4th Quarter 2021 Earnings Supplement January 26, 2022

2Central Pacific Financial Corp. Forward-Looking Statements This document may contain forward-looking statements concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, the payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our various business initiatives; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believes," "plans," "anticipates," "expects," "intends," "forecasts," "hopes," "targeting," "continue," "remain," "will," "should," "estimates," "may" and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. While we believe that our forward-looking statements and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the adverse effects of the COVID-19 pandemic virus on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees as well as the effects of government programs and initiatives in response to COVID-19; the impact of our participation in the Paycheck Protection Program (“PPP”) and fulfillment of government guarantees on our PPP loans; our ability to successfully implement our Banking-as-a-Service initiatives, including adoption of the initiatives by customers and risks faced by any of our bank partnerships including reputational and regulatory risk; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; our ability to successfully implement our business initiatives; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, earthquakes and pandemic virus and disease, including COVID-19) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd- Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau (the "CFPB"), government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings or regulatory or other governmental inquiries and proceedings and the resolution thereof, the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System (the "FRB" or the "Federal Reserve"); inflation, interest rate, securities market and monetary fluctuations, including the anticipated replacement of the London Interbank Offered Rate ("LIBOR") Index and the impact on our loans and debt which are tied to that index; negative trends in our market capitalization and adverse changes in the price of the Company's common stock; political instability; acts of war or terrorism; pandemic virus and disease, including COVID- 19; changes in consumer spending, borrowing and savings habits; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; cybersecurity and data privacy breaches and the consequence therefrom; the ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; technological changes and developments; changes in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board ("FASB") and other accounting standard setters and the cost and resources required to implement such changes; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items. For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the forward-looking statements, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the forward-looking statements contained in this Form 8-K. Forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

