As filed with the Securities and Exchange Commission onJune 21July 23, 2013

1933 Act Registration No. 333-________-189509

---------------------------------------------------------------------------------------------------------------------

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

| | | |

| [ X] | Pre-Effective | [ ] | Post-Effective |

| | Amendment No. 1 | | Amendment No. |

THE CALVERT FUND

(Calvert Ultra-Short Income Fund)

[Exact Name of Registrant as Specified in Charter]

Area Code and Telephone Number: 800-368-2745

4550 Montgomery Avenue, Suite 1000N

Bethesda, MD 20814

-----------------------------------

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

Calvert Investments, Inc.

4550 Montgomery Ave. Suite 1000N

Bethesda, MD 20814

-----------------------------------------

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

Title of Securities Being Registered: Shares of beneficial interest, no par value per share.

No filing fee is due for Registrant because of reliance on Section 24(f) of the Investment Company Act of 1940, which permits registration of an indefinite number of securities. A Rule 24f-2 Notice for the Registrant’s fiscal year ended September 30, 2012 was filed with the Commission on December 27, 2012.

It is proposed that Pursuant to Rule 461 promulgated under the Securities Act of 1933, as amended, the Registrant requests the acceleration of the effective date of this filing so that it will

becomebe effective on July2524, 2013,pursuant to Rule 488 of the Securities Act of 1933or as soon as practicable thereafter.

IMPORTANT INFORMATION REGARDING YOUR INVESTMENT

| |

| CALVERT TAX-FREE RESERVES | CALVERT MONEY MARKET |

| MONEY MARKET PORTFOLIO | PORTFOLIO |

| |

| a series of | a series of |

| |

| CALVERT TAX-FREE RESERVES | CALVERT SOCIAL INVESTMENT FUND |

| 4550 Montgomery Avenue, Suite 1000N | 4550 Montgomery Avenue, Suite 1000N |

| Bethesda, Maryland 20814 | Bethesda, Maryland 20814 |

| 800-368-2745 | 800-368-2745 |

| |

| |

| CALVERT FIRST GOVERNMENT | CALVERT CASH RESERVES |

| MONEY MARKET FUND | INSTITUTIONAL PRIME FUND |

| |

| a series of | a series of |

| |

| FIRST VARIABLE RATE FUND FOR | CALVERT CASH RESERVES |

| GOVERNMENT INCOME | 4550 Montgomery Avenue, Suite 1000N |

| 4550 Montgomery Avenue, Suite 1000N | Bethesda, Maryland 20814 |

| Bethesda, Maryland 20814 | 800-368-2745 |

| 800-368-2745 | |

July[23],, 2013

Dear Shareholder:

I am writing to inform you of the upcoming joint special meeting of shareholders (the “Meeting”) of (i) Calvert Tax-Free Reserves Money Market Portfolio (“CTFR Portfolio”), a series of Calvert Tax-Free Reserves, (ii) Calvert Money Market Portfolio (“CSIF Portfolio”), a series of Calvert Social Investment Fund, (iii) Calvert First Government Money Market Fund (“Calvert First Government Fund”), a series of First Variable Rate Fund for Government Income, and (iv) Calvert Cash Reserves Institutional Prime Fund (“CCR Prime Fund”), a series of Calvert Cash Reserves (collectively, the

“Acquired Funds”), to be held on Friday, September 20, 2013 at 9:00 a.m., Eastern Time, in the Tenth Floor Conference Room of Calvert Investments, Inc., 4550 Montgomery Avenue, Suite 1000N, Bethesda, Maryland 20814.

A. Fund Reorganizations

As indicated in the chart below, the Board of Trustees of Calvert Social Investment Fund with respect to the CSIF Portfolio, the Board of Trustees of First Variable Rate Fund for Government Income with respect to Calvert First Government Fund, and the Board of Trustees of Calvert Cash Reserves with respect to CCR Prime Fund, each recommends that the respective Acquired Fund be combined with the Calvert Ultra-Short Income Fund (“Ultra-Short Fund”), a series of The Calvert Fund, in each case in a tax-free reorganization (each a “Tax-Free Reorganization”). The Board of Trustees of Calvert Tax-Free Reserves also recommends that the CTFR Portfolio be combined with the Ultra-Short Fund, and while this combination will not qualify as a tax-free reorganization, CTFR Portfolio’s shareholders are not expected to incur taxes as a result of the transaction (the “Taxable Reorganization” and together with the Tax-Free Reorganizations, the “Reorganizations”). The Ultra-Short Fund normally invests in floating-rate securities and securities with durations of less than or equal to one year, but it is not a money market fund and is not subject to the restrictions of Rule 2a-7 under the Investment Company Act of 1940 (the “1940 Act”) that apply to the Acquired Funds, which all operate as money market funds. By utilizing a strategy that invests in fixed income securities with short-term durations, the portfolio managers would have greater flexibility to seek out attractive investment opportunities acrossthe yield curvea wider range of short-term fixed-income instruments based upon the portfolio managers’ evaluation of then-prevailing and anticipated economic, financial and business conditions.

| |

| Acquired Fund | Acquiring Fund |

| CTFR Portfolio | Ultra-Short Fund |

CSIF Portfolio

Calvert First Government Fund

CCR Prime Fund |

You are being asked to vote on a proposal to exchange the assets of your Acquired Fund for shares of equal value of the Ultra-Short Fund. If the Agreement and Plan of Reorganization applicable to your Acquired Fund is approved by shareholders, you will become a shareholder of Ultra-Short Fund. Details of the Reorganization applicable to your Acquired Fund, the voting process and the Meeting are set forth in the enclosed Prospectus/Proxy Statement.

The Boards of Trustees of Calvert Tax-Free Reserves, Calvert Social Investment Fund, First Variable Rate Fund for Government Income, and Calvert Cash Reserves, and I believe the Reorganizations offer you the opportunity to pursue your goals in a larger fund with a stronger performance history that will also have the flexibility to invest in a wider range of short-term fixed-income instruments. After careful consideration, the

Trustees have unanimously approved the Reorganizations and believe the Reorganizations are in the best interests of the CTFR Portfolio, CSIF Portfolio, Calvert First Government Fund, and CCR Prime Fund and you, as a shareholder. The Trustees recommend that you vote FOR this proposal.

B. Approval of Ultra-Short Fund’s Rule 12b-1 Plan by Class O Shareholders of Calvert First Government Fund

If the Reorganizations are approved, Acquired Fund shareholders would then hold Class A shares of Ultra-Short Fund, which are subject to 12b-1 fees. Pursuant to Ultra-Short Fund’s Distribution Plan under Rule 12b-1 (“Rule 12b-1 Plan”), Class A shares are subject to an ongoing distribution and shareholder servicing fee at an annual rate of 0.25% of the average daily net assets. This fee will be paid by the Fund to compensate Calvert Investment Distributors, Inc., as the principal underwriter and distributor of the Fund’s shares, for services rendered and expenses borne in connection with activities primarily intended to result in the sale of shares of the Fund. Because these fees are paid out of the assets of Ultra-Short Fund on an ongoing basis, over time, these fees will increase the cost of your investment and may cost you more than paying other types of sales charges. However, Calvert Investment Management, Inc., the investment advisor, has contractually agreed to limit direct net annual operating expenses of Ultra-Short Fund through January 31, 2016, and has also contractually agreed to provide an additional expense reimbursement to the Ultra-Short Fund for the period commencing on the first date on which any Reorganization closes through September 30, 2014.

Shareholders of Class O shares of CTFR Portfolio, CSIF Portfolio, and Calvert First Government Fund, and Class I shares of CCR Prime Fund do not pay 12b-1 fees, so, if the Reorganizations are consummated, those shareholders will pay more in 12b-1 fees. Since CTFR Portfolio, CSIF Portfolio and CCR Prime Fund have only one share class, a vote to approve the related Reorganization will also effectively be a vote to approve Ultra-Short Fund’s 12b-1 Plan. Class O shareholders of Calvert First Government Fund will be asked to separately approve the 12b-1 fees in connection with the corresponding Reorganization because Class O is the only class of Calvert First Government Fund that will pay more in 12b-1 fees if that Reorganization is consummated. The approval of Ultra-Short Fund’s 12b-1 Plan by Class O shareholders of Calvert First Government Fund is a necessary prerequisite for the consummation of the corresponding Reorganization. Further details of the Rule 12b-1 Plan and the 12b-1 fees are set forth in the enclosed Prospectus/Proxy Statement. The Trustees recommend that Class O shareholders of Calvert First Government Fund vote FOR this proposal.

Regardless of whether you plan to attend the Meeting in person, PLEASE VOTE VIA THE INTERNET OR TELEPHONE, OR COMPLETE, DATE, SIGN AND RETURN YOUR PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE so that you will be represented at the Meeting. Your internet or telephone vote or your properly executed proxy cards must be received by 9:00 a.m., Eastern Time, on September 20, 2013. If you vote by internet or telephone or return a proxy card, and are present at the Meeting, you may change your vote at that time.

However, attendance in person at the Meeting, by itself, will not automatically revoke your vote.

I appreciate the time you will take to review this important matter. If we may be of any assistance, please call us at 800-368-2745. Our hearing-impaired shareholders may call 800-541-1524 for a TDD connection.

