Investor Presentation September 2022

2Central Pacific Financial Corp. Forward-Looking Statements This document may contain forward-looking statements concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, the payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our business initiatives; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believes," "plans," "anticipates," "expects," "intends," "forecasts," "hopes," "targeting," "continue," "remain," "will," "should," "estimates," "may" and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. While we believe that our forward-looking statements and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the adverse effects of the COVID-19 pandemic virus on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees as well as the effects of government programs and initiatives in response to COVID-19; the impact of our participation in the Paycheck Protection Program ("PPP") and fulfillment of government guarantees on our PPP loans; our ability to successfully implement our Banking-as-a-Service initiatives, including adoption of the initiatives by customers and risks faced by any of our bank collaborations including reputational and regulatory risk; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; our ability to successfully implement our business initiatives; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, earthquakes and pandemic viruses and diseases, including COVID-19) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau (the "CFPB"), government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings or regulatory or other governmental inquiries and proceedings and the resolution thereof, the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulatory orders or actions we are or may become subject to; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System (the "FRB" or the "Federal Reserve"); inflation, interest rate, securities market and monetary fluctuations, including the anticipated replacement of the London Interbank Offered Rate ("LIBOR") Index and the impact on our loans and debt which are tied to that index; negative trends in our market capitalization and adverse changes in the price of the Company's common stock; political instability; acts of war or terrorism; pandemic virus and disease, including COVID-19; changes in consumer spending, borrowings and savings habits; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; cybersecurity and data privacy breaches and the consequence therefrom; the ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; technological changes and developments; changes in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board ("FASB") and other accounting standard setters and the cost and resources required to implement such changes; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items. For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the forward-looking statements, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the forward-looking statements contained in this Form 8-K. Forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

3Central Pacific Financial Corp. Central Pacific Financial - Corporate Profile MARKET INFORMATION NYSE TICKER CPF SUBSIDIARY CENTRAL PACIFIC BANK (CPB) TOTAL ASSETS $7.3 BILLION MARKET CAP $625 MILLION SHARE PRICE $22.88 DIVIDEND YIELD 4.6% Central Pacific Financial Corp. is a Hawaii-based bank holding company. Central Pacific Bank (CPB) was founded in 1954 by Japanese-American veterans of World War II to serve the needs of families and small businesses that did not have access to financial services. Today CPB is the 4th largest financial institution in Hawaii with 27 branches across the State. CPB is a market leader in residential mortgage, small business banking and digital banking. Note: Total assets as of 6/30/22. Other Market Information above as of 8/26/22.

4Central Pacific Financial Corp. CPF Investment Highlights Well positioned to capitalize on improving macro trends Accelerating & sustainable growth NIM tailwinds Focus on driving efficiency Strong credit & capital profile Digital & BaaS initiatives to expand future market & growth 1 2 3 4 5 6

5Central Pacific Financial Corp. FACTORS FOR A FAVORABLE HAWAII OUTLOOK Rebound in International visitors expected • Japanese visitors to Hawaii expected to increase as COVID testing requirements are ending and daily passenger limits are increasing Significant increase expected in Defense spending • National Defense Authorization Act appropriated $1 billion for a Hawaii health and environmental recovery fund in 2022 Continued housing strength and development • Significant home construction ongoing with two major master-planned community projects being built in West Oahu totaling over 15,000 homes 1 Source: University of Hawaii Economic Research Organization (UHERO). Tourism Visitor arrivals YTD compared to 2019 90% Employment Unemployment Rate July 2022 4.1% Housing Oahu Median Single- Family Home Price July 2022 $1.1 Million Growth Real GDP projected 2022 increase 3.5%1 KEY HAWAII ECONOMIC METRICS

6Central Pacific Financial Corp. 3,000 3,500 4,000 4,500 5,000 5,500 2016 2017 2018 2019 2020 2021 2Q2022 $ M ill io ns Loan Balances Outstanding-Excluding PPP • Loan market share increased from 13% to 15% in the last 5 years* • Weighted average LTVs of 64% for Residential Mortgage, 61% for Home Equity and 62% for Commercial Mortgage • Strong Consumer credit quality with weighted average origination FICO of 740 for Hawaii Consumer and 745 for Mainland Consumer • Mainland loan portfolio purchase/participation strategy provides geographic diversification and higher yield opportunities $5.3B C&I 10% Construction 3% Residential Mortgage 36% Home Equity 13% Coml Mortgage 25% Consumer 13% Loan Portfolio Composition as of June 30, 2022 Core loans grew in 2Q 2022 by 11.8% on a linked quarter annualized basis Strong and diverse loan portfolio, with over 75% secured by real estate * Market share among the 4 largest Hawaii banks (Bank of Hawaii, First Hawaiian Bank, American Savings Bank and Central Pacific Bank). Source: S&P Global.

