UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| þ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under § 240.14a-12 |

|

| US AIRWAYS GROUP, INC. |

| (Name of Registrant as Specified in its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| þ | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

April 27, 2012

To Our Stockholders:

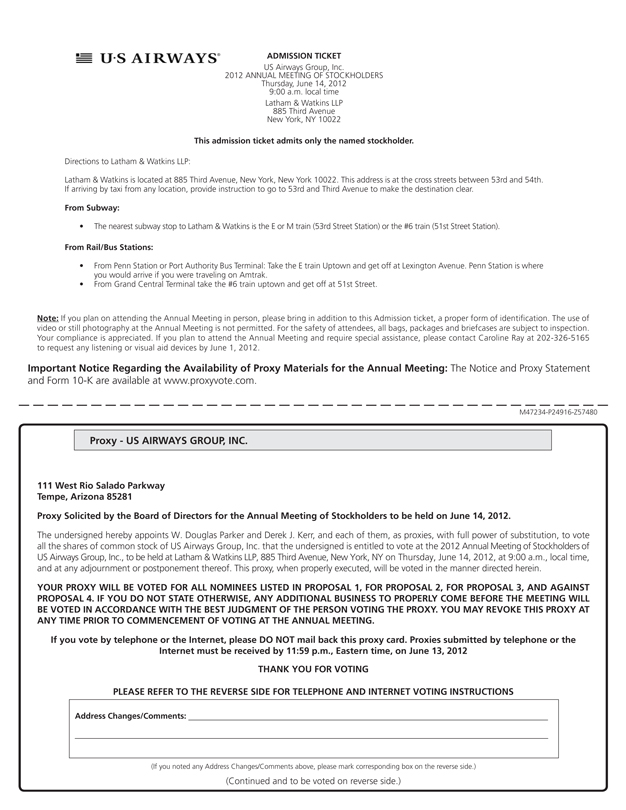

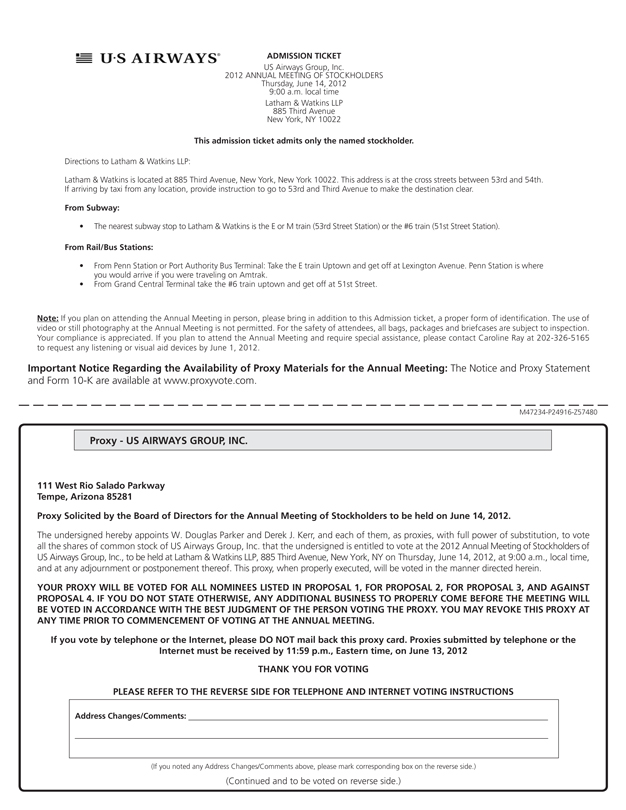

On behalf of the Board of Directors, we invite you to attend the Annual Meeting of Stockholders of US Airways Group, Inc. to be held at the offices of Latham & Watkins LLP, located at 885 Third Avenue, New York, New York 10022, on Thursday, June 14, 2012 at 9:00 a.m., local time.

The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted and procedures for voting at the meeting.

It is important that your shares be represented at the Annual Meeting. Whether or not you plan to attend, we request that you complete, date, sign and return the enclosed proxy card (if you received our proxy materials by mail), or vote by telephone or over the Internet as directed on the instructions provided. Of course, returning your proxy does not prevent you from attending the Annual Meeting and voting your shares in person. If you choose to attend the Annual Meeting in person, you may revoke your proxy and cast your votes at the meeting.

If you plan to attend the Annual Meeting, are a stockholder of record and received our proxy materials by mail, please mark your proxy card in the space provided for that purpose. An admission ticket is included with the proxy card for each stockholder of record. If your shares are not registered in your own name but rather held in street name and you would like to attend the Annual Meeting, please ask the broker, trust, bank or other nominee that holds the shares to provide you with evidence of your share ownership. Please be sure to bring the admission ticket or evidence of your share ownership to the meeting.

All stockholders now have the option to register for and receive copies of our proxy statements, annual reports and other stockholder materials electronically. All stockholders (record and street name) can save us (and the environment) the cost of printing and mailing these documents by visiting our website atwww.usairways.comunder “Company info” — “About US” — “Investor relations” — “Shareholder information” and following the instructions on how to request electronic delivery of stockholder materials.

|

| Sincerely, |

|

|

| W. Douglas Parker |

| Chairman of the Board and |

| Chief Executive Officer |

US AIRWAYS GROUP, INC.

111 WEST RIO SALADO PARKWAY

TEMPE, ARIZONA 85281

NOTICE OF 2012 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, JUNE 14, 2012

April 27, 2012

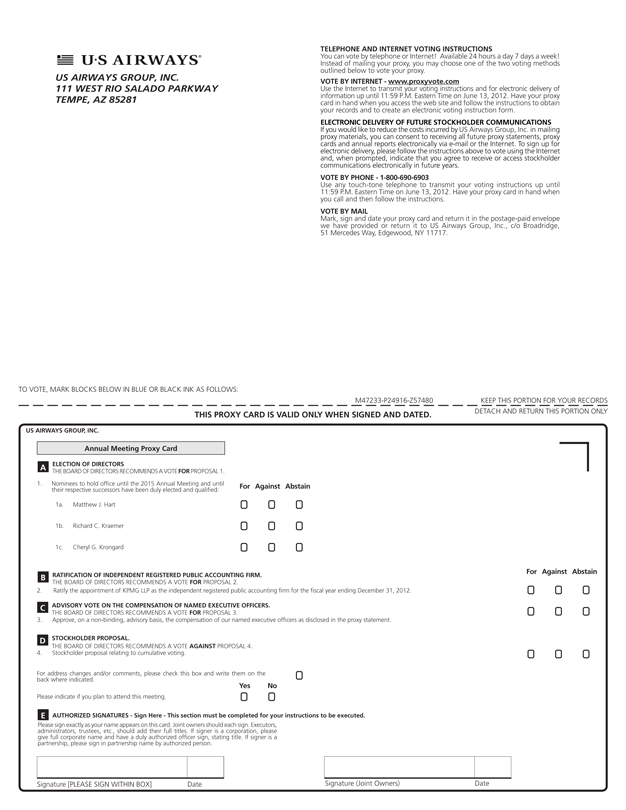

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of US Airways Group, Inc., a Delaware corporation, will be held at the offices of Latham & Watkins LLP, located at 885 Third Avenue, New York, New York 10022, on Thursday, June 14, 2012 at 9:00 a.m., local time, for the purposes of considering and acting upon:

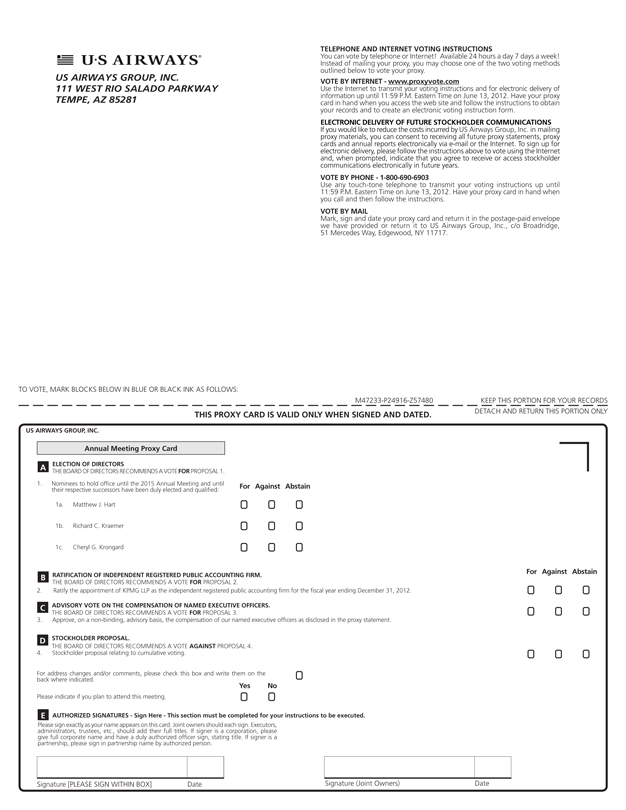

1. a proposal to elect three directors in Class I to serve until the 2015 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified;

2. a proposal to ratify the appointment of KPMG LLP as the independent registered public accounting firm of US Airways Group, Inc. for the fiscal year ending December 31, 2012;

3. a proposal to consider and approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in the attached Proxy Statement;

4. a proposal to consider and vote upon a stockholder proposal relating to cumulative voting; and

5. such other business as properly may come before the Annual Meeting or any adjournments thereof. The Board of Directors is not aware of any other business to be presented to a vote of the stockholders at the Annual Meeting.

