Exhibit 99.2

EKSPORT

FINANS

NORWAY

FINANCIAL REPORT

Q2/2017

Financial highlights 03 Report from the board of directors and CEO 04 Results 04 Balance sheet 05 Lending 05 Securities 05 Liquidity 05 Prospects for the second half-year of 2017 06 Events after the balance sheet date 07 Condensed statement of comprehensive income 08 Condensed balance sheet 09 Condensed statement of changes in equity 10 Condensed cash flow statement 11 Notes to the condensed financial statements 12 Cover photo: Elin Anundskås (Eksportfinans) Some of the information herein constitutes “forward-looking statements” within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements rely on a number of assumptions concerning future events. These forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which are outside of Eksportfinans’ control, which may cause actual results to differ materially from any future results expressed or implied from the forward-looking statements. As a result, any forward-looking statements included herein should not be regarded as a representation that the plans, objectives, results or other actions discussed will be achieved. Please see the Company’s Annual Report on Form20-F filed with the U.S. Securities and Exchange Commission for a discussion of certain factors that may cause actual results, performance or events to be materially different from those referred to herein. Eksportfinans disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Financial highlights The information for the second quarters ended June 30, 2017 and 2016 are unaudited. Second quarter First half -year (NOK million) 2017 2016 2017 2016 Net interest income 52 56 114 132 Total comprehensive income 1) (61) (86) (213) (104) Return on equity 2) (3.5%) (4.6%) (6.1%) (2.8%) Net return on average assets and liabilities 3) 0.45% 0.07% 0.26% 0.20% Net operating expenses / average assets 4) 0.49% 0.20% 0.47% 0.24% Total assets 25,731 41,237 25,731 41,237 Loans outstanding 5) 14,744 21,962 14,744 21,962 Public sector borrowers or guarantors 6) 43.6% 36.5% 43.6% 36.5% Core capital adequacy 72.3% 43.9% 72.3% 43.9% Capital adequacy 72.3% 43.9% 72.3% 43.9% Exchange rate NOK/USD 7) 8.3870 8.3776 8.3870 8.3776 Definitions 1) Total comprehensive income for the period includes net losses on financial instruments at fair value which amount to NOK 328 million for the first half-year of 2017 compared to net losses of NOK 525 million for the first half-year of 2016. For the second quarter of 2017 net losses on financial instruments at fair value amount to NOK 97 million compared to net losses on financial instruments at fair value of NOK 455 million in the second quarter of 2016. 2) Return on equity: Total comprehensive income for the period/average equity (average of opening and closing balance). 3) Net return on average assets and liabilities: The difference between net interest income/average interest generating assets and net interest expense/average interest-bearing liabilities (average of daily calculations for the period). 4) Net operating expenses (salaries and other administrative expenses + depreciation + other expenses—other income)/average assets (average of opening and closing balance). 5) Total loans outstanding: Consists of loans due from customers and part of loans due from credit institutions in the balance sheet. Accrued interest and unrealized gains/(losses) are not included. For more information see notes 4, 5 and 6 to the accompanying condensed financial statements. 6) The ratio of public sector loans (municipalities, counties and Norwegian and foreign central government, including the Norwegian Guarantee Institute for Export Credits (GIEK) as borrowers or guarantors) to total lending. 7) Exchange rate at balance sheet date.

Report from the board of directors Results Second quarter 2017 Net interest income was NOK 52 million for the second quarter of 2017 compared to NOK 56 million for the same period in 2016. The decrease was mainly due to the reduction of interest generating assets. Total comprehensive income was negative NOK 61 million for the second quarter of 2017, compared to negative NOK 86 million for the second quarter of 2016. The fluctuations in these figures are primarily due to unrealized losses and gains on Eksportfinans’ own debt (as explained in the section “Net other operating income”). First half-year 2017 Net interest income was NOK 114 million for the first half-year of 2017 compared to NOK 132 million for the same period in 2016. The reduction is primarily due to a lower level of interest generating assets. Profit/(loss) for the period The comprehensive income was negative NOK 213 million for the first half-year of 2017. The comparable figure for 2016 was negative NOK 104 million. The fluctuations in these figures are primarily due to unrealized losses and gains on Eksportfinans’ own debt (as explained in the section “Net other operating income”). Table 1 below shows the calculation of thenon-IFRS measure of profit, excluding unrealized gains and losses on financial instruments and realized losses hedged by the Portfolio Hedge Agreement (“PHA”), with the corresponding return on equity. This calculation may be of interest to investors because it allows assessment of the performance of the underlying business operations without the volatility caused by fair value fluctuations, including specifically the reversal of previously recognized unrealized gains on Eksportfinans’ own debt. Thisnon-IFRS measure of profit amounted to NOK 18 million in the first half-year of 2017, compared to NOK 171 million in the same period of 2016. The decrease was mainly due to a gain booked in the first half-year of 2016 related to the sale of Eksportfinans’ office property, combined with lower net interest income. Net other operating income Second quarter First half-year (NOK million) 2017 2016 2017 2016 Comprehensive income according to IFRS (61) (86) (213) (104) Net unrealized losses/(gains) 84 286 308 295 Unrealized gains/(losses) related to Glitnir 1) 0 0 0 71 Tax effect of the items above (21) (71) (77) (91)Non-IFRS profit for the period excluding unrealized gains/(losses) on financial instruments and excluding realized losses/(gains) hedged by the PHA 2 129 18 171 Return on equity based on profit for the period excluding unrealized gains/(losses) on financial instruments and excluding realized losses/(gains) hedged by the PHA 0.2% 6.7% 0.5% 4.4% Table 1:Non-IFRS profit for the period 1) Reversal of previously recognized gains/losses (at exchange rates applicable at reporting date). Net other operating income was negative NOK 328 million for the first half-year of 2017 compared to negative NOK 284 million for the

first half-year of 2016. This was primarily due to fluctuations in the credit spreads of Eksportfinans’ own debt. In the first half-year of 2017, unrealized losses on Eksportfinans’ own debt amounted to NOK 320 million compared to unrealized gains of NOK 577 million for the same period in 2016 (see note 2 to the accompanying condensed financial statements). Net of derivatives, this resulted in an unrealized loss of NOK 313 million in the first half-year of 2017 (whereof around NOK 314 million was due to the before mentioned credit spread effects), compared to an unrealized loss of NOK 470 million for the same period of 2016 (see note 15 to the accompanying condensed financial statements). The cumulative unrealized gain due to credit spread effects on Eksportfinans’ own debt net of derivatives, was NOK 494 million as of June 30, 2017, compared to NOK 810 million as of December 31, 2016 and NOK 1,159 million as of June 30, 2016. Total operating expenses Total operating expenses amounted to NOK 70 million in the first half-year of 2017, compared to NOK 67 million in the same period in 2016. Balance sheet Total assets amounted to NOK 25.7 billion at June 30, 2017, compared to NOK 33.2 billion at December 31, 2016 and NOK 41.2 billion at June 30, 2016. The reduction was due to scheduled repayments of debt. Outstanding bond debt was NOK 15.2 billion at June 30, 2017, compared to NOK 22.6 billion at December 31, 2016 and NOK 28.7 billion at June 30, 2016. The core capital ratio was 72.3 percent at June 30, 2017, compared to 61.0 percent at December 31, 2016 and 43.9 percent at June 30, 2016. Lending The volume of total outstanding loans was NOK 14.7 billion at June 30, 2017, compared to NOK 18.3 billion at December 31, 2016 and NOK 22.0 billion at June 30, 2016. The decrease in volume of outstanding loans is a function of maturing loans in combination with no new lending. Securities The securities portfolio was NOK 5.5 billion at June 30, 2017, compared to NOK 8.8 billion at December 31, 2016 and NOK 9.2 billion at June 30, 2016. The securities portfolio consists of twosub-portfolios. The first is subject to the PHA with Eksportfinans’ shareholders which has been in place since February 29, 2008 (the “PHA portfolio”), and the second is maintained for the purpose of liquidity (the “liquidity reserve portfolio”). The fair value of the PHA portfolio was NOK 2.8 billion at June 30, 2017, compared to 4.4 billion at December 31, 2016, and 5.4 billion at June 30, 2016. For further information on the PHA see note 14 to the accompanying condensed financial statements. The fair value of the liquidity reserve portfolio was NOK 2.7 billion at June 30, 2017, compared to NOK 4.4 billion at December 31, 2016 and NOK 3.8 billion at June 30, 2016. Liquidity As at June 30, 2017, short-term liquidity amounted to NOK 3.4 billion, consisting of the liquidity reserve portfolio of NOK 2.7 billion and cash equivalents of NOK 0.7 billion. Including the PHA portfolio of NOK 2.8 billion, total liquidity reserves amounted to NOK 6.2 billion at June 30, 2017.