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES OF CTFR PORTFOLIO, CSIF PORTFOLIO, CALVERT FIRST GOVERNMENT FUND, OR CCR PRIME FUND YOU OWN. IN ORDER TO AVOID THE UNNECESSARY EXPENSE OF FURTHER SOLICITATION, PLEASE VOTE PROMPTLY.

| |

| CALVERT TAX-FREE RESERVES | CALVERT MONEY MARKET |

| MONEY MARKET PORTFOLIO | PORTFOLIO |

| |

| a series of | a series of |

| |

| CALVERT TAX-FREE RESERVES | CALVERT SOCIAL INVESTMENT FUND |

| 4550 Montgomery Avenue, Suite 1000N | 4550 Montgomery Avenue, Suite 1000N |

| Bethesda, Maryland 20814 | Bethesda, Maryland 20814 |

| 800-368-2745 | 800-368-2745 |

| |

| |

| CALVERT FIRST GOVERNMENT | CALVERT CASH RESERVES |

| MONEY MARKET FUND | INSTITUTIONAL PRIME FUND |

| |

| a series of | a series of |

| |

| FIRST VARIABLE RATE FUND FOR | CALVERT CASH RESERVES |

| GOVERNMENT INCOME | 4550 Montgomery Avenue, Suite 1000N |

| 4550 Montgomery Avenue, Suite 1000N | Bethesda, Maryland 20814 |

| Bethesda, Maryland 20814 | 800-368-2745 |

| 800-368-2745 | |

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

To be held on September 20, 2013

To the Shareholders of the Above Named Funds:

NOTICE IS HEREBY GIVEN that a Joint Special Meeting of Shareholders of (i) Calvert Tax-Free Reserves Money Market Portfolio (“CTFR Portfolio”), a series of Calvert Tax-Free Reserves; (ii) Calvert Money Market Portfolio (“CSIF Portfolio”), a series of Calvert Social Investment Fund; (iii) Calvert First Government Money Market Fund (“Calvert First Government Fund”), a series of First Variable Rate Fund for Government Income; and (iv) Calvert Cash Reserves Institutional Prime Fund (“CCR Prime Fund”), a series of Calvert Cash Reserves, will be held on Friday, September 20, 2013 at 9:00 a.m., Eastern Time, in the Tenth Floor Conference Room of Calvert Investments, Inc., 4550 Montgomery Avenue, Suite 1000N, Bethesda, Maryland 20814, as may be adjourned from time to time (the “Meeting”), for the purposes listed below:

For Shareholders of CTFR Portfolio

1. To approve the Agreement and Plan of Reorganization (the “CTFR Portfolio Reorganization Plan”), providing for the transfer of all of the assets of the

CTFR Portfolio, a series of Calvert Tax-Free Reserves, to the Calvert Ultra-Short Income Fund (“Ultra-Short Fund”), a series of The Calvert Fund, in exchange for shares of the Ultra-Short Fund. The CTFR Portfolio Reorganization Plan also provides for distribution of these shares of the Ultra-Short Fund to shareholders of the CTFR Portfolio in liquidation and subsequent termination of the CTFR Portfolio.

For Shareholders of CSIF Portfolio

2. To approve the Agreement and Plan of Reorganization (the “CSIF Portfolio Reorganization Plan”), providing for the transfer of all of the assets of the CSIF Portfolio, a series of Calvert Social Investment Fund, to the Ultra-Short Fund, a series of The Calvert Fund, in exchange for shares of the Ultra-Short Fund. The CSIF Portfolio Reorganization Plan also provides for distribution of these shares of the Ultra-Short Fund to shareholders of the CSIF Portfolio in liquidation and subsequent termination of the CSIF Portfolio.

For ALL Shareholders of Calvert First Government Fund

3. To approve the Agreement and Plan of Reorganization (the “First Government Reorganization Plan”), providing for the transfer of all of the assets of the Calvert First Government Fund, a series of First Variable Rate Fund for Government Income, to the Ultra-Short Fund, a series of The Calvert Fund, in exchange for shares of the Ultra-Short Fund. The First Government Reorganization Plan also provides for distribution of these shares of the Ultra-Short Fund to shareholders of the Calvert First Government Fund in liquidation and subsequent termination of the Calvert First Government Fund. Approval of this Reorganization is contingent on shareholder approval of Proposal 4.

For Class O Shareholders of Calvert First Government Fund ONLY

4. To approve the Rule 12b-1 Plan of Ultra-Short Fund.

For Shareholders of CCR Prime Fund

5. To approve the Agreement and Plan of Reorganization (the “CCR Prime Reorganization Plan”), providing for the transfer of all of the assets of the CCR Prime Fund, a series of Calvert Cash Reserves, to the Ultra-Short Fund, a series of The Calvert Fund, in exchange for shares of the Ultra-Short Fund. The CCR Prime Reorganization Plan also provides for distribution of these shares of the Ultra-Short Fund to shareholders of the CCR Prime Fund in liquidation and subsequent termination of the CCR Prime Fund.

For Shareholders of each Portfolio

6. To consider and act upon any other business that may properly come before the Meeting.

The matters referred to above are discussed in detail in the Prospectus/Proxy Statement accompanying this Notice. The Board of Trustees of the CTFR Portfolio, CSIF Portfolio, Calvert First Government Fund, and CCR Prime Fund have fixed the close of business on July 22, 2013 as the record date for determining shareholders of each Portfolio entitled to notice of and to vote at the Meeting.

July[23],, 2013

By Order of the Board of Trustees,

William M. Tartikoff, Esq.

Vice President

ACQUISITION OF ASSETS OF

| |

| CALVERT TAX-FREE RESERVES | CALVERT MONEY MARKET |

| MONEY MARKET PORTFOLIO | PORTFOLIO |

| |

| a series of | a series of |

| |

| CALVERT TAX-FREE RESERVES | CALVERT SOCIAL INVESTMENT FUND |

| 4550 Montgomery Avenue, Suite 1000N | 4550 Montgomery Avenue, Suite 1000N |

| Bethesda, Maryland 20814 | Bethesda, Maryland 20814 |

| 800-368-2745 | 800-368-2745 |

| |

| |

| CALVERT FIRST GOVERNMENT | CALVERT CASH RESERVES |

| MONEY MARKET FUND | INSTITUTIONAL PRIME FUND |

| |

| a series of | a series of |

| |

| FIRST VARIABLE RATE FUND FOR | CALVERT CASH RESERVES |

| GOVERNMENT INCOME | 4550 Montgomery Avenue, Suite 1000N |

| 4550 Montgomery Avenue, Suite 1000N | Bethesda, Maryland 20814 |

| Bethesda, Maryland 20814 | 800-368-2745 |

| 800-368-2745 | |

BY AND IN EXCHANGE FOR SHARES OF

CALVERT ULTRA-SHORT INCOME FUND

a series of

THE CALVERT FUND

4550 Montgomery Avenue, Suite 1000N

Bethesda, Maryland 20814

800-368-2745

PROSPECTUS/PROXY STATEMENT

DATED JULY[23],, 2013

This Prospectus/Proxy Statement is being furnished in connection with separate Agreements and Plans of Reorganization (each a “Plan,” and together, the “Plans”) which will be submitted to shareholders of the following portfolios (each an “Acquired Fund,” and together, the “Acquired Funds”): Calvert Tax-Free Reserves Money Market Portfolio (“CTFR Portfolio”),

a series of Calvert Tax-Free Reserves; Calvert Money Market Portfolio (“CSIF Portfolio”), a series of Calvert Social Investment Fund; Calvert First Government Money Market Fund (“Calvert First Government Fund”), a series of First Variable Rate Fund for Government Income; and Calvert Cash Reserves Institutional Prime Fund (“CCR Prime Fund”), a series of Calvert Cash Reserves. The plans will be considered at a joint Special Meeting of Shareholders to be held on September 20, 2013 at 9:00 a.m. Eastern time, in the Tenth Floor Conference Room of Calvert Investments, Inc., 4550 Montgomery Avenue, Suite 1000N, Bethesda, Maryland 20814, and any adjournments thereof (the “Meeting”). In addition, Class O shareholders of Calvert First Government Fund will consider Ultra-Short Fund's Rule 12b-1 Plan.

GENERAL

Subject to the approval of the shareholders of the Acquired Funds, the Boards of Trustees of Calvert Tax-Free Reserves, Calvert Social Investment Fund, First Variable Rate Fund for Government Income, and Calvert Cash Reserves (the “Merging Trusts”) have approved the reorganization of CTFR Portfolio, CSIF Portfolio, Calvert First Government Fund, and CCR Prime Fund, respectively, into the Calvert Ultra-Short Income Fund (“Ultra-Short Fund”)(together with the Acquired Funds, the “Funds”), a series of The Calvert Fund (together with the Merging Trusts, the “Trusts”).

In the reorganizations, all of the assets of the Acquired Funds will be acquired by Ultra-Short Fund in exchange for Class A shares of Ultra-Short Fund (the “Reorganizations” and each individually, a “Reorganization”). If the Reorganizations are approved, Class A shares of Ultra-Short Fund will be distributed to shareholders of the corresponding Acquired Fund in liquidation of that Acquired Fund, and each Acquired Fund will be terminated. You will then hold that number of full and fractional shares of Ultra-Short Fund which have an aggregate net asset value equal to the aggregate net asset value of your shares of the Acquired Fund immediately prior to the Reorganization.