Information relating to the above matters is set forth in the attached Proxy Statement. You must have been a stockholder of record at the close of business on April 16, 2012 to vote at the Annual Meeting. If you do not expect to attend the meeting in person, you are requested to vote: (1) by telephone as directed on the instructions provided; (2) over the Internet as directed on the instructions provided; or (3) if you received our proxy materials by mail, by completing, signing and dating the enclosed proxy card and returning it without delay in the enclosed envelope, which requires no postage stamp if mailed in the United States. Voting by phone, Internet or mail will not prevent you from later revoking that proxy and voting in person at the Annual Meeting. If you want to vote at the Annual Meeting, but your shares are held in street name by a broker, trust, bank or other nominee, you will need to obtain proof of ownership as of April 16, 2012 and a proxy to vote the shares from such broker, trust, bank or other nominee.

|

| By Order of the Board of Directors, |

|

|

| Caroline B. Ray |

| Corporate Secretary |

Tempe, Arizona

April 27, 2012

PLEASE READ THE ATTACHED PROXY STATEMENT AND THEN PROMPTLY INDICATE YOUR VOTING INSTRUCTIONS: (1) BY TELEPHONE BY CALLING 1-800-690-6903; (2) OVER THE INTERNET AT WWW.PROXYVOTE.COM; OR (3) IF YOU RECEIVED OUR PROXY MATERIALS BY MAIL, BY COMPLETING, SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT WITHOUT DELAY IN THE ENCLOSED ENVELOPE.

TABLE OF CONTENTS

US AIRWAYS GROUP, INC.

111 West Rio Salado Parkway

Tempe, Arizona 85281

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 14, 2012

THE MEETING

| | |

| Purpose, Place, Date and Time | | We are furnishing this Proxy Statement to the stockholders of US Airways Group, Inc. in connection with the solicitation by our Board of Directors of proxies to be voted at the 2012 Annual Meeting of Stockholders and any adjournments of that meeting. The Annual Meeting will be held at the offices of Latham & Watkins LLP, located at 885 Third Avenue, New York, New York 10022, on Thursday, June 14, 2012 at 9:00 a.m., local time, for the purposes set forth in the accompanying Notice of 2012 Annual Meeting of Stockholders. When used in this Proxy Statement, the terms “we,” “us,” “our,” and “the Company” refer to US Airways Group, Inc. and its consolidated subsidiaries, while “US Airways Group” refers to US Airways Group, Inc. and “US Airways” refers to our wholly owned subsidiary, US Airways, Inc. |

| |

| | The approximate date on which we are first sending the Notice of the 2012 Annual Meeting of Stockholders, this Proxy Statement and the accompanying proxy card to stockholders, or sending a Notice Regarding the Availability of Proxy Materials and posting the proxy materials atwww.proxyvote.com, is April 27, 2012. |

| |

| Record Date; Stockholders Entitled to Vote | | Stockholders of record at the close of business on April 16, 2012, the “record date,” are entitled to receive notice of and to vote at the Annual Meeting and at any adjournments thereof. On the record date, there were 162,141,321 shares of our common stock, $0.01 par value per share, outstanding and eligible to be voted at the Annual Meeting. Each share of our common stock entitles its owner to one vote on each matter submitted to the stockholders. |

| |

| Quorum | | The presence, in person or by proxy, of a majority of the outstanding shares of our common stock is necessary to constitute a quorum at the Annual Meeting. |

| |

| | Under the rules of the New York Stock Exchange, or NYSE, member firms that hold shares in street name for beneficial owners may, to the extent that those beneficial owners do not furnish voting instructions with respect to any or all proposals submitted for stockholder action, vote in their discretion upon proposals that are considered routine proposals under the NYSE rules. We believe that Proposal 2 is routine, and Proposals 1, 3 and 4 are non-discretionary. Member brokerage firms that do not receive instructions from their clients as to “non-discretionary” proposals cannot vote on the non-discretionary proposals. If the brokerage firm returns a proxy card without voting on a non-discretionary proposal because it received no instructions, this is referred to as a “broker non-vote” on the proposal. “Broker non-votes” are considered in determining whether a quorum exists at the Annual Meeting. |

| |

| Vote Required for Proposal 1: Election of Directors | | Our bylaws provide for a majority voting standard for the election of directors in uncontested elections, which are generally defined as elections in which the number of nominees does not exceed the number of directors to be elected at the meeting. Under the majority voting standard, in uncontested elections of directors, such as this election, each director must be elected by the affirmative vote of a majority of the votes cast with respect to such director by the shares present in person or represented by proxy and entitled to vote therefor. A majority of the

|

| | |

| | votes cast means that the number of votes cast “for” a nominee exceeds the number of votes cast “against” that nominee. Brokers do not have discretionary authority to vote on this proposal. Abstentions and broker non-votes are not considered votes cast “for” or “against” a nominee’s election and therefore will have no effect in determining whether a nominee has received a majority of the votes cast. In this election, an incumbent director nominee who does not receive the required number of votes for re-election is expected to tender his resignation to the Board of Directors in accordance with the policy adopted by the Board of Directors. The Corporate Governance and Nominating Committee of the Board of Directors (or other committee as directed by the Board) will then make a determination as to whether to accept or reject the tendered resignation, generally within 90 days after certification of the election results of the stockholder vote. Following such determination, we will publicly disclose the decision regarding any tendered resignation in a Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”). |

| |

| | In the vote to elect three directors in Class I to serve until the 2015 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified, stockholders may, with respect to each nominee: |

| |

| | • vote for the election of the nominee; |

| |

| | • vote against the election of the nominee; or |

| |

| | • abstain from voting on the election. |

| |

| | THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES. |

| |

| Vote Required for Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | | The proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm will require the affirmative vote of the holders of a majority of the shares represented, in person or by proxy, and entitled to vote at the Annual Meeting, provided a quorum is present. Abstentions are considered in determining the number of votes required to obtain the necessary majority vote for the proposal and, therefore, will have the same legal effect as voting against the proposal. Brokers have discretionary authority to vote on this proposal. Broker non-votes will have no effect on the outcome of this proposal. |

| |

| | In the vote to ratify the appointment of KPMG LLP as our independent registered public accounting firm, stockholders may: |

| |

| | • vote for the ratification; |

| |

| | • vote against the ratification; or |

| |

| | • abstain from voting on the ratification. |

| |

| | THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. |

| |

| Vote Required for Proposal 3: Advisory Vote to Approve the Compensation of Named Executive Officers | | The proposal to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC will require an affirmative vote from the holders of a majority of the shares represented, in person or by proxy, and entitled to vote at the Annual Meeting, provided a quorum is present. Abstentions are considered in determining the number of votes required to obtain the necessary majority vote for the proposal and, therefore, will have the same legal effect as voting against the proposal. Brokers do not have discretionary authority to vote on this proposal. Broker non-votes will have no effect on the outcome of this proposal. Because your vote is advisory, it will not be binding on the Board of Directors or

|

2

| | | | |

| | the Company. However, the Board of Directors will review the voting results and take them into consideration when making future decisions about executive compensation. |

| |

| | In the vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement, stockholders may: |

