A. CATHERINE NGO President & Chief Executive Officer DAVID S. MORIMOTO Executive Vice President & Chief Financial Officer September 2017

Forward-Looking Statements 1 This presentation may contain forward-looking statements concerning: projections of revenues, income/loss, earnings/loss per share, capital expenditures, dividends, capital structure, or other financial items, plans and objectives of management for future operations, future economic performance, or any of the assumptions underlying or relating to any of the foregoing. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts, and may include the words “believes,” “plans,” “intends,” “expects,” “anticipates,” “forecasts,” “hopes,” “should,” “estimates”, “may”, “will”, “target” or words of similar meaning. While we believe that our forward-looking statements and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could materially differ from forward-looking statements for a variety of reasons, including, but not be limited to: an increase in inventory or adverse conditions in the Hawaii and California real estate markets and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; the impact of local, national, and international economies and events (including natural disasters such as wildfires, tsunamis, storms and earthquakes) on the Company’s business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, changes in capital standards, other regulatory reform, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau, government-sponsored enterprise reform, and any related rules and regulations on our business operations and competitiveness; the costs and effects of legal and regulatory developments, including the resolution of legal proceedings or regulatory or other governmental inquiries and the results of regulatory examinations or reviews; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, securities market and monetary fluctuations; negative trends in our market capitalization and adverse changes in the price of the Company’s common shares; political instability; acts of war or terrorism; changes in consumer spending, borrowings and savings habits; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; technological changes; changes in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters; our ability to attract and retain skilled employees; changes in our organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items. For further information on factors that could cause actual results to materially differ from forward-looking statements, please see the Company’s publicly available Securities and Exchange Commission filings, including the Company’s Form 10-K for the fiscal year ended December 31, 2016, and, in particular, the discussion of “Risk Factors” set forth therein. The Company does not update any of its forward-looking statements except as required by law.

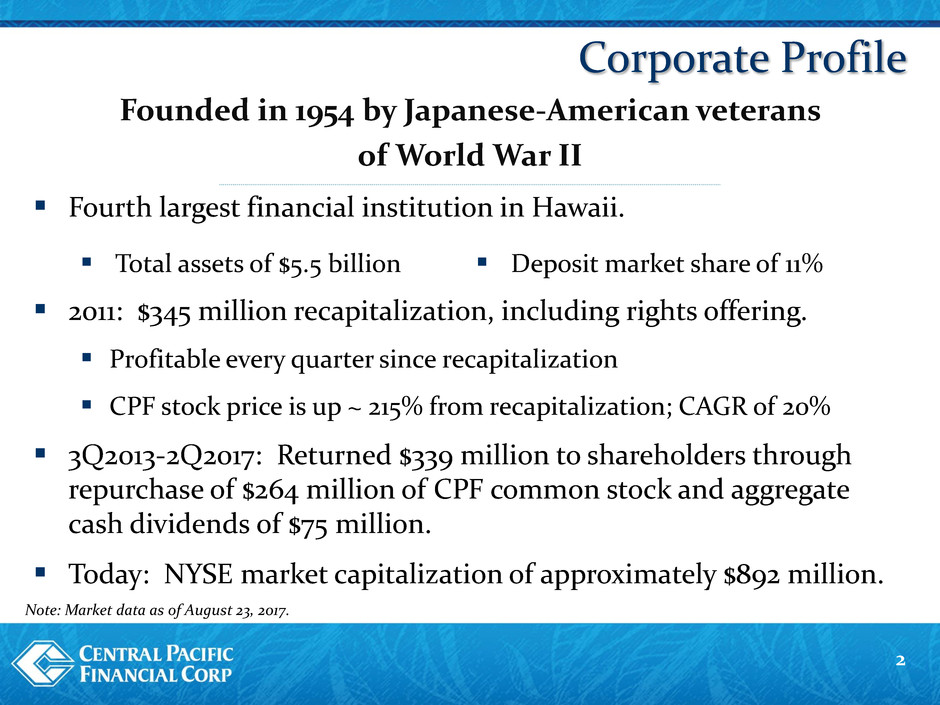

Corporate Profile 2 Founded in 1954 by Japanese-American veterans of World War II Fourth largest financial institution in Hawaii. 2011: $345 million recapitalization, including rights offering. Profitable every quarter since recapitalization CPF stock price is up ~ 215% from recapitalization; CAGR of 20% 3Q2013-2Q2017: Returned $339 million to shareholders through repurchase of $264 million of CPF common stock and aggregate cash dividends of $75 million. Today: NYSE market capitalization of approximately $892 million. Total assets of $5.5 billion Deposit market share of 11% Note: Market data as of August 23, 2017.

Shareholder Value Drivers 3 Strong Hawaii Market Relationship Banking Growth Opportunities Asset Quality Improvements Efficiency Enhancements Capital Optimization

Population of 1.4 million (2016). Four major islands – Oahu is home to 70% of the state’s total population. Real State GDP (2016) $72.9 billion, +2.0% from 2015. Forecasts expect a 1.9% increase in 2017. State unemployment rate of 2.7% is below the national unemployment rate of 4.3% (July 2017). Economy driven primarily by tourism, military & real estate construction industries. 2016 marked the fifth straight year of record tourism in Hawaii and is on pace for a sixth straight record year in 2017. In 2016, visitor spending was $15.6 billion and over 8.9 million visitors came to Hawaii. Through July 2017, visitor spending and arrivals increased 8.9% and 4.7%, respectively, over the same prior year period. Hawaii at a Glance 4 Source: US Census Bureau, Bureau of Economic Analysis , Bureau of Labor Statistics, Hawaii Tourism Authority and State of Hawaii Department of Business Economic Development & Tourism

