UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý | |

Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| ý | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

| Six Flags Entertainment Corporation | |||

| (Name of Registrant as Specified In Its Charter) | |||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| Payment of Filing Fee (Check the appropriate box): | |||

| ý | No fee required. | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1 | ) | Title of each class of securities to which transaction applies: | |

| (2 | ) | Aggregate number of securities to which transaction applies: | |

| (3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4 | ) | Proposed maximum aggregate value of transaction: | |

| (5 | ) | Total fee paid: | |

| o | Fee paid previously with preliminary materials. | ||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1 | ) | Amount Previously Paid: | |

| (2 | ) | Form, Schedule or Registration Statement No.: | |

| (3 | ) | Filing Party: | |

| (4 | ) | Date Filed: | |

SIX FLAGS ENTERTAINMENT CORPORATION

924 Avenue J East

Grand Prairie, Texas 75050

March [●], 2018

Dear Fellow Stockholder:

We are pleased to invite you to attend the 2018 Annual Meeting of Stockholders of Six Flags Entertainment Corporation to be held on Wednesday, May 2, 2018, at 2:00 p.m., Eastern Time, at The Yale Club of New York City, 50 Vanderbilt Avenue, New York, New York 10017.

Details regarding the business to be conducted at the Annual Meeting are described in the Notice of Internet Availability of Proxy Materials you received in the mail and in this proxy statement.

As in prior years, we have elected to provide access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission’s “notice and access” rules. This process expedites stockholders' receipt of proxy materials, lowers the costs of delivery, and conserves natural resources.

On March [●], 2018, we began mailing our stockholders a notice containing instructions on how to access our proxy materials and vote online, by telephone or by mail, and to receive a printed copy of the materials by mail.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, by telephone or by mail. If you attend the Annual Meeting, you will be able to vote in person, even if you have previously voted. Please review the instructions on each of your voting options described in this proxy statement, as well as in the Notice of Internet Availability of Proxy Materials you received in the mail.

On behalf of the directors, officers and employees of Six Flags Entertainment Corporation, we would like to express our appreciation for your continued support.

| Sincerely, | ||

JIM REID-ANDERSON Chairman, President and Chief Executive Officer | ||

SIX FLAGS ENTERTAINMENT CORPORATION

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

| Time and Date | 2:00 p.m. Eastern Time, on Wednesday, May 2, 2018. | |

| Place | The Yale Club of New York City, 50 Vanderbilt Avenue, New York, New York 10017. | |

| Items of Business | (1) Election of seven nominees named in the Proxy Statement as directors; | |

| (2) Approve an amendment to the Company's Restated Certificate of Incorporation, as amended, to increase the number of authorized shares of the Company's common stock from 140,000,000 shares to 280,000,000 shares; | ||

| (3) Advisory vote to ratify the appointment of KPMG LLP as independent registered public accounting firm for the year ending December 31, 2018; | ||

| (4) Advisory vote to approve executive compensation; and | ||

| (5) Consideration of such other business as may properly come before the Annual Meeting. | ||

| Adjournments and Postponements | Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. | |

| Record Date | You are entitled to vote only if you were a stockholder of the Company as of the close of business on March 7, 2018. | |

| Voting | Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions in the Notice of Internet Availability of Proxy Materials you received in the mail, the section titled "General Information" beginning on page 1 of the proxy statement, or if you requested to receive printed proxy materials, your enclosed proxy card. | |

| By Order of the Board of Directors, | |

DANIELLE J. BERNTHAL Secretary | |

Grand Prairie, Texas March [●], 2018 | |

Important Notice Regarding Internet Availability of Proxy Materials

Our proxy statement is attached. Financial and other information concerning Six Flags Entertainment Corporation is contained in our 2017 Annual Report. The proxy statement and the 2017 Annual Report are available at investors.sixflags.com.

TABLE OF CONTENTS

GENERAL INFORMATION

This Proxy Statement is being furnished to holders of common stock of Six Flags Entertainment Corporation (the "Company" or "we" or "us") in connection with the solicitation of proxies by the Board of Directors for use in voting at the 2018 Annual Meeting of Stockholders (the "Annual Meeting") to be held on Wednesday, May 2, 2018, at 2:00 p.m., Eastern Time, at The Yale Club of New York City, 50 Vanderbilt Avenue, New York, New York 10017, and at any postponement or adjournment thereof.

Internet Availability of Proxy Materials

Pursuant to rules of the Securities and Exchange Commission ("SEC"), the Company is furnishing proxy materials to its stockholders primarily via the Internet instead of mailing printed copies of those materials to each stockholder. On March [●], 2018, the Company began mailing a Notice of Internet Availability of Proxy Materials to stockholders of record as of the close of business on March 7, 2018, other than to those stockholders who previously requested to receive electronic or paper delivery of communications. The Notice of Internet Availability of Proxy Materials contains instructions on how to access an electronic copy of the proxy materials including this Proxy Statement and the Annual Report for the year ended December 31, 2017.

This process is designed to expedite stockholders' receipt of proxy materials, lower the cost of the annual meeting, and help conserve natural resources. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. If you have previously elected to receive the proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

Quorum

The quorum requirement for holding the Annual Meeting and transacting business is a majority of the outstanding shares of common stock entitled to vote. The shares may be present in person or represented by proxy at the meeting. Abstention votes and broker non-votes (as described below) are counted as present for the purpose of determining whether a quorum exists for the Annual Meeting.

Required Vote

| Proposal | Voting Requirement | Tabulation Treatment | |

| Votes Withheld/Abstentions | Broker Non-Votes | ||

| Election of Directors | Plurality of votes cast to elect each director; the seven nominees with the highest number of affirmative FOR votes will be elected | Not counted for purposes of calculating approval percentage | Brokers do not have discretionary authority; not counted for purposes of calculating approval percentage |

| Amendment to the Company's Restated Certificate of Incorporation | Majority of total outstanding shares of common stock entitled to vote at Annual Meeting | Treated as a vote against the matter for purposes of calculating approval percentage | Brokers have discretionary authority |

| Advisory Vote to Ratify Appointment of KPMG LLP | Majority of shares present at Annual Meeting | Treated as a vote against the matter for purposes of calculating approval percentage | Brokers have discretionary authority |

| Advisory Vote on Executive Compensation | Majority of shares present at Annual Meeting; not binding on Company | Treated as a vote against the matter for purposes of calculating approval percentage | Brokers do not have discretionary authority; not counted for purposes of calculating approval percentage |

With respect to Proposal 1 (election of directors), stockholders may vote FOR all or some of the nominees or stockholders may vote WITHHOLD with respect to one or more of the nominees. For the other items of business, stockholders may vote FOR, AGAINST or ABSTAIN.

All properly executed proxies delivered pursuant to this solicitation and not revoked in a timely manner will be voted in accordance with the directions given and, for any other business that may properly come before the Annual Meeting, in the discretion of the persons named in the proxy.

1

A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. A broker is entitled to vote shares held for a beneficial holder on routine matters, such as the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm, without instructions from the beneficial holder of those shares. However, a broker is not entitled to vote shares held for a beneficial holder on certain non-routine items, such as the election of directors, absent instructions from the beneficial holders of such shares.

In order to minimize the number of broker non-votes, the Company encourages you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided to you by your broker, bank or other nominee.