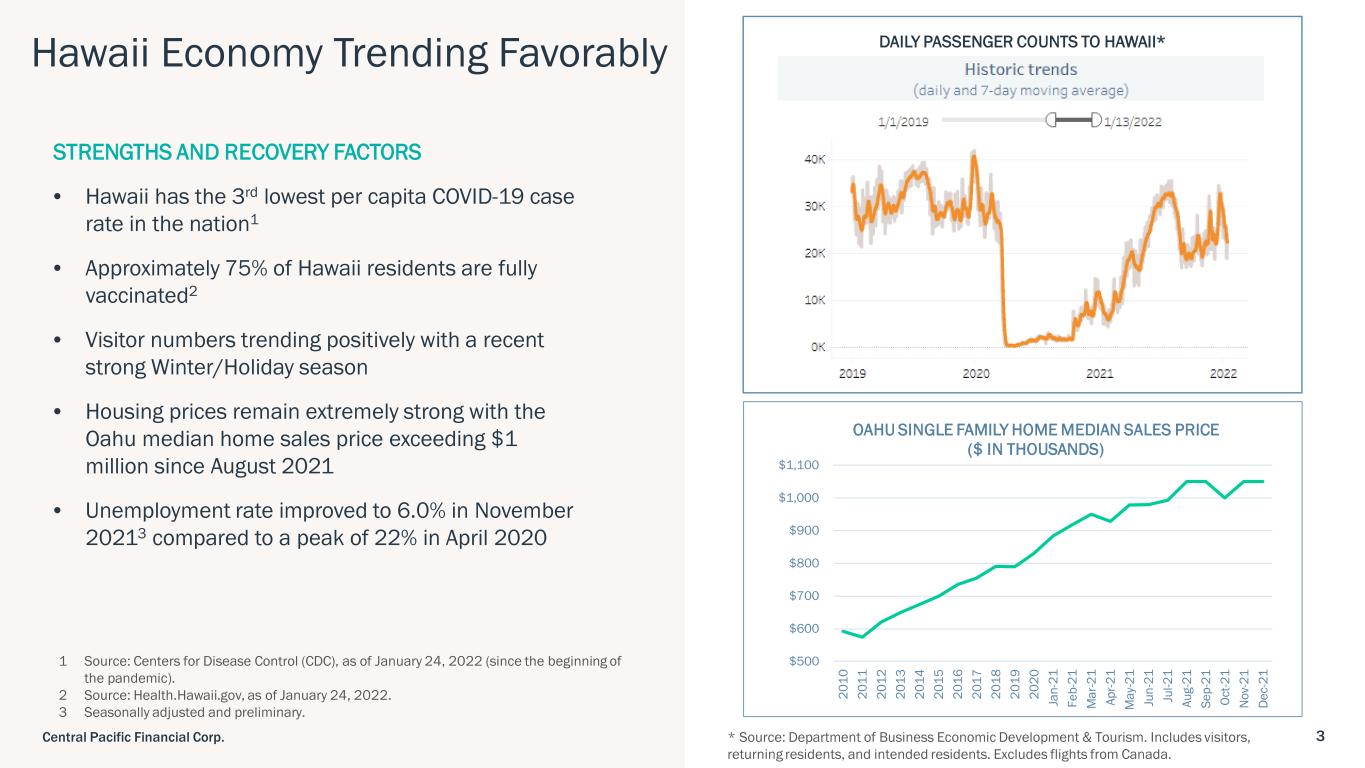

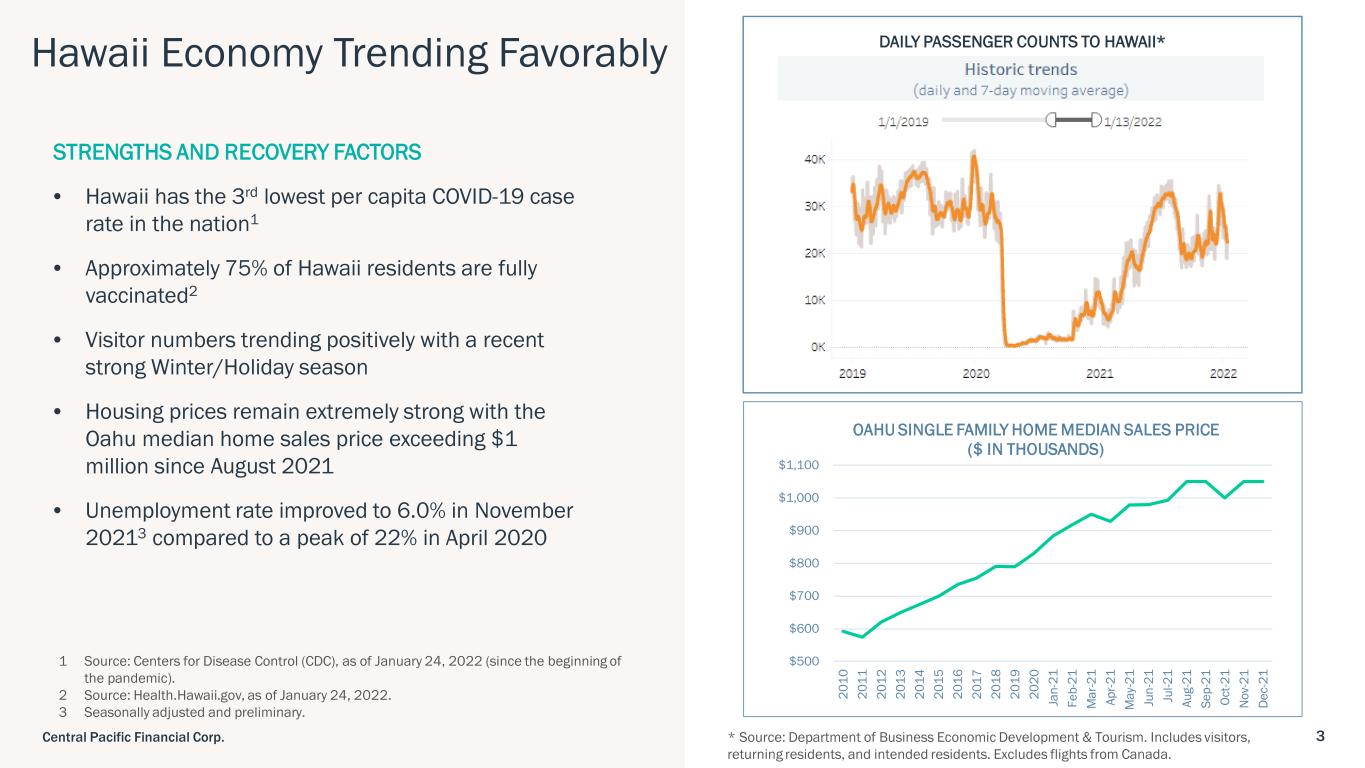

3Central Pacific Financial Corp. Hawaii Economy Trending Favorably STRENGTHS AND RECOVERY FACTORS • Hawaii has the 3rd lowest per capita COVID-19 case rate in the nation1 • Approximately 75% of Hawaii residents are fully vaccinated2 • Visitor numbers trending positively with a recent strong Winter/Holiday season • Housing prices remain extremely strong with the Oahu median home sales price exceeding $1 million since August 2021 • Unemployment rate improved to 6.0% in November 20213 compared to a peak of 22% in April 2020 * Source: Department of Business Economic Development & Tourism. Includes visitors, returning residents, and intended residents. Excludes flights from Canada. DAILY PASSENGER COUNTS TO HAWAII* 1 Source: Centers for Disease Control (CDC), as of January 24, 2022 (since the beginning of the pandemic). 2 Source: Health.Hawaii.gov, as of January 24, 2022. 3 Seasonally adjusted and preliminary. $500 $600 $700 $800 $900 $1,000 $1,100 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 Ja n- 21 Fe b- 21 M ar -2 1 Ap r-2 1 M ay -2 1 Ju n- 21 Ju l-2 1 Au g- 21 Se p- 21 Oc t-2 1 N ov -2 1 De c- 21 OAHU SINGLE FAMILY HOME MEDIAN SALES PRICE ($ IN THOUSANDS)