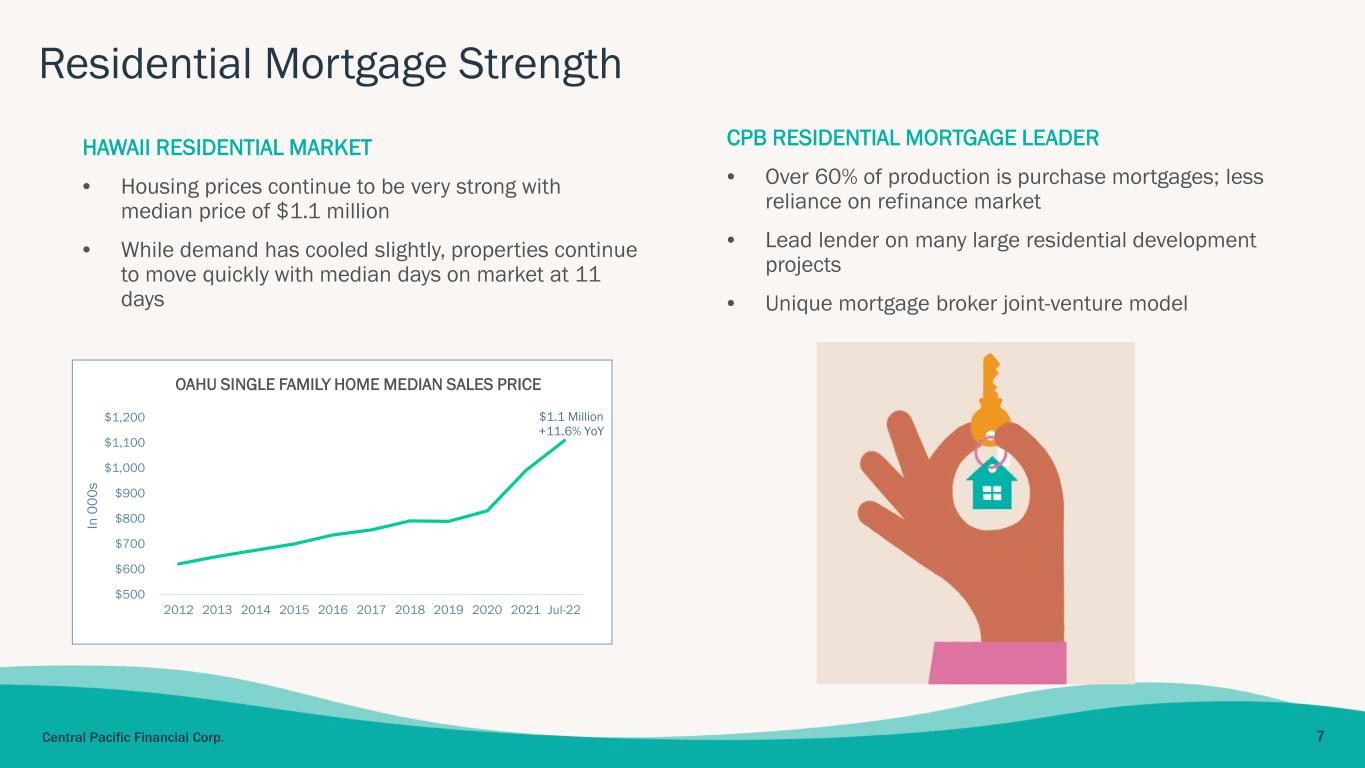

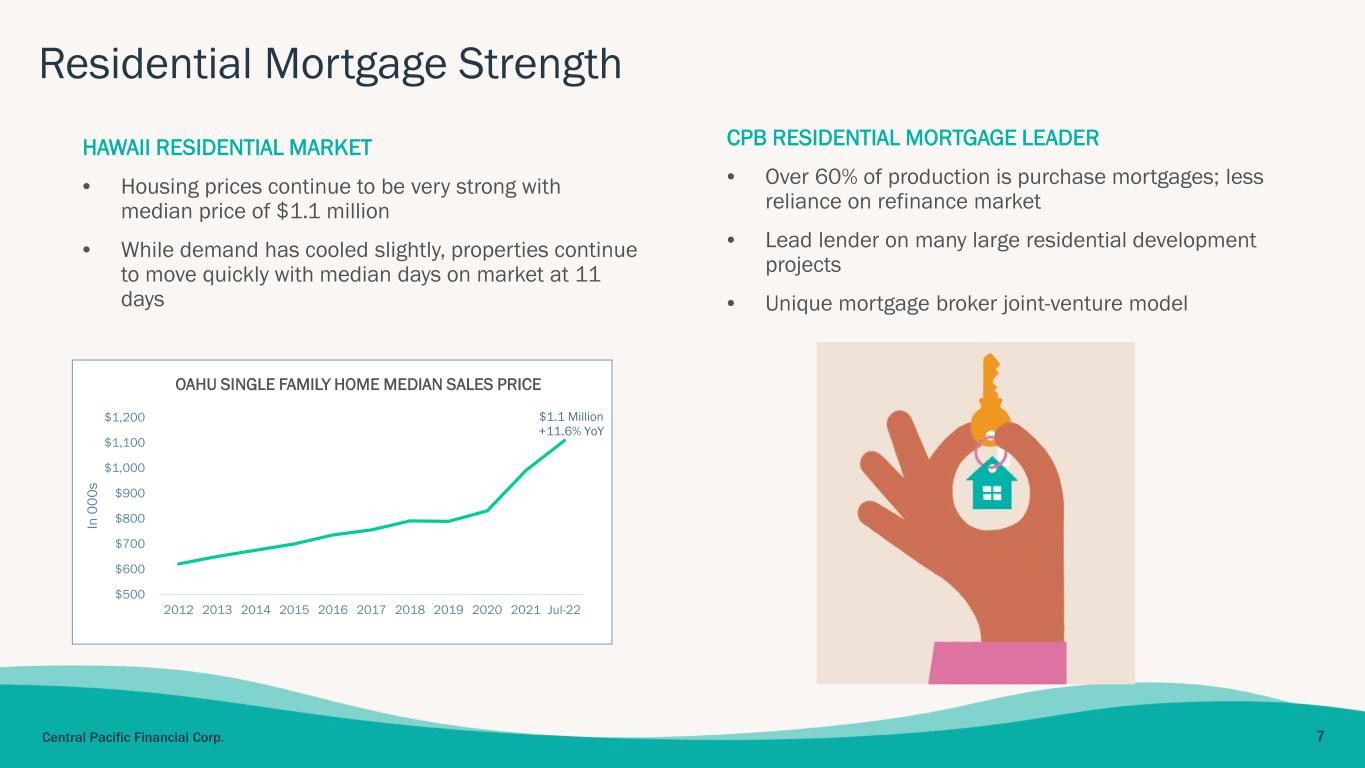

7Central Pacific Financial Corp. Residential Mortgage Strength SMALL BUSINESSES $1.1 Million +11.6% YoY $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Jul-22 In 0 00 s OAHU SINGLE FAMILY HOME MEDIAN SALES PRICE HAWAII RESIDENTIAL MARKET • Housing prices continue to be very strong with median price of $1.1 million • While demand has cooled slightly, properties continue to move quickly with median days on market at 11 days CPB RESIDENTIAL MORTGAGE LEADER • Over 60% of production is purchase mortgages; less reliance on refinance market • Lead lender on many large residential development projects • Unique mortgage broker joint-venture model

8Central Pacific Financial Corp. Small Business Leader SMALL BUSINESSES 2021 Lender of the Year Category 2 by the SBA’s Hawaii District Office Originated more SBA loans based on count and $ than the 3 other large Hawaii banks combined1 Innovative Programs & Technology CPB Foundation started a financial management and networking accelerator program in 2021 for local women entrepreneurs called ‘WE by Rising Tide’ Outperformed on the PPP program, originating 30% of all PPP loans in the State of Hawaii; over 600 new PPP borrowers have converted to CPB customers thus far Niche Markets CPB has strong market share in the dental and physician niche, being the primary bank to nearly half of the dentists and a quarter of the physicians in the State of Hawaii 1 As reported by the SBA for the 2021 Fiscal Year.