Each of CTFR Portfolio, CSIF Portfolio, Calvert First Government Fund, and CCR Prime Fund is a separate diversified series of Calvert Tax-Free Reserves, Calvert Social Investment Fund, First Variable Rate Fund for Government Income, and Calvert Cash Reserves, respectively, each of which is a Massachusetts business trust and is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). Ultra-Short Fund is a separate non-diversified series of The Calvert Fund, another Massachusetts business trust, which is also an open-end management investment company registered under the 1940 Act. The investment objective of each Acquired Fund is similar to that of Ultra-Short Fund, as follows:

| | |

Fund CTFR Portfolio | | Investment Objective The Fund seeks to earn the highest level of interest income, exempt from federal income taxes, as is consistent with prudent investment management, preservation of capital, and the quality and maturity characteristics of the Fund. |

2

| |

| CSIF Portfolio | The Fund seeks to provide the highest level of current |

| | income, consistent with liquidity, safety and security of |

| | capital, through investment in money market instruments |

| | meeting the Fund’s investment criteria, including |

| | financial, sustainability and social responsibility factors. |

| |

| Calvert First Government Fund | The Fund is a U.S. Government-only money market fund |

| | that seeks to earn the highest possible yield consistent |

| | with safety, liquidity, and preservation of capital. In |

| | pursuing its objective, the Fund invests only in U.S. |

| | Government obligations, including such obligations |

| | subject to repurchase agreements with recognized |

| | securities dealers and banks. The Fund seeks to maintain a |

| | constant net asset value of $1.00 per share. |

| |

| CCR Prime Fund | The Fund seeks to obtain the highest level of current |

| | income, consistent with safety, preservation of capital and |

| | liquidity that is available through investments in specified |

| | money market instruments. The Fund seeks to maintain a |

| | constant net asset value of $1.00 per share. |

| |

| Ultra-Short Fund | The Fund seeks to maximize income, to the extent |

| | consistent with preservation of capital, through investment |

| | in short-term bonds and income-producing securities. |

While each Fund seeks to maximize income while preserving capital, there are some differences in the investment objectives of the Funds. Unlike the Acquired Funds, Ultra-Short Fund is not a money market fund and does not seek to maintain a constant net asset value of $1.00 per share, so the value of its shares will fluctuate based on the value of the investments that it holds. In addition, CTFR Portfolio seeks interest income exempt from federal income taxes, Calvert First Government Fund invests only in U.S. Government obligations, and CSIF Portfolio invests in instruments that meet specific criteria, including financial, sustainability and social responsibility factors, which are not part of the investment objectives of the other Funds.

The investment strategies for each Acquired Fund are also similar to those for Ultra-Short Fund, but there are some differences. While the Acquired Funds are diversified funds, Ultra-Short Fund is non-diversified, which means it may invest a greater percentage of its assets in a particular issuer. While Ultra-Short Fund’s average portfolio duration will normally be less than one year, itmaywill likely have a longer average portfolio duration than the Acquired Funds. Furthermore, unlike the Acquired Funds, Ultra-Short Fund may invest up to 35% of its net assets in below-investment grade, high-yield debt securities, (known as junk bonds), and up to 25% of its net assets in foreign debt securities.

Ultra- Short Fund is not a money market fund. It does not seek to maintain a constant net asset value of $1.00 per share and it is not subject to the conditions of Rule 2a-7 under the 1940

3

Act, so the value of its shares will fluctuate based on the value of the investments that it holds and it is therefore possible to lose money by investing in the Fund.

Calvert Investment Management, Inc. (“CIM” or the “Advisor”) serves as the investment Advisor for the Acquired Funds and Ultra-Short Fund.

This Prospectus/Proxy Statement explains concisely the information about Ultra-Short Fund that you should know before voting on the Plan. Please read it carefully and keep it for future reference. Additional information concerning each Fund and the Reorganizations is contained in the documents described below, all of which have been filed with the Securities and Exchange Commission (“SEC”):

| |

| Information about CTFR Portfolio: | How to Obtain this Information: |

| |

| Prospectus of Calvert Tax-Free Reserves relating to | Copies are available upon request and |

| CTFR Portfolio, dated April 30, 2013, as | without charge if you: |

| supplemented | |

| |

| Statement of Additional Information of Calvert Tax- | · Visit www.calvert.com on the |

| Free Reserves relating to CTFR Portfolio, dated April | internet; |

| 30, 2013 | |

| · Write to: |

| Annual Report of Calvert Tax-Free Reserves relating | Calvert Tax-Free Reserves |

| to CTFR Portfolio for the year ended December 31, | 4550 Montgomery Avenue |

| 2012 | Suite 1000N |

| | Bethesda, Maryland 20814; or |

| |

| | · Call (800) 368-2745 toll-free. |

| | · |

| |

| |

| Information about CSIF Portfolio: | How to Obtain this Information: |

| |

| Prospectus of Calvert Social Investment Fund relating | Copies are available upon request and |

| to CSIF Portfolio, dated January 31, 2013, as | without charge if you: |

| supplemented | |

| | · Visit www.calvert.com on the |

| Statement of Additional Information of Calvert Social | internet; |

| Investment Fund relating to CSIF Portfolio, dated | |

| January 31, 2013, as supplemented | |

| · Write to: |

| Annual Report of Calvert Social Investment Fund | Calvert Social Investment Fund |

| relating to CSIF Portfolio for the year ended | 4550 Montgomery Avenue |

| September 30, 2012 | Suite 1000N |

| | Bethesda, Maryland 20814; or |

| Semi-Annual Report of Calvert Social Investment | |

| Fund relating to CSIF Portfolio for the period ended | · Call (800) 368-2745 toll-free. |

4

| |

| March 31, 2013 | |

| |

| |

| Information about Calvert First Government Fund: | How to Obtain this Information: |

| |

| Prospectus of First Variable Rate Fund for | Copies are available upon request and |

| Government Income relating to Calvert First | without charge if you: |

| Government Fund, dated April 30, 2013, as | |

| supplemented | · Visit www.calvert.com on the |

| internet; |

| Statement of Additional Information of First Variable | |

| Rate Fund for Government Income relating to Calvert | |

| First Government Fund, dated April 30, 2013 | · Write to: |

| | First Variable Rate Fund for |

| Annual Report of First Variable Rate Fund for | Government Income |

| Government Income relating to Calvert First | 4550 Montgomery Avenue |

| Government Fund for the year ended December 31, | Suite 1000N |

| 2012 | Bethesda, Maryland 20814; or |

| |

| | · Call (800) 368-2745 toll-free. |

| | · |

| |

| Information about CCR Prime Fund: | How to Obtain this Information: |

| |

| Prospectus of Calvert Cash Reserves relating to CCR | Copies are available upon request and |

| Prime Fund, dated January 31, 2013, as supplemented | without charge if you: |

| |

| Statement of Additional Information of Calvert Cash | · Visit www.calvert.com on the |

| Reserves relating to CCR Prime Fund, dated January | internet; |

| 31, 2013 | |

| |

| Annual Report of Calvert Cash Reserves relating to | · Write to: |

| CCR Prime Fund for the year ended September 30, | Calvert Cash Reserves |

| 2012 | 4550 Montgomery Avenue |

| | Suite 1000N |

| Semi-Annual Report of Calvert Cash Reserves relating | Bethesda, Maryland 20814; or |

| to CCR Prime Fund for the period ended March 31, | |

| 2013 | · Call (800) 368-2745 toll-free. |

| | · |

5

| |

| Information about Ultra-Short Fund: | How to Obtain this Information: |

| |

| Prospectus of The Calvert Fund relating to Ultra-Short | Copies are available upon request and |

| Fund, dated January 31, 2013, as supplemented | without charge if you: |

| |

| Statement of Additional Information of The Calvert | · Visit www.calvert.com on the |

| Fund relating to Ultra-Short Fund, dated January 31, | internet; |

| 2013, as supplemented | |

| |

| Annual Report of The Calvert Fund relating to Ultra- | · Write to: |

| Short Fund for the year ended September 30, 2012 | The Calvert Fund |

| | 4550 Montgomery Avenue |

| Semi-Annual Report of The Calvert Fund relating to | Suite 1000N |

| Ultra-Short Fund for the period ended March 31, 2013 | Bethesda, Maryland 20814; or |

| |

| | · Call (800) 368-2745 toll-free. |

| |

| |

| |

| Information about the Reorganizations: | How to Obtain this Information: |

| |

Statement of Additional Information dated July[23], | Copies are available upon request and |

| 2013, which relates to this Prospectus/Proxy Statement | without charge if you: |

| and the Reorganizations | |

| | · Write to: |

| | The Calvert Fund |

| | 4550 Montgomery Avenue |

| | Suite 1000N |

| | Bethesda, Maryland 20814; or |

| |

| | · Call (800) 368-2745 toll-free. |

You can also obtain copies of any of these documents without charge on the EDGAR database on the SEC’s internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549.

Information relating to Ultra-Short Fund contained in the Prospectus of The Calvert Fund dated January 31, 2013, as supplemented (SEC File No. 811-03416), is incorporated by reference in this document. (This means that such information is legally considered to be part of this Prospectus/Proxy Statement.) Information relating to CTFR Portfolio contained in the Prospectus of Calvert Tax-Free Reserves dated April 30, 2013 (SEC File No. 811-03101), information relating to CSIF Portfolio contained in the Prospectus of Calvert Social Investment Fund dated January 31, 2013, as supplemented (SEC File No. 811-03334), information relating to Calvert First Government Fund contained in the Prospectus of First Variable Rate Fund for

6

Government Income dated April 30, 2013 (SEC File No. 811-02633), and information relating to CCR Prime Fund contained in the Prospectus of Calvert Cash Reserves dated January 31, 2013 (SEC File No. 811-03418), also is incorporated by reference in this document. The Statement of Additional Information dated July[23],, 2013 relating to this Prospectus/Proxy Statement and the Reorganizations, which includes the financial statements of Calvert Tax-Free Reserves relating to CTFR Portfolio for the year ended December 31, 2012, financial statements of Calvert Social Investment Fund relating to CSIF Portfolio for the year ended September 30, 2012 and the six months ended March 31, 2013, financial statements of First Variable Rate Fund for Government Income relating to Calvert First Government Fund for the year ended December 31, 2012, and financial statements of Calvert Cash Reserves relating to CCR Prime Fund for the year ended September 30, 2012 and the six months ended March 31, 2013, and pro forma financial information of The Calvert Fund relating to Ultra-Short Fund for the twelve-month period ended March 31, 2013, is incorporated by reference in its entirety in this document.

