Exhibit 99.1

Confidential – Subject to Non-Disclosure Agreement

US Airways Presentation

January 10, 2013

Table of Contents

Tab 1: Creating the World’s Best Airline

Tab 2: Network Overview

Tab 3: Synergies and Transition Costs Agreement

Tab 4: Labor Integration Disclosure

Tab 5: Valuation / Proposal Non

to

Subject

Appendix –

Tab A: Why Now? Confidential

Tab B: The US Airways Model

Tab C: What People Are Saying

Forward Looking Statements

Certain of the statements contained or referred to herein are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue” and similar terms used in connection with statements regarding, among others, the outlook, expected fuel costs, revenue and pricing environment, and expected financial performance and liquidity position of the Company, including whether or not a combination with AMR Corporation is implemented and the terms, conditions or future financial performance of any such combination. Such statements include, but are not limited to, statements about future financial and operating results, including synergies, the Company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. These statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties that could cause the Company’s actual results and financial position to differ materially from these statements. Such risks and uncertainties include, but are not limited to, the following: the impact of significant operating losses in the future; downturns in economic conditions and their impact on passenger demand, Agreement

booking practices and related revenues; the impact of the price and availability of fuel and significant disruptions in the supply of aircraft fuel; competitive practices in the industry, including the impact of industry consolidation; increased costs of financing, a reduction in the availability of financing and fluctuations in interest rates; the Company’s high level of fixed obligations and ability to fund general corporate requirements, obtain additional financing and respond to competitive developments; any failure to comply with the liquidity covenants contained in financing Disclosure arrangements; provisions in credit card processing and other commercial agreements that may affect the Company’s liquidity; the impact of union—disputes, employee strikes and other labor-related disruptions; the inability to maintain labor costs at competitive levels; interruptions or disruptions Non in service at one or more of the Company’s hub airports or focus city; regulatory changes affecting the allocation of slots; the Company’s reliance to on third-party regional operators or third-party service providers; the Company’s reliance on and costs, rights and functionality of third-party distribution channels, including those provided by global distribution systems, conventional travel agents and online travel agents; changes in government regulation; the impact of changes to the Company’s business model the loss of key personnel or inability to attract and retain qualified Subject personnel; the impact of conflicts overseas or terrorist attacks, and the impact of ongoing security concerns; the Company’s ability to operate and – grow its route network; the impact of environmental regulation; the Company’s reliance on technology and automated systems and the impact of

any failure or disruption of, or delay in, these technologies or systems; costs of ongoing data security compliance requirements and the impact of

any significant data security breach; the impact of any accident involving the Company’s aircraft or the aircraft of its regional operators; delays in scheduled aircraft deliveries or other loss of anticipated fleet capacity; the Company’s dependence on a limited number of suppliers for aircraft, Confidential aircraft engines and parts; the Company’s ability to operate profitably out of Philadelphia International Airport; the impact of weather conditions and seasonality of airline travel; the impact of possible future increases in insurance costs or reductions in available insurance coverage; the impact of global events that affect travel behavior, such as an outbreak of a contagious disease; the impact of foreign currency exchange rate fluctuations; the Company’s ability to use NOLs and certain other tax attributes; and other risks and uncertainties listed from time to time in the Company’s reports to and filings with the Securities and Exchange Commission (“SEC”). There may be other factors not identified above of which the Company is not currently aware that may affect matters discussed in the forward-looking statements, and may also cause actual results to differ materially from those discussed. The Company assumes no obligation to update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting such estimates other than as required by law. Additional factors that may affect the future results of the Company are set forth in the section entitled “Risk Factors” in the Company’s Report on Form 10-Q for the quarter ended September 30, 2012 and in the Company’s other filings with the SEC, which are available at www.usairways.com.

Creating The World’s Best Airline

AA – US Combination is Compelling for All Stakeholders

• AA-US combination would create the world’s premier airline

• Combined network can compete more effectively with United, Delta and others

• Impossible to accomplish without a US merger

• Significantly strengthens oneworld alliance

• Supported by employees

• Job security, improved opportunities through stronger carrier

• Labor contracts negotiated and supported by employees

• Superior recoveries for investors/creditors

• Enormous value creation through $1.4 billion in synergies

• Better service for customers/communities

• Third comprehensive network to compete with United and Delta

• Improved service to more cities

• Our work with AA has strengthened our view

Confidential – Subject to Non-Disclosure Agreement

• Synergy estimates conservative

• Tremendous upside to creditors versus ambitious AA standalone plan

Recent Mergers Have Reduced AA’s—Disclosure

Non

Prominence in the Industry to

Subject

–

Confidential

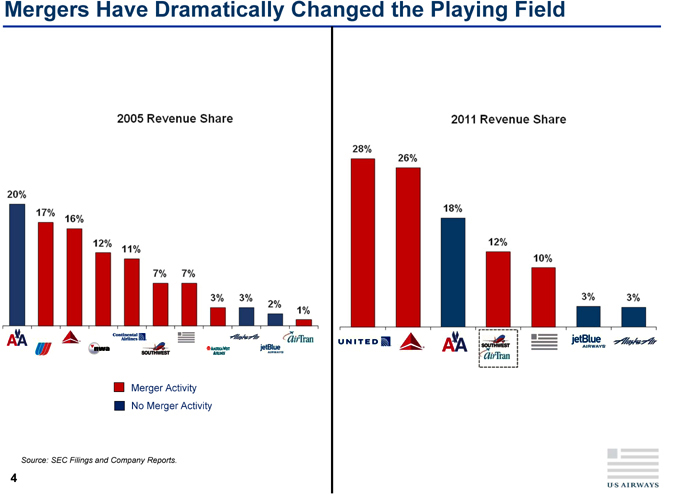

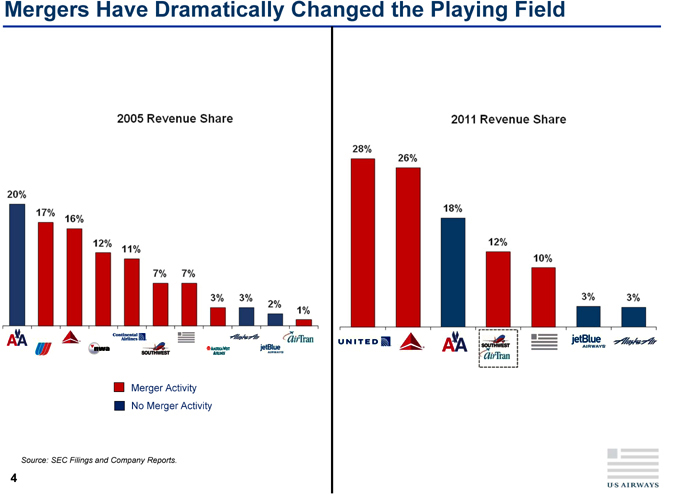

Mergers Have Dramatically Changed the Playing Field

Confidential – Subject to Non-Disclosure Agreement

Source: SEC Filings and Company Reports.

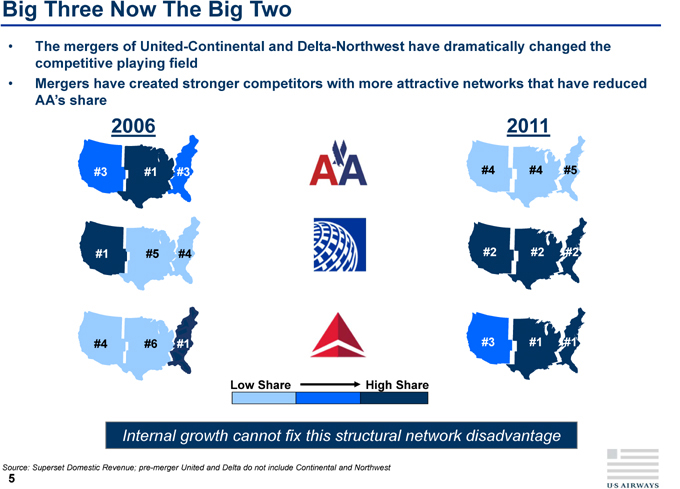

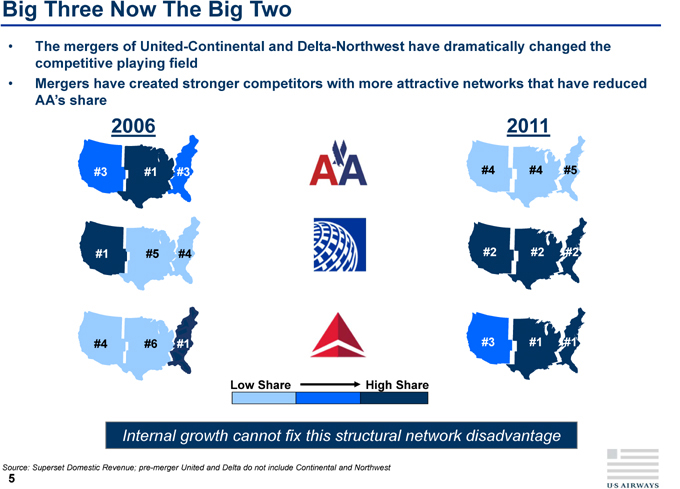

Big Three Now The Big Two

• The mergers of United-Continental and Delta-Northwest have dramatically changed the competitive playing field

• Mergers have created stronger competitors with more attractive networks that have reduced AA’s share

Internal growth cannot fix this structural network disadvantage

Source: Superset Domestic Revenue; pre-merger United and Delta do not include Continental and Northwest

Other Airlines’ More Attractive Networks Have Put AA at a Revenue Disadvantage

• Due to other airlines’ strengthened networks, AA’s unit revenue has declined

• If AA’s 2012 relative RASM had remained at 2005 levels, AA would have generated $1.7B in additional annual revenue

Source: ATA Industry Revenue, AA Reported Revenue, AA ASMs, RPMs, Onboards from T-100; jetBlue excluded from entire period Updated through 2Q12

The Response to the Challenges of Recent Agreement

Mergers: Disclosure

-

Non

to

AA-US Combination Creates The World’s Subject

–

Best Airline Confidential

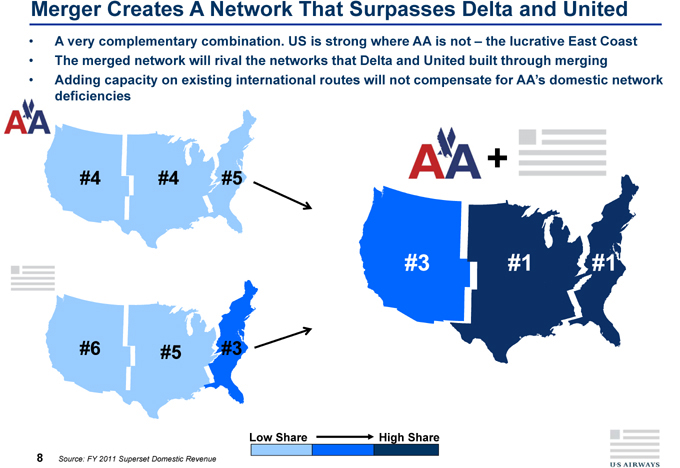

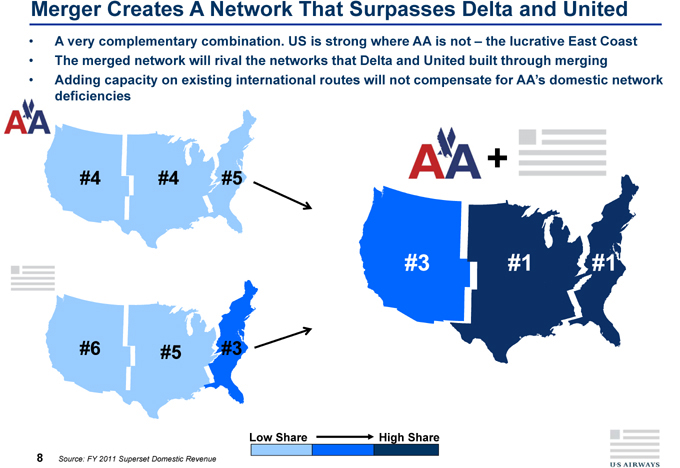

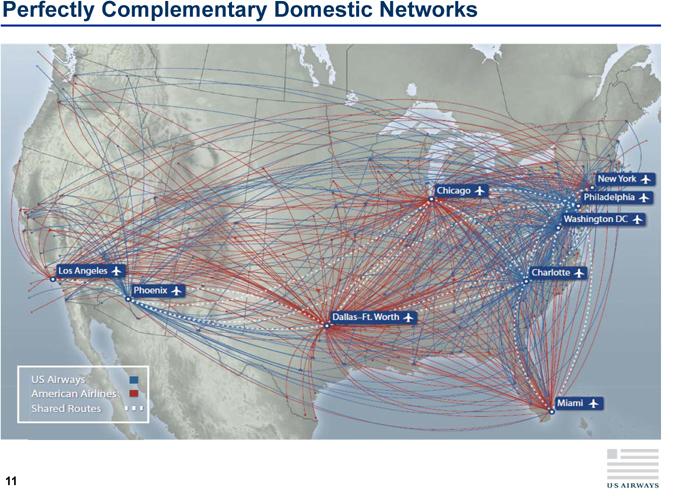

Merger Creates A Network That Surpasses Delta and United

• A very complementary combination. US is strong where AA is not – the lucrative East Coast

• The merged network will rival the networks that Delta and United built through merging

• Adding capacity on existing international routes will not compensate for AA’s domestic network deficiencies

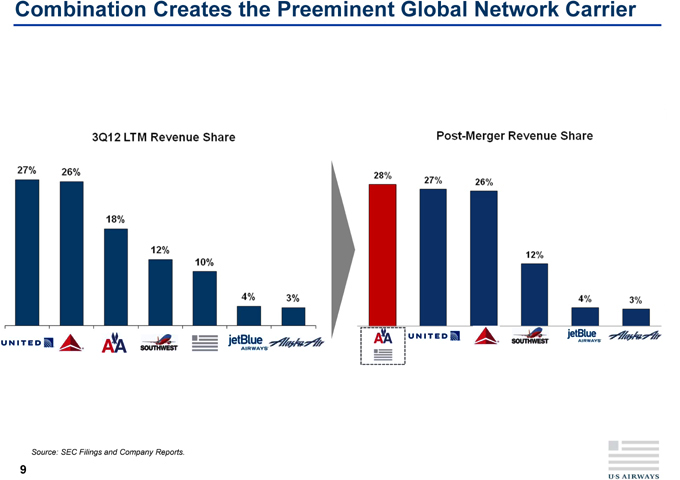

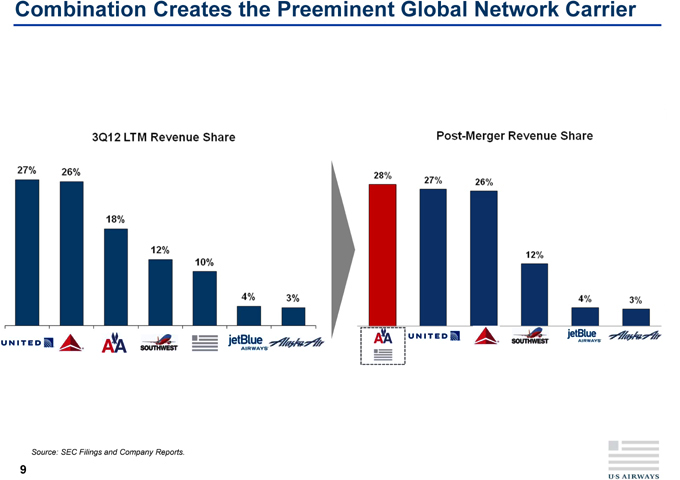

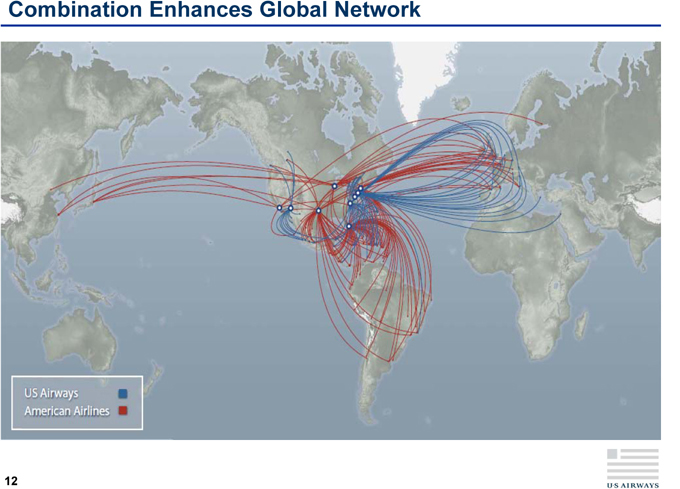

Combination Creates the Preeminent Global Network Carrier

Source: SEC Filings and Company Reports.

9

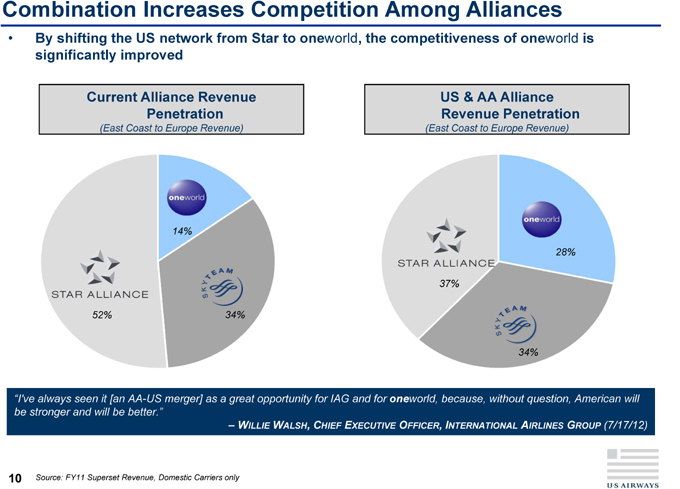

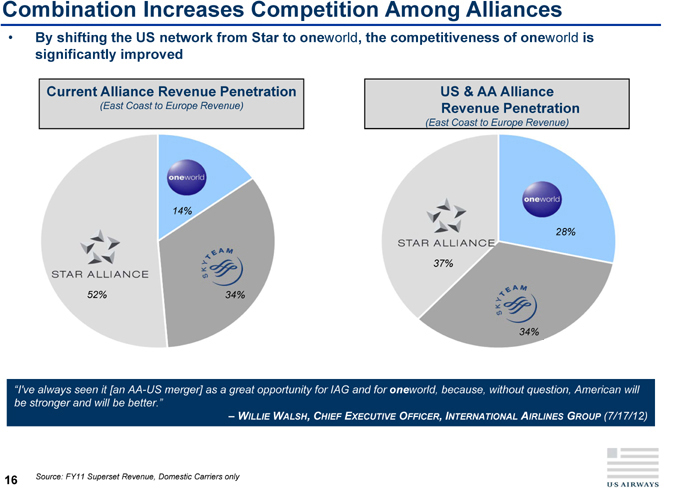

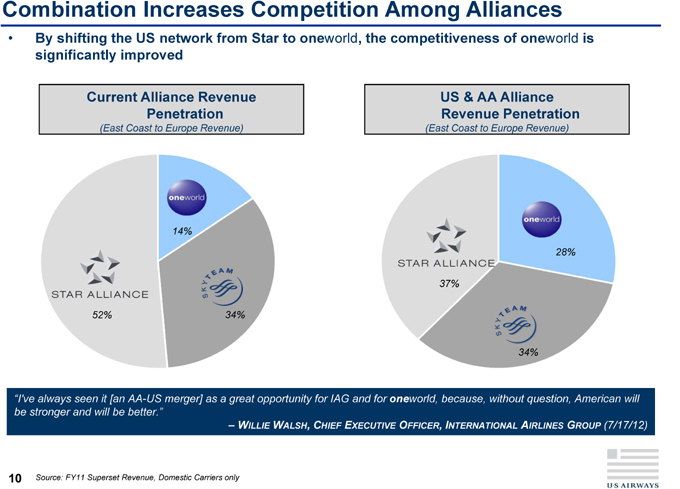

Combination Increases Competition Among Alliances

• By shifting the US network from Star to oneworld, the competitiveness of oneworld is significantly improved

“I’ve always seen it [an AA-US merger] as a great opportunity for IAG and for oneworld, because, without question, American will be stronger and will be better.”

