Exhibit 99.1

THIS IS NOT A SOLICITATION OF ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THIS DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT.

IN THE UNITED STATES BANKRUPTCY COURT

DISTRICT OF DELAWARE

| | x | |

| | : | |

In re | | : | Chapter 11 |

| | : | |

Premier International Holdings Inc., et al., | | : | Case No. 09-12019 (CSS) |

| | : | |

Debtors. | | : | (Jointly Administered) |

| | : | |

| | x | |

DISCLOSURE STATEMENT FOR DEBTORS’ JOINT PLAN

OF REORGANIZATION UNDER

CHAPTER 11 OF THE BANKRUPTCY CODE

PAUL, HASTINGS, JANOFSKY & WALKER LLP

191 North Wacker Drive, 30th Floor

Chicago, Illinois 60606

Telephone: (312) 499-6000

Facsimile: (312) 499-6100

Attorneys for Debtors and

Debtors in Possession

RICHARDS, LAYTON & FINGER, P.A.

One Rodney Square

920 North King Street

Wilmington, Delaware 19801

Telephone: (302) 651-7700

Facsimile: (302) 651-7701

Attorneys for Debtors and

Debtors in Possession

Dated: July 22, 2009

TABLE OF CONTENTS

| | Page |

| | |

I. | INTRODUCTION | 4 |

| A. | HOLDERS OF CLAIMS ENTITLED TO VOTE | 5 |

| B. | VOTING PROCEDURES | 7 |

| C. | CONFIRMATION HEARING | 8 |

II. | OVERVIEW OF THE PLAN | 10 |

III. | GENERAL INFORMATION | 16 |

| A. | Overview of Chapter 11 | 16 |

| B. | overview of the DEBTORS AND their PRINCIPAL ASSETS | 17 |

| | 1. | Introduction | 17 |

| | 2. | Corporate Structure | 17 |

| | 3. | Regional Theme Parks | 18 |

| | 4. | Theme Park Operations | 20 |

| | 5. | Marketing and Promotional Activities | 20 |

| | 6. | Park Maintenance and Inspection | 21 |

| | 7. | Capital Expenditures | 22 |

| | 8. | Insurance | 22 |

| | 9. | Competition | 22 |

| | 10. | Seasonality | 23 |

| | 11. | Environmental and Other Regulations | 23 |

| | 12. | Recent Acquisitions | 23 |

| | 13. | International Licensing | 24 |

| | 14. | Six Flags New Orleans and Related Litigation | 24 |

| | 15. | Recent Park Sales and Asset Dispositions | 25 |

| | 16. | Employees and Labor Matters | 25 |

| | 17. | Pending Legal Proceedings and Claims | 25 |

| C. | corporate governance and management | 27 |

| | 1. | Board of Directors | 27 |

| | 2. | Executive Management | 30 |

| | 3. | Executive Compensation | 31 |

| D. | partnership parks and time warner financing | 34 |

| E. | Capital structure and Significant Prepetition Indebtedness | 36 |

| | 1. | Prepetition Credit Agreement | 37 |

| | 2. | Derivative Financial Instruments | 38 |

| | 3. | Unsecured Notes | 38 |

| | 4. | Preferred Income Equity Redeemable Shares | 40 |

| | 5. | Guarantees of Partnership Parks Loan | 40 |

| | 6. | Trade Debt | 40 |

| F. | recent financial information | 40 |

IV. | KEY EVENTS LEADING TO THE COMMENCEMENT OF THE REORGANIZATION CASES | 41 |

| A. | Financial challenges | 41 |

| | 1. | Challenging Market Conditions | 41 |

| | 2. | Exchange Offers | 42 |

i

TABLE OF CONTENTS

(continued)

| | | | Page |

| | | | |

| | 3. | Negotiations with Avenue | 43 |

| B. | The Restructuring agreement | 44 |

V. | THE REORGANIZATION CASES | 46 |

| A. | First Day Orders | 46 |

| | 1. | Case Administration Orders | 46 |

| | 2. | Critical Obligations | 46 |

| | 3. | Business Operations | 46 |

| | 4. | Financial Operations | 46 |

| B. | Creditors’ Committee | 46 |

| C. | rejection of certain agreements | 47 |

| D. | Schedules and Bar Date | 48 |

VI. | THE PLAN OF REORGANIZATION | 48 |

| A. | Introduction | 48 |

| B. | Classification and Treatment of Claims and Equity Interests Under the Plan of Reorganization | 48 |

| | 1. | Unclassified | 50 |

| | 2. | Classified | 52 |

| C. | Means of Implementing the Plan | 59 |

| | 1. | Intercompany Claims | 59 |

| | 2. | Restructuring and Other Transactions | 59 |

| | 3. | Exemption from Securities Laws | 62 |

| | 4. | Registration Rights Agreement and Securities Exchange Listing | 65 |

| | 5. | Continued Corporate Existence | 65 |

| D. | Plan Provisions Governing Distribution | 65 |

| | 1. | The Distribution Date | 65 |

| | 2. | Distributions on Account of Allowed General Unsecured Claims | 66 |

| | 3. | Date of Distributions | 66 |

| | 4. | Disbursing Agent | 66 |

| | 5. | Expenses of the Disbursing Agent | 66 |

| | 6. | Rights and Powers of Disbursing Agent | 66 |

| | 7. | Delivery of Distributions | 67 |

| | 8. | Unclaimed Distributions | 68 |

| | 9. | Distribution Record Date | 68 |

| | 10. | Manner of Payment | 68 |

| | 11. | No Fractional Distributions | 68 |

| | 12. | Limitation on Cash Distributions | 68 |

| | 13. | Setoffs and Recoupment | 69 |

| | 14. | Allocation of Plan Distributions Between Principal and Interest | 69 |

| E. | Procedures for Treating Disputed Claims | 69 |

| | 1. | Objections | 69 |

| | 2. | Adjustment to Certain Claims Without a Filed Objection | 69 |

| | 3. | No Distributions Pending Allowance | 70 |

| | 4. | Distributions After Allowance | 70 |

ii

TABLE OF CONTENTS

(continued)

| | | | Page |

| | | | |

| | 5. | Resolution of Administrative Expense Claims and Claims | 70 |

| | 6. | Estimation of Claims | 70 |

| | 7. | Interest | 70 |

| | 8. | Disallowance of Certain Claims | 71 |

| | 9. | Indenture Trustee as Claim Holder | 71 |

| | 10. | Offer of Judgment | 71 |

| | 11. | Amendments to Claims | 71 |

| | 12. | Claims Paid and Payable by Third Parties | 71 |

| | 13. | Personal Injury Claims | 72 |

| F. | Provisions Governing Executory Contracts and Unexpired Leases | 72 |

| | 1. | Assumption or Rejection of Executory Contracts and Unexpired Leases | 72 |

| | 2. | Approval of Assumption or Rejection of Executory Contracts and Unexpired Leases | 72 |

| | 3. | Inclusiveness | 72 |

| | 4. | Cure of Defaults | 73 |

| | 5. | Bar Date for Filing Proofs of Claim Relating to Executory Contracts and Unexpired Leases Rejected Pursuant to the Plan | 73 |

| | 6. | Indemnification Obligations | 73 |

| | 7. | Insurance Policies | 74 |

| | 8. | Benefit Plans | 74 |

| | 9. | Retiree Benefits | 74 |

| G. | Corporate Governance and Management of the Reorganized Debtors | 74 |

| | 1. | General | 74 |

| | 2. | Postconfirmation Board | 74 |

| | 3. | Filing of Postconfirmation Organizational Documents | 74 |

| | 4. | Officers of the Reorganized Debtors | 75 |

| | 5. | Long-Term Incentive Plan | 75 |

| H. | Conditions Precedent to Effective Date | 75 |

| | 1. | Conditions Precedent to Effectiveness | 75 |

| | 2. | Waiver of Conditions | 76 |

| | 3. | Satisfaction of Conditions | 76 |

| I. | Effect of Confirmation | 76 |

| | 1. | Vesting of Assets | 76 |

| | 2. | Binding Effect | 76 |

| | 3. | Discharge of Claims and Termination of Preconfirmation Equity Interests | 77 |

| | 4. | Discharge of Debtors | 77 |

| | 5. | Exculpation | 77 |

| | 6. | Limited Releases | 78 |

| | 7. | Avoidance Actions/Objections | 78 |

| | 8. | Injunction or Stay | 78 |

| J. | Retention of Jurisdiction | 79 |

iii

TABLE OF CONTENTS

(continued)

