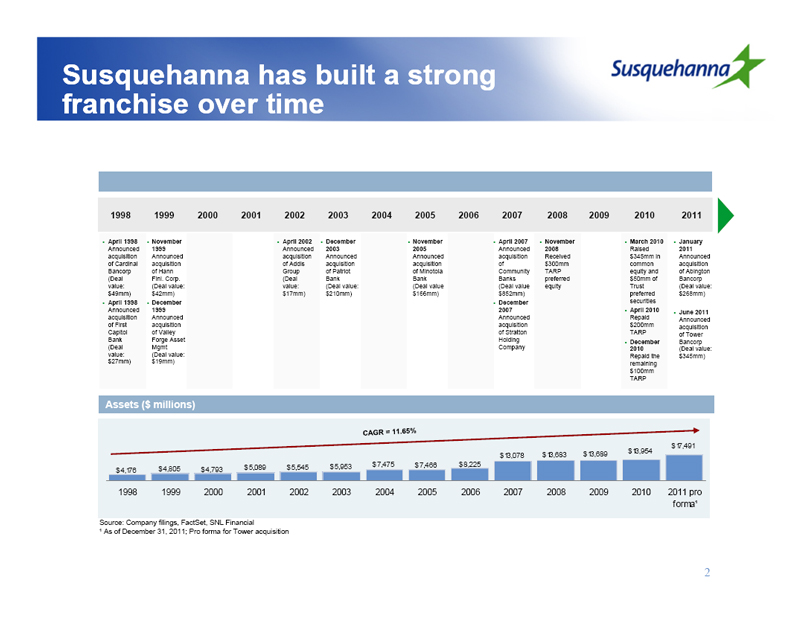

Susquehanna has built a strong franchise over time

1998

April 1998 Announced acquisition of Cardinal Bancorp (Deal value: $49mm)

April 1998 Announced acquisition of First Capitol Bank (Deal value: $27mm)

1999

November 1999 Announced acquisition of Hann Finl. Corp. (Deal value: $42mm)

December 1999 Announced acquisition of Valley Forge Asset Mgmt (Deal value: $19mm)

2000

2001

2002

April 2002 Announced acquisition of Addis Group (Deal value: $17mm)

2003

December 2003 Announced acquisition of Patriot Bank (Deal value: $210mm)

2004

2005

November 2005 Announced acquisition of Minotola Bank (Deal value $166mm)

2006

2007

April 2007 Announced acquisition of Community Banks (Deal value $852mm)

December 2007 Announced acquisition of Stratton Holding Company

2008

November 2008 Received $300mm TARP preferred equity

2009

March 2010 Raised $345mm in common equity and $50mm of Trust preferred securities

April 2010 Repaid $200mm TARP

December 2010 Repaid the remaining $100mm TARP

2011

January 2011 Announced acquisition of Abington Bancorp (Deal value: $268mm)

June 2011 Announced acquisition of Tower Bancorp (Deal value: $345mm)

Assets ($ millions)

CAGR = 11.65%

$4,176 $4,805 $4,793 $5,089 $5,545 $5,953 $7,475 $7,466 $8,225 $13,078 $13,683 $13,689 $13,954 $17,491

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 pro forma1

Source: Company filings, FactSet, SNL Financial

1 As of December 31, 2011; Pro forma for Tower acquisition

2

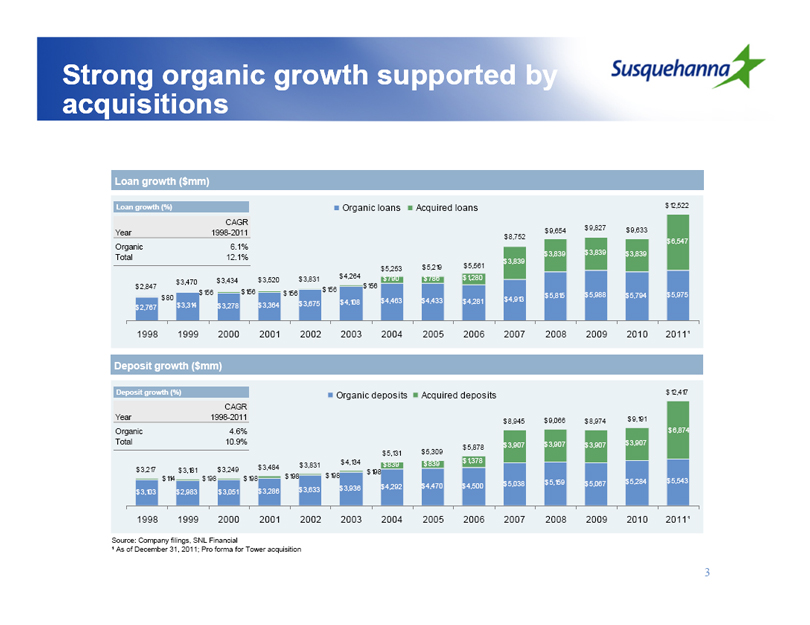

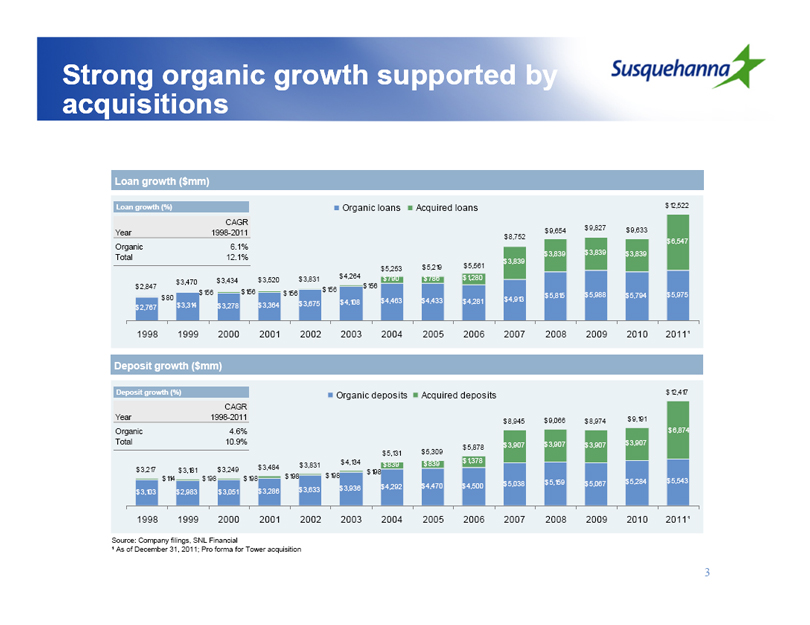

Strong organic growth supported by acquisitions

Loan growth ($mm)

Loan growth (%) Organic loans Acquired loans

Year CAGR 1998-2011

Organic 6.1%

Total 12.1%

$2,847 $3,470 $3,434 $3,520 $3,831 $4,264 $5,253 $5,219 $5,561 $8,752 $9,654 $9,827 $9,633 $12,522

$790 $786 $1,280 $3,839 $3,839 $3,839 $3,839 $6,547

$80 $156 $156 $156 $156 $156

$2,767 $3,314 $3,278 $3,364 $3,675 $4,108 $4,463 $4,433 $4,281 $4,913 $5,815 $5,988 $5,794 $5,975

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 20111

Deposit growth ($mm)

Deposit growth (%) Organic deposits Acquired deposits

Year CAGR 1998-2011

Organic 4.6%

Total 10.9%

$3,217 $3,181 $3,249 $3,484 $3,831 $4,134 $5,131 $5,309 $5,878 $ 8,945 $9,066 $8,974 $9,191 $12,417

$839 $839 $1,378 $3,907 $3,907 $3,907 $3,907 $6,874

$114 $198 $198 $198 $198 $198

$3,103 $2,983 $3,051 $3,286 $3,633 $3,936 $4,292 $4,470 $4,500 $5,038 $5,159 $5,067 $5,284 $5,543

