Filed by Computer Network Technology Corporation pursuant to Rule 425 of the Securities Act of 1933, as amended, and deemed to be filed pursuant to Rule 14a-6 of the Securities Exchange Act of 1934, as amended.

Subject: Computer Network Technology Corporation

Commission File No. 333-122758

ON MAY 9, 2005, McDATA CORPORATION, A DELAWARE CORPORATION, AND COMPUTER NETWORK TECHNOLOGY CORPORATION, A MINNESOTA CORPORATION, ISSUED THE FOLLOWING JOINT PRESS RELEASE, MADE AVAILABLE THE FOLLOWING SLIDE PRESENTATION, AND UTILIZED THE FOLLOWING Q&A IN CONNECTION WITH A CONFERENCE CALL AND WEBCAST:

FOR IMMEDIATE

RELEASE:

| May 9, 2005 |

|

Contacts | | |

McDATA Media: Jil Backstrom Office: (720) 558-4774 press.release@mcdata.com | McDATA Investors: Renee Lyall Office: (720) 558-4629 renee.lyall@mcdata.com | CNT Investors: Greg Barnum Office: (763)268-6110 greg_barnum@cnt.com | CNT Media: Gail Greener Office: (763) 268-6791 gail_greener@cnt.com |

| | | |

McDATA and CNT Announce Post-Acquistion Business Model and

Product and Services Roadmap

Customers and partners benefit from combined expertise, technologies and market leadership

BROOMFIELD, Colo., and MINNEAPOLIS —May 9, 2005—McDATA Corporation (Nasdaq: MCDTA/MCDT), and Computer Network Technology Corporation, “CNT” (Nasdaq: CMNT), two recognized leaders in the storage networking space, today outlined the post-acquisition go-to-market strategy, combined roadmap and targeted business model during a conference call and webcast hosted by John Kelley, McDATA chairman, president and CEO, Ernest Sampias, chief financial officer for McDATA and Tom Hudson, chairman, president and CEO of CNT. The combined roadmap provides solid direction for McDATA to more broadly address partner and customer needs with unmatched technology and services leadership and expertise across SAN, MAN and WAN environments.

The CNT acquisition further strengthens McDATA’s Global Enterprise Data Infrastructure initiative, meeting customers and partners’ growing requirements for information lifecycle management, utility computing and on-demand access to information. McDATA’s existing line of Intrepid® Directors, Sphereon® Fabric Switches, Eclipse™ SAN Routers and security and management software will be complemented by CNT’s UltraNet™ extension products, their Replication Appliance and Matrix Switches, supported with professional and maintenance services.

“EMC has had long and successful relationships with both McDATA and CNT that have helped our customers build and deploy infrastructures for information lifecycle management. We look forward to continuing our work with the combined company and providing our mutual customers with some of

the industry’s most advanced storage networking solutions,” said Tom Joyce, vice president, platforms marketing, EMC.

“We are very pleased with the acquisition, as combining McDATA and CNT, both trusted Hitachi Data Systems partners, will result in a technology leader with very competitive solution offerings,” said Scott Genereux, executive vice president and general manager, Worldwide Sales, Channels, and Support, Hitachi Data Systems. “Our relationship with McDATA will continue to prosper as we move forward with our Application Optimized Storage™ solutions strategy. These solutions, integrating hardware, software and services plus best of breed networking components, such as McDATA’s, will allow organizations to more closely align business and IT objectives.”

“IBM has had a deep relationship with both McDATA and CNT. We are excited to leverage and benefit from the unified company to offer our customers an expanded portfolio of information on demand solutions,” said Robert Mahoney, Business Line Executive Storage Networking, IBM.

“This is a good move for both McDATA and CNT. Both have been in business for more than 20 years, both serve Global-2000 accounts, many of which they share. They are both established storage players; the combined technologies will accelerate their ability to sell more complete storage solutions,” said Randy Kerns, analyst for Evaluator Group. “This promotes McDATA’s GEDI strategy and establishes a better positioned data infrastructure company with the breadth of products, services, and solutions to deliver to OEM partners and customers their shared vision of the optimized global data infrastructure. The acquisition makes sense both for companies, their channel partners and their customers.”

For more information regarding the combined companies offering and synergies, please listen to today’s call. The call will be audio webcast live via the Internet at www.mcdata.com. A replay of the conference call will be archived for 30 days at www.mcdata.com.

###

About McDATA (www.mcdata.com)

McDATA (Nasdaq: MCDTA/MCDT) is the only data infrastructure solutions provider that can deliver a Global Enterprise Data Infrastructure- a globally connected, centrally managed and highly optimized data network. With more than 20 years of storage networking experience, McDATA is trusted in the world’s largest data centers, connecting more than two-thirds of all networked data and enabling information access anytime, anywhere.

About CNT

CNT is the expert in today’s most cost-effective and reliable storage networking solutions. For over 20 years, businesses around the world have depended on us to improve business efficiency, increase data availability and manage their business-critical information. CNT applies its technology, products and expertise in open storage networking architecture and business continuity to help companies build end-to-end solutions consisting of analysis, planning and design, multi-vendor integration, implementation and ongoing remote management of the SAN or storage infrastructure. For more information, visit CNT’s Web site at http://www.cnt.com or call 763-268-6000.

Forward-Looking Statements: This press release contains statements about expected future events that are forward-looking and subject to risks and uncertainties. Readers are urged to consider statements that include the terms “believes”, “belief”, “expects”, “plans”, “objectives”, “estimates”, “anticipates”, “intends”, “targets”, or the like to be uncertain and forward-looking. Factors that could cause actual results to differ and vary materially from expectations include, but are not limited to, our relationships with EMC, IBM and HDS and the level of their orders, aggressive price competition by numerous other SAN and IP switch suppliers, OEM qualification of our new products, manufacturing constraints, our ability to integrate CNT’s operations with our operations and other risk factors that are disclosed in our filings with the Securities and Exchange Commission. These cautionary statements by us should not be construed as exhaustive or as any admission regarding the adequacy of disclosures made by us. All cautionary statements should be read as being applicable to all forward-looking statements wherever they appear. We do not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It:

McDATA has filed a registration Statement on SEC Form S-4 and McDATA and CNT have filed a Joint Proxy Statement/Prospectus with the SEC in connection with the proposed merger. The Registration Statement was declared effective by the SEC on April 19, 2005 and the Joint Proxy Statement/Prospectus containing information about McDATA, CNT and the proposed merger will be mailed to stockholders of McDATA and shareholders of CNT on or before April 25, 2005. Investors and security holders are urged to read the Registration Statement and the Joint Proxy Statement/Prospectus carefully in their entirety. The Registration Statement and Joint Proxy Statement/Prospectus contain important information about McDATA, CNT, the proposed merger, the persons soliciting proxies relating to the proposed merger, their interests in the transaction and related maters. Investors and security holders can obtain free copies of these documents through the website maintained by the SEC at http://www.sec.gov. Free copies of the Joint Proxy Statement/Prospectus may also be obtained from McDATA by directing a request by mail to McDATA Corporation at 380 Interlocken Crescent, Broomfield, CO 80021, telephone (720) 558-4629, or from CNT by directing a request by mail to CNT at 6000 Nathan Lane North, Plymouth Minnesota 55442, telephone (763) 268-6130.

In addition to the Registration Statement and the Joint Proxy Statement/Prospectus, McDATA and CNT file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any reports, statements or other information filed by McDATA and CNT at the SEC public reference rooms at 450 Fifth Street, N.W., Washington, D.C. 20549 or at any of the SEC’s other public reference rooms in New York, New York and Chicago, Illinois. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. McDATA’s and CNT’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

McDATA, CNT, directors and certain executive officers of McDATA and CNT, Mellon Investor Services LLC and certain affiliates and employees of Mellon Investor Services may be considered participants in the solicitation of proxies in connection with the proposed merger. Mellon Investor Services will be paid to solicit proxies in connection with the proposed merger. Certain directors and executive officers may have direct or indirect interests in the proposed merger due to securities holdings of McDATA and CNT, and consulting arrangements, service as directors and officers and rights to severance payments following the proposed merger. In addition, certain directors and officers, after the proposed merger will be indemnified by McDATA and will benefit from insurance coverage for liabilities that may arise from their services as directors and officers of CNT prior to the proposed merger. Additional information regarding the participants in the solicitation is contained in the Registration Statement and Joint Proxy Statement/Prospectus filed by McDATA and CNT with the SEC.

# # #

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

McDATA + CNT

Driving Increased Value to Customers,

Partners and Shareholders

Conference Call and Road Show Presentation

May 9 – May 12, 2005

McDATA + CNT: Acquisition Update Conference Call

Speakers

• John Kelley –Chairman, President and CEO, McDATA

• Tom Hudson - Chairman, President and CEO, CNT

• Ernest Sampias – Chief Financial Officer, McDATA

Moderator

• Renee Lyall – Sr. Director, Investor Relations, McDATA

Replay Information

• Telephone replay available May 9 beginning at 12 Noon ET through Friday, May 13. To access the telephone replay dial (706) 645-9291. Pass code: 5733495.

• Audio webcast and presentation slides will be archived at www.mcdata.com for one month.

2

Securities Litigation Reform Act – Safe Harbor

This presentation includes forward looking statements regarding McDATA’s business outlook.

These statements are only predictions and are subject to risks and uncertainties. McDATA’s actual results may differ materially. Any forward looking statements made today are subject to risks and uncertainties as described in the Company’s reports on Forms 10-K, 10-Q, 8-K, and the registration statement on Form S-4 that are filed with the SEC.

McDATA assumes no obligation to update these forward looking statements.

This presentation includes non-GAAP financial measures. You may find the most directly comparable GAAP financial measures and a reconciliation of the differences between these non-GAAP financial measures in our fiscal fourth quarter financial results press release on our website at www.mcdata.com.

3

Additional Information and Where To Find It:

McDATA has filed a registration Statement on SEC Form S-4 and McDATA and CNT have filed a Joint Proxy Statement/Prospectus with the SEC in connection with the proposed merger. The Registration Statement was declared effective by the SEC on April 19, 2005 and the Joint Proxy Statement/Prospectus containing information about McDATA, CNT and the proposed merger was mailed to stockholders of McDATA and shareholders of CNT on or before April 25, 2005. Investors and security holders are urged to read the Registration Statement and the Joint Proxy Statement/Prospectus carefully in their entirety. The Registration Statement and Joint Proxy Statement/Prospectus contain important information about McDATA, CNT, the proposed merger, the persons soliciting proxies relating to the proposed merger, their interests in the transaction and related maters. Investors and security holders can obtain free copies of these documents through the website maintained by the SEC at http://www.sec.gov. Free copies of the Joint Proxy Statement/Prospectus may also be obtained from McDATA by directing a request by mail to McDATA Corporation at 380 Interlocken Crescent, Broomfield, CO 80021, telephone (720) 558-4629, or from CNT by directing a request by mail to CNT at 6000 Nathan Lane North, Plymouth Minnesota 55442, telephone (763) 268-6130.

In addition to the Registration Statement and the Joint Proxy Statement/Prospectus, McDATA and CNT file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any reports, statements or other information filed by McDATA and CNT at the SEC public reference rooms at 450 Fifth Street, N.W., Washington, D.C. 20549 or at any of the SEC’s other public reference rooms in New York, New York and Chicago, Illinois. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. McDATA’s and CNT’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

McDATA, CNT, directors and certain executive officers of McDATA and CNT, Mellon Investor Services LLC and certain affiliates and employees of Mellon Investor Services may be considered participants in the solicitation of proxies in connection with the proposed merger. Mellon Investor Services will be paid to solicit proxies in connection with the proposed merger. Certain directors and executive officers may have direct or indirect interests in the proposed merger due to securities holdings of McDATA and CNT, and consulting arrangements, service as directors and officers and rights to severance payments following the proposed merger. In addition, certain directors and officers, after the proposed merger will be indemnified by McDATA and will benefit from insurance coverage for liabilities that may arise from their services as directors and officers of CNT prior to the proposed merger. Additional information regarding the participants in the solicitation is contained in the Registration Statement and Joint Proxy Statement/Prospectus filed by McDATA and CNT with the SEC.