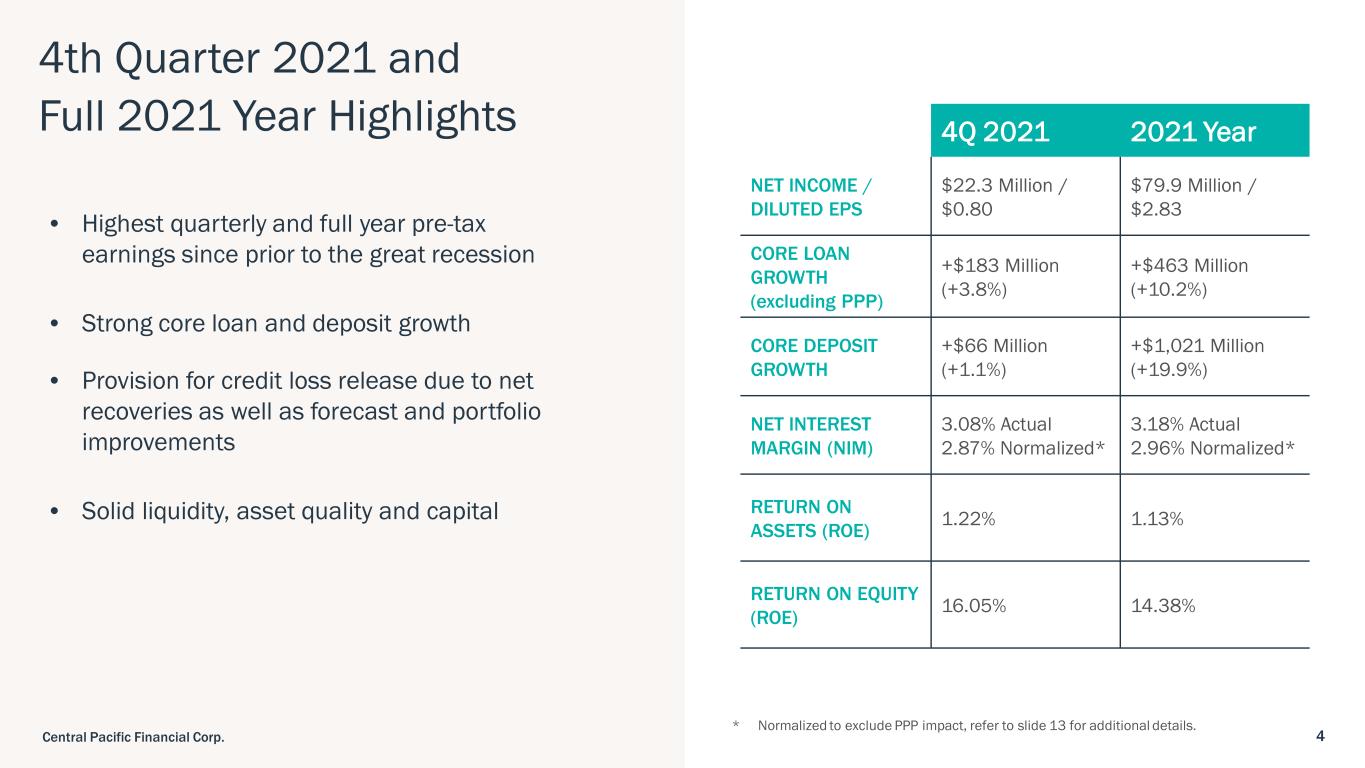

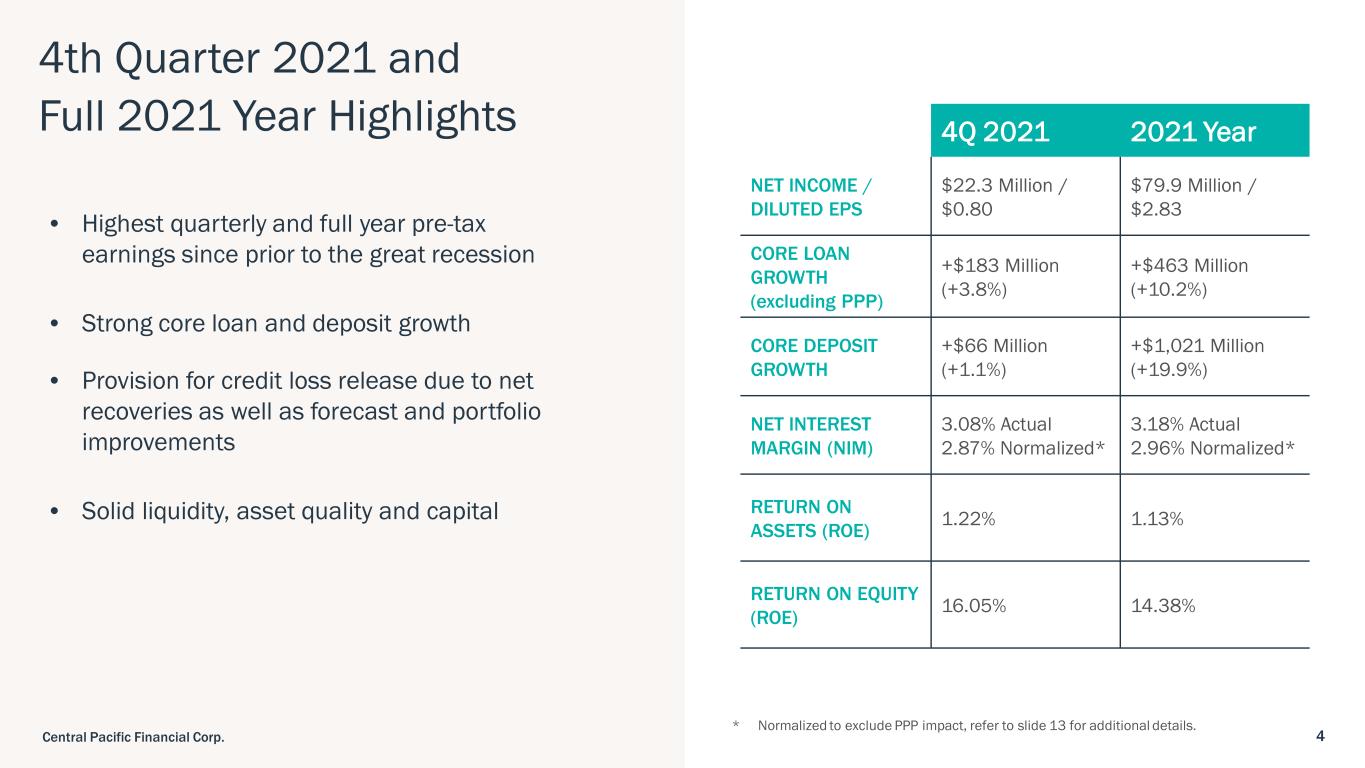

4Central Pacific Financial Corp. 4th Quarter 2021 and Full 2021 Year Highlights • Highest quarterly and full year pre-tax earnings since prior to the great recession • Strong core loan and deposit growth • Provision for credit loss release due to net recoveries as well as forecast and portfolio improvements • Solid liquidity, asset quality and capital 4Q 2021 2021 Year NET INCOME / DILUTED EPS $22.3 Million / $0.80 $79.9 Million / $2.83 CORE LOAN GROWTH (excluding PPP) +$183 Million (+3.8%) +$463 Million (+10.2%) CORE DEPOSIT GROWTH +$66 Million (+1.1%) +$1,021 Million (+19.9%) NET INTEREST MARGIN (NIM) 3.08% Actual 2.87% Normalized* 3.18% Actual 2.96% Normalized* RETURN ON ASSETS (ROE) 1.22% 1.13% RETURN ON EQUITY (ROE) 16.05% 14.38% * Normalized to exclude PPP impact, refer to slide 13 for additional details.

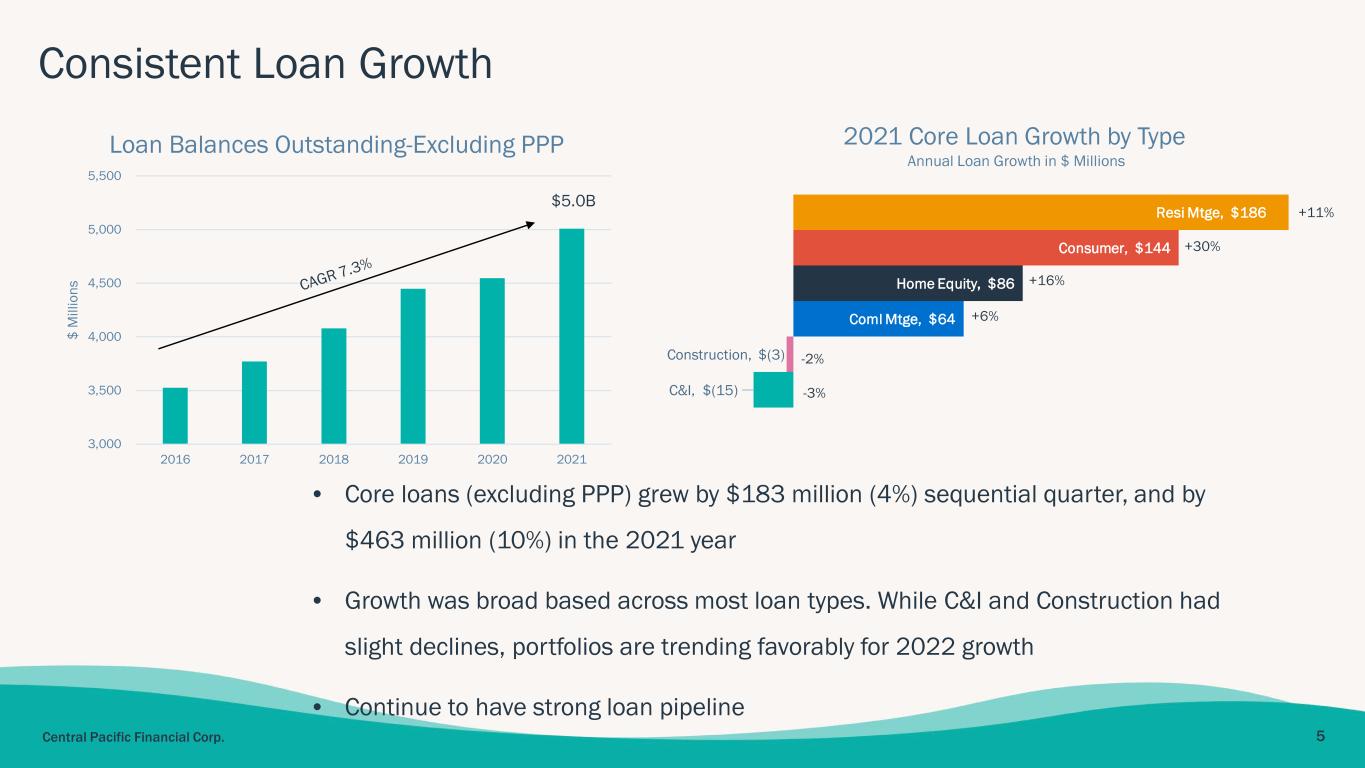

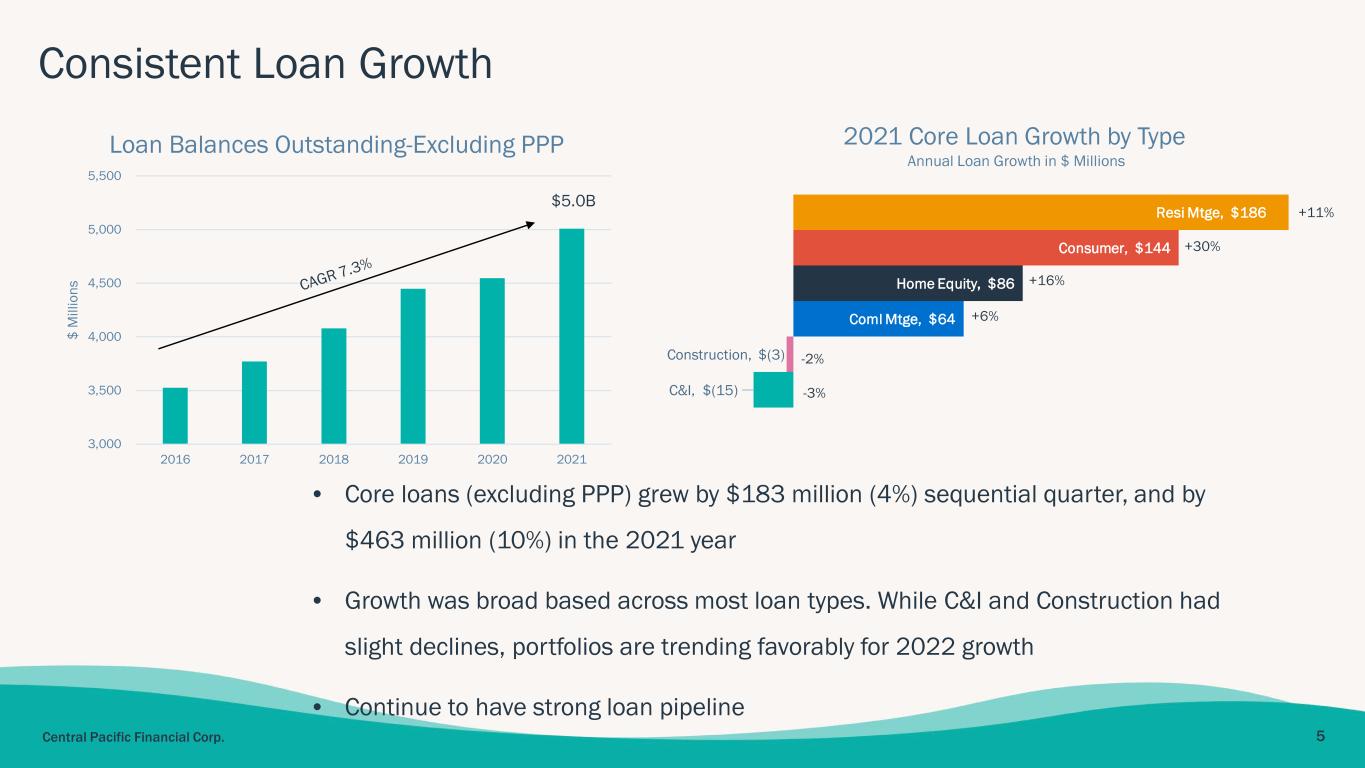

5Central Pacific Financial Corp. Consistent Loan Growth • Core loans (excluding PPP) grew by $183 million (4%) sequential quarter, and by $463 million (10%) in the 2021 year • Growth was broad based across most loan types. While C&I and Construction had slight declines, portfolios are trending favorably for 2022 growth • Continue to have strong loan pipeline $5.0B 3,000 3,500 4,000 4,500 5,000 5,500 2016 2017 2018 2019 2020 2021 $ M ill io ns Loan Balances Outstanding-Excluding PPP C&I, $(15) Construction, $(3) Coml Mtge, $64 Home Equity, $86 Consumer, $144 Resi Mtge, $186 Annual Loan Growth in $ Millions 2021 Core Loan Growth by Type +30% +16% +6% -2% -3% +11%