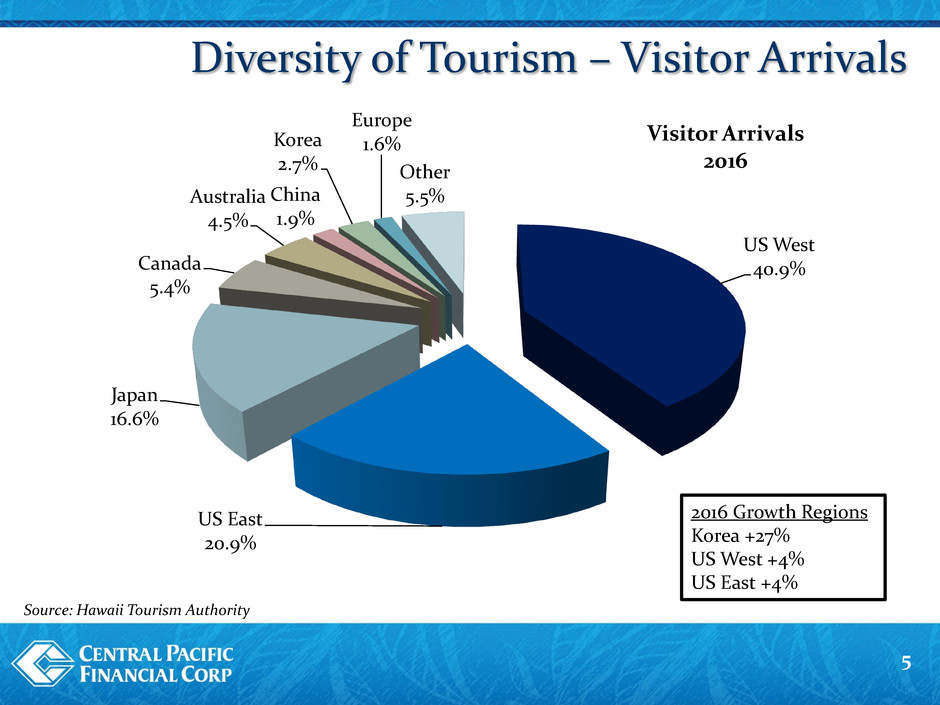

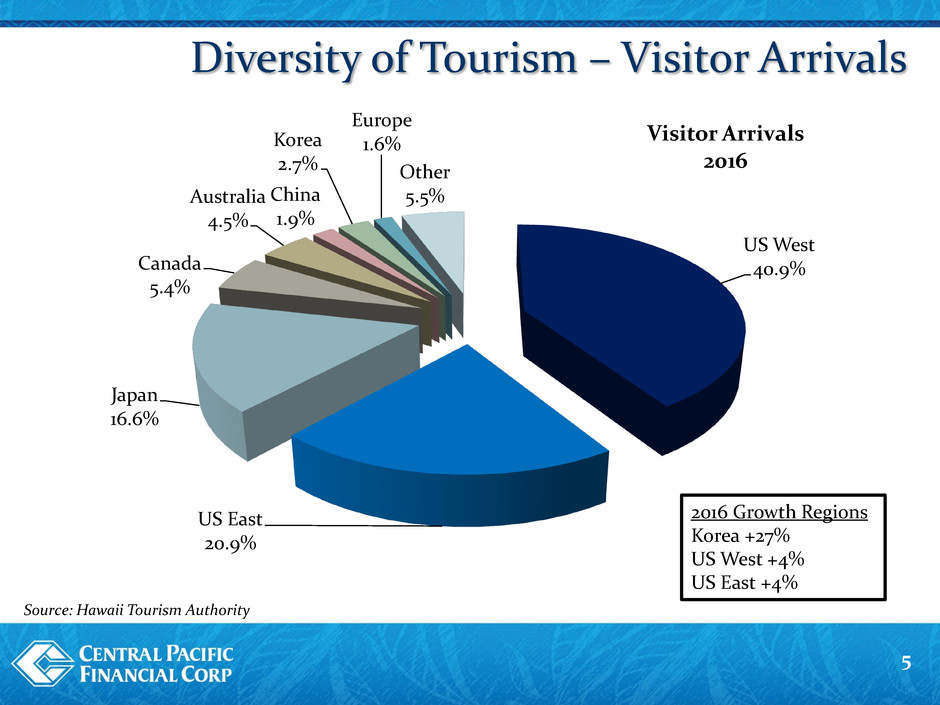

Diversity of Tourism – Visitor Arrivals 5 Source: Hawaii Tourism Authority 2016 Growth Regions Korea +27% US West +4% US East +4% US West 40.9% US East 20.9% Japan 16.6% Canada 5.4% Australia 4.5% China 1.9% Korea 2.7% Europe 1.6% Other 5.5% Visitor Arrivals 2016

6 Source: Honolulu Board of Realtors & National Association of Realtors. Data as of June 2017. Strong Real Estate Market $750.0 $266.2 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 $800.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2Q17 T h ous an d s Existing Single Family Home Median Sales Price Oahu U.S.