–WILLIE WALSH, CHIEF EXECUTIVE OFFICER, INTERNATIONAL AIRLINES GROUP (7/17/12)

10 Source: FY11 Superset Revenue, Domestic Carriers only

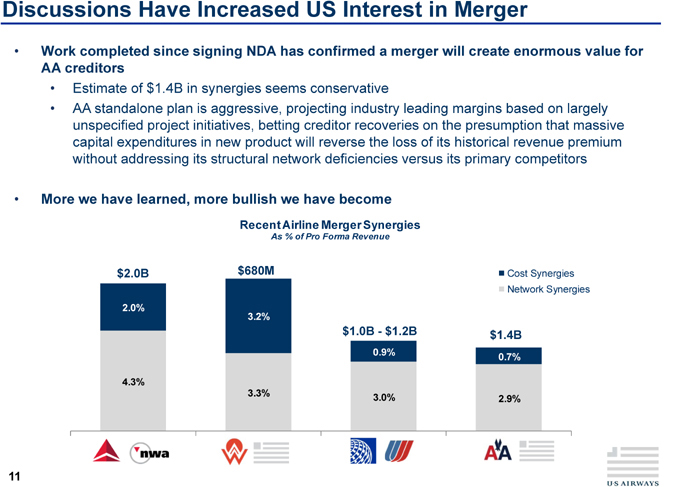

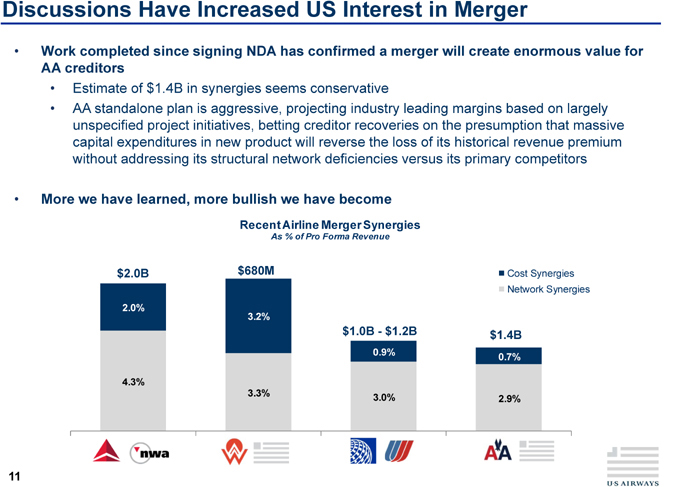

Discussions Have Increased US Interest in Merger

• Work completed since signing NDA has confirmed a merger will create enormous value for

AA creditors

• Estimate of $1.4B in synergies seems conservative

• AA standalone plan is aggressive, projecting industry leading margins based on largely

unspecified project initiatives, betting creditor recoveries on the presumption that massive

capital expenditures in new product will reverse the loss of its historical revenue premium Agreement

without addressing its structural network deficiencies versus its primary competitors

• More we have learned, more bullish we have become Disclosure

-

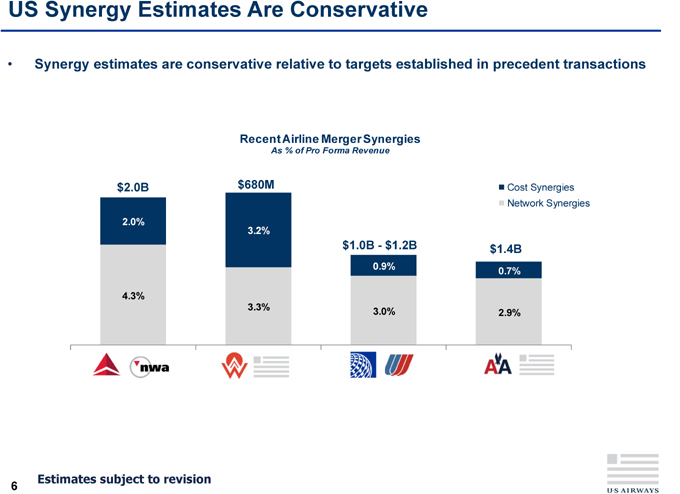

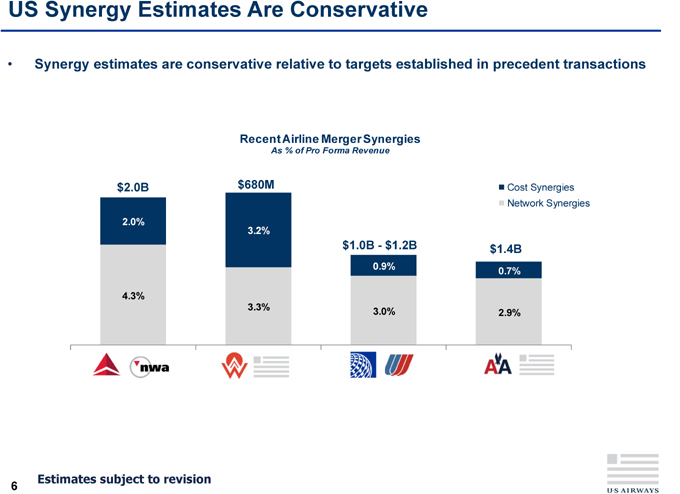

Recent Airline Merger Synergies Non

As % of Pro Forma Revenue to

$2.0B $680M Cost Synergies Subject

–

Network Synergies

2.0%

3.2% Confidential

$1.0B—$1.2B $1.4B

0.9% 0.7%

4.3%

3.3% 3.0% 2.9%

Agreement

Disclosure

US Offer Provides Clear Path to Value Non -

to

Subject

–

Confidential

12

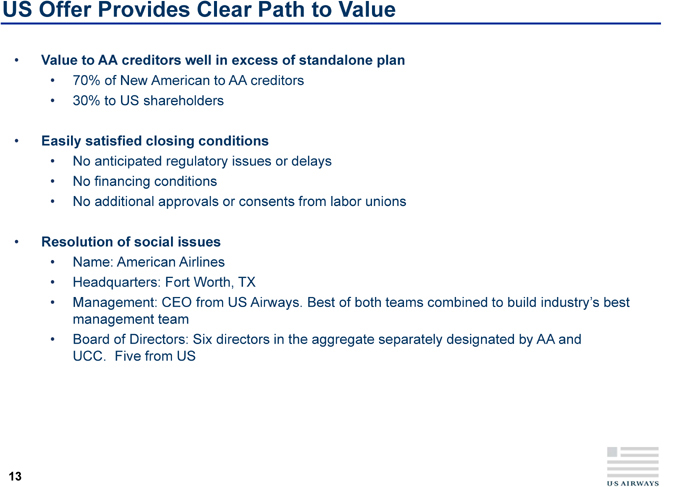

US Offer Provides Clear Path to Value

• Value to AA creditors well in excess of standalone plan

• 70% of New American to AA creditors

• 30% to US shareholders

• Easily satisfied closing conditions Agreement

• No anticipated regulatory issues or delays

• No financing conditions

• No additional approvals or consents from labor unions Disclosure

-

Non

• Resolution of social issues to

• Name: American Airlines Subject

• Headquarters: Fort Worth, TX –

• Management: CEO from US Airways. Best of both teams combined to build industry’s best

management team Confidential

• Board of Directors: Six directors in the aggregate separately designated by AA and

UCC. Five from US

13

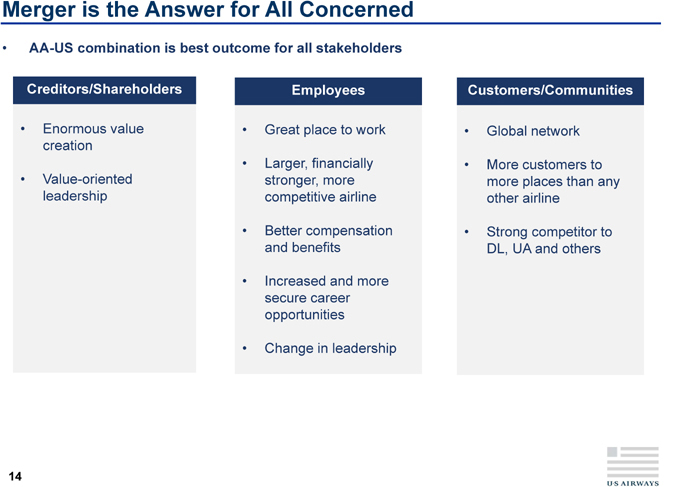

Merger is the Answer for All Concerned

• AA-US combination is best outcome for all stakeholders

Creditors/Shareholders Employees Customers/Communities

• Enormous value • Great place to work • Global network

creation Agreement

• Larger, financially • More customers to

• Value-oriented stronger, more more places than any

leadership competitive airline other airline Disclosure

-

Non

• Better compensation • Strong competitor to to

and benefits DL, UA and others Subject

• Increased and more –

secure career

opportunities Confidential

• Change in leadership

14

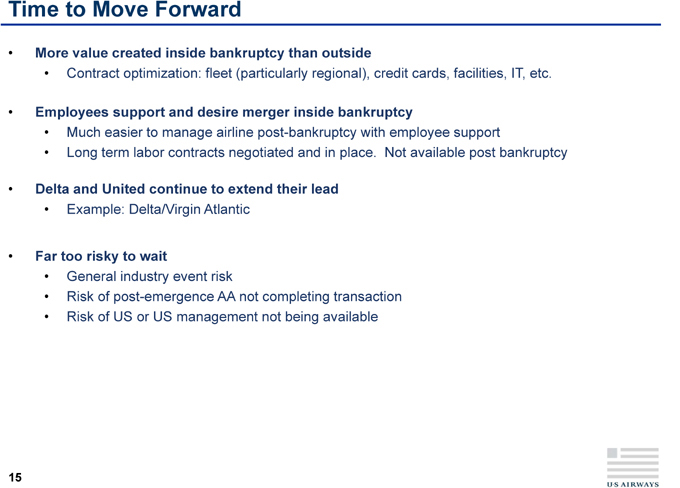

Time to Move Forward

• More value created inside bankruptcy than outside

• Contract optimization: fleet (particularly regional), credit cards, facilities, IT, etc.

• Employees support and desire merger inside bankruptcy

• Much easier to manage airline post-bankruptcy with employee support

• Long term labor contracts negotiated and in place. Not available post bankruptcy Agreement

• Delta and United continue to extend their lead Disclosure

• Example: Delta/Virgin Atlantic -

Non

to

• Far too risky to wait Subject

• General industry event risk –

• Risk of post-emergence AA not completing transaction

• Risk of US or US management not being available Confidential

15

Confidential – Subject to Non-Disclosure Agreement

Network Overview

Confidential – Subject to Non-Disclosure Agreement

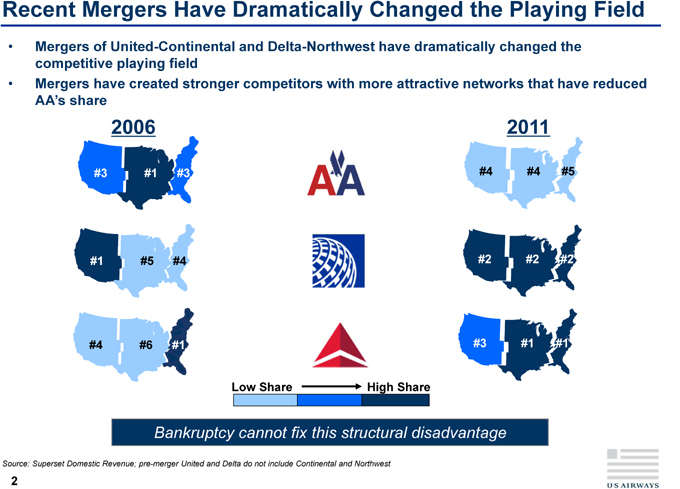

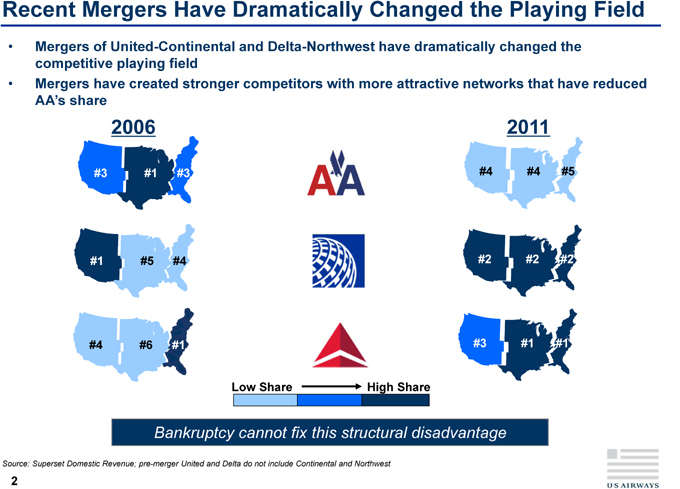

Recent Mergers Have Dramatically Changed the Playing Field

• Mergers of United-Continental and Delta-Northwest have dramatically changed the competitive playing field

• Mergers have created stronger competitors with more attractive networks that have reduced AA’s share

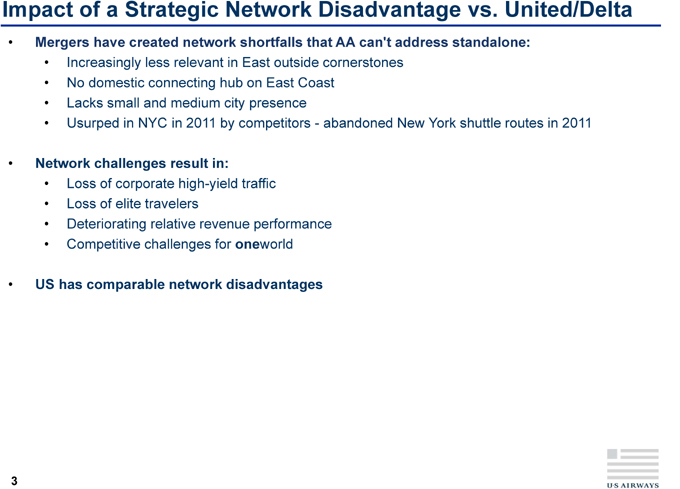

Impact of a Strategic Network Disadvantage vs. United/Delta

• Mergers have created network shortfalls that AA can’t address standalone:

• Increasingly less relevant in East outside cornerstones

• No domestic connecting hub on East Coast

• Lacks small and medium city presence

• Usurped in NYC in 2011 by competitors—abandoned New York shuttle routes in 2011 Agreement

• Network challenges result in:

• Loss of corporate high-yield traffic

• Loss of elite travelers Disclosure

-

• Deteriorating relative revenue performance Non

to

• Competitive challenges for oneworld Subject

• US has comparable network disadvantages –

Confidential

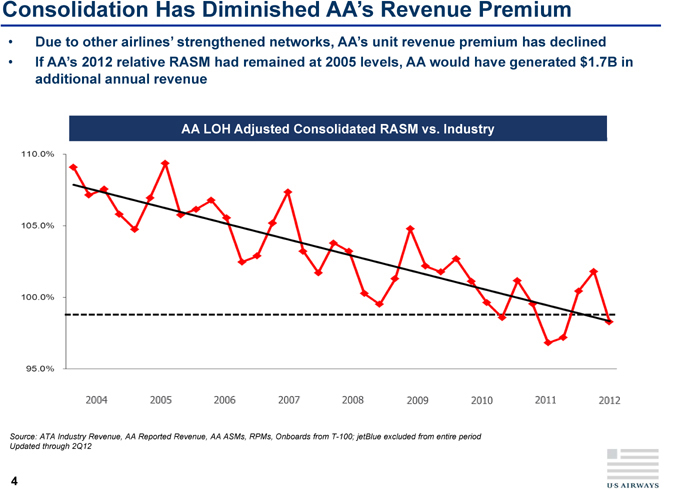

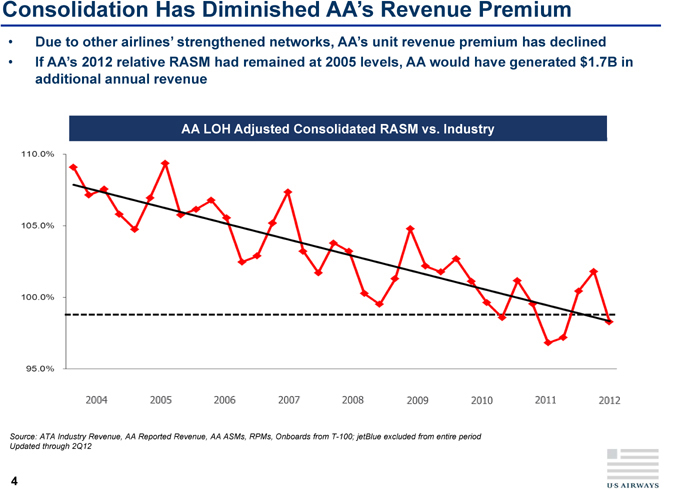

Consolidation Has Diminished AA’s Revenue Premium

• Due to other airlines’ strengthened networks, AA’s unit revenue premium has declined

• If AA’s 2012 relative RASM had remained at 2005 levels, AA would have generated $1.7B in additional annual revenue

Source: ATA Industry Revenue, AA Reported Revenue, AA ASMs, RPMs, Onboards from T-100; jetBlue excluded from entire period Updated through 2Q12

