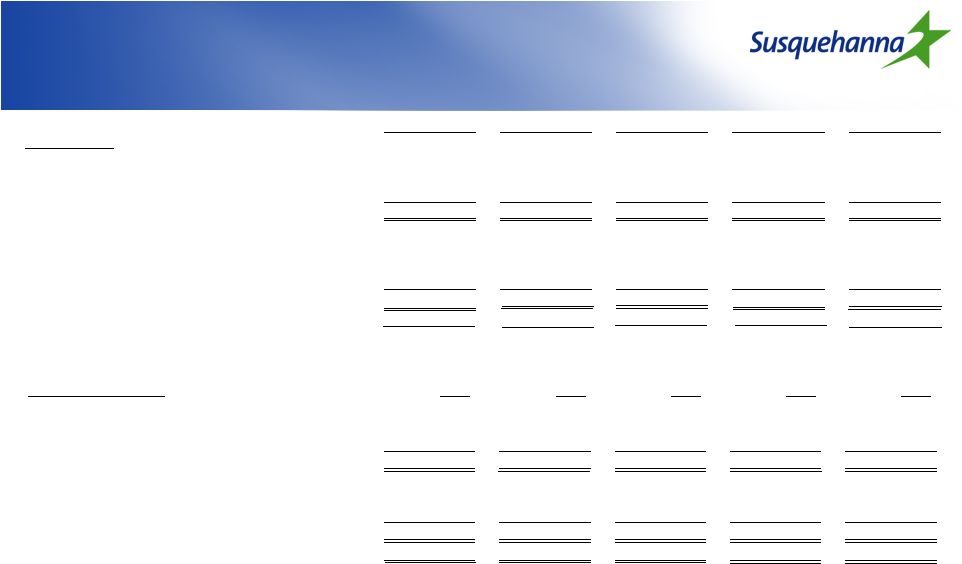

Non-GAAP Reconciliation (Dollars and share data in thousands) Non-GAAP Reconciliation (Dollars and share data in thousands) 36 The efficiency ratio is a non-GAAP based financial measure. Management excludes merger-related expenses and certain other selected items when calculating this ratio, which is used to measure the relationship of operating expenses to revenues. Tangible Common Ratio 3Q12 2Q12 1Q12 4Q11 3Q11 End of period balance sheet data Shareholders' equity 2,584,682 $ 2,544,730 $ 2,512,584 $ 2,189,628 $ 2,035,845 $ Goodwill and other intangible assets (1) (1,263,361) (1,267,630) (1,268,582) (1,006,412) (1,005,368) Tangible common equity (numerator) 1,321,321 $ 1,277,100 $ 1,244,002 $ 1,183,216 $ 1,030,477 $ Assets 18,106,730 $ 18,040,009 $ 17,807,026 $ 14,974,789 $ 14,365,229 $ Goodwill and other intangible assets (1) (1,263,361) (1,267,630) (1,268,582) (1,047,112) (1,045,692) Tangible assets (denominator) 16,843,369 $ 16,772,379 $ 16,538,444 $ 13,927,677 $ 13,319,537 $ Tangible common ratio 7.84% 7.61% 7.52% 8.50% 7.74% (1) Net of applicable deferred income taxes 3Q12 2Q12 1Q12 4Q11 3Q11 Efficiency Ratio Other expense 122,910 $ 121,475 $ 120,355 $ 162,395 $ 100,745 $ Less: Merger related expenses (1,500) (3,318) (11,479) (12,211) (1,293) Loss on extinguishment of debt (5,451) 0 0 (50,020) 0 Noninterest operating expense (numerator) 115,959 $ 118,157 $ 108,876 $ 100,164 $ 99,452 $ Taxable-equivalent net interest income 152,948 $ 156,416 137,837 118,780 110,668 Other income 43,661 39,811 39,515 71,347 36,800 Less: Net realized gain on acquisition 0 0 0 (39,143) 0 Denominator 196,609 $ 196,227 $ 177,352 $ 150,984 $ 147,468 $ Efficiency ratio 58.98% 60.21% 61.39% 66.34% 67.44% The tangible common ratio is a non-GAAP based financial measure using non-GAAP based amounts. The most directly comparable GAAP-based measure is the ratio of common shareholders’ equity to total assets. In order to calculate tangible common shareholders equity and assets, our management subtracts the intangible assets from both the common shareholders’ equity and total assts. Tangible common equity is then divided by the tangible assets to arrive at the ratio. Management uses the ratio to assess the strength of our capital position. |