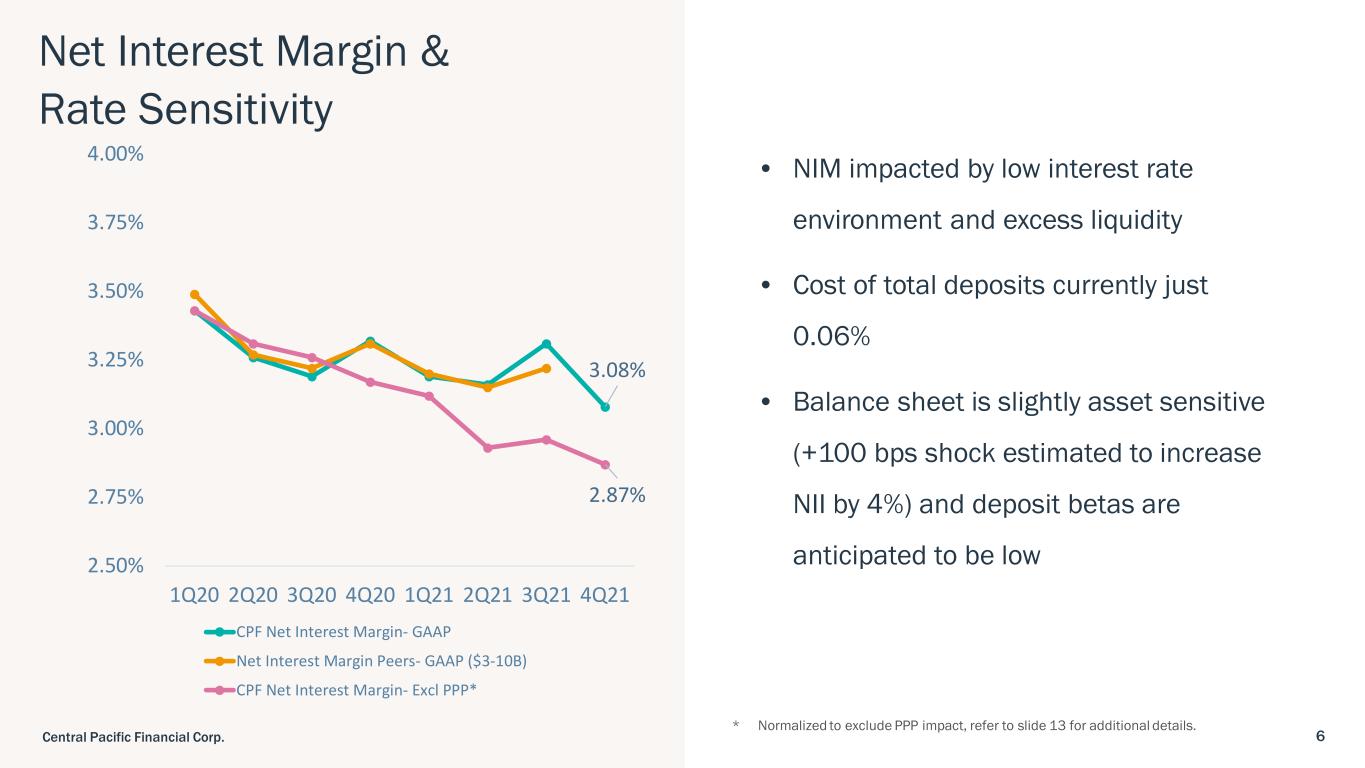

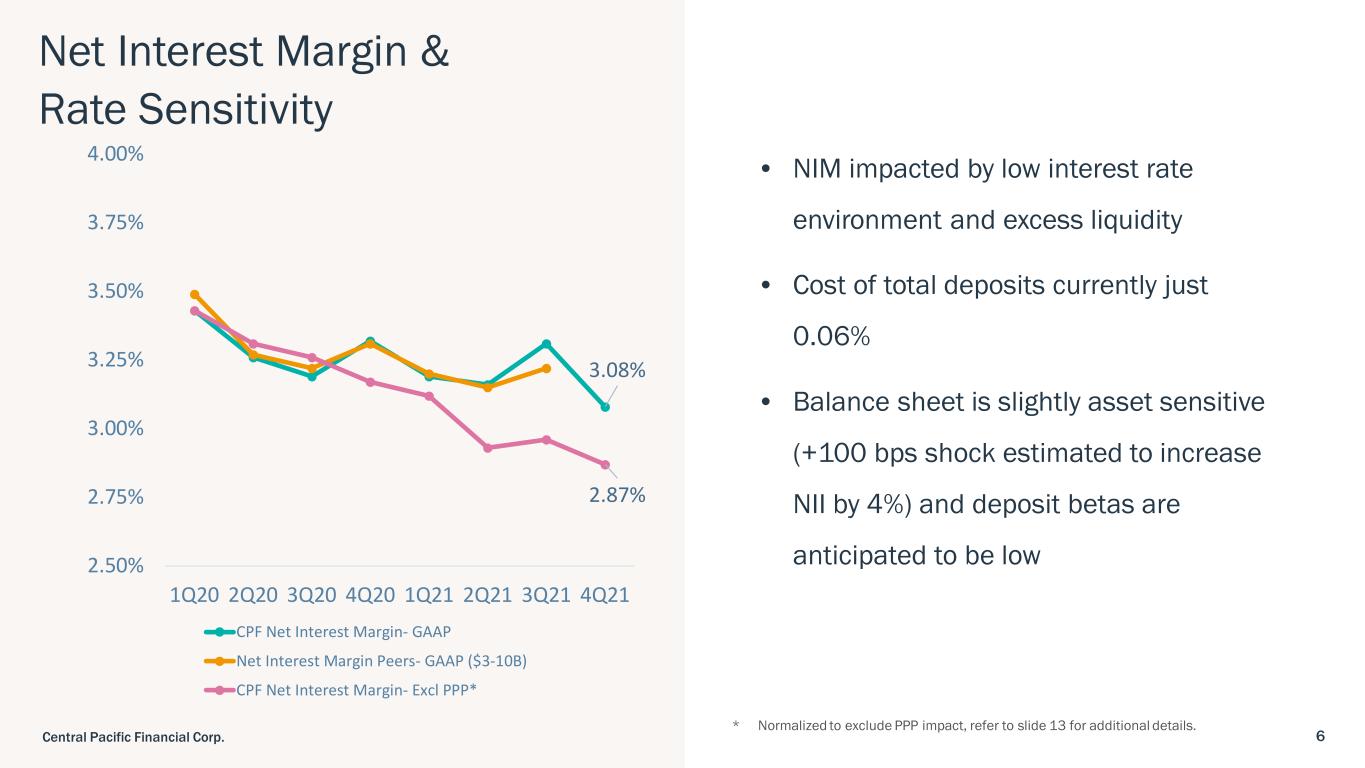

6Central Pacific Financial Corp. Net Interest Margin & Rate Sensitivity * Normalized to exclude PPP impact, refer to slide 13 for additional details. 3.08% 2.87% 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% 4.00% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 CPF Net Interest Margin- GAAP Net Interest Margin Peers- GAAP ($3-10B) CPF Net Interest Margin- Excl PPP* • NIM impacted by low interest rate environment and excess liquidity • Cost of total deposits currently just 0.06% • Balance sheet is slightly asset sensitive (+100 bps shock estimated to increase NII by 4%) and deposit betas are anticipated to be low