Revocation of Proxies

Your proxy may be revoked at any time prior to the Annual Meeting. If you provide more than one proxy, the proxy having the latest date will revoke any earlier proxy. If you attend the Annual Meeting in person, you will be given the opportunity to revoke your proxy and vote in person. If you are a stockholder of record or hold shares through a broker or bank and are voting by Internet or telephone, your vote must be received by 11:59 p.m. Eastern Time on May 1, 2018 to be counted.

Record Date

Only stockholders of record as of the close of business on March 7, 2018 are entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment thereof. As of March 7, 2018, the Company had issued and outstanding 84,631,653 shares of common stock, the Company's only class of outstanding securities entitled to vote at the Annual Meeting. Each stockholder of the Company will be entitled to one vote for each share of common stock registered in its name on March 7, 2018.

Proxy Voting Methods

If at the close of business on March 7, 2018, you were a stockholder of record or held shares through a broker or bank, you may vote your shares by proxy on the Internet, by telephone or by mail. You may also vote in person at the Annual Meeting. For shares held through a broker or nominee, you may vote by submitting voting instructions to your broker or nominee. To reduce the Company's administrative and postage costs, we suggest that you vote on the Internet or by phone, both of which are available 24 hours a day. You may revoke your proxies at the times and in the manners described above.

If you are a stockholder of record or hold shares through a broker or bank and are voting by Internet or telephone, your vote must be received by 11:59 p.m. Eastern Time on May 1, 2018 to be counted.

INTERNET

| • | If your shares are registered in your name: Go to www.envisionreports.com/SIX and follow the online instructions. You will need the 15-digit control number included on your Notice or proxy card when you access the web page. |

| • | If your shares are held in a stock brokerage account or by a bank or other nominee: Go to www.proxyvote.com and follow the instructions that you receive from your broker, bank or other nominee. |

TELEPHONE

| • | If your shares are registered in your name: Call toll-free (800) 652-8683 and follow the recorded instructions. You will need the 15-digit control number included on your Notice or proxy card when you call. |

| • | If your shares are held in a stock brokerage account or by a bank or other nominee: Vote your shares over the telephone by following the voting instructions that you receive from your broker, bank or other nominee. |

MAIL

| • | Request a proxy card by following the instructions on your Notice. |

| • | When you receive the proxy card, mark your selections on the proxy card. |

| • | Date and sign your name exactly as it appears on your proxy card. |

| • | Mail the proxy card in the postage-paid envelope that will be provided to you. |

The granting of proxies electronically is allowed by Section 212(c)(2) of the Delaware General Corporation Law. Whether or not you attend the Annual Meeting, your vote is important. You may vote your shares by proxy on the Internet, by telephone or by completing, signing and timely returning a proxy card. You may also vote in person at the Annual Meeting.

2

Householding

We have adopted a procedure called "householding," which the SEC has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, the proxy materials, to multiple stockholders who share the same address unless we received contrary instructions from one or more of the stockholders. This procedure reduces printing costs, mailing costs, and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written request, we will deliver promptly a separate copy of the Notice and, if applicable, the proxy materials, to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy of the Notice and, if applicable, the proxy materials, stockholders may write or email us at the following address of our principal executive office and email address:

Six Flags Entertainment Corporation

924 Avenue J East

Grand Prairie, Texas 75050

Attention: Investor Relations

spurtell@sftp.com

972-595-5180

Stockholders who share the same address and are receiving separate copies of the Notice, and if applicable, the proxy materials, who want to receive a single copy of the Notice, and if applicable, the proxy materials, may write or email us at the address of our principal executive office and email address set forth above.

Stockholders who hold shares in street name through a broker, bank or other nominee may contact their broker, bank or other similar organization to request information about householding.

Solicitation of Proxies

This proxy solicitation is being made on behalf of the Company. The expense of preparing, printing and mailing this Proxy Statement is being paid by the Company. Proxies may be solicited by directors, officers, and employees of the Company in person, or by mail, telephone, e-mail or other electronic means. The Company will not specially compensate those persons for their solicitation activities.

3

CORPORATE GOVERNANCE

The Board of Directors

The Company's business, property and affairs are managed under the direction of the Board of Directors of the Company (the "Board"). The Board is elected by stockholders to oversee management and to ensure that the long-term interests of stockholders are being served. The Board has responsibility for establishing broad corporate policies and for the overall performance of the Company. It is not, however, involved in operating details on a day-to-day basis. The Board is advised of the Company's business through discussions with the Chief Executive Officer and other officers of the Company, by reviewing reports, analyses and materials provided to them and by participating in Board meetings and meetings of the committees of the Board.

The Board has four regularly scheduled meetings during the year to review significant developments affecting the Company and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between regularly scheduled meetings. Directors are expected to attend all scheduled Board and committee meetings as well as the annual meeting of stockholders. The Board held 8 meetings during 2017. Each of the directors of the Company attended at least 75% of the aggregate of the meetings of the Board and of the meetings of committees of the Board on which such director served. All of the then-current directors of the Company attended the Company's annual meeting of stockholders in 2017 and the Company expects that each director nominee will attend the Annual Meeting.

The Board only has one class of directors. As a result, all directors are elected each year by the Company's stockholders at the annual meeting. Directors may be removed with or without cause by the holders of a majority of the shares then entitled to vote at an election of directors.

Each director of the Company was elected at the Company's annual meeting of stockholders in 2017. The Board currently has seven directors and all seven directors of the Company are being nominated by the Board at the Annual Meeting. See "Proposal 1: Election of Directors."

Stockholders and other interested parties may contact Jon L. Luther, the Lead Independent Director, and the other non-employee directors by writing to the Lead Independent Director c/o Six Flags Entertainment Corporation, 924 Avenue J East, Grand Prairie, Texas 75050.

Independence

The Board has affirmatively determined that five of the seven current directors, including all members of its Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, are "independent" within the meaning of the Company's director independence standards as set forth in the Company's Corporate Governance Guidelines. These standards reflect the independence standards adopted by the New York Stock Exchange ("NYSE"). The independent directors are Kurt M. Cellar, Jon L. Luther, Usman Nabi, Stephen D. Owens and Richard W. Roedel.

None of the independent directors, their respective affiliates or members of their immediate family, directly or indirectly, receive any fee or payment from the Company or its affiliates, other than the director compensation described below, or have engaged in any transaction with the Company or its affiliates or have any relationship with the Company or its affiliates which, in the judgment of the Board, is inconsistent with a determination that the director is independent. There is no family relationship among any of the directors or executive officers of the Company.

Corporate Governance Documents

The Company's Corporate Governance Guidelines, Code of Business Conduct and Ethics, Code of Ethics for Senior Management and the charters of the Board committees provide the framework for the governance of the Company. Each of these documents is available on the Company's website at investors.sixflags.com.

Corporate Governance Guidelines

The Corporate Governance Guidelines cover, among other things, the functions of the Board, the qualifications of directors, director independence, the selection process for new directors, Board committees, compensation of the Board, the succession plan for the chief executive officer and other senior executives, and stock ownership guidelines for directors and senior executives.

Code of Business Conduct and Ethics

The Company has adopted and maintains a Code of Business Conduct and Ethics that covers all directors, officers and employees of the Company and its subsidiaries. The Code of Business Conduct and Ethics requires, among other things, that

4

the directors, officers and employees exhibit and promote the highest standards of honest and ethical conduct; avoid conflicts of interest; comply with laws, rules and regulations; and otherwise act in the Company's best interest.