| | |

| | Ÿ | | vote for the proposal; |

| | |

| | Ÿ | | vote against the proposal; or |

| | |

| | Ÿ | | abstain from voting on the proposal. |

| |

| | THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS. |

| |

| Vote Required for Proposal 4: Stockholder Proposal Relating to Cumulative Voting | | The stockholder proposal scheduled to be presented at the Annual Meeting related to cumulative voting will require approval of the affirmative vote of the holders of a majority of the shares represented, in person or by proxy, and entitled to vote at the Annual Meeting, provided a quorum is present. Abstentions are considered in determining the number of votes required to obtain the necessary majority vote for the proposal and, therefore, will have the same legal effect as voting against the proposal. Brokers do not have discretionary authority to vote on this proposal. Broker non-votes will have no effect on the outcome of this proposal. |

| |

| | In the vote to approve this stockholder proposal, stockholders may: |

| | |

| | Ÿ | | vote for the proposal; |

| | |

| | Ÿ | | vote against the proposal; or |

| | |

| | Ÿ | | abstain from voting on the proposal. |

| |

| | THE BOARD OF DIRECTORS RECOMMENDS A VOTE “AGAINST” THE STOCKHOLDER PROPOSAL RELATED TO CUMULATIVE VOTING. |

| |

| Voting of Proxies | | You should specify your choices with regard to each of the proposals: |

| | |

| | Ÿ | | by telephone as directed on the instructions provided; |

| | |

| | Ÿ | | over the Internet as directed on the instructions provided; or |

| | |

| | Ÿ | | if you received our proxy materials by mail, on the enclosed proxy card by signing, dating and returning it in the accompanying postage-paid envelope. |

| |

| | Instructions for voting by telephone or over the Internet are set forth in the Notice of the 2012 Annual Meeting of Stockholders. If your shares are held in street name, the voting instruction form sent to you by your broker, trust, bank or other nominee should indicate whether the institution has a process for you to provide voting instructions by telephone or over the Internet. |

| |

| | All properly executed proxies received by us in time to be voted at the Annual Meeting and not revoked will be voted at the Annual Meeting in accordance with the directions noted therein. In the absence of such instructions, the shares represented by a signed and dated proxy card will be voted “FOR” the election of all director nominees, “FOR” the ratification of the appointment of the independent registered public accounting firm, “FOR” the approval, on a non-binding, advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement and “AGAINST” the stockholder proposal relating to cumulative voting. |

3

| | | | |

| | If any other matters properly come before the Annual Meeting, the persons named as proxies will vote upon those matters according to their judgment. The Board of Directors knows of no other items of business that will be presented for consideration at the Annual Meeting other than those described in this Proxy Statement. In addition, except for Proposal 4, no stockholder proposals or nominations were received on a timely basis, pursuant to the Company’s Amended and Restated Bylaws, that were not subsequently withdrawn. Accordingly, no such matters may be brought to a vote at the Annual Meeting. |

| |

| Revocation of Proxies | | Any stockholder delivering a proxy has the power to revoke it at any time before it is voted by: |

| | |

| | Ÿ | | giving notice of revocation to Caroline B. Ray, our Corporate Secretary, at US Airways Group, Inc., 111 West Rio Salado Parkway, Tempe, Arizona 85281 (by mail or overnight delivery); |

| | |

| | Ÿ | | executing and delivering to our Corporate Secretary a proxy card relating to the same shares bearing a later date; |

| | |

| | Ÿ | | voting again prior to the time at which the Internet and telephone voting facilities close by following the procedures applicable to those methods of voting; or |

| | |

| | Ÿ | | voting in person at the Annual Meeting. |

| |

| | Please note, however, that under the NYSE rules, any beneficial owner of our common stock whose shares are held in street name by a member brokerage firm may only revoke his or her proxy and vote his or her shares in person at the Annual Meeting in accordance with applicable NYSE rules and procedures, as employed by the beneficial owner’s brokerage firm. If you want to vote at the Annual Meeting, but your shares are held in street name by a broker, trust, bank or other nominee, you will need to obtain proof of ownership as of April 16, 2012 and a proxy to vote the shares from such broker, trust, bank or other nominee. |

| |

| Solicitation of Proxies | | In addition to soliciting proxies through the mail, we may solicit proxies through our directors, officers and employees in person and by email, telephone or facsimile. We may also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares held of record by them. We will pay all expenses incurred in connection with the solicitation of proxies. In addition, we have retained MacKenzie Partners to assist in the solicitation for an estimated fee of $25,000, plus expenses. |

| |

| Inspector of Election | | All votes at the Annual Meeting will be counted by Broadridge Investor Communication Solutions, Inc., our inspector of election. The inspector of election will separately tabulate affirmative and negative votes, abstentions and broker non-votes. |

| |

| Electronic Delivery of Proxy Materials | | All stockholders now have the option to register for and receive copies of our proxy statements, annual reports and other stockholder materials electronically. All stockholders (record and street name) can save us (and the environment) the cost of printing and mailing these documents by visiting our website atwww.usairways.comunder “Company info” — “About US” — “Investor relations” — “Shareholder information” and following the instructions on how to sign up for electronic delivery of stockholder materials. |

| |

| | This year, we intend both to mail our proxy materials to certain stockholders and to use the “Notice and Access” method of providing proxy materials and our Annual Report on Form 10-K for the year ended December 31, 2011 to certain stockholders. Under the Notice and Access method, if you have not opted to receive an email notification, you will receive by mail a simple “Notice Regarding the Availability of Proxy Materials” which will direct you to a website where you may access proxy |

4

| | |

| | materials online. You will also be told how to request proxy materials (at no charge) via mail or email, as you prefer. In order to eliminate the mailing of a paper notice and to speed your ability to access the proxy materials and our Annual Report on Form 10-K for the year ended December 31, 2011, we encourage you to sign up for electronic delivery of the Notice using the instructions described above. |

| |

| Householding of Proxy Materials | | The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports, or Notices Regarding the Availability of Proxy Materials, with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report, or Notice Regarding the Availability of Proxy Materials, addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies. In accordance with these rules, only one proxy statement and annual report, or Notice Regarding the Availability of Proxy Materials, will be delivered to multiple stockholders sharing an address unless we have received contrary instructions from one or more of the stockholders. |

| |

| | If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, or Notice Regarding the Availability of Proxy Materials, please notify your broker, direct your written request to Caroline B. Ray, Corporate Secretary, US Airways Group, Inc., 111 West Rio Salado Parkway, Tempe, Arizona 85281, or contact Caroline B. Ray at (480) 693-0800. Stockholders who currently receive multiple copies of the proxy statement and annual report, or Notice Regarding the Availability of Proxy Materials, at their address and would like to request “householding” of their communications should contact their broker. |

5

PROPOSAL 1 — ELECTION OF DIRECTORS

| | |

Election of Directors | | The Board of Directors currently consists of nine members and one vacancy. All directors are also directors of our principal operating subsidiary, US Airways. Herbert M. Baum, a director since 2005, has determined to retire as a director of the Company effective as of the date of the Annual Meeting and therefore he is not a nominee for election at the Annual Meeting. |

| |

| | Upon the recommendation of the Corporate Governance and Nominating Committee, our Board of Directors has nominated Matthew J. Hart, Richard C. Kraemer and Cheryl G. Krongard to serve as directors in Class I. Each of the nominees is currently a director of US Airways Group. |

| |

| | If re-elected as a director at the Annual Meeting, each of the nominees would serve a three-year term expiring at the 2015 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified. If each of these nominees is elected, the Board will consist of eight directors divided into three classes as follows: three directors in Class I (terms expiring in 2015), two directors in Class II (terms expiring in 2013) and three directors in Class III (terms expiring in 2014), and there will be one vacancy in each of Class I and Class II. Stockholders may only vote their shares to elect three persons as directors in Class I at the 2012 Annual Meeting of Stockholders. |

| |

| | Each of the nominees has consented to serve another term as a director, if re-elected. If any of the nominees should be unavailable to serve for any reason (which is not anticipated), the Board of Directors may designate a substitute nominee or nominees (in which event the persons named on the proxy card will vote the shares represented by all valid proxies for the election of the substitute nominee or nominees), or allow the vacancies to remain open until a suitable candidate or candidates are located. |

| |

| | The Board of Directors unanimously recommends that the stockholders vote “FOR” the proposal to re-elect Matthew J. Hart, Richard C. Kraemer and Cheryl G. Krongard to serve as directors in Class I for a three-year term expiring at the 2015 Annual Meeting of Stockholders and until their successors have been duly elected and qualified. |

| |

| Directors and Director Nominees | | Set forth below is certain information as of April 27, 2012 regarding our director nominees and continuing directors, including their ages, qualifications and principal occupations (which have continued for at least the past five years unless otherwise noted). There are no family relationships among the directors and executive officers. |