9Central Pacific Financial Corp. Japan Competitive Advantage • Paul Yonamine, CPF CEO, is on the Board of Directors of Sumitomo Mitsui Banking Corporation (SMBC) and Seven & i Holdings. He is also the Board Chair of the U.S. Japan Council. He previously served as the IBM Japan President and led KPMG Consulting in Japan • Hikaru Utsugi, head of CPB International banking spent 30+ years at Mitsubishi UFJ Bank • Japan recently loosened travel restrictions. CPB Team has resumed business development travel to Japan • CPB currently has nearly $1 billion in Japan-related deposits (+10% in last 2 years), growth in CPB’s Japan business will further accelerate in 2H2022

10Central Pacific Financial Corp. • 2Q 2022 Core NIM (excluding PPP) increased by 13 bps sequential quarter to 3.01%1 due to asset sensitivity and the rising rate environment • 3Q 2022 Core NIM estimated to further increase by 10-15 bps 1 Excludes $0.9MM in PPP net interest income, and $33MM in average PPP loan balances. * Immediate reflects an instantaneous, parallel rate shock, whereas gradual reflects a parallel rate ramp evenly over 12 months. Asset Sensitive Balance Sheet 3.3% 5.8% 4.1% 8.2% +100 bps +200 bps Net Interest Income Rate Sensitivity As of June 30, 2022 Gradual* Immediate*

11Central Pacific Financial Corp. Solid Low-Cost Core Deposit Portfolio 4,000 4,500 5,000 5,500 6,000 6,500 7,000 2016 2017 2018 2019 2020 2021 2Q2022 $ M ill io ns Total Deposits $6.6B @ 0.06% avg cost • Strong deposit portfolio consisting of 93% core deposits and a total deposit cost of just 0.06% in the 2Q 2022 • Deposit repricing betas anticipated to be low. Betas were just 13% in the prior Fed tightening cycle (2016-2019, excludes government time deposits) Noninterest Bearing Demand 35% Interest Bearing Demand 22% Savings & Money Market 33% Time 10% Deposit Portfolio Composition as of June 30, 2022