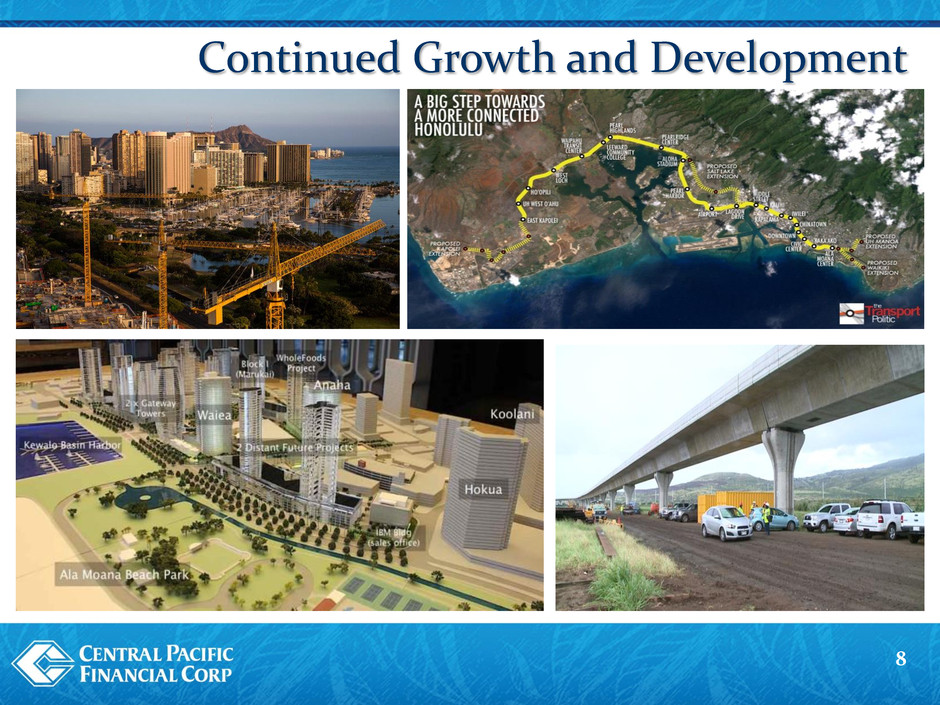

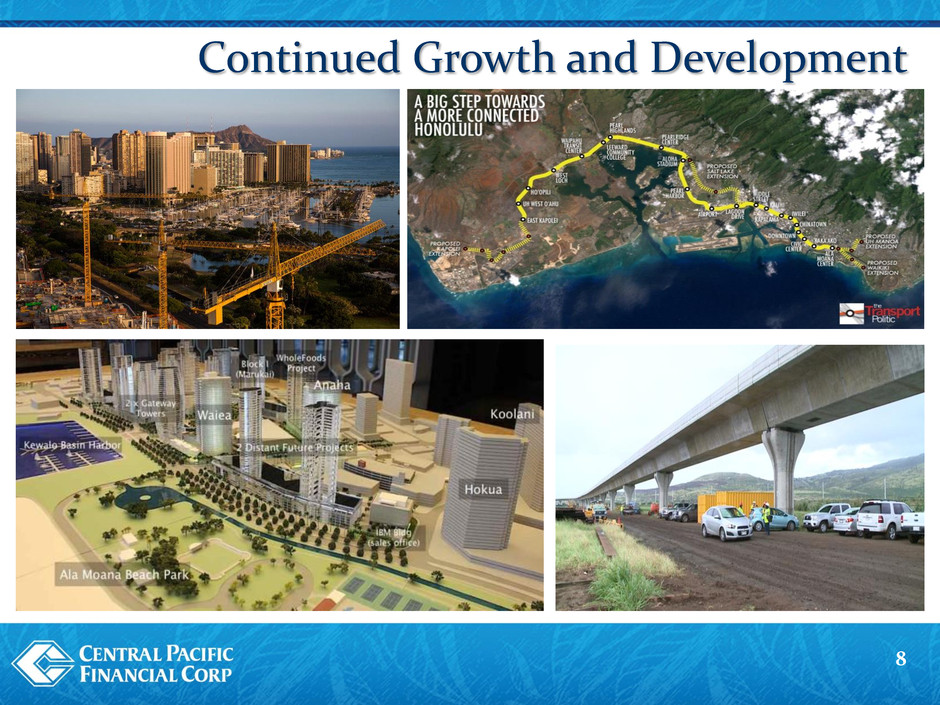

Continued Growth and Development 7 1. Residential High-Rise Condominium Development in Honolulu Proposed master plan includes 22 new high-rise towers in Honolulu. Thirteen developments have completed successful sales and begun construction or have completed construction over the past few years. 2. Rail Construction $10.0 billion, 20-mile route. Full route to be in operation by 2024. 3. Modernization of Honolulu International Airport $1.3 billion effort that began in 2013 and is expected to be completed by the end of 2020. 4. Military Construction Hawaii remains a key strategic location for the U.S. Military as it is the headquarters of the United States Pacific Command. As a result, Hawaii benefits from consistent federal construction investments in its military bases. 5. Ko Olina Resort Development in West Oahu Four Seasons Resort Oahu Ko Olina completed $500 million renovation in 2016. China Oceanwide Holdings Group Company plans to break ground in 2017 on a $1 billion+ project to develop an Atlantis Resorts in West Oahu. Source: Honolulu Star Advertiser, Hawaii Community Development Authority, Honolulu Rail Transit, Hawaii Airports Modernization, Pacific Business News.

