Investor Presentation November 2022

2Central Pacific Financial Corp. Forward-Looking Statements This document may contain forward-looking statements (“FLS”) concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, the payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our business initiatives; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believes," "plans," "anticipates," "expects," "intends," "forecasts," "hopes," "targeting," "continue," "remain," "will," "should," "estimates," "may" and other similar expressions are intended to identify FLS but are not the exclusive means of identifying such statements. While we believe that our FLS and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the effects of inflation and rising interest rates; the adverse effects of the COVID-19 pandemic virus (and ongoing pandemic variants) on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees as well as the effects of government programs and initiatives in response to COVID-19; the impact of our participation in the Paycheck Protection Program ("PPP") and fulfillment of government guarantees on our PPP loans; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; our ability to achieve the objectives of our RISE2020 initiative; our ability to successfully implement and achieve the objectives of our Banking-as-a-Service ("BaaS") initiatives, including adoption of the initiatives by customers and risks faced by any of our bank collaborations including reputational and regulatory risk; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, earthquakes and pandemic viruses and diseases, including COVID-19) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau (the "CFPB"), government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings or regulatory or other governmental inquiries and proceedings and the resolution thereof, the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System (the "FRB" or the "Federal Reserve"); securities market and monetary fluctuations, including the anticipated replacement of the London Interbank Offered Rate ("LIBOR") Index and the impact on our loans and debt which are tied to that index and uncertainties regarding potential alternative reference rates, including the Secured Overnight Financing Rate ("SOFR"); negative trends in our market capitalization and adverse changes in the price of the Company's common stock; political instability; acts of war or terrorism; pandemic virus and disease, including COVID-19; changes in consumer spending, borrowings and savings habits; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; cybersecurity and data privacy breaches and the consequence therefrom; the ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; technological changes and developments; changes in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board ("PCAOB"), the Financial Accounting Standards Board ("FASB") and other accounting standard setters and the cost and resources required to implement such changes; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items. For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the FLS, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the FLS contained in this document. FLS speak only as of the date on which such statements are made. We undertake no obligation to update any FLS to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

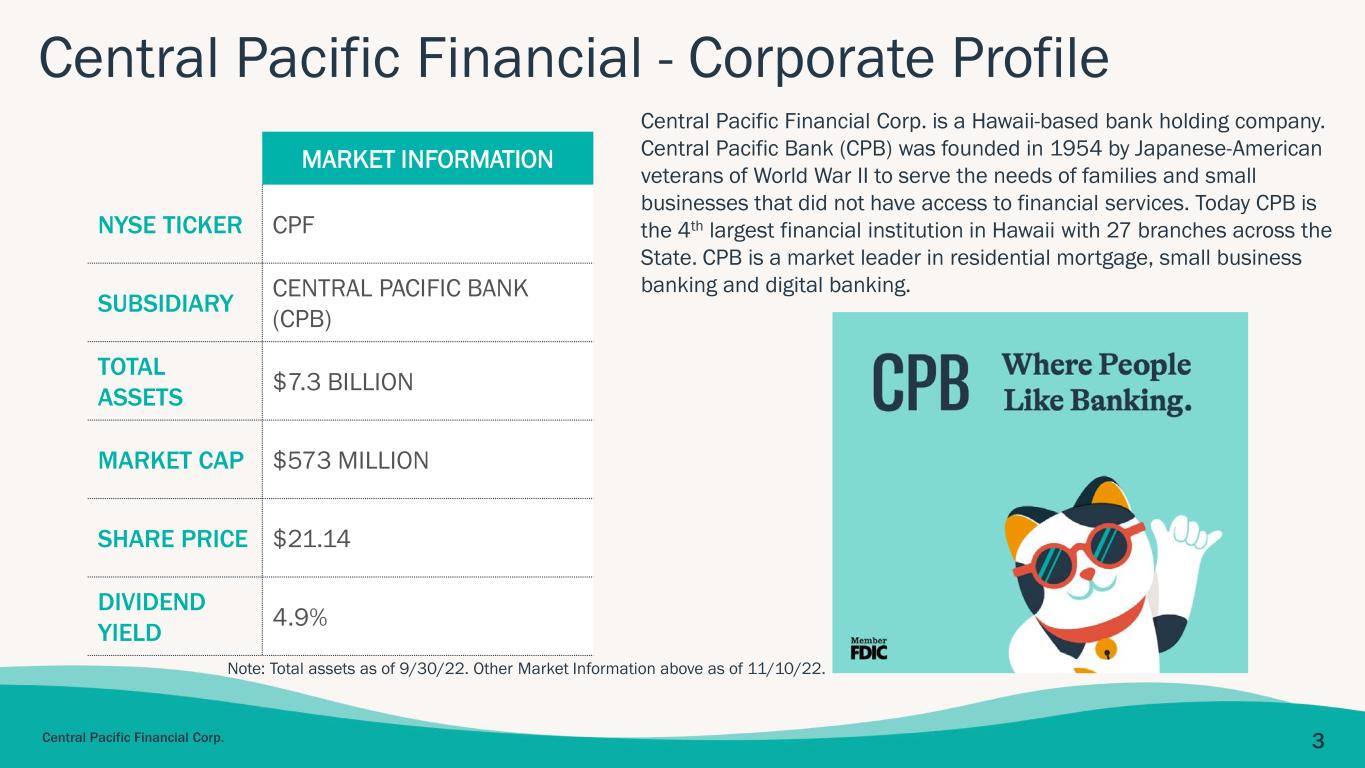

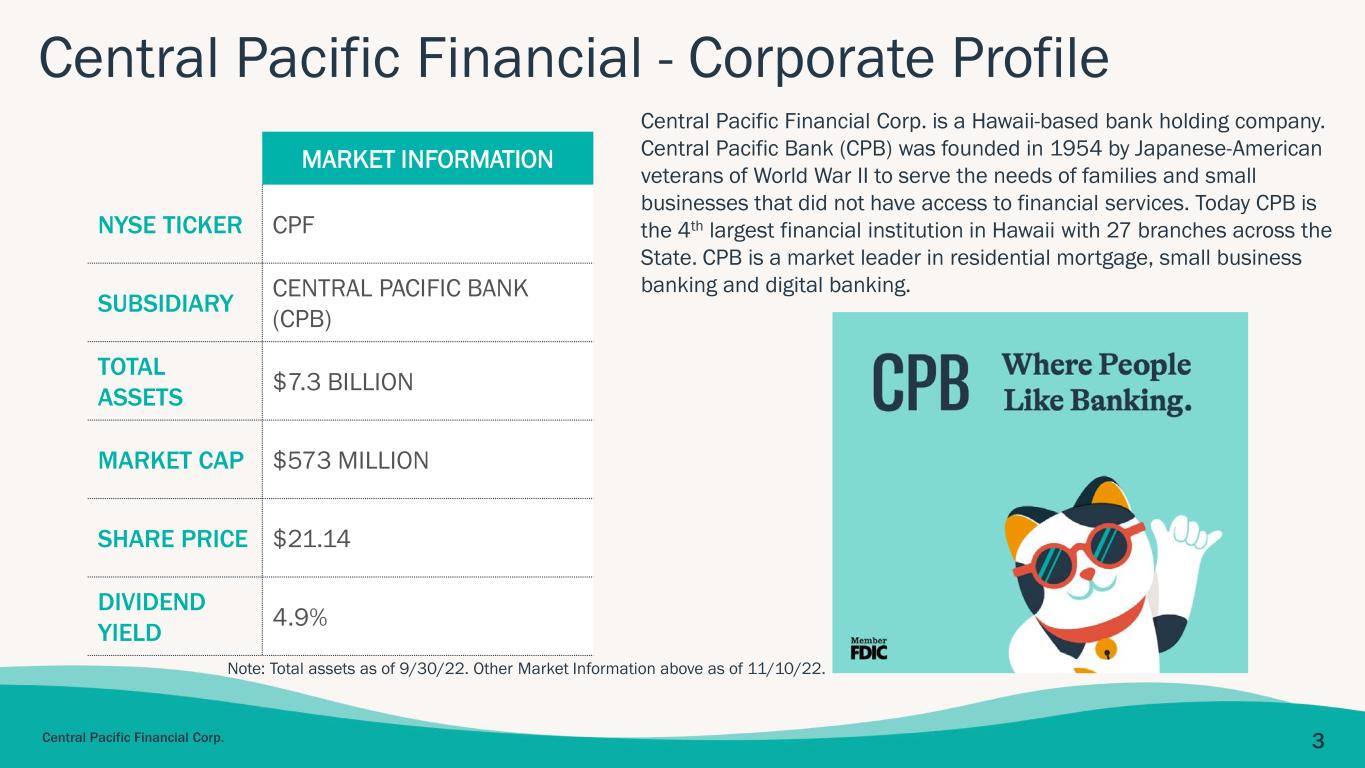

3Central Pacific Financial Corp. Central Pacific Financial - Corporate Profile MARKET INFORMATION NYSE TICKER CPF SUBSIDIARY CENTRAL PACIFIC BANK (CPB) TOTAL ASSETS $7.3 BILLION MARKET CAP $573 MILLION SHARE PRICE $21.14 DIVIDEND YIELD 4.9% Central Pacific Financial Corp. is a Hawaii-based bank holding company. Central Pacific Bank (CPB) was founded in 1954 by Japanese-American veterans of World War II to serve the needs of families and small businesses that did not have access to financial services. Today CPB is the 4th largest financial institution in Hawaii with 27 branches across the State. CPB is a market leader in residential mortgage, small business banking and digital banking. Note: Total assets as of 9/30/22. Other Market Information above as of 11/10/22.