Code of Ethics for Senior Management

The Company has also adopted and maintains a separate Code of Ethics for Senior Management that imposes specific standards of conduct on members of senior management including persons with financial reporting responsibilities at the Company. Each member of the Company's senior management is required to annually certify in writing his or her compliance during the prior year with the Code of Ethics for Senior Management.

The Company intends to post amendments to or waivers from the Company's Corporate Governance Guidelines, Code of Business Conduct and Ethics and the Company's Code of Ethics for Senior Management on the Company's website at investors.sixflags.com. No waivers have been made or granted prior to the date of this Proxy Statement.

Availability of Corporate Governance Documents

The Company's Corporate Governance Guidelines, Code of Business Conduct and Ethics, Code of Ethics for Senior Management and charters of the committees of the Board are available on the Company's website at investors.sixflags.com. A printed copy of each of these documents is available, without charge, by sending an email to spurtell@sftp.com or by sending a written request to the Company at the following address: Six Flags Entertainment Corporation, 924 Avenue J East, Grand Prairie, Texas 75050, Attention: Investor Relations.

Board Committees

The Board has designated an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The membership of the committees as of March 1, 2018, and the function of each committee, are described below.

| Director | Board of Directors | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||||

| Kurt M. Cellar | ü | Chairw | ü | |||||

| Nancy A. Krejsa | ü | |||||||

| Jon L. Luther | ü | Chair | ||||||

| Usman Nabi | ü | ü | Chair | |||||

| Stephen D. Owens | ü | ü | ü | |||||

| James Reid-Anderson | Chair | |||||||

| Richard W. Roedel | ü | üw | ü | |||||

| Number of 2017 Meetings | 8 | 8 | 6 | 4 | ||||

___________________________

w Audit Committee Financial Expert

Audit Committee

The overall purpose of the Audit Committee is to oversee the accounting and financial reporting process of the Company and the audits of the financial statements of the Company. In fulfilling this purpose, the Audit Committee's duties and responsibilities include, among other things, (i) the appointment, compensation, evaluation and oversight of the work of the Company's independent auditors; (ii) review and approval of the independent auditor's engagement including the pre-approval of all audit and permitted non-audit engagements; (iii) oversight of the independent auditor's independence; (iv) review of the results of the year-end audit; (v) review of the adequacy and effectiveness of the Company’s accounting and internal control policies and procedures; (vi) review of management’s financial risk assessment and financial risk management policies, and the Company’s major financial risk exposures and the steps taken to monitor and control such exposures; (vii) establishment of procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submissions by employees of concerns regarding questionable accounting or auditing matters; (viii) oversight of the Company's legal and regulatory compliance and the Company's safety programs as established by management; and (ix) review of the Company's information technology strategic objectives including network and data security. As part of the Audit Committee's oversight of risk assessment and risk management, it discusses data security risks.

5

All members of the Audit Committee are independent within the meaning of SEC regulations. In addition, the Board has determined that Messrs. Cellar and Roedel are each qualified as an audit committee financial expert under SEC regulations and that all members of the Audit Committee have the accounting and related financial management expertise required by the NYSE. The SEC has determined that the audit committee financial expert designation does not impose on the person with that designation, any duties, obligations or other liabilities that are greater than the duties, obligations or liabilities imposed on such person as a member of the Audit Committee in the absence of such designation. Members of the Audit Committee may not serve on the audit committee of more than four public companies, including the Company. In the event a member serves on more than three public company audit committees, the Board must determine that such simultaneous service would not impair the ability of such member to serve effectively on the Company's Audit Committee. None of the members of the Audit Committee serve on the audit committee of more than three public companies.

Compensation Committee

The Compensation Committee, among other duties, (i) is responsible for establishing and reviewing the Company's overall compensation philosophy; (ii) determines the appropriate compensation levels for the Company's executive officers (which includes the review and approval of corporate goals and objectives used in determining executive officer compensation); (iii) reviews all incentive compensation and equity-based compensation plans, benefit plans and new executive compensation programs, and oversees the administration of such plans; (iv) grants awards of shares or stock options pursuant to the Company's equity-based plans; and (v) reviews employee salary levels.

The Compensation Committee may form and delegate any of its responsibilities to a subcommittee so long as such subcommittee is solely comprised of Compensation Committee members. No such delegation with respect to executive compensation was made in 2017. In addition, the Compensation Committee has the direct responsibility for the appointment, termination, compensation and oversight of any compensation and benefit consultants retained by the Company in respect of executive compensation. The Compensation Committee has retained Deloitte Consulting LLP ("Deloitte") to advise it in connection with ongoing compensation matters related to the Company. During 2017, Deloitte affiliates provided tax, international development, and other consulting services to the Company. The Company has reviewed the services provided by Deloitte and its affiliates and has approved the provision of such services. The Company does not believe that such non-compensation services impair Deloitte’s ability to provide independent advice to the Compensation Committee or otherwise present a conflict of interest. The aggregate fees paid to Deloitte for executive compensation services to the Compensation Committee during 2017 were $92,407, and the aggregate fees paid to Deloitte for tax, international development and other consulting services to the Company during 2017 were $1,280,792.

The Board has determined that each member of the Compensation Committee is a "non-employee director" as defined in Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and meets the independence requirements of the NYSE and the "outside director" requirements of Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code").

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee serves, or has served, as an officer or employee of the Company. In addition, no interlocking relationship exists between the Board or the Compensation Committee and the board of directors or compensation committee of any other company, nor did any such interlocking relationship exist during 2017.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for recommending qualified candidates to the Board for election as directors of the Company, including the slate of directors that the Board proposes for election by stockholders at the Annual Meeting. The Nominating and Corporate Governance Committee also advises and makes recommendations to the Board on all matters concerning directorship practices, including recommendations concerning the functions and duties of the committees of the Board, and, in conjunction with the Compensation Committee, compensation for non-employee directors. The Nominating and Corporate Governance Committee developed and recommended to the Board the Company's Corporate Governance Guidelines, and reviews, on a regular basis, the overall corporate governance of the Company. All members of the Nominating and Corporate Governance Committee are independent within the meaning of the NYSE requirements.

6

Communications with the Board of Directors

Stockholders who wish to communicate with the Board may do so by writing to a specific director, including the Lead Independent Director, or to the entire Board at the following address: Board of Directors—Stockholder Communications, c/o Six Flags Entertainment Corporation, 924 Avenue J East, Grand Prairie, Texas 75050, Attention: Secretary. The Secretary will forward all such communications to the directors to whom they are addressed.

Meetings of Independent Directors

The Board schedules at least four meetings each year for the independent directors outside the presence of any member of management. The independent directors may meet in executive session at such other times as determined by the Lead Independent Director. At each executive session, the Lead Independent Director or, in his absence, one of the other independent directors, will chair that executive session. The Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee also meet regularly in executive session without management.