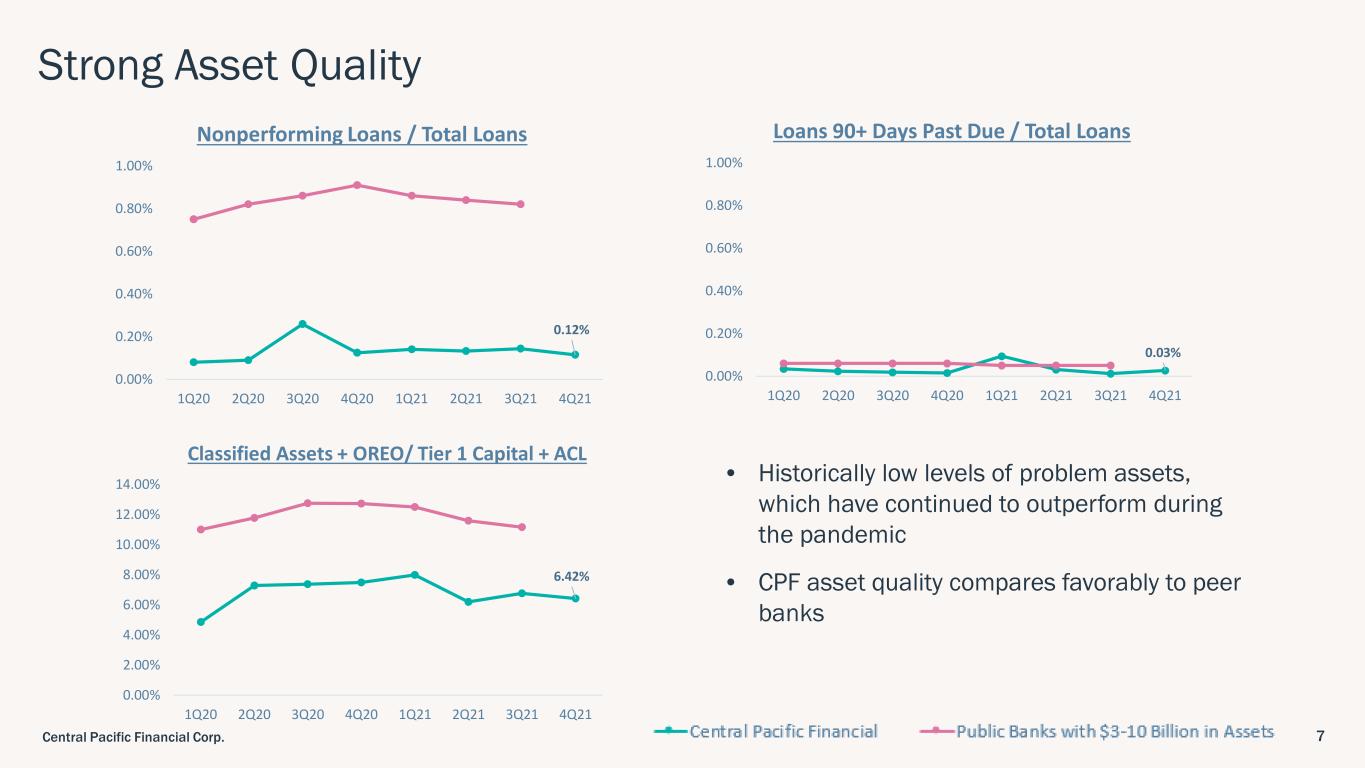

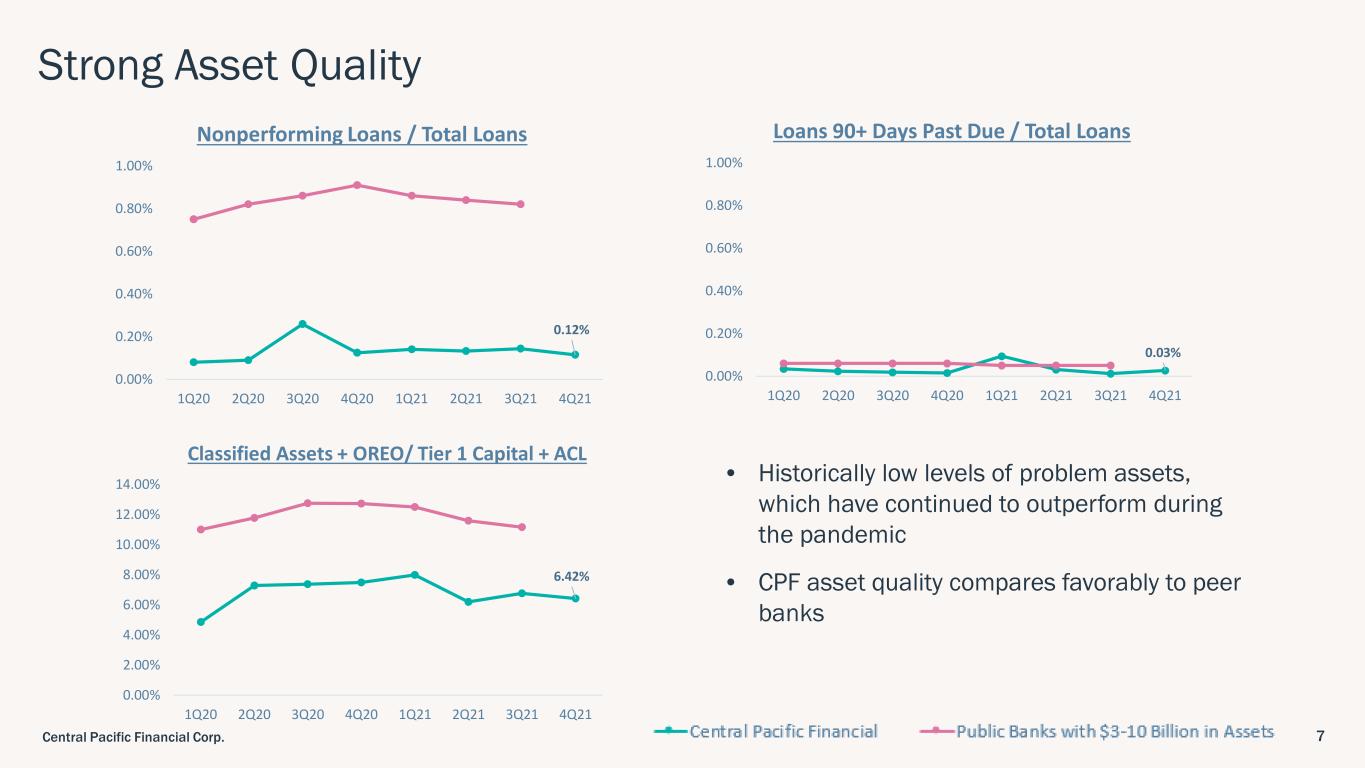

7Central Pacific Financial Corp. Strong Asset Quality 0.03% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Loans 90+ Days Past Due / Total Loans 0.12% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Nonperforming Loans / Total Loans 6.42% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Classified Assets + OREO/ Tier 1 Capital + ACL • Historically low levels of problem assets, which have continued to outperform during the pandemic • CPF asset quality compares favorably to peer banks