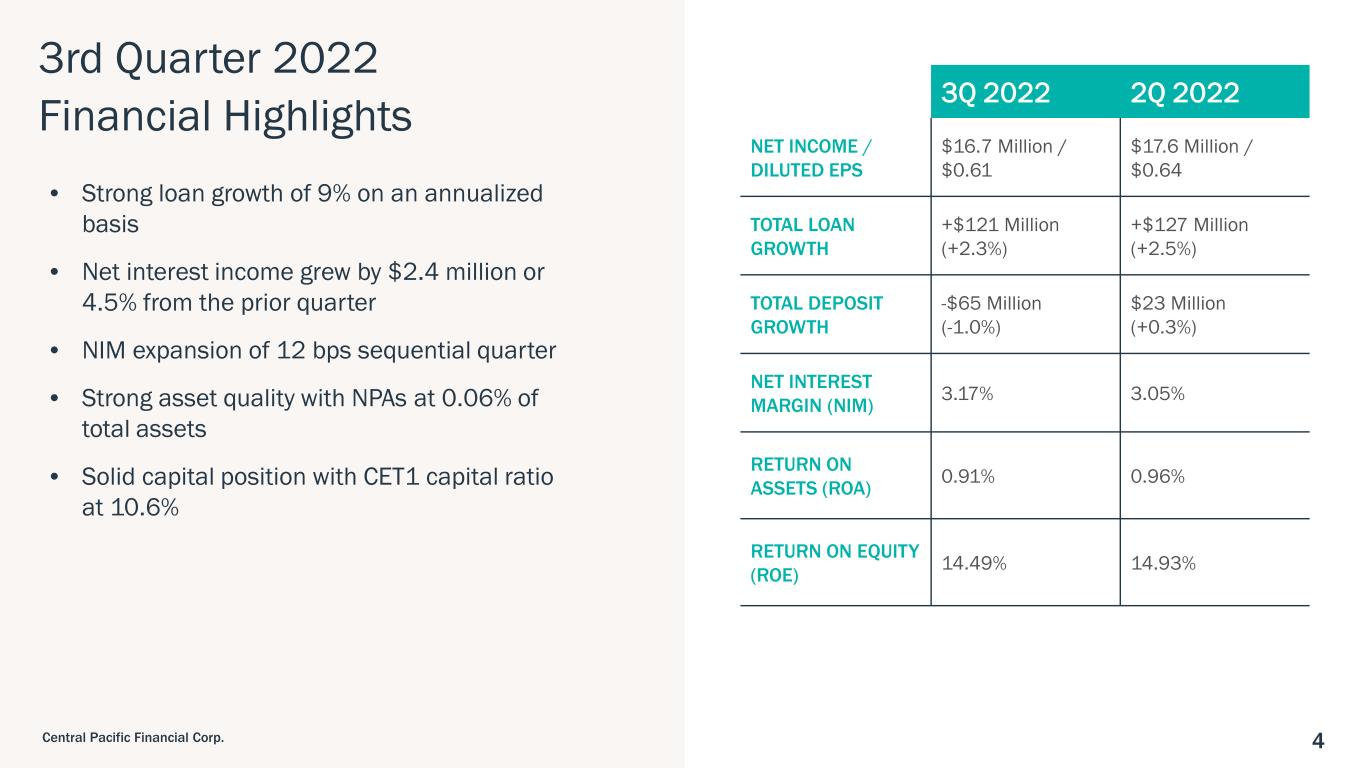

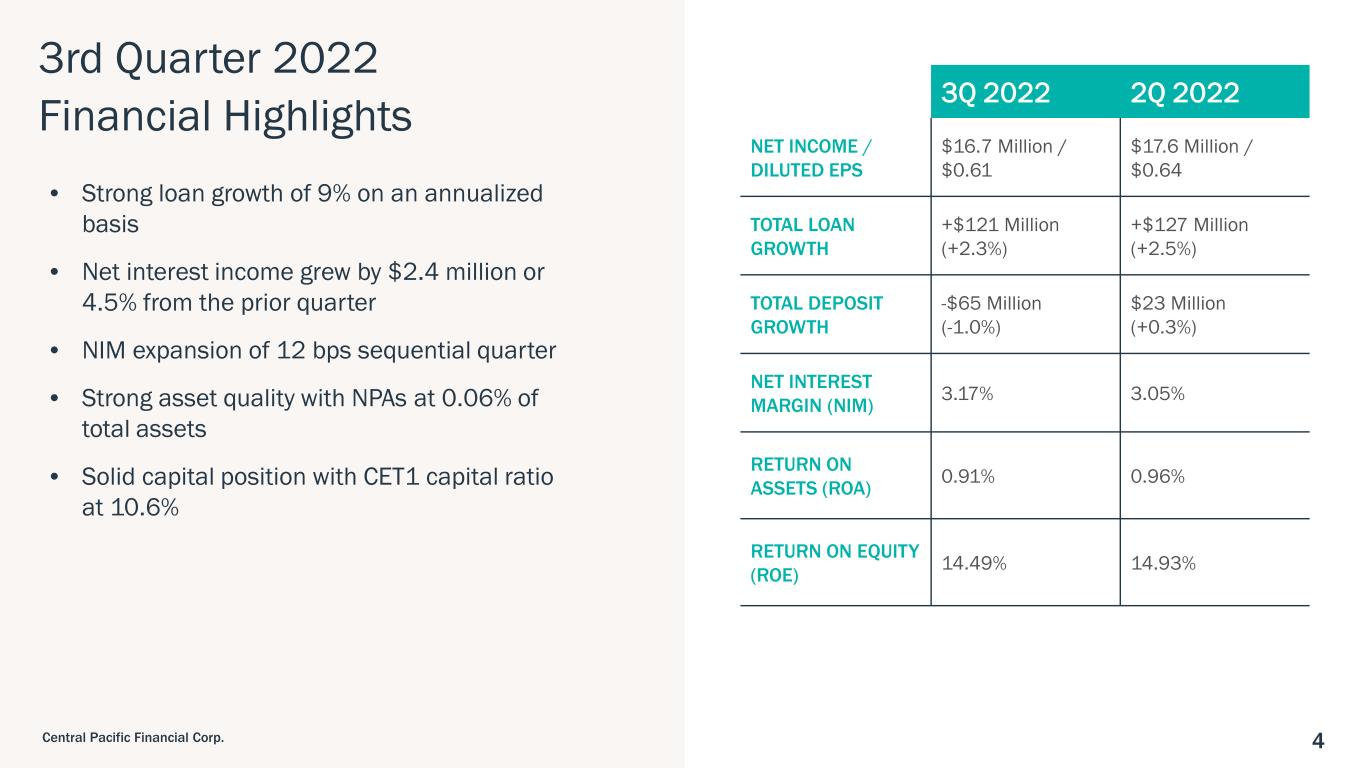

44Central Pacific Financial Corp. 3rd Quarter 2022 Financial Highlights • Strong loan growth of 9% on an annualized basis • Net interest income grew by $2.4 million or 4.5% from the prior quarter • NIM expansion of 12 bps sequential quarter • Strong asset quality with NPAs at 0.06% of total assets • Solid capital position with CET1 capital ratio at 10.6% 3Q 2022 2Q 2022 NET INCOME / DILUTED EPS $16.7 Million / $0.61 $17.6 Million / $0.64 TOTAL LOAN GROWTH +$121 Million (+2.3%) +$127 Million (+2.5%) TOTAL DEPOSIT GROWTH -$65 Million (-1.0%) $23 Million (+0.3%) NET INTEREST MARGIN (NIM) 3.17% 3.05% RETURN ON ASSETS (ROA) 0.91% 0.96% RETURN ON EQUITY (ROE) 14.49% 14.93%

5Central Pacific Financial Corp. CPF Investment Highlights Well positioned to capitalize on improving Hawaii trends Consistent & sustainable growth Valuable deposit franchise Focus on driving efficiency Strong credit & capital profile Digital & BaaS initiatives to expand future market & growth 1 2 3 4 5 6