Board Leadership Structure

Currently, Mr. Reid-Anderson serves as the Company's Chief Executive Officer and as the Chairman of the Board. The Board does not have a policy on whether or not the roles of the Chief Executive Officer and Chairman should be separate and believes it should maintain flexibility to select the Company's Chairman and Board leadership structure from time to time. The Company's Bylaws provide that the Board may designate a Chairman. Accordingly, the Board reserves the right to vest the responsibilities of the Chief Executive Officer and Chairman in the same person or in two different individuals depending on what it believes is in the best interest of the Company. In July 2017, when Mr. Duffey retired as the Company's Chief Executive Officer, the Board determined that the most effective leadership structure for the Company was for Mr. Reid-Anderson, who was serving as the Company's Executive Chairman at the time, to serve as both Chairman and Chief Executive Officer, as he had prior to Mr. Duffey's tenure as Chief Executive Officer. The Board believes that this combined role provides strong unified leadership for the Company, enhances communication between management and the Board and enables management to more efficiently execute the Company's strategic initiatives and business plans. Given his in-depth knowledge of the Company, the Board believes Mr. Reid-Anderson continues to be best positioned to develop agendas that ensure the Board's time and attention are focused on the most critical matters. His role ensures decisive leadership and clear accountability.

The Board believes that there is no single Board leadership structure that would be most effective in all circumstances and therefore retains the authority to modify this structure to best address the Company's and the Board's then current circumstances as and when appropriate. The Board believes that this leadership structure, together with the role of the Lead Independent Director, is currently in the best interest of the Company and its stockholders. Mr. Luther serves as the Company's Lead Independent Director and his role helps ensure a strong independent Board. As the Lead Independent Director, Mr. Luther presides at meetings of the independent members of the Board and serves as the presiding director in performing such other functions as the Board may direct, including advising on the selection of committee chairs and advising management on the agenda for Board meetings.

Board Role in Risk Oversight

The Company's management is responsible for identifying, assessing and managing the material risks facing the business. The Board, and in particular, the Audit Committee, are responsible for overseeing the Company's processes for assessing and managing risk. Each of the Chief Executive Officer, Chief Financial Officer, General Counsel and Vice President of Internal Audit, with input as appropriate from other management members, report and provide relevant information directly to either the Board and/or the Audit Committee on various types of identified material financial, reputation, legal, operational, environmental and business risks to which the Company is or may be subject, as well as mitigation strategies for certain salient risks. In accordance with NYSE requirements and as set forth in its charter, the Audit Committee periodically reviews and discusses the Company's business and financial risk management and risk assessment policies and procedures with senior management, the Company's independent auditor and the Vice President of Internal Audit of the Company. The Audit Committee reports its risk assessment function to the full Board and the Board reviews and discusses such risks at a regularly scheduled Board meeting. With the oversight of the Board, the Company has implemented practices and programs designed to help manage the risks to which the Company is exposed and to align risk-taking appropriately with the Company's efforts to increase stockholder value. The Board believes that the leadership structure described above under "Board Leadership Structure" facilitates the Board's oversight of risk management because it allows the Board, with leadership from the Lead Independent Director and by working through committees, including the independent Audit Committee, to participate actively in the oversight of management's actions.

7

Nomination Process

Role of the Nominating and Corporate Governance Committee

The Board has adopted a set of Corporate Governance Guidelines which includes qualification criteria that the Nominating and Corporate Governance Committee uses to identify individuals it believes are qualified to become directors. In making recommendations of nominees pursuant to the Corporate Governance Guidelines, the Nominating and Corporate Governance Committee believes that candidates should possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of the stockholders. The Nominating and Corporate Governance Committee also evaluates whether a candidate has an inquisitive and objective perspective, practical wisdom and mature judgment. With respect to diversity, the Nominating and Corporate Governance Committee and the Board as a whole broadly construe diversity to mean not only diversity of race, gender and ethnicity, but also diversity of opinions, perspectives, and professional and personal experiences. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law. The Board believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. The Board therefore considers diversity in identifying nominees for director but does not have a separate policy directed toward diversity. In assessing whether a candidate has the appropriate time to devote to Board service, the Nominating and Corporate Governance Committee will consider the number of boards of directors on which such candidate already serves. Although candidates must be committed to serving on the Board for an extended period of time, the Board does not believe that directors should expect to be routinely re-nominated annually.

After identifying the qualified individuals and conducting interviews, as appropriate, the Nominating and Corporate Governance Committee will recommend the selected individuals to the Board. The Nominating and Corporate Governance Committee uses the same process to evaluate all candidates whether they are recommended by the Company or by one of the Company's stockholders.

The Nominating and Corporate Governance Committee may retain a director search firm to help identify qualified director candidates.

Stockholder Recommendations and Nominations—Suggestions for director candidates nominated by a stockholder

Stockholders may recommend director candidates for consideration by the Nominating and Corporate Governance Committee by sending the name and supporting information in accordance with Rule 14a-8 of the Exchange Act and the information set forth in the Company's Corporate Governance Guidelines (available on the Company’s website at investors.sixflags.com) to the Secretary or Lead Independent Director, c/o Six Flags Entertainment Corporation, 924 Avenue J East, Grand Prairie, Texas 75050. The Nominating and Corporate Governance Committee evaluates the qualifications of candidates properly submitted by stockholders in the same manner as it evaluates the qualifications of director candidates identified by itself or the Board.

Stockholder Recommendations and Nominations—Director candidates nominated by a stockholder

The Company's Bylaws permit a stockholder to nominate directors for election at an annual meeting. A nominating stockholder is required to provide written notice of that stockholder's intent to make the nomination to the Secretary of the Company not less than 90 days nor earlier than 120 days before the first anniversary of the Company's previous annual meeting. In order to be considered timely for the 2019 annual meeting, notice of the nomination must be received by the Secretary of the Company on or after January 2, 2019 and on or before February 1, 2019. A nominating stockholder must provide the information required by the Company's Bylaws and each nominee must meet the qualifications required by the Company's Bylaws.

Stockholder Recommendations and Nominations—Proxy access candidates

In 2017, the Company received a stockholder proposal to adopt a proxy access bylaw. Upon management’s recommendations based on various factors including the positive engagement with the stockholder, the Board amended the Company's Bylaws in February 2018 to implement proxy access. As amended, the Company's Bylaws permit a stockholder or group of up to 20 stockholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years, to nominate and include in the Company’s proxy materials director nominees constituting up to two directors or 20% of the Board, whichever is greater, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the Company's Bylaws. A nominating stockholder is required to provide written notice of that stockholder's intent to make the nomination to the Secretary of the Company not less than 120 days nor earlier than 150 days before the first anniversary of the date that the Company sent its proxy statement for the prior year’s annual meeting of stockholders. In order to be considered timely for the 2019 annual meeting, notice of the nomination must be received by the Secretary of the Company on

8

or after October 21, 2018 and on or before November 20, 2018. Nominating stockholders and nominees must satisfy the requirements set forth in the Company's Bylaws.