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 20111

Source: Company filings, SNL Financial

1 As of December 31, 2011; Pro forma for Tower acquisition

3

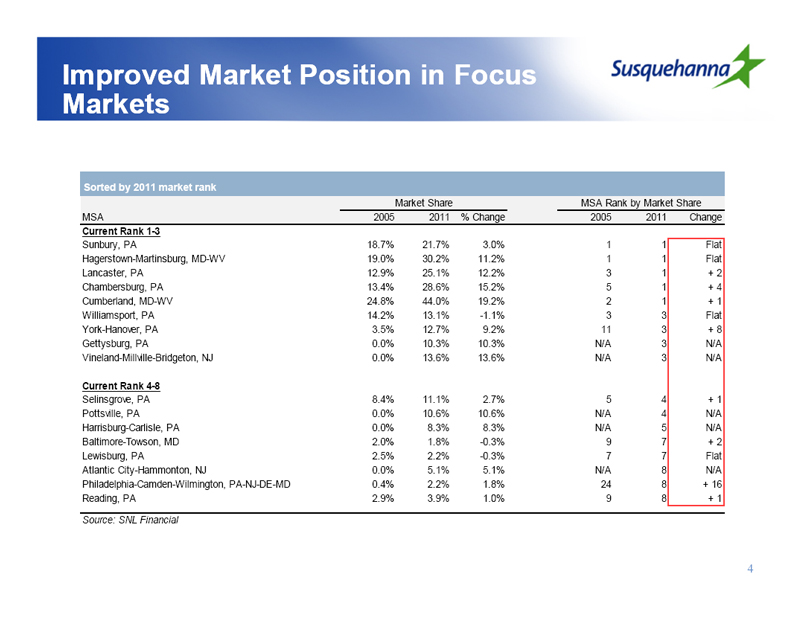

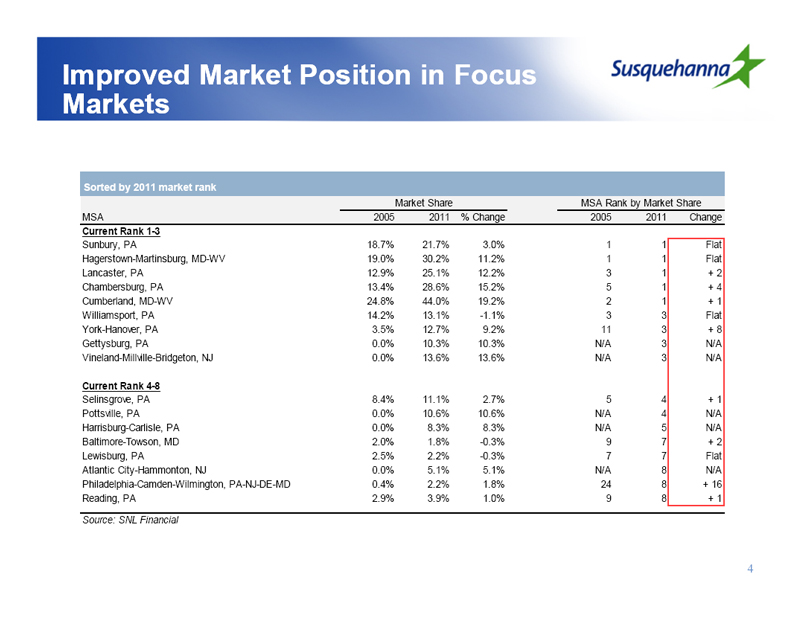

Improved Market Position in Focus Markets

Sorted by 2011 market rank

Market Share MSA Rank by Market Share

MSA 2005 2011 % Change 2005 2011 Change

Current Rank 1-3

Sunbury, PA 18.7% 21.7% 3.0% 1 1 Flat

Hagerstown-Martinsburg, MD-WV 19.0% 30.2% 11.2% 1 1 Flat

Lancaster, PA 12.9% 25.1% 12.2% 3 1 + 2

Chambersburg, PA 13.4% 28.6% 15.2% 5 1 + 4

Cumberland, MD-WV 24.8% 44.0% 19.2% 2 1 + 1

Williamsport, PA 14.2% 13.1% -1.1% 3 3 Flat

York-Hanover, PA 3.5% 12.7% 9.2% 11 3 + 8

Gettysburg, PA 0.0% 10.3% 10.3% N/A 3 N/A

Vineland-Millville-Bridgeton, NJ 0.0% 13.6% 13.6% N/A 3 N/A

Current Rank 4-8

Selinsgrove, PA 8.4% 11.1% 2.7% 5 4 + 1

Pottsville, PA 0.0% 10.6% 10.6% N/A 4 N/A

Harrisburg-Carlisle, PA 0.0% 8.3% 8.3% N/A 5 N/A

Baltimore-Towson, MD 2.0% 1.8% -0.3% 9 7 + 2

Lewisburg, PA 2.5% 2.2% -0.3% 7 7 Flat

Atlantic City-Hammonton, NJ 0.0% 5.1% 5.1% N/A 8 N/A

Philadelphia-Camden-Wilmington, PA-NJ-DE-MD 0.4% 2.2% 1.8% 24 8 + 16

Reading, PA 2.9% 3.9% 1.0% 9 8 + 1

Source: SNL Financial

4

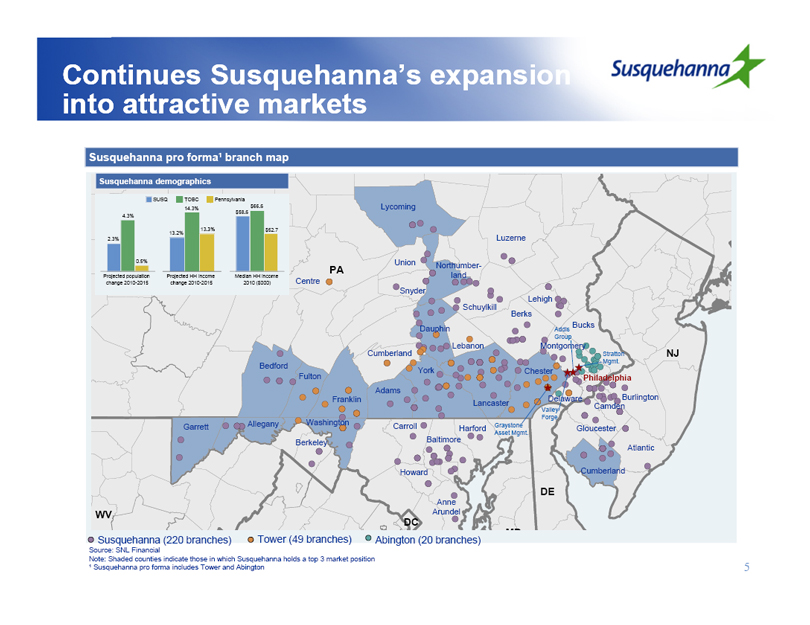

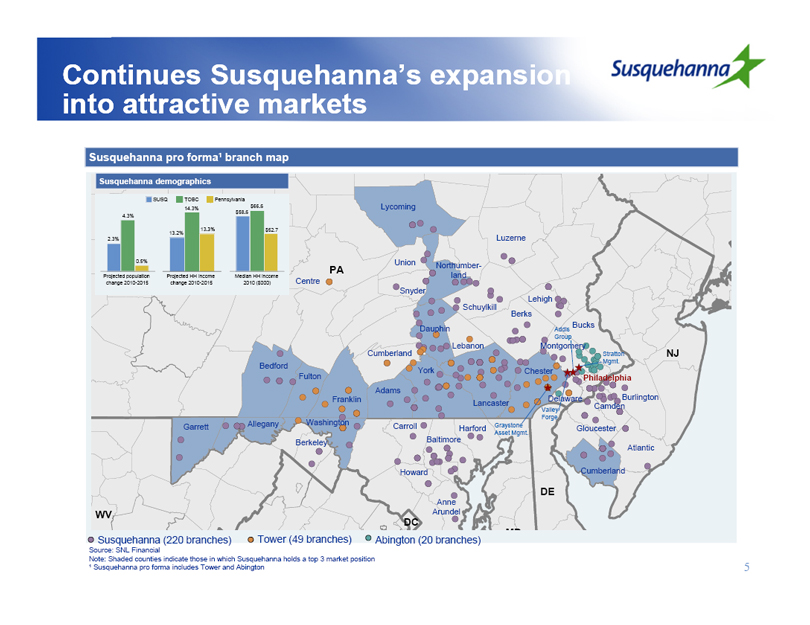

Continues Susquehanna’s expansion into attractive markets

Susquehanna pro forma1 branch map

Susquehanna demographics

SUSQ TOBC Pennsylvania

2.3% 4.3% 0.5%

Projected population change 2010-2015

13.2% 14.3% 13.3%

Projected HH income change 2010-2015

$58.6 $66.6 $52.7

Median HH income 2010 ($000)

Lycoming

Union

Berkeley

Luzerne

PA

Centre

Northumberland

Snyder

Schuylkill

Lehigh

Berks

Bucks

Addis Group

Dauphin

Cumberland

Lebanon

Addis Group

Montgomery

Stratton Mgmt.

NJ

Chester

York

Philadelphia

Bedford

Fulton

Franklin

Adams

Lancaster

Delaware

Burlington

Camden

Valley Forge

Garrett

Allegany

Washington

Carroll

Harford

Graystone Asset Mgmt.