| | | | Page |

| | | | |

| K. | Miscellaneous Provisions | 80 |

| | 1. | Effectuating Documents and Further Transactions | 80 |

| | 2. | Withholding and Reporting Requirements | 81 |

| | 3. | Corporate Action | 81 |

| | 4. | Modification of Plan | 81 |

| | 5. | Revocation or Withdrawal of the Plan | 82 |

| | 6. | Plan Supplement | 82 |

| | 7. | Payment of Statutory Fees | 82 |

| | 8. | Dissolution of the Creditors’ Committee | 82 |

| | 9. | Exemption from Transfer Taxes | 82 |

| | 10. | Expedited Tax Determination | 83 |

| | 11. | Exhibits/Schedules | 83 |

| | 12. | Substantial Consummation | 83 |

| | 13. | Severability of Plan Provisions | 83 |

| | 14. | Governing Law | 83 |

| | 15. | Notices | 83 |

VII. | PROJECTIONS AND VALUATION ANALYSIS | 84 |

| A. | Consolidated Condensed Projected Financial Statements | 84 |

| | 1. | Responsibility for and Purpose of the Projections | 84 |

| | 2. | Pro Forma Financial Projections | 84 |

| B. | Valuation | 84 |

| | 1. | Overview | 84 |

VIII. | CERTAIN FACTORS AFFECTING THE DEBTORS | 84 |

| A. | Certain Bankruptcy Law Considerations | 84 |

| | 1. | Risk of Non-Confirmation of the Plan of Reorganization | 84 |

| | 2. | Non-Consensual Confirmation | 85 |

| | 3. | Risk of Delay in Confirmation of the Plan | 85 |

| B. | Additional Factors To Be Considered | 86 |

| | 1. | The Debtors Have No Duty to Update | 86 |

| | 2. | No Representations Outside This Disclosure Statement Are Authorized | 86 |

| | 3. | Projections and Other Forward-Looking Statements Are Not Assured, and Actual Results May Vary | 86 |

| | 4. | The Amount of Claims Could Be More Than Projected | 86 |

| | 5. | Debtors Could Withdraw the Plan | 86 |

| | 6. | No Legal or Tax Advice Is Provided to You by This Disclosure Statement | 86 |

| | 7. | No Admission Made | 87 |

| | 8. | Even if the Plan is confirmed, the Debtors will continue to face risks | 87 |

| | 9. | The Debtors’ business may be negatively affected if they are unable to assume key executory contracts | 87 |

iv

TABLE OF CONTENTS

(continued)

| | | | Page |

| | | | |

| | 10. | Business Factors and Competitive Conditions | 88 |

| | 11. | Variances from Projections | 90 |

| C. | Certain Tax Matters | 90 |

IX. | CONFIRMATION OF THE PLAN OF REORGANIZATION | 90 |

| A. | Confirmation Hearing | 90 |

| B. | Requirements for Confirmation of the Plan of Reorganization | 91 |

| | 1. | Requirements of Section 1129(a) of the Bankruptcy Code | 91 |

| | 2. | Requirements of Section 1129(b) of the Bankruptcy Code | 93 |

X. | ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN OF REORGANIZATION | 94 |

| A. | Liquidation Under Chapter 7 | 94 |

| B. | Alternative Plan of Reorganization | 94 |

XI. | CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN | 95 |

| A. | Consequences to the Debtors | 95 |

| | 1. | Cancellation of Indebtedness Income | 95 |

| | 2. | Section 382 Limitation | 96 |

| | 3. | Alternative Minimum Tax | 97 |

| B. | FEDERAL INCOME TAX CONSEQUENCES TO HOLDERS OF CLAIMS | 97 |

| | 1. | Consequences to Holders of Unsecured Notes Claims Against SFI | 99 |

| | 2. | Consequences to Holders of General Unsecured SFI Claims and General Unsecured SFO Claims | 99 |

| | 3. | Consequences to Holders of 2016 Notes Claims | 100 |

| | 4. | Consequences to Holders of Prepetition Credit Agreement Claims | 100 |

| | 5. | Distributions in Respect of Accrued but Unpaid Interest | 102 |

| | 6. | Market Discount and Premium | 103 |

| | 7. | Consequences to Holders of Preconfirmation SFI Equity Interests | 103 |

| C. | INFORMATION REPORTING AND WITHHOLDING | 104 |

XII. | CONCLUSION | 104 |

EXHIBIT A – Debtors’ Joint Chapter 11 Plan

v

SUMMARY OF PLAN

The following is a summary of the Debtors’ Joint Plan of Reorganization Under Chapter 11 of the Bankruptcy Code, dated as of July 22, 2009 (as the same may be amended or modified, the “Plan”), of Six Flags, Inc. (“SFI”) and certain of its affiliates (collectively, the “Debtors”),(1) the debtors and debtors in possession in these chapter 11 cases. This Disclosure Statement describes the Plan and the distributions contemplated thereunder for each of the Debtors and their creditors. Unless otherwise defined herein, all capitalized terms contained in this Disclosure Statement have the meanings ascribed to them in the Plan. Unless the context requires otherwise, reference to “we,” “our,” and “us” are to SFI and all of its Debtor and non-Debtor subsidiaries (collectively, “Six Flags,” or the “Company”).

The Debtors commenced their chapter 11 cases in order to restructure over $2.6 billion of debt and preferred equity obligations after a series of strategic decisions were made between 1998 and 2005 to acquire theme parks and execute significant capital expenditures for new attractions. The current management team, which was not installed until late 2005 and early 2006, inherited a highly-leveraged balance sheet, a brand that had been tarnished over the course of several years, and a business in need of comprehensive operational restructuring. In an effort to address these issues, the current management team has worked diligently over the past three years to expand and improve the product offerings, diversify and grow revenues, increase operational efficiency and operating cash flows, and reduce the inherited debt obligations through, among other things, the sale of parks, the successful negotiation and execution of the Debtors’ Prepetition Credit Agreement on favorable terms, and the completion of an exchange offer for the 2010 Notes, 2013 Notes, and 2014 Notes, which exchanged an aggregate of approximately $530.6 million in principal amount for $400 million of the 2016 Notes, thereby reducing principal by approximately $130.6 million and providing for extended debt maturity until 2016 for the exchanged instruments.

Despite significant success from these endeavors, the Debtors remain highly leveraged, with substantial annual capital expenditure requirements and interest costs, and significant portions of their extant debt and preferred equity obligations maturing in the near future. This capital structure is not sustainable, particularly with the impact of the current recession in the United States, limited access to capital markets, increasing unemployment, and

(1) The Debtors are the following thirty-seven entities (the last four digits of their respective taxpayer identification numbers, if any, follow in parentheses): Astroworld GP LLC (0431), Astroworld LP (0445), Astroworld LP LLC (0460), Fiesta Texas Inc. (2900), Funtime, Inc. (7495), Funtime Parks, Inc. (0042), Great America LLC (7907), Great Escape Holding Inc. (2284), Great Escape Rides L.P. (9906), Great Escape Theme Park L.P. (3322), Hurricane Harbor GP LLC (0376), Hurricane Harbor LP (0408), Hurricane Harbor LP LLC (0417), KKI, LLC (2287), Magic Mountain LLC (8004), Park Management Corp. (1641), PP Data Services Inc. (8826), Premier International Holdings Inc. (6510), Premier Parks of Colorado Inc. (3464), Premier Parks Holdings Inc. (9961), Premier Waterworld Sacramento Inc. (8406), Riverside Park Enterprises, Inc. (7486), SF HWP Management LLC (5651), SFJ Management Inc. (4280), SFRCC Corp. (1638), Six Flags, Inc. (5059), Six Flags America LP (8165), Six Flags America Property Corporation (5464), Six Flags Great Adventure LLC (8235), Six Flags Great Escape L.P. (8306), Six Flags Operations Inc. (7714), Six Flags Services, Inc. (6089), Six Flags Services of Illinois, Inc. (2550), Six Flags St. Louis LLC (8376), Six Flags Theme Parks Inc. (4873), South Street Holdings LLC (7486), Stuart Amusement Company (2016). The mailing address of each of the Debtors solely for purposes of notices and communications is 1540 Broadway, 15th Floor, New York, NY 10036 (Attn: James Coughlin).

1

reduced disposable income and consumer spending. As a result, in late 2008, the Debtors, with the assistance of their advisors, began to explore capital structure restructuring alternatives, including refinancing options, recapitalizations, and a potential chapter 11 filing.

In April 2009, after discussions with several holders of unsecured notes, the Company instituted exchange offers to convert such notes into shares of SFI’s common stock. The Company determined to institute these exchange offers in order to avoid the potentially adverse impact of a chapter 11 filing on its brand and business, while preserving the significant value of the favorable terms of the Prepetition Credit Agreement. This effort, however, was unsuccessful for two primary reasons: (1) the minimum tender thresholds were not met; and (2) even more importantly, the Company determined that these exchange offers would have ultimately been inadequate to resolve its financial challenges due to significant, and unexpected, declines in financial performance and liquidity for reasons beyond management’s control (e.g., macro economic turbulence, rising levels of national unemployment, a Swine Flu epidemic, and adverse weather conditions), as well as higher-than-expected “put” obligations from the Company’s Partnership Parks (defined herein). Accordingly, even if the minimum tender conditions were satisfied, the Company would have continued to face significant challenges maintaining adequate liquidity and necessary financial covenant compliance under the Prepetition Credit Agreement.

Due to the uncertain prospects of a successful outcome to the exchange offers, and consistent with the Company’s fiduciary duty to evaluate all potential alternatives, beginning in March 2009, the Debtors and Avenue Capital Management (“Avenue”) — the largest holder of 2016 Notes, a significant holder of other unsecured notes, and one of the Company’s lenders under the Prepetition Credit Agreement — engaged in discussions regarding a potential restructuring that would have ultimately been premised upon (i) the holders of 2016 Notes receiving a majority of the equity in a reorganized SFI, and (ii) the reinstatement of the favorable terms of the Prepetition Credit Agreement. As the negotiations continued over approximately two months, it became clear to the Debtors that the proposals made by Avenue were inadequate to provide a viable financial restructuring for the Debtors’ businesses — especially when coupled with an ongoing decline in the Debtors’ financial performance — because, among other things, the proposed transaction failed to provide sufficient liquidity for future business needs, and failed to address the Debtors future ability to maintain continuing financial covenant compliance under the Prepetition Credit Agreement.