4

McDATA + CNT: Acquisition Update Conference Call Agenda

Agenda

• PRELIMINARY FQ105 FINANCIAL RESULTS

• Strategic Overview

• Combined Product and Services Roadmap

• Go-To-Market Model

• Operational Plans

• Execution Imperatives

• Summary

• Q&A

5

McDATA Q1 FY2005 Preliminary Non-GAAP Operating Results

| | Q105E | | Q404A | | Q104A | |

| | | | | | | |

Revenue | | $98 -$99M | | $ | 105.8 | M | $ | 97.2 | M |

| | | | | | | |

Gross Margin | | 53% - 54% | | 56.0 | % | 56.4 | % |

| | | | | | | |

Operating Expense | | $49 - $51M | | $ | 54.0 | M | $ | 54.3 | M |

| | | | | | | |

Operating Income | | $2.5 - $3.5M | | $ | 5.2 | M | $ | 0.6 | M |

| | | | | | | |

Operating Margin | | 2.5% - 3.5% | | 5.0 | % | 0.6 | % |

| | | | | | | |

Net Income | | $2.5 - $3.5M | | $ | 6.8 | M | $ | 1.2 | M |

| | | | | | | |

EPS | | $0.02 - $0.03 | | $ | 0.06 | | $ | 0.01 | |

6

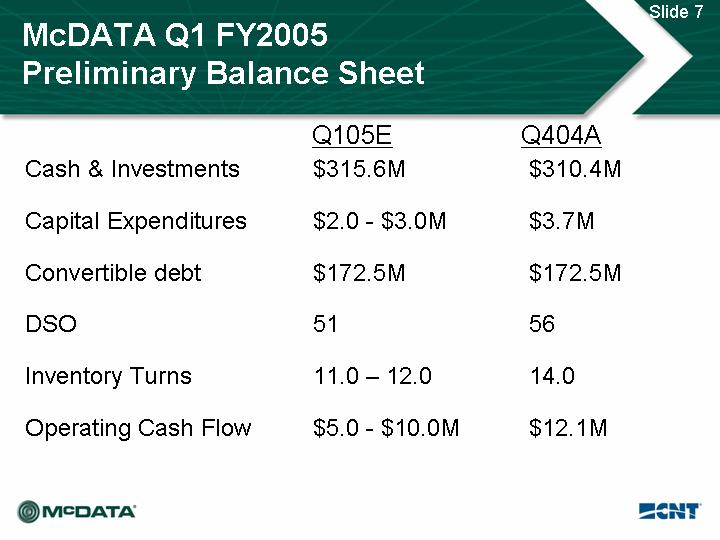

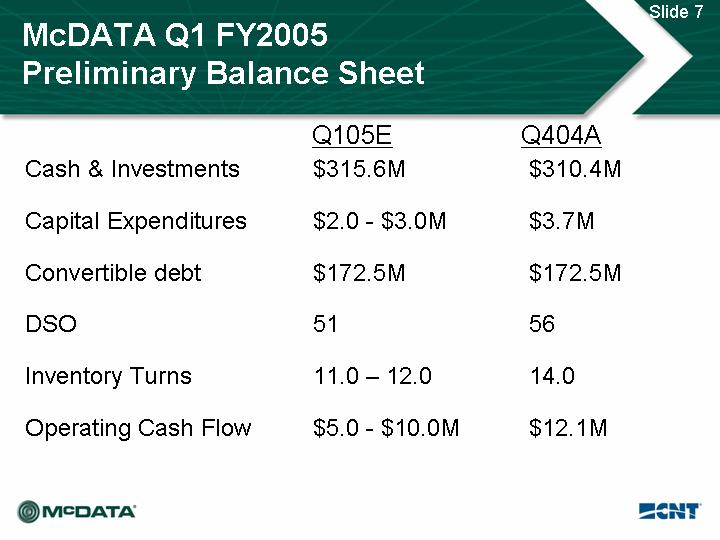

McDATA Q1 FY2005 Preliminary Balance Sheet

| | Q105E | | Q404A | |

| | | | | |

Cash & Investments | | $315.6M | | $ | 310.4 | M |

| | | | | | |

Capital Expenditures | | $2.0 - $3.0M | | $ | 3.7 | M |

| | | | | | |

Convertible debt | | $172.5M | | $ | 172.5 | M |

| | | | | | |

DSO | | 51 | | 56 | |

| | | | | |

Inventory Turns | | 11.0 – 12.0 | | 14.0 | |

| | | | | |

Operating Cash Flow | | $5.0 - $10.0M | | $ | 12.1 | M |

7

CNT Q1 FY2005 Preliminary Revenue Results

| | Q105E | | Q404A | | Q104A | |

| | | | | | | |

Product revenue | | $51 - $54M | | $ | 72.4 | M | $ | 63.7 | M |

| | | | | | | | | |

Service revenue | | $30 - $32M | | $ | 31.6 | M | $ | 32.6 | M |

| | | | | | | | | |

Total revenue | | $81 - $86M | | $ | 103.9 | M | $ | 96.2 | M |

8

McDATA + CNT: Acquisition Update Conference Call Agenda

Agenda

• Preliminary FQ105 Financial Results

• STRATEGIC OVERVIEW

• Combined Product and Services Roadmap

• Go-To-Market Model

• Operational Plans

• Execution Imperatives

• Summary

• Q&A

9

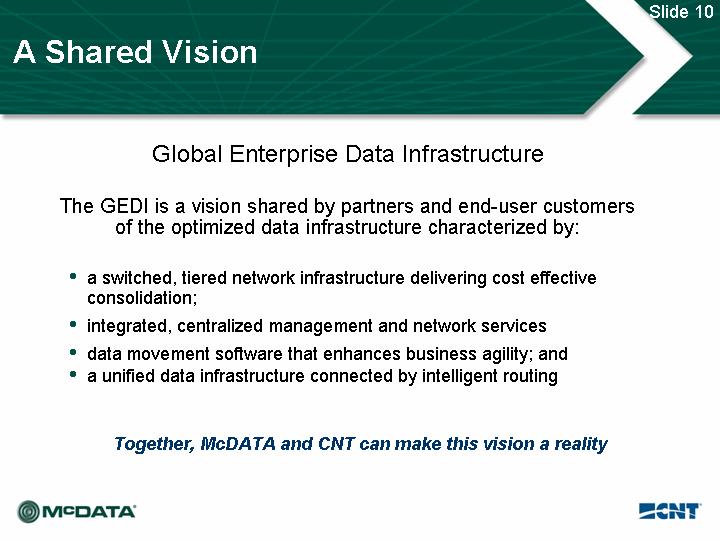

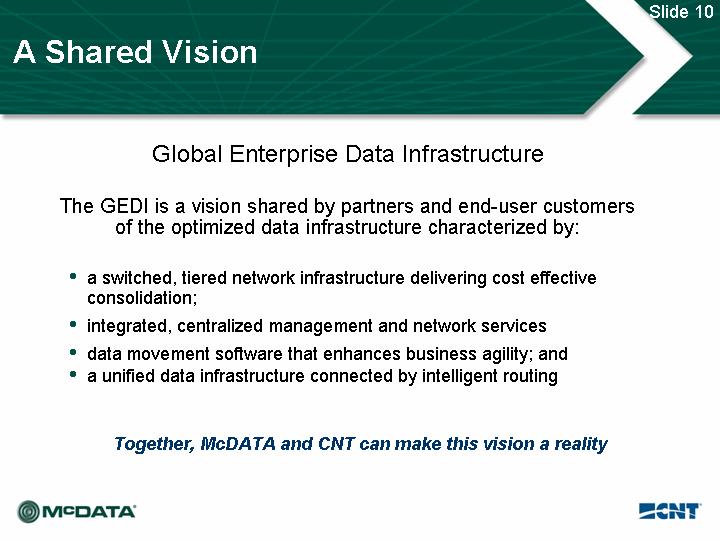

A Shared Vision

Global Enterprise Data Infrastructure

The GEDI is a vision shared by partners and end-user customers

of the optimized data infrastructure characterized by:

• a switched, tiered network infrastructure delivering cost effective consolidation;

• integrated, centralized management and network services

• data movement software that enhances business agility; and

• a unified data infrastructure connected by intelligent routing

Together, McDATA and CNT can make this vision a reality

10

A Common Goal

To become the most respected and reliable

data infrastructure company, delivering

data management solutions to the enterprise

• Unifying diverse storage products

• Bringing networking technologies together

• Enabling any storage strategy

• Connecting sites across the globe

11

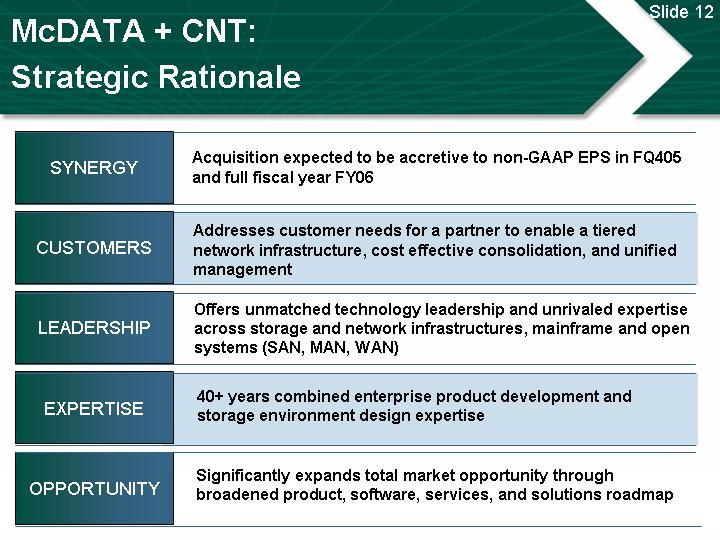

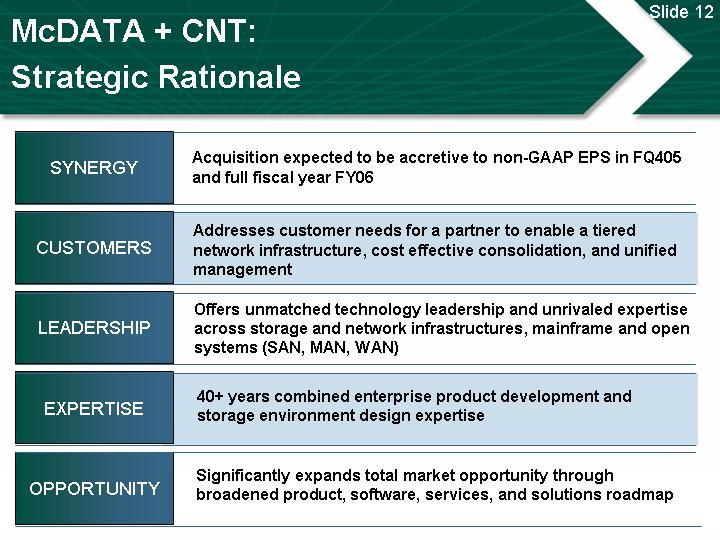

McDATA + CNT: Strategic Rationale

SYNERGY | | Acquisition expected to be accretive to non-GAAP EPS in FQ405 and full fiscal year FY06 |

| | |

CUSTOMERS | | Addresses customer needs for a partner to enable a tiered network infrastructure, cost effective consolidation, and unified management |

| | |

LEADERSHIP | | Offers unmatched technology leadership and unrivaled expertise across storage and network infrastructures, mainframe and open systems (SAN, MAN,WAN) |

| | |

EXPERTISE | | 40+ years combined enterprise product development and storage environment design expertise |

| | |

OPPORTUNITY | | Significantly expands total market opportunity through broadened product, software, services, and solutions roadmap |

12

McDATA + CNT: Straightforward Synergies

• Consolidate facilities and IT systems

• Rationalize duplication across vendors, marketing programs, product lines, and other functional areas

• Eliminate redundancies in terms of contracted support, headcount and administrative expenses

• Straightforward synergies = positive impact to bottom line

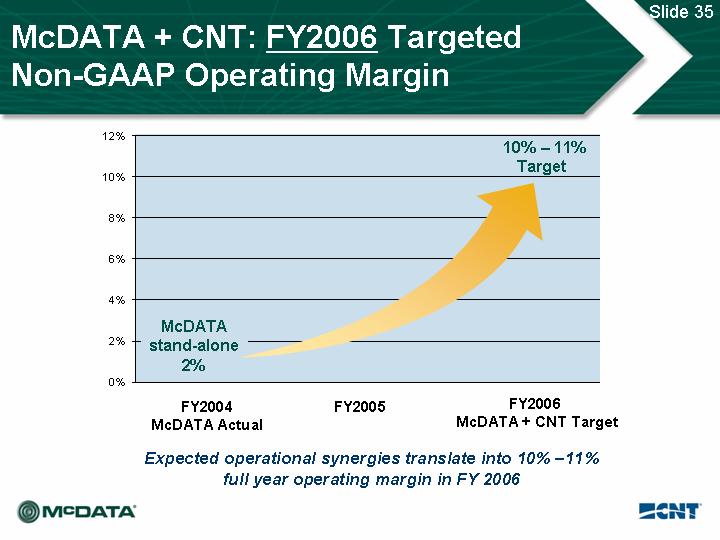

• Combined company expected to achieve10%+ non-GAAP operating margin target by FQ405

• Acquisition expected to be accretive to non-GAAP EPS in FQ405

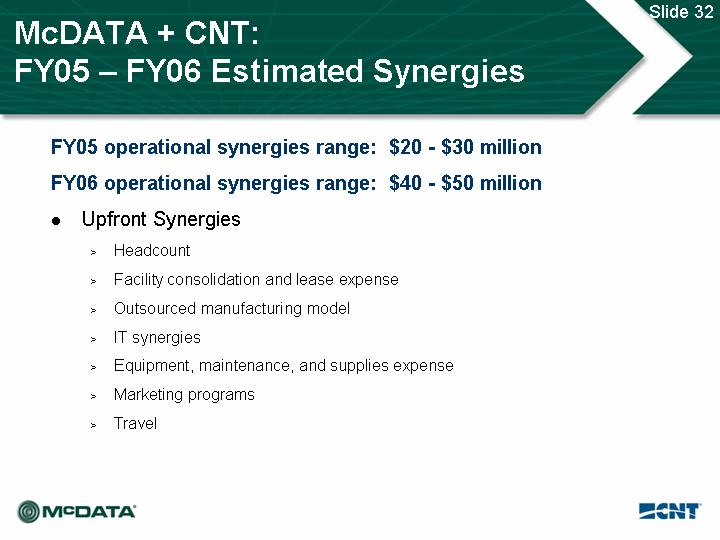

• Acquisition will achieve $20-$30 million in operational cost savings during the current partial fiscal year (FY05) and $40-$50 million in operational cost savings during the first full fiscal year as a combined company (FY06)

13

McDATA + CNT: Expansive Customer Base

Services and Outsourcing Customers

Financial | Health Care | Retail | Utilities | Telco |

| | | | |

[LOGO] | [LOGO] | [LOGO] | [LOGO] | [LOGO] |

14

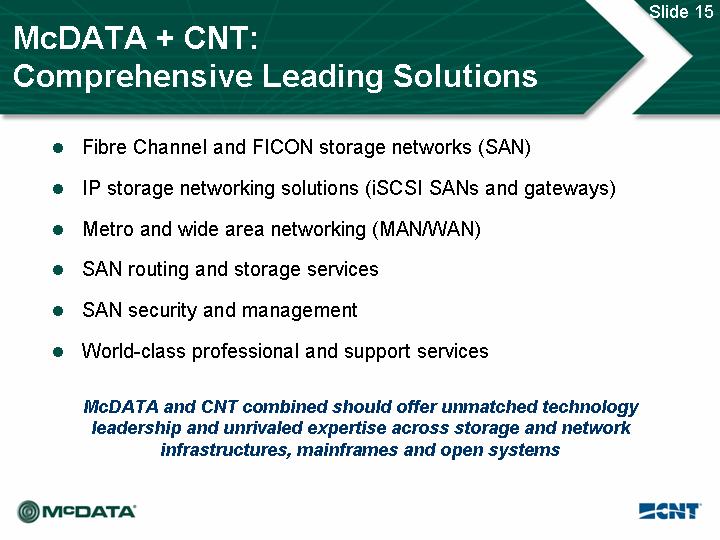

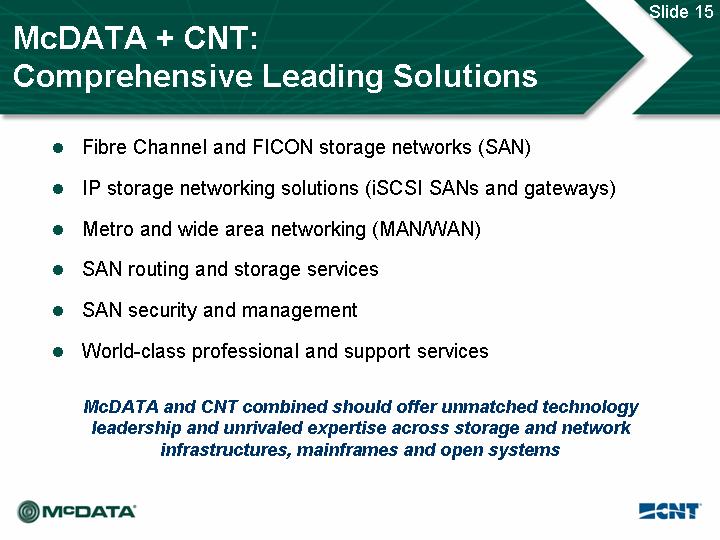

McDATA+ CNT: Comprehensive Leading Solutions

• Fibre Channel and FICON storage networks (SAN)