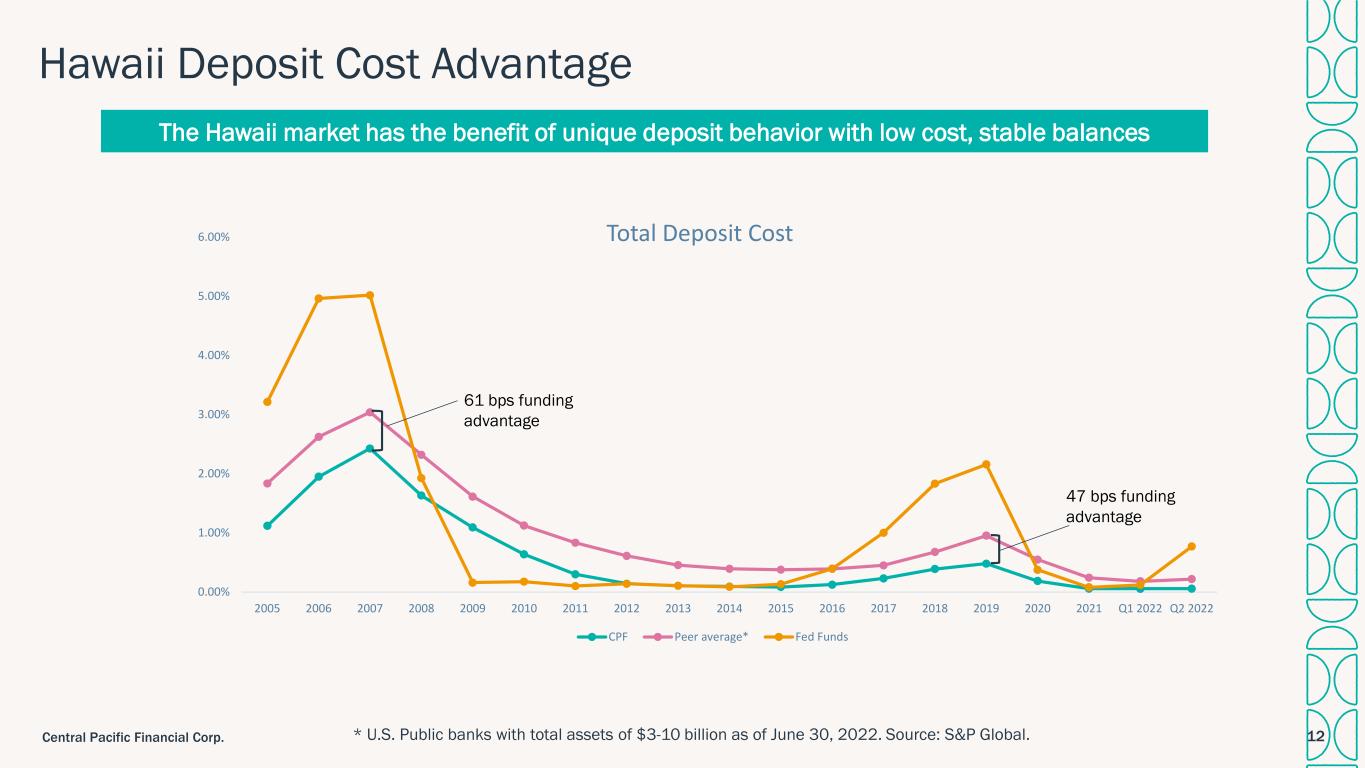

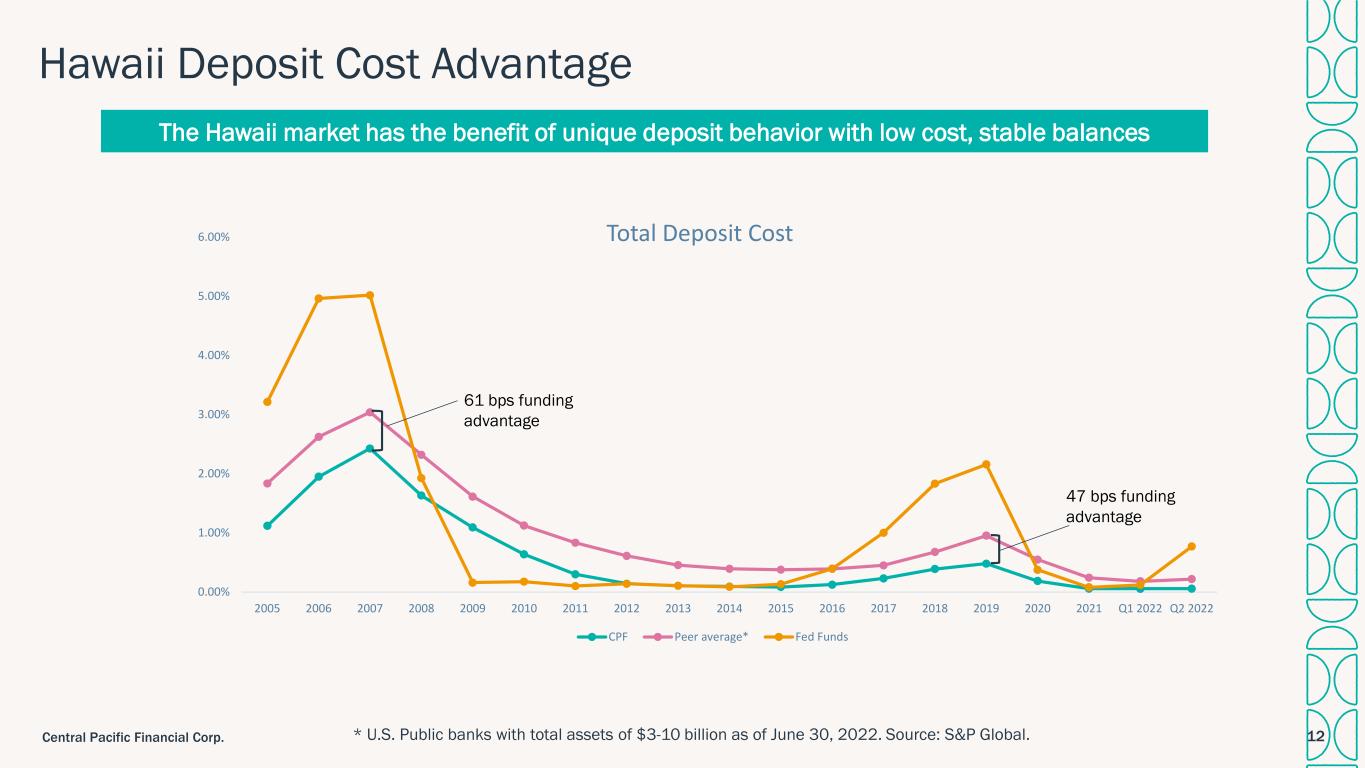

12Central Pacific Financial Corp. Hawaii Deposit Cost Advantage 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 Total Deposit Cost CPF Peer average* Fed Funds 61 bps funding advantage 47 bps funding advantage * U.S. Public banks with total assets of $3-10 billion as of June 30, 2022. Source: S&P Global. The Hawaii market has the benefit of unique deposit behavior with low cost, stable balances

13Central Pacific Financial Corp. Branch Consolidation - 8 branches consolidated since 2020 (-23%) - Currently operating 27 branches in the State of Hawaii FTE Reduction - Reduced total FTE from 833 to 774 over the last 2 years (-7%) through attrition enabled by efficiency gains SUCCESSFUL EXECUTION TO DATE: CONTINUED FOCUSED EXECUTION TO DRIVE EFFICIENCY RATIO UNDER 60% • Service Now implementation: using automation to improve internal processing • Consolidated Loan Origination System: straight-through processing from start to finish • Digital Channels: continued transaction migration