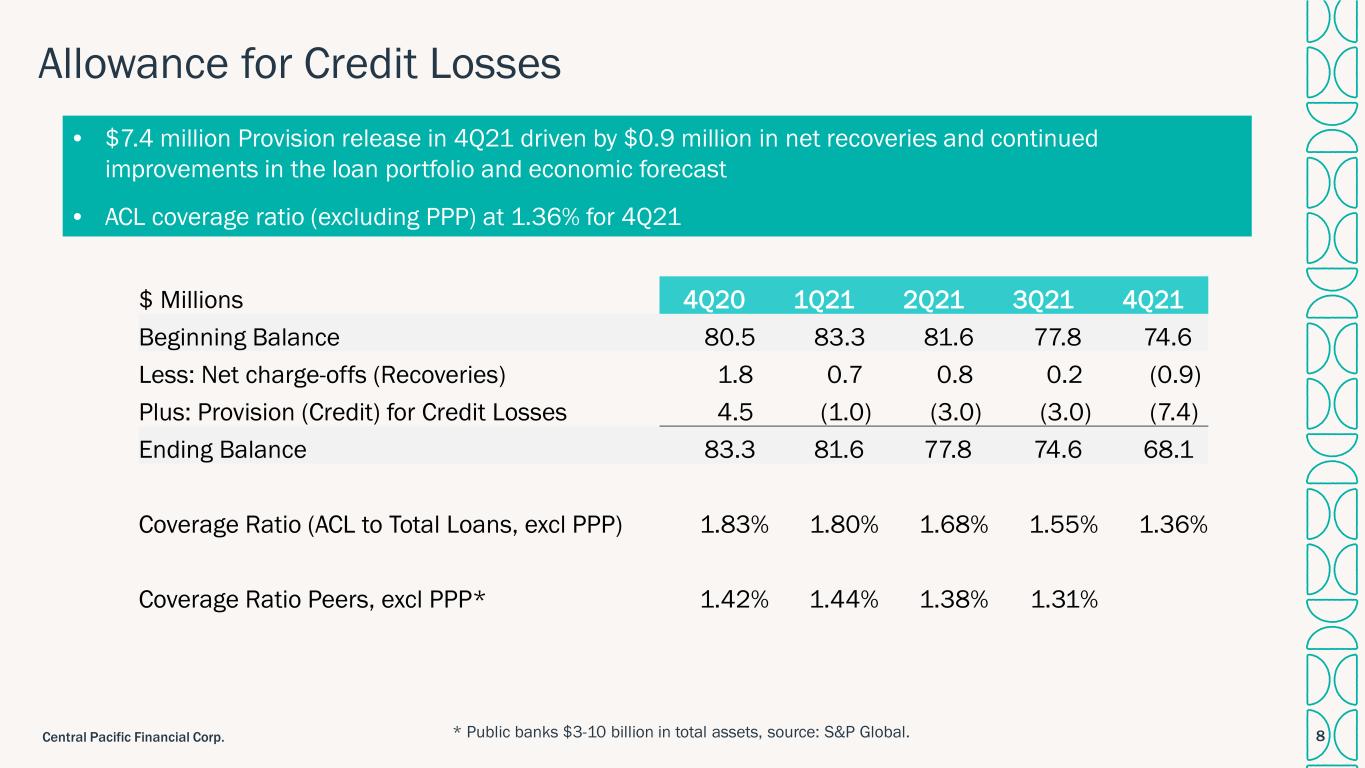

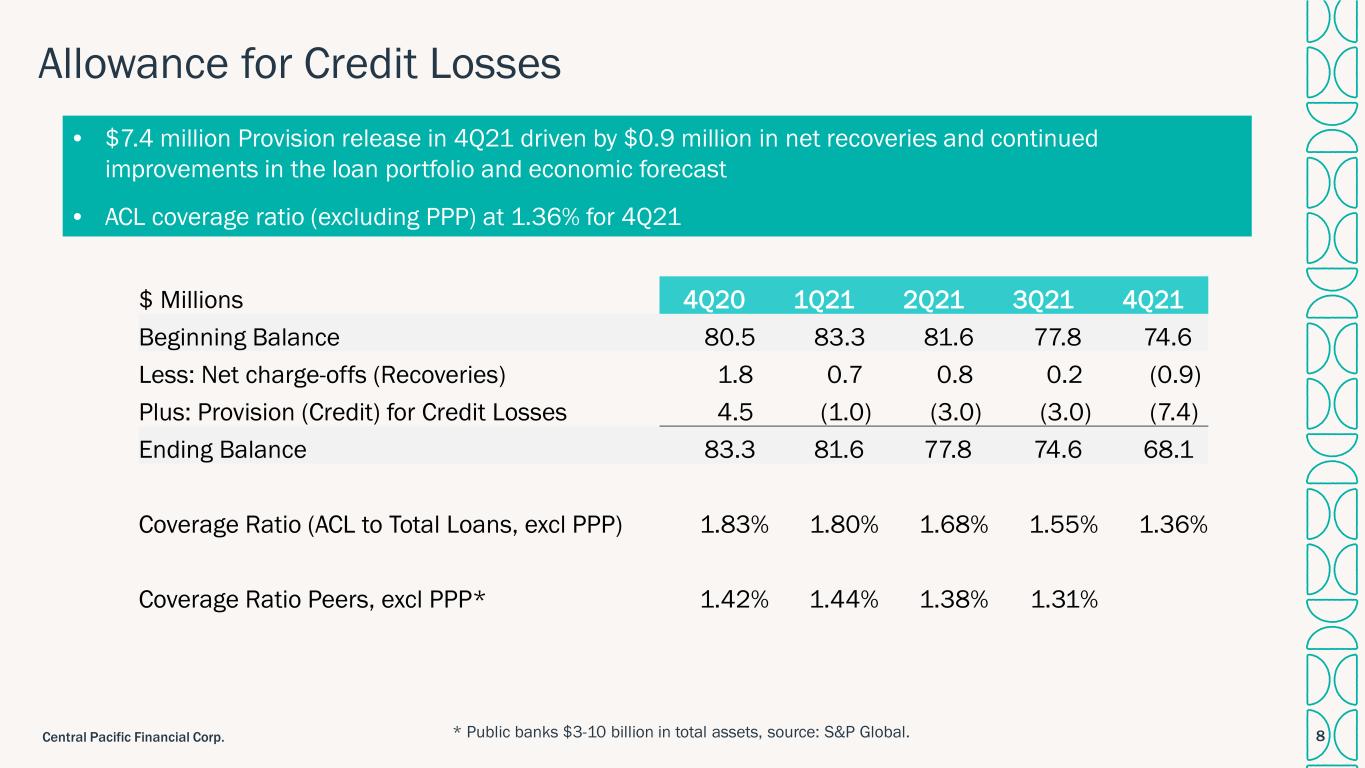

8Central Pacific Financial Corp. Allowance for Credit Losses $ Millions 4Q20 1Q21 2Q21 3Q21 4Q21 Beginning Balance 80.5 83.3 81.6 77.8 74.6 Less: Net charge-offs (Recoveries) 1.8 0.7 0.8 0.2 (0.9) Plus: Provision (Credit) for Credit Losses 4.5 (1.0) (3.0) (3.0) (7.4) Ending Balance 83.3 81.6 77.8 74.6 68.1 Coverage Ratio (ACL to Total Loans, excl PPP) 1.83% 1.80% 1.68% 1.55% 1.36% Coverage Ratio Peers, excl PPP* 1.42% 1.44% 1.38% 1.31% • $7.4 million Provision release in 4Q21 driven by $0.9 million in net recoveries and continued improvements in the loan portfolio and economic forecast • ACL coverage ratio (excluding PPP) at 1.36% for 4Q21 * Public banks $3-10 billion in total assets, source: S&P Global.