Gloucester

Baltimore

Howard

Atlantic

Cumberland

Anne Arundel

DE

WV

DC

Susquehanna (220 branches) Tower (49 branches) Abington (20 branches)

Source: SNL Financial

Note: Shaded counties indicate those in which Susquehanna holds a top 3 market position

1 Susquehanna pro forma includes Tower and Abington

5

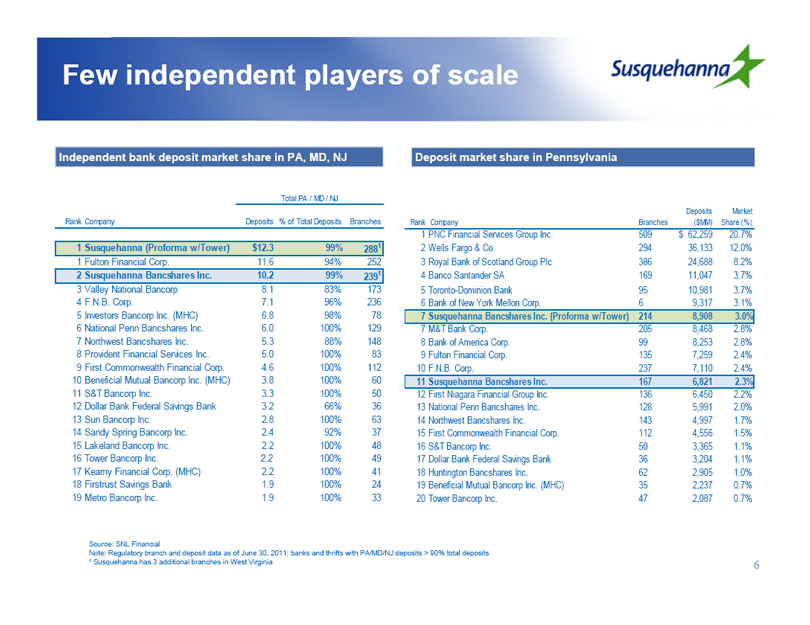

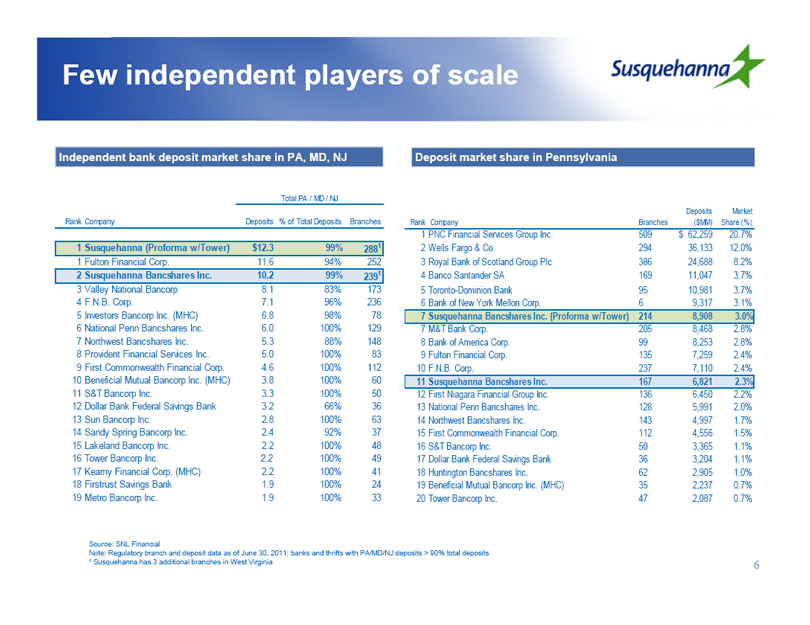

Few independent players of scale

Independent bank deposit market share in PA, MD, NJ

Total PA / MD / NJ

Rank Company Deposits % of Total Deposits Branches

1 Susquehanna (Proforma w/Tower) $12.3 99% 2881

1 Fulton Financial Corp. 11.6 94% 252

2 Susquehanna Bancshares Inc. 10.2 99% 2391

3 Valley National Bancorp 8.1 83% 173

4 F.N.B. Corp. 7.1 96% 236

5 Investors Bancorp Inc. (MHC) 6.8 98% 78

6 National Penn Bancshares Inc. 6.0 100% 129

7 Northwest Bancshares Inc. 5.3 88% 148

8 Provident Financial Services Inc. 5.0 100% 83

9 First Commonwealth Financial Corp. 4.6 100% 112

10 Beneficial Mutual Bancorp Inc. (MHC) 3.8 100% 60

11 S&T Bancorp Inc. 3.3 100% 50

12 Dollar Bank Federal Savings Bank 3.2 66% 36

13 Sun Bancorp Inc. 2.8 100% 63

14 Sandy Spring Bancorp Inc. 2.4 92% 37

15 Lakeland Bancorp Inc. 2.2 100% 48

16 Tower Bancorp Inc. 2.2 100% 49

17 Kearny Financial Corp. (MHC) 2.2 100% 41

18 Firstrust Savings Bank 1.9 100% 24

19 Metro Bancorp Inc. 1.9 100% 33

Deposit market share in Pennsylvania

Deposits Market

Rank Company Branches ($MM) Share (%)

1 PNC Financial Services Group Inc. 509 $ 62,259 20.7%

2 Wells Fargo & Co. 294 36,133 12.0%

3 Royal Bank of Scotland Group Plc 386 24,688 8.2%

4 Banco Santander SA 169 11,047 3.7%

5 Toronto-Dominion Bank 95 10,981 3.7%

6 Bank of New York Mellon Corp. 6 9,317 3.1%

7 Susquehanna Bancshares Inc. (Proforma w/Tower) 214 8,908 3.0%

7 M&T Bank Corp. 205 8,468 2.8%

8 Bank of America Corp. 99 8,253 2.8%

9 Fulton Financial Corp. 135 7,259 2.4%

10 F.N.B. Corp. 237 7,110 2.4%

11 Susquehanna Bancshares Inc. 167 6,821 2.3%

12 First Niagara Financial Group Inc. 136 6,450 2.2%

13 National Penn Bancshares Inc. 128 5,991 2.0%

14 Northwest Bancshares Inc. 143 4,997 1.7%

15 First Commonwealth Financial Corp. 112 4,556 1.5%

16 S&T Bancorp Inc. 50 3,365 1.1%

17 Dollar Bank Federal Savings Bank 36 3,204 1.1%

18 Huntington Bancshares Inc. 62 2,905 1.0%

19 Beneficial Mutual Bancorp Inc. (MHC) 35 2,237 0.7%

20 Tower Bancorp Inc. 47 2,087 0.7%

Source: SNL Financial

Note: Regulatory branch and deposit data as of June 30, 2011; banks and thrifts with PA/MD/NJ deposits > 90% total deposits

1 Susquehanna has 3 additional branches in West Virginia

6

Fourth Quarter Financial Highlights

Significant Improvement in Credit Quality

NCO/Average Loans = 0.95% versus 1.42% in 4Q10

NPA/Loans & OREO = 1.88% versus 2.23% at 12/31/10

Negative NPA Generation for the second consecutive quarter

Loan portfolio contraction halted, as net loans & leases grew 1% for the second consecutive quarter

Core deposits increased 4.2% from prior quarter

Strong capital position that meets fully-phased-in requirements of Basel III

7

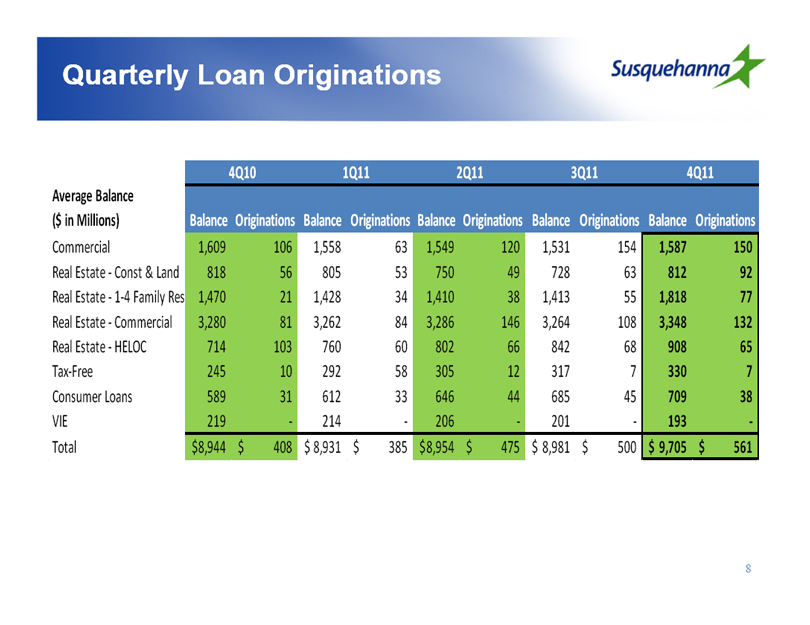

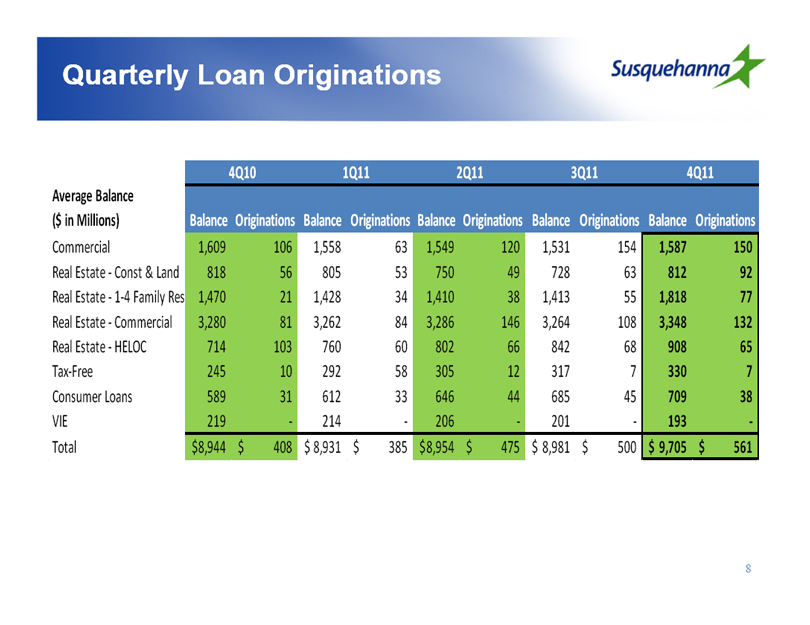

Quarterly Loan Originations

4Q10 1Q11 2Q11 3Q11 4Q11

Average Balance

($ in Millions) Balance Originations Balance Originations Balance Originations Balance Originations Balance Originations