Continued Growth and Development 8

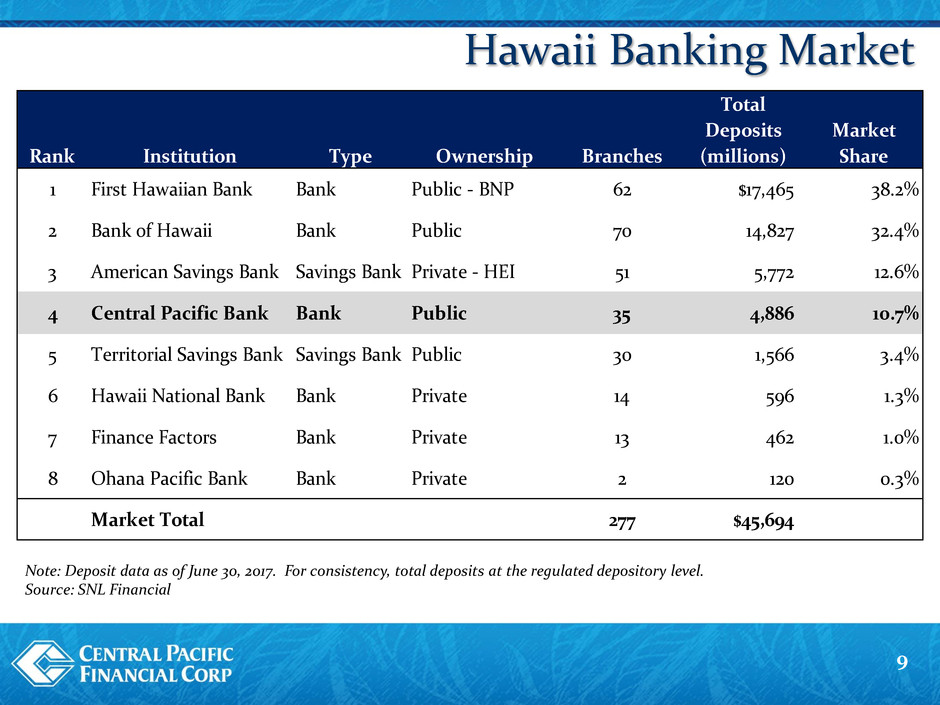

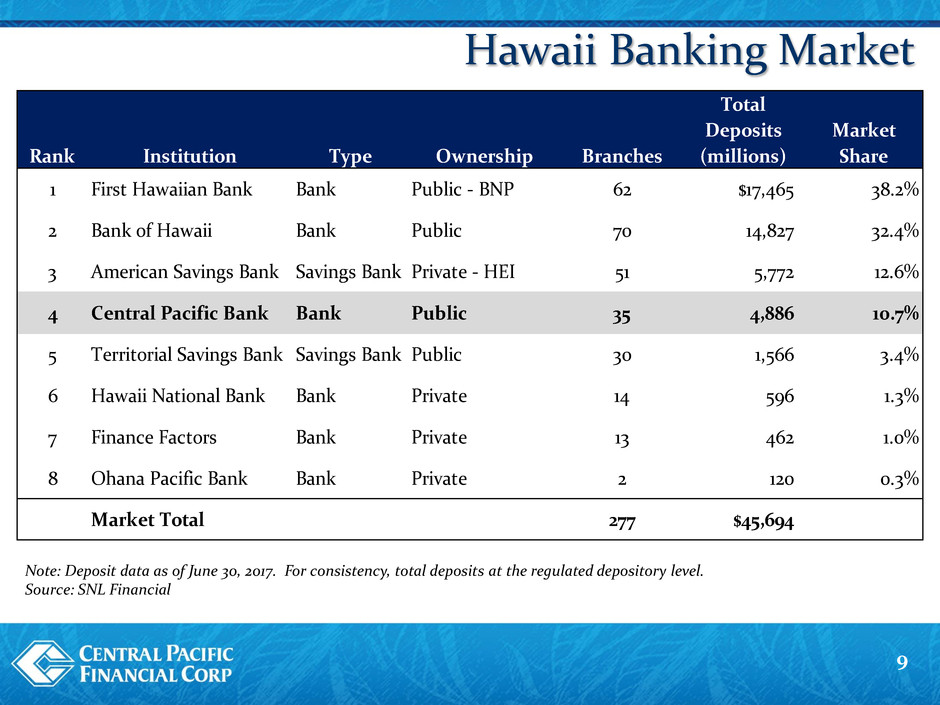

Hawaii Banking Market Note: Deposit data as of June 30, 2017. For consistency, total deposits at the regulated depository level. Source: SNL Financial 9 Total Deposits Market Rank Institution Type Ownership Branches (millions) Share 1 First Hawaiian Bank Bank Public - BNP 62 $17,465 38.2% 2 Bank of Hawaii Bank Public 70 14,827 32.4% 3 American Savings Bank Savings Bank Private - HEI 51 5,772 12.6% 4 Central Pacific Bank Bank Public 35 4,886 10.7% 5 Territorial Savings Bank Savings Bank Public 30 1,566 3.4% 6 Hawaii National Bank Bank Private 14 596 1.3% 7 Finance Factors Bank Private 13 462 1.0% 8 Ohana Pacific Bank Bank Private 2 120 0.3% Market Total 277 $45,694

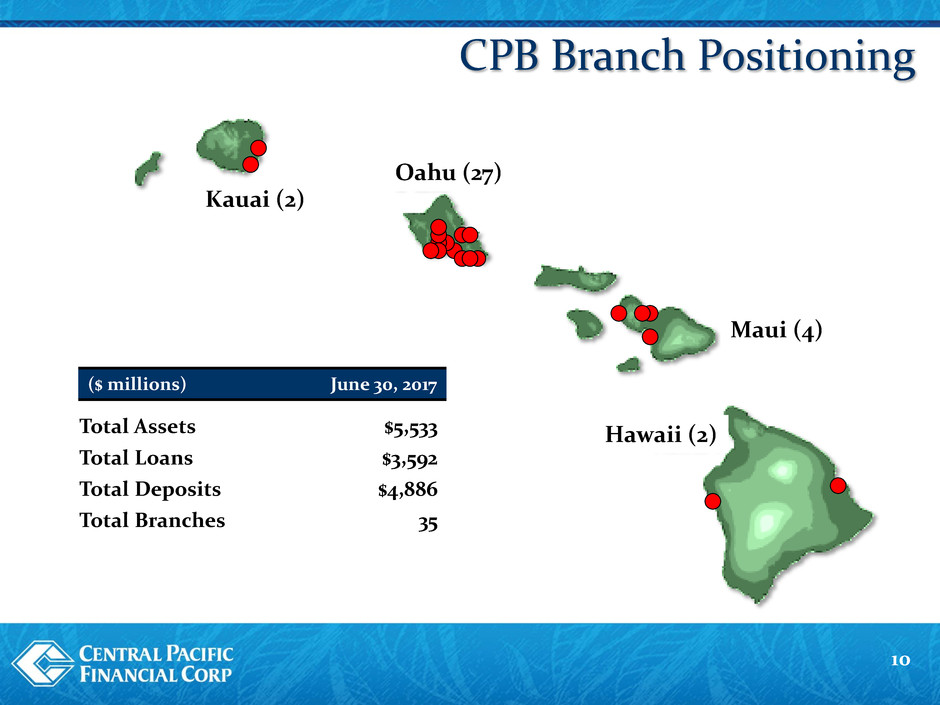

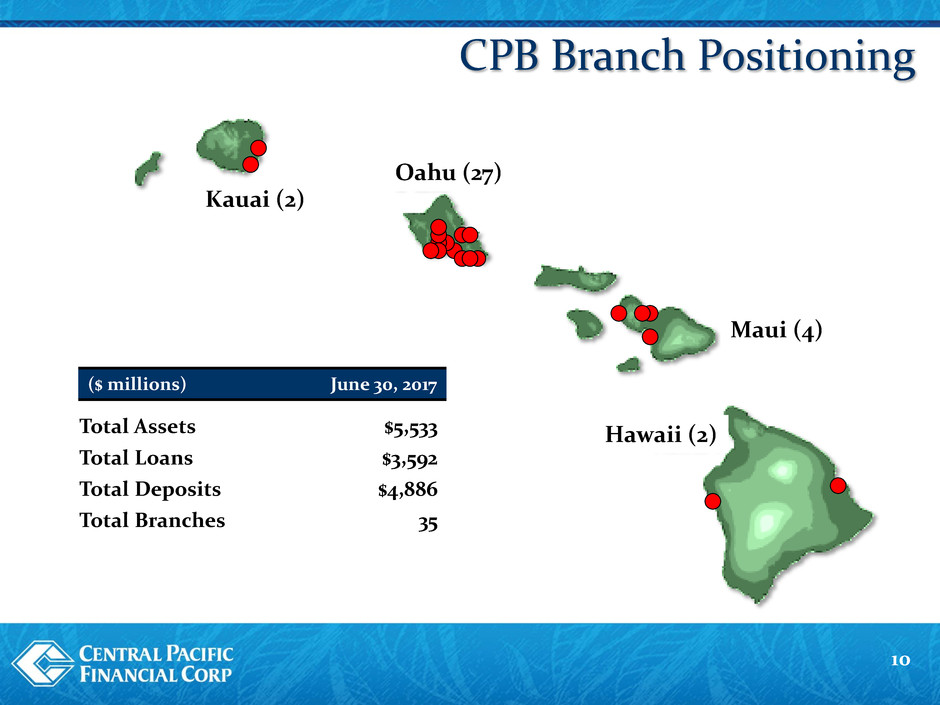

Kauai (2) Oahu (27) Maui (4) Hawaii (2) CPB Branch Positioning ($ millions) June 30, 2017 10 Total Assets $5,533 Total Loans $3,592 Total Deposits $4,886 Total Branches 35

Relationship Banking Growth Opportunities 11 Launched a customer experience initiative to create a competitive advantage and differentiate ourselves from the rest of the market. Identified and focused on targeted market niches. Initiated strategic business development agreements with Hokuyo Bank in Japan in 2015 and with the TSUBASA Alliance of Japan (comprised of 6 regional banks in Japan) in 2017. Established joint ventures with local real estate companies and developers to source residential mortgage loan volume.