Table 2: Estimated cumulative liquidity (NOK billion) Estimated debt maturing 2) Estimated loan receivables maturing 3) Estimated investments maturing 4) Estimated cumulative liquidity 5) Short-term liquidity at June 30, 2017 1) 3.4 2017 2.2 2.3 0.2 3.7 2018 1.7 3.3 0.4 5.6 2019 4.3 3.0 0.3 4.6 2020 1.0 2.1 0.4 6.1 2021 2.2 1.2 0.3 5.3 2022 0.3 0.9 0.3 6.2 2023 0.2 0.5 0.2 6.7 2024 0.1 0.4 0.2 7.2 Thereafter 3.8 1.1 0.6 5.1 Total 15.8 14.8 2.8 1) Short-term liquidity is comprised of the sum of the liquidity reserve portfolio (at fair value) and deposits. 2) Principal amount of own debt securities. The column includes single- and multi-callable issues. Includes principal cash flows of derivatives economically hedging structured bond debt. For the structured bond debt with call and trigger options, the expected maturity is estimated using a sophisticated valuation system. The actual maturities might differ from these estimations. 3) Represents principal amount of loan receivables. 4) Represents principal amount of investments in the PHA portfolio. 5) Represents estimated cumulative liquidity atyear-end (calculated as the amount at prior period end minus estimated long-term debt maturing during period plus estimated loans receivable and long-term investments maturing during the period) except for the first row which states the actual liquidity at June 30, 2017. The company manages liquidity risk both through matching maturities for assets and liabilities and through stress-testing for the short and medium term. A maturity analysis of financial liabilities based on expected maturities is included in note 16 to the accompanying condensed financial statements. Table 2 above shows cumulative liquidity, as measured by short-term liquidity as of March 31, 2017, plus maturing loans and investments and minus maturing bond debt, based on estimated maturities. During the second quarter of 2017, the liquidity position has been strengthened by the issue of NOK 2 billion of bond debt, combined with foreign exchange rate fluctuations and movements in key market risk factors, primarily on the debt portfolio. Liquidity reserves combined with the company’s liquidity contingency plans are expected to meet liquidity needs going forward. Contingency plans comprise repo of securities, commercial paper, the company’s USD 250 million credit facility with its three largest owner banks (see note 14 to the accompanying condensed financial statements) and sale of assets. Prospects for the second half-year of 2017 The board expects continued stable operations, and decreasing net interest income due to further reductions of interest generating assets in the second half-year of 2017. Eksportfinans has a solid capital base and a comfortable liquidity position. The board continues to monitor the situation in the international capital markets and its impact on Eksportfinans’ balance sheet and liquidity position in the short and medium term.

Events after the balance sheet date There are no events after the balance sheet date materially affecting the financial statements. Oslo, August 17, 2017 EKSPORTFINANS ASA The board of directors

Condensed statement of profit or loss and other comprehensive income The information for the six months ended June 30, 2017 and 2016 is unaudited. Second quarter First half-year (NOK million) 2017 2016 2017 2016 Note Interest and related income 179 336 359 722 Interest and related expenses 127 280 245 590 Net interest income 52 56 114 132 Net commissions related to banking services 0 (1) 0 (1) Net gains/(losses) on financial instruments at fair value (97) (455) (328) (525) 2,15 Other income 0 239 0 242 Net other operating income/(loss) (97) (217) (328) (284) Total operating income (45) (161) (214) (152) Salaries and other administrative expenses 33 27 61 55 Depreciations 0 1 1 5 Other expenses 3 5 8 7 Total operating expenses 36 33 70 67Pre-tax operating loss (81) (194) (284) (219) Taxes (20) (108) (71) (115) Profit/loss for the period (61) (86) (213) (104) Other comprehensive income 0 0 0 0 Total comprehensive income (61) (86) (213) (104) The accompanying notes are an integral part of these condensed financial statements.