As the Debtors’ financial condition continued to decline during late spring, and in an effort to evaluate all potential alternatives, provide a market check and potential pricing competition to the Avenue proposals and ultimately maximize value for all stakeholders, with Avenue’s knowledge the Debtors initiated discussions with certain of the Prepetition Lenders to the Prepetition Credit Agreement (collectively, the “Participating Lenders”) on May 29, 2009, regarding the terms of a comprehensive balance sheet restructuring that would involve the conversion of approximately $1.8 billion of debt into equity. These discussions led to negotiations that ultimately resulted in a reorganization agreement that is unanimously supported by JP Morgan Chase Bank, N.A., as administrative agent under the Prepetition Credit Agreement (the “Prepetition Agent”), and the Participating Lenders, which together at that time represented approximately fifty percent of the outstanding Prepetition Credit Agreement obligations. With the assistance of their financial advisors and legal counsel, the Debtors determined that a pre-

2

negotiated chapter 11 restructuring based upon the reorganization agreement with the Participating Lenders represents the most effective and efficient way to de-lever their balance sheet to an appropriate level, enabling the Company to achieve profitability on a sustainable basis. These restructuring efforts will allow the Debtors to focus their resources on the operation of their parks and to continue management’s recent operational successes with appropriate liquidity and a sustainable capital structure.

Faced with the prospect of impending debt maturities and the expiration of 30-day grace periods for interest payments under certain series of unsecured notes, the Debtors commenced the Reorganization Cases on June 13, 2009. The Plan, which is attached as Exhibit A, reflects the reorganization agreement reached with the Participating Lenders. The Plan provides for the reorganization of the Debtors as going concerns (the “Reorganized Debtors”). An integral component of the agreement with the Participating Lenders is the conversion of a portion of the Debtors’ obligations under the Prepetition Credit Agreement into equity in Reorganized SFI.

Under the Plan, the holders of Prepetition Credit Agreement Claims against Six Flags Theme Parks Inc. (“SFTP”) and certain of its wholly-owned domestic subsidiaries will convert these Claims into (i) approximately 92% of the New Common Stock to be issued by Reorganized SFI (subject to dilution by the Long-Term Incentive Plan), and (ii) a new term loan in the aggregate amount of $600 million (the “New Term Loan”). Prepetition Credit Agreement Claims against Six Flags Operations, Inc. (“SFO”) will be discharged and exchanged for a new guaranty of the obligations under the New Term Loan by Reorganized SFO. All other secured Claims against the Debtors that are Allowed, if any, will either be paid in full or reinstated, in the Debtors’ discretion. Allowed Unsecured Claims against all of the Debtors other than SFI and SFO will be paid in full or be reinstated (but solely to the extent such Claims are Allowed). Claims against SFTP, SFO, and SFI, respectively, based on a guaranty of the obligations of the Acquisition Parties (defined below) to Time Warner, Inc. and certain affiliates of Time Warner, Inc. under a certain promissory note and a certain Subordinated Indemnity Agreement will be discharged and exchanged for new guarantees of such obligations (as may be amended in connection with the emergence from Chapter 11). The holders of Allowed Unsecured Claims against SFO (which includes Claims arising under the 2016 Notes Indenture) will convert their Claims against SFO into approximately 7% of the New Common Stock to be issued by Reorganized SFI (subject to dilution by the Long-Term Incentive Plan). The holders of Allowed Unsecured Claims against SFI (which includes Claims arising under the 2010 Notes Indenture, the 2013 Notes Indenture, the 2014 Notes Indenture, and the 2015 Notes Indenture, SFI’s guaranty of the 2016 Notes Indenture) will convert their claims against SFI into approximately 1% of the New Common Stock to be issued by Reorganized SFI (subject to dilution by the Long-Term Incentive Plan). All existing equity interests in SFI will be canceled under the Plan. All existing Equity Interests in SFI’s direct subsidiary SFO will be cancelled, and 100% of the newly-issued common stock of SFO will be issued to SFI on the Effective Date in consideration for SFI’s distribution of the New Common Stock in Reorganized SFI to certain holders of Allowed Claims, as described above. The existing Equity Interests in all Debtors other than SFI and SFO (“Preconfirmation Subsidiary Equity Interests”) will remain unaltered by the Plan. The proposed treatment of Claims and Equity Interests under the Plan are discussed further in Section VI.B. of this Disclosure Statement.

3

Based upon the Debtors’ estimate of the Allowed Claims in these Reorganization Cases, the Plan provides for a recovery of approximately % to holders of SFTP Prepetition Credit Agreement Claims, a 100% recovery for the holders of all Other Secured Claims, a 100% recovery for the holders of Unsecured Claims against all Debtors other than SFO and SFI, % to holders of Unsecured SFO Claims, % to holders of Unsecured SFI Claims, and no recovery for holders of Preconfirmation Equity Interests in SFI. These projections are based on assumptions described herein and are not guaranteed. The Plan is supported by the Debtors and the Participating Lenders.

THE DEBTORS BELIEVE THAT THE PLAN WILL ENABLE THEM TO REORGANIZE SUCCESSFULLY AND ACCOMPLISH THE OBJECTIVES OF CHAPTER 11 AND THAT ACCEPTANCE OF THE PLAN IS IN THE BEST INTERESTS OF THE DEBTORS AND THEIR CREDITORS. THE DEBTORS URGE ALL CREDITORS ENTITLED TO VOTE ON THE PLAN TO ACCEPT THE PLAN.

I. INTRODUCTION

The Debtors submit this Disclosure Statement pursuant to section 1125 of title 11 of the United States Code (the “Bankruptcy Code”) to holders of equity interests (“Preconfirmation Equity Interests”) in and Claims against the Debtors in connection with (i) the solicitation of acceptances of the Plan filed by the Debtors with the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) and (ii) the hearing to consider confirmation of the Plan (the “Confirmation Hearing”) scheduled for , 2009 at : .m. (prevailing Eastern Time).

Annexed as Exhibits to this Disclosure Statement are copies of the following documents:

· The Plan (Exhibit A);

· Order of the Bankruptcy Court, dated [ ], 2009 (the “Disclosure Statement Order”), approving, among other things, this Disclosure Statement and establishing certain procedures with respect to the solicitation and tabulation of votes to accept or reject the Plan (attached hereto without exhibits) (Exhibit B);

· The Debtors’ most recent financial statements for the year ended December 31, 2008, as well as the Debtors’ Projected Financial Information (Exhibit C); and

· The Debtors’ Liquidation Analysis (Exhibit D).

A Ballot for the acceptance or rejection of the Plan is enclosed with the Disclosure Statement mailed to the holders of Claims that the Debtors believe may be entitled to vote to accept or reject the Plan.

On [ ], 2009, after notice and a hearing, the Bankruptcy Court signed the Disclosure Statement Order, approving this Disclosure Statement as containing adequate

4

information of a kind and in sufficient detail to enable a hypothetical investor of the relevant classes to make an informed judgment whether to accept or reject the Plan. APPROVAL OF THIS DISCLOSURE STATEMENT DOES NOT, HOWEVER, CONSTITUTE A DETERMINATION BY THE BANKRUPTCY COURT AS TO THE FAIRNESS OR MERITS OF THE PLAN.

The Disclosure Statement Order, a copy of which is annexed hereto as Exhibit B, sets forth in detail, among other things, the deadlines, procedures and instructions for voting to accept or reject the Plan and for filing objections to confirmation of the Plan, the record date for voting purposes and the applicable standards for tabulating Ballots. In addition, detailed voting instructions accompany each Ballot. Each holder of a Claim entitled to vote on the Plan should read the Disclosure Statement, the Plan, the Disclosure Statement Order and the instructions accompanying the Ballots in their entirety before voting on the Plan. These documents contain important information concerning the classification of Claims and Preconfirmation Equity Interests for voting purposes and the tabulation of votes. No solicitation of votes to accept the Plan may be made except pursuant to section 1125 of the Bankruptcy Code.

A. HOLDERS OF CLAIMS ENTITLED TO VOTE

Pursuant to the provisions of the Bankruptcy Code, only holders of allowed claims or equity interests in classes of claims or equity interests that are impaired and that are not deemed to have rejected the proposed plan are entitled to vote to accept or reject a proposed plan. Classes of claims or equity interests in which the holders of claims or equity interests are unimpaired under a chapter 11 plan are deemed to have accepted the plan and are not entitled to vote to accept or reject the plan. For a detailed description of the treatment of Claims and Preconfirmation Equity Interests under the Plan, see Section VI.B. of this Disclosure Statement.

Claims in Class 4 (SFTP Prepetition Credit Agreement Claims), Class 5 (SFTP TW Guaranty Claims), Class 6 (SFTP TW Indemnity Claims), Class 8 (SFO Prepetition Credit Agreement Claims), Class 9 (SFO TW Guaranty Claims), Class 10 (SFO TW Indemnity Claims), Class 11 (SFO Unsecured Claims), Class 12 (SFI TW Guaranty Claims), Class 13 (SFI TW Indemnity Claims), and Class 14 (SFI Unsecured Claims) of the Plan are impaired and, to the extent Claims in such Classes are Allowed, the holders of such Claims will receive distributions under the Plan. As a result, holders of Claims in those Classes are entitled to vote to accept or reject the Plan.