6

| | |

Director Nominees | | Principal Occupation, Business Experience, Other Directorships Held and Age |

| |

| | The three director nominees are listed below. |

| |

Matthew J. Hart (Class I) (Audit, Compensation and Human Resources, and Finance Committees) | | Mr. Hart was President and Chief Operating Officer of Hilton Hotels Corporation, a hotel developer and operator, from 2004 until the acquisition of Hilton by the Blackstone Group in 2007. He served as Executive Vice President and Chief Financial Officer of Hilton from 1996 to 2004. Before joining Hilton in 1996, Mr. Hart was Senior Vice President and Treasurer of The Walt Disney Company from 1995 to 1996, and was Executive Vice President and Chief Financial Officer for Host Marriott Corp. from 1993 to 1995. He serves on the Boards of Directors of Great American Group, Inc. and Air Lease Corporation and is a member of the Board of Directors of Heal the Bay, a non-profit organization. Mr. Hart previously served on the Board of Directors of Kilroy Realty Corporation from 1997 to 2008. Mr. Hart served on the Boards of Directors of America West Holdings Corporation (“America West”) and America West Airlines, Inc. (“AWA”) from 2004 to 2005, and was elected to the Boards of US Airways Group and US Airways in 2006. Age 60. |

| |

| |

| | The Board believes that Mr. Hart is qualified and has nominated him to serve as a director because of his financial expertise, his risk management experience, his extensive experience as a senior operating and finance executive in developing strategies for large public companies, in particular, companies in the travel industry, his mergers and acquisitions experience, his service as a public company director and his airline experience gained as a director of Air Lease, America West and the Company. |

| |

Richard C. Kraemer (Class I) (Audit, Compensation and Human Resources, and Corporate Governance and Nominating Committees) | | Mr. Kraemer is President of Chartwell Capital, Inc., a private investment company. Mr. Kraemer served as a director of America West and AWA from 1992 to 2007. He became a member of the Boards of US Airways Group and US Airways in 2005. Age 68. Mr. Kraemer, in his capacity as Chairman of the Corporate Governance and Nominating Committee, has responsibility for a number of leadership duties customarily held by a lead independent director, including: coordinating agendas for and presiding over regular meetings of the non-management directors of the Board; communicating with Mr. Parker following those executive sessions and facilitating other communications between the Board and Mr. Parker; coordinating the annual evaluation of the Board and its Committees and communicating the results of those evaluations; coordinating recommendations by the Corporate Governance and Nominating Committee for the assignment of directors to the Board’s Committees; discussing the nomination of each continuing director in advance of the end of that director’s term; and leading the effort to recruit new directors. The Board believes that Mr. Kraemer is qualified and has nominated him to serve as a director because of his financial expertise, his corporate governance, human resources and labor relations expertise, his experience in developing strategy for, and managing, a large public company such as America West, his success as an investor, and his airline experience gained as a director of America West and the Company. |

| |

Cheryl G. Krongard (Class I) (Compensation and Human Resources and Finance Committees) | | Ms. Krongard retired in 2004 as a Senior Partner of Apollo Management, L.P. Ms. Krongard was the Chief Executive Officer of Rothschild Asset Management Inc. from 1994 to 2000. She served as Senior Managing Director for Rothschild North America Inc. from 1994 to 2000. Additionally, she served as a director of Rothschild North America, Rothschild Asset Management, Rothschild Asset Management BV and Rothschild Realty Inc. and as Managing Member of

|

7

| | |

Director Nominees | | Principal Occupation, Business Experience, Other Directorships Held and Age |

| |

| | Rothschild Recovery Fund L.P. She was elected a lifetime governor of the Iowa State University Foundation in 1997 and has served as Chairperson of its Investment Committee. Ms. Krongard is also a member of the Dean’s Advisory Council, Iowa State University College of Business. Ms. Krongard also serves as a director of Legg Mason, Inc. and served as a director of Educate, Inc. (formerly Sylvan Learning) from June 2004 until June 2007. Ms. Krongard has served as a director of US Airways Group and US Airways since 2003. Age 56. |

| |

| | The Board believes that Ms. Krongard is qualified and has nominated her to serve as a director because of her financial and financial services sector expertise, her experience as a senior executive working at large, complex organizations, her service as a public company director, her success as an investor, and her airline experience gained as a director of the Company. |

8

| | |

Continuing Directors | | Principal Occupation, Business Experience, Other Directorships Held and Age |

| |

| | The five directors whose terms will continue after the Annual Meeting and will expire at the 2013 Annual Meeting (Class II) or the 2014 Annual Meeting (Class III) are listed below. |

| |

Denise M. O’Leary (Class II) (Audit and Compensation and Human Resources Committees) | | Ms. O’Leary has been a private investor in early stage companies since 1996. From 1983 until 1996, she was employed at Menlo Ventures, a venture capital firm, first as an Associate and then as a General Partner. She serves as a director of Medtronic, Inc. and Calpine Corporation. Additionally, she is the Chairwoman of the Board of Directors of the Corporation for Supportive Housing and a member of the Board of Trustees of the Bonfils-Stanton Foundation. Ms. O’Leary served as a director of America West and AWA from 1998 to 2007 and became a member of the Boards of US Airways Group and US Airways in 2005. Age 54. |

| |

| | The Board believes that Ms. O’Leary’s financial expertise, her experience in the oversight of risk management, her human resources expertise, her extensive service as a public company director, her success as an investor, and her airline industry expertise gained as a director of America West and the Company make her qualified to serve as a director. |

| |

George M. Philip (Class II) (Audit and Corporate Governance and Nominating Committees) | | Mr. Philip is the President of the University at Albany, State University of New York. From 1971 to 2007 he served in various positions with the New York State Teachers’ Retirement System and retired after 13 years as Executive Director. He also serves as a member of the Board of Directors of First Niagara Financial Group, Inc; Vice Chair of the St. Peter’s Hospital Board of Directors; and Chair of the Catholic Health East Investment Committee. Mr. Philip is a member of the Kentucky Teachers’ Retirement System investment advisory committee, Vice Chair of Fuller Road Management Corporation, a not-for-profit company, and a director of The Research Foundation at SUNY. In past years, Mr. Philip was President of the Executive Committee of the National Council on Teacher Retirement; Chair of the Council of Institutional Investors; Chair of the University at Albany Council, SUNY; a member of the Board of Saratoga Performing Arts Center; and a member of the NYSE Pension Managers Advisory Committee and the State Academy of Public Administration. Mr. Philip has served as a director of US Airways Group and US Airways since 2004. Age 64. |

| |

| | The Board believes that Mr. Philip’s financial expertise, his corporate governance expertise, his experience in working in and managing large, complex organizations, his experience in the oversight of risk management, his success as an investor, and his airline industry experience gained as a director of the Company make him qualified to serve as a director. |

| |

W. Douglas Parker(Class III) (Labor Committee) | | Mr. Parker has served as Chairman of the Board and Chief Executive Officer of US Airways Group and US Airways since 2005. Mr. Parker also served as President of US Airways Group and US Airways from 2005 to 2006. Mr. Parker served as Chairman of the Board and Chief Executive Officer of America West and AWA from 2001 to 2007, and served as a director of America West and AWA from 1999 to 2007. Mr. Parker joined AWA as Senior Vice President and Chief Financial Officer in 1995. He was elected President of AWA in 2000 and Chief Operating Officer of AWA in 2000. Mr. Parker served on the Board of Directors of Pinnacle West Capital Corporation from 2007 until February 2012. Age 50. |

| |

| | The Board believes that Mr. Parker’s financial and airline marketing expertise, his human resources and labor relations expertise, his nearly quarter century of experience in the airline industry, his 16 years’ experience as a senior airline executive charged with developing and executing America West’s and the |