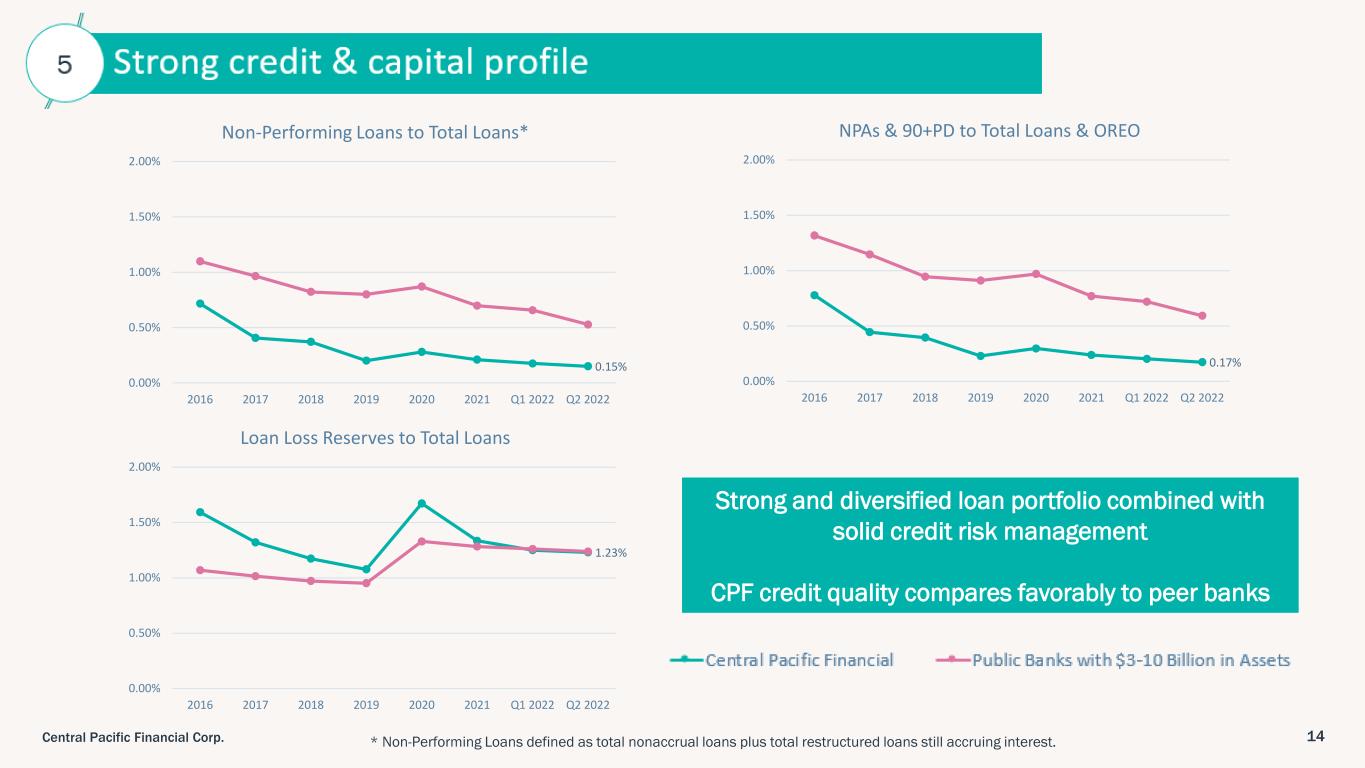

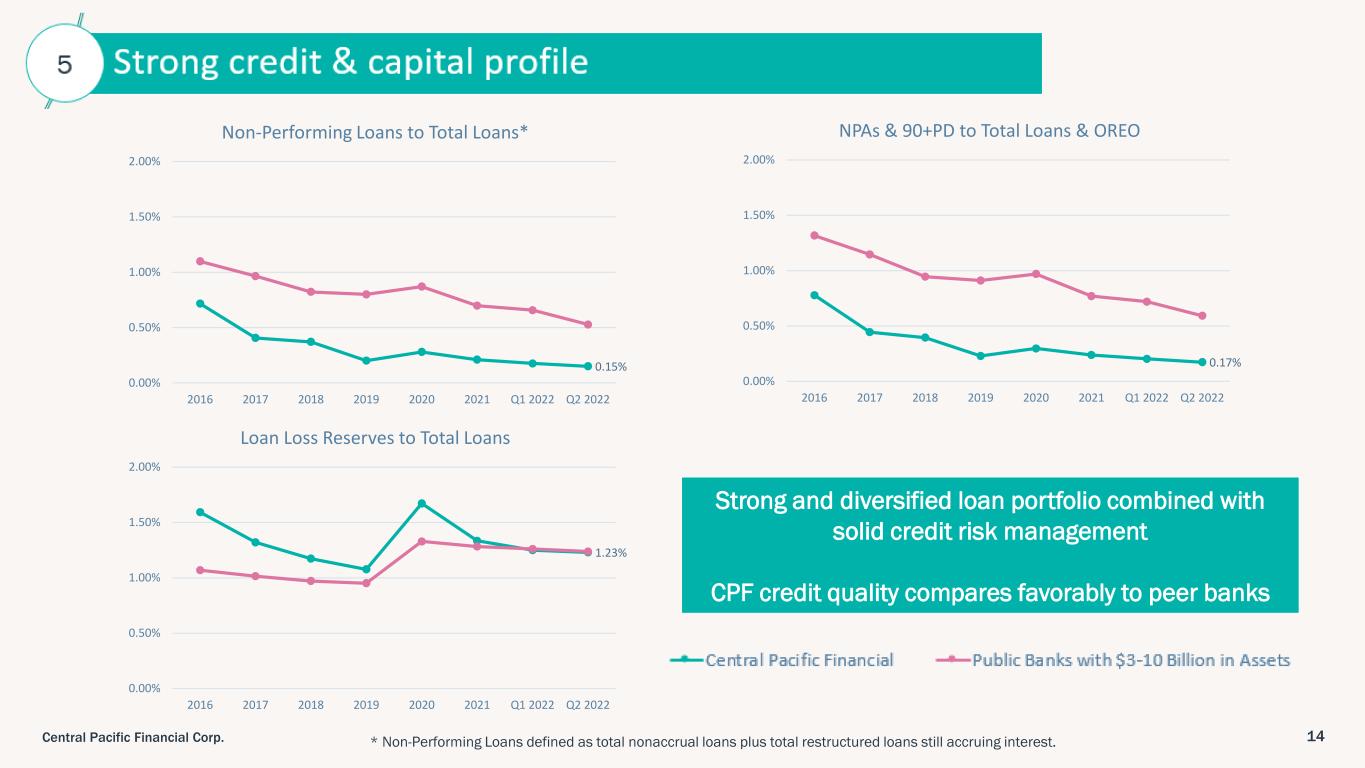

14Central Pacific Financial Corp. Strong and diversified loan portfolio combined with solid credit risk management CPF credit quality compares favorably to peer banks 0.15% 0.00% 0.50% 1.00% 1.50% 2.00% 2016 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 Non-Performing Loans to Total Loans* 0.17% 0.00% 0.50% 1.00% 1.50% 2.00% 2016 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 NPAs & 90+PD to Total Loans & OREO 1.23% 0.00% 0.50% 1.00% 1.50% 2.00% 2016 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 Loan Loss Reserves to Total Loans * Non-Performing Loans defined as total nonaccrual loans plus total restructured loans still accruing interest.