• IP storage networking solutions (iSCSI SANs and gateways)

• Metro and wide area networking (MAN/WAN)

• SAN routing and storage services

• SAN security and management

• World-class professional and support services

McDATA and CNT combined should offer unmatched technology

leadership and unrivaled expertise across storage and network

infrastructures, mainframes and open systems

15

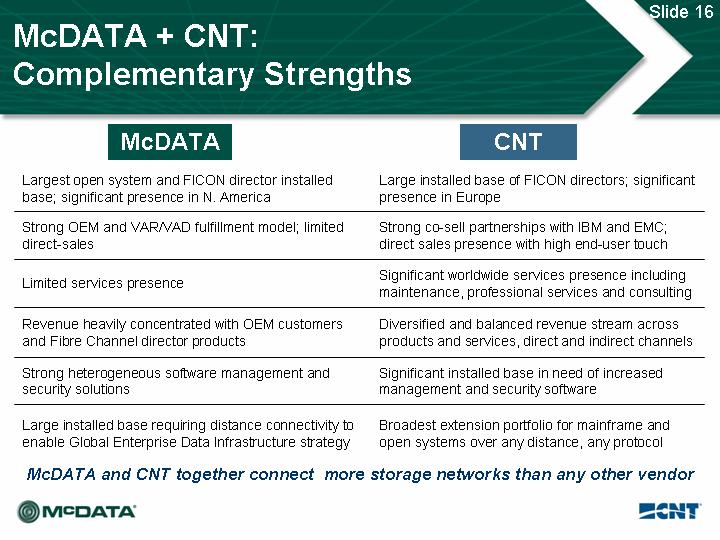

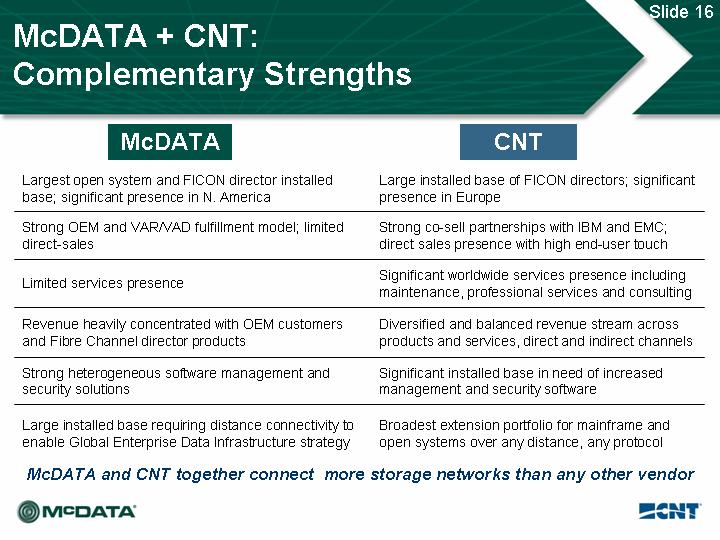

McDATA+ CNT: Complementary Strengths

McDATA | | CNT |

| | |

Largest open system and FICON director installed base; significant presence in N. America | | Large installed base of FICON directors; significant presence in Europe |

| | |

Strong OEM and VAR/VAD fulfillment model; limited direct-sales | | Strong co-sell partnerships with IBM and EMC; direct sales presence with high end-user touch |

| | |

Limited services presence | | Significant worldwide services presence including maintenance, professional services and consulting |

| | |

Revenue heavily concentrated with OEM customers and Fibre Channel director products | | Diversified and balanced revenue stream across products and services, direct and indirect channels |

| | |

Strong heterogeneous software management and security solutions | | Significant installed base in need of increased management and security software |

| | |

Large installed base requiring distance connectivity to enable Global Enterprise Data Infrastructure strategy | | Broadest extension portfolio for mainframe and open systems over any distance, any protocol |

McDATA and CNT together connect more storage networks than any other vendor

16

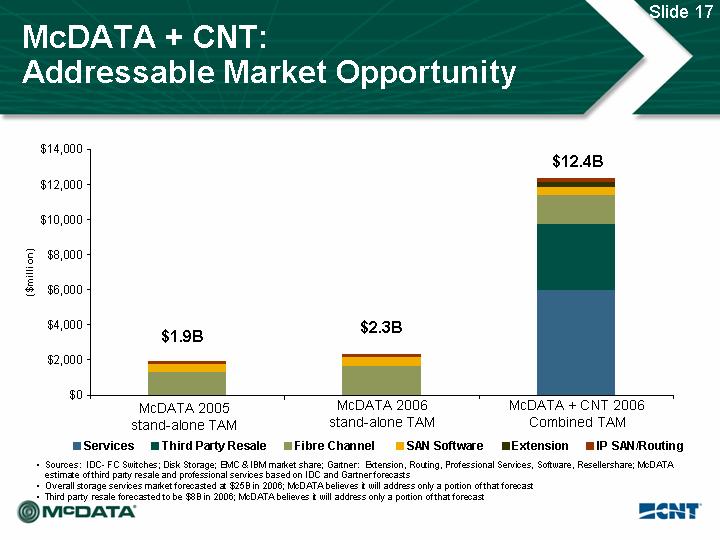

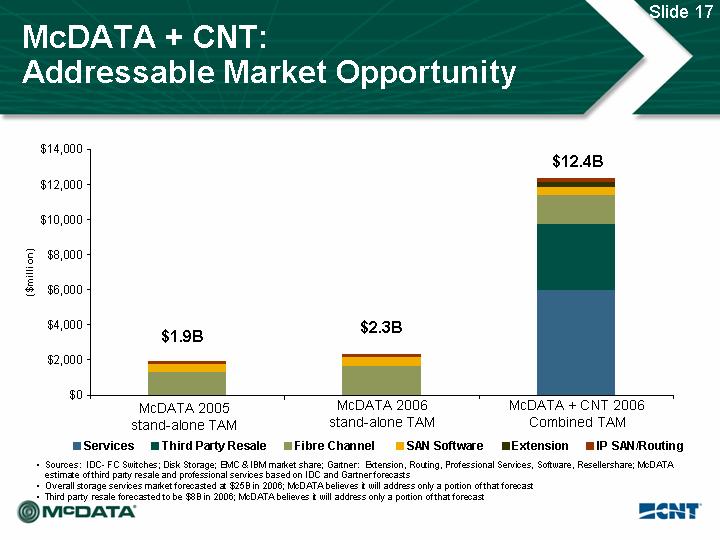

McDATA+ CNT: Addressable Market Opportunity

[CHART]

• Sources: IDC- FC Switches; Disk Storage; EMC & IBM market share; Gartner: Extension, Routing, Professional Services, Software, Resellershare; McDATA estimate of third party resale and professional services based on IDC and Gartner forecasts

• Overall storage services market forecasted at $25B in 2006; McDATA believes it will address only a portion of that forecast

• Third party resale forecasted to be $8B in 2006; McDATA believes it will address only a portion of that forecast