Strong Loan Growth 12 5.5 Year CAGR +13% +26% +20% -9% +3% $4,030 $3,042 $2,169 $2,064 $2,204 $2,631 $2,932 $3,212 $3,525 $3,546 $3,592 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 Balances Outstanding Comml Mtg Construct/Dev C&I Consumer/Other Res Mtg Million s

Core Deposit Franchise 13 $4.9 billion in deposits as of June 30, 2017, with total core deposits at 81% Noninterest- Bearing DDA 28% Interest-Bearing DDA 19% Savings & Money Mkt 30% CDs < $100M 4% CDs > $100M 5% Government CDs 14%

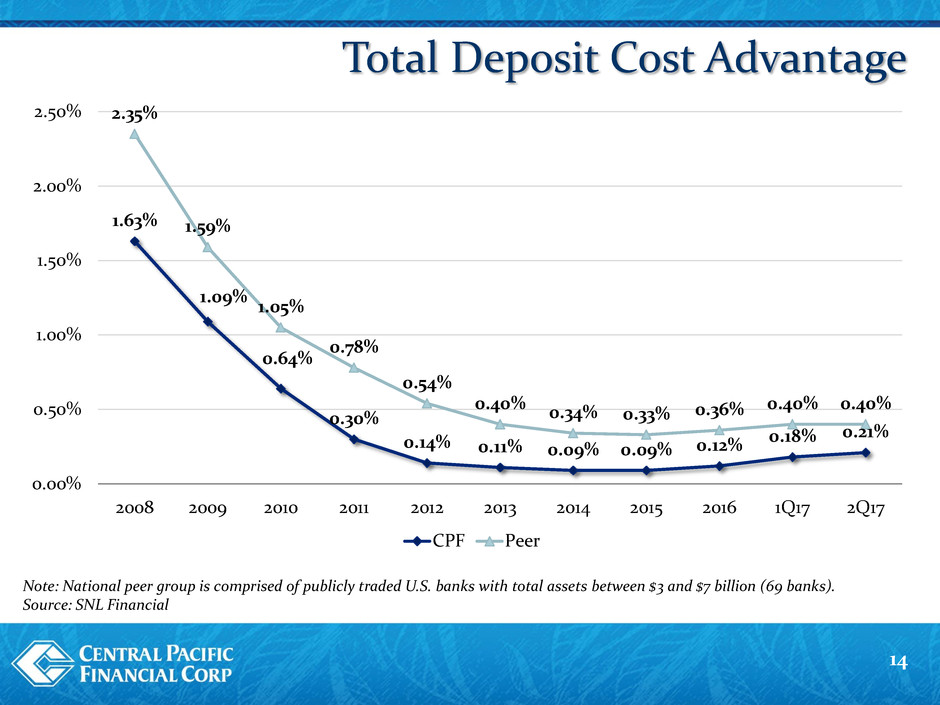

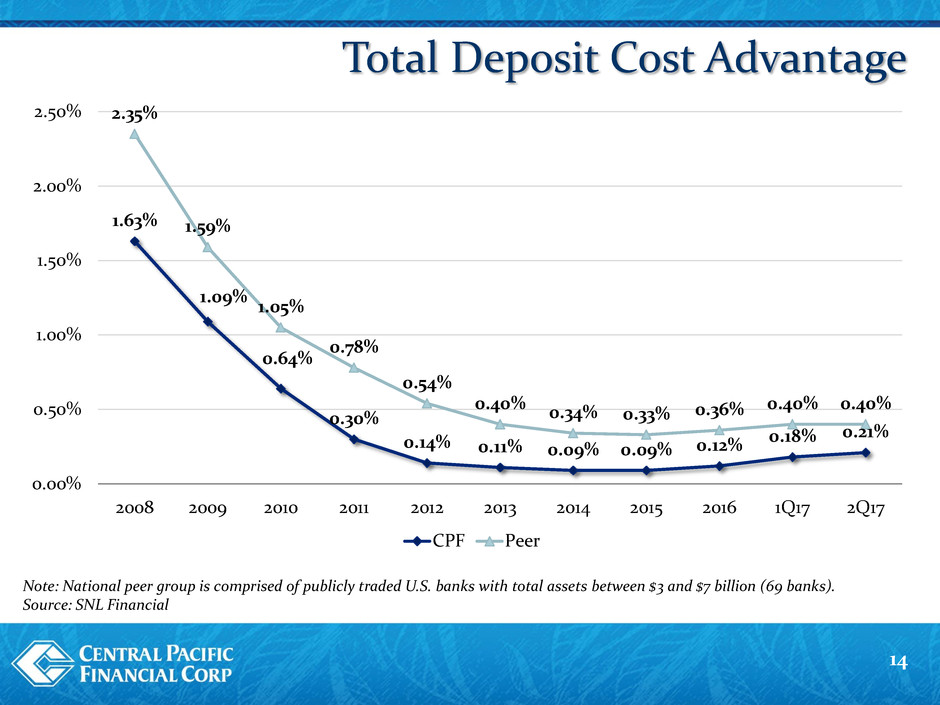

Total Deposit Cost Advantage 14 Note: National peer group is comprised of publicly traded U.S. banks with total assets between $3 and $7 billion (69 banks). Source: SNL Financial 1.63% 1.09% 0.64% 0.30% 0.14% 0.11% 0.09% 0.09% 0.12% 0.18% 0.21% 2.35% 1.59% 1.05% 0.78% 0.54% 0.40% 0.34% 0.33% 0.36% 0.40% 0.40% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 CPF Peer