Stockholder Engagement

The Company's relationship with its stockholders is an important part of the Company’s success and the Company believes it is important to engage with its stockholders and to obtain their perspectives. During early 2018, our stockholder outreach team, led by the Company's Senior Vice President, Investor Relations, and including the Company's Compensation Committee and Nominating and Corporate Governance Committee chairs and members of senior management, met with stockholders on a variety of issues. The Company's management team believes that this approach to engaging openly with the Company's stockholders on topics such as executive compensation and corporate governance drives increased corporate accountability, improves decision making and ultimately creates long-term value. The Company is committed to:

| • | Accountability: Driving and supporting strong corporate governance and Board practices to ensure oversight, accountability, and good decision making. |

| • | Transparency: Maintaining high levels of transparency on a range of financial, executive compensation, and governance issues to build trust and sustain two-way dialogue that supports the Company's business success. |

| • | Engagement: Proactively engaging with stockholders in conversations on a variety of topics to identify emerging trends and issues to inform the Company's thinking and approach. |

The Company holds meetings during the course of each year with many of its stockholders through in-person and teleconference meetings as well as by participating at various conferences. In addition, the Company's senior management team, including the Chairman, President and Chief Executive Officer, and the Chief Financial Officer, regularly engage in meaningful dialogue with the Company's stockholders through the Company's quarterly earnings calls and other channels for communication. Through these activities, we discuss and receive input, provide additional information, and address questions about our business strategy, executive compensation programs, corporate governance and other topics of interest to our stockholders. These engagement efforts allow us to better understand our stockholders’ priorities and perspectives, and provide us with useful input concerning our compensation and corporate governance practices. For example, this year stockholder feedback influenced the Company's implementation of proxy access and the specific terms adopted through an amendment to the Company's Bylaws.

9

2017 NON-EMPLOYEE DIRECTOR COMPENSATION

The Nominating and Corporate Governance Committee and the Compensation Committee, consulting with each other, are responsible for recommending to the Board compensation and benefits for non-employee directors. In discharging this duty, the committees are guided by three goals: (i) compensation should fairly pay directors for work required in a company of our size and scope; (ii) compensation should align directors' interests with the long-term interests of stockholders; and (iii) the structure of the compensation should be simple, transparent and easy for stockholders to understand. Annual compensation for non-employee directors for 2017 was comprised of cash compensation (which can be deferred into stock units) and equity compensation in the form of restricted stock awards.

Description of Non-Employee Director Compensation

At least annually, the Nominating and Corporate Governance Committee and the Compensation Committee review the non-employee director compensation program. The Compensation Committee retained Deloitte to provide advice in connection with ongoing compensation matters related to the Company. Deloitte provided the Compensation Committee with an analysis of the competitiveness of the Company's non-employee director compensation program. The Nominating and Corporate Governance Committee and the Compensation Committee considered the market data, the amount and timing of past increases to the non-employee directors’ compensation, and the mix of cash and equity compensation, when determining the changes to non-employee director compensation.

Cash and Equity Compensation

The following table sets forth the annual compensation to non-employee directors in 2017. The cash compensation is paid in equal quarterly installments at the beginning of each fiscal quarter.

_________________________

| Amount($) | |||

Cash Retainer(1) | 70,000 | ||

Equity Retainer(1)(2) | 150,000 | ||

| Lead Independent Director Retainer | 30,000 | ||

Audit Committee Chairman Retainer(1) | 25,000 | ||

| Compensation Committee Chairman Retainer | 15,000 | ||

Nominating and Corporate Governance Committee Chairman Retainer(1) | 15,000 | ||

| Audit Committee Member Retainer | 12,500 | ||

| Compensation Committee Member Retainer | 10,000 | ||

| Nominating and Corporate Governance Committee Member Retainer | 7,500 | ||

| (1) | Effective as of May 3, 2017, the Board approved an increase in (i) the annual equity retainer to $150,000, (ii) the annual cash retainer for the Audit Committee Chairman to $25,000, and (iii) the annual cash retainer for the Nominating and Corporate Governance Committee Chairman to $15,000. Effective as of the Annual Meeting, the Board approved an increase in (i) the annual equity retainer to $160,000, and (ii) the annual cash retainer for the Compensation Committee Chairman to $25,000. |

| (2) | Granted in the form of time-vested (12 month) restricted stock awards determined by dividing the amount of the equity retainer by the closing price of the Company's common stock on the date of grant. The restricted stock vests in full on the earlier of the day immediately prior to the first annual meeting of stockholders of the Company after the date of grant or the first anniversary of the date of grant if the director continues to serve as a director through such date (or on the earlier of the death or disability of such director). |

Cash Retainer Deferral Program

The Company maintains a director cash retainer deferral program under the Company's Long-Term Incentive Plan. This program allows members of the Board to elect to receive stock units under the Long-Term Incentive Plan in lieu of the cash compensation for such member's services as a director. The cash compensation that a director may elect to receive in stock units is only the cash compensation that the director otherwise would receive for services as a director of the Company and does not include any cash compensation for being the lead independent director, or chairman or member of any committee of the Board. Each deferred stock unit accumulates dividend equivalents that are converted to additional deferred stock units annually. The conversion of stock units into shares and the distribution of such shares under this program will occur on the first business day following the thirtieth day after a director's service as a director terminates.

10

Stock Ownership Guidelines

To further the Company's objective of aligning the interests of directors with the Company's stockholders, the Board has adopted stock ownership guidelines for directors. Each director should seek to have a level of ownership of Company stock that has a value approximately equal to at least three times the director's annual cash retainer. For purposes of the guidelines, the annual cash retainer does not include any additional cash compensation paid for participation on any committee of the Board or for serving as Chairman of any such committee. The ownership level should be achieved within three years of (i) the effective date of the guidelines for directors serving as of the adoption of the guidelines or (ii) the date the person first becomes a director for newly appointed or elected directors. All of the directors are in compliance with the Company's stock ownership guidelines.

2017 Non-Employee Director Compensation

Employee directors do not receive any compensation in connection with their director service. During 2017, Messrs. Duffey and Reid-Anderson were the only employee-directors and their respective compensation as an employee is set forth in the 2017 Summary Compensation Table. Mr. Nabi previously advised the Board that he did not wish to receive any director fees because of his position with H Partners, LP, a significant stockholder of the Company. The following table sets forth compensation paid to or earned by each non-employee director for the year ending December 31, 2017:

| Director | Fees Earned or Paid in Cash($)(1)(2) | Stock Awards($)(3)(4) | Total($) | ||||||

| Kurt M. Cellar | 100,417 | 149,966 | 250,383 | ||||||

| Nancy A. Krejsa | 58,333 | 149,966 | 208,299 | ||||||

| Jon L. Luther | 114,951 | 149,966 | 264,917 | ||||||

| Usman Nabi | — | — | — | ||||||

| Stephen D. Owens | 92,500 | 149,966 | 242,466 | ||||||

| Richard W. Roedel | 89,951 | 149,966 | 239,917 | ||||||

_________________________

| (1) | The following table sets forth the annual cash compensation earned by each non-employee director in 2017: |

| Committees | ||||||||||||||||||

| Director | Retainer($) | Lead Independent Director($) | Audit Committee Chair / Member($) | Compensation Committee Chair / Member($) | Nominating Corporate Governance Chair / Member($) | Total Cash Amount($) | ||||||||||||

| Kurt M. Cellar | 70,000 | — | 22,917 | — | 7,500 | 100,417 | ||||||||||||

| Nancy A. Krejsa | 58,333 | — | — | — | — | 58,333 | ||||||||||||

| Jon L. Luther | 69,951 | 30,000 | — | 15,000 | — | 114,951 | ||||||||||||

| Usman Nabi | — | — | — | — | — | — | ||||||||||||

| Stephen D. Owens | 70,000 | — | 12,500 | 10,000 | — | 92,500 | ||||||||||||

| Richard W. Roedel | 69,951 | — | 12,500 | — | 7,500 | 89,951 | ||||||||||||

| (2) | Non-employee directors may defer all or a portion of their cash retainer in the form of stock units under the Long-Term Incentive Plan pursuant to the Company's director cash retainer deferral program. The amounts for Messrs. Luther and Roedel include $70,000, which they each elected to defer pursuant to the director cash retainer deferral program. Accordingly, Messrs. Luther and Roedel were each granted 1,133 deferred stock units in 2017. In addition, Messrs. Luther and Roedel each received 343 deferred stock units representing accumulated dividend equivalents on their deferred stock unit account. See "—Description of Non-Employee Director Compensation" for a discussion of the Company's director cash retainer deferral program. |