17

McDATA+ CNT: Acquisition Update Conference Call Agenda

Agenda

• Preliminary FQ105 Financial Results

• Strategic Overview

• COMBINED PRODUCT AND SERVICES ROADMAP

• Go-To-Market Model

• Operational Plans

• Execution Imperatives

• Summary

• Q&A

18

McDATA+ CNT: Fibre Channel Product Roadmap

Pre-Acquisition | | Post-Acquisition |

| | |

Tier-1 | | [GRAPHIC] | [GRAPHIC] | Intrepid 10000 |

Intrepid 10000 | | |

| | [GRAPHIC] |

UMD | | |

| | |

Tier-2 | | [GRAPHIC] | [GRAPHIC] | Intrepid 6140 |

Intrepid 6140 | | |

| | |

| | [GRAPHIC] | | |

FC/9000 | | | | |

| | | | |

| | [GRAPHIC] | EOL | |

CD/9000 | | |

| | |

| | Sphereon |

Tier-3 | | 4700 |

Sphereon | | [GRAPHIC] | [GRAPHIC] | 4400 |

3232 | | |

4500 | | |

4300 | | |

| | | | | |

19

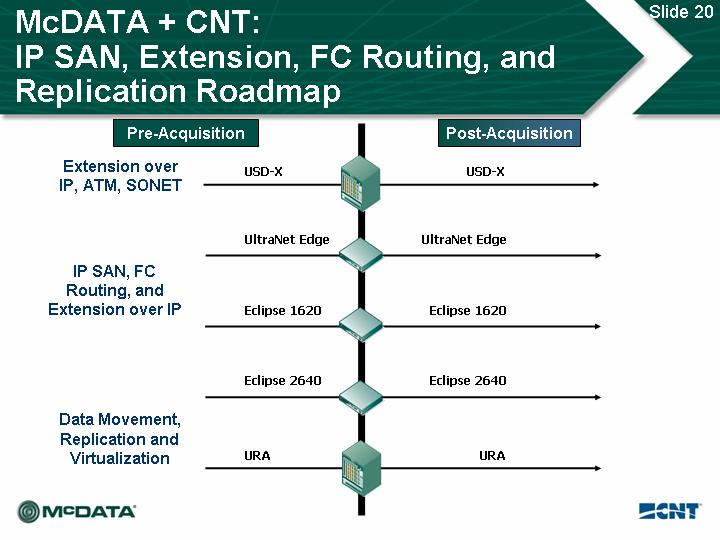

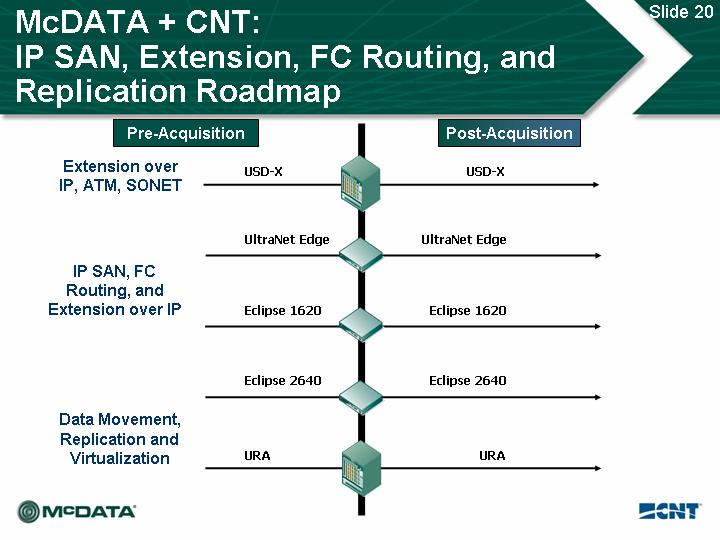

McDATA + CNT IP SAN, Extension, FC Routing, and Replication Roadmap

Pre-Acquisition | | Post-Acquisition |

| | |

Extension over | | |

IP, ATM, SONET | | USD-X | [GRAPHIC] | USD-X | |

| | | | | |

| | UltraNet Edge | [GRAPHIC] | UltraNet Edge | |

| | | | | |

IP SAN, FC | | | | | |

Routing, and | | | | | |

Extension over IP | | Eclipse 1620 | [GRAPHIC] | Eclipse 1620 | |

| | | | | |

| | | | | |

| | Eclipse 2640 | [GRAPHIC] | Eclipse 2640 | |

| | | | | |

Data Movement, | | | | | |

Replication and | | | | | |

Virtualization | | URA | [GRAPHIC] | URA | |

20

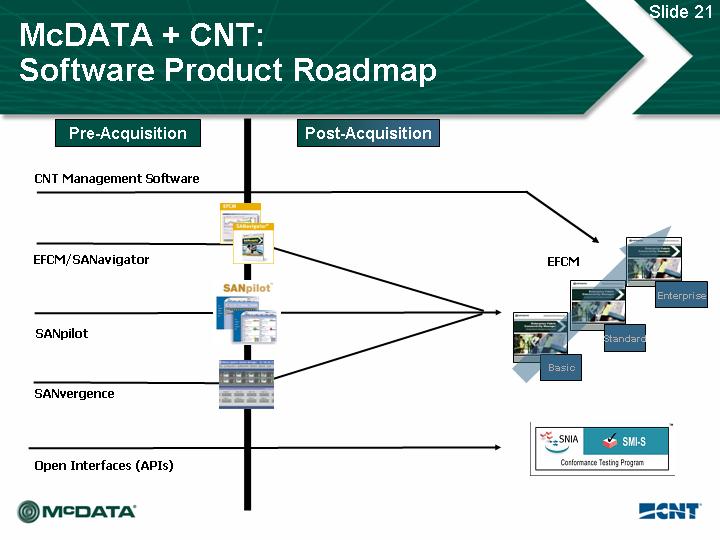

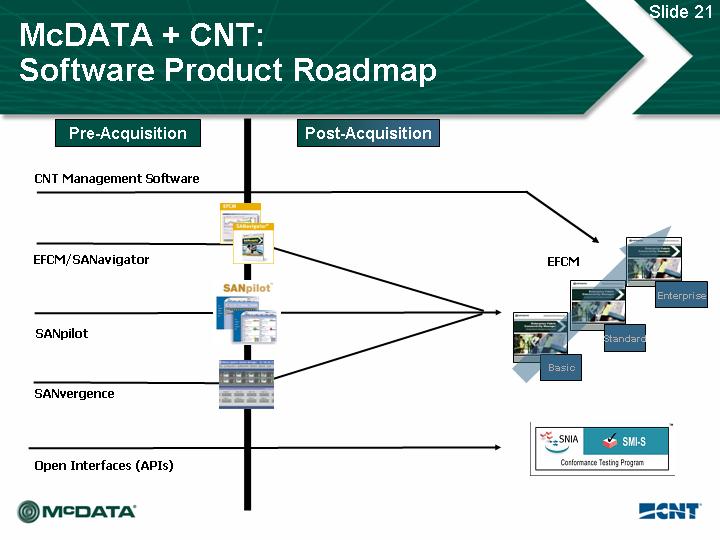

McDATA+ CNT: Software Product Roadmap

Pre-Acquisition | | Post-Acquisition |

| | |

CNT Management Software | | |

| | |

[GRAPHIC] | | |

EFCM/SANavigator | | |

| | [GRAPHIC] |

[GRAPHIC] | | EFCM | Enterprise |

SANpilot | | [GRAPHIC] | |

| | Standard | |

[GRAPHIC] | | [GRAPHIC] | |

SANvergence | | Basic | |

| | |

| | [GRAPHIC] |

Open Interfaces (APIs) | | |

| | | | | |

21

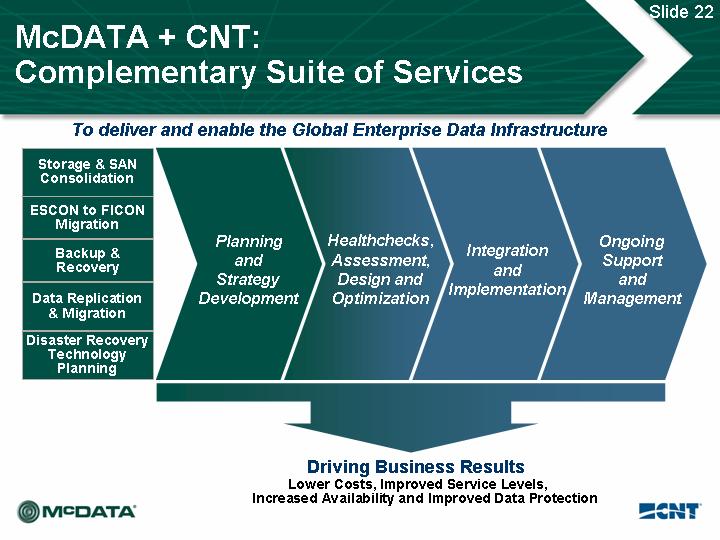

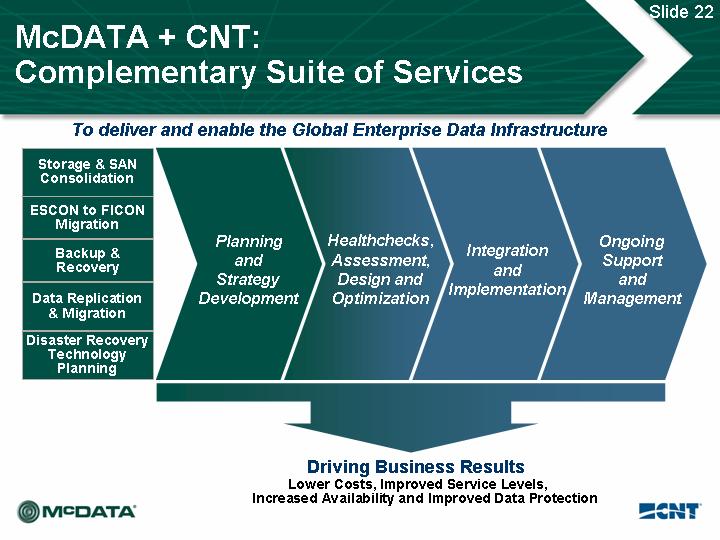

McDATA+ CNT: Complementary Suite of Services

To deliver and enable the Global Enterprise Data Infrastructure

Storage & SAN | | | | |

Consolidation | | | | |

| | | | |

ESCON to FICON | | | | |

Migration | | | | |

| Planning | Healthchecks, | Integration | Ongoing |

Backup & | and | Assessment, | and | Support |

Recovery | Strategy | Design and | Implementation | and |

| Development | Optimization | | Management |

Data Replication | | | | |

& Migration | | | | |

| | | | |

Disaster Recovery | | | | |

Technology | | | | |

Planning | | | | |

Driving Business Results

Lower Costs, Improved Service Levels,

Increased Availability and Improved Data Protection

22

McDATA+ CNT: Integrated Product and Services Sale

[CHART]

23

McDATA + CNT: Industry Leading Partnerships

Services and Outsourcing Partners

Software | Network | Hardware | Telco |

| | | |

[LOGO] | [LOGO] | [LOGO] | [LOGO] |

24

McDATA+ CNT: Acquisition Update Conference Call Agenda

Agenda

• Preliminary FQ105 Financial Results

• Strategic Overview

• Combined Product and Services Roadmap

• GO-TO-MARKET MODEL

• Operational Plans

• Execution Imperatives

• Summary

• Q&A

25

McDATA+ CNT: Drives Value To OEMs, VAR/VADs, and Customers

The broader products, services, and solutions offerings, combined with the larger installed base should:

• Enable the combined company to better meet the objectives and programs of all channel partners

• Provide channel partners the ability to offer diverse and highly differentiated solutions to their customers driving market expansion and increased sales opportunities

• Increase flexibility and value for end-user customers

Together, McDATA and CNT are uniquely positioned to assist partners and

customers in the evolution to the Global Enterprise Data Infrastructure

26

McDATA+ CNT: OEM Partner Perspective

“EMC has had long and successful relationships with both McDATA and CNT that has helped our customers build and deploy infrastructures for information lifecycle management. We look forward to continuing our work with the combined company and providing our mutual customers with some of the industry’s most advanced storage networking solutions.”

-Tom Joyce, vice president, platforms marketing, EMC

“We are very pleased with the acquisition, as combining McDATA and CNT, both trusted Hitachi Data Systems partners, will result in a technology leader with very competitive solution offerings. Our relationship with McDATA will continue to prosper as we move forward with our Application Optimized Storage™ solutions strategy. These solutions, integrating hardware, software and services plus best of breed networking components, such as McDATA’s, will allow organizations to more closely align business and IT objectives.”

-Scott Genereux, executive vice president and general manager,

worldwide sales, channels, and support, Hitachi Data Systems

“IBM has had a deep relationship with both McDATA and CNT. We are excited to leverage and benefit from the unified company to offer our customers an expanded portfolio of information on demand solutions.” -Robert Mahoney, business line executive storage networking, IBM

27

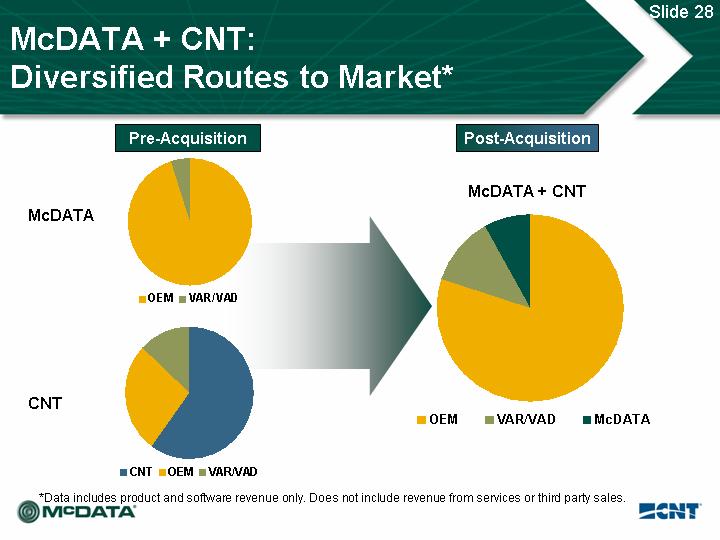

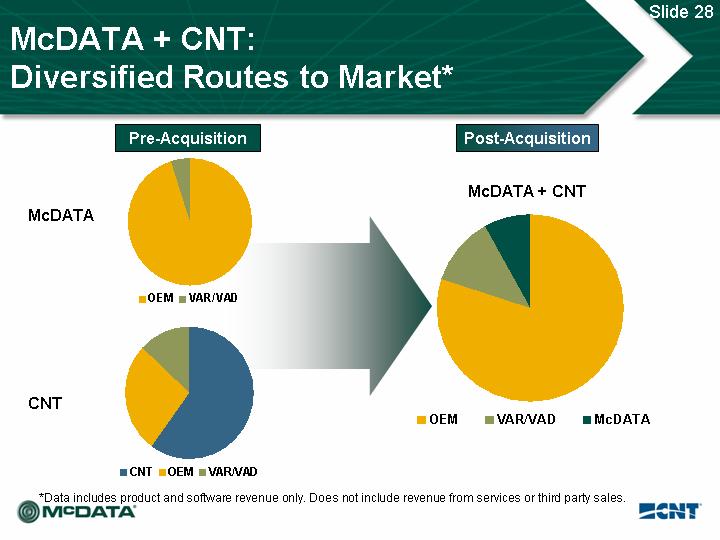

McDATA + CNT: Diversified Routes to Market*

Pre-Acquisition | | Post-Acquisition |

| | | |

| McDATA | [CHART] | | McDATA + CNT |

| | | | |

| CNT | [CHART] | | [CHART] |

*Data includes product and software revenue only. Does not include revenue from services or third party sales.

28

McDATA + CNT: Leveraging the Customer Opportunity

• Installed base is who’s who among Global 1000

• Trusted names for over 40 years in enterprise mainframe, open system, and distance extension infrastructures across multi-vendor solutions

• Largest FICON and FibreChannel director presence, deployed in more than 10,000 data centers with more than 3,000 customers worldwide

• Design and implementation expertise to meet even the most complex customer requirements

• Unique, vertically integrated offering of SAN, MAN, and WAN solutions, software, and services will drive increased value to customers and distribution partners, including OEMs, VARs, VADs, and SIs

McDATA and CNT are proven experts at translating technology into business results

29

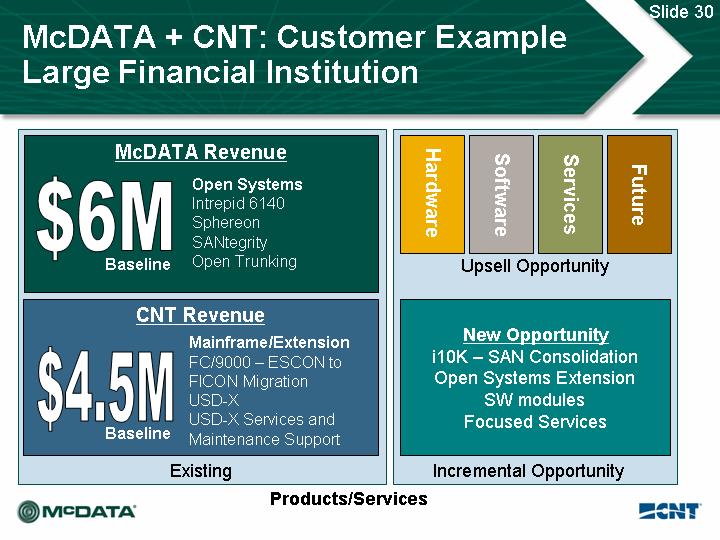

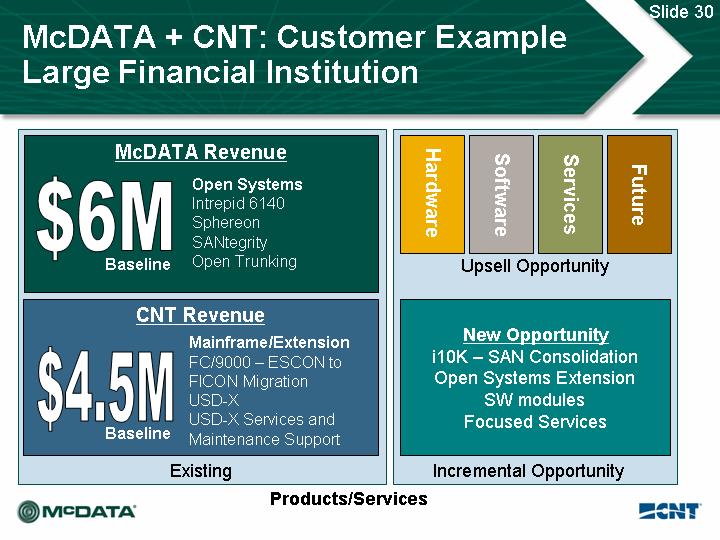

McDATA + CNT: Customer Example Large Financial Institution

McDATA Revenue | | |

| | |

$6M

Baseline | | Open Systems | | Hardware | Software | Services | Future |

Interpid 6140 | |

Spehereon | |

SANtegrity | |

Open Trunking | | Upsell Opportunity |

| | | |

CNT Revenue | | |

| | |

| Mainframe/Extension | | New Opportunity |

$4.5M

Baseline | | FC/9000 – ESCON to | | i10K – SAN Consolidation |

FICONE Migration | | Open Systems Extension |

USD-X | | SW modules |

USD-X Services and | | Focused Services |

Maintenance Support | | |

| | | |

Existing | | Incremental Opportunity |

Products/Services

30

McDATA + CNT: Acquisition Update Conference Call Agenda

Agenda

• Preliminary FQ105 Financial Results

• Strategic Overview

• Combined Product and Services Roadmap

• Go to Market Model

• OPERATIONAL PLANS

• Execution Imperatives

• Summary

• Q&A

31

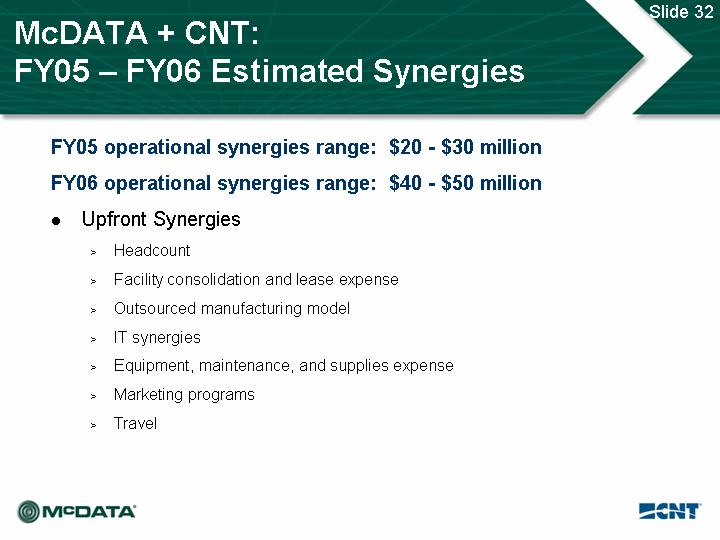

McDATA + CNT: FY05 – FY06 Estimated Synergies

FY05 operational synergies range: $20 - $30 million

FY06 operational synergies range: $40 - $50 million

• Upfront Synergies

• Headcount

• Facility consolidation and lease expense

• Outsourced manufacturing model

• IT synergies

• Equipment, maintenance, and supplies expense

• Marketing programs

• Travel

32

McDATA + CNT: Q4 FY2005 Non-GAAP Operating Targets

Revenue: | | $200 - $205 million | |

Gross profit: | | $100 - $105 million | |

Gross margin: | | 49% - 50% | |

Operating expense: | | $77 - $82 million | |

R&D | | $32 - $34 million | |

S&M | | $38 - $40 million | |

G&A | | $6.5 - $8.5 million | |

Operating profit: | | $20 - $25 million | |

Operating margin: | | 10% + | |

*EPS: | | $0.08 - $0.10 | |

*Assumes 160 million fully diluted shares outstanding and tax rate of approximately 30%

33

McDATA + CNT: FY2006 Targeted Non-GAAP Operating Expenses

[CHART]