9

| | |

Continuing Directors | | Principal Occupation, Business Experience, Other Directorships Held and Age |

| |

| | Company’s strategies, his more than ten years of experience as the Chairman and Chief Executive Officer of the Company, his mergers and acquisitions experience, and his service as a public company director make him qualified to serve as a director. |

| |

Bruce R. Lakefield(Class III) (Finance and Labor Committees) | | Mr. Lakefield served as President and Chief Executive Officer of US Airways Group and US Airways from 2004 to 2005. US Airways Group and US Airways filed for bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code in September 2004 which case culminated in the merger of US Airways Group and America West in 2005. After this, Mr. Lakefield served as Vice Chairman of the Board of US Airways Group and US Airways. Mr. Lakefield served as Chairman and Chief Executive Officer of Lehman Brothers International from 1995 until 1999. He has served as a Senior Advisor to the Investment Policy Committee of HGK Asset Management, Inc. from 2000 to 2004. Mr. Lakefield has served as a director of US Airways Group and US Airways since 2003. Age 68. |

| |

| | The Board believes that Mr. Lakefield’s financial and financial services sector expertise, his experience as a senior executive working at large, complex organizations, his service as a public company director, his success as an investor, and his airline experience gained as the President and Chief Executive Officer, Vice Chairman and a director of the Company make him qualified to serve as a director. |

| |

William J. Post (Class III) (Compensation and Human Resources and Labor Committee) | | Mr. Post served as Chairman of the Board of Pinnacle West Capital Corporation, an energy holding company, from 2001, and Chief Executive Officer from 1999, until he retired in April 2009. Mr. Post served as a director of Pinnacle West from 1997 and Arizona Public Service Company, its major subsidiary and an electric utility, from 1994 until May 2010. Mr. Post previously served in other management capacities at Pinnacle West, including as President from 1997 until 2008, as Chief Executive Officer of Arizona Public Service Company from 1998 until 2002 and as its Chairman from 2001 until April 2009. Currently, Mr. Post serves as Chairman of Swift Transportation Company, a position he has held since January 2011, and as a director of First Solar, Inc. since June 2010. He previously served as member of the Board of Directors of Phelps Dodge Corporation (now Freeport McMoRan) from 2001 until November 2007. He also holds various positions at certain charitable and educational entities, including as Chairman of the Arizona State University Board of Trustees, its Foundation and as Chairman of the Translational Genomics Research Institute. Mr. Post has served as a director of US Airways Group and US Airways since September 2011. Age 61. |

| |

| | The Board believes that Mr. Post’s extensive experience operating in a complex and highly regulated environment, as well as his broad business knowledge and strategic perspective, make him qualified to serve as a director. |

10

PROPOSAL 2 — RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| | |

Ratification of Independent Registered Public Accounting Firm | | The Audit Committee of our Board of Directors, in accordance with its charter and authority delegated to it by the Board of Directors, has appointed the firm of KPMG LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2012, and the Board of Directors has directed that such appointment be submitted to our stockholders for ratification at the Annual Meeting. KPMG LLP has served as our independent auditors for more than 16 years. Our Audit Committee considers KPMG LLP to be well qualified. If the stockholders do not ratify the appointment of KPMG LLP, the Audit Committee will reconsider the appointment. |

| |

| | A representative of KPMG LLP will be present at the Annual Meeting and will have an opportunity to make a statement if he or she desires to do so. The representative will also be available to respond to appropriate questions from stockholders. |

| |

| | The Audit Committee of the Board of Directors and the Board of Directors unanimously recommend that the stockholders vote “FOR” the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm. |

| |

| IndependentRegistered Public Accounting Firm Fees | | The following table presents fees for professional services rendered by KPMG LLP for the audits of the financial statements of US Airways Group and its subsidiaries as of and for the fiscal years ended December 31, 2011 and 2010, as well as fees for other services rendered by KPMG LLP during these periods. |

| | | | | | | | |

| | | Fiscal 2011 | | | Fiscal 2010 | |

Audit Fees | | $ | 2,169,700 | | | $ | 2,134,900 | |

Audit-Related Fees | | | 428,100 | | | | 400,000 | |

Tax Fees | | | 22,400 | | | | 11,300 | |

All Other Fees | | | — | | | | — | |

| | | | | | | | |

Total | | $ | 2,620,200 | | | $ | 2,546,200 | |

| | | | | | | | |

| | |

| | Audit Fees for fiscal years ended December 31, 2011 and 2010 were for professional services rendered for the audits of the annual financial statements included in our Annual Report on Form 10-K (including fees for the audits of internal control over financial reporting as required by Section 404 of the Sarbanes-Oxley Act of 2002), quarterly review of the financial statements included in our Quarterly Reports on Form 10-Q and services rendered in connection with SEC filings. |

| |

| | Audit-Related Feesfor the fiscal year ended December 31, 2011 and 2010 were for statutory audits, services rendered in connection with securities offerings and other SEC filings, significant auditing work on transactions and consultations concerning financial accounting and reporting standards. |

| |

| | Tax Feesas of the fiscal years ended December 31, 2011 and 2010 were for U.S. and international tax compliance. |

| |

| | There were no fees that fall into the classification ofAll Other Feesfor the fiscal years ended December 31, 2011 and 2010. |

| |

| Audit Committee Disclosure | | The Audit Committee has determined that the rendering of the permitted non-audit services during the 2011 fiscal year by KPMG LLP is compatible with maintaining the independent registered accounting firm’s independence. |

11

| | |

| Policy onAudit Committee Pre-Approval | | The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent registered public accounting firm. The Audit Committee has adopted policies and procedures for the pre-approval of audit and non-audit services rendered by our independent registered public accounting firm. The policy generally pre-approves certain specified services in the defined categories of audit services, audit-related services, tax services and permitted non-audit services up to specified amounts, and sets requirements for specific case-by-case pre-approval of discrete projects. Pre-approval may be given as part of the Audit Committee’s approval of the scope of the engagement of our independent registered public accounting firm or on an individual basis. The Chair of the Audit Committee has been delegated the authority by the Audit Committee to pre-approve the engagement of the independent auditors when the entire Audit Committee is unable to do so, but any pre-approval decisions must be presented to the full Audit Committee at its next scheduled meeting. The Audit Committee has delegated the Vice President and Controller to monitor the performance of all services provided by the independent auditor and to determine whether these services are in compliance with the pre-approval policy. The Vice President and Controller is required to report the results of his monitoring to the Audit Committee on a periodic basis. The policy prohibits retention of the independent registered public accounting firm to perform prohibited non-audit functions as defined in Section 201 of the Sarbanes-Oxley Act of 2002 or the rules of the SEC, and also considers whether the proposed services are compatible with the independence of the independent registered public accounting firm. All non-audit services provided by KPMG LLP during fiscal years 2011 and 2010 were pre-approved in accordance with the pre-approval policy described above. |

12

PROPOSAL 3 — ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

| | | | |

Advisory Vote to Approve Executive Compensation | | The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) enables our stockholders to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC. |

| |

| | The Compensation and Human Resources Committee and the Board of Directors believe that our compensation practices align our executive compensation structure with our stockholders’ interests and current market practices. Our compensation strategy is designed to provide a total compensation package that will not only attract and retain high-caliber executive officers and employees, but will also align employee contributions with our corporate objectives and stockholder interests. Our compensation programs are designed to be flexible and complementary and to collectively meet our compensation objectives. |

| |

| | Highlights of our program include: |

| | |

| | Ÿ | | a commitment to pay-for-performance with a substantial portion of each named executive officer’s compensation being “at-risk” and subject to important financial performance measures aligned with stockholder interests. We make a significant portion of our executives’ compensation variable and at risk and tied directly to our measurable performance. Consistent with this focus, the largest portion of our executives’ compensation is in the form of performance-based annual cash and long-term equity incentives; |

| | |

| | Ÿ | | a compensation package that focuses on both short and long-term goals, encouraging executives to focus on the success of the company both during the immediate fiscal year and for the future; |

| | |

| | Ÿ | | consistent with our focus on maintaining a cost advantage versus our principal competitors, compensation that is targeted below that of the other large network airlines. For instance, for 2011, total compensation for our CEO was the lowest of, and 37% below the average for, the other large network airlines (using 2010 compensation data reported in 2011 for American Airlines, Delta Air Lines and United Airlines); |

| | |

| | Ÿ | | an understanding that the Company’s total stockholder return, or “TSR,” is affected by the limited ability of the Company to pass on the cost of jet fuel, a commodity that increased our costs by over $1.3 billion (10% of our revenue, or margin points) in 2011 as compared to 2010; |

| | |

| | Ÿ | | a continued commitment to good compensation governance practices where compensation packages are consistent with market practice and are reasonable in light of our and each individual officer’s performance, as well as good disclosure practices; and |

| | |

| | Ÿ | | clawback provisions for all incentive compensation paid to our named executive officers and stock ownership guidelines that further align our named executive officers’ long-term interests with those of our stockholders. |

| |

| | Stockholders are urged to read the Compensation Discussion and Analysis section of this Proxy Statement for more information about our compensation practices which reflect our compensation philosophy. |

| |

| | We are asking our stockholders to indicate their support for our named executive officer compensation as described in this Proxy Statement pursuant to the compensation disclosure rules of the SEC. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers |