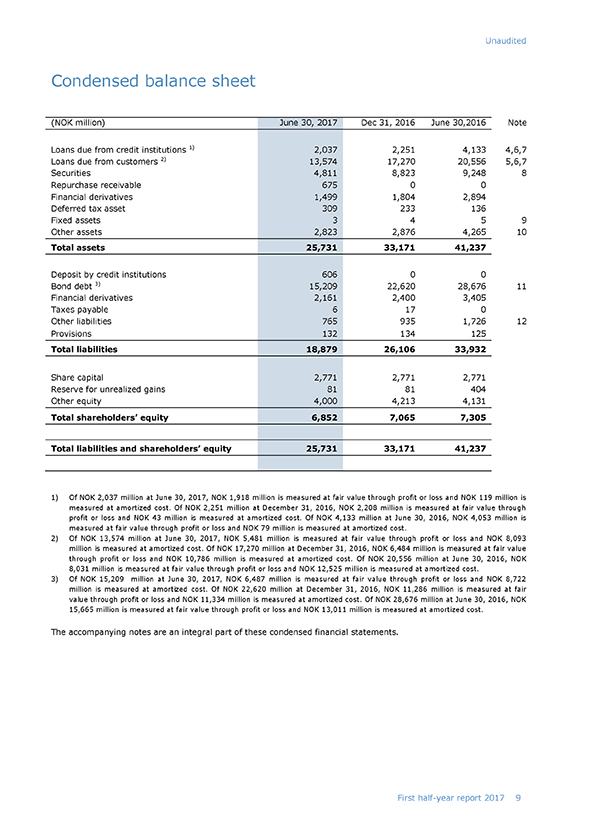

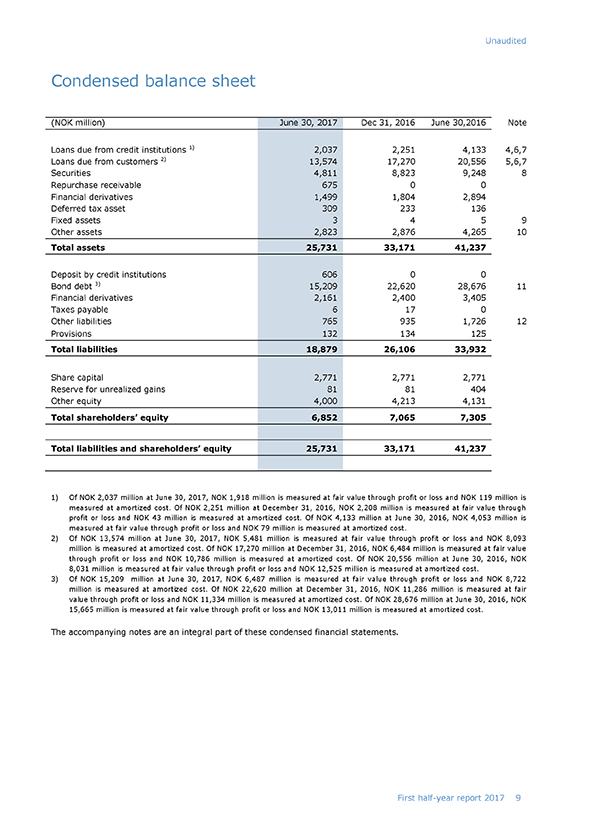

Condensed balance sheet (NOK million) June 30, 2017 Dec 31, 2016 June 30,2016 Note Loans due from credit institutions 1) 2,037 2,251 4,133 4,6,7 Loans due from customers 2) 13,574 17,270 20,556 5,6,7 Securities 4,811 8,823 9,248 8 Repurchase receivable 675 0 0 Financial derivatives 1,499 1,804 2,894 Deferred tax asset 309 233 136 Fixed assets 3 4 5 9 Other assets 2,823 2,876 4,265 10 Total assets 25,731 33,171 41,237 Deposit by credit institutions 606 0 0 Bond debt 3) 15,209 22,620 28,676 11 Financial derivatives 2,161 2,400 3,405 Taxes payable 6 17 0 Other liabilities 765 935 1,726 12 Provisions 132 134 125 Total liabilities 18,879 26,106 33,932 Share capital 2,771 2,771 2,771 Reserve for unrealized gains 81 81 404 Other equity 4,000 4,213 4,131 Total shareholders’ equity 6,852 7,065 7,305 Total liabilities and shareholders’ equity 25,731 33,171 41,237 1) Of NOK 2,037 million at June 30, 2017, NOK 1,918 million is measured at fair value through profit or loss and NOK 119 million is measured at amortized cost. Of NOK 2,251 million at December 31, 2016, NOK 2,208 million is measured at fair value through profit or loss and NOK 43 million is measured at amortized cost. Of NOK 4,133 million at June 30, 2016, NOK 4,053 million is measured at fair value through profit or loss and NOK 79 million is measured at amortized cost. 2) Of NOK 13,574 million at June 30, 2017, NOK 5,481 million is measured at fair value through profit or loss and NOK 8,093 million is measured at amortized cost. Of NOK 17,270 million at December 31, 2016, NOK 6,484 million is measured at fair value through profit or loss and NOK 10,786 million is measured at amortized cost. Of NOK 20,556 million at June 30, 2016, NOK 8,031 million is measured at fair value through profit or loss and NOK 12,525 million is measured at amortized cost. 3) Of NOK 15,209 million at June 30, 2017, NOK 6,487 million is measured at fair value through profit or loss and NOK 8,722 million is measured at amortized cost. Of NOK 22,620 million at December 31, 2016, NOK 11,286 million is measured at fair value through profit or loss and NOK 11,334 million is measured at amortized cost. Of NOK 28,676 million at June 30, 2016, NOK 15,665 million is measured at fair value through profit or loss and NOK 13,011 million is measured at amortized cost. The accompanying notes are an integral part of these condensed financial statements.

Condensed statement of changes in equity (NOK million) Share capital1) Reserve unrealized gains Other equity Comprehensive Income 2) Total equity Equity at January 1, 2016 2,771 566 4,072 0 7,409 Actuarial gains/(losses) and other comprehensive income 0 (162) 162 0 Profit/(loss) for the period 0 0 0 (104) (104) Equity at June 30, 2016 2,771 404 4,234 (104) 7,305 Equity at January 1, 2017 2,771 81 4,213 0 7,065 Actuarial gains/(losses) and other comprehensive income 0 0 0 0 0 Profit/(loss) for the period 0 0 0 (213) (213) Equity at June 30, 2017 2,771 81 4,213 (213) 6,852 1) Restricted equity that cannot be paid out to the owners without a shareholder resolution to reduce the share capital in accordance with the Public Limited Companies Act under Norwegian Law. 2) The allocation of income for the period between the reserve for unrealized gains and other equity show that if the allocation was performed at this date, it would have emptied the reserve for unrealized gains and reduced other equity by NOK 132 million. The closing balances would have been NOK 0 million for the reserve for unrealized gains, and NOK 4,081million for other equity. The accompanying notes are an integral part of these condensed financial statements.

Condensed cash flow statement First half-year (NOK million) 2017 2016Pre-tax operating profit/(loss) (284) (219) Provided by operating activities: Accrual of contribution from the Norwegian government (58) (37) Unrealized losses/(gains) on financial instruments at fair value 308 295 Realized losses on financial instruments at fair value through profit and loss (non cash item) 0 165 Depreciation 1 5 Principal collected on loans 3,386 5,809 Purchase of financial investments (trading) (9,783) (12,971) Proceeds from sale or redemption of financial investments (trading) 12,369 27,517 Contribution paid by the Norwegian government 100 0 Taxes paid (17) (75) Changes in: Accrued interest receivable 224 174 Other receivables (170) 595 Accrued expenses and other liabilities (292) (319) Net cash flow from operating activities 5,784 20,939 Proceeds from sale or redemption of financial investments 1,030 2 Net cash flow from financial derivatives (34) (377) Net cash flow from investing activities 996 (375) Change in debt to credit institutions 605 0 Net proceeds from issuance of commercial paper debt 253 0 Net proceeds from issuance of bond debt 2,000 0 Principal payments on bond debt (9,898) (20,815) Net cash flow from financing activities (7,040) (20,815) Net change in cash and cash equivalents 1) (260) (251) Cash and cash equivalents at beginning of period 1,010 2,827 Effect of exchange rates on cash and cash equivalents (2) (111) Cash and cash equivalents 1) at end of period 748 2,465 1) Cash equivalents are defined as bank deposits with original maturity less than three months. See note 4. The accompanying notes are an integral part of these condensed financial statements.