Commercial 1,609 106 1,558 63 1,549 120 1,531 154 1,587 150

Real Estate - Const & Land 818 56 805 53 750 49 728 63 812 92

Real Estate - 1-4 Family Res 1,470 21 1,428 34 1,410 38 1,413 55 1,818 77

Real Estate - Commercial 3,280 81 3,262 84 3,286 146 3,264 108 3,348 132

Real Estate - HELOC 714 103 760 60 802 66 842 68 908 65

Tax-Free 245 10 292 58 305 12 317 7 330 7

Consumer Loans 589 31 612 33 646 44 685 45 709 38

VIE 219 - 214 - 206 - 201 - 193 -

Total $8,944 $408 $8,931 $385 $8,954 $475 $8,981 $500 $9,705 $561

8

Asset Quality

($ in Millions)

SUSQ Nonaccruals ABBC Nonaccruals

225 200 175 150 125 100

$197 $213 $191 $160 $8 $148

4Q10 1Q11 2Q11 3Q11 4Q11

SUSQ TDRs ABBC TDRs

125 100 75 50 25

$115 $78 $62 $62 $10 $63

4Q10 1Q11 2Q11 3Q11 4Q11

$215 $240 $219 $190 $197

$18 $27 $28 $30 $41

$197 $213 $191 $160 $156

2.23% 2.49% 2.26% 1.95% 1.88%

4Q10 1Q11 2Q11 3Q11 4Q11

Nonaccruals OREO Total NPAs/Total Loans & OREO

($ in millions) 4Q10 1Q11 2Q11 3Q11 4Q11

NPL’s Beginning of Period $227.4 $196.9 $212.9 $190.7 $160.1

Abington NPL’s $- $- $- $- $7.9

New NonAccruals $43.6 $61.2 $23.4 $20.4 $36.0

Cure/Exits/Other $(36.3) $(4.7) $(13.5) $(28.8) $(12.9)

Gross Charge-Offs $(25.9) $(27.4) $(21.7) $(14.8) $(22.9)

Transfer to OREO $(11.9) $(13.0) $(10.4) $(7.5) $(11.7)

NPL’s End of Period $196.9 $212.9 $190.7 $160.1 $156.5

9

Asset Quality

($ in Millions)