An investment in Ultra-Short Fund:

· is not an investment in a money market fund

· is not a deposit of, or guaranteed by, any bank

· is not insured by the FDIC, the Federal Reserve Board or any other government agency

· is not endorsed by any bank or government agency

· involves investment risk, including possible loss of the purchase payment of your original

investment

7

| |

| Table of Contents |

| |

| SUMMARY | 10 |

| Why are the Reorganizations being proposed? | 10 |

| What are the key features of each Reorganization? | 10 |

| After the Reorganizations, what shares will I own? | 11 |

| How will the Reorganizations affect me? | 11 |

| How do the Trustees recommend that I vote? | 12 |

| Will I be able to purchase, exchange and redeem shares and receive distributions in the same way? | 12 |

| How do the Funds’ investment objectives and principal investment strategies compare? | 13 |

| How do the Funds’ fees and expenses compare? | 20 |

| What is the Portfolio Turnover rate? | 24 |

| How do the Funds’ performance records compare? | 24 |

| Who will be the Advisor and Service Providers of my Fund after the Reorganizations? 29 |

| What will the management fees be after the Reorganizations? | 29 |

| What will be the primary federal tax consequences of the Reorganizations? | 31 |

| RISKS | 32 |

| Are the risk factors for the Funds similar? | 32 |

| What are the primary risks of investing in each Fund? | 32 |

INFORMATION ABOUT THE REORGANIZATIONREORGANIZATIONS | 36 |

| Agreements and Plans of Reorganization | 38 |

| Federal Income Tax Consequences | 39 |

| Pro Forma Capitalization | 40 |

| Distribution of Shares | 43 |

| Purchase and Redemption Procedures | 44 |

| Exchange Privileges | 45 |

| Check Writing Privileges | 45 |

| New Accounts and New Purchases of Acquired Fund Shares | 45 |

| Market Timing Policy | 45 |

| Dividend Policy | 46 |

| COMPARATIVE INFORMATION ON SHAREHOLDERS’ RIGHTS | 46 |

| Form of Organization | 46 |

| Capitalization | 46 |

| Shareholder Liability | 47 |

| Shareholder Meetings and Voting Rights | 47 |

| Liquidation | 47 |

| Liability and Indemnification of Trustees | 48 |

| INFORMATION CONCERNING THE MEETING AND VOTING | |

| REQUIREMENTS | 48 |

| Shareholder Information | 51 |

| Control Persons and Principal Holders of Securities | 51 |

| SHAREHOLDER INFORMATION FOR ULTRA-SHORT FUND | 53 |

| How Shares Are Priced | 53 |

| When Your Account Will Be Credited | 54 |

| Dividends, Capital Gains and Taxes | 54 |

| | |

| Federal Taxes | | 55 |

| Other Tax Information | | 55 |

| How to Sell Shares | | 55 |

| Exchanges | | 56 |

| | |

LEGAL MATTERS | | 59 |

| | |

OTHER BUSINESS | | 59 |

| INFORMATION ABOUT THE DISTRIBUTION PLAN UNDER RULE 12B-1 | | 56 |

| Background | | 53 |

| Summary of the Rule 12b-1 Plan | | 54 |

| Required Vote | | 54 |

| FINANCIAL STATEMENTS AND EXPERTS | | 59 |

| LEGAL MATTERS | | 59 |

| ADDITIONAL INFORMATION | | 59 |

| OTHER BUSINESS | | 59 |

| Exhibit A—Agreement and Plan of Reorganization for CTFR Portfolio | A -1 |

| Exhibit B—Agreement and Plan of Reorganization for CSIF Portfolio | B -1 |

| Exhibit C—Agreement and Plan of Reorganization for Calvert First Government Fund | C -1 |

| Exhibit D—Agreement and Plan of Reorganization for CCR Prime Fund | D -1 |

SUMMARY

THIS SECTION SUMMARIZES THE PRIMARY FEATURES AND CONSEQUENCES OF THE REORGANIZATIONS. IT MAY NOT CONTAIN ALL OF THE INFORMATION THAT IS IMPORTANT TO YOU. TO UNDERSTAND THE REORGANIZATIONS, YOU SHOULD READ THIS ENTIRE PROSPECTUS/PROXY

STATEMENT AND THE RELEVANT EXHIBITS.

This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Proxy Statement, the Prospectuses and Statements of Additional Information relating to the Funds, and the Plans that are attached to this Prospectus/Proxy Statement as Exhibit A, Exhibit B, Exhibit C and Exhibit D.

Why are the Reorganizations being proposed?

For the past few years, interest rates have been at historically low levels, which means that the Acquired Funds have been investing in low yielding money market instruments. As a result, the Advisor has voluntarily reimbursed the Acquired Funds’ expenses to maintain a positive yield on the Acquired Funds. Persistent low yields from the securities in which the Acquired Funds invest have created a challenge for the Advisor to continue to maintain money market funds as investment options. The proposed Reorganizations will allow shareholders of each Acquired Fund to own a fund that may invest more broadly than a money market fund but still seeks to maximize income while preserving capital, and with a greater amount of combined assets after the Reorganizations.While itAlthough it is not a money market fund, and therefore does not maintain a stable net asset value and is not subject to the conditions of Rule 2a-7 under the 1940 Act, Ultra-Short Fund has a similar investment objective to each Acquired Fund, while providing and provides a better opportunity for return on shareholders’ investment. It is expected that fund operating expenses of Ultra-Short Fund will be higher than for each of the Acquired Funds after the Reorganizations, primarily due to the termination of the management fee waivers and expense reimbursements in place with the Acquired Funds, but. Unlike Class O shares of CTFR Portfolio, CSIF Portfolio, and Calvert First Government Fund, and Class I shares of CCR Prime Fund, Ultra-Short Fund Class A shares are also subject to a separate Distribution and Service (12b-1) fee of 0.25%. However, the Advisor has agreed to contractually limit direct net annual operating expenses of Ultra-Short Fund through January 31, 2016. In addition, the Advisor has agreed to an additional expense reimbursement with Ultra-Short Fund for a period commencing on the first date on which any Reorganization closes through September 30, 2014. The Reorganizations could create better efficiencies for the portfolio management team and perhaps lower expenses for Ultra-Short Fund as assets grow, which would benefit all shareholders of the Ultra-Short Fund, including those of the Acquired Funds.

What are the key features of each Reorganization?

The Plans set forth the key features of the Reorganizations. For a complete description of your relevant Reorganization, see the Exhibits. The Plans generally provide for the following:

10

the transfer in kind of all of the assets of the Acquired Fund to Ultra-Short Fund in exchange for Class A shares of Ultra-Short Fund; the liquidation of the Acquired Fund by distribution of Class A shares of Ultra-Short Fund to the Acquired Fund’s shareholders; the Reorganization of CTFR Portfolio as a taxable transaction; and the structuring of the Reorganization for CSIF Portfolio, Calvert First Government Fund, and CCR Prime Fund in a manner intended to qualify as a tax-free reorganization for federal income tax purposes.

Subject to the required shareholder approval, the Reorganizations for CSIF Portfolio and CCR Prime Fund are expected to be completed on or about September 27, 2013, and the Reorganizations for CTFR Portfolio and Calvert First Government Fund are expected to be completed on or about November 15, 2013.

After the Reorganizations, what shares will I own?

If you own shares of an Acquired Fund on the date on which the related Reorganization is completed, you will own Class A shares of Ultra-Short Fund.

The new shares you receive will have the same total value as your shares of the Acquired Fund immediately prior to that Reorganization.

How will the Reorganizations affect me?

It is anticipated that the Reorganizations will result in better operating efficiencies and may provide shareholders of the Acquired Funds the opportunity to earn higher yields by expanding investments in short-term fixed-income securities. Upon the reorganization of the Acquired Funds into Ultra-Short Fund, operating efficiencies are anticipated to be achieved by Ultra-Short Fund because it will have a greater level of assets. It is believed that a larger, combined fund will have a greater likelihood of gaining additional assets, which may lead to greater economies of scale. As of March 31, 2013, the net assets of each Portfolio were as follows:

| | |

| Fund | | Net Assets |

| Acquired Funds: | | |

| CTFR Portfolio | $ | 403,383,991 |

| CSIF Portfolio | $ | 127,163,620 |

| Calvert First Government Fund | $ | 96,488,810 |

| CCR Prime Fund | $ | 132,608,721 |

| |

| Ultra-Short Fund | $ | 457,210,835 |

11

Upon approval of the Reorganizations, Acquired Fund shareholders will receive Class A shares of Ultra-Short Fund, which are subject to 12b-1 fees of 0.25%. Class B and Class C shares of Calvert First Government Fund are currently subject to 12b-1 fees of 1.00%. Class O shares of CTFR Portfolio, CSIF Portfolio, and Calvert First Government Fund, and Class I shares of CCR Prime Fund are not subject to 12b-1 fees, so those shareholders will pay more in 12b-1 fees. However, the Advisor has contractually agreed to limit direct net annual operating expenses of Ultra-Short Fund through January 31, 2016, and has also contractually agreed to provide an additional expense reimbursement to the Ultra-Short Fund for the period commencing on the first date on which any Reorganization closes through September 30, 2014.It is believed that a larger, combined fund will have a greater likelihood of gaining additional assets, which may lead to greater economies of scale. For a comparison of the fees and expenses of each Acquired Fund and Ultra-Short Fund, please see “How do the Funds’ fees and expenses compare” below.