| (3) | The dollar value represents the aggregate grant date fair value computed in accordance with stock-based accounting rules (Financial Standards Accounting Board ASC Topic 718) of the restricted stock awards granted to directors in 2017. Dividends on unvested restricted stock accumulate and are paid on or about the time that the shares of common stock underlying the restricted stock are delivered. The assumptions used in the calculation of these amounts are discussed in Note 9 to the Company's consolidated financial statements included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2017. |

| (4) | As of December 31, 2017, each non-employee director (other than Mr. Nabi) had 2,429 shares of restricted stock outstanding, which vest on May 1, 2018. Each non-employee director (other than Mr. Nabi) had only one unvested award |

11

outstanding as of December 31, 2017 and therefore, the grant date fair value of such award is reflected in the 2017 Non-Employee Director Compensation Table. There are no outstanding stock option awards for any non-employee director.

PROPOSAL 1: ELECTION OF DIRECTORS

At the Annual Meeting, seven directors are nominated for election to the Board to serve for the next year and until their respective successors are elected and qualified. At this time the Board believes it is appropriately sized at seven members but will review possible candidates for the two vacancies if and when circumstances merit. Each nominee has consented to be named as a nominee and to serve if elected. Should any of the nominees become unable to serve as a director (which the Board does not expect), the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

Information Concerning Nominees

| Name | Age as of March 1, 2018 | Position with the Company | ||

| Kurt M. Cellar | 48 | Director | ||

| Nancy A. Krejsa | 60 | Director | ||

| Jon L. Luther | 74 | Director | ||

| Usman Nabi | 43 | Director | ||

| Stephen D. Owens | 47 | Director | ||

| James Reid-Anderson | 58 | Chairman, President and Chief Executive Officer | ||

| Richard W. Roedel | 68 | Director | ||

Kurt M. Cellar has served as a director of the Company since May 2010. Since 1999, Mr. Cellar has served as a corporate director for many companies in a variety of industries. From 1999 to 2008, Mr. Cellar worked for the hedge fund Bay Harbour Management, L.C. He was partner and portfolio manager from 2003 until his departure in 2008. During his five year tenure as portfolio manager at Bay Harbour, the fund was recognized by Bloomberg as the top performing hedge fund in its class. Prior to Bay Harbour, Mr. Cellar was with the private equity firm Remy Investors. Before that, he was a strategy consultant at LEK/Alcar. Mr. Cellar is currently a director of Giraffe Holdings, Inc., Hawaiian Telecom Holdco, Inc., where he is Chairman of its Audit Committee and a member of the Nominating and Corporate Governance Committee, Home Buyers Warranty, where he is Chairman of its Audit Committee and U.S. Concrete Inc., where he is Chairman of its Compensation Committee and a member of its Nominating and Corporate Governance Committee. Mr. Cellar has had significant leadership roles in previous director assignments, including Chairman of the Board and chair roles of each committee. Within the last five years, Mr. Cellar was also a member of the Board of Directors of Horizon Lines, Inc., where he was Chairman of its Nominating and Corporate Governance Committee, Angiotech Pharmaceuticals, where he was Co-Chairman of its Board, and Edison Mission Energy Trust. He has many times, and, without exception, been asked to serve on board special committees. He has been an invited speaker on various board issues over the years. He has participated in many board related continuing education venues with the NACD and Harvard University. Mr. Cellar has a Masters in Business Administration from the Wharton School of Business and a BA in Economics/Business from the University of California, Los Angeles. Mr. Cellar is a former Chartered Financial Analyst. Mr. Cellar is well qualified to serve on the Board based on his significant accounting and financial experience and his other public company board experience.

Nancy A. Krejsa was named a director of the Company in March 2017. Ms. Krejsa previously served as Senior Vice President, Investor Relations and Corporate Communications for Six Flags since October 2010. Prior to joining the Company, she served as Senior Vice President, Strategy and Communications for Siemens Healthcare Diagnostics from November 2007 to September 2010 following Siemens’ acquisition of Dade Behring. From 1994 to 2007 Ms. Krejsa held senior roles at Dade Behring as Senior Vice President of Communications and Investor Relations, Vice President of U.S. Operations, Treasurer, and Assistant Controller. Prior to joining Dade Behring, Ms. Krejsa held a number of financial management positions at American Hospital Supply and Baxter International, including Vice President, Controller of the Hospital Supply distribution business. Ms. Krejsa has a B.S. in Finance from Indiana University and an M.B.A. in Accounting from DePaul University. Ms. Krejsa’s six years of experience as a member of the Company’s senior leadership team has provided her a deep understanding of the Company’s business, and her 17 years of senior leadership roles in finance and operations at prior companies make her qualified to serve as a director for the Company.

Jon L. Luther has served as a director of the Company since May 2010. Mr. Luther served as Chief Executive Officer of Dunkin' Brands Group Inc., a quick-service restaurant franchisor whose brands include Dunkin' Donuts and Baskin-Robbins, from January 2003 to January 2009 and Chairman from March 2006 to January 2009. In January 2009, he assumed the role of

12

Executive Chairman, and in July 2010, became the Non-Executive Chairman, a position he held until his retirement in May 2013. Mr. Luther is also a director and member of the Nominating and Corporate Governance Committee of Tempur Sealy International Inc., a bedding provider, as well as a director of Arby's Restaurant Group, Inc., a privately held quick-service sandwich chain. Mr. Luther is also the Chairman of the Board of Directors of The Culinary Institute of America and also serves as Chairman of its Executive Committee. Within the last five years, Mr. Luther served as a director and member of the Compensation Committee and Nominating and Corporate Governance Committee of Brinker International, Inc., an owner and franchisor of certain restaurant brands and Mr. Luther served as Chairman for the International Franchise Association and was a member of its Executive Committee. Mr. Luther brings to the Board executive leadership experience and vast business experience and expertise in the food and beverage segment as well as in brand marketing.

Usman Nabi has served as a director of the Company since May 2010. Mr. Nabi is a Senior Partner at H Partners Management, an investment management firm. Prior to joining H Partners in 2006, Mr. Nabi was at Perry Capital, the Carlyle Group, and Lazard Freres. Mr. Nabi serves as a director and member of the Compensation Committee and the Nominating and Corporate Governance Committee of Tempur Sealy International Inc. As a Senior Partner at H Partners Management, Mr. Nabi brings to the Board a keen business and financial sense and strong investment experience especially in the consumer sector.

Stephen D. Owens has served as a director of the Company since May 2010. Mr. Owens is co-founder and Managing Director of Staple Street Capital, a private equity firm. Prior to founding Staple Street Capital in 1995, Mr. Owens was a Managing Director at The Carlyle Group in the firm's U.S. Buyout team. While at Carlyle, Mr. Owens co-founded the firm's Global Consumer & Retail Group, was a senior member of the firm's Global Communications & Media Group, and executed and oversaw investments in the business services and transportation sectors. Previously, Mr. Owens was a principal investor and investment banker with Lehman Brothers in their New York and Hong Kong offices. Mr. Owens' business and finance experience, including helping to create value in multi-location consumer-facing businesses, qualifies him to serve on the Board.