Claims in Class 1 (Other Priority Claims), Class 2 (Secured Tax Claims), Class 3 (Other Secured Claims), and Class 7 (Subsidiary Unsecured Claims) of the Plan are unimpaired. As a result, holders of Claims in those Classes are conclusively presumed to have accepted the Plan.

The Bankruptcy Code defines “acceptance” of a plan by a class of claims as acceptance by creditors in that class that hold at least two-thirds in dollar amount and more than one-half in number of the claims that cast ballots for acceptance or rejection of the plan. For a more detailed description of the requirements for confirmation of the Plan, see Section IX of this Disclosure Statement.

5

If a Class of Claims entitled to vote on the Plan rejects the Plan, the Debtors reserve the right to amend the Plan or request confirmation of the Plan pursuant to section 1129(b) of the Bankruptcy Code or both. Section 1129(b) of the Bankruptcy Code permits the confirmation of a plan of reorganization notwithstanding the rejection of a plan by one or more impaired classes of claims or equity interests. Under that section, a plan may be confirmed by a bankruptcy court if it does not “discriminate unfairly” and is “fair and equitable” with respect to each rejecting class. For a more detailed description of the requirements for confirmation of a nonconsensual plan, see Section IX.B.2 of this Disclosure Statement.

Holders of Subordinated Securities Claims (Class 15), if any, Preconfirmation SFO Equity Interests (Class 17) and Preconfirmation SFI Equity Interests (Class 18) will not receive any distribution under the Plan and are therefore deemed to have rejected the Plan. With respect to the Classes of Claims and equity interests that are deemed to have rejected the Plan, i.e., Class 15 and Class 17, the Debtors intend to request confirmation of the Plan pursuant to section 1129(b) of the Bankruptcy Code.

THE DEBTORS AND THE PARTICIPATING LENDERS RECOMMEND THAT HOLDERS OF CLAIMS IN CLASSES 4, 5, 6, 8, 9, 10, 11, 12, 13 AND 14 VOTE TO ACCEPT THE PLAN.

6

The Debtors’ legal advisors are Paul, Hastings, Janofsky & Walker LLP and Richards, Layton & Finger, P.A. Their financial advisor is Houlihan, Lokey, Howard & Zukin Inc. (“Houlihan Lokey”). They can be contacted at:

HOULIHAN, LOKEY, HOWARD & ZUKIN CAPITAL, INC. 245 Park Avenue New York, NY 10167-0001 Phone (212) 497-4100 Facsimile (212) 687-0529 Attn: David Preiser David Hilty John-Paul Hanson Financial Advisor and Investment Banker for the Debtors and Debtors in Possession | | PAUL, HASTINGS, JANOFSKY & WALKER LLP 191 North Wacker Drive, 30th Floor Chicago, Illinois 60606 Telephone: (312) 499-6000 Facsimile: (312) 499-6100 Attn: Paul E. Harner Steven T. Catlett Counsel for the Debtors and Debtors in Possession RICHARDS, LAYTON & FINGER, P.A. One Rodney Square 920 North King Street Wilmington, Delaware 19801 Telephone: (302) 651-7700 Facsimile: (302) 651-7701 Attn:Daniel J. DeFranceschi Delaware counsel for the Debtors and Debtors in Possession |

B. VOTING PROCEDURES

If you are entitled to vote to accept or reject the Plan, a Ballot is enclosed for the purpose of voting on the Plan. If you hold Claims in more than one Class and you are entitled to vote Claims in more than one Class, you will receive separate Ballots, which must be used for each separate Class of Claims. The Debtors, with the approval of the Bankruptcy Court, have engaged Kurtzman Carson Consultants LLC to serve as the voting agent with respect to Claims in Classes that are entitled to vote on the Plan. The voting agent will assist in the solicitation process by, among other things, answering questions, providing additional copies of all solicitation materials, and generally overseeing the solicitation process for Claims. The voting agent will also process and tabulate ballots for each of the respective Classes that are entitled to vote to accept or reject the Plan and will file a voting report as soon as practicable before the Confirmation Hearing.

Ballots and master ballots (“Master Ballots”) should be returned to:

Six Flags Ballot Processing

c/o Kurtzman Carson Consultants LLC

2335 Alaska Avenue

El Segundo, CA 90245

7

If the return envelope provided with your Ballot was addressed to your bank or brokerage firm, please allow sufficient time for that firm to process your vote on Master Ballot before the Voting Deadline (4 p.m. prevailing Eastern Time, , 2009).

Do not return your notes, securities, or any other documents with your Ballot.

MORE DETAILED INSTRUCTIONS REGARDING HOW TO VOTE ON THE PLAN ARE CONTAINED ON THE BALLOTS DISTRIBUTED TO HOLDERS OF CLAIMS THAT ARE ENTITLED TO VOTE ON THE PLAN. TO BE COUNTED, YOUR BALLOT INDICATING ACCEPTANCE OR REJECTION OF THE PLAN MUST BE RECEIVED BY NO LATER THAN 4:00 P.M. (PREVAILING EASTERN TIME) ON , 2009. ANY EXECUTED BALLOT RECEIVED THAT DOES NOT INDICATE EITHER AN ACCEPTANCE OR A REJECTION OF THE PLAN SHALL NOT BE COUNTED.

Any Claim in an impaired Class as to which an objection or request for estimation is pending or which is listed on the Schedules as unliquidated, disputed or contingent is not entitled to vote unless the holder of such Claim has obtained an order of the Bankruptcy Court temporarily allowing such Claim for the purpose of voting on the Plan.

Pursuant to the Disclosure Statement Order, the Bankruptcy Court set , 2009 as the record date for holders of Claims entitled to vote on the Plan. Accordingly, only holders of record as of the applicable record date that otherwise are entitled to vote under the Plan will receive a Ballot and may vote on the Plan.

If you are a holder of a Claim entitled to vote on the Plan and you did not receive a Ballot, received a damaged Ballot or lost your Ballot or if you have any questions concerning the Disclosure Statement, the Plan or the procedures for voting on the Plan, please call Kurtzman Carson Consultants LLC at ( ) - .

C. CONFIRMATION HEARING

Pursuant to section 1128 of the Bankruptcy Code, the Confirmation Hearing will be held on , 2009 at :00 [ ].m. (prevailing Eastern Time) before the Honorable Christopher S. Sontchi, Room #6, at the United States Bankruptcy Court for the District of Delaware, 824 Market Street, Wilmington, Delaware 19801. The Bankruptcy Court has directed that objections, if any, to confirmation of the Plan must be served and filed so that they are received on or before [ ], 2009 at 4:00 p.m. (prevailing Eastern Time) in the manner described below in Section IX.A of this Disclosure Statement. The Confirmation Hearing may be adjourned from time to time without further notice except for the announcement of the adjournment date made at the Confirmation Hearing or at any subsequent adjourned Confirmation Hearing.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS ANOTHER TIME IS SPECIFIED HEREIN, AND THE DELIVERY OF THIS DISCLOSURE STATEMENT SHALL NOT CREATE AN IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE INFORMATION STATED SINCE THE DATE HEREOF. HOLDERS OF CLAIMS SHOULD

8

CAREFULLY READ THIS DISCLOSURE STATEMENT IN ITS ENTIRETY, INCLUDING THE PLAN, PRIOR TO VOTING ON THE PLAN.

FOR THE CONVENIENCE OF HOLDERS OF CLAIMS AND PRECONFIRMATION EQUITY INTERESTS, THIS DISCLOSURE STATEMENT SUMMARIZES THE TERMS OF THE PLAN. IF ANY INCONSISTENCY EXISTS BETWEEN THE PLAN AND THE DISCLOSURE STATEMENT, THE TERMS OF THE PLAN ARE CONTROLLING. THE DISCLOSURE STATEMENT MAY NOT BE RELIED ON FOR ANY PURPOSE OTHER THAN TO DETERMINE WHETHER TO VOTE TO ACCEPT OR REJECT THE PLAN, AND NOTHING STATED HEREIN SHALL CONSTITUTE AN ADMISSION OF ANY FACT OR LIABILITY BY ANY PARTY, OR BE ADMISSIBLE IN ANY PROCEEDING INVOLVING THE DEBTORS OR ANY OTHER PARTY, OR BE DEEMED CONCLUSIVE EVIDENCE OF THE TAX OR OTHER LEGAL EFFECTS OF THE PLAN ON THE DEBTORS OR HOLDERS OF CLAIMS OR EQUITY INTERESTS. CERTAIN OF THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, BY NATURE, ARE FORWARD-LOOKING AND CONTAIN ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. ADDITIONAL FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE FORWARD-LOOKING STATEMENTS MADE IN THIS DISCLOSURE STATEMENT ARE SET FORTH IN THE REPORTS OR DOCUMENTS THAT WE FILE FROM TIME TO TIME WITH THE SEC, INCLUDING OUR MOST RECENT ANNUAL REPORT ON FORM 10-K FILED WITH THE SEC ON MARCH 11, 2009 (FILE NO. 0000701374), INCLUDING THE AMENDMENT THERETO FILED WITH THE SEC ON APRIL 30, 2009, ATTACHED AS EXHIBIT C AND EACH OF WHICH IS HEREBY INCORPORATED BY REFERENCE HEREIN.