After the Reorganizations, the value of your shares will depend on the performance of Ultra-Short Fund rather than that of the Acquired Fund. The Boards of Trustees overseeing the Funds believe that the Reorganizations will benefit the Acquired Funds and Ultra-Short Fund. The costs of the Reorganizations, including the costs of the Meeting, the proxy solicitation or any adjourned session, are estimated to be $100,000, and will be paid by the Funds, but because the Advisor is reimbursing a substantial portion of each Fund’s expenses, the merger costs will effectively be borne by the Advisor.

Dividends for the Acquired Funds are accrued daily and paid monthly, and Ultra-Short Fund will pay dividends from net investment income on a monthly basis. Like the Acquired Funds, Ultra-Short Fund will distribute net realized capital gains, if any, at least annually. These dividends and distributions will continue to be automatically reinvested in additional shares of Ultra-Short Fund or distributed in cash, in accordance with your election.

How do the Trustees recommend that I vote?

The Trustees of each Merging Trust, including the Trustees who are not “interested persons” as such term is defined in the 1940 Act (the “Disinterested Trustees”), have concluded that each Reorganization would be in the best interests of the relevant Acquired Fund and its shareholders, and that the shareholders’ interests will not be diluted as a result of the Reorganizations. Accordingly, the Trustees have submitted the Plans for approval by the shareholders of the Acquired Funds.

THE TRUSTEES RECOMMEND THAT YOU VOTE FOR THE RELEVANT PLAN AND THE REORGANIZATION CONTEMPLATED THEREBY

THE TRUSTEES ALSO RECOMMEND THAT CLASS O SHAREHOLDERS OF CALVERT FIRST GOVERNMENT FUND VOTE TO APPROVE THE 12B-1 PLAN OF ULTRA-SHORT FUND

Will I be able to purchase, exchange and redeem shares and receive distributions in the same way?

After the Reorganization, you will be able to redeem and exchange the Ultra-Short Fund Class A shares that you receive and you will receive distributions on those shares. You will also

12

be able to purchase additional Class A shares of Ultra-Short Fund. Class B, Class C, Class I and Class O shares are not offered by Ultra-Short Fund, and thus are not available for purchase. Investments in the Funds are not insured. For more information, see “Purchase and Redemption Procedures,” “Exchange Privileges” and “Dividend Policy” below. While Acquired Fund shareholders may continue to purchase shares of an Acquired Fund until the day immediately prior to the applicable Reorganization, the Boards of Trustees closed the Acquired Funds to new investors as of June 6, 2013, so new share purchases of an Acquired Fund by new investors will no longer be processed and any purchase money received in connection with an application to establish a new account in an Acquired Fund will be returned.

Unlike the Acquired Funds, Ultra-Short Fund does not offer checkwriting as a service. Therefore, as an Ultra-Short Fund shareholder after the Reorganization, you will not be able to redeem shares of the Ultra-Short Fund by writing a check. Checks written on an Acquired Fund will be processed through August 31, 2013, but after that date checks will no longer be processed and will be returned to the shareholder. Orders for new checks on an Acquired Fund are no longer being accepted. Shareholders may continue to redeem their shares via an electronic funds transfer, as described in the applicable prospectus, until the Valuation Date.

How do the Funds’ investment objectives and principal investment strategies compare?

The investment objective of each Acquired Fund is similar to that of Ultra-Short Fund. The investment objectives of the Funds are non-fundamental, which means that each may be changed by vote of the respective Fund’s Trustees and without shareholder approval, upon 60 days’ notice. The investment strategies of the Funds are also similar, but Ultra-Short Fund is not a money market fund and its investments are not required to comply with money market fund requirements, including Rule 2a-7 of the 1940 Act.

The following tables summarize Ultra-Short Fund and each Acquired Fund with respect to their investment objectives and principal investment strategies, as set forth in the Prospectuses and Statements of Additional Information relating to the Funds.

| |

| | Ultra-Short Fund |

| |

| Investment | The Fund seeks to maximize income, to the extent consistent with preservation of |

| Objective | capital, through investment in short-term bonds and income-producing securities. |

| |

| Principal | The Fund seeks to achieve its investment objective by investing, under normal |

| Investment | circumstances, at least 80% of its net assets (including borrowings for investment |

| Strategies | purposes) in a portfolio of floating-rate securities (e.g., corporate floating rate |

| | securities) and securities with durations of less than or equal to one year. The |

| | Fund will provide shareholders with at least 60 days’ notice before changing this |

| | 80% policy. The Fund uses an active strategy, seeking relative value to earn |

| | incremental income. |

| |

| | The Fund typically invests at least 65% of its net assets in investment grade, U.S. |

| | dollar-denominated debt securities, as assessed at the time of purchase. A debt |

| | security is investment grade when assigned a credit quality rating of BBB- or |

13

| |

| higher by Standard & Poor’s Ratings Services (“Standard & Poor’s”) or an

equivalent rating by another nationally recognized statistical rating organization (“NRSRO”), including Moody’s Investors Service or Fitch Ratings, or if unrated, considered to be of comparable credit quality by the Fund’s Advisor. |

|

|

|

| |

| The Fund invests principally in bonds issued by U.S. corporations, the U.S.

government or its agencies, and U.S. government-sponsored entities (e.g., the

Federal National Mortgage Association (“FNMA”) and the Federal Home Loan Mortgage Corporation (“FHLMC”)). The Fund also may invest in trust preferred securities, taxable municipal securities, asset-backed securities (“ABS”), including commercial mortgage-backed securities, and repurchase agreements. |

|

|

|

|

|

| |

| The Fund may invest in securities that represent interests in pools of mortgage loans or other assets assembled for sale to investors by various U.S. governmental agencies, government-related organizations and private issuers. These investments may include derivative securities such as collateralized mortgage obligations (“CMOs”) and ABS. |

|

|

|

|

| |

| In addition, the Fund may invest in leveraged loans. The loans in which the Fund will invest are expected to be below-investment-grade quality and to bear interest at a floating rate that resets periodically. |

|

|

| |

| The Fund may invest up to 35% of its net assets in below-investment grade, high-yield debt securities (commonly known as “junk bonds”), including bonds rated in default. A debt security is below investment grade when assigned a credit quality rating below BBB- by Standard & Poor’s or an equivalent rating by another NRSRO, or if unrated, considered to be of comparable credit quality by the Fund’s Advisor. |

|

|

|

|

|

| |

| The Fund may also invest up to 25% of its net assets in foreign debt securities. Foreign debt securities include American Depositary Receipts (“ADRs”). |

|

| |

| The Fund is “non-diversified,” which means it may invest a greater percentage of its assets in a particular issuer than a “diversified” fund. |

|

| |

| Under normal circumstances, the Fund’s average portfolio duration will be less than one year. Duration is a measure of the expected average life of a fixed income security that is used to determine the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in interest rates. Similarly, a Fund with a longer average portfolio duration will be more sensitive to changes in interest rates than a Fund with a shorter average portfolio duration. |

|

|

|

|

|

|

| |

| The Fund uses a hedging technique that includes the purchase and sale of U.S. Treasury securities and related futures contracts to manage the duration of the Fund. |

|

| |

14

| |

| | Tobacco Exclusion. The Fund seeks to avoid investing in companies classified |

| | under the tobacco industry sector of the Barclays Global Aggregate Index, the |

| | Barclays U.S. High Yield Index or the Barclays Global Emerging Market Index; |

| | or, in the opinion of the Fund’s Advisor, any similar securities in the Barclays |

| | Municipal Index. |

| |

| |

| | CTFR Portfolio |

| |

| Investment | The Fund seeks to earn the highest level of interest income, exempt from federal |

| Objective | income taxes, as is consistent with prudent investment management, preservation |

| of capital, and the quality and maturity characteristics of the Fund. |

|

| |

| Principal | Under normal market conditions, at least 80% of the income from the Fund will |

| Investment | be exempt from federal income tax. |

| Strategies | |

| | The Fund invests in fixed and floating rate municipal bonds and notes, variable |

| | rate demand notes, tax-exempt commercial paper, and other high-quality, short- |

| | term municipal obligations. The Advisor looks for securities with strong credit |

| | quality that are attractively priced. All investments generally must comply with |

| | applicable money market fund requirements, including Rule 2a-7 of the |

| | Investment Company Act of 1940. |

| |

| | Many of the instruments held by the fund are supported by a credit facility (to |

| | improve the credit quality) or liquidity facility (to shorten the maturity) provided |

| by banks; thus, the Fund has an exposure to the banking industry. |

| |

| | The Fund may purchase securities that have not been rated by a nationally |

| | recognized statistical ratings organization (“NRSRO”), so long as the Advisor |

| | determines they are of comparable credit quality to rated securities permissible |

| | for the Fund. |

As described above, there are some differences in the investment objectives and strategies of CTFR Portfolio and Ultra-Short Fund. Unlike Ultra-Short Fund, CTFR Portfolio seeks to maintain a constant net asset value of $1.00 per share and focuses its investments on securities whose income is exempt from federal income tax. Unlike CTFR Portfolio, Ultra-Short Fund is not a money market fund, is non-diversified, invests mostly in securities that are not exempt from federal income tax, may invest up to 35% of its net assets in below-investment grade, high-yield debt securities, and may invest up to 25% of its net assets in foreign debt securities. Ultra-Short Fund does not focus on providing investors with income that is exempt from federal income tax.