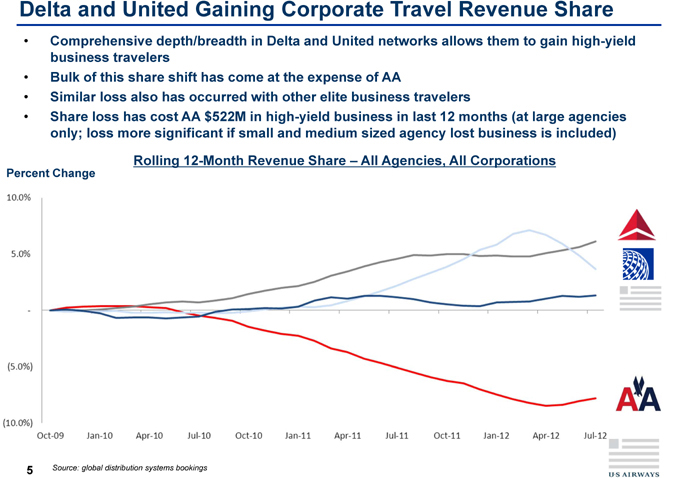

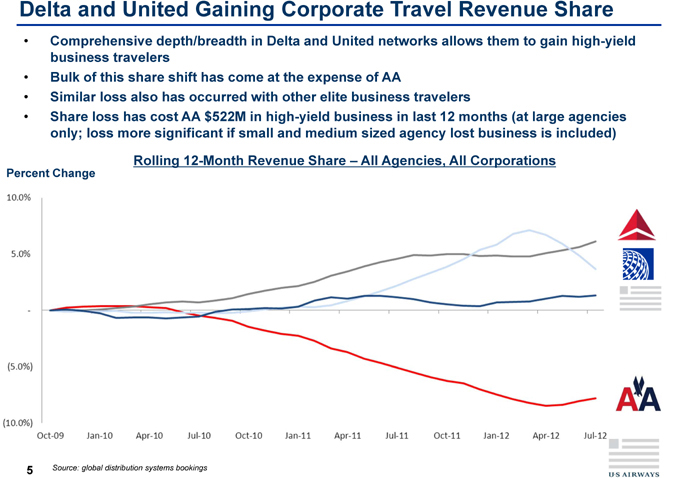

Delta and United Gaining Corporate Travel Revenue Share

• Comprehensive depth/breadth in Delta and United networks allows them to gain high-yield

business travelers

• Bulk of this share shift has come at the expense of AA

• Similar loss also has occurred with other elite business travelers

• Share loss has cost AA $522M in high-yield business in last 12 months (at large agencies

only; loss more significant if small and medium sized agency lost business is included) Agreement

Rolling 12-Month Revenue Share – All Agencies, All Corporations

Percent Change Disclosure

-

Non

to

Subject

–

Confidential

5 | | Source: global distribution systems bookings |

East Coast Scope/Depth Example: AA Uncompetitive Versus Delta and United

• AA cannot connect customers up and down the East Coast

• Structural issue since AA does not have an East Coast connecting hub

• AA cannot fix standalone (e.g. by growing BUF-ORD by 20%)

• Merger solves problem

Source: Diio Mi July 2012 Peak Day Schedule

Southwest, jetBlue and others also provide competition in the marketplace

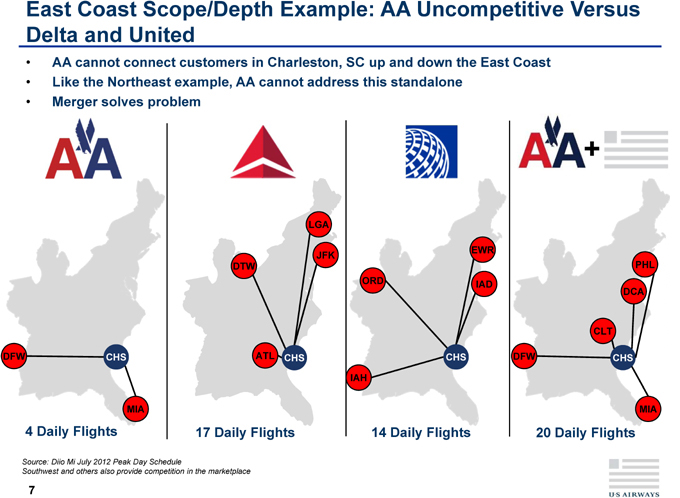

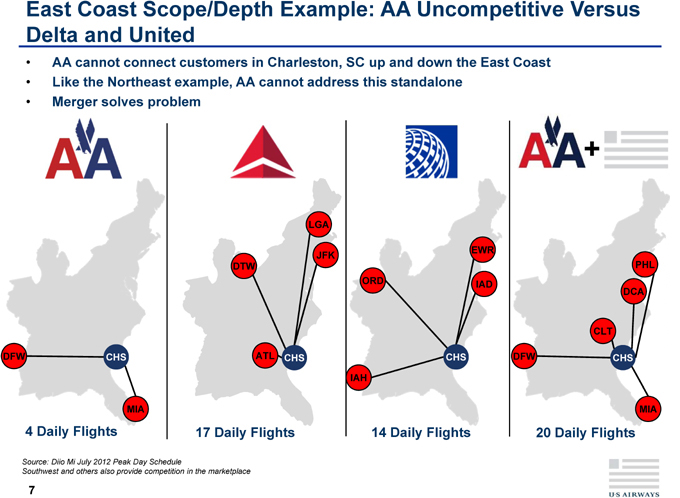

East Coast Scope/Depth Example: AA Uncompetitive Versus Delta and United

• AA cannot connect customers in Charleston, SC up and down the East Coast

• Like the Northeast example, AA cannot address this standalone

• Merger solves problem

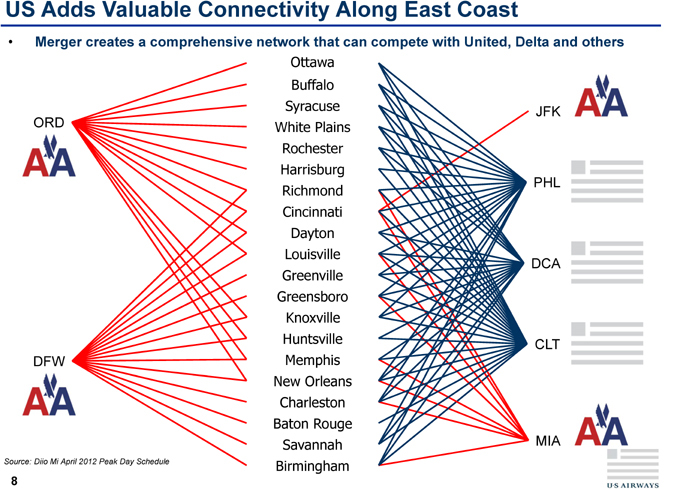

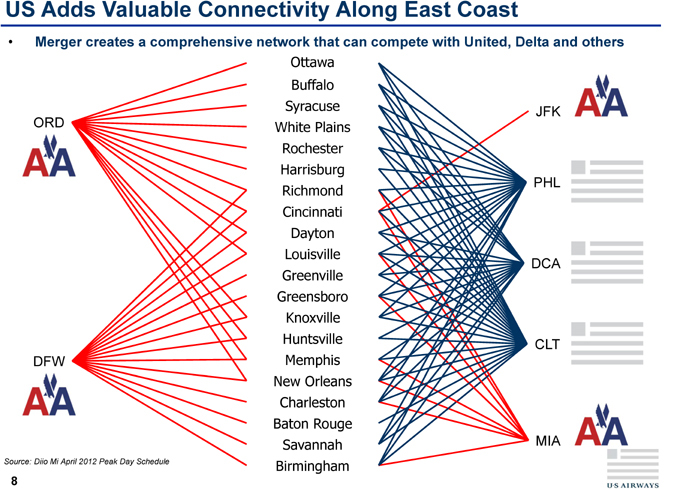

US Adds Valuable Connectivity Along East Coast

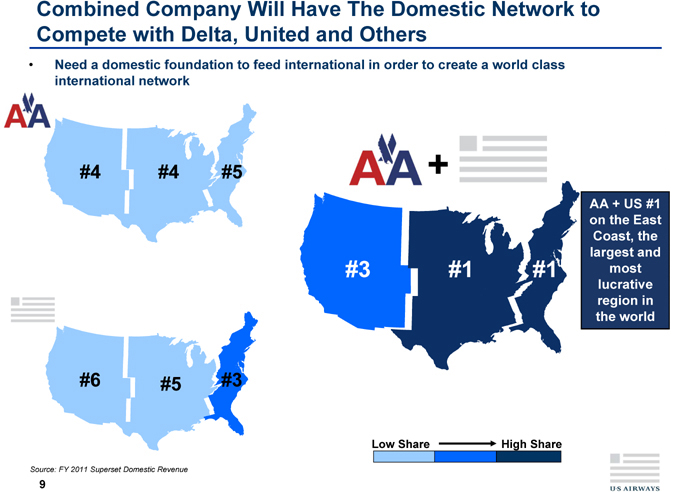

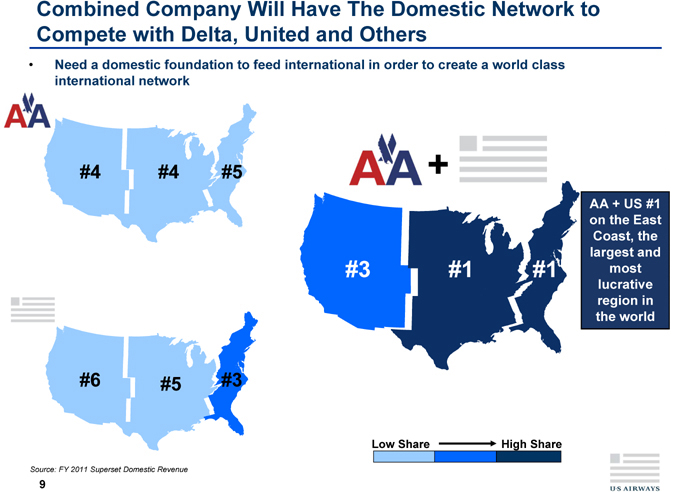

Combined Company Will Have The Domestic Network to Compete with Delta, United and Others

• Need a domestic foundation to feed international in order to create a world class international network

Source: FY 2011 Superset Domestic Revenue

9

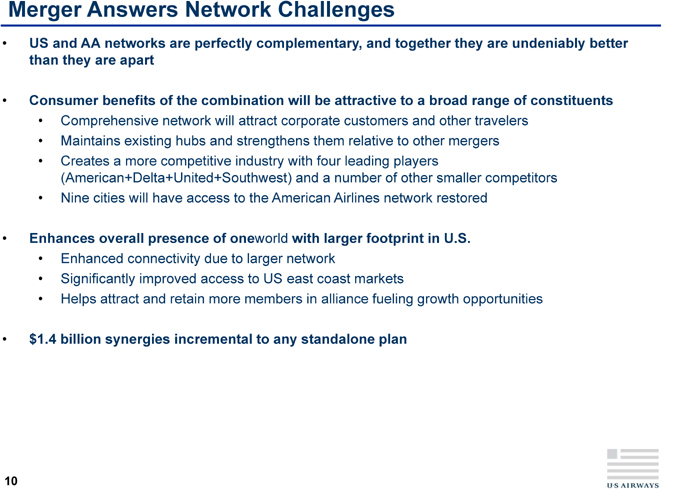

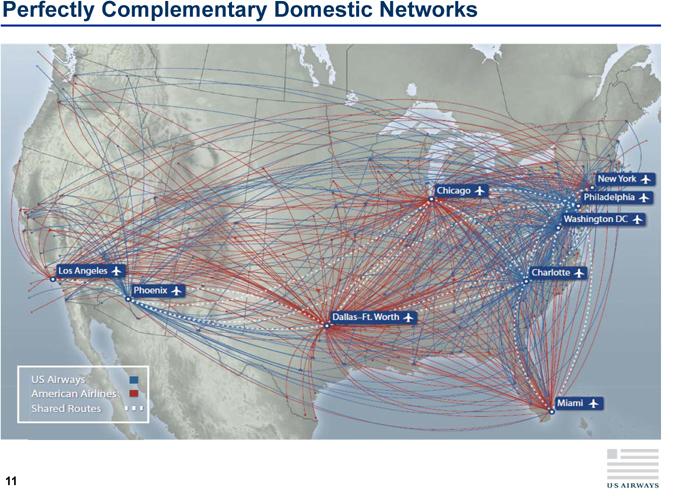

Merger Answers Network Challenges

• US and AA networks are perfectly complementary, and together they are undeniably better

than they are apart

• Consumer benefits of the combination will be attractive to a broad range of constituents

• Comprehensive network will attract corporate customers and other travelers

• Maintains existing hubs and strengthens them relative to other mergers Agreement

• Creates a more competitive industry with four leading players

(American+Delta+United+Southwest) and a number of other smaller competitors

• Nine cities will have access to the American Airlines network restored Disclosure

-

Non

• Enhances overall presence of oneworld with larger footprint in U.S. to

• Enhanced connectivity due to larger network Subject

• Significantly improved access to US east coast markets –

• Helps attract and retain more members in alliance fueling growth opportunities Confidential

• $1.4 billion synergies incremental to any standalone plan

10

Confidential – Subject to Non-Disclosure Agreement

Confidential – Subject to Non-Disclosure Agreement

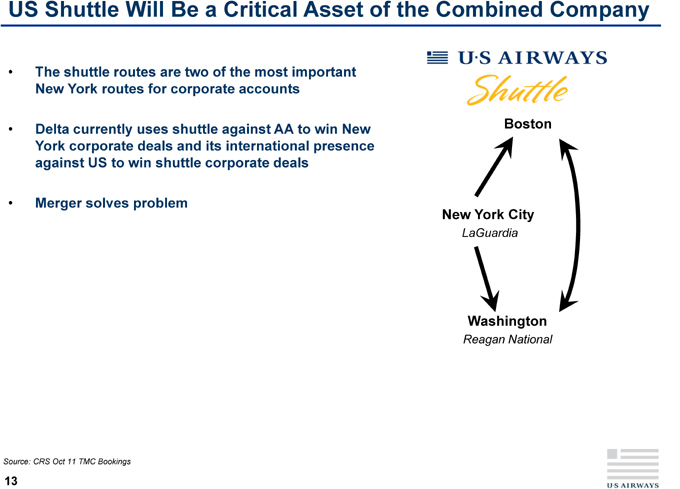

US Shuttle Will Be a Critical Asset of the Combined Company

• The shuttle routes are two of the most important

New York routes for corporate accounts

• Delta currently uses shuttle against AA to win New Boston

York corporate deals and its international presence Agreement

against US to win shuttle corporate deals

• Merger solves problem Disclosure

-

New York City Non

LaGuardia to

Subject

–

Washington Confidential

Reagan National

Source: CRS Oct 11 TMC Bookings

13

Merged Airline Can Compete More Effectively in Chicago

• The combined airline will have a larger local passenger base in Chicago than United

• United will still have a larger overall operation due to its international flying, but with a solid domestic foundation, the combined airline can compete effectively for international business with United in Chicago

Local Chicago Passengers Agreement

Year Ending 1Q 2011 in millions

Disclosure

-

Non

to

Subject

–

Confidential

+

Source: Diio YE 1Q11 O&D Passengers

14

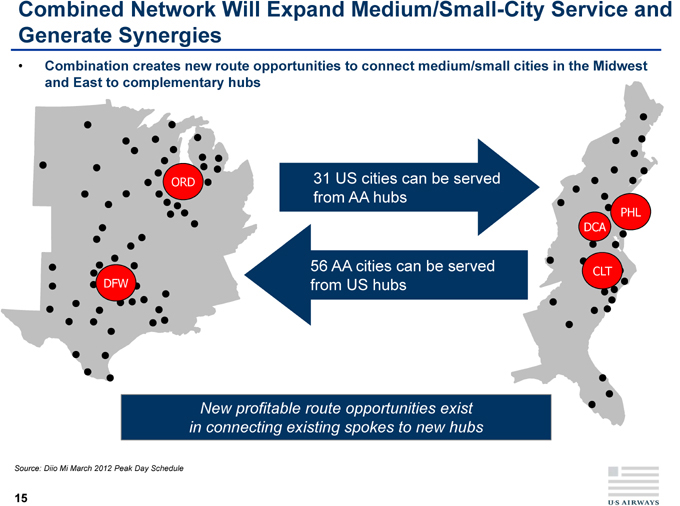

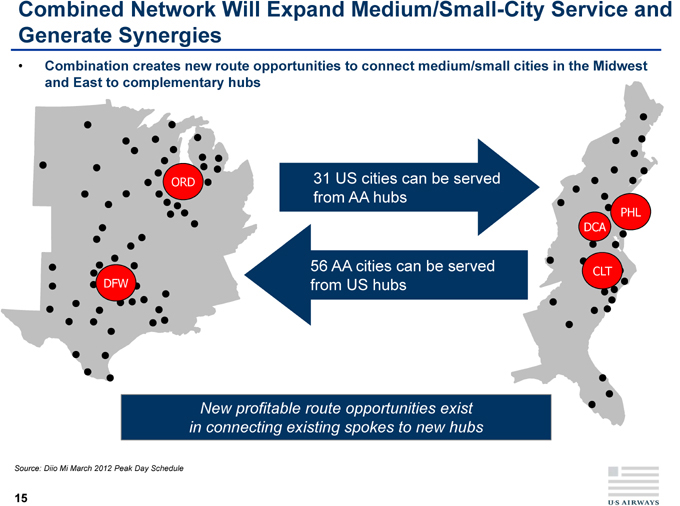

Combined Network Will Expand Medium/Small-City Service and Generate Synergies

• Combination creates new route opportunities to connect medium/small cities in the Midwest and East to complementary hubs

Source: Diio Mi March 2012 Peak Day Schedule

15

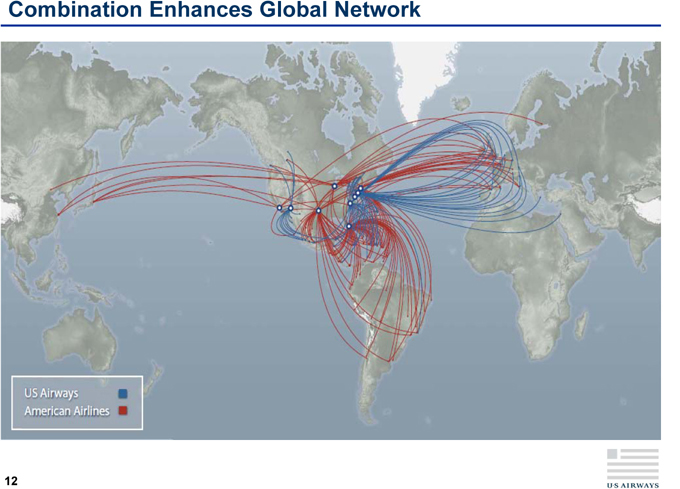

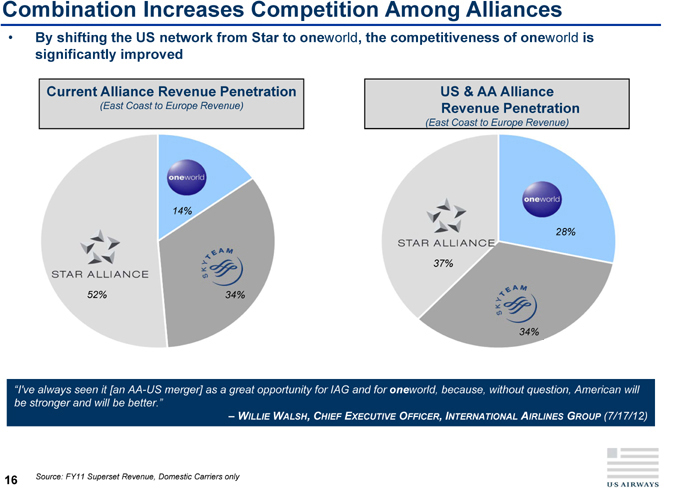

Combination Increases Competition Among Alliances

• By shifting the US network from Star to oneworld, the competitiveness of oneworld is significantly improved

“I’ve always seen it [an AA-US merger] as a great opportunity for IAG and for oneworld, because, without question, American will be stronger and will be better.”