Notes to the accounts 1. Accounting policies Eksportfinans’ first half-year condensed interim financial statements have been presented in accordance with International Financial Reporting Standards (IFRS), in line with IFRS as adopted by the European Union (EU). The condensed interim financial statements have been prepared in accordance with IAS 34, Interim Financial Reporting. Except for the changed presentation of interest income and expenses related to the 108 agreement, described below, the accounting policies and methods of computation applied in the preparation of these condensed interim financial statements (including information as of and for the year ended December 31, 2016) are the same as those applied in Eksportfinans’ annual financial statements of 2016. Those financial statements were approved for issue by the Board of Directors on February 16, 2017 and included in the company’s Annual Report on Form20-F for theyear-end December 31, 2016. These policies have been consistently applied to all the periods presented. These financial statements should be read in conjunction with the annual report on Form20-F for the year ended December 31, 2016. Judgments made in the preparations of these financial statements are the same as those made in theyear-end financial statements. The interim financial statements do not include risk disclosures and which should be read in conjunction with the annual financial statements. The Norwegian Ministry of Trade, Industry and Fisheries and Eksportfinans have agreed to amend part of the «108 agreement» with effect from January 1, 2017. These amendments will simplify the accounting and reporting procedures of the agreement. The amendments have also changed the presentation of interest income and expenses for the loans under the 108 agreement, with the effect from January 1, 2017. From January 1, 2017, the interest income reflects the actual interest rate paid by the borrower, adjusted by the interest rate adjustments paid by the government. The interest expense reflects the actual interest rate paid to the lender. Previously, both interest income and interest expense were based on reference rates as specified by the 108 agreement. As this change was not reflected in the Q1 quarterly report, the Q1 2017 numbers for both gross interest income and gross interest expenses are reduced by NOK 70 million as of June 30, 2017, compared to the previously reported numbers for March 31, 2017. The net interest income is not impacted by this change. IFRS 9 “Financial Instruments” IASB has completed the new standard for financial instruments, IFRS 9 “Financial instruments”. IFRS 9 covers recognition and derecognition, classification and measurement, impairment and hedging and replaces the current requirements covering these areas in IAS 39. The standard is endorsed by the EU and the standard is effective as from annual periods beginning on or after January 1, 2018. Earlier application is permitted. There is no change to the intention not to early adopt the standard as communicated in the annual financial statements for 2016. The detailed assessment of the classification and measurement of financial assets will be performed during Q2 and Q3 2017, however based on the current assessment, no material changes are expected for financial assets. There will be an impact on the company’s accounting for financial liabilities, as the new requirements affect the accounting for financial liabilities that are designated at fair value through profit or loss and the company has bond debt for which the fair value option is applied. Under IAS 39, the changes in fair value have been recognized in profit and loss. Under IFRS 9, the company expects to continue to use the fair value option, and consequently, the changes in fair value as a result of changes in credit spread will be recognized in OCI. As previously communicated, the company does not plan to apply the hedge accounting rules in IFRS 9. The new impairment model requires the recognition of impairment provisions based on expected credit losses (ECL) rather than only incurred credit losses as is the case under IAS 39. As a result of the guarantees covering the majority of the loans, the company does not expect that changing to a ECL model will result in any material changes to the impairment provisions. The information for the six month periods ended June 30, 2017 and 2016 is unaudited. The information as of and for the year ended December 31, 2016 is derived from the company’s audited consolidated financial statements as of and for the year ended December 31, 2016.

2. Net gains/(losses) on financial instruments at fair value Net realized and unrealized gains/(losses) on financial instruments at fair value Second quarter First half-year (NOK million) 2017 2016 2017 2016 Securities held for trading 0 (1) 0 2 Securities designated as at fair value at initial recognition (2) 0 (2) 0 Financial derivatives (4) (4) (9) (16) Other financial instruments at fair value (7) (164) (9) (216) Net realized gains/(losses) (13) (169) (20) (230) Loans and receivables 2 9 11 87 Securities 1) 27 28 69 66 Financial derivatives 2) (31) (662) (66) (1,024) Bond debt 3) 4) (80) 339 (320) 577 Other (2) 0 (2) (1) Net unrealized gains/(losses) (84) (286) (308) (295) Net realized and unrealized gains/(losses) (97 (455) (328) (525) 1) Net unrealized gains/(losses) on securities Second quarter First half-year (NOK million) 2017 2016 2017 2016 Securities held for trading 23 18 53 25 Securities designated as at fair value at initial recognition 4 10 16 41 Total 27 28 69 66 2) The Portfolio Hedge Agreement entered into in March 2008, is included with a loss of NOK-92 million as of June 30, 2017 and a gain of NOK 37 million as of June 30, 2016. 3) In the first half-year of 2017, Eksportfinans had an unrealized loss of NOK 320 million (gain of NOK 577 million in the corresponding period of 2016) on its own debt. 4) In the first half-year of 2017, Eksportfinans had an unrealized loss of NOK 320 million of financial liabilities classified as level 3 in the fair value hierarchy (gain of NOK 577 million in the corresponding period of 2016). See note 15 for a presentation of the above table including effects from economic hedging. 3. Capital adequacy Capital adequacy is calculated in accordance with the CRD IV regulations in force from the Financial Supervisory Authority of Norway. These regulations were implemented as of September 30, 2014. The company has adopted the standardized approach to capital requirements. Eksportfinans’ leverage ratio1) was 25.3 % at June 30, 2017, compared to 14.5 % at June 30, 2016. Risk-weighted assets andoff-balance sheet items (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Book value Risk-weighted value Book value Risk- Weighted value Book value Risk-weighted value Total assets 25,731 8,324 33,171 9,922 41,237 13,281Off-balance sheet items 0 51 50 Operational risk 588 588 1,151 Total currency risk 0 0 0 Total risk-weighted value 8,912 10,561 14,481

The company’s regulatory capital (NOK million and in percent of risk-weighted value) June 30, 2017 Dec 31, 2016 June 30, 2016 Core capital 2) 6,446 72.3% 6,445 61.0% 6,356 43.9% Total regulatory capital 6,446 72.3% 6,445 61.0% 6,356 43.9% 1) Indicates the ratio of the core capital divided by the book value of assets. 2) Includes share capital, other equity, and other deductions and additions in accordance with the Norwegian capital adequacy regulations. 4. Loans due from credit institutions (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Cash equivalents 1) 748 1,010 2,465 Loans to other credit institutions, nominal amount (also included in note 6) 2) 1,224 1,281 1,720 Accrued interest on loans and unamortized premium/discount on purchased loans 77 (13) (10) Adjustment to fair value on loans (12) (27) (42) Total 2,037 2,251 4,133 1) Cash equivalents are defined as bank deposits with maturity of less than three months. 2) The company has acquired certain loan agreements from banks for which the selling bank provides a repayment guarantee, therefore retaining the credit risk of the loans. Under IFRS these loans are classified as loans to credit institutions. Of the loans to credit institutions these loans amounted to NOK 176 million at June 30, 2017, NOK 191 million at December 31,2016 and NOK 206 million at June 30, 2016. 5. Loans due from customers (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Loans due from customers, nominal amount (also included in note 6) 13,519 17,008 20,243 Accrued interest on loans and unamortized premium/discount on purchased loans 36 239 282 Adjustment to fair value on loans 19 23 31 Total 13,574 17,270 20,556