15

| |

| | CSIF Portfolio |

| |

| Investment | The Fund seeks to provide the highest level of current income, consistent with |

| Objective | liquidity, safety and security of capital, through investment in money market |

| | instruments meeting the Fund’s investment criteria, including financial, |

| | sustainability and social responsibility factors. |

| |

| Principal | The Fund invests in high quality money market instruments, such as commercial |

| Investment | paper, variable rate demand notes, corporate, agency and taxable municipal |

| Strategies | obligations, and repurchase agreements. All investments must comply with the |

| | SEC’s money market fund requirements per Rule 2a-7 of the Investment |

| | Company Act of 1940. |

| |

| | Sustainable and Socially Responsible Investing. The Fund seeks to invest in |

| | companies and other enterprises that demonstrate positive environmental, social |

| | and governance performance as they address corporate responsibility and |

| | sustainability challenges. Calvert believes that there are long-term benefits in an |

| | investment philosophy that attaches material weight to the environment, |

| | workplace relations, human rights, Indigenous Peoples’ rights, community |

| | relations, product safety and impact, and corporate governance and business |

| | ethics. Calvert also believes that managing risks and opportunities related to these |

| | issues can contribute positively to company performance as well as to investment |

| | performance over time. The Fund has sustainable and socially responsible |

| | investment criteria that reflect specific types of companies in which the Fund |

| | seeks to invest and seeks to avoid investing. |

| |

| | Investments are first selected for financial soundness and then evaluated |

| | according to the Fund’s sustainable and socially responsible investment criteria. |

| | Investments must be consistent with the Fund’s current investment criteria, |

| | including financial, sustainability and social responsibility factors, the application |

| of which is in the economic interest of the Fund and its shareholders. |

|

As described above, there are some differences in the investment objectives and strategies of CSIF Portfolio and Ultra-Short Fund. Unlike Ultra-Short Fund, CSIF Portfolio seeks to maintain a constant net asset value of $1.00 per share and only invests in securities that are consistent with the Fund’s current investment criteria, including financial, sustainability and social responsibility factors. Unlike CSIF Portfolio, Ultra-Short Fund is not a money market fund, is non-diversified, may invest up to 35% of its net assets in below-investment grade, high-yield debt securities, and may invest up to 25% of its net assets in foreign debt securities. Ultra-Short Fund seeks to avoid investing in companies classified under the tobacco industry sector, but does not apply the broader set of sustainability or social responsibility factors that are used by CSIF Portfolio.

16

| |

| | Calvert First Government Fund |

| |

| Investment | The Fund is a U.S. Government-only money market fund that seeks to earn the |

| Objective | highest possible yield consistent with safety, liquidity, and preservation of |

| | capital. In pursuing its objective, the Fund invests only in U.S. Government |

| | obligations, including such obligations subject to repurchase agreements with |

| | recognized securities dealers and banks. The Fund seeks to maintain a constant |

| | net asset value of $1.00 per share. |

| |

| Principal | The Fund invests in money market instruments issued by the U.S. Treasury, such |

| Investment | as U.S. Treasury bills and U.S. Treasury notes and bonds having short-term |

| Strategies | maturities, or by U.S. Government agencies and instrumentalities (collectively |

| | referred to as “U.S. Government obligations”). The Fund may invest in these |

| | securities directly or through repurchase agreements and variable-rate demand |

| | notes. All investments generally must comply with applicable money market fund |

| | requirements, including Rule 2a-7 of the Investment Company Act of 1940. |

As described above, there are some differences in the investment objectives and strategies of Calvert First Government Fund and Ultra-Short Fund. Unlike Ultra-Short Fund, Calvert First Government Fund seeks to maintain a constant net asset value of $1.00 per share and invests only in U.S. Government obligations. Unlike Calvert First Government Fund, Ultra-Short Fund is not a money market fund, is non-diversified, may invest in bonds issued by U.S. corporations, may invest up to 35% of its net assets in below-investment grade, high-yield debt securities, and may invest up to 25% of its net assets in foreign debt securities.

| | |

| | CCR Prime Fund |

| |

| Investment | The Fund seeks to obtain the highest level of current income, consistent with |

| Objective | safety, preservation of capital and liquidity that is available through investments |

| | in specified money market instruments. The Fund seeks to maintain a constant |

| | net asset value of $1.00 per share. |

| |

| Principal | The Fund’s assets are invested primarily in top-tier securities, such as: |

| Investment | | |

| Strategies | • | high-quality, short-term investments, including obligations of the U.S. |

| | | Government and agency or instrumentality securities; |

| |

| | • | high-quality, U.S. dollar-denominated international money market |

| | | investments; |

| |

| | • | certificates of deposit of major banks; |

17

| |

| • | commercial paper; |

| • | eligible high-grade, short-term corporate obligations and participation |

| | interests in such obligations; |

| • | repurchase agreements; |

| • | bankers acceptances; |

| • | floating rate notes; |

| • | variable-rate demand notes; and |

| • | taxable municipal securities. |

The Fund invests in accordance with Rule 2a-7 under the Investment Company Act of 1940, as amended.

As described above, there are some differences in the investment objectives and strategies of CCR Prime Fund and Ultra-Short Fund. Unlike Ultra-Short Fund, CCR Prime Fund seeks to maintain a constant net asset value of $1.00 per share and focuses its investments on top-tier securities. Unlike CCR Prime Fund, Ultra-Short Fund is not a money market fund, is non-diversified, may invest up to 35% of its net assets in below-investment grade, high-yield debt securities, and may invest up to 25% of its net assets in foreign debt securities.

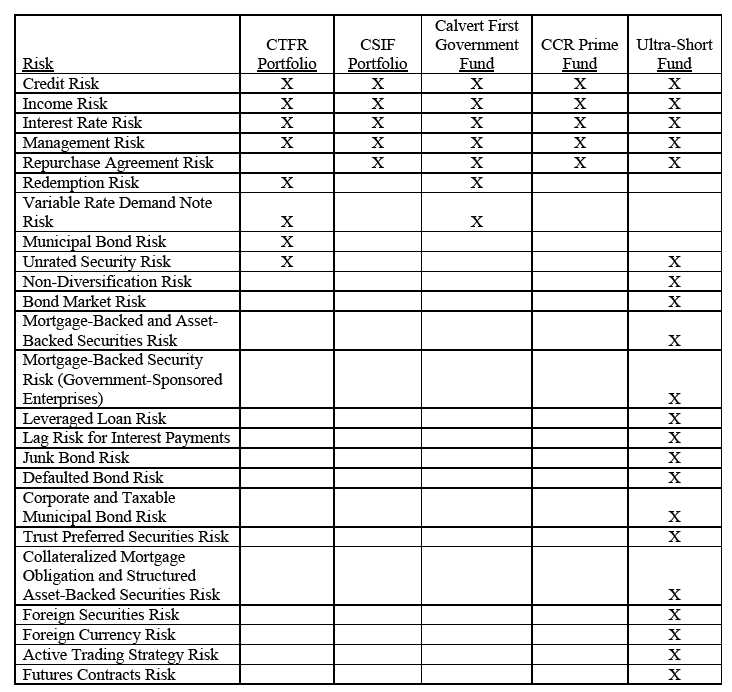

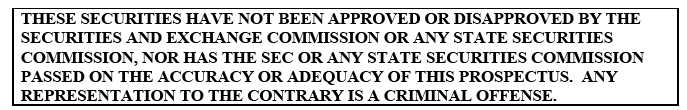

The principal risks of the Funds are similar as well, although there are some differences stemming from the variations in the investment strategies of the Funds. Because Ultra-Short Fund may invest in a broader range of instruments than the Acquired Funds, itmay alsowill incur additional risks. The following table lists the principal risks of investing in each of the Funds. Although each Acquired Fund seeks to preserve the value of its shareholders’ investments at $1.00 per share, there can be no guarantee that it will be able to maintain this value and it is possible to lose money by investing in an Acquired Fund. For a discussion of the Funds’ principal risks, see the section entitled “Risks” below.

18

The Funds have other investment policies, practices and restrictions which, together with their related risks, are also set forth in the Prospectuses and Statements of Additional Information of the Funds.

Although the Acquired Funds and Ultra-Short Fund have similar investment objectives and similar investment strategies,all or a substantial portion of the securities held by the Acquired Funds may be sold after the Reorganizations in order to comply with the investment practices of Ultra-Short Fundin connection with the Reorganizations. For any such sales, any . The transaction costs of any such sales will be borne by Ultra-Short Fund. Such, and such costsarewill ultimately be borne by the Fund’s shareholders. It is expected that any necessary sales

19

will not incur significant transaction costs because the securities held by the Acquired Funds are all high-quality, liquid short-term investments. In addition, prior to the consummation of the Reorganizations, the Advisor will attempt to reduce the need for such transactions by reinvesting the proceeds of maturing securities held by the Acquired Funds into cash or investments with maturities of seven days or less.

How do the Funds’ fees and expenses compare?

CTFR Portfolio and CSIF Portfolio offer only Class O shares and CCR Prime Fund offers only Class I shares, while Calvert First Government Fund offers Class B, Class C and Class O shares. Ultra-Short Fund offers two classes of shares – Class A and Class Y. Upon completion of the Reorganizations, shareholders of the Acquired Funds will hold Class A shares of Ultra-Short Fund. Ultra-Short Fund’s Class Y shares are not involved in the Reorganizations and, because the Class Y shares are not relevant to the Acquired Fund shareholders in deciding whether or not to approve any Reorganization, they are not discussed in detail in this document. You may refer to each Fund’s Prospectus and Statement of Additional Information for more information on its shares. You will not pay any initial or deferred sales charge in connection with the Reorganization.