13

| | |

| | and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we are asking our stockholders to vote “FOR” the following resolution at the Annual Meeting: |

| |

| | “RESOLVED, that the Company’s stockholders approve, on a non-binding, advisory basis, the compensation of the named executive officers pursuant to the compensation disclosure rules of the SEC as described in the Compensation Discussion and Analysis, the compensation tables, narrative discussion and any related material disclosed in the Company’s Proxy Statement for the 2012 Annual Meeting of Stockholders.” |

| |

| | The say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation and Human Resources Committee or our Board of Directors. Our Board of Directors and our Compensation and Human Resources Committee value the opinions of our stockholders and will consider the outcome of this advisory vote when making future decisions about the Company’s executive compensation. |

| |

| | The Board of Directors has adopted a policy providing for an annual say-on-pay advisory vote. Unless the Board of Directors modifies its policy on the frequency of future say-on-pay advisory votes, the next say-on-pay advisory vote will be held at the 2013 annual meeting of stockholders. |

| |

| | The Board of Directors unanimously recommends that the stockholders vote “FOR” the approval of the compensation of our named executive officers. |

14

PROPOSAL 4 — STOCKHOLDER PROPOSAL RELATING TO CUMULATIVE VOTING

| | |

| |

Stockholder Proposal Relating to Cumulative Voting | | Mrs. Evelyn Y. Davis, Watergate Office Building, 2600 Virginia, N.W., Suite 215, Washington, D.C. 20037, who is the beneficial owner of 2,200 shares of our common stock upon submission of this proposal, has advised us of her intention to introduce the following resolution at the Annual Meeting. To be adopted, this resolution, which is opposed by the Board of Directors, would require the affirmative vote of the holders of at least a majority of the shares of common stock, present in person or represented by proxy at the Annual Meeting and entitled to vote. |

| |

| | RESOLVED: “That the stockholders of U.S. Airways, assembled in Annual Meeting in person and by proxy, hereby request the Board of Directors to take the necessary steps to provide for cumulative voting in the election of directors, which means each stockholder shall be entitled to as many votes as shall equal the number of shares he or she owns multiplied by the number of directors to be elected, and he or she may cast all of such votes for a single candidate, or two or more of them as he or she see fit.” |

| |

| | REASONS: “Many states have mandatory cumulative voting, so do National Banks.” |

| |

| | “In addition, many corporations have adopted cumulative voting.” |

| |

| | “Last year the owners of 40,013,545 shares, representing approximately 35% of shares voting, voted FOR this proposal.” |

| |

| | “If you AGREE, please mark your proxy FOR this resolution.” |

| |

| Our Response to the Stockholder Proposal | | Our Board of Directors recommends that our stockholders vote against Proposal 4. Our present system for election of directors, which is like that of most major publicly traded corporations, provides that each share of common stock is entitled one vote for each nominee for director. This system allows all stockholders to vote on the basis of their share ownership. Our Board of Directors believes this voting system is the most fair and the most likely to produce an effective board of directors that will represent the interests of all of our stockholders. |

| |

| | In contrast, cumulative voting could promote special interest representation on the Board of Directors and would permit stockholders representing less than a majority of all shares to elect a director. This proposal would potentially allow a small stockholder group to have a disproportionate effect on the election of directors, possibly leading to the election of directors who advocate the positions of the groups responsible for their election rather than positions which are in the best interests of all stockholders. The Board believes that no director should represent or favor the interests of any one stockholder or a limited group of stockholders. Rather, every director must represent the stockholders as a whole. The Board of Directors feels strongly that it is the duty of each director to administer our business and affairs for the benefit of all stockholders. In addition, the support by directors of the special interests of the constituencies that elected them could create partisanship and divisiveness among members of the Board of Directors and impair the Board’s ability to operate effectively as a governing body, to the detriment of all stockholders. For these reasons, cumulative voting also may interfere with the Corporate Governance and Nominating Committee’s efforts to develop and maintain a Board of Directors possessing the wide range of skills, characteristics and experience necessary to best serve all stockholders’ interests. |

15

| | |

| | Our Board of Directors has taken a number of steps to achieve greater accountability to stockholders, and it does not believe cumulative voting is necessary or enhances that accountability. Our Board of Directors has amended our bylaws to adopt a majority voting standard for the election of directors in uncontested elections. Currently, all but one of our directors (our Chief Executive Officer) is independent. Our Board of Directors has a robust process to ensure the nomination and election of independent directors. Procedures adopted by the Corporate Governance and Nominating Committee, which itself is composed solely of independent directors, include an examination of the candidate’s qualifications in light of our standards for overall structure and composition of the Board and the minimum director qualifications set forth in our Corporate Governance Guidelines and the Corporate Governance and Nominating Committee’s charter as well as the candidate’s independence as set forth in SEC rules and regulations and the NYSE listing standards. |

| |

| | The proponent of this proposal has offered no evidence that cumulative voting would produce a more qualified or effective Board of Directors. Accordingly, the Board believes the present method of voting best promotes the election of directors who will represent the interests of our stockholders as a whole. |

| |

| | The Board of Directors unanimously recommends that the stockholders vote “AGAINST” this stockholder proposal. |

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of April 16, 2012, by (1) each of our directors and nominees for director, (2) each of the individuals named in the Summary Compensation Table in this Proxy Statement and (3) all of our directors and executive officers as a group, based in each case on information furnished to us by these persons. We believe that each of the named individuals and each director and executive officer included in the group has sole voting and investment power with regard to the shares shown, except as otherwise noted.

| | | | | | | | |

| | | Common Stock

Beneficially Owned(1) | |

Name of Beneficial Owner and Relationship to Company | | Amount and Nature

of Beneficial Ownership | | | Percent

of Class | |

W. Douglas Parker | | | 835,555 | (2) | | | * | |

Chairman of the Board and Chief Executive Officer | | | | | | | | |

J. Scott Kirby | | | 167,732 | (3) | | | * | |

President | | | | | | | | |

Robert D. Isom, Jr. | | | 42,863 | (4) | | | * | |

Executive Vice President and Chief Operating Officer | | | | | | | | |

Stephen L. Johnson | | | 22,334 | (5) | | | * | |

Executive Vice President — Corporate and Government Affairs | | | | | | | | |

Derek J. Kerr | | | 31,269 | (6) | | | * | |

Executive Vice President and Chief Financial Officer | | | | | | | | |

Herbert M. Baum | | | 65,582 | (7) | | | * | |

Director | | | | | | | | |

Matthew J. Hart | | | 50,726 | (8) | | | * | |

Director | | | | | | | | |

Richard C. Kraemer | | | 80,135 | (9) | | | * | |

Director | | | | | | | | |

Cheryl G. Krongard | | | 47,020 | (10) | | | * | |

Director | | | | | | | | |

Bruce R. Lakefield | | | 47,020 | (11) | | | * | |

Vice Chairman and Director | | | | | | | | |

Denise M. O’Leary | | | 64,838 | (12) | | | * | |

Director | | | | | | | | |

George M. Philip | | | 47,020 | (13) | | | * | |

Director | | | | | | | | |

William J. Post | | | — | (14) | | | * | |

Director | | | | | | | | |

All directors and executive officers as a group (14 persons) | | | 1,532,004 | (15) | | | * | |

| * | Represents less than 1% of the outstanding shares of our common stock. |

| (1) | Beneficial ownership as reported in the table has been determined in accordance with SEC rules and regulations and includes shares of our common stock that may be issued upon the exercise of stock options that are exercisable within 60 days of April 16, 2012 and restricted stock units, or RSUs, that vest within 60 days of April 16, 2012. Pursuant to SEC rules and regulations, all shares not currently outstanding which are subject to stock options exercisable within 60 days of April 16, 2012 and RSUs that vest within 60 days of April 16, 2012, are deemed to be outstanding for the purpose of computing “Percent of Class” held by the holder thereof but are not deemed to be outstanding for the purpose of computing the “Percent of Class” held by any other stockholder. Beneficial ownership as reported in the table excludes shares of our common stock that may be issued upon the exercise of stock appreciation rights, or SARs, that are exercisable within 60 days of April 16, 2012. The number of shares that will be received upon exercise of such SARs is not |