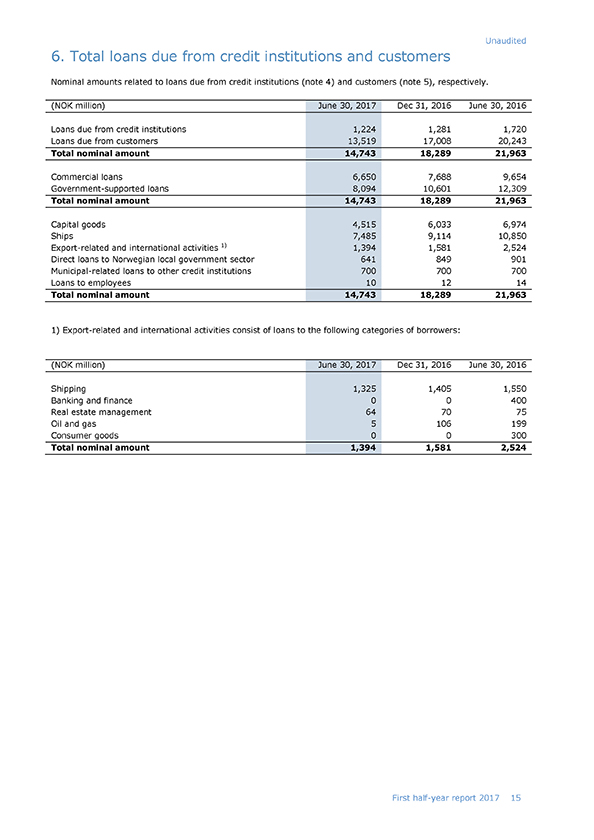

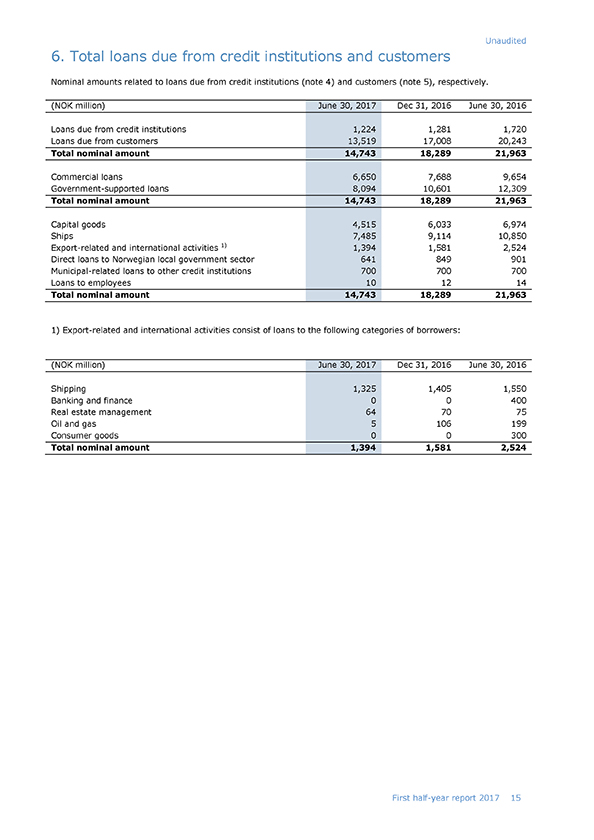

6. Total loans due from credit institutions and customers Nominal amounts related to loans due from credit institutions (note 4) and customers (note 5), respectively. (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Loans due from credit institutions 1,224 1,281 1,720 Loans due from customers 13,519 17,008 20,243 Total nominal amount 14,743 18,289 21,963 Commercial loans 6,650 7,688 9,654 Government-supported loans 8,094 10,601 12,309 Total nominal amount 14,743 18,289 21,963 Capital goods 4,515 6,033 6,974 Ships 7,485 9,114 10,850 Export-related and international activities 1) 1,394 1,581 2,524 Direct loans to Norwegian local government sector 641 849 901 Municipal-related loans to other credit institutions 700 700 700 Loans to employees 10 12 14 Total nominal amount 14,743 18,289 21,963 1) Export-related and international activities consist of loans to the following categories of borrowers: (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Shipping 1,325 1,405 1,550 Banking and finance 0 0 400 Real estate management 64 70 75 Oil and gas 5 106 199 Consumer goods 0 0 300 Total nominal amount 1,394 1,581 2,524

7. Loans past due or impaired (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Interest and principal installment1-30 days past due 0 0 96 Not matured principal on loans with payments1-30 days past due 0 0 895 Interest and principal installment31-90 days past due 0 0 13 Not matured principal on loans with payments31-90 days past due 0 0 80 Interest and principal installment more than 90 days past due 8 30 71 Not matured principal on loans with payments more than 90 days past due 21 47 50 Total loans past due 29 77 1,206 Relevant collateral or guarantees received 1) 0 77 1,206 Fair value adjustment on loans past due 0 0 0 Impairments on loans measured at amortized cost 0 0 0 1) The company considers all loans to be secured in a satisfactory manner. For these transactions, amounting to NOK 29 million, the Norwegian government, through the Guarantee Institute for Export Credit (GIEK), guarantees approximately 90 percent of the amounts in default. The remaining 10 percent are guaranteed by private banks, most of them operating in Norway. Where applicable, claims have already been submitted in accordance with the guarantees. 8. Securities and repurchase receivable (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Trading portfolio 4,672 7,659 7,417 Repurchase receivable 675 0 0 Other securities at fair value through profit and loss 139 1,164 1,831 Total 5,486 8,823 9,248

9. Fixed assets (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Intangible assets 1 1 2 Other fixed assets 2 3 3 Total fixed assets 3 4 5 10. Other assets (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Settlement account 108 Agreement 142 397 351 Cash collateral provided 2,042 1,660 2,574 Collateral deposit 1) 629 647 1,257 Other 10 82 83 Total other assets 2,823 2,786 4,265 1) The collateral deposit relates to a USD 75 million deposit of collateral for the benefit of Citibank N.A. to cover Eksportfinans’ day to day settlement activity. This amount can be adjusted up or down depending on settlement activity of Eksportfinans. Citibank is entitled to at any time without prior notice to Eksportfinans toset-off or transfer all or part of the deposit in or towards satisfaction of all or any part of the secured obligations. 11. Bond debt (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Commercial paper debt 253 0 0 Bond debt 15,392 23,254 29,915 Adjustment to fair value on debt (574) (894) (1,517) Accrued interest 138 260 278 Total bond debt 15,209 22,620 28,676 12. Other liabilities (NOK million) June 30, 2017 Dec 31, 2016 June 30, 2016 Grants to mixed credits 15 20 27 Cash collateral received 718 684 1,527 Other short-term liabilities 32 231 172 Total other liabilities 765 935 1,726

13. Segment information The company is divided into two business areas: Lending and Securities. The company also has a treasury department responsible for theday-to-day risk management and asset and liability management. Income and expenses related to treasury are divided between the two business areas. For income and expenses between the segments, the transactions are at arms length. Income and expenses divided between segments Lending Securities First half-year First half-year (NOK million) 2017 2016 2017 2016 Net interest income 1) 82 92 32 41 Commissions and income related to banking services 2) 0 0 0 0 Commissions and expenses related to banking services 2) 0 0 0 0 Net gains/(losses) on financial instruments at fair value 0 (153) (11) (13) Income/expense allocated by volume 3) (5) 122 (4) 126 Net other operating income (5) (31) (15) 113 Total operating income 77 61 17 153 Total operating expenses 33 31 37 36Pre-tax operating profit/(loss) 44 30 (20) 117 Taxes 11 (22) (5) (2)Non-IFRS profit for the period excluding unrealized gains/(losses) on financial instruments and excluding realized losses/(gains) hedged by the PHA 33 52 (15) 119 1) Net interest income includes interest income directly attributable to the segments based on Eksportfinans’ internal pricing model. The treasury department obtains interest on Eksportfinans’ equity and in addition the positive or negative result (margin) based on the difference between the internal interest income from the segments and the actual external funding cost. Net interest income in the treasury department is allocated to the reportable segments based on volume for the margin, and risk weighted volume for the interest on equity. 2) Income/(expense) directly attributable to each segment. 3) Income/expense, other than interest, in the treasury department has been allocated to the business areas by volume. These are items included in net other operating income in the income statement. Reconciliation of segment profit measure to total comprehensive income: First half-year (NOK million) 2017 2016 Lending 33 52 Securities (15) 119Non-IFRS profit for the period excluding unrealized gains/(losses) on financial instruments and excluding realized losses/(gains) hedged by the PHA 18 171 Net unrealized gains/(losses) 1) (308) (295) Unrealized losses/(gains) related to the Icelandic bank exposure included above 1) 0 (71) Tax effect of the items above 77 91 Total comprehensive income (213) (104) 1) Reversal of previously recognized loss (at exchange rates applicable at reporting date).