James Reid-Anderson was named Chairman, President and Chief Executive Officer of the Company in July 2017. From February 2016 to July 2017 he served as Executive Chairman of the Company, and from August 2010 to February 2016, Mr. Reid-Anderson served as Chairman, President and Chief Executive Officer of the Company. Under his leadership the Company set a new strategic direction and achieved all-time high guest and employee satisfaction ratings, significant operational improvements and a twelve times total stock return since joining the Company. Mr. Reid-Anderson had previously served as Chairman, President and Chief Executive Officer of Dade Behring Inc., a manufacturer and distributor of medical diagnostics equipment and supplies, where he drove a tenfold increase in Dade Behring’s share price along with significant employee morale improvements and customer satisfaction increases, all achieving record levels. Mr. Reid-Anderson negotiated the sale of Dade Behring Inc. to Siemens AG, a worldwide manufacturer and supplier for the industrial, energy and healthcare industries, in 2007 and subsequently assumed various roles including becoming a member of Siemens AG’s managing board and Chief Executive Officer of Siemens’ $20 billion Healthcare Sector. Earlier in his career Mr. Reid-Anderson held roles of increasing responsibility at PepsiCo, Diageo and Mobil, and as adviser to Apollo Management L.P., a private equity firm. Mr. Reid-Anderson is a fellow of the Association of Chartered Certified Accountants, U.K. and holds a Bachelor of Commerce degree from the Birmingham University, U.K. Mr. Reid-Anderson’s prior experience as Chairman, President and Chief Executive Officer of Dade Behring, a restructured public company, as well as his extensive operational, international and financial background, make him especially qualified to serve as Chairman and lead the Company to operational and financial success.

Richard W. Roedel has been a director of the Company since December 2010. Mr. Roedel is a director and Chairman of the Audit Committee of LSB Industries, Inc. as well as a director and Chairman of the Risk Committee of IHS Markit, Inc. Mr. Roedel is a member of the Audit Committee and is the Non-Executive Chairman of Luna Innovations Incorporated. Over the years, Mr. Roedel has been the chairman of several governance, compensation and special committees. Mr. Roedel served on the Board of Directors of Lorillard, Inc. from 2008 through 2015, when it was acquired by Reynolds American Inc. Mr. Roedel also served as Chair of the Audit Committee of Lorillard, Inc. as well as a member of its Nominating & Corporate Governance Committee. Mr. Roedel served on the Board of Directors of Sealy Corporation in several capacities, including Chairman of its Audit Committee, until March 2013 when Sealy was acquired by Tempur-Pedic International Inc. Mr. Roedel served on the Board of Directors of BrightPoint, Inc. in several capacities until October 2012, when it was acquired by Ingram Micro Inc., including Chairman of its Audit Committee, Chairman of its Compensation Committee and member of its Nominating and Corporate Governance Committee. Mr. Roedel was a director of Broadview Holdings, Inc., a private company, and was Chairman of its Audit Committee and a member of its Compensation Committees until 2012. Mr. Roedel was a director and Chairman of the Audit Committee of Dade Behring Holdings, Inc. from October 2002 until November 2007 when Dade Behring was acquired by Siemens AG. Mr. Roedel is a member of the National Association of Corporate Directors (NACD) Risk Oversight Advisory Council. Mr. Roedel recently served a three-year term on the Standing Advisory Group of the Public Company Accounting Oversight Board (PCAOB). From 1985 through 2000, Mr. Roedel was employed by the accounting firm BDO Seidman LLP, having been managing partner of its Chicago and New York Metropolitan area offices and later Chairman and CEO. As a result of these and other professional experiences, Mr. Roedel has extensive experience in

13

finance, accounting and risk management and in public company board and committee practices, which make him well-qualified to serve on the Board.

Vote Required

A plurality of the votes cast is required to elect each director. If you own shares through a bank, broker, or other holder of record, you must instruct your bank, broker, or other holder of record how to vote in order for them to vote your shares so that your vote can be counted on this Proposal 1.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF ALL OF THE NOMINEES NAMED ABOVE.

14

AUDIT COMMITTEE REPORT

The members of the Audit Committee have been appointed by the Board. The Audit Committee is governed by a written charter that has been approved and adopted by the Board and that will be reviewed and reassessed annually by the Audit Committee. The Audit Committee is comprised of three independent directors.

The Audit Committee assists the Board in fulfilling its responsibility to oversee management's conduct of the Company's financial reporting process. It does so by reviewing (i) the financial reports and other financial information provided by the Company to any governmental body or to the public, (ii) the Company's systems of internal controls regarding finance, disclosure, accounting and legal compliance and (iii) the Company's auditing, accounting and financial reporting processes generally.

Management is responsible for the preparation and integrity of the Company's consolidated financial statements. The independent registered public accounting firm is responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon. The Audit Committee has independently met and held discussions with management and the independent registered public accounting firm.

The following is the report of the Audit Committee of the Company with respect to the Company's audited consolidated financial statements for the fiscal year ended December 31, 2017.

To fulfill its responsibility, the Audit Committee has done the following:

| • | The Audit Committee has reviewed and discussed with management the Company's audited consolidated financial statements and management's assessment of the effectiveness of the Company's internal controls over financial reporting. |

| • | The Audit Committee has discussed with KPMG LLP, the Company's independent auditors, the matters required to be discussed by Auditing Standard No. 1301 regarding the auditors' judgments about the quality of the Company's accounting principles as applied in its financial reporting. |

| • | The Audit Committee has received written disclosures and the letter from KPMG LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG LLP's communications with the Audit Committee concerning independence and has discussed with KPMG LLP its independence. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the Company's audited consolidated financial statements and management's assessment of the Company's internal controls over financial reporting for the fiscal year ended December 31, 2017 be included in the Company's Annual Report on Form 10-K for such year for filing with the SEC.

| THE AUDIT COMMITTEE | |

Kurt M. Cellar (Chair) Stephen D. Owens Richard W. Roedel | |

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board of Directors of the Company has reviewed and discussed the Compensation Discussion and Analysis below with the Company's management and, based on such review and discussion, the Committee recommended to the Board of Directors that this Compensation Discussion and Analysis be included in this Proxy Statement.

| THE COMPENSATION COMMITTEE | |

Jon L. Luther (Chair) Stephen D. Owens Usman Nabi | |

15

EXECUTIVE COMPENSATION

Overview

This section of the Proxy Statement contains information regarding our compensation programs, policies and objectives and, in particular, their application to a specific group of individuals that we refer to as our named executive officers.

| Name | Title | |

| James Reid-Anderson | Chairman, President and Chief Executive Officer | |

| John M. Duffey | Former President and Chief Executive Officer | |

| Marshall Barber | Chief Financial Officer | |

| Lance C. Balk | General Counsel | |

| Brett Petit | Senior Vice President, Marketing | |

| Catherine Aslin | Senior Vice President, Human Resources | |

This section is organized as follows:

| • | Compensation Discussion and Analysis. This section contains a description of the specific types of compensation we pay, a discussion of our compensation policies, information regarding how those policies were applied to the compensation of the named executive officers for 2017 and other information that we believe may be useful to investors regarding compensation of the named executive officers. |

| • | Compensation Policies and Risk Management Practices. This section describes the Company's compensation policies and practices as they relate to the Company's risk management. |

| • | Description of Employment Agreements of Named Executive Officers. This section refers to the employment agreements between the named executive officers and the Company. |

| • | 2017 Executive Compensation Tables. This section provides information, in tabular formats specified in applicable SEC rules, regarding the amount or value of various types of compensation paid to the named executive officers and related information. |

| • | Potential Payments Upon Termination. This section provides information regarding amounts that could become payable to the named executive officers following specified events. |

The parts of this Executive Compensation section described above are intended to be read together and each provides information not included in the others. In addition, for information regarding the Compensation Committee and its responsibilities, please see "Corporate Governance—Board Committees—Compensation Committee" above.