17

| | currently determinable and therefore is not included in the table above because each SAR gives the holder the right to receive the excess of the market price of one share of stock at the exercise date over the exercise price, which is not determinable until the date of exercise. |

| (2) | Includes 470,055 shares held directly, 309,375 shares underlying stock options and 56,125 shares underlying vested RSUs. Excludes 112,250 unvested RSUs. Excludes the following SARs: (a) 196,000 SARs at an exercise price of $19.30; (b) 120,000 SARs at an exercise price of $38.44; (c) 90,000 SARs at an exercise price of $45.01; (d) 196,820 SARs at an exercise price of $8.84; (e) 275,000 SARs at an exercise price of $6.70; (f) 849,000 SARs at an exercise price of $3.10; (g) 154,040 SARs at an exercise price of $7.42; and (h) 80,179 SARs at an exercise price of $8.14. |

| (3) | Includes 87,190 shares held directly, 41,250 shares underlying stock options and 39,292 shares underlying vested RSUs. Excludes 78,583 unvested RSUs. Excludes the following SARs: (a) 165,000 SARs at an exercise price of $19.30; (b) 36,000 SARs at an exercise price of $38.44; (c) 75,000 SARs at an exercise price of $46.11; (d) 63,000 SARs at an exercise price of $45.01; (e) 136,530 SARs at an exercise price of $8.84; (f) 178,755 SARs at an exercise price of $6.70; (g) 589,000 SARs at an exercise price of $3.10; (h) 106,867 SARs at an exercise price of $7.42; and (i) 56,131 SARs at an exercise price of $8.14. |

| (4) | Includes 20,529 shares held directly and 22,334 shares underlying vested RSUs. Excludes 44,666 unvested RSUs. Excludes the following SARs: (a) 70,000 SARs at an exercise price of $31.14; (b) 101,630 SARs at an exercise price of $8.84; (c) 143,855 SARs at an exercise price of $6.70; (d) 292,000 SARs at an exercise price of $3.10; and (e) 31,905 SARs at an exercise price of $8.14. |

| (5) | Includes 22,334 shares underlying vested RSUs. Excludes 44,666 unvested RSUs. Excludes the following SARs: (a) 175,000 SARs at an exercise price of $2.80; (b) 275,000 SARs at an exercise price of $3.10; and (c) 31,905 SARs at an exercise price of $8.14. |

| (6) | Includes 8,935 shares held directly and 22,334 shares underlying vested RSUs. Excludes 44,666 unvested RSUs. Excludes the following SARs: (a) 51,500 SARs at an exercise price of $19.30; (b) 12,500 SARs at an exercise price of $38.44; (c) 12,500 SARs at an exercise price of $45.01; (d) 26,020 SARs at an exercise price of $8.84; (e) 51,020 SARs at an exercise price of $6.70; (f) 25,000 SARs at an exercise price of $7.65; (g) 292,000 SARs at an exercise price of $3.10; and (h) 31,905 SARs at an exercise price of $8.14. |

| (7) | Includes 40,832 shares held directly and 24,750 shares underlying stock options. |

| (8) | Includes 40,270 shares held directly, 2,550 shares held indirectly for the benefit of Mr. Hart’s children and 7,906 shares underlying stock options. |

| (9) | Includes 55,385 shares held directly and 24,750 shares underlying stock options. |

| (10) | Includes 38,770 shares held directly and 8,250 shares underlying stock options. |

| (11) | Includes 38,770 shares held directly and 8,250 shares underlying stock options. |

| (12) | Includes 40,088 shares held directly and 24,750 shares underlying stock options. |

| (13) | Includes 38,770 shares held directly and 8,250 shares underlying stock options. |

| (14) | Mr. Post joined the Board of Directors in September 2011. |

| (15) | Includes 887,170 shares held directly, 2,550 shares held indirectly for the benefit of a director’s children, 457,531 shares underlying stock options and 184,753 shares underlying vested RSUs held by our executive officers and directors as a group. Excludes 372,830 shares underlying unvested RSUs and 5,271,340 SARs. |

18

The following table sets forth information regarding the beneficial ownership of our common stock as of April 16, 2012 for each person known to us to be the beneficial owner of more than 5% of our outstanding common stock.

| | | | | | | | |

| | | Common Stock

Beneficially Owned | |

Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial Ownership | | | Percent of Class | |

FMR, LLC 82 Devonshire Street Boston, MA 02109 | | | 21,818,709 | (1) | | | 13.5 | % |

Whitebox Advisors, LLC 3033 Excelsior Boulevard, Suite 300 Minneapolis, MN 55416 | | | 11,836,763 | (2) | | | 7.3 | % |

Wellington Management Company, LLP 280 Congress Street Boston, MA 02210 | | | 11,361,702 | (3) | | | 7.0 | % |

Manning & Napier Advisors, LLC 290 Woodcliff Drive Fairport, NY 14450 | | | 8,369,420 | (4) | | | 5.2 | % |

| (1) | The amount shown and the following information is derived solely from Amendment No. 10 to the Schedule 13G filed by FMR, LLC (“FMR”), reporting beneficial ownership as of December 31, 2011. According to the amended Schedule 13G, FMR has sole dispositive power over 21,818,709 shares and sole voting power over 1,700 shares of our common stock. Fidelity Management & Research Company (“Fidelity”), 82 Devonshire Street, Boston, Massachusetts 02109, a wholly owned subsidiary of FMR and an investment adviser registered under Section 203 of the Investment Advisers Act of 1940, is the beneficial owner of 21,818,709 shares, or 13.24%, of the outstanding shares of our common stock as a result of acting as investment adviser to various investment companies (the “Funds”). Each of Edward C. Johnson 3d (Chairman of FMR), FMR (through its control of Fidelity) and the Funds has sole power to dispose of the 21,818,709 shares owned by the Funds. Members of Mr. Johnson’s family may be deemed to form a controlling group with respect to FMR. Neither FMR nor Mr. Johnson has the sole power to vote or direct the voting of the shares owned directly by the Fidelity Funds, which power resides with the Funds’ Boards of Trustees. |

| (2) | The amount shown and the following information is derived solely from the Schedule 13G filed by Whitebox Advisors, LLC (“WA”), Whitebox Multi-Strategy Advisors, LLC (“WMSA”), Whitebox Multi-Strategy Partners, L.P. (“WMSP”), Whitebox Multi-Strategy Fund, L.P. (“WMSFLP”), Whitebox Multi-Strategy Fund, Ltd. (“WMSFLTD”), Whitebox Concentrated Convertible Arbitrage Advisors, LLC (“WCCAA”), Whitebox Concentrated Convertible Arbitrage Partners, L.P. (“WCCAP”), Whitebox Concentrated Convertible Arbitrage Fund , L.P. (“WCCAFLP”), Whitebox Concentrated Convertible Arbitrage Fund, Ltd. (“WCCAFLTD”), Pandora Select Advisors, LLC (“PSA”), Pandora Select Partners, L.P. (“PSP”), Pandora Select Fund, L.P. (“PSFLP”), Pandora Select Fund, Ltd. (“PSFLTD”), HFR RVA Combined Master Trust (“HFR”) and IAM Mini-Fund 14 Limited (“IAM”) (collectively, the “Whitebox Entities”), reporting beneficial ownership as of December 31, 2011. According to the Schedule 13G, WA, in its capacity as investment advisor to its client, is the beneficial owner of 11,836,763 shares of our common stock and has shared voting power over 11,836,763 shares and shared dispositive power over 11,836,763 shares of our common stock. Each of WMSA, WMSP, WMSFLP and WMSFLTD is the beneficial owner of 4,855,143 shares of our common stock and has shared voting power over 4,855,143 shares and shared dispositive power over 4,855,143 shares of our common stock. Each of WCCAA, WCCAP, WCCAFLP and WCCAFLTD is the beneficial owner of 4,239,388 shares of our common stock and has shared voting power over 4,239,388 shares and shared dispositive power over 4,239,388 shares of our common stock. Each of |