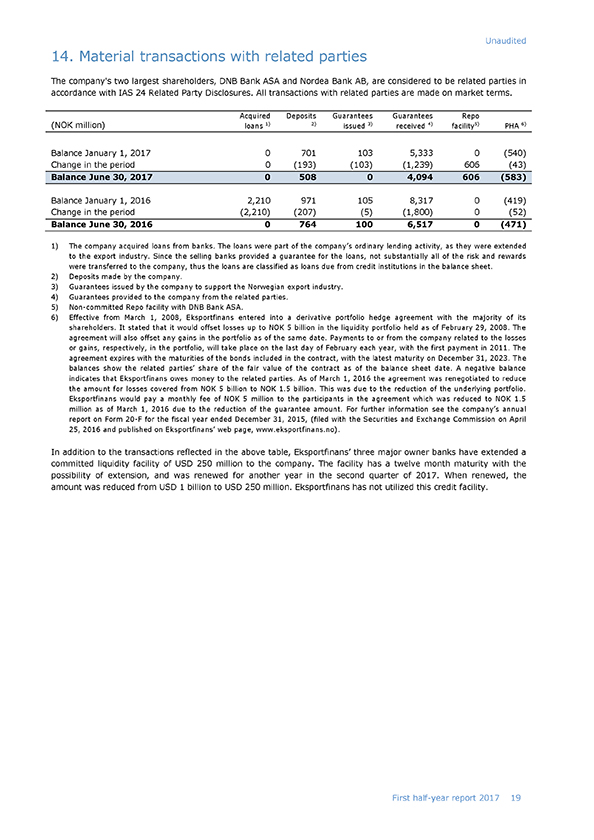

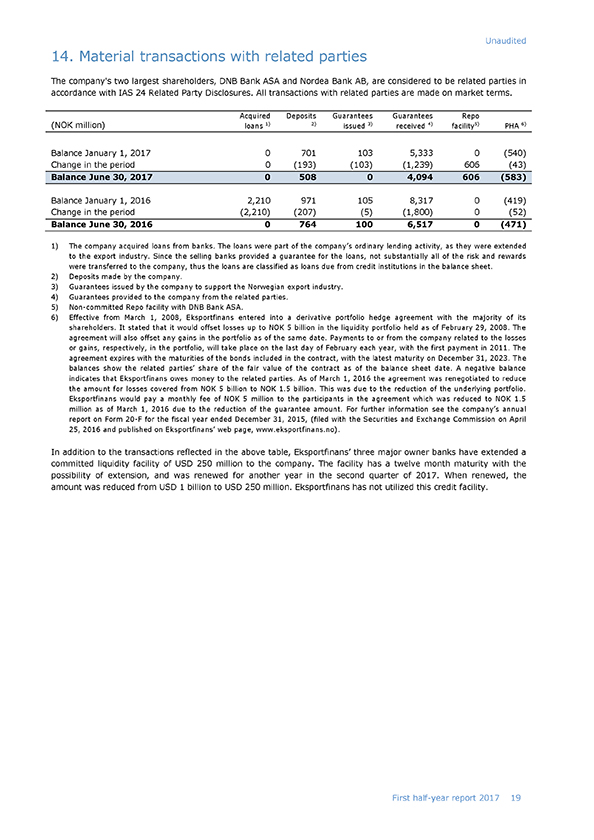

14. Material transactions with related parties The company’s two largest shareholders, DNB Bank ASA and Nordea Bank AB, are considered to be related parties in accordance with IAS 24 Related Party Disclosures. All transactions with related parties are made on market terms. (NOK million) Acquired loans 1) Deposits 2) Guarantees issued 3) Guarantees received 4) Repo facility5) PHA 6) Balance January 1, 2017 0 701 103 5,333 0 (540) Change in the period 0 (193) (103) (1,239) 606 (43) Balance June 30, 2017 0 508 0 4,094 606 (583) Balance January 1, 2016 2,210 971 105 8,317 0 (419) Change in the period (2,210) (207) (5) (1,800) 0 (52) Balance June 30, 2016 0 764 100 6,517 0 (471) 1) The company acquired loans from banks. The loans were part of the company’s ordinary lending activity, as they were extended to the export industry. Since the selling banks provided a guarantee for the loans, not substantially all of the risk and rewards were transferred to the company, thus the loans are classified as loans due from credit institutions in the balance sheet. 2) Deposits made by the company. 3) Guarantees issued by the company to support the Norwegian export industry. 4) Guarantees provided to the company from the related parties. 5)Non-committed Repo facility with DNB Bank ASA. 6) Effective from March 1, 2008, Eksportfinans entered into a derivative portfolio hedge agreement with the majority of its shareholders. It stated that it would offset losses up to NOK 5 billion in the liquidity portfolio held as of February 29, 2008. The agreement will also offset any gains in the portfolio as of the same date. Payments to or from the company related to the losses or gains, respectively, in the portfolio, will take place on the last day of February each year, with the first payment in 2011. The agreement expires with the maturities of the bonds included in the contract, with the latest maturity on December 31, 2023. The balances show the related parties’ share of the fair value of the contract as of the balance sheet date. A negative balance indicates that Eksportfinans owes money to the related parties. As of March 1, 2016 the agreement was renegotiated to reduce the amount for losses covered from NOK 5 billion to NOK 1.5 billion. This was due to the reduction of the underlying portfolio. Eksportfinans would pay a monthly fee of NOK 5 million to the participants in the agreement which was reduced to NOK 1.5 million as of March 1, 2016 due to the reduction of the guarantee amount. For further information see the company’s annual report on Form20-F for the fiscal year ended December 31, 2015, (filed with the Securities and Exchange Commission on April 25, 2016 and published on Eksportfinans’ web page, ). In addition to the transactions reflected in the above table, Eksportfinans’ three major owner banks have extended a committed liquidity facility of USD 250 million to the company. The facility has a twelve month maturity with the possibility of extension, and was renewed for another year in the second quarter of 2017. When renewed, the amount was reduced from USD 1 billion to USD 250 million. Eksportfinans has not utilized this credit facility.

15. Market risk—effects from economic hedging Note 2 specifiesthe net realized and unrealized gains/losses on financial instruments, showing separately the gains/losses related to financial derivatives. When presented to the company’s management and Board of Directors, the figures are prepared showing the various financial instruments after netting with related economic hedges, since derivatives are used as economic hedges of the market risk of specific assets and liabilities. The below table specifies net realized and unrealized gains/(losses) on financial instruments at fair value, netted with related economic hedges. Net realized and unrealized gains/(losses) on financial instruments at fair value Second quarter First half-year (NOK million) 2017 2016 2017 2016 Securities 1) (7) (5) (11) (14) Other financial instruments at fair value 1) (6) (164) (9) (216) Net realized gains/(losses) (13) (169) (20) (230) Loans and receivables 1) 13 16 30 82 Securities 1) (26) 0 (24) 109 Bond debt 1) 2) 3) (63) (284) (313) (470) Other financial instruments at fair value 1) (2) 1 (2) 0 Net unrealized gains/(losses) (78) (267) (309) (279) Financial derivatives related to the 108 Agreement 4) (6) (19) 1 (16) Net realized and unrealized gains/(losses) (97) (455) (328) (525) 1) Including financial derivatives with purpose of economic hedging. 2) Accumulated net gain on own debt is NOK 494 million as of June 30, 2017, compared to NOK 1,159 million as of June 30, 2016. 3) In the first half-year of 2017, Eksportfinans had an unrealized loss of NOK 313 million (loss of NOK 470 million in the same period of 2016) on its own debt, net of derivatives. 4) Derivatives related to components of the 108 Agreement. The 108 Agreement is accounted for at amortized cost, hence these derivatives are not included in the effects related to financial instruments at fair value. Interest, and the interest effect of economic hedging instruments, is classified as interest income or expense in the statement of comprehensive income. Changes in fair value are recorded in the line item ‘Net gains/losses) on financial instruments at fair value’. For the first half-year of 2017 and 2016, the company recorded NOK 352 million and NOK 710 million respectively, of interest income on loans due from credit institutions, loans due from customers and securities and NOK 398 million and NOK 971 million, respectively, of interest expense on commercial paper and bond debt, subordinated debt and capital contribution securities. In the same periods the company recorded positive NOK 7 million, and positive NOK 11 million, respectively, of interest income on economic hedging instruments and negative NOK 152 million and negative NOK 382 million, respectively, of interest expense on economic hedging instruments.