–WILLIE WALSH, CHIEF EXECUTIVE OFFICER, INTERNATIONAL AIRLINES GROUP (7/17/12)

16 Source: FY11 Superset Revenue, Domestic Carriers only

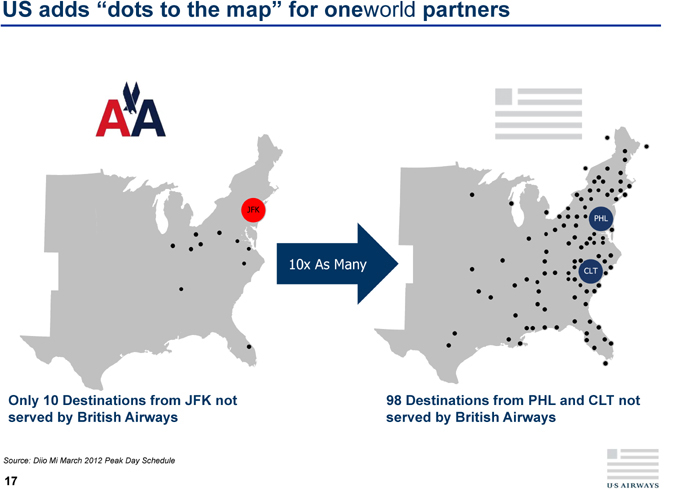

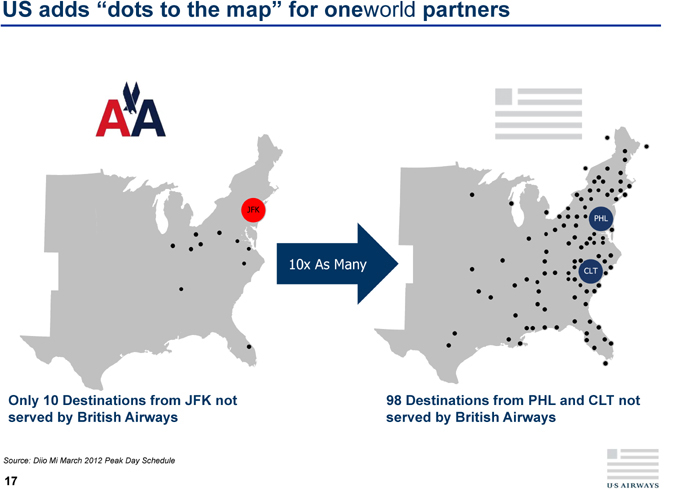

US adds “dots to the map” for oneworld partners

Only 10 Destinations from JFK not

served by British Airways

Source: Diio Mi March 2012 Peak Day Schedule

98 Destinations from PHL and CLT not

served by British Airways

17

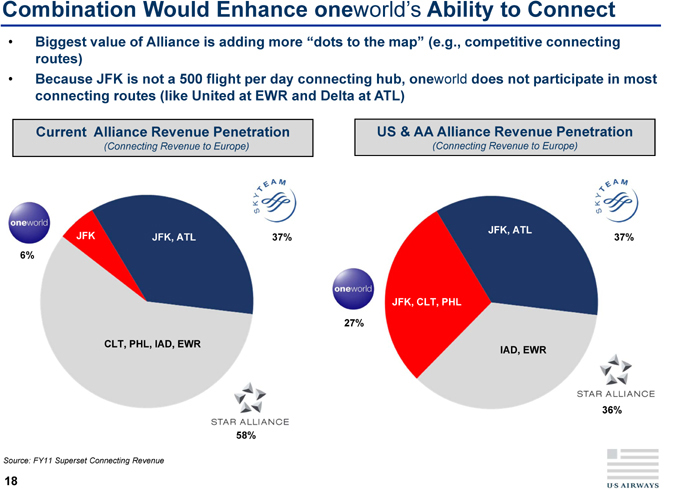

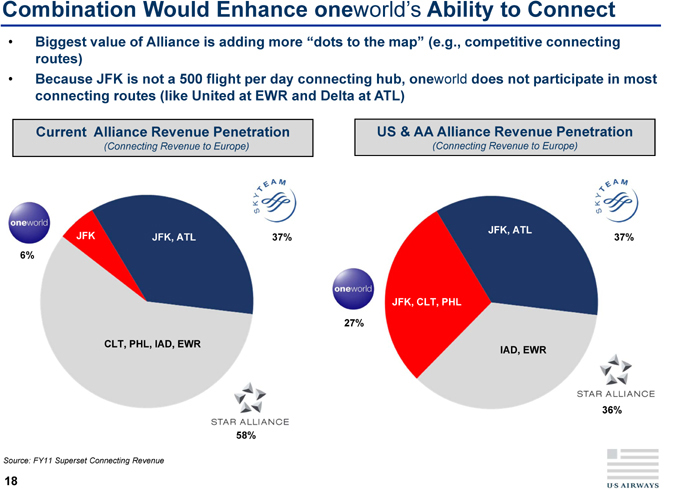

Combination Would Enhance oneworld’s Ability to Connect

• Biggest value of Alliance is adding more “dots to the map” (e.g., competitive connecting routes)

• Because JFK is not a 500 flight per day connecting hub, oneworld does not participate in most connecting routes (like United at EWR and Delta at ATL)

Source: FY11 Superset Connecting Revenue

18

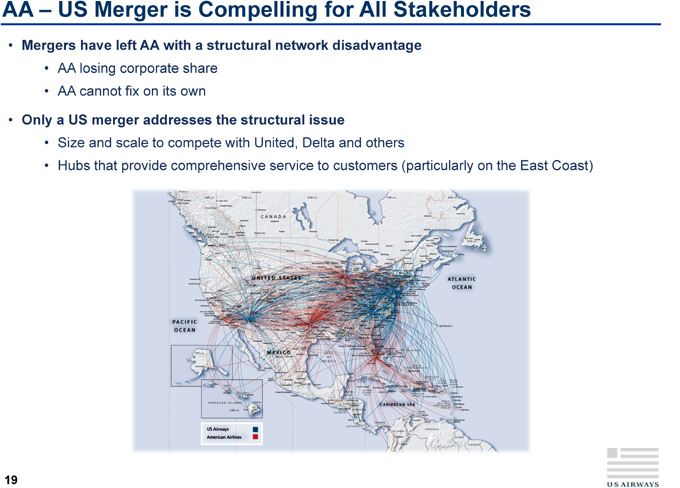

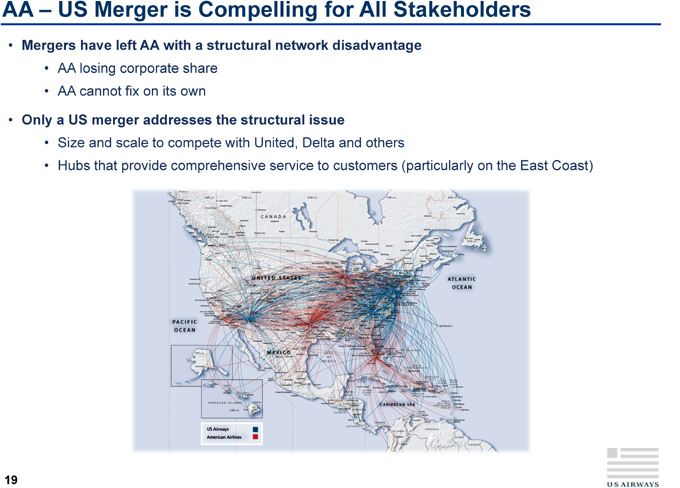

AA – US Merger is Compelling for All Stakeholders

• Mergers have left AA with a structural network disadvantage

• AA losing corporate share

• AA cannot fix on its own

• Only a US merger addresses the structural issue

• Size and scale to compete with United, Delta and others Agreement

• Hubs that provide comprehensive service to customers (particularly on the East Coast)

Disclosure

-

Non

to

Subject

–

Confidential

19

Confidential – Subject to Non-Disclosure Agreement

Synergies and Transition Items

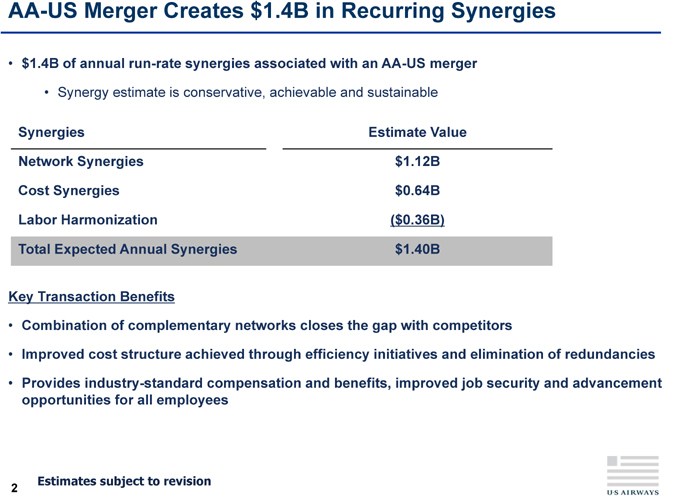

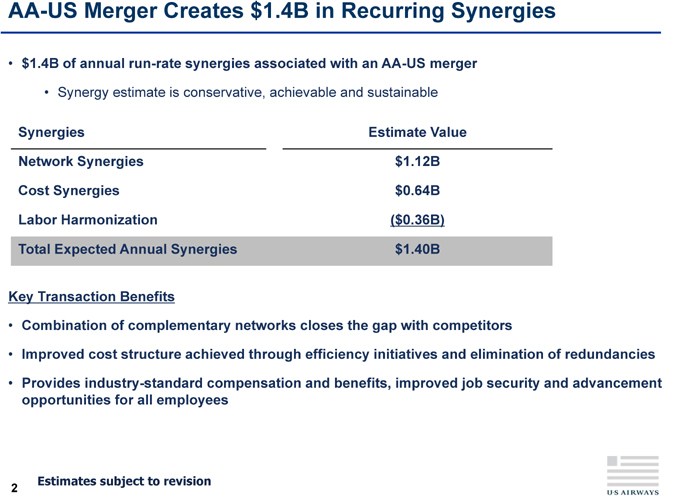

AA-US Merger Creates $1.4B in Recurring Synergies

• $1.4B of annual run-rate synergies associated with an AA-US merger

• Synergy estimate is conservative, achievable and sustainable

Synergies Estimate Value

Network Synergies $ 1.12B Agreement

Cost Synergies $ 0.64B Disclosure

Labor Harmonization ($ 0.36B) -

Non

Total Expected Annual Synergies $ 1.40B to

Subject

–

Key Transaction Benefits

• Combination of complementary networks closes the gap with competitors Confidential

• Improved cost structure achieved through efficiency initiatives and elimination of redundancies

• Provides industry-standard compensation and benefits, improved job security and advancement opportunities for all employees

2 | | Estimates subject to revision |

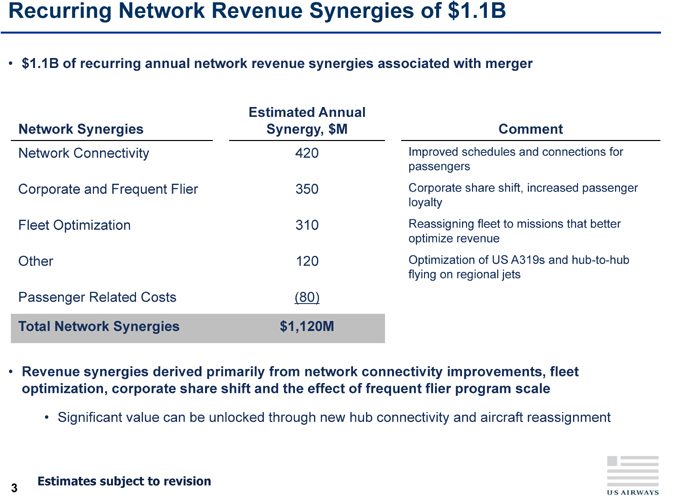

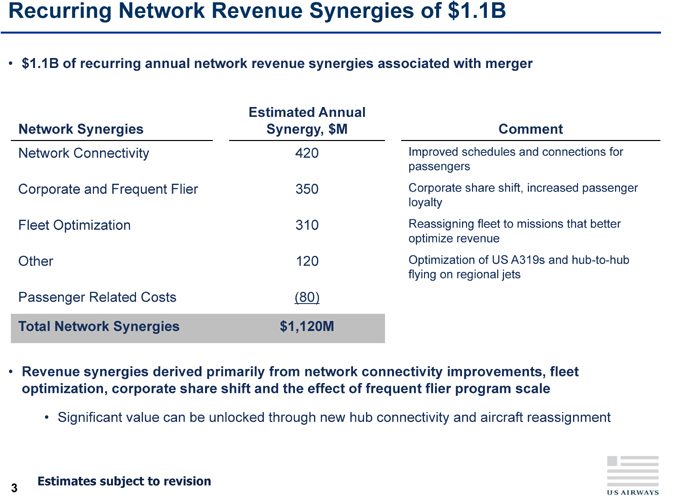

Recurring Network Revenue Synergies of $1.1B

• $1.1B of recurring annual network revenue synergies associated with merger

Estimated Annual

Network Synergies Synergy, $M Comment

Network Connectivity 420 Improved schedules and connections for Agreement

passengers

Corporate and Frequent Flier 350 Corporate share shift, increased passenger

loyalty Disclosure

-

Fleet Optimization 310 Reassigning fleet to missions that better Non

optimize revenue to

Other 120 Optimization of US A319s and hub-to-hub

flying on regional jets Subject

–

Passenger Related Costs (80)

Total Network Synergies $1,120M Confidential

• Revenue synergies derived primarily from network connectivity improvements, fleet optimization, corporate share shift and the effect of frequent flier program scale

• Significant value can be unlocked through new hub connectivity and aircraft reassignment

Estimates subject to revision

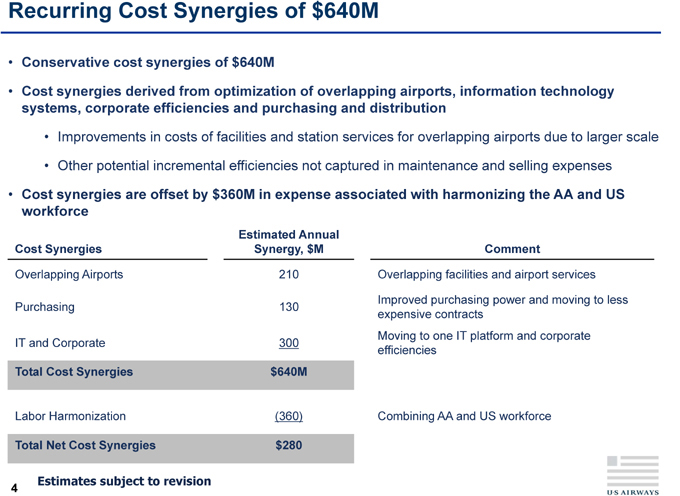

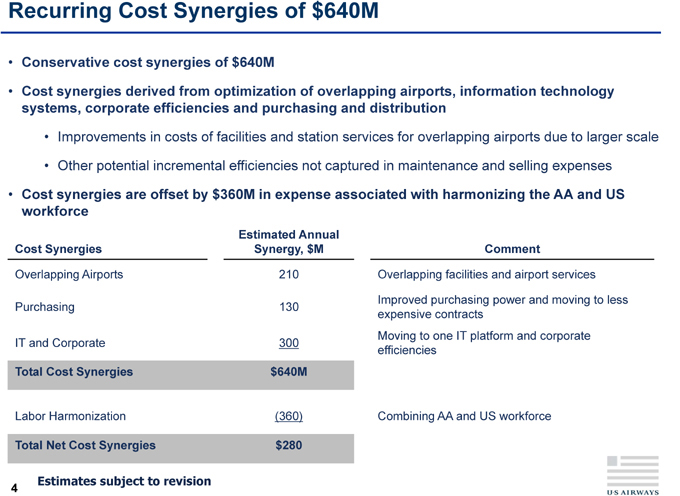

Recurring Cost Synergies of $640M

• Conservative cost synergies of $640M

• Cost synergies derived from optimization of overlapping airports, information technology systems, corporate efficiencies and purchasing and distribution

• Improvements in costs of facilities and station services for overlapping airports due to larger scale Agreement

• Other potential incremental efficiencies not captured in maintenance and selling expenses

• Cost synergies are offset by $360M in expense associated with harmonizing the AA and US Disclosure

workforce

-

Estimated Annual Non

Cost Synergies Synergy, $M Comment to

Overlapping Airports 210 Overlapping facilities and airport services Subject

–

Purchasing 130 Improved purchasing power and moving to less

expensive contracts

IT and Corporate 300 Moving to one IT platform and corporate Confidential

efficiencies

Total Cost Synergies $640M

Labor Harmonization (360) Combining AA and US workforce

Total Net Cost Synergies $280

4 | | Estimates subject to revision |

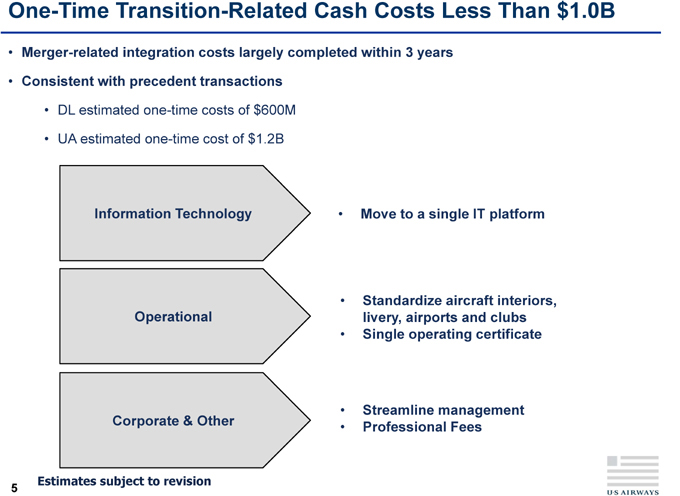

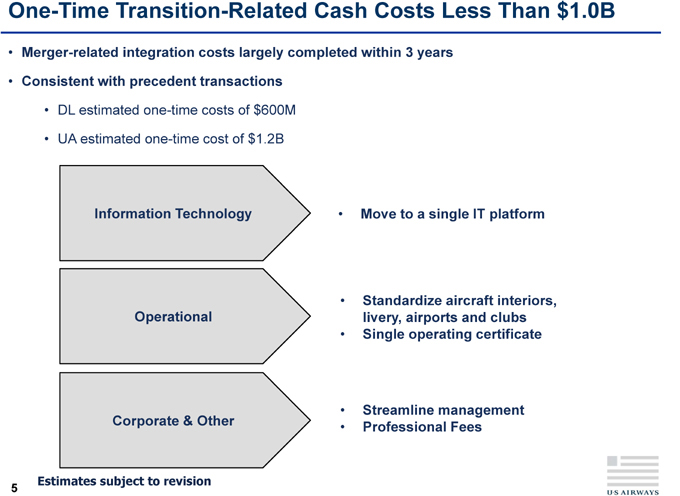

One-Time Transition-Related Cash Costs Less Than $1.0B

• Merger-related integration costs largely completed within 3 years

• Consistent with precedent transactions

• DL estimated one-time costs of $600M

• UA estimated one-time cost of $1.2B Agreement

Disclosure

Information Technology • Move to a single IT platform -

Non

to

Subject

–

• Standardize aircraft interiors,

Operational livery, airports and clubs

• Single operating certificate Confidential

• Streamline management

Corporate & Other • Professional Fees

5 | | Estimates subject to revision |

US Synergy Estimates Are Conservative

• Synergy estimates are conservative relative to targets established in precedent transactions