OAEM

360 350 340 330 320 310 300 290 280 270 260 250

$331 $333 $297 $278 $51 $299

4Q10 1Q11 2Q11 3Q11 4Q11

SUSQ OAEM ABBC OAEM

Substandard

540 520 500 480 460 440 420 400 380 360

$523 $529 $482 $436 $50 $384

4Q10 1Q11 2Q11 3Q11 4Q11

SUSQ Substandard ABBC Substandard

Past Due 30-89 days

90 80 70 60 50 40 30

$85 $86 $44 $39 $2 $57

4Q10 1Q11 2Q11 3Q11 4Q11

SUSQ Past Due 30-89 days ABBC Past Due 30-89 days

Past due days or more

25 20 15 10 5 0

$21 $10 $18 $13 $10

4Q10 1Q11 2Q11 3Q11 4Q11

SUSQ Past due days or more ABBC Past due days or more

10

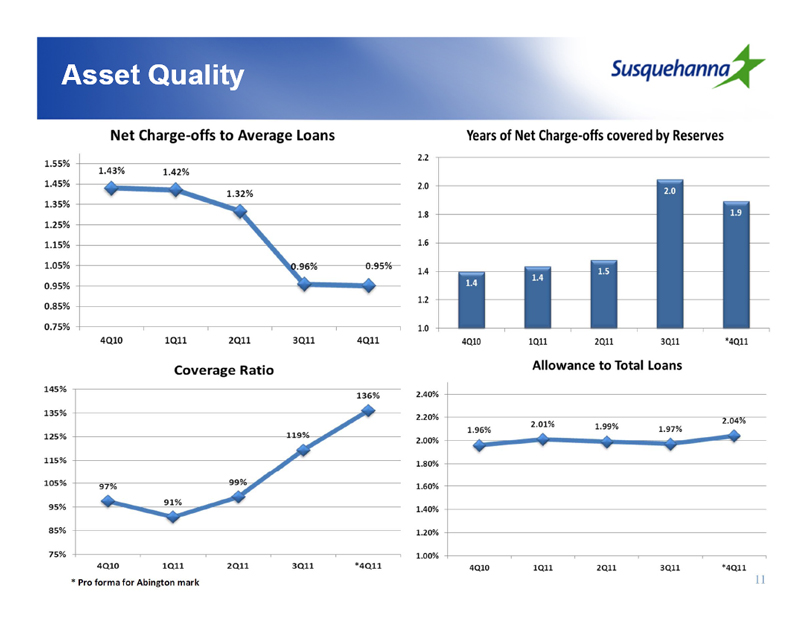

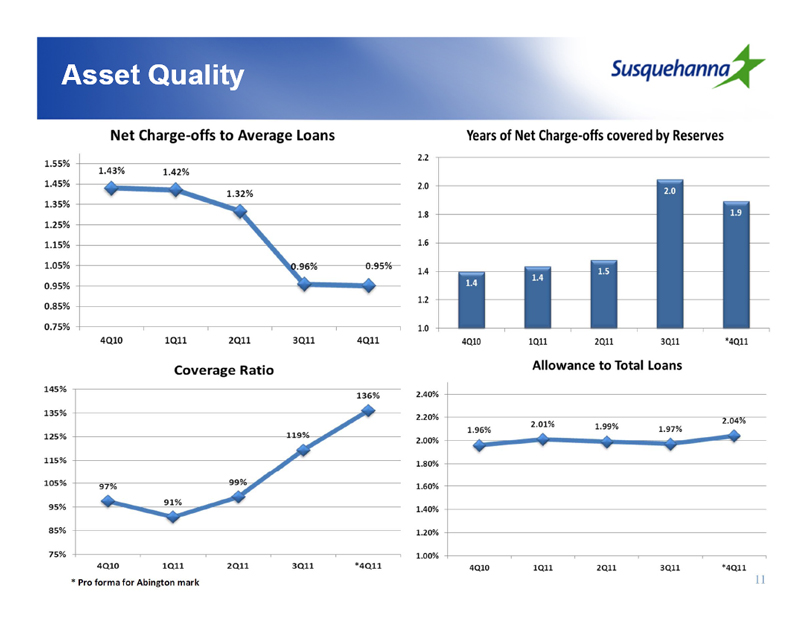

Asset Quality

Net Charge-offs to Average Loans

1.55% 1.45% 1.35% 1.25% 1.15% 1.05% 0.95% 0.85% 0.75%

1.43% 1.42% 1.32% 0.96% 0.95%

4Q10 1Q11 2Q11 3Q11 4Q11

Year of Net Charge-offs covered by Reserves

2.2 2.0 1.8 1.6 1.4 1.2 1.0

1.4 1.4 1.5 2.0 1.9

4Q10 1Q11 2Q11 3Q11 4Q11

Coverage Ratio

145% 135% 125% 115% 105% 95% 85% 75%

97% 91% 99% 119% 136%

4Q10 1Q11 2Q11 3Q11 4Q11

* Pro forma for Abington mark

Allowance to Total Loans

2.40% 2.20% 2.00% 1.80% 1.60% 1.40% 1.20% 1.00%

1.96% 2.01% 1.99% 1.97% 2.04%

4Q10 1Q11 2Q11 3Q11 4Q11

11

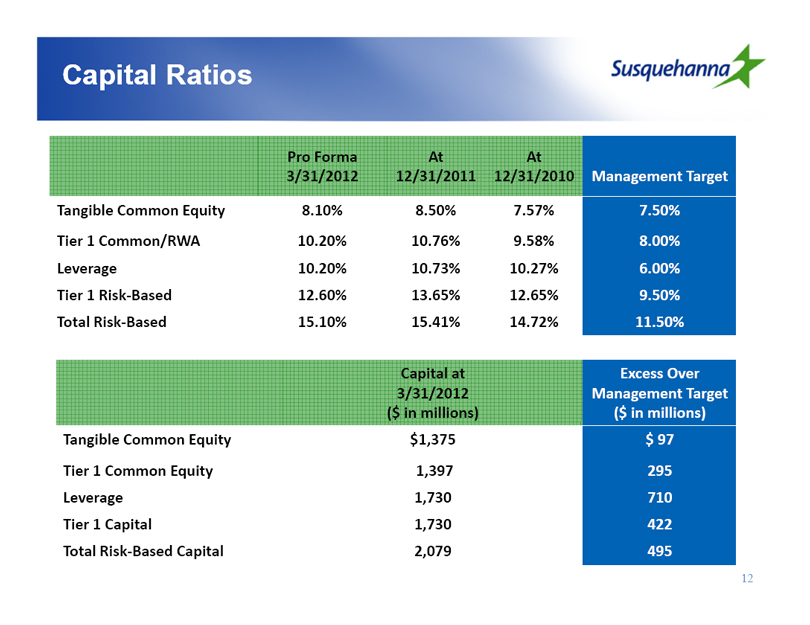

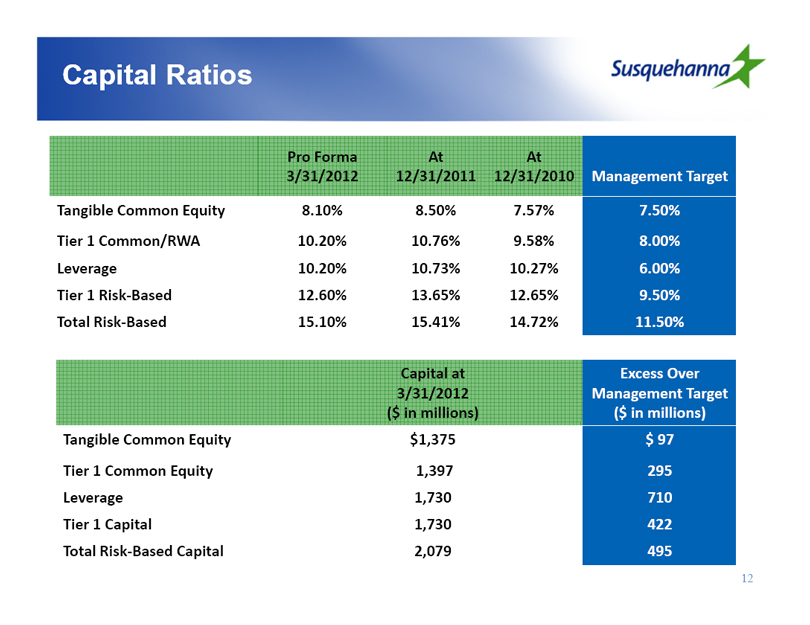

Capital Ratios

Pro Forma At At

3/31/2012 12/31/2011 12/31/2010 Management Target

Tangible Common Equity 8.10% 8.50% 7.57% 7.50%

Tier 1 Common/RWA 10.20% 10.76% 9.58% 8.00%

Leverage 10.20% 10.73% 10.27% 6.00%

Tier 1 Risk-Based 12.60% 13.65% 12.65% 9.50%

Total Risk-Based 15.10% 15.41% 14.72% 11.50%

Capital at Excess Over

3/31/2012 Management Target

($ in millions) ($ in millions)

Tangible Common Equity $1,375 $ 97

Tier 1 Common Equity 1,397 295

Leverage 1,730 710

Tier 1 Capital 1,730 422

Total Risk-Based Capital 2,079 495

12

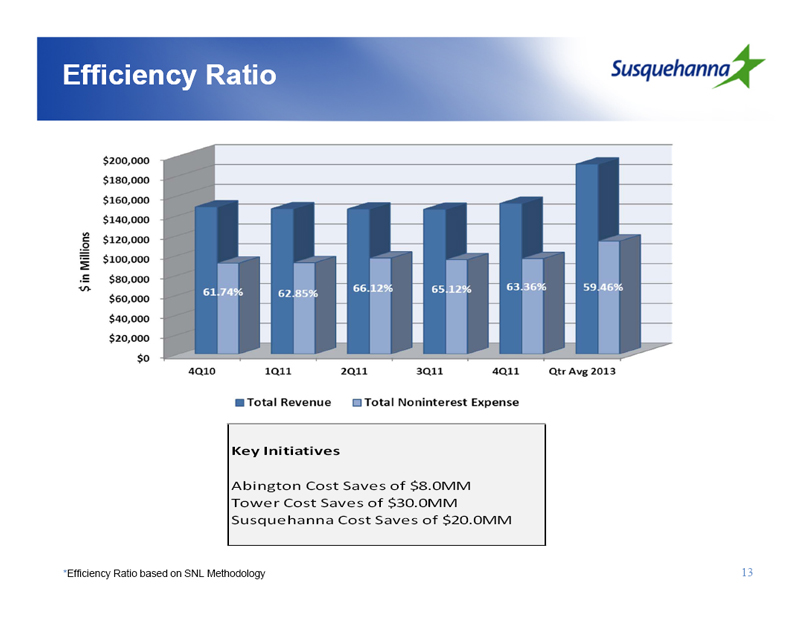

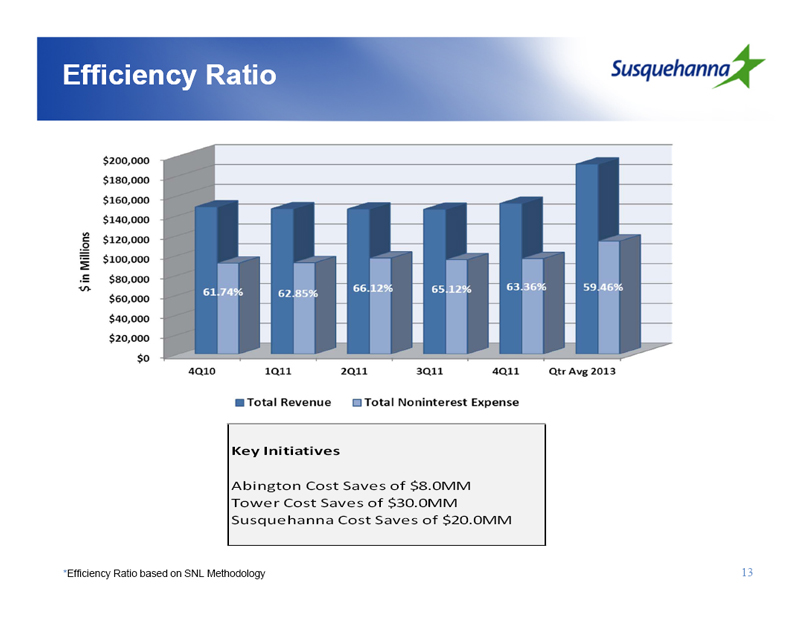

Efficiency Ratio

$ in Millions

$200,000 $180,000 $160,000 $140,000 $120,000 $100,000 $80,000 $60,000 $40,000 $20,000 $0