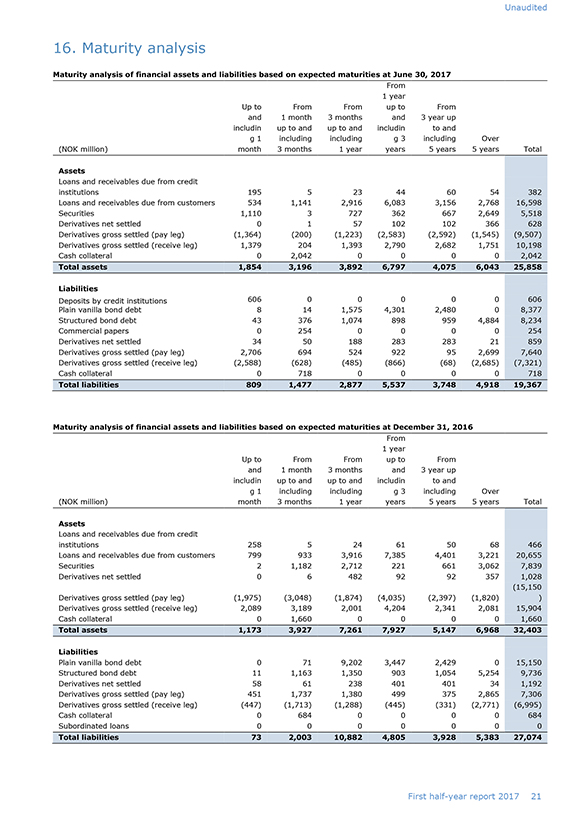

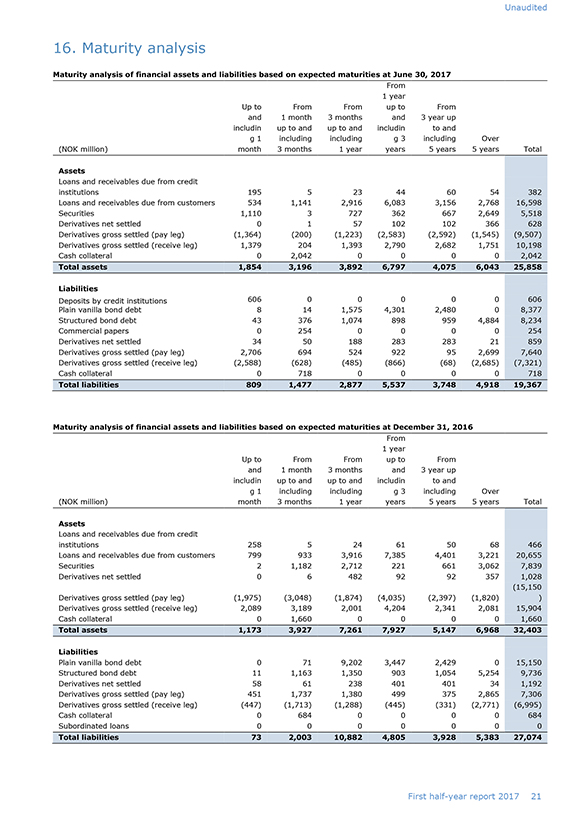

16. Maturity analysis Maturity analysis of financial assets and liabilities based on expected maturities at June 30, 2017 (NOK million) Up to and including 1 month From 1 month up to and including 3 months From 3 months up to and including 1 year From 1 year up to and including 3 years From 3 year up to and including 5 years Over 5 years Total Assets Loans and receivables due from credit institutions 195 5 23 44 60 54 382 Loans and receivables due from customers 534 1,141 2,916 6,083 3,156 2,768 16,598 Securities 1,110 3 727 362 667 2,649 5,518 Derivatives net settled 0 1 57 102 102 366 628 Derivatives gross settled (pay leg) (1,364) (200) (1,223) (2,583) (2,592) (1,545) (9,507) Derivatives gross settled (receive leg) 1,379 204 1,393 2,790 2,682 1,751 10,198 Cash collateral 0 2,042 0 0 0 0 2,042 Total assets 1,854 3,196 3,892 6,797 4,075 6,043 25,858 Liabilities Deposits by credit institutions 606 0 0 0 0 0 606 Plain vanilla bond debt 8 14 1,575 4,301 2,480 0 8,377 Structured bond debt 43 376 1,074 898 959 4,884 8,234 Commercial papers 0 254 0 0 0 0 254 Derivatives net settled 34 50 188 283 283 21 859 Derivatives gross settled (pay leg) 2,706 694 524 922 95 2,699 7,640 Derivatives gross settled (receive leg) (2,588) (628) (485) (866) (68) (2,685) (7,321) Cash collateral 0 718 0 0 0 0 718 Total liabilities 809 1,477 2,877 5,537 3,748 4,918 19,367 Maturity analysis of financial assets and liabilities based on expected maturities at December 31, 2016 (NOK million) Up to and including 1 month From 1 month up to and including 3 months From 3 months up to and including 1 year From 1 year up to and including 3 years From 3 year up to and including 5 years Over 5 years Total Assets Loans and receivables due from credit institutions 258 5 24 61 50 68 466 Loans and receivables due from customers 799 933 3,916 7,385 4,401 3,221 20,655 Securities 2 1,182 2,712 221 661 3,062 7,839 Derivatives net settled 0 6 482 92 92 357 1,028 Derivatives gross settled (pay leg) (1,975) (3,048) (1,874) (4,035) (2,397) (1,820) (15,150) Derivatives gross settled (receive leg) 2,089 3,189 2,001 4,204 2,341 2,081 15,904 Cash collateral 0 1,660 0 0 0 0 1,660 Total assets 1,173 3,927 7,261 7,927 5,147 6,968 32,403 Liabilities Plain vanilla bond debt 0 71 9,202 3,447 2,429 0 15,150 Structured bond debt 11 1,163 1,350 903 1,054 5,254 9,736 Derivatives net settled 58 61 238 401 401 34 1,192 Derivatives gross settled (pay leg) 451 1,737 1,380 499 375 2,865 7,306 Derivatives gross settled (receive leg) (447) (1,713) (1,288) (445) (331) (2,771) (6,995) Cash collateral 0 684 0 0 0 0 684 Subordinated loans 0 0 0 0 0 0 0 Total liabilities 73 2,003 10,882 4,805 3,928 5,383 27,074 Maturity analysis of financial assets and liabilities based on expected maturities at June 30, 2016