9Central Pacific Financial Corp. Solid Capital Position STRONG CAPITAL • Increased quarterly cash dividend by 4% to $0.26 per share which will be payable on March 15, 2022 • $229 million capital cushion to the well-capitalized Total RBC minimum of 10% at 12/31/21 • Repurchased 305,594 shares in the 4Q 2021, and returned $45.6 million in capital to shareholders in 2021 through cash dividends and share repurchases • Board authorized a new $30 million share repurchase program in January 2022 * Excludes the PPP impact to the assets denominator, refer to slide 13 for more details. 11.2% 1.0% 2.3% 8.7% 7.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 12/31/2021 12/31/2021 12/31/2021 Capital Ratios CET1 Tier 1 Tier 2 TOTAL RISK BASED CAPITAL TIER 1 LEVERAGE* TANGIBLE COMMON EQUITY* 14.5%

Mahalo

11Central Pacific Financial Corp. Appendix

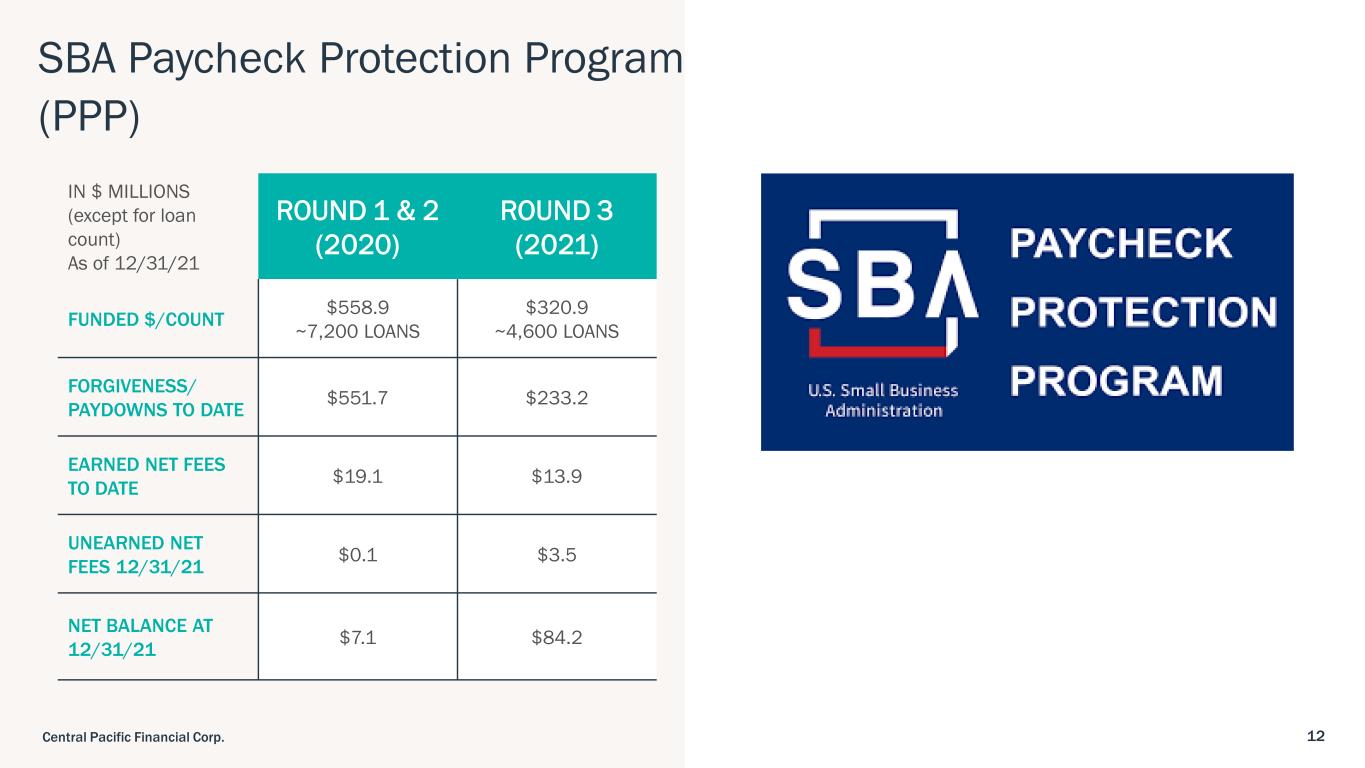

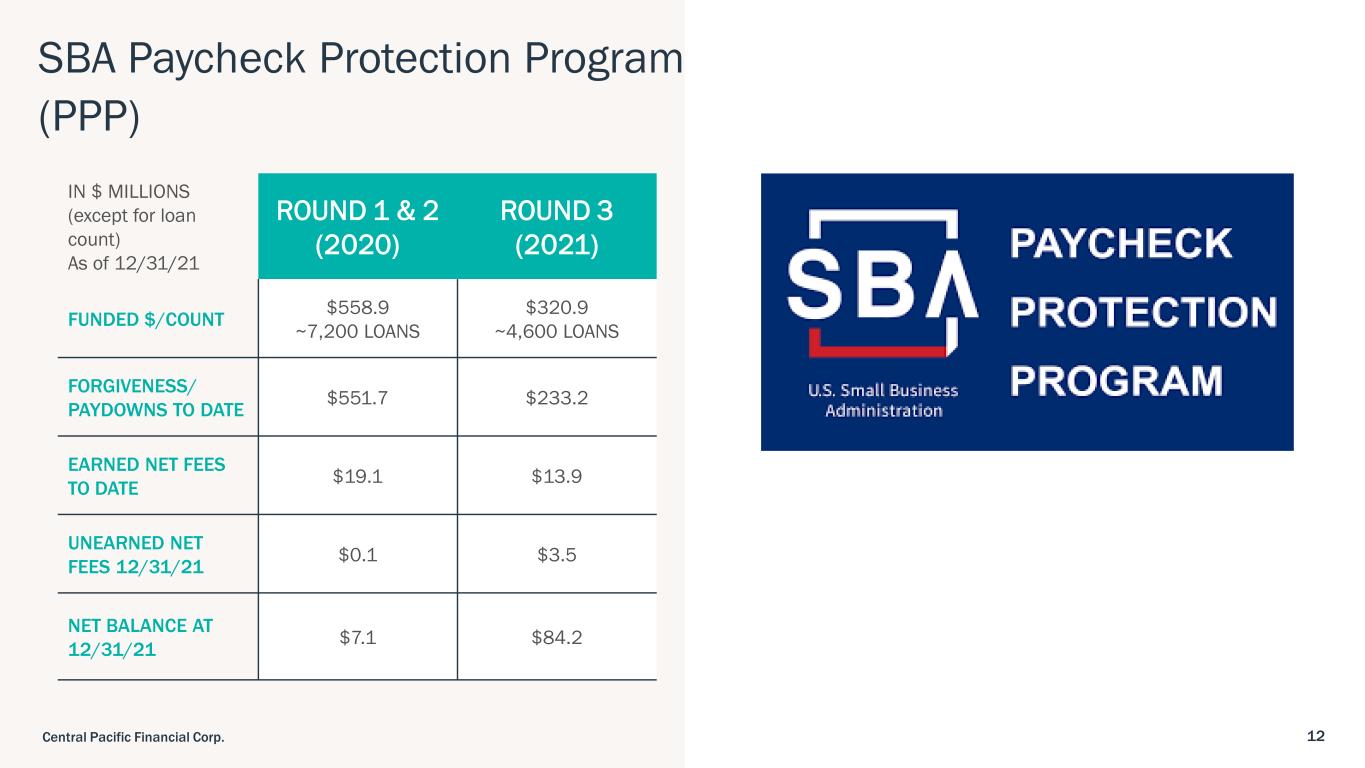

12Central Pacific Financial Corp. SBA Paycheck Protection Program (PPP) IN $ MILLIONS (except for loan count) As of 12/31/21 ROUND 1 & 2 (2020) ROUND 3 (2021) FUNDED $/COUNT $558.9 ~7,200 LOANS $320.9 ~4,600 LOANS FORGIVENESS/ PAYDOWNS TO DATE $551.7 $233.2 EARNED NET FEES TO DATE $19.1 $13.9 UNEARNED NET FEES 12/31/21 $0.1 $3.5 NET BALANCE AT 12/31/21 $7.1 $84.2