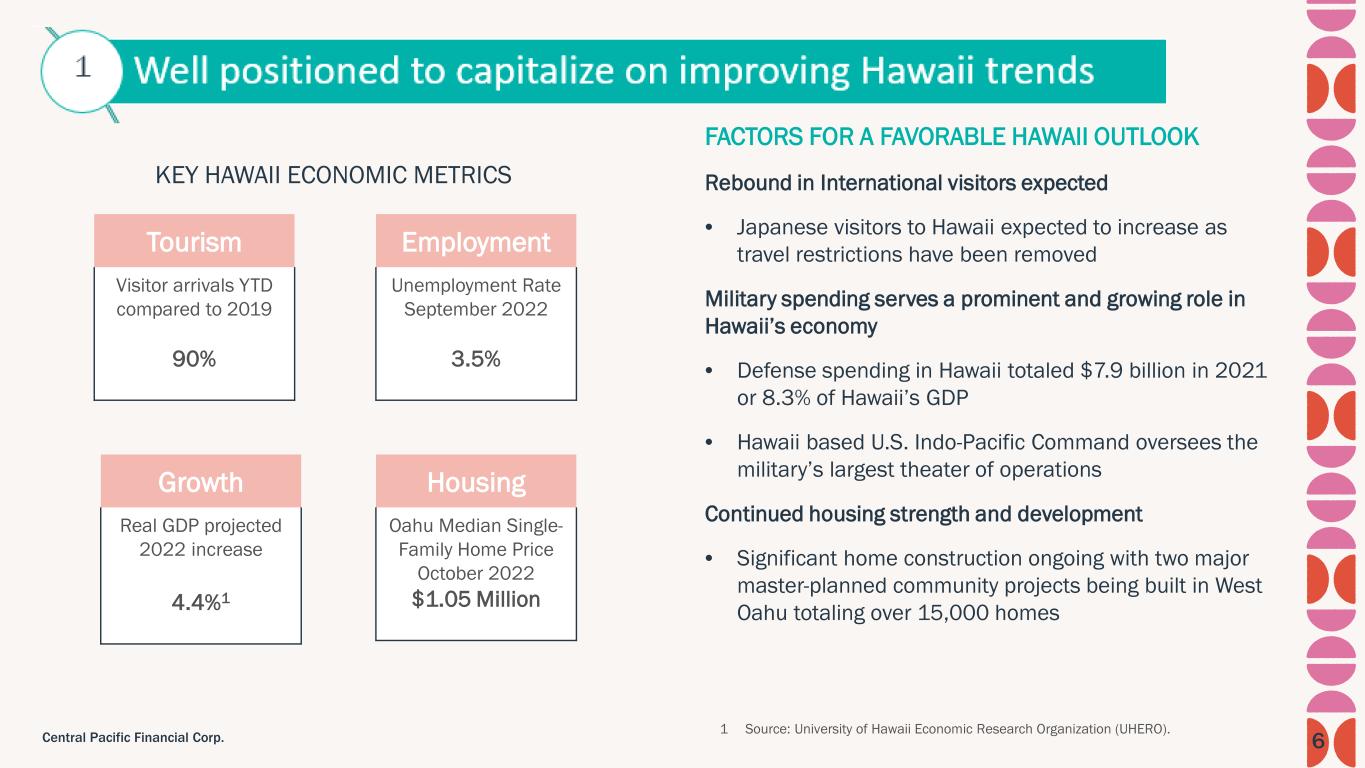

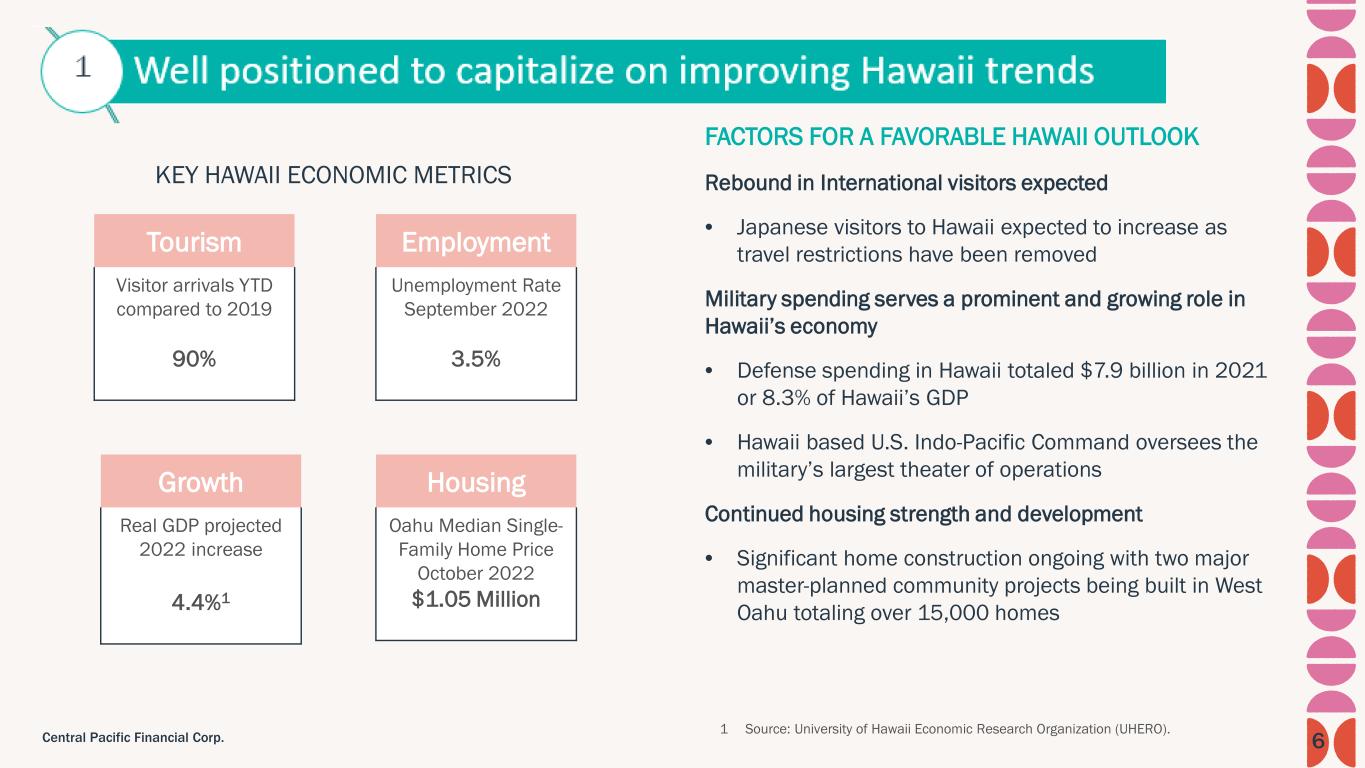

6Central Pacific Financial Corp. FACTORS FOR A FAVORABLE HAWAII OUTLOOK Rebound in International visitors expected • Japanese visitors to Hawaii expected to increase as travel restrictions have been removed Military spending serves a prominent and growing role in Hawaii’s economy • Defense spending in Hawaii totaled $7.9 billion in 2021 or 8.3% of Hawaii’s GDP • Hawaii based U.S. Indo-Pacific Command oversees the military’s largest theater of operations Continued housing strength and development • Significant home construction ongoing with two major master-planned community projects being built in West Oahu totaling over 15,000 homes 1 Source: University of Hawaii Economic Research Organization (UHERO). Tourism Visitor arrivals YTD compared to 2019 90% Employment Unemployment Rate September 2022 3.5% Housing Oahu Median Single- Family Home Price October 2022 $1.05 Million Growth Real GDP projected 2022 increase 4.4%1 KEY HAWAII ECONOMIC METRICS

7Central Pacific Financial Corp. C&I 10% Construction 3% Residential Mortgage 35% Home Equity 13% Coml Mortgage 25% Consumer 14% Loan Portfolio Composition as of September 30, 2022 Core loans grew in 3Q 2022 by 9.2% on a linked quarter annualized basis Strong and diverse loan portfolio, with over 75% secured by real estate • Loan market share increased from 13% to 15% in the last 5 years* • Weighted average LTVs of 64% for Residential Mortgage, 61% for Home Equity and 61% for Commercial Mortgage • Strong Consumer credit quality with weighted average origination FICO of 744 for Hawaii Consumer and 742 for Mainland Consumer • Mainland loan portfolio purchase/participation strategy provides geographic diversification * Market share among the 4 largest Hawaii banks (Bank of Hawaii, First Hawaiian Bank, American Savings Bank and Central Pacific Bank). Source: S&P Global. 3,000 3,500 4,000 4,500 5,000 5,500 2016 2017 2018 2019 2020 2021 3Q2022 $ M ill io ns Loan Balances Outstanding-Excluding PPP $5.4B