ALL HOLDERS OF CLAIMS SHOULD CAREFULLY READ AND CONSIDER FULLY THE RISK FACTORS SET FORTH IN SECTION VIII OF THIS DISCLOSURE STATEMENT BEFORE VOTING TO ACCEPT OR REJECT THE PLAN.

SUMMARIES OF CERTAIN PROVISIONS OF AGREEMENTS REFERRED TO IN THIS DISCLOSURE STATEMENT DO NOT PURPORT TO BE COMPLETE AND ARE SUBJECT TO, AND ARE QUALIFIED IN THEIR ENTIRETY BY, REFERENCE TO THE FULL TEXT OF THE APPLICABLE AGREEMENT, INCLUDING THE DEFINITIONS OF TERMS CONTAINED IN SUCH AGREEMENT.

THE DEBTORS BELIEVE THAT THE PLAN WILL ENABLE THEM TO REORGANIZE SUCCESSFULLY AND ACCOMPLISH THE OBJECTIVES OF CHAPTER 11 AND THAT ACCEPTANCE OF THE PLAN IS IN THE BEST INTERESTS OF THE DEBTORS AND THEIR CREDITORS.

IRS CIRCULAR 230 NOTICE: TO ENSURE COMPLIANCE WITH IRS CIRCULAR 230, HOLDERS OF CLAIMS AND PRECONFIRMATION EQUITY INTERESTS ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF FEDERAL TAX ISSUES CONTAINED OR REFERRED TO IN THIS DISCLOSURE STATEMENT IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY HOLDERS OF CLAIMS OR PRECONFIRMATION EQUITY INTERESTS FOR THE PURPOSE OF

9

AVOIDING PENALTIES THAT MAY BE IMPOSED ON THEM UNDER THE INTERNAL REVENUE CODE; (B) SUCH DISCUSSION IS WRITTEN IN CONNECTION WITH THE PROMOTION OR MARKETING BY THE DEBTORS OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN; AND (C) HOLDERS OF CLAIMS AND PRECONFIRMATION EQUITY INTERESTS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

II. OVERVIEW OF THE PLAN

The following table briefly summarizes the classification and treatment of Administrative Expense Claims, Claims and Preconfirmation Equity Interests under the Plan:

Class | | Type of Claim or

Equity Interest | | Treatment | | Approximate

Allowed

Amount(2) | | Approximate

Percentage

Recovery |

| | | | | | | | |

— | | Administrative Expense Claims | | Paid in full, in Cash, on the later of the Effective Date or when such Claim becomes Allowed, or as soon thereafter as is practicable; Claims incurred in the ordinary course of business will be paid in full or performed, as applicable, in the ordinary course of business. | | $ , plus any amounts incurred and payable in the ordinary course of business | | 100% |

(2) The amounts set forth herein are the Debtors’ estimates based on the Debtors’ books and records. The Bar Date (as defined below) has not yet occurred. Actual amounts will depend upon the amounts of Claims timely filed before the Bar Date, final reconciliation and resolution of all Administrative Expense Claims and Claims, and the negotiation of cure amounts. Accordingly, the actual amounts may vary significantly from the amounts set forth herein.

10

Class | | Type of Claim or

Equity Interest | | Treatment | | Approximate

Allowed

Amount(2) | | Approximate

Percentage

Recovery |

| | | | | | | | |

— | | Professional Compensation and Reimbursement Claims | | Paid in full, in Cash, in accordance with the order of the Bankruptcy Court allowing any such Claim. | | Undetermined | | 100% |

| | | | | | | | |

— | | Priority Tax Claims | | Either (i) paid in full, in Cash, on the Effective Date or as soon thereafter as is practicable, or (ii) commencing on the Effective Date or as soon thereafter as is practicable, paid in full, in Cash, over a period not exceeding five years from and after the Petition Date, in equal semi-annual Cash payments with interest for the period after the Effective Date at the rate determined under applicable non-bankruptcy law. | | Undetermined(3) | | 100% |

(3) The Debtors have not yet made a determination as to the correct classification of outstanding tax claims, and as such, the entirety of the estimate is currently included in Class 2 (Secured Tax Claims). Classification of tax claims as secured or priority shall not be deemed to be a waiver of the Debtors’ rights or defenses with respect to such Claims.

11

Class | | Type of Claim or

Equity Interest | | Treatment | | Approximate

Allowed

Amount(2) | | Approximate

Percentage

Recovery |

| | | | | | | | |

1 | | Other Priority Claims | | Unimpaired. Paid in full, in Cash, on the later of the Effective Date and the date such Claim becomes an Allowed Other Priority Claim or as soon thereafter as is practicable. | | $ | | 100% |

| | | | | | | | |

2 | | Secured Tax Claims | | Unimpaired. Either (i) paid in full, in Cash, on the Effective Date or as soon thereafter as is practicable or (ii) commencing on the Effective Date or as soon thereafter as is practicable, paid in full, in Cash, over a period not exceeding five years from and after the Petition Date, in equal semi-annual Cash payments with interest at the rate determined under applicable non-bankruptcy law. | | $ (4) | | 100% |

| | | | | | | | |

3 | | Other Secured Claims | | Unimpaired. Either (i) reinstated, (ii) paid in full, including any required interest, in Cash, on the later of the Effective Date and the date such Claim becomes an Allowed Other Secured Claim, or as soon thereafter as is practicable, or (iii) receive the Collateral securing such Other Allowed Secured Claim and any required interest. | | $0 | | 100% |

(4) The Debtors have not yet made a determination as to the correct classification of outstanding tax claims, and as such, the entirety of the estimate is currently included in Class 2 (Secured Tax Claims). Classification of tax claims as secured or priority shall not be deemed to be a waiver of the Debtors’ rights or defenses with respect to such Claims. In addition, this amount is subject to change based on the outcome of any pending audits of the Debtors.

12

Class | | Type of Claim or

Equity Interest | | Treatment | | Approximate

Allowed

Amount(2) | | Approximate

Percentage

Recovery |

| | | | | | | | |

4 | | SFTP Prepetition Credit Agreement Claims | | Impaired. On each periodic Distribution Date, each holder of an Allowed Prepetition Credit Agreement Claim shall receive its Ratable Proportion of the New Term Loan and ninety-two percent (92%) of newly issued New Common Stock in Reorganized SFI, subject to dilution by the Long-Term Incentive Plan, in full and complete satisfaction of such SFTP Prepetition Credit Agreement Claim. | | $1.1264 billion, plus accrued and unpaid interest | | 100% |

| | | | | | | | |

5 | | SFTP TW Guaranty Claims | | Impaired. On the Effective Date, SFTP’s guaranty of the obligations under the TW Loan shall be discharged and TW shall receive a new guaranty of the obligations under the TW Loan by Reorganized SFTP. | | Undetermined | | N/A |

| | | | | | | | |

6 | | SFTP TW Indemnity Claims | | Impaired. On the Effective Date, the SFTP’s guaranty of the obligations under the Subordinated Indemnity Agreement shall be discharged and exchanged for a new guaranty of the obligations under the Subordinated Indemnity Agreement by Reorganized SFTP. | | Undetermined | | N/A |

| | | | | | | | |

7 | | Subsidiary Unsecured Claims | | Unimpaired. Each Allowed Subsidiary Unsecured Claim shall be either (i) Reinstated, or (ii) paid in full, in Cash, on the Effective Date or as soon as practicable. | | $ million(5) | | 100% |

(5) The numbers listed here are estimates. The Bar Date for filing proofs of claim has not yet occurred, and the Debtors have not completed their analysis of all claims.

13

Class | | Type of Claim or

Equity Interest | | Treatment | | Approximate

Allowed

Amount(2) | | Approximate

Percentage

Recovery |

| | | | | | | | |

8 | | SFO Prepetition Credit Agreement Claims | | Impaired. On the Effective Date, SFO’s guaranty of the obligations under the Prepetition Credit Agreement shall be discharged and exchanged for a new guaranty of the obligations under the New Term Loan by Reorganized SFO. | | Contingent and unliquidated | | N/A |

| | | | | | | | |

9 | | SFO TW Guaranty Claims | | Impaired. On the Effective Date, SFO’s guaranty of the obligations under the TW Loan shall be discharged and TW shall receive a new guaranty of the obligations under the TW Loan by Reorganized SFO. | | Undetermined | | N/A |

| | | | | | | | |

10 | | SFO TW Indemnity Claims | | Impaired. On the Effective Date, SFO’s guaranty of the obligations under the Subordinated Indemnity Agreement shall be discharged and exchanged for a new guaranty of the obligations under the Subordinated Indemnity Agreement by Reorganized SFO. | | Undetermined | | N/A |

| | | | | | | | |

11 | | SFO Unsecured Claims | | Impaired. On each periodic Distribution Date, Allowed SFO Unsecured Claims receive a Distribution Pro Rata Share of 7% of newly issued New Common Stock in Reorganized SFI, subject to dilution by the Long-Term Incentive Plan. | | $ million(6) | | %(7) |

(6) The estimated amount set forth above excludes (a) any claims arising under executory contracts and unexpired leases that may be assumed or rejected under the Plan, and (b) future claims that may arise or be filed as the Debtors continue with their reorganization. The numbers listed here are estimates. The bar date for filing proofs of claim has not yet occurred, and the Debtors have not completed their analysis of all claims.