(NOK million) Up to and including 1 month From 1 month up to and including 3 months From 3 months up to and including 1 year From 1 year up to and including 3 years From 3 year up to and including 5 years Over 5 years Total Assets Loans and receivables due from credit institutions 1,705 5 24 65 58 72 1,929 Loans and receivables due from customers 655 923 5,105 8,732 5,361 4,002 24,778 Securities 271 3 4,122 1,182 627 3,480 9,685 Derivatives net settled 0 (8) 485 100 103 409 1,090 Derivatives gross settled (pay leg) (3,203) (5,326) (6,482) (6,453) (15,640) (4,356) (41,460) Derivatives gross settled (receive leg) 3,256 5,429 7,021 7,272 16,258 5,190 44,426 Cash collateral 0 2,574 0 0 0 0 2,574 Total assets 2,685 3,601 10,275 10,898 6,767 8,797 43,023 Liabilities Plain vanilla bond debt 2,455 12 12,003 3,517 2,699 0 20,686 Structured bond debt 176 1,018 624 2,244 830 6,140 11,033 Derivatives net settled 56 61 298 563 563 81 1,624 Derivatives gross settled (pay leg) 4,613 1,229 1,642 365 58 2,733 10,640 Derivatives gross settled (receive leg) (3,813) (1,204) (1,571) (304) (55) (3,030) (9,976) Cash collateral 0 1,527 0 0 0 0 1,527 Subordinated loans 0 0 0 0 0 0 0 Total liabilities 3,488 2,644 12,996 6,386 4,095 5,925 35,534 The figures in the above table include principal and interest payable (receivable) at nominal value. For the figures in the above table, call and trigger dates as estimated in models are applied in the classification of the maturities. For some issues with call and trigger optionalities, the expected maturity is estimated using a sophisticated valuation system which is further described in our annual financial statements. The actual maturities might differ from these estimations. 17. Fair value of financial instruments The methodology used for calculating fair values of financial instruments is consistent with the methodology defined in our audited annual report for the fiscal year ending 2016. 17.1 Sensitivity analysis Loans due from credit institutions or customers: The following table shows the unrealized loss of each category of loans by increasing the credit spread by 1 basis point as well as the percentage of total lending portfolio. June 30, 2017 December 31, 2016 (NOK million and percentage) Sensitivity (1 bp) Percentage Sensitivity (1 bp) Percentage Direct loans (0.5) 10.2 % (0.6) 10.1 % Loans to municipalities (0.5) 9.8 % (0.5) 11.2 % Collaboration loans — — Guaranteed loans (1.3) 80.0 % (1.5) 78.7 % Total loans 100.0 % 100.0 % The spreads applied for fair value measurement of the combined total lending portfolio are in the range from 0 basis points to 105 basis points as of June 30, 2017 (from 0 basis points to 111 basis points as ofyear-end 2016). For the combined total lending portfolio over the past two years credit spreads have changed 3 basis points per month in 95 percent of the time, representing NOK 7 million. As ofyear-end 2016 a 95 percent confidence interval was 4 basis points representing NOK 10 million. Securities: Eksportfinans retrieved prices and credit spread quotes from four different market makers and pricing vendors as of June 30, 2017. Among the four different quote providers, the major price provider (Bloomberg) covered 74 percent (73 percent as ofyear-end 2016). Eksportfinans also holds two securities originally in the PHA portfolio issued by the

defaulted Washington Mutual (nownon-existent). These securities were priced using recovery rates retrieved from Bloomberg. Bond debt: The following table shows the unrealized gain of each category of bond debt by increasing the credit spread by 1 basis point: June 30, 2017 December 31, 2016 (NOK million) Sensitivity (1 bp) Sensitivity (1 bp) Unstructured bond debt 1.8 2.1 Structured bond debt 5.0 5.7 The spreads applied for fair value measurement of bond debt are in the range from 42 basis points to 98 basis points as of June 30, 2017 (from 75 basis points to 125 basis points as ofyear-end 2016). 17.2 Financial assets measured at fair value through profit or loss June 30, 2017 December 31, 2016 (NOK million) Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total Loans due from credit institutions 557 1,037 325 1,918 773 1,082 353 2,208 Loans due from customers 0 34 5,448 5,481 0 225 6,259 6,484 Securities 0 5,486 0 5,486 0 8,822 0 8,822 Financial derivatives 0 669 830 1,499 0 1,036 768 1,804 Other assets 0 2,042 0 2,042 0 1,660 0 1,660 Total fair value 557 9,266 6,602 16,425 773 12,825 7,380 20,978 17.3 Financial liabilities measured at fair value through profit or loss June 30, 2017 December 31, 2016 (NOK million) Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total Deposits by credit institutions 0 606 0 606 0 0 0 0 Commercial paper debt 0 253 0 253 0 0 0 0 Bond debt 0 0 6,234 6,234 0 0 11,285 11,285 Financial derivatives 0 1,600 561 2,161 0 1,577 823 2,400 Other liabilities 0 718 0 718 0 684 0 684 Total fair value 0 3,177 6,795 9,972 0 2,261 12,108 14,369 Movement of level 3 financial assets From January 1, 2017 to June 30, 2017 From January 1, 2016 to June 30, 2016 (NOK million) Loans and receivables due from credit institutions Loans and receivables due from customers Financial derivatives Total Loans and receivables due from credit institutions Loans and receivables due from customers Financial derivatives Total Opening balance 353 6,260 769 7,382 408 9,602 928 10,938 Total gains or losses !) (8) (122) 76 (55) (19) (316) 246 (89) Settlements (20) (690) (15) (725) (24) (1,563) (11) (1,598) Closing balance 325 5,448 830 6,602 365 7,723 1,163 9,251 Total gains or losses !) for the period in profit or loss for assets held at the end of the reporting period (8) (122) 81 (49) (19) (316) 303 (32) *) Presented under the line item ‘Net gains/(losses) on financial instruments at fair value’ in the statement of comprehensive income. Movement of level 3 financial liabilities From January 1, 2017 to June 30, 2017 From January 1, 2016 to June 30, 2016

(NOK million) Bond debt 3) Financial derivatives Total Bond debt 3) Financial derivatives Total Opening balance 11,286 823 12,109 35,856 997 36,853 Total gains or losses 1) 2) 320 (237) 83 (577) (155) (731) Issues 2,000 0 2,000 0 0 0 Settlements (7,372) (25) (7,397) (19,614) (7) (19,621) Transfers 0 0 0 0 0 0 Closing balance 6,234 561 6,795 15,665 835 16,500 Total gains or losses 1) 2) for the period in profit or loss for liabilities held at the end of the reporting period 376 (233) 143 (387) (97) (485) 1) Presented under the line item ‘Net gains/(losses) on financial instruments at fair value’ in the statement of comprehensive income. 2) For liabilities, positive figures are represented as losses and negative figures are represented as gains. 3) Structured bond debt and unstructured bond debt have been classified as bond debt as of June 30, 2017. 17.4 Fair value of financial assets and liabilities The following table presents the financial assets and liabilities, with the fair value and carrying value (book value) of each class of financial instrument: June 30, 2017 Dec 31, 2016 June 30, 2016 (NOK million) Fair value Carrying value Fair value Carrying value Fair value Carrying value Assets Loans due from credit institutions 1,994 2,037 2,203 2,251 4,072 4,133 Loans due from customers 14,241 13,574 18,688 17,270 22,495 20,556 Securities 4,811 4,811 8,823 8,823 9,248 9,248 Repurchase Receivable 675 675 0 0 0 0 Financial derivatives 1,499 1,499 1,804 1,804 2,894 2,894 Other assets 2,823 2,823 2,786 2,786 4,265 4,265 Liabilities Deposit by credit institutions 606 606 0 0 0 0 Bond debt 15,571 15,209 23,712 22,620 30,212 28,677 Financial derivatives 2,161 2,161 2,400 2,400 3,405 3,405 Other liabilities 766 765 937 935 1,730 1,726 18. Contingencies There are no significant contingencies as of June 30, 2017. 19. Events after the balance sheet date There are no events after the balance sheet date materially affecting the financial statements.