61.74% 62.85% 66.12% 65.12% 63.36% 59.46%

4Q10 1Q11 2Q11 3Q11 4Q11 Qtr Avg 2013

Total Revenue Total Noninterest Expense

Key Initiatives

Abington Cost Saves of $8.0MM

Tower Cost Saves of $30.0MM

Susquehanna Cost Saves of $20.0MM

*Efficiency Ratio based on SNL Methodology

13

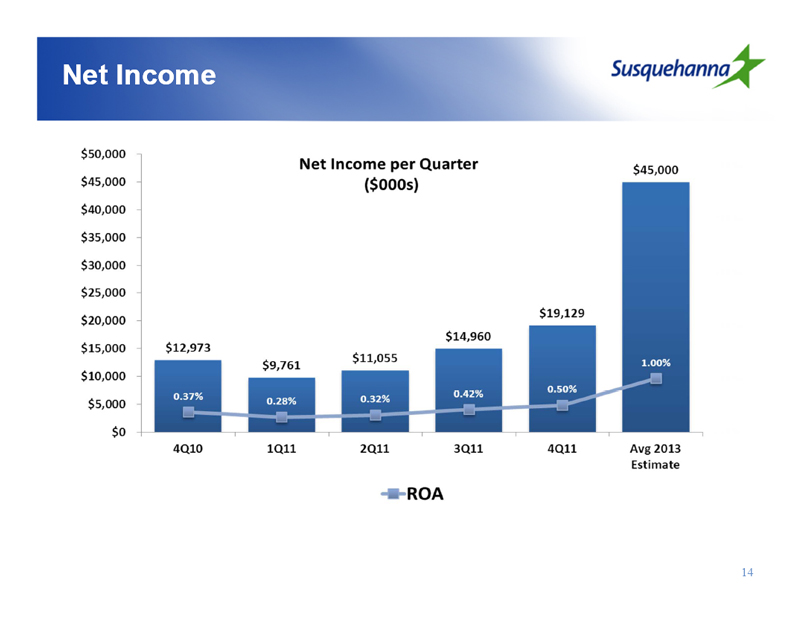

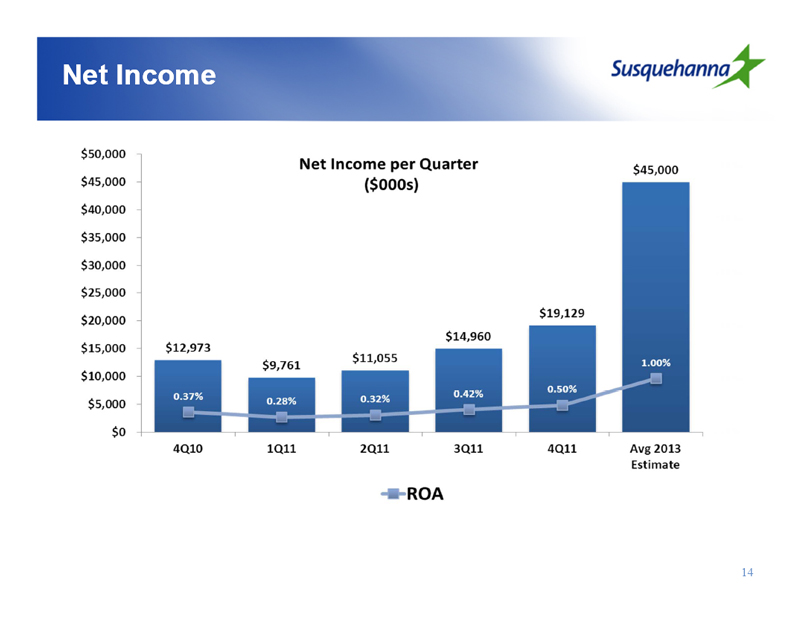

Net Income

Net Income per Quarter

($000s)

$50,000 $45,000 $40,000 $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $0

$12,973 $9,761 $11,055 $14,960 $19,129 $45,000

0.37% 0.28% 0.32% 0.42% 0.50% 1.00%

4Q10 1Q11 2Q11 3Q11 4Q11 Avg 2013 Estimate

ROA

14

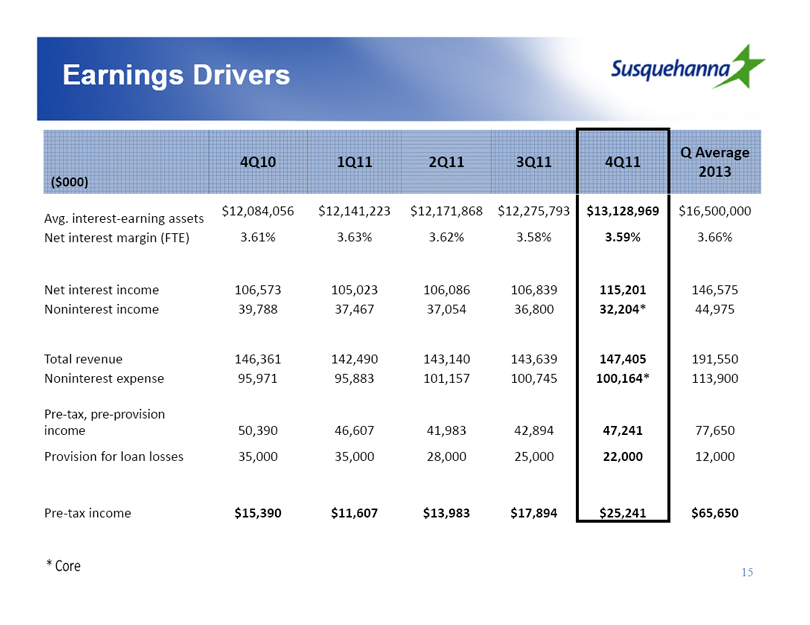

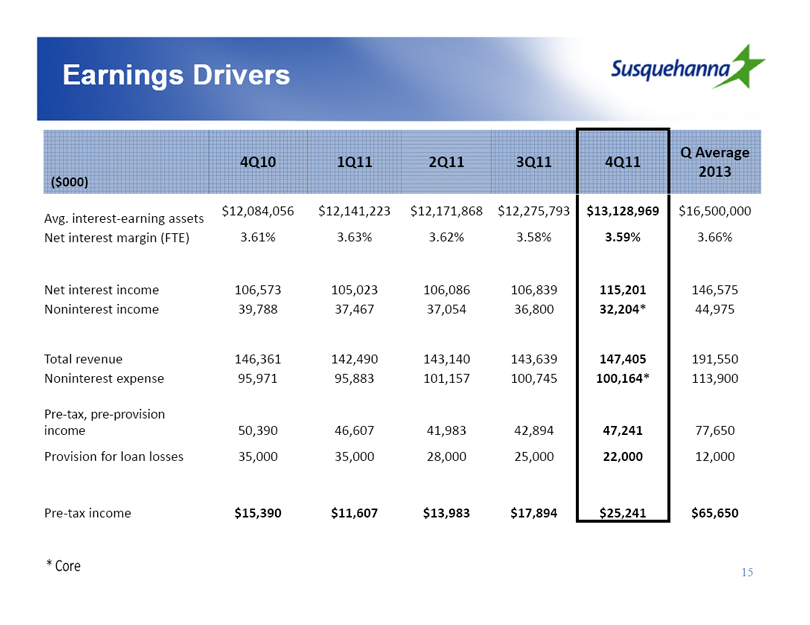

Earnings Drivers

($000) 4Q10 1Q11 2Q11 3Q11 4Q11 Q Average 2013

Avg. interest-earning assets $12,084,056 $12,141,223 $12,171,868 $12,275,793 $13,128,969 $16,500,000