Estimates subject to revision

Confidential – Subject to Non-Disclosure Agreement

Labor Integration

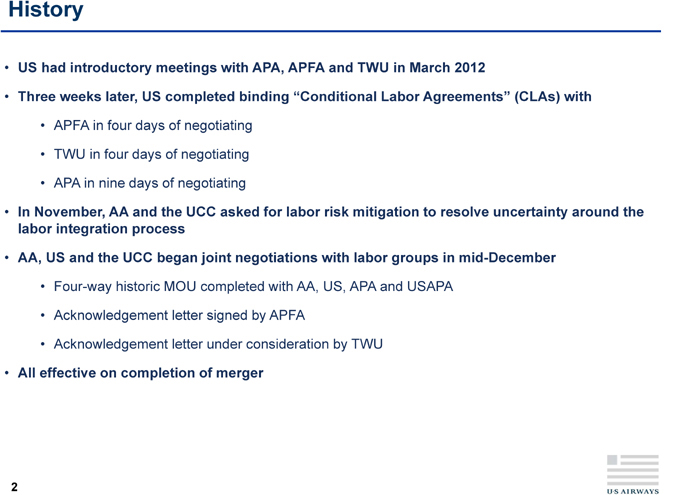

History

• US had introductory meetings with APA, APFA and TWU in March 2012

• Three weeks later, US completed binding “Conditional Labor Agreements” (CLAs) with

• APFA in four days of negotiating

• TWU in four days of negotiating Agreement

• APA in nine days of negotiating Disclosure

• In November, AA and the UCC asked for labor risk mitigation to resolve uncertainty around the -

labor integration process Non

to

• AA, US and the UCC began joint negotiations with labor groups in mid-December Subject

• Four-way historic MOU completed with AA, US, APA and USAPA –

• Acknowledgement letter signed by APFA Confidential

• Acknowledgement letter under consideration by TWU

• All effective on completion of merger

Historic Four-way Pilot MOU

• All US and AA pilots agreed to be bound by existing six-year AA CBA as modified by the US

CLA

• Incremental $87M in value

• Profit Sharing eliminated

• Move to US vacation program Agreement

• On closing of merger, US pilots will Disclosure

• Move to the AA CBA -

Non

• Waive all CIC provisions in their current contract to

• Receive $40M and retro pay at AA rates back to the date of MOU ratification Subject

–

• Transition arrangements protect pilots at US and AA (last approximately three years after

merger close) Confidential

• US aircraft will be flown by US pilots

• AA aircraft will be flown by AA pilots

• New American agrees to a minimum scheduled block floor (approximately 8% below combined

2012)

• Seniority integration will be completed post-merger based on McCaskill-Bond legislation

APFA Acknowledgement Letter

• Clarifies that the “me-too” language is not triggered by merger or four-way pilot deal

• Clarifies that certain pay raises in standalone and CLA are not multiplicative

Confidential – Subject to Non-Disclosure Agreement

TWU Acknowledgement Letter

• Clarifies that the “me-too” language is not triggered by merger or four-way pilot deal (or similar

future deal with flight attendants)

• Moves all TWU workgroups onto the AA CBAs

• Commits the New American to insource approximately 1,000 station jobs that would be

outsourced on a standalone basis Agreement

• Commits TWU to seniority integration based on Date of Hire with US IAM workforce, so long as

IAM is agreeable; otherwise McCaskill-Bond seniority integration will apply Disclosure

-

Non

to

Subject

–

Confidential

Summary

• Vast majority of employees at both US and AA strongly support merger

• Pre-merger agreements with labor are historic in the airline industry

• Six-year deals with all AA labor groups complete

• Creates a new paradigm for management-labor partnership in the airline industry Agreement

Disclosure

-

Non

to

Subject

–

Confidential

Confidential – Subject to Non-Disclosure Agreement

Valuation / Proposal

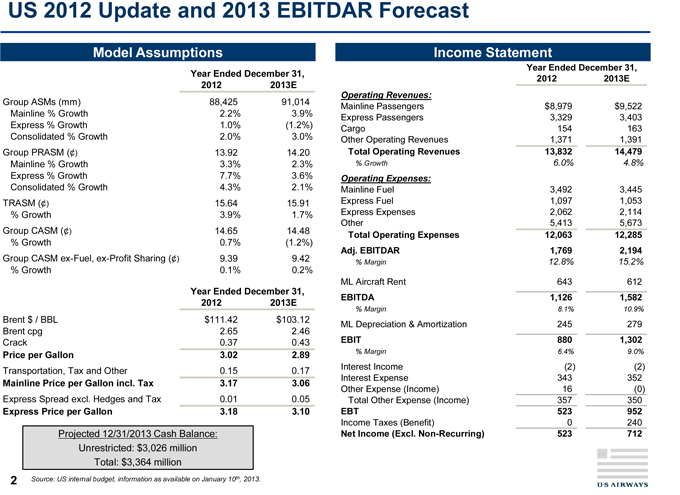

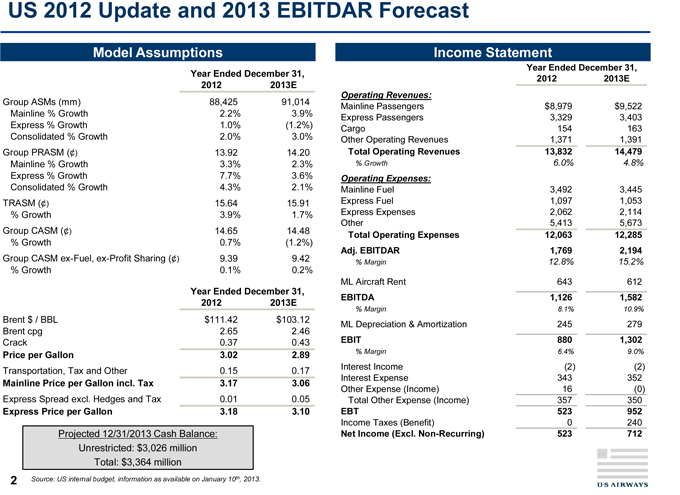

US 2012 Update and 2013 EBITDAR Forecast

Model Assumptions

Year Ended December 31,

2012 2013E

Group ASMs (mm) 88,425 91,014

Mainline % Growth 2.2% 3.9%

Express % Growth 1.0% (1.2%)

Consolidated % Growth 2.0% 3.0%

Group PRASM (¢) 13.92 14.20

Mainline % Growth 3.3% 2.3%

Express % Growth 7.7% 3.6%

Consolidated % Growth 4.3% 2.1%

TRASM (¢) 15.64 15.91

% Growth 3.9% 1.7%

Group CASM (¢) 14.65 14.48

% Growth 0.7% (1.2%)

Group CASM ex-Fuel, ex-Profit Sharing (¢) 9.39 9.42

% Growth 0.1% 0.2%

Year Ended December 31,

2012 2013E

Brent $ / BBL $111.42 $103.12

Brent cpg 2.65 2.46

Crack 0.37 0.43

Price per Gallon 3.02 2.89

Transportation, Tax and Other 0.15 0.17

Mainline Price per Gallon incl. Tax 3.17 3.06

Express Spread excl. Hedges and Tax 0.01 0.05

Express Price per Gallon 3.18 3.10

Source: US internal budget.

Income Statement

Year Ended December 31,

2012 2013E

Operating Revenues:

Mainline Passengers $8,979 $9,522

Express Passengers 3,329 3,403

Cargo 154 163

Other Operating Revenues 1,371 1,391

Total Operating Revenues 13,832 14,479 Agreement

% Growth 6.0% 4.8%

Operating Expenses:

Mainline Fuel 3,492 3,445

Express Fuel 1,097 1,053 Disclosure

Express Expenses 2,062 2,114 -

Other 5,413 5,673 Non

Total Operating Expenses 12,063 12,285 to

Adj. EBITDAR 1,769 2,194

% Margin 12.8% 15.2% Subject

ML Aircraft Rent 643 612 –

EBITDA 1,126 1,582

% Margin 8.1% 10.9%

ML Depreciation & Amortization 245 279 Confidential

EBIT 880 1,302

% Margin 6.4% 9.0%

Interest Income (2) (2)

Interest Expense 343 352

Other Expense (Income) 16 (0)

Total Other Expense (Income) 357 350

EBT 523 952

Income Taxes (Benefit) 0 240

Net Income (Excl. Non-Recurring) 523 712

US 2012 Update and 2013 EBITDAR Forecast Source: US internal budget, information as available on January 10th, 2013. Model Assumptions Income Statement Projected 12/31/2013 Cash Balance: Unrestricted: $3,026 million Total: $3,364 million

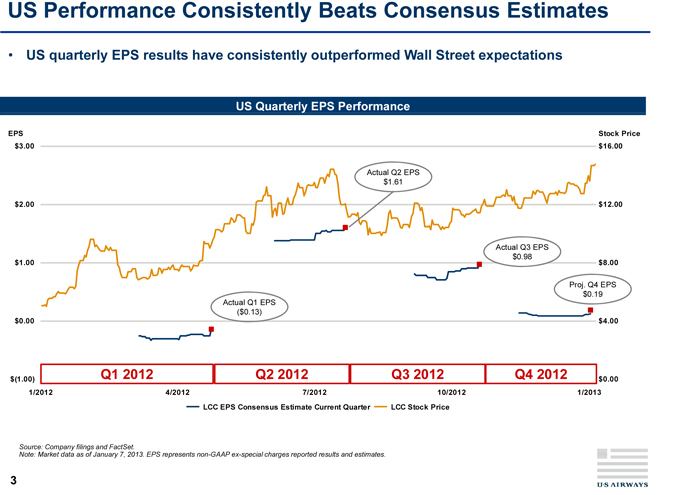

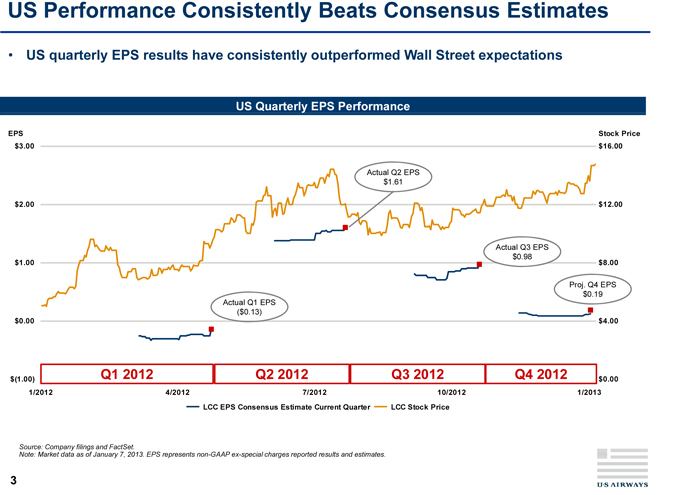

US Performance Consistently Beats Consensus Estimates

US quarterly EPS results have consistently outperformed Wall Street expectations

US Performance Consistently Beats Consensus Estimates Source: Company filings and FactSet. Note: Market data as of January 7, 2013. EPS represents non-GAAP ex-special charges reported results and estimates. US quarterly EPS results have consistently outperformed Wall Street expectations Q1 2012 Q2 2012 Q3 2012 Q4 2012 US Quarterly EPS Performance Actual Q1 EPS ($0.13) Actual Q2 EPS $1.61 Actual Q3 EPS $0.98 Proj. Q4 EPS $0.19

1/2012 4/2012 7/2012 10/2012 1/2013

LCC EPS Consensus Estimate Current Quarter LCC Stock Price

Source: Company filings and FactSet.

Note: Market data as of January 7, 2013. EPS represents non-GAAP ex-special charges reported results and estimates.

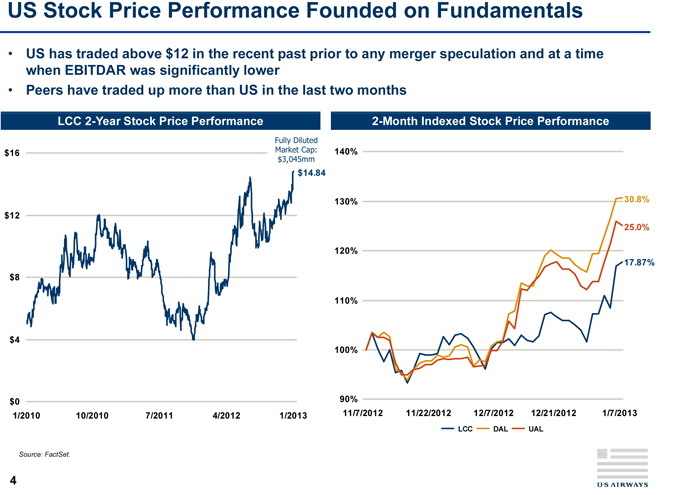

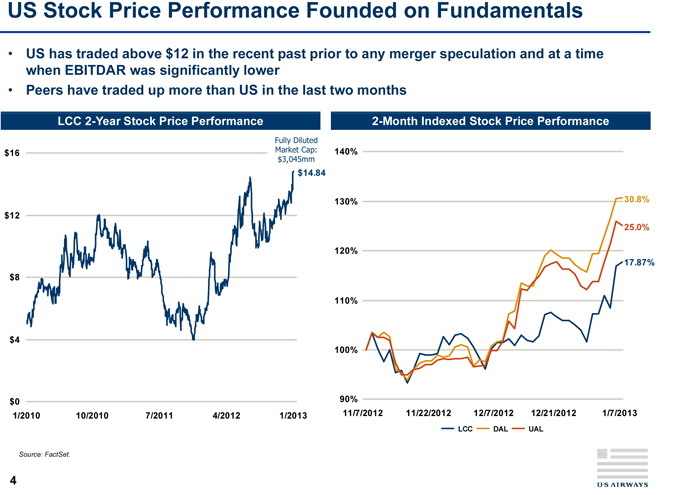

US Stock Price Performance Founded on Fundamentals Source: FactSet. US has traded above $12 in the recent past prior to any merger speculation and at a time when EBITDAR was significantly lower Peers have traded up more than US in the last two months LCC 2-Year Stock Price Performance 2-Month Indexed Stock Price Performance Fully Diluted Market Cap: $3,045mm

US has traded above $12 in the recent past prior to any merger speculation and at a time when EBITDAR was significantly lower

Peers have traded up more than US in the last two months

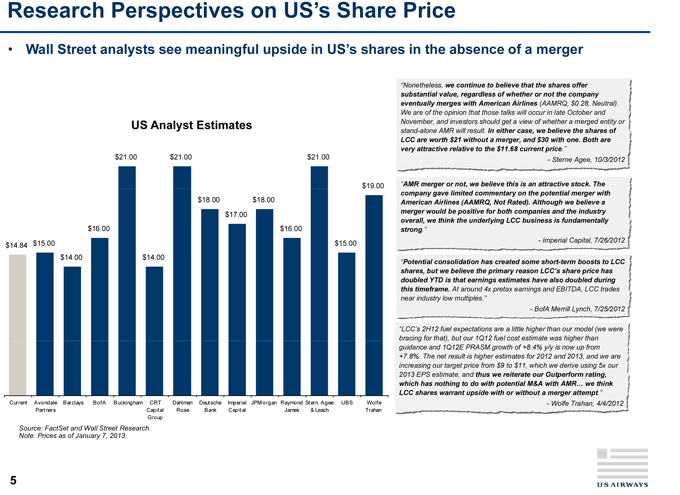

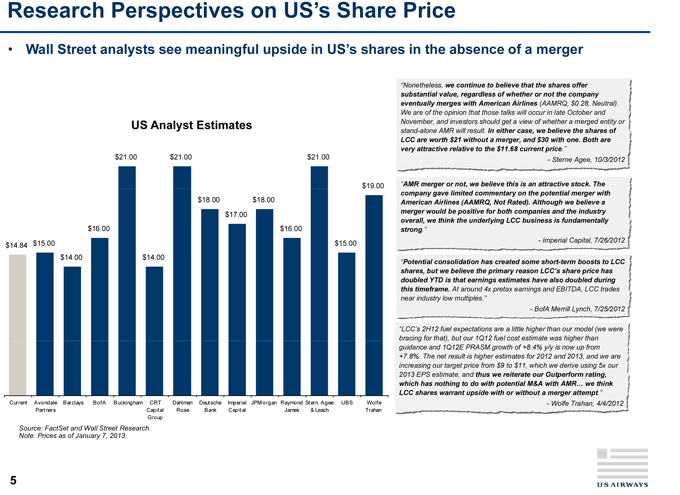

Research Perspectives on US’s Share Price US Analyst Estimates Source: FactSet and Wall Street Research. Note: Prices as of January 7, 2013. “Nonetheless, we continue to believe that the shares offer substantial value, regardless of whether or not the company eventually merges with American Airlines (AAMRQ, $0.28, Neutral). We are of the opinion that those talks will occur in late October and November, and investors should get a view of whether a merged entity or stand-alone AMR will result. In either case, we believe the shares of LCC are worth $21 without a merger, and $30 with one. Both are very attractive relative to the $11.68 current price.” - Sterne Agee, 10/3/2012 “AMR merger or not, we believe this is an attractive stock. The company gave limited commentary on the potential merger with American Airlines (AAMRQ, Not Rated). Although we believe a merger would be positive for both companies and the industry overall, we think the underlying LCC business is fundamentally strong.” - Imperial Capital, 7/26/2012 “Potential consolidation has created some short-term boosts to LCC shares, but we believe the primary reason LCC’s share price has doubled YTD is that earnings estimates have also doubled during this timeframe. At around 4x pretax earnings and EBITDA, LCC trades near industry low multiples.” - BofA Merrill Lynch, 7/25/2012 “LCC’s 2H12 fuel expectations are a little higher than our model (we were bracing for that), but our 1Q12 fuel cost estimate was higher than guidance and 1Q12E PRASM growth of +8.4% y/y is now up from +7.8%. The net result is higher estimates for 2012 and 2013, and we are increasing our target price from $9 to $11, which we derive using 5x our 2013 EPS estimate, and thus we reiterate our Outperform rating, which has nothing to do with potential M&A with AMR... we think LCC shares warrant upside with or without a merger attempt.” - Wolfe Trahan, 4/4/2012 Wall Street analysts see meaningful upside in US’s shares in the absence of a merger Company Price Current 14.84 Avondale Partners 15 Barclays 14 BofA 16 Buckingham 21 CRT Capital Group 14 Dahlman Rose 21 Deutsche Bank 18 Imperial Capital 17 JPMorgan 18 Raymond James 16 Stern, Agee & Leach 21 UBS 15 Wolfe Trahan 19