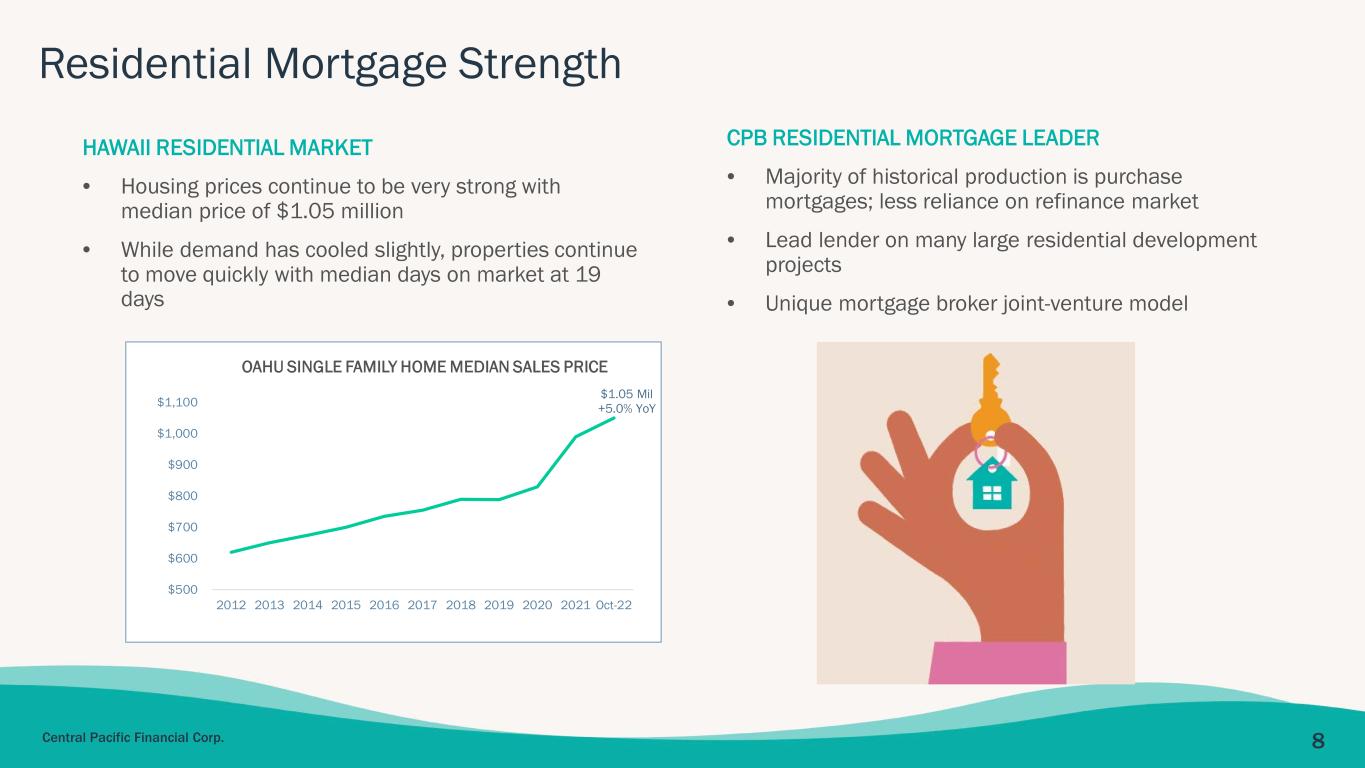

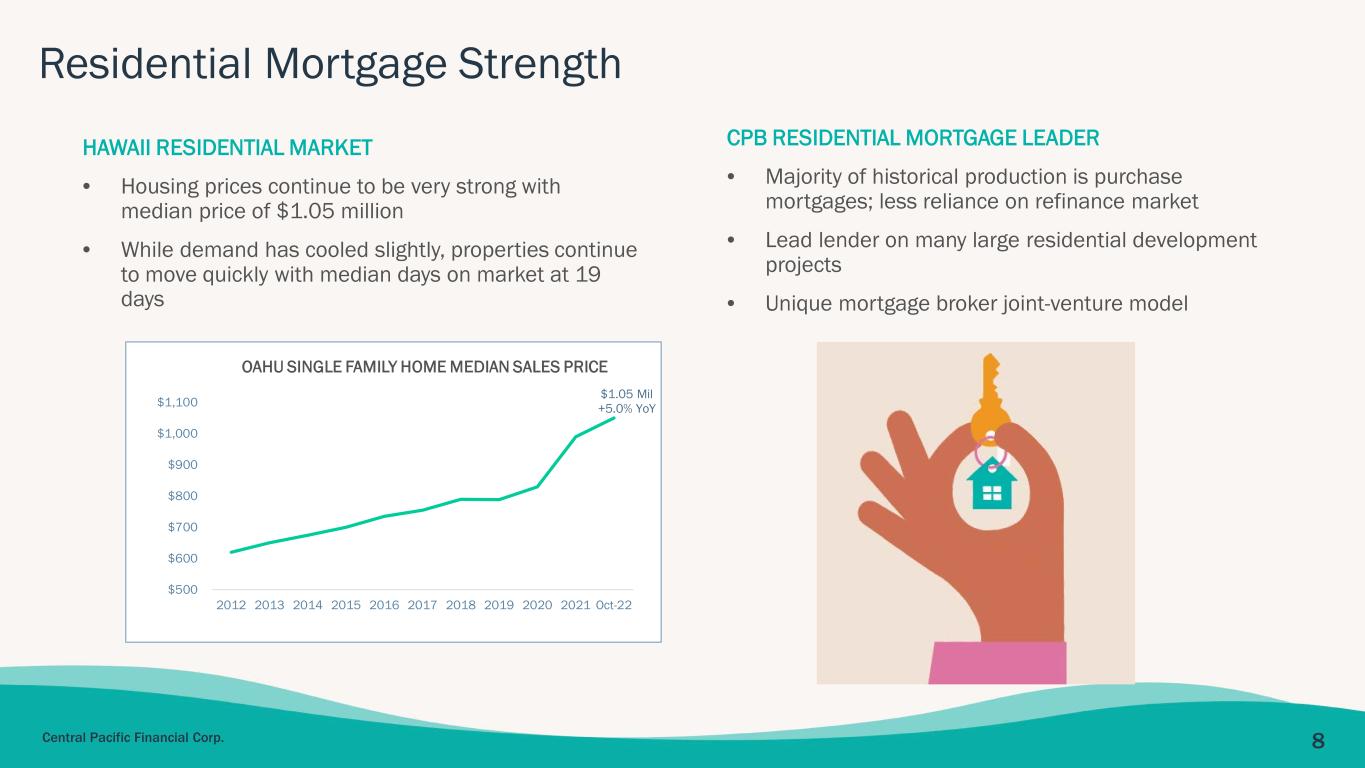

8Central Pacific Financial Corp. Residential Mortgage Strength SMALL BUSINESSES HAWAII RESIDENTIAL MARKET • Housing prices continue to be very strong with median price of $1.05 million • While demand has cooled slightly, properties continue to move quickly with median days on market at 19 days CPB RESIDENTIAL MORTGAGE LEADER • Majority of historical production is purchase mortgages; less reliance on refinance market • Lead lender on many large residential development projects • Unique mortgage broker joint-venture model $1.05 Mil +5.0% YoY $500 $600 $700 $800 $900 $1,000 $1,100 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Oct-22 OAHU SINGLE FAMILY HOME MEDIAN SALES PRICE

9Central Pacific Financial Corp. Small Business Leader SMALL BUSINESSES 2021 Lender of the Year Category 2 by the SBA’s Hawaii District Office Originated more SBA loans based on count and $ than the 3 other large Hawaii banks combined1 Innovative Programs & Technology CPB Foundation started a financial management and networking accelerator program in 2021 for local women entrepreneurs called ‘WE by Rising Tide’ Outperformed on the PPP program, originating 30% of all PPP loans in the State of Hawaii; over 600 new PPP borrowers have converted to CPB customers thus far Niche Markets CPB has strong market share in the dental and physician niche, being the primary bank to nearly half of the dentists and a quarter of the physicians in the State of Hawaii 1 As reported by the SBA for the 2021 Fiscal Year.

10Central Pacific Financial Corp. Japan Competitive Advantage • Paul Yonamine, CPF CEO, is on the Board of Directors of Sumitomo Mitsui Banking Corporation (SMBC) and Seven & i Holdings. He previously served as the IBM Japan President and led KPMG Consulting in Japan • Hikaru Utsugi, head of CPB International banking spent 30+ years at Mitsubishi UFJ Bank • Japan recently loosened travel restrictions. CPB Team has resumed business development travel to Japan • CPB currently has nearly $1 billion in Japan-related deposits (+10% in last 2 years), growth in CPB’s Japan business will further accelerate in 2023