Expected operational synergies significantly reduce FY2006

operating expense as a percent of revenue

34

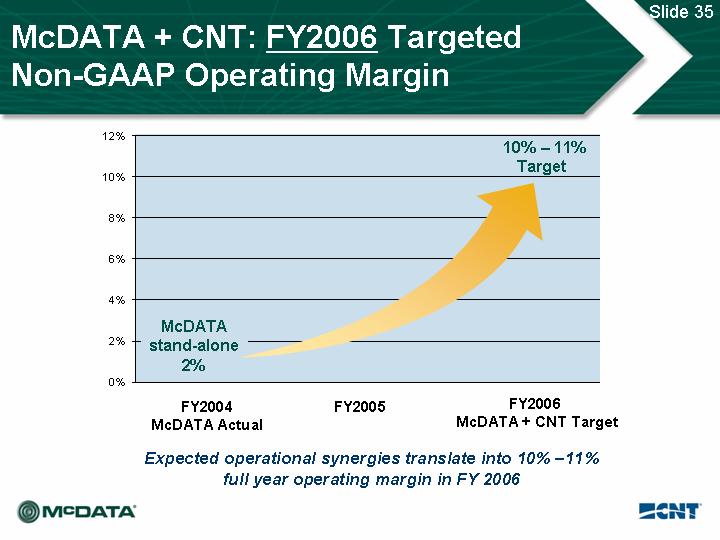

McDATA + CNT: FY2006 Targeted Non-GAAP Operating Margin

[CHART]

Expected operational synergies translate into 10% –11%

full year operating margin in FY 2006

35

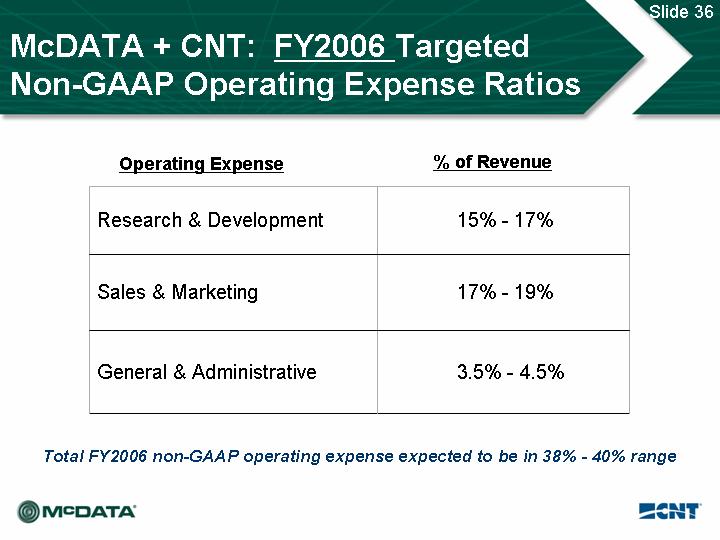

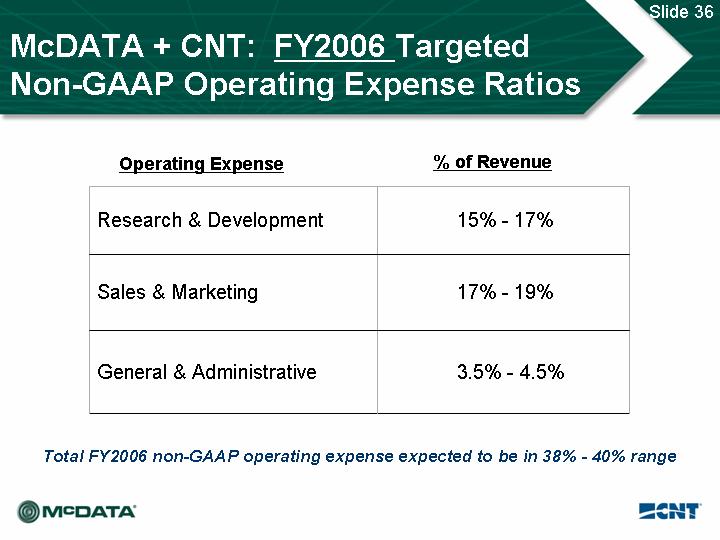

McDATA + CNT: FY2006 Targeted Non-GAAP Operating Expense Ratios

Operating Expense | | % of Revenue | |

| | | |

Research & Development | | 15% - 17% | |

| | | |

Sales & Marketing | | 17% - 19% | |

| | | |

General & Administrative | | 3.5% - 4.5% | |

Total FY2006 non-GAAP operating expense expected to be in 38% - 40% range

36

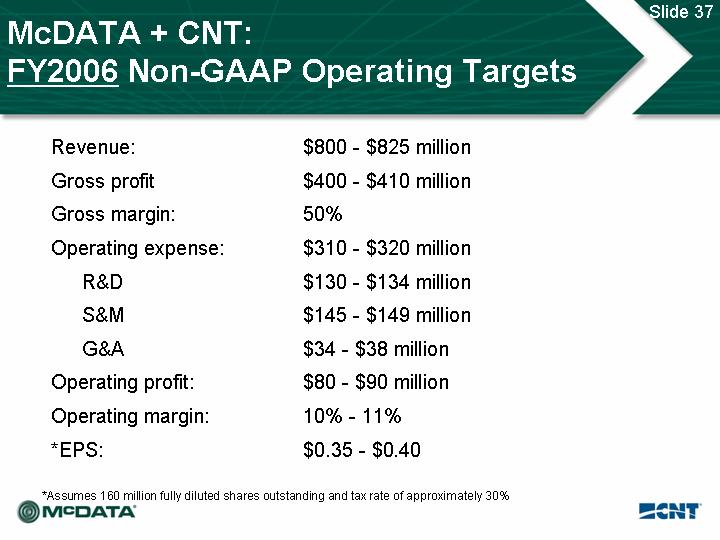

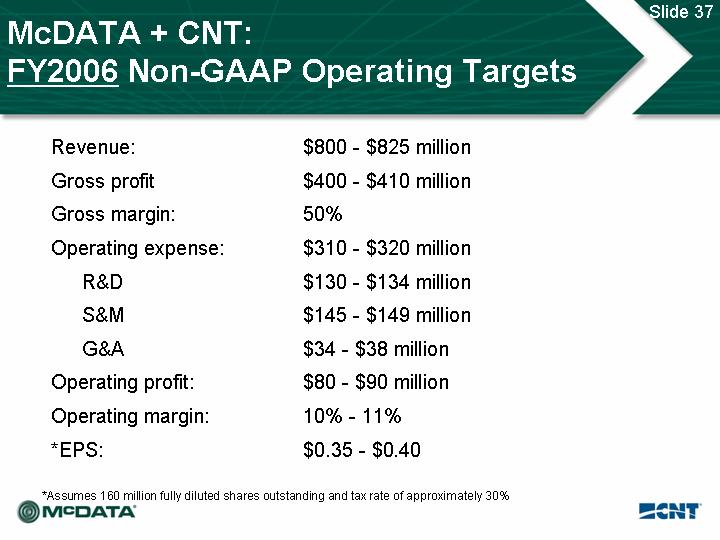

McDATA + CNT: FY2006 Non-GAAP Operating Targets

Revenue: | | $800 - $825 million |

Gross profit | | $400 - $410 million |

Gross margin: | | 50% |

Operating expense: | | $310 - $320 million |

R&D | | $130 - $134 million |

S&M | | $145 - $149 million |

G&A | | $34 - $38 million |

Operating profit: | | $80 - $90 million |

Operating margin: | | 10% - 11% |

*EPS: | | $0.35 - $0.40 |

*Assumes 160 million fully diluted shares outstanding and tax rate of approximately 30%

37

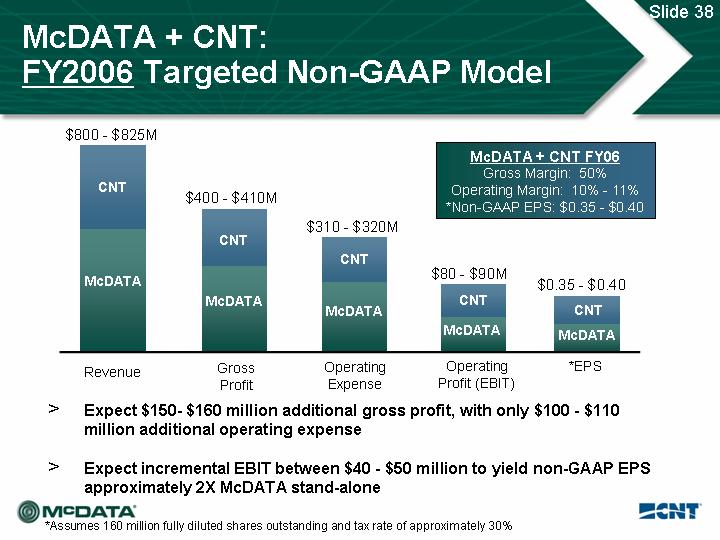

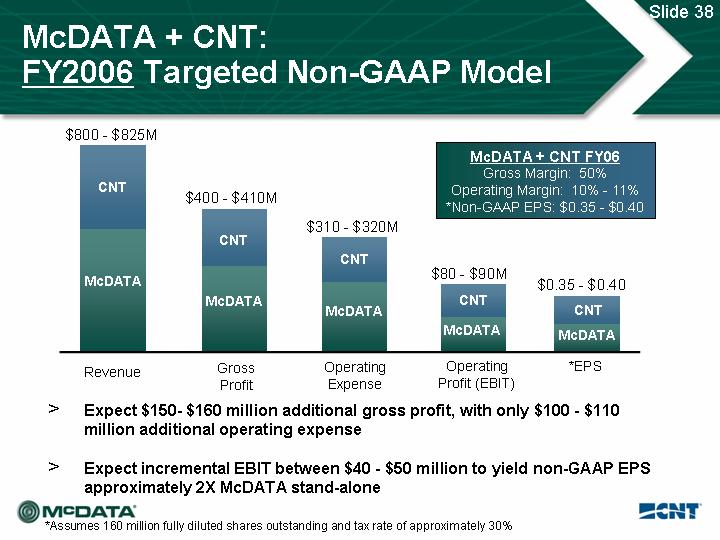

McDATA + CNT: FY2006 Targeted Non-GAAP Model

| McDATA + CNT FY06 |

| Gross Margin: 50% |

| Operating Margin: 10% - 11% |

| *Non-GAAP EPS: $0.35 - $0.40 |

[CHART]

• Expect $150- $160 million additional gross profit, with only $100 - $110 million additional operating expense

• Expect incremental EBIT between $40 - $50 million to yield non-GAAP EPS approximately 2X McDATA stand-alone

*Assumes 160 million fully diluted shares outstanding and tax rate of approximately 30%

38

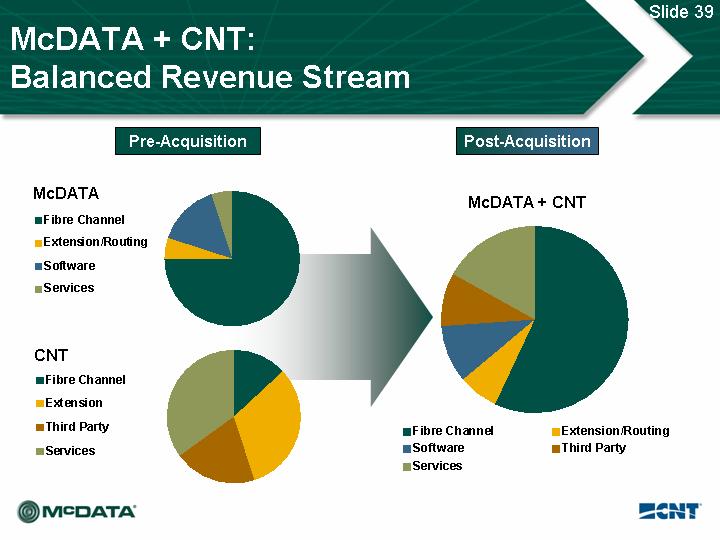

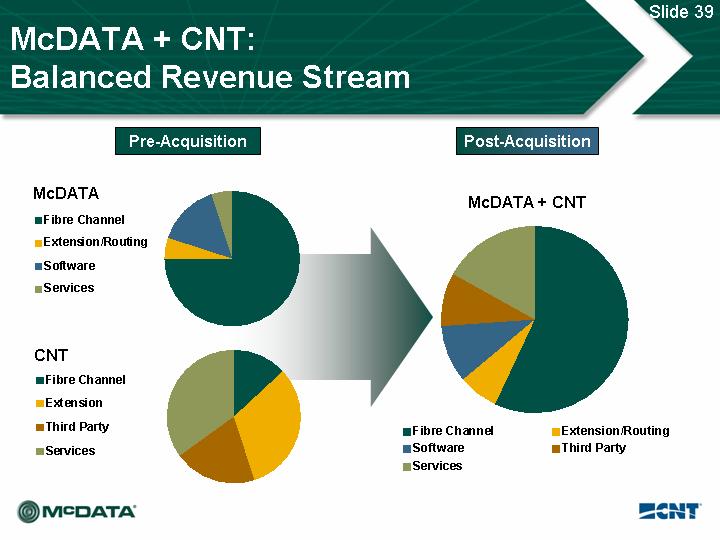

McDATA + CNT: Balanced Revenue Stream

Pre-Acquisition | | Post-Acquisition |

| | |

McDATA | [CHART] | | McDATA + CNT |

| | | |

| | | [CHART] |

| | | |

CNT | [CHART] | | |

39

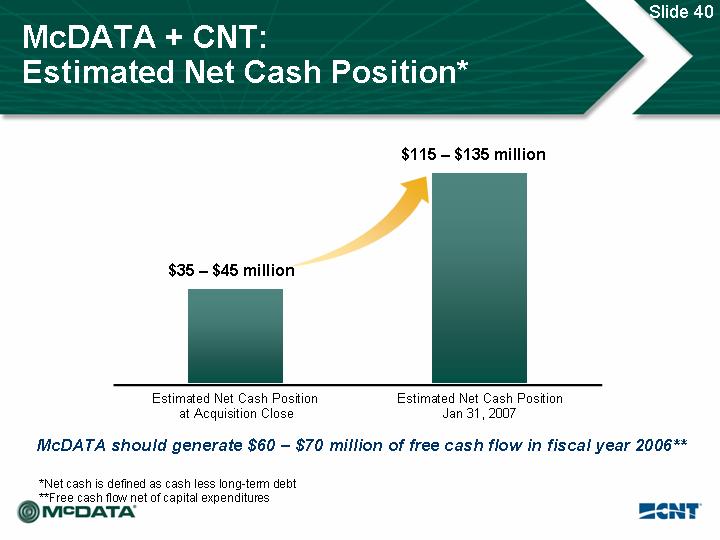

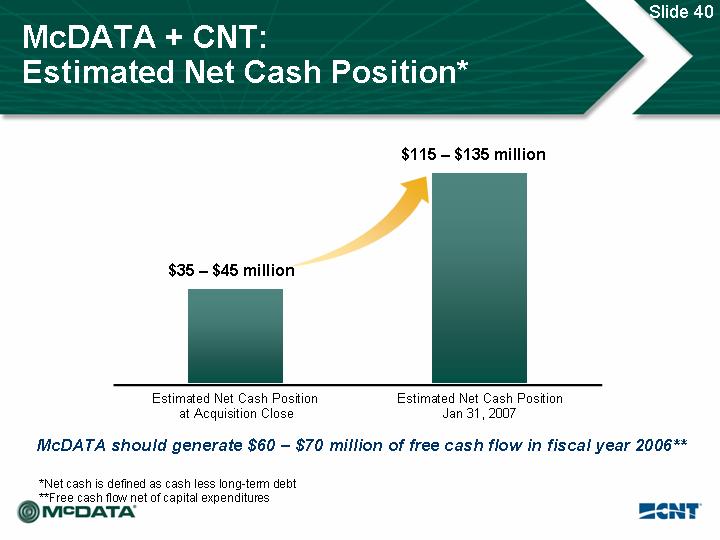

McDATA + CNT: Estimated Net Cash Position*

[CHART]