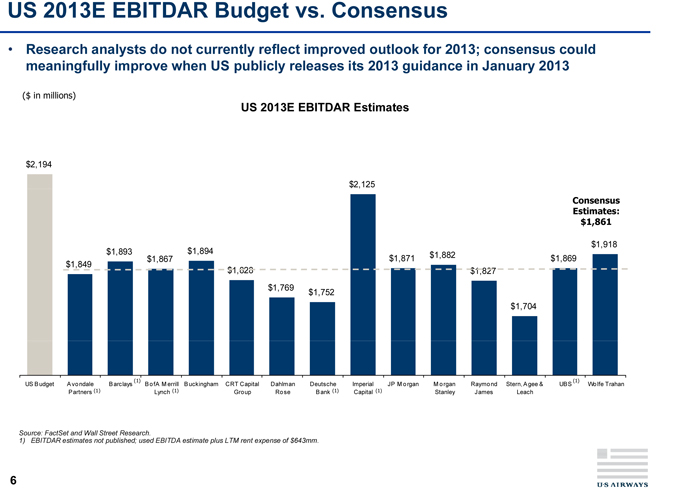

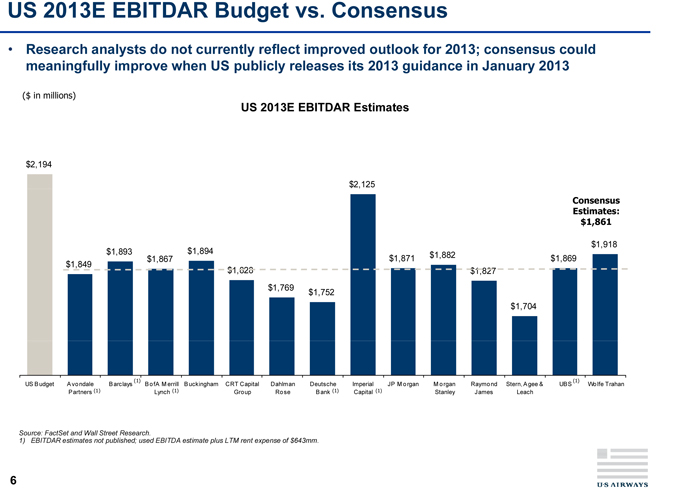

US Budget 2194 Avondale Partners 1849 Barclays 1893 BofA Merrill Lynch 1867 Buckingham 1894.4 CRT Capital Group 1827.6 Dahlman Rose 1769.1 Deutsche Bank 1752.4 Imperial Capital 2125 JP Morgan 1871 Morgan Stanley 1882 Raymond James 1827 Stern, Agee & Leach 1704 UBS 1869 Wolfe Trahan 1918 US 2013E EBITDAR Budget vs. Consensus US 2013E EBITDAR Estimates Source: FactSet and Wall Street Research. 1) EBITDAR estimates not published; used EBITDA estimate plus LTM rent expense of $643mm. Consensus Estimates: $1,861 ($ in millions) Research analysts do not currently reflect improved outlook for 2013; consensus could meaningfully improve when US publicly releases its 2013 guidance in January 2013 (1) (1) (1) (1) (1) (1)

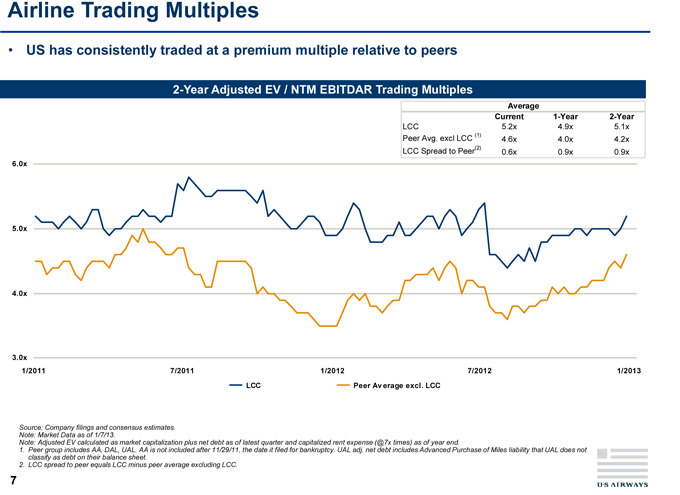

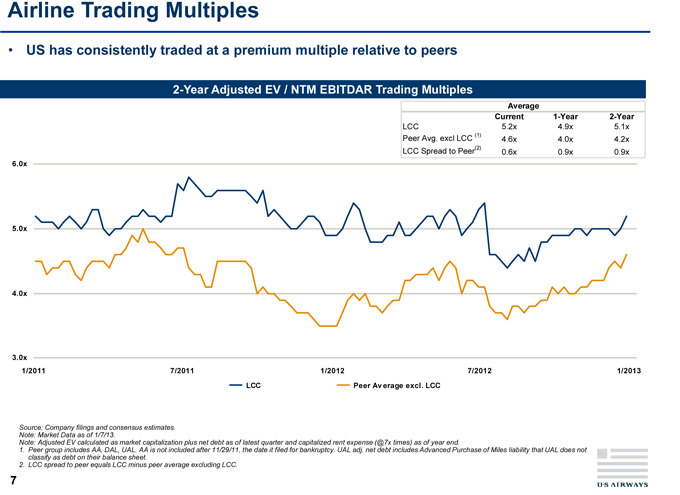

Airline Trading Multiples Source: Company filings and consensus estimates. Note: Market Data as of 1/7/13. Note: Adjusted EV calculated as market capitalization plus net debt as of latest quarter and capitalized rent expense (@7x times) as of year end. Peer group includes AA, DAL, UAL. AA is not included after 11/29/11, the date it filed for bankruptcy. UAL adj. net debt includes Advanced Purchase of Miles liability that UAL does not classify as debt on their balance sheet. LCC spread to peer equals LCC minus peer average excluding LCC. US has consistently traded at a premium multiple relative to peers 2-Year Adjusted EV / NTM EBITDAR Trading Multiples

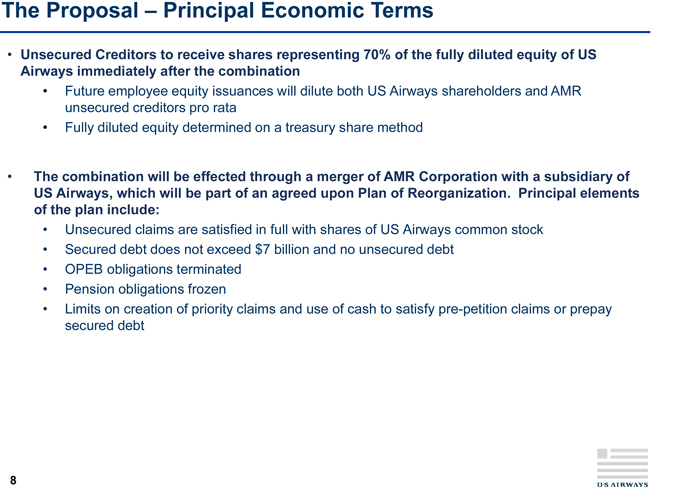

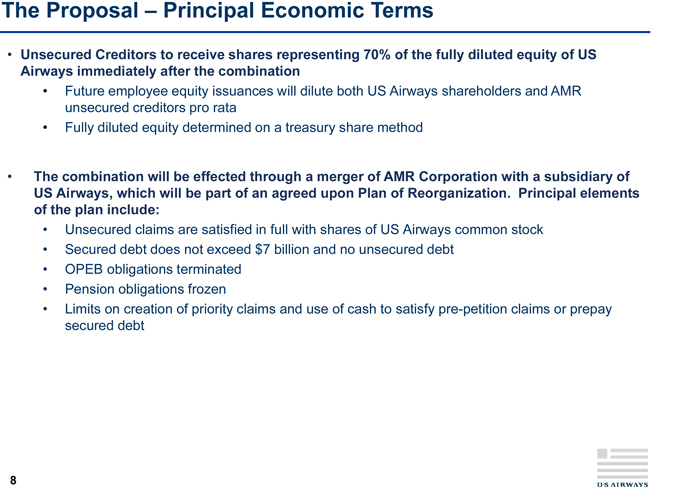

The Proposal – Principal Economic Terms Unsecured Creditors to receive shares representing 70% of the fully diluted equity of US Airways immediately after the combination Future employee equity issuances will dilute both US Airways shareholders and AMR unsecured creditors pro rata Fully diluted equity determined on a treasury share method The combination will be effected through a merger of AMR Corporation with a subsidiary of US Airways, which will be part of an agreed upon Plan of Reorganization. Principal elements of the plan include: Unsecured claims are satisfied in full with shares of US Airways common stock Secured debt does not exceed $7 billion and no unsecured debt OPEB obligations terminated Pension obligations frozen Limits on creation of priority claims and use of cash to satisfy pre-petition claims or prepay secured debt

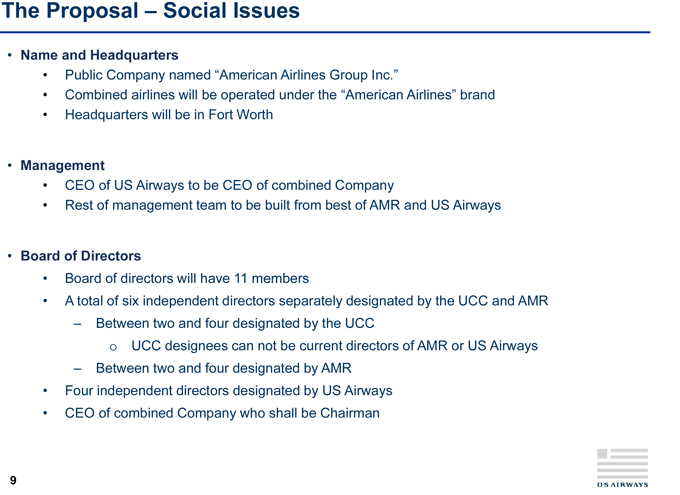

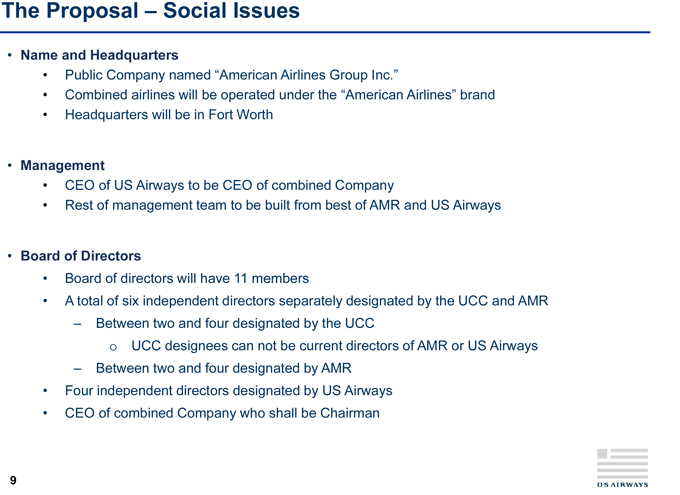

The Proposal – Social Issues Name and Headquarters Public Company named “American Airlines Group Inc.” Combined airlines will be operated under the “American Airlines” brand Headquarters will be in Fort Worth Management CEO of US Airways to be CEO of combined Company Rest of management team to be built from best of AMR and US Airways Board of Directors Board of directors will have 11 members A total of six independent directors separately designated by the UCC and AMR Between two and four designated by the UCC UCC designees can not be current directors of AMR or US Airways Between two and four designated by AMR Four independent directors designated by US Airways CEO of combined Company who shall be Chairman

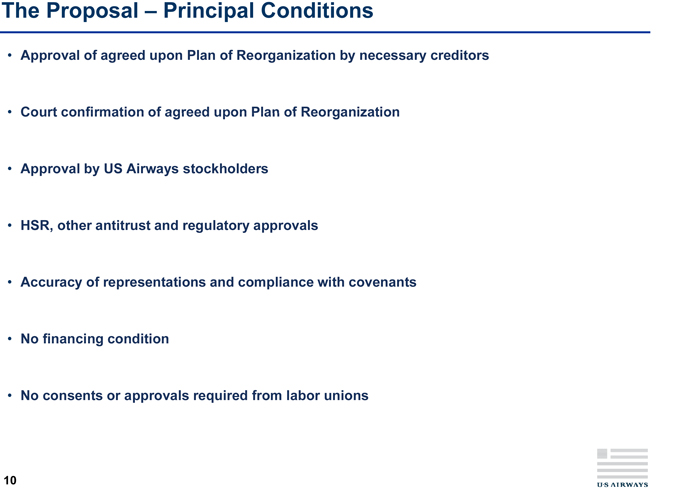

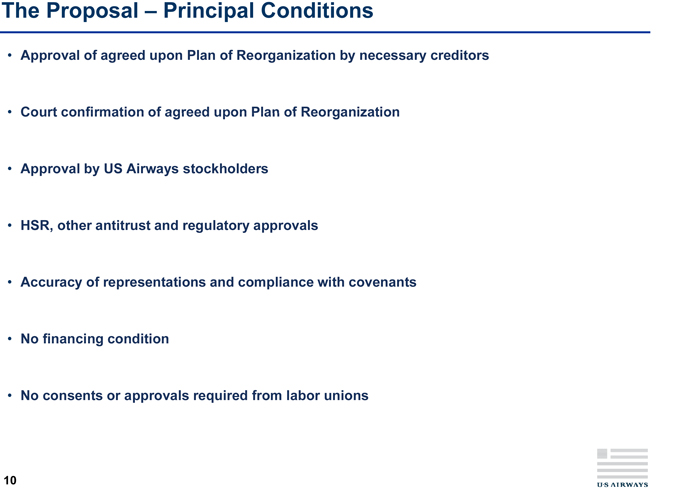

The Proposal – Principal Conditions Approval of agreed upon Plan of Reorganization by necessary creditors Court confirmation of agreed upon Plan of Reorganization Approval by US Airways stockholders HSR, other antitrust and regulatory approvals Accuracy of representations and compliance with covenants No financing condition No consents or approvals required from labor unions

The Proposal Provides value far superior to standalone plan Easily satisfied closing conditions provide a high degree of certainty Management team built by combining the best of both teams to successfully execute the integration and create the world’s best airline

Confidential – Subject to Non-Disclosure Agreement

Based on Public Information

Why Now?

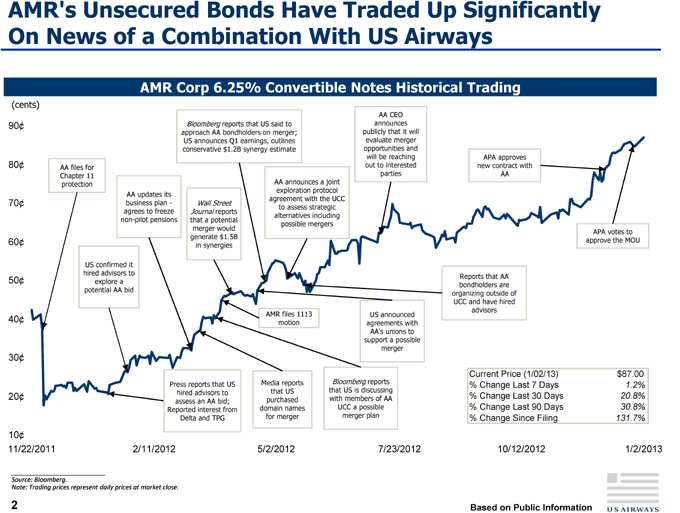

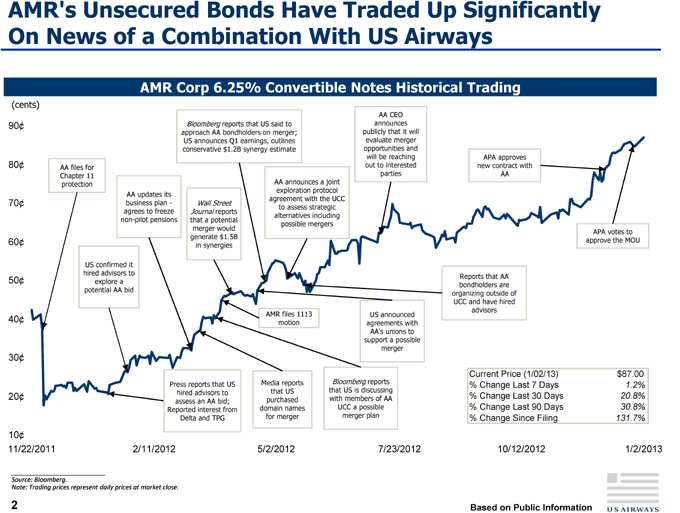

AMR’s Unsecured Bonds Have Traded Up Significantly On News of a Combination With US Airways

AMR Corp 6.25% Convertible Notes Historical Trading

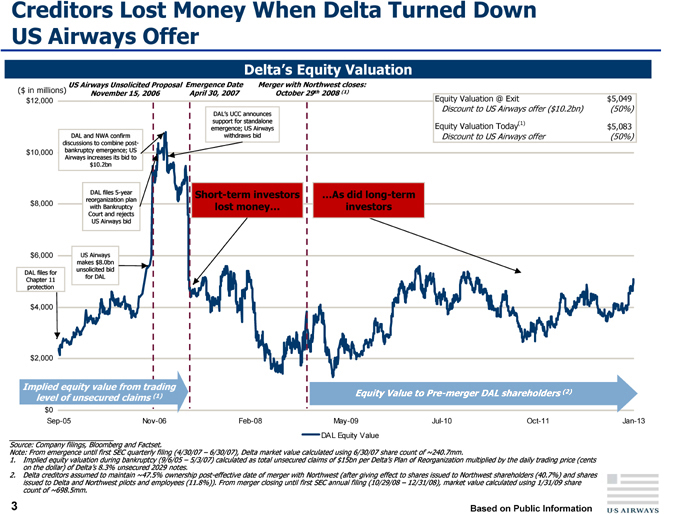

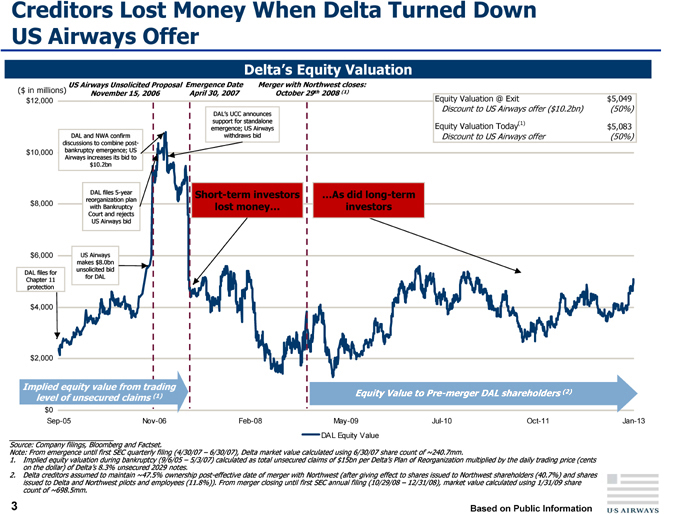

Creditors Lost Money When Delta Turned Down US Airways Offer

1. Implied equity valuation during bankruptcy (9/6/05 – 5/3/07) calculated as total unsecured claims of $15bn per Delta’s Plan of Reorganization multiplied by the daily trading price (cents on the dollar) of Delta’s 8.3% unsecured 2029 notes.

2. Delta creditors assumed to maintain ~47.5% ownership post-effective date of merger with Northwest (after giving effect to shares issued to Northwest shareholders (40.7%) and shares issued to Delta and Northwest pilots and employees (11.8%)). From merger closing until first SEC annual filing (10/29/08 – 12/31/08), market value calculated using 1/31/09 share count of ~698.5mm.