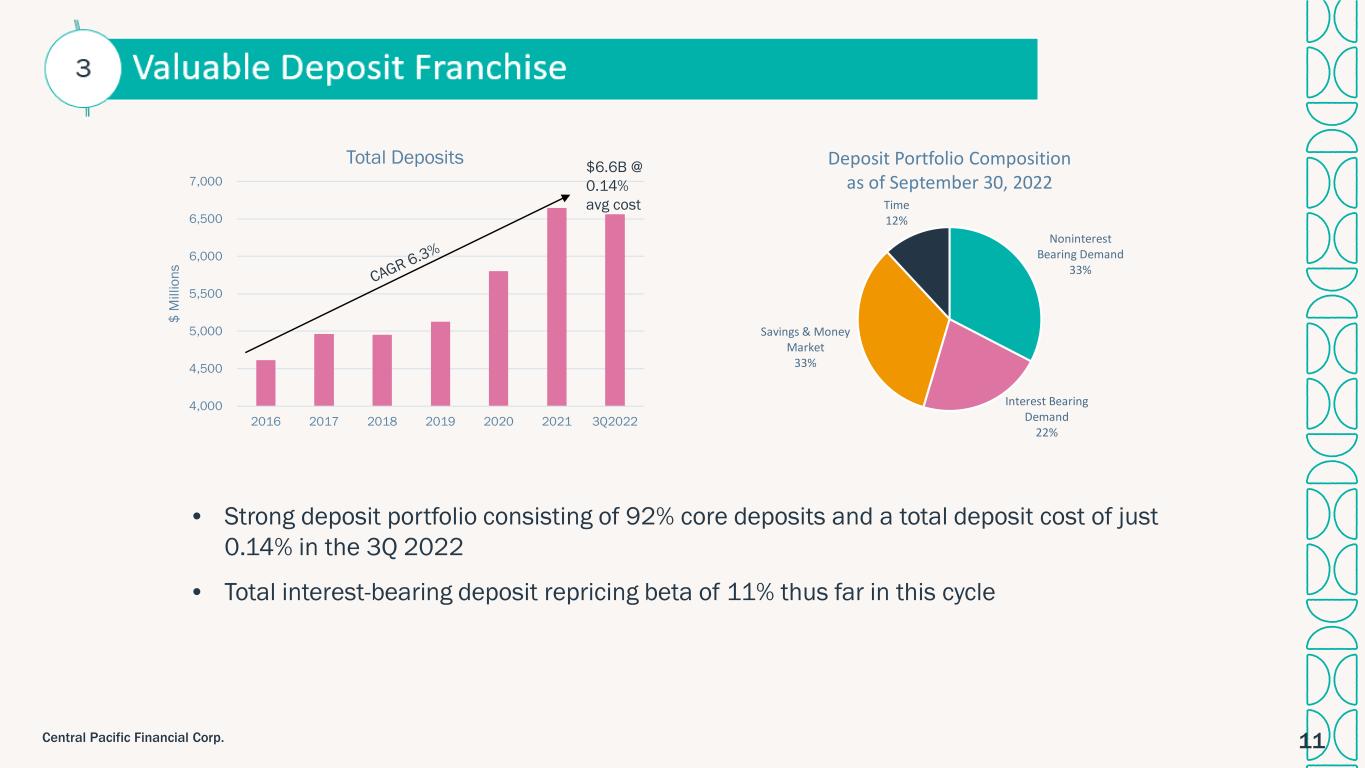

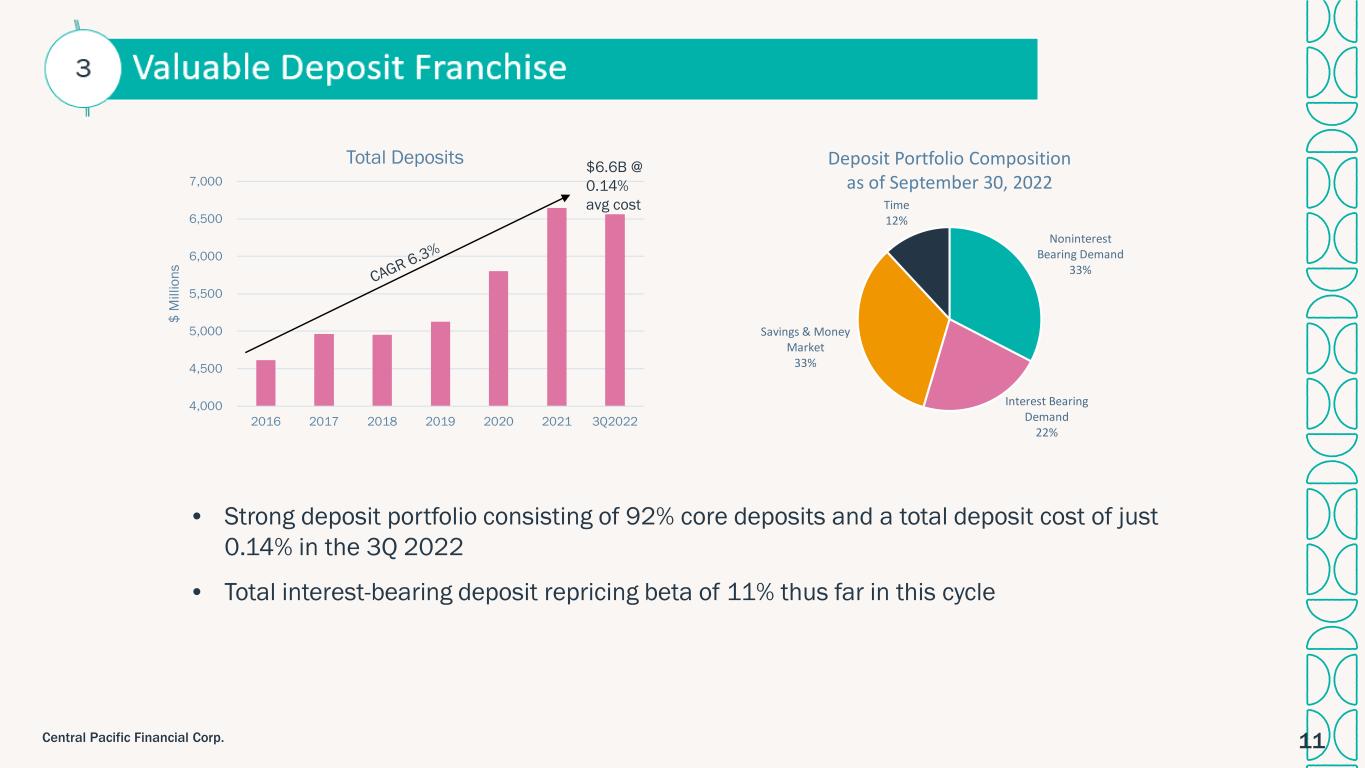

11Central Pacific Financial Corp. • Strong deposit portfolio consisting of 92% core deposits and a total deposit cost of just 0.14% in the 3Q 2022 • Total interest-bearing deposit repricing beta of 11% thus far in this cycle 4,000 4,500 5,000 5,500 6,000 6,500 7,000 2016 2017 2018 2019 2020 2021 3Q2022 $ M ill io ns Total Deposits $6.6B @ 0.14% avg cost Noninterest Bearing Demand 33% Interest Bearing Demand 22% Savings & Money Market 33% Time 12% Deposit Portfolio Composition as of September 30, 2022

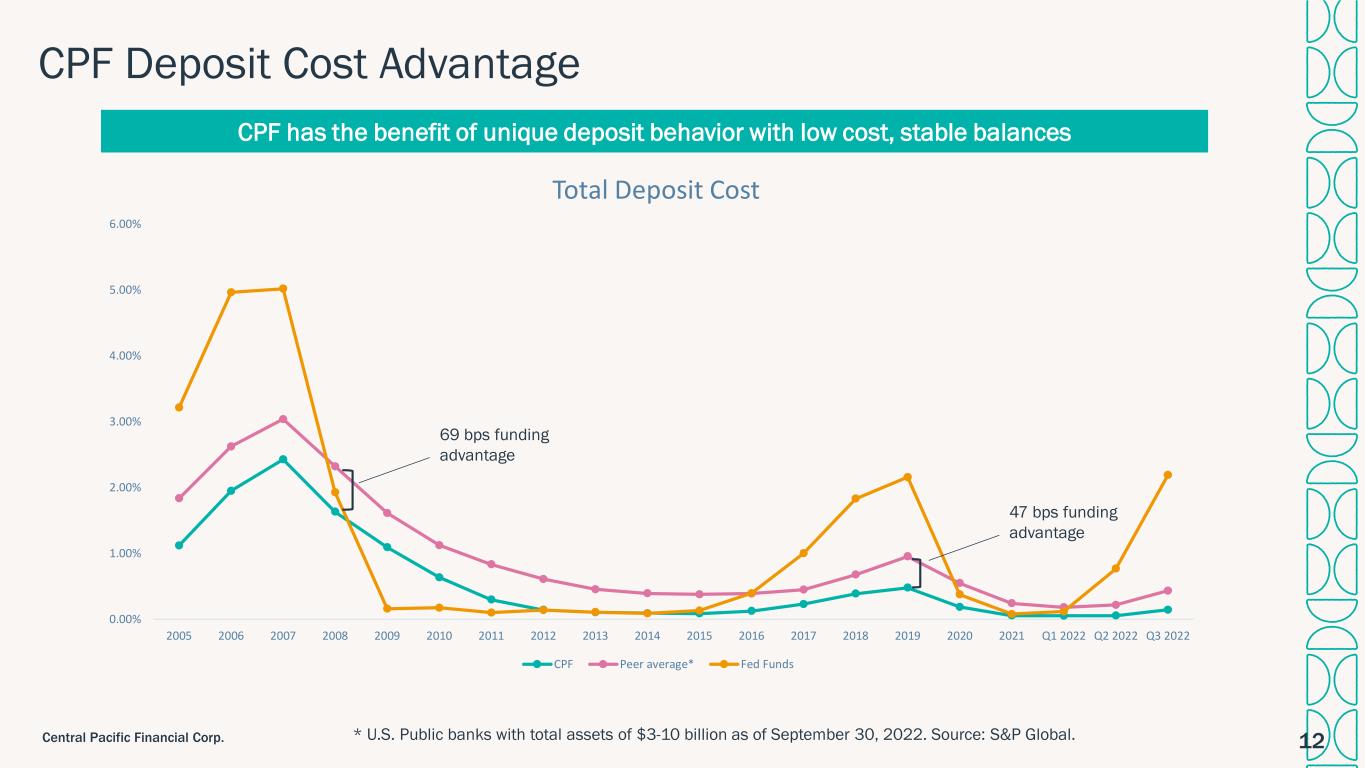

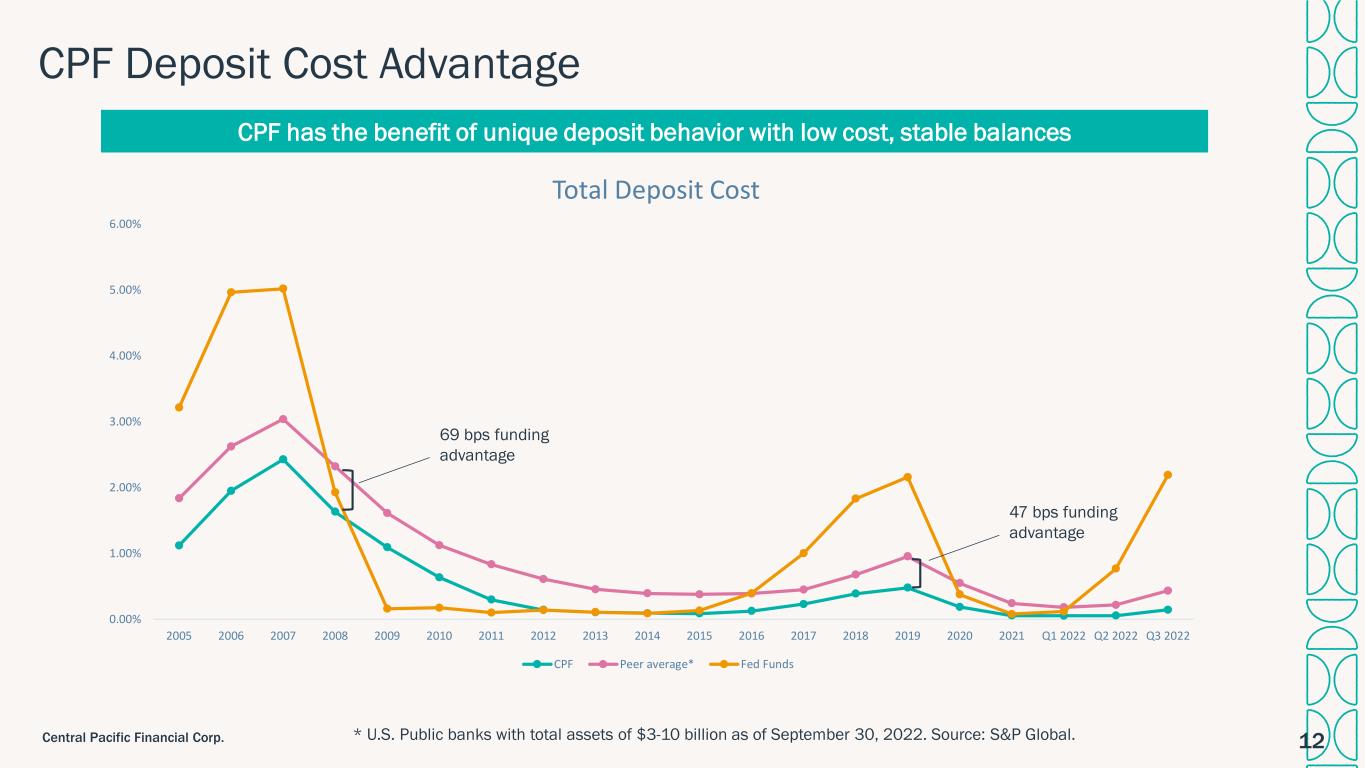

12Central Pacific Financial Corp. 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 Q3 2022 Total Deposit Cost CPF Peer average* Fed Funds 47 bps funding advantage CPF Deposit Cost Advantage * U.S. Public banks with total assets of $3-10 billion as of September 30, 2022. Source: S&P Global. CPF has the benefit of unique deposit behavior with low cost, stable balances 69 bps funding advantage