14

Class | | Type of Claim or

Equity Interest | | Treatment | | Approximate

Allowed

Amount(2) | | Approximate

Percentage

Recovery |

| | | | | | | | |

12 | | SFI TW Guaranty Claims | | Impaired. On the Effective Date, SFI’s guaranty of the obligations under the TW Loan shall be discharged and TW shall receive a new guaranty of the obligations under the TW Loan by Reorganized SFI. | | Undetermined | | N/A |

| | | | | | | | |

13 | | SFI TW Indemnity Claims | | Impaired. On the Effective Date, SFI’s guaranty of the obligations under the Subordinated Indemnity Agreement shall be discharged and exchanged for a new guaranty of the obligations under the Subordinated Indemnity Agreement by Reorganized SFI. | | Undetermined | | N/A |

| | | | | | | | |

14 | | SFI Unsecured Claims | | Impaired. On each periodic Distribution Date, Allowed SFI Unsecured Claims receive a Distribution Pro Rata Share of 1% of newly issued New Common Stock in Reorganized SFI, subject to dilution by the Long-Term Incentive Plan. | | $ million(8) | | %(9) |

| | | | | | | | |

15 | | Subordinated Securities Claims | | Impaired. No distribution. | | $0 | | 0% |

| | | | | | | | |

16 | | Preconfirmation Subsidiary Equity Interests | | Unimpaired. Unaltered by the terms of the Plan. | | N/A | | N/A |

(7) Based on the estimated Common Equity Value range set forth in Section VII.B of this Disclosure Statement. The ultimate magnitude of the Claims arising from the 2016 Notes Indenture may be substantial and may have a significant dilutive effect on the estimated recovery to other holders of SFO Unsecured Claims.

(8) The estimated amount set forth above excludes (a) any claims arising under executory contracts and unexpired leases that may be assumed or rejected under the Plan, and (b) future claims that may arise or be filed as the Debtors continue with their reorganization. The magnitude of claims arising under executory contracts or unexpired leases for rejection damages may be substantial and may have a significant dilutive effect on the estimated recovery to holders of SFI Unsecured Claims. The numbers listed here are estimates. The Bar Date for filing proofs of claim has not yet occurred, and the Debtors have not completed their analysis of all claims.

(9) Based on the estimated Common Equity Value range set forth in Section VII.B of this Disclosure Statement. The ultimate magnitude of SFI Unsecured Claims may be substantial and may have a significant dilutive effect on the estimated recovery to each holder of SFI Unsecured Claims.

15

Class | | Type of Claim or

Equity Interest | | Treatment | | Approximate

Allowed

Amount(2) | | Approximate

Percentage

Recovery |

| | | | | | | | |

17 | | Preconfirmation SFO Equity Interests | | Impaired. No distribution. | | N/A | | 0% |

| | | | | | | | |

18 | | Preconfirmation SFI Equity Interests | | Impaired. No distribution. | | N/A | | 0% |

For detailed historical and projected financial information and valuation estimates, see Section VII below, entitled “PROJECTIONS AND VALUATION ANALYSIS,” as well as Exhibit C to this Disclosure Statement.

III. GENERAL INFORMATION

A. OVERVIEW OF CHAPTER 11

Chapter 11 is the principal business reorganization chapter of the Bankruptcy Code. Under chapter 11 of the Bankruptcy Code, a debtor is authorized to reorganize its business for the benefit of itself, its creditors and its equity interest holders. In addition to permitting the rehabilitation of a debtor, another goal of chapter 11 is to promote equality of treatment for similarly situated creditors and similarly situated equity interest holders with respect to the distribution of a debtor’s assets. The commencement of a chapter 11 case creates an estate that is comprised of all of the legal and equitable interests of the debtor as of the Petition Date. The Bankruptcy Code provides that the debtor may continue to operate its business and remain in possession of its property as a “debtor in possession.”

The consummation of a plan of reorganization is the principal objective of a chapter 11 reorganization case. A plan of reorganization sets forth the means for satisfying claims against and interests in a debtor. Confirmation of a plan of reorganization by the bankruptcy court binds the debtor, any issuer of securities under the plan, any person acquiring property under the plan and any creditor or equity interest holder of a debtor. Subject to certain limited exceptions, the order approving confirmation of a plan discharges a debtor from any debt that arose prior to the date of confirmation of the plan and substitutes therefor the obligations specified under the confirmed plan.

Certain holders of claims against and interests in a debtor are permitted to vote to accept or reject the plan. Prior to soliciting acceptances of the proposed plan, however, section 1125 of the Bankruptcy Code requires a debtor to prepare, and obtain bankruptcy court approval of, a disclosure statement containing adequate information of a kind, and in sufficient detail, to enable a hypothetical investor of the relevant classes to make an informed judgment regarding the plan. The Debtors are submitting this Disclosure Statement to holders of Claims against and Preconfirmation Equity Interests in the Debtors to satisfy the requirements of section 1125 of the Bankruptcy Code.

16

B. OVERVIEW OF THE DEBTORS AND THEIR PRINCIPAL ASSETS

1. Introduction

From the creation of the Six Flags brand in 1961 with one theme park in Arlington, Texas, to its expansion over the past 48 years both throughout the United States and internationally, Six Flags has established its position as a leader in the amusement and theme park industries. Today, Six Flags is the largest regional theme-park operator in the world. The 20 parks(10) the Company operates had attendance of approximately 25.3 million during the 2008 season in geographically diverse markets across North America. Its theme parks offer a complete family-oriented entertainment experience. Its theme parks generally offer a broad selection of state of the art and traditional thrill rides, water attractions, themed areas, concerts and shows, restaurants, game venues and retail outlets. In the aggregate, during 2008 the Company’s theme parks (excluding Six Flags New Orleans) offered more than 800 rides, including over 120 roller coasters, making it the leading provider of “thrill rides” in the industry.

Six Flags believes that its parks benefit from limited direct competition, since the combination of a limited supply of real estate appropriate for theme park development, high initial capital investment, long development lead-time and zoning restrictions provides each of its parks with a significant degree of protection from competitive new theme park openings. Based on the Company’s knowledge of the development of other theme parks in the United States, it would cost approximately $300 million and take a minimum of two years to construct a new regional theme park comparable to one of the major Six Flags-branded theme parks.

The Company has worldwide ownership of the “Six Flags” brand name. Partnership Parks own the rights to the names “Six Flags Over Texas” and “Six Flags Over Georgia,” respectively. The Company also holds exclusive long-term licenses from certain affiliates of Time Warner Inc. for theme park usage throughout the United States (except the Las Vegas metropolitan area), Canada, Mexico and other countries of certain Warner Bros. and DC Comics characters. These characters include Bugs Bunny, Daffy Duck, Tweety Bird, Yosemite Sam, Batman, Superman and others. In addition, the Company has certain rights to use the Hanna-Barbera and Cartoon Network characters, including Yogi Bear, Scooby-Doo, The Flintstones and others, as well as rights related to The Wiggles and Thomas the Tank Engine and Friends. The Company uses these characters to market its parks and to provide an enhanced family entertainment experience, including character meet and greets, meals, photograph and autograph opportunities and new retail options. The Company’s licenses include the right to sell merchandise featuring the characters at the parks, and to use the characters in advertising, as walk-around characters and themes for rides, attractions and retail outlets. The Company believes using these characters promotes increased attendance, supports higher ticket prices, increases lengths of stay and enhances in-park spending.

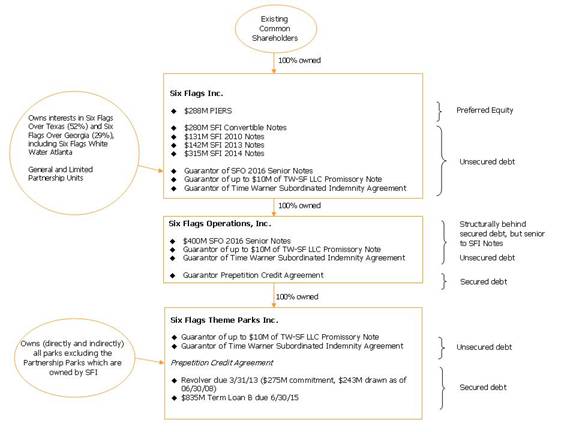

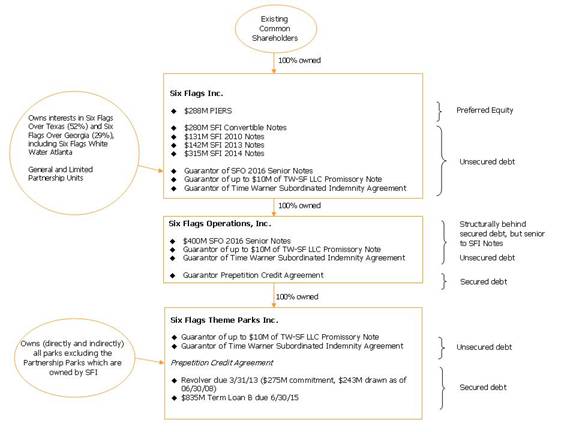

2. Corporate Structure

From its headquarters in New York City, Six Flags operates parks throughout North America, and has entered into development agreements to extend its brand beyond North America. SFI, a publicly-traded corporation, is the ultimate parent of each of the other Six Flags entities, including all of the Debtors. SFI directly owns three subsidiaries: Six Flags Operations Inc. (“SFO”), a Debtor, SF HWP Management LLC, a Debtor, and GP Holdings, Inc., a non-Debtor. Six Flags conducts the majority of its business through SFO which, in turn, owns all of

(10) This figure excludes the New Orleans park, which has been closed since Hurricane Katrina in 2005.