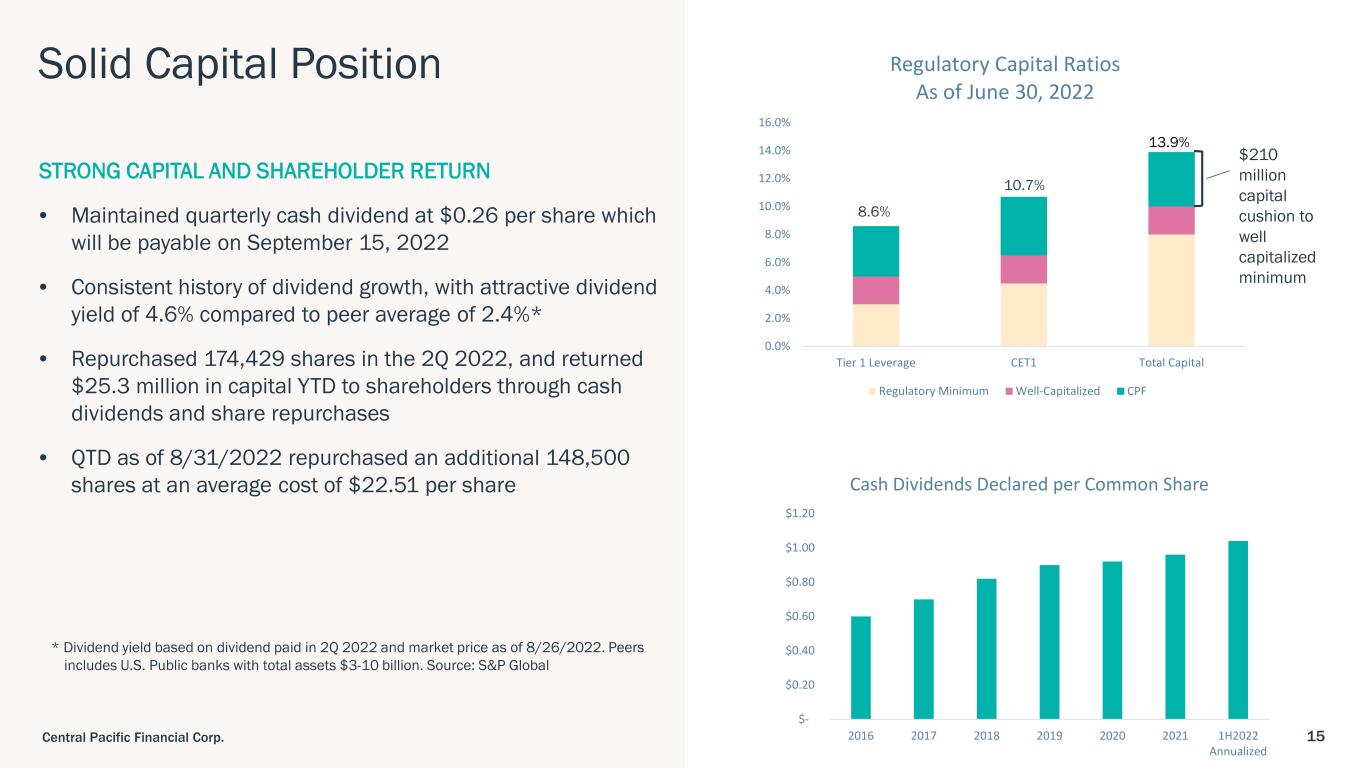

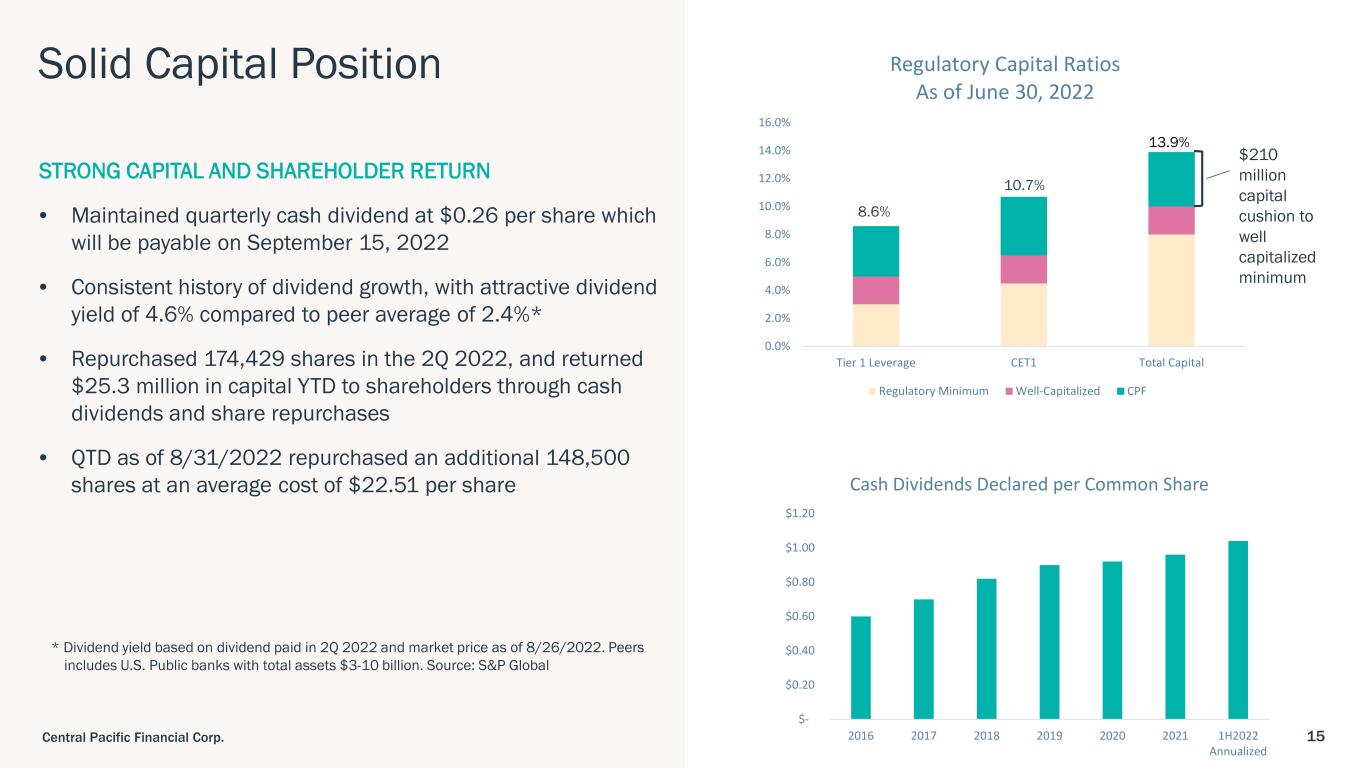

15Central Pacific Financial Corp. Solid Capital Position 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Tier 1 Leverage CET1 Total Capital Regulatory Capital Ratios As of June 30, 2022 Regulatory Minimum Well-Capitalized CPF 10.7% 13.9% 8.6% STRONG CAPITAL AND SHAREHOLDER RETURN • Maintained quarterly cash dividend at $0.26 per share which will be payable on September 15, 2022 • Consistent history of dividend growth, with attractive dividend yield of 4.6% compared to peer average of 2.4%* • Repurchased 174,429 shares in the 2Q 2022, and returned $25.3 million in capital YTD to shareholders through cash dividends and share repurchases • QTD as of 8/31/2022 repurchased an additional 148,500 shares at an average cost of $22.51 per share $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 2016 2017 2018 2019 2020 2021 1H2022 Annualized Cash Dividends Declared per Common Share * Dividend yield based on dividend paid in 2Q 2022 and market price as of 8/26/2022. Peers includes U.S. Public banks with total assets $3-10 billion. Source: S&P Global $210 million capital cushion to well capitalized minimum

16Central Pacific Financial Corp. Shaka - Hawaii’s first fully digital bank account • Successful launch with over 4,000 accounts opened in the first 6 months • Product expansion and continued development ongoing • Unique brand marketing and social-media strategy • Meeting the needs of younger generation with preference for digital channels Banking-as-a-Service (BaaS) Initiative • Starting with Swell fintech launch in 3Q 2022, with CPB serving as bank sponsor and unique credit enhancement model mitigating risk to CPB • Other BaaS opportunities under exploration • Provides enhanced diversification and growth opportunity, expanding beyond Hawaii market • Incremental fee income opportunities

Mahalo

18Central Pacific Financial Corp. Appendix

19Central Pacific Financial Corp. Central Pacific Bank ranked #1 Best-in-State Bank in Hawaii for 2022