Net interest margin (FTE) 3.61% 3.63% 3.62% 3.58% 3.59% 3.66%

Net interest income 106,573 105,023 106,086 106,839 115,201 146,575

Noninterest income 39,788 37,467 37,054 36,800 32,204* 44,975

Total revenue 146,361 142,490 143,140 143,639 147,405 191,550

Noninterest expense 95,971 95,883 101,157 100,745 100,164* 113,900

Pre-tax, pre-provision income 50,390 46,607 41,983 42,894 47,241 77,650

Provision for loan losses 35,000 35,000 28,000 25,000 22,000 12,000

Pre-tax income $15,390 $11,607 $13,983 $17,894 $25,241 $65,650

* Core

15

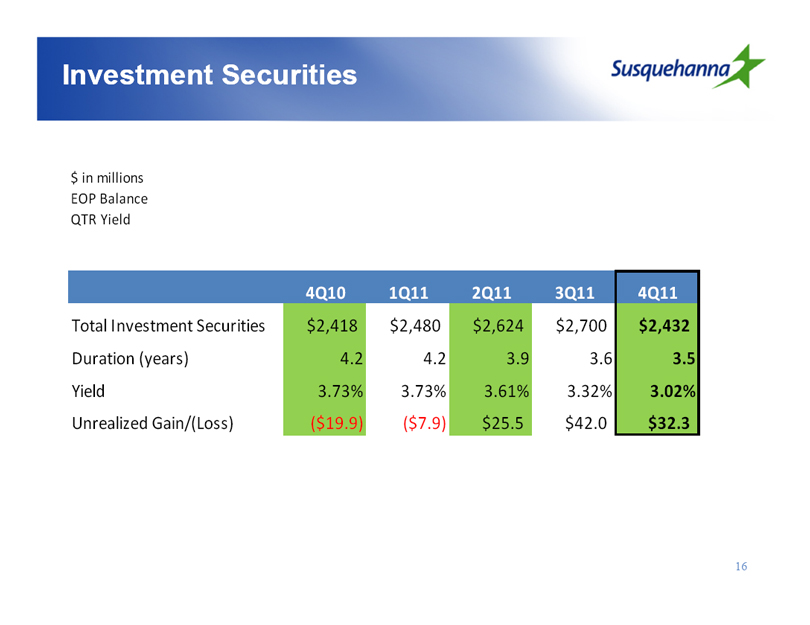

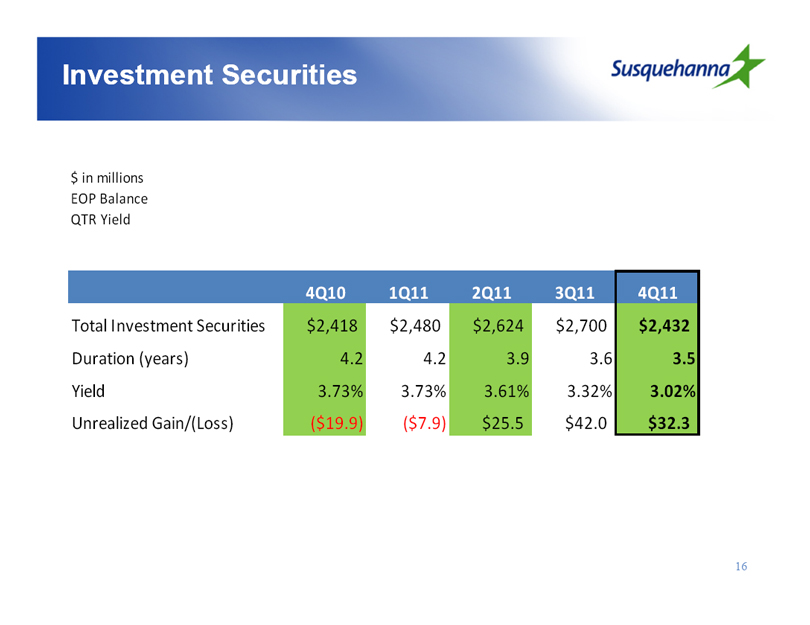

Investment Securities

$ in millions

EOP Balance

QTR Yield

4Q10 1Q11 2Q11 3Q11 4Q11

Total Investment Securities $2,418 $2,480 $2,624 $2,700 $2,432

Duration (years) 4.2 4.2 3.9 3.6 3.5

Yield 3.73% 3.73% 3.61% 3.32% 3.02%

Unrealized Gain/(Loss) ($19.9) ($7.9) $25.5 $42.0 $32.3

16

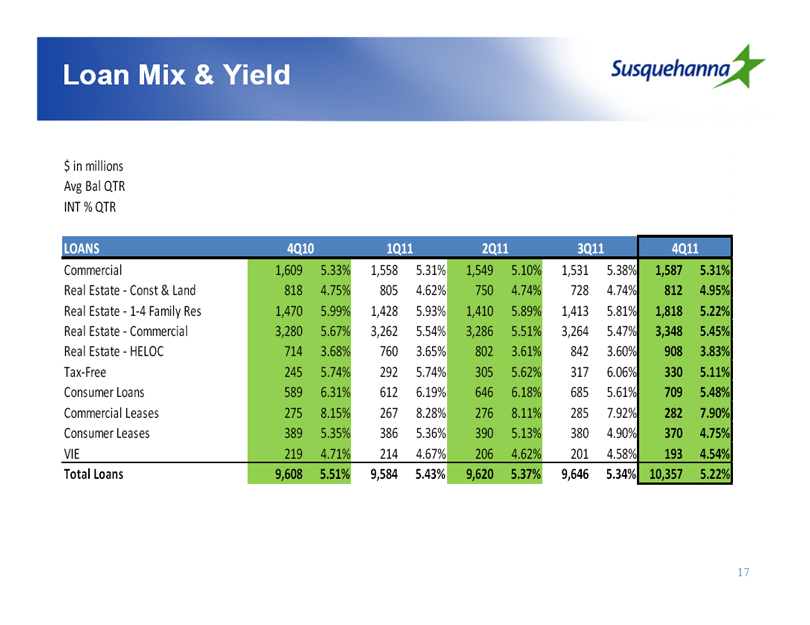

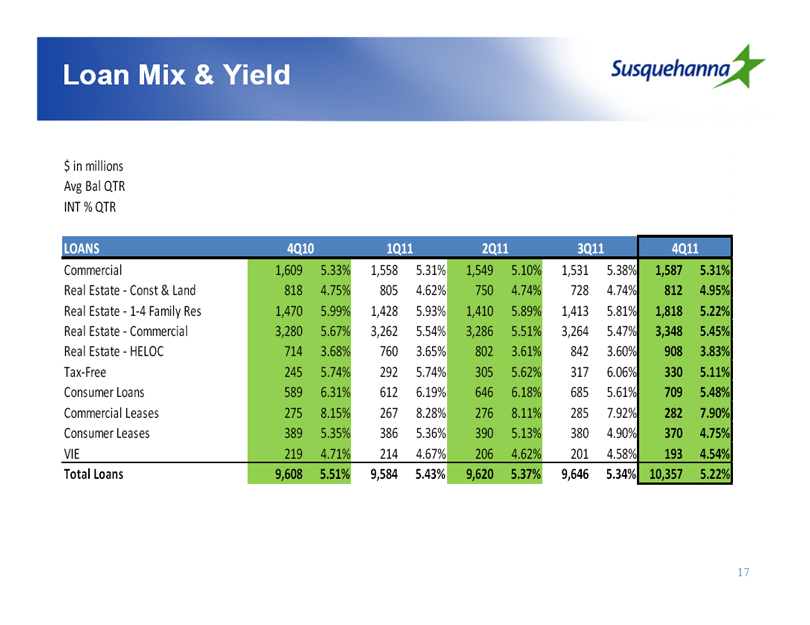

Loan Mix & Yield

$ in millions

Avg Bal QTR

INT % QTR

LOANS 4Q10 1Q11 2Q11 3Q11 4Q11

Commercial 1,609 5.33% 1,558 5.31% 1,549 5.10% 1,531 5.38% 1,587 5.31%

Real Estate - Const & Land 818 4.75% 805 4.62% 750 4.74% 728 4.74% 812 4.95%

Real Estate - 1-4 Family Res 1,470 5.99% 1,428 5.93% 1,410 5.89% 1,413 5.81% 1,818 5.22%

Real Estate - Commercial 3,280 5.67% 3,262 5.54% 3,286 5.51% 3,264 5.47% 3,348 5.45%