The following tables allow you to compare the various fees and expenses that you may pay for buying and holding shares of each of the Funds. The columns entitled “Ultra-Short Fund (Pro Forma)” show you what fees and expenses are estimated to be, assuming the Reorganizations take place. As shown in the table below, Class A shares of Ultra-Short Fund are subject to 12b-1 fees of 0.25%. Class B and Class C shares of Calvert First Government Fund are subject to 12b-1 fees of 1.00%, while Class O shares of CTFR Portfolio, CSIF Portfolio, and Calvert First Government Fund, and Class I shares of CCR Prime Fund are not subject to 12b-1 fees. The Class A shares of Ultra-Short Fund received by Acquired Fund shareholders through the Reorganizations will be subject to a 12b-1 fee. However, the Advisor of Ultra-Short Fund has agreed to contractually limit direct net annual fund operating expenses through January 31, 2016, so that these expenses will not exceed 0.89% for Class A shares. The Advisor has also agreed to reimburse Ultra-Short Fund an additional 0.10% for the period from the date on which the first Reorganization closes through September 30, 2014.

The CTFR Portfolio and Calvert First Government Fund expense amounts, set forth in the following tables and in the examples, are the expenses for the 12-month period ended December 31, 2012. The CSIF Portfolio and CCR Prime Fund expense amounts, set forth in the following tables and in the examples, are the annualized expenses for the 6-month period ended March 31, 2013. The Ultra-Short Fund (Pro Forma) expense amounts, set forth in the following tables and in the examples, are based on the annualized estimated combined expenses of Ultra-Short Fund and the Acquired Funds for the period ended March 31, 2013, assuming the Reorganizations had taken place on April 1, 2012.

20

Shareholder Fees (fees paid directly from your investment)

|

CTFR

Portfolio |

CSIF

Portfolio | Calvert First

Government

Fund |

| Calvert First

Government

Fund |

| Calvert First

Government

Fund |

CCR Prime

Fund | Ultra-

Short

Fund |

| Ultra-Short

Fund

(Pro Forma)(2) |

|

|

|

| | Class O | Class O | Class B | | Class C | | Class O | Class I | Class A | Class A | |

| | | | | | | | | | | | | |

| Maximum Sales | None | None | None | | None | | None | None | 1.25 | % | 1.25 | % |

| Charge (Load) | | | | | | | | | | | | |

| Imposed on | | | | | | | | | | | | |

| Purchases (as a % | | | | | | | | | | | | |

| of offering price) | | | | | | | | | | | | |

| Maximum Deferred | None | None | 5.00 | % | 1.00 | % | None | None | None | | None | |

| Sales Charge | | | | | | | | | | | | |

| (Load) (as a % of | | | | | | | | | | | | |

| the lesser of the | | | | | | | | | | | | |

| value redeemed or | | | | | | | | | | | | |

| the amount | | | | | | | | | | | | |

| invested)(1) | | | | | | | | | | | | |

| Redemption Fee (as | None | None | None | | None | | None | None | 2.00 | % | 2.00 | % |

| a % of amount | | | | | | | | | | | | |

| redeemed or | | | | | | | | | | | | |

| exchanged within 7 | | | | | | | | | | | | |

| days of purchase) | | | | | | | | | | | | |

| Exchange Fee | None | None | None | | None | | None | None | None | | None | |

(1) The contingent deferred sales charge reduces over time.

(2) No sales charges will be imposed on shareholders of Acquired Funds in connection with the Reorganizations, or on any Class A shares of Ultra-Short Fund they subsequently purchase in that same account. In addition, the redemption fee will be waived for the first seven days after the initial transfers.

21

Fees and Expenses (as a percentage of average daily net assets)

|

CTFR

Portfolio |

|

CSIF

Portfolio |

| Calvert First

Government

Fund |

| Calvert First

Government

Fund |

| Calvert First

Government

Fund |

|

CCR Prime

Fund |

| Ultra-

Short

Fund |

| Ultra-Short

Fund

(Pro Forma) | |

| |

| |

| | Class O | | Class O | | Class B | | Class C | | Class O | | Class I | | Class A | Class A | |

| | | | | | | | | | | | | | | | | |

| Management Fees | 0.51 | % | 0.50 | % | 0.50 | % | 0.50 | % | 0.50 | % | 0.30 | % | 0.55 | % | 0.55 | % |

| Distribution and | None | | None | | 1.00 | % | 1.00 | % | None | | None | | 0.25 | % | 0.25 | % |

| Service (12b-1) | | | | | | | | | | | | | | | | |

| Fees | | | | | | | | | | | | | | | | |

| Other Expenses | 0.22 | % | 0.34 | % | 1.63 | % | 0.89 | % | 0.30 | % | 0.10 | % | 0.25 | % | 0.17 | % |

| Total Annual Gross | 0.73 | % | 0.84 | % | 3.13 | % | 2.39 | % | 0.80 | % | 0.40 | % | 1.05 | % | 0.97 | % |

| Fund Operating | | | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | | | |

| Less Fee Waiver | -- | | -- | | (1.13%) | (1) | (0.39%) | (1) | -- | | -- | | (0.16%) | (2) | (0.18%) | (3) |

| and/or Operating | | | | | | | | | | | | | | | | |

| Reimbursement | | | | | | | | | | | | | | | | |

| Net Expenses | 0.73 | % | 0.84 | % | 2.00 | % | 2.00 | % | 0.80 | % | 0.40 | % | 0.89 | % | 0.79 | % |

(1) The Advisor has agreed to contractually limit net annual fund operating expenses through January 31, 2015. Direct net operating expenses will not exceed 2.00% for Class B and 2.00% for Class C. Only the Board of Trustees of the Fund may terminate the Fund’s expense limitation before the contractual period expires, upon 60 days’ prior notice to shareholders.

(2) The Advisor has agreed to contractually limit direct net annual fund operating expenses through January 31, 2015. Direct net operating expenses will not exceed 0.89% for Class A. Only the Board of Trustees of the Fund may terminate the Fund’s expense limitation before the contractual period expires, upon 60 days’ prior notice to shareholders.

(3) The Advisor has agreed to contractually limit direct net annual fund operating expenses through January 31, 2016. Direct net operating expenses will not exceed 0.89% for Class A. The Advisor has also agreed to further reimburse Ultra-Short Fund an additional 0.10% from the date on which the first Reorganization closes through September 30, 2014. Only the Board of Trustees of the Fund may terminate the Fund’s expense limitation before the contractual period expires, upon 60 days’ prior notice to shareholders.

22

The columns entitled “Ultra-Short Fund (Pro Forma)” show what fees and expenses are estimated to be if all the Reorganizations take place. However, each Reorganization is an independent transaction that may be consummated even if the shareholders of another Acquired Fund do not approve the corresponding Reorganization. If a Reorganization is not approved and not consummated, or if a significant amount of assets of an Acquired Fund are redeemed prior to the close of the corresponding Reorganization, total annual gross operating expenses for Ultra-Short Fund would be expected to be in the range of 0.97% to 1.05%. However, there would be no difference in the net expenses paid by shareholders because of the contractual expense limitation agreement with the Advisor, as well as the additional 0.10% reimbursement provided by the Advisor through September 30, 2014.

The tables below show examples that are intended to help you compare the cost of investing in the Funds and Ultra-Short Fund Pro Forma, assuming the Reorganizations take place. The examples assume that you invest $10,000 in the Funds for the one-, three-, five- and ten-year periods commencing as of September 27, 2013. The first chart shows your costs if you sold your shares at the end of the period and the second chart shows your costs if you continued to hold your shares. The examples also assume that your investment has a 5% return each year and that each Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, if you redeemed your shares, your costs would be:

Examples of Fund Expenses

| | | | | | | | |

| | | One Year | | Three Years | | Five Years | | Ten Years |

| CTFR Portfolio | $ | 75 | $ | 233 | $ | 406 | $ | 907 |

| (Class O) | | | | | | | | |

| CSIF Portfolio | $ | 86 | $ | 268 | $ | 466 | $ | 1,038 |

| (Class O) | | | | | | | | |

| Calvert First Government | $ | 703 | $ | 1,223 | $ | 1,708 | $ | 2,779 |

| Fund (Class B) | | | | | | | | |

| Calvert First Government | $ | 303 | $ | 695 | $ | 1,228 | $ | 2,687 |

| Fund (Class C) | | | | | | | | |

| Calvert First Government | $ | 82 | $ | 256 | $ | 444 | $ | 990 |

| Fund (Class O) | | | | | | | | |

| CCR Prime Fund (Class I) | $ | 41 | $ | 129 | $ | 224 | $ | 505 |

| Ultra-Short Fund | $ | 215 | $ | 434 | $ | 677 | $ | 1,373 |

| (Class A) | | | | | | | | |

| Ultra-Short Fund (Pro | $ | 81 | $ | 280 | $ | 508 | $ | 1,163 |

| Forma) (Class A) | | | | | | | | |

You would pay the following expenses if you did not redeem your shares:

23

| | | | | | | | |

| | | One Year | | Three Years | | Five Years | | Ten Years |

| CTFR Portfolio | $ | 75 | $ | 233 | $ | 406 | $ | 907 |

| (Class O) | | | | | | | | |

| CSIF Portfolio | $ | 86 | $ | 268 | $ | 466 | $ | 1,038 |

| (Class O) | | | | | | | | |

| Calvert First Government | $ | 203 | $ | 823 | $ | 1,508 | $ | 2,779 |

| Fund (Class B) | | | | | | | | |

| Calvert First Government | $ | 203 | $ | 695 | $ | 1,228 | $ | 2,687 |

| Fund (Class C) | | | | | | | | |

| Calvert First Government | $ | 82 | $ | 256 | $ | 444 | $ | 990 |

| Fund (Class O) | | | | | | | | |

| CCR Prime Fund (Class I) | $ | 41 | $ | 129 | $ | 224 | $ | 505 |

| Ultra-Short Fund | $ | 215 | $ | 434 | $ | 677 | $ | 1,373 |

| (Class A) | | | | | | | | |

| Ultra-Short Fund (Pro | $ | 81 | $ | 280 | $ | 508 | $ | 1,163 |

| Forma) (Class A) | | | | | | | | |

What is the Portfolio Turnover rate?