17

the capital stock of SFTP. SFTP owns, directly or through its subsidiaries, all of Six Flags’ parks other than the Partnership Parks (as defined below).

GP Holdings, Inc., through its subsidiaries, is the general partner of the partnerships that own portions of both Six Flags Over Georgia (including Six Flags White Water Atlanta) and Six Flags Over Texas (collectively, the “Partnership Parks”). GP Holdings, Inc. and its subsidiaries, as well as the entities that hold units in the Partnership Parks, are not Debtors in the Reorganization Cases. In addition, the entities that own and operate the Company’s foreign parks are not debtors in the Reorganization Cases.

3. Regional Theme Parks

The chart below summarizes key business information about the Company’s theme parks.

Name of Park and

Location | | Description | | Market Area(s) | | Population Within

Radius from Park

Location |

Six Flags America

Largo, MD | | 523 acres—combination theme and water park and approximately 300 acres of potentially developable land | | Washington, D.C. and Baltimore | | 7.0 million – 50 miles

11.7 million – 100 miles |

| | | | | | |

Six Flags Discovery Kingdom

Vallejo, CA | | 138 acres—theme park plus marine and land animal exhibits | | San Francisco/Oakland and Sacramento | | 5.5 million – 50 miles

10.2 million – 100 miles |

| | | | | | |

Six Flags Fiesta Texas

San Antonio, TX | | 224 acres—combination theme and water park | | San Antonio | | 2.1 million – 50 miles

3.7 million – 100 miles |

| | | | | | |

Six Flags Great Adventure/Six Flags Hurricane Harbor/Six Flags Wild Safari

Jackson, NJ | | 2,200 acres—separately gated theme park, water park and drive-through safari and approximately 700 acres of potentially developable land | | New York City and Philadelphia | | 13.7 million – 50 miles

27.2 million – 100 miles |

| | | | | | |

Six Flags Great America

Gurnee, IL | | 304 acres—combination theme and water park and approximately 20 acres of potentially developable land | | Chicago and Milwaukee | | 8.5 million – 50 miles

13.1 million – 100 miles |

18

Six Flags Kentucky Kingdom Louisville, KY | | 58 acres—combination theme and water park | | Louisville and Lexington | | 1.4 million – 50 miles

4.6 million – 100 miles |

| | | | | | |

Six Flags Magic Mountain/Six Flags Hurricane Harbor Valencia, CA | | 262 acres—separately gated theme park and water park | | Los Angeles | | 10.6 million – 50 miles

17.8 million – 100 miles |

| | | | | | |

Six Flags Mexico Mexico City, Mexico | | 110 acres—theme park | | Mexico City, Mexico | | 30.0 million – 50 miles

42.0 million – 100 miles |

| | | | | | |

Six Flags New England Agawam, MA | | 284 acres—combination theme and water park | | Springfield, Providence, Hartford/New Haven, and Boston | | 3.1 million – 50 miles

15.2 million – 100 miles |

| | | | | | |

Six Flags Over Georgia Austell, GA/ Six Flags White Water Atlanta Marietta, GA | | 359 acres—separately gated theme park and water park on 290 acres and 69 acres, respectively | | Atlanta | | 4.2 million – 50 miles

7.0 million – 100 miles |

| | | | | | |

Six Flags Over Texas/Six Flags Hurricane Harbor Arlington, TX | | 264 acres—separately gated theme park and water park on 217 and 47 acres, respectively | | Dallas/Fort Worth | | 6.5 million – 50 miles

7.1 million – 100 miles |

| | | | | | |

Six Flags St. Louis Eureka, MO | | 497 acres—combination theme and water park and approximately 240 acres of potentially developable land | | St. Louis | | 2.6 million – 50 miles

3.8 million – 100 miles |

| | | | | | |

La Ronde Montreal, Canada | | Theme park on 146 acres | | Montreal, Quebec, Canada | | 4.3 million – 50 miles

5.8 million – 100 miles |

19

The Great Escape and Splashwater Kingdom/Six Flags Great Escape Lodge & Indoor Waterpark Lake George, NY | | 351 acres—combination theme and water park, plus 200 room hotel and 38,000 square foot indoor waterpark | | Albany | | 1.1 million – 50 miles

3.1 million – 100 miles |

4. Theme Park Operations

Each of the Six Flags theme parks is managed by a park president who reports to a regional vice president or senior vice president in the Park Strategy and Management Group. The park president is responsible for all operations and management of the individual park. Local advertising, ticket sales, community relations and hiring and training of personnel are the responsibility of individual park management in coordination with corporate support teams.

Each park president also directs a full-time, on-site management team. Each management team includes senior personnel responsible for operations and maintenance, in-park food, beverage, merchandising and games, marketing and promotion, sponsorships, human resources and finance. Finance directors at Six Flags’ parks report to the Senior Vice President, Finance and Chief Accounting Officer, and with their support staff, provide financial services to their respective parks and park management teams. Park management compensation structures are designed to provide financial incentives for individual park managers to execute the Company’s strategy and to maximize revenues and free cash flow.

Six Flags’ parks are generally open daily from Memorial Day through Labor Day. In addition, most of the parks are open during weekends prior to and following their daily seasons, often in conjunction with holiday-themed events. Due to their location, certain parks have longer operating seasons. Typically, the parks charge a basic daily admission price, which allows unlimited use of all rides and attractions, although in certain cases special rides and attractions require the payment of an additional fee.

5. Marketing and Promotional Activities

Six Flags attracts visitors through multi-media marketing and promotional programs for each of its parks. The national programs are designed to market and enhance the Six Flags brand name. Regional and local programs are tailored to address the different characteristics of their respective markets and to maximize the impact of specific park attractions and product introductions. All marketing and promotional programs are updated or completely changed each year to address new developments. Marketing programs are supervised by the Company’s Executive Vice President, Entertainment and Marketing, with the assistance of its senior management and advertising agencies.

Six Flags frequently develops alliance, sponsorship and co-marketing relationships with well-known national, regional and local consumer goods companies and retailers to supplement its advertising efforts and to provide attendance incentives in the form of

20

discounts and/or premiums. Six Flags also arranges for popular local radio and television programs to be filmed or broadcast live from its parks.

Group sales represented approximately 29% of aggregate attendance in the 2008 season at Six Flags’ parks. Each park has a group sales director and a sales staff dedicated to group sales and pre-sold ticket programs through a variety of methods, including online promotions, direct mail, telemarketing and personal sales calls. Six Flags offers discounts on season pass and multi-visit tickets, tickets for specific dates and tickets to affiliated groups such as businesses, schools and religious, fraternal and similar organizations.

Season pass sales establish an attendance base in advance of the season, thus reducing, to some extent, exposure to inclement weather. Additionally, season pass holders often bring paying guests and generate “word of mouth” advertising for the parks. During the 2008 season, season pass attendance constituted approximately 28% of the total attendance at Six Flags’ parks.

Six Flags also implements promotional programs as a means of targeting specific market segments and geographic locations not generally reached through group or retail sales efforts. The promotional programs utilize coupons, sweepstakes, reward incentives and rebates to attract additional visitors. These programs are implemented through online promotions, direct mail, telemarketing, direct-response media, sponsorship marketing and targeted multi-media programs. The special promotional offers are usually for a limited time and offer a reduced admission price or provide some additional incentive to purchase a ticket.

6. Park Maintenance and Inspection

Six Flags’ rides are inspected daily by maintenance personnel during the operating season. These inspections include safety checks, as well as regular maintenance and are made through both visual inspection of the ride and test operation. The Company’s senior management and the individual park personnel evaluate the risk aspects of each park’s operation. Potential risks to employees and staff as well as to the public are evaluated. Contingency plans for potential emergency situations have been developed for each facility. During the off-season, maintenance personnel examine the rides and repair, refurbish and rebuild them where necessary. This process includes x-raying and magnafluxing (a further examination for minute cracks and defects) steel portions of certain rides at high-stress points. Six Flags has approximately 800 full-time employees who devote substantially all of their time to maintaining the parks and their rides and attractions.

In addition to the Company’s maintenance and inspection procedures, third party consultants are retained by Six Flags or its insurance carriers to perform an annual inspection of each park and all attractions and related maintenance procedures. The results of these inspections are reported in written evaluation and inspection reports, as well as written suggestions on various aspects of park operations. In certain states, state inspectors also conduct annual ride inspections before the beginning of each season. Other portions of each park are subject to inspections by local fire marshals and health and building department officials. Furthermore, Six Flags uses Ellis & Associates as water safety consultants at its parks in order to train life guards and audit safety procedures.