Significantly Reduced NPAs 15 0.16% of Total Assets $144 $500 $303 $196 $90 $47 $42 $16 $9 $9 $9 $- $100 $200 $300 $400 $500 $600 2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 Million s C&D Comml Mtg Res Mtg C&I/Other

Strong Reserve Coverage 16 Note: National peer group is comprised of publicly traded U.S. banks with total assets between $3 and $7 billion (69 banks). Source: SNL Financial 2.97% 6.75% 8.89% 5.91% 4.37% 3.19% 2.53% 1.97% 1.61% 1.56% 1.47% 1.48% 2.00% 2.08% 1.97% 1.69% 1.48% 1.23% 1.11% 0.98% 1.00% 0.99% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 ALLL/Total Loans CPF Peer

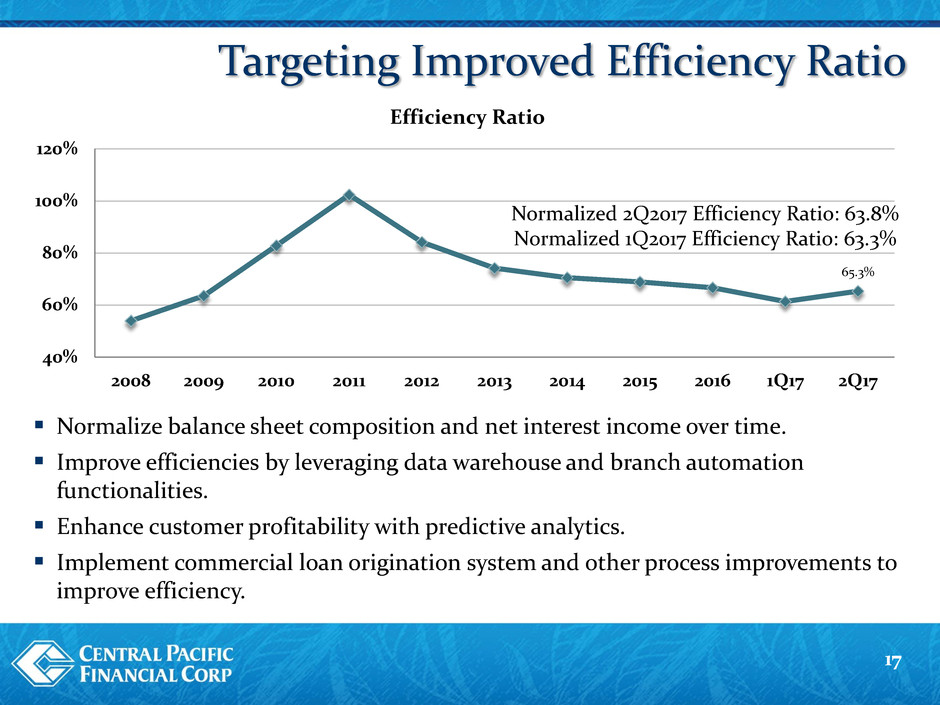

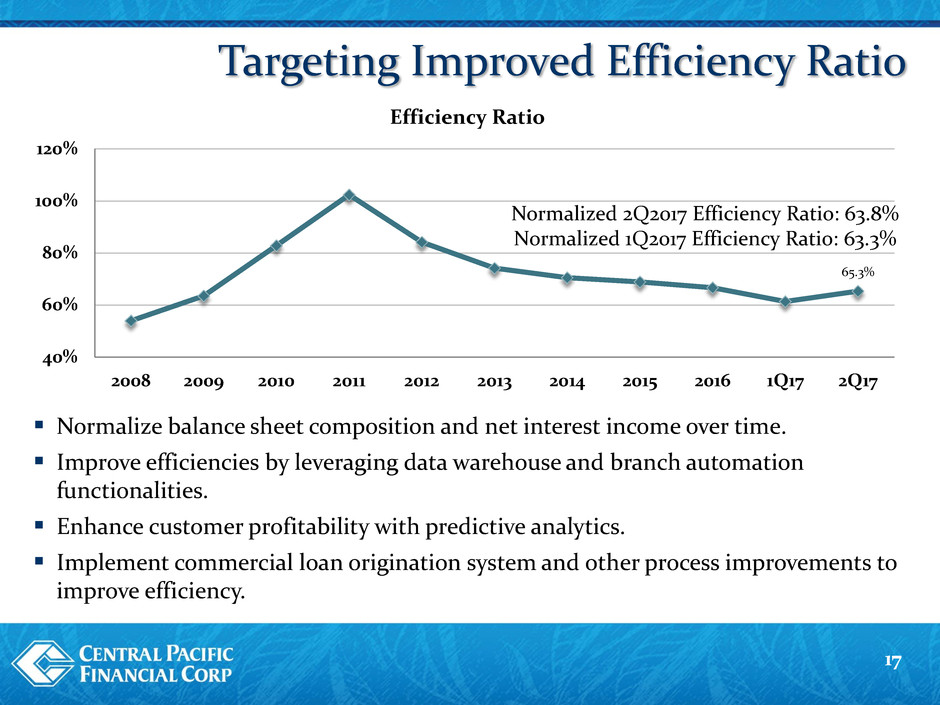

Targeting Improved Efficiency Ratio 17 Normalize balance sheet composition and net interest income over time. Improve efficiencies by leveraging data warehouse and branch automation functionalities. Enhance customer profitability with predictive analytics. Implement commercial loan origination system and other process improvements to improve efficiency. Normalized 2Q2017 Efficiency Ratio: 63.8% Normalized 1Q2017 Efficiency Ratio: 63.3% 65.3% 40% 60% 80% 100% 120% 2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 Efficiency Ratio

Capital Optimization 18 Reinstated quarterly cash dividend of $0.08 per share in 3Q2013. Increased cash dividend by 25% in 3Q2014, 20% in 1Q2015, 17% in 4Q2015, 14% in 3Q2016 and 13% in 2Q2017. Aggregate cash dividends of $75 million returned to our shareholders since 3Q2013. Share repurchase activity to optimize the capital structure. Repurchased over 12.3 million shares of CPF common stock at a total cost of $264 million, or $21.43 per share, through 2Q2017. Capital ratios remain strong as of June 30,2017: Common Equity Tier 1 Capital: 12.9% Total Risk Based Capital: 16.4% Tier 1 Risk Based Capital: 15.2% Leverage Capital: 10.7%

Shareholder Value Drivers 19 Strong Hawaii Market Relationship Banking Growth Opportunities Asset Quality Improvements Efficiency Enhancements Capital Optimization