McDATA should generate $60 – $70 million of free cash flow in fiscal year 2006**

*Net cash is defined as cash less long-term debt

**Free cash flow net of capital expenditures

40

McDATA + CNT: Acquisition Update Conference Call Agenda

Agenda

• Preliminary FQ105 Financial Results

• Strategic Overview

• Combined Product and Services Roadmap

• Go to Market Model

• Operational Plans

• EXECUTION IMPERATIVES

• Summary

• Q&A

41

Execution Imperatives

Targeted Execution Timeline FY2005

• May 24 – Special Meeting of Shareholders

• June 1 – Acquisition Close

• July 31 – Achieve 70% of headcount related synergies

• September 30 – Achieve Oracle system integration

• October 31 – Achieve 90%+ of headcount related synergies

• December 31 – Achieve fully outsourced manufacturing model

• January 31 – Acquisition to be accretive to non-GAAP EPS

42

1. Operational Cost Reduction and Efficiencies

• Start immediately at acquisition close and achieve synergies quickly

• Rationalize facilities

• Outsource Lumberton manufacturing operations

• Complete targeted headcount reduction of approximately 25%

• Integration of procurement and services

• Improve supply chain management

• Standardize and automate

• Consolidate and outsource

43

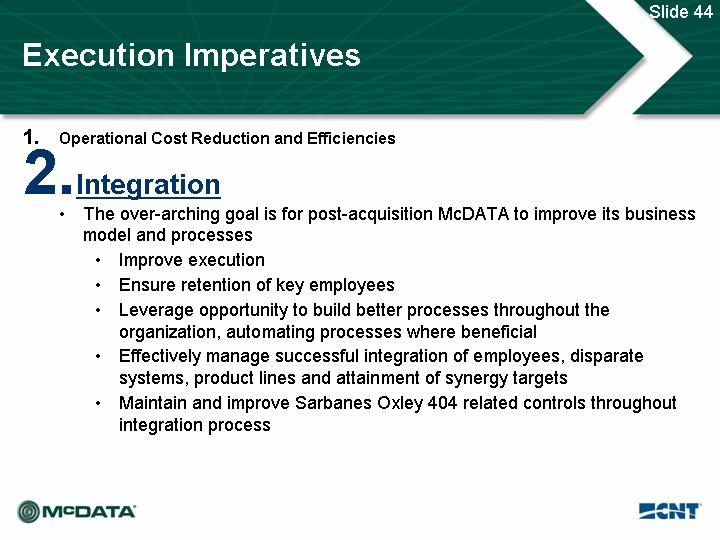

1. Operational Cost Reduction and Efficiencies

2. Integration

• The over-arching goal is for post-acquisition McDATA to improve its business model and processes

• Improve execution

• Ensure retention of key employees

• Leverage opportunity to build better processes throughout the organization, automating processes where beneficial

• Effectively manage successful integration of employees, disparate systems, product lines and attainment of synergy targets

• Maintain and improve Sarbanes Oxley 404 related controls throughout integration process

44

1. Operational Cost Reduction and Efficiencies

2. Integration

3. Achieve Product Roadmap Deliverables

• Deliver 4 Gbps Sphereon 4400 and 4700 in second fiscal quarter 2005

• Deliver EFCM 9.0 before end of fiscal year 2005

• Bring virtualization solution to market 1H06

• Execute on blade strategy with QLogic

• Improve fast cycling of product introductions

• Deliver to partners and customers tools to enable their GEDI strategy

• Successfully rationalize product lines

45

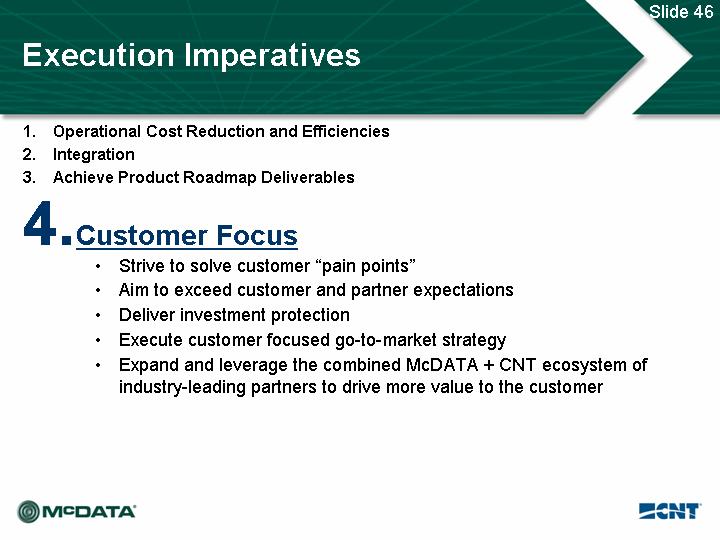

1. Operational Cost Reduction and Efficiencies

2. Integration

3. Achieve Product Roadmap Deliverables

4. Customer Focus

• Strive to solve customer “pain points”

• Aim to exceed customer and partner expectations

• Deliver investment protection

• Execute customer focused go-to-market strategy

• Expand and leverage the combined McDATA + CNT ecosystem of industry-leading partners to drive more value to the customer

46

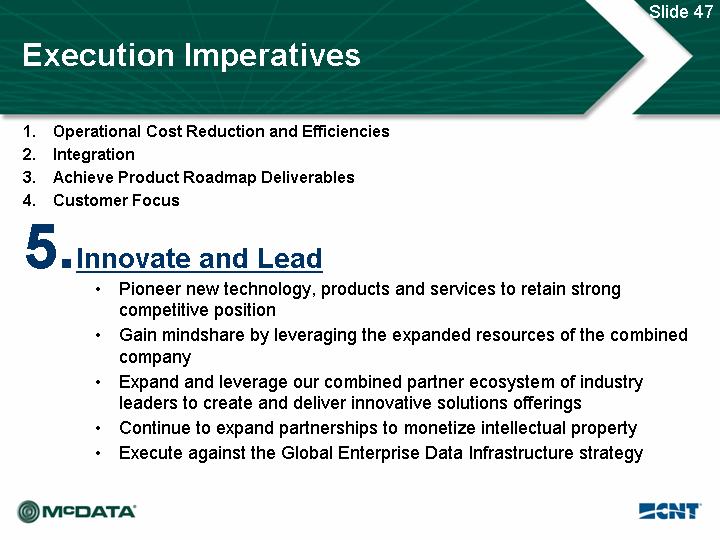

1. Operational Cost Reduction and Efficiencies

2. Integration

3. Achieve Product Roadmap Deliverables

4. Customer Focus

5. Innovate and Lead

• Pioneer new technology, products and services to retain strong competitive position

• Gain mindshare by leveraging the expanded resources of the combined company

• Expand and leverage our combined partner ecosystem of industry leaders to create and deliver innovative solutions offerings

• Continue to expand partnerships to monetize intellectual property

• Execute against the Global Enterprise Data Infrastructure strategy

47

1. Operational Cost Reduction and Efficiencies

2. Integration

3. Achieve Product Roadmap Deliverables

4. Customer Focus

5. Innovate and Lead

6. Drive Shareholder Value

• Drive profitable revenue growth

• Exercise smart cost controls

• Convey clear and consistent communications

• Provide clear and measurable goals

• Deliver consistent execution

48

McDATA + CNT: Acquisition Update Conference Call Agenda

Agenda

• Preliminary FQ105 Financial Results

• Strategic Overview

• Combined Product and Services Roadmap

• Go to Market Model

• Operational Plans

• Execution Imperatives

• SUMMARY

• Q&A

49

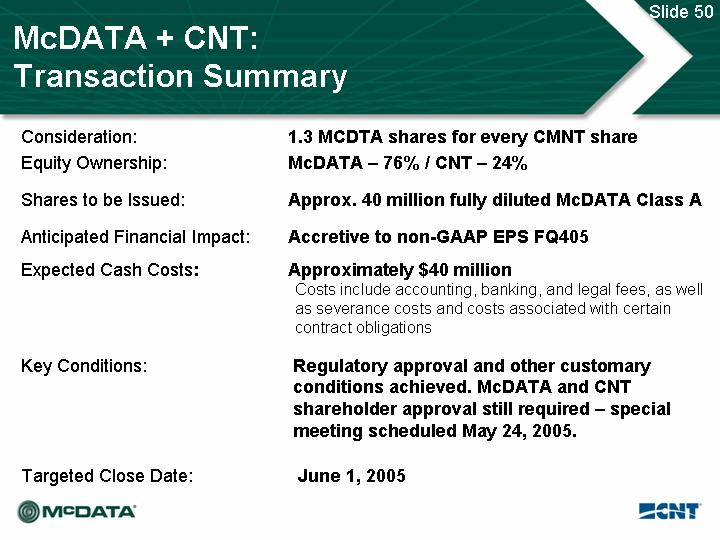

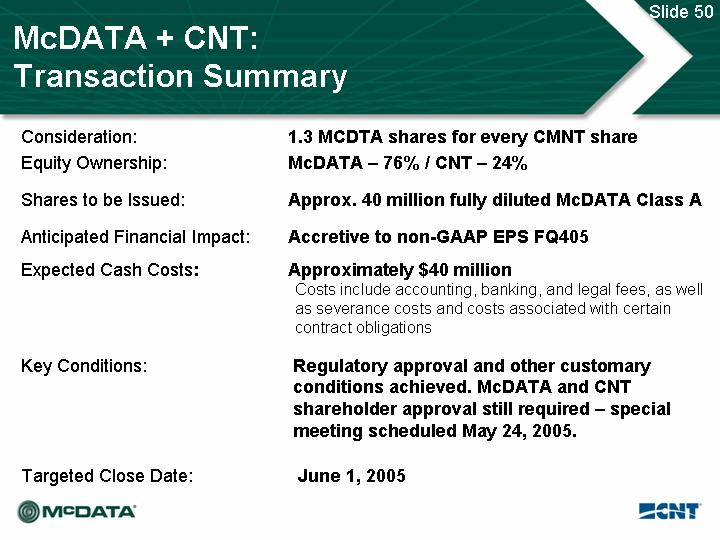

McDATA + CNT: Transaction Summary

Consideration: | | 1.3 MCDTA shares for every CMNT share |

| | |

Equity Ownership: | | McDATA – 76% / CNT – 24% |

| | |

Shares to be Issued: | | Approx. 40 million fully diluted McDATA Class A |

| | |

Anticipated Financial Impact: | | Accretive to non-GAAP EPS FQ405 |

| | |

Expected Cash Costs: | | Approximately $40 million |

| | Costs include accounting, banking, and legal fees, as well as severance costs and costs associated with certain contract obligations |

| | |

Key Conditions: | | Regulatory approval and other customary conditions achieved. McDATA and CNT shareholder approval still required – special meeting scheduled May 24, 2005. |

| | |

Targeted Close Date: | | June 1, 2005 |

50

McDATA + CNT: Summary Financial Model Targets

| | Pre-acquisition | | Post-synergy | |

| | FY 2004 | | FY 2006 | |

| | McDATA Actual | | Targets | |

Non-GAAP Operating Expense as % of revenue | | 54 | % | 38% - 40% of revenue | |

| | | | | |

Non-GAAP Operating Margin | | 2 | % | 10% - 11% | |

| | | | | |

Non-GAAP EPS | | $ | 0.12 | | $0.35 - $0.40 | |

| | | | | |

Revenue per Employee (Annualized) | | $ | 384K | | $500K+ | |

51

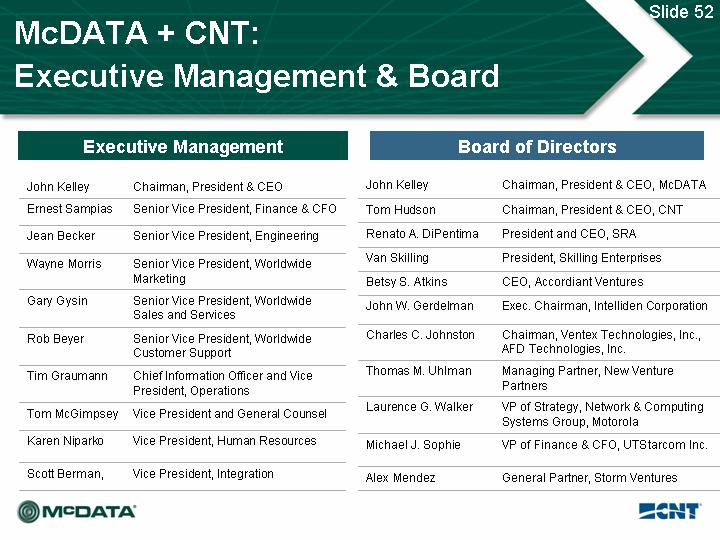

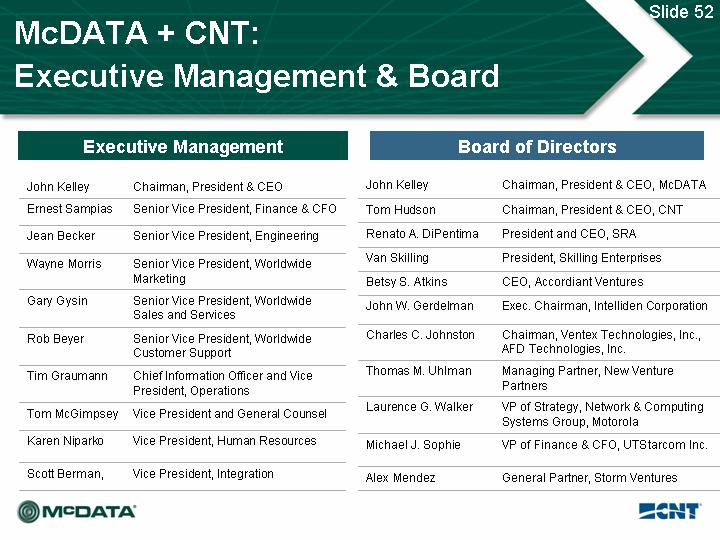

McDATA + CNT: Executive Management & Board

Executive Management |

| |

John Kelley | Chairman, President & CEO |

Ernest Sampias | Senior Vice President, Finance & CFO |

Jean Becker | Senior Vice President, Engineering |

Wayne Morris | Senior Vice President, Worldwide Marketing |

Gary Gysin | Senior Vice President, Worldwide Sales and Services |

Rob Beyer | Senior Vice President, Worldwide Customer Support |

Tim Graumann | Chief Information Officer and Vice President, Operations |

Tom McGimpsey | Vice President and General Counsel |

Karen Niparko | Vice President, Human Resources |

Scott Berman, | Vice President, Integration |

Board of Directors |

| |

John Kelley | Chairman, President & CEO, McDATA |

Tom Hudson | Chairman, President & CEO, CNT |

Renato A. DiPentima | President and CEO, SRA |

Van Skilling | President, Skilling Enterprises |

Betsy S. Atkins | CEO, Accordiant Ventures |

John W. Gerdelman | Exec. Chairman, Intelliden Corporation |

Charles C. Johnston | Chairman, Ventex Technologies, Inc., AFD Technologies, Inc. |