19

| | PSA, PSP, PSFLP and PSFLTD is the beneficial owner of 1,713,348 shares of our common stock and has shared voting power over 1,713,348 shares and shared dispositive power over 1,713,348 shares of our common stock. HFR is the beneficial owner of 494,967 shares of our common stock. IAM is the beneficial owner of 533,917 shares of our common stock. Each of WMSP, WCCAP, PSP, HFR and IAM is deemed to beneficially own shares of our common stock as a result of its ownership of debt securities convertible into shares of our common stock. Each of WMSFLP, WMSFLTD, WCCAFLP, WCCAFLTD, PSFLP and PSFLTD is deemed to beneficially own shares of our common stock as a result of its indirect ownership of debt securities convertible into shares of our common stock. The Whitebox Entities may be deemed to constitute a “group” within the meaning of Rule 13d-5(b)(1) under the Securities Exchange Act of 1934. Each of WA, WMSA, WMSFLP, WMSFLTD, WCCAA, WCCAFLP, WCCAFLTD, PSA, PSFLP and PSFLTD disclaims indirect beneficial ownership of the shares of our stock except to the extent of its pecuniary interest in such shares. The address of the business office of WA, WMSA, WMSFLP, WCCAA, WCCAFLP, PSA and PSFLP is 3033 Excelsior Boulevard, Suite 300, Minneapolis, MN 55416. The address of the business office of WMSP, WMSFLTD, WCCAP, WCCAFLTD, PSP and PSFLTD is Trident Chambers, P.O. Box 146, Waterfront Drive, Wickhams Cay, Road Town, Tortola, British Virgin Islands. The address of the business office of HFR is HFR RVA Combined Master Trust, 65 Front Street, Hamilton, HM 11, Bermuda. The address of the business office of IAM is IAM Mini-Fund 14 Limited, Boundary Hall, Cricket Square, George Town, Grand Cayman, KY1-1102 Cayman Islands. |

| (3) | The amount shown and the following information is derived solely from the Schedule 13G filed by Wellington Management Company, LLP (“Wellington Management”), reporting beneficial ownership as of December 31, 2011. According to the Schedule 13G, Wellington Management, in its capacity as investment advisor, has shared voting power over 6,047,067 shares and shared dispositive power over 11,361,702 shares of our common stock. These shares of common stock are owned of record by clients of Wellington Management. Those clients have the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, such shares. |

| (4) | The amount shown and the following information is derived solely from the Schedule 13G filed by Manning & Napier Advisors, LLC (“Manning & Napier”), reporting beneficial ownership as of December 31, 2011. According to the Schedule 13G, Manning & Napier, in its capacity as investment advisor, has sole voting power over 5,994,110 shares and sole dispositive power over 8,369,420 shares of our common stock. |

20

INFORMATION ABOUT OUR BOARD OF DIRECTORS

AND CORPORATE GOVERNANCE

| | | | |

Corporate Governance Guidelines | | Our Board of Directors has adopted Corporate Governance Guidelines, or the Governance Guidelines, to facilitate our mission and to set forth general principles and policies by which the Board of Directors will manage its affairs. The Governance Guidelines are reviewed annually by the Corporate Governance and Nominating Committee. The full text of the Governance Guidelines is posted on our website atwww.usairways.com. |

| |

Director Independence | | The Governance Guidelines contain standards for determining director independence that meet or exceed the existing listing standards adopted by the SEC and NYSE. The Governance Guidelines define an “independent” director as one who: |

| | |

| | Ÿ | | the Board has affirmatively determined not to have a material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us); |

| | |

| | Ÿ | | is not a member of our management or our employee and has not been a member of our management or our employee for a minimum of three years; |

| | |

| | Ÿ | | is not, and in the past three years has not been, affiliated with or employed by a present or former auditor of US Airways Group (or of an affiliate); |

| | |

| | Ÿ | | is not, and in the past three years has not been, part of an interlocking directorate in which one of our executive officers serves on the compensation committee of another company that concurrently employs the director; |

| | |

| | Ÿ | | has no immediate family members meeting the descriptions set forth in the above bullets; and |

| | |

| | Ÿ | | satisfies any additional requirements for independence promulgated from time to time by the NYSE. |

| |

| | The Governance Guidelines also note that the Board will consider all other relevant facts and circumstances, including issues that may arise as a result of any director compensation (whether direct or indirect), any charitable contributions we make to organizations with which a director is affiliated and any consulting arrangement between us and a director. The Corporate Governance and Nominating Committee reports annually to the full Board on these matters. |

| |

| | Pursuant to the Governance Guidelines, the Corporate Governance and Nominating Committee and the Board of Directors undertake an annual review of director independence. Based on the Committee’s review in 2012, the Board of Directors affirmatively determined that all of our directors are independent of us and our management under the standards set forth in the Governance Guidelines and under the NYSE listing standards, except for Mr. Parker, our Chairman and Chief Executive Officer. All of the members of the Audit Committee, the Compensation and Human Resources Committee and the Corporate Governance and Nominating Committee are independent under the standards set forth in the Governance Guidelines and under applicable NYSE listing standards. |

| |

| Board Meetings | | The Board of Directors conducts its business through meetings of the full Board and through committees of the Board of Directors. The Board of Directors regularly meets with only non-management directors of the Board present. During 2011, our Board of Directors held seven meetings. In 2011, each incumbent director attended at least 79% of the aggregate number of meetings of the Board held during the period for which he or she has been a director and of the committees on which he or she served. |

21

| | |

| Board Committees | | The Board of Directors currently has five standing committees: the Audit Committee, the Compensation and Human Resources Committee, the Corporate Governance and Nominating Committee, the Finance Committee and the Labor Committee. |

| |

| | The Audit Committee currently is comprised of four non-employee directors, Messrs. Philip (Chair), Hart and Kraemer and Ms. O’Leary. In 2011, the Audit Committee met nine times. The Audit Committee oversees our internal accounting function and oversees and reports to the Board of Directors with respect to other auditing and accounting matters, including the selection of our independent auditors, the scope of annual audits, fees to be paid to our independent auditors and the performance of our independent auditors. Our Audit Committee is also responsible for reviewing and approving all material transactions with any related party. A copy of the Audit Committee charter is available on our website atwww.usairways.com. |

| |

| | The Committee meets the NYSE composition requirements, including the requirements dealing with financial literacy and financial sophistication. The Board of Directors has determined that all members of the Committee are independent directors under the current NYSE listing standards, satisfy the independence requirements of Section 10A of the Exchange Act and Rule 10A-3(b)(1), and are independent within the meaning set forth in our Governance Guidelines. In addition, the Board of Directors has determined that each member of the Committee is an “audit committee financial expert” as defined by the SEC. |

| |

| | The Compensation and Human Resources Committeecurrently is comprised of five non-employee directors, Messrs. Hart (Chair), Kraemer and Post and Mses. Krongard and O’Leary. The Compensation and Human Resources Committee met six times in 2011. The Committee reviews and approves the compensation for our executive officers. The Committee also administers our 2008 Equity Incentive Plan, or the 2008 Plan, our 2011 Incentive Award Plan, or the 2011 Plan, and other employee benefit plans. A copy of the Compensation and Human Resources Committee charter is available on our website atwww.usairways.com. |

| |

| | The Board of Directors has determined that all members of the Committee are independent within the meaning of NYSE listing standards and our Governance Guidelines, are “non-employee directors” as defined by Rule 16b-3 under the Exchange Act and are “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code and related regulations. |

| |

| | Compensation and Human Resources Committee Process for Executive Compensation |

| |

| | Our Compensation and Human Resources Committee’s charter gives the Compensation and Human Resources Committee the authority and responsibility to review and approve our overall compensation strategy and policies, including performance goals for executive officers. The Compensation and Human Resources Committee is responsible for reviewing and approving the compensation and other terms of employment of our Chief Executive Officer and for evaluating his performance. The Committee is also responsible for reviewing and approving the compensation and other terms of employment of the other executive officers, with input from the Chief Executive Officer. The Committee periodically reviews and assesses the performance of our executive officers, with input from individual members of senior management, the full Board of Directors, and any other appropriate persons. The Committee administers our incentive plans and approves awards under those plans, determines the general design of non-executive compensation plans, and makes recommendations to the Board regarding changes to our executive compensation and benefit plans. The Committee is also responsible for oversight of our significant human resources policies, compensation risk management and succession planning, as well as oversight of our workforce diversity. |

22

| | |

| | The Committee has the authority to delegate its duties to subcommittees, but to date has not done so. The Committee has delegated a limited amount of its authority to administer, interpret and amend our general employee benefit plans to our senior-most human resources officer (currently the Executive Vice President - People, Communications and Public Affairs) and the administration of our 2011 Plan to our CEO, the Executive Vice President - Corporate and Government Affairs and the Executive Vice President - People, Communications and Public Affairs in connection with the assignment by persons who are not executive officers of certain awards, but did not delegate the authority to approve changes that would materially change the cost of the plans or any authority regarding our incentive compensation plans. |

| |