APPENDIX 20

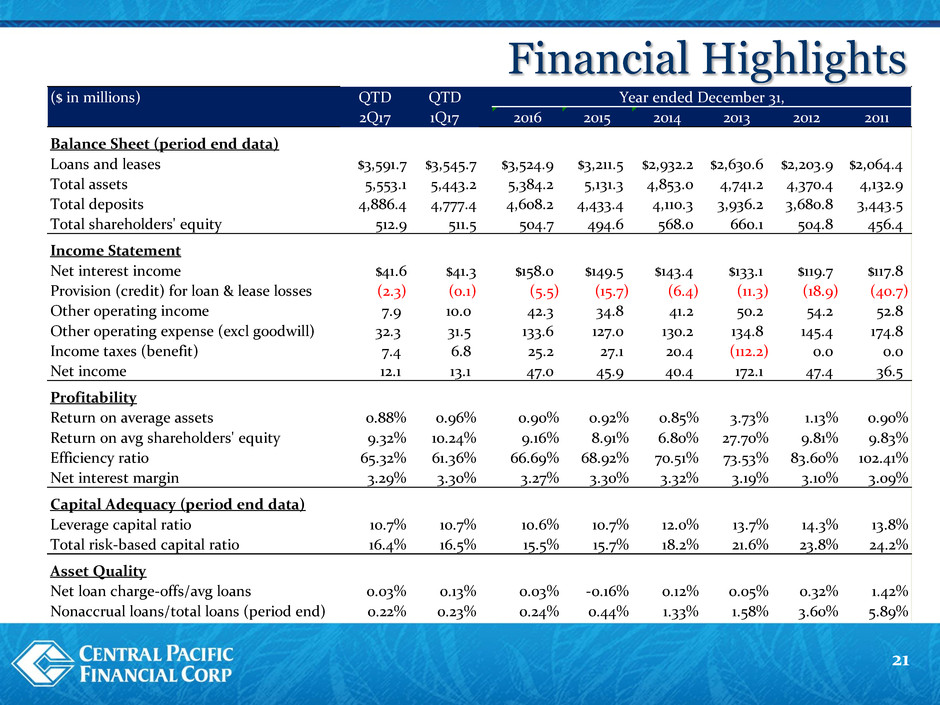

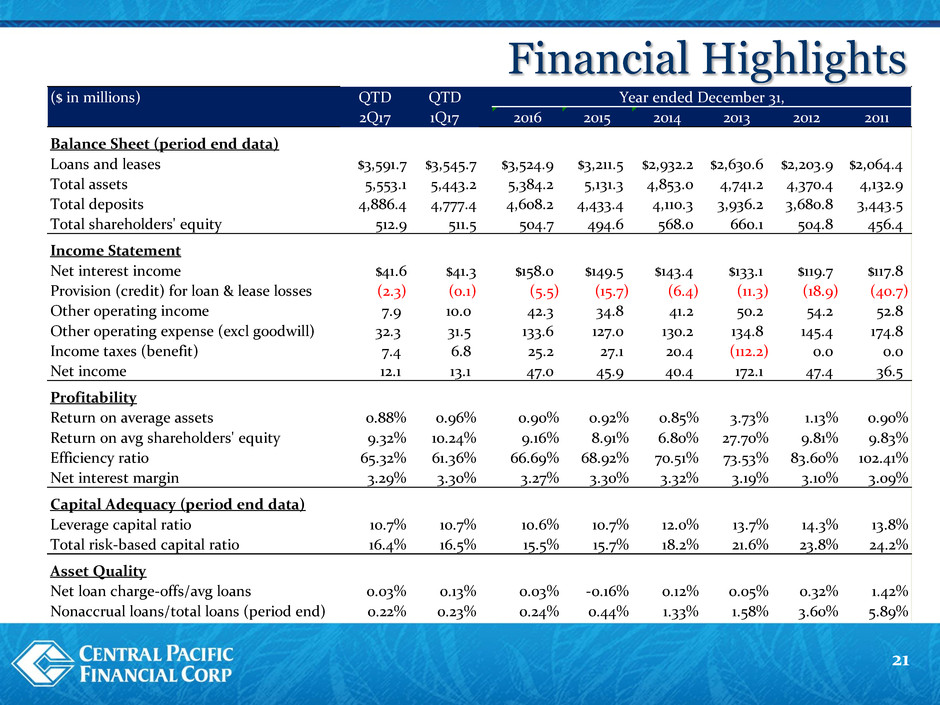

Financial Highlights 21 ($ in millions) QTD QTD 2Q17 1Q17 2016 2015 2014 2013 2012 2011 Balance Sheet (period end data) Loans and leases $3,591.7 $3,545.7 $3,524.9 $3,211.5 $2,932.2 $2,630.6 $2,203.9 $2,064.4 Total assets 5,553.1 5,443.2 5,384.2 5,131.3 4,853.0 4,741.2 4,370.4 4,132.9 Total deposits 4,886.4 4,777.4 4,608.2 4,433.4 4,110.3 3,936.2 3,680.8 3,443.5 Total shareholders' equity 512.9 511.5 504.7 494.6 568.0 660.1 504.8 456.4 Income Statement Net interest income $41.6 $41.3 $158.0 $149.5 $143.4 $133.1 $119.7 $117.8 Provision (credit) for loan & lease losses (2.3) (0.1) (5.5) (15.7) (6.4) (11.3) (18.9) (40.7) Other operating income 7.9 10.0 42.3 34.8 41.2 50.2 54.2 52.8 Other operating expense (excl goodwill) 32.3 31.5 133.6 127.0 130.2 134.8 145.4 174.8 Income taxes (benefit) 7.4 6.8 25.2 27.1 20.4 (112.2) 0.0 0.0 Net income 12.1 13.1 47.0 45.9 40.4 172.1 47.4 36.5 Profitability Return on average assets 0.88% 0.96% 0.90% 0.92% 0.85% 3.73% 1.13% 0.90% Return on avg shareholders' equity 9.32% 10.24% 9.16% 8.91% 6.80% 27.70% 9.81% 9.83% Efficiency ratio 65.32% 61.36% 66.69% 68.92% 70.51% 73.53% 83.60% 102.41% Net interest margin 3.29% 3.30% 3.27% 3.30% 3.32% 3.19% 3.10% 3.09% Capital Adequacy (period end data) Leverage capital ratio 10.7% 10.7% 10.6% 10.7% 12.0% 13.7% 14.3% 13.8% Total risk-based capital ratio 16.4% 16.5% 15.5% 15.7% 18.2% 21.6% 23.8% 24.2% Asset Quality Net loan charge-offs/avg loans 0.03% 0.13% 0.03% -0.16% 0.12% 0.05% 0.32% 1.42% Nonaccrual loans/total loans (period end) 0.22% 0.23% 0.24% 0.44% 1.33% 1.58% 3.60% 5.89% Year ended December 31,