Thomas M. Uhlman | Managing Partner, New Venture Partners |

Laurence G. Walker | VP of Strategy, Network & Computing Systems Group, Motorola |

Michael J. Sophie | VP of Finance & CFO, UTStarcom Inc. |

Alex Mendez | General Partner, Storm Ventures |

52

McDATA + CNT: A Valuable Combination

• Best-in-class, complementary products

Heritage of innovation and patented technologies with more than 40 years combined experience

• Value-added services offerings - Level 1, 2, 3, and support systems

Both with more than 20 years combined expertise in SANs, MANs, and WANs

• Customer and partner focused go-to-market model

Vertically integrated offering drives increased value to distribution partners

• Unparalleled enterprise brand recognition and trust

Deployed in more than 10,000 data centers with more than 20,000 directors installed

• Substantial synergies driven by clear, measurable, achievable cost opportunities

Acquisition to be accretive in fiscal fourth quarter 2005

53

McDATA + CNT: Acquisition Update Conference Call Agenda

Agenda

• Preliminary FQ105 Financial Results

• Strategic Overview

• Combined Product and Services Roadmap

• Go to Market Model

• Operational Plans

• Execution Imperatives

• Summary

• Q&A

54

McDATA/CNT Acquisition Conference Call and Road Show Q&A

McDATA Acquisition of CNT

Questions and Answers

Deal Terms and Proxy-Related

1. What is the timeframe for completing the transaction?

• Should the acquisition be approved by shareholders at the special meeting scheduled May 24, 2005, we will target to close the acquisition on June 1, 2005, allowing the joint entity to begin combined operations for accounting purposes at the start of the month.

2. Did CNT’s restatement of earnings impact either the timing or the terms of the transaction?

• CNT’s restatement may have delayed the close of the transaction, but the targeted June 1, 2005, close date remains within the May – July 2005 range originally targeted when McDATA announced plans to acquire CNT on January 18, 2005.

• CNT’s restatement did not impact the terms of the transaction.

3. Does the CNT shareholder lawsuit impact the transaction?

• At this time, the lawsuit has not impacted the transaction.

• CNT and McDATA believe the lawsuit is without merit and intend to defend against it vigorously.

4. What regulatory approvals have you received, and what approvals are pending?

• Regulatory approvals received:

• Early termination of HSR waiting period

• Domestic and international clearance from the FCC

• Form S-4 Registration Statement declared effective by SEC

• Required PUC approvals

• Approvals pending:

• McDATA and CNT shareholder approval

5. What percentage of shareholders is required to vote for the deal to be approved?

• In order for the acquisition to be approved, a quorum of McDATA Class A and Class B votes must be present or by proxy at the special meeting on May 24, 2005, and the majority of votes cast must approve the acquisition.

• This means more than 50% of McDATA shares outstanding need to be represented by proxy, and more than 50% of these votes cast need to be in favor of the acquisition. This includes Class A and Class B McDATA shareholders.

• A quorum of CNT votes entitled to be cast is required, and a majority of the votes entitled to be cast must vote in favor of the acquisition.

• This means more than 50% of CNT shares outstanding need to be represented by proxy or in person, and more than 50% of CNT votes cast need to be in favor of the acquisition.

6. Are there any additional proposals submitted for shareholder approval?

• Yes. McDATA’s shareholders are also voting to approve an amendment to the 2001 McDATA Equity Incentive Plan to increase authorization of common stock issuable under the plan by 3 million shares.

• In addition, McDATA shareholders are voting to approve an amendment to the 2001 McDATA Equity Incentive Plan for options and equity awards granted under the 2001 plan to be awarded in McDATA Class A common stock.

Statements May Be Forward Looking – Subject to Safe Harbor

55

• CNT shareholders are also voting to approve any motion for adjournment or postponement of their respective special meetings

7. Why does McDATA want to amend the 2001 Equity Incentive Plan to increase authorization of common stock? Why do you want to award Class A common shares vs. Class B common shares?

• The McDATA board of directors wants to continue offering equity incentives to attract, retain, and motivate highly qualified individuals essential to the long-term growth and success of McDATA. We believe equity awards encourage employee loyalty to McDATA and align employee interests with the interests of McDATA’s stockholders.

• As of April 12, 2005, McDATA had approximately 991 employees worldwide, each of whom is eligible to receive awards under the 2001 Plan. The acquisition of CNT will significantly increase the number of employees eligible for awards under the 2001 Plan. As a result, the McDATA board of directors believes and recommends that the shares authorized under the 2001 Plan be appropriately increased.

• We currently have approximately 2 million shares remaining for the 2001 plan. We believe an increase of 3 million shares is sufficient for the plan until 2006, or longer.

• In addition, the McDATA board of directors believes the 2001 Plan needs to be amended to give McDATA the flexibility to grant awards under the 2001 Plan in either McDATA Class A stock or Class B common stock because upon closing, former CNT employees will have Class A options and McDATA employees will have Class B options creating a potential disparity.

8. Where will the company’s headquarters be located?

• McDATA will maintain its headquarters in Broomfield, CO.

9. Is this considered a merger of equals or an acquisition?

• This is an acquisition of CNT by McDATA.

10. What are the expected cash costs from closing the transaction?

• We expect cash costs associated with the transaction to be approximately $40 million or less.

• These costs include accounting, banking, and legal fees, as well as severance costs and costs associated with certain contract obligations.

11. What is Tom Hudson’s compensation package?

• CNT entered into an employment agreement with Tom Hudson, CNT’s CEO and President in March, 2003.

• The agreement provides for a rolling 3-year term until Mr. Hudson reaches age 65.

• Pursuant to the terms of this agreement, following the completion of the merger and termination of employment, Mr. Hudson is entitled to receive a lump sum payment of 300% of his base salary plus 300% of the bonus he would receive under CNT’s bonus plan if operating results met CNT’s plan for the year in which the termination occurred.

• Mr. Hudson is entitled to receive an additional payment to make him whole for any excise tax owed under Section 280G of the Code as a result of the lump sum payment.

• Under the agreement, Mr. Hudson’s benefits will continue for a 3-year period, and all options will vest and be exercisable for a three-year period (or the life of the option, if shorter) following his termination date.

• It is estimated that Mr. Hudson will receive a lump sum payment aggregating $3 million upon consummation of the merger and termination of employment.

56

12. What will Tom Hudson’s role be in the combined company?

• Mr. Hudson will be a member of Board of Directors of the combined company.

• McDATA and Mr. Hudson are currently in discussions regarding his potential role as a consultant or transitional employee with the combined company for a 12-month period following the close of the acquisition.

13. Explain Greg Barnum’s severance compensation and role in the combined company?

• In March 2003, CNT entered into an employment agreement with Greg Barnum, CNT’s CFO.The agreement provides for a rolling 3-year term until Mr. Barnum reaches age 65.

• Mr. Barnum’s employment will be terminated in connection with the completion of the merger.

• Pursuant to the terms of this agreement, following the completion of the merger and termination of employment, Mr. Barnum is entitled to receive a lump sum payment equal to 200% of his base salary plus 200% of the bonus he would receive under CNT’s bonus plan if operating results meet CNT’s plan for the year in which the termination occurred.

• Mr. Barnum’s benefits will continue for a 3-year period, and all options will vest and be exercisable pursuant to their terms for a three-year period (or the life of the option, if shorter) following his termination date.

• Mr. Barnum is entitled to receive an additional payment to make him whole for any excise tax owed under Section 280G of the Code as a result of the lump sum payment.

• It is estimated that Mr. Barnum will receive a lump sum payment aggregating $800,000 upon consummation of the merger and termination of employment.

• Mr. Barnum has agreed to enter into a 6-month consulting agreement with McDATA to render services after the effective time of the merger pursuant to which he will receive bi-weekly minimum payments of $10,416.67, subject to monthly maximum payments of $20,833.34.

• In addition, Mr. Barnum will receive $500 as additional consideration for the one-year non-compete clause contained in the consulting agreement.

14. Will other CNT executives or employees receive compensation packages?

• Options granted to CNT Directors, Ms. Earley, Mr. Kelen and Mr. Ryan, which are not currently vested will vest immediately prior to the effective time of the merger.

• One-half of the options granted to Edward Walsh, CNT’s Vice President of Strategy, Marketing and Alliances, under an option agreement dated May 8, 2002 which have not previously vested will vest immediately prior to the effective time of the merger.

• Pursuant to an offer letter dated February 19, 1997, CNT has agreed to provide Mark Knittel 6 months severance upon termination of employment for non-performance, and McDATA will honor this severance agreement.

• Also, under the terms of the merger agreement, McDATA has covenanted to CNT to pay Jeffrey A. Bertelsen, Robert R. Beyer, Edward J. Walsh and Mark R. Knittel severance equal to 12 months of base salary if they are terminated within 12 months of the effective time of the merger other than for cause. Payment is conditioned upon entering into noncompetition and nonsolicitation agreements for a period of 12 months and the execution of a general release of claims.

• Other executives and employees of CNT will receive severance packages if they are not employees of the combined entity

• CNT employees will generally be eligible for two (2) weeks severance pay plus an additional two (2) weeks pay for each full year of service (the minimum an employee would be eligible for is four (4) weeks). In addition, employees will be eligible for one (1) month’s paid COBRA insurance continuation.

• McDATA employees impacted by the acquisition will also receive severance packages.

57

15. Who will make up the management team of the combined company?

• John Kelley – chairman, president & CEO

• Ernest Sampias- senior vice president, finance & CFO

• Jean Becker – senor vice president, engineering

• Wayne Morris – senior vice president, worldwide marketing

• Gary Gysin – senior vice president, worldwide sales and professional services

• Rob Beyer – senior vice president, worldwide customer support

• Tim Graumann – chief information officer and vice president, operations

• Tom McGimpsey – vice president and general counsel

• Karen Niparko – vice president, human resources

• Scott Berman –vice president, integration

16. Who will be on the combined Board of Directors?

• The McDATA Board of Directors will be expanded to 10 members to include Tom Hudson, the current Chairman and CEO of CNT, and Renny DiPentima, a current Board member of CNT.

• Existing McDATA board members include: John Kelley, Van Skilling, John Gerdelman, Charles Johnston, Betsy Atkins, Thomas Uhlman, Larry Walker, Mike Sophie, and Alex Mendez.

17. Do you plan to guarantee CNT’s debt?

• Yes. McDATA will provide a parent guarantee of CNT’s convertible debt, which currently totals $124.4 million due in February, 2007.

18. CNT has an existing partnership with Brocade. Does the combined company intend to resell Brocade products?

• McDATA intends to honor CNT’s existing contracts. However, we can not speculate on Brocade’s actions and response to the acquisition.

Synergy / Financial

1. How many facilities will the combined company lease and/or own? Where?

• The only facility owned by McDATA is located at 4 McDATA Parkway in Broomfield, Colorado. This facility is primarily engineering resources and labs. All other facilities and offices are leased.

• Headquarters will remain in Broomfield, Colorado, currently located at 380 Interlocken Crescent, moving to the new headquarters building at 11802 Ridge Parkway, Bldg #2, in the first part of 2006. Build-out of the new headquarters begins in June of this year.

• McDATA will also maintain leased space 1722 Boxelder Street, Louisville, Colorado. This facility is dedicated to configuration and testing.

• Throughout the integration process, we will be terminating leases on several regional and international offices in geographies where redundancies are present.

• CNT’s Plymouth, Minnesota, headquarters will continue to house engineering, sales, marketing, support, a call center, and administrative operations. In the future, McDATA may sub-lease out a portion of this office space.

• The Lumberton facility is under lease, and our objective is to outsource these manufacturing operations and sublease the facility.

58

2. Do you plan to move to a fully outsourced manufacturing model?

• Yes. We plan to move to a fully outsourced manufacturing model by the end of the calendar year 2005.

3. What is the anticipated headcount of the combined entity?

• The anticipated combined company headcount is between 1,500 – 1,600 employees, down from the combined 2,100 now.

• The anticipated headcount reduction is approximately 25%.

4. How do you plan to retain valuable employees?

• McDATA is a very attractive employer.

• The Company offers generous benefits, and the culture exemplifies innovation, camaraderie, high ethics, and rewards those employees that excel.

• We believe employees want to be a part of such an organization.

• In addition, there are structured retention plans that may be offered to key employees whose skill sets are critical to the success of the combined company.

5. In what organization and functional groups are the headcount reductions most significant?

• In our efforts to be a world-class organization, employees from both companies are being evaluated and there will be restructuring, reorganization, and reductions across both CNT and McDATA.

• There will be headcount reductions across all functional groups.

• Sales and marketing, engineering, and G&A, on average, will experience 25% headcount reductions.

6. How long will it take to achieve synergy goals?

• We expect to achieve 70% of headcount related synergies within 60 days following the close of the transaction. The close date is currently targeted as June 1, 2005.

• We expect to achieve 90%+ of headcount synergies by October 31, 2005, as transitional employees are let go.

• Additional synergies should be realized as redundant facilities are closed and leases are sub-leased and/or terminated, as development ceases on certain product lines, and as we continue to integrate every day business activities, events, and IT systems.

• We expect the acquisition to be accretive to non-GAAP earnings in the fourth quarter fiscal 2005, ending January 31, 2006.

• We expect the operating expense run rate to be approximately $80 million quarterly in FY06, resulting in total combined operating expenses of $310 - $320 million for the full fiscal year, versus total combined operating expenses of $374 million for the fiscal year 2004 ended January 31, 2005.