Compensation Discussion and Analysis

Executive Summary

The Company's goals for its executive compensation program are to attract, motivate and retain a talented and experienced management team that will provide leadership for the Company's long-term success. The Company seeks to accomplish these goals in a way that rewards performance and is aligned with its stockholders' interests as exemplified by the Company's Project 600 and Project 750 performance-based award programs described below. These unique programs provide long-term aspirational performance goals and are designed to incentivize early achievement of the goals and provide reduced incentives for late achievement. The Company has engaged meaningfully with certain major stockholders on the Company’s performance-based award programs and, based on such discussions, believes that many large stockholders favorably view these long-term aspirational performance goals and agree that they align Company performance with the interests of stockholders. This dialogue with stockholders has led to enhanced descriptions of the performance awards as well as certain refinements to the methodology for determining achievement of one of the performance targets as described below.

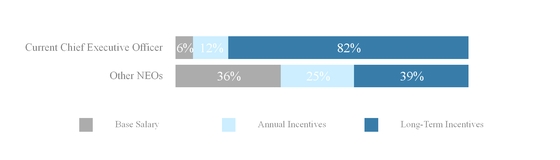

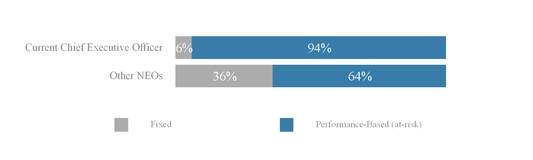

The compensation for the named executive officers consists of four elements—base salaries, annual incentives, long-term equity awards, and perquisites and benefits—that are designed to reward performance in a simple and straightforward manner.

16

The Company believes the compensation program for the named executive officers is instrumental in helping the Company achieve its strong financial performance. The Company's focused business strategy, proven management team, and highly customized compensation program work together to deliver results. Some of the Company's financial results for 2017 include the following:

| Key Financial Metric | 2017 Financial Results | |

| Revenue | $1.359 billion (3% increase over 2016) | |

| Investment in New Capital | $135 million (9% of revenue plus an incremental investment to open a new waterpark in Mexico) | |

| 1-year total stockholder return (TSR) (12/31/17) | 16.0% | |

| Cumulative 3-year TSR (12/31/17) | 76.4% | |

| Cumulative 5-year TSR (12/31/17) | 175% | |

| Dividend Per Share | $2.62 (10% increase over 2016) | |

| Stock Repurchases | $499 million (8.4 million shares) | |

In July 2017, Mr. Reid-Anderson was reappointed as Chief Executive Officer and Mr. Duffey, the former Chief Executive Officer, retired from the Company. In connection with this CEO transition, the Compensation Committee recommended and the Board approved certain changes to compensation for Mr. Reid-Anderson. In recognition of the increase in Mr. Reid-Anderson's responsibilities from Executive Chairman to Chairman, President and Chief Executive Officer, Mr. Reid-Anderson's base salary was increased by $800,000 to $1,800,000. Mr. Reid-Anderson's annual incentive was increased to a target opportunity of 200% of his base salary, however, the Board determined that for the 2017 transition year Mr. Reid-Anderson’s actual annual incentive would continue to be determined based on the target opportunity of 100% of the base salary paid to Mr. Reid-Anderson in 2017. Mr. Reid-Anderson was also granted options to purchase 500,000 shares of common stock.

The Project 600 shares that Mr. Duffey forfeited upon his retirement, and as more fully described under "—Description of Employment Agreements of Named Executive Officers," were transferred back to Mr. Reid-Anderson, increasing Mr. Reid-Anderson's total target award under the Project 600 program by 185,000 shares. In addition, the target award of 150,000 shares under Project 750 that Mr. Duffey forfeited upon his retirement were transferred to Mr. Reid-Anderson. The primary rationale for making these changes to Mr. Reid-Anderson's compensation was to acknowledge his increased roles and responsibilities and to ensure his retention with the Company. The following table shows that the aggregate number of Project 600 and Project 750 shares awarded to Messrs. Reid-Anderson and Duffey did not increase in connection with the change in their roles during 2017:

| CEO Target Shares of Stock under Project 600 and Project 750 | |||||||||

Original Target Shares Awarded(1) | 2016 CEO Transition(2) | 2017 CEO Transition(3) | |||||||

| Project 600 | |||||||||

| James Reid-Anderson | 500,000 | 250,000 | 435,000 | ||||||

| John M. Duffey | 120,000 | 370,000 | 185,000 | ||||||

| Project 600 Total | 620,000 | 620,000 | 620,000 | ||||||

| Project 750 | |||||||||

| James Reid-Anderson | — | — | 150,000 | ||||||

| John M. Duffey | 150,000 | 150,000 | — | ||||||

| Project 750 Total | 150,000 | 150,000 | 150,000 | ||||||

_________________________

| (1) | Original grant for Project 600 and Project 750 were announced on October 24, 2014, and October 28, 2016, respectively. |

| (2) | Project 600 shares transferred to Mr. Duffey upon CEO succession on February 18, 2016. |

| (3) | Shares transferred to Mr. Reid-Anderson upon reappointment to CEO and retirement of Mr. Duffey on July 18, 2017. The Project 600 performance goal was not achieved in 2017. If the Project 600 Modified EBITDA goal is achieved in 2018, the maximum number of shares that participants will be entitled to receive is 50% of their target award. |

17

Stockholder-Aligned Company Practices

The following table highlights certain practices that the Company maintains and others that the Company has avoided or prohibited because the Company believes doing so enhances its pay for performance philosophy and further aligns executives' interests with those of the Company's stockholders:

| Practices Maintained by the Company | Practices NOT Maintained by the Company | ||||

| Objective performance metrics align interests of management with interests of stockholders | High percentage of fixed compensation | ||||

| Stock ownership requirements | Hedging ownership of Company stock | ||||

| Limited perquisites | Excessive perquisites | ||||

| Double-trigger change in control severance | Excise tax gross-ups upon change in control | ||||

| Equity awards with four year vesting to promote retention | Dividends on equity paid prior to vesting | ||||

| Alignment of compensation with stockholder interests | Repricing of options without stockholder approval | ||||

| Performance goals that drive long-term stockholder value creation | Guaranteed minimum payouts or uncapped award opportunities | ||||

| Long-Term Incentive Plan contains clawback provision | |||||

| Program administered by an independent committee | |||||

| Compensation Committee retains independent compensation consultant | |||||

| Annual Say on Pay Vote | |||||

Last Year's Say on Pay Vote and Stockholder Outreach