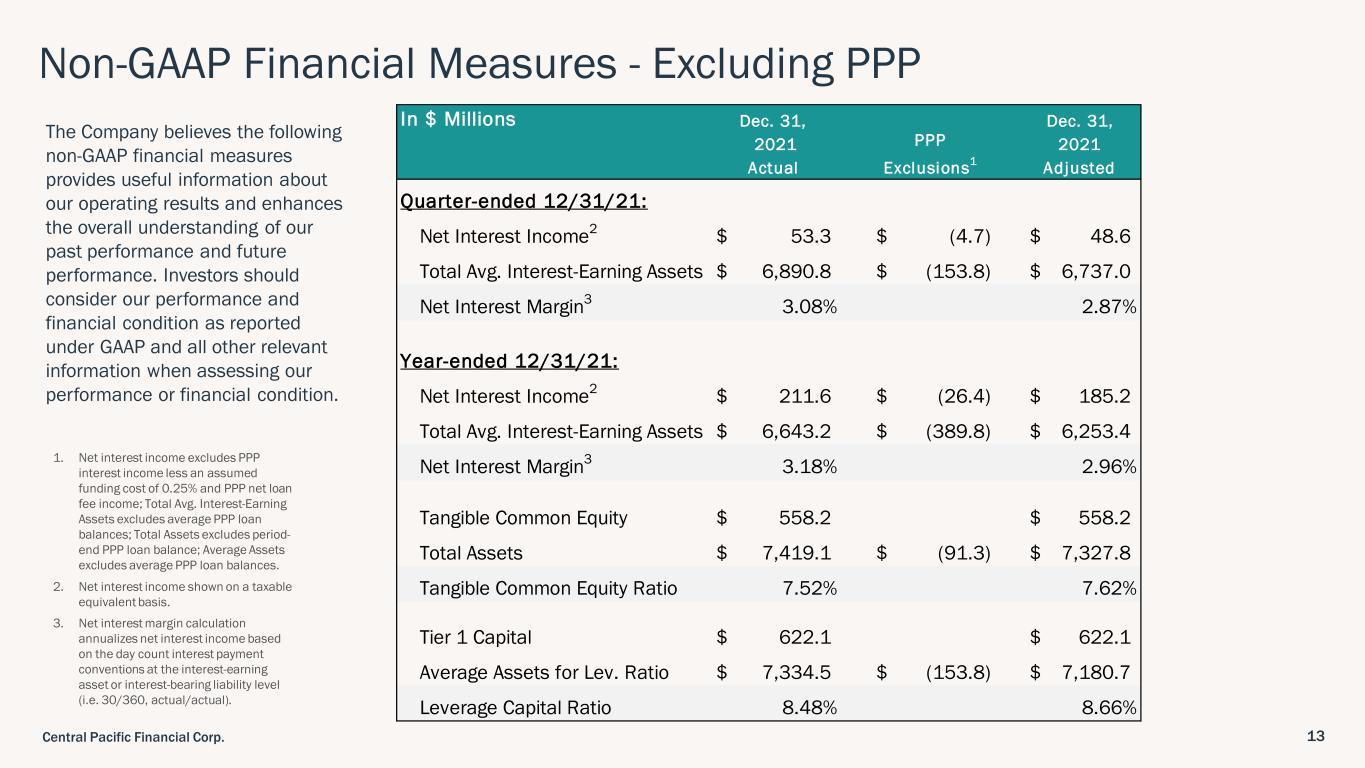

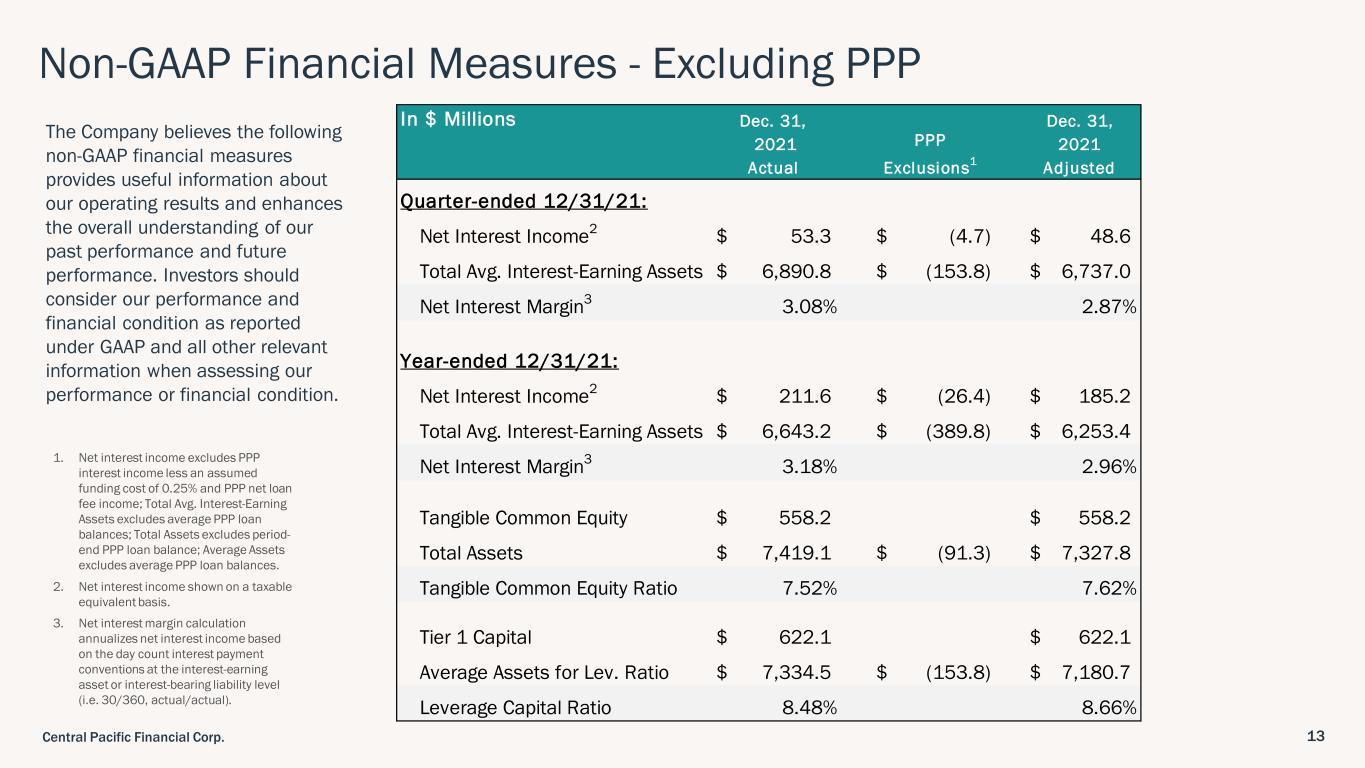

13Central Pacific Financial Corp. Non-GAAP Financial Measures - Excluding PPP 1. Net interest income excludes PPP interest income less an assumed funding cost of 0.25% and PPP net loan fee income; Total Avg. Interest-Earning Assets excludes average PPP loan balances; Total Assets excludes period- end PPP loan balance; Average Assets excludes average PPP loan balances. 2. Net interest income shown on a taxable equivalent basis. 3. Net interest margin calculation annualizes net interest income based on the day count interest payment conventions at the interest-earning asset or interest-bearing liability level (i.e. 30/360, actual/actual). The Company believes the following non-GAAP financial measures provides useful information about our operating results and enhances the overall understanding of our past performance and future performance. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. In $ Millions Dec. 31, 2021 Actual PPP Exclusions1 Dec. 31, 2021 Adjusted Quarter-ended 12/31/21: Net Interest Income2 53.3$ (4.7)$ 48.6$ Total Avg. Interest-Earning Assets 6,890.8$ (153.8)$ 6,737.0$ Net Interest Margin3 3.08% 2.87% Year-ended 12/31/21: Net Interest Income2 211.6$ (26.4)$ 185.2$ Total Avg. Interest-Earning Assets 6,643.2$ (389.8)$ 6,253.4$ Net Interest Margin3 3.18% 2.96% Tangible Common Equity 558.2$ 558.2$ Total Assets 7,419.1$ (91.3)$ 7,327.8$ Tangible Common Equity Ratio 7.52% 7.62% Tier 1 Capital 622.1$ 622.1$ Average Assets for Lev. Ratio 7,334.5$ (153.8)$ 7,180.7$ Leverage Capital Ratio 8.48% 8.66%