Real Estate - HELOC 714 3.68% 760 3.65% 802 3.61% 842 3.60% 908 3.83%

Tax-Free 245 5.74% 292 5.74% 305 5.62% 317 6.06% 330 5.11%

Consumer Loans 589 6.31% 612 6.19% 646 6.18% 685 5.61% 709 5.48%

Commercial Leases 275 8.15% 267 8.28% 276 8.11% 285 7.92% 282 7.90%

Consumer Leases 389 5.35% 386 5.36% 390 5.13% 380 4.90% 370 4.75%

VIE 219 4.71% 214 4.67% 206 4.62% 201 4.58% 193 4.54%

Total Loans 9,608 5.51% 9,584 5.43% 9,620 5.37% 9,646 5.34% 10,357 5.22%

17

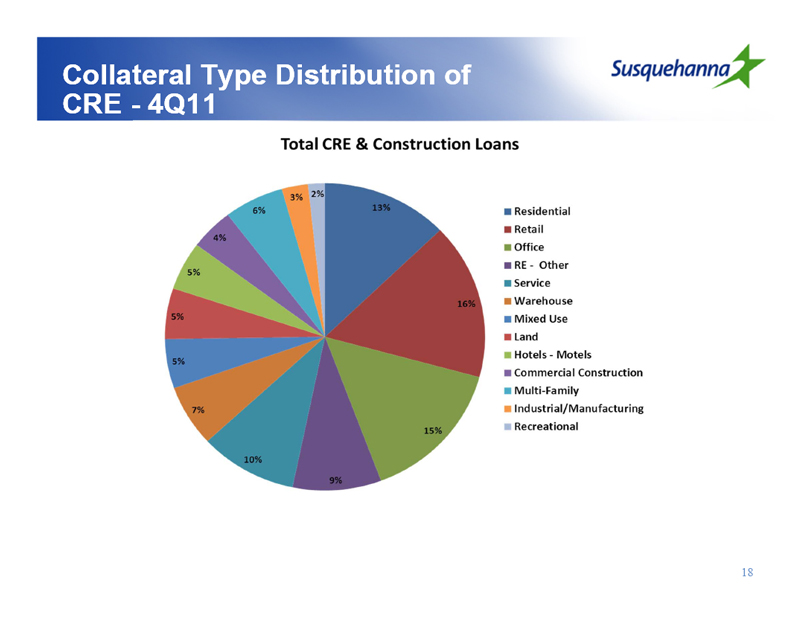

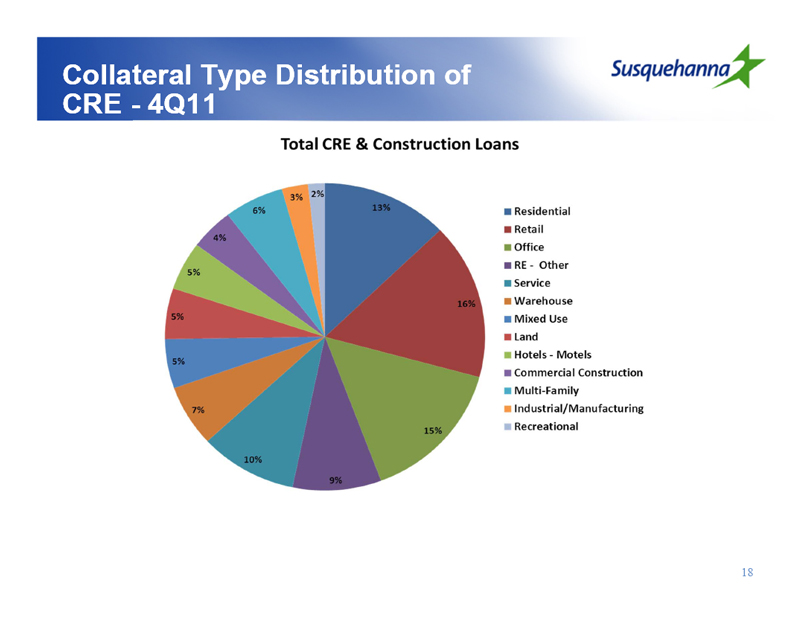

Collateral Type Distribution of CRE - 4Q11

Total CRE & Construction Loans

Residential

Retail

Office

RE - Other

Service

Warehouse

Mixed Use

Land

Hotels - Motels

Commercial Construction

Multi-Family

Industrial/Manufacturing

Recreational

13% 16% 15% 9% 10% 7% 5% 5% 5% 4% 6% 3% 2%

18

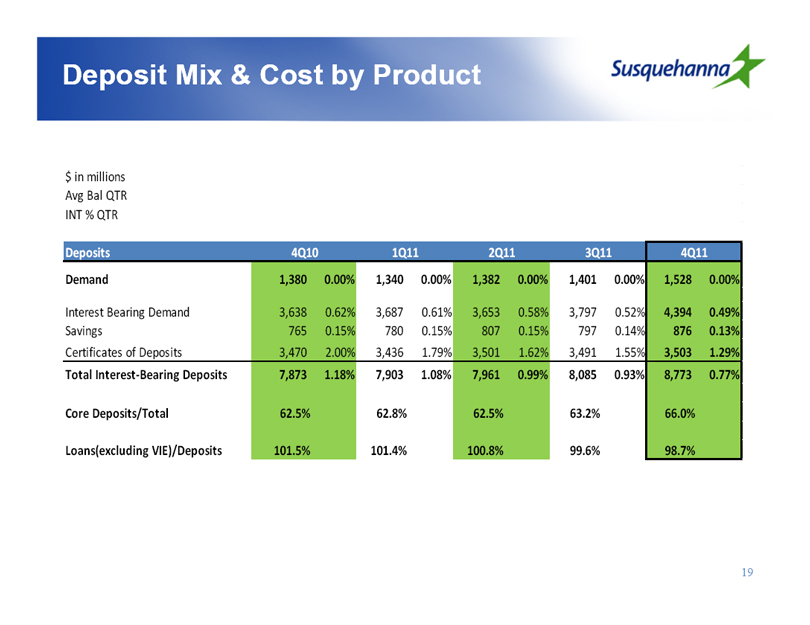

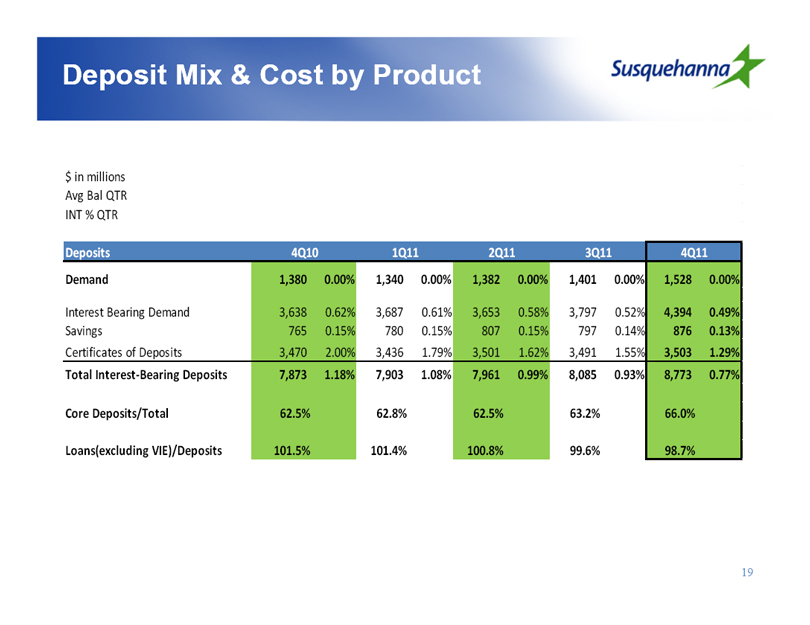

Deposit Mix & Cost by Product

$ in millions

Avg Bal QTR

INT % QTR

Deposits 4Q10 1Q11 2Q11 3Q11 4Q11

Demand 1,380 0.00% 1,340 0.00% 1,382 0.00% 1,401 0.00% 1,528 0.00%

Interest Bearing Demand 3,638 0.62% 3,687 0.61% 3,653 0.58% 3,797 0.52% 4,394 0.49%

Savings 765 0.15% 780 0.15% 807 0.15% 797 0.14% 876 0.13%

Certificates of Deposits 3,470 2.00% 3,436 1.79% 3,501 1.62% 3,491 1.55% 3,503 1.29%

Total Interest-Bearing Deposits 7,873 1.18% 7,903 1.08% 7,961 0.99% 8,085 0.93% 8,773 0.77%

Core Deposits/Total 62.5% 62.8% 62.5% 63.2% 66.0%

Loans(excluding VIE)/Deposits 101.5% 101.4% 100.8% 99.6% 98.7%

19

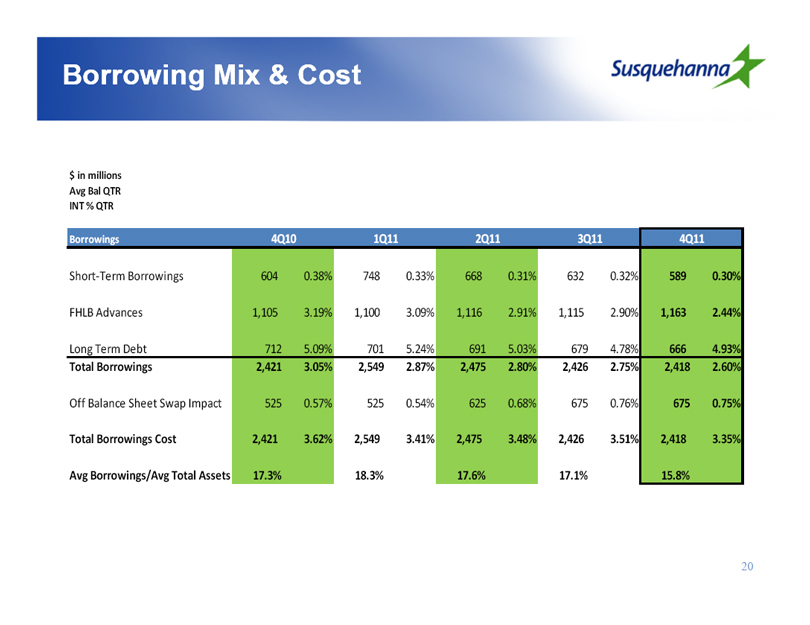

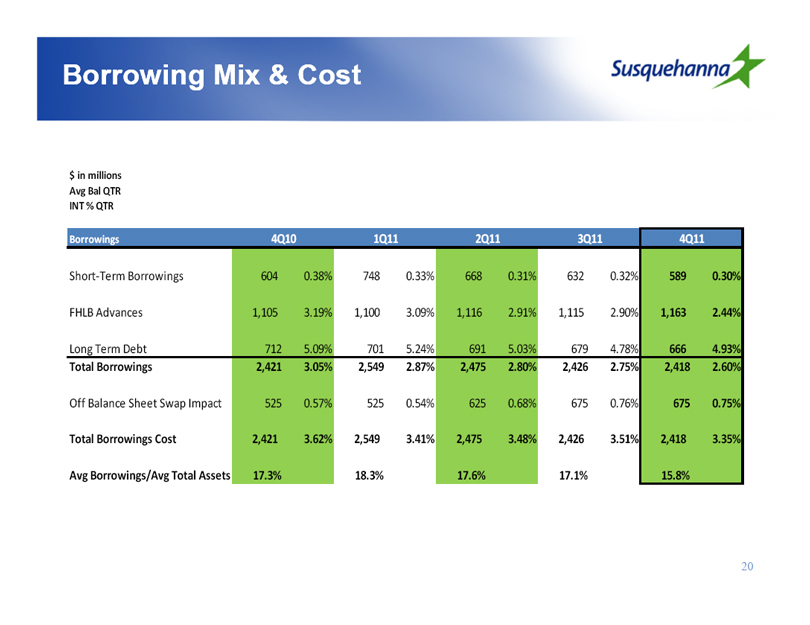

Borrowing Mix & Cost

$ in millions

Avg Bal QTR

INT % QTR

Borrowings 4Q10 1Q11 2Q11 3Q11 4Q11

Short-Term Borrowings 604 0.38% 748 0.33% 668 0.31% 632 0.32% 589 0.30%

FHLB Advances 1,105 3.19% 1,100 3.09% 1,116 2.91% 1,115 2.90% 1,163 2.44%

Long Term Debt 712 5.09% 701 5.24% 691 5.03% 679 4.78% 666 4.93%

Total Borrowings 2,421 3.05% 2,549 2.87% 2,475 2.80% 2,426 2.75% 2,418 2.60%

Off Balance Sheet Swap Impact 525 0.57% 525 0.54% 625 0.68% 675 0.76% 675 0.75%

Total Borrowings Cost 2,421 3.62% 2,549 3.41% 2,475 3.48% 2,426 3.51% 2,418 3.35%

Avg Borrowings/Avg Total Assets 17.3% 18.3% 17.6% 17.1% 15.8%

20

Strategic Objectives for 2012-2013

Continuing strong progress in improving credit quality

Completing acquisition and integration of Tower Bancorp

Growing loans, deposits and revenue

Increasing profitability and shareholder dividends

21