3 | | Based on Public Information |

The US Airways Model

Confidential – Subject to Non-Disclosure Agreement

1 | | Based on Public Information |

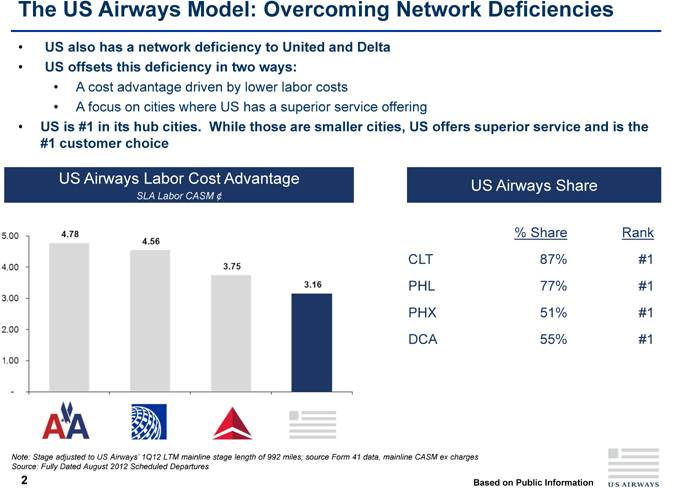

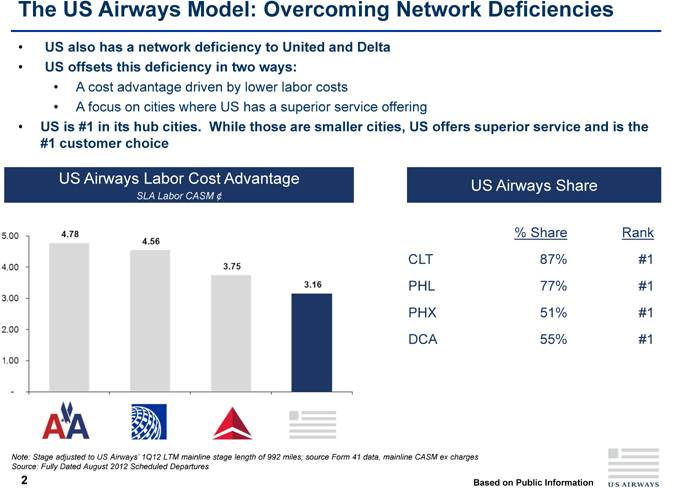

The US Airways Model: Overcoming Network Deficiencies

• US also has a network deficiency to United and Delta

• US offsets this deficiency in two ways:

• A cost advantage driven by lower labor costs

• A focus on cities where US has a superior service offering

• US is #1 in its hub cities. While those are smaller cities, US offers superior service and is the

#1 customer choice Agreement

US Airways Labor Cost Advantage US Airways Share

SLA Labor CASM ¢ Disclosure

-

% Share Rank Non

to

CLT 87% #1 Subject

PHL 77% #1 –

PHX 51% #1 Confidential

DCA 55% #1

Note: Stage adjusted to US Airways’ 1Q12 LTM mainline stage length of 992 miles; source Form 41 data, mainline CASM ex charges Source: Fully Dated August 2012 Scheduled Departures

2 | | Based on Public Information |

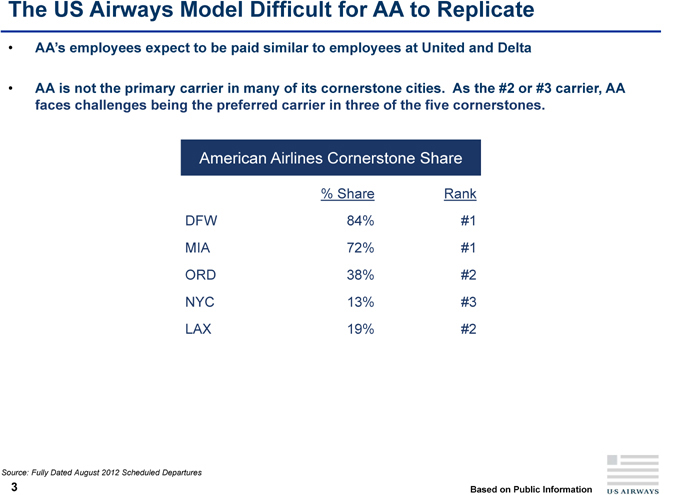

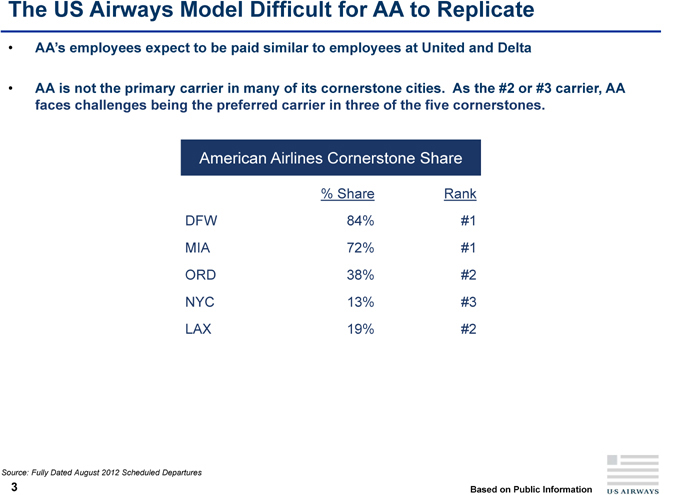

The US Airways Model Difficult for AA to Replicate

• AA’s employees expect to be paid similar to employees at United and Delta

• AA is not the primary carrier in many of its cornerstone cities. As the #2 or #3 carrier, AA faces challenges being the preferred carrier in three of the five cornerstones.

American Airlines Cornerstone Share Agreement

% Share Rank Disclosure

-

DFW 84% #1 Non

MIA 72% #1 to

ORD 38% #2 Subject

–

NYC 13% #3

LAX 19% #2 Confidential

Source: Fully Dated August 2012 Scheduled Departures

Based on Public Information

What People Are Saying

1 | | Based on Public Information |

What People Are Saying – Merger Benefits: Synergies and Timing

“The titan that emerges will be impressive with estimated $39.2 billion in revenue, $4.2 billion in EBITDA, and leverage flat to lower at 3-4x (pro forma as of September 30), roughly in line versus United and Delta (fierce competitors which will not sit idly by while American pulls itself together). Our estimates include $500-750 million of revenue benefits in the first 1-2 years as American optimizes and strengthens its network and competitive strategy. We estimate cost savings approaching $1 billion, mostly from concessions AMR recently achieved in labor negotiations and eliminations of overlapping overhead offset by modestly higher US Airways labor costs. Merger synergies could expand EBITDA margin by 250 basis points to an above average 10.7% versus 8.3% for US Airways (and AMR’s paltry 5.7%).”

– VICKI BRYAN, ANALYST, GIMME CREDIT (1/3/13)

“We think [US Airways] is about to win its aggressive bid to buy bankrupt AMR Corp. The resulting juggernaut would be rivaled only by global leaders United Continental and Delta Air Lines.”

– VICKI BRYAN, ANALYST, GIMME CREDIT (1/3/13)

“The upside of an American-US Airways combination is too good to pass up, and doing it in bankruptcy brings more benefits. In revenue, network, leadership, labor and corporate culture, this is a chance to transform American, not just put a new paint job on the fleet…American would have to increase revenue by roughly 50 percent to catch up to United and Delta. That’s never going to happen as a stand-alone.””

– MITCHELL SCHNURMAN, COLUMNIST, DALLAS MORNING NEWS (12/18/12)

“AMR, frankly, is too small and too unprofitable to ever seriously complete as a standalone. Its labor relations record is appalling and its strategy for reorganization essentially is the same plan pursued over the past decade which landed it in bankruptcy.”

– VICKI BRYAN, ANALYST, GIMME CREDIT (12/12/12)

“We believe [the Allied Pilots Association contract ratification] this helps pave the way to a potential merger between AMR and LCC, as we have been discussing for some time, and would expect a positive market reaction.”

– JAMIE BAKER, ANALYST, JP MORGAN CHASE (12/7/12)

2 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Merger Benefits: Synergies and Timing

“AMR has been dragged kicking and screaming to the table. Yet there it now sits because, as we have speculated, AMR’s stakeholders are becoming universally convinced that a merger presents the best chance today and in the future for the resulting carrier to compete with any reasonable success against Delta and United-Continental as well as global behemoths emerging overseas.”

– VICKI BRYAN, ANALYST, GIMME CREDIT (8/31/12)

“We believe AMR management sees substantial risk in emerging from bankruptcy without a pilot CBA in place. We believe AMR management would have a very hard time pitching its post-bankruptcy equity to the investment community with no certainty on future labor costs, particularly given a network strategy that we view as highly suspect. We also believe many of AMR’s unsecured creditors, many of whom represent future owners of AMR’s future equity, would share the same opinion…So in the aftermath of an APA rejection we believe APA would simply dig in and make minimal progress with AMR on new terms. The more that dragged closer to the 18-month limit on AMR’s exclusivity, the more the UCC would likely squirm, in our opinion, and the more attractive LCC’s offer becomes. LCC’s offer not only contains a more attractive platform of sustainable growth that many analysts view as credible, but it also offers labor certainty.”

– HUNTER KEAY, SENIOR AIRLINE ANALYST, WOLFE TRAHAN &CO. (8/8/12)

“Combining the revenues of American and US Airways would move the merged carriers to the top of the largest airline in the world list. The industry has changed so much because of consolidation that there is no way a small carrier, which American has become, can compete with Delta and United. American will be able to survive as a stand-alone carrier but only for a few years, and then they will be right back where they are now.”

– ROBERT HERBST, ANALYST, AIRLINEFINANCIALS.COM (8/5/12)

3 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Merger Benefits: Synergies and Timing

“In our view, M&A post Ch. 11 is sub-optimal given the difficulty of optimizing IT contracts, fleet orders, credit card agreements and real estate needs. Ultimately, we believe the unsecured creditor’s committee will be forced to have to have a heart to heart conversation with AMR mgmt.”

– DAN MCKENZIE, ANALYST, RODMAN & RENSHAW (7/26/12)

“AMR’s operating performance has not improved in bankruptcy as core operating margins remain under pressure. AMR matched our estimates with its proposed $2 billion in cost savings, mostly from labor, but unless it improves the quality of revenue any cost structure cobbled together now will again most likely become too expensive.”

– VICKI BRYAN, ANALYST, GIMME CREDIT (7/25/12)

“In 2006…Horton returned to American, in part, to lead the way on acquisitions. He studied all the options, including one last summer. The latest reason for stopping short: American concluded that it should complete its own restructuring first. That process is now well under way, so American has opened the door to hear from other bidders—and Horton himself. It’s well past time for him to deliver. Or someone else will.”

– MITCHELL SCHNURMAN, COLUMNIST, FORT WORTH STAR-TELEGRAM (7/14/12)

“[American’s decision to consider a merger] is something we have been pushing for. We firmly believe that the only way our company can grow and compete is through a merger prior to exiting bankruptcy. There is still a great deal of work to do, but between Mr. Horton’s announcement today and our negotiating efforts, I am hopeful that the US Airways team will soon have all the information it needs to explore the possibility of a merger.”

– LAURA GLADING, PRESIDENT, ASSOCIATION OF PROFESSIONAL FLIGHT ATTENDANTS (7/10/12)

“Mr. Horton’s letter [concerning a possible merger] represents an important milestone by acknowledging what we have believed for some time—that consolidation involving American Airlines is essential for all of the airline’s stakeholders…It’s an affirmation that consolidation represents the most promising path for our airline’s future.”

– CAPTAIN DAVE BATES, FORMER PRESIDENT, ALLIED PILOTS ASSOCIATION (7/10/12)

4 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Merger Benefits: Synergies and Timing

“My problem is when American showed me [their standalone] business plan: there is nothing new, except that they are going to bring the more premier passengers back on American. How are they going to do that? You don’t think United is going to try to do that? Other carriers are, so I asked them, ‘what are you going to do differently?’ ‘We’re going to continue doing what we’re doing, because we do it well.’ Bad answer. You can’t continue doing things the way you’re doing. You’ve got to look at things differently. The [US Airways] model that I saw made a tremendous amount of sense and I haven’t seen a downside to this.”

– JIM LITTLE, INTERNATIONAL PRESIDENT, TRANSPORT WORKERS UNION (6/18/12)

“I don’t know anybody who’s looked at it from 30,000 feet that would tell you that they think the standalone scenario is superior. [AMR] has not competed well when it was going from No. 1 to No. 2 now to the third position, and I don’t see how a standalone would solve that, especially with this ‘shrink and then re-grow’ strategy they are doing.”

– ROBERT W. MANN, AIRLINE ANALYST, R.W. MANN & COMPANY (6/07/12)

“AMR’s standalone plan contradicts itself, in our view. Just this afternoon AMR’s restructuring adviser said AMR would consider a merger because management’s fiduciary duty involves “maximizing stakeholder value.” If that’s true then why not explore one now? Is labor not a stakeholder? Even in a post-BK merger with LCC, wouldn’t AMR standalone have to reset wages higher? To us this feels more about self-preservation than maximizing stakeholder value, which an LCC bid would seem to do.”

– HUNTER KEAY, SENIOR AIRLINE ANALYST, WOLFE TRAHAN &CO. (4/25/12)

“If they merge in bankruptcy, they can keep the extra value inside…The airline could invest in the company and in making labor happy.”

– VAUGHN CORDLE, ANALYST, AIRLINEFORECASTS LLC (4/20/12)

5 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Synergy Precedents

“We expect our synergies, pre-tax, to be $400 million in 2013, so still on track there, and we realized $80 million of that in the first half of 2012. We expect our total acquisition and integration costs to be $550 million, so no change in that guidance.”

– TAMMY ROMO, CHIEF FINANCIAL OFFICER, SOUTHWEST AIRLINES CO. (9/6/12)

MERGER OF SOUTHWEST / AIRTRAN, ANNOUNCED 2011

“First and foremost, as we are two years into this merger, is the achievement of $1 billion to $1.2 billion in synergies…I think that the trajectory that we’re on, we fully expect to realize these synergies.”

– JOHN RAINEY, CHIEF FINANCIAL OFFICER, UNITED CONTINENTAL HOLDINGS, INC. (9/5/12) MERGER OF UNITED / CONTINENTAL, ANNOUNCED 2010

“Even though we still don’t have exact numbers on synergies achieved, we are seeing that especially on items as cross-selling the results are bigger than we expected initially.”

– JORGE VILCHES, CHIEF EXECUTIVE OFFICER, LATAM AIRLINES GROUP SA (8/13/12)

MERGER OF LAN / TAM, ANNOUNCED 2011

“In our first year, we achieved net cost and revenue synergies of 74 million euros, some 64 million euros more than target and have already increased our annual synergy target from 2015 onwards from 400 million euros to 500 million euros.”

– WILLIE WALSH, CHIEF EXECUTIVE OFFICER, INTERNATIONAL AIRLINES GROUP (7/17/12) MERGER OF BRITISH AIRWAYS / IBERIA, ANNOUNCED 2010

6 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Alternatives: Why US Airways Is the Best Partner

“I don’t think there’s really any other realistic prospect out there for American.”

– SAVANTHI SYTH, ANALYST, RAYMOND JAMES (8/31/12)

“We understand AMR’s interest in pursuing merger discussions with JetBlue and Alaska. However, industry sources tell us JFK carve-outs under an AMR/JBLU combination would likely kill the deal. As for Alaska, we doubt Delta would permit AMR to walk away with it without overpaying.”

– DAN MCKENZIE, ANALYST, RODMAN & RENSHAW (7/26/12)

“There’s no way that the DOJ and the DOT are going to let Delta or United in any way, shape or form to get any part of American Airlines.”

– ROBERT HERBST, ANALYST, AIRLINEFINANCIALS.COM (7/12/12)

“We absolutely would not consider [a merger]. We are about organic growth. Let them merge—let them try to integrate cultures and their operations. We’ll just keep taking a new airplane and adding our own JetBlue experience.”

– DAVE BARGER, CHIEF EXECUTIVE OFFICER, JETBLUE AIRLINES (4/23/12)

“In order to get the best resolution for everybody, all options should be on the table.”

– JOSH GOTBAUM, PRESIDENT, PENSION BENEFIT GUARANTY CORPORATION (4/20/12)

7 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – U.S. Airways Management

“A merger with US Air offers two for one: a new management team to go along with a bigger network. American needs both. Bad blood between labor and management goes back for decades… Horton supporters say this is simply an emotional response to tough times. Fact is, that’s reason enough to make a move. Here’s another: US Air’s Doug Parker and his team look like an upgrade, not just a dose of fresh air.”

– MITCHELL SCHNURMAN, COLUMNIST, DALLAS MORNING NEWS (12/18/12)

“AMR’s existing plan is essentially the same failed strategy that drove the company to failure over the past decade. We remain convinced that the best solution for AMR is to be run by someone else, and the best candidate in our view still is US Airways.”

– VICKI BRYAN, ANALYST, GIMME CREDIT (12/7/12)

“…management has been able to take this system and make it into one of the more profitable legacy airline operations through sheer skill and determination.”

– RAY NEIDL, ANALYST, MAXIM GROUP (10/24/12)

“[US Airways] has done a terrific job managing its airline for profits (and financial stability), an accomplishment when considering that US Airways starts from a revenue deficit vs the industry given its relatively weaker hub structure.”

– DAN MCKENZIE, ANALYST, THE BUCKINGHAM RESEARCH GROUP (10/23/12)

“The current management team at US Airways came from the much smaller America West that took over US Airways while it was in bankruptcy. Within six months, the management team had turned US Airways from a consistent money-loser to one of the highest margin legacy carriers, despite its hub operations being in Charlotte and Philadelphia. Since 2010, US Airways has outperformed American’s operating margins by an average of 450bp. We believe the US Airways management team could do the same at American.”

– BOB MCADOO, ANALYST, IMPERIAL CAPITAL (8/29/12)

8 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – U.S. Airways Management

“As has been written extensively in the press, most agree that an LCC takeover of AMR would likely lead to a stronger and more successful competitor. The entity could leverage LCC’s broad Eastern U.S. presence to enhance AMR’s and LCC’s Trans-Atlantic operations. LCC’s management team has already demonstrated the ability to execute a successful merger followed by a turnaround…Public pronouncements by AMR’s CEO Tom Horton point to a strong desire to retain control. However, bankruptcy alone will not solve AMR’s revenue problems, in our view. We believe Mr. Horton is well aware that an AMR/LCC combination solves many of both companies’ strategic issues.”

– BOB MCADOO, ANALYST, IMPERIAL CAPITAL (8/16/12)

“What history proves in this industry is jogging in place normally results in road kill. I think Doug recognizes that very well.”

– JEFF KAUFFMAN, ANALYST, STERNE AGEE & LEACH (8/8/12)

“[Doug Parker has] played a difficult hand pretty well. He started with America West, which was a small low-cost carrier without a great future, and combined that with US Airways, which was headed for liquidation. Over time, he’s built that into a pretty profitable carrier.”

– PHILIP BAGGALEY, ANALYST, STANDARD & POORS (8/8/12)

“History may prove [Doug Parker], in fact, was probably the single most important agent of change in this industry post-deregulation.”