13Central Pacific Financial Corp. Branch Consolidation - 8 branches consolidated since 2020 (-23%) - Currently operating 27 branches in the State of Hawaii FTE Reduction - Reduced total FTE from 833 to 774 over the last 2 years (-7%) through attrition enabled by efficiency gains SUCCESSFUL EXECUTION TO DATE: CONTINUED FOCUSED EXECUTION TO DRIVE EFFICIENCY RATIO UNDER 60% • Service Now implementation: using automation to improve internal processing • Consolidated Loan Origination System: straight-through processing from end-to-end • Digital Channels: continued transaction migration

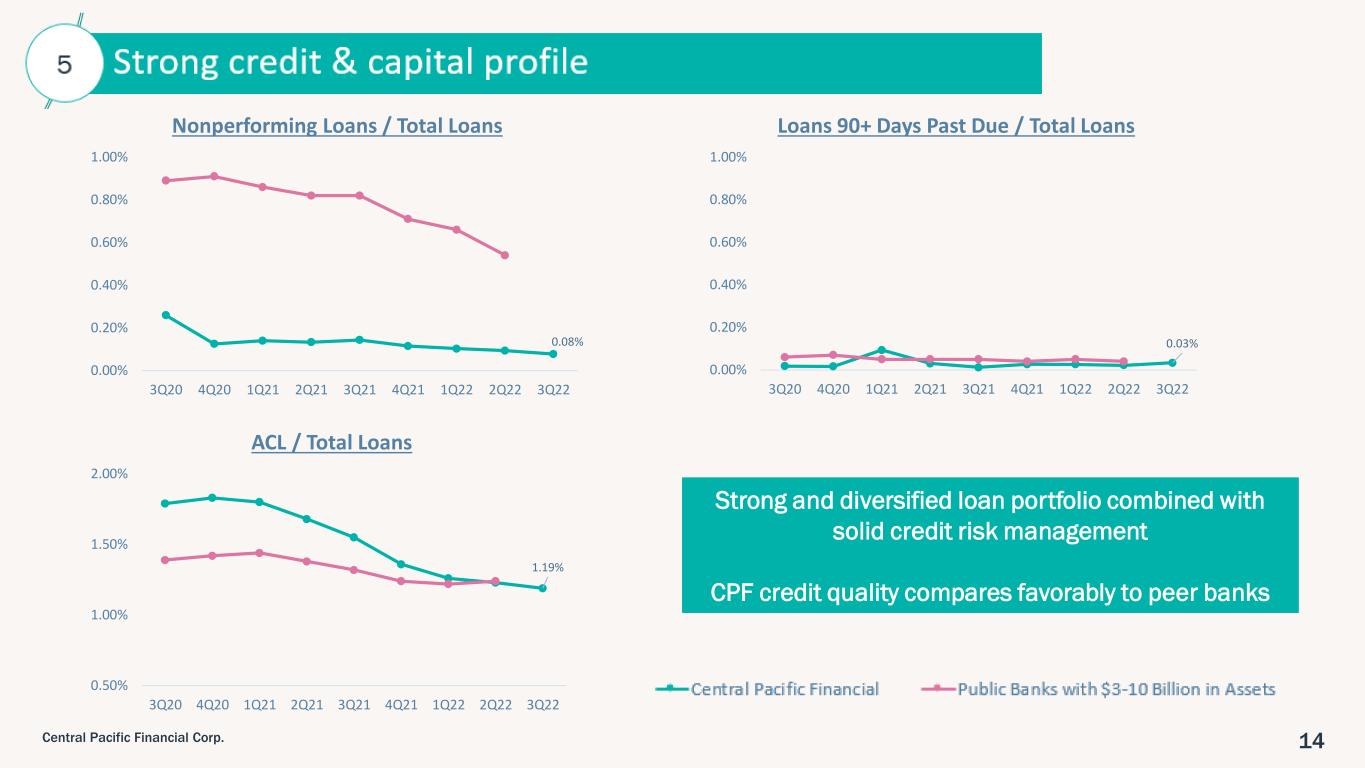

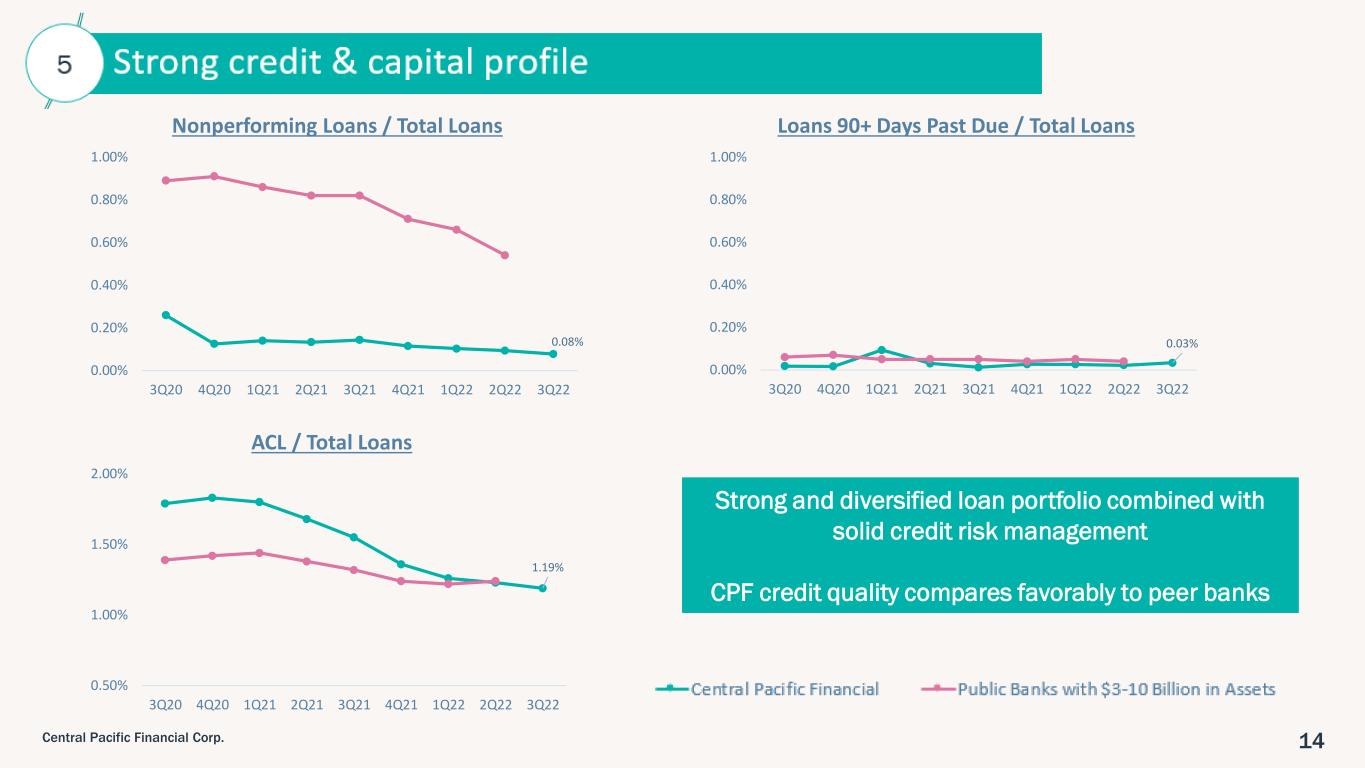

14Central Pacific Financial Corp. Strong and diversified loan portfolio combined with solid credit risk management CPF credit quality compares favorably to peer banks 0.08% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Nonperforming Loans / Total Loans 1.19% 0.50% 1.00% 1.50% 2.00% 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 ACL / Total Loans 0.03% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Loans 90+ Days Past Due / Total Loans

15Central Pacific Financial Corp Strong Credit Profile to Weather a Recession Key Strength Factors: • Loan portfolio is over 75% secured by real estate with strong LTVsReal Estate Focus • 83% of total loan portfolio is in Hawaii • Hawaii real estate values are exceptionally strong and have a track record of outperforming the broader nation Majority of Loans in Hawaii • Tighter LTV standards compared to regulatory requirements • Loan amounts >$500K fully underwritten with well-defined credit standards, including repayment capacity Conservative Underwriting • Total portfolio as of 9/30/22 of $310 million or just 5.7% of total loans • Strong origination FICO scores 740+ • Purchases must meet CPB’s internal underwriting guidelines • Portfolio is granular and well diversified by originator and state Mainland Unsecured Consumer Risk Managed