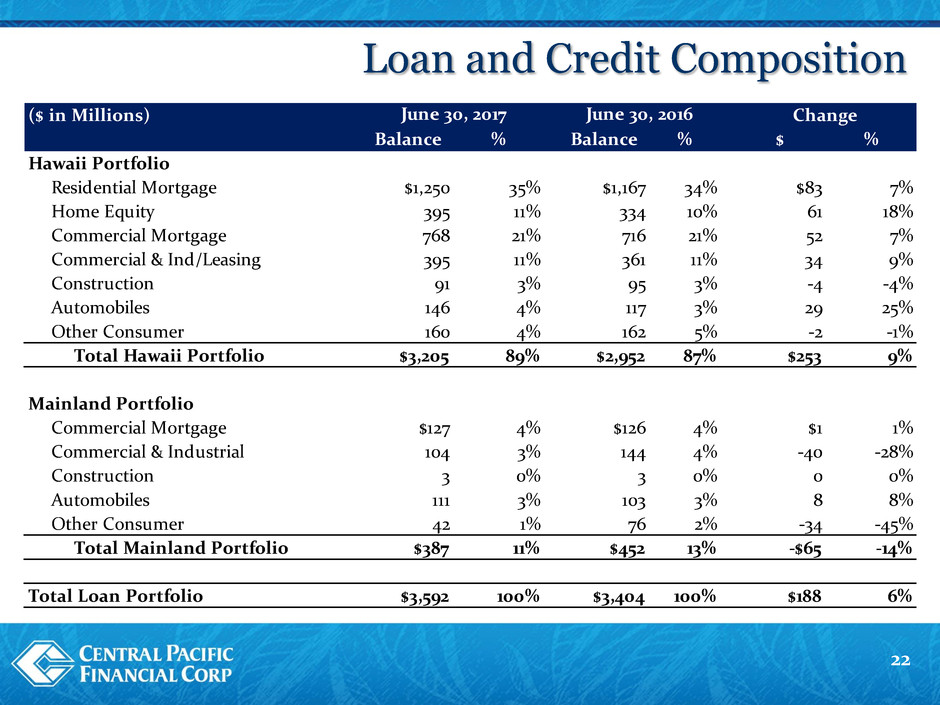

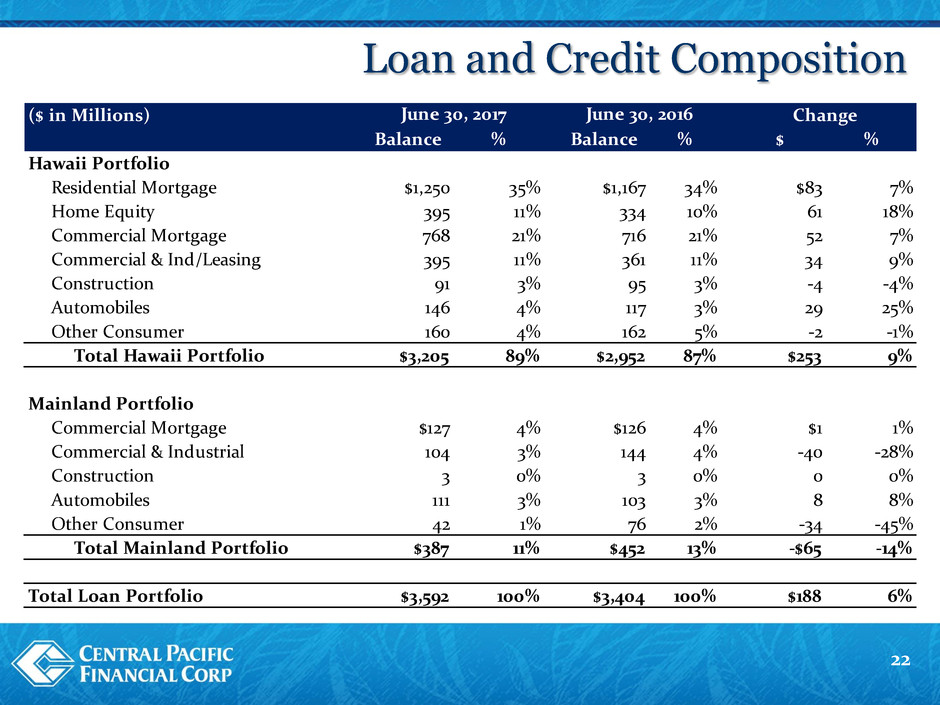

Loan and Credit Composition 22 ($ in Millions) Balance % Balance % $ % Hawaii Portfolio Residential Mortgage $1,250 35% $1,167 34% $83 7% Home Equity 395 11% 334 10% 61 18% Commercial Mortgage 768 21% 716 21% 52 7% Commercial & Ind/Leasing 395 11% 361 11% 34 9% Construction 91 3% 95 3% -4 -4% Automobiles 146 4% 117 3% 29 25% Other Consumer 160 4% 162 5% -2 -1% Total Hawaii Portfolio $3,205 89% $2,952 87% $253 9% Mainland Portfolio Commercial Mortgage $127 4% $126 4% $1 1% Commercial & Industrial 104 3% 144 4% -40 -28% Construction 3 0% 3 0% 0 0% Automobiles 111 3% 103 3% 8 8% Other Consumer 42 1% 76 2% -34 -45% Total Mainland Portfolio $387 11% $452 13% -$65 -14% Total Loan Portfolio $3,592 100% $3,404 100% $188 6% June 30, 2017 June 30, 2016 Change

Stable Net Interest Margin 23 NIM has been stable around 3.30% for the last 3 years. Expect NIM to be in the 3.20 t0 3.30% range over the next couple of quarters. Future improvements in the NIM will result from continuing to grow the loan portfolio and stabilizing the investment and loan yields. 4.02% 3.62% 2.91% 3.09% 3.10% 3.19% 3.32% 3.30% 3.27% 3.30% 3.29% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 Net Interest Margin