– HUNTER KEAY, SENIOR AIRLINE ANALYST, WOLFE TRAHAN &CO. (8/6/12)

“[US Airways] has the smallest and weakest system of the remaining four hub and spoke U.S. carriers. Still, management has been able to take this system and make it into one of the more profitable legacy airline operations through sheer skill and determination. Due to the size, we believe that the basic franchise has less flexibility in an economic downturn, which poses a greater challenge to management. However, this management team has been able to take this smaller franchise and navigate it through previous crisis situations. Even though it has some constraints with reducing capacity in an economic downturn and with potential cost increases from open labor contracts, we believe that management can successfully navigate these challenges.”

– RAY NEIDL, ANALYST, THE MAXIM GROUP (7/26/12)

9 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – U.S. Airways Management

“Parker…was a central figure—arguably the central figure—in the consolidation that helped restructure he U.S. airline industry. But he’s not done.”

– “PARKER’S PITCH, HORTON’S STALL,” AIRLINE WEEKLY (7/23/12)

“You have to give credit to Doug because he’s got it on the agenda…Six months ago, l don’t think anyone thought that was a possibility. Tom last week saying they are looking at consolidation opportunities demonstrates that Doug has been very effective.”

– WILLIE WALSH, CHIEF EXECUTIVE OFFICER, INTERNATIONAL AIRLINES GROUP (7/17/12)

“[Doug Parker] brings a charismatic personality to the public…He is more like ‘one of us’ as opposed to ‘one of them’ when he does this. It puts him on a level playing field with the employees. I don’t always like what he has to say…but I can see that he’s trying to build a successful business model.”

– ROGER HOLMIN, PRESIDENT, ASSOCIATION OF FLIGHT ATTENDANTS – US AIRWAYS CHAPTER (7/17/12)

“Although we agree that a merger makes operating sense, we continue to view US Airways as one of the better managed airlines with strong earnings potential regardless of a merger outcome.”

– BOB MCADOO, ANALYST, IMPERIAL CAPITAL (7/5/12)

“[Doug Parker is] kind of the wunderkind of the airline industry.”

– HERB KELLEHER, FORMER PRESIDENT, SOUTHWEST AIRLINES (6/21/12)

“[Doug Parker] really wants to go for the long haul, to run an airline. I don’t think he’s interested in running AT&T, if a better offer comes along, and I think his priority is to make US Airways a better, stronger airline.”

– ROBERT HERBST, ANALYST, AIRLINEFINANCIALS.COM (6/16/12)

10 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – U.S. Airways Management

“[Doug Parker] was willing to forward his position even when he was the only one in the room that felt that way. He is a venturesome visionary and he flavors that with pragmatism.”

– HERB KELLEHER, FORMER PRESIDENT, SOUTHWEST AIRLINES (6/16/12)

“A combined LCC/AMR, managed by the current LCC leadership, would be a stronger entity than would a standalone AMR, in our opinion. The added benefits of a merged entity would come from adding LCC’s substantial Eastern U.S. market presence and LCC’s existing Trans-Atlantic operation to AMR’s operation.”

– BOB MCADOO, ANALYST, IMPERIAL CAPITAL (5/29/12)

“We have to pause…to give credit where credit is due [for US Airways’ agreements with AMR labor]. Certainly to Doug Parker, Scott Kirby and the US Airways team for learning from the past and for stepping up to the plate. (What was it [former APA President] Captain Bates said about this team – I think he called them ‘lean and entrepreneurial’).”

– HOLLY HEGEMAN, EDITOR, PLANEBUSINESS (4/24/12)

“Some have worried that a combined US Airways/American would look like US Airways. It won’t. It will be American but better-run. The airline will remain American Airlines and will be headquartered right where it is today. There will just be a better team in place to run a better network.”

– BRETT SNYDER, EDITOR, CRANKY FLIER (4/23/12)

“Working with US Airways, APA was able to achieve in just over a week far more than we had been able to achieve in more than five years of trying to bargain with AMR management. Our interaction with US Airways was in stark contrast to what we have been experiencing with AMR. We dealt directly with the people whose jobs are to run an airline. Many of the talks consisted of president-to-president interaction. In accordance with the APA Constitution and Bylaws, there were always two members of the APA Negotiating Committee present during these negotiations. Completely absent from the discussion were the posturing and game-playing that characterizes the approach AMR management takes when dealing with us.”

– CAPTAIN DAVE BATES, FORMER PRESIDENT, ALLIED PILOTS ASSOCIATION (4/20/12)

11 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – U.S. Airways Management

“US Airways has a very strong management team that has kept that airline profitable and run a top-notch on-time operation for the past several years. American’s management has struggled—the bottom of the industry in financial losses and often in late and canceled flights as well.”

– SCOTT MCCARTNEY, COLUMNIST, “THE MIDDLE SEAT TERMINAL,” WALL STREET JOURNAL (4/20/12)

“I absolutely believe if anyone in the industry could do [a merger], it is Doug Parker.”

– VAUGHN CORDLE, ANALYST, AIRLINEFORECASTS LLC (4/20/12)

12 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Value

“Fundamentals are tracking ahead of expectations, which in turn justifies incremental upside to the carrier’s standalone valuation.”

– DAN MCKENZIE, ANALYST, THE BUCKINGHAM RESEARCH GROUP (10/25/12)

“The US Airways investment case will change dramatically if it is successful in merging with American. Although our current estimates do not reflect a merger, we believe there is a 75% probability of a merger going through either in or beyond bankruptcy, and that such a move would be positive for both carriers and the industry. Moreover, if the merger were to take place, LCC would likely move above our target price – possibly to between $17 and $22 (based on 5-6x rudimentary post-synergy combined EBITDAR estimate).”

– SAVANTHI SYTH, ANALYST, RAYMOND JAMES (10/25/12)

“Even without a merger we see upside for shares of LCC, which trade at just 3.5x our 2014 EPS est. and we firmly reject the premise that shares trade at a merger-related premium.”

– HUNTER KEAY, SENIOR AIRLINE ANALYST, WOLFE TRAHAN &CO. (10/24/12)

“LCC is performing nicely in a less than ideal economic climate with fuel prices well above $3/gal. Whether stand alone or with AMR, we see upside to LCC shares – though the latter is our preference.”

– KEVIN CRISSEY, ANALYST, UBS (10/24/12)

“We believe an AMR/LCC combination will be announced in the coming months. However, as a fallback assumption, we believe a standalone LCC does not deserve to trade at such a steep discount. LCC’s reported 3Q12 net income of $197mn is almost twice as much as Southwest’s $97mn during the same period.”

– BOB MCADOO, ANALYST, IMPERIAL CAPITAL (10/24/12)

13 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Value

“Our 12-month price target for LCC shares is $18, which represents 49% upside potential from last close of $12.09… our valuation methodology does not give the company credit for a potential merger with AMR (which we believe could be worth to an additional $5-7 of upside per share).”

– MICHAEL LINENBERG, MANAGING DIRECTOR, DEUTSCHE BANK SECURITIES (10/24/12)

“We believe the vast majority of creditors that have a long term interest in post-BK AMR and a functioning knowledge of the history of the U.S. airline industry (e.g. holders of current claims that will turn into AMR equity) will view the clear and present pitfalls associated with 20% growth over a five year period in a mature industry from an already oversaturated U.S. market. We believe a merger between AMR and LCC has more value creation potential, in large part due to the avoidance of the current standalone proposal, so therefore, we think it happens.”

– HUNTER KEAY, SENIOR AIRLINE ANALYST, WOLFE TRAHAN &CO. (8/6/12)

“If the nondisclosure agreement process with AMR is fair & transparent, we expect LCC to make a formal offer to merge with AMR. If it’s not and the unsecured creditor’s committee is unwilling to break AMR’s window of exclusivity, US Airways would have nothing to lose by going hostile (the key is labor which is already aboard). Either way, we believe bondholders will have the opportunity to explore a recovery that is probably too good to pass up.”

– DAN MCKENZIE, ANALYST, RODMAN & RENSHAW (7/26/12)

“AMR’s major unions have all jumped the fence to back the merger with US Airways. The unions may not believe in miracles but they do believe they will have a better future with a larger, financially stronger airline that is decidedly not run by Mr. Horton and his team. We agree, and we suspect the unsecured creditors agree as well. Recall that there are no assets available to back AMR’s unsecured debt—all its assets are backing secured debt and even some of that is impaired. This means unsecured creditors also will stand the best chance of value recovery if a stronger, more profitable airline can emerge from bankruptcy. That certainly doesn’t describe the AMR status quo. Finally, it will be AMR’s unsecured creditors, its unions, and ultimately the bankruptcy court that will make the decision about AMR’s fate—not Mr. Tom Horton.”

– VICKI BRYAN, ANALYST, GIMME CREDIT (7/25/12)

14 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Value

“We estimate that AMR bondholders with impaired claims face a 21% downside if AMR doesn’t merge with US Airways and a 41% upside if a merger occurs based on current trading levels; AMR shareholders get wiped out regardless; and US Airways shareholders have 30% downside with no deal and 59% upside if a deal occurs and the entity achieves all of our projected synergies.”

– BASILI ALUKOS, EQUITY ANALYST, MORNINGSTAR (6/7/12)

15 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Labor

“US Airways has done a remarkable job winning over AMR’s beleaguered employees, a feat accomplished in a matter of months that AMR couldn’t manage in a decade.”

– VICKI BRYAN, ANALYST, GIMME CREDIT (1/3/13)

“The APA leadership continues to support a merger with US Airways as the best path to a stronger, more competitive American Airlines that may in turn enhance its pilots’ long-term career prospects. In a recent filing a large number of unsecured creditors not on the unsecured creditors committee expressed the desire to change the AMR Board and management so there could be great pressure here for change, which we believe would lead to a merger.”

– RAY NEIDL, ANALYST, THE MAXIM GROUP (12/7/12)

“Investors have inquired whether the tentative agreement between AMR and its pilots represents “labor détente”, thereby diminishing the prospects for consolidation. We believe the opposite is true. A stand-alone plan inclusive of a pilot contract is a must-have for AMR’s unsecured creditors committee, in our view, so that it may be compared to the merits of a merger. Quite frankly, two plans are expected to come under consideration, and the lack of a completed stand-alone plan threatened to weigh down the process. With that impediment seemingly cleared (though still subject to ratification), creditors are more likely to receive competing plans by year-end or early next.”

– JAMIE BAKER, ANALYST, JP MORGAN CHASE (11/13/12)

“More importantly, if creditors pass up the merger today, they pass up on labor certainty. Six-year expedited labor contracts are in place if the merger happens before AMR exits bankruptcy thanks to arbitration backstop agreements—a source of rare competitive advantage. …However, if AMR exits as a standalone airline and then decides to merge with US Airways after the fact, AMR management and labor go back to the negotiating table and start from scratch, which likely entails years of delay, which means creditors would likely be years away from labor peace, and thus potentially years away from a proper recovery. This alone should be enough to motivate creditors to pass on AMR exiting as a standalone carrier.”

– DAN MCKENZIE, ANALYST, THE BUCKINGHAM RESEARCH GROUP (10/23/12)

16 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Labor

“[Mergers of Northwest-Delta and United-Continental have left American] a distant third. Corporate fliers, which make up your bread and butter, want a carrier that offers them the most options and bigger is better. Size matters.”

– TOM HOBAN, COMMUNICATIONS CHAIRMAN, ALLIED PILOTS ASSOCIATION (10/11/12)

“Although mergers, with the contentious process of integrating seniority lists, are usually anathema to pilots, APA pilots are overwhelmingly in favor of a merger with US Airways.[the tentative agreement with US Airways] s superior by orders of magnitude for the pilot group, offering a voluntary limit to a modest amount of code sharing and the promise of real compensation parity, to include profit sharing and retirement as well as wages, with industry leaders.”

– JASON GOLDBERG, PRINCIPAL, THE LEADING EDGE AVIATION CONSULTING GROUP (10/4/12)

“Members of the unsecured creditors committee aren’t sitting there with their heads in the sand. They got the results of the pilot vote — the sound rejection of the last offer — and have heard the rhetoric from flight attendants leaders. That’s why it’s hard for me to fathom that we have a stand-alone American after this thing.”

– FRED LOWRANCE, ANALYST, AVONDALE PARTNERS (9/12/12)

“While AMR management has reluctantly reversed its rhetoric on mergers, it’s becoming apparent that if we are to close the network and revenue gap with the competition, management is going to have to come to grips with the fact that further industry consolidation that involves AMR will bring the most value to AMR’s stakeholders and is the most rational path to creating a long-term viable and profitable company.”

– KEITH WILSON, PRESIDENT, ALLIED PILOTS ASSOCIATION (8/17/12)

17 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Labor

“Labor terms for AMR’s standalone plan are coming into focus, likely allowing the creditors’ committee to voice an informed opinion on the next steps for AMR in coming weeks/months. Although AMR management remains “in control” of the bankruptcy process for now, recent union votes and rhetoric send a clear signal that already contentious labor relations could be getting even worse—creating a poisonous culture that likely would not support a successful standalone plan longer-term. AMR labor unions continue to support a merger with LCC, and we still view such a merger as the most likely outcome of this bankruptcy process.”

– FRED LOWRANCE, ANALYST, AVONDALE PARTNERS (8/23/12)

“We firmly believe that the only way for American Airlines to grow and compete and perhaps even to survive is through a merger that puts Doug Parker and his team in charge.”

– NATIONAL OFFICERS, ASSOCIATION OF PROFESSIONAL FLIGHT ATTENDANTS (8/19/12)

“Our union’s strategic focus remains unchanged. APA is committed to pursuing consolidation as the best path for ensuring a brighter future for American Airlines and the pilots we represent. Our goal is to create a new American Airlines that can compete on an equal footing with Delta Air Lines and United Airlines. By doing so, our pilots will be able to enjoy the secure, rewarding careers that we all want and deserve.”

– KEITH WILSON, PRESIDENT, ALLIED PILOTS ASSOCIATION (8/10/12)

“US Airways…reached tentative contract agreements with American’s major unions, contracts that aren’t nearly as generous as what they had before bankruptcy but are better than what American was initially offering, and with more jobs preserved. For US Airways, these new contract terms would be extended to its own unions too, who are currently compensated less. But Parker says the new terms are affordable thanks to expected merger synergies. Put another way, the airline can afford to pay its workers more if this merger happens, as convincing an argument as any for an airline seeking labor support.”

– “PARKER’S PITCH, HORTON’S STALL,” AIRLINE WEEKLY (7/23/12)

18 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Labor

“AMR reports they still are not interested in pursuing a merger with LCC, but if AMR’s labor’s contracts are rejected by the court, it would likely take months or even more than a year to renegotiate if neither side capitulates on demands. And no airline has emerged from Ch. 11 without labor contracts in place (too risky). The implication: bondholders may not want to wait that long. In contrast, labor contracts are in place under a LCC merger scenario. Bottom line, 55,000 employees at AMR aren’t wrong; and it’s hard to envision the creditor’s committee ultimately supporting a plan where labor isn’t onboard. The precedent is powerful; consolidated airlines make superior business models.”

– DAN MCKENZIE, ANALYST, RODMAN & RENSHAW (6/13/12)

“It is my view, after the events of [April 20], that the bondholders and everyone interested in this case should think long and hard about the qualitative side of a potential standalone entity and what losing your people – in such spectacular and resounding fashion – really means to the present and to the future of American Airlines.”

– HOLLY HEGEMAN, EDITOR, PLANEBUSINESS (4/24/12)

“We all know there is an alternative path that is far superior for us, all of American Airlines, the communities we serve and the industry overall. A merger now with US Airways will save jobs, pensions and salaries and provide a much brighter future for American Airlines, our customers and all the airline’s employees.”

– CAPTAIN DAVE BATES, FORMER PRESIDENT, ALLIED PILOTS ASSOCIATION (4/20/12)

“This agreement puts flight attendants in a far better position than any proposal American Airlines management has made. Equally important is the business plan US Airways has put forward, which I strongly believe will bring American Airlines back to profitability and competitiveness. A combined US Airways and American Airlines will eliminate the competitive advantage of Delta and United and making us relatively competitive in both size and network.”

– LAURA GLADING, PRESIDENT, ASSOCIATION OF PROFESSIONAL FLIGHT ATTENDANTS (4/20/12)

“[US Airways] is currently profitable and could elevate American to a top-tier carrier. If a merger were to take place it could help turn around our airline, give us new management and a path towards a more positive future, something that has long been missing in our work lives.”

– JIM LITTLE, INTERNATIONAL PRESIDENT, TRANSPORT WORKERS UNION (4/20/12)

19 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Labor

“All our members think we would be better off by merging with US Airways…US Airways could be the light at the end of the tunnel for our members. We know where we’re going with American Airlines.”

– RICK MULLINGS, ORGANIZER, TWU LOCAL 514 (TULSA) (4/20/12)

“A combination of US Airways and American could bolster the oneworld Alliance, make frequent-flier programs at both American and US Airways more stable bets for long-term rewards and give employees at both companies more long-term job security. It likely could help US Airways solve the seniority integration problem at its pilots union, which has been unable to internally mesh together pilots from the old US Airways with pilots from America West Airlines. Moving them to a more lucrative contract at American with a much larger seniority list could be a strong incentive to settle that mess.”

– SCOTT MCCARTNEY, COLUMNIST, “THE MIDDLE SEAT TERMINAL,” WALL STREET JOURNAL (4/20/12)

“For the American unions, it’s a real indictment to the company’s plan. In fact, they are casting their lot with the devil they don’t know rather than the devil they do.”

– BOB MANN, PRESIDENT, R. W. MANN GROUP (4/20/12)

20 US Airways does not, by its reference to or distribution of these statements, imply its endorsement of or concurrence with the opinions, conclusions or recommendations quoted above. Based on Public Information

What People Are Saying – Service / Network

“US Airways thinks of itself as the perfect partner to fill in American’s network voids. It would bring more than 8 billion scheduled ASMs, including a big chunk of business in the Northeast. The two companies overlap on only 2% to 3% of their direct routes, so there’s no antitrust issue. A combo would allow American not only to connect more dots worldwide but also to add hubs in Phoenix; Charlotte, N.C.; and Philadelphia. The Philly hub would give American another international gateway to take the pressure off JFK. ‘If the merger could be effected with US Airways’ senior management put in charge, it could be a terrifying competitor,’ says [Michael] Boyd.”

– BILL SAPORITO, ASSISTANT MANAGING EDITOR, TIME (10/8/12)

“In airline networks—in any network business—‘bigger is beautiful,’ says Booz & Co. transportation consultant Andrew Tipping. You can collect more customers, especially given that they like to concentrate their flying with one airline to get frequent-flyer perks. In a network business, if you’re not first, you’re last.”

– BILL SAPORITO, ASSISTANT MANAGING EDITOR, TIME (10/8/12)

“US Airways has the small town (East Coast and Midwest) network that can bring in (passenger) feed. Both carriers would face a better future as a consolidated entity. US Airways could bring traffic and flow back to an American network that has lost traffic and flow. On the other hand, it would solve US Airways’ niche of being a connecting carrier, with exposure in Asia and Europe.”

– JEFF KAUFFMAN, ANALYST, STERNE AGEE & LEACH (8/5/12)

“There will be consolidation. I can see merit in that argument given the network that US Airways has, which I think complements the American network.”