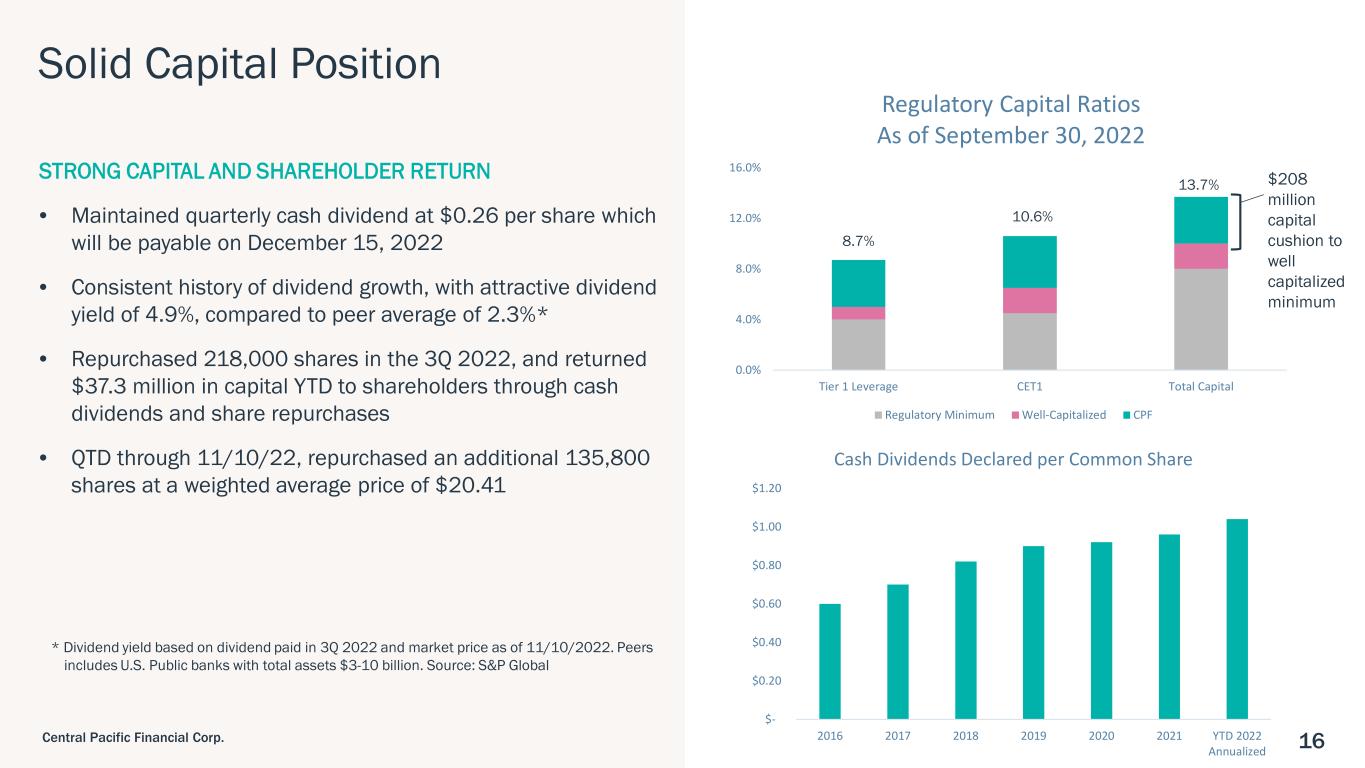

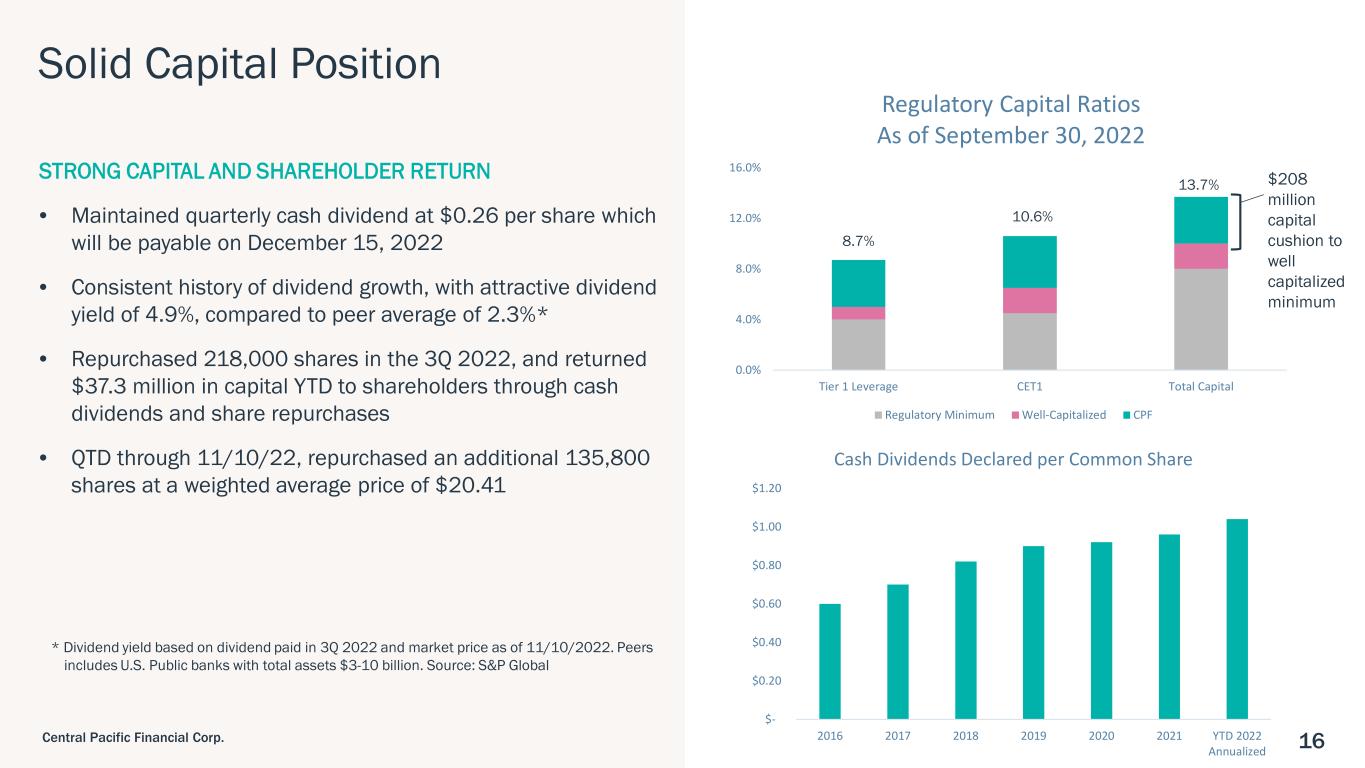

1616Central Pacific Financial Corp. 0.0% 4.0% 8.0% 12.0% 16.0% Tier 1 Leverage CET1 Total Capital Regulatory Capital Ratios As of September 30, 2022 Regulatory Minimum Well-Capitalized CPF 13.7% 10.6% Solid Capital Position 8.7% STRONG CAPITAL AND SHAREHOLDER RETURN • Maintained quarterly cash dividend at $0.26 per share which will be payable on December 15, 2022 • Consistent history of dividend growth, with attractive dividend yield of 4.9%, compared to peer average of 2.3%* • Repurchased 218,000 shares in the 3Q 2022, and returned $37.3 million in capital YTD to shareholders through cash dividends and share repurchases • QTD through 11/10/22, repurchased an additional 135,800 shares at a weighted average price of $20.41 * Dividend yield based on dividend paid in 3Q 2022 and market price as of 11/10/2022. Peers includes U.S. Public banks with total assets $3-10 billion. Source: S&P Global $208 million capital cushion to well capitalized minimum $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 2016 2017 2018 2019 2020 2021 YTD 2022 Annualized Cash Dividends Declared per Common Share