Ultra-Short Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the examples, affect the Ultra-Short Fund’s performance. During the most recent fiscal year, Ultra-Short Fund’s portfolio turnover rate was 210% of the average value of its portfolio. Ultra-Short Fund’s turnover rate may increase as a result of the Reorganizations due to the anticipated sale of some of the portfolio securities that Ultra-Short Fund will acquire from the Acquired Funds.

How do the Funds’ performance records compare?

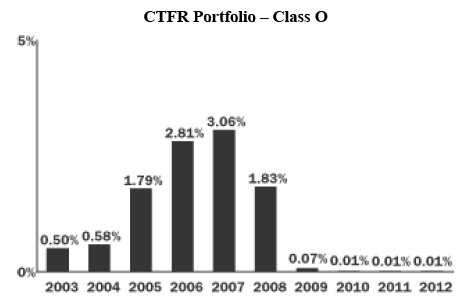

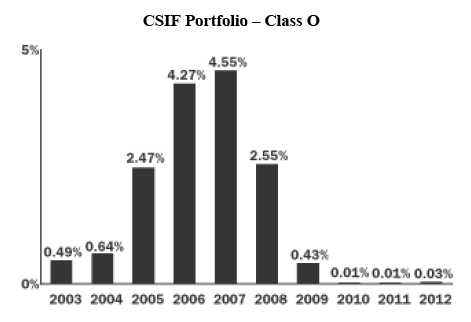

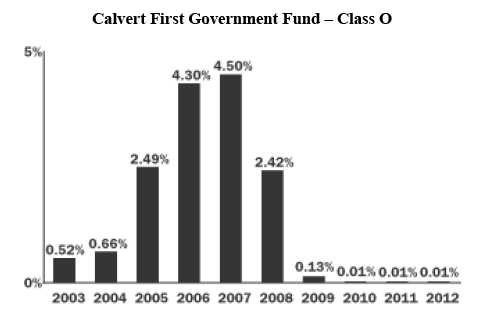

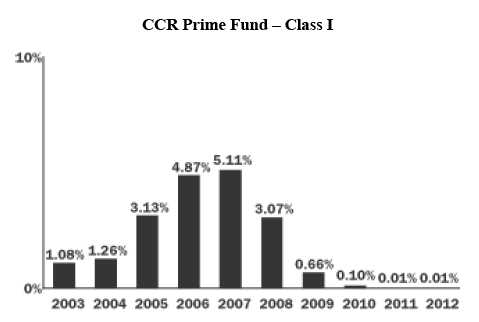

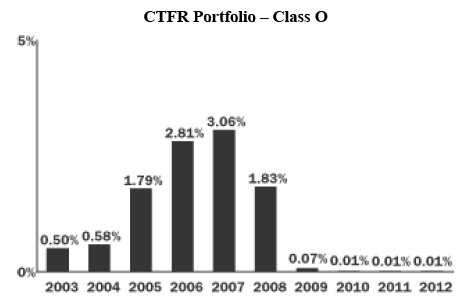

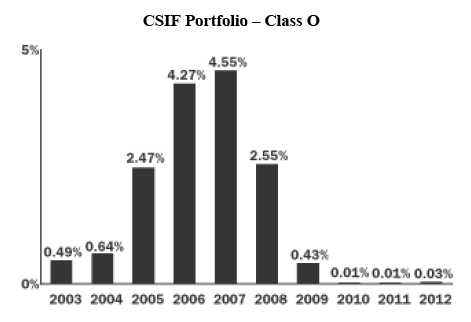

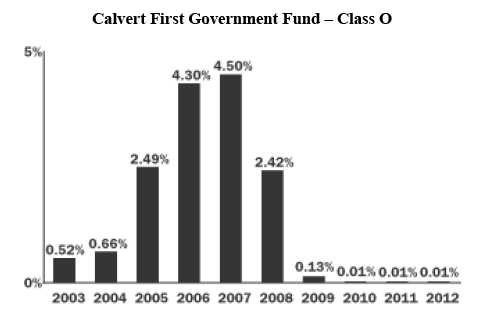

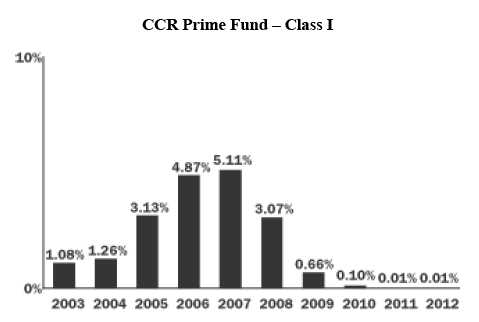

The following charts show how the shares of each Acquired Fund and Ultra-Short Fund have performed in the past. Past performance, before and after taxes, does not necessarily indicate how the Fund will perform in the future. For updated performance information, visit www.calvert.com.

Year-by-Year Total Return (%)

The charts below show the percentage gain or loss in each full calendar year for the Class O shares of CTFR Portfolio, CSIF Portfolio, and Calvert First Government Fund, Class I shares of CCR Prime Fund, and Class A shares of Ultra-Short Fund. The return for any of Calvert First

24

Government Fund’s or Ultra-Short Fund’s other Classes of shares will differ from the returns shown in the bar chart, depending upon the expenses of that Class.

These charts should give you a general idea of the risks of investing in each Fund by showing how the Fund’s return has varied from year to year. These charts include the effects of fund expenses. Each Fund's average annual returns in the charts below do not reflect any sales charge that you may be required to pay upon purchase or redemption of the Fund’s shares (although you will not pay any sales charges in connection with the shares received through the Reorganizations or any future purchases of Ultra-Short Fund shares in that same account). Any sales charge will reduce your return. Each Fund can also experience short-term performance swings as indicated in the high and low quarter information at the bottom of each chart.

| | |

| Best Quarter: 2nd - 2007 | 0.78 | % |

| Worst Quarter: 1st - 2011 | 0.00 | % |

25

| | |

| Best Quarter: 3rd - 2007 | 1.15 | % |

| Worst Quarter: 1st - 2010 | 0.00 | % |

| | |

| Best Quarter: 1st - 2007 | 1.14 | % |

| Worst Quarter: 2nd - 2010 | 0.00 | % |

| | |

| Best Quarter: 2nd - 2007 | 1.28 | % |

| Worst Quarter: 4th - 2011 | 0.00 | % |

26

| | |

| Best Quarter: 2nd - 2009 | 3.25 | % |

| Worst Quarter: 3rd - 2011 | - 0.78 | % |

The next set of tables lists the average annual total return by class of each Acquired Fund and Ultra-Short Fund, for the past one, five and ten years and since inception, as applicable (through December 31, 2012). Each table compares the performance of the applicable Fund over time with that of an index and/or peer average.

Average Annual Total Return (for the period ended 12/31/2012)

| | | | | | |

| CTFR Portfolio | 1 Year | | 5 Years | | 10 Years | |

| | Ended | | Ended | | Ended | |

| | 12/31/12 | | 12/31/12 | | 12/31/12 | |

| |

| Class O Shares | 0.01 | % | 0.38 | % | 1.06 | % |

| |

| Lipper Tax-Exempt | 0.01 | % | 0.40 | % | 1.10 | % |

| Money Market Funds | | | | | | |

| Average | | | | | | |

| | | | | | |

| CSIF Portfolio | 1 Year | | 5 Years | | 10 Years | |

| | Ended | | Ended | | Ended | |

| | 12/31/12 | | 12/31/12 | | 12/31/12 | |

| |

| Class O Shares | 0.03 | % | 0.60 | % | 1.53 | % |

| |

| Lipper Money Market | 0.02 | % | 0.47 | % | 1.45 | % |

| Funds Average | | | | | | |

27

| | | | | | |

| Calvert First | 1 Year | | 5 Years | | 10 Years | |

| Government Fund | Ended | | Ended | | Ended | |

| | 12/31/12 | | 12/31/12 | | 12/31/12 | |

| |

| Class O Shares | 0.01 | % | 0.51 | % | 1.50 | % |

| |

| Class B Shares | -4.99 | % | 0.03 | % | 0.86 | % |

| |

| Class C Shares | -0.99 | % | 0.23 | % | 0.85 | % |

| |

| Lipper U.S. Government | 0.01 | % | 0.37 | % | 1.40 | % |

| Money Market Funds | | | | | | |

| Average | | | | | | |

| |

| |

| CCR Prime Fund | 1 Year | | 5 Years | | 10 Years | |

| | Ended | | Ended | | Ended | |

| | 12/31/12 | | 12/31/12 | | 12/31/12 | |

| |

| Class I Shares | 0.01 | % | 0.76 | % | 1.91 | % |

| |

| Lipper Institutional | 0.06 | % | 0.61 | % | 1.75 | % |

| Money Market Funds | | | | | | |

| Average | | | | | | |

For current yield information on any of the Acquired Funds, call 800-368-2745, or visit Calvert’s website at www.calvert.com.

After-tax returns for Ultra-Short Fund are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. The after-tax returns shown are not relevant to you if you hold your Fund shares through a tax-deferred arrangement such as a 401(k) plan or individual retirement account. The return after taxes on distributions and sale of Fund shares may be higher than the return before taxes because the calculation assumes that shareholders receive a tax benefit for capital losses incurred on the sale of their shares.

The average total return table for Ultra-Short Fund shows the Fund’s returns with the maximum sales charge deducted. No sales charge has been applied to the index or average used for comparison in the table.

28

| | | | | | |

| Ultra-Short Fund | 1 Year | | 5 Years | | Since | |

| | Ended | | Ended | | Inception | |

| | 12/31/12 | | 12/31/12 | | 10/31/06 | |