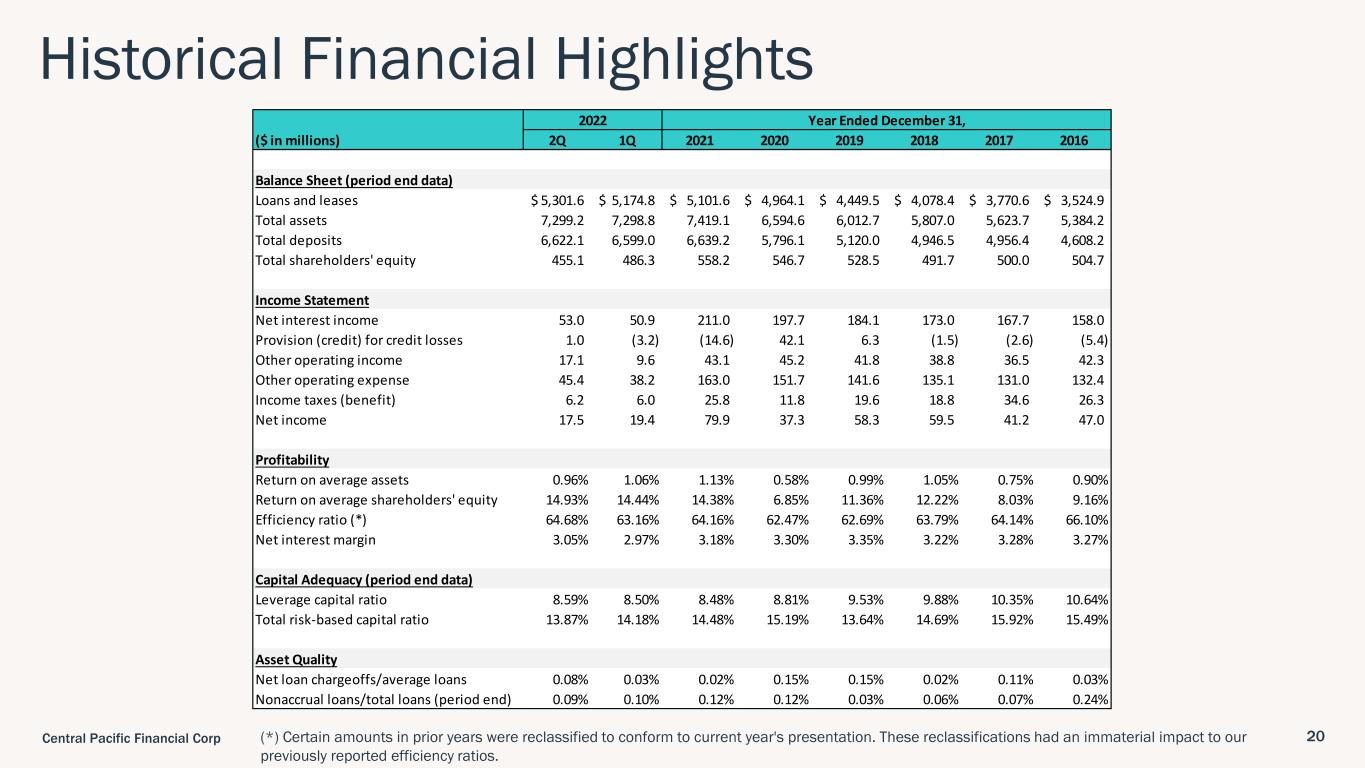

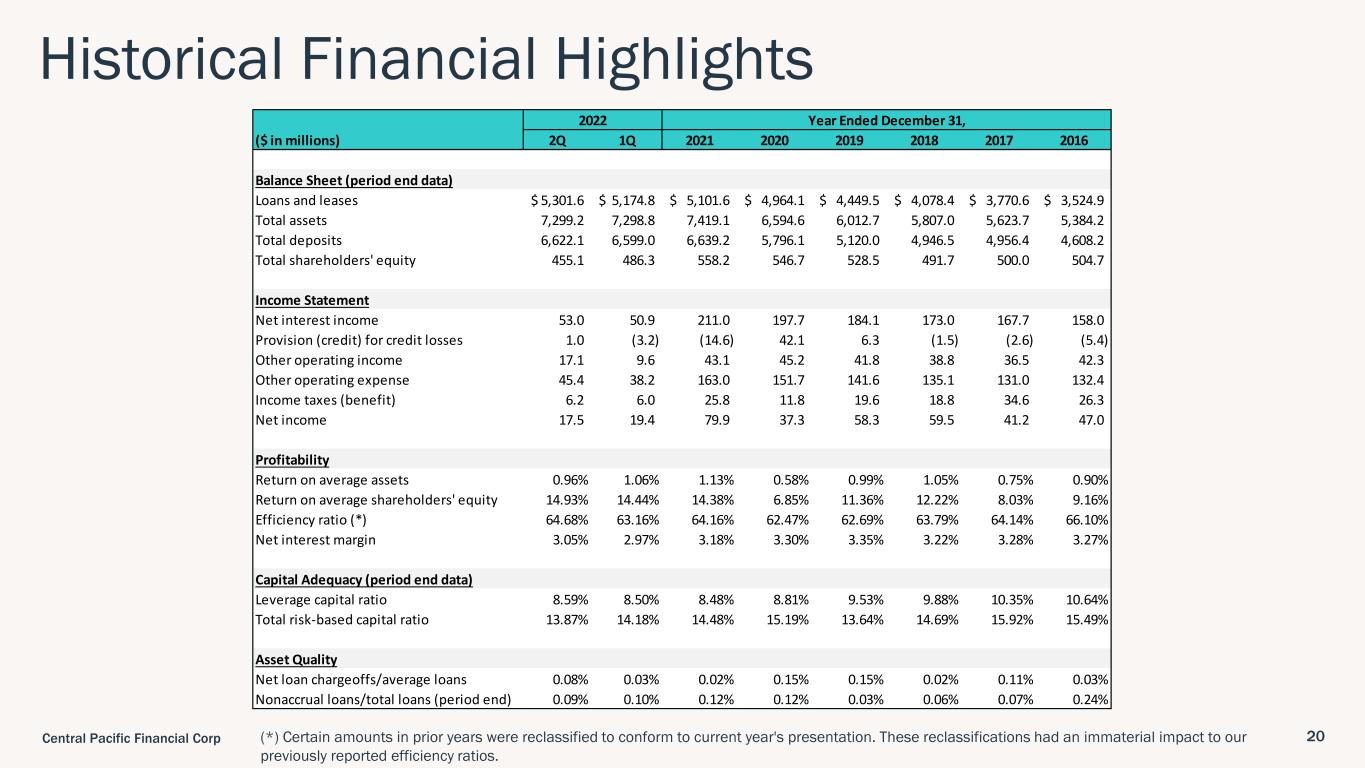

20Central Pacific Financial Corp Historical Financial Highlights (*) Certain amounts in prior years were reclassified to conform to current year's presentation. These reclassifications had an immaterial impact to our previously reported efficiency ratios. ($ in millions) 1Q 2021 2020 2019 2018 2017 2016 Balance Sheet (period end data) Loans and leases 5,301.6$ 5,174.8$ 5,101.6$ 4,964.1$ 4,449.5$ 4,078.4$ 3,770.6$ 3,524.9$ Total assets 7,299.2 7,298.8 7,419.1 6,594.6 6,012.7 5,807.0 5,623.7 5,384.2 Total deposits 6,622.1 6,599.0 6,639.2 5,796.1 5,120.0 4,946.5 4,956.4 4,608.2 Total shareholders' equity 455.1 486.3 558.2 546.7 528.5 491.7 500.0 504.7 Income Statement Net interest income 53.0 50.9 211.0 197.7 184.1 173.0 167.7 158.0 Provision (credit) for credit losses 1.0 (3.2) (14.6) 42.1 6.3 (1.5) (2.6) (5.4) Other operating income 17.1 9.6 43.1 45.2 41.8 38.8 36.5 42.3 Other operating expense 45.4 38.2 163.0 151.7 141.6 