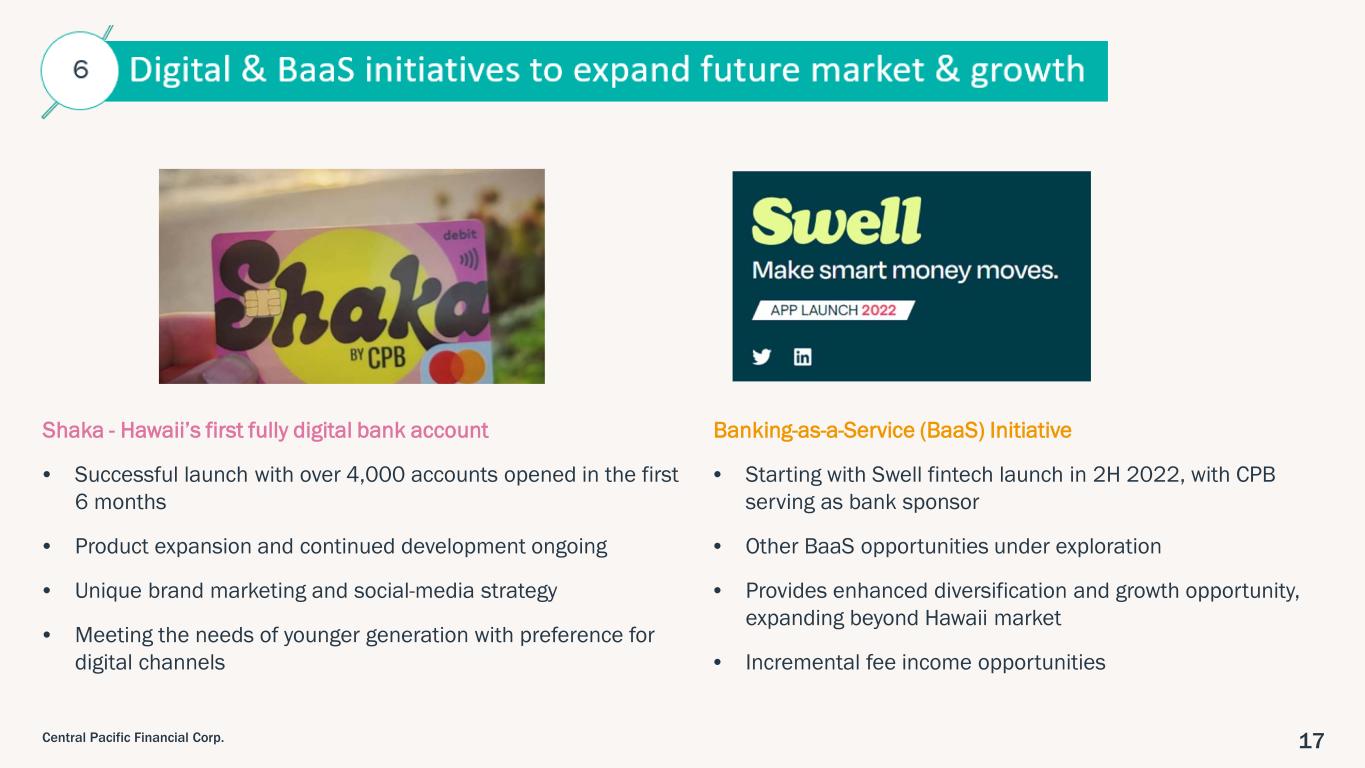

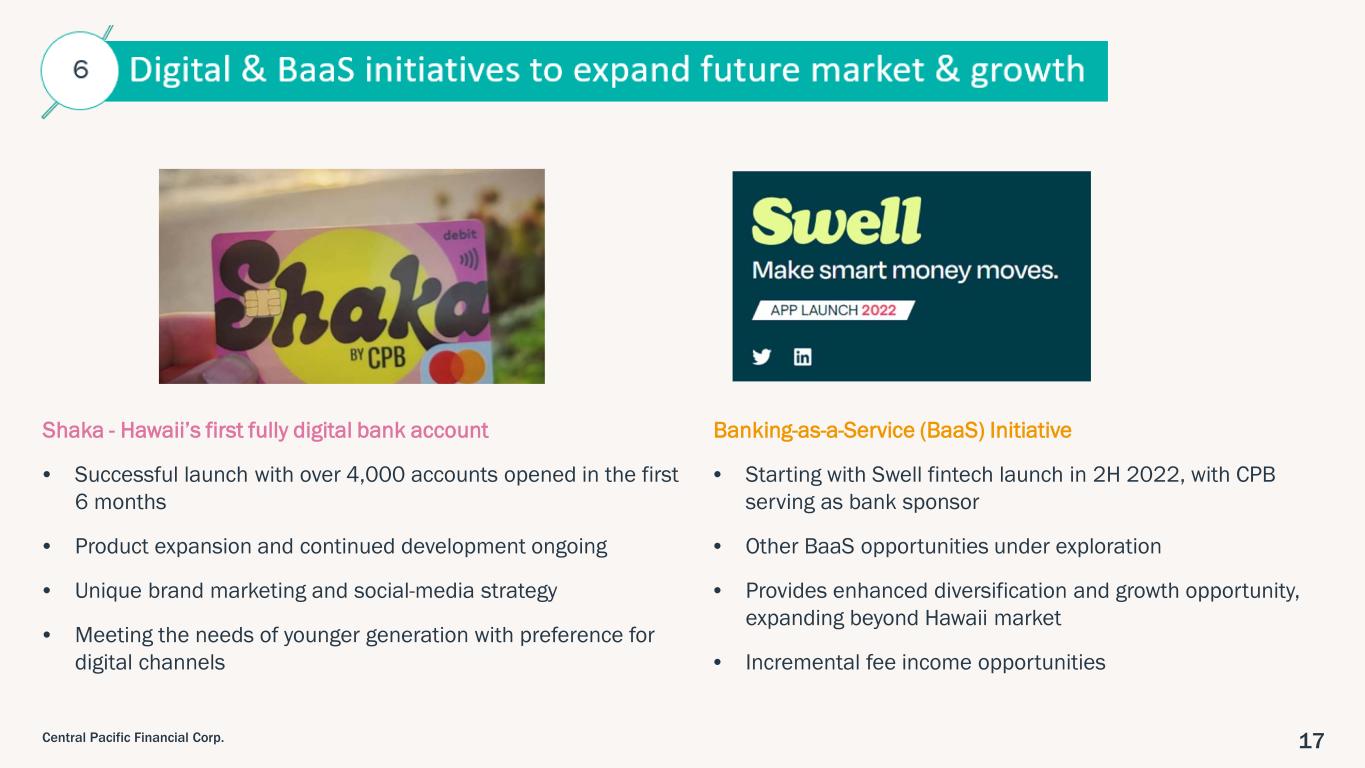

17Central Pacific Financial Corp. Shaka - Hawaii’s first fully digital bank account • Successful launch with over 4,000 accounts opened in the first 6 months • Product expansion and continued development ongoing • Unique brand marketing and social-media strategy • Meeting the needs of younger generation with preference for digital channels Banking-as-a-Service (BaaS) Initiative • Starting with Swell fintech launch in 2H 2022, with CPB serving as bank sponsor • Other BaaS opportunities under exploration • Provides enhanced diversification and growth opportunity, expanding beyond Hawaii market • Incremental fee income opportunities

18Central Pacific Financial Corp. Swell Risk Management Strategy is being adjusted as appropriate to mitigate evolving risks • Continue to go slowly, learn and iterate • Financial impact to CPF has been immaterial to date; anticipate less than $4 million in loan/deposit balances by year-end 2022 • Establishing Swell line of credit concentration limit at $40 million until the end of 2023 • Swell line of credit average FICO score increased to 720 • Elevate Credit acquisition • Elevate Credit announced it will be acquired and taken private by Park Cities Asset Management. Park Cities was the lead investor in the 1Q2022 Swell Financial Series A capital raise and Alex Dunev, Co-Founder & Chief Investment Officer of Park Cities, is a member of the Swell Board of Directors.

Mahalo

20Central Pacific Financial Corp. Appendix

21Central Pacific Financial Corp. Central Pacific Bank ranked #1 Best-in-State Bank in Hawaii for 2022

22Central Pacific Financial Corp Historical Financial Highlights (*) Certain amounts in prior years were reclassified to conform to current year's presentation. These reclassifications had an immaterial impact to our previously reported efficiency ratios. ($ in millions) 3Q 2Q 1Q 2021 2020 2019 2018 2017 2016 Balance Sheet (period end data) Loans and leases 5,422.2$ 5,301.6$ 5,174.8$ 5,101.6$ 4,964.1$ 4,449.5$ 4,078.4$ 3,770.6$ 3,524.9$ Total assets 7,337.6 7,299.2 7,298.8 7,419.1 6,594.6 6,012.7 5,807.0 5,623.7 5,384.2 Total deposits 6,556.4 6,622.1 6,599.0 6,639.2 5,796.1 5,120.0 4,946.5 4,956.4 4,608.2 Total shareholders' equity 438.5 455.1 486.3 558.2 546.7 528.5 491.7 500.0 504.7 Income Statement Net interest income 55.4 53.0 50.9 211.0 197.7 184.1 173.0 167.7 158.0 Provision (credit) for credit losses 0.4 1.0 (3.2) (14.6) 42.1 6.3 (1.5) (2.6) (5.4) Other operating income 9.6 17.1 9.6 43.1 45.2 41.8 38.8 36.5 42.3 Other operating expense 42.0 45.4 38.2 163.0 151.7 141.6 135.1 131.0 132.4 Income taxes (benefit) 5.9 6.2 6.0 25.8 11.8 19.6 18.8 34.6 26.3 Net income 16.7 17.5 19.4 79.9 37.3 58.3 59.5 41.2 47.0 Profitability Return on average assets 0.91% 0.96% 1.06% 1.13% 0.58% 0.99% 1.05% 0.75% 0.90% Return on average shareholders' equity 14.49% 14.93% 14.44% 14.38% 6.85% 11.36% 12.22% 8.03% 9.16% Efficiency ratio (*) 64.62% 64.68% 63.16% 64.16% 62.47% 62.69% 63.79% 64.14% 66.10% Net interest margin 3.17% 3.05% 2.97% 3.18% 3.30% 3.35% 3.22% 3.28% 3.27% Capital Adequacy (period end data) Leverage capital ratio 8.65% 8.59% 8.50% 8.48% 8.81% 9.53% 9.88% 10.35% 10.64% Total risk-based capital ratio 13.74% 13.87% 14.18% 14.48% 15.19% 13.64% 14.69% 15.92% 15.49% Asset Quality Net loan chargeoffs/average loans 0.12% 0.08% 0.03% 0.02% 0.15% 0.15% 0.02% 0.11% 0.03% Nonaccrual loans/total loans (period end) 0.08% 0.09% 0.10% 0.12% 0.12% 0.03% 0.06% 0.07% 0.24% Year Ended December 31,2022

23Central Pacific Financial Corp. • Stable, low-rate sensitive core deposit base has supported NIM expansion • 3Q 2022 NIM increased by 12 bps sequential quarter to 3.17% due to asset sensitivity and the rising rate environment * Immediate reflects an instantaneous, parallel rate shock, whereas gradual reflects a parallel rate ramp evenly over 12 months. Asset Sensitive Balance Sheet 1.8% 2.8% 2.2% 4.0% +100 bps +200 bps Net Interest Income Rate Sensitivity As of September 30, 2022 Gradual* Immediate* Rate Sensitivity

24Central Pacific Financial Corp. Environmental, Social & Governance (ESG) 2021 ESG report released in early 2022 can be viewed here: https://www.cpb.bank/esg