21

7. Capital Expenditures

Six Flags regularly makes capital investments for new rides and attractions at its parks. Six Flags purchases both new and used rides and attractions. In addition, Six Flags rotates rides among parks to provide fresh attractions. Six Flags believes that the selective introduction of new rides and attractions, including family entertainment attractions, is an important factor in promoting each of the parks in order to achieve market penetration and encourage longer visits, which lead to increased attendance and in-park spending.

In addition, Six Flags generally makes capital investments in the food, retail, games and other in-park areas to increase per capita guest spending. Six Flags also makes annual enhancements in the theming and landscaping of its parks in order to provide a more complete family oriented entertainment experience. In 2007, Six Flags began a multi-year initiative to improve its information technology infrastructure, which will enhance its operational efficiencies. Capital expenditures are planned on an annual basis with most expenditures made during the off-season. Expenditures for materials and services associated with maintaining assets, such as painting and inspecting existing rides, are expensed as incurred and are not included in capital expenditures.

8. Insurance

Six Flags maintains insurance of the type and in amounts that it believes are commercially reasonable and that are available to businesses in its industry. Six Flags maintains multi-layered general liability policies that provide for excess liability coverage of up to $100.0 million per occurrence. For incidents arising after November 15, 2003, at the Company’s U.S. parks, its self-insured retention (“SIR”) is $2.5 million per occurrence. In addition, for incidents arising after November 1, 2004, the Company has a one-time additional $500,000 SIR, in the aggregate, applicable to claims in any policy year. For incidents at those parks during the twelve months prior to that date, the SIR is $2.0 million per occurrence. For incidents during the twelve months ended November 15, 2002, the SIR is $1.0 million per occurrence. Retention levels for the Company’s international parks are nominal. The SIR after November 15, 2003 is $0.75 million for workers compensation claims ($0.5 million for the two prior years). Six Flags’ general liability policies cover the cost of punitive damages only in certain jurisdictions in which a claim occurs. The Company maintains fire and extended coverage, workers’ compensation, business interruption, terrorism and other forms of insurance typical to businesses in this industry. The fire and extended coverage policies insure the Company’s real and personal properties (other than land) against physical damage resulting from a variety of hazards.

9. Competition

Six Flags’ parks compete directly with other theme parks, water parks and amusement parks and indirectly with all other types of recreational facilities and forms of entertainment within their market areas, including movies, sports attractions and vacation travel. Accordingly, the Company’s business is and will continue to be subject to factors affecting the recreation and leisure-time industries generally, such as general economic conditions and changes in discretionary consumer spending habits. Within each park’s regional market area, the principal factors affecting direct theme park competition include location, price, the uniqueness

22

and perceived quality of the rides and attractions in a particular park, the atmosphere and cleanliness of a park and the quality of its food and entertainment.

10. Seasonality

Six Flags’ operations are highly seasonal, with approximately 80% of park attendance and revenues occurring in the second and third calendar quarters of each year, with the most significant period falling between Memorial Day and Labor Day. In 2008, for example, the Company realized approximately 120% of its annual adjusted EBITDA during the months of June through October.

11. Environmental and Other Regulations

Six Flags’ operations are subject to federal, state and local environmental laws and regulations including laws and regulations governing water and sewer discharges, air emissions, soil and groundwater contamination, the maintenance of underground and above-ground storage tanks and the disposal of waste and hazardous materials. In addition, the Company’s operations are subject to other local, state and federal governmental regulations including, without limitation, labor, health, safety, zoning and land use and minimum wage regulations applicable to theme park operations, and local and state regulations applicable to restaurant operations at each park. Finally, certain of the Company’s facilities are subject to laws and regulations relating to the care of animals. Six Flags believes that it is in substantial compliance with applicable environmental and other laws and regulations and, although no assurance can be given, the Company does not foresee the need for any significant expenditure in this area in the near future.

Portions of the undeveloped areas at certain of the Company’s parks are classified as wetlands. Accordingly, Six Flags may need to obtain governmental permits and other approvals prior to conducting development activities that affect these areas, and future development may be limited and/or prohibited in some or all of these areas. Additionally, the presence of wetlands in portions of the Company’s undeveloped land could adversely affect its ability to dispose of such land and/or the price the Company receives in any such disposition. Moreover, the undeveloped areas that are not wetlands will require comprehensive land-use entitlement in order to make such land developable, which may require substantial time, cost and effort to meet zoning and other regulatory requirements, and there can be no assurances that the outcome of such efforts would be successful, or that the increase in value, if any, will economically justify such expenditures of time, cost and effort.

12. Recent Acquisitions

On June 18, 2007, SFI acquired a 40% interest in a venture that owns dick clark productions, inc. (“dcp”) for a net investment of approximately $39.7 million. In 2008, Six Flags leveraged the dcp library, which includes the Golden Globes, the American Music Awards, the Academy of Country Music Awards, So You Think You Can Dance, American Bandstand and Dick Clark’s New Year’s Rockin’ Eve, to provide additional product offerings in its parks. In addition, the Company believes that its investment in dcp provides it with additional sponsorship and promotional opportunities. Red Zone Capital Partners II, L.P. (“Red Zone”), a private equity fund managed by Daniel M. Snyder and Dwight C. Schar, who are both members of SFI’s Board

23

of Directors, is the majority owner of the parent of dcp. During the fourth quarter of 2007, an additional third party investor purchased approximately 2.0% of the interest in dcp from Six Flags and Red Zone. As a result, the Company’s ownership interest is approximately 39.2%.

On July 31, 2007, Six Flags acquired the minority equity interest in Six Flags Discovery Kingdom that was held by its partner, an agency of the City of Vallejo, California, for a cash purchase price of approximately $52.8 million.

13. International Licensing

In March 2008, Six Flags entered into an agreement with Tatweer Dubai LLC, a member of Dubai Holding (“Tatweer”), to create a Six Flags-branded theme park in Dubai, United Arab Emirates. Pursuant to the agreement, the Company is required to provide design and development services for the creation of the park, which will be operated and managed by Tatweer or its affiliate. Six Flags also granted Tatweer the exclusive right to use its brand in certain countries for certain time periods, including the United Arab Emirates. As consideration for the Company’s services and the exclusivity rights granted in the agreement, the Company is entitled to receive license and other fees over the design and development period plus an ongoing royalty fee once the park opens.

14. Six Flags New Orleans and Related Litigation

The Company’s New Orleans park sustained extensive damage in Hurricane Katrina in late August, 2005, and has not reopened. The Company has determined that the carrying value for the assets destroyed was approximately $34.0 million, for which Six Flags recorded a receivable in 2005. This amount does not include the property and equipment owned by the lessor, which is also covered by the Company’s insurance policies. The park is covered by up to approximately $180 million in property insurance, subject to a 3% deductible in the case of named storms calculated by the insurers at approximately $5.5 million. The property insurance includes business interruption coverage.

As noted above, in connection with damage sustained to the New Orleans park during Hurricane Katrina, in December 2006, Six Flags commenced a declaratory action in Louisiana federal district court seeking judicial determination that its flood insurance sublimit was not applicable by virtue of a separate “Named Storm” peril. In February 2008, the court ruled in summary judgment that the flood insurance sublimit was applicable to the policies, including the Named Storm provision. Six Flags appealed this ruling. In April 2009, the U.S. Court of Appeals for the Fifth Circuit upheld the district court ruling, with the exception of one excess policy covering damages over $75 million, providing a possible additional $11 million of property damages coverage if total damages are set at the $129 million claimed amount. Coverage issues as to the one excess policy were remanded to the district court for further consideration of the Company’s claim. In addition, damages disputes between Six Flags and its insurers about the total amount of Six Flags’ Katrina damages and the portion of damages that are covered wind/storm damages (which are not subject to the flood sublimit) are being decided in an ongoing appraisal proceeding in New Orleans before a selected panel of three appraisers, as required by the insurance policies.

24

15. Recent Park Sales and Asset Dispositions

In April 2007, Six Flags completed the sale of the stock of its subsidiaries that owned three of the Company’s water parks and four of its theme parks (the “Sale Parks”) to PARC 7F-Operations Corporation for an aggregate purchase price of $312 million, consisting of $275 million in cash and a note receivable for $37 million. Pursuant to the purchase agreement, SFTP agreed to provide a limited guaranty to a creditor of the buyer related to the future results of operations of the Sale Parks of up to $10 million, decreasing by a minimum of one million dollars annually. The parks sold were Darien Lake near Buffalo, New York; Waterworld USA in Concord, California; Elitch Gardens in Denver, Colorado; Splashtown in Houston, Texas; the Frontier City theme park and the White Water Bay water park in Oklahoma City, Oklahoma; and Wild Waves and Enchanted Village near Seattle, Washington.

Six Flags recorded a non-cash impairment charge against assets held for sale in connection with this transaction in its consolidated financial statements for the year ended December 31, 2006 in the amount of $84.5 million. The net proceeds from the sale were used to repay indebtedness, fund capital expenditures, working capital needs, and acquire the minority interests in Six Flags Discovery Kingdom and dcp, as described above.

16. Employees and Labor Matters

As of March 1, 2009, Six Flags employed approximately 2,040 full-time employees. During the 2008 operating season the Company employed approximately 28,500 seasonal employees. In this regard, Six Flags competes with other local employers for qualified students and other candidates on a season-by-season basis. As part of the seasonal employment program, the Company employs a significant number of teenagers, which subjects the Company to child labor laws.