7. What does the structure of the combined company look like?

• When the transaction is closed and the acquisition is completed, CNT will become a wholly-owned subsidiary of McDATA for tax-related reasons.

• All employees of the joint company will be McDATA employees and all products and services will be McDATA branded products and services

59

8. Do you plan to continue to report revenue in four categories: product revenue, software revenue, services revenue, and ESCON revenue?

• McDATA will report financial results quarterly with revenue broken into the following categories:

1. Product – will include revenue from all hardware product and associated firmware sales

• Product revenue will be separated into two categories:

• McDATA products – to include revenue from all McDATA and CNT hardware products and associated firmware sales

• Third party products – to include revenue generated from the resale of third party products such as storage arrays

2. Software – will include revenue from add-on software sales and related maintenance contracts, as well as royalty payments from QLogic and Network Appliance

3. Services – will include revenue from maintenance, professional services, consulting, and network monitoring

4. Other - will include ESCON and other revenue contributors averaging less than $1 million in revenue quarterly

9. Discuss the estimated charges related to this transaction, and explain the impact of purchase accounting as it pertains to McDATA’s acquisition of CNT.

• We are not prepared at this time to discuss in detail the charges related to this transaction.

• We expect to record the majority of the charges during our second fiscal quarter.

• We expect cash costs associated with the transaction to be approximately $40 million or less.

• These costs include accounting, banking, and legal fees, as well as severance costs and costs associated with certain contract obligations.

• We do not expect to write off a significant amount of in-process R&D as is typical in most technology M&A transactions; however we may have other one-time technology write-offs as we rationalize the product lines that may result in a write-off of goodwill and intangible assets.

• We will have more information when we close the transaction, but as referenced in our S-4 filing, the third party valuation firm has preliminarily identified the following amortizable intangible assets:

• $43.4 million for developed technology

• $23.6 million for customer lists

• $7 million for customer order backlog

• $5 million for trademarks

• CNT’s balance sheet reflects deferred revenue tied largely to maintenance contracts. Purchase accounting rules dictate that the fair value of deferred revenue is often times valued at the actual cost of the service provided. While McDATA will be able to recognize this revenue, we can not at this time determine the profit margin until the valuation is determined. We expect to be able to provide additional information on our second fiscal quarter 2005 earnings conference call.

10. What is the expected gross margin of the combined company?

• McDATA targets gross margins to be approximately 50% for the first full fiscal year following the close of the acquisition. This fiscal year begins February 1, 2006 and ends January 31, 2007.

11. What is the estimated annual capital expenditure for the combined company?

• Historically, capital expenditures have been equivalent to approximately 5% of annual revenue for both CNT and McDATA.

• We expect this trend to continue, and we therefore anticipate capital expenditures for the combined company to be approximately $40 - $50 million annually.

60

12. What legacy CNT revenue streams will McDATA be able to maintain and grow?

• We believe we can increase fibre channel director and FICON revenue driven by growth in the Intrepid Director platform driven by the i10k and upgrades to the 6140 over the coming months.

• We believe we will increase extension revenue – SAN extension and mainframe extension – as these products will be sold through all channels into a considerably larger installed base.

• We believe services revenue should grow driven largely by maintenance agreements.

• We expect to expand the customer base into which we sell third-party products.

13. What is the targeted operating model for the combined company in FY 2006?

• McDATA expects to achieve in FY 2006, ending January 31, 2007, the following operating metrics:

• Gross Margin: 50%

• Non-GAAP Operating Margin: 10 – 11%

• Operating expense as a percent of revenue: 38% - 40%

• Research & Development expense as a percent of revenue: 15% - 17%

• Sales & Marketing expense as a percent of revenue: 17% - 19%

• General & Administrative expense as a percent of revenue: 3.5% - 4.5%

• Revenue per employee to exceed $500,000

14. What percentage of revenue do you expect EMC will represent in the second half of 2005 and fiscal year 2006?

• We have not historically forecasted EMC’s contribution to revenue, and we do not plan to forecast or estimate their revenue contribution at this time.

• We do expect a more diversified revenue stream as a result of the acquisition.

• EMC remains an important partner to McDATA, and we plan to build upon the existing relationship.

• EMC and CNT also have a long-standing and mutually beneficial relationship.

• We believe the combination of McDATA and CNT will create more value for all partners, including EMC.

• The broader products, services, and solutions offerings, combined with the larger installed base created by merging McDATA and CNT should:

• Enable the combined company to better meet channel partners’ objectives and programs

• Provide channel partners the ability to offer diverse and highly differentiated solutions to their customers, driving market expansion and increased sales opportunities

• Increase flexibility for end-user customers.

15. What percentage of revenue do you expect IBM will represent in the second half of 2005 and fiscal year 2006?

• We have not historically forecasted IBM’s contribution to revenue, and we do not plan to provide a forecast or estimate their revenue contribution at this time.

• We do expect revenue contribution from IBM to increase over time as we continue to benefit from our OEM agreement signed in October, 2004, and because both McDATA and CNT have forged strong relationships with IBM as a reseller and OEM of our respective product lines.

• We believe the combination of McDATA and CNT will create more value for all partners, including IBM.

61

16. What McDATA products is IBM currently reselling under the OEM agreement, or IBM TotalStorage brand, and what CNT products do you expect IBM to resell under the OEM agreement?

• Under McDATA’s current OEM agreement with IBM, IBM is reselling McDATA’s Intrepid 10000 and 6140 director class products, Eclipse 2640 SAN router, and Sphereon 3232, 4500 and 4300 fabric switches under the IBM Total Storage brand.

• IBM also has an OEM agreement with CNT and sells both the FC/9000 and UMD under the IBM Total Storage brand. IBM resells and co-sells other CNT products.

• Sometime after the acquisition closes, we will announce all products IBM plans to resell.

17. The combined company will have reduced net cash – how do you plan to improve the cash position?

• At the expected June 1 close:

• The combined company’s cash position will be approximately $370 million.

• Net of debt, the combined company’s cash position will be approximately $30 million, including the estimated $40 million in one-time cash charges associated with the transaction.

• CNT convertible debt at closing: $124.4 million – matures February 2007; converts to CMNT stock at $19.17.

• Post close, CNT’s convertible debt will be convertible into McDATA Class A shares at a conversion price of $14.75 per share. This is because each share of CNT stock converts to 1.3 shares of McDATA Class A stock.

• McDATA convertible debt at closing: $172.5 million – matures February 2010; converts to McDATA Class A common stock $10.71.

• Total debt at closing: $296.9 million.

• Total outstanding interest rate swap positions: $230.25 million.

• We expect to our cash position to be largely improved by the company’s ability to generate free cash flow. We expect to generate free cash flow of approximately $60 - $70 million between the targeted close date of June 1, 2005, and the end of our fiscal year 2006, ending January 31, 2007. This estimate of free cash flow is net of capital expenditures.

• We are making every effort to minimize the one-time cash costs associated with closing the transaction.

• We are always evaluating opportunities to purchase back debt at a discount, thereby improving our net cash position.

• Other opportunities to improve the cash position on the balance sheet, should we choose to pursue them, may include:

• Entering into a sale leaseback on our R&D facility which would raise $25M - $35M in net new cash.

• Refinance the CNT debt prior to maturity. Should we pursue this route, we would likely look to the equity-linked markets, but would likely wait until some recovery in stock price.

• Interest rate swaps will likely stay in place post-close. The likely rise in interest expense over the time should be more than offset by rising interest income on our cash position and on the free cash flow we will generate.

62

18. What do you plan to do with CNT’s convertible debt?

• We may look at opportunities to purchase back debt opportunistically at a discount, thereby improving our net cash position.

• We may raise additional capital to refinance the CNT debt prior to maturity. We will likely look to the equity-linked markets, but will probably wait until some recovery in stock price.

19. Do you believe you will be Sarbanes Oxley 404 compliant by the end of the combined companies FY05, ending January 31, 2006?

• We are very focused on the combined company receiving a clean opinion next year.

• Earning a clean opinion is a key goal of the integration team throughout their planning process.

Product and Services Roadmap

1. What Director platform does the combined entity plan to continue to sell and develop?

• The Intrepid 10000 and UMD are industry leading products and the best in the market.

• The Intrepid director platform will continue to be sold, including current products, the Intrepid 10000 and 6140.

• The UMD is a very innovative product, and the team that engineered the product did an outstanding job. We expect the Intrepid platform to become more dynamic in future generations as the combined company’s engineering team will include engineers from McDATA, Sanera, and CNT.

• We believe our engineers’ expertise in FICON will be of particular benefit as we work to solidify our market leading position in the high-end mainframe environments.

2. Why did you decide to continue with the Intrepid 10000 versus the UMD?

• McDATA’s market share position and installed base of loyal fibre channel switch and director customers is significantly larger than CNT’s.

• The Intrepid 10000 can be seamlessly and non-disruptively deployed into any McDATA storage network, and it can be managed with McDATA’s award-winning management software today. In addition, the Intrepid 10000 will seamlessly connect with the blade servers McDATA is bringing to market with QLogic, meeting customer requirements for cost-effective, core to “new edge” enterprise connectivity.

• While the UMD is an excellent technology product, it is not fully interoperable with McDATA’s large installed base.

• The Intrepid 10000 has also achieved a larger number of OEM qualifications than the UMD.

• There are also feature and functionality advantages associated with the Intrepid 10000, including enhanced fibre channel security and a robust product roadmap, including future support of EMC’s Fabric X/Storage Router.

3. What CNT products does the combined company intend to continue to sell and support?

• CNT products and services, including the UltraNet Edge, USD-X, URA, matrix switches and the complete services suite will continue to be available through the combined company and channel partners

• The UMD will be available approximately through the end of the calendar year, although development on this platform will be discontinued at the close of the acquisition; estimated transaction close date is June 1, 2005. Dependent on customer demand, existing upgrades to the UMD (port cards, optional software) may be available after the end of the calendar year.

63

• The FC/9000 will be available through approximately the end of the calendar year, although development on this platform will be discontinued at the close of the acquisition; estimated transaction close date is June 1, 2005. Dependent on customer demand, existing upgrades to the FC/9000 (port cards, optional software) may be available after the end of the calendar year.

• The CD/9000 will no longer be available at the close of the transaction; estimated transaction close date is June 1, 2005. Maintenance service and support will be provided on equipment under current maintenance contracts for a period of time, typically five (5) years from the end of life date.

4. What legacy McDATA products does the combined company intend to sell?

• All current McDATA products will continue to be sold by the combined company and channel partners, including OEMs, VARs, VADs, and SIs.

5. Will McDATA offer a migration program for FC/9000 and UMD customers to move to the Intrepid Director platform with the Intrepid 6140 and/or Intrepid 10000?

• The majority of FC/9000 installations are in FICON mainframe environments. McDATA will seek to upgrade these customers to the Intrepid 6140 or Intrepid 10000 over time, and we will target these customers as upgrade opportunities with our OEM and VAR/VAD partners.

• Approximately 2/3 of UMD deployments are in FICON mainframe environments, with approximately 1/3 deployed in open systems environments. McDATA is very focused on customer satisfaction, and we plan to manage this situation on a customer-by-customer basis.

a. In terms of FICON mainframe deployments, customers with UMDs deployed may prefer to maintain their current environment, and we will work with these customers and support their needs through additional port card sales to increase scalability and maintenance and support.

b. In terms of open systems deployments, we will work with these customers to migrate to the Intrepid platform so they may immediately benefit from the end-to-end product, software and services suite available from McDATA.

6. Will McDATA products interoperate with CNT products?

• McDATA is committed to developing and supporting application and solution level interoperability across the installed base of products and future products.

• Specifically, McDATA will support interoperability between CNT’s distance and extension products and McDATA switches and directors.

• We also intend to support FICON interoperability between McDATA and CNT products for mainframe environments.

7. Will McDATA provide network management interoperability via SANavigator and EFCM?

• Yes. In fact, McDATA software can already discover and manage the FC/9000.

• In addition, SANavigator software has always been a heterogeneous SAN management tool, and already manages CNT environments.

• Going forward, we intend to develop even more highly integrated levels of management with subsequent releases of our software.

8. Do you plan to continue to resell third-party products?

• Yes, the combined company will continue to resell third party products, including storage arrays and software.

64

9. What third-party products does the combined company intend to sell?

• Historically, CNT resold storage arrays from the major vendors, software solutions from IBM, VERITAS, and Legato, Adva WDM equipment, and McDATA and Brocade fabric switches.

• We anticipate the combined entity will continue to resell most of the above categories of products as it supports and complements our channel partners strategies and end-user customer needs.

10. What are you doing to protect the current FC/9000 and UMD installed base from competitive take-outs?

• Approximately 90% of FC/9000 installations are in FICON mainframe environments, and approximately 2/3 of UMD deployments are in FICON mainframe environments.

• McDATA and CNT are the trusted FICON vendors with the longest and most successful track record in the heart of the data center mainframe.

• These customers are extremely risk averse and highly unlikely to rip and replace a working, trusted FICON solution with an unknown and unproven competitive FICON solution.

• CNT’s customers have proven to be loyal to CNT over time, and we believe the competitive risk is mitigated due to this loyalty in both FICON and open systems deployments.

• We believe the competitive risk is further mitigated by today’s product roadmap announcements which should eliminate confusion regarding the combined company’s direction with the director platform.

• While McDATA and CNT are required to act as separate companies until the transaction is completed, CNT, as a reseller of McDATA products, may begin selling the Intrepid 10000, Intrepid 6140, and all McDATA products immediately.

• We are currently developing targeted marketing plans to protect the installed base, and these will go into effect when the transaction is completed; estimated date June 1, 2005.

• �� It is important to emphasize that combined McDATA and CNT do more than sell fibre channel products. We believe McDATA and CNT combined will offer unmatched technology leadership and expertise across SAN, MAN and WAN environments to address OEM and customer needs as they architect a converged data and storage network infrastructure and evolve to the Global Enterprise Data Infrastructure (GEDI).

11. What programs do you intend to put in place for legacy CNT customers to encourage them to remain customers of McDATA?

• We strongly believe that the value proposition of the combined CNT/McDATA is readily recognized by our customers and partners.

• The combined entity will be the leader in FICON and distance extension solutions, and the company will offer complete storage infrastructure solutions form the highest performance core backbone director, to low-cost 4 Gbps fabric switches and the “new edge” in embedded blade servers; unprecedented scalability and interoperability for intelligent data movement and replication across multi-vendor storage and SAN fabrics; and secure and simplified management of local and remote storage networks ensuring maximum network availability.

• Together, McDATA and CNT should offer unmatched technology leadership and expertise across SAN, MAN and WAN environments, and we believe the combined company is uniquely positioned to work with partners and customers to enable the evolution to the Global Enterprise Data Infrastructure (GEDI)