135.1 131.0 132.4 Income taxes (benefit) 6.2 6.0 25.8 11.8 19.6 18.8 34.6 26.3 Net income 17.5 19.4 79.9 37.3 58.3 59.5 41.2 47.0 Profitability Return on average assets 0.96% 1.06% 1.13% 0.58% 0.99% 1.05% 0.75% 0.90% Return on average shareholders' equity 14.93% 14.44% 14.38% 6.85% 11.36% 12.22% 8.03% 9.16% Efficiency ratio (*) 64.68% 63.16% 64.16% 62.47% 62.69% 63.79% 64.14% 66.10% Net interest margin 3.05% 2.97% 3.18% 3.30% 3.35% 3.22% 3.28% 3.27% Capital Adequacy (period end data) Leverage capital ratio 8.59% 8.50% 8.48% 8.81% 9.53% 9.88% 10.35% 10.64% Total risk-based capital ratio 13.87% 14.18% 14.48% 15.19% 13.64% 14.69% 15.92% 15.49% Asset Quality Net loan chargeoffs/average loans 0.08% 0.03% 0.02% 0.15% 0.15% 0.02% 0.11% 0.03% Nonaccrual loans/total loans (period end) 0.09% 0.10% 0.12% 0.12% 0.03% 0.06% 0.07% 0.24% 2Q Year Ended December 31,2022

21Central Pacific Financial Corp. Environmental, Social & Governance (ESG) 2021 ESG report released in early 2022 can be viewed here: